1. Introduction

Following the collapse of the Berlin Wall in the 1990s, a myriad of transition economies in Europe embarked on a profound process of transformation. These changes were not restricted to economics but also permeated political, social, cultural, and other sectors. Countries that were previously engaged in a limited global network witnessed remarkable economic transformations. The pace of this shift was amplified with their entry into the European Union (EU), one of the most substantial economic blocks worldwide. The European Union consistently expands its international trade potential every day. As they pursue a growth strategy centered on exports, these countries have indicated levels of exports and imports that exceed the worldwide average. The evolution stages and economic shifts of these nations have continually piqued the interest of economic scholars. The influence of the public sector’s size on openness and other economic activities in transition economies has been explored in various studies. Such research primarily concentrates on macroeconomic variables like economic growth, inflation, financial integration and progress, interest rates, and borrowing. Moreover, the repercussions of political elements such as corruption in these economies have also garnered attention. This research is sparked by the alterations these nations have experienced regarding government size and trade openness. Inevitably, the augmentation of infrastructure by the government during this shift would induce additional influences on the economy. The impact of trade openness on the scope of government essentially materializes in two ways. The first approach is known as the compensation hypothesis. This suggests that the government offsets any escalated costs and risks that arise from an increase in trade openness. As a result, the extent of state intervention in the economy, reflected by public spending, broadens. However, from a liberal point of view, this might result in a long-term economic downturn. The second avenue is referred to as the efficiency hypothesis. According to this theory, greater trade openness prompts a reduction in taxes, thereby boosting the competitiveness of domestic businesses and enticing foreign capital. Consequently, the level of public expenditure contracts along with the reduction in public revenue. The main aim of this study is to evaluate these two predominant effects within the context of 11 transitioning countries. This evaluation will expose the challenges these countries grapple with during their shift to a free market economy.

From a liberal perspective, one would expect minimal government intervention. Yet, attaining this completely can be difficult in these nations that are transitioning from socialist and closed economies to more liberal ones. Openness, which underscores the provision of unhindered international trade in goods and services with minimal state intervention, is a significant concept. A nation’s openness level indicates foreign trade’s influence on its economy and its openness to external economies. The European Union Trade Commission posits trade openness as an essential tool that allows European Union firms to achieve global competitiveness. This perspective asserts that maintaining an open trade policy is integral for EU firms to sustain their competitive edge on a worldwide scale. Firms engaged in exporting activities demonstrate higher productivity levels and facilitate the creation of millions of jobs across the EU. Moreover, imports enable the EU to leverage resources from other countries, which include the production of new and cost-efficient intermediate to final goods and services, innovative ideas, advanced technologies, and more. The continuity of these aspects firmly cements the EU’s position in the global economic sphere [

1]. Particularly after the 1980s, trade openness gained prominence due to liberalization policies, and was regarded as a critical factor for enhancing welfare [

2]. A prevailing issue in today’s developing nations is the scarcity of resources and savings. As a result, the participation of international corporations and resources is essential in order to produce high-quality goods with remarkable factor productivity. This approach will lead to the advancement and competitiveness of industries. Therefore, in a free market system, a nation’s capability to efficiently produce in the long run hinges on its foreign trade policies. To accomplish absolute trade openness, a country must eliminate all restrictions on imports and exports. However, this cannot be achieved solely based on free market regulations. Hence, the state is anticipated to support the process with policies and practices encouraging trade openness through public expenditures and other guidelines.

Moreover, the extent of governmental intervention in economic affairs has been a topic of contentious debate within economics for several centuries. The classical school of economics perceived the state as a “Leviathan” beast, considering its economic activities as mere instruments. In contrast, Keynesian theory posited fiscal policy instruments as the primary impetus for addressing economic issues and stabilizing macroeconomic factors. Governmental economic activities can influence every variable in the economy, either directly or indirectly. As highlighted by Rodrik [

3], rising trade openness levels can affect governmental size. The perspectives on international trade and trade openness have evolved since the era of mercantilism. Mercantilist theory underlined that a state would grow wealthier through exporting via international trade, and thus, should implement policies promoting exports. Meanwhile, classical and neoclassical schools of thought advocated that countries could establish firms through foreign trade that would vie with global firms, thereby attaining production efficiency via technological advancements, R&D, and technology transfers. However, the Keynesian perspective asserts that such goals can be realized through fiscal policy tools such as public expenditures, taxes, and public borrowing. Drawing from these perspectives expressed in various economic doctrines, one can infer that the state’s size and trade openness are either directly or indirectly interconnected.

This research delves into the influence of trade openness on the size of the government, drawing upon the arguments mentioned earlier. The first scenario postulates that the level of government spending escalates with increased trade openness, while the second scenario argues for a decrease in government expenditure in response to heightened trade openness. Particularly significant is the extent of a state’s economic involvement when it comes to augmenting a country’s growth and welfare levels. This is due to the fact that prolonged state economic activity can induce inefficiencies and provoke various forms of economic loss. The relevance of this study emerges in this context, as it attempts to predict the nature of this correlation using data from 11 CCE countries.

Research on the relationship between trade openness and government size was initiated by Cameron [

4] and was later expanded upon by Rodrik [

3], who put forth the compensation hypothesis. This hypothesis posits that trade openness leads to an increase in public expenditures due to the risk associated with open trade, leading to a demand for compensatory expenditures from the exposed segments of society, thus necessitating higher public expenditures from the government [

5]. However, Alesina and Wacziarcg [

6] contest this, arguing that the primary catalyst for increased public expenditure in the context of trade openness is the size of the country rather than external risks. Various studies in the literature corroborate this claim, demonstrating that while the compensation hypothesis holds for developed countries, the efficiency hypothesis tends to be applicable for developing countries. However, Ram [

7] opposes Alesina ve Wacziarg [

6], asserting that consistent results cannot be achieved when cross-country heterogeneity is accounted for. Similarly, Kimakova [

8] supports the compensation hypothesis, having tested the relationship between financial openness and government size. Garrett [

9], on the other hand, argues for the usage of more dynamic variables, such as market integration and public expenditure growth rates, instead of trade openness and aggregate output. In recent times, two different hypotheses have been explored to elucidate the impacts of economic openness on public spending and taxation [

10]. Firstly, the compensation hypothesis, whose groundwork was laid by Cameron [

4] but was formally hypothesized by Rodrik [

3], suggests that public sector compensatory expenditures are a response to the external risks and shocks that societal individuals face due to trade fluctuations caused by trade openness [

3]. Secondly, the efficiency hypothesis proposes that the revenue-reducing effect on the taxation system, due to the capital mobility brought about by openness, has a detrimental impact on the upkeep of public size [

5]. As a consequence, the efficiency hypothesis dictates that the proportion of public expenditures decreases.

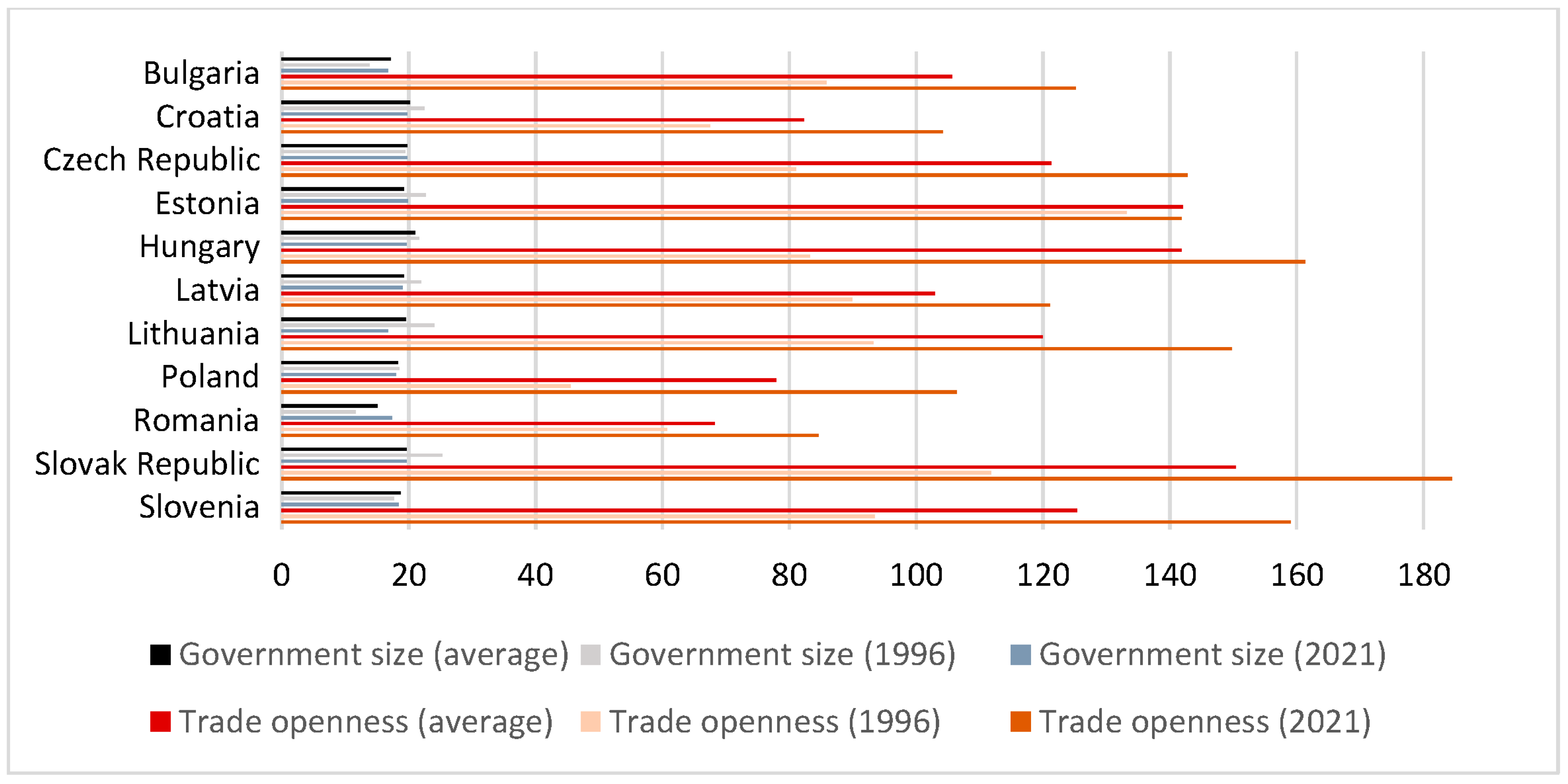

The nations selected for this study have experienced a swift transformation in public expenditure levels and trade openness after the 1990s. Between 1996 and 2021, the average public expenditure as a percentage of GDP in these countries ranged between 15% and 21%. In the post-transition period, all of these countries recorded a decrease in levels of public expenditure. In contrast, trade openness saw a significant surge during this period. For instance, Poland witnessed a 133% increase in trade openness from 1996 to 2021. The primary aim of this study is to examine the correlation between public expenditures and trade openness in these nations. Upon reviewing prior studies, it is clear that research surrounding the efficiency and compensation hypotheses has been relatively limited in the context of EU member states. This study primarily focuses on the chosen 11 EU member transition economies, given these nations’ substantial growth in trade openness in recent years.

Taking into account the aforementioned factors, the primary goal of this research is to decipher the nature of the relationship between trade openness and the size of the government in 11 European Union countries. In alignment with the efficiency and compensation hypotheses, two main hypotheses are put forward in the study. These aim to determine the effects of both positive and negative shocks in government size on trade openness. Through the lens of public choice theory, the study will shed light on the influence of government’s economic activities’ scale on the free market. Additionally, the research introduces notable innovations to the existing literature. Firstly, it pioneers an analysis of the relationship between trade openness and government size using the public choice theory perspective. Secondly, it is one of the inaugural studies addressing the subject in these specific countries. In these aspects, the study anticipates making a substantial contribution to the field’s literature.

Upon reviewing the existing literature, this research diverges in several key aspects. Predominantly, there are minimal studies that scrutinize the validity of the efficiency and compensation hypotheses within the context of the CCE countries. Existing investigations typically concentrate on individual countries, marking this study’s approach as distinctive. Moreover, the application of a causality analysis method to test these hypotheses in the specific countries in focus has not been widely adopted. In these respects, this study brings new insights to the academic literature.

This study delves into the causal link between trade openness levels and government size, and is organized into five sections. Following the introduction, the

Section 2 offers both the theoretical foundation and a review of the theoretical and empirical literature concerning trade openness and government size. The

Section 3 details the data and econometric methods employed. The

Section 4 presents the empirical results.

Section 5 provides a discussion of these findings. Finally, the

Section 6 concludes the study by interpreting the empirical results and outlining the policy implications.

2. Theoretical Background and Literature Review

The correlation between trade openness and government size is illuminated through the compensation and efficiency hypotheses. The seminal study examining the interplay between trade and government size was initiated by Cameron [

4], and its development was later advanced by Rodrik [

3]. Cameron [

4] posits that globalization’s rise engenders an escalation in inter-country trade relations. The hastening of industrial concentration paves the way for workers to form unions and collectively bargain to safeguard their rights. Such robust unions catalyze an elevation in social welfare expenditures such as pensions, employment insurance, social security, and job training, culminating in increased government size. Rodrik [

3] contributed to the literature with another foundational study in this area, arriving at similar conclusions about the government size and trade openness relationship but from a broader perspective. By underscoring external risks in countries with open trade policies, he highlights the expenditures on social insurance and assistance made to shield society from these risks, thereby exerting pressure to boost public expenditures. In this context, Rodrik [

3] asserts that compensatory public expenditures are undertaken to mitigate the societal welfare loss stemming from external risks and shocks associated with openness. This relationship, where trade openness drives up government size, is termed the compensation hypothesis in the scholarly literature. A substantial body of research lends support to the compensation hypothesis [

8,

9,

11,

12,

13,

14,

15,

16].

The efficiency hypothesis provides another perspective on the connection between trade openness and government size. At the heart of the efficiency hypothesis lies the premise that governments may have to curtail their tax collections in response to amplified capital openness, necessitating cuts in public expenditures to avoid budgetary shortfalls [

5]. The overarching objective of the efficiency hypothesis is to lessen the tax burden to safeguard the international competitiveness of domestic firms and stave off cost pressures [

10]. Diminished tax revenues inevitably result in reduced public spending. From the 1980s onward, as the globalization trend gained momentum and public interventions in the economy began to recede, the growth rate of tax revenues saw a downturn. During this era, while the tax base was expanded, statutory corporate tax rates witnessed a decline in OECD and EU member countries, among others [

17,

18,

19,

20,

21]. Consequently, there was no decrease in tax revenues. Per the efficiency hypothesis, a key complement to the reduction in capital taxation is that capital openness and trade openness exert a downward effect on the size of the government, as opposed to augmenting it. The literature also corroborates the efficiency hypothesis, with numerous supporting studies [

5,

7,

22,

23].

The correlation between government size and trade openness, as predicted by the compensation and efficiency hypotheses, is also analyzed in light of aspects such as countries’ political systems and economic structures. Some research indicates that the validity of the compensation hypothesis is contingent upon the degree of democracy in countries [

16,

24,

25]. Assessing the repercussions of trade openness based on countries’ sizes, Mendonça and Oliveira [

26] argue that trade openness augments the public sector’s size in developing nations, whereas it does not prompt a similar enlargement in affluent nations.

Conversely, Abizadeh [

27] elucidates that in small, open economies, the government’s economic role contracts as trade openness amplifies. With capital fluidity increasing among countries due to globalization, affecting economic ebbs and flows, the concept of capital openness has been considered. Consequently, a few studies probe the relationship between financial openness, globalization, and government size; Quinn [

28], for instance, establishes a positive link between financial openness, economic growth, and public expenditures, suggesting that capital openness widens income disparity. Kimakova [

8], incorporating financial openness into the function of openness and government size, posits that it triggers increased public spending. However, Garrett and Mitchell [

29] suggest that trade openness and financial openness culminate in reduced total public expenditure, while countries with high Foreign Direct Investment (FDI) tend to impose heavier taxes on substantial capital. Cusack and Garrett [

30] propose that diminishing barriers to capital flows and increasing financial integration impede the growth of government size. In a subsequent study, Garrett [

9] asserted that the relationship between trade openness and government size is positive, but capital mobility does not lead to an uptick in government size.

To our knowledge, the existing literature lacks studies analyzing the relationship between trade openness and the size of the government for EU countries, marking a unique aspect of this study. While several foundational studies have examined the relationship between trade openness variables, few pertain to our focus. For instance, Molana et al. [

31] supported the compensation hypothesis in their study of 23 industrialized OECD countries for the years 1948–1998. Islam [

32], applying the bounds test method for long-run estimations, found public expenditures in most countries, including Australia, Canada, England, Norway, Sweden, and the USA, to be influenced by openness and terms of trade volatility. Epifani and Gancia [

14] suggested that globalization might have resulted in excessively large governments, based on their study encompassing 143 countries. Benarroch and Pandey [

33] focused on the connection between trade openness and aggregate and disaggregated government expenditure in 119 low- and high-income countries between 1972 and 2000. Their findings highlighted a causal relationship between openness and education expenditures, but only in low-income countries, providing no support for the compensation hypothesis. A variety of empirical studies have been conducted in recent years to elucidate the relationship between trade openness and government size [

34,

35,

36,

37,

38,

39,

40,

41,

42,

43]. For example, Lin et al. [

34] discovered that heightened trade openness enlarges the government size in small developing countries from 1985 to 2010. Vianna and Mollick [

38] obtained results supporting the compensation hypothesis in Latin countries, using panel data analysis for 2003–2010. Williams’ 2021 study [

40] delivered intriguing findings. Based on panel data for 126 countries from 1980 to 2018, the relationship between trade openness and government size was negative in high-income countries but positive in low-income ones. Bharati et al. [

41] also found results endorsing the compensation hypothesis in their study of 137 countries. In a long-term analysis of Spain, Espuelas [

42] found that trade openness positively affects social spending when fiscal capacity is high, but negatively when it is low, over the period 1850–2000. Additionally, there are regional studies, such as the one by Cabral [

44] that discovered a positive relationship between trade openness and government size in 32 Mexican states between 1996 and 2006.

Despite existing analyses of the link between trade openness and government size within EU nations, research in this area remains relatively sparse. This study seeks to augment the literature by examining this connection in the context of 11 EU member Central and Eastern European (CCE) nations.

4. Results

In panel data analysis, the selection of a causality approach relies on cross-sectional dependence and the homogeneity of slope coefficients. In this investigation, the association between the degree of trade openness and government size is ascertained via the Kónya bootstrap Granger causality test [

48]. The hypotheses examined in this study include both the compensation and efficiency hypotheses, with the causality analysis designed to reflect this focus. To verify the compensation hypothesis, the study examines whether positive disturbances in trade openness trigger corresponding shocks in public spending. Conversely, based on the efficiency hypothesis, it inspects whether positive trade openness shocks lead to negative disruptions in government size. Consequently, the initial phase of the investigation involves the identification of the slope coefficients’ homogeneity and cross-sectional dependence. The results of the cross-sectional dependence test for the models in use are presented in

Table 2. The findings shown in

Table 2 indicate the existence of cross-sectional dependence in both the government size–openness and openness–government size relationships at a 1% significance level. This refutes the null hypothesis of “no cross-sectional dependence”, implying that a shock in one unit will have an impact on the other units.

Table 3 presents the results for homogeneity, and based on these findings, the null hypothesis asserting “slope parameters are homogeneous” is rejected in both causality estimation relationships at the 1% significance level. This suggests that the slope parameters are, in fact, heterogeneous.

This investigation implements the asymmetric bootstrap Granger causality test, originally developed by Yılancı and Aydın [

50] and Kónya [

48], given that all models used in our estimations exhibit characteristics of cross-sectional dependence and heterogeneity in slope parameters. This particular test was selected due to its specific requisites that perfectly align with our data structure. To provide a more concrete understanding, the existence of cross-sectional dependence means that the shocks or disturbances occurring in one unit can influence the others. Meanwhile, heterogeneity in slope parameters implies that the relationship between the independent and dependent variables may vary across cross-sectional units. To provide insight into the outcomes of our analysis,

Table 4 presents the results of the asymmetric Granger causality test, showcasing the causality from openness to government Size.

Results from the asymmetric bootstrap panel Granger causality test are presented in

Table 4. To examine the validity of the efficiency and compensation hypotheses, the Granger causality tests were performed on the positive aspects of trade openness and their influence on the positive and negative facets of government size. The findings, as shown in

Table 4, reveal that a unidirectional Granger causality relationship from the positive components of trade openness (

openness+) to the positive components of government size (

government size+) is evident in Bulgaria, Croatia, Czechia, and Estonia. This suggests that advancements in trade openness levels correspondingly expand the public sector size in these countries. These results, therefore, underscore the applicability of the compensation hypothesis in Bulgaria, Croatia, Czechia, and Estonia. Simultaneously, for Slovenia, the data indicate a unidirectional Granger causality relationship running from the positive components of trade openness (

openness+) to the negative components of government size (

government size−). This signifies that enhancements in Slovenia’s trade openness inversely affect the size of the government. Consequently, these findings validate the efficiency hypothesis for Slovenia.

5. Discussions

The results of the causality analysis can be contextualized by considering the unique traits of each country’s policies during the transition period. For instance, Bulgaria witnessed a steady surge in its level of openness from 1996 to 2021, during which public expenditures also rose. Following the disintegration of the Soviet Union in the 1990s, countries like Bulgaria promptly embraced a free market economy. Bulgaria’s admission to the European Union in 2007 was a significant milestone, despite the economic collapse of the Soviet Union in the 1990s that severely impacted Bulgaria more than its counterparts. Though EU membership has led to substantial socio-economic progress in Bulgaria, it is clear that the country’s economic conditions have been influenced by energy and economic policies shared with the Russian Federation. Factors such as shared cultural, religious, and linguistic ties between Russia and Bulgaria also contribute to this impact. Owing to these relationships, Bulgaria’s transition to the free market economy took place somewhat later than in other countries. Bulgaria conducts major trade operations with Germany, the Russian Federation, Italy, Turkey, Romania, and Greece. However, Bulgaria’s export figures remain below the average of the European Union, which suggests that its private sector development is modest when compared with other countries. This relative lag in private sector growth has likely imposed a necessity on Bulgarian administrations to augment state economic activity as a means of boosting the economy. The results of the causality analysis conducted within the scope of this study affirm these circumstances, and a review of public expenditure composition also provides supportive statistical data. For instance, the government expenditure on economic affairs in Bulgaria stands at 18%, which is over double the average of the European Union. It seems likely that Bulgaria, with its sufficient level of trade openness, may have implemented numerous state-led measures to foster the development of its private sector economy during the transition period. Comparable outcomes are observed in other countries as well. Czechia, for example, boosted its trade openness from 80% in 1996 to 143% in 2021, marking an approximate 70% increase in its transition to a free market economy after the 1990s. It stands as one of the leading recipients of foreign direct investment among transitioning economies and outpaces many developed nations in terms of institutional and political factors, including a high human development index, macroeconomic stability, and fiscal discipline. In 1996, foreign capital investments in Czechia were around EUR 1 billion, which soared to EUR 9 billion by 2019 [

47]. In 2019, with a per capita national income of 29,000 people, Czechia exported EUR 166 billion and imported EUR 153 billion. Major export destinations included Germany, Slovakia, Poland, and France, with machinery and transport equipment constituting 60% of the export structure. In this regard, Czechia contributes significantly to Germany’s automotive sector, which boasts an export volume of around EUR 1.5 trillion [

47]. Post the socialist regime, the Czech Republic has made remarkable economic strides. During this phase, it is probable that state economic activities were meticulously planned and contributed to the achievement of stable macroeconomic targets. This observation is further corroborated by the causality results obtained for the Czech Republic. With an average public expenditure ratio of 20%, this country significantly surpasses the average of the nations included in the analysis. This implies that the state’s economic activities in Czechia may bear relevance to other macroeconomic variables, particularly the level of trade openness. It is plausible to conclude that similar outcomes hold for other nations as well. In these nations, when there is a rise in foreign trade deficits, it not only impacts public spending but also has adverse effects on the country’s revenue systems. One consequence of this is the complication of tax laws, which can subsequently lead to decreased taxpayer compliance [

59]. It is crucial for such countries to ensure that the growth in trade openness is sustainable, as failure to do so may unfavorably impact transition economies in the long term [

60]. Moreover, the negative repercussions of this situation may extend beyond fiscal structures and also affect banking systems [

61].

In contrast, Slovenia experiences a unique dynamic where positive shocks in trade openness influence negative shocks in government size, suggesting that advancements in trade openness reduce the size of the government. This is largely attributable to Slovenia’s policies that aim to diminish taxes to enhance the competitiveness of local businesses, resulting in an outcome that aligns with the efficiency hypothesis. Since taxes constitute a principal source of government revenue, their reduction directly contributes to a decrease in public sector size. Between 1996 and 2021, Slovenia’s level of openness experienced a 71% increment [

47]. Its main trade partners include Germany, Italy, Austria, Croatia, France, and the Russian Federation. Enjoying a strategic position among Eastern European nations, Slovenia boasts a robust economic and institutional infrastructure, as well as a well-educated workforce. Its principal export items encompass machinery and transport equipment (43%) and chemical products (12%) [

47]. Moreover, Slovenia functions as a proficient intermediary producer for high-export-capacity nations such as Germany and France within the European Union. In the realm of economic policies, practices like tax incentives applied to firms in Slovenia bolster private sector activities, thereby shrinking the size of the public sector in the economy. The causality result obtained in this study corroborates this scenario. Regarding the nations scrutinized in this study, Slovenia appears to have successfully maintained a certain equilibrium in the state’s role within the economy throughout its transition to the free market system.

6. Conclusions

Following their integration into the EU and the turbulent 1990s, socialist countries rapidly transitioned to the free market economy, undergoing significant transformations. These shifts encompassed not just economic aspects but also political, social, cultural, and other domains, with the most profound impact manifesting in the economic field. The downfall of prosperity in the Soviet Union during the 1990s had a lasting influence on these countries, which lingers to this day. Some of these nations still maintain strong economic ties with the Russian Federation. In the intervening period, countries like Hungary, Czechia, and Slovenia swiftly embraced the free market economy, leveraging this transition as an opportunity to develop sophisticated production channels. The varying positive and negative implications of this process on these countries have been widely explored in the academic literature. Numerous studies have scrutinized the interplay between state-led economic activities and the development of the private sector. A key finding of this study is the established connection between state size in the economic realm and trade openness, emblematic of private sector advancement since the socialist era. This area of research, greatly influenced by the pioneering work of Rodrik [

3], has been the subject of extensive empirical and theoretical exploration. The foundational relationship between trade openness and government size is assessed via the compensation hypothesis and the efficiency hypothesis, both grounded in Rodrik’s work. There seem to be two potential paths for these countries. Firstly, states that effectively manage their public expenditure composition and efficiency to boost the private sector economy can turn this into an opportunity. Secondly, countries may opt to lower tax rates to enhance the competitiveness of domestic firms, consequently leading to a reduction in public expenditures.

This paper endeavors to scrutinize the causal association between government size and openness in Bulgaria, Croatia, Czechia, Estonia, Hungary, Latvia, Lithuania, Poland, Romania, Slovak Republic, and Slovenia from 1996 to 2021. This is accomplished by applying the bootstrap Granger causality methodology developed by Kónya [

48]. The findings demonstrate that a notable causality, stemming from positive facets of openness to positive components of government size, exists solely for Bulgaria, Croatia, Czechia, and Estonia. This strongly underpins the compensation hypothesis in these nations. Moreover, the bootstrap Granger causality test results reveal a causal relationship originating from positive aspects of openness to negative components of government size in Slovenia, substantiating the efficiency hypothesis in Slovenia’s case.

The findings of this study offer several notable economic and policy inferences. For Bulgaria, Croatia, Czechia, and Estonia, where a causality link is established from government size to openness, it is evident that state-led economic activities intensify alongside trade openness and the embrace of a free-market economy during the transition period. Identifying the causality direction unearthed in this research has considerable implications for subsequent studies. The export composition of Bulgaria, Croatia, Czechia, and Estonia exposes a shared characteristic: the machinery and equipment export rates in these nations surpass the average of other countries, as well as the EU. It is plausible, therefore, to infer that the post-1990s state policies were effectively planned and executed in these nations. Undeniably, the cornerstone to successfully transitioning from a socialist regime to a free-market economy, culminating in EU integration, lies in producing high-quality goods and marketing them globally. Insights into this circumstance are provided by the trade partners of these countries and their export composition. It is probable that these states, leveraging their historical experiences, have enhanced their foreign trade volumes while sustaining an appropriate limit to the state’s economic size.

The compensation hypothesis suggests that increased levels of trade openness have a direct, augmenting effect on state power. As countries become more open to trade, there is an amplified need for infrastructure, heightened risks to social security, and an increase in other socio-labor requirements. These growing necessities are typically met by the state, thereby expanding its role in compensation for these expenditures. The findings of this study affirm the validity of the compensation hypothesis in Bulgaria, Croatia, Czechia, and Estonia. These results have various political and economic repercussions for both the economies and their governments. Primarily, state expenditures generally cater to infrastructure, social security costs, and subsidies. Such expenditures mitigate risks emanating from increased trade openness. Yet, these situations also need to be assessed through the lens of public choice theory, which essentially deems the state’s economic activity as inefficient and ineffective. According to public choice theory, public economic actions originate from the maximizing motives of actors involved in the supply–demand process. For instance, political parties and voters may prefer short-term policies for re-election purposes over long-term strategies. This political short-sightedness hinders optimal economic output benefits. Therefore, in these countries, free market activities paradoxically end up enlarging the state’s economic size. If not accounted for, in the long run, heightened trade openness may again decrease the output level due to increased state economic activities. Of course, the costs resulting from trade openness must be compensated. The critical point is determining the limit of state cover for these costs, as exceeding this limit would lead to another significant issue—financing public expenditures. Particularly from the monetarist perspective, state economic activities and the fiscal policy impact on these activities hinge on public expenditure financing. According to this view, if public expenditures are financed through private borrowing, market interest rates will escalate, leading to a decline in private sector investments—a phenomenon known as the crowding-out effect. The potential for such an effect in countries where the compensation hypothesis is applicable, as revealed in this study, should not be overlooked. Ignoring this risk can inhibit the influence of public expenditures on aggregate demand and national income, resulting in lower national income output levels. Furthermore, globalization and increased trade openness do not necessarily result in worsening income distribution in countries, leading to factors such as poverty escalation. To prevent the deterioration of these factors, states need to undertake long-term spending aligned with social state approaches. Thus, structural measures should be taken to ensure that increased trade openness does not induce long-term distortions like poverty. Indeed, the compensation hypothesis fundamentally rests on this notion.

The research indicates that the efficiency hypothesis holds for Slovenia, suggesting several interpretations regarding Slovenia in terms of this hypothesis. The efficiency hypothesis suggests that growth in globalization and trade openness prompts a decrease in tax rates to maintain the competitiveness of domestic firms, thereby reducing public expenditures. This is also applicable to global corporations, whose primary aim is profit maximization and retaining global capital within the country over extended periods. However, the efficiency hypothesis demands that the state forego significant public revenues, a scenario only identified in Slovenia according to this study. The efficiency hypothesis, rooted in public choice theory, essentially describes the diminishing impact of trade openness on public expenditure from the supply side of the production stage. Particularly based on supply-side economics and the monetarist perspective, public expenditures financed through taxes and borrowing can undermine domestic producers’ competitiveness. Financing public expenditures via taxes on income and wealth can decrease aggregate private sector demand, negatively affecting investment decisions. Financing through borrowing may similarly lead to an investment decline due to a crowding-out effect. Indeed, the efficiency hypothesis is grounded on the belief that taxes, which are governments’ main revenue source, should be lowered. This scenario results in the evaporation of the state’s primary income source, compelling a reduction in public expenditures to cater to societal needs. This downsizing of public expenditures equates to a cutback in social expenditures such as education and healthcare, which can decrease the welfare of low- to middle-income individuals, potentially increasing income inequality and poverty. Conversely, to enhance the country’s aggregate output level, which is the underpinning of the efficiency hypothesis, tax revenues need to be curtailed to attract global capital and mobile labor force. Slovenia seems to have implemented a similar model since the Soviet Union’s collapse. High capital taxes can lead to capital fleeing overseas, preventing foreign capital inflow, and the loss of skilled labor, thereby decreasing national income levels. However, it should be noted that reducing tax revenues to maintain tax competition and protect domestic firms’ competitiveness may have other economic implications. If the state attempts to finance through taxes while decreasing capital taxes, it would result in increased taxes on income and labor, leading to tax justice distortions. One conclusion from this study, especially for Slovenia, is that future research needs to thoroughly investigate this issue.

This research significantly enhances the current body of literature in multiple ways. Primarily, to our understanding, it stands as one of the pioneering studies to examine the correlation between trade openness and government size specifically in CCE countries. What sets this research apart from others is its unique approach to the subject matter through the lens of public choice theory. Accordingly, it uncovers the impact of state economic activities on the free market economy in these post-Soviet nations. In this light, the study’s distinctive standpoint makes it a valuable contribution to the existing literature. Furthermore, its employment of asymmetric causality analysis separates it from empirical studies exploring the relationship between trade openness and government size.

Like all research, this study has its constraints. Initially, due to the unavailability of data for certain countries, the timeframe of the study was confined to 1996–2021. Second, the analysis only encompasses 11 countries, as the study seeks to test the public economic activities’ trade openness levels of nations that transitioned from the Soviet Union, in relation to the theory of monetary preference. Lastly, given that the research hinges on causality analysis, it overlooks other factors that might influence the level of trade openness.

Overall, we anticipate that this study will shed light on whether trade openness can stimulate expansion in the public sector, and also underscore that our approach towards country-specific evaluations may vary. In the current era, it becomes crucial to comprehend the economic and trade implications of globalization and regional integrations, like the European Union, to elucidate the relationship between a country’s trade openness and its public sector size. Future research could contribute vital insights into the economic assessment of the correlation between the degree of globalization and the public sector within nations exhibiting varied economic, political, social, and institutional traits amid globally evolving circumstances.