Supply and Demand Changes, Pig Epidemic Shocks, and Pork Price Fluctuations: An Empirical Study Based on an SVAR Model

Abstract

:1. Introduction

2. Materials and Methods

2.1. Data Sources

- 1.

- Data Sources: In total, 156 sample data from January 2009 to December 2021 were selected to investigate the influencing factors of pork price fluctuations in China. The data for the pork price, corn price, and chicken price were sourced from the China Agricultural Products Price Survey Yearbook. The data for the pig herd and sow herd were sourced from the China Statistical Yearbook. The data for urban residents’ per capita disposable income, rural residents’ per capita disposable income, soybean price (SP), and imported pork were sourced from the National Bureau of Statistics. The data for the epidemic intensity index is sourced from the Burick Agricultural Database.

- 2.

- Variable Selection: The pork price (POP) was selected to represent the changes in the pork price. Factors related to supply, demand, and epidemic situations were chosen to investigate the main factors influencing pork price fluctuations.

- 3.

- Data processing: Pork price (POP) was selected as the dependent variable, while the corn price (CP), pig herd (PH), sow herd (SH), imported pork (IP), chicken price (CHP), monthly average of urban residents per capita disposable income (URPCDI), monthly average of rural residents’ per capita disposable income (RRPCDI), and epidemic depth index (EDI) were chosen as the independent variables. To ensure the accuracy and objectivity of the model results, seasonal adjustments were made to the prices of major livestock products, and then the POP, CP, CHP, URPCDI, and RRPCDI were deflated using the price deflator index, which was calculated based on the national consumer price index (CPI) of January 2009. Then, the deflated data were processed using a logarithm to reduce heteroscedasticity between the variables [29].

2.2. Methods

- (1)

- Stationarity test: To avoid the issue of spurious regression in regression analysis, it is necessary to perform a stationarity test. Therefore, the Augmented Dickey-Fuller (ADF) test is employed. The test statistic is compared with the critical value at a 5% significance level. If the test statistic is smaller than the critical value, the null hypothesis can be rejected, indicating that the series is stationary at the significance level. If the opposite pattern is found, it suggests that the series is non-stationary, and differencing is required to achieve stationarity for the non-stationary series.

- (2)

- Cointegration test: The Johansen cointegration test is employed to determine whether long-term equilibrium relationships exist in the variables and to obtain the number and vector of cointegration relationships.

- (3)

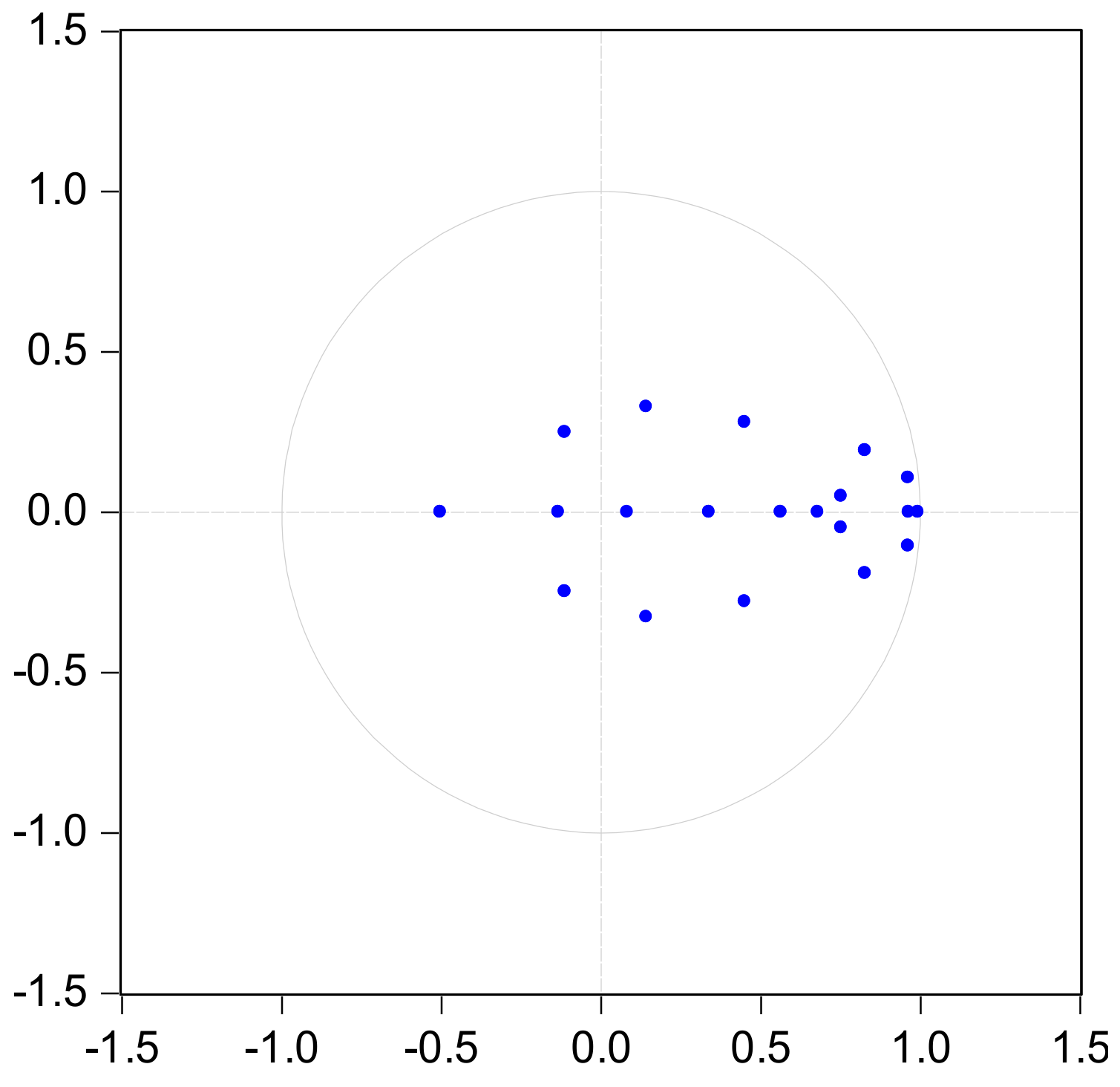

- Determination of lag order and stability test: The optimal lag order of the model is determined using information criteria such as the Akaike information criterion (AIC), Schwarz criterion (SC), Hannan–Quinn criterion (HQ), etc. Then, the parameters of the model are estimated using the Full information maximum likelihood (FIML) method and a characteristic root decomposition is performed to determine whether the roots are within the unit circle. If all roots are within the unit circle, the model is considered stable. Otherwise, adjustments or modifications may be necessary to ensure model stability.

- (4)

- Impulse response function: The impulse response function is used to analyze the interaction effect and dynamic change trends among variables.

- (5)

- Variance decomposition analysis: The contribution degree of different external shocks to each variable in the model is analyzed to measure the importance of different external shocks.

3. Empirical Analysis

3.1. Stationarity Test

3.2. Cointegration Test

3.3. Determination of Lag Order and Parameter Estimation

3.4. Stability Test

3.5. Impulse Response Function Analysis

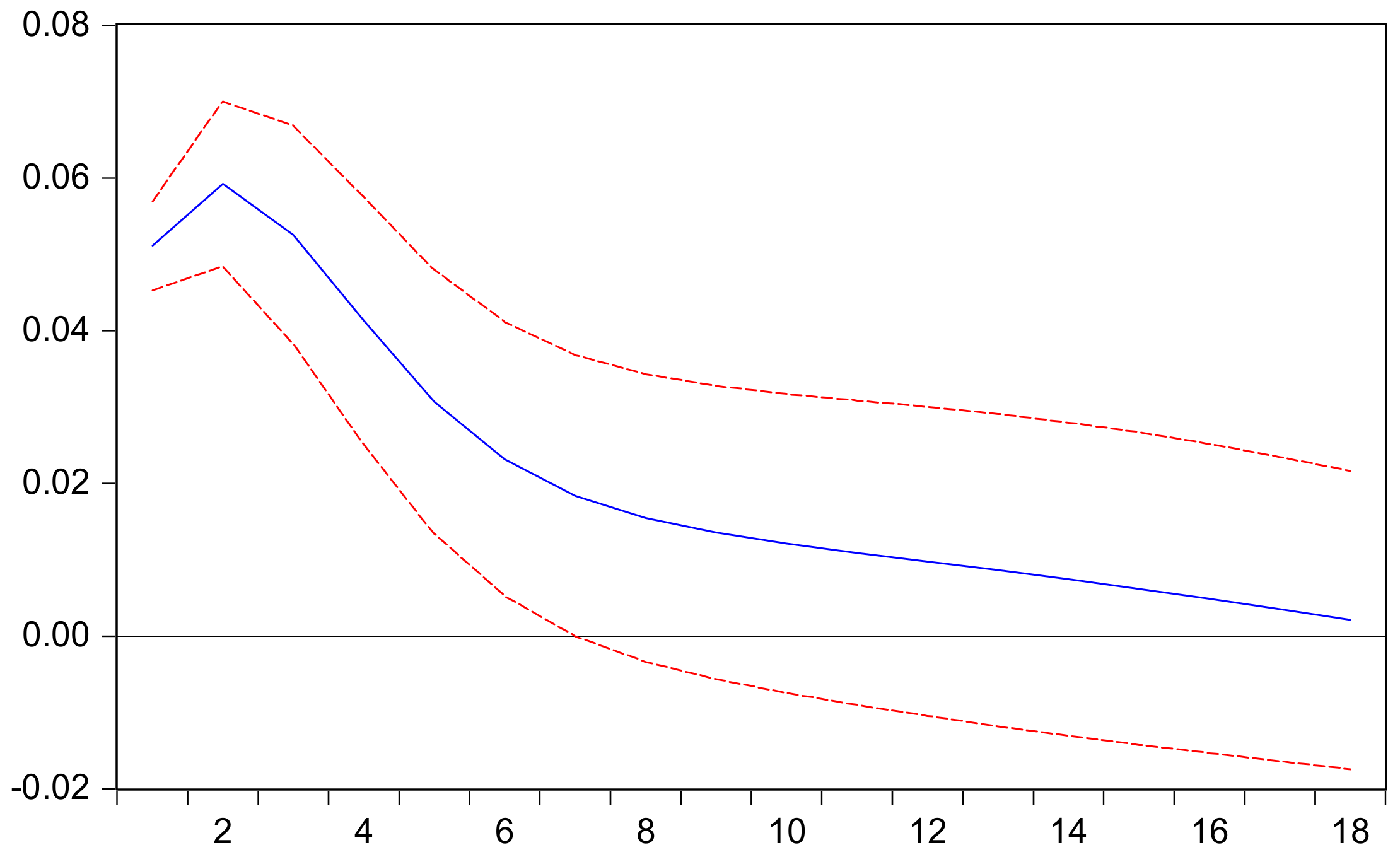

3.5.1. Dynamic Response Relationship between Pork Price and Pork Price Fluctuation

3.5.2. Dynamic Response Relationship between Supply and Pork Price Fluctuation

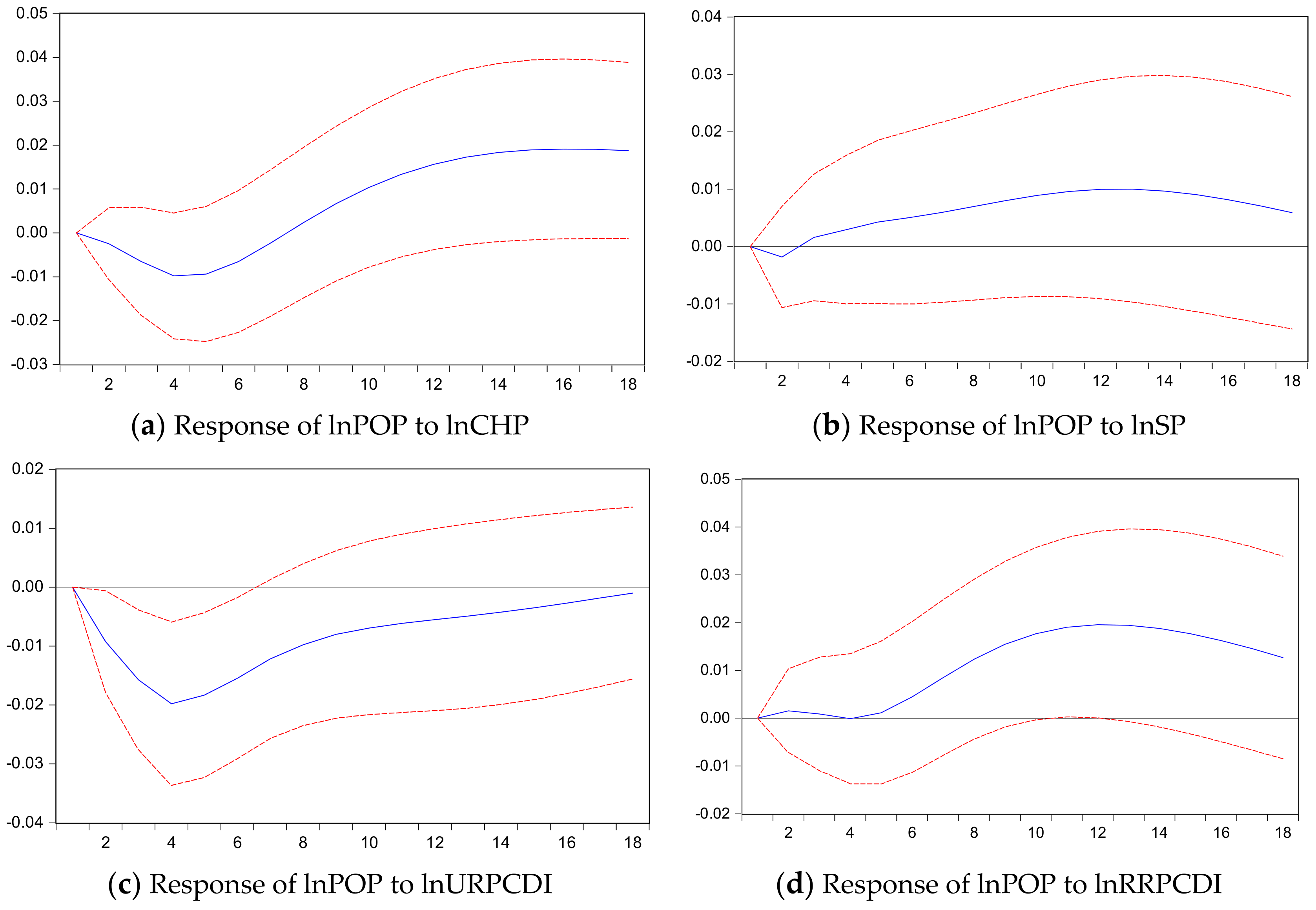

3.5.3. Dynamic Response Relationship between Demand and Pork Price Fluctuation

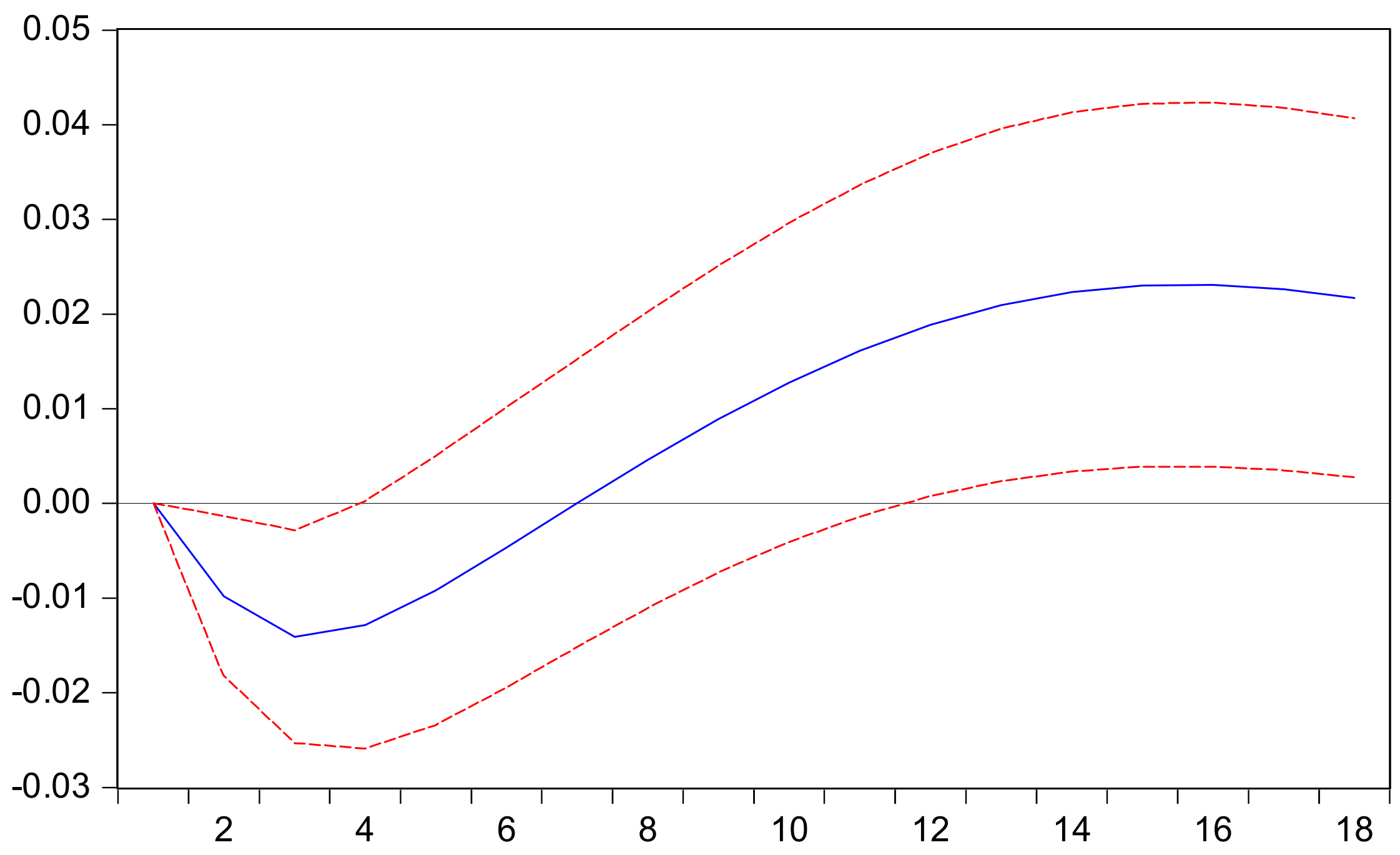

3.5.4. Dynamic Response Relationship between Pig Epidemic Impact and Pork Price Fluctuation

3.6. Variance Decomposition Analysis

4. Conclusions and Suggestions

4.1. Conclusions

4.2. Suggestions

- (1)

- In terms of the pork price, it is recommended to enhance price monitoring through big data analysis. The research findings indicate that the pork price is significantly influenced by its own dynamics, meaning that short-term fluctuations in the pork price may have a prolonged impact on future price trends. It is suggested that relevant departments should collect all kinds of data related to pork prices, including the pig herd, sow herd, consumption, import and export data, epidemic information, and residents’ income levels, to create a big data platform. Then, the big data platform should be used to monitor and analyze the factors affecting the pork price, build a relationship model between the pork supply–demand ratio and pork price, and analyze price trends, which will help pig farms and farmers to make informed breeding plans based on timely market information, avoid blindly following market trends, and contribute to stabilizing the supply and market. When there is a deviation from the predicted pork supply–demand ratio, the pork price may deviate from the supply–demand equilibrium price. Based on the big data platform, the pork supply can be adjusted from the perspectives of the pig herd, sow herd, and imports, for example, by increasing reserve management and reverse-regulating pig cycles so as to assist in future pork price regulation.

- (2)

- In terms of supply, it is recommended to maintain a stable pig herd to ensure the supply of pork in the market. At present, the proportion of small-scale family farming in China is still high. However, with the deepening development of green ecological farming and circular economy in China, the structural transformation of pig farming is underway, and the advantages of large-scale farms have also gradually emerged. According to statistics, in China, the number of farms (farmers) with 1–49 slaughter pigs per year accounted for 93.80% of the total number, while the number of slaughter pigs in large-scale farms accounted for 57% of the total number of slaughter pigs in 2020. Compared to small-scale family farming, large-scale farms have lower comprehensive costs, higher requirements for pig epidemic prevention and control, and better management efficiency. It is evident that there is significant potential for improvement and expansion in the supply capacity of China’s pig farming industry through the development of large-scale farms. To increase the inventory of the pig herd, it is recommended to continue promoting large-scale farming, provide greater support to farmers, and promote the high-quality development of pig farming towards modernization and industrialization in order to ensure a self-sufficiency rate of pork that meets the safety level.

- (3)

- In terms of demand, in order to effectively alleviate the fluctuations of pork prices, the residents’ per capita disposable income should have been increased, especially in rural areas residents, enhancing the potential for pork consumption in a positive economy. At the same time, residents should be guided to diversify their meat consumption structure; chicken, plant meat, and other alternatives to pork consumption can alleviate the contradiction in demand under special circumstances. Although the market for plant substitutes is not yet mature, the Chinese government has listed cultured meat and artificial dairy as future food to be developed in China’s “14th Five-Year” National Agricultural Technology Development Plan to improve food security and the sustainability of its food system. It can be observed that the impact of substitutes on pork prices is a focus of future research, particularly plant-based substitutes. Due to the lack of data on plant substitution prices, soybean prices, the main component of plant substitutes, were chosen for analysis in this paper. The results may have deviation to some extent.

- (4)

- During disease outbreaks, the first six months have a negative impact on the pork price, and farmers bear the greatest losses. In such situations, the government should implement strict control measures, scientifically and effectively manage the outbreaks, and provide corresponding subsidies to farmers. In addition, consumer decision-making is influenced by information dissemination, public opinion guidance, and policy control and can induce changes in pork supply and demand, alleviate pork price fluctuations caused by reduced supply, and mitigate the impact. After approximately six months, efforts should be made to guide and support farmers in resuming production, promote the expansion of the pig farming scale, increase pig production capacity, and ensure the stable production, supply, and price of live pigs. This paper only analyzed the impact of the pig epidemics on pork prices. However, in the event of human epidemics (such as COVID-19), the individual or combined effects of human and animal epidemics can be further considered based on the availability of data.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Yan, Z.; Cao, Y.; Liu, Y. Analysis on the Law of “Hog Cycle” based on EMD. Price Theory Pract. 2022, 459, 121–124. [Google Scholar] [CrossRef]

- Zhang, H.; Chen, S.; Chen, N.; Wang, Z. Development of China’s pig industry in 2022 and trends in 2023. China Swine Ind. 2023, 18, 13–18. [Google Scholar] [CrossRef]

- Shi, Z.; Li, J.; Hu, X. The Impact of Pig epidemic on China’s Pork Supply and Demand. J. Agrotech. Econ. 2023, 3, 4–17. [Google Scholar] [CrossRef]

- Yao, H.; Zang, C.; Zuo, X.; Xian, Y.; Lu, Y.; Huang, Y.; Li, X. Tradeoff analysis of the pork supply and food security under the influence of African swine fever and the COVID-19 outbreak in China. Geogr. Sustain. 2022, 3, 32–43. [Google Scholar] [CrossRef]

- Cui, M.; Zhang, Y.; Huo, J.; Yang, D. The Impact of COVID-19 Policy Response on Food Prices: A Case Study in China. Sustainability 2023, 15, 9490. [Google Scholar] [CrossRef]

- Zheng, J.; Wu, Z.; Shi, A. Empirical study on influencing factors of pork price fluctuation in China based on VAR model. Chin. J. Anim. Sci. 2022, 58, 259–265. [Google Scholar] [CrossRef]

- Duan, Y.; Wang, G.; Shi, A. Analysis of Influential Factors for Pork Price Fluctuating in Sichuan Based on VAR Model. J. Sichuan Agric. Univ. 2011, 29, 580–584. [Google Scholar]

- Sun, D.; Chen, L. Analysis of dynamic relationship between pork price and influencing factors. Chin. J. Anim. Sci. 2020, 36, 74–77. [Google Scholar] [CrossRef]

- Utnik-Bana’s, K.; Schwarz, T.; Szymanska, E.J.; Bartlewski, P.M.; Satoła, Ł. Scrutinizing Pork Price Volatility in the European Union over the Last Decade. Animals 2022, 12, 100. [Google Scholar] [CrossRef]

- Sirohi, J.; Hloušková, Z.; Bartoňová, K.; Malec, K.; Maitah, M.; Koželský, R. The Vertical Price Transmission in Pork Meat Production in the Czech Republic. Agriculture 2023, 13, 1274. [Google Scholar] [CrossRef]

- Zhang, F.; Hu, T. Analysis on fluctuation of pig price and regulation policy in China. Chin. J. Anim. Sci. 2012, 48, 16–19. [Google Scholar]

- Hayes, D.J.; Schulz, L.L.; Hart, C.E.; Jacobs, K.L. A Descriptive Analysis of the COVID Impacts on U.S. Pork, Turkey, and Egg Markets. Agribusines 2021, 37, 122–141. [Google Scholar] [CrossRef] [PubMed]

- Li, H.; Hu, C.; LÜ, Z.; Li, M.; Guo, X. African swine fever and meat prices fluctuation: An empirical study in China based on TVP-VAR model. J. Integr. Agric. 2021, 20, 2289–2301. [Google Scholar] [CrossRef]

- Fan, P.; Yao, W.; Chen, Y.; Tang, L. Research on the Impact of the New Coronary Pneumonia Epidemic on Pork Market Price and Countermeasure—Based on the data analysis of Changzhou City, Jiangsu Province. Price Theory Pract. 2020, 8, 80–83. [Google Scholar] [CrossRef]

- Hua, J.; Su, G.; Jia, Y. Research on Pork Price Forecasting and Risk Early Warning Under Impact of Swine Epidemic. Agric. Econ. Manag. 2022, 76, 101–113. [Google Scholar]

- Ma, M.; Wang, H.; Hua, Y.; Qin, F.; Yang, J. African swine fever in China: Impacts, responses, and policy implications. Food Policy 2021, 102, 102065. [Google Scholar] [CrossRef]

- Zhu, Z.; Ma, Y. Study on China’s Government Frozen Pork Storage Policy and Its Implementation Effects. Price Theory Pract. 2022, 460, 66–70. [Google Scholar] [CrossRef]

- Cui, M.; Zhang, X.; Zhang, Y.; Yang, D.; Huo, J.; Xia, F. Effects of Policy Intervention on Food System Resilience to Emergency Risk Shock: Experience from China during COVID-19 Pandemic. Foods 2023, 12, 2345. [Google Scholar] [CrossRef]

- Kang, H.; Xiao, H. Relationship of Livestock Meat Price and Inflation in China under Background of African Swine Fever—Based on Research of VEC Model. Agric. Econ. Manag. 2020, 16, 76–85. [Google Scholar]

- Shi, Z.; Zhou, H.; Hu, X. Statistical Test of Heterogeneous Effect of Epidemic Shock on Pork Price and CPI Fluctuation. Stat. Decis. 2021, 37, 49–53. [Google Scholar] [CrossRef]

- Wang, H.; Wang, M. Research on the Influence of Net Distribution and Emotion on the Price Fluctuation of Livestock Products—Analysis of Baidu Index and Sina Weibo Big Data Based on COVID-19 Epidemic. Price Theory Pract. 2021, 8, 108–111. [Google Scholar] [CrossRef]

- Ma, C.; Tao, J.; Tan, C.; Liu, W.; Li, X. Negative Media Sentiment about the Pig Epidemic and pork price fluctuation: A Study on Spatial Spillover Effect and Mechanism. Agriculture 2023, 13, 658. [Google Scholar] [CrossRef]

- Sun, J.; Ortega, D.L.; Lin, W. Food values drive Chinese consumers’ demand for meat and milk substitutes. Appetite 2023, 181, 106392. [Google Scholar] [CrossRef] [PubMed]

- Arrigoni, A.; Marveggio, D.; Allievi, F.; Dotelli, G.; Scaccabarozzi, G. Environmental and health-related external costs of meat consumption in Italy: Estimations and recommendations through life cycle assessment. Sci. Total Environ. 2023, 869, 161773. [Google Scholar] [CrossRef] [PubMed]

- Jiang, F.; Wei, H.; Tao, Q. Empirical Research on the Influential Factors of Chinese Crude Drug Price Based on SVAR Model. China Pharm. 2021, 32, 2695–2700. [Google Scholar]

- Pan, F.; Wang, N.; Deng, H.; Liu, L. Time-varying supply response of feeding sows based on the TVP-VAR-SV model. Res. Agric. Mod. 2022, 43, 627–637. [Google Scholar] [CrossRef]

- Xiang, L. Research on the Influencing Factors and Industrial Development of China’s Hog Price Fluctuation. Master’s Thesis, Xihua University, Chengdu, China, 2022. [Google Scholar]

- Li, W.; Dang, Y.; Fang, F.; Xue, Q.; Du, X. An empirical analysis of the impact of pig epidemic on pork price. J. Henan Agric. Univ. 2022, 56, 868–876. [Google Scholar] [CrossRef]

- Liu, M.; Liu, F.; Liu, Y. Empirical study of pig price fluctuation in China based on VAR model. Chin. J. Anim. Sci. 2020, 56, 184–188. [Google Scholar] [CrossRef]

- Gao, T. Application and Examples of Econometric Analysis Methods and Modeling EViews, 4th ed.; Tsinghua University Publishing House: Beijing, China, 2020; pp. 251–268. [Google Scholar]

- Shumba, T.; Mukorera, S. Monetary Policy Implications on Macroeconomic Performance in the Common Monetary Area: A Panel-SVAR Framework. Economies 2023, 11, 144. [Google Scholar] [CrossRef]

- Yang, Y.; Zhang, S.; Zhang, N.; Wen, Z.; Zhang, Q.; Xu, M.; Zhang, Y.; Niu, M. The Dynamic Relationship between China’s Economic Cycle, Government Debt, and Economic Policy. Sustainability 2022, 14, 1029. [Google Scholar] [CrossRef]

- Liu, S.; Xiao, H. Seasonal fluctuation characteristics of China’s mutton price and the shock effect of substitute price: An empirical analysis based on HEGY test and SVAR model. J. China Agric. Univ. 2022, 27, 264–274. [Google Scholar]

- Li, S.; Shen, L. Currency is distracted from Their Intended Purpose and Virtual Economic Prosperity: Evidence based on Financial and Real Estate Industry. Southwest Financ. 2019, 460, 32–41. [Google Scholar]

- Noda, H.; Kyo, K. Dynamic relationships among changes in prices of beef, pork, and chicken in Japan: A Bayesian approach. J. Agric. Food Res. 2022, 11, 100464. [Google Scholar] [CrossRef]

- Liu, R.; Zhang, R.; Yu, J. Investigation of influencing factors of price fluctuation of agricultural products—Take pork price. Anhui Agric. Sci. Bull. 2021, 27, 124–127. [Google Scholar] [CrossRef]

- Yan, Z.; Liu, Y.; Cao, Y. Supply determines price: A study of “pig cycle” based on EMD. J. Commer. Econ. 2022, 4, 185–188. [Google Scholar]

- Zhang, M.; Liu, S.; Liu, F. Spatial-Temporal Effects of Pork Price Changes in China. Econ. Geogr. 2018, 38, 135–142. [Google Scholar] [CrossRef]

- Zhao, S.; Miao, X.; Bai, L. Spatiotemporal correlation of pork price and its influencing factors. China Price 2023, 6, 102–104. [Google Scholar]

- He, S.; Zeng, H.; He, B. Estimation and cyclical comparison of pork demand elasticity of rural residents in China: Based on extended linear expenditure system. Jiangsu Agric. Sci. 2017, 45, 335–338. [Google Scholar] [CrossRef]

- Liu, Y.; Han, Q. The impact of COVID-19 on Chinese residents’ pork consumption behavior and countermeasures: An analysis based on 525 questionnaires from Chinese residents. Chin. J. Anim. Sci. 2021, 57, 256–260. [Google Scholar] [CrossRef]

- Wang, X. Research on Meat Consumption and Influencing Factors of Chinese Residents. Master’s Thesis, Northeast Agricultural University, Harbin, China, 2020. [Google Scholar]

- Panagiotou, D. Asymmetric price responses of the US pork retail prices to farm and wholesale price shocks: A nonlinear ARDL approach. J. Econ. Asymmetries 2021, 23, e00185. [Google Scholar] [CrossRef]

- State Council. Opinions on Promoting the High-Quality Development of Animal Husbandry. 2020. Available online: http://www.gov.cn/zhengce/content/2020-09/27/content_5547612.htm (accessed on 16 January 2022).

- Han, M.; Yu, W.; Clora, F. Boom and Bust in China’s Pig Sector during 2018–2021: Recent Recovery from the ASF Shocks and Longer-Term Sustainability Considerations. Sustainability 2022, 14, 6784. [Google Scholar] [CrossRef]

- Yan, Z.; Cao, Y.; Liu, Y.; Liu, L. Analysis of pork price fluctuation rule based on modal data decomposition. Stat. Decis. 2023, 39, 84–88. [Google Scholar] [CrossRef]

| Variable | ADF Statistic | Critical Value | p-Value | Stationarity | ||

|---|---|---|---|---|---|---|

| 1% | 5% | 10% | ||||

| lnPOP | 0.0367 | −2.5801 | −1.9429 | −1.6153 | 0.6930 | Non-stationary |

| lnCP | −1.7893 | −3.4731 | −2.8802 | −2.5768 | 0.3847 | Non-stationary |

| lnPH | −1.9763 | −3.4731 | −2.8802 | −2.5768 | 0.2971 | Non-stationary |

| lnSH | −0.4993 | −2.5801 | −1.9429 | −1.6153 | 0.4986 | Non-stationary |

| lnIP | −3.3245 | −4.0187 | −3.4393 | −3.1440 | 0.0662 | Non-stationary |

| lnCHP | −3.2407 | −4.0187 | −3.4393 | −3.1440 | 0.0805 | Non-stationary |

| lnSP | 3.7013 | −2.5801 | −1.9429 | −1.6153 | 0.9999 | Non-stationary |

| lnURPCDI | −2.8572 | −4.0187 | −3.4393 | −3.1440 | 0.1796 | Non-stationary |

| lnRRPCDI | −3.1233 | −4.0187 | −3.4393 | −3.1440 | 0.1046 | Non-stationary |

| lnEDI | −2.7721 | −3.4731 | −2.8802 | −2.5768 | 0.0647 | Non-stationary |

| Variable | ADF Statistic | Critical Value | p-Value | Stationarity | ||

|---|---|---|---|---|---|---|

| 1% | 5% | 10% | ||||

| dlnPOP | −6.6943 | −2.5802 | −1.9429 | −1.6153 | 0.0000 | Stationary |

| dlnCP | −6.0765 | −2.5802 | −1.9429 | −1.6153 | 0.0000 | Stationary |

| dlnPH | −5.7188 | −2.5802 | −1.9429 | −1.6153 | 0.0000 | Stationary |

| dlnSH | −6.7794 | −2.5802 | −1.9429 | −1.6153 | 0.0000 | Stationary |

| dlnIP | −10.5639 | −2.5802 | −1.9429 | −1.6153 | 0.0000 | Stationary |

| dlnCHP | −7.2978 | −2.5802 | −1.9429 | −1.6153 | 0.0000 | Stationary |

| dlnSP | −7.3922 | −3.4734 | −2.8803 | −2.5769 | 0.0000 | Stationary |

| dlnURPCDI | −9.4532 | −3.4734 | −2.8803 | −2.5769 | 0.0000 | Stationary |

| dlnRRPCDI | −9.5298 | −3.4734 | −2.8803 | −2.5769 | 0.0000 | Stationary |

| dlnEDI | −9.1391 | −2.5802 | −1.9429 | −1.6153 | 0.0000 | Stationary |

| No. of CE(s) | Eigenvalue | Statistic | 5% Critical Value | p |

|---|---|---|---|---|

| None * | 0.5076 | 401.8734 | 251.2650 | 0.0000 |

| At most 1 * | 0.3636 | 292.7855 | 208.4374 | 0.0000 |

| At most 2 * | 0.2901 | 223.1963 | 169.5991 | 0.0000 |

| At most 3 * | 0.2732 | 170.4279 | 134.6780 | 0.0001 |

| At most 4 * | 0.2144 | 121.2948 | 103.8473 | 0.0021 |

| At most 5 * | 0.1523 | 84.1308 | 76.9728 | 0.0128 |

| At most 6 * | 0.1466 | 58.6829 | 54.0790 | 0.0184 |

| At most 7 | 0.1053 | 34.2753 | 35.1928 | 0.0626 |

| At most 8 | 0.0913 | 17.1450 | 20.2618 | 0.1272 |

| At most 9 | 0.0155 | 2.4033 | 9.1645 | 0.6968 |

| Lag | LogL | LR | FPE | AIC | SC | HQ |

|---|---|---|---|---|---|---|

| 0 | 1708.3520 | NA | 1.25 × 10−22 | −22.0565 | −21.8593 | −21.9764 |

| 1 | 3520.2970 | 3365.0400 | 2.76 × 10−32 | −44.2896 | −42.1203 * | −43.4084 |

| 2 | 3687.8840 | 289.4681 * | 1.17 × 10−32 * | −45.1673 * | −41.0260 | −43.4851 * |

| Month | S.E. | LnPOP (%) | LnCP (%) | LnPH (%) | LnSH (%) | LnIP (%) | LnCHP (%) | LnSP (%) | LnURPCDI (%) | LnRRPCDI (%) | LnEDI (%) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 0.0511 | 100.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| 3 | 0.1011 | 86.8732 | 1.7180 | 1.2348 | 2.7116 | 0.7549 | 0.4716 | 0.0577 | 3.2588 | 0.0314 | 2.8881 |

| 5 | 0.1251 | 73.6769 | 2.2102 | 8.3253 | 2.0098 | 1.7955 | 1.4864 | 0.2106 | 6.7764 | 0.0290 | 3.4799 |

| 7 | 0.1420 | 61.5289 | 1.7813 | 20.7050 | 1.6167 | 2.0452 | 1.3877 | 0.4670 | 7.1821 | 0.4766 | 2.8094 |

| 9 | 0.1588 | 50.8479 | 1.4724 | 31.2769 | 1.3781 | 1.9507 | 1.3067 | 0.8183 | 6.3739 | 1.9318 | 2.6433 |

| 11 | 0.1750 | 42.7348 | 1.3061 | 36.8072 | 1.2344 | 1.7966 | 2.0078 | 1.2347 | 5.5285 | 3.7926 | 3.5573 |

| 13 | 0.1890 | 37.1024 | 1.2457 | 38.3205 | 1.2890 | 1.6455 | 3.2377 | 1.6168 | 4.8911 | 5.3806 | 5.2707 |

| 15 | 0.2003 | 33.2835 | 1.3035 | 37.5770 | 1.6996 | 1.5037 | 4.6117 | 1.8783 | 4.4325 | 6.4535 | 7.2565 |

| 17 | 0.2090 | 30.6339 | 1.4848 | 35.8412 | 2.6014 | 1.3840 | 5.9013 | 1.9925 | 4.0935 | 7.0133 | 9.0542 |

| 18 | 0.2127 | 29.5986 | 1.6142 | 34.8544 | 3.2451 | 1.3382 | 6.4788 | 2.0012 | 3.9561 | 7.1287 | 9.7846 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pang, J.; Yin, J.; Lu, G.; Li, S. Supply and Demand Changes, Pig Epidemic Shocks, and Pork Price Fluctuations: An Empirical Study Based on an SVAR Model. Sustainability 2023, 15, 13130. https://doi.org/10.3390/su151713130

Pang J, Yin J, Lu G, Li S. Supply and Demand Changes, Pig Epidemic Shocks, and Pork Price Fluctuations: An Empirical Study Based on an SVAR Model. Sustainability. 2023; 15(17):13130. https://doi.org/10.3390/su151713130

Chicago/Turabian StylePang, Jie, Juan Yin, Guangchang Lu, and Shimei Li. 2023. "Supply and Demand Changes, Pig Epidemic Shocks, and Pork Price Fluctuations: An Empirical Study Based on an SVAR Model" Sustainability 15, no. 17: 13130. https://doi.org/10.3390/su151713130

APA StylePang, J., Yin, J., Lu, G., & Li, S. (2023). Supply and Demand Changes, Pig Epidemic Shocks, and Pork Price Fluctuations: An Empirical Study Based on an SVAR Model. Sustainability, 15(17), 13130. https://doi.org/10.3390/su151713130