Does Gender and Cultural Diversity Matter for Sustainability in Healthcare? Evidence from Global Organizations

Abstract

:1. Introduction

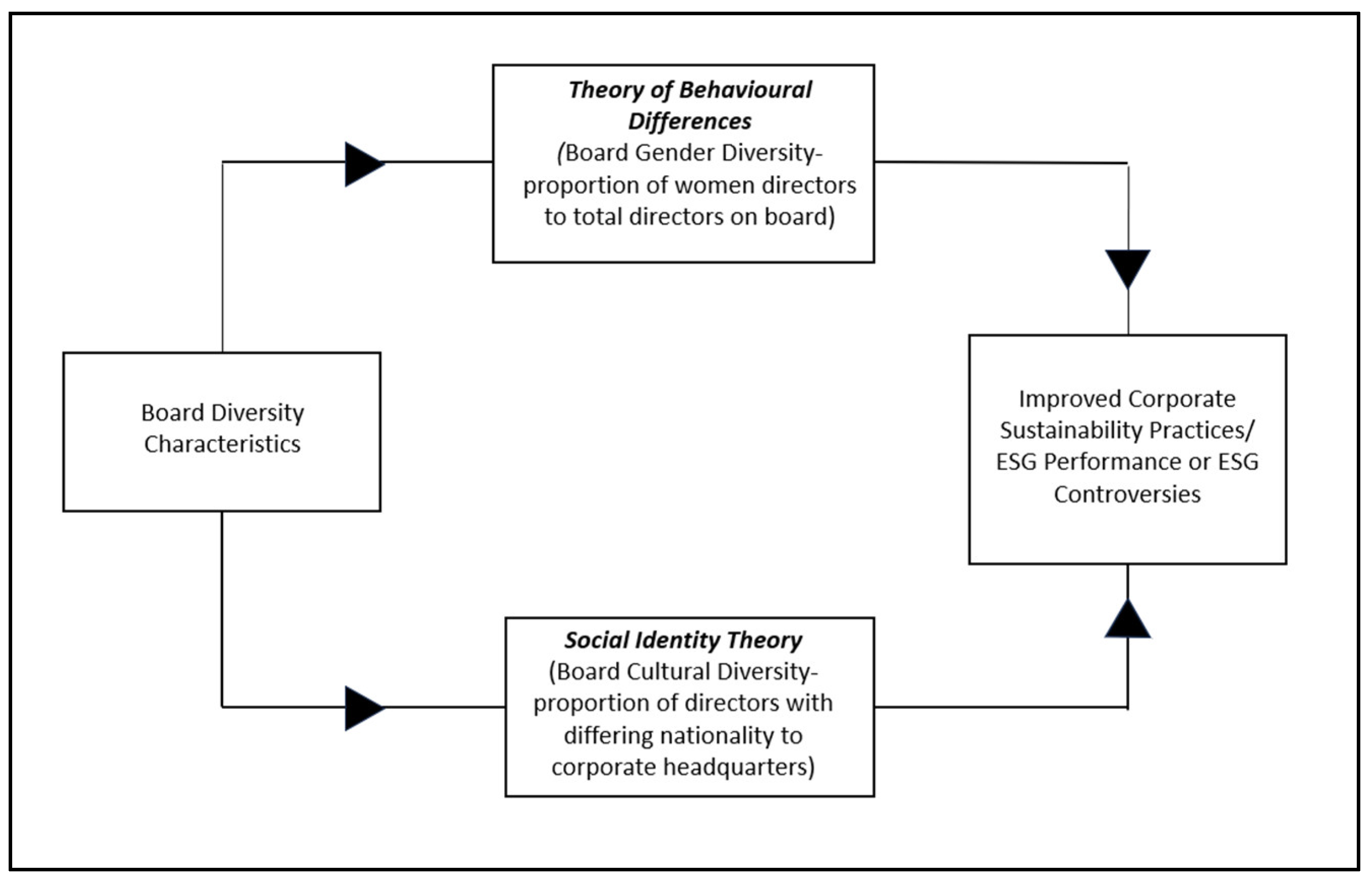

2. Theoretical Rationale and Hypothesis Development

2.1. Sustainability in Healthcare

2.2. Gender-Linked Differences-Behaviour Theory

2.3. Cultural Diversity-Social Identity Theory

2.4. Board Diversity and Sustainability Practices—Testing for Critical Mass Theory

3. Research Methodology

3.1. Data and Sample

3.2. Variable Definitions

3.2.1. Dependent Variable—Corporate Sustainability Practices (CSP)

3.2.2. Independent Variables

3.2.3. Control Variables

3.3. Estimation Methodology

4. Research Findings

4.1. Descriptive Statistics

4.2. Correlation Analysis

4.3. Regression Analysis—Baseline Results

4.4. BGD and Corporate Sustainability Performance—Testing for Critical Mass Theory

4.5. Board Diversity and Corporate Sustainability Performance—Robustness Tests

4.5.1. Alternative Variables and Robustness Tests

4.5.2. Endogeneity Concerns

5. Discussion and Conclusions

6. Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. Definition of Variables

| BIND | Percentage of independent board members |

| BSKILL | Relevant industry knowledge and skills of board members (percentage score) |

| BMEET | Number of board meetings |

| BTENURE | Length of time served as a director (in years) |

| BSIZE | Total number of board members |

| CEO DUAL | When the CEO simultaneously chairs the board (nominal variable) |

| FSIZE | Natural logarithm of total firm assets |

| MTB | Market to book value |

| ROA | Return on assets ratio |

| LEVERAGE | Total liabilities divided by total assets |

| World Bank Governance Indicators | |

| Voice and Accountability | Perceptions of the extent to which a country’s citizens can participate in selecting their government, as well as freedom of expression, freedom of association, and a free media |

| Political Stability | Perceptions of the likelihood of political instability and/or politically motivated violence, including terrorism |

| Government Effectiveness | Perceptions of the quality of public services, the quality of the civil service and the degree of its independence from political pressures, the quality of policy formulation and implementation, and the credibility of the government’s commitment to such policies |

| Regulatory Quality | Perceptions of the ability of the government to formulate and implement sound policies and regulations that permit and promote private sector development |

| Rule of Law | Perceptions of the extent to which agents have confidence in and abide by the rules of society, and in particular, the quality of contract enforcement, property rights, the police, and the courts, as well as the likelihood of crime and violence |

| Control of Corruption | Perceptions of the extent to which public power is exercised for private gain, including both petty and grand forms of corruption, as well as “capture” of the state by elites and private interests |

References

- Beasy, K.; Gale, F. Disrupting the status-quo of organisational board composition to improve sustainability outcomes: Reviewing the evidence. Sustainability 2020, 12, 1505. [Google Scholar] [CrossRef] [Green Version]

- Jain, T.; Zaman, R. When boards matter: The case of corporate social irresponsibility. Br. J. Manag. 2020, 31, 365–386. [Google Scholar] [CrossRef]

- Nadeem, M.; Zaman, R.; Saleem, I. Boardroom gender diversity and corporate sustainability practices: Evidence from Australian Securities Exchange listed firms. J. Clean. Prod. 2017, 149, 874–885. [Google Scholar] [CrossRef]

- Kinateder, H.; Choudhury, T.; Zaman, R.; Scagnelli, S.D.; Sohel, N. Does boardroom gender diversity decrease credit risk in the financial sector? Worldwide evidence. J. Int. Financ. Mark. Inst. Money 2021, 73, 101347. [Google Scholar] [CrossRef]

- Guest, P.M. Does board ethnic diversity impact board monitoring outcomes? Br. J. Manag. 2019, 30, 53–74. [Google Scholar] [CrossRef] [Green Version]

- Lloyd, J.; Davis, R.; Moses, K. Recognizing and Sustaining the Value of Community Health Workers and Promotores; Center for Health Care Strategies: Trenton, NJ, USA, 2020; p. 13. [Google Scholar]

- Staniškienė, E.; Stankevičiūtė, Ž. Social sustainability measurement framework: The case of employee perspective in a CSR-committed organisation. J. Clean. Prod. 2018, 188, 708–719. [Google Scholar] [CrossRef]

- Zaman, R.; Atawnah, N.; Baghdadi, G.A.; Liu, J. Fiduciary duty or loyalty? Evidence from co-opted boards and corporate misconduct. J. Corp. Financ. 2021, 70, 102066. [Google Scholar] [CrossRef]

- Ayuso, S.; Argandoña, A. Responsible corporate governance: Towards a stakeholder board of directors? Corp. Ownersh. Control 2009, 6, 9–19. [Google Scholar] [CrossRef]

- Martínez-Ferrero, J.; Lozano, M.B.; Vivas, M. The impact of board cultural diversity on a firm’s commitment toward the sustainability issues of emerging countries: The mediating effect of a CSR committee. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 675–685. [Google Scholar] [CrossRef]

- Safkaur, O. Corporate social responsibility in the health sector for Papua Indonesia. Int. J. Sci. Technol. Res. 2016, 5, 159–167. [Google Scholar]

- Demir, M.; Min, M. Consistencies and discrepancies in corporate social responsibility reporting in the pharmaceutical industry. Sustain. Account. Manag. Policy J. 2019, 10, 333–364. [Google Scholar] [CrossRef]

- Assefa, Y.; Gilks, C.F.; van de Pas, R.; Reid, S.; Gete, D.G.; Van Damme, W. Reimagining global health systems for the 21st century: Lessons from the COVID-19 pandemic. BMJ Glob. Health 2021, 6, e004882. [Google Scholar] [CrossRef] [PubMed]

- Hakovirta, M.; Denuwara, N. How COVID-19 redefines the concept of sustainability. Sustainability 2020, 12, 3727. [Google Scholar] [CrossRef]

- Marimuthu, M.; Paulose, H. Emergence of sustainability based approaches in healthcare: Expanding research and practice. Procedia-Soc. Behav. Sci. 2016, 224, 554–561. [Google Scholar] [CrossRef] [Green Version]

- Kuhlman, T.; Farrington, J. What is sustainability? Sustainability 2010, 2, 3436–3448. [Google Scholar] [CrossRef] [Green Version]

- Fuente, J.A.; García-Sanchez, I.M.; Lozano, M.B. The role of the board of directors in the adoption of GRI guidelines for the disclosure of CSR information. J. Clean. Prod. 2017, 141, 737–750. [Google Scholar] [CrossRef]

- Boukattaya, S.; Omri, A. Impact of board gender diversity on corporate social responsibility and irresponsibility: Empirical evidence from France. Sustainability 2021, 13, 4712. [Google Scholar] [CrossRef]

- Ferrero-Ferrero, I.; Fernández-Izquierdo, M.Á.; Muñoz-Torres, M.J. Integrating sustainability into corporate governance: An empirical study on board diversity. Corp. Soc. Responsib. Environ. Manag. 2015, 22, 193–207. [Google Scholar] [CrossRef]

- Harjoto, M.A.; Laksmana, I.; Yang, Y.W. Board nationality and educational background diversity and corporate social performance. Corp. Gov. Int. J. Bus. Soc. 2018, 19, 217–239. [Google Scholar] [CrossRef]

- Achour, N.; Price, A.D. Resilience strategies of healthcare facilities: Present and future. Int. J. Disaster Resil. Built Environ. 2010, 1, 264–276. [Google Scholar] [CrossRef] [Green Version]

- Lloret, A. Modeling corporate sustainability strategy. J. Bus. Res. 2016, 69, 418–425. [Google Scholar] [CrossRef]

- Pereno, A.; Eriksson, D. A multi-stakeholder perspective on sustainable healthcare: From 2030 onwards. Futures 2020, 122, 102605. [Google Scholar] [CrossRef]

- Rosenberg-Yunger, Z.R.; Daar, A.S.; Singer, P.A.; Martin, D.K. Healthcare sustainability and the challenges of innovation to biopharmaceuticals in Canada. Health Policy 2008, 87, 359–368. [Google Scholar] [CrossRef] [PubMed]

- Berwick, D.M.; Hackbarth, A.D. Eliminating waste in US health care. JAMA 2012, 307, 1513–1516. [Google Scholar] [PubMed]

- Sadatsafavi, H.; Walewski, J. Corporate sustainability: The environmental design and human resource management interface in healthcare settings. HERD Health Environ. Res. Des. J. 2013, 6, 98–118. [Google Scholar] [CrossRef] [PubMed]

- Goh, C.Y.; Marimuthu, M. The path towards healthcare sustainability: The role of organisational commitment. Procedia-Soc. Behav. Sci. 2016, 224, 587–592. [Google Scholar] [CrossRef] [Green Version]

- Udry, J.R. Biological limits of gender construction. Am. Sociol. Rev. 2000, 65, 443–457. [Google Scholar] [CrossRef] [Green Version]

- Dahlmann, J.M. The Lenses of Gender: Transforming the Debate on Sexual Inequality; JSTOR: New York, NY, USA, 1994; Volume 92, pp. 1929–1942. [Google Scholar]

- Bem, S.L. Gender schema theory: A cognitive account of sex typing. Psychol. Rev. 1981, 88, 354. [Google Scholar] [CrossRef]

- Schwartz, S.H.; Rubel, T. Sex differences in value priorities: Cross-cultural and multimethod studies. J. Personal. Soc. Psychol. 2005, 89, 1010. [Google Scholar] [CrossRef] [Green Version]

- Chang, E.H.; Milkman, K.L. Improving decisions that affect gender equality in the workplace. Organ. Dyn. 2020, 49, 100709. [Google Scholar] [CrossRef]

- Koenig, A.M.; Eagly, A.H. Evidence for the social role theory of stereotype content: Observations of groups’ roles shape stereotypes. J. Personal. Soc. Psychol. 2014, 107, 371. [Google Scholar] [CrossRef]

- Byron, K.; Post, C. Women on boards of directors and corporate social performance: A meta-analysis. Corp. Gov. Int. Rev. 2016, 24, 428–442. [Google Scholar] [CrossRef]

- Dutton, J.E.; Duncan, R.B. The influence of the strategic planning process on strategic change. Strateg. Manag. J. 1987, 8, 103–116. [Google Scholar] [CrossRef]

- Hillman, A.J. Board diversity: Beginning to unpeel the onion. Corp. Gov. Int. Rev. 2015, 23, 104–107. [Google Scholar] [CrossRef]

- Heilman, M.E. Sex bias in work settings: The lack of fit model. Res. Organ. Behav. 1983, 5, 269–298. [Google Scholar]

- Di Dio, L.; Saragovi, C.; Koestner, R.; Aubé, J. Linking personal values to gender. Sex Roles 1996, 34, 621–636. [Google Scholar] [CrossRef]

- Amorelli, M.F.; García-Sánchez, I.M. Trends in the dynamic evolution of board gender diversity and corporate social responsibility. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 537–554. [Google Scholar] [CrossRef]

- Nadeem, M.; Suleman, T.; Ahmed, A. Women on boards, firm risk and the profitability nexus: Does gender diversity moderate the risk and return relationship? Int. Rev. Econ. Financ. 2019, 64, 427–442. [Google Scholar] [CrossRef]

- Mason, E.S.; Mudrack, P.E. Gender and ethical orientation: A test of gender and occupational socialization theories. J. Bus. Ethics 1996, 15, 599–604. [Google Scholar] [CrossRef]

- Hoffman, L.R. Homogeneity of member personality and its effect on group problem-solving. J. Abnorm. Soc. Psychol. 1959, 58, 27. [Google Scholar] [CrossRef]

- Sila, V.; Gonzalez, A.; Hagendorff, J. Women on board: Does boardroom gender diversity affect firm risk? J. Corp. Financ. 2016, 36, 26–53. [Google Scholar] [CrossRef] [Green Version]

- Golesorkhi, B. Gender differences and similarities in judgments of trustworthiness. Women Manag. Rev. 2006, 21, 195–210. [Google Scholar] [CrossRef]

- Beutel, A.M.; Marini, M.M. Gender and values. Am. Sociol. Rev. 1995, 60, 436–448. [Google Scholar] [CrossRef]

- Birindelli, G.; Dell’Atti, S.; Iannuzzi, A.P.; Savioli, M. Composition and activity of the board of directors: Impact on ESG performance in the banking system. Sustainability 2018, 10, 4699. [Google Scholar] [CrossRef]

- Galbreath, J. Is board gender diversity linked to financial performance? The mediating mechanism of CSR. Bus. Soc. 2018, 57, 863–889. [Google Scholar] [CrossRef]

- Gul, F.A.; Srinidhi, B.; Ng, A.C. Does board gender diversity improve the informativeness of stock prices? J. Account. Econ. 2011, 51, 314–338. [Google Scholar] [CrossRef]

- Gul, F.A.; Hutchinson, M.; Lai, K.M. Gender-diverse boards and properties of analyst earnings forecasts. Account. Horiz. 2013, 27, 511–538. [Google Scholar] [CrossRef]

- Delis, M.D.; Gaganis, C.; Hasan, I.; Pasiouras, F. The effect of board directors from countries with different genetic diversity levels on corporate performance. Manag. Sci. 2017, 63, 231–249. [Google Scholar] [CrossRef] [Green Version]

- Brimhall, K.C.; Saastamoinen, M. Striving for social good through organizational inclusion: A latent profile approach. Res. Soc. Work Pract. 2020, 30, 163–173. [Google Scholar] [CrossRef]

- Adams, R.B.; de Haan, J.; Terjesen, S.; van Ees, H. Board diversity: Moving the field forward. Corp. Gov. Int. Rev. 2015, 23, 77–82. [Google Scholar] [CrossRef]

- Harjoto, M.A.; Laksmana, I.; Yang, Y.-w. Board diversity and corporate investment oversight. J. Bus. Res. 2018, 90, 40–47. [Google Scholar] [CrossRef]

- Yilmaz, M.K.; Hacioglu, U.; Nantembelele, F.A.; Sowe, S. Corporate board diversity and its impact on the social performance of companies from emerging economies. Glob. Bus. Organ. Excell. 2021, 41, 6–20. [Google Scholar] [CrossRef]

- Tasheva, S.; Hillman, A.J. Integrating diversity at different levels: Multilevel human capital, social capital, and demographic diversity and their implications for team effectiveness. Acad. Manag. Rev. 2019, 44, 746–765. [Google Scholar] [CrossRef]

- Hogg, M.A. Social identity theory. In Understanding Peace and Conflict through Social Identity Theory; Springer: Berlin/Heidelberg, Germany, 2016; pp. 3–17. [Google Scholar]

- Rato, D.; Prada, R. Towards social identity in socio-cognitive agents. Sustainability 2021, 13, 11390. [Google Scholar] [CrossRef]

- Scheepers, D.; Ellemers, N. Social identity theory. In Social Psychology in Action; Springer: Berlin/Heidelberg, Germany, 2019; pp. 129–143. [Google Scholar]

- Dunham, Y. Mere membership. Trends Cogn. Sci. 2018, 22, 780–793. [Google Scholar] [CrossRef]

- Turner, M.E.; Pratkanis, A.R. A social identity maintenance model of groupthink. Organ. Behav. Hum. Decis. Process. 1998, 73, 210–235. [Google Scholar] [CrossRef]

- Van Rossem, A.H. Generations as social categories: An exploratory cognitive study of generational identity and generational stereotypes in a multigenerational workforce. J. Organ. Behav. 2019, 40, 434–455. [Google Scholar] [CrossRef]

- Jackson, G.; Apostolakou, A. Corporate social responsibility in Western Europe: An institutional mirror or substitute? J. Bus. Ethics 2010, 94, 371–394. [Google Scholar] [CrossRef]

- Zaid, M.A.; Wang, M.; Adib, M.; Sahyouni, A.; Abuhijleh, S.T. Boardroom nationality and gender diversity: Implications for corporate sustainability performance. J. Clean. Prod. 2020, 251, 119652. [Google Scholar] [CrossRef]

- Cao, J.; Ellis, K.M.; Li, M. Inside the board room: The influence of nationality and cultural diversity on cross-border merger and acquisition outcomes. Rev. Quant. Financ. Account. 2019, 53, 1031–1068. [Google Scholar] [CrossRef]

- Hogg, M.A. Social identity, self-categorization, and the small group. In Understanding Group Behavior; Psychology Press: London, UK, 2018; pp. 227–253. [Google Scholar]

- Ferreira, D. Board diversity. In Corporate Governance: A Synthesis of Theory, Research, and Practice; John Wiley & Sons, Inc.: Hoboken, NJ, USA, 2010; Chapter 12; pp. 225–242. [Google Scholar]

- Olie, R.; Klijn, E.; Leenders, H. United or Divided? Antecedents of Board Cohesiveness in International Joint Ventures. Acad. Manag. Proc. 2020, 2020, 21123. [Google Scholar] [CrossRef]

- Maznevski, M.L.; Chudoba, K.M. Bridging space over time: Global virtual team dynamics and effectiveness. Organ. Sci. 2000, 11, 473–492. [Google Scholar] [CrossRef] [Green Version]

- Torchia, M.; Calabrò, A.; Huse, M. Women directors on corporate boards: From tokenism to critical mass. J. Bus. Ethics 2011, 102, 299–317. [Google Scholar] [CrossRef]

- Yoder, J.D. Rethinking tokenism: Looking beyond numbers. Gend. Soc. 1991, 5, 178–192. [Google Scholar] [CrossRef]

- Lim, W.-K.; Park, C.-K. Mandating Gender Diversity and the Value Relevance of Sustainable Development Disclosure. Sustainability 2022, 14, 7465. [Google Scholar] [CrossRef]

- Orazalin, N.; Baydauletov, M. Corporate social responsibility strategy and corporate environmental and social performance: The moderating role of board gender diversity. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 1664–1676. [Google Scholar] [CrossRef]

- Yarram, S.R.; Adapa, S. Board gender diversity and corporate social responsibility: Is there a case for critical mass? J. Clean. Prod. 2021, 278, 123319. [Google Scholar] [CrossRef]

- Joecks, J.; Pull, K.; Vetter, K. Gender diversity in the boardroom and firm performance: What exactly constitutes a “critical mass?”. J. Bus. Ethics 2013, 118, 61–72. [Google Scholar] [CrossRef]

- Arena, C.; Cirillo, A.; Mussolino, D.; Pulcinelli, I.; Saggese, S.; Sarto, F. Women on board: Evidence from a masculine industry. Corp. Gov. 2015, 15, 339–356. [Google Scholar] [CrossRef]

- Glass, C.; Cook, A. Do women leaders promote positive change? Analyzing the effect of gender on business practices and diversity initiatives. Hum. Resour. Manag. 2018, 57, 823–837. [Google Scholar] [CrossRef]

- Galbreath, J. When do board and management resources complement each other? A study of effects on corporate social responsibility. J. Bus. Ethics 2016, 136, 281–292. [Google Scholar] [CrossRef]

- Downs, J.A.; Reif, M.L.K.; Hokororo, A.; Fitzgerald, D.W. Increasing women in leadership in global health. Acad. Med. J. Assoc. Am. Med. Coll. 2014, 89, 1103. [Google Scholar] [CrossRef] [PubMed]

- Abdullah, S.N.; Ismail, K.N.I.K.; Nachum, L. Does having women on boards create value? The impact of societal perceptions and corporate governance in emerging markets. Strateg. Manag. J. 2016, 37, 466–476. [Google Scholar] [CrossRef]

- Loukil, N.; Yousfi, O. Does gender diversity on corporate boards increase risk-taking? Can. J. Adm. Sci. 2016, 33, 66–81. [Google Scholar] [CrossRef]

- Ahmed, I. Staff well-being in high-risk operating room environment: Definition, facilitators, stressors, leadership, and team-working—A case-study from a large teaching hospital. Int. J. Healthc. Manag. 2019, 12, 1–17. [Google Scholar] [CrossRef]

- Daniels, I.M. Racial, Ethnic and Gender Diversity on Boards of Directors: Implications for Profitability and Analyst Recommendations. Ph.D. Thesis, Florida State University, Tallahassee, FL, USA, 2019. [Google Scholar]

- Zaman, R.; Jain, T.; Samara, G.; Jamali, D. Corporate governance meets corporate social responsibility: Mapping the interface. Bus. Soc. 2020, 61, 690–752. [Google Scholar] [CrossRef]

- Dorfleitner, G.; Halbritter, G.; Nguyen, M. Measuring the level and risk of corporate responsibility–An empirical comparison of different ESG rating approaches. J. Asset Manag. 2015, 16, 450–466. [Google Scholar] [CrossRef]

- Fatemi, A.; Glaum, M.; Kaiser, S. ESG performance and firm value: The moderating role of disclosure. Glob. Financ. J. 2018, 38, 45–64. [Google Scholar] [CrossRef]

- López, M.V.; Garcia, A.; Rodriguez, L. Sustainable development and corporate performance: A study based on the Dow Jones sustainability index. J. Bus. Ethics 2007, 75, 285–300. [Google Scholar] [CrossRef]

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.L. Corporate social and financial performance: A meta-analysis. Organ. Stud. 2003, 24, 403–441. [Google Scholar] [CrossRef]

- Sariannidis, N.; Giannarakis, G.; Litinas, N.; Konteos, G. A GARCH examination of macroeconomic effects on US stock market: A distinction between the total market index and the sustainability index. Eur. Res. Stud. 2010, 13, 129–140. [Google Scholar] [CrossRef] [Green Version]

- Ramsden, A.C.A.K. Analysis of Board Diversity and Performance. Thomson Reuters. 2016. Available online: https://d3kex6ty6anzzh.cloudfront.net/uploads/54/544c990015d034f737f077a8d6d5a81d2ea48d70.pdf (accessed on 12 July 2023).

- Refinitiv. Methodology. 2023. Available online: https://www.refinitiv.com/content/dam/marketing/en_us/documents/methodology/diversity-inclusion-rating-methodology.pdf (accessed on 12 July 2023).

- Gul, F.A.; Leung, S. Board leadership, outside directors’ expertise and voluntary corporate disclosures. J. Account. Public Policy 2004, 23, 351–379. [Google Scholar] [CrossRef]

- Antara, D.; Putri, A.; Ratnadi, N.M.D.; Wirawati, N.G.P. Effect of Firm Size, Leverage, and Environmental Performance on Sustainability Reporting. Am. J. Humanit. Soc. Sci. Res. 2020, 4, 40–46. [Google Scholar]

- Kaufmann, D.; Kraay, A.; Mastruzzi, M. Governance matters III: Governance indicators for 1996, 1998, 2000, and 2002. World Bank Econ. Rev. 2004, 18, 253–287. [Google Scholar] [CrossRef] [Green Version]

- Wintoki, M.B.; Linck, J.S.; Netter, J.M. Endogeneity and the dynamics of internal corporate governance. J. Financ. Econ. 2012, 105, 581–606. [Google Scholar] [CrossRef]

- Nadeem, M.; De Silva, T.-A.; Gan, C.; Zaman, R. Boardroom gender diversity and intellectual capital efficiency: Evidence from China. Pac. Account. Rev. 2017, 29, 590–615. [Google Scholar] [CrossRef] [Green Version]

- Ouyang, Y.; Zhang, Y.; Xue, X. The Impact of Board Cultural Diversity on Company ESG Performance under Different Risk Backgrounds. In Proceedings of the 5th International Conference on Financial Management, Education and Social Science, Hohhot, China, 9–10 April 2022; pp. 9–10. [Google Scholar]

- Khatib, S.F.; Abdullah, D.F.; Elamer, A.A.; Abueid, R. Nudging toward diversity in the boardroom: A systematic literature review of board diversity of financial institutions. Bus. Strategy Environ. 2021, 30, 985–1002. [Google Scholar] [CrossRef]

- Khatri, I. Board gender diversity and sustainability performance: Nordic evidence. Corp. Soc. Responsib. Environ. Manag. 2023, 30, 1495–1507. [Google Scholar] [CrossRef]

- Jouber, H. Women leaders and corporate social performance: Do critical mass, CEO managerial ability and corporate governance matter? Manag. Decis. 2022, 60, 1185–1217. [Google Scholar] [CrossRef]

- Kyaw, K.; Olugbode, M.; Petracci, B. Can board gender diversity promote corporate social performance? Corp. Gov. Int. J. Bus. Soc. 2017, 17, 789–802. [Google Scholar] [CrossRef]

- Bruna, M.G.; Dang, R.; Scotto, M.-J.; Ammari, A. Does board gender diversity affect firm risk-taking? Evidence from the French stock market. J. Manag. Gov. 2019, 23, 915–938. [Google Scholar] [CrossRef]

- Aliani, K. Does board diversity improve carbon emissions score of best citizen companies? J. Clean. Prod. 2023, 405, 136854. [Google Scholar] [CrossRef]

- Kang, H.; Cheng, M.; Gray, S.J. Corporate governance and board composition: Diversity and independence of Australian boards. Corp. Gov. Int. Rev. 2007, 15, 194–207. [Google Scholar] [CrossRef]

- Fayyaz, U.E.R.; Jalal, R.N.U.D.; Venditti, M.; Minguez-Vera, A. Diverse boards and firm performance: The role of environmental, social and governance disclosure. Corp. Soc. Responsib. Environ. Manag. 2022, 30, 1457–1472. [Google Scholar] [CrossRef]

- Piechocka-Kałużna, A.; Tłuczak, A.; Łopatka, P. The Impact of CSR/ESG Reporting on the Cost of Capital: An Example of US Healthcare Entities. Eur. Res. Stud. J. 2021, 24, 679–690. [Google Scholar] [CrossRef] [PubMed]

| N | Mean | Std. | P25 | Median | P75 | |

|---|---|---|---|---|---|---|

| Panel A: Dependent Variable | ||||||

| ESG Performance | 451 | 0.617 | 0.200 | 0.482 | 0.662 | 0.776 |

| ESG Controversies | 451 | 0.840 | 0.274 | 0.833 | 1.000 | 1.000 |

| Panel B: Independent variables | ||||||

| BGD | 451 | 0.224 | 0.111 | 0.154 | 0.222 | 0.300 |

| BCD | 451 | 0.103 | 0.194 | 0.000 | 0.000 | 0.100 |

| Panel C: Control Variables | ||||||

| BIND | 451 | 0.765 | 0.210 | 0.714 | 0.833 | 0.909 |

| BSKILL | 451 | 0.480 | 0.286 | 0.217 | 0.500 | 0.702 |

| BMEET | 451 | 2.223 | 0.354 | 1.946 | 2.197 | 2.398 |

| BTENURE | 451 | 2.169 | 0.340 | 1.967 | 2.190 | 2.375 |

| BSIZE | 451 | 2.431 | 0.217 | 2.303 | 2.485 | 2.565 |

| CEO DUAL | 451 | 0.581 | 0.494 | 0.000 | 1.000 | 1.000 |

| FSIZE | 451 | 23.221 | 1.552 | 22.191 | 23.220 | 24.433 |

| MTB | 451 | 1.109 | 0.200 | 0.986 | 1.079 | 1.155 |

| ROA | 451 | 0.058 | 0.121 | 0.036 | 0.058 | 0.107 |

| LEVERAGE | 451 | 0.541 | 0.217 | 0.402 | 0.539 | 0.654 |

| Voice and Accountability | 451 | 0.986 | 0.597 | 1.003 | 1.051 | 1.110 |

| Political Stability | 451 | 0.510 | 0.309 | 0.336 | 0.474 | 0.678 |

| Government Effectiveness | 451 | 1.500 | 0.262 | 1.477 | 1.489 | 1.577 |

| Regulatory Quality | 451 | 1.406 | 0.413 | 1.327 | 1.497 | 1.628 |

| Rule of Law | 451 | 1.515 | 0.360 | 1.514 | 1.596 | 1.622 |

| Control of Corruption | 451 | 1.374 | 0.455 | 1.329 | 1.381 | 1.475 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) | (13) | (14) | (15) | (16) | (17) | (18) | (19) | (20) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (1) ESG Performance | 1.00 | |||||||||||||||||||

| (2) ESG Controversies | −0.08 | 1.00 | ||||||||||||||||||

| (3) BGD | 0.28 * | −0.01 * | 1.00 | |||||||||||||||||

| (4) BCD | 0.23 * | −0.15 * | 0.20 * | 1.00 | ||||||||||||||||

| (5) BIND | 0.11 * | −0.09 * | 0.29 * | −0.22 * | 1.00 | |||||||||||||||

| (6) BSKILL | −0.12 * | −0.08 | 0.16 * | 0.06 | 0.14 * | 1.00 | ||||||||||||||

| (7) BMEET | 0.12 * | −0.04 | −0.14 * | −0.05 | −0.28 * | −0.14 * | 1.00 | |||||||||||||

| (8) BTENURE | −0.11 * | −0.09 * | 0.07 | 0.02 | 0.09 * | 0.21 * | −0.22 * | 1.00 | ||||||||||||

| (9) BSIZE | 0.43 * | −0.14 * | −0.02 | 0.07 | 0.04 | −0.12 * | 0.01 | −0.13 * | 1.00 | |||||||||||

| (10) CEO DUAL | −0.13 * | −0.11 * | 0.09 * | −0.20 * | 0.07 | 0.05 | −0.04 | 0.17 * | −0.13 * | 1.00 | ||||||||||

| (11) FSIZE | −0.14 * | 0.00 | 0.07 | 0.12 * | −0.06 | −0.01 | −0.07 | 0.17 * | 0.00 | 0.00 | 1.00 | |||||||||

| (12) MTB | −0.07 | −0.01 | 0.08 * | 0.05 | 0.05 | 0.23 * | −0.18 * | 0.09 * | −0.08 * | 0.02 | 0.40 * | 1.00 | ||||||||

| (13) ROA | −0.08 * | 0.18 * | 0.05 | 0.10 * | −0.17 * | −0.12 * | −0.04 | −0.08 * | 0.05 | 0.00 | 0.27 * | −0.01 | 1.00 | |||||||

| (14) LEVERAGE | −0.08 | −0.06 | 0.07 | −0.02 | 0.14 * | 0.20 * | −0.22 * | 0.14 * | −0.04 | 0.09 * | 0.33 * | 0.55 * | −0.02 | 1.00 | ||||||

| (15) VA Index | −0.06 | 0.09 * | 0.10 * | −0.21 * | 0.06 | 0.01 | −0.04 | −0.06 | 0.03 | −0.06 | −0.06 | 0.06 | −0.03 | −0.03 | 1.00 | |||||

| (16) PS Index | −0.04 | 0.12 * | −0.16 * | −0.16 * | −0.49 * | −0.20 * | 0.18 * | −0.18 * | −0.07 | −0.10 * | −0.10 * | −0.08 * | 0.08 | −0.20 * | 0.54 * | 1.00 | ||||

| (17) Govt. Effect. | −0.10 * | 0.09 * | −0.10 * | −0.24 * | −0.10 * | −0.07 | 0.02 | −0.07 | −0.05 | −0.07 | −0.06 | 0.03 | −0.04 | −0.07 | 0.86 * | 0.68 * | 1.00 | |||

| (18) Reg Quality | −0.09 * | 0.07 | 0.06 | −0.25 * | 0.16 * | 0.01 | −0.07 | −0.04 | −0.01 | −0.06 | −0.05 | 0.10 * | −0.09 * | 0.00 | 0.92 * | 0.43 * | 0.87 * | 1.00 | ||

| (19) Rule of Law | −0.15 * | 0.08 * | 0.03 | −0.19 * | −0.10 * | 0.04 | −0.06 | 0.01 | −0.11 * | 0.03 | −0.02 | 0.05 | −0.06 | 0.00 | 0.80 * | 0.58 * | 0.81 * | 0.78 * | 1.00 | |

| (20) Cont. Corrupt | 0.03 | 0.09 * | 0.08 * | −0.11 * | −0.05 | −0.05 | −0.03 | −0.13 * | 0.01 | −0.17 * | −0.09 * | 0.09 * | −0.02 | −0.06 | 0.91 * | 0.65 * | 0.88 * | 0.87 * | 0.79 * | 1 |

| DV | ESG Performancet + 1 | ||||

|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | |

| BGD | 0.173 *** | 0.151 ** | 0.149 ** | ||

| (2.83) | (2.38) | (2.38) | |||

| BCD | 0.136 ** | 0.155 ** | 0.153 ** | ||

| (2.02) | (2.31) | (2.30) | |||

| BIND | 0.207 *** | 0.246 *** | 0.222 *** | ||

| (3.68) | (4.39) | (3.94) | |||

| BSKILL | 0.036 * | 0.029 | 0.033 * | ||

| (1.78) | (1.44) | (1.66) | |||

| BMEET | 0.008 | 0.007 | 0.005 | ||

| (0.59) | (0.53) | (0.38) | |||

| BTENURE | −0.014 | −0.014 | −0.010 | ||

| (−0.62) | (−0.58) | (−0.44) | |||

| BSIZE | −0.087 ** | −0.086 ** | −0.090 ** | ||

| (−2.23) | (−2.20) | (−2.32) | |||

| CEO DUAL | −0.054 *** | −0.053 *** | −0.056 *** | ||

| (−3.09) | (−3.03) | (−3.19) | |||

| FSIZE | −0.004 | −0.006 | −0.005 | ||

| (−0.63) | (−0.85) | (−0.67) | |||

| MTB | 0.095 ** | 0.101 *** | 0.094 ** | ||

| (2.44) | (2.61) | (2.44) | |||

| ROA | 0.006 | 0.013 | 0.008 | ||

| (0.12) | (0.27) | (0.16) | |||

| LEVERAGE | −0.027 | −0.028 | −0.032 | ||

| (−0.76) | (−0.78) | (−0.89) | |||

| Voice and Accountability | −0.009 | −0.039 | −0.009 | ||

| (−0.11) | (−0.45) | (−0.11) | |||

| Political Stability | −0.020 | −0.005 | −0.012 | ||

| (−0.72) | (−0.19) | (−0.44) | |||

| Government Effectiveness | 0.041 | 0.023 | 0.039 | ||

| (1.07) | (0.61) | (1.04) | |||

| Regulatory Quality | −0.043 | −0.036 | −0.041 | ||

| (−1.28) | (−1.08) | (−1.22) | |||

| Rule of Law | 0.033 | 0.024 | 0.027 | ||

| (0.52) | (0.38) | (0.43) | |||

| Control of Corruption | 0.050 | 0.038 | 0.038 | ||

| (0.93) | (0.70) | (0.70) | |||

| Year FE | Yes | Yes | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes | Yes | Yes |

| Country FE | Yes | Yes | Yes | Yes | Yes |

| Observations | 451 | 451 | 451 | 451 | 451 |

| Adjusted R-squared | 0.912 | 0.911 | 0.917 | 0.917 | 0.918 |

| ESG Performancet + 1 | |||

|---|---|---|---|

| (1) | (2) | (3) | |

| BGD—I | −0.010 ** | −0.010 ** | |

| (−2.02) | (−2.08) | ||

| BGD—II | 0.002 | 0.002 | |

| (1.05) | (0.97) | ||

| BGD—III | 0.003 *** | 0.003 *** | |

| (3.06) | (2.90) | ||

| BCD—I | 0.005 | 0.002 | |

| (0.18) | (0.08) | ||

| BCD—II | 0.010 | 0.010 | |

| (0.35) | (0.35) | ||

| BCD—III | 0.086 *** | 0.079 *** | |

| (2.80) | (2.63) | ||

| BIND | 0.276 *** | 0.371 *** | 0.300 *** |

| (3.96) | (5.39) | (4.28) | |

| BSKILL | −0.048 * | −0.051 * | −0.050 * |

| (−1.66) | (−1.74) | (−1.75) | |

| BMEET | 0.095 *** | 0.091 *** | 0.096 *** |

| (3.90) | (3.70) | (3.95) | |

| BTENURE | 0.043 * | 0.050 ** | 0.036 |

| (1.79) | (2.02) | (1.49) | |

| BSIZE | 0.349 *** | 0.340 *** | 0.352 *** |

| (9.19) | (8.87) | (9.29) | |

| CEO DUAL | 0.012 | 0.029 * | 0.016 |

| (0.73) | (1.68) | (0.93) | |

| FSIZE | −0.017 *** | −0.015 ** | −0.018 *** |

| (−2.92) | (−2.56) | (−3.16) | |

| MTB | 0.011 | 0.013 | 0.010 |

| (0.22) | (0.26) | (0.21) | |

| ROA | −0.164 ** | −0.180 ** | −0.159 ** |

| (−2.41) | (−2.59) | (−2.33) | |

| LEVERAGE | −0.003 | 0.004 | 0.007 |

| (−0.08) | (0.08) | (0.18) | |

| Voice and Accountability | −0.207 | −0.244 | −0.182 |

| (−1.06) | (−1.23) | (−0.93) | |

| Political Stability | 0.004 | 0.026 | −0.012 |

| (0.06) | (0.38) | (−0.18) | |

| Government Effectiveness | 0.127 | 0.096 | 0.133 |

| (1.36) | (1.01) | (1.42) | |

| Regulatory Quality | −0.096 | −0.077 | −0.104 |

| (−1.18) | (−0.92) | (−1.29) | |

| Rule of Law | 0.005 | 0.017 | 0.012 |

| (0.12) | (0.36) | (0.25) | |

| Control of Corruption | 0.221 ** | 0.185 * | 0.223 ** |

| (2.33) | (1.87) | (2.30) | |

| Year FE | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes |

| Country FE | Yes | Yes | Yes |

| Observations | 451 | 451 | 451 |

| Adjusted R-squared | 0.917 | 0.917 | 0.918 |

| Panel A: Evidence from Alternative Dependent Variables: ESG Controversies | ||||

|---|---|---|---|---|

| ESG Controversies | ||||

| (1) | (2) | (3) | ||

| −0.096 *** | −0.143 ** | |||

| BGD | (−2.62) | (−1.97) | ||

| −0.311 ** | 0.357 *** | |||

| BCD | (−3.44) | (−3.45) | ||

| Other Controls | Yes | Yes | Yes | |

| Year FE | Yes | Yes | Yes | |

| Firm FE | Yes | Yes | Yes | |

| Country FE | Yes | Yes | Yes | |

| Observations | 451 | 451 | 451 | |

| Adjusted R-squared | 0.509 | 0.510 | 0.511 | |

| Panel B: Boardroom Diversity and Corporate Sustainability Performance-Alternative Independent Variable | ||||

| ESG Performancet + 1 | ||||

| (1) | (2) | (3) | ||

| Blau GD Index | 7.555 ** | 7.224 ** | ||

| (2.38) | (2.31) | |||

| Blau CD Index | 0.224 *** | 0.220 *** | ||

| (3.54) | (3.49) | |||

| Other Controls | Yes | Yes | Yes | |

| Year FE | Yes | Yes | Yes | |

| Firm FE | Yes | Yes | Yes | |

| Country FE | Yes | Yes | Yes | |

| Observations | 451 | 451 | 451 | |

| Adjusted R-squared | 0.917 | 0.919 | 0.920 | |

| Panel C: System GMM Regression—Addressing Endogeneity in Boardroom Diversity (Gender and Cultural) and Corporate Sustainability Performance | ||||

| ESG Performancet + 1 | ||||

| (1) | (2) | (3) | ||

| 0.147 *** | 0.186 *** | |||

| BGD | (4.38) | (4.65) | ||

| 0.031 ** | 0.035 *** | |||

| BCD | (2.34) | (2.65) | ||

| ESG Performance t | 0.991 *** | 0.936 *** | 0.982 *** | |

| (72.99) | (58.93) | (72.02) | ||

| Other Controls | Yes | Yes | Yes | |

| Year FE | Yes | Yes | Yes | |

| Firm FE | Yes | Yes | Yes | |

| Country FE | Yes | Yes | Yes | |

| Observations | 356 | 356 | 356 | |

| AR (1) p-value | 0.000 | 0.000 | 0.000 | |

| AR (2) p-value | 0.984 | 0.757 | 0.927 | |

| Hansen J test | 0.506 | 0.407 | 0.507 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

de Klerk, K.; Singh, F. Does Gender and Cultural Diversity Matter for Sustainability in Healthcare? Evidence from Global Organizations. Sustainability 2023, 15, 11695. https://doi.org/10.3390/su151511695

de Klerk K, Singh F. Does Gender and Cultural Diversity Matter for Sustainability in Healthcare? Evidence from Global Organizations. Sustainability. 2023; 15(15):11695. https://doi.org/10.3390/su151511695

Chicago/Turabian Stylede Klerk, Kylie, and Favil Singh. 2023. "Does Gender and Cultural Diversity Matter for Sustainability in Healthcare? Evidence from Global Organizations" Sustainability 15, no. 15: 11695. https://doi.org/10.3390/su151511695

APA Stylede Klerk, K., & Singh, F. (2023). Does Gender and Cultural Diversity Matter for Sustainability in Healthcare? Evidence from Global Organizations. Sustainability, 15(15), 11695. https://doi.org/10.3390/su151511695