2. Annual Indicator Measuring the Development of the Digital Economy and Society in Hungary and Austria

The Digital Economy and Society Index (DESI) is an indicator that measures the digital economy and society development in EU member states. It provides a framework for EU countries to discuss their economic and budgetary plans and track progress throughout the year. The index allows monitoring of the achievements of member states in terms of digital competitiveness, considering aspects such as human capital, broadband connectivity, the use of digital technologies by businesses, and the availability of digital public services.

In 2022, Hungary ranked 22nd among the 27 EU member states, while Austria occupied the 10th position. In terms of human capital, the Netherlands and Finland are the frontrunners in the EU, while Romania and Bulgaria are behind. Austria surpasses the EU average in almost all indicators, with the exception of the “Enterprises providing ICT training” indicator, where Austria is slightly below the EU average. Hungary performs well in the area of internet access. It takes a leading role in terms of the penetration of broadband systems with speeds of at least 1 Gbps (13.2% of total connections), compared to the EU average of 1.3%. Hungary also demonstrates strong preparedness for 5G, the advanced version of the 4G LTE network, as well as widespread utilization of cable broadband systems and networks with speeds of at least 100 Mbps. Ensuring 100% coverage of gigabit networks in all households by 2030 is a fundamental objective of the Digital Decade strategy. The strategy is built around four main pillars: digital infrastructure, digital skills, digital economy, and digital governance. Hungary aims to surpass the EU average in terms of digital development by the middle of the decade and to be among the top 10 EU economies in terms of digitalization by 2030 [

31].

Austria surpasses the EU average in terms of 5G network coverage. However, the coverage and utilization of very high-capacity fixed networks remain below the EU average. Ensuring higher-speed coverage in rural areas continues to be a significant challenge that Austria needs to address in order to achieve nationwide gigabit connectivity by 2030 [

32].

Hungary ranks 23rd in terms of human capital and performs below the EU average in most indicators. Only 49% of Hungarians possess basic digital skills, significantly lagging behind the EU average of 54%. Other indicators also demonstrate relatively low levels of digital skills. To address the shortcomings in digital skills, Hungary has developed an ambitious policy framework. The new digital strategy outlines three priority areas for digital skills: (1) development of digital competencies (based on the DigComp4 framework); (2) increase in the number and qualification of IT professionals and engineers; (3) support for structural changes in education and vocational training to enhance digital skills. Hungary still faces challenges within the framework of the DESI concerning the integration of digital technologies in businesses and the provision of digital public services. The goal of the Hungarian National Social Inclusion Strategy 2030 is to improve the digital literacy of students, parents, and teachers. It is important to focus on the development of digital infrastructure, reduction of online risks, and enhancement of IT infrastructure in schools. The top performers in the integration of digital technologies are Finland, Denmark, and Sweden, whereas Romania, Bulgaria, and Hungary show the weakest performance [

31].

In terms of human capital, Austria ranks 11th among the 27 EU member states, a position above the EU average. Austria follows two main strategies regarding digital skills. The Digital Action Plan focuses on education and training with the goal of equipping everyone with basic digital skills and competencies. The KTI Strategy (Research, Technology, and Innovation) for 2030 sets three objectives: innovation, excellence, and knowledge. To ensure that every individual possesses basic skills, the Austrian government has introduced measures for all age groups. Starting from 2022, basic digital education is included as a mandatory subject in the curriculum. Through the Digi Scheck initiative, the Federal Ministry of Labor and Economics provides a financial subsidy of EUR 500 for courses accessible to apprentices to enhance their professional skills, particularly in the field of digitalization, resource management, or climate protection. This subsidy is available for a maximum of three courses per year. Additionally, Austria launched over 1790 activities during the 2021 EU Codex Week. In order to develop basic digital skills, the “Digi-Bonus” program was launched in 2022, which provides training opportunities and financial support. The program targets individuals who face difficulties in internet usage or have limited knowledge on how to handle digital tasks in their professional and personal lives. Businesses, especially SMEs, will also be encouraged to promote the development of their employees’ skills in the following areas: IT management, cybersecurity, cloud services, and e-commerce. A federal funding program with a budget of EUR 2.6 million has been initiated to provide vouchers for “Digital Pro Bootcamps”, where participants will undergo a four-week training program. Austria leads in cross-border online sales (16% of Austrian businesses have cross-border online sales to other EU countries), followed by Belgium, Denmark, Malta, and Slovenia (all above 13%) [

32].

Hungary has largely completed the implementation of the National Information and Communications Strategy for the 2014–2020 period and the Digital Prosperity Program 2.0 (“DJP 2.0”) launched in 2017. In the autumn of 2021, a new strategic framework was adopted for the next 10 years: the National Digitalization Strategy (NDS) for the 2021–2030 period [

31].

In Austria, numerous projects and activities are planned for the 2022–2024 period in the field of scientific and technological disciplines, with a focus on the following areas: ICT, artificial intelligence (AI), cybersecurity, the internet and digital technology, and information and communication technologies. Furthermore, in the academic year 2023/24, a new technical university for digitalization and digital transformation—Technische Universität für Digitalisierung und Digitale Transformation (TU DuDT) in Linz—will be established [

32]. Ninety-three percent of Austrian households now have internet access with a minimum speed of 30 Mbps. However, the country lags behind in terms of coverage of very high-capacity networks (VHCNs), significantly below the EU average. The high usage rate of mobile broadband internet (91%) among individuals indicates that Austrian households utilize mobile broadband as a supplement or substitute for fixed-line connections. In the field of digital public services, Austria’s Digital Action Plan strategy aims to provide a one-stop service for businesses and individuals. The Government Program 2020–2024 outlines the step-by-step implementation of this objective. In 2021, Malta was leading with 100% VHCN coverage, followed by Luxembourg, Denmark, Spain, Latvia, the Netherlands, and Portugal with above 90% coverage. The poorest performers were Greece (20%), Cyprus (41%), Italy (44%), and Austria (45%). There has been significant progress in Hungary (30 percentage points), Czechia, and Germany (19 percentage points each) [

32].

The European Community, the OECD, and the European Union have taken numerous initiatives to catalyze the widespread industrial adoption of information and communication technologies and automation [

33,

34]. Industry 4.0 also requires appropriate qualifications, problem-solving skills, and scientific preparedness from university students and educators, as they represent the potential future workforce [

35]. Given the economic environment characterized by slow growth, low inflation, and limited fiscal space, the resources required for the development of Industry 4.0 and the digital economy (initial investment, training and learning time requirements, a more flexible labor market, etc.), and the risks associated with the widespread and rapid transition to Industry 4.0, gradual progress is advantageous rather than disadvantageous. This should be reflected in the time horizon of support policies and institutional functioning [

36,

37,

38,

39]. According to [

40], the development of the digital economy is linked not only to the development of the information technology and innovation industry but also to the improvement of the labor market, where new jobs, professions, and workforce are created.

There is a significant difference in the levels of digital development between Hungary and Austria, but the two countries have different cooperative advantages. For example, in Hungary, the skilled workforce is cheaper than in Austria, yet well-educated. Austria started the digital transition much earlier and at a higher level than Hungary, where digitalization began several years later after the regime change of 1989, and even then, only in small steps. Closing this gap can take a long time, if it is possible or even deemed necessary at all. Based on the results of the DESI macro indicators, it is evident that Austria is on an advanced level and is making good progress in digital transformation, while Hungary is moderately developed. As a result, we further examined the micro level to assess the validity of the DESI results at the company level.

3. Research Design

A quantitative questionnaire survey was conducted to explore the readiness of small, medium, and large companies in Hungary and Austria regarding Industry 4.0 and their future plans related to it.

When compiling our questionnaire, we relied primarily on the “National Technology Platform for Industry 4.0” questionnaire project developed by MTA SZTAKI, which assessed the needs, expectations, and current state of Industry 4.0 in the industry and strategic economic management at the surveyed companies. Data collection was conducted through in-person interviews, online surveys, and email correspondence, involving a total of 155 companies altogether, of which 101 are Hungarian and 54 are Austrian ones. We examined the readiness, current status, future plans, and opportunities of the surveyed companies regarding Industry 4.0. The quantitative survey was carried out within the following industries: manufacture of machinery, industrial equipment, repair of electrical equipment, manufacture of electrical equipment; manufacture, trade, and repair of road vehicles and motorcycles; storage and complementary transport activities; manufacture of computers, electronic, and optical products; manufacture of chemical substances and products. In the selected industries, Industry 4.0 is already present or is playing a prominent role. Manufacturing and service companies were also surveyed. On the qualitative side, four semi-structured interviews were conducted, two with Hungarian companies and two with Austrian companies. The interviews aimed to explore the digital preparedness of the companies and their future plans and to provide recommendations for businesses embarking on the path of digitalization. The complete survey was conducted from 2021–2022. The 54 Austrian questionnaires were uniformly collected online, which allowed for the highest response rate. The Hungarian questionnaires were conducted using two methods: in-person interviews using snowball sampling for half of the sample and computer-assisted telephone interview (CATI) with the assistance of Ipsos Zrt. for the other half, utilizing the company database of Opten. From the database, companies operating in the industries identified in the target group (mechanical engineering, automotive industry, logistics, electronics industry, chemical manufacturing), which are most likely to be affected by the digitalization transition, were selected. The analysis was performed using the IBM SPSS 25.0 software package. Of the multivariate statistical methods, cluster analysis and principal component analysis were the most prominent. Since the questions were mainly focused on the correlations between variables (and the correlations between the subcriteria of each question), principal component analysis was chosen. For the variables for which principal component analysis was performed, we examined whether a possible cluster analysis could add to the research. The general experience and the resulting conclusion was that, because the number of elements was very low, the population was typically divided into 2 clusters, which were disproportionate (e.g., 25–75%), which in itself would not be a problem. However, we could not detect a significant correlation with the basic demographic variables (where there appeared to be one, again, due to the low number of items, this could not be carried out using chi-square statistics), so using this method is unfortunately not feasible for examining the questions of the questionnaire. For examining the relationships between variables, principal component analysis was chosen. The Hungarian sample was weighted, and this was carried out in a two-dimensional manner based on the main economic activity and the size of the company, as we had highly accurate data on these aspects. The population sample of the target group is presented in the following two tables, according to the distribution of main activities (

Table 1 and

Table 2). According to the EU classification, we refer to micro enterprises in the cases of companies that employ 0–9 employees and small enterprises 10–49 employees, but for the sake of better transparency, with firms with industrial activities, we present all enterprises employing 0–49 people as small enterprises and those employing over 250 employees as large enterprises.

As seen in

Table 1, it is evident that most responses came from companies in the logistics and machinery repair/manufacturing sectors. The other three sectors, namely machinery manufacturing, electronic manufacturing, and chemical manufacturing, had a roughly equal number of participating companies, with 12 companies from machinery manufacturing, 12 companies from electronics, and 10 companies from chemical manufacturing. Among Hungarian companies, small businesses were the most active, with 58 companies participating in the questionnaire, while only 17 large companies were included.

Among Austrian companies, no responses were received from small businesses, only from medium and large enterprises. Twenty-seven medium-sized and twenty-seven large companies participated in the questionnaire. Most responses came from the machinery manufacturing and repair sector, while the other sectors were roughly evenly distributed.

4. Results

Our first research question focused on the current level of preparedness for Industry 4.0 strategies among Hungarian and Austrian companies. For this question, we created the following summary chart (

Figure 1). “Implemented Industry 4.0 strategy” refers to projects that have been successfully completed and companies that are actively using Industry 4.0 technologies.

Among the large Hungarian companies, 11 have already started to move towards Industry 4.0, which means that in their cases the strategy is either being developed, implemented, completed, or deployed. Among medium-sized enterprises, 7 companies have indicated this option, while among small enterprises, 26 companies have chosen one of the listed options out of 58 companies, a surprisingly high proportion. Of the small enterprises, 32 have no Industry 4.0 strategy at all and none have fully implemented it. Only one company is in the process of implementation with a pilot project. Ref. [

41]’s research examined hypotheses regarding differences between SMEs and large companies in terms of implementing Industry 4.0. The results of the comparisons also show that SMEs have a lower level of Industry 4.0 implementation. This confirms the assumption that large companies have more opportunities to adopt new technologies and transform into smart factories. However, this situation may change in the future if new technologies become more accessible to smaller companies, for example, through leasing.

Figure 1 clearly shows that all responding large Austrian companies have some form of Industry 4.0 strategy. Of these, 16 companies are in the process of developing a strategy, 3 have already completed it, 3 have already implemented and are actively using Industry 4.0 technologies, and 11 are in the process of implementation and have pilot projects underway. Among the medium-sized companies, 19 companies already have an Industry 4.0 strategy at some stage and only 2 companies are without a strategy.

At the company level, there is also a significant difference between the two countries. Only two of the Austrian medium-sized enterprises surveyed do not have an Industry 4.0 strategy at some stage, while half of the medium-sized enterprises surveyed in Hungary do not have such a strategy. In the large Austrian companies surveyed, all companies have already started to move towards Industry 4.0 technologies. The study sample of [

42] includes 65 companies located in the Marche region (Italy). Their results also show that almost all companies have started to address the implementation of Industry 4.0. This is an important result for those companies that have not yet started to implement any measures, as it means that they are already lagging far behind most companies, thus making the implementation of intervention measures a necessity. For most companies, there is still a long way to go until they can be considered fully digitized.

For the 2nd research question, we examined the aspects that company leaders consider important when introducing and developing digital transformation. Respondents were able to select multiple options from the provided possibilities.

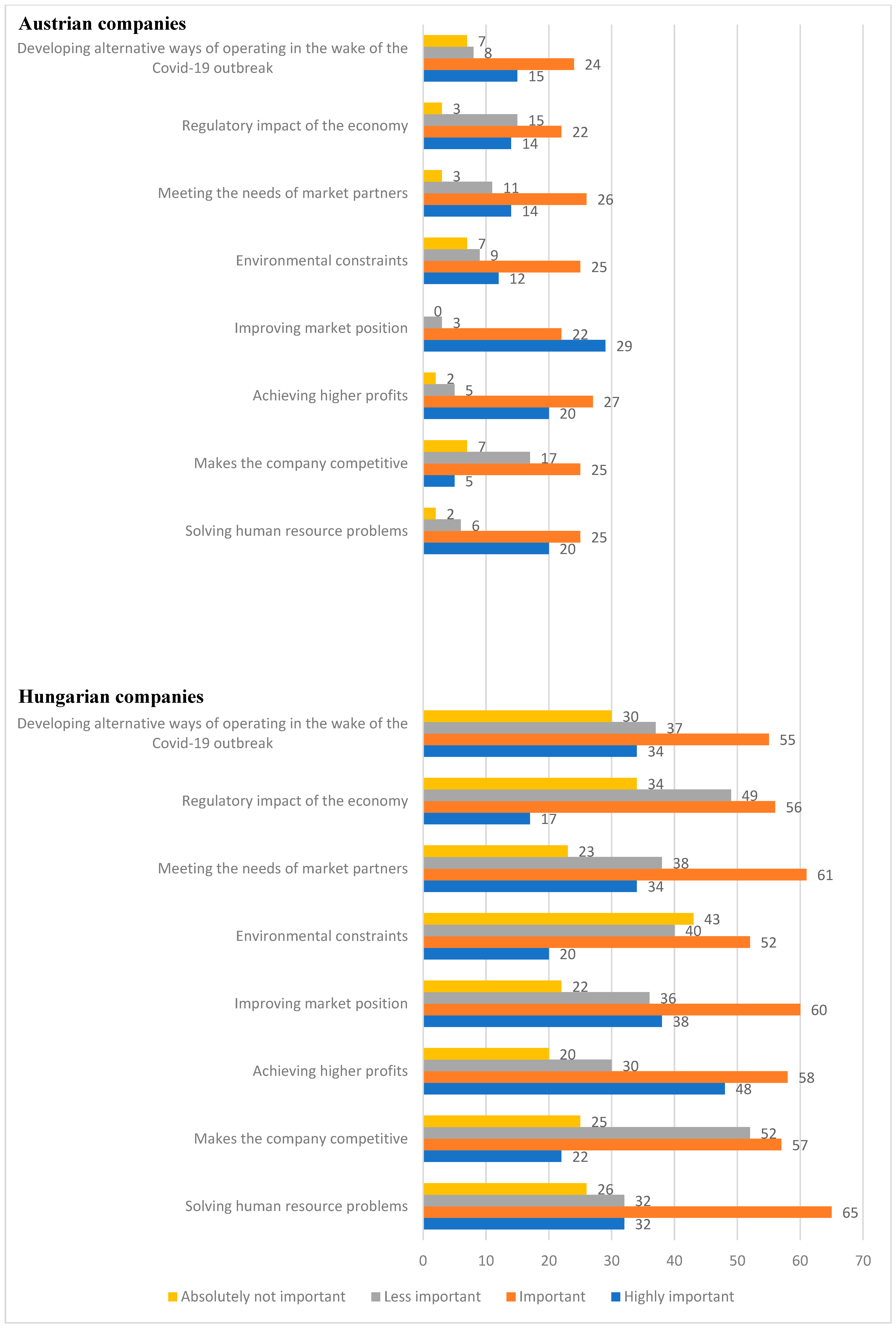

Figure 2 was created for this topic, with the first graph focusing on Austrian companies and the second on Hungarian companies.

Among Hungarian companies, 48 firms consider the opportunity for higher profits to be of paramount importance when it comes to the implementation of an Industry 4.0 strategy. Investment in Industry 4.0 technologies involves a significant volume of resources, and many companies decide to invest when they have projects that can “cover” these costs. Therefore, it is natural and not surprising that achieving higher profits is a prominent consideration for Hungarian companies. However, other important factors include addressing the issue of human resources, meeting the expectations of market partners, ensuring competitiveness, and the regulatory impact on the economy. Regarding the development of alternative modes of operation in response to the consequences of the COVID-19 pandemic, opinions are divided: 30 companies do not consider it important at all, while 24 companies consider it to be of significant importance. For these companies, online communication, automation of various processes, and home office conditions have become important. The epidemic has made providing a range of digital tools and internet access to help people work from home necessary. This situation has further highlighted the importance of digital preparedness and flexibility in companies. They have had to react quickly to the pandemic situation and to completely rethink their organizational functioning. What is deemed “not important at all” is the environmental imperative, as indicated by 43 companies.

Among Austrian companies, improving market position was a prominent consideration, with 29 out of 54 companies. Additionally, 20 companies considered the solution to the human resources issue to be of significant importance. Interestingly, none of the companies regarded improving market position as not important at all in relation to the implementation of the Industry 4.0 strategy. In a study conducted by [

43], qualitative interviews were conducted with a total of 68 Austrian companies. In their study, the most important barriers that hinder the implementation of Industry 4.0 were investigated. The results show that no single obstacle was considered significant enough to completely prevent the adoption of Industry 4.0. Companies perceive the biggest risks to be IT and data security, lack of skilled labor, and unresolved technical problems. Ethical conflicts and difficulties due to economic framework conditions were considered the least important. In general, the hindrances identified are considered solvable challenges for companies, rather than being fundamental obstacles. In this research question, we also examined which industry sector included the companies that considered certain attributes as particularly important. In the case of Hungarian companies, the machinery manufacturing and repair industry had the highest number of attributes marked as of paramount importance. This is clearly illustrated in the following figure (

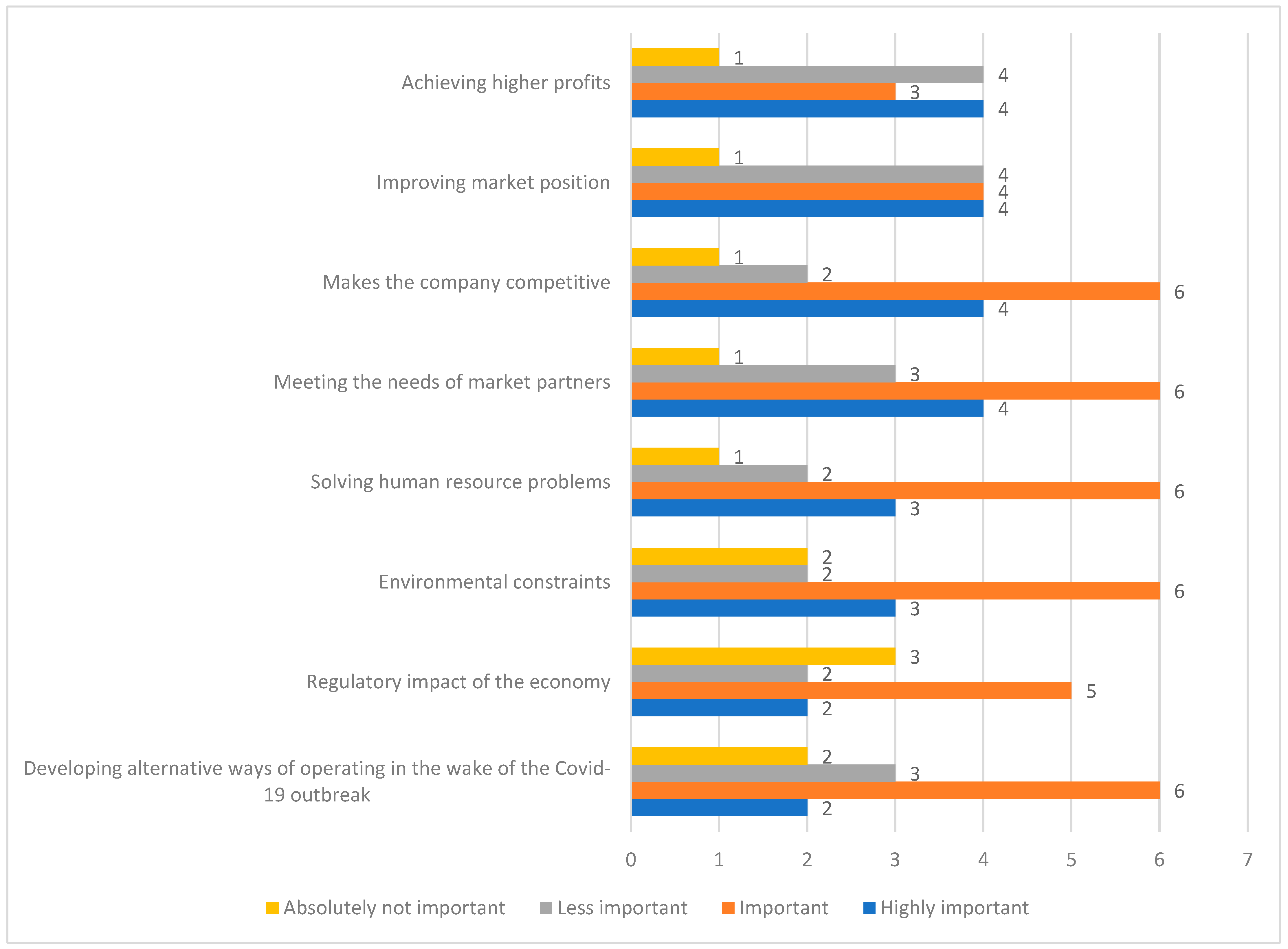

Figure 3).

The figure shows that among companies in the machinery manufacturing, industrial machinery and equipment repair, and electrical equipment manufacturing industry, four companies each highlighted the importance of achieving higher profits, improving market position, competitiveness, and meeting market partners’ requirements. However, the prominently marked attributes are also noteworthy. Six companies consider competitiveness, meeting market partners’ requirements, solving the human resources problem, environmental compliance, and developing alternative operational modes due to the consequences of the COVID-19 pandemic as important. These results are not surprising, as this industry is closely linked to modern manufacturing and production lines. Machinery and equipment manufactured in this industry can be found in various sectors where modern technology has already been introduced, such as energy services, production and manufacturing facilities, and manufacturing and repair workshops for transportation vehicles. According to the Hungarian Central Statistical Office (KSH) report in 2022, electrical equipment manufacturing experienced the highest growth rate (20%) in Hungary, driven by the establishment of plants engaged in the production of electric motors and batteries, as well as gradual production growth.

In the case of the Austrian sample, surprisingly, companies operating in the chemical industry identified the most prominently important attributes. This is depicted in

Figure 4.

Among companies operating in the chemical industry, eight companies highlighted competitiveness. Additionally, six companies emphasized the improvement of market position and achieving higher profits through the implementation of Industry 4.0-supporting developments. All attributes were marked, although only two companies considered developing alternative operational modes due to the consequences of the COVID-19 pandemic as important. The chemical industry, along with the pharmaceutical industry, is one of the most important industrial sectors in Austria, contributing 9.9% to the economy. According to the latest available data from the Annual Report of the Austrian Chemical Industry Federation (FCIO) for the year 2020, the Austrian chemical industry comprises a total of 233 companies with 46,000 employees. Due to the crisis, it experienced a slight decline of −0.8%. As the third-largest industrial sector, the chemical industry is a key sector in Austria. In terms of research and development expenditures, chemical industry companies are also at the forefront: currently, 11% of all investments in research and development in the Austrian economy come from the chemical industry [

44].

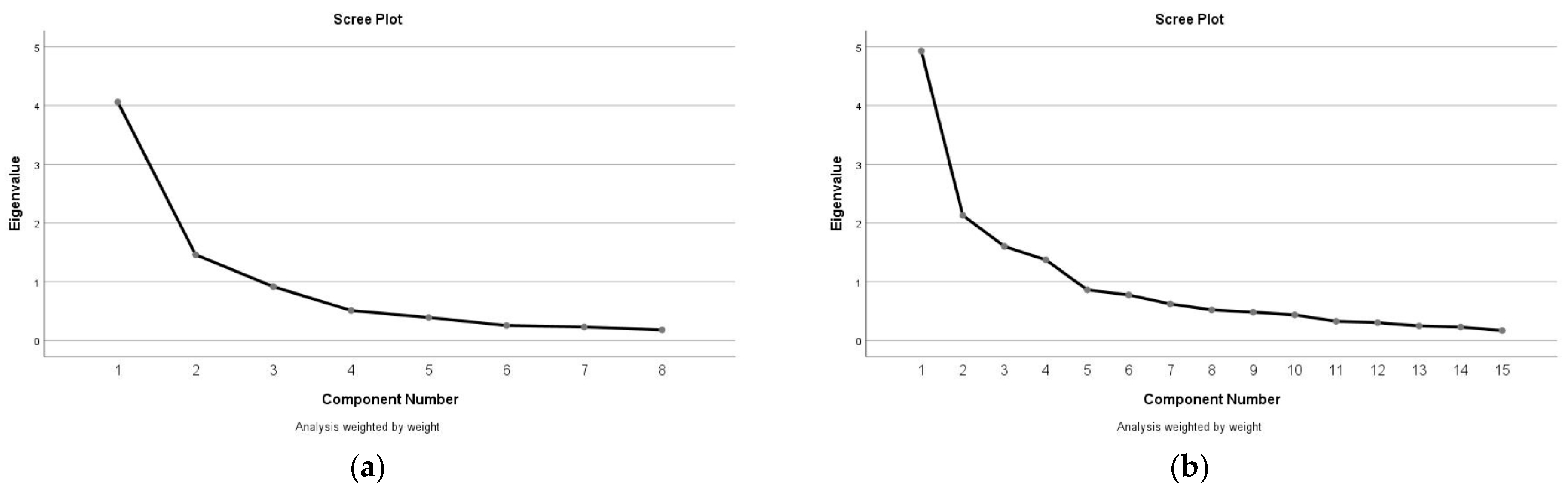

We conducted the analysis of the 3rd research question using principal component analysis. When determining the factors, we initially applied an a priori criterion, meaning that we pre-determined the number of factors. There were two main reasons for this approach. Firstly, since we were working with relatively few variables, we did not want to overly fragment the factors. Secondly, for the sake of easier understanding and visualization, we decided to determine two factors in each factor analysis. Additionally, as commonly used by researchers when determining the number of factors, we applied the Kaiser criterion, which examines the eigenvalues of the individual components. If the eigenvalue is lower than 1, it indicates that the added value is less than that of a single variable, thus not contributing significantly to the understanding of relationships. The Kaiser–Meyer–Olkin (KMO) measure is the most important indicator of whether the variables are suitable for factor analysis. Values above 0.9 are considered excellent, while values below 0.5 are considered unacceptable [

45].

Table 3 shows the KMO and Bartlett’s test results.

The table clearly shows that the KMO value is 0.889, which is considered very good. The KMO value represents the average of the measures of sampling adequacy (MSA) presented in the anti-image correlation matrix. The KMO value of 0.889 supported the conduct of the principal component analysis.

Table 4 presents the KMO and Bartlett’s test values for the Austrian questionnaire regarding the 3rd research question.

The KMO value is 0.738, which is considered adequate, supporting the use of factor analysis for the Austrian sample as well.

The scree plot is used for the graphical representation of eigenvalues and provides assistance in determining the number of factor dimensions. According to the elbow rule, it is advisable to maximize the number of factors where the scree plot has a sharp break, indicating a change in the slope of the curve (see

Figure 5).

The scree plot is a plot of the eigenvalues in the order of the factors, where the eigenvalues are measured on the y-axis and on the x-axis. Both the Hungarian and the Austrian scree plots clearly show that the eigenvalue of the 3rd principal component is below 1 and, from that point on, the curve flattens out, indicating minimal information content. Therefore, we do not use these components. Next, the factors were rotated with the aim of maximizing the variance of the principal components, resulting in an unrotated factor weight matrix. The factor weight can have a value between −1 and +1, referring to the correlation between the original variable and the factor. There may be variables correlated with the principal component that are unrelated, and rotation helps to eliminate this. The axes of the factors are rotated to make the result more meaningful [

45].

The research question addressed whether there is a correlation between the areas where Industry 4.0-supporting development projects were implemented in Hungarian and Austrian companies.

The principal component analysis was performed to determine the 2–2 determinant principal components. As a result of the analysis, we combined the 15 variables into 2 principal components. The principal components were given the

Table 5 and

Table 6.

According to Industry 4.0, the two main areas in the case of Hungarian companies that operate similarly and have undergone developments are the improvement of manufacturing and sales, as well as the enhancement of areas supporting manufacturing and sales. It is evident that where there have been improvements in procurement and logistics, and other supporting areas such as quality assurance are also strong.

According to Industry 4.0, the two main areas in the case of Austrian companies that operate similarly are the improvement of internal processes and the enhancement of customer-specific areas. There is a strong correlation in areas such as sales, service, information technology, information security, and customer relationship management, while research and development, for example, is independent of sales improvement. In Austria, an increasing number of companies are integrating their systems with customers to serve them even faster and more efficiently. The scope of Industry 4.0 technology extends beyond the boundaries of the company.

In summary, the results of the third research question indicate a correlation between different areas in terms of the implementation of Industry 4.0 developments in companies. Both Hungarian and Austrian companies mainly focused on internal developments, but the results show that Austria is more open to external collaborations and the enhancement of customer-specific areas. According to [

46], the primary area of development is production, followed by other areas if there are additional areas to which development can extend.

Presentation of the Interview Results

On the qualitative side, a total of four semi-structured interviews were conducted, with two Hungarian and two Austrian companies. We aimed to explore the current state of digital preparedness and future plans of Hungarian and Austrian companies, as well as gather recommendations for businesses embarking on the path of digitalization. In Hungary, two interviews were conducted. The first interview was conducted with László Fükő, the plant manager of a large tool manufacturing corporation in the county of Borsod-Abaúj-Zemplén, where Industry 4.0 technologies are already in use. The second interview was conducted with István Liker, the CEO of Liker Motors Kft, a small to medium-sized enterprise (SME). This provided insights into the digital preparedness of SMEs in different market situations and business perspectives. In the interviews conducted with Austrian subjects, Michael Vinatzer, the CEO of Transalpina GmbH, presented the digitalization journey of a dynamically growing small company. Additionally, we had a discussion with Dr. Ewald Koppensteiner, the CEO of HPW Metallwerk, about the operations of a large Austrian corporation that is among the leading suppliers in the automotive industry.

During the qualitative research, László Fükő said that digitalization is an inevitable process, but the most important thing is to have a “Lean” process in the company. Lean and digitalization alone are not the same as Industry 4.0; they are just pre-conditions for it. The advantage of digitalization is that information is relayed in a clean and transparent way from A to B, without distortion. A lot of live labor can be replaced by digitized and automated electronic processes, and efficiency can be increased by leaps and bounds. The downside is that, in a manual process, it is easier for people to intervene and make changes when they are needed. Another possible disadvantage is the need for appropriate know-how and the capacity to utilize it. This means having people who can maintain and improve the operating digital systems, and these individuals need to be skilled and well paid. The expert’s recommendation for SMEs is to start with Lean processes and streamlining before moving on to digitalization.

Regarding SMEs, István Liker, the CEO of Liker Motors Kft, mentioned that the company celebrated its 40th anniversary last year and specializes in manufacturing and repairing electric motors. They have over 200 employees and produce over 70,000 electric motors annually, all handmade. Therefore, digitalization is of utmost importance to them, as well as continuous development. Not only accounting and payroll but the entire production, inventory management, recipe handling, and all processes within the company are computerized and software driven. The efficiency gains from digitalization are usually not measured in numbers but rather in employee performance, which also determines their compensation. István believes that smaller companies that embark on digitalization often burden themselves with additional tasks. For those who want to digitalize, it is crucial to carefully consider which computer software or system to use for digitalization, as introducing a new system is easier than replacing an existing one.

During the interview with Michael Vinatzer, the CEO of Transalpina GmbH in Austria, we learned that the company specializes in the import and wholesale of high-quality semi-finished products and raw materials for industry. They serve numerous clients in the EU and, more recently, in Asia as well. They recently opened a small manufacturing facility where they use CNC machines to produce specialized products and prototypes for their clients. Due to the size of the company, Industry 4.0 currently does not make much sense for them. However, they are increasingly using digital tools for communication with their customers and suppliers, whether transmitting test certificates digitally, expediting complaint processing, or managing their inventory electronically for their customers or themselves. This further confirms that the industry must cope with the fact that customers are becoming fully integrated into their processes in the medium and long term [

47]. All their production processes are programmable and programmed. However, the machines do not communicate with each other. They are programmed and work according to the program, but they need to be overwritten if, for example, a tool breaks during machining. The company measures efficiency with metrics, but they do not have specific key figures that directly measure the efficiency changes resulting from digitalization. They often get the best ideas related to digitalization when visiting their customers and suppliers. Today, very few companies in Europe are not digitalized in some form. In Austria, digitalization is already necessary to meet all legal requirements, including regular tax payments. Every company has electronic programs, and their bookkeeping is more or less electronic.

In our interview with Dr. Ewald Koppensteiner, the CEO of HPW Metallwerk GmbH, he explained that the company has 230 employees in Linz. They specialize in the development and manufacturing of special wires. One area of focus is winding wires, specifically flat copper wires and small aluminum flat wires, electrically insulated, for heavy electrical engineering, mainly for large generators and motors. The third area is the production of high-performance cables for the automotive industry. Everything is automated, from control and regulation to supervision, even the testing of product properties, all in a sequential and automated manner. Testing is performed for every millimeter of the manufactured wire. The development and optimization of this process took years, and it represents the applied concept of Industry 4.0. All data are stored and can be evaluated, allowing the system to provide the customer with detailed information about the product parameters throughout the entire length being produced. This required significant efforts in process engineering but resulted in higher-quality products. As a result, they have become market leaders in Europe. The high level of automation was primarily possible because these products need to be manufactured in very large quantities. In Austria, during the COVID-19 pandemic there were financing opportunities for investments related to the development of digitalization. This was a temporary project, and the Austrian government provided investment support for it. From the interviews and the questionnaire survey, it is evident that, among the surveyed companies, there are some where the prerequisites for implementing the developments at a faster pace are not met, while others are progressing rapidly with the development of digitalization. In the case of HPW Metallwerk GmbH, it is clear that if a company is a supplier to the automotive industry, they “buy a ticket” for continuous development, where they have to keep up with the pace dictated by their customers. If they cannot keep up with the pace, they will fall behind in the competition. The interviews also confirmed that decision-making processes regarding a new strategy can be carried out quickly in privately owned Hungarian companies, as they do not have to wait for approval from a parent company.

5. Discussion

Digitalization is one of the drivers of economic growth and is emerging in an increasing number of industries. Industry 4.0 primarily refers to innovative manufacturing technology, efficiency, and competitiveness applied to the production of modern products, where repetitive tasks are entrusted to robots and artificial intelligence. We first examined the Digital Economy and Society Index (DESI) of Austria and Hungary and concluded that Austria is advanced and making good progress in the digital transition, while Hungary is moderately advanced. We then further investigated whether this relevant difference is also noticeable at the level of Hungarian and Austrian companies. Through our research, we provided insights through quantitative analysis of 101 Hungarian and 54 Austrian companies to assess their Industry 4.0 readiness and the extent to which the technology has been implemented and conducted qualitative interviews with two Austrian and two Hungarian company leaders. Both the quantitative and qualitative surveys revealed significant differences between the two countries. In the case of surveyed Austrian medium-sized companies, 90.48% have an Industry 4.0 strategy, while in Hungarian companies, only half of the surveyed firms, including both medium-sized and small businesses, have such strategies. Among Hungarian large companies, 75% have an Industry 4.0 strategy, while all surveyed Austrian companies have embarked on the Industry 4.0 technology path. Ref. [

48] found in their research that digitalization and technology adoption have begun in Hungary, but there is still a significant lag compared to other more advanced countries. They identified the lack of a clear digital strategy in value-creating (production and logistics) processes and the lack of management support as the major obstacles to implementing Industry 4.0. Many companies are hesitant due to the unknown economic benefits of digital investments and concerns about high costs. One possible reason for this difference is what [

43] mentioned in their qualitative study, namely that the identified obstacles largely represent challenges for Austrian companies but not fundamental barriers. None of the identified obstacles were considered relevant enough to completely hinder the implementation of Industry 4.0 technology in a company.

In the second research question, we investigated the expectations of leaders regarding Industry 4.0 technologies. Among Hungarian companies, 48 firms considered the possibility of achieving higher profits to be of outstanding importance in relation to the implementation of Industry 4.0 strategies. However, the resolution of human resource issues, meeting the requirements of market partners, and competitiveness were also considered important factors. For Austrian companies, improving market position was clearly the most prominent aspect. In this research question, we also examined the industries to which the companies prioritizing specific attributes belong. In the case of Hungarian companies, the machinery manufacturing and repair industry had the highest number of attributes marked as of outstanding importance. This may be due to the industry’s connection to modern manufacturing, where the products of machinery and mechanical equipment are highly relevant.

In the case of the Austrian sample, companies operating in the chemical industry identified the highest number of attributes marked as of outstanding importance. The chemical industry is the third-largest industrial sector in Austria, and companies in this sector also excel in research and development expenditures.

Finally, the third research question aimed to examine whether there is a correlation between the areas where the implementation of Industry 4.0-supporting developments took place in Hungarian and Austrian companies. According to Industry 4.0, the two main areas for Hungarian companies that operate similarly and have undergone developments are the improvement of manufacturing and sales, as well as the enhancement of areas supporting manufacturing and sales. In the case of Austrian companies, the focus is on the improvement of internal processes and the development of customer-specific areas. For Austrian companies, the scope of Industry 4.0 technology extends beyond the companies themselves, as an increasing number of companies are integrating their systems with customers to enhance service efficiency.

From the interviews, it also became evident that, among the interviewed companies, there are those that lack the prerequisites to implement developments at a faster pace, while others are progressing rapidly in digitalization. Business leaders are compelled to respond quickly to changes, and if they fail to do so and reject new business paradigms, they may experience how easily they can be replaced by business partners [

49]. Ref. [

50] also identified the major barriers that can hinder the adoption of new technologies related to Industry 4.0, including implementation costs, market competition, and resistance to acceptance. It is important for companies to be able to react quickly to changes, as mentioned in the interviews, if they do not want to be left behind by their competitors.

Our research has concluded that there are relevant differences in digital maturity between the two examined countries at both macro and micro levels. However, it is crucial to note that Hungarian leaders also believe in the importance of digital transformation. If they allocate more resources to this endeavor, the industrial transition can be more successful and accelerated within companies. Therefore, it is of utmost importance for the government to support the preparation for digital transition through management education and allocate resources in this field. This way, the necessary actions would also be demonstrated. Ref. [

51] has also shown that companies should participate in and contribute to the training of their employees. Governments should support continuing education programs. To meet the needs of the economy, Education 4.0 should be seen from a four-dimensional perspective: vocational education, entrepreneurship education, financial education, and digital education.

Like all research, this has its limitations. Although the COVID-19 pandemic has brought with it site closures, making it difficult to reach out to companies and survey them, the rapid progress within the field justifies the publication of the results, as they represent milestones for further developments and innovative solutions. The different economic development and industrial performance of the countries and industries in Central Europe that were examined in our research are representative of the continent’s performance, which is not negligible in the context of supply chains in world trade. We believe that the main lessons and trends are still well presented in our study; the case studies provide even more insight into the digital preparedness of companies. The authors will continue to make efforts to survey more Austrian firms in the future, possibly through Hungarian subsidiaries. The study provides a good basis for further research, for which the authors will conduct further interviews and case studies. We would like to explore this further in the future, narrowed down to a specific sector in order to provide more detailed results, for example, within the automotive industry. Industry 5.0 could also be an important topic to research in the future. The Industry 5.0 revolution is still in its infancy, but it is important to note that this could be an important topic for further research as well. Uncertainty management will be especially important among Industry 5.0 solutions, which require close integration of operators and technical systems. The vision of Industry 5.0 goes beyond efficiency and productivity by putting the worker at the center of the production process and by emphasizing sustainability.