Abstract

Considering carbon neutral development strategies, ecological ports and green growth concepts have become the future development trend of ports. As an important technology for green port construction, the stable operation of port shore power systems is particularly important. However, as a new field of transmission system, the development of port shore power is also facing many new risks and challenges. For example, the shore power system has security risks as well as technical and economic difficulties. There are also problems such as the lack of regulations on shore power systems. To ensure the safe and stable operation of a port grid system, this paper proposes a risk decision method for a transmission system in a market environment based on interval number and cumulative prospect theory. Based on the constructed risk evaluation index system of a port shore power supply system, a risk decision model based on cumulative prospect theory and an improved gray target risk model (CPT-IGT) are constructed considering the uncertainty and ambiguity of the index attributes and weight information as well as the risk attitude held by decision-makers; these models are developed with improved interval gray number and cumulative prospect theory. Finally, a case study applied to the risk decision of a port shore power supply system verified the reasonableness and effectiveness of the method. The results show that the proposed method has some advantages in dealing with language terms, representing language uncertainty, and reflecting risk decisions in different environments. The research can provide a theoretical basis for the risk assessment of a port power system in the future and provide suggestions for the green growth of the port.

1. Introduction

As a result of carbon neutral development strategies, ecological ports and green growth concepts have become the future development trend of ports, promoting the use of clean energy generation and grid connections in ports. According to statistics, the global port shore power market reached 1340.1 million dollars in 2022 and is expected to reach 2351.2 million dollars by 2030 [1], which shows that port shore power is a rapidly growing market. The port shore power supply system is a new field of transmission system, and its development also faces many new risks and challenges. For example, shore power systems use high-voltage transmission technology, which can create safety hazards for people on board and on shore. For some economically underdeveloped areas, there are technical and economic difficulties in installing shore power. In some areas, the lack of regulations cannot incentivize the construction of shore power in ports. In addition, for shipowners, the installation of on-board equipment to receive shore power will be considered from an economic point of view. The risk assessment and decision-making research of a port shore power transmission system is helpful for the safe and stable operation of a port grid system (namely transmission systems), and also has important significance for the safety and stability of the whole grid system.

Many scholars have conducted extensive research on port shore power technology and transmission system risk assessment. Shore power equipment and technology have been studied by scholars to reduce emissions from ships in ports. First, the financial [2], environmental [3,4], and socio-economic [5] impacts of port power were quantified, and shore power was identified as having significant benefits in these areas. However, the use of shore power systems will cause a large amount of harmonic content, which needs to be managed to avoid impact on electric utilities [6]. In addition, some scholars have studied the challenges faced by the installation of port shore power. The main risks of port power are outlined as follows. Terminals often do not consider providing space for shore power sub-stations and cable trays. Shore power system equipment is relatively expensive, and some port power investment has economic and technical difficulties. Liquefied natural gas (LNG) or other alternative energy sources may be more cost-effective and practical [7]. Moreover, port shore power involves many stakeholders, and the development of shore power needs to consider the influence of these subjects. It can be seen from the study that in the case of medium to high fuel prices, ship operators have an economic incentive to use shore power. Emission reduction regulations in port areas will also encourage port and ship operators to invest in shore power [8]. At present, any relevant studies have mainly analyzed the economic and social benefits of shore power and the challenges faced by shore power [9,10,11], and have rarely analyzed the risks generated by a shore power system.

After summarizing the available studies, it was found that the existing literature mainly concerns the economic and social benefits of port shore power, and concerns less the risks of port shore power. However, with the development of port shore power, its transmission network has generated more risks and needs to be studied. In recent years, large-scale renewable energy sources have been connected to the port grid, achieving the goals of safety and reliability and the economic and environmental protection of port shore power network systems. As the scale of electricity consumption continues to expand, the structure becomes increasingly complex, and an increasing number of variable factors increases the potential risks of the transmission system; these risks can be described as follows [12]: (1) Transmission equipment risk. The quality and reliability of early transmission equipment is poor, which causes certain risks for the safety of the transmission system. (2) Network structure risk. For example, the technical level of some power supply enterprises to set up the grid is low; as long as any unit in the grid structure fails to operate, it will have a serious impact on the work of the entire distribution network. (3) Spare capacity risk. In the process of regional development, there is often imbalance between power demand and power supply, which may lead to the risk of insufficient power supply. (4) Renewable energy access risks. Because the supply of renewable energy is affected by weather, season, and other factors, the electricity generated by it fluctuates greatly, which aggravates the instability of power grid voltage and the shortage of power grid peak load capacity.

In the transmission system risk assessment, there have been some studies on transmission system risk assessment. Transmission lines are often considered an important part of moving electricity from power plants to load centers. Some scholars have carried out simulation analyses on the cascade failure model to identify critical and highly-loaded lines whose failure can lead to cascading failures in power systems [13]. Some scholars also analyzed the probability and loss of transmission system risk emergencies by constructing multi-layer optimization models [14]. In addition, there have been some studies on the risk decision-making of the transmission system. By constructing an index system and using the Topsis method [15], the economic evaluation method [16], the entropy weight method [17], and other research methods, scholars evaluated transmission system projects to make decisions.

Throughout the research field of transmission system risk, relatively little research has been done on decision-making that incorporates influencing factors such as the ambiguity of human thinking, the variability of the external environment, and the attitude of decision-makers when facing risks. Prospect theory and the gray target model are effective methods to quantify the influencing factors of decision makers’ risk decisions, and they are also the methods used in this paper.

In 1979, Kahneman and Tversky [18] proposed prospect theory (PT). The main points of the theory are outlined as follows. People have inconsistent risk preference behaviors when facing gains and losses. They become risk seeking in the face of loss, but risk avoiding in the face of gain. The establishment and change of reference points affect people’s feelings of gain and loss, and then affect people’s decision-making. On this basis, Tversky and Kahneman [19] introduced the cumulative general function into prospect theory to form cumulative prospect theory (CPT), which was used to improve and develop prospect theory and provided the theoretical basis for this study.

In the study of risky decisions, the gray target model is an effective research method for selecting the decision with the best value from the bullseye in the region of satisfactory effects, and the closer to the bullseye the value is, the better the effect. In the 1980s, Deng [20] proposed the gray target decision method, which inspired the key research direction of decision problems in gray system theory [21]. Scholars have studied the traditional gray target model from different perspectives. Feng et al. [22] evaluated a gray target model by appraising a firm’s financial status based on Altman coefficients. Liu et al. [23] analyzed the insulation state of a solid insulated ring main unit using a modified gray target model. Wang [24] designed a dynamic gray target model for manufacturing resources and used it to analyze a networked manufacturing resource evaluation case. Jia et al. [25] evaluated the combat survivability of aircraft using a multi-attribute intelligent gray target model. Li et al. [26] proposed a risk-benefit collaborative decision model and analyzed its application in decision-making for load adjustment schemes. Guo et al. [27] studied vehicle path optimization using a gray target model.

In this paper, we study the risk decision problem of port shore power transmission systems and construct a combined model based on cumulative prospect theory and an improved gray target decision model for example analysis. Then, the proposed model is compared with the traditional gray target decision model to verify the reasonableness and comprehensiveness of the method for solving such decision problems. This paper applies the cumulative prospect theory and improved gray target decision model in the field of port shore power, which can provide a theoretical basis for the risk assessment of port shore power supply systems in the future, and provide reference for the successful investment of port shore power.

This paper consists of the following sections. The second section constructs the evaluation index system for risk decision assessment of the port shore power system. The third section describes the relevant theoretical knowledge of this paper, which is used in the later part. The fourth section presents the model design. The fifth section carries out the arithmetic analysis. The sixth section analyzes the conclusion.

2. Indicator System

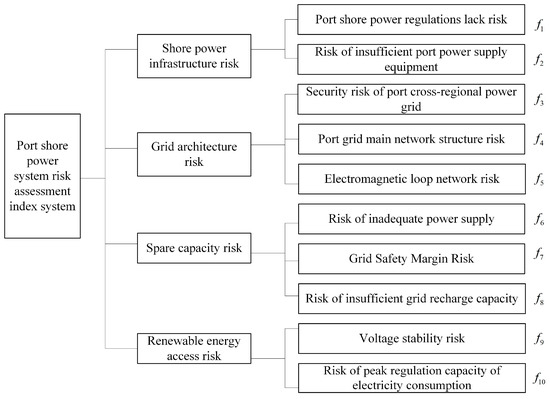

Based on the above analysis and with reference to the literature [12], the evaluation index system for the risk decision assessment of port shore power systems is obtained and shown in Figure 1. The specific indicators are explained as follows.

Figure 1.

Risk assessment index system of a port shore power supply system.

f1: There are technical and economic difficulties in installing shore power in some areas.

f2: Regulations in some areas are lacking, so there is no incentive for the construction of port shore power.

f3: With the development of the power grid and the increase of investment in the trans-regional power grid, the trans-regional transmission capacity of the port shore power grid has gradually increased, which has intensified the security risks of the trans-regional power grid of the transmission system.

f4: Port shore power requires space on the dock for shore power sub-stations and cable reels. It is difficult to install shore power if there is no reserved space in the port.

f5: The electromagnetic loop network refers to the parallel operation of two groups of lines with different voltage levels through the connection of the magnetic circuit of the transformer at both ends. The main hidden danger of the electromagnetic loop network is that large amounts of power flow pour into the lower voltage grid when the higher voltage grid is cut off, which can easily cause serious problems threatening the safe and stable operation of power systems.

f6, f7, f8: In the process of using shore power, ships need a lot of power supply, and there is often an imbalance between power demand and power supply, which leads to the risk of insufficient power supply and aggravates the risk of insufficient compensation capacity of the grid.

f9, f10: Because the supply of renewable energy is affected by weather, the season, and other factors, the generated power fluctuates greatly, which aggravates the instability of power grid voltage and the shortage of power grid peak load capacity.

3. Methodology

3.1. Interval Gray Number

Gray system theory is an effective methodology that can be used to solve uncertain problems with partially known information [28], and the number of gray intervals is a basic concept in the theory of gray systems.

3.1.1. Interval Gray Nature

When the amount of interval ash portrays the uncertainty of the information, the changes in the interval numbers and the effect of different possible distributions on the value in the interval are considered [29]. Therefore, the amount of interval ash to verify the meaning of decision-making information in the application is more abundant, which improves the accuracy of the decision-making. The definition is as follows:

Definition 1.

The amount of ash with both a lower bound and an upper boundary is called an interval gray number, and it is denoted as . If , then, the interval gray number degenerates to a constant.

In practice, the attribute values given by the decision-maker are generally non-negative interval gray numbers. In this paper, we draw on the corresponding definition in the literature [30] to address the quadratic and power operations on interval gray numbers.

3.1.2. Comparison Rules for Interval Gray Numbers

The comparison rules of interval gray numbers in this paper refer to Li et al. [12] and are defined as follows:

Definition 2.

Let both and be non-negative

interval gray numbers. If and satisfy , then we call ; otherwise, , where , and . When , .

Property 1.

, and are non-negative interval gray numbers; if and , then .

3.2. Cumulative Prospect Theory

In prospect theory, the prospect is the basic unit of study. The prospect can be expressed as [26], where x0 denotes the i-th possible outcome of the prospect; pi is the probability of occurrence of the corresponding outcome xi (1 ≤ i ≤ n), and the decision-making process of an individual is actually the “prospect” selection process. The literature [19] introduced cumulative general letters into prospect theory to form a cumulative prospect theory, which further improved and developed the content of prospects. The value function and decision-making weight function jointly determine the prospect value, which is an important part of accumulating the theory of prospects. Prospect theory assumes that people’s judgment of value is based on the benefits and losses of a reference point, not the absolute amount of resources. Therefore, the independent variable in the value function is relative to the benefits and losses of a reference point. The value function in the literature [19] can represent the decision-maker processes that tend to be widely used for risk evasion and income loss mitigation. The specific expression is as follows:

In Formula (1), is the deviation of result xi compared to the reference point x0. If xi > x0, it is defined as the income; when the number of bumps in a function is xi < x0, there is a decrease in sensitivity; parameters and represent the convexity degree of the power function of regional value of gain and loss, respectively, and indicates decreasing sensitivity; the coefficient is used to represent the characteristics when the loss area is steeper than the income area. indicates losses and aversion. If the results of the xi phase and the reference point x0 are expressed in the form of intuition trapezoidal blur, then it gives the following:

To use accumulated prospect theory, prospect f must be expressed as an orderly sequence based on the value of so that .

In accumulated prospect theory, the prospect V(f) is determined by the value function v and the decision-making weight function , which is as follows:

where, and represent the positive and negative parts of f, respectively, and and represent the positive and negative parts of , respectively.

In Formula (3), the decision-making weight can be found by the capacity function w; that is the following:

where and represent the positive and negative parts of , respectively.

For risk prospects, the w+ and w− functions given by reference [31] are as follows:

where , , and are model parameters.

To better solve the decision-making problem whose evaluation information is the interval ash, reference [19] provides the following definition:

Definition 3.

Here, and denote amounts of interval ash. Among them, and use the interval ash as the reference point; then, the prospect value function of the interval gray [32] is the following:

where and are model parameters.

In Formula (6), the distance D of the two-range ash is equal to .

3.3. Improved Gray Target Decision Model

3.3.1. Positive and Negative Bullseye Distance and Bullseye Spacing

Definition 4.

Let be the decision information evaluation value of scenario Ai under indicator xj, and ; then, x+ and x− are said to be the positive and negative bullseyes in the gray target decision, respectively, which are calculated as follows:

In Equation (7), the interval gray number and operations can be derived directly based on the rules for comparing the size of interval gray numbers in Definition 3.

Definition 5

([20]). Let be the evaluation value of the decision information in scenario Ai under indicator xj and . Then, and are said to be the bullseye distance between scenario Ai and the positive and negative bullseyes, and the solution formula is shown below:

In Equation (8), is the indicator weight.

Definition 6

([20]). Let x+ and x− be the positive and negative bullseye, respectively, and xD is the positive and negative bullseye spacing, whose calculation formula is shown below:

In Equation (9), is the indicator weight.

3.3.2. Comprehensive Judgment Distance

For decision solution Ai, consider Ai, positive bullseye x+ and negative bullseye x− as three points in space. Then, the distance from the solution to the positive bullseye, the distance from the solution to the negative bullseye, and the distance between the positive and negative bullseye can be regarded as three straight lines in space and satisfy . If the three lines are not colinear and they create a triangle, the projection of the distance between decision solution Ai and the positive bullseye on the positive and negative bullseye spacing xD is , where is the angle between the two lines of the positive bullseye spacing and the positive and negative bullseye spacing. Obviously, the smaller the projection, the closer the solution to the positive bullseye, and the farther from the negative bullseye, the better is the solution. The projection of the solution is denoted as the combined judging distance of the solution, which is defined in detail below:

Definition 7

([33]). Let x+ and x− be the positive and negative bullseye distances of scheme Ai and xD be the positive and negative bullseye distances; then, is said to be the comprehensive judging distance, and its solution formula is shown below.

In Equation (10), the smaller is, the smaller the projection and the better the scheme Ai.

3.3.3. Improved Method for Determining Weights

For weights, the traditional gray target model uses the gray entropy method [33] to determine the weight sequence of indicators. For the index weight coefficient , the corresponding gray entropy can be defined as follows: . According to the maximum entropy theorem, should be adjusted to minimize the uncertainty of and thus maximize the .

In order to consider objective decision evaluation information more comprehensively, this paper constructs an optimization model to solve the weight and provides a new weight determination method. The detailed steps are shown as follows.

Step 1. Assume the weight coefficient of the optimal criterion is known and construct the optimization model with the idea of deviation maximization. The principle is as follows: the attribute value difference of the decision scheme under a certain index is small, indicating that the index plays a small role in the ranking of the decision scheme and has a small weight, and vice versa. Its optimization model is shown below:

It should be noted that Equation (11) adopts the interval gray number distance formula in the literature [12].

Step 2. Considering the spatial proximity between the effect measure of the decision scheme and the positive bullseye, the sum of the comprehensive evaluation distances of the scheme should be minimized, and the target optimization model can be obtained as follows:

In Equation (12), the distance between positive and negative bullseye x+ and x− and the distance between bullseye xD can be obtained from Definitions 5 and 6 above.

To comprehensively consider the evaluation information of decision-makers, the above two optimization models are transformed into an equivalent single objective optimization model, as shown below:

In Equation (13), and represent the relative importance of the two optimization models. To ensure fair competition between the two optimization objective functions, is chosen. MATLAB programming is used to obtain the optimal weight coefficient .

4. Model Design

4.1. Description of the Problem

A multicriteria gray target risk decision-making problem is set, in which n schemes constitute scheme set and m indicators constitute the index set . The attribute value of scheme Ai to index fj is interval gray number . Since the decision problem relies heavily on the uncertain changes in the external operating environment and the market environment, this paper comprehensively considers the decision problem facing s possible market states, which constitute the state set . In the hth state, the probability of occurring is the interval gray number , and the decision value of scheme Ai for indicator fj in state is the interval gray number . Therefore, the decision effect matrix in s market states can be obtained to determine the optimal ranking of the solution set A.

4.2. Decision-Making Step

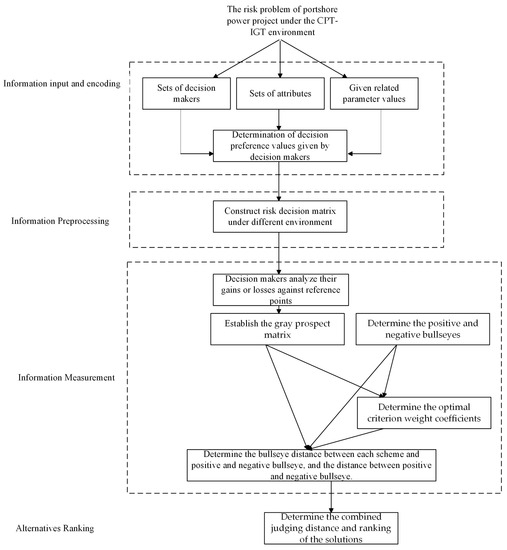

Based on the above problems, the steps of the interval number gray target risk decision model based on cumulative prospect theory constructed in this paper are shown in Figure 2.

Figure 2.

The flowchart of the CPT-IGT framework.

Step 1. Give the risk decision matrix for each scenario in s market states.

Step 2. Determine the gray prospect decision matrix. In practical decision-making, decision-makers judge their own “gain” or “loss” by reference points and use other alternatives as reference points to derive the gray prospect matrix.

The cumulative prospect value function obtained according to Equation (5) in Definition 3 is solved as follows:

The probability weight function is solved by the following equation:

Accordingly, the formula for solving the gray prospect value for each scenario under each indicator can be obtained as follows:

where and result in a gray foreground decision matrix .

Step 3. Determine the positive and negative bullseyes. According to Definitions 4 and 6, the solution equations for positive bullseye and negative bullseye are derived as follows:

Step 4. Determine the optimal criterion weight coefficients. The gray cumulative prospect matrix, the positive and negative bullseye distances for each scenario, and the positive and negative bullseye distances are substituted into the optimization model in (13) and programmed using MATLAB 2017a software to derive the optimal criterion weight coefficients .

Step 5. Determine the bullseye distance between each scheme and positive and negative bullseye, and the distance between positive and negative bullseye. The positive and negative bullseye and gray foreground matrices are considered in Definitions 4–6, and the positive bullseye distance , negative bullseye distance and positive and negative bullseye distance xD are found for each scheme.

Step 6. Determine the combined judging distance and ranking of the solutions. The positive and negative bullseye distance and the positive and negative bullseye distance are substituted into Equation (10) to obtain the comprehensive evaluation distance for each solution, while the solution set is ranked according to the principle that states: “the smaller is, the better the solution”. Finally, the best solution in the solution set is obtained.

5. Case Study

5.1. An Illustrative Example about Port Shore Power Project Risk

This paper takes as an example the construction of a port shore power project in a container port area of a hub port along the coast of China, where the power grid company within the port’s territorial jurisdiction intends to evaluate the port’s investment in the construction of a power supply grid project. There are three power supply systems among them with construction option set , each with a negligible difference in investment cost, and the main consideration is the impact of their risk factors. In recent years, power systems have been increasingly affected by the external operating environment and the market environment. Therefore, to comprehensively consider the risks to the transmission system caused by different operating environments and according to the research needs, this paper evaluates a port shore power supply system by hiring an expert group with reference to the evaluation index in Figure 1. Among them, the risk of insufficient port power supply equipment (f2) is expressed by the number of insufficient power supply equipment (unit: sets). The port grid main network structure risk (f4) is expressed by the insufficient floor space of the port power supply equipment (unit: m2). The risk of inadequate power supply (f6) is expressed in the quantity of insufficient power supply capacity (unit: kVa). The risk of peak regulation capacity of electricity consumption (f10) is expressed as the percentage of electricity generation from renewable sources (unit: %). Other indicator risk values are scored by experts. The expert group determined a scenario with the least risk to the transmission system of a power supply system in three external operating environments, good, medium, and poor. Among them, the score given is the interval gray number, ranging from 0 to 1. The obtained gray assessment data are shown in Table 1. As can be seen from Table 1, in a good external environment, the risk of each indicator of the scheme is relatively lower than that of other external environments.

Table 1.

Decision matrix of the three external operation environment states of the port shore power supply system.

In order to eliminate the influence of the index dimension on the decision results, the following formula can be used to convert the decision matrix X into the matrix Z:

where, if and are actual values, and take the values obtained by Formula (18), otherwise take the values obtained by Formula (19).

According to Equations (14) and (15), the interval gray number prospect value function and the probability weight function , with other alternatives as reference points, are taken as the values of each parameter: , = 2.25, = 0.61, and = 0.69; thus, the interval gray number prospect decision matrix is calculated, as shown in Table 2.

Table 2.

Gray prospect decision matrix.

Based on Definition 4 and the optimal decision principle of cost-based indicators, the positive bullseye and negative bullseye values of the indicator set are shown below:

{[−1.1776, −0.7285], [−0.2321, −0.0225], [−1.3466, −0.8484], [−1.0591, −0.6557], [−0.4039, −0.3777], [−0.9926, −0.6254], [−0.9544, −0.8530], [−0.4937, −0.2453], [−0.3137, −0.2543], [−0.8787, −0.7145]}.

{[0.3284, 0.5064], [0.4379, 0.4794], [0.3786, 0.4381], [−0.4039, −0.3777], [−0.2097, −0.0427], [0.3644, 0.4144], [−0.0164, 0.1019], [0.2505, 0.3800], [0.3930, 0.6018], [0.3771, 0.5724]}.

Substituting the gray foreground decision matrix and the positive and negative bullseye into Model (9), the optimal criterion weight coefficients = {0.0392, 0.4414, 0.0308, 0.0173, 0.0449, 0.0569, 0.0270, 0.1038, 0.1798, 0.0589} are programmed and solved in this paper using MATLAB 2017a.

Each scenario is solved according to Step 5. (i) The positive bullseye distance is obtained as = 0.7944, = 0.2164, = 0.9186. (ii) The negative bullseye distance is obtained as = 0.7233, = 1.3014, = 0.6153. (iii) The positive and negative bullseye distance is obtained as xD = 1.5178.

Substituting the positive and negative bullseye distances and bullseye spacing for each scenario into Definition 7, the final combined judged distances of the scenarios are xA1 = 0.1959, xA2 = 0.0269, xA3 = 0.4149.

Based on the principle that the smaller the comprehensive evaluation distance is, the better the scheme, the schemes are ranked as follows: A2 > A1 > A3. Therefore, scheme A2 is the optimal scheme, that is, the transmission risk of transmission system A2 is the smallest.

By analyzing A2 scheme specifically, it is found that A2 scheme performs better in the aspects of power supply equipment risk and network architecture, indicating that these two secondary indexes are the key factors in port shore power risk decision-making. Therefore, the proposal for the development of port shore power is put forward. On the one hand, in order to enhance the construction of the port shore power infrastructure, funds can be invested in the construction of port shore power facilities through government procurement and private investment. On the other hand, the government should formulate policies to encourage the development of port shore power, such as granting tax concessions to ships using shore power and subsidizing the construction costs of port shore power. In addition, space should be reserved for the development of port shore power in the planning of new terminals, and the port shore power network structure should be properly planned.

5.2. Comparative Analysis

To illustrate the rationality and effectiveness of this method, the proposed method in this paper is compared and analyzed with the traditional gray target decision model proposed in the literature [33]. Since the traditional gray target decision model cannot synthesize three different external environments of good, medium, and poor, this paper ranks the whole scenario by using the results obtained from the solution of the traditional gray target decision model for the market state under the above three external environments. Among them, the index weights are the same as the results of obtained by the method in this paper, and the ranking results are shown in Table 3.

Table 3.

Ranking results of the traditional gray target model in three external environments.

The method proposed in this paper is compared with the results obtained from the traditional gray target decision model in the literature [33], and the following conclusions are obtained.

(1) The method proposed in this paper fully takes into account the different external environments that decision-makers need to face and the different subjective attitudes toward risk and other influencing factors; decision-makers apply risk avoidance when facing gains and preferred outcomes and higher sensitivity when facing losses, which is more in line with reality. The traditional gray target model does not take into account the different subjective risk attitudes held by decision-makers in different external environments and assumes that decision-makers hold the same risk preferences for losses and gains, which is somewhat inconsistent with reality.

(2) In this paper, we consider three kinds of external environments: good, medium, and poor, and conclude that the risk of the solution is the lowest. The traditional gray target model only draws corresponding conclusions for different states, and the decision results in the above three states are different, so it is difficult to draw a definite and uniform conclusion.

(3) The traditional gray target model is solved by the gray entropy method, while this paper solves the index weight coefficients more objectively by constructing a difference maximization model, which is methodologically superior.

In addition, in order to evaluate the effectiveness of the proposed method, it is compared with three existing decision-making methods in transmission system risk decision-making research. Three representative methods are selected for comparison: improved Topsis method proposed by Niu et al. [15], economic evaluation method based on Monte Carlo simulation proposed by González et al. [16], and decision method based on entropy weight method and system dynamics proposed by Zhang et al. [17]. As shown in Table 4, the research in this paper has the following characteristics.

Table 4.

Characteristics of the proposed method and other decision-making methods.

(1) The methods proposed by Niu et al. [15], González et al. [16], and Zhang et al. [17] have some advantages, but in general, they focus on economic benefit assessment to make optimal decisions. The proposed method takes into account the many risk factors existing in the transmission system and the special risks of port power, and then constructs an index system to make a comprehensive evaluation under different risk environments. Therefore, the proposed method is more suitable for the risk decision-making problem of shore power.

(2) The proposed method shows some advantages in dealing with language terms and in representing language uncertainty. As mentioned earlier, different people have different meanings for language. Moreover, the weights extracted from the language should contain information about uncertainty. On this point, the language processing models proposed by Niu et al. [15], González et al. [16], and Zhang et al. [17] do not show this information. The proposed method shows this information.

(3) The proposed method has some advantages in reflecting risk decision-making in different environments. In reality, the environment where the decision is made is uncertain, and the risk decision needs to consider the impact of the environment. However, in Niu et al. [15], the influence of different environments on risk decision-making is not considered. González et al. [16], Zhang et al. [17], and the proposed method take into account the effects of different environments.

(4) The proposed method does not consider the sensitivity analysis of indicators. González et al. [16] consider the sensitivity of indicators. However, the proposed method does not analyze the sensitivity of indicators and the importance of indicators in risk decision-making, which needs to be improved.

6. Conclusions

With the development of peak carbon and carbon neutral strategies, new equipment and technology for large-scale transmission systems have been continuously developed and financed, creating intelligent transmission systems and complex system terminal environments. Moreover, this implies that intelligent transmission systems are more vulnerable to the external environment, and the systems have increased risks. This paper takes a port shore power supply system as the research background; applies external environment uncertainty considerations in the risk impact and ambiguity study of transmission systems; uses interval number theory, cumulative prospect theory, and gray target theory; it then constructs an improved gray target decision model based on the interval number of cumulative prospect theory to conduct risk-based decision research on the port shore power supply system. Moreover, an arithmetic example is used to compare the proposed model with the traditional gray target model to show that the decision model is more reasonable and comprehensive. The specific advantages and contributions of this paper are summarized below.

First, the proposed method is studied according to the actual risk factors of a shore power system and is more suitable for the risk decision-making problem of shore power.

Second, the proposed method has some advantages in dealing with language terms, representing language uncertainty, and reflecting risk decisions in different environments.

Third, this paper applies prospect theory and the gray target model to the study of port shore power, which can provide a theoretical basis for the risk assessment of a port power supply system in the future, and provide suggestions for the realization of green growth of ports.

However, there are still some problems in this paper that need to be improved in the future outlined below. (1) This paper does not have a detailed analysis of the risks of various situations of the shore power system. In the future, we can further analyze the risks in different environments from the aspects of probability and harm degree. (2) The sensitivity of each indicator and the importance of each indicator are not analyzed. Further research on the indicators is needed in the future.

Author Contributions

Conceptualization, C.D. and T.L.; methodology, T.L.; software, T.L.; validation, C.D.; formal analysis, C.D.; investigation, C.D. and T.L.; resources, C.D. and T.L.; data curation, C.D.; writing—original draft preparation, C.D.; visualization, C.D.; supervision, C.D.; project administration, C.D.; writing—review and editing, C.D. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Talent introduction research fund, China under Zhejiang Ocean University [JX6311180823].

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Global Information. Available online: https://www.giiresearch.com/report/dmin1285071-global-shore-power-market.html (accessed on 17 August 2023).

- Sciberras, E.A.; Zahawi, B.; Atkinson, D.J. Electrical characteristics of cold ironing energy supply for berthed ships. Transp. Res. Part D 2015, 39, 31–43. [Google Scholar] [CrossRef]

- Ballini, F.; Bozzo, R. Air pollution from ships in ports: The socio-economic benefit of cold-ironing technology. Res. Transp. Bus. Manag. 2015, 17, 92–98. [Google Scholar] [CrossRef]

- Vaishnav, P.; Fischbeck, P.S.; Morgan, M.G.; Corbett, J.J. Shore power for vessels calling at US ports: Benefits and costs. Environ. Sci. Technol. 2016, 50, 1102–1110. [Google Scholar] [CrossRef] [PubMed]

- Winkel, R.; Weddige, U.; Johnsen, D.; Hoen, V.; Papaefthimiou, S. Shore side electricity in Europe: Potential and environmental benefits. Energy Policy 2016, 88, 584–593. [Google Scholar] [CrossRef]

- Kotrikla, A.M.; Lilas, T.; Nikitakos, N. Abatement of air pollution at an aegean island port utilizing shore side electricity and renewable energy. Mar. Policy 2017, 75, 238–248. [Google Scholar] [CrossRef]

- Innes, A.; Monios, J. Identifying the unique challenges of installing cold ironing at small and medium ports—The case of Aberdeen. Transp. Res. Part D 2018, 62, 298–313. [Google Scholar] [CrossRef]

- Zis, T.P. Prospects of cold ironing as an emissions reduction option. Transp. Res. Part A 2019, 119, 82–95. [Google Scholar] [CrossRef]

- Roberts, T.; Williams, I.; Preston, J.; Clarke, N.; Odum, M.; O’Gorman, S. Ports in a Storm: Port-City Environmental Challenges and Solutions. Sustainability 2023, 15, 9722. [Google Scholar] [CrossRef]

- He, Z.; Lam, J.S.L.; Liang, M. Impact of Disruption on Ship Emissions in Port: Case of Pandemic in Long Beach. Sustainability 2023, 15, 7215. [Google Scholar] [CrossRef]

- Antunes, T.A.; Castro, R.; Santos, P.J.; Pires, A.J. Standardization of Power-from-Shore Grid Connections for Offshore Oil & Gas Production. Sustainability 2023, 15, 5041. [Google Scholar]

- Li, C.; Chai, Y.; Qi, Z. Improved Grey Target Risk Decision Model in Smart Transmission System Based on Prospect Theory. Oper. Res. Manag. Sci. 2014, 3, 83–90. (In Chinese) [Google Scholar]

- Fekri, M.; Nikoukar, J.; Gharehpetian, G.B. Vulnerability risk assessment of electrical energy transmission systems with the approach of identifying the initial events of cascading failures. Electr. Power Syst. Res. 2023, 220, 109271. [Google Scholar] [CrossRef]

- Ding, T.; Li, C.; Yan, C.; Li, F.; Bie, Z. A bilevel optimization model for risk assessment and contingency ranking in transmission system reliability evaluation. IEEE Trans. Power Syst. 2016, 32, 3803–3813. [Google Scholar] [CrossRef]

- Niu, D.; Song, Z.; Wang, M.; Xiao, X. Improved TOPSIS method for power distribution network investment decision-making based on benefit evaluation indicator system. Int. J. Energy Sect. Manag. 2017, 11, 595–608. [Google Scholar] [CrossRef]

- González, J.S.; Payán, M.B.; Santos, J.R. Optimum design of transmissions systems for offshore wind farms including decision making under risk. Renew. Energy 2013, 59, 115–127. [Google Scholar] [CrossRef]

- Zhang, L.; Wu, J.; Zhang, J.; Su, F.; Bian, H.; Li, L. A dynamic and integrated approach of safety investment decision-making for power grid enterprises. Process Saf. Environ. Prot. 2022, 162, 301–312. [Google Scholar] [CrossRef]

- Kahneman, D.; Tversky, A. Prospect theory: An analysis of decision under risk. Economica 1979, 47, 263–291. [Google Scholar]

- Tversky, A.; Kahneman, D. Advances in prospect theory: Cumulative representation of uncertainty. J. Risk Uncertain. 1992, 5, 297–323. [Google Scholar] [CrossRef]

- Deng, J.L. Control problems of grey systems. Syst. Control Lett. 1982, 1, 288–294. [Google Scholar]

- Liu, S.F.; Lin, Y. Grey Information: Theory and Practical Applications; Springer: London, UK, 2006. [Google Scholar]

- Feng, J.Y.; Zhang, H. Grey target model appraising firms’ financial status based on altman coefficients. J. Grey Syst. 2006, 18, 133–142. [Google Scholar]

- Liu, S.X.; Cao, Y.D.; Hou, C.G.; Liu, X.; Li, J. Application of improved gray target theory based assessment on insulation state of solid-insulated ring main unit. J. Power Syst. Technol. 2013, 37, 3577–3583. [Google Scholar]

- Wang, B.; Tao, J.L.; Liu, D.F.; Chen, X.B. Dynamic evaluation model of networked manufacturing resources based on grey target decision. Inf. Technol. J. 2013, 12, 534. [Google Scholar]

- Jia, L.; Tong, Z.; Wang, C.; Li, S. Aircraft combat survivability calculation based on combination weighting and multiattribute intelligent grey target decision model. Math. Probl. Eng. 2016, 2016, 8934749. [Google Scholar] [CrossRef]

- Li, R.; Jiang, Z.; Ji, C.; Li, A.; Yu, S. An improved risk-benefit collaborative grey target decision model and its application in the decision making of load adjustment schemes. Energy 2018, 156, 387–400. [Google Scholar] [CrossRef]

- Guo, K.; Hu, S.; Zhu, H.; Tan, W. Industrial information integration method to vehicle routing optimization using grey target decision. J. Ind. Inf. Integr. 2022, 27, 100336. [Google Scholar] [CrossRef]

- George, W.; Richard, G. Curvature of the probability weighting function. Manag. Sci. 1996, 42, 1676–1690. [Google Scholar]

- Alefeld, G.; Mayer, G. Interval analysis: Theory and applications. J. Comp. Appl. Math. 2000, 121, 421–464. [Google Scholar] [CrossRef]

- Luo, D. Decision-making Methods with Three-parameter Interval Grey Number. Syst. Eng. Theory Pract. 2009, 29, 124–130. [Google Scholar] [CrossRef]

- Zhang, X.; Fan, Z.P. A Method for Risky Interval Multiple Attribute Decision Making on Prospect Theory. Oper. Res. Manag. Sci. 2012, 3, 44–50. (In Chinese) [Google Scholar]

- Wang, J.Q.; Zhou, L. Grey-stochastic multi-criteria decision-making approach based on prospect theory. Syst. Eng. Theory Pract. 2010, 9, 1658–1664. (In Chinese) [Google Scholar]

- Song, J.; Dang, Y.; Wang, Z.; Zhang, K. New decision model of grey target with both the positive clout and the negative clout. Syst. Eng. Theory Pract. 2010, 10, 1822–1827. (In Chinese) [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).