Behavioral Intentions of Bank Employees to Implement Green Finance

Abstract

:1. Introduction

2. Literature Review and Hypotheses Development

2.1. Literature Review

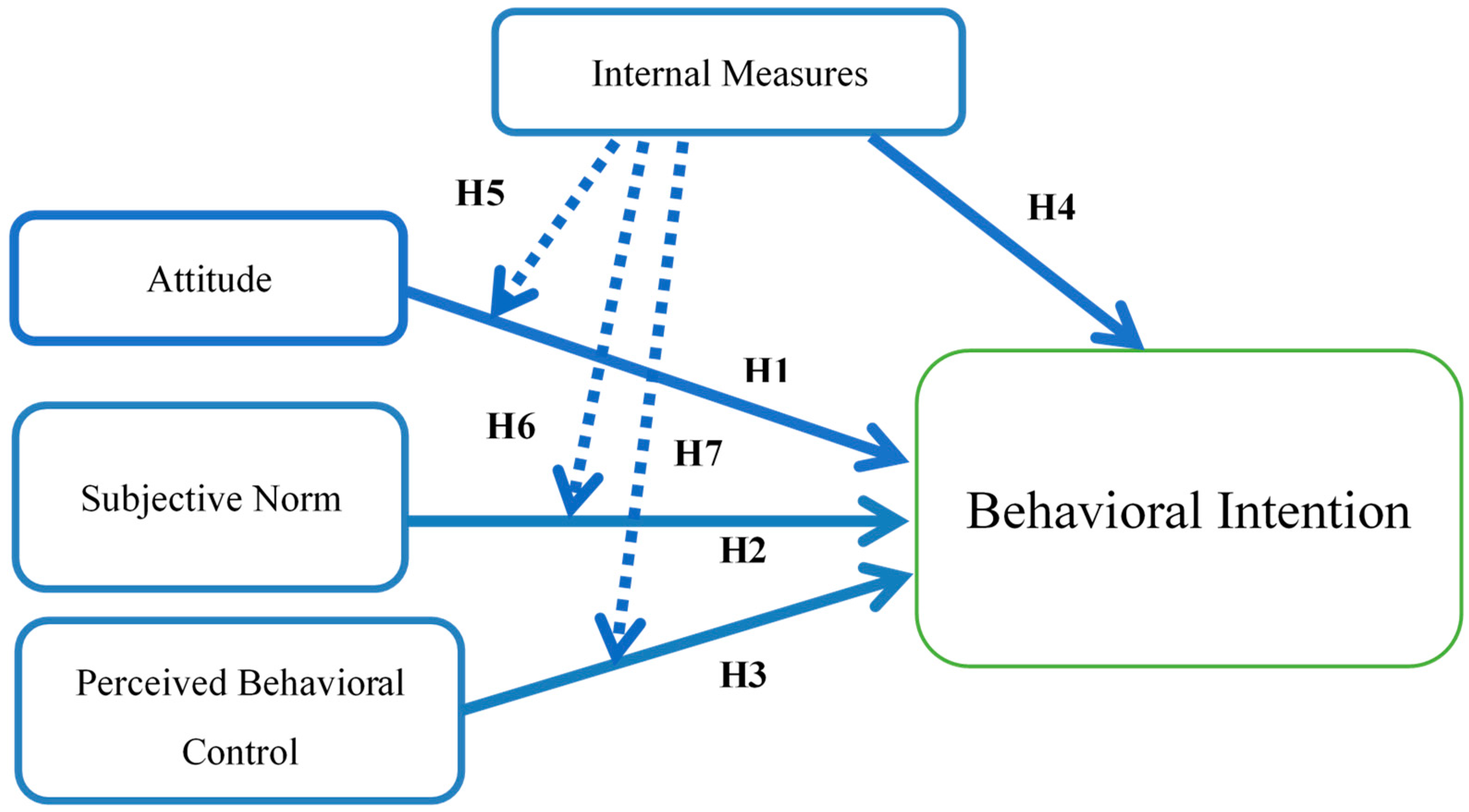

2.2. Hypothesis Development

3. Data Collection and Methodology

3.1. Data Collection

3.2. Methodology

4. Empirical Result

5. Discussion

6. Managerial Implications

6.1. Theoretical Implications

- (i)

- Attitude and perceived behavioral control are significantly and positively related to the behavioral intention of bank employees to implement green finance. With the rise in green finance, the banking industry should be committed to improving the positive attitudes of employees toward the implementation of green finance, eliminating the pressure that comes from supervisors, peers, and customers, and making employees aware that banks can provide sufficient resources. This can help all stakeholders to implement green finance and further help to reduce the obstacles expected by employees. In addition, for female, senior, and new junior employees, as well as older and younger employees, banks should make more effort to establish their attitudes, subjective norms, and perceived behavioral control when implementing green finance.

- (ii)

- It is recommended that banks should establish ESG executive officers, specify incentive measures, strengthen cross-departmental coordination and cooperation, and enhance ESG education and training for all employees. In addition, in terms of relevant internal measures, the banking industry must still consider the strength of the implementation and establish the psychological boundaries of its employees.

6.2. Practical Implications

7. Conclusions and Research Limitations

7.1. Conclusions

7.2. Research Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Lee, Y.C. Overview and Trends of Green Finance Talents in Taiwan. Employ. Secur. 2019, 18, 38–44. [Google Scholar]

- Financial Supervisory Commission. Green Finance Action Plan 1.0. 2017. Available online: https://www.fsc.gov.tw/websitedowndoc?file=chfsc/201802131614480.pdf&filedisplay=1061106%E7%B6%A0%E8%89%B2%E9%87%91%E8%9E%8D%E8%A1%8C%E5%8B%95%E6%96%B9%E6%A1%88%EF%BC%88%E6%A0%B8%E5%AE%9A%E6%9C%AC%EF%BC%89%E5%AE%8C%E6%95%B4.pdf (accessed on 10 January 2022).

- Financial Supervisory Commission. Green Finance Action Plan 3.0. 2022. Available online: https://www.fsc.gov.tw/websitedowndoc?file=chfsc/202209281336330.pdf&filedisplay=%E7%B6%A0%E8%89%B2%E9%87%91%E8%9E%8D%E8%A1%8C%E5%8B%95%E6%96%B9%E6%A1%883.0.pdf (accessed on 10 January 2022).

- Clark, F. Developing ESG and Sustainable Finance Frameworks. Taiwan Bank. 2022, 150, 62–67. [Google Scholar]

- Tsai, L.S. Exploring the Behavior Intention of Enterprise Employees toward Participating in Philanthropic Activities by Theory of Planned Behavior. Ph.D. Thesis, Tamkang University, New Taipei City, Taiwan, 2018. [Google Scholar]

- Aziz, F.; Md Rami, A.A.; Zaremohzzabieh, Z.; Ahrari, S. Effects of Emotions and Ethics on Pro-Environmental Behavior of University Employees: A Model Based on the Theory of Planned Behavior. Sustainability 2021, 13, 7062. [Google Scholar] [CrossRef]

- Alshebami, A.S. Green Innovation, Self-Efficacy, Entrepreneurial Orientation and Economic Performance: Interactions among Saudi Small Enterprises. Sustainability 2023, 15, 1961. [Google Scholar] [CrossRef]

- Asadi, S.; Pourhashemi, S.O.; Nilashi, M.; Abdullah, R.; Samad, S.; Yadegaridehkordi, E.; Aljojo, N.; Razali, N.S. Investigating Influence of Green Innovation on Sustainability Performance: A case on Malaysian hotel industry. J. Clean. Prod. 2020, 258, 120860. [Google Scholar]

- Jiang, W.; Chai, H.; Shao, J.; Feng, T. Green Entrepreneurial Orientation for Enhancing Firm Performance: A Dynamic Capability Perspective. J. Clean. Prod. 2018, 198, 1311–1323. [Google Scholar] [CrossRef]

- Alshebami, A.S. Evaluating the Relevance of Green Banking Practices on Saudi Banks’ Green Image: The Mediating Effect of Employees’ Green Behavior. J. Bank. Regul. 2021, 22, 275–286. [Google Scholar] [CrossRef]

- Muangmee, C.; Dacko-Pikiewicz, Z.; Meekaewkunchorn, N.; Kassakorn, N.; Khalid, B. Green Entrepreneurial Orientation and Green Innovation in Small and Medium-Sized Enterprises (SMEs). Soc. Sci. 2021, 10, 136. [Google Scholar] [CrossRef]

- Battisti, M.; Perry, M. Walking the Talk? Environmental Responsibility from the Perspective of Small-Business Owners. Corp. Soc. Responsib. Environ. Manag. 2011, 18, 172–185. [Google Scholar] [CrossRef]

- Green, K.W.; Inman, R.A. Using a Just-in-Time Selling Strategy to Strengthen Supply Chain Linkages. Int. J. Prod. Res. 2005, 43, 3437–3453. [Google Scholar] [CrossRef]

- Khan, P.A.; Johl, S.K.; Akhtar, S. Firm Sustainable Development Goals and Firm Financial Performance through the Lens of Green Innovation Practices and Reporting: A Proactive Approach. J. Risk Financ. Manag. 2021, 14, 605. [Google Scholar] [CrossRef]

- Höhne, N.; Khosla, S.; Fekete, H.; Gilbert, A. Mapping of Green Finance Delivered by IDFC Members in 2011; Ecofys: Cologne, Germany, 2012; p. 14. [Google Scholar]

- Zadek, S.; Flynn, C. South-Originating Green Finance: Exploring the Potential; The Geneva International Finance Dialogues: Geneva, Switzerland, 2013. [Google Scholar]

- PricewaterhouseCoopers Consultants. Exploring Green Finance Incentives in China. Available online: https://silo.tips/download/exploring-green-finance-incentives-in-china (accessed on 5 October 2000).

- Hsu, Y.C.; Li, Y.H. Opportunities and Challenges of ESG Development in the Financial Industry. Financ. Jt. Credit 2022, 40, 21–28. [Google Scholar]

- Financial Supervisory Commission. Green Finance Action Plan 2.0. 2020. Available online: https://www.fsc.gov.tw/websitedowndoc?file=chfsc/202104191513590.pdf&filedisplay=%E7%B6%A0%E8%89%B2%E9%87%91%E8%9E%8D%E8%A1%8C%E5%8B%95%E6%96%B9%E6%A1%882.0.pdf (accessed on 10 January 2022).

- Asia-Pacific Economic Cooperation. Green Finance for Green Growth, 17th Finance Ministers’ Meeting, Japan, November, 2010. Available online: http://mddb.apec.org/Pages/search.aspx?setting=ListMeeting&DateRange=2010/11/01%2C2010/11/end&Name=17th%20Finance%20Ministers%27%20Meeting%202010 (accessed on 10 January 2022).

- Bose, S.; Khan, H.Z.; Monem, R.M. Does Green Banking Performance Pay Off? Evidence from a Unique Regulatory Setting in Bangladesh. Corp. Gov. Int. Rev. 2021, 29, 162–187. [Google Scholar] [CrossRef]

- Sharma, M.; Choubey, A. Green Banking Initiatives: A Qualitative Study on Indian Banking Sector. Environ. Dev. Sustain. 2022, 24, 293–319. [Google Scholar] [CrossRef]

- Zhang, X.; Wang, Z.; Zhong, X.; Yang, S.; Siddik, A.B. Do Green Banking Activities Improve the Banks’ Environmental Performance? The Mediating Effect of Green Financing. Sustainability 2022, 14, 989. [Google Scholar] [CrossRef]

- Sabbir, M.M.; Taufique, K.M.R. Sustainable Employee Green Behavior in the Workplace: Integrating Cognitive and Non-Cognitive Factors in Corporate Environmental Policy. Bus. Strategy Environ. 2022, 31, 110–128. [Google Scholar] [CrossRef]

- Chen, J.; Siddik, A.B.; Zheng, G.W.; Masukujjaman, M.; Bekhzod, S. The Effect of Green Banking Practices on Banks’ Environmental Performance and Green Financing: An Empirical Study. Energies 2022, 15, 1292. [Google Scholar] [CrossRef]

- Ajzen, I. From Intentions to Action: A Theory of Planned Behaviour. In Action-Control: From Cognition to Behaviour; Kuhl, J., Beckmann, J., Eds.; Springer: New York, NY, USA, 1985; pp. 11–39. [Google Scholar]

- Ajzen, I.; Driver, B.L. Application of the Theory of Planned Behavior to Leisure Choice. J. Leis. Res. 1992, 24, 207–224. [Google Scholar] [CrossRef]

- Ajzen, I.; Fishbein, M. Understanding Attitude and Predicting Social Behavior; Prentice-Hall: Englewood Cliffs, NJ, USA, 1980. [Google Scholar]

- Ajzen, I. The Theory of Planned Behavior. Organ. Behav. Hum. Decis. Process. 1991, 50, 179–211. [Google Scholar] [CrossRef]

- Ajzen, I. Nature and Operation of Attitudes. Annu. Rev. Psychol. 2001, 52, 27–58. [Google Scholar] [CrossRef] [Green Version]

- Raza, S.A.; Ahmed, R.; Ali, M.; Qureshi, M.A. Influential Factors of Islamic Insurance Adoption: An Extension of Theory of Planned Behavior. J. Islam. Mark. 2019, 11, 1497–1515. [Google Scholar]

- Bhattacherjee, A. Acceptance of E-Commerce Services: The Case of Electronic Brokerages. IEEE Trans. Syst. Man Cybern. Part A Syst. Hum. 2000, 30, 411–420. [Google Scholar] [CrossRef] [Green Version]

- Bouarar, A.C.; Mouloudj, K. Using the Theory of Planned Behavior to Explore Employees Intentions to Implement Green Practices. Dirassat J. Econ. Issue 2021, 12, 641–659. [Google Scholar]

- Khalid, B.; Shahzad, K.; Shafi, M.Q.; Paille, P. Predicting Required and Voluntary Employee Green Behavior Using the Theory of Planned Behavior. Corp. Soc. Responsib. Environ. Manag. 2022, 29, 1300–1314. [Google Scholar] [CrossRef]

- Luo, M.Y. The Study on Employee Intention of Corporate Social Responsibility Activity by the Theory of Planned Behavior-A Case of Chunghwa Post. Master’s Thesis, National Taipei University, New Taipei City, Taiwan, 2014. [Google Scholar]

- Gamel, J.; Bauer, A.; Decker, T.; Menrad, K. Financing Wind Energy Projects: An Extended Theory of Planned Behavior Approach to Explain Private Households’ Wind Energy Investment Intentions in Germany. Renew. Energy 2022, 182, 592–601. [Google Scholar] [CrossRef]

- Katz, I.M.; Rauvola, R.S.; Rudolph, C.W.; Zacher, H. Employee Green Behavior: A Meta-Analysis. Corp. Soc. Responsib. Environ. Manag. 2022, 29, 1146–1157. [Google Scholar] [CrossRef]

- Chen, S.-C.; Hung, C.-W. Elucidating the Factors Influencing the Acceptance of Green Products: An Extension of Theory of Planned Behavior. Technol. Forecast. Soc. Change 2016, 112, 155–163. [Google Scholar] [CrossRef]

- Zhang, L.; Fan, Y.; Zhang, W.; Zhang, S. Extending the Theory of Planned Behavior to Explain the Effects of Cognitive Factors across Different Kings of Green Products. Sustainability 2019, 11, 4222. [Google Scholar] [CrossRef] [Green Version]

- Central Bank of the Republic of China (Taiwan). The Development and Challenges of Sustainable Finance in Taiwan. Financ. Stab. Rep. 2021, 15, 97–101. [Google Scholar]

- Hagger, M.S.; Chatzisarantis, N.L.D.; Biddle, S.J.H. A Meta-Analytic Review of the Theories of Reasoned Action and Planned Behavior in Physical Activity: Predictive Validity and the Contribution of Additional Variables. J. Sport Exerc. Psychol. 2002, 24, 3–32. [Google Scholar] [CrossRef]

- Nunnally, J.C. Psychometric Theory; McGraw-Hill: New York, NY, USA, 1978. [Google Scholar]

- Myers, R.H. Classical and Modern Regression with Applications; Duxbury Press: Boston, MA, USA, 1990. [Google Scholar]

- Baron, R.M.; Kenny, D.A. The Moderator-Mediator Variable Distinction in Social Psychological Research: Conceptual, Strategic, and Statistical Considerations. J. Personal. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef] [PubMed]

| Construct | Definition | Question | Reference |

|---|---|---|---|

| Attitude | The attitude of bank employees towards the implementation of green finance is positive or negative. |

| Ajzen (1991, 2001) [29,30] Aziz et al. (2021) [6] |

| Subjective Norm | Bank employees feel the influence of key stakeholders when implementing green finance. |

| Ajzen (1991) [29] Bhattacherjee (2000) [32] |

| Perceived Behavioral Control | The degree of difficulty for bank employees to implement green finance |

| Ajzen (2001) [30] Katz et al. (2022) [37] |

| Internal Measures | In the process of promoting green finance business, banks need to take measures including cross-departmental consultation, education and training, and letting stakeholders fully understand the potential benefits. |

| CBRC (Taiwan) (2021) [40] Clark (2022) [4] |

| Behavioral Intention | The subjective probability that bank employees engage in the implementation of green finance |

| Ajzen (2001) [30] |

| Constructs | Number of Items | Cronbach’s α |

|---|---|---|

| All | 21 | 0.979 |

| Attitude | 4 | 0.959 |

| Subjective Norm | 5 | 0.955 |

| Perceived Behavioral Control | 4 | 0.890 |

| Internal Measures | 4 | 0.948 |

| Behavioral Intention | 4 | 0.970 |

| Attitude | Subjective Norm | Perceived Behavioral Control | Internal Measures | Behavioral Intentions | |

|---|---|---|---|---|---|

| Years of Service in the Bank | * | * | * | * | * |

| Service Department | |||||

| Education | |||||

| Education Major | |||||

| Age | * | * | * | ||

| Gender | * | ||||

| Type of Bank Service |

| Attitude | Subjective Norm | Perceived Behavioral Control | Internal Measures | Behavioral Intention | |

|---|---|---|---|---|---|

| Mean | 3.9126 | 3.6081 | 3.3882 | 3.6870 | 3.7703 |

| Standard Deviation | 0.9954 | 0.9473 | 0.8941 | 1.0527 | 0.9125 |

| Attitude | 1.00 | ||||

| Subjective Norm | 0.807 *** | ||||

| Perceived Behavioral Control | 0.694 *** | 0.770 *** | |||

| Internal Measures | 0.754 *** | 0.833 *** | 0.727 *** | ||

| Behavioral Intention | 0.845 *** | 0.797 *** | 0.810 *** | 0.771 *** | 1.00 |

| Independent Variable | Coefficient | R Squared |

|---|---|---|

| Attitude | 0.845 *** (17.36) | 0.713 |

| Subjective Norm | 0.797 *** (14.53) | 0.636 |

| Perceived Behavioral Control | 0.810 *** (15.18) | 0.656 |

| Internal Measures | 0.771 *** (13.34) | 0.595 |

| Model | Independent Variable | Coefficient | T-Statistic | p-Value | R2 |

|---|---|---|---|---|---|

| Model 1 | Attitude | 0.529 ** | 7.492 | 0.000 | 0.748 |

| Subjective Norm | 0.319 ** | 4.307 | 0.000 | ||

| Model 2 | Attitude | 0.455 ** | 7.243 | 0.000 | 0.808 |

| Subjective Norm | 0.090 | 1.213 | 0.227 | ||

| Perceived Behavioral Control | 0.401 ** | 6.199 | 0.000 | ||

| Model 3 | Attitude | 0.433 ** | 6.774 | 0.000 | 0.810 |

| Subjective Norm | 0.028 | 0.334 | 0.739 | ||

| Perceived Behavioral Control | 0.380 ** | 5.786 | 0.000 | ||

| Internal Measures | 0.104 | 1.602 | 0.112 |

| Independent Variable | Model 1 | Model 2 | Model 3 |

|---|---|---|---|

| Attitude | 0.845 *** (17.36) | 0.610 *** (8.86) | 0.559 *** (7.21) |

| Internal Measures | 0.312 *** | 0.306 *** | |

| Attitude × Internal Measures | −0.083 | ||

| R2 | 0.713 | 0.755 | 0.759 |

| ΔR2 | 0.713 | 0.042 | 0.004 |

| F | 301.302 | 185.182 | 125.080 |

| ΔF | 1.948 | ||

| VIF | 2.321 | 1.754 |

| Independent Variable | Model 1 | Model 2 | Model 3 |

|---|---|---|---|

| Subjective Norm | 0.797 *** (14.53) | 0.505 *** (5.36) | 0.500 *** (5.30) |

| Internal Measures | 0.350 *** (3.71) | 0.313 *** (3.16) | |

| Subjective Norm × Internal Measures | −0.076 (−1.22) | ||

| R2 | 0.636 | 0.673 | 0.677 |

| ΔR2 | 0.636 | 0.038 | 0.004 |

| F | 211.202 | 123.657 | 83.265 |

| ΔF | 1.484 | ||

| VIF | 3.27 | 1.437 |

| Independent Variable | Model 1 | Model 2 | Model 3 |

|---|---|---|---|

| Perceived Behavioral Control | 0.810 *** (15.18) | 0.528 *** (7.60) | 0.519 *** (7.52) |

| Internal Measures | 0.388 ** (5.58) | 0.343 *** (4.68) | |

| Perceived Behavioral Control × Internal Measures | −0.098 (−1.76) | ||

| R2 | 0.656 | 0.727 | 0.734 |

| ΔR2 | 0.656 | 0.071 | 0.007 |

| F | 230.403 | 159.512 | 109.223 |

| ΔF | 3.090 | ||

| VIF | 2.119 | 1.378 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, H.-Y.; Guo, R.; Hung, C.-C.; Lin, Z.-H.; Wu, M. Behavioral Intentions of Bank Employees to Implement Green Finance. Sustainability 2023, 15, 11717. https://doi.org/10.3390/su151511717

Chen H-Y, Guo R, Hung C-C, Lin Z-H, Wu M. Behavioral Intentions of Bank Employees to Implement Green Finance. Sustainability. 2023; 15(15):11717. https://doi.org/10.3390/su151511717

Chicago/Turabian StyleChen, Hung-Yu, Raofeng Guo, Chin-Chao Hung, Zong-Han Lin, and Mengshan Wu. 2023. "Behavioral Intentions of Bank Employees to Implement Green Finance" Sustainability 15, no. 15: 11717. https://doi.org/10.3390/su151511717

APA StyleChen, H.-Y., Guo, R., Hung, C.-C., Lin, Z.-H., & Wu, M. (2023). Behavioral Intentions of Bank Employees to Implement Green Finance. Sustainability, 15(15), 11717. https://doi.org/10.3390/su151511717