How Do Global Uncertainties Spillovers Affect Leading Renewable Energy Indices? Evidence from the Network Connectedness Approach

Abstract

:1. Introduction

2. Literature Review

3. Methodology

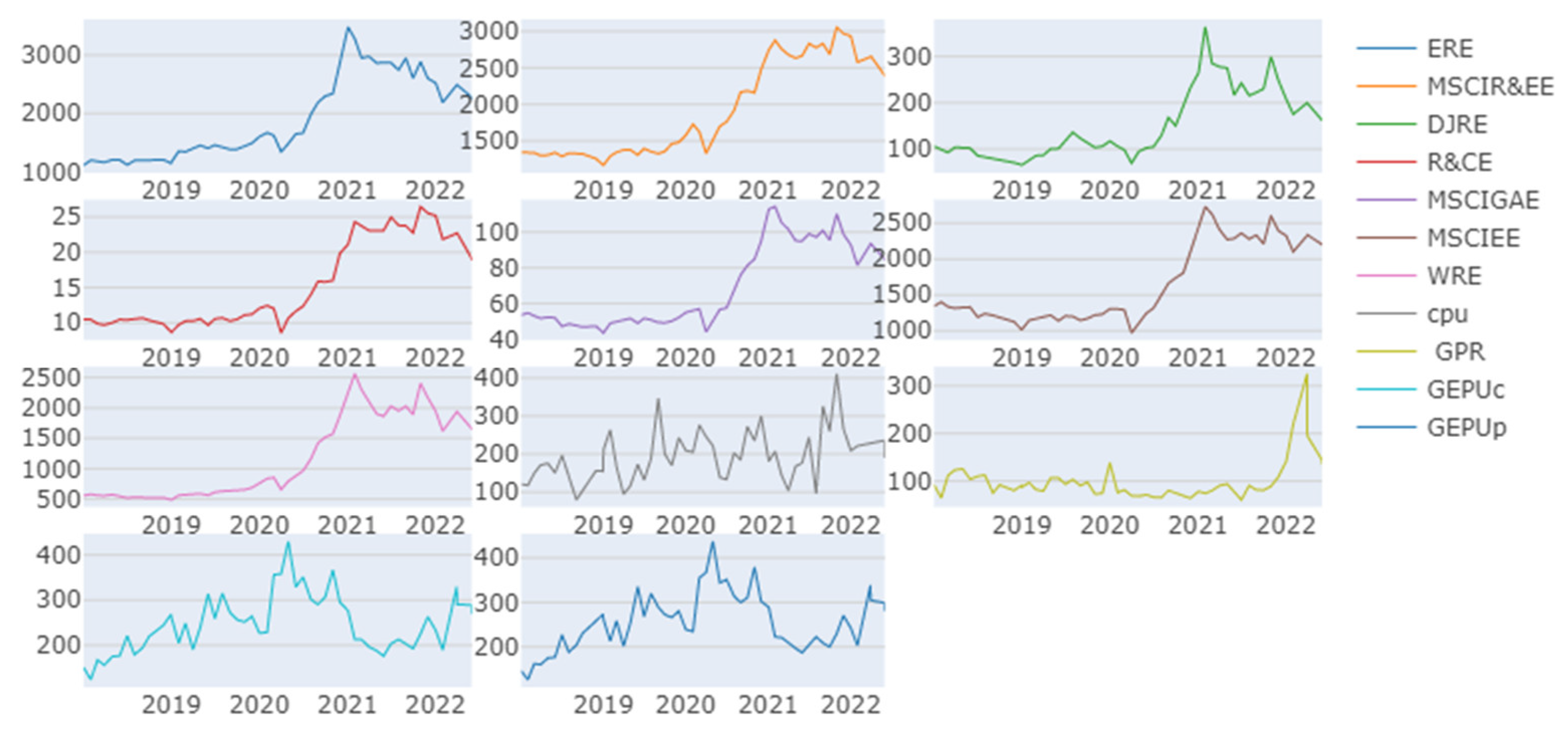

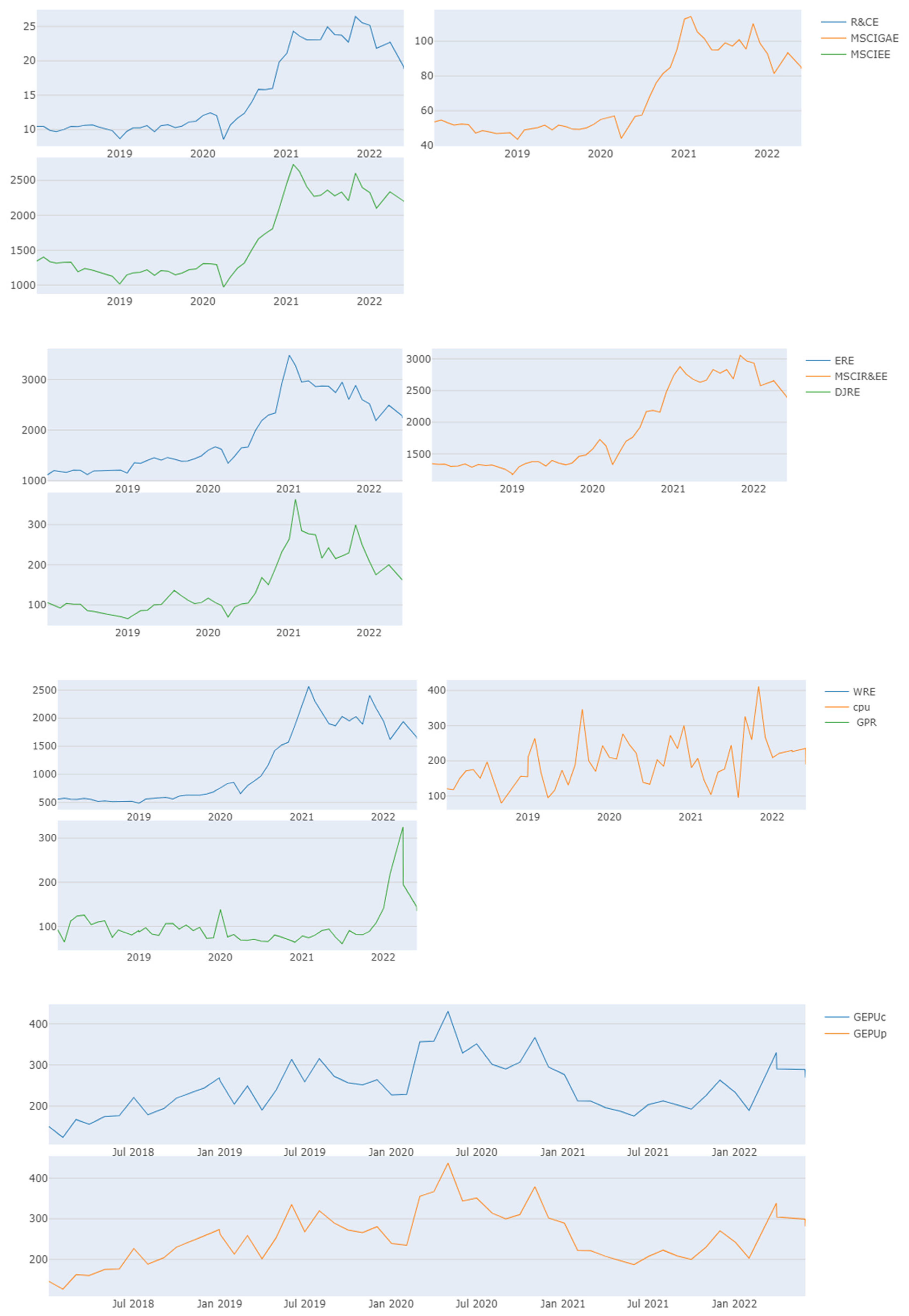

3.1. Data Description

3.2. Model Description

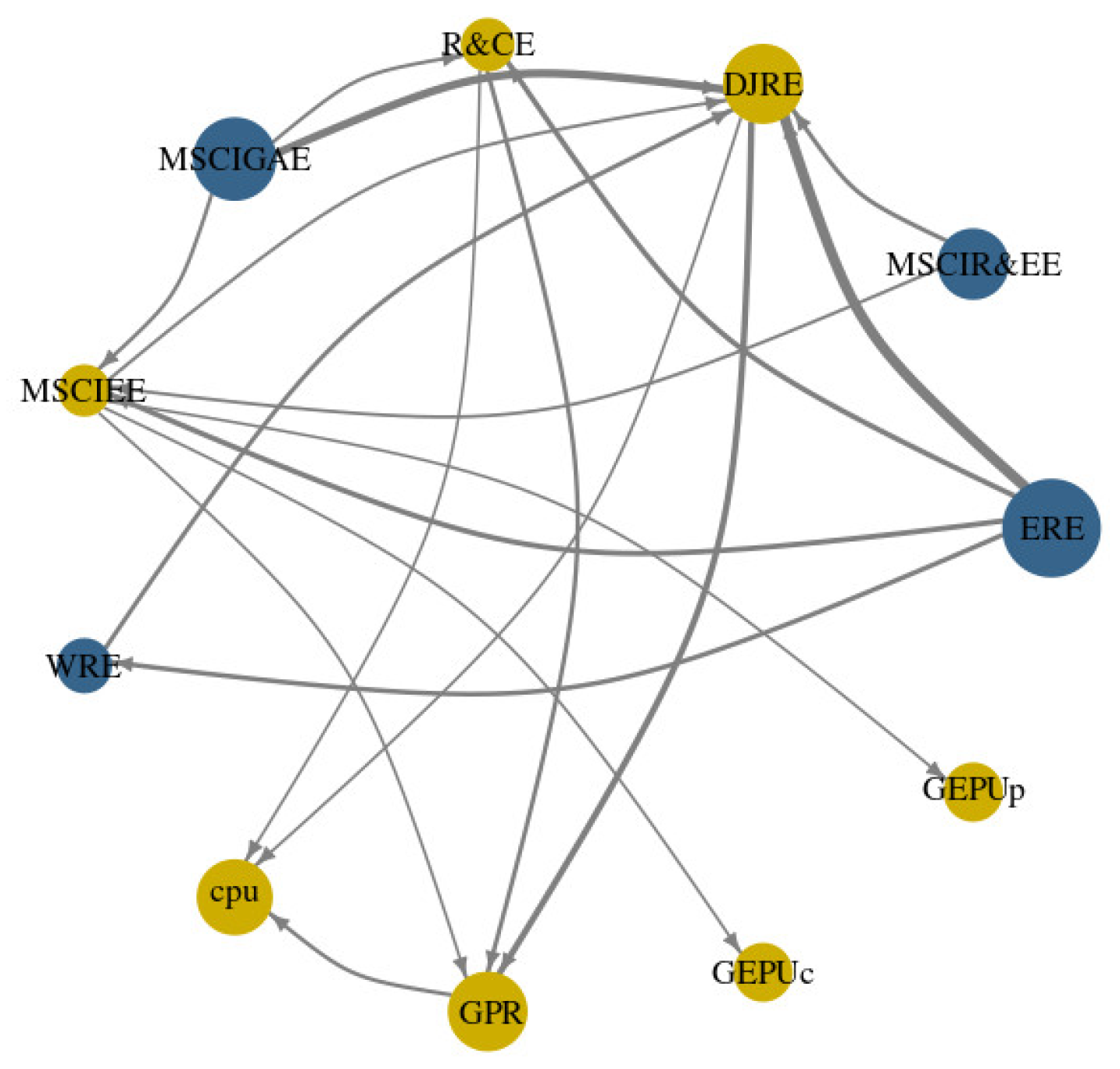

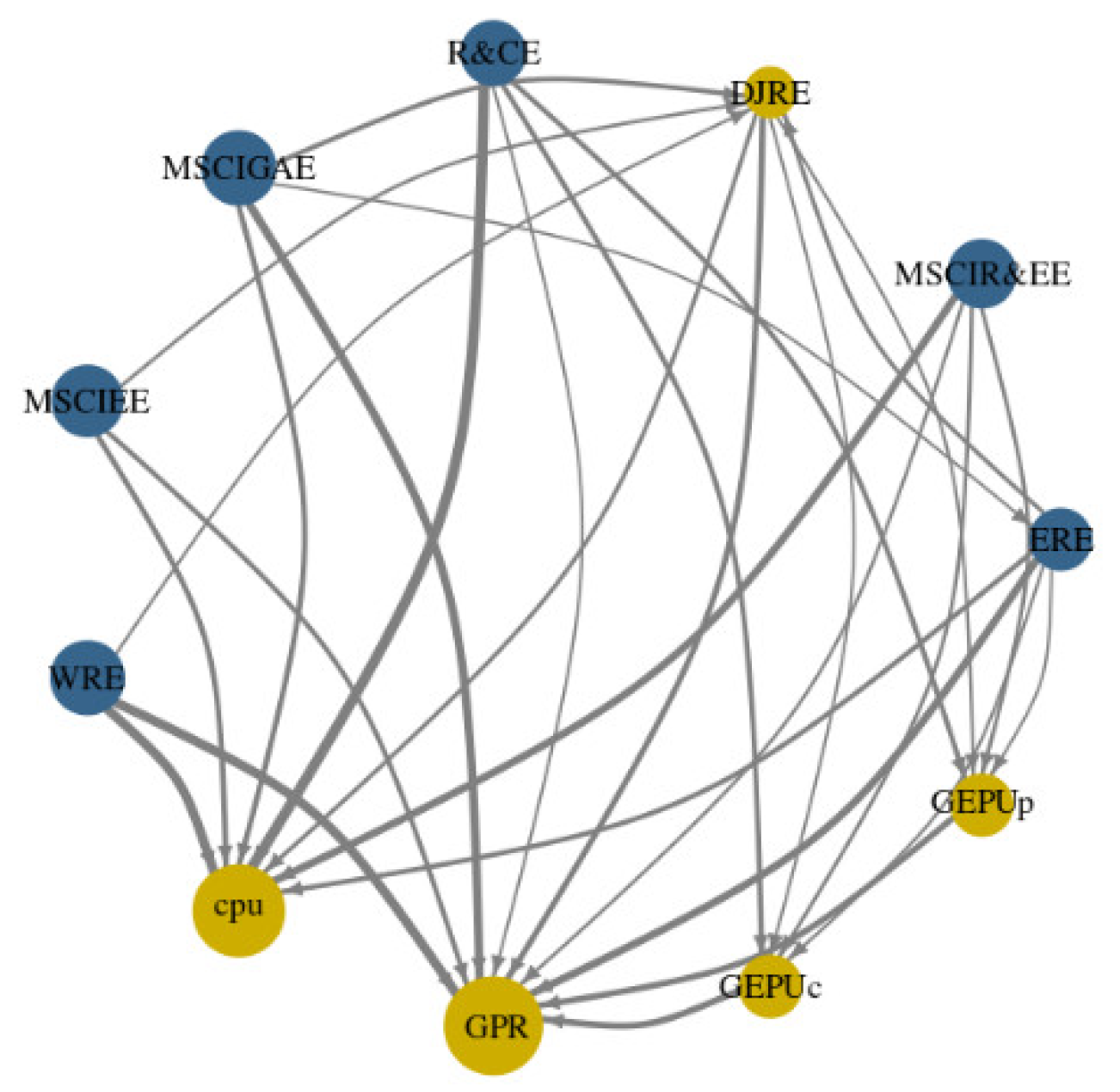

4. Results and Discussion

5. Conclusions and Policy Implications

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Xu, X.; Wei, Z.; Ji, Q.; Wang, C.; Gao, G. Global renewable energy development: Influencing factors, trend predictions, and countermeasures. Resour. Policy 2019, 63, 101470. [Google Scholar] [CrossRef]

- García-Álvarez, M.T.; Moreno, B.; Soares, I. Analyzing the environmental and resource pressures from European energy activity: A comparative study of EU member states. Energy 2016, 115, 1375–1384. [Google Scholar] [CrossRef]

- Liu, J.; Ma, F.; Tang, Y.; Zhang, Y. Geopolitical risk and oil volatility: A new insight. Energy Econ. 2019, 84, 104548. [Google Scholar] [CrossRef]

- Hemrit, W.; Benlagha, N. Does the renewable energy index respond to the pandemic uncertainty? Renew. Energy 2021, 177, 336–347. [Google Scholar] [CrossRef]

- Inglesi-Lotz, R. The impact of renewable energy consumption to economic growth: A panel data application. Energy Econ. 2016, 53, 58–63. [Google Scholar] [CrossRef]

- Lambert, R.J.; Silva, P.P. The challenges of determining the employment effects of renewable energy. Renew. Sustain. Energy Rev. 2012, 16, 4667–4674. [Google Scholar] [CrossRef]

- Kinab, E.; Elkhoury, M. Renewable energy use in Lebanon: Barriers and solutions. Renew. Sustain. Energy Rev. 2012, 16, 4422–4431. [Google Scholar] [CrossRef]

- Payne, J.E.; Truong, H.H.D.; Chu, L.K.; Doğan, B.; Ghosh, S. Economic complexity and energy security affect energy efficiency measures: Evidence from panel quantile analysis. Energy Policy 2023, 177, 113547. [Google Scholar] [CrossRef]

- Aguirre, M.; Ibikunle, G. Determinants of renewable energy growth: A global sample analysis. Energy Policy 2014, 69, 374–384. [Google Scholar] [CrossRef]

- Li, R.; Wang, Q.; Liu, Y.; Jiang, R. Per-capita carbon emissions in 147 countries: The effect of economic, energy, social, and trade structural changes. Sustain. Prod. Consum. 2021, 27, 1149–1164. [Google Scholar] [CrossRef]

- Hoang, A.T.; Nižetić, S.; Olcer, A.I.; Ong, H.C.; Chen, W.H.; Chong, C.T.; Nguyen, X.P. Impacts of COVID-19 pandemic on the global energy system and the shift progress to renewable energy: Opportunities, challenges, and policy implications. Energy Policy 2021, 154, 112322. [Google Scholar] [CrossRef] [PubMed]

- Shekhar, J.; Suri, D.; Somani, P.; Lee, S.J.; Arora, M. Reduced renewable energy stability in India following COVID-19: Insights and key policy recommendations. Renew. Sustain. Energy Rev. 2021, 144, 111015. [Google Scholar] [CrossRef] [PubMed]

- Wang, J.; Ma, F.; Bouri, E.; Zhong, J. The volatility of clean energy and natural gas, uncertainty indices, and global economic conditions. Energy Econ. 2022, 108, 105904. [Google Scholar] [CrossRef]

- Zhang, Y.; Wang, Y. Forecasting crude oil futures market returns: A principal component analysis combination approach. Int. J. Forecast. 2023, 39, 659–673. [Google Scholar] [CrossRef]

- Lundgren, A.I.; Milicevic, A.; Uddin, G.S.; Kang, S.H. Connectedness network and dependence structure mechanism in green investments. Energy Econ. 2018, 72, 145–153. [Google Scholar] [CrossRef]

- Wang, X.; Li, J.; Ren, X. Asymmetric causality of economic policy uncertainty and oil volatility index on time-varying nexus of the clean energy, carbon, and green bond. Int. Rev. Financ. Anal. 2022, 83, 102306. [Google Scholar] [CrossRef]

- Dutta, A.; Bouri, E.; Saeed, T. News-based equity market uncertainty and crude oil volatility. Energy 2021, 222, 119930. [Google Scholar] [CrossRef]

- Li, Y.; Huang, J.; Gao, W.; Zhang, H. Analyzing the time-frequency connectedness among oil, gold prices, and BRICS geopolitical risks. Resour. Policy 2021, 73, 102134. [Google Scholar] [CrossRef]

- Liang, C.; Wei, Y.; Li, X.; Zhang, X.; Zhang, Y. Uncertainty and crude oil market volatility: New evidence. Appl. Econ. 2020, 52, 2945–2959. [Google Scholar] [CrossRef]

- Pirgaip, B.; Dinçergök, B. Economic policy uncertainty, energy consumption, and carbon emissions in G7 countries: Evidence from a panel Granger causality analysis. Environ. Sci. Pollut. Res. 2020, 27, 30050–30066. [Google Scholar] [CrossRef]

- Shang, Y.; Han, D.; Gozgor, G.; Mahalik, M.K.; Sahoo, B.K. The impact of climate policy uncertainty on renewable and non-renewable energy demand in the United States. Renew. Energy 2022, 197, 654–667. [Google Scholar] [CrossRef]

- Sadorsky, P. Correlations and volatility spillovers between oil prices and the stock prices of clean energy and technology companies. Energy Econ. 2012, 34, 248–255. [Google Scholar] [CrossRef]

- Reboredo, J.C.; Rivera-Castro, M.A.; Ugolini, A. Wavelet-based test of co-movement and causality between oil and renewable energy stock prices. Energy Econ. 2017, 61, 241–252. [Google Scholar] [CrossRef]

- Ferrer, R.; Shahzad, S.J.H.; López, R.; Jareño, F. Time and frequency dynamics of connectedness between renewable energy stocks and crude oil prices. Energy Econ. 2018, 76, 1–20. [Google Scholar] [CrossRef]

- Song, Y.; Ji, Q.; Du, Y.J.; Geng, J.B. The dynamic dependence of fossil energy, investor sentiment, and renewable energy stock markets. Energy Econ. 2019, 84, 104564. [Google Scholar] [CrossRef]

- Chu, L.K.; Ghosh, S.; Doğan, B.; Nguyen, N.H.; Shahbaz, M. Energy security as the new determinant of renewable energy: The role of economic complexity in top energy users. Energy 2023, 263, 125799. [Google Scholar] [CrossRef]

- Caldara, D.; Iacoviello, M. Measuring geopolitical risk. Am. Econ. Rev. 2022, 112, 1194–1225. [Google Scholar] [CrossRef]

- Gong, X.; Xu, J. Geopolitical risk and dynamic connectedness between commodity markets. Energy Econ. 2022, 110, 106028. [Google Scholar] [CrossRef]

- Overland, I. The geopolitics of renewable energy: Debunking four emerging myths. Energy Res. Soc. Sci. 2019, 49, 36–40. [Google Scholar] [CrossRef]

- Cai, Y.; Wu, Y. Time-varying interactions between geopolitical risks and renewable energy consumption. Int. Rev. Econ. Financ. 2021, 74, 116–137. [Google Scholar] [CrossRef]

- Rasoulinezhad, E.; Taghizadeh-Hesary, F.; Sung, J.; Panthamit, N. Geopolitical risk and energy transition in Russia: Evidence from ARDL bounds testing method. Sustainability 2020, 12, 2689. [Google Scholar] [CrossRef]

- Yang, K.; Wei, Y.; Li, S.; He, J. Geopolitical risk and renewable energy stock markets: An insight from multiscale dynamic risk spillover. J. Clean. Prod. 2021, 279, 123429. [Google Scholar] [CrossRef]

- Overland, I.; Bazilian, M.; Uulu, T.I.; Vakulchuk, R.; Westphal, K. The GeGaLo index: Geopolitical gains and losses after energy transition. Energy Strategy Rev. 2019, 26, 100406. [Google Scholar] [CrossRef]

- Su, C.W.; Khan, K.; Umar, M.; Zhang, W. Does renewable energy redefine geopolitical risks? Energy Policy 2021, 158, 112566. [Google Scholar] [CrossRef]

- Baker, S.R.; Bloom, N.; Davis, S.J. Measuring economic policy uncertainty. Q. J. Econ. 2016, 131, 1593–1636. [Google Scholar] [CrossRef]

- Pham, L.; Nguyen, C.P. How do stock, oil, and economic policy uncertainty influence the green bond market? Financ. Res. Lett. 2022, 45, 102128. [Google Scholar] [CrossRef]

- Wen, H.; Lee, C.C.; Zhou, F. How does fiscal policy uncertainty affect corporate innovation investment? Evidence from China’s new energy industry. Energy Econ. 2022, 105, 105767. [Google Scholar] [CrossRef]

- Broadstock, D.C.; Cheng, L.T. Time-varying relation between black and green bond price benchmarks: Macroeconomic determinants for the first decade. Financ. Res. Lett. 2019, 29, 17–22. [Google Scholar] [CrossRef]

- Danish, U.R.; Khan, S.U.D. Relationship between energy intensity and CO2 emissions: Does economic policy matter? Sustain. Dev. 2020, 28, 1457–1464. [Google Scholar] [CrossRef]

- Antonakakis, N.; Chatziantoniou, I.; Filis, G. Dynamic spillovers of oil price shocks and economic policy uncertainty. Energy Econ. 2014, 44, 433–447. [Google Scholar] [CrossRef]

- Appiah-Otoo, I. Impact of economic policy uncertainty on renewable energy growth. Energy Res. Lett. 2021, 2, 19444. [Google Scholar] [CrossRef]

- Chu, L.K.; Le, N.T.M. Environmental quality and the role of economic policy uncertainty, economic complexity, renewable energy, and energy intensity: The case of G7 countries. Environ. Sci. Pollut. Res. 2022, 29, 2866–2882. [Google Scholar] [CrossRef] [PubMed]

- Sendstad, L.H.; Chronopoulos, M. Sequential investment in renewable energy technologies under policy uncertainty. Energy Policy 2020, 137, 111152. [Google Scholar] [CrossRef]

- Borozan, D. Asymmetric effects of policy uncertainty on renewable energy consumption in G7 countries. Renew. Energy 2022, 189, 412–420. [Google Scholar] [CrossRef]

- Shafiullah, M.; Miah, M.D.; Alam, M.S.; Atif, M. Does economic policy uncertainty affect renewable energy consumption? Renew. Energy 2021, 179, 1500–1521. [Google Scholar] [CrossRef]

- Zeng, Q.; Yue, X. Re-evaluating the asymmetric economic policy uncertainty, conventional energy, and renewable energy consumption nexus for BRICS. Environ. Sci. Pollut. Res. 2022, 29, 20347–20356. [Google Scholar] [CrossRef]

- Sohail, M.T.; Xiuyuan, Y.; Usman, A.; Majeed, M.T.; Ullah, S. Renewable energy and non-renewable energy consumption: Assessing the asymmetric role of monetary policy uncertainty in energy consumption. Environ. Sci. Pollut. Res. 2021, 28, 31575–31584. [Google Scholar] [CrossRef]

- Liu, R.; He, L.; Liang, X.; Yang, X.; Xia, Y. Is there any difference in the impact of economic policy uncertainty on the investment of traditional and renewable energy enterprises?—A comparative study based on regulatory effects. J. Clean. Prod. 2020, 255, 120102. [Google Scholar] [CrossRef]

- Lang, Q.; Ma, F.; Mirza, N.; Umar, M. The interaction of climate risk and bank liquidity: An emerging market perspective for transitions to low carbon energy. Technol. Forecast. Soc. Chang. 2023, 191, 122480. [Google Scholar] [CrossRef]

- Liang, C.; Umar, M.; Ma, F.; Huynh, T.L. Climate policy uncertainty and world renewable energy index volatility forecasting. Technol. Forecast. Soc. Chang. 2022, 182, 121810. [Google Scholar] [CrossRef]

- Hong, H.; Karolyi, G.A.; Scheinkman, J.A. Climate finance. Rev. Financ. Stud. 2020, 33, 1011–1023. [Google Scholar] [CrossRef]

- Bartram, S.M.; Hou, K.; Kim, S. Real effects of climate policy: Financial constraints and spillovers. J. Financ. Econ. 2022, 143, 668–696. [Google Scholar] [CrossRef]

- Krueger, P.; Sautner, Z.; Starks, L.T. The importance of climate risks for institutional investors. Rev. Financ. Stud. 2020, 33, 1067–1111. [Google Scholar] [CrossRef]

- Zhou, D.; Siddik, A.B.; Guo, L.; Li, H. Dynamic relationship among climate policy uncertainty, oil price, and renewable energy consumption—Findings from TVP-SV-VAR approach. Renew. Energy 2023, 204, 722–732. [Google Scholar] [CrossRef]

- Bouri, E.; Iqbal, N.; Klein, T. Climate policy uncertainty and the price dynamics of green and brown energy stocks. Financ. Res. Lett. 2022, 47, 102740. [Google Scholar] [CrossRef]

- Gernaat, D.E.; de Boer, H.S.; Daioglou, V.; Yalew, S.G.; Müller, C.; van Vuuren, D.P. Climate change impacts on renewable energy supply. Nat. Clim. Chang. 2021, 11, 119–125. [Google Scholar] [CrossRef]

- Mercure, J.F.; Salas, P.; Vercoulen, P.; Semieniuk, G.; Lam, A.; Pollitt, H.; Vinuales, J.E. Reframing incentives for climate policy action. Nat. Energy 2021, 6, 1133–1143. [Google Scholar] [CrossRef]

- Sarker, P.K.; Bouri, E.; Marco, C.K.L. Asymmetric effects of climate policy uncertainty, geopolitical risk, and crude oil prices on clean energy prices. Environ. Sci. Pollut. Res. 2023, 30, 15797–15807. [Google Scholar] [CrossRef]

- Sweidan, O.D. Is the geopolitical risk an incentive or obstacle to renewable energy deployment? Evidence from a panel analysis. Renew. Energy 2021, 178, 377–384. [Google Scholar] [CrossRef]

- Wang, Y.; Bouri, E.; Fareed, Z.; Dai, Y. Geopolitical risk and the systemic risk in the commodity markets under the war in Ukraine. Financ. Res. Lett. 2022, 49, 103066. [Google Scholar] [CrossRef]

- Gavriilidis, K. Measuring Climate Policy Uncertainty. 2021. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3847388 (accessed on 23 July 2023).

- Diebold, F.X.; Yilmaz, K. Measuring financial asset return and volatility spillovers, with application to global equity markets. Econ. J. 2009, 119, 158–171. [Google Scholar] [CrossRef]

- Koop, G.; Korobilis, D.; Pettenuzzo, D. Bayesian compressed vector autoregressions. J. Econom. 2019, 210, 135–154. [Google Scholar] [CrossRef]

- Ando, T.; Greenwood-Nimmo, M.; Shin, Y. Quantile connectedness: Modeling tail behavior in the topology of financial networks. Manag. Sci. 2022, 68, 2401–2431. [Google Scholar] [CrossRef]

- Chatziantoniou, I.; Gabauer, D.; Stenfors, A. Interest rate swaps and the transmission mechanism of monetary policy: A quantile connectedness approach. Econ. Lett. 2021, 204, 109891. [Google Scholar] [CrossRef]

- Koop, G.; Pesaran, M.H.; Potter, S.M. Impulse response analysis in nonlinear multivariate models. J. Econom. 1996, 74, 119–147. [Google Scholar] [CrossRef]

- Pesaran, H.H.; Shin, Y. Generalized impulse response analysis in linear multivariate models. Econ. Lett. 1998, 58, 17–29. [Google Scholar] [CrossRef]

- Bhutt, N.A.; Khan, S.; Khan, U.A.; Matlani, A. The impact of COVID-19 on conventional and Islamic stocks: Empirical evidence from Pakistan. J. Econ. Adm. Sci. 2022. online ahead of print. [Google Scholar]

- Singh, V.K.; Kumar, P.; Nishant, S. Global connectedness of MSCI energy equity indices: A system-wide network approach. Energy Econ. 2019, 84, 104477. [Google Scholar] [CrossRef]

- Lorente, D.B.; Mohammed, K.S.; Cifuentes-Faura, J.; Shahzad, U. Dynamic connectedness among climate change index, green financial assets, and renewable energy markets: Novel evidence from a sustainable development perspective. Renew. Energy 2023, 204, 94–105. [Google Scholar] [CrossRef]

| ERE | MSCIR&EE | DJRE | R&CE | MSCIGAE | MSCIEE | WRE | CPU | GPR | GEPU_C | GEPU_P | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | 1904.832 | 1910.42 | 149.879 | 15.23 | 69.119 | 1646.20 | 1169.30 | 195.23 | 99.368 | 247.31 | 255.79 |

| Variance | 497,851.258 | 416,608.64 | 5425.612 | 36.51 | 528.988 | 301,093.998 | 459,465.859 | 4435.67 | 1903.635 | 4019.353 | 4208.288 |

| Skewness | 0.548 * | 0.435 | 0.910 *** | 0.578 * | 0.539 * | 0.541 * | 0.521 * | 0.751 ** | 3.199 *** | 0.534 * | 0.399 |

| −0.082 | −0.161 | −0.007 | −0.068 | −0.087 | −0.086 | −0.097 | −0.021 | 0 | −0.09 | −0.197 | |

| Ex. Kurtosis | −1.144 *** | −1.516 *** | −0.148 | −1.376 *** | −1.336 *** | −1.365 *** | −1.353 *** | 0.896 | 12.524 *** | −0.015 | −0.136 |

| −0.001 | 0 | −0.887 | 0 | 0 | 0 | 0 | −0.117 | 0 | −0.701 | −0.869 | |

| JB | 5.643 * | 6.872 ** | 7.510 ** | 7.270 ** | 6.631 ** | 6.832 ** | 6.559 ** | 6.878 ** | 445.041 *** | 2.567 | 1.471 |

| −0.06 | −0.032 | −0.023 | −0.026 | −0.036 | −0.033 | −0.038 | −0.032 | 0 | −0.277 | −0.479 | |

| ERS | −0.904 | −0.759 | −1.224 | −0.983 | −0.963 | −0.775 | −0.79 | −2.018 ** | −1.655 * | −1.243 | −1.125 |

| −0.371 | −0.452 | −0.227 | −0.331 | −0.341 | −0.443 | −0.434 | −0.05 | −0.105 | −0.221 | −0.266 | |

| Q(10) | 210.135 *** | 230.831 *** | 171.687 *** | 223.680 *** | 213.736 *** | 208.929 *** | 218.514 *** | 13.143 ** | 43.615 *** | 64.623 *** | 68.363 *** |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | −0.015 | 0 | 0 | 0 | |

| Q2(10) | 191.119 *** | 223.947 *** | 128.474 *** | 216.212 *** | 199.228 *** | 197.156 *** | 187.531 *** | 9.789 * | 25.687 *** | 57.900 *** | 60.560 *** |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | −0.077 | 0 | 0 | 0 |

| ERE | MSCIR&EE | DJRE | R&CE | MSCIGAE | MSCIEE | WRE | CPU | GPR | GEPU_C | GEPU_P | FROM | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ERE | 25.15 | 15.48 | 3.09 | 8.71 | 18.75 | 10.04 | 12.15 | 0.12 | 1.25 | 2.6 | 2.65 | 74.85 |

| MSCIR&EE | 19.44 | 18.71 | 4.98 | 13.25 | 16.65 | 9.99 | 12.22 | 0.08 | 1.29 | 1.68 | 1.71 | 81.29 |

| DJRE | 22.87 | 13.08 | 7.32 | 7.96 | 18.92 | 11.11 | 13.11 | 0.48 | 1.83 | 1.7 | 1.61 | 92.68 |

| R&CE | 18.55 | 17.47 | 6.64 | 14.35 | 16.48 | 10.79 | 12.48 | 0.1 | 0.79 | 1.18 | 1.17 | 85.65 |

| MSCIGAE | 22.08 | 16.47 | 3.78 | 9.76 | 19.21 | 11.58 | 12.74 | 0.09 | 1.26 | 1.52 | 1.51 | 80.79 |

| MSCIEE | 20.04 | 16.14 | 4.92 | 10.42 | 18.66 | 12.98 | 13.08 | 0.06 | 1.19 | 1.28 | 1.24 | 87.02 |

| WRE | 21.11 | 16.38 | 4.75 | 10.24 | 17.66 | 10.24 | 14.5 | 0.19 | 1.67 | 1.65 | 1.61 | 85.5 |

| CPU | 2.53 | 4.46 | 5.79 | 5.24 | 2.37 | 1.22 | 4.16 | 56.03 | 8.88 | 4.83 | 4.49 | 43.97 |

| GPR | 4.72 | 6.19 | 13.63 | 8.98 | 4.76 | 6.5 | 4.66 | 1.55 | 36.96 | 6.33 | 5.71 | 63.04 |

| GEPU_C | 4.69 | 2.09 | 2.53 | 3.3 | 5.87 | 6.54 | 3.88 | 3.12 | 2.55 | 32.71 | 32.72 | 67.29 |

| GEPU_P | 4.63 | 2.25 | 2.21 | 3.24 | 5.9 | 6.5 | 3.88 | 3.12 | 2.28 | 32.66 | 33.34 | 66.66 |

| TO | 140.65 | 110.01 | 52.31 | 81.1 | 126.01 | 84.51 | 92.36 | 8.93 | 22.99 | 55.44 | 54.42 | 828.74 |

| Inc.Own | 165.8 | 128.72 | 59.63 | 95.45 | 145.22 | 97.49 | 106.86 | 64.96 | 59.95 | 88.15 | 87.76 | cTCI/TCI |

| NET | 65.8 | 28.72 | −40.37 | −4.55 | 45.22 | −2.51 | 6.86 | −35.04 | −40.05 | −11.85 | −12.24 | 82.87/75.34 |

| NPT | 10 | 8 | 4 | 5 | 9 | 6 | 7 | 0 | 1 | 2 | 3 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rehman, M.Z.; Khan, S.; Khan, U.A.; Alonazi, W.B.; Noman, A.A. How Do Global Uncertainties Spillovers Affect Leading Renewable Energy Indices? Evidence from the Network Connectedness Approach. Sustainability 2023, 15, 13630. https://doi.org/10.3390/su151813630

Rehman MZ, Khan S, Khan UA, Alonazi WB, Noman AA. How Do Global Uncertainties Spillovers Affect Leading Renewable Energy Indices? Evidence from the Network Connectedness Approach. Sustainability. 2023; 15(18):13630. https://doi.org/10.3390/su151813630

Chicago/Turabian StyleRehman, Mohd Ziaur, Shabeer Khan, Uzair Abdullah Khan, Wadi B. Alonazi, and Abul Ala Noman. 2023. "How Do Global Uncertainties Spillovers Affect Leading Renewable Energy Indices? Evidence from the Network Connectedness Approach" Sustainability 15, no. 18: 13630. https://doi.org/10.3390/su151813630

APA StyleRehman, M. Z., Khan, S., Khan, U. A., Alonazi, W. B., & Noman, A. A. (2023). How Do Global Uncertainties Spillovers Affect Leading Renewable Energy Indices? Evidence from the Network Connectedness Approach. Sustainability, 15(18), 13630. https://doi.org/10.3390/su151813630