Modern Hydrogen Technologies in the Face of Climate Change—Analysis of Strategy and Development in Polish Conditions

Abstract

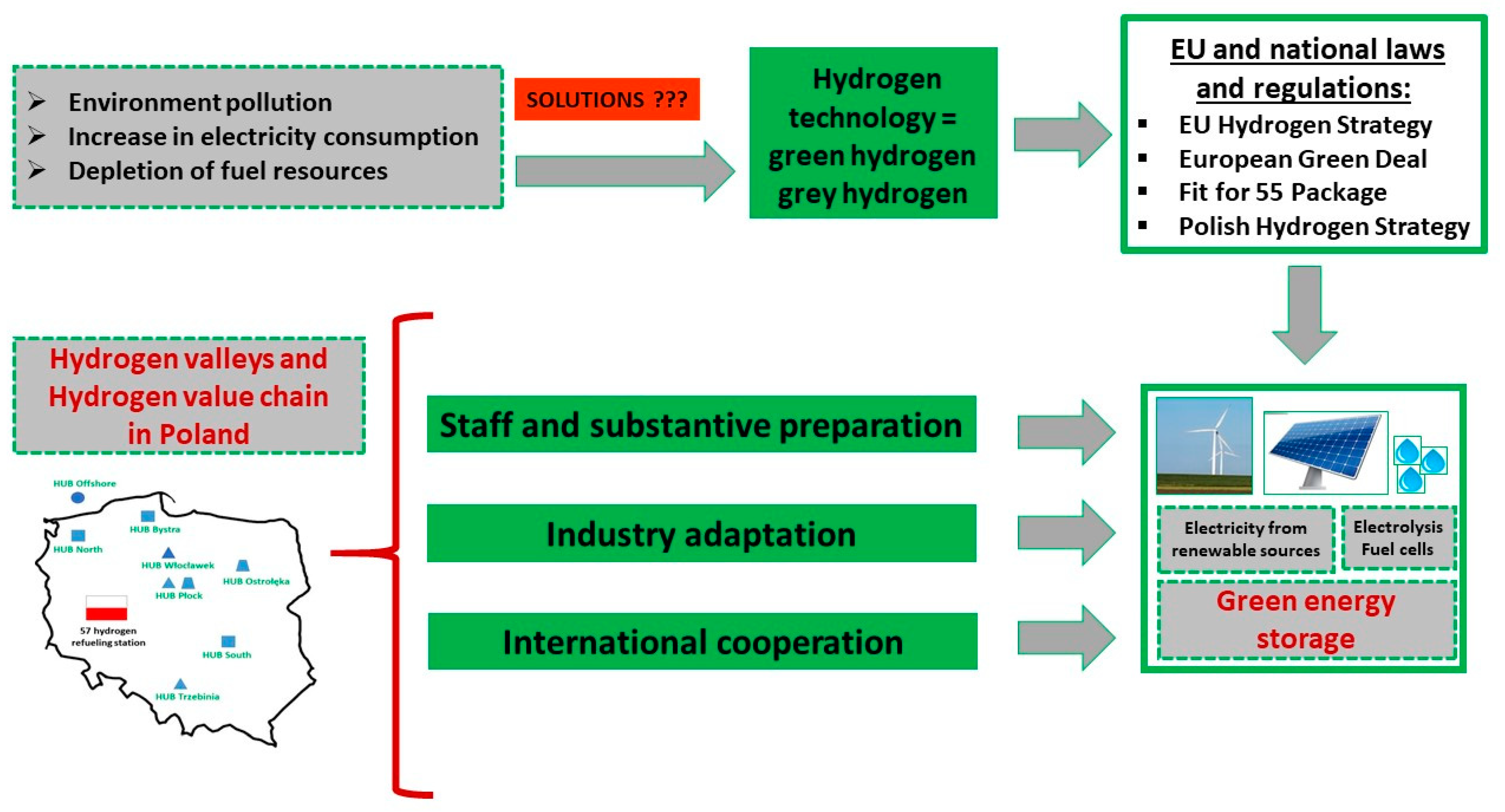

:1. Introduction

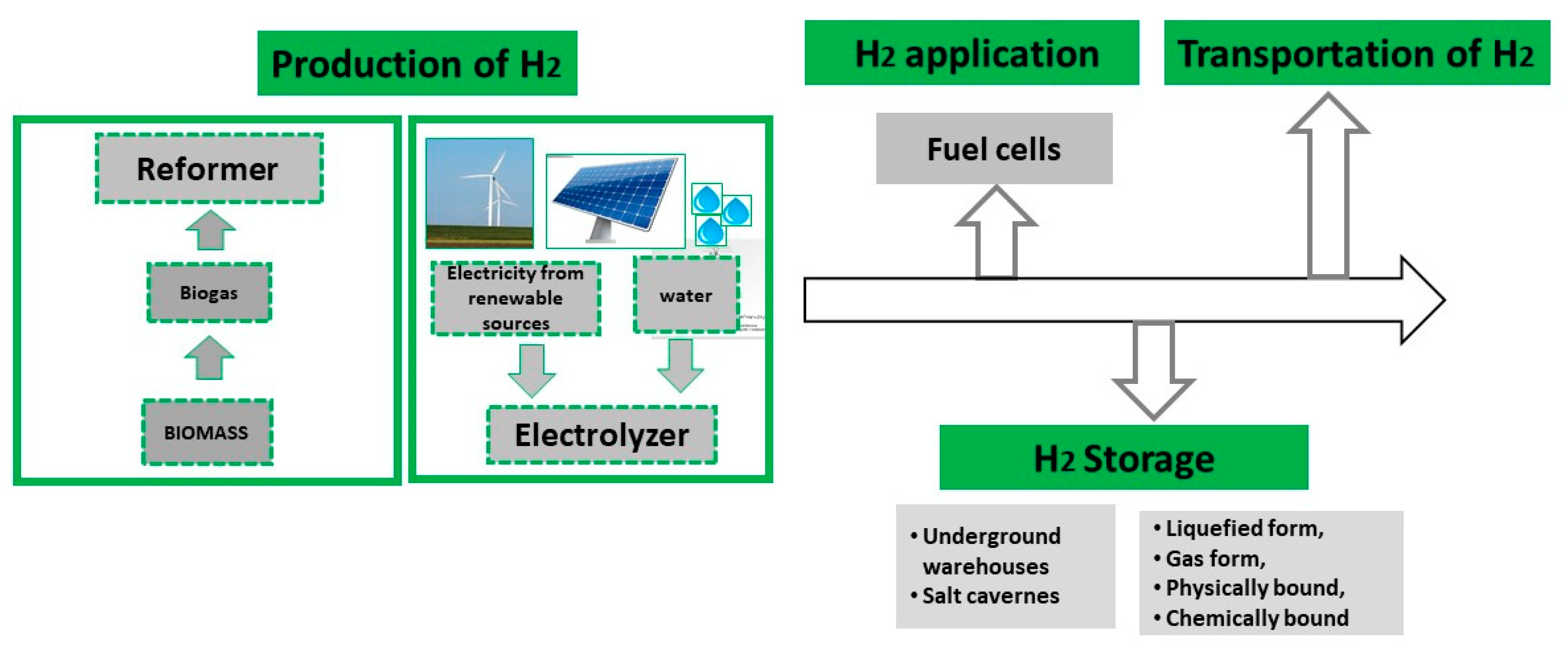

1.1. The Idea of Using Hydrogen Fuel Cells

1.2. RES Electrolyzer Fuel Cells: Green Energy Storage

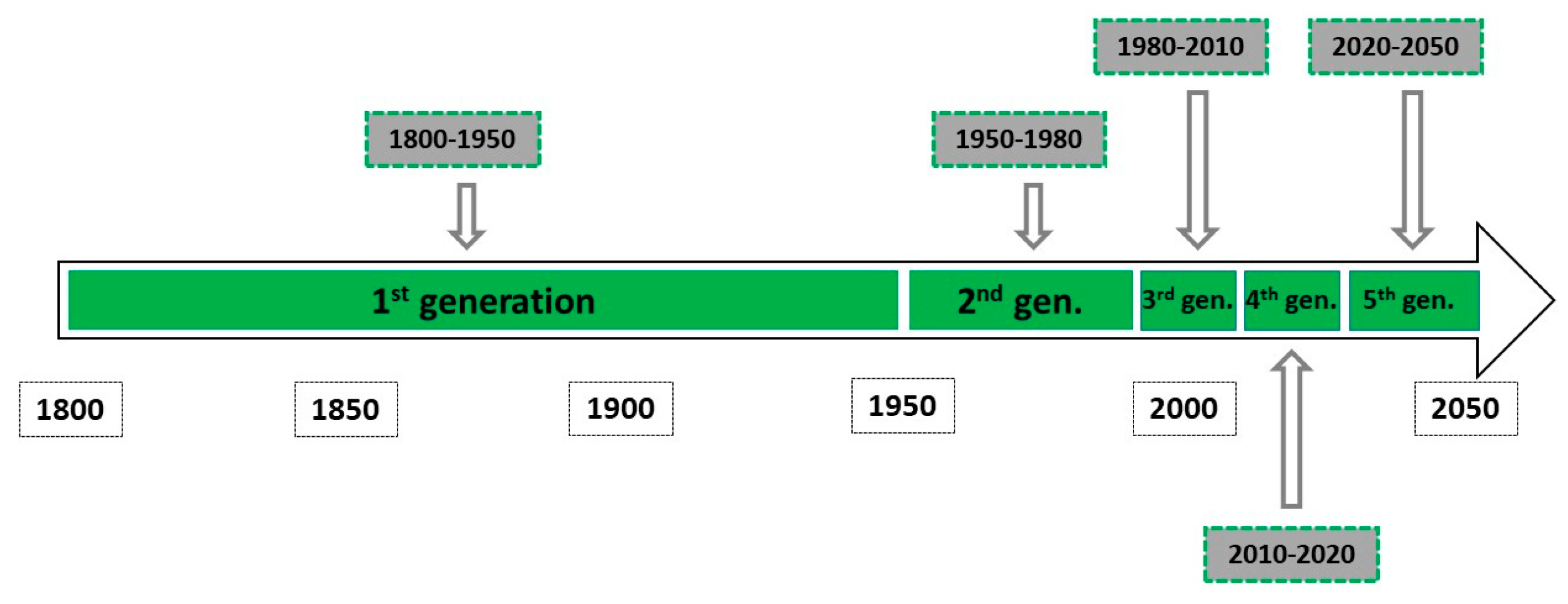

- First-generation electrolyzers, used in the years 1800–1950, were used for the production of ammonia; they were alkaline electrolyzers (usually KOH) working at atmospheric pressure; the separator was asbestos; later, the electrolysis process was used for the production of chlorine, where hydrogen became a new by-product;

- Second-generation electrolyzers, used in the years 1950–1980, were based on polymers showing special transport properties—proton exchange. This solution allowed the use of water instead of alkali, which made it possible to reduce the system, reduce its size, and achieve higher efficiency and power density. The leading companies were General Electric, later Hamilton Sundstrand (USA), Siemens, and ABB (Germany);

- Third-generation electrolyzers, used in the years 1980–2010, are characterized by higher efficiency and durability over 50,000 h at lower investment costs and are mostly used for hydrogen production;

- Fourth-generation electrolyzers, developed in the years 2010–2020, are an important element in the process of decarbonization in many industry sectors, not only the energy sector. The constantly increasing capacity of electrolyzer stacks allows for lower capital expenditures (CAPEX), which increases the importance of electrolysis in the energy policy agenda and green hydrogen-specific objectives;

- Fifth-generation electrolyzers, after 2020 to 2050, are most likely to increase electrolyzer capacity from the MW scale to the GW scale, which will be achieved through lower costs (<200 USD/kW) and an increase in lifetime (>50,000 h). These assumptions will require greater production capacity and the rapid, ground-breaking development of research on materials for electrolyzers.

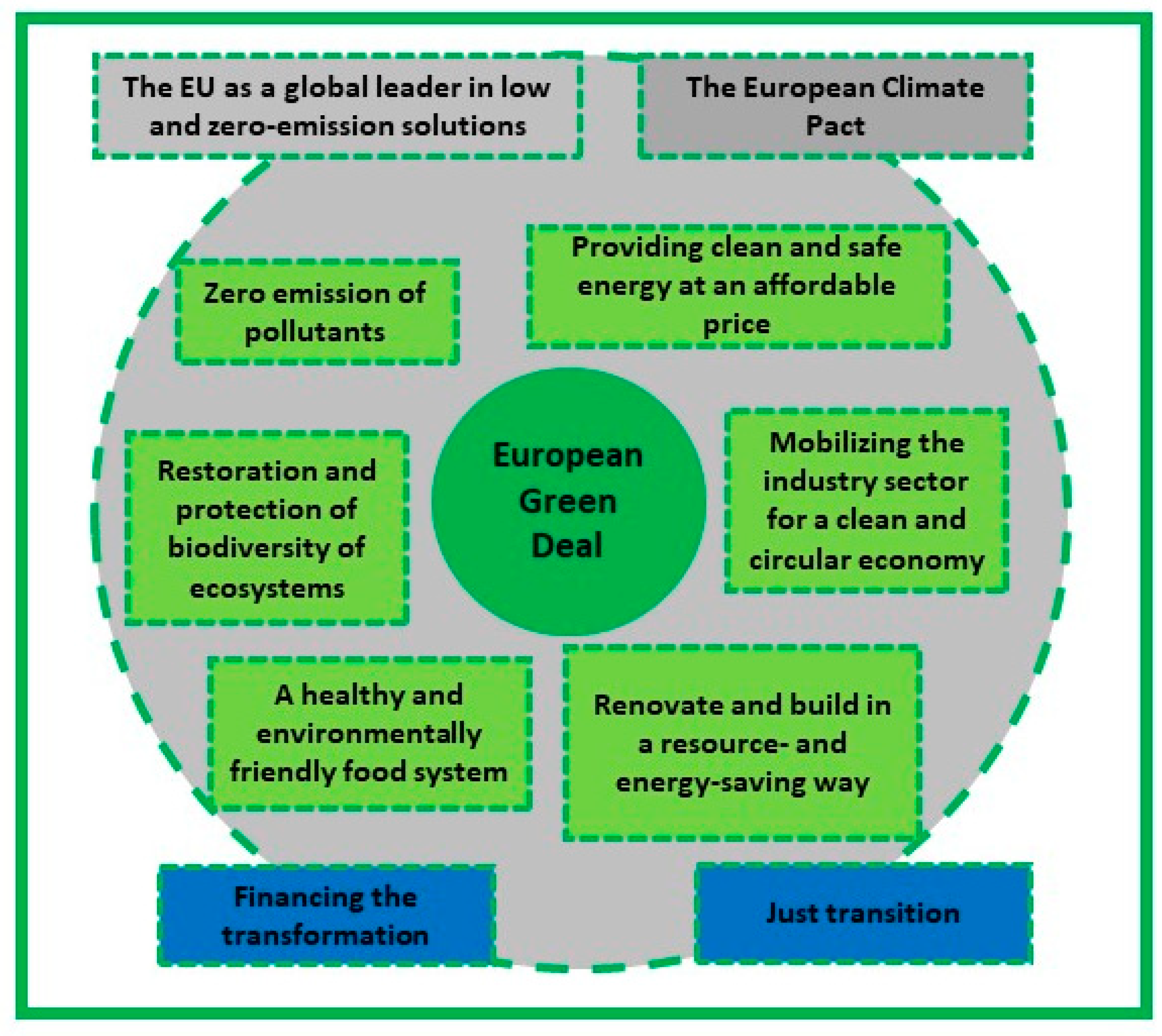

2. Development of the Hydrogen Value Chain Based on Applicable Legal Acts

- Europe without pollution—pollution of air and water—and a solution to the problem of industrial pollution;

- Transitioning to a circular economy—adopting a new circular economy action plan by March 2020;

- “Farm to Fork” program—targets for reducing chemical pesticides (50% by 2030), fertilizers, and increasing the area of organic crops;

- Green Common Agricultural Policy—high environmental and climate ambitions under the reform of the Common Agricultural Policy;

- JUST Transition Mechanism—financial support for regional energy transformation plans;

- Financing transformation—funds for green innovations and public investments;

- Clean, Affordable, and Secure Energy—Assessment of member states’ ambitions as part of their national energy and climate plans;

- Achieving climate neutrality—a proposal for the first climate act that records the goal of climate neutrality by 2050;

- Sustainable transport and the adoption of a strategy for sustainable and smart mobility, as well as the review of the Alternative Fuels Infrastructure Directive and the TEN-T Regulation [23];

- Protecting Europe’s natural capital—a proposal for an EU biodiversity strategy to 2030.

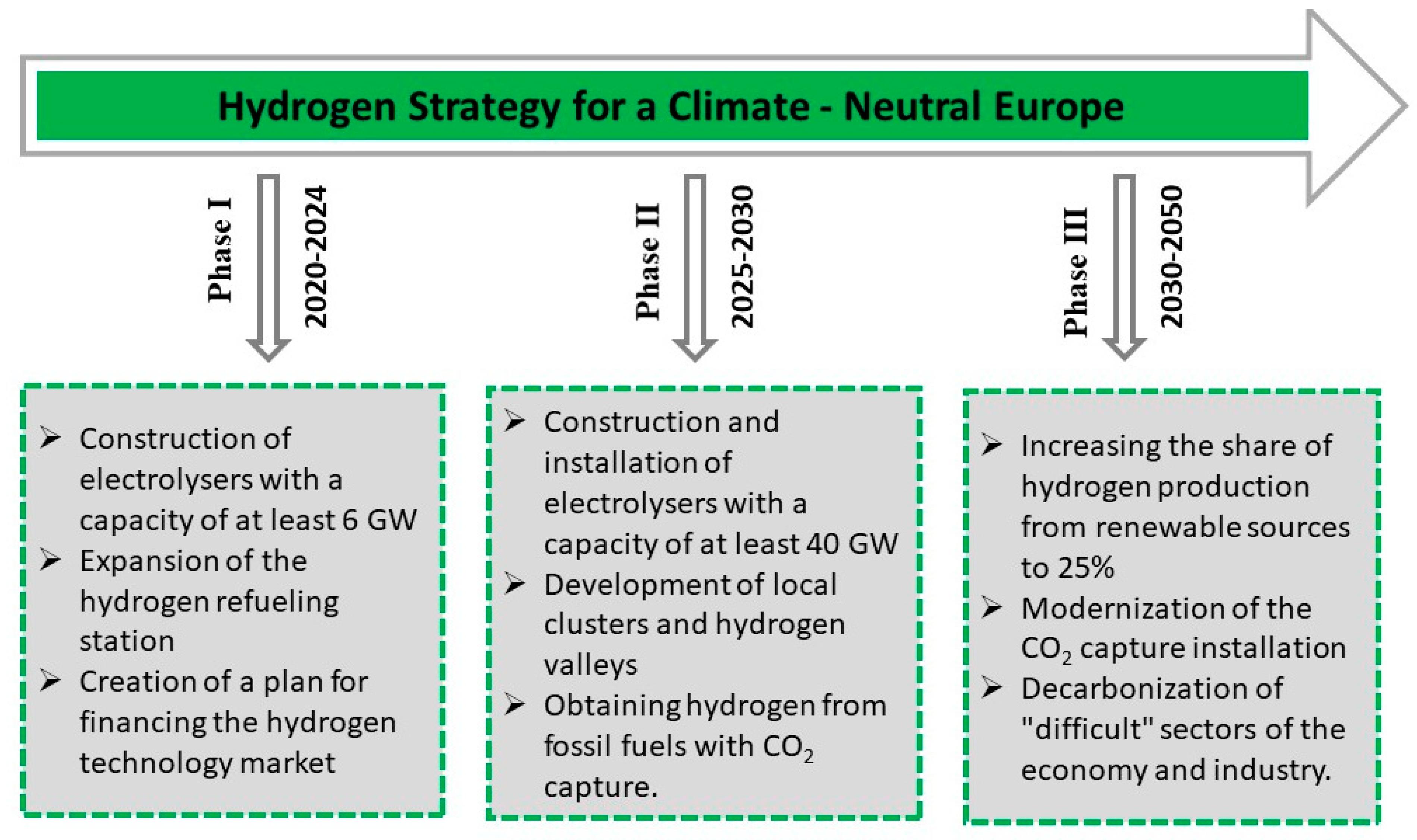

- Phase I covers the period from 2020 to 2024, and its goal is to install electrolyzers powered by renewable energy with a capacity of at least 6 GW and a production capacity of 1 million tons of renewable hydrogen. In this phase, it is planned to increase the production of electrolyzers and build them at demand centers such as steel mills or refineries. A refueling station for buses equipped with fuel cells is to be developed. The years envisaged for this stage will also be the time for creating the hydrogen market, stimulating its liquidity, and planning the benefits of hydrogen investments. The steps taken are centralized and provide for the stationary use of energy to produce hydrogen.

- Phase II covers the period from 2025 to 2030. In these years, the strategic goal is to install electrolyzers powered by renewable energy with a capacity of at least 40 GW and, at the same time, produce 10 million tons of renewable hydrogen in the European Union. Compared to the first phase, which lasted 4 years, this is an almost seven-fold increase, which gives an idea of the dynamics of activities related to the development of the hydrogen economy in this phase. The use of hydrogen will be possible even for more energy-intensive sectors of the economy, such as steel production or heat supply to buildings. At this stage, it is planned to increase price competitiveness. This phase will play an important role in stabilizing the RES-based electricity system by performing supporting and buffering functions.

- Phase III is the period from 2030 to 2050. This is the last phase in which technologies are expected to mature and expand into other sectors of the economy [36,37,38]. The entire investment plan for the European Union, spread over 30 years, is estimated at EUR 180–470 billion, which consists of the construction of electrolyzers, the construction and connection of new renewable energy sources, refueling stations, and infrastructure. Further funds in the amount of EUR 850–1000 million are to be spent on the creation of 400 hydrogen refueling stations [39,40].

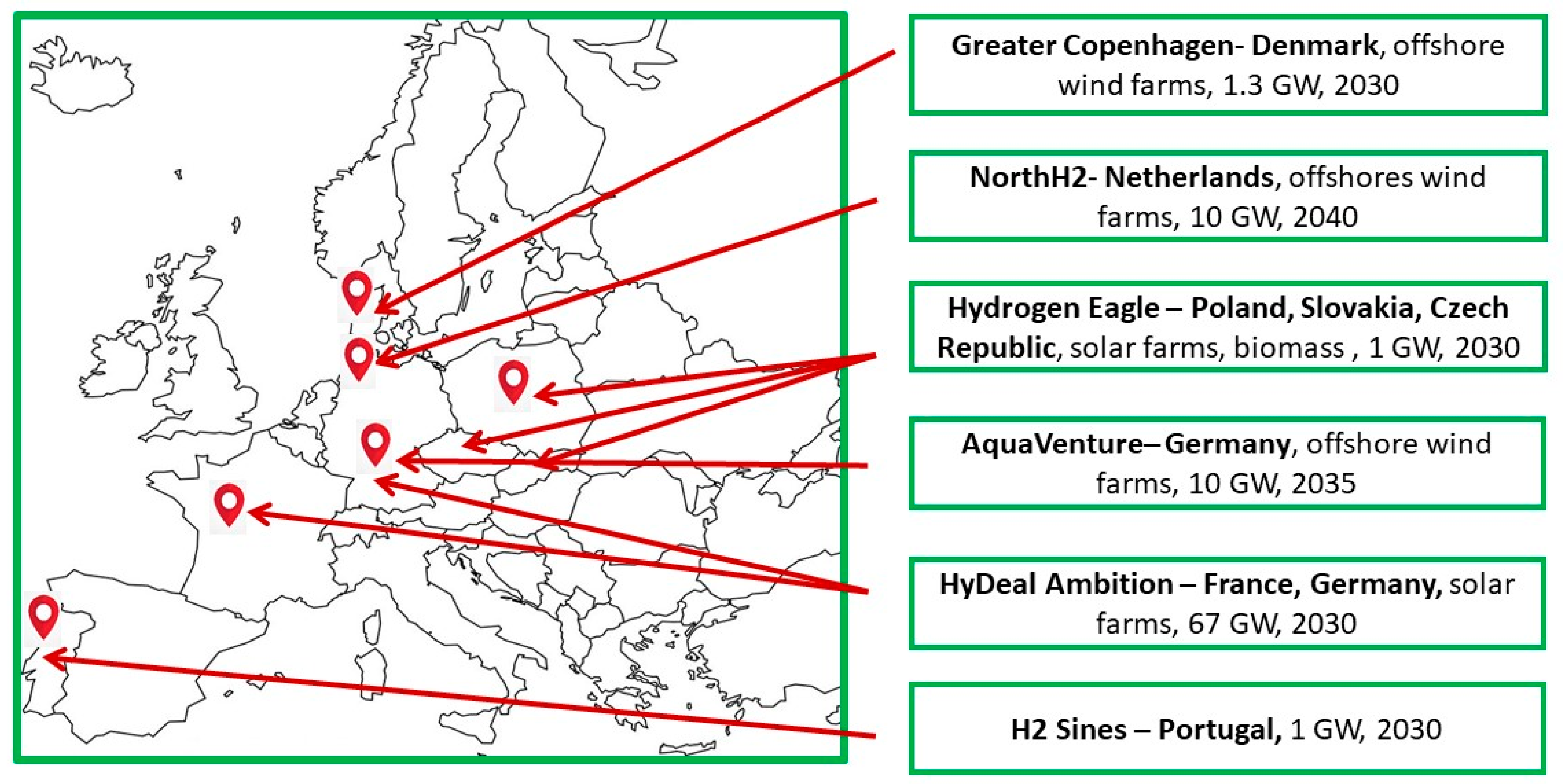

3. Potential and Prospects for the Development of the Hydrogen Market—Good Practices in European Countries

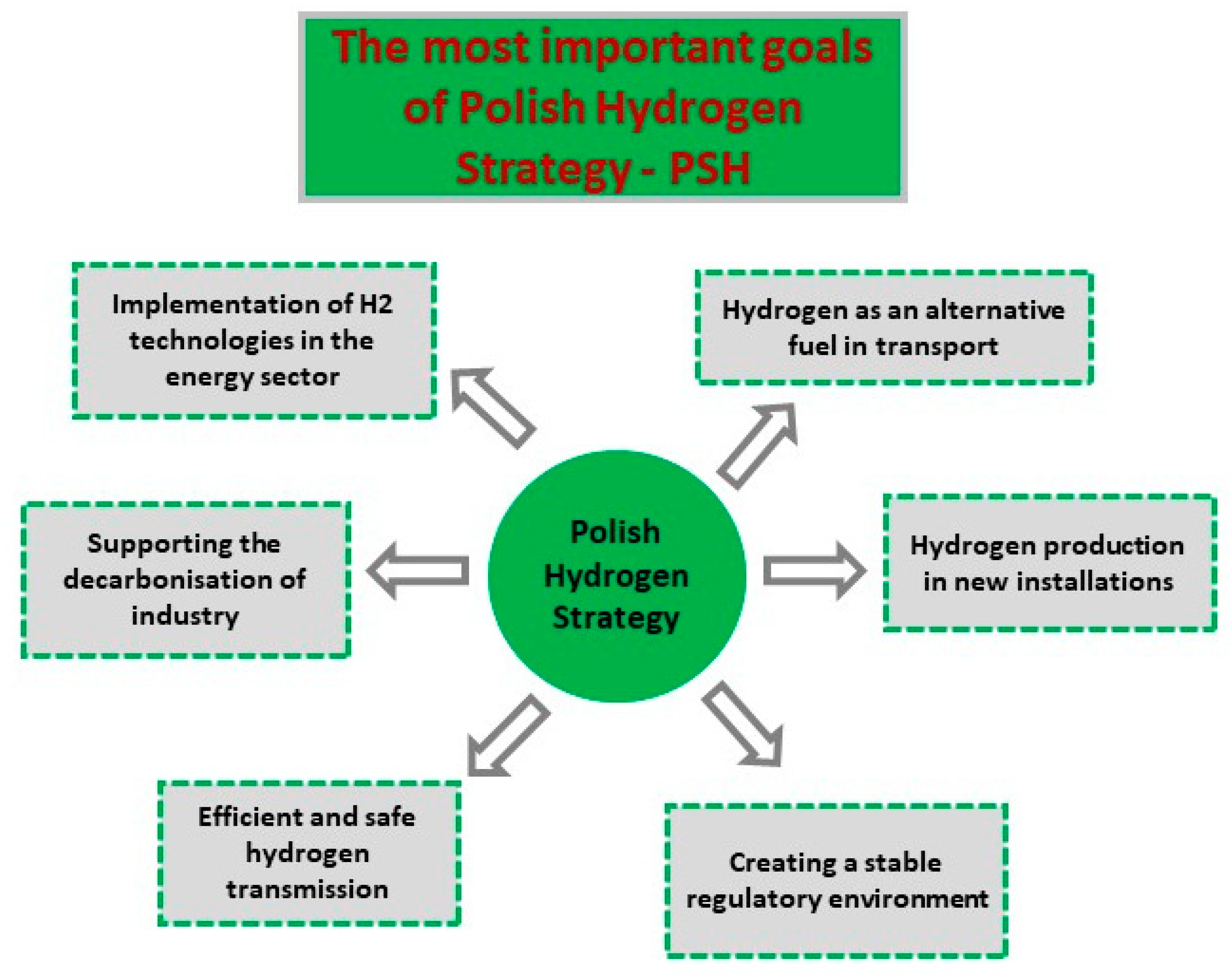

4. Development and Initiatives in the Field of Hydrogen Technologies in Poland—Road Map in Poland

- Flagship project related to electromobility in Polish transport;

- Polish Nuclear Energy Program;

- Strategic Electromobility Development Program.

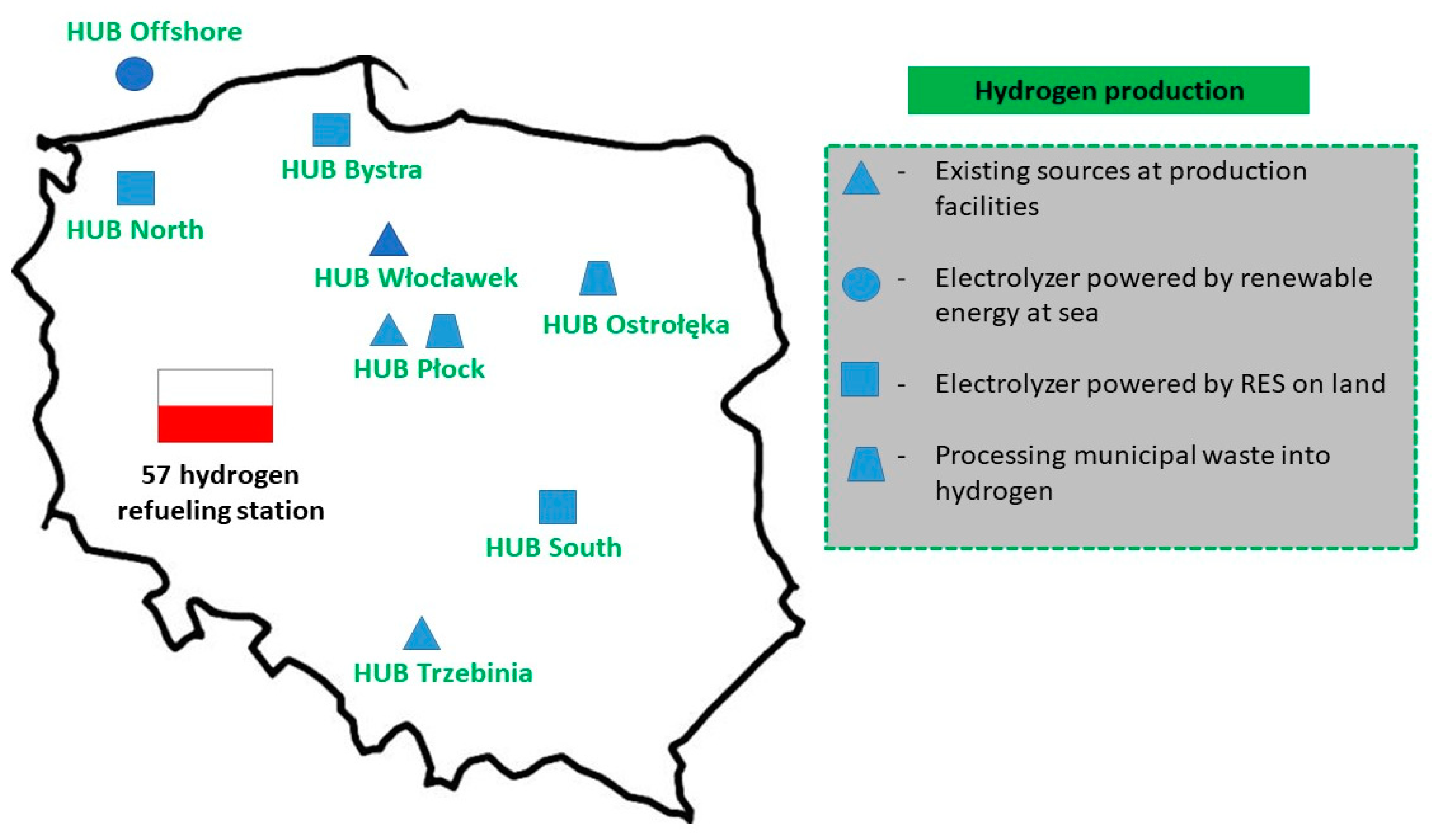

4.1. Development of Hydrogen Technology Infrastructure and the Hydrogen Value Chain in Poland—Hydrogen Valleys

- Scale of the project—in addition to the planned demonstration projects, stakeholders must plan at least two large, multi-million (EUR) investments as part of the valley operation. Typically, a valley consists of multiple sub-projects that make up a larger project portfolio. It is assumed that the hydrogen valley should have investment outlays of at least EUR 20 million. The European average is EUR 100 million;

- Geographically defined area—hydrogen ecosystems must cover a given area or region. It can be a local hydrogen hub and its hinterland, a region in a given country, or a cross-border region—e.g., a transport corridor along a major waterway;

- Coverage of the hydrogen value chain—i.e., activities planned in the valley from hydrogen production using energy from renewable sources through storage and distribution to its use—off-take in the region;

- The possibility of using hydrogen in several sectors of the economy—the use of regionally produced hydrogen in projects in transport, industry, and energy, applying the principle of one source—has many applications in various sectors. It is assumed that hydrogen should be used in at least two sectors of the economy;

- The activities of stakeholders in a given hydrogen valley are carried out according to a given feasibility study, which guarantees that the activities have a real chance of launching the project and obtaining financing from EU, national, and regional funds.

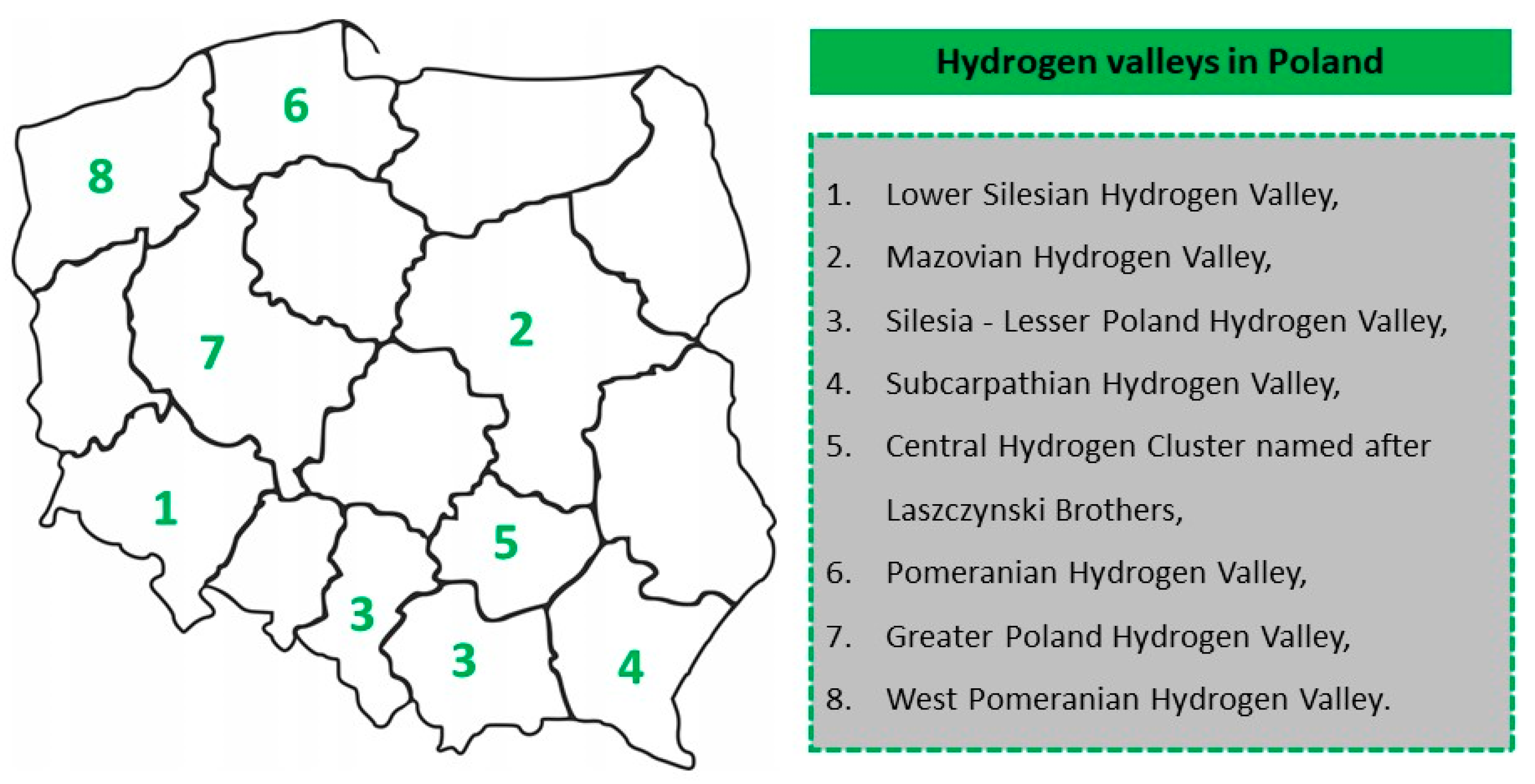

4.2. Hydrogen Valleys in Poland

- Lower Silesian Hydrogen Valley;

- Mazovian Hydrogen Valley;

- Silesia—Lesser Poland Hydrogen Valley;

- Subcarpathian Hydrogen Valley;

- Central Hydrogen Cluster named after Laszczynski Brothers;

- Pomeranian Hydrogen Valley;

- Greater Poland Hydrogen Valley;

- West Pomeranian Hydrogen Valley.

- A proposal for a new wording of the regulations regarding the area of clean transport, which are mandatory for cities with more than 100,000 inhabitants. They show an average annual exceedance of nitrogen dioxide (NO2) pollution. A modification of the catalog of vehicles authorized to enter the zone was also included. In addition, it has been possible for municipal authorities to assign separate exemptions related to vehicle traffic;

- Reducing the amount and frequency of collecting fees related to EIPA numbers in order to significantly accelerate the expansion of the vehicle charging network;

- Changing the management board’s obligations regarding the installation and use of charging points in buildings to the designated power level and shortening the period for examining applications;

- Introduction of the concept of an electrically assisted bicycle, which ensures the development and assistance for the most diverse electric vehicles, and improvement of definitions related to the use of hydrogen in transport.

4.3. Analysis of Hydrogen Production and Storage Possibilities in Polish Conditions

- Azoty Group—42% market share (producing approx. 420,000 tons/year, a significant part of the hydrogen is sold on the market—covering approx. 85% of domestic sales);

- LOTOS Group—14% market share (producing approx. 145,000 tons/year, used for own purposes);

- PKN Orlen—14% share (producing approx. 145,000 tons/year, used for own purposes);

- Jastrzebska Spolka Weglowa—7% share (producing approx. 75 thousand tons per year);

- Others: 23%.

5. Summary

- Implementation of assumptions in accordance with the recommendations of the European Commission regarding the need to implement zero-emission methods of obtaining hydrogen;

- Implementation of the objectives and assumptions of the Polish Hydrogen Strategy and supporting documents, including, in particular, the Energy Policy of Poland PEP2040, based on a just transformation, a zero-emission energy system, and the pursuit of good air quality;

- Development of hydrogen technologies in the three main sectors where hydrogen is used—transport, energy, and industry;

- Striving for economic growth by creating jobs and investments in the creation of the hydrogen value chain, including the construction of new electrolyzers,

- Development of hydrogen technologies in the field of initiatives in the form of clusters and hydrogen valleys;

- Activities of hydrogen valley stakeholders and Polish leaders in the energy industry, taking into account long-term plans supported by programs subsidizing activities related to hydrogen technologies;

- International cooperation between Poland, Slovakia, and the Czech Republic under the project HydrogenEagle, whose main assumption is the production of green hydrogen using biomass and solar farms in electrolyzers with a capacity of 1 GW;

- Activities related to gathering specialized staff in the field of hydrogen technologies by creating didactic courses, organizing training, and post-graduate studies;

- Plans to create 57 hydrogen refueling stations in Poland, obtained in hubs from four sources;

- Poland is ranked fifth in the global ranking of hydrogen producers and third in hydrogen production in Europe;

- Implementation of projects based on the production of hydrogen from biomethane and the processing of municipal waste, which is also tantamount to recycling activities.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Włodarczyk, R. The Use of Fuel Cell Technology as Electricity and Heat Generators in Residential Buildings. Instal 2021, 6, 22–28. [Google Scholar] [CrossRef]

- Włodarczyk, R.; Kacprzak, A. Magazynowanie Energii w Postaci Wodoru w Warunkach Polskich—Potencjał i Wyzwania (w:) Nowoczesne Technologie Konwersji i Magazynowania Energii; Politechnika Częstochowska: Czestochowa, Poland, 2019; pp. 138–165. ISBN 978-83-7193-721-7. (In Polish) [Google Scholar]

- EUR-Lex-52020DC0301-EN-EUR-Lex. Available online: https://eur-lex.europa.eu/legal-content/PL/TXT (accessed on 10 July 2023).

- Wlodarczyk, R. Research on the Functional Properties of Materials Used for PEMFC Fuel Cell Interconnectors; Publisher Czestochowa University of Technology: Czestochowa, Poland, 2011. [Google Scholar]

- Final Report: Assessment of Electrolysers, Scottish Government, Riaghaltas na h-Alba, October 2022. Available online: https://www.gov.scot/binaries/content/documents/govscot/publications/research-and-analysis/2022/10 (accessed on 10 July 2023).

- Wang, S.; Lu, A.; Zhong, C.-J. Hydrogen production form water electrolysis: Role of catalysts. Nano Converg. 2021, 8, 4. [Google Scholar] [CrossRef] [PubMed]

- Buttler, A.; Spliethoff, H. Current status of water electrolysis for energy storage, grid balancing and sector coupling via power-to gas and power-to-liqiuds: A review. Renew. Sustain. Energy Rev. 2018, 82, 2440–2452. [Google Scholar] [CrossRef]

- Naimi, Y.; Antar, A. Hydrogen generation by water electrolysis. In Advances in Hydrogen Generation Technologies; IntechOpen: London, UK, 2018; ISBN 978-1-78923-535-7. [Google Scholar] [CrossRef]

- Herman, A.; Chaudhuri, T.; Spagnol, P. Bipolar plates for PEM fuel cells: A review. Int. J. Hydrog. Energy 2005, 30, 1297–1302. [Google Scholar] [CrossRef]

- Ball, M.; Wietschel, M. The future of hydrogen–opportunities and challenges. Int. J. Hydrog. Energy 2009, 34, 615–627. [Google Scholar] [CrossRef]

- Tani, T.; Sekiguchi, N.; Sakai, M.; Ohta, D. Optimization of solar hydrogen systems based on hydrogen production cost. Sol. Energy 2000, 68, 143–149. [Google Scholar] [CrossRef]

- Oliver Ristau, Hydrogen for Europe. Opportunity for Portugal. Available online: https://www.dw.com/pl/jak-s%C5%82o%C5%84ce-zamienia-wod%C4%99-morsk%C4%85-w-wod%C3%B3r-szansa-dla-portugalii/a-55704054 (accessed on 8 June 2023).

- Ishaq, H.; Dincer, I.; Crawford, C. A review on hydrogen production and utilization: Challenges and opportunities. Int. J. Hydrog. Energy 2022, 47, 26238–26264. [Google Scholar] [CrossRef]

- Patonia, A.; Poudineh, R. Cost-Competitive Green Hydrogen: How to Lower the Cost of Electrolysers? The Oxford Institute for Energy Studies: Oxford, UK, 2022; ISBN 978-1-78467-193-8. [Google Scholar]

- Guandalini, G.; Campanari, S.; Valenti, G. Comparative assessment and safety issues in state-of-the-art hydrogen production technologies. Int. J. Hydrog. Energy 2016, 41, 18901–18920. [Google Scholar] [CrossRef]

- Editorial: Gram w zielone: Energia z farmy PV I magazynu energii za 0,145 USD/kWh. Available online: https://www.gramwzielone.pl/energia-sloneczna/20532/energia-z-farmy-pv-i-magazynu-energii-za-0145-usdkwh (accessed on 8 June 2023).

- Cullen, D.A.; Neyerlin, K.C.; Ahluwalia, R.K.; Mukundan, R.; More, L.K.; Borup, R.L.; Weber, A.Z.; Myers, D.J.; Kusoglu, A. New roads and challenges for fuel cells in heavy-duty transportation. Nat. Energy 2021, 6, 462–474. [Google Scholar] [CrossRef]

- Mustain, W.E.; Chetenet, M.; Page, M.; Kim, Y.S. Durability challenges of anion exchange membrane fuel cells. R. Soc. Chem. 2020, 13, 2805–2838. [Google Scholar] [CrossRef]

- Fan, L.; Tu, Z.; Chan, S.W. Recent development of hydrogen and fuel cell technologies: A review. Energy Rep. 2021, 7, 8421–8446. [Google Scholar] [CrossRef]

- IRENA. Green Hydrogen Cost Reduction: Scaling Up Electrolysers to Meet the 1.5 °C Climate Goal; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2020. [Google Scholar]

- Yue, M.; Lambert, H.; Pahon, E.; Roche, R.; Jemei, S.; Hissel, D. Hydrogen energy systems: A critical review of technologies, applications, trends and challenges. Renew. Sustain. Energy Rev. 2021, 146, 111180. [Google Scholar] [CrossRef]

- Rai, S.; Habil, M.; Massey, D. A review on green hydrogen: An alternative of climate change mitigation. Indian J. Adv. Chem. Sci. 2021, 9, 340–345. [Google Scholar]

- Birol, F. Chapter 2: Producing hydrogen and hydrogen-based production. Report prepared by the IEA for the G20. In The Future of Hydrogen, Seizing Today’s Opportunities; International Energy Agency: Tokyo, Japan, 2019. [Google Scholar]

- Kumar, S.S.; Himabindu, V. A comparative analysis of friction stir and tungsten inert gas dissimilar AA5082-AA7075 butt welds. Mater. Sci. Energy Technol. 2019, 2, 442–454. [Google Scholar] [CrossRef]

- IRENA. Hydrogen: A renewable energy perspective. In Proceedings of the 2nd Hydrogen Energy Ministerial Meeting, Tokyo, Japan, 1 September 2019. [Google Scholar]

- Reksten, A.H.; Thomassen, M.S.; Moller-Holst, S.; Sundseth, K. Projecting the future cost of PEM and alkaline water electrolysers; a CAPEX model including electrolyser plant size and technology development. Int. J. Hydrog. Energy 2022, 47, 38106–38113. [Google Scholar] [CrossRef]

- Komunikat Dotyczący Pakietu Fit for 55—Ministerstwo Klimatu i Środowiska—Portal Gov.pl. Available online: https://gov.pl/web/klimat/komunikat-dotyczacy-pakietu-fit-for-55 (accessed on 10 July 2023).

- Unijna Strategia Wodorowa. Available online: osw.waw.pl (accessed on 10 July 2023).

- Sobolewski, M. Europejski Zielony Ład: W Stronę Neutralności Klimatycznej; Wydawnictwo Sejmowe dla Biura Analiz Sejmowych: Warszawa, Poland, 2020; p. 2. (In Polish) [Google Scholar]

- Ciechanowska, M. Strategia w zakresie wodoru na rzecz Europy neutralnej dla klimatu. Nafta-Gaz 2020, 12, 95. [Google Scholar]

- Climate action and the Green Deal, Microsoft Word—PL 366-7.doc. Available online: https://commission.europa.eu/strategy-and-policy/priorities-2019-2024/european-green-deal/climate-action-and-green-deal_en (accessed on 10 July 2023).

- DECYZJA RADY (UE) 2016/590—z Dnia 11 Kwietnia 2016 r.—w Sprawie Podpisania, w Imieniu Unii Europejskiej, Porozumienia Paryskiego Przyjętego w Ramach Ramowej Konwencji Narodów Zjednoczonych w Sprawie Zmian Klimatu. Available online: https://eur-lex.europa.eu/legal-content/PL/TXT/PDF (accessed on 10 July 2023).

- Józefiak. “Europejski Zielony Ład” Jako Nowa Unijna Strategia w Zakresie Ochrony Klimatu. In Jaka Przyszłość Unii Europejskiej?: Wyzwania, Problemy, Szanse; Kurczewska, U., Ed.; Oficyna Wydawnicza SGH: Warszawa, Poland, 2020; p. 81. Available online: eur-lex.europa.eu (accessed on 10 July 2023).

- EU Strategies on Hydrogen and Energy System Integration, European Parliament. Available online: https://www.europarl.europa.eu/RegData/etudes/ATAG/2021/690599/EPRS_ATA(2021)690599_EN.pdf (accessed on 10 July 2023).

- A Hydrogen Strategy for a Climate-Neutral Europe, Komunikat Komisji do Europejskiego Parlamentu, Bruksela 07.08.2020, Teksty Przyjęteeuropejska Strategia w Zakresie Wodoru—Środa, 19 Maja 2021 r. Available online: file:///C:/Users/HP/Downloads/EU_Hydrogen_Strategy.pdf (accessed on 10 July 2023).

- Schalenbach, M.; Carmo, M.; Fritz, D.L.; Mergel, J.; Stolten, D. Pressurized PEM water electrolysis: Efficiency and gas crossover. Int. J. Hydrog. Energy 2013, 35, 14921–14933. [Google Scholar] [CrossRef]

- What Is Green Hydrogen? An Expert Explains Its Benefits|World Economic Forum. Available online: www.weforum.org (accessed on 10 July 2023).

- Renewable Hydrogen: What Are the Benefits for the EU? Available online: https://www.europarl.europa.eu/ (accessed on 1 July 2023).

- Zore, U.K.; Yedire, S.G.; Pandi, N.; Manickam, S.; Sonawane, S. A review on recent advances in hydrogen energy, fuel cell, biofuel and fuel refining via ultrasound process intensification. Ultrason. Sonochem. 2021, 73, 105536. [Google Scholar] [CrossRef] [PubMed]

- Refueling Protocols for Medium and Heavy-Duty Vehicles. Available online: https://cordis.europa.eu/programme/id/H2020_FCH-04-2-2019 (accessed on 10 July 2023).

- Sonja van Rensssen, The hydrogen solution? Nat. Clim. Change 2020, 10, 799–801. [CrossRef]

- Zeroemisyjna Polska 2050, Fundacja WWF Polska. Available online: https://www.wwf.pl/sites/default/files/inline/WWF_Polska_11_listopada.pdf (accessed on 10 July 2023). (In Polish).

- EGHAC—The European Green Hydrogen Acceleration Center. Available online: https://single-market-economy.ec.europa.eu/system/files (accessed on 10 July 2023).

- Plan Rozwoju w Zakresie Zaspokojenia Obecnego i Przyszłego Zapotrzebowania na Energię Elektryczną na Lata 2021–2030; Polskie Sieci Elektroenergetyczne: Warszawa, Poland, 2020. (In Polish)

- Strategia UE na Rzecz Integracji Sektora Energetycznego—Stowarzyszenie Energii Odnawialnej. Available online: seo.org.pl (accessed on 10 July 2023).

- H2 Subsidies|The Netherlands grants €800 m for over 1 GW of Green Hydrogen Projects for Heavy Industry|Hydrogen News and Intelligence. Available online: hydrogeninsight.com (accessed on 10 July 2023).

- International Energy Agency. Global Hydrogen Review, Clean Energy Ministerial Advancing Clean Energy Together. Available online: www.iea.org (accessed on 10 July 2023).

- Puertollano Green Hydrogen Plant—Iberdrola. Available online: https://www.iberdrola.com/conocenos/nuestra-actividad/hidrogeno-verde/puertollano-planta-hidrogeno-verde (accessed on 10 July 2023).

- Salvi, U.P.; Visco, C.; Novelli, V. Focus on Hydrogen: A Role for Hydrogen in Italy’s Clean Energy Strategy; Italian Association for Hydrogen and Fuel Cells (H2IT): London, UK, 2018. [Google Scholar]

- Recent Developments in the French Hydrogen Sector: The Draft Hydrogen Ordinance|Herbert Smith Freehills|Global Law Firm. Available online: https://www.herbertsmithfreehills.com/latest-thinking (accessed on 10 July 2023).

- Ørsted Takes Final Investment Decision on First Renewable Hydrogen Project. Available online: https://www.4coffshore.com/news/%C3%B8rsted-takes-final-investment-decision-for-hydrogen-project-nid20818.html (accessed on 2 July 2023).

- ORLEN Group to Launch International Hydrogen Program|PKN ORLEN. Available online: https://www.orlen.pl/en/about-the-company/media/press-releases/2021/june/orlen-group-to-launch-international-hydrogen-program (accessed on 2 July 2023).

- Informacje o Strategii na rzecz Odpowiedzialnego Rozwoju, Ministerstwo Funduszy i Polityki Regionalnej. Available online: https://www.gov.pl/web/fundusze-regiony/informacje-o-strategii-na-rzecz-odpowiedzialnego-rozwoju (accessed on 6 June 2023).

- Polska Strategia Wodorowa do Roku 2030 z Perspektywą do Roku 2040; Ministerstwo Klimatu i Środowiska: Warszawa, Poland, 2021.

- Prawo wodorowe- środowisko regulacyjne wspierające rozwój gospodarki wodorowej, Global Compact Network Poland, Know-How Hub- Centrum Transferu Wiedzy. Available online: https://ungc.org.pl/raport-prawo-wodorowe-srodowisko-regulacyjne-wspierajace-rozwoj-gospodarki-wodorowe (accessed on 10 July 2023). (In Polish).

- Plan na Rzecz Odpowiedzialnego Rozwoju—Ministerstwo Funduszy i Polityki Regionalnej—Portal Gov.pl. Available online: https://www.gov.pl/web/fundusze-regiony/plan-na-rzecz-odpowiedzialnego-rozwoju (accessed on 10 July 2023).

- Polityka Energetyczna Polski Do 2040 Roku (PEP 2040). Available online: https://www.gov.pl/documents/33372/436746/PEP2040_projekt_v12_2018-11-23.pdf/ee3374f4-10c3-5ad8-1843-f58dae119936 (accessed on 8 June 2023). (In Polish)

- Krajowy Plan na Rzecz Energii i Klimat. Available online: https://bip.mos.gov.pl/index.php?id=5608 (accessed on 8 June 2023).

- Energy Policy: General Principles|Fact Sheets on the European Union|European Parliament. Available online: https://www.europarl.europa.eu/factsheets/en/sheet/68/energy-policy-general-principles (accessed on 10 July 2023).

- EU’s Clean Hydrogen Partnership Launches €195 m Research Call|ICIS. Available online: https://www.worldhydrogenweek.com/ (accessed on 10 July 2023).

- Roland Berger: An Update on Hydrogen Valleys|Roland Berger. Available online: https://www.rolandberger.com/en/Insights/Publications/Hydrogen-Valleys-go-global-An-update.html (accessed on 10 July 2023).

- DOLINY WODOROWE—Agencja Rozwoju Przemysłu S.A. Available online: arp.pl (accessed on 10 July 2023).

- Inwestycje w Technologie Wodorowe. Available online: https://www.orlen.pl/pl/zrownowazony-rozwoj/projekty-transformacyjne/wodor/Naklady-inwestycyjne (accessed on 10 July 2023).

- “Clean Cities—Hydrogen Mobility in Poland (Phase I)”. nr projektu: INEA/CEF/TRAN/M2019/2359474. Available online: orlen.pl (accessed on 4 July 2023).

- ORLEN Zbuduje w Polskich Miastach Stacje Tankowania Wodoru. Available online: https://www.orlen.pl/pl/zrownowazony-rozwoj/projekty-transformacyjne/wodor/aktualnosci-o-wodorze/pkn-orlen-zbuduje-w-polskich-miastach-stacje-tankowania-wodoru (accessed on 4 July 2023).

- COP24—Ministerstwo Klimatu i Środowiska—Portal Gov.pl. Available online: https://www.gov.pl/web/klimat/cop24-zakonczony-sukcesem (accessed on 10 July 2023).

- PURE H2—Instalacja Oczyszczania Wodoru i Infrastruktura do Tankowania—Grupa LOTOS S.A. Available online: https://www.lotos.pl/2840/poznaj_lotos/projekty_dofinansowane_przez_ue/pure_h2_-_instalacja_oczyszczania_wodoru_i_infrastruktura-do-tankowania (accessed on 10 July 2023).

- Vision & Mission|Hydrogen Europe. Available online: https://hydrogeneurope.eu/mission-vision (accessed on 10 July 2023).

- PGNiG Rozpoczęło Projekt ELIZA; Chce Rozwijać Technologię Wodorową|FXMAG. Available online: https://www.fxmag.pl/artykul/pgnig-rozpoczelo-projekt-eliza-chce-rozwijac-technologie-wodorowa (accessed on 10 July 2023).

- Hydrogen Roadmap Europe, Luxembourg: Publications Office of the European Union. 2019. Available online: https://op.europa.eu/en/publication-detail/-/publication/0817d60d-332f-11e9-8d04-01aa75ed71a1 (accessed on 10 July 2023).

- Green Hydrogen in Europe: Do Strategies Meet Expectations? Available online: www.intereconomics.eu (accessed on 10 July 2023).

- Rozwój gospodarki wodorowej w UE i państwach członkowskich—środowisko regulacyjne i finansowe, Global Compact Network Poland, Know-How Hub Centrum Transferu Wiedzy, ISBN 978-83-958559-1-7. Available online: https://ungc.org.pl/wp-content/uploads/2021/12/Rozwo%CC%81j_gospodarki_wodorowej.pdf (accessed on 10 July 2023).

| Country | Production/ton | Electrolysis Capacity/GW | Planned Expenditures in Billion Euro |

|---|---|---|---|

| Netherlands | 75 thousand | 3–4 | 0.5 |

| Germany | 10 million | 7–8 | 9 |

| Sweden | 5 million | 4–6 | thousand |

| Spain | 500 thousand | 4 | 8.9 |

| France | No data | 6.5 | 2 |

| Portugal | 170 thousand | 1 | thousand |

| Poland | 165 thousand | 1.7 | 3.7 |

| Types of Valleys | Descriptions |

|---|---|

| Type 1 | Small hydrogen valley, specialized mainly in the transport sector, for which hydrogen in the region is produced from RES in electrolyzers with a capacity of up to 10 MW, stored, and distributed for purposes such as public transport and hydrogen refueling stations, CAPEX, i.e., capital expenditures account for (production capacity), is approx. EUR 20 million. |

| Type 2 | Medium hydrogen valley, focused on decarbonization of energy-intensive industry, a type that is currently being implemented in Poland. The projects in these valleys are located around entities called anchors, i.e., large corporations and their needs. Activities within these valleys primarily integrate two sectors: industry and transport. Hydrogen is produced in electrolyzers with a capacity of up to 10–300 MW, and the capital expenditure (CAPEX) is around EUR 100 million. |

| Type 3 | A large hydrogen valley characterized by very good conditions for the production of energy and hydrogen from RES, with the use of large-scale hydrogen production for the needs of the region and for export—see: Australia (contract to Japan), Arab countries—long-term contracts, with the use of 250–1000 MW of electrolyzer capacity, and the CAPEX is approx. EUR 500 million, and more. |

| Valley | Headquarters | Concept | Stakeholders | Specializations | Achievements |

|---|---|---|---|---|---|

| Lower Silesian Hydrogen Valley | Wroclaw | Management of hydrogen hubs. | KGHM, ZAK Kedzierzyn-Kozle, ARP S.A. Toyota, Z-Klaster, Wroclaw University of Science and Technology, University of Wroclaw, UMWD, Linde, Total. | green ammonia, green heat, green copper and metallurgy, green river transport, hydrogen storage, RES, biogas, water pipelines. | Two applications in the consortium for Clean Hydrogen Partnership, first show at DDW in Europe—Hydrogen Week in Brussels; green H2 production: 720 t/y. |

| Mazovian Hydrogen Valley | Plock | Integration to the needs of a large concern. | PKN Orlen, ARP S.A., BGK Toyota, KAPE, AGH, Siemens Energy, Warsaw University of Technology, Energy Institute University of Warsaw. | petrochemicals, synthetic fuels, production of green hydrogen, biogas, HRS, hydrogen logistics, energy storage, green chemistry. | Petrochemicals, synthetic fuels, production of green hydrogen, biogas, HRS, hydrogen logistics, energy storage, green chemistry. |

| Silesia—Lesser Poland Hydrogen Valley | Katowice | Energy transformation in Silesia and Lesser Poland based on FSI. | Orlen South, Polenergia, ARP S.A., JSW Innovation, Azoty Group, The Silesian Technical University, AGH, KOMAG, IPTE, Katowicka SSE, GZM, Columbus. | green glycol, energy transformation of Silesia, hydrogen production, hydrogen storage, green steel, zero-emission public transport, CCUS. | Commissioning of the installation for the production of green glycol; H2Poland portal. |

| Subcarpathian Hydrogen Valley | Rzeszow | Integration around the university and the aviation valley. | Rzeszów University of Technology, Podkarpackie Marshal’s Office, Pole-nergia, city of Sanok, ARP S.A., entities from the aviation valley, Autosan, ML System. | hydrogen buses, aviation, hydrogen in the energy sector, green heat, hydrogen-strings. | Application for project development assistance. |

| Central Hydrogen Cluster named after Laszczynski Brothers | Kielce | Integration around the project of decarbonisation of raw material mines. | Industrial Group Industria, ARP S.A., city of Kielce, commune of Chęciny, Świętokrzyska University of Technology, Colum-bus, ML System, AIUT, Azoty Group. | hydrogen production, hydrogen dump trucks, hydrogen storage, RES, green public transport. | Feasibility study; transition to the implementation phase. |

| Pomeranian Hydrogen Valley | Gdansk | Integration around local government initiatives, decarbonisation of the port of Gdynia, concept of “Shore H2 Valley”. | Pomeranian Marshal’s Office, Cluster of Hydrogen Technologies, city of Gdynia, PKP Energetyka, port of Gdynia, Sescom, Gdańsk University of Technology. | zero-emission public transport, hydrogen production, offshore, port decarbonisation, hydrogen storage, production of electrolyzers, HRS. | Completed mapping of the region’s potential in PDA format. |

| Greater Poland Hydrogen Valley | Poznan | Integration around local government initiatives and the needs of a large corporation. | Wielkopolska Marshal’s Office, ZE PAK, Solaris, Adam Mickiewicz University, Poznań University of Technology, ARR Konin, city of Piła, Wielkopolska Council of Thirty | hydrogen production, hydrogen storage, HRS, hydrogen buses, RES. | Mapping the needs of the region; h2wielkopolska.pl portal. |

| West Pomeranian Hydrogen Valley | Szczecin | Integration around a large chemical concern; the “Shore H2 Valley” concept. | West Pomeranian University, Azoty Group, ARP S.A., Enea, Port Police, Maritime University of Technology, NFOŚ, ZUT, Koszalin University of Technology. | green ammonia, low-emission sea transport, low-emission river transport, ammonia collection infrastructure, hydrogen production, offshore. | Over 30 entities interested in the development of the hydrogen valley. |

| Hydrogen Value Chain | Activity Area | Stakeholder |

|---|---|---|

| Production | separation of hydrogen from coke oven gas | Jastrzębska Społka Weglowa (JSW) |

| use of electrolyzers to produce H2 from renewable energy sources | Lotos, Polish Power Grids (PSE) | |

| sale of electrolyzers powered by PV | Sescom | |

| scaling own production of “grey” hydrogen for sale | Azoty Group | |

| production and use of “green” hydrogen; cogeneration converted to hydrogen combustion | Polenergia | |

| distribution of electrolyzers | RB Consulting | |

| the use of electrolyzers with electricity from biomass | Pątnów Adamów Konin Power Plant Complex (ZE PAK) | |

| the use of electrolyzers in cooperation with renewable energy sources | Orlen | |

| production of SNG (synthetic natural gas): hydrogen from electrolysis with electricity from RES; carbon dioxide from emission installations | Tauron Wytwarzanie | |

| separation of hydrogen from coke oven gas | Walbrzych Plants Coke “Victoria” | |

| methane steam reforming | Steelproduct | |

| Storage | injection of hydrogen into distribution and transmission networks; underground storage | PGNiG |

| Stako from the Worthington Industries Group | tanks | |

| Application | vehicle charging stations | Lotos, PKN ORLEN, PGNiG |

| use of hydrogen in locomotives | PKP Cargo | |

| hydrogen locomotive prototype | H. Cegielski | |

| development of fuel cell models | EC Grupa (Energocontrol Sp. z o.o.) | |

| hydrogen emergency power system | APS Energia with the Gdańsk University of Technology | |

| hydrogen bus production | Solaris | |

| combustion of hydrogen in cogeneration turbines | Polenergia (z Siemens) | |

| Transmission in gas networks | hydrogen blending in gas pipelines | PGNiG |

| Apparatus and devices | gas meters | Intergas |

| pressure tanks | cGAS controls | |

| hydrogen sensors | Emag Serwis | |

| cryostatic devices | Frankoterm |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Włodarczyk, R.; Kaleja, P. Modern Hydrogen Technologies in the Face of Climate Change—Analysis of Strategy and Development in Polish Conditions. Sustainability 2023, 15, 12891. https://doi.org/10.3390/su151712891

Włodarczyk R, Kaleja P. Modern Hydrogen Technologies in the Face of Climate Change—Analysis of Strategy and Development in Polish Conditions. Sustainability. 2023; 15(17):12891. https://doi.org/10.3390/su151712891

Chicago/Turabian StyleWłodarczyk, Renata, and Paulina Kaleja. 2023. "Modern Hydrogen Technologies in the Face of Climate Change—Analysis of Strategy and Development in Polish Conditions" Sustainability 15, no. 17: 12891. https://doi.org/10.3390/su151712891

APA StyleWłodarczyk, R., & Kaleja, P. (2023). Modern Hydrogen Technologies in the Face of Climate Change—Analysis of Strategy and Development in Polish Conditions. Sustainability, 15(17), 12891. https://doi.org/10.3390/su151712891