1. Introduction

Research, development, and innovation activities (R&D&I) provide an essential contribution to the social, cultural, and economic development of any country or region. Therefore, they constitute a major concern for the agents involved in those activities, such as universities.

The role of the university in innovation has increased tremendously and the diffusion and commercialization of knowledge and technology has become widely accepted as a “third mission” of the university, established in the context of university–industry relations [

1,

2,

3].

In recent decades, universities have endeavored to develop this “third mission” by fostering links with industry and facilitating the transfer of knowledge and technology, among other means of collaboration.

Since the final decades of the 20th century, universities have striven ever harder to develop means of collaboration with companies that will lead to the dissemination and commercialization of generated knowledge and technology. The motivation for this collaboration includes the increasing demand for innovation (mostly technological), along with the availability of company resources for R&D; a change in the paradigm of the university; and a reduction in research funding from the state (even before the financial crisis) [

4,

5,

6,

7,

8]. On the other hand, according to several authors, university–industry (hereinafter U–I) collaboration can both positively influence the economic and social environment in the region where universities are located and increase the prestige of the entrepreneurial institution [

9].

Likewise, collaboration between universities and industry has been a priority in the political agendas of research in the US since the Bayh–Dole Act of 1980 [

6,

10]. In the European context, although the regulations thereon are significantly more recent (Treaty on the Functioning of the European Union, 2007), the road to fully functioning cooperation on a European level is certainly being paved, and the concept of technology commercialization as another form of social contribution by universities has been strengthened [

11].

In addition to regulating this process, policymakers and public institutions responsible for business development and innovation, together with universities themselves (for example, through their technology transfer offices (TTOs)), have explored various ways to promote university–industry collaboration, although the expected results have not always been achieved.

Consequently, there is logical interest among researchers in studying the many aspects of U–I collaboration in order to contribute towards improvements in the efficiency of the process, and, on this basis, to improve sustainable technology and knowledge transfer activities. The literature on U–I collaboration can be grouped under several categories, such as organizational structures, regional or international comparisons/case studies, types of collaboration, barriers and obstacles, impacts of university research, tangible outputs of university research (patents, licenses, and spin-offs), and efficiency of university research transfer. Moreover, academic engagement has been studied by different authors [

8,

10,

12,

13,

14,

15,

16,

17].

One line of research has focused on the linkage creation among parties as a necessary step for academic engagement or other technology and knowledge transfer activities [

18,

19,

20,

21,

22,

23,

24].

Several of the experiences studied in this field are focused on the initial phase of the process, specifically on the making contact phase. Meetings among the parties involved represent a common formula to promote this phase of first contact. In such meetings, speed-dating methodologies can prove an effective tool for making first contact and promoting linkage between leaders of research groups and representatives of companies.

Nonetheless, in addition to the fact that very few articles specifically focus on speed dating to promote U–I collaboration, it can be said that the results obtained by those authors who have reported these experiences have not always been as encouraging as expected [

25].

One possible explanation for these poor results could be that speed dating applied to the matching of researchers and companies requires previous tasks aimed at preselecting participants and at defining certain specifications for speed-dating sessions. Both elements can be relevant in enabling the parties to overcome barriers and in creating an effective link for subsequent collaboration.

This research proposes an innovative procedure for organizing U–I meetings based on precharacterized speed-dating sessions, where the participating candidates are previously assessed and selected based on their potential to collaborate in accordance with certain relevant variables taken from the literature on efficiency in technology and knowledge transfer activities.

This procedure has been named “potential-driven speed dating” (hereinafter, PDSD).

The validity of the PDSD procedure as an effective tool to organize and manage the first meeting between members of university research groups and representatives of economic agents with the ability and interest to exploit the results of their research is studied using the action research (AR) methodology.

The main premise is that the preselection of the participants, particularly the research groups, leads to a greater potential for effective matchmaking. If the PDSD is valid, it could imply an improvement in the efficiency of the collaboration process between research groups and companies by positively influencing the speed with which the initial bond among the parties occurs.

Thus, it would be interesting to carry out an in-depth study not only of the design of the speed-dating sessions to identify the most important characteristics that the speed dates gather but also of the meeting itself to make it as effective as possible in creating the linkage during first contact.

Finally, within the framework of this speed-dating meeting, any potential barriers that may impede collaboration could be explored with all parties involved.

To this end, the following research questions are posed:

Q1: Among the possible ways to promote interaction between research groups and companies in the setting of university–industry meetings, can the potential-driven speed-dating (PDSD) procedure be an effective tool for encouraging initial contact in a conducive way to generate a link among the parties, ultimately leading to technology or knowledge transfer or to other possible forms of collaboration?

Q2: For this to be the case, should the meeting and the speed-dating format respond to certain characteristics that can be identified from AR itself with the help of the interested parties?

Q3: Finally, as a tool to direct and channel the process of university–industry collaboration, is it possible to identify those external context barriers or internal barriers of the parties (research groups and companies), which, if removed or influenced, could increase the capacity of the meeting based on potential-driven speed dating?

AR was carried out within the framework of a pilot project, which was financed by a public foundation in charge of promoting business and entrepreneurial activity. It was executed by a university spin-off, which the authors of this study had the opportunity to work with for the entire planning and execution process, as well as on the subsequent follow-up on of the results.

The pilot project consisted of the definition and implementation of a procedure for the organization and management of a university–industry meeting in which speed-dating sessions between previously selected research groups and companies could take place. If successful, the procedure resulting from this pilot project could be replicated in the future by public agencies that support entrepreneurship and innovation, incorporating the improvements encountered therein.

This article is structured as follows. Subsequent to the Introduction in

Section 1,

Section 2 describes the conceptual background upon which the framework of this research is based.

Section 3 introduces the methodology and explains the AR process that was planned and carried out within the university–industry meeting. The results are collected and analyzed in

Section 4.

Section 5 addresses the discussions regarding the implications. This article ends with the conclusions, where future lines of research are also proposed.

2. Conceptual Framework

University–industry collaboration processes are based on interactions between university researchers and scientists of companies who work together to translate the results of academic research with commercial potential into market applications [

26]. Technology transfer (commonly abbreviated as “TT”) relies heavily on patents and other forms of intellectual property protection, while knowledge transfer (commonly abbreviated as “KT”) is a less tangible phenomenon than TT, which consists of a broader range of services, with fewer organized interactions that may or may not have commercial purposes [

27]. These two transfers are considered the main elements of U–I collaboration, although spin-offs and other forms of collaboration might also be included [

4].

Building on this U–I collaboration, some authors encourage the university to play a leading role in achieving sustainable development, going beyond integrating sustainability concepts into the existing curriculum, implementing measures for a sustainable campus or support for sustainability projects, as well as through the opening of institutional boundaries, involving the university and its research groups in strategic alliances, ensuring that the notion of sustainable communities extends beyond the walls of the university [

28,

29,

30,

31]. In fact, as proposed by the United Nations 2030 Sustainable Development Goals (specifically SDG 17: Partnerships for sustainable development), multistakeholder collaboration is needed in innovation for sustainability [

32]. In this sense, there is increasing interest in creating models for sustainable university–industry relationships [

33,

34].

In studying the interaction between university and business, several authors propose dividing the unit of analysis of the collaboration process into three phases: initiation, implementation, and finalization [

35]. Rajalo and Vadi (2017) suggest that some critical preconditions emerge in the initiation and implementation phases, and that these have an impact on the way in which parties cross the boundaries. In this regard, other authors identify three elements of the initiation phase: drivers of interaction, channels of interaction, and the perceived benefits [

36]. Regarding the drivers of interaction, another line of research seeks to unravel the nature of the obstacles to collaboration between the two parties, and which explores the influence of various mechanisms on lowering barriers related to the orientation of universities and to the transactions involved in working with university partners [

37].

Furthermore, certain authors point out that the procedures for supporting U–I collaboration continue to be too bureaucratic, since they focus more on managing innovation relationships rather than supporting KT and TT. This bureaucratic inflexibility has been found in several regional studies to be a major barrier to university–industry interactions [

11,

38,

39].

These conclusions suggest that actions oriented towards fostering engagement should focus directly on the researchers rather than on the structure of the university. According to Debackere et al. (2014) [

39], evidence indicates that individual researchers are the most powerful source for initiating interactions with stakeholders in innovation ecosystems, often with limited participation from university administrators. This idea is supported by other authors, who argue that the time it takes to achieve the commercialization of research results is negatively related to licensing revenues, and that in order to shorten this time, it would be more efficient for this initiative to be taken by the person responsible for the research [

40].

In this line of research, our study considers that research groups (groups of researchers with common resources and research topics, usually from the same university) should constitute the relevant unit of analysis.

Furthermore, this work focuses on the initial phase of the university–industry collaboration process, specifically on the partner selection and contact-making phase.

Among other tools and methodologies, speed dating has been evaluated as being an effective tool for the promotion of engagement between researchers and businesses with the main aim of enhancing university–industry collaboration [

25].

Although the term “speed dating” comes from another context, related to romantic dating, several similarities among the objectives of these two situations can be found. In the romantic process, single women and men seeking a partner attend an encounter where they experience a sequence of many short dates to make informed decisions regarding their preferences to subsequently meet up for a more complete date [

41]. In the university–industry collaboration context, Kadlec (2019) suggests that speed dating can help to enhance mutual cooperation among universities and companies and promote technology transfer.

However, the conclusions reached by Kadlec (2019) were not very encouraging, since the results of the speed-dating event under study resulted in only 1 of the 44 new contacts eventually transforming into real cooperation in the form of consulting. The results suggest that “speed dating itself has a limited direct impact on real technology transfer”, from where it can be indirectly concluded that certain previous planning tasks would be necessary to ensure the effective implementation of speed dating in this context.

In this respect, when analyzing what leads to the formation of university–industry linkages, several authors suggest that partner evaluation and selection prior to collaboration is necessary [

18,

42,

43].

Along this line of research, this study proposes an innovative procedure to manage the whole process, starting with a methodology to assess and select the participants in the event and ending with the aspects to be considered when assigning the researchers and the companies’ representatives to the different speed-dating sessions.

With regard to the efficiency of the process of transfer from university to industry, many relevant studies have been carried out in several ways with a variety of approaches; these studies have been classified according to the different perspectives and aspects assumed by the authors, who have considered addressing a literature review [

8,

9,

10,

12,

44,

45,

46].

Among the most cited nonfinancial variables for the measurement of efficiency in the transfer process from university to industry, based on the outputs, the following can be highlighted: completed research projects based on grants, contracts signed with economic agents to deliver research services, patents/software registered and licensed, and academic entrepreneurship in the form of spin-offs.

A meeting organized under the formula of PDSD could enable a set of research groups, preselected by their transfer potentiality, to expeditiously ascertain a wide range of companies potentially interested in their research and to rapidly assess the potential for close and stable collaboration that would be conducive to the transfer of their knowledge and/or technology or to other possible collaborations.

3. Materials and Methods

The previous section presented the theoretical framework that provides the basis for this study on speed dating as an effective tool to promote U–I collaboration.

In this section, the action research (AR) approach applied to this study is carefully explained.

Essentially, it can be stated that AR consists of a spiral of research cycles and actions, comprising the following phases: planning (an improvement to a practice); acting (implementation of the planned improvement), monitoring (description of the effects of the action), and evaluation (the outcomes of the action). The purpose of AR is to improve a practice under a given context through practical actions with the involvement and assistance of those stakeholders that are already working with or are related to the practices to be improved [

47].

AR has its origins in the research work of Kurt Lewin and his associates from the mid-1940s. At the time, he succeeded in making the notion of collaborative research with stakeholders the central interest of a wide range of social scientists. However, AR is under development, and there are still many unanswered questions and unresolved issues [

48,

49].

Since the 1940s, several researchers have followed Lewin’s footsteps and developed this methodology further or contributed with their own adaptations. At the present, the term AR covers many forms of action-oriented research and offers a wide variety of options for potential action researchers as to what might be appropriate for their research question [

50]. In particular, the learning outcomes of the application of AR in operations management [

51,

52] were found to be interesting for this work, since some of the premises taken into account in that research field can be extended to those considered in this study, where the main objective would be the validation of an innovative procedure for the organization of university–industry meetings based on speed dating.

Coughlan and Coghlan (2002) summarized the main characteristics of AR: research in action, rather than research about action; participative research, concurrent with action; a sequence of events; and an approach to problem solving.

In this respect, AR can be viewed as a variant of case research, where the researcher is not an independent observer but a participant in the implementation of a system, who simultaneously wants to evaluate a certain intervention technique. The intervention technique is adapted as it is used, and the understanding of its scope and limitations improves with each application [

53].

Considering the previous conceptualization, we chose the AR approach for this study and not the case study approach because of the opportunity to participate in the speed-dating process as a classic action researcher, that is, not as an independent observer but as a direct participant, whereby the procedure of planning, organizing, executing, and analyzing the results of the speed-dating event would become the subject of research.

In conclusion, the main reason was that the authors of this paper had the opportunity to participate directly in a real speed-dating event and to develop the procedure for its planning, organization, and management. Our limits as action researchers were those of the scope of the main project, as stated by its promoters. However, there was the opportunity to obtain relevant primary conclusions that could be taken as starting points for subsequent AR.

In the following paragraphs, we establish the necessary elements for the application of the AR methodology and take into account all of its previous characterization.

3.1. Planning the Action Research

3.1.1. Context and Background

The European Union’s university transfer activities fail to reach the levels of other economies [

39,

54].

Furthermore, the 2014 report of the Independent Expert Group on Open Innovation and Knowledge Transfer points out one major problem of U–I collaboration in the European context that needs to be addressed: the breadth and the depth of interactions between Europe’s knowledge institutes and industries [

39]. Debackere et al. (2014) also highlighted that, in this respect, given the heterogeneity of the European context, it should be noted that certain countries, such as Spain, which constitutes one of the largest economies in the EU, have to make a greater effort.

Consequently, there is a growing interest on the part of the European policymakers and public authorities, especially in those countries with the greatest lack of such collaboration, in promoting efficient instruments to encourage collaboration between these research groups and companies that are potentially interested in their lines of research and developed technology.

In terms of U–I collaboration, the latest report, that of 2016/17, of the National Conference of University Rectors in Spain (known as CRUE), introduces the nature of the problem: “among the results of the Spanish university, the ones related to the activity of knowledge transfer and innovation are those that lack, to a greater extent, the desired volume and intensity”.

The CRUE 2016/17 report points out that universities produce more than 60% of Spanish science and possess the necessary human capital to help companies and institutions to transform the knowledge they produce into practical applications. However, concerning the economic weight of the country and the expense in R&D&I, “the results are very far from the objectives” [

55].

Therefore, it was considered convenient by the Andalusian Government (one of the 17 autonomous communities that comprise the Spanish state) to explore which practices or tools could be applied by the parties involved and, more precisely, by the institutions in charge of promoting innovation based on U–I collaboration in order to enhance the efficiency of the collaboration process.

3.1.2. Main Project and Its Interested Parties

In order to promote new ways of encouraging U–I collaboration, Andalucia Emprende (a Spanish public foundation) launched a pilot project that consisted in the organization of a meeting between university research groups and companies, called “Rounds of Transfer”. The objective of this pilot project was to validate a new model of U–I meetings based on speed-dating rounds among the heads of research groups of the University of Seville, one of the principal Spanish universities, and representatives of the R&D&I departments of companies.

The pilot project, “Rounds of Transfer”, served as a framework for the development of this AR. The authors of this article had the opportunity to collaborate closely with experts from “MSIG Smart Management”, who, together with the public foundation “Andalucía Emprende”, co-organized the meetings.

Our commitment, as researchers, involved collaboration in developing and applying a procedure capable of initiating the generation of a link between research groups with a greater potential for KT and TT and representatives of R&D&I departments in companies, as well as verifying whether this procedure could accelerate the speed of the contact-making phase and, as a result, exert a positive effect on the efficiency of the entire collaboration process.

This procedure, which was called “potential-driven speed dating”, should begin by identifying and evaluating a series of relevant variables for the selection of research groups with greater transfer potential, as well as for the selection of companies with a high probability of being interested in the results of their research.

The next step of this procedure was to find the best practices to channel direct contact among the parties, allowing the leaders of the research groups to expeditiously communicate the results of their research and their interests in stable collaboration to the representatives of the various interested companies, one by one and personally, and subsequently to hear from the representatives of the companies regarding their own interests and proposals for this collaboration.

MSIG Smart Management SL is a spin-off from Pablo de Olavide University (Seville, Spain), which is focused on advanced consultancy on the development of solutions within the scope of management and on decision-making systems.

Andalucía Emprende is a Spanish public foundation that aims to promote entrepreneurship and business development in the revitalization of the economy of the Andalusian region. In this line of action, this public agent offers specialized technical assistance in the search for new business opportunities and provides support in the incorporation of factors related to innovation and internationalization. To this end, this public foundation offers more than 250 Andalusian Entrepreneurship Centers (CADEs) and another 50 information points, all equipped with a technical team of specialists in business creation and development.

Spain is part of the European common framework of research and innovation. In the 2019 European Innovation Scoreboard, Spain was classified as a Moderate Innovator. However, over time, Spain’s performance increased, relative to that of the EU in 2011, by 8.4 percentage points, as well as with strong increases in 2016 and 2017. In 2018, it reached 85% of the EU average [

56]. In terms of surface area, Spain is the second largest country in the EU, with 506,000 square kilometers, and it is the fifth most populous country, with 46.45 million inhabitants, according to data from the official EU website (

https://europa.eu/european-union/about-eu, accessed on 12 April 2019). Comparing the living standards in terms of GDP per inhabitant in PPS (a common national currency called the purchasing power standard, obtained by measuring the price of a range of goods and services in each country relative to income), Spain is situated in the middle of the 28 UE countries, with a value of 91.

The University of Seville, where this pilot project took place, is one of the 4 universities responsible for doubling the number of national patents in 4 years, together with the Polytechnic University of Catalonia (UPC), the Polytechnic University of Madrid (UPM), and the Polytechnic University of Valencia (UPV), which, together, have registered more than 100 national patents over the last 5 years [

57]. The University of Seville was founded during the 15th century, and, during the academic year 2017–18, it managed an income budget of nearly EUR 459 million, more than 72,000 students, and 6777 researchers grouped into 573 research groups [

58].

3.1.3. Purpose of the Action Research

This action research strove to verify the validity of the “potential-driven speed-dating” procedure (PDSD) as an efficient tool in the organization of U–I meetings by orienting the organizers in a previous assessment and selection of university research groups with enough potential to transfer technology and/or knowledge. The PDSD also aided in channeling the first meeting between the leaders of the preselected university research groups and representatives of economic agents with sufficient ability and interest to exploit the result of their research.

This first meeting, organized under the formula of PDSD, should allow the participating research groups to be rapidly introduced to a wide range of highly interested companies. As a result of this first meeting, it is expected that a more lasting bond may be produced, which bears fruit in the form of a license, contract, project, or in other forms of knowledge and technology transfer.

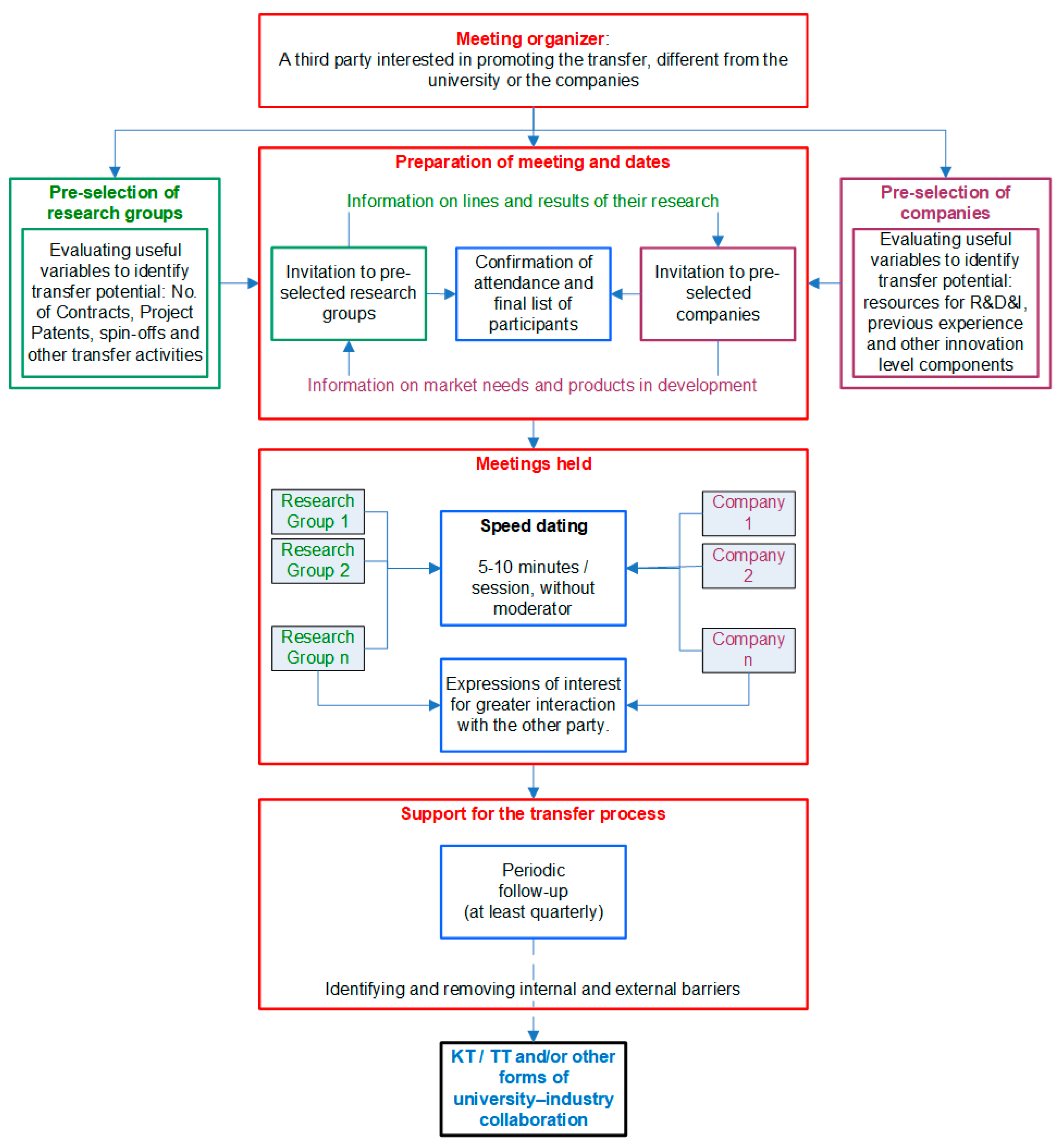

The main milestones and aspects of the PDSD procedure that were considered when organizing the meeting are summarized in

Figure 1 below.

3.1.4. Action Plan

Once the context was defined, the action research was framed in a pilot project of meetings between research groups and companies, and the purpose and research questions were established. Therefore, it was then necessary to define an action plan that described all of the steps and activities planned to be carried out in this action research.

Table 1 summarizes the action plan for this action research.

3.2. Development of Action Research

3.2.1. Data and Sources of Information

For reasons of accessibility and efficiency, the main source of information for this research was the Andalusian research system, which includes the University of Seville. The identification of researchers with high transfer potential was performed through an analysis of the groups of the Andalusian Plan for Research, Development, and Innovation based on the Scientific Information System of Andalusia (SICA).

SICA is an ideal repository for research, since it connects scientists and Andalusian research groups and allows them to work in a network with 3250 groups, 58,791 users, and with access to the production of 1,644,249 scientific publications.

The pilot model (i.e., the object of this action research) was expected to be based on the information available from the University of Seville. Therefore, in addition to SICA, we used publicly accessible sources of information related to the activity of its research groups, such as SISIUS and STCE. SISIUS (

http://investigacion.us.es/sisius, accessed on 12 April 2019) is a database of the production of the research groups of the University of Seville. Furthermore, the University of Seville offers information on technology-based and knowledge-based companies, through the Secretariat for Knowledge Transfer and Entrepreneurship—STCE (

http://stce.us.es/web/es, accessed on 12 April 2019) [

59,

60].

3.2.2. Preselection of Research Groups

From the previously quoted databases, updated to September 2018, the necessary data for the subsequent analysis were extracted and incorporated into a spreadsheet showing the main fields which allowed for classifying and subsequently preselecting the groups according to the criteria and variables that were determined jointly with the experts from MSIG Smart Management.

The underlying logic of the preselection method (schematized in

Figure 2) is that those research groups that have reached a certain level of output for certain preselected variables, thereby demonstrating their effectiveness in past transfer activities, should have a greater potential for transfer, which is considered the main criterion for preselection for participation in the meeting.

In total, all of the available data on the scientific–technological production oriented to the transfer were recorded: 573 research groups, grouping 6777 researchers, with an average of 12 researchers per group, whose managers are directly responsible for 1580 research projects, 20 networks, 2780 contracts for research, 485 research plans, 2858 grants, 22 project evaluations, 18 scholarships, and 20 grants. Furthermore, these 573 research groups have registered 756 patents/software packages, and 21 spin-offs (otherwise known as technology/knowledge-based start-ups) have been generated from their research.

From the previous data, the following variables were selected from the literature as the most cited nonfinancial variables to measure the efficiency of the transfer process from the university to industry based on the outputs (see

Section 2. Conceptual Framework): (1) the number of projects executed or contracts signed with economic agents to exploit the group’s research results and to deliver services; (2) the number of patents/software packages registered based on the group’s research; and, finally, (3) the number of spin-offs (also called technology/knowledge-based start-ups) generated from the group’s research and/or by the group’s members.

The volume of outputs per research group for these three variables was computed, and later analyzed to develop an individual profile of each research group. The

Table 2 summarizes the data collected, grouped in terms of research area and selection variable.

A process of cuts was subsequently carried out in stages based on the profile of each research group, which allowed for the initial sample to be reduced until a set of research groups with high potential for knowledge or technology transfer was reached.

The process began with a first cut, which consisted in eliminating those groups that did not produce technology transfer, considering that this occurs when the value of all chosen variables is zero. As a result, the initial population of 573 groups was reduced to 393 groups with transfer activity.

For the second cut, carried out by the experts from MSIG Smart Management, an analysis of the population was carried out by means of descriptive statistics, in particular by identifying quartiles and then by classifying cases according to these quartiles. Consequently, those groups located in the top 25% were identified as Q1 of transfer production, and the groups located between 50% and 25% of the transfer production were identified as Q2.

Given that we could expect different results from each research area, both in terms of scientific production and in the way of transferring the knowledge or technology generated towards society, we proceeded on two levels in the second section:

Global level: by considering the 393 research groups preselected in the first cut together, without considering the research area to which they belong, and by selecting those that have a spin-off, along with those that are located in the Q1 and/or Q2 quartile in some of the other variables.

Individual level: where the same profile is applied but discriminated according to research area.

Bringing together the 52 research groups selected as type 1 (i.e., global level) and as type 2 (i.e., individual level by area), which added another 18 research groups, the total figure amounted to 70 groups, which accounted for 17.81% of the 393 groups that were initially preselected, according to the distribution presented in

Table 3.

3.2.3. Preparation for the Meeting between Research Groups and Companies

For the final selection of the research groups to be invited to the “Rounds of Transfer” meeting, we proceeded to identify their activities and lines of research and to ask the leaders of each research group about their interest and current situation for participating in a meeting with companies that might be interested in receiving the transfer of the results of their research and their technology. Initially, 14 groups confirmed their interest in participating. However, 2 groups canceled their participation before the meetings related to scheduling difficulties of their leaders.

Table 4 shows the research line of the groups that were finally invited to the meetings.

The identification and selection of companies to be invited to the meeting were based on the information that the Spanish public foundation “Andalucía Emprende” has on 5 groups of economic agents, which were identified as their targets as co-organizers of the meeting, namely, (1) consolidated entrepreneurs that have been incubated by the foundation and have proven potential for the development of business initiatives; (2) companies and entrepreneurs who have participated in innovation and knowledge transfer activities organized by the foundation; (3) investors who have participated in funding rounds, with interest in the development of technology-based start-ups; (4) SMEs large enough to get involved in the development of new business initiatives with an innovative base as identified in each zone by the Entrepreneurship Centers (CADEs) that are deployed by this public foundation throughout the region; and (5) agents responsible for the technology and development of large groups and corporations, who have participated in other events (tractor companies) or are considered to be of interest by the MSIG Smart Management experts.

Out of a total of 690 identified economic agents, 477 agents were preselected by the technicians of Andalucia Emprende for their participation in the “Rounds of Transfer”. In the selection criteria, the ability to bring to the market the possible developments derived from the transfer of research results of the preselected groups was prioritized by the technicians of Andalucia Emprende. Of these 477 agents, 55 confirmed their participation, for whom the foundation then proceeded to carry out the interview programs according to the possible area of interest of each agent.

As a result, for 2 of the 14 initially selected research groups, no economic agents were identified who could apply or develop their respective research results and, therefore, their participation was cancelled.

For the preparation of the meeting, organized under the format of speed dating, planning was drawn up with the activities and materials to be developed for the meeting, which included, among other documents, the formal invitation to be sent by email, the program of the day, a brochure summarizing the areas of application of the research results, an information leaflet on the research results of each group, the interview program of each research group and each company, the presentation of the meeting, the procedure for conducting the “Rounds of Transfer” and, finally, a register for the companies interested in a possible collaboration with each research group.

In total, 12 research groups and 55 companies were invited and confirmed their participation in the “Rounds of Transfer” meeting.

3.2.4. Holding the Meeting and Monitoring the Action Research

The meeting, called “Rounds of Transfer”, took place on 17 December in the facilities assigned for this purpose by the School of Engineering of the University of Seville, with 12 research groups and 55 companies in attendance.

Table 5 summarizes the program of meeting and the research actions during the meeting:

The speed dates were held as scheduled between 10:00 and 13:30, after an initial presentation to the attendees, in the Hall of Ceremonies of the School. In this presentation, the objectives of the project were laid out in detail, as was the PDSD procedure to be followed in the selection of the participants and the operation of the speed-dating meetings.

In a specially designated space in the central courtyard of the School of Engineering, tables were marked with the identification code and name of each research group, next to which another area with catering was made available as a coffee corner to facilitate networking and the exchange of contact information among the participants. Each table was assigned a technician from the “Andalucía Emprende” public foundation (co-organizer of the meeting), who supplied various support functions and guidance to the representatives of the research groups and companies.

At the end of the meeting, a list was made available to the representatives of the companies to voluntarily express which research groups they were interested in for possible collaboration. A questionnaire was also provided to gather their responses to the aspects of interest for this research. The questionnaire, in addition to measuring the satisfaction of the participating companies, aimed to identify the importance that companies granted to certain characteristics of the research groups in order to assess their potential capacity for the generation of transfer activities.

A questionnaire was also delivered to the research group leaders. This questionnaire, in addition to measuring the satisfaction of the participating research groups, aimed to identify the importance granted to certain characteristics of the companies in the assessment of their potential capacity for the generation of transfer activities. The research groups were informed that they would be contacted in order to facilitate a meeting with the interested companies with support from the co-organizers of the meeting.

The questionnaires completed by the companies and research groups during the meeting provided significant information, both quantitative and qualitative, to reach conclusions regarding the research questions. Both questionnaires, one of them given to the companies and the other given to the research groups, are structured in several sections. In these two questionnaires, the participants were asked for their opinion regarding the meeting and the level at which it had met their expectations, as well as the degree to which it had affected differential aspects concerning other transfer activities in which they had participated. Likewise, the questionnaires asked about the companies or research groups, depending on the case, that had aroused the greatest interest in terms of potential transfer generation.

The aim was to identify the internal characteristics of the other party, as well as aspects of the external context, which would stand out because of their relevance in promoting an effective transfer of knowledge or technology. Finally, the participants were also requested to assess the factors that the members of each party perceived as determining factors when measuring the potential of KT or TT between a research group and a company. For this reason, the questionnaire combined open-ended questions with closed-ended questions on a list of options to be explored in addition to questions based on a Likert scale with values between 1 and 9, whereby 1 indicates the most negative value, 9 represents the most positive value, and 5 provides the central value.

3.2.5. Monitoring the Results of the Meeting Three Months Later

Three months later, the meeting was followed up based on a semi-structured interview with the research group leaders who participated in the meeting to evaluate the results in terms of subsequent contact with the companies that had expressed an interest after considering that there was a probability of realizing an eventual transfer activity with any of the companies.

To support this interview, which was conducted via a phone call between 22 March and 1 April 2019, a questionnaire was designed that sought to contrast the aspects related to the action research questions after this first cycle was completed.

The questionnaire was structured in 4 sections.

In the first section, the research group leaders were asked about the degree to which the speed-dating format applied during the meeting had been useful in facilitating transfer activities.

In the second section, they were asked about the characteristics of the meeting under the speed-dating format.

The third section asked about the companies that had the greatest interest in continuing contact to explore a potential transfer generation.

Finally, in the last section, the aim was to identify the internal characteristics of research groups and companies, as well as aspects of the external context, that could be considered as barriers to an effective transfer of technology.

The questionnaire combined open-ended questions with closed-ended questions on a list of options to be explored in addition to questions based on a Likert scale, with values between 1 and 9, with 1 being the most negative value, 9 being the most positive value, and 5 being the central value.

The follow-up was attended by 11 of the 12 groups participating in the meeting, and the interviews lasted an average of 20 min each. The information obtained was transcribed and sent for validation to the interviewee.

In the same way as those used during the meeting, the questionnaires applied during the follow-up interviews, conducted 3 months after the meeting, provided both significant quantitative and qualitative information and allowed for the gathering of information to complete the formation of conclusions regarding the research questions.

4. Results and Discussion

The main results of the action research process can be summarized as follows.

In the meeting, 12 research groups participated (17% of the selected groups), together with 55 companies (representing an average of 4.6 companies per group). The speed-dating format that took place during the meeting generated 73 expressions of interest from companies wishing to maintain subsequent contact for future collaboration (an average of 6 per group).

In the follow-up carried out 3 months after the meeting, it was found that six research groups maintained subsequent contact with the companies that had expressed interest (50% of the groups), which is estimated as exactly 29 contacts (40% of the expressions of interest).

Out of these six research groups, four indicated that these subsequent contacts allowed them to harbor transfer expectations (66% of those who maintained subsequent contact, 33% of the total of participating groups). On a scale of o to 9 points, where 1 represents “none”, and 9 means “definite”, the average probability given by those responsible for the research groups to translate their expectations into real transfer activities was 4.91 on this Likert scale, which is very close to the central value of 5, whose literal meaning is “cannot be estimated”.

Regarding participation in the surveys carried out during the meeting, which was offered voluntarily by the co-organizers of the meeting and by ourselves as those responsible for this action research, it should be noted that 11 out of the 12 participating groups completed the survey, while of the participating companies, only 9 provided a valid questionnaire.

The follow-up carried out 3 months after the meeting was focused on the research groups, and, as was previously mentioned, 11 of the 12 groups participated.

In turn, the main findings regarding the research questions can be summarized as follows.

Q1: Among the possible ways to promote interaction between research groups and companies in the setting of university–industry meetings, can the potential-driven speed dating (PDSD) procedure provide an effective tool for encouraging initial contact in a conducive way to generate a link among the parties, ultimately leading to technology or knowledge transfer or other possible forms of collaboration?

For both companies and research groups, the average assessment of the degree to which this meeting has represented differential aspects concerning other technology transfer activities in which they participated was 7 (on the scale used, with values between 1 and 9, corresponding to the value “better”). No company or research group valued the experience below 5.

In the follow-up carried out 3 months after the meeting, the research groups gave the utility of the format of speed dating an average rating of 7 (on the scale used, with values between 1 and 9, corresponding to the value “moderate”).

Moreover, to the open-ended question “What is your opinion about the meeting between companies and research groups?”, all responses from both parties showed very positive feedback regarding this format.

Table 6 and

Table 7 show the responses from both parties, i.e., the companies and the research groups, respectively.

Regarding the rest of the issues raised, which sought to verify the validity of the variables used in the selection of the participants in the meeting, it is interesting to analyze certain differences between the responses of the two parties. For example, for the research groups, the most relevant factor for measuring the transfer potential of a research group is the number of previously signed transfer contracts (scored with an average value of 7.27 out of 9), while the companies mainly identified the experience of promoting or creating companies (spin-offs) as the greatest determining factor (7.5 points on average out of 9).

On the other hand, when assessing the potential of companies to receive/facilitate a transfer of technology or knowledge from a university research group, both parties, research groups and companies, considered that the R&D budget available to companies is the most important factor (scored with a mean value of 7.27 and 7.38 points out of 9, respectively).

Q2: For this to be the case, should the meeting and the speed-dating format respond to certain characteristics that can be identified from the action research itself with the help of the interested parties?

Based on the information obtained from the semi-structured interviews for the follow-up carried out 3 months after the meeting, it should be noted that the format of the meeting with speed dating, according to the research groups interviewed, should respond to certain characteristics. These characteristics are presented in

Figure 3 below.

Regarding possible improvements in the format of the speed dating, the suggestions made by the research groups include: “increasing the selection of companies concerning the activity of the research group” and “having information on the companies that are presented”.

On the other hand, of the improvements proposed by the companies, it is worth highlighting: “encouraging networking during coffee”, “receiving more information from groups in advance to have better-prepared interviews”, “improving the allocation of research groups in number and typology”, and, finally, “to mark dynamism, both groups and companies move and agree meetings at different tables, which provides greater balance and helps to break up the static image of the University”.

Q3: Finally, as a tool to direct and channel the process of university–industry collaboration, is it possible to identify those external context barriers or internal barriers of the parties (research groups and companies), which, if removed or influenced, could increase the capacity of the meeting based on potential-driven speed dating?

Regarding the process of TT/KT, 6 of the 11 research groups considered the support of the university as a central element. However, the aspect considered the least relevant, marked by only 3 of the 11 research groups, involved the regulations governing the transfer process.

On the industry side, this view did not change significantly. For six of the nine companies, the resources available to the group to market their research remained the key factor in the transfer process, while no company considered the regulatory regulations as relevant.

In the follow-up conducted 3 months later, when asking the research groups to identify which factors could constitute barriers to the transfer process, the lack of government support for TT/KT stood out as a factor of the external context (36% of the respondents), while as a factor related to the characteristics of the research groups themselves, the resources available to market the research were highlighted (45% of respondents).

4.1. Implications for Research on University–Industry Collaboration

Nowadays, research commercialization is widely accepted as one of the missions of a university, and its role in innovation has increased significantly. Likewise, collaboration between universities and industry has become a priority in the political agendas of research around the world. Stable collaboration between university research groups and companies is considered an effective basis for efficient and sustainable technology and knowledge transfer activities. In this context, there is interest by policymakers and public authorities in promoting efficient tools towards fostering effective links between universities and industry as a first step in facilitating the transfer of knowledge and technology.

According to this argument, it is important to increase the efficiency of the knowledge and technology transfer process and to consider practices and tools which could be applied to improve how university research groups initiate their relations with potentially interested companies.

In this respect, three questions were posed by this AR. The implications from the findings of the study are discussed in the

Table 8.

4.2. Implications for the Interested Parties in the Main Project

Research, development, and innovation activities (R&D&I) must contribute essentially to the sustainable development of any country or region [

28,

29,

30,

31]. These activities constitute a major concern not only for policymakers and regulatory authorities but also for the agents involved in said activities, such as universities and companies.

Government agencies and the universities themselves have made concerted efforts to increase U–I collaboration levels. Nonetheless, both parties should accept that they must improve their role to help research groups and companies interested in their results overcome the specific barriers present in the transfer process [

11,

38,

39].

From this first cycle of action research, it can be concluded that the lack of resources and support for research groups in the commercialization of their results represents the main factor highlighted by the parties involved. However, not only financial resources are involved but also the efficient management of such resources and, therefore, the promotion of tools and procedures that are genuinely useful in achieving the intended results must be considered within the framework of university–industry meetings [

18,

19,

20,

21,

22,

23,

24,

25].

Beyond the validity of the speed-dating format in the context of university–industry meetings, it is worth highlighting the PDSD procedure followed to conduct this action research and manage the entire process of preparing, managing, and monitoring the meeting. This procedure can be reproduced by the interested parties and, in particular, it can be applied by the public bodies and authorities involved in innovation and/or entrepreneurship to promote similar meetings in order to facilitate the first contact between researchers and managers of R&D&I in companies that have been previously selected for their potential for stable collaboration in the form of a license, contract, or other knowledge and technology transfer activities.

Nevertheless, if policies aim to successfully increase the efficiency of the transfer of university research results by fostering collaboration, then not only academics but also firms need to become skilled at initiating and maintaining such collaboration, thereby challenging both internal and external barriers.

5. Conclusions

Since knowledge and technology transfer in the EU still fails to reach the levels desired, it has become a problem in terms of the use of human capital and profitability of the effort made in university research. New formulae are therefore needed in order to increase the effectiveness of interactions between universities and companies.

In this context, a procedure capable of reducing the time required for the generation of contacts and for creating an effective linkage between researchers and representatives of R&D&I departments in companies could exert a major effect on the efficiency of the whole collaboration process through the acceleration of its initial phase.

The results of the action research undertaken show that the PDSD procedure in the framework of meetings between research groups and companies does indeed constitute an effective tool for the organization and channeling of the meeting. The PDSD procedure allows the leaders of research groups, preselected in terms of their transfer potential, to efficiently achieve a large number of first contacts with representatives of R&D&I in companies that are highly interested in their research results in order to become familiarized with each other and to assess the potential for a longer lasting and more productive collaboration. Moreover, a specific structure for this format is proposed, which encompasses all the information and preferences from the involved parties observed in the process.

With respect to the format, for this action research, it is possible to additionally conclude that the meeting and the short appointments should (1) be propitiated by a third party interested in the promotion of the transfer, different from the university or the company; (2) be prepared in advance to ensure that each party has information from the other before the meeting is held; (3) take place in a structured and formal framework; (4) have a maximum duration of 5–10 min; and (5) be carried out without the moderation of a third party.

Furthermore, regarding the possible barriers to the transfer process, it can be concluded that the lack of governmental support for TT and KT activities, as well as the resources available to research groups to commercialize research, are the two factors highlighted by the parties involved, which suggests that the support of public administrations in the commercialization of research by university groups can prove itself to be a major factor.

Nevertheless, given that action research consists in a spiral of research cycles and actions, to improve a practice under a given context, with the involvement and assistance of the stakeholders that already work or are related to the practices to be improved [

47], it seems to be appropriate to point out that the conclusions obtained here are limited, since they concern only the first cycle thereof. Consequently, it is appropriate to propose the promotion of new meetings to the parties interested in this action research, which could propitiate new research cycles in order to improve the results and expand the conclusions of this study.

Finally, it is necessary to develop three topics in detail to improve the PDSD procedure as a tool to favor the generation of transfer between university research groups and companies.

Firstly, the procedure for the preselection of research groups and companies with greater potential in knowledge and technology transfer should be further studied in order to verify whether the variables chosen for preselecting the parties are applicable by other promoters of such meetings. For the PDSD procedure, the research groups and companies invited to the meeting must guarantee that they are indeed good candidates for the intended result to be achieved.

Secondly, the preparation of the meeting should be carefully designed. It is essential that companies and research groups are well equipped to participate effectively in this type of meeting, having previously received and reviewed all the relevant information for the preparation of the meeting.

Lastly, the support required for the completion of the transfer process should not be overlooked. Once the first contact takes place and both parties express their mutual interest, any subsequent barriers that arise must be eliminated by the meeting organizer in order to successfully complete the transfer process.