Abstract

The Carbon Emissions Trading Scheme (CETS) is an important part of China’s environmental reform agenda, which aims to facilitate the green development of enterprises. Using data from listed companies from 2008 to 2020, this study adopts the CETS as a quasi-natural experiment. This study empirically examines the impact of CETS implementation on corporate environmental protection investment (EPI) and explores the underlying mechanisms using the difference-in-difference (DID) method. The results show that: (1) The implementation of CETS significantly promotes firms’ EPI. A series of robustness tests confirms the findings. (2) This study further analyses the impact mechanism of the CETS in promoting the enterprises’ EPI, which is mainly manifested in an increase in emission costs and enforcement rigidity. (3) The heterogeneity test results show that the CETS has a more significant positive effect on the environmental investment of state-owned, large, and heavily polluting enterprises. The conclusions of this study provide both theoretical support and empirical evidence for the implementation of carbon emissions trading policies.

1. Introduction

China has experienced significant economic growth and development since the implementation of its reform and opening-up policy four decades ago [1]. However, this rapid economic progress has been accompanied by severe environmental pollution and degradation [2]. Yale University’s 2020 Global Environmental Performance Index report ranked China 120th in the world for air quality, highlighting the environmental challenges the country faces. The Chinese Ministry of Ecology and Environment issued the “China Ecological Environment Status Bulletin 2020”, which stated that the proportion of cities with air quality exceeding the standard reached 40.1% in 2020. Therefore, strengthening China’s environmental governance is urgent. As economic agents, enterprises are primary energy consumers and the main pollution producers [3,4]. The integration of environmental investment and pollution reduction has emerged as a crucial decision-making factor for enterprises, reflecting their commitment to corporate social responsibility [5,6]. Notably, China has witnessed a substantial increase in its total investment in environmental pollution control, showcasing a sustained upward trend. However, navigating the intricacies of environmental investment presents significant managerial complexities. The “win–win” balance between ecological objectives and economic gains remains an ongoing challenge in the field.

To address the urgent need for sustainable development, the government has implemented many environmental protection policies. These include the reform of sewage fees, the establishment of low-carbon city pilots, and the introduction of an environmental protection tax law. The study by Jiang et al. [7] shows the positive attitude of China’s carbon trading market towards solving environmental problems and promoting sustainable development in the future. Drawing on the experience of Western countries in reducing emissions, China gradually launched pilot carbon trading markets in 2011, introducing emissions trading schemes into the flexible market mechanism to improve environmental governance. Specifically, the National Development and Reform Commission selected seven regions to explore carbon trading schemes. In 2013, the piloting of China’s carbon emissions trading scheme (CETS) commenced in several key cities and regions, including Shenzhen, Beijing, Tianjin, Shanghai, Guangdong, Hubei, and Chongqing. These pilot areas encompass a broad geographical representation, ranging from the eastern coastal regions to the central and western regions of China. According to statistics provided by the NDRC, in 2014, all seven pilot sites launched online trading. More than 1900 enterprises and service companies participated in the pilot, and the total carbon emissions allocated were about 1.2 billion tons.

Compared to previous environmental policies, the CETS combines government oversight and market regulation. In addition to requiring companies in the pilot cities to conserve energy and reduce emissions, it also sets certain carbon emission quotas [8,9]. Under the scheme, companies with surplus allowances can sell them at market prices to other companies that need additional allowances to meet their emissions targets. This market-based approach allows for an efficient allocation of carbon-reduction efforts and incentivizes companies to actively participate in emission-reduction activities [10,11]. The main purpose of the CETS is to encourage enterprises to improve the use of energy resources or invest in environmental protection, thereby reducing carbon emissions from production. However, when the carbon price is low in the early stages of the carbon market, enterprises are more inclined to purchase allowances to meet their emissions needs rather than invest in environmental protection. In the long run, the purchase of allowances by companies is not sustainable. Companies will gradually increase their investment in environmental protection and their participation in low-carbon innovation activities to meet carbon trading targets.

The effectiveness of the CETS in incentivizing firms to increase their investment in environmental protection investments (EPI) is still uncertain. While previous studies have examined the impact of CETS on various macro-level indicators such as urban carbon intensity [12,13], energy efficiency [14], and green technology innovation [15,16], there is a lack of research focusing on the micro-level effects of CETS on firms’ environmental investments and their economic consequences. Therefore, it is crucial to investigate the specific effects of the implementation of the CETS on firms’ environmental investments and to analyze the corresponding economic outcomes at the micro level. Therefore, can CETS have an impact on enterprise EPI? What are the mechanisms and effects? Are the effects significantly regionally and temporally heterogeneous? Taking the launch of carbon markets as an exogenous shock, this paper attempts to make a differential analysis to assess the impact of the CETS on enterprises’ EPI.

In this study, we manually use data on listed firms from 2008 to 2020. Using a difference-in-difference (DID) design, we empirically examine the impact of the CETS on firms’ EPI. In addition, we examine two potential channels through which the CETS may affect firms’ EPI: increased pollution costs and strengthened local policies. Controlling for differences in firm size, property rights, and types of pollution, we further analyze the heterogeneous effects of CETS on firms’ environmental protection investments.

The marginal contribution is mainly reflected in three ways. First, based on the emission-reduction effect of CETS demonstrated by other scholars, we introduce the DID model to discuss the effect of the CETS on enterprise EPI. Second, concerning the nature of the CETS, which combines government supervision and market competition, we examine the potential mechanisms of the CETS on firms’ EPI, including increasing the cost of emissions and increasing the rigidity of law enforcement. Finally, this paper analyzes the heterogeneity effects of the CETS on EPI in terms of firm ownership type, firm size, and pollution level. The findings of this paper provide different policy implications for policymakers and firms.

The subsequent sections of this paper are structured as follows. Section 2 provides a literature review that examines the previous research on CETSs and EPI. Section 3 contains a theoretical analysis and research hypotheses. Section 4 outlines the research design, including details of the data sources, sample selection, and methodology. Section 5 presents the empirical results. Section 6 discusses the mechanisms and heterogeneity of the results. Section 7 provides conclusions and policy recommendations.

2. Literature Review

The literature related to this paper can be categorized into two main strands. The first strand of the literature focuses on understanding the factors that influence enterprises’ EPI. Scholars have examined various factors such as firm characteristics [9,17], industry characteristics [3,18], government regulations [14,19], and market incentives to explore their impact on firms’ environmental investment decisions. These studies provide insights into the motivations and determinants behind firms’ engagement in environmental protection activities.

The concept of EPI refers to the allocation of resources by companies to reduce their environmental impact while maintaining production levels as high as possible. However, there is no consensus among academics on the effects of corporate EPI. Some argue that environmental investment may crowd out other business decisions and increase financial risks for firms [20]. Furthermore, there have been cases of excessive environmental investment due to a lack of investment guidance and vulnerability to factors such as corporate governance, political relations, and policy constraints [21]. The presence of negative externalities and high risks associated with environmental investments may also force firms to increase their environmental expenditures, undermining their voluntary commitment in this area.

On the other hand, there is a body of literature suggesting that firms can benefit from EPI. For example, environmental investments can help establish a positive corporate reputation by signaling the firm’s willingness to take on more social responsibility, thereby increasing the firm’s value [22]. Moreover, empirical evidence suggests that EPI contributes to the long-term financial performance of firms. Chen and Ma [23] found that financial performance improved in the third year following environmental investments, highlighting the long-term strategic importance.

The second strand of the literature focuses on studying the economic impact of carbon emissions trading schemes (CETSs). These studies analyze the effects of CETSs on carbon intensity [24,25], energy efficiency [14], technological innovation [26], and other economic and environmental indicators at the macro level. For example, carbon market pilots introduce price signals to better align technology and finance, stimulating increased investment in low-carbon technologies and driving significant advances in green technologies [27,28]. Using patent data from Chinese A-share listed companies between 2009 and 2016, Yao et al. [29] employ a DID approach to examine the impact of carbon markets on firms’ green innovation activities, using the CETS pilot implemented in seven provinces and cities in late 2013 as a quasi-natural experiment. They provide valuable insights into the effectiveness and efficiency of CETSs as policy instruments for reducing carbon emissions and promoting sustainable development.

The CETS is a flexible, government-imposed environmental regulatory tool that originated in the European Union and is now widely used globally to reduce carbon emissions. The EU ETS is the largest carbon trading market in the world, accounting for approximately 90% of the total carbon trading volume [30]. China’s CETS pilot program, the second largest in the world, covers key industries such as steel, electricity, chemicals, construction, paper, and non-ferrous metals [31,32]. The pilot program establishes a carbon price, facilitates the commercialization of carbon emission permits, and allows emitters to participate in the buying and selling of emission-reduction obligations. The Chinese government sets a cap on carbon dioxide emissions for companies by issuing carbon emission permits.

In conclusion, few studies have examined the impact of training on firms’ EPI, and even fewer studies have examined how training affects firms’ EPI [33]. To fill the gap, by taking the implementation of the pilot carbon markets in 2013 as a quasi-natural experiment of environmental regulation, this study attempts to study the impact of the CETS on enterprises’ environmental investment. Addressing this issue under the realistic background of China is not only conducive to effectively controlling environmental pollution but also provides policy references for promoting Chinese enterprises’ acquisition of green development.

3. Theoretical Analysis and Research Hypotheses

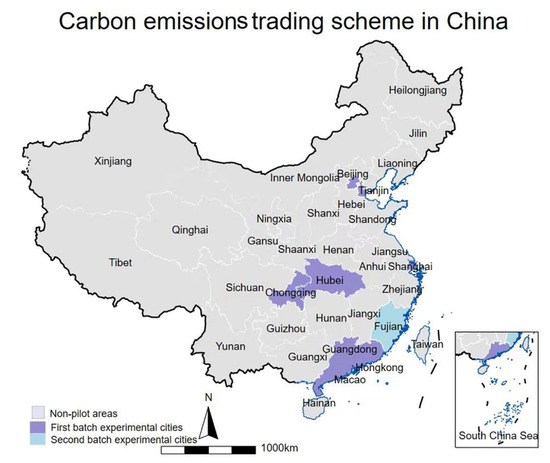

In 2013, the Chinese government inaugurated carbon trading pilot initiatives in strategic regions, including Beijing, Shanghai, Tianjin, Chongqing, Hubei, Guangdong, and Shenzhen. These initiatives proved to be successful in instituting operational carbon emissions trading markets within the designated pilot areas, subsequently facilitating the commencement of online trading activities. Furthermore, in December 2016, Fujian Province introduced its own carbon trading market, marking the eighth such pilot undertaking nationwide. In the following years, beginning in 2017, the scope of the carbon emissions trading market progressively expanded beyond the initial pilot regions, encompassing the entire nation and concentrating its initial efforts on the power-generation sector to propel market growth. By August 2020, the carbon emissions trading market had extended its reach to encompass nearly 3000 enterprises across the entire country, building on the foundation of the pilot provinces and cities. The temporal and spatial distribution of these carbon emission trading system (CETS) pilot programs is visually represented in Figure 1.

Figure 1.

The temporal and spatial distribution of the CETS pilot.

The environment is a resource with the property of public goods. Without environmental regulations, enterprises do not need to pay for their pollution behavior, while the public bears the cost of environmental governance. Investment in environmental protection is an additional cost for enterprises to reduce environmental pollution. Therefore, self-interested companies have no incentive to participate in pollution control. However, the externality of environmental problems prompts the government to intervene and guide corporate environmental behaviors through environmental regulation and encourage enterprises to participate in pollution treatment. The CETS mainly applies the price mechanism to internalize the external costs of carbon emissions to reduce corporate carbon emissions. It has two direct effects. The first is the cost-push effect. Corporate compliance costs will increase after being constrained by the CETS, which provides incentives for enterprises to benefit from trading. Therefore, the CETS incorporates environmental factors into the objective function of the production decision-making of enterprises and realizes the internalization of environmental pollution, resulting in a reverse constraint on corporate pollution behavior and a positive incentive for pollution-control and emission-reduction behavior. It also improves enterprises’ initiatives in environmental protection and increases their investment in environmental protection. Therefore, we propose the following hypothesis:

Hypothesis 1.

The implementation of a CETS can promote enterprises’ EPI in the pilot regions.

The core objective of the CETS is to internalize the negative externalities associated with environmental pollution resulting from carbon emissions by incorporating them into the costs borne by enterprises. The level of carbon emissions costs determines how enterprises incorporate environmental costs into their production, operation, and investment decisions. Implementing the CETS has led to an increase in emissions costs. Some enterprises would take the initiative to increase their direct investment in environmental protection to reduce emission costs in the long run. In contrast, enterprises with higher production costs pay more attention to cost control [34]. The implementation of a CETS raises the cost of carbon emissions, while the increase in green investment helps reduce the cost of emissions. Therefore, enterprises with high production costs are more motivated to reduce their production costs by increasing their environmental investment. Supposing the mechanism to increase the carbon emission cost of enterprises is established, the CETS should significantly affect enterprises with relatively high production costs. Therefore, we propose the following hypothesis:

Hypothesis 2.

The implementation of a CETS can stimulate firms’ EPI by increasing the cost of pollution emissions.

Although the CETS is formulated based on administrative regulations, it has certain market characteristics, and the actual enforcement of the carbon market is relatively weak. Meanwhile, there are considerable geographical differences between provinces and cities in China and variations in the regional legal system [35]. On the one hand, in regions with a stronger legal system, the enforcement efficiency of regulations is relatively higher, which can alleviate the weak enforcement rigidity of the CETS, making the CETS a significant catalyst for corporate environmental investment. On the other hand, for areas with a weaker legal system, the enforcement of laws and regulations is relatively weaker, leading to a less-effective CETS in increasing corporate environmental protection investment. Based on the above analysis, if a rigid law enforcement mechanism is established in the region where the enterprise is located, the role of the CETS in promoting EPI will be more exerted in places with a poor legal system. Therefore, we propose the following hypothesis:

Hypothesis 3.

The implementation of CETS can stimulate firms’ EPI by strengthening law enforcement rigidity.

4. Research Design

4.1. Econometrics Model

To investigate potential differences in environmental protection investments (EPI) across firms before and after the implementation of carbon emissions trading schemes (CETSs), this study uses the analytical framework formulated by Zhang et al. [35] to propose the following econometric model

where the subscript i denotes the A-share listed companies, t presents the year, c implies the city, and signifies the enterprises’ environmental protection investments in city c in year t. expresses the difference-in-difference term. is a sequence of control variables that affect the firms’ environmental investment. Referring to Liu et al. [36] and Yang et al. [37], to control for other indicators of economic characteristics of corporate EPI, this study introduces five firm-level indicators, including firm size (Size), firm age (Age), firm value (Tobq), and firm profitability (Roa), as control variables. is the firm fixed effects, is the city fixed effects, is the timefixed effects, and is a random error term.

4.2. Variables

4.2.1. Independent Variables

Following the launch of the CETS pilot program in 2011, China’s carbon trading platform was first introduced in Shenzhen and subsequently expanded to other regions, including Beijing, Tianjin, Shanghai, Guangdong, Hubei, Chongqing, and Fujian. However, the above provinces are mainly divided into two batches of CETS pilots, and the specific situation is as follows. In 2013, the Chinese government inaugurated carbon trading pilot initiatives in strategic regions, including Beijing, Shanghai, Tianjin, Chongqing, Hubei, Guangdong, and Shenzhen. Furthermore, in 2016, Fujian Province introduced its carbon trading market. Therefore, following the approach used by Liu and Zhang [38], the dummy variable is the independent variable of the policy, which means that if the CETS was implemented in the province during period t, the of the listed companies included in the province is 1; otherwise, it is equal to 0.

4.2.2. Dependent Variables

Referring to Zhang et al. [35], this study collects investment expenditure data related to environmental protection, pollution control, energy conservation, and emission reduction from the annual financial reports of listed companies. These expenditures are considered to be the company’s direct investment in environmental protection. The environmental protection investment data are then divided by the company’s total assets and then multiplied by 100, which is normalized to give a percentage. This standardization makes it easier to compare and analyze the environmental investments of different companies.

4.2.3. Control Variables

To account for the potential influences of various firm characteristics on corporate environmental investment, this study controls for the following variables, as suggested by Zhang et al. [35] and Zhou and Wang [39]: (1) Firm size (Size): This variable is calculated as the natural logarithm of total assets. It represents the scale or magnitude of the firm. (2) Firm financial leverage (Lev): Defined as the ratio of total liabilities to total assets. This variable reflects the extent to which a firm relies on debt financing. (3) Firm age (Age): Measured as the difference between the year in which the firm made its first environmental investment and the year of its establishment. It captures the length of the firm’s existence and experience in the market. (4) Firm profitability (Roa): Expressed as the return on assets, which is calculated by dividing the net income by the total assets. This variable indicates the profitability performance of the firm. (5) Firm value (Tobq): It is calculated as the ratio of the total market value of equity to the total book value. This variable represents the market valuation of the firm relative to its book value.

4.3. Data Sources

To reduce the potential influence of extreme outliers, winsorization involves replacing extreme values with values at the 1st and 99th percentiles of the respective variable. This approach helps to minimize the impact of extreme values on the statistical analysis, thereby ensuring more robust and reliable results. The environmental investment data used in the study are collected manually from companies’ annual financial reports. This ensures accurate and detailed information on companies’ environmental investment activities. Other relevant data such as the company size, financial leverage, company age, company profitability, and company value are derived from the CSMAR database. Table 1 shows the descriptive statistics, which provide a summary of the distribution, central tendency, and dispersion of the variables, giving an insight into their characteristics within the sample.

Table 1.

Descriptive statistics.

5. Empirical Results

5.1. Parallel Trend Test

The application of the difference-in-difference (DID) model depends on satisfying the parallel trend hypothesis. To satisfy the parallel trend hypothesis, it is essential to verify that there are no significant differences or systematic variations in pre-intervention trends in environmental investment between the treated and control groups. This ensures that any subsequent differences observed in the post-treatment period can be attributed to the implementation of the training and not to pre-existing differences between the groups. Fulfilling this assumption strengthens the causal interpretation of the DID results and allows for a more robust estimation of the causal impact of the training on firms’ EPI. If the above assumptions cannot be met, the DID method may introduce bias in the estimation of the policy effect. Following Jacobson et al. [40] and Gao et al. [14], a model is developed to further investigate parallel trends, as shown in Equation (2).

where signifies the year of the policy implementation. k < 0 and k > 0 mean before and after the k year of the policy implementation, respectively. If the enterprise is in the year (k = −2, −3, −4) before implementation, the value of is 1; if the enterprise is in the year (k = 1, 2, 3, 4) after the enforcement of the policy, the value of is 0. indicates a significant difference in enterprises’ EPI between the treatment and the control group in year k. , denote the fixed effects on the firm, year, and city, respectively, and is the error term.

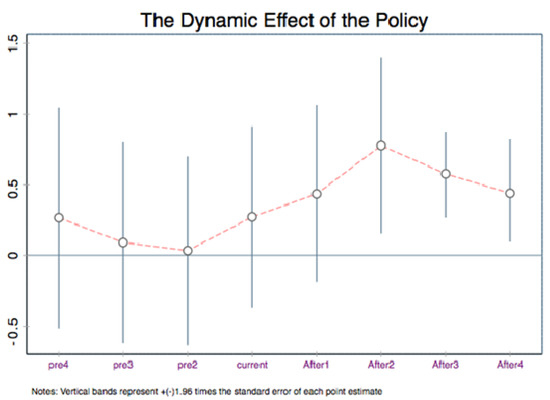

Figure 2 shows the results of the parallel trend test, which aims to assess the impact of training on the EPI of enterprises. It is worth noting that the base period for this evaluation corresponds to the year immediately preceding the implementation of the policy, thus excluding the year designated “Pre1”. In the three years before the pilot program, the confidence intervals of the regression coefficients consistently crossed the null level, indicating that there were no statistically significant differences between the treatment and control cohorts prior to the start of the training pilots. After this period, from the second year after the start of the CETS, the regression coefficients showed a clear upward trend. This discernible pattern suggests a delayed impact of the CETS on firms’ environmental investment, with the policy gradually manifesting its ability to stimulate environmental investment efforts. In conclusion, the pattern observed in the parallel trend analysis provides empirical support that confirms the credibility of the difference-in-differences (DID) model.

Figure 2.

The parallel trend test of CETS on enterprises’ EPI.

5.2. The Results of Benchmark Regression

Table 2 presents the regression results examining the relationship between the CETS and firms’ environmental investments. The results in columns (1)–(5) demonstrate that after controlling for fixed effects such as individual enterprise, industry, city, and year, the coefficient of CETS remains consistently positive and statistically significant at the 10% level. This indicates that the pilot program has significantly increased the environmental investment of the enterprise. For instance, in the regression results for column (5) of Table 2, when considering the firm, industry, city, and year fixed effects, the estimated coefficient of CETS is 0.314, which statistically significant at the 5% confidence level. This implies that the implementation of the CETS leads to a notable boost in firms’ environmental investment when compared to enterprises in non-carbon-trading cities. These findings align with the conclusions drawn by Liu et al. [21] and Wen et al. [41].

Table 2.

The baseline regression results.

The possible reason for this result is that, in the past, the central government paid less attention to environmental protection, while local governments ignored environmental pollution in traditional energy industries and often traded environmental pollution for GDP to develop the economy. Meanwhile, consumers’ awareness of environmental protection was weak. Firms tend to locate in areas with lax environmental regulations to minimize the cost of environmental compliance, which has led to a relatively low emphasis on environmental investment. However, as the Chinese government has intensified its environmental protection requirements and implemented measures to address pollution, coupled with the growing consumer demand for green products due to improving living standards, enterprises have increasingly recognized the importance of investing in environmental protection. Since the implementation of the CETS in 2013, there has been a notable shift in enterprises’ motivation to invest in environmental protection. This shift is particularly evident among heavily polluting enterprises that face pressing needs for energy conservation, emission reduction, and clean production. The increase in environmental investment among enterprises in pilot cities is significantly higher than that observed among enterprises in non-pilot cities, reflecting the impact and effectiveness of the CETS in stimulating environmental investment.

5.3. Robustness Test

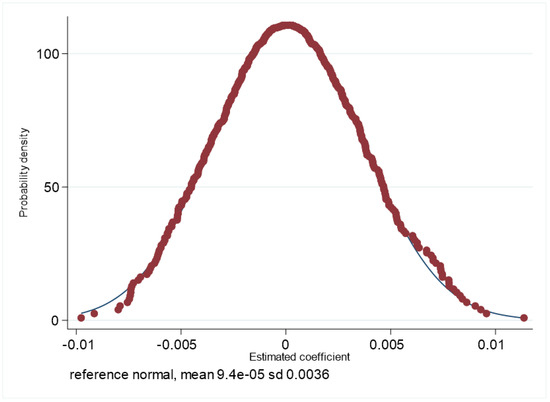

5.3.1. Placebo Test

In order to test whether the impact of the CETS on enterprises’ EPI is affected by missing variables and potentially unobserved factors, a placebo test is conducted [42,43]. In this study, 36 cities are randomly selected as pilot cities, where enterprises in these pilot cities are re-identified as the treated group, while enterprises in other cities are the control group. Five hundred random bootstrapping samples are performed, and the result is shown in Figure 3. The mean value of the placebo coefficient is close to 0 and follows a normal distribution. Meanwhile, a line with an estimated coefficient of 0.3 is far from this distribution (not plotted here). The result suggests that there is no significant deviation in the estimation results, so the beneficial effect of the pilots on enterprises’ environmental investment is not affected by random probability. The conclusion that the CETS can significantly improve enterprises’ EPI is robust.

Figure 3.

The placebo test of CETS on enterprises’ environmental investment.

5.3.2. PSM-DID

In order to address the challenge of achieving trend consistency and mitigating sample selection bias in the control group, propensity score matching (PSM) is employed in this study. The PSM technique helps to select a control group that closely resembles the treatment group based on key covariates. Specifically, a logit model is used to estimate the propensity scores, and the k nearest neighbor matching method (with k = 4) is applied. The covariates used for matching include company size (Size), company financial leverage (Lev), company age (Age), company profitability (Roa), and company value (Tobq). These variables are selected based on their potential influence on environmental protection investment, as suggested by Hamilton and Nickerson [44]. By including these covariates in the matching process, the comparability between the control group and treated group is improved. The PSM-DID model is expressed in Equation (3). This model allows for the estimation of the treatment effect while controlling for potential confounding factors through the matching process.

To address the potential heterogeneity in enterprise environmental investment due to diverse enterprise characteristics across different cities, a PSM approach is employed to match the samples prior to regression analysis [45,46]. Table 3 presents the regression results using the matched data obtained through PSM, with the inclusion of control variables, firm individual fixed effects, city individual fixed effects, and time fixed effects in a stepwise manner in columns (1)–(4). The PSM-DID method is applied to examine the impact of the CETS on enterprise EPI. The results in Table 3 show that the estimated coefficients of the policy variables are significantly positive at the 1% level after matching using the PSM method. By using the PSM-DID method and controlling for various factors, this study improves the reliability of the estimated policy effects and provides stronger evidence of the relationship between the CETS and enterprises’ EPI.

Table 3.

The regression results of the PSM-DID method.

6. Further Analysis

6.1. The Mechanism Analysis

This paper examines the potential mechanism of the CETS on firms’ EPI from the perspective of rising pollution costs and rigid law enforcement. The essence of the CETS is to internalize the negative externalities of pollution caused by carbon emissions into firms’ costs. The level of carbon emission costs determines how much enterprises incorporate environmental costs into their production, operation, and investment decisions. After the start of carbon markets, the emission cost of enterprises increases. Some enterprises take the initiative to increase their direct investment in environmental protection to achieve emission reduction and reduce the emission cost in the long run.

To analyze the influence of carbon markets on enterprises’ environmental investment concerning production costs, this study incorporates variables representing the firm’s operating costs with a one-period lag, as suggested by Tian et al. [47]. These costs are classified as high-cost and low-cost based on the median value. A dummy variable, Cost, is then introduced, taking a value of 1 if the firm’s cost exceeds the median and 0 otherwise. Additionally, an interaction term between Cost and the CETS is added to the benchmark model. The empirical results presented in columns (1) to (2) indicate that the coefficient of Cost × CETS is significantly positive. This finding suggests that the CETS can incentivize enterprises to increase their EPI by raising the cost associated with their pollution.

Although the CETS is based on administrative regulations, it has certain market characteristics and weak law enforcement rigidity. There are great differences in the legal system among different regions in China [48,49]. In regions with a strong legal system, the efficiency of the enforcement of rules and regulations is higher. Moreover, the rules of handling affairs according to rules and regulations is stronger, alleviating the deficiency of the weak enforcement rigidity of the CETS to a certain extent. Thus, the carbon market has a significant role in increasing enterprises’ investment in environmental protection. However, in regions with weak legal systems, the enforcement of laws and regulations is relatively weak and the enforcement rigidity of the CETS itself is weak, dramatically decreasing the role of carbon markets in enterprises’ environmental protection investment.

Based on the aforementioned analysis, it can be inferred that the effectiveness of the CETS in driving enterprises’ environmental investment is contingent on the strength of the law-enforcement mechanism in the respective regions where they operate. Drawing inspiration from the work of Wang et al. [50], this study incorporates the “Development index of market intermediary organizations and legal system environment index” as part of the marketization index specific to the enterprise’s location. Employing the median value as a reference point, the rigidity of law enforcement is categorized as either strong or weak. To capture this distinction, a binary variable named Law is introduced, taking a value of 1 if the index exceeds the median and 0 otherwise. By introducing the interaction terms of Law and CETS into the benchmark model, a differential analysis is conducted. The empirical findings presented in columns (3) to (4) of Table 4 indicate that the coefficients of Law × CETS are statistically significant at the 5% level. This suggests that the CETS plays a vital role in fostering corporations’ EPI, particularly in regions characterized by a weaker legal environment. By enhancing the rigidity of law enforcement, the CETS effectively encourages enterprises to prioritize environmental protection measures.

Table 4.

Mechanism test.

6.2. Heterogeneity Analysis

There are obvious differences in enterprises’ environmental investment responses to carbon markets depending on the enterprises’ characteristics [51]. Therefore, we test the different types of enterprises affected by the CETS according to enterprises’ scale, property, and pollution level.

The results in Table 5 show that the coefficient estimate of the interaction term in column (1) is 0.042, which is statistically significant at the 1% level. This result indicates that there is a significant positive impact of environmental investment in large firms after the implementation of the CETS compared to small firms. The reason seems to be that larger firms face stricter environmental regulation standards. Under the influence of the pilots, larger enterprises have more incentives to reduce energy consumption and switch to clean energy. Therefore, the carbon markets have a more pronounced effect on increasing environmental investments by larger firms.

Table 5.

Heterogeneity analysis.

The coefficient of the interaction term in column (2) is estimated to be 0.127, indicating statistical significance at the 1% level. This result suggests that the impact of the CETS on enterprises’ EPI is more pronounced and positive for SOEs compared to non-SOEs. The findings imply that the CETS has a greater favorable effect on promoting environmental investments specifically within the context of state-owned enterprises. Under the policy shock, SOEs actively correspond to the national environmental protection policy and have a greater social responsibility to address environmental issues. Therefore, SOEs’ environmental protection investment benefits more from the CETS.

The coefficient of the interaction term in column (3) is estimated to be 0.101 and is significantly positive at the 1% level. The findings suggest that the implementation of the CETS encourages heavily polluting firms to increase their EPI. The possible reason for this is that the positive effect of environmental regulation is stronger for firms in highly polluting industries, which consume large amounts of highly polluting energy sources such as coal and emit more pollutants such as carbon dioxide during the production process, while firms in cleaner industries mostly use new sources of energy such as hydroelectricity, nuclear power, and wind power. Therefore, the pilot policy has had a greater effect on promoting environmental investment in polluting enterprises than in clean enterprises.

7. Conclusions and Policy Implications

This paper empirically analyses the impact of the CETS on companies’ EPI using data on listed companies from 2008 to 2020. The results show that, first, CETSs can significantly increase companies’ environmental investment. This confirms the reliability of the results. Second, the mechanism test suggests that the CETS benefits firms’ environmental investment by increasing the cost of pollution and making enforcement more stringent. Third, the policy effects are heterogeneous concerning firm size, ownership, and whether firms belong to highly polluting industries. The positive effects are more pronounced for large firms, state-owned enterprises, and firms in heavily polluting industries.

The findings of this study have important policy implications. First, since the CETS affects enterprises’ EPI, policymakers should strengthen the introduction of carbon markets in pilot cities and gradually expand the coverage scope to induce the low-carbon and green transformation of the economy. Second, considering the impact mechanism of the CETS on enterprises’ environmental investment, policymakers should encourage and even subsidize enterprises’ research activities to offset their production costs and make enterprises more motivated to make the environmental investment. Meanwhile, improving the rigidity of law enforcement in various regions will help improve enterprises’ investment in environmental protection. Relevant judicial departments should strictly enforce the law, and bankrupt enterprises should invest in environmental protection. Third, this study finds that the different degrees of influence of carbon markets depending on the scale, nature, and type of enterprises also have policy significance. This suggests that China’s policy arrangements for addressing climate change should differ under the influence of the heterogeneity mentioned above. Therefore, given the more significant impact of carbon markets on these types of companies, policymakers should prioritize more targeted enterprises and industries when promoting the CETS and expanding pilot cities for green economic transformation.

Author Contributions

Conceptualization, S.L. and L.L.; methodology, D.G.; software, S.L.; validation, S.L., Y.L. and L.L.; formal analysis, Y.L.; investigation, L.L.; resources, Y.L.; data curation, S.L.; writing—original draft preparation, D.G. and S.L.; writing—review and editing, D.G. and L.L; visualization, D.G.; supervision, D.G.; project administration, S.L.; funding acquisition, L.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Soft Science Research Programme of Henan Province in [Research on Carbon Trading Market in Henan Province under the constraints of Dual carbon Targets] grant number [232400411036].

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data and material are available from the corresponding author upon reasonable request.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Duan, K.; Ren, X.; Wen, F.; Chen, J. Evolution of the information transmission between Chinese and international oil markets: A quantile-based framework. J. Commod. Mark. 2023, 29, 100304. [Google Scholar] [CrossRef]

- Duanmu, J.L.; Bu, M.L.; Pittman, R. Does market competition dampenenvironmental performance: Evidence from China. Strat. Manag. J. 2018, 39, 3006–3030. [Google Scholar] [CrossRef]

- Huang, L.; Lei, Z. How environmental regulation affect corporate green investment: Evidence from China. J. Clean. Prod. 2021, 279, 123560. [Google Scholar] [CrossRef]

- Chen, L.; Dong, T.; Nan, G.; Xiao, Q.; Xu, M.; Ming, J. Impact of the introduction of marketplace channel on e-tailer’s logistics service strategy. Manag. Decis. Econ. 2023, 44, 2835–2855. [Google Scholar] [CrossRef]

- Wang, Q.; Dou, J.S.; Jia, S.H. A meta-analytic review of corporate social responsibility and corporate financial performance: The moderating effect of contextual factors. Bus. Soc. 2015, 4, 1083–1121. [Google Scholar] [CrossRef]

- Gao, D.; Yan, Z.; Zhou, X.; Mo, X. Smarter and Prosperous: Digital Transformation and Enterprise Performance. Systems 2023, 11, 329. [Google Scholar] [CrossRef]

- Jiang, J.; Xie, D.; Ye, B.; Shen, B.; Chen, Z. Research on China’s cap-and-trade carbon emission trading scheme: Overview and outlook. Appl. Energy 2016, 178, 902–917. [Google Scholar] [CrossRef]

- Ren, X.; Li, W.; Duan, K.; Zhang, X. Does climate policy uncertainty really affect corporate financialization? Environ. Dev. Sustain. 2023, 1–19. [Google Scholar] [CrossRef]

- Gao, D.; Li, Y.; Tan, L. Can environmental regulation break the political resource curse: Evidence from heavy polluting private listed companies in China. J. Environ. Plan. Manag. 2023, 1–27. [Google Scholar] [CrossRef]

- Teixidó, J.; Verde, S.F.; Nicolli, F. The impact of the EU Emissions Trading System on low-carbon technological change: The empirical evidence. Ecol. Econ. 2019, 164, 106347. [Google Scholar] [CrossRef]

- Huang, Y.; Duan, K.; Urquhart, A. Time-varying dependence between Bitcoin and green financial assets: A comparison between pre-and post-COVID-19 periods. J. Int. Financ. Mark. Inst. Money 2023, 82, 101687. [Google Scholar] [CrossRef]

- Dai, S.L.; Qian, Y.W.; He, W.J.; Wang, C.; Shi, T.Y. The spatial spillover effect of China’s carbon emissions trading policy on industrial carbon intensity: Evidence from a spatial difference-in-difference method. Struct. Change Econ. Dyn. 2022, 63, 139–149. [Google Scholar] [CrossRef]

- Chen, L.; Dong, T.; Peng, J.; Ralescu, D. Uncertainty Analysis and Optimization Modeling with Application to Supply Chain Management: A Systematic Review. Mathematics 2023, 11, 2530. [Google Scholar] [CrossRef]

- Gao, D.; Tan, L.; Mo, X.; Xiong, R. Blue Sky Defense for Carbon Emission Trading Policies: A Perspective on the Spatial Spillover Effects of Total Factor Carbon Efficiency. Systems 2023, 11, 382. [Google Scholar] [CrossRef]

- Zhang, L.; Cao, C.; Tang, F.; He, J.; Li, D. Does China’s emissions trading system foster corporate green innovation? Evidence from regulating listed companies. Technol. Anal. Strategy Manag. 2019, 31, 199–212. [Google Scholar] [CrossRef]

- Li, G.; Wen, H. The low-carbon effect of pursuing the honor of civilization? A quasi-experiment in Chinese cities. Econ. Anal. Policy 2023, 78, 343–357. [Google Scholar] [CrossRef]

- Mo, J.Y. Technological innovation and its impact on carbon emissions: Evidence from Korea manufacturing firms participating emission trading scheme. Technol. Anal. Strateg. Manag. 2022, 34, 47–57. [Google Scholar] [CrossRef]

- Smale, R.; Hartley, M.; Hepburn, C.; Ward, J.; Grubb, M. The impact of CO2 emissions trading on firm profits and market prices. In Emissions Trading and Competitiveness; Routledge: Abingdon-on-Thames, UK, 2012; pp. 31–48. [Google Scholar]

- Li, G.; Gao, D.; Li, Y. Impacts of Market-based Environmental Regulation on Green Total Factor Energy Efficiency in China. China World Econ. 2023, 31, 92–114. [Google Scholar] [CrossRef]

- Hart, S.L.; Ahuja, G. Does it pay to be green? An empirical examination of the relationship between emission reduction and firm performance. Bus. Strategy Environ. 1996, 5, 30–37. [Google Scholar] [CrossRef]

- Liu, G.; Yang, Z.; Zhang, F.; Zhang, N. Environmental tax reform and environmental investment: A quasi-natural experiment based on China’s Environmental Protection Tax Law. Energy Econ. 2022, 109, 1060. [Google Scholar] [CrossRef]

- Tang, G.; Li, L.; Wu, D. Environmental regulation, industry attributes and corporate environmental investment. Account. Res. 2013, 6, 83–89, 96. [Google Scholar]

- Chen, Y.; Ma, Y. Does green investment improve energy firm performance? Energy Policy 2021, 153, 112252. [Google Scholar] [CrossRef]

- Martin, R.; Muûls, M.; Wagner, U.J. The impact of the European union emissions trading scheme on regulated firms: What is the evidence after ten years? Rev. Environ. Econ. Policy 2016, 10, 129–148. [Google Scholar] [CrossRef]

- Wei, Y.; Zhu, R.; Tan, L. Emission trading scheme, technological innovation, and competitiveness: Evidence from China’s thermal power enterprises. J. Environ. Manag. 2022, 320, 115874. [Google Scholar] [CrossRef] [PubMed]

- Hu, J.; Pan, X.; Huang, Q. Quantity or quality? The impacts of environmental regulation on firms’ innovation-Quasi-natural experiment based on China’s carbon emissions trading pilot. Technol. Forecast. Soc. Chang. 2020, 158, 120122. [Google Scholar] [CrossRef]

- Kunapatarawong, R.; Martínez-Ros, E. Towards green growth: How does green innovation affect employment? Res. Policy 2016, 45, 1218–1232. [Google Scholar] [CrossRef]

- Li, G.; Gao, D.; Shi, X.X. How does information and communication technology affect carbon efficiency? Evidence at China’s city level. Energy Environ. 2023, 0958305X231156405. [Google Scholar] [CrossRef]

- Yao, Y.; Hu, D.; Yang, C.; Tan, Y. The impact and mechanism of fintech on green total factor productivity. Green Financ. 2021, 3, 198–221. [Google Scholar] [CrossRef]

- Keohane, N.; Petsonk, A.; Hanafi, A. Toward a club of carbon markets. Clim. Chang. 2017, 144, 81–95. [Google Scholar] [CrossRef]

- Liu, M.; Li, Y. Environmental regulation and green innovation: Evidence from China’s carbon emissions trading policy. Financ. Res. Lett. 2022, 48, 103051. [Google Scholar] [CrossRef]

- Xu, W.; Wan, B.; Zhu, T.; Shao, M. CO2 emissions from China’s iron steel industry. J. Clean Prod. 2016, 139, 1504–1511. [Google Scholar] [CrossRef]

- Yang, S. Carbon emission trading policy and firm’s environmental investment. Financ. Res. Lett. 2023, 54, 103695. [Google Scholar] [CrossRef]

- Duan, K.; Zhao, Y.; Wang, Z.; Chang, Y. Asymmetric spillover from Bitcoin to green and traditional assets: A comparison with gold. Int. Rev. Econ. Financ. 2023, 88, 1397–1417. [Google Scholar] [CrossRef]

- Zhang, Q.; Yu, Z.; Kong, D. The real effect of legal institutions: Environmental courts firm environmental protection expenditure. J. Environ. Econ. Manag. 2019, 98, 102254. [Google Scholar] [CrossRef]

- Liu, L.; Zhao, Z.; Zhang, M.; Zhou, D. Green investment efficiency in the Chinese energy sector: Overinvestment or underinvestment? Energy Policy 2022, 160, 112694. [Google Scholar] [CrossRef]

- Yang, L.; Qin, H.; Gan, Q.; Su, J. Internal control quality, enterprise environmental protection investment and finance performance: An empirical study of China’s a-share heavy pollution industry. Int. J. Environ. Res. Public Health 2020, 17, 6082. [Google Scholar] [CrossRef]

- Liu, J.Y.; Zhang, Y.J. Has carbon emissions trading system promoted non-fossil energy development in China? Appl. Energy 2021, 302, 117613. [Google Scholar] [CrossRef]

- Zhou, F.; Wang, X. The carbon emissions trading scheme and green technology innovation in China: A new structural economics perspective. Econ. Anal. Policy 2022, 74, 365–381. [Google Scholar] [CrossRef]

- Jacobson, L.S.; LaLonde, R.J.; Sullivan, D.G. Earnings losses of displaced workers. Am. Econ. Rev. 1993, 83, 685–709. [Google Scholar]

- Wen, H.; Lee, C.-C.; Zhou, F. Green credit policy, credit allocation efficiency and upgrade of energy-intensive enterprises. Energy Econ. 2021, 94, 105099. [Google Scholar] [CrossRef]

- Chen, L.; Nan, G.; Li, M.; Feng, B.; Liu, Q. Manufacturer’s online selling strategies under spillovers from online to offline sales. J. Oper. Res. Soc. 2023, 74, 157–180. [Google Scholar] [CrossRef]

- Lu, F.; Yao, Y. Rule of Law, Financial Development and Economic Growth under Financial repression. Soc. Sci. China 2004, 1, 42–55. (In Chinese) [Google Scholar]

- Hamilton, B.H.; Nickerson, J.A. Correcting for endogeneity in strategic management research. Strateg. Organ. 2003, 1, 51–78. [Google Scholar] [CrossRef]

- Gu, Y.; Ho, K.C.; Yan, C.; Gozgor, G. Public environmental concern, CEO turnover, and green investment: Evidence from a quasi-natural experiment in China. Energy Econ. 2021, 100, 105379. [Google Scholar] [CrossRef]

- Chen, J.; Geng, Y.; Liu, R. Carbon emissions trading and corporate green investment: The perspective of external pressure and internal incentive. Bus. Strategy Environ. 2022; early view. [Google Scholar] [CrossRef]

- Tian, Y.; Wan, Q.; Tan, Y. Exploration on Inter-Relation of Environmental Regulation, Economic Structure, and Economic Growth: Provincial Evidence from China. Sustainability 2022, 15, 248. [Google Scholar] [CrossRef]

- Martin, R.; Muûls, M.; De Preux, L.B.; Wagner, U.J. Industry compensation under relocation risk: A firm-level analysis of the EU emissions trading scheme. Am. Econ. Rev. 2014, 104, 2482–2508. [Google Scholar] [CrossRef]

- Ren, X.; Wang, R.; Duan, K.; Chen, J. Dynamics of the sheltering role of Bitcoin against crude oil market crash with varying severity of the COVID-19: A comparison with gold. Res. Int. Bus. Financ. 2022, 62, 101672. [Google Scholar] [CrossRef]

- Wang, X.L.; Fan, G.; Hu, L.P. Report on China’s Marketization Index by Province; Social Sciences Academic Press: Beijing, China, 2018. [Google Scholar]

- Zhang, D.; Kong, Q.; Wang, Y.; Vigne, S.A. Exquisite workmanship through net-zero emissions? The effects of carbon emission trading policy on firms’ export product quality. Energy Econ. 2023, 123, 106701. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).