Evaluating the Economic Feasibility of Plant Factory Scenarios That Produce Biomass for Biorefining Processes

Abstract

1. Introduction

1.1. Knowledge Gap in Literature

1.2. Research Aim and Structure

- What are the main drivers and variables to consider during an economic feasibility evaluation of plant factory projects that produce feedstocks for biorefining processes?

- What is the economic feasibility for the use of plant factories to produce biomass feedstocks for the biorefining industry?

2. Literature

2.1. Literature Review of Existing Plant Factory Knowledge

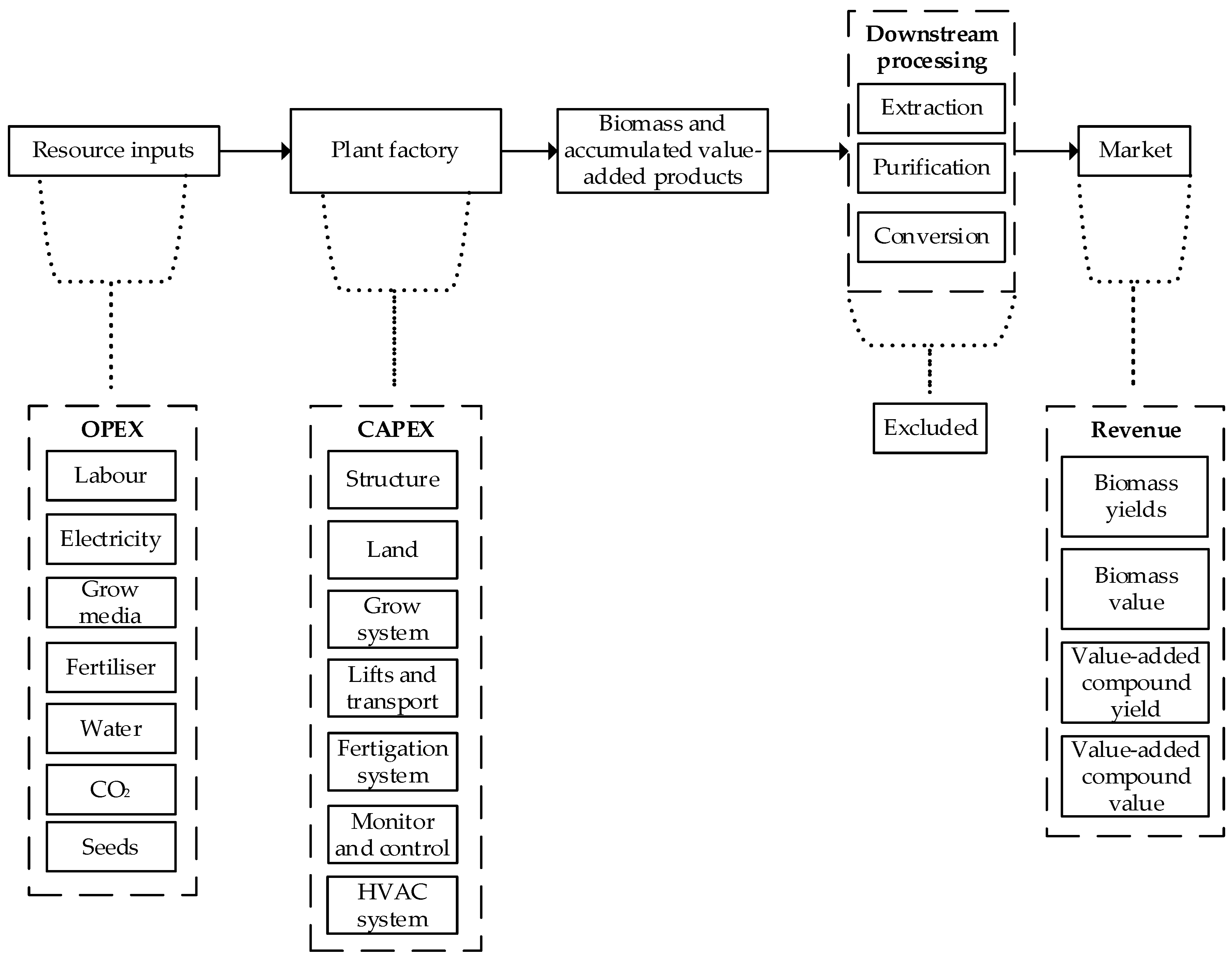

2.2. Literature Review for the Establishment of a Plant Factory System Boundary

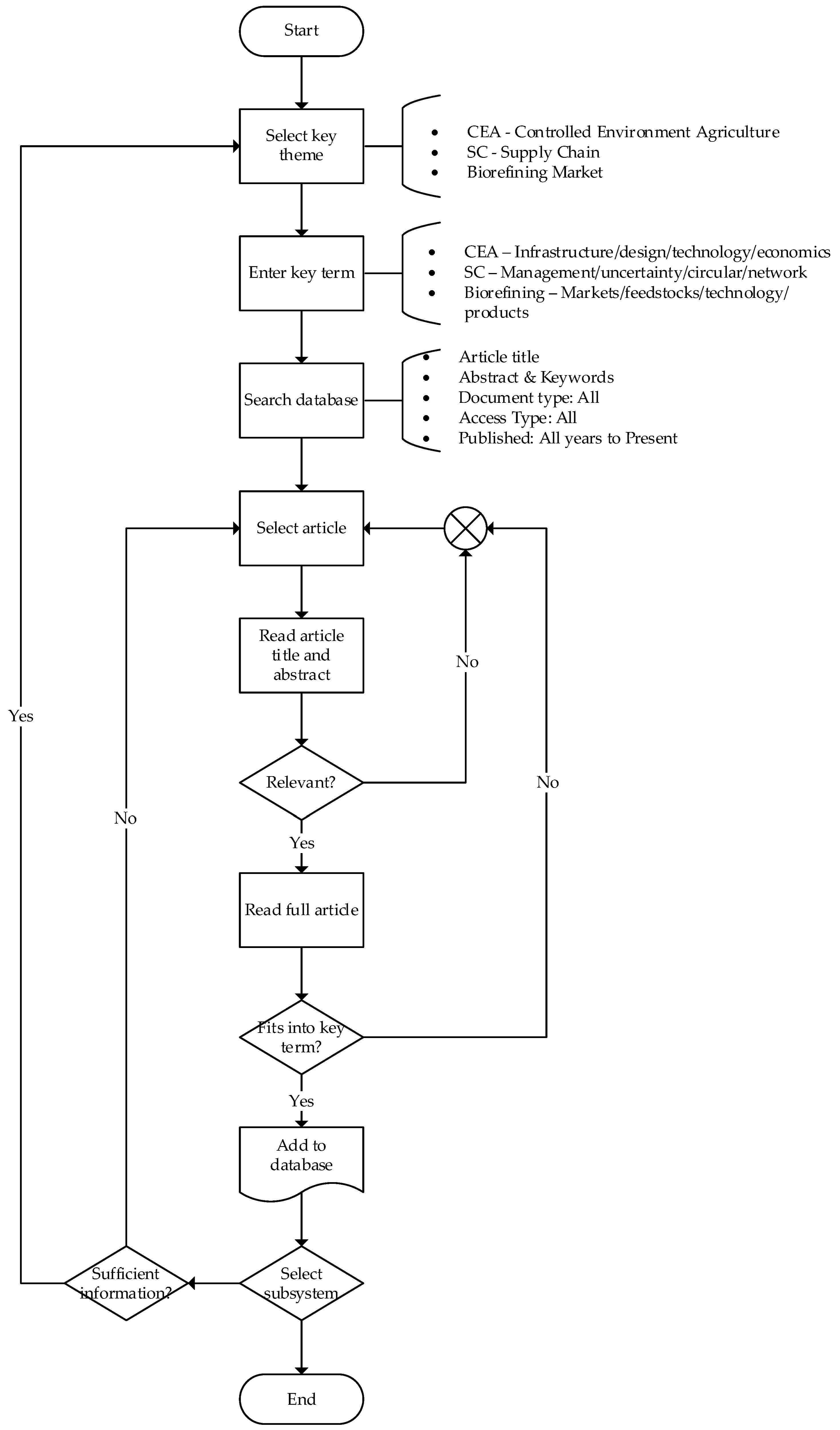

3. Methodology

3.1. Plant Factory Scenario Descriptions

3.1.1. Crop Selection

3.1.2. Market and Product Selection

3.1.3. Technology and Integration Selection

3.2. Economic Modelling of Plant Factory Scenarios

3.2.1. Data Acquisition

3.2.2. Data Processing

Capital Expenditure (CAPEX) Calculations

Operating Expenditure (OPEX) Calculations

Economic Feasibility Calculations

4. Results

4.1. Plant Factory Scenario Cultivation Conditions

4.2. Plant Factory Scenario CAPEX Results

4.3. Plant Factory Scenario OPEX Results

4.4. Plant Factory Scenario Revenue Results

4.4.1. Tomato-Based Plant Factory Revenue Results

4.4.2. Lettuce-Based Plant Factory Revenue Results

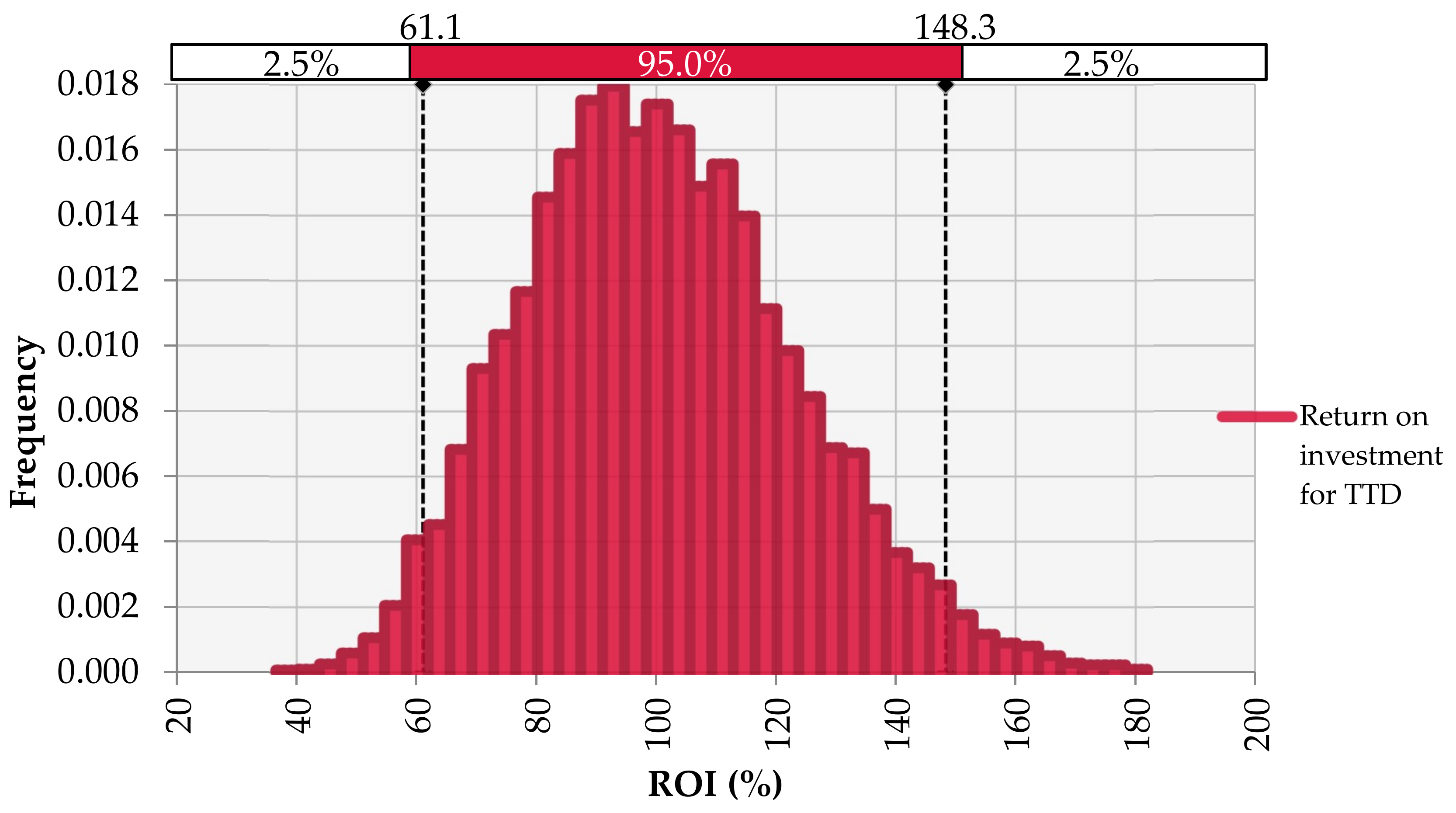

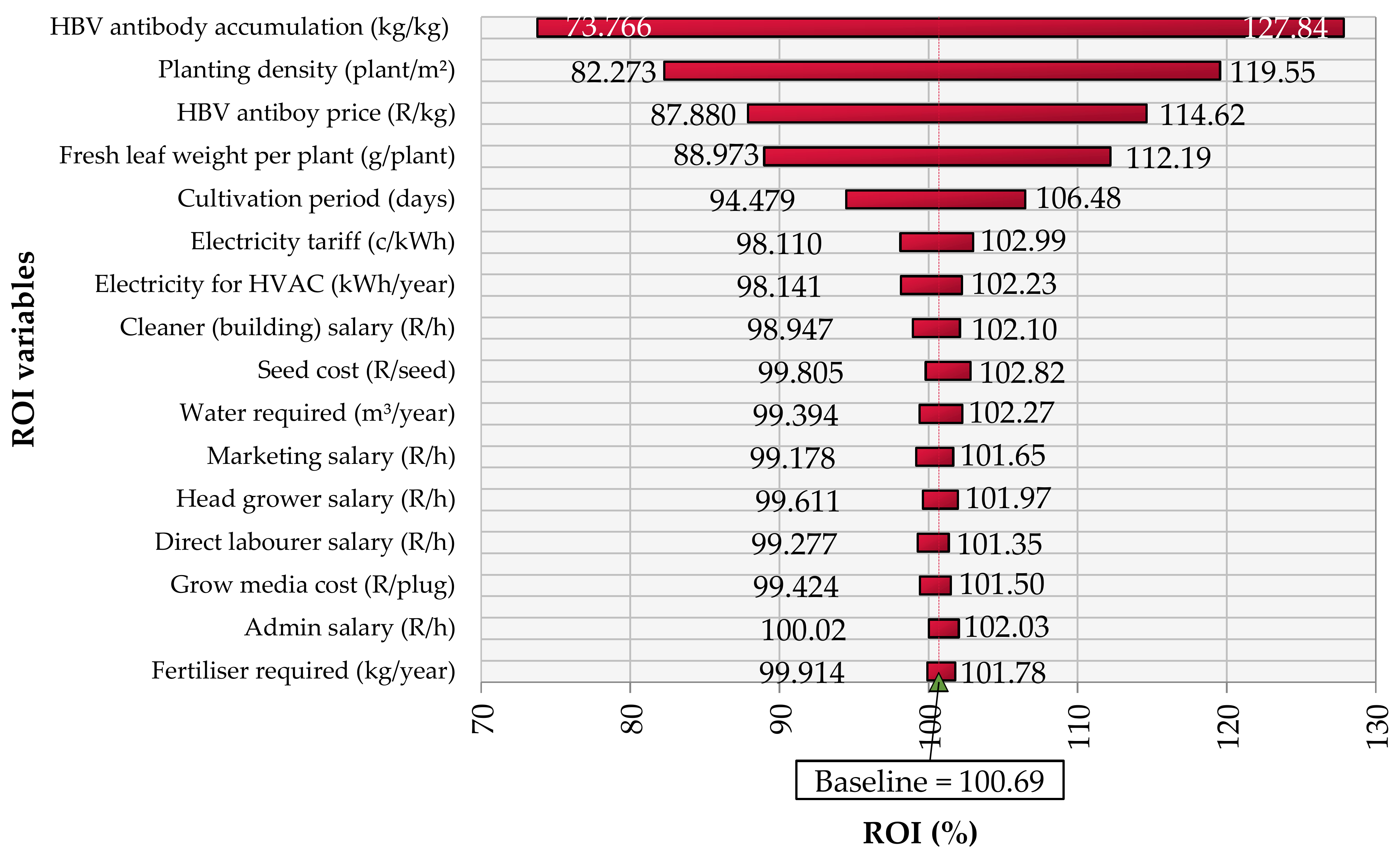

4.4.3. Tobacco-Based Plant Factory Revenue Results

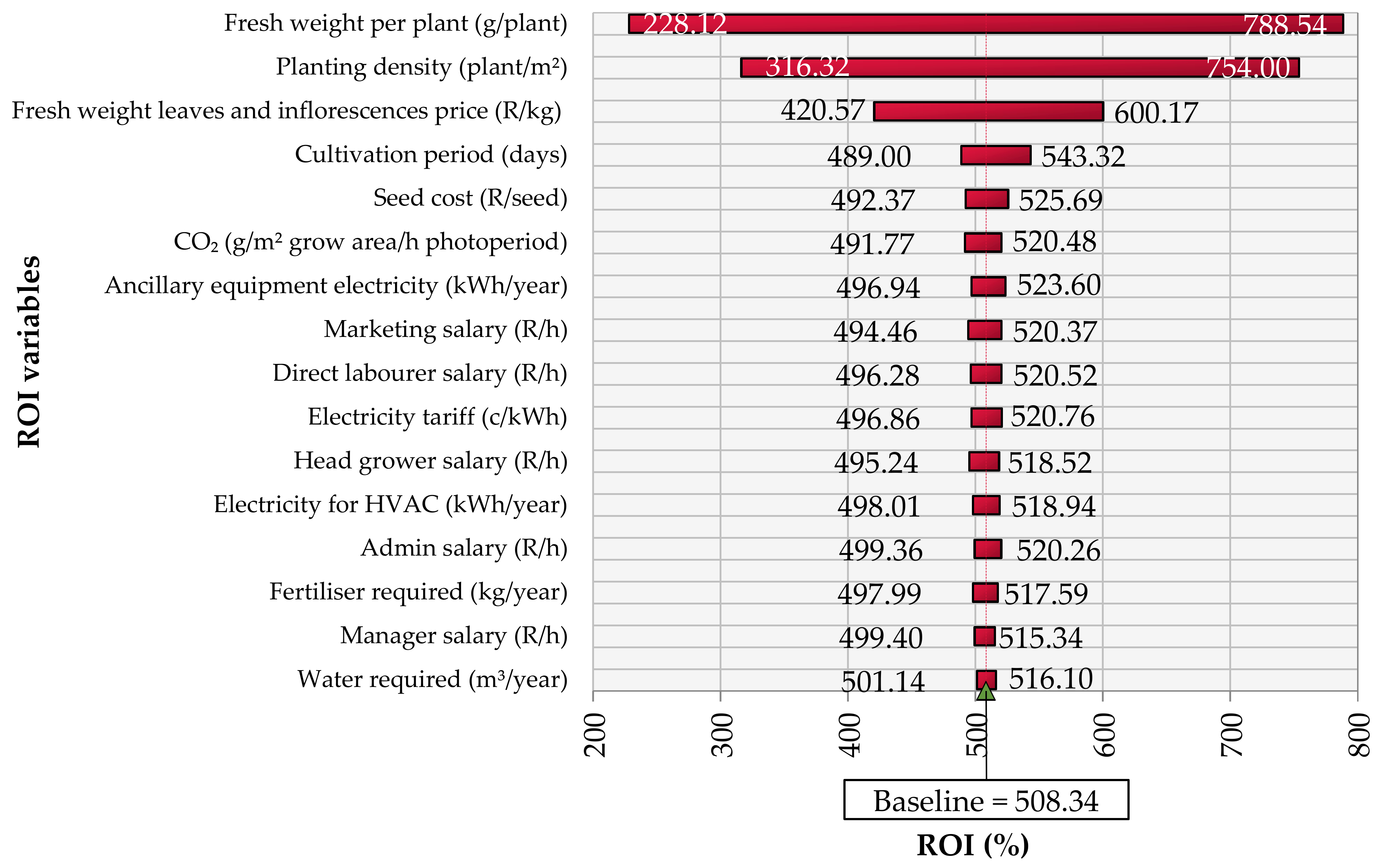

4.4.4. Cannabis-Based Plant Factory Revenue Results

5. Discussion

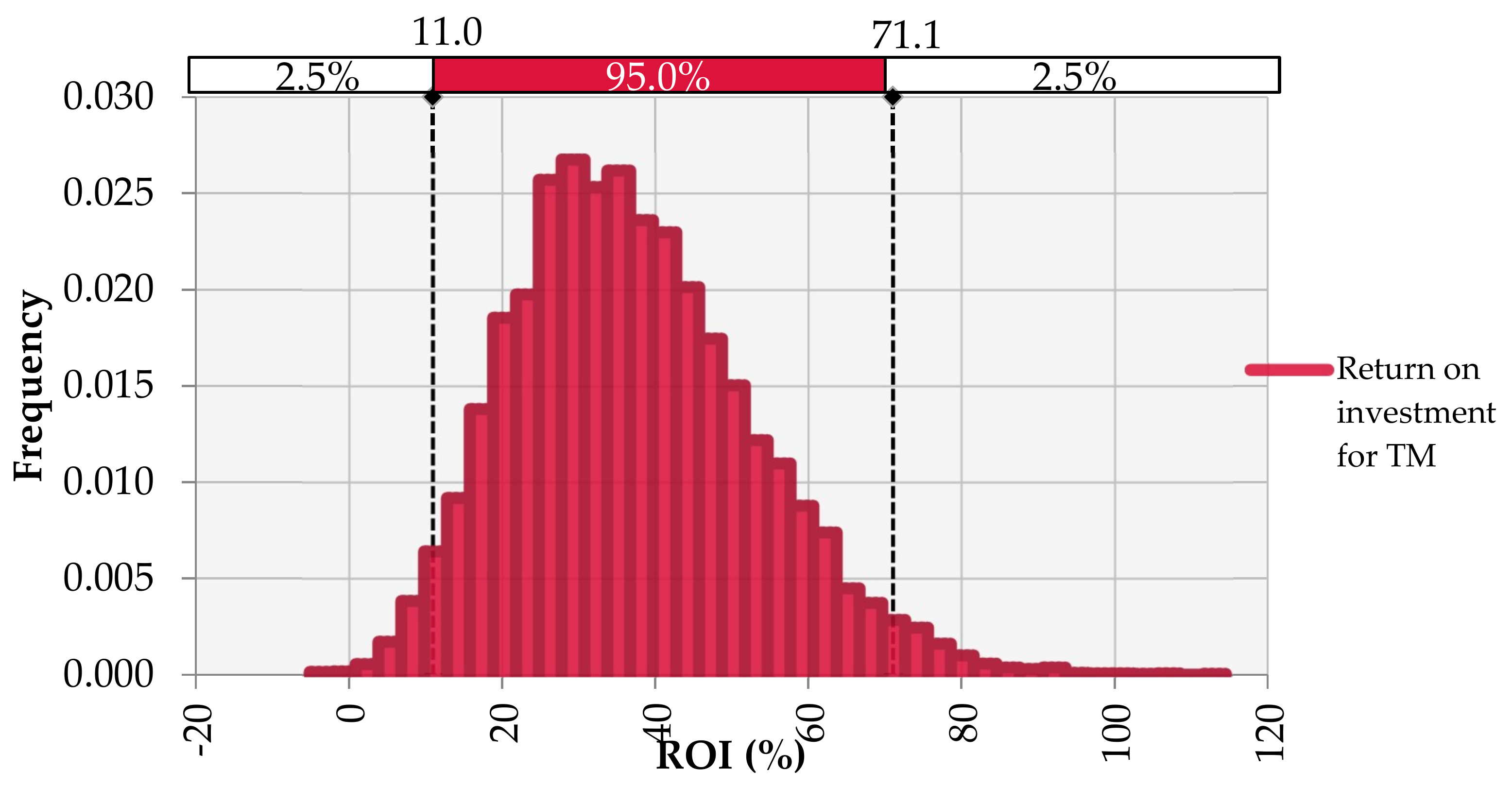

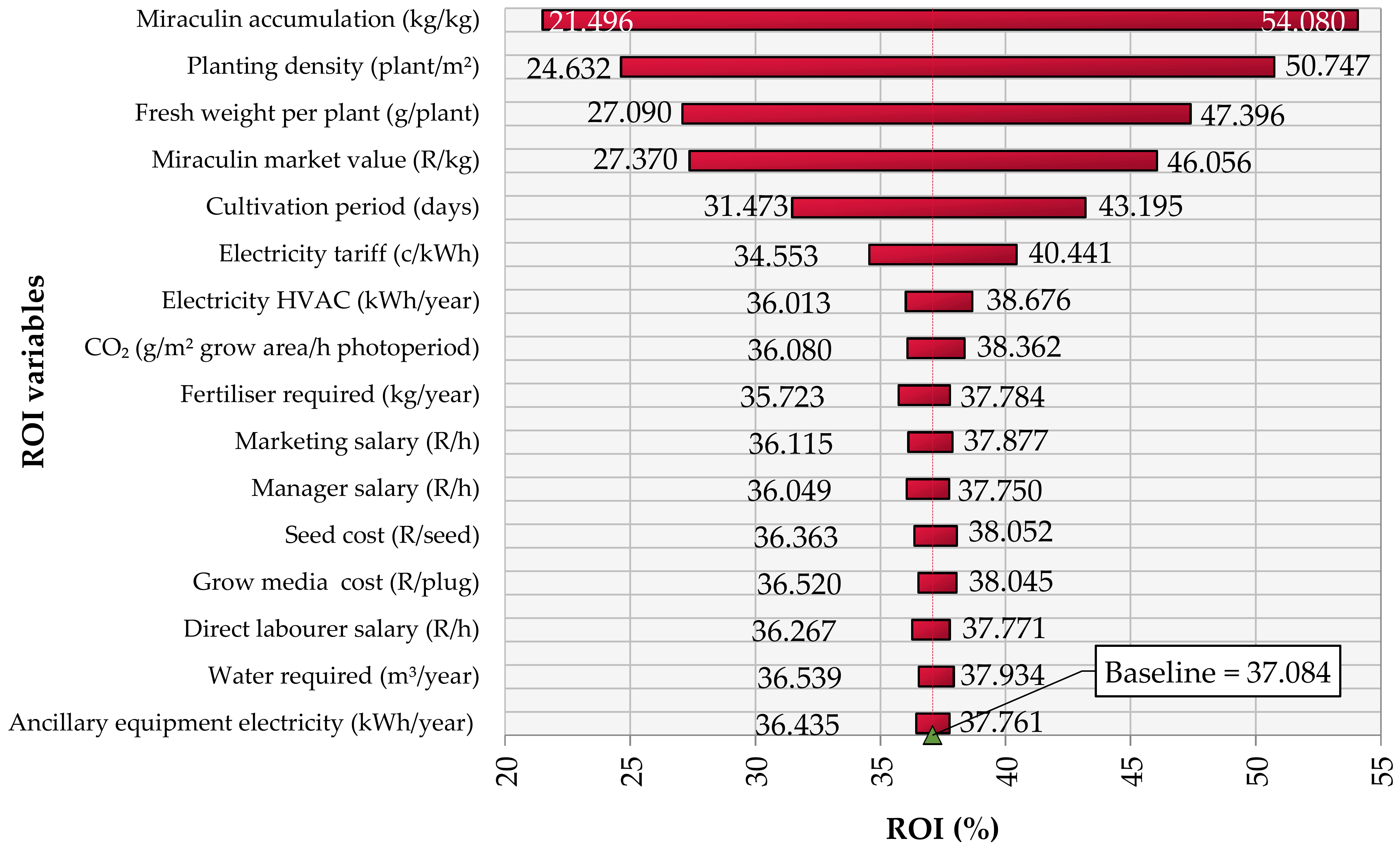

5.1. Tomato-Based Plant Factory Scenarios

5.2. Lettuce-Based Plant Factory Scenarios

5.3. Tobacco and Cannabis Plant Factory Scenarios

5.4. Economic Feasibility of Plant Factory Scenarios

5.5. Implications and Limitations

- Exploring how the plant factory system boundary can be conceptualised to show dependencies within the greater economy;

- Contributing to the debate around the use of plant factories by providing a new perspective to the applicability of the plant factory concept within the greater biorefining industry.

- The initial review of the plant factory literature in Section 2 alluded to the fact that crop yield data were not easily available for crops grown in plant factories. Directly comparable results of crop yields and cultivation conditions under varying degrees of CEA were even more scarce. This paper had to use best-available crop data to populate the economic model, which approximated the crop growth rates under specific cultivation conditions. Future research can include the standardised cultivation of various crops to draw a clear correlation between crop growth performance and the level of environmental control provided by CEA structures.

- The economic feasibility analysis of this paper considered the costs associated with operating plant factories within the defined scenarios. The revenue potential of these scenarios was based on the revenue potential of the final products which would be produced within the cultivated biomass in each plant factory. This paper calculated capital for uncertainty to put the economic indexes of each scenario in the context of the omitted expenses of the economic model. Future research can include the expansion of the economic feasibility analysis to include the downstream processing steps which were omitted from the analysis. This will lead to a more detailed techno-economic analysis which includes the extraction and purification costs of value-added compounds from host plants.

- The economic feasibility analysis also only considered monocultures within a specific scenario. Future research can include the investigation of contract farming within plant factories and the simultaneous cultivation of different crops to produce a variety of products for multiple markets.

6. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Kuswardhani, N.; Soni, P.; Shivakoti, G.P. Comparative Energy Input–Output and Financial Analyses of Greenhouse and Open Field Vegetables Production in West Java, Indonesia. Energy 2013, 53, 83–92. [Google Scholar] [CrossRef]

- Kalantari, F.; Tahir, O.M.; Joni, R.A.; Fatemi, E. Opportunities and Challenges in Sustainability of Vertical Farming: A Review. J. Landsc. Ecol. 2018, 11, 35–60. [Google Scholar] [CrossRef]

- Muller, A.; Ferré, M.; Engel, S.; Gattinger, A.; Holzkämper, A.; Huber, R.; Müller, M.; Six, J. Can Soil-Less Crop Production Be a Sustainable Option for Soil Conservation and Future Agriculture? Land Use Policy 2017, 69, 102–105. [Google Scholar] [CrossRef]

- D’Adamo, I.; Gastaldi, M.; Morone, P.; Rosa, P.; Sassanelli, C.; Settembre-Blundo, D.; Shen, Y. Bioeconomy of Sustainability: Drivers, Opportunities and Policy Implications. Sustainability 2021, 14, 200. [Google Scholar] [CrossRef]

- Engler, N.; Krarti, M. Review of Energy Efficiency in Controlled Environment Agriculture. Renew. Sustain. Energy Rev. 2021, 141, 110786. [Google Scholar] [CrossRef]

- Goodman, W.; Minner, J. Will the Urban Agricultural Revolution Be Vertical and Soilless? A Case Study of Controlled Environment Agriculture in New York City. Land Use Policy 2019, 83, 160–173. [Google Scholar] [CrossRef]

- Zeidler, C.; Schubert, D.; Vrakking, V. Vertical Farm 2.0: Designing an Economically Feasible Vertical Farm-A Combined European Endeavor for Sustainable Urban Agriculture. Available online: https://www.researchgate.net/publication/321427717 (accessed on 11 October 2020).

- Li, L.; Li, X.; Chong, C.; Wang, C.-H.; Wang, X. A Decision Support Framework for the Design and Operation of Sustainable Urban Farming Systems. J. Clean. Prod. 2020, 268, 121928. [Google Scholar] [CrossRef]

- Hu, M.-C.; Chen, Y.-H.; Huang, L.-C. A Sustainable Vegetable Supply Chain Using Plant Factories in Taiwanese Markets: A Nash–Cournot Model. Int. J. Prod. Econ. 2014, 152, 49–56. [Google Scholar] [CrossRef]

- De Oliveira, F.J.B.; Ferson, S.; Dyer, R. A Collaborative Decision Support System Framework for Vertical Farming Business Developments. Int. J. Decis. Support Syst. Technol. 2021, 13, 34–66. [Google Scholar] [CrossRef]

- Shamshiri, R.R.; Kalantari, F.; Ting, K.C.; Thorp, K.R.; Hameed, I.A.; Weltzien, C.; Ahmad, D.; Mojgan Shad, Z. Advances in Greenhouse Automation and Controlled Environment Agriculture: A Transition to Plant Factories and Urban Agriculture. Int. J. Agric. Biol. Eng. 2018, 11, 1–22. [Google Scholar] [CrossRef]

- Kwon, S.-Y.; Ryu, S.-H.; Lim, J.-H. Design and Implementation of an Integrated Management System in a Plant Factory to Save Energy. Clust. Comput. 2014, 17, 727–740. [Google Scholar] [CrossRef]

- Halgamuge, M.N.; Bojovschi, A.; Fisher, P.M.J.; Le, T.C.; Adeloju, S.; Murphy, S. Internet of Things and Autonomous Control for Vertical Cultivation Walls towards Smart Food Growing: A Review. Urban For. Urban Green. 2021, 61, 127094. [Google Scholar] [CrossRef]

- Graamans, L.; Baeza, E.; van den Dobbelsteen, A.; Tsafaras, I.; Stanghellini, C. Plant Factories versus Greenhouses: Comparison of Resource Use Efficiency. Agric. Syst. 2018, 160, 31–43. [Google Scholar] [CrossRef]

- Graamans, L.; van den Dobbelsteen, A.; Meinen, E.; Stanghellini, C. Plant Factories; Crop Transpiration and Energy Balance. Agric. Syst. 2017, 153, 138–147. [Google Scholar] [CrossRef]

- Martin, M.; Poulikidou, S.; Molin, E. Exploring the Environmental Performance of Urban Symbiosis for Vertical Hydroponic Farming. Sustainability 2019, 11, 6724. [Google Scholar] [CrossRef]

- Martin, M.; Svensson, N.; Eklund, M. Who Gets the Benefits? An Approach for Assessing the Environmental Performance of Industrial Symbiosis. J. Clean. Prod. 2015, 98, 263–271. [Google Scholar] [CrossRef]

- de Oliveira, F.J.B.; Ferson, S.; Dyer, R.A.D.; Thomas, J.M.H.; Myers, P.D.; Gray, N.G. How High Is High Enough? Assessing Financial Risk for Vertical Farms Using Imprecise Probability. Sustainability 2022, 14, 5676. [Google Scholar] [CrossRef]

- Benke, K.; Tomkins, B. Future Food-Production Systems: Vertical Farming and Controlled-Environment Agriculture. Sustain. Sci. Pract. Policy 2017, 13, 13–26. [Google Scholar] [CrossRef]

- Orsini, F.; Pennisi, G.; Zulfiqar, F.; Gianquinto, G. Sustainable Use of Resources in Plant Factories with Artificial Lighting (PFALs). Eur. J. Hortic. Sci. 2020, 85, 297–309. [Google Scholar] [CrossRef]

- Martin, M.; Weidner, T.; Gullström, C. Estimating the Potential of Building Integration and Regional Synergies to Improve the Environmental Performance of Urban Vertical Farming. Front. Sustain. Food Syst. 2022, 6, 1–18. [Google Scholar] [CrossRef]

- Thomson, A.; Price, G.W.; Arnold, P.; Dixon, M.; Graham, T. Review of the Potential for Recycling CO2 from Organic Waste Composting into Plant Production under Controlled Environment Agriculture. J. Clean. Prod. 2022, 333, 130051. [Google Scholar] [CrossRef]

- Benis, K.; Ferrão, P. Commercial Farming within the Urban Built Environment—Taking Stock of an Evolving Field in Northern Countries. Glob. Food Sec. 2018, 17, 30–37. [Google Scholar] [CrossRef]

- Santiteerakul, S.; Sopadang, A.; Tippayawong, K.Y.; Tamvimol, K. The Role of Smart Technology in Sustainable Agriculture: A Case Study of Wangree Plant Factory. Sustainability 2020, 12, 4640. [Google Scholar] [CrossRef]

- Martin, M.; Molin, E. Environmental Assessment of an Urban Vertical Hydroponic Farming System in Sweden. Sustainability 2019, 11, 4124. [Google Scholar] [CrossRef]

- Srai, J.S.; Tsolakis, N.; Kumar, M.; Bam, W. Circular Supply Chains and Renewable Chemical Feedstocks: A Network Configuration Analysis Framework. Prod. Plan. Control 2018, 29, 464–482. [Google Scholar] [CrossRef]

- De Jong, E.; Higson, A.; Walsh, P.; Wellisch, M. Task 42 Biobased Chemicals—Value Added Products from Biorefineries. 2011. Available online: https://www.wur.nl/en/show/IEA-Bioenergy-Task-42-Biorefining-Sustainable-processing-of-biomass-into-Biobased-Products-and-Bioenergy.htm (accessed on 11 October 2020).

- Niu, G.; Masabni, J. Plant Production in Controlled Environments. Horticulturae 2018, 4, 28. [Google Scholar] [CrossRef]

- Iddio, E.; Wang, L.; Thomas, Y.; McMorrow, G.; Denzer, A. Energy Efficient Operation and Modeling for Greenhouses: A Literature Review. Renew. Sustain. Energy Rev. 2020, 117, 109480. [Google Scholar] [CrossRef]

- Kozai, T. Smart Plant Factory; Kozai, T., Ed.; Springer: Singapore, 2018; ISBN 978-981-13-1064-5. [Google Scholar]

- Allardyce, C.S.; Fankhauser, C.; Zakeeruddin, S.M.; Grätzel, M.; Dyson, P.J. The Influence of Greenhouse-Integrated Photovoltaics on Crop Production. Sol. Energy 2017, 155, 517–522. [Google Scholar] [CrossRef]

- Gruda, N.; Bisbis, M.; Tanny, J. Influence of Climate Change on Protected Cultivation: Impacts and Sustainable Adaptation Strategies—A Review. J. Clean. Prod. 2019, 225, 481–495. [Google Scholar] [CrossRef]

- Khoshnevisan, B.; Shariati, H.M.; Rafiee, S.; Mousazadeh, H. Comparison of Energy Consumption and GHG Emissions of Open Field and Greenhouse Strawberry Production. Renew. Sustain. Energy Rev. 2014, 29, 316–324. [Google Scholar] [CrossRef]

- Bartzas, G.; Zaharaki, D.; Komnitsas, K. Life Cycle Assessment of Open Field and Greenhouse Cultivation of Lettuce and Barley. Inf. Process. Agric. 2015, 2, 191–207. [Google Scholar] [CrossRef]

- Scott, N.R.; Rutzke, C.J.; Albright, L.D. Energy Conversion Options for Energy-Efficient Controlled Environment Agriculture. HortScience 2005, 40, 287–292. [Google Scholar] [CrossRef]

- Tsolakis, N.; Bam, W.; Srai, J.S.; Kumar, M. Renewable Chemical Feedstock Supply Network Design: The Case of Terpenes. J. Clean. Prod. 2019, 222, 802–822. [Google Scholar] [CrossRef]

- Miret, C.; Chazara, P.; Montastruc, L.; Negny, S.; Domenech, S. Design of Bioethanol Green Supply Chain: Comparison between First and Second Generation Biomass Concerning Economic, Environmental and Social Criteria. Comput. Chem. Eng. 2016, 85, 16–35. [Google Scholar] [CrossRef]

- Giarola, S.; Bezzo, F.; Shah, N. A Risk Management Approach to the Economic and Environmental Strategic Design of Ethanol Supply Chains. Biomass Bioenergy 2013, 58, 31–51. [Google Scholar] [CrossRef]

- Zhang, F.; Johnson, D.M.; Johnson, M.A. Development of a Simulation Model of Biomass Supply Chain for Biofuel Production. Renew. Energy 2012, 44, 380–391. [Google Scholar] [CrossRef]

- Perkis, D.F.; Tyner, W.E. Developing a Cellulosic Aviation Biofuel Industry in Indiana: A Market and Logistics Analysis. Energy 2018, 142, 793–802. [Google Scholar] [CrossRef]

- Flodén, J.; Williamsson, J. Business Models for Sustainable Biofuel Transport: The Potential for Intermodal Transport. J. Clean. Prod. 2016, 113, 426–437. [Google Scholar] [CrossRef]

- Ahlgren, S.; Bernesson, S.; Nordberg, Å.; Hansson, P.A. Nitrogen Fertiliser Production Based on Biogas-Energy Input, Environmental Impact and Land Use. Bioresour. Technol. 2010, 101, 7181–7184. [Google Scholar] [CrossRef] [PubMed]

- Moon, K.-B.; Park, J.-S.; Park, Y.-I.; Song, I.-J.; Lee, H.-J.; Cho, H.S.; Jeon, J.-H.; Kim, H.-S. Development of Systems for the Production of Plant-Derived Biopharmaceuticals. Plants 2019, 9, 30. [Google Scholar] [CrossRef]

- Wirz, H.; Sauer-Budge, A.F.; Briggs, J.; Sharpe, A.; Shu, S.; Sharon, A. Automated Production of Plant-Based Vaccines and Pharmaceuticals. J. Lab. Autom. 2012, 17, 449–457. [Google Scholar] [CrossRef] [PubMed]

- Gilbert, P.; Alexander, S.; Thornley, P.; Brammer, J. Assessing Economically Viable Carbon Reductions for the Production of Ammonia from Biomass Gasification. J. Clean. Prod. 2014, 64, 581–589. [Google Scholar] [CrossRef]

- Doherty, W.O.S.; Mousavioun, P.; Fellows, C.M. Value-Adding to Cellulosic Ethanol: Lignin Polymers. Ind. Crops Prod. 2011, 33, 259–276. [Google Scholar] [CrossRef]

- Cai, C.M.; Zhang, T.; Kumar, R.; Wyman, C.E. Integrated Furfural Production as a Renewable Fuel and Chemical Platform from Lignocellulosic Biomass. J. Chem. Technol. Biotechnol. 2014, 89, 2–10. [Google Scholar] [CrossRef]

- Rout, P.K.; Nannaware, A.D.; Prakash, O.; Kalra, A.; Rajasekharan, R. Synthesis of Hydroxymethylfurfural from Cellulose Using Green Processes: A Promising Biochemical and Biofuel Feedstock. Chem. Eng. Sci. 2016, 142, 318–346. [Google Scholar] [CrossRef]

- Rosales-Calderon, O.; Arantes, V. A Review on Commercial-Scale High-Value Products That Can Be Produced alongside Cellulosic Ethanol. Biotechnol. Biofuels 2019, 12, 240. [Google Scholar] [CrossRef]

- Putro, J.N.; Soetaredjo, F.E.; Lin, S.-Y.; Ju, Y.-H.; Ismadji, S. Pretreatment and Conversion of Lignocellulose Biomass into Valuable Chemicals. RSC Adv. 2016, 6, 46834–46852. [Google Scholar] [CrossRef]

- Yang, M.; Baral, N.R.; Simmons, B.A.; Mortimer, J.C.; Shih, P.M.; Scown, C.D. Accumulation of High-Value Bioproducts in Planta Can Improve the Economics of Advanced Biofuels. Proc. Natl. Acad. Sci. USA 2020, 117, 8639–8648. [Google Scholar] [CrossRef]

- Swart, W.J. The Economic Feasibility of Commercial Biodiesel Production in South Africa including Sensitivity Analyses of Important Production and Related Parameters; Stellenbosch University: Stellenbosch, South Africa, 2012. [Google Scholar]

- Weidner, T.; Yang, A.; Hamm, M.W. Energy Optimisation of Plant Factories and Greenhouses for Different Climatic Conditions. Energy Convers. Manag. 2021, 243, 114336. [Google Scholar] [CrossRef]

- Xydis, G.A.; Liaros, S.; Avgoustaki, D.D. Small Scale Plant Factories with Artificial Lighting and Wind Energy Microgeneration: A Multiple Revenue Stream Approach. J. Clean. Prod. 2020, 255, 120227. [Google Scholar] [CrossRef]

- Hwang, H.; An, S.; Pham, M.D.; Cui, M.; Chun, C. The Combined Conditions of Photoperiod, Light Intensity, and Air Temperature Control the Growth and Development of Tomato and Red Pepper Seedlings in a Closed Transplant Production System. Sustainability 2020, 12, 9939. [Google Scholar] [CrossRef]

- Hiwasa-Tanase, K.; Hirai, T.; Kato, K.; Duhita, N.; Ezura, H. From Miracle Fruit to Transgenic Tomato: Mass Production of the Taste-Modifying Protein Miraculin in Transgenic Plants. Plant Cell Rep. 2012, 31, 513–525. [Google Scholar] [CrossRef] [PubMed]

- Hiwasa-Tanase, K.; Ezura, H. Molecular Breeding to Create Optimized Crops: From Genetic Manipulation to Potential Applications in Plant Factories. Front. Plant Sci. 2016, 7, 1–7. [Google Scholar] [CrossRef] [PubMed]

- Shiina, T.; Hosokawa, D.; Roy, P.; Nakamura, N.; Thammawong, M.; Orikasa, T. Life Cycle Inventory Analysis of Leafy Vegetables Grown in Two Types of Plant Factories. Acta Hortic. 2011, 919, 115–122. [Google Scholar] [CrossRef]

- Malhotra, K.; Subramaniyan, M.; Rawat, K.; Kalamuddin, M.; Qureshi, M.I.; Malhotra, P.; Mohmmed, A.; Cornish, K.; Daniell, H.; Kumar, S. Compartmentalized Metabolic Engineering for Artemisinin Biosynthesis and Effective Malaria Treatment by Oral Delivery of Plant Cells. Mol. Plant 2016, 9, 1464–1477. [Google Scholar] [CrossRef]

- Bohmert-Tatarev, K.; McAvoy, S.; Daughtry, S.; Peoples, O.P.; Snell, K.D. High Levels of Bioplastic Are Produced in Fertile Transplastomic Tobacco Plants Engineered with a Synthetic Operon for the Production of Polyhydroxybutyrate. Plant Physiol. 2011, 155, 1690–1708. [Google Scholar] [CrossRef]

- Shanmugaraj, B.; Bulaon, C.J.I.; Phoolcharoen, W. Plant Molecular Farming: A Viable Platform for Recombinant Biopharmaceutical Production. Plants 2020, 9, 842. [Google Scholar] [CrossRef]

- Nagatoshi, Y.; Ikeda, M.; Kishi, H.; Hiratsu, K.; Muraguchi, A.; Ohme-Takagi, M. Induction of a Dwarf Phenotype with IBH1 May Enable Increased Production of Plant-Made Pharmaceuticals in Plant Factory Conditions. Plant Biotechnol. J. 2016, 14, 887–894. [Google Scholar] [CrossRef]

- Meher, K.K.; Panchwagh, A.M.; Rangrass, S.; Gollakota, K.G. Biomethanation of Tobacco Waste. Environ. Pollut. 1995, 90, 199–202. [Google Scholar] [CrossRef]

- Grisan, S.; Polizzotto, R.; Raiola, P.; Cristiani, S.; Ventura, F.; di Lucia, F.; Zuin, M.; Tommasini, S.; Morbidelli, R.; Damiani, F.; et al. Alternative Use of Tobacco as a Sustainable Crop for Seed Oil, Biofuel, and Biomass. Agron. Sustain. Dev. 2016, 36, 55. [Google Scholar] [CrossRef]

- Carvalho, F.S.; Fornasier, F.; Leitão, J.O.M.; Moraes, J.A.R.; Schneider, R.C.S. Life Cycle Assessment of Biodiesel Production from Solaris Seed Tobacco. J. Clean. Prod. 2019, 230, 1085–1095. [Google Scholar] [CrossRef]

- Vanhove, W.; Van Damme, P.; Meert, N. Factors Determining Yield and Quality of Illicit Indoor Cannabis (Cannabis spp.) Production. Forensic Sci. Int. 2011, 212, 158–163. [Google Scholar] [CrossRef] [PubMed]

- Andre, C.M.; Hausman, J.-F.; Guerriero, G. Cannabis Sativa: The Plant of the Thousand and One Molecules. Front. Plant Sci. 2016, 7, 1–17. [Google Scholar] [CrossRef] [PubMed]

- Touliatos, D.; Dodd, I.C.; McAinsh, M. Vertical Farming Increases Lettuce Yield per Unit Area Compared to Conventional Horizontal Hydroponics. Food Energy Secur. 2016, 5, 184–191. [Google Scholar] [CrossRef] [PubMed]

- Twyman, R.M.; Stoger, E.; Schillberg, S.; Christou, P.; Fischer, R. Molecular Farming in Plants: Host Systems and Expression Technology. Trends Biotechnol. 2003, 21, 570–578. [Google Scholar] [CrossRef]

- Huebbers, J.W.; Buyel, J.F. On the Verge of the Market—Plant Factories for the Automated and Standardized Production of Biopharmaceuticals. Biotechnol. Adv. 2021, 46, 107681. [Google Scholar] [CrossRef]

- Mir-Artigues, P.; Twyman, R.M.; Alvarez, D.; Cerda Bennasser, P.; Balcells, M.; Christou, P.; Capell, T. A Simplified Techno-economic Model for the Molecular Pharming of Antibodies. Biotechnol. Bioeng. 2019, 116, 2526–2539. [Google Scholar] [CrossRef]

- Antibodies Hepatitis B Virus Antibody. Available online: https://www.antibodies-online.com/antibody/5579718/anti-Hepatitis+B+Virus+HBV+antibody/ (accessed on 7 October 2022).

- Antibodies Hepatitis B Virus Antibody. Available online: https://www.antibodies-online.com/antibody/3027643/anti-Hepatitis+B+Virus+HBV+antibody/ (accessed on 7 October 2022).

- Hirai, T.; Kurokawa, N.; Duhita, N.; Hiwasa-Tanase, K.; Kato, K.; Kato, K.; Ezura, H. The HSP Terminator of Arabidopsis Thaliana Induces a High Level of Miraculin Accumulation in Transgenic Tomatoes. J. Agric. Food Chem. 2011, 59, 9942–9949. [Google Scholar] [CrossRef]

- Sun, H.-J.; Cui, M.; Ma, B.; Ezura, H. Functional Expression of the Taste-Modifying Protein, Miraculin, in Transgenic Lettuce. FEBS Lett. 2006, 580, 620–626. [Google Scholar] [CrossRef]

- McAdam, B.; Brennan Fournet, M.; McDonald, P.; Mojicevic, M. Production of Polyhydroxybutyrate (PHB) and Factors Impacting Its Chemical and Mechanical Characteristics. Polymers 2020, 12, 2908. [Google Scholar] [CrossRef]

- Fatica, A.; Di Lucia, F.; Marino, S.; Alvino, A.; Zuin, M.; De Feijter, H.; Brandt, B.; Tommasini, S.; Fantuz, F.; Salimei, E. Study on Analytical Characteristics of Nicotiana Tabacum L., Cv. Solaris Biomass for Potential Uses in Nutrition and Biomethane Production. Sci. Rep. 2019, 9, 16828. [Google Scholar] [CrossRef] [PubMed]

- Matassa, S.; Esposito, G.; Pirozzi, F.; Papirio, S. Exploring the Biomethane Potential of Different Industrial Hemp (Cannabis Sativa L.) Biomass Residues. Energies 2020, 13, 3361. [Google Scholar] [CrossRef]

- Anctil, A.; Lee, E.; Lunt, R.R. Net Energy and Cost Benefit of Transparent Organic Solar Cells in Building-Integrated Applications. Appl. Energy 2020, 261, 114429. [Google Scholar] [CrossRef]

- Riera-Vila, I.; Anderson, N.O.; Hodge, C.F.; Rogers, M. Anaerobically-Digested Brewery Wastewater as a Nutrient Solution for Substrate-Based Food Production. Horticulturae 2019, 5, 43. [Google Scholar] [CrossRef]

- Amigun, B.; Petrie, D.; Gorgens, J. Economic Risk Assessment of Advanced Process Technologies for Bioethanol Production in South Africa: Monte Carlo Analysis. Renew. Energy 2011, 36, 3178–3186. [Google Scholar] [CrossRef]

- Kim, J.; Realff, M.J.; Lee, J.H. Optimal Design and Global Sensitivity Analysis of Biomass Supply Chain Networks for Biofuels under Uncertainty. Comput. Chem. Eng. 2011, 35, 1738–1751. [Google Scholar] [CrossRef]

- Souza, S.V.; Gimenes, R.M.T.; Binotto, E. Economic Viability for Deploying Hydroponic System in Emerging Countries: A Differentiated Risk Adjustment Proposal. Land Use Policy 2019, 83, 357–369. [Google Scholar] [CrossRef]

- Resurreccion, E.P.; Roostaei, J.; Martin, M.J.; Maglinao, R.L.; Zhang, Y.; Kumar, S. The Case for Camelina-Derived Aviation Biofuel: Sustainability Underpinnings from a Holistic Assessment Approach. Ind. Crops Prod. 2021, 170, 113777. [Google Scholar] [CrossRef]

- Hao, X.; Guo, X.; Zheng, J.; Celeste, L.; Kholsa, S.; Chen, X. Response of Greenhouse Tomato to Different Vertical Spectra of LED Lighting under Overhead High Pressure Sodium and Plasma Lighting. Acta Hortic. 2017, 1170, 1003–1110. [Google Scholar] [CrossRef]

- Kato, K.; Maruyama, S.; Hirai, T.; Hiwasa-Tanase, K.; Mizoguchi, T.; Goto, E.; Ezura, H. A Trial of Production of the Plant-Derived High-Value Protein in a Plant Factory. Plant Signal. Behav. 2011, 6, 1172–1179. [Google Scholar] [CrossRef] [PubMed]

- Li, L.; Tong, Y.; Lu, J.; Li, Y.; Yang, Q. Lettuce Growth, Nutritional Quality, and Energy Use Efficiency as Affected by Red–Blue Light Combined with Different Monochromatic Wavelengths. HortScience 2020, 55, 613–620. [Google Scholar] [CrossRef]

- Chowdhury, S.P.; Dietel, K.; Rändler, M.; Schmid, M.; Junge, H.; Borriss, R.; Hartmann, A.; Grosch, R. Effects of Bacillus Amyloliquefaciens FZB42 on Lettuce Growth and Health under Pathogen Pressure and Its Impact on the Rhizosphere Bacterial Community. PLoS One 2013, 8, e68818. [Google Scholar] [CrossRef] [PubMed]

- Yamori, W.; Evans, J.R.; Von Caemmerer, S. Effects of Growth and Measurement Light Intensities on Temperature Dependence of CO(2) Assimilation Rate in Tobacco Leaves. Plant. Cell Environ. 2010, 33, 332–343. [Google Scholar] [CrossRef] [PubMed]

- Fu, X.; Ye, L.; Kang, L.; Ge, F. Elevated CO2 Shifts the Focus of Tobacco Plant Defences from Cucumber Mosaic Virus to the Green Peach Aphid. Plant. Cell Environ. 2010, 33, 2056–2064. [Google Scholar] [CrossRef] [PubMed]

- Lee, M.; Boyd, R.A.; Ort, D.R. The Photosynthetic Response of C 3 and C 4 Bioenergy Grass Species to Fluctuating Light. GCB Bioenergy 2022, 14, 37–53. [Google Scholar] [CrossRef]

- McMurtrey, J.E. Tobacco. Available online: https://www.britannica.com/plant/common-tobacco (accessed on 11 February 2022).

- Naim-Feil, E.; Pembleton, L.W.; Spooner, L.E.; Malthouse, A.L.; Miner, A.; Quinn, M.; Polotnianka, R.M.; Baillie, R.C.; Spangenberg, G.C.; Cogan, N.O.I. The Characterization of Key Physiological Traits of Medicinal Cannabis (Cannabis Sativa L.) as a Tool for Precision Breeding. BMC Plant Biol. 2021, 21, 294. [Google Scholar] [CrossRef] [PubMed]

- Moscariello, C.; Matassa, S.; Esposito, G.; Papirio, S. From Residue to Resource: The Multifaceted Environmental and Bioeconomy Potential of Industrial Hemp (Cannabis Sativa L.). Resour. Conserv. Recycl. 2021, 175, 105864. [Google Scholar] [CrossRef]

- SolarAdvice Solar Panels. Available online: https://solaradvice.co.za/shop/solar-power/solar-panels (accessed on 14 October 2022).

- WeedSeedsExpress Cannabis Seeds Price List. Available online: https://weedseedsexpress.com/price-list-cannabis-seeds (accessed on 26 September 2022).

- Shao, Y.; Heath, T.; Zhu, Y. Developing an Economic Estimation System for Vertical Farms. Int. J. Agric. Environ. Inf. Syst. 2016, 7, 26–51. [Google Scholar] [CrossRef]

- Kato, K.; Yoshida, R.; Kikuzaki, A.; Hirai, T.; Kuroda, H.; Hiwasa-Tanase, K.; Takane, K.; Ezura, H.; Mizoguchi, T. Molecular Breeding of Tomato Lines for Mass Production of Miraculin in a Plant Factory. J. Agric. Food Chem. 2010, 58, 9505–9510. [Google Scholar] [CrossRef]

- Abcam Recombinant Miraculin Protein (His Tag) (Ab235869). Available online: https://www.abcam.com/recombinant-miraculin-protein-his-tag-ab235869.html (accessed on 27 August 2022).

- BioCrick Miraculin, Recombinant Protein Catalog# BCP20013. Available online: https://www.biocrick.com/Miraculin-Recombinant-Protein--BCP20013.html (accessed on 27 August 2022).

- Duhita, N.; Hiwasa-Tanase, K.; Yoshida, S.; Ezura, H. Single-Step Purification of Native Miraculin Using Immobilized Metal-Affinity Chromatography. J. Agric. Food Chem. 2009, 57, 5148–5151. [Google Scholar] [CrossRef]

- Duhita, N.; Hiwasa-Tanase, K.; Yoshida, S.; Ezura, H. A Simple Method for Purifying Undenatured Miraculin from Transgenic Tomato Fruit. Plant Biotechnol. 2011, 28, 281–286. [Google Scholar] [CrossRef]

- Lopez-Arenas, T.; González-Contreras, M.; Anaya-Reza, O.; Sales-Cruz, M. Analysis of the Fermentation Strategy and Its Impact on the Economics of the Production Process of PHB (Polyhydroxybutyrate). Comput. Chem. Eng. 2017, 107, 140–150. [Google Scholar] [CrossRef]

- LeBlanc, Z.; Waterhouse, P.; Bally, J. Plant-Based Vaccines: The Way Ahead? Viruses 2020, 13, 5. [Google Scholar] [CrossRef] [PubMed]

- Dubey, K.K.; Luke, G.A.; Knox, C.; Kumar, P.; Pletschke, B.I.; Singh, P.K.; Shukla, P. Vaccine and Antibody Production in Plants: Developments and Computational Tools. Brief. Funct. Genom. 2018, 17, 295–307. [Google Scholar] [CrossRef]

- Milay, L.; Berman, P.; Shapira, A.; Guberman, O.; Meiri, D. Metabolic Profiling of Cannabis Secondary Metabolites for Evaluation of Optimal Postharvest Storage Conditions. Front. Plant Sci. 2020, 11, 1–15. [Google Scholar] [CrossRef]

- Hiwasa-Tanase, K.; Ohmura, S.; Kitazawa, N.; Ono, A.; Suzuki, T.; Ezura, H. Improvement of Recombinant Miraculin Production in Transgenic Tomato by Crossbreeding-Based Genetic Background Modification. Transgenic Res. 2022, 31, 567–578. [Google Scholar] [CrossRef]

- FAO. FAOSTAT. Available online: https://www.fao.org/faostat/en/#data/PP (accessed on 24 October 2021).

- Bohmert, K.; Balbo, I.; Kopka, J.; Mittendorf, V.; Nawrath, C.; Poirier, Y.; Tischendorf, G.; Trethewey, R.N.; Willmitzer, L. Transgenic Arabidopsis Plants Can Accumulate Polyhydroxybutyrate to up to 4% of Their Fresh Weight. Planta 2000, 211, 841–845. [Google Scholar] [CrossRef]

- Dobrogojski, J.; Spychalski, M.; Luciński, R.; Borek, S. Transgenic Plants as a Source of Polyhydroxyalkanoates. Acta Physiol. Plant. 2018, 40, 162. [Google Scholar] [CrossRef]

- Statista Price of Polypropylene Worldwide from 2017 to 2022. Available online: https://www.statista.com/statistics/1171084/price-polypropylene-forecast-globally/ (accessed on 28 August 2022).

- Nitkiewicz, T.; Wojnarowska, M.; Sołtysik, M.; Kaczmarski, A.; Witko, T.; Ingrao, C.; Guzik, M. How Sustainable Are Biopolymers? Findings from a Life Cycle Assessment of Polyhydroxyalkanoate Production from Rapeseed-Oil Derivatives. Sci. Total Environ. 2020, 749, 141279. [Google Scholar] [CrossRef]

- Cannabis Benchmarks U.S. Cannabis Spot Index. Available online: https://www.cannabisbenchmarks.com/reports/u-s-cannabis-spot-index-august-26-2022/ (accessed on 26 August 2022).

- Cannabis Benchmarks Canada Cannabis Spot Index. Available online: https://www.cannabisbenchmarks.com/reports/canada-cannabis-spot-index-august-26-2022/ (accessed on 26 August 2022).

| Article Type | Objective | Selected Crops | References |

|---|---|---|---|

| Economic modelling | Design of an economically feasible modular vertical farm | Lettuce and tomatoes | [7] |

| Assessing financial risk of vertical farms using imprecise probability | Lettuce | [18] | |

| Development of a decision support framework to help design and operate urban farming systems | Leafy greens | [8] | |

| Development of a vegetable supply chain in the urban environment using plant factories | Leafy greens | [9] | |

| Resource/ technology reviews | Quantify and compare resource requirements of greenhouses and plant factories | Lettuce | [14] |

| Review of technology options available to greenhouses and plant factories | Lettuce and tomatoes | [11] | |

| Review of Internet of Things (IoT) solutions to monitor edible crop growth in vertical farms | Edible biomass, mostly leafy greens | [13] | |

| Review of differences in energy efficiencies between plant factory technology solutions | Edible biomass | [5] | |

| Review of controlled environment agriculture case studies in terms of challenges and opportunities | Leafy greens | [19] | |

| Review of the resource use efficiencies within plant factories | Leafy greens, highlights lack of larger crop growth data | [20] | |

| Plant factory integration | Evaluating the industrial symbiosis of plant factories with surrounding industries | Leafy greens and herbs | [21] |

| Evaluating the industrial symbiosis of plant factories with surrounding industries based on environmental impact measurements | Leafy greens and herbs | [16] | |

| Evaluating the integration of plant factories with on-site composting infrastructure | Lettuce | [22] | |

| Plant factory assessments | Assessing the environmental, economic and social impacts of urban agriculture | Edible biomass | [23] |

| Assessing the role of IoT technology within a plant factory case study | Lettuce | [24] | |

| Assessing the environmental impact of the constituent elements which make up a plant factory structure and business | Edible biomass | [25] |

| Key Research Themes | References |

|---|---|

| CEA/Plant factory design and operation | [1,2,8,11,28,29,30,31,32,33,34] |

| Supply chain under uncertainty | [9,26,27,35,36,37,38,39,40,41] |

| Biorefining markets | [27,42,43,44,45,46,47,48,49,50,51,52] |

| Plant Factory Component | Space Breakdown (%) | References |

|---|---|---|

| Germination and nursery | 15 | [54] |

| Growth phase bottom layer | 60 | [18,53] |

| Harvest, packaging, and storage | 15 | [30] |

| Walkways, offices, and ancillary spaces | 10 | Assumed |

| Total | 100 | - |

| Scenario | Plant Factory Structure | Market | Products |

|---|---|---|---|

| Tomato—food (TF) | High-wire | Food | Edible tomatoes |

| Tomato—miraculin (TM) | Vertical farm (five levels) | Food/ biopharmaceutical | Miraculin accumulated in tomatoes |

| Lettuce—food (LF) | Vertical farm (five levels) | Food | Edible lettuce |

| Lettuce—miraculin (LM) | Vertical farm (five levels) | Food/ biopharmaceutical | Miraculin accumulated in lettuce |

| Lettuce—renewable— integrated (LRI) | Vertical farm (five levels) | Food | Edible lettuce, with solar panels and alternative fertiliser considered |

| Tobacco—conventional (TC) | Vertical farm (five levels) | Biopharmaceutical/ bio-based products | Tobacco biomass, accumulated artemisinin, biodiesel, and biomethane |

| Tobacco—PHB (TPHB) | Vertical farm (five levels) | Bio-based products | Polyhydroxybutyrate (PHB) polymer accumulated in tobacco |

| Tobacco—transgenic (TT) | Vertical farm (five levels) | Biopharmaceutical | Hepatitis B virus (HBV) antibodies accumulated in tobacco |

| Tobacco—transgenic—dwarf (TTD) | Vertical farm (five levels) | Biopharmaceutical | HBV antibodies accumulated in dwarf tobacco |

| Cannabis—conventional (CC) | Vertical farm (three levels) | Medicinal/recreational | Value in cannabidiol (CBD) content |

| Modelling Method | Objective | References |

|---|---|---|

| Monte Carlo | Economic risk assessment of biofuel technologies | [81] |

| Monte Carlo | Biomass supply chain development for biofuel production | [82] |

| Monte Carlo and System Dynamics | Review of greenhouse modelling techniques | [29] |

| Monte Carlo | Assessing economic viability of hydroponic cultivation in emerging markets | [83] |

| Probability bound analysis | Assessing financial risk of vertical farms using imprecise probability | [18] |

| Monte Carlo | Life cycle assessment (LCA) of biodiesel production from tobacco seeds | [65] |

| Monte Carlo | Sustainability assessment of bio-based aviation fuel | [84] |

| Growing Area | Planting Density | Biomass Yield per Plant | PPFD | Average Temperature | CO2 Concentration | Photoperiod | Cultivation Period | |

|---|---|---|---|---|---|---|---|---|

| (m2) | (Plant/m2) | (g Fresh Weight/Plant) | (µmol/m2/s) | (°C) | (ppm) | (h) | (Days) | |

| Scenario | ||||||||

| TF | 1020 | 2.5–2.8 | 20,320–30,480 | 600 | 22.5 | 1000 | 12 | 90–110 |

| TM | 2720 | 27–44 | 171–250 | 400 | 22.5 | 1000 | 12 | 70–90 |

| LF | 2720 | 32–66 | 80–200 | 200 | 17 | 1000 | 16 | 30–42 |

| LM | 2720 | 32–66 | 80–200 | 200 | 17 | 1000 | 16 | 30–42 |

| LRI | 2720 | 32–66 | 80–200 | 200 | 17 | 1000 | 16 | 30–42 |

| TC | 2720 | 3.6–4.8 | ~1700 | 275 | 27.5 | 750 | 13 | 100–130 |

| TPHB | 2720 | 32–44 | 67–101 | 275 | 27.5 | 750 | 13 | 90–110 |

| TT | 2720 | 26–39 | 43–59 | 275 | 27.5 | 750 | 13 | 74–84 |

| TTD | 2720 | 36–53 | 35–44 | 275 | 27.5 | 750 | 13 | 74–84 |

| CC | 1632 | 10–30 | 83–373 | 500 | 26 | 950 | 16 | 70–80 |

| Quantity | Unit Price (R) | Total Component Price (R) | Depreciation Cost per Year (R/Year) | |

|---|---|---|---|---|

| Panel (455 W rating) | 500 | 3334 | 1,666,925 | - |

| Inverter (8 kW) | 22 | 43,413 | 955,075 | - |

| Installation | - | - | 428,000 | - |

| Total CAPEX | 3,050,000 | 122,000 |

| Scenarios | Cost (R) | Lifespan (Years) | Depreciation per Year (%) | Depreciation Cost per Year (R/Year) | |||

|---|---|---|---|---|---|---|---|

| Construction | |||||||

| Structure | TF | 6,745,000 | 30 | 3.33 | 224,833 | ||

| TM | |||||||

| LF, LM, LRI | |||||||

| TC, TPHB, TT, TTD | |||||||

| CC | |||||||

| Equipment | |||||||

| Plant factory module | TF | 3,430,353 | 25 | 4 | 137,214 | ||

| TM | 17,151,765 | 25 | 4 | 686,071 | |||

| LF, LM, LRI | 17,151,765 | 20,201,765 a | 25 | 4 | 686,071 | 808,071 a | |

| TC, TPHB, TT, TTD | 17,151,765 | 25 | 4 | 686,071 | |||

| CC | 10,291,059 | 25 | 4 | 441,642 | |||

| Lift and transport car | TF | 100,000 | 15 | 6.67 | 6667 | ||

| TM | |||||||

| LF, LM, LRI | |||||||

| TC, TPHB, TT, TTD | |||||||

| CC | |||||||

| Fertigation system | TF | 328,720 | 10 | 10 | 32,872 | ||

| TM | |||||||

| LF, LM, LRI | |||||||

| TC, TPHB, TT, TTD | |||||||

| CC | |||||||

| Monitor and control system | TF | 997,577 | 10 | 10 | 99,758 | ||

| TM | 2,497,801 | 10 | 10 | 249,780 | |||

| LF, LM, LRI | 2,497,801 | 10 | 10 | 249,780 | |||

| TC, TPHB, TT, TTD | 2,497,801 | 10 | 10 | 249,780 | |||

| CC | 1,546,739 | 10 | 10 | 154,674 | |||

| HVAC system | TF | 836,595 | 10 | 10 | 83,660 | ||

| TM | |||||||

| LF, LM, LRI | |||||||

| TC, TPHB, TT, TTD | |||||||

| CC | 511,105 | 10 | 10 | 51,110 | |||

| Total CAPEX | TF | 12,438,245 | - | - | 585,003 | ||

| TM | 27,659,880 | - | - | 1,283,882 | |||

| LF, LM, LRI | 27,659,880 | 30,709,880 a | - | - | 1,283,882 | 1,405,882 a | |

| TC, TPHB, TT, TTD | 27,659,880 | - | - | 1,283,882 | |||

| CC | 19,522,622 | - | - | 881,799 | |||

| Scenarios | |||

| OPEX component | Unit | TF | TM |

| Fixed cost | |||

| Indirect labour | R/year | 1,499,273–1,820,279 | 1,499,904–1,819,928 |

| Variable (COGS) cost | |||

| Direct labour | R/year | 44,831–102,254 | 67,267–153,381 |

| Electricity | R/year | 2,493,606–3,474,307 | 4,990,472–7,031,889 |

| Water | R/year | 27,762–56,661 | 74,026–151,092 |

| Fertiliser | R/year | 85,232–249,538 | 227,221–665,379 |

| Grow media | R/year | 28,556–41,144 | 190,344–331,501 |

| Seeds | R/year | 1,081–1,559 | 938,925–1,629,663 |

| CO2 | R/year | 190,498–260,537 | 507,981–694,757 |

| Total COGS | R/year | 3,026,155–4,033,157 | 7,649,327–9,904,036 |

| Scenarios | ||||

|---|---|---|---|---|

| OPEX component | Unit | LF | LM | LRI |

| Fixed cost | ||||

| Indirect labour | R/year | 1,496,505–1,821,113 | ||

| Variable (COGS) cost | ||||

| Direct labour | R/year | 67,263–153,384 | ||

| Grid electricity | R/year | 3,969,748–5,569,269 | 3,509,923–4,955,137 | |

| Water | R/year | 61,100–114,189 | ||

| Fertiliser | R/year | 184,864–502,663 | ||

| Grow media | R/year | 522,790–1,064,527 | 71,693–136,903 | |

| Seeds | R/year | 59,815–120,663 | ||

| CO2 | R/year | 677,290–926,297 | ||

| Total COGS | R/year | 6,059,818–7,815,184 | 5,596,623–7,207,506 (panels) 5,454,366–7,112,600 (grains) 4,990,546–6,499,481 (combined) | |

| Scenarios | |||||

|---|---|---|---|---|---|

| OPEX component | Unit | TC | TPHB | TT | TTD |

| Fixed cost | |||||

| Indirect labour | R/year | 1,498,525–1,825,671 | |||

| Variable (COGS) cost | |||||

| Direct labour | R/year | 67,257–153,381 | |||

| Electricity | R/year | 4,452,982–6,392,575 | |||

| Water | R/year | 69,922–163,230 | |||

| Fertiliser | R/year | 219,298–719,451 | |||

| Grow media | R/year | 16,655–26,054 | 173,400–268,689 | 185,156–294,406 | 253,819–399,207 |

| Seeds | R/year | 32,634–50,817 | 340,188–526,262 | 361,714–573,686 | 497,917–784,409 |

| CO2 | R/year | 550,339–752,628 | |||

| Total COGS | R/year | 5,816,197–7,840,108 | 6,393,465–8,434,953 | 6,435,846–8,488,624 | 6,692,149–8,737,868 |

| Scenario | ||

|---|---|---|

| OPEX component | Unit | CC |

| Fixed cost | ||

| Indirect labour | R/year | 1,498,023–1,822,495 |

| Variable (COGS) cost | ||

| Direct labour | R/year | 44,828–102,261 |

| Electricity | R/year | 4,664,240–6,433,889 |

| Water | R/year | 72,977–98,105 |

| Fertiliser | R/year | 216,546–427,402 |

| Grow media | R/year | 222,168–557,353 |

| Seeds | R/year | 7,572,613–18,710,626 |

| CO2 | R/year | 406,384–555,778 |

| Total COGS | R/year | 14,152,192–25,731,525 |

| Scenarios | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Unit | TF | TM | LF | LM | LRI | TC | TPHB | TT | TTD | CC | |

| Revenue | R/year | 1,010,876–1,635,218 (producer price) 4,195,270–10,599,920 (hydroponic price) | 3,204,000,000–7,066,000,000 (miracle berry) 14,652,953–31,506,451 (sugar equivalent) | 729,257–1,996,895 (producer price) 10,945,263–28,962,000 (hydroponic price) | 1,081,285–3,011,150 (sugar equivalent) | 729,257–1,996,895 (producer price) 10,945,263–28,962,000 (hydroponic price) | 2,235,798–3,329,928 (producer price) 19,982–36,106 (methane) 4314–6521 (biodiesel) 26,086–120,392 (artemisinin) | 12,564–19,870 (polypropylene price) 49,878–86,110 (PHB price) | 25,231,351–48,806,539 (HBV antibody) | 27,519,590–51,613,595 (HBV antibody) | 50,999,614–225,340,789 |

| Cost of Cultivation a | R/year R/kg/year | 5,247,052–6,308,527 35–53 | 10,596,485–12,867,671 108–184 | 8,988,2645–10,783,088 40–101 | 8,988,2645–10,783,088 N/A | 8,643,900–10,298,222 (panels) 8,389,501–10,065,881 (grains) 8,042,543–9,582,324 (combined) 38–97 (panels) 37–96 (grains) 35–91 (combined) | 8,743,519–10,795,692 147–203 | 9,325,878–11,383,441 N/A | 9,371,340–11,435,940 N/A | 9,620,235–11,701,874 N/A | 16,702,559–28,286,586 455–1,480 (whole plant) 1,516–4,935 (leaves and inflorescences) |

| ROI | % | −36 (producer price) 11 (hydroponic price) | 17,600 (miracle berry) 37 (sugar equivalent) | −31 (producer price) 31 (hydroponic price) | −29 | 29 (panels) 33 (grains) 31 (combined) | N/A | N/A | 93 | 101 | 508 |

| Payback Period b | years | 9 (hydroponic price) | 0.006 (miracle berry) 3 (sugar equivalent) | 3.23 (hydroponic price) | N/A | 3.45 (panels) 3.03 (grains) 3.23 (combined) | N/A | N/A | 1.1 | 1.0 | 0.20 |

| Capital for uncertainty | R/year | −1,624,654–4,871,751 (hydroponic price) | 3,031,137–19,655,509 (sugar equivalent) | 1,194,202–18,899,854 (hydroponic price) | N/A | 1,633,439–19,341,092 (panels) 1,738,310–19,692,730 (grains) 2,160,251–20,086,477 (combined) | N/A | N/A | 14,870,937–38,352,675 | 16,888,055–41,009,508 | 31,597,483–199,523,749 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pesch, H.; Louw, L. Evaluating the Economic Feasibility of Plant Factory Scenarios That Produce Biomass for Biorefining Processes. Sustainability 2023, 15, 1324. https://doi.org/10.3390/su15021324

Pesch H, Louw L. Evaluating the Economic Feasibility of Plant Factory Scenarios That Produce Biomass for Biorefining Processes. Sustainability. 2023; 15(2):1324. https://doi.org/10.3390/su15021324

Chicago/Turabian StylePesch, Heino, and Louis Louw. 2023. "Evaluating the Economic Feasibility of Plant Factory Scenarios That Produce Biomass for Biorefining Processes" Sustainability 15, no. 2: 1324. https://doi.org/10.3390/su15021324

APA StylePesch, H., & Louw, L. (2023). Evaluating the Economic Feasibility of Plant Factory Scenarios That Produce Biomass for Biorefining Processes. Sustainability, 15(2), 1324. https://doi.org/10.3390/su15021324