How Can We Promote Smartphone Leasing via a Buyback Program?

Abstract

1. Introduction

- (1)

- How does the manufacturer set buyback prices when buying back used leasing smartphones from the retailer selling and leasing smartphones simultaneously?

- (2)

- How does the buyback program affect demand, profits, consumer surplus, social welfare, and the environmental impact of the supply chain system?

- (3)

- Can and how does the buyback program enhance the retailer’s motivation to promote smartphone leasing?

- (1)

- As far as we know, this is the first paper considering a manufacturer buyback scheme for used leasing smartphones from a retailer leasing and selling smartphones simultaneously in a circular economy. This paper fills the research gap of how manufacturers set the price when considering buying back used leasing smartphones from retailers leasing and selling smartphones simultaneously.

- (2)

- Some papers have paid attention to internal competition between leasing and selling businesses, but few papers have paid attention to the effect of buyback programs on this internal competition. Based on market competition theory, consumer utility theory, and game equilibrium theory, this paper mainly analyzed the effect of buyback programs on the smartphone leasing and selling market to provide theoretical guidance for the implementation of buyback programs while smartphone leasing and sale demand coexist.

- (3)

- In addition, this paper studies the interactive environmental impact of the manufacturer’s buyback program and the retailer’s hybrid selling–leasing transformation on supply chain system.

- (1)

- If consumers’ acceptance of leasing is moderate, the retailer will benefit from hybrid selling–leasing transformation. If the manufacturer chooses to buy buck used leasing smartphones from the retailer, he should set a high buyback price that is not lower than the residual value of used leasing smartphones.

- (2)

- The buyback program cannot change the leasing price, but it can increase selling price, leasing demand, and manufacturer’s profits, as well as decrease the supply chain’s environmental impact. Additionally, if the consumers’ acceptance of leasing is relatively low, it has the potential to drive a retailer’s shift towards hybrid selling–leasing transformation. Hybrid selling–leasing transformation of the retailer will not only provide more convenience to consumers but also promote the development of leasing as a sustainable consumption pattern.

- (3)

- After the hybrid selling–leasing transformation, without a buyback program, only the manufacturer has an incentive to promote smartphone leasing by improving consumers’ acceptance of leasing; with a buyback program, both the manufacturer and retailer have an incentive to promote smartphone leasing by improving consumers’ acceptance of leasing. As consumers’ acceptance of leasing improves, more smartphones will be rented out, and this will greatly reduce the likelihood of smartphone idleness and will be beneficial for resource recycling and sustainable urban development.

2. Literature Review

2.1. Hybrid Selling–Leasing Strategy

2.2. Buyback Program

2.3. Smartphone Leasing

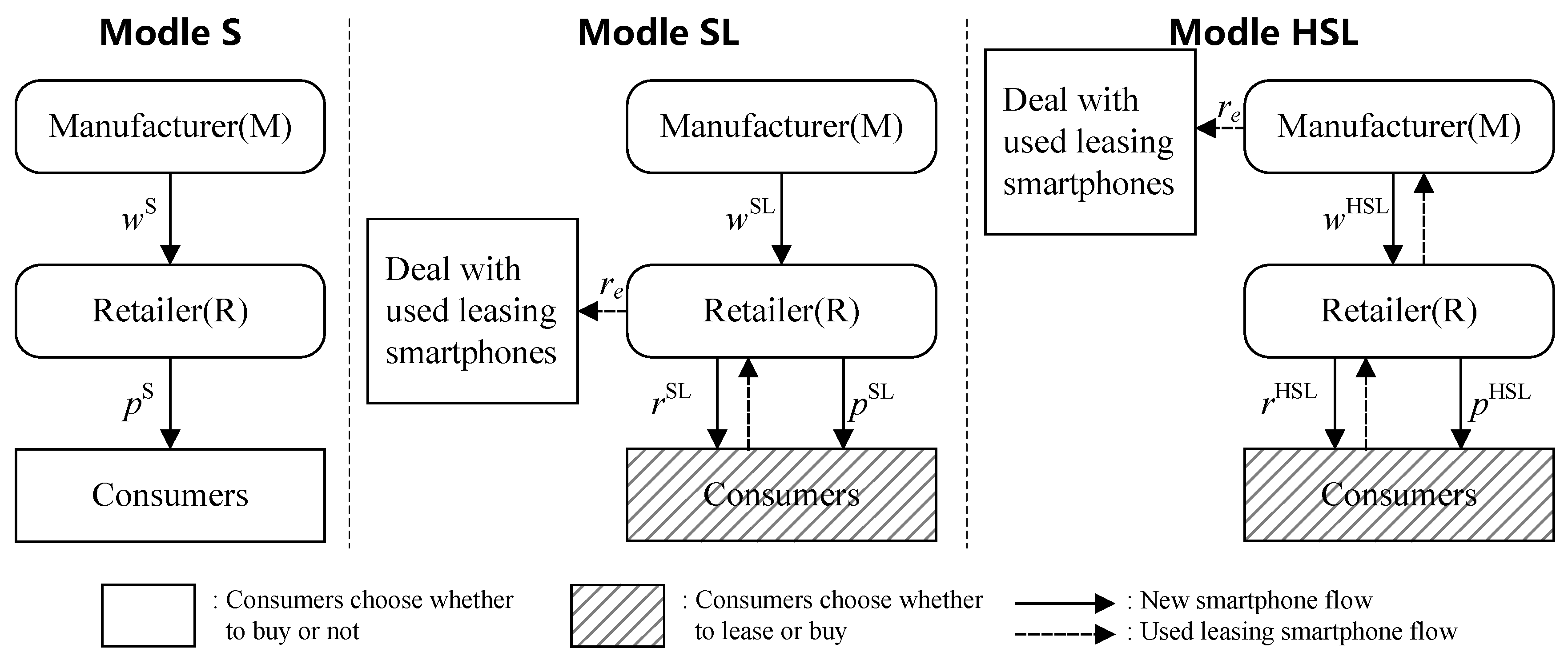

3. Problem Descriptions

4. Modeling and Solving

4.1. Pure Selling (Model S)

| Wholesale price () | |

| Selling price () | |

| Wholesale quantity () | |

| Selling quantity () | |

| Profit of manufacturer () | |

| Profit of retailer () | |

| Profit of supply chain () | |

| Consumer surplus () | |

| Social welfare () |

4.2. Hybrid Selling–Leasing without a Buyback Program (Model SL)

| Wholesale price () | |

| Leasing price () | |

| Selling price () | |

| Wholesale quantity () | |

| Leasing quantity () | |

| Selling quantity () | |

| Profit of manufacturer () | |

| Profit of retailer () | |

| Profit of supply chain () | |

| Consumer surplus () | |

| Social welfare () |

4.3. Hybrid Selling–Leasing with Buyback Program (Model HSL)

| Wholesale price () | |

| Buyback price () | |

| Leasing price () | |

| Selling price () | |

| Wholesale quantity () | |

| Leasing quantity () | |

| Selling quantity () | |

| Profit of manufacturer () | |

| Profit of retailer () | |

| Profit of supply chain () | |

| Consumer surplus () | |

| Social welfare () |

5. Comparisons and Analysis

5.1. Comparisons of Three Models

- (1)

- ;

- (2)

- ;

- (3)

- ;

- (4)

- .

- (1)

- ;

- (2)

- and increase as decreases and increase.

- (1)

- ;

- (2)

- ;

- (3)

- If , , if , .

- (1)

- If , , ;

- (2)

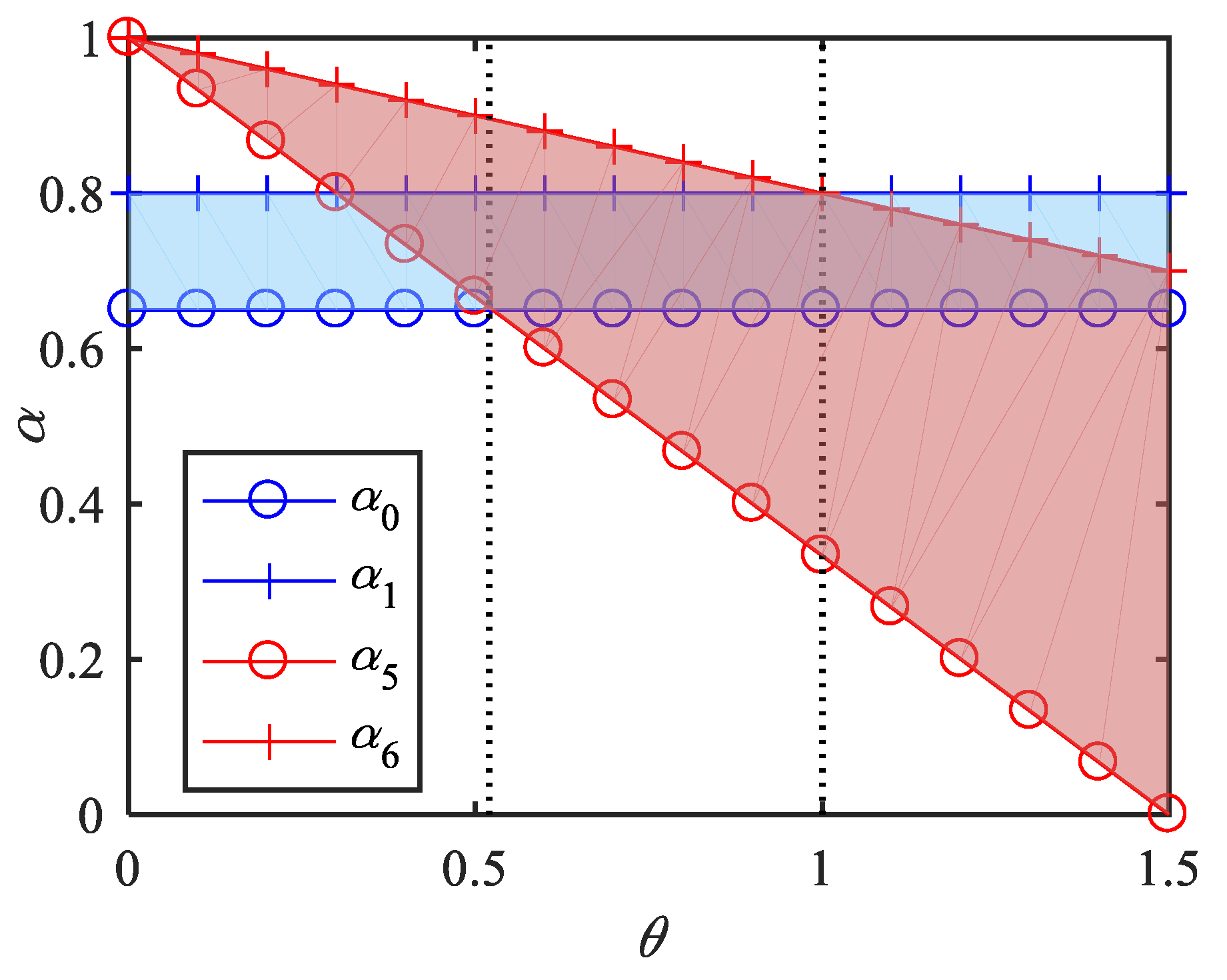

- If , , if , ; if , .

- (1)

- If , , , ;

- (2)

- If , , , .

- (1)

- If and , .

- (2)

- .

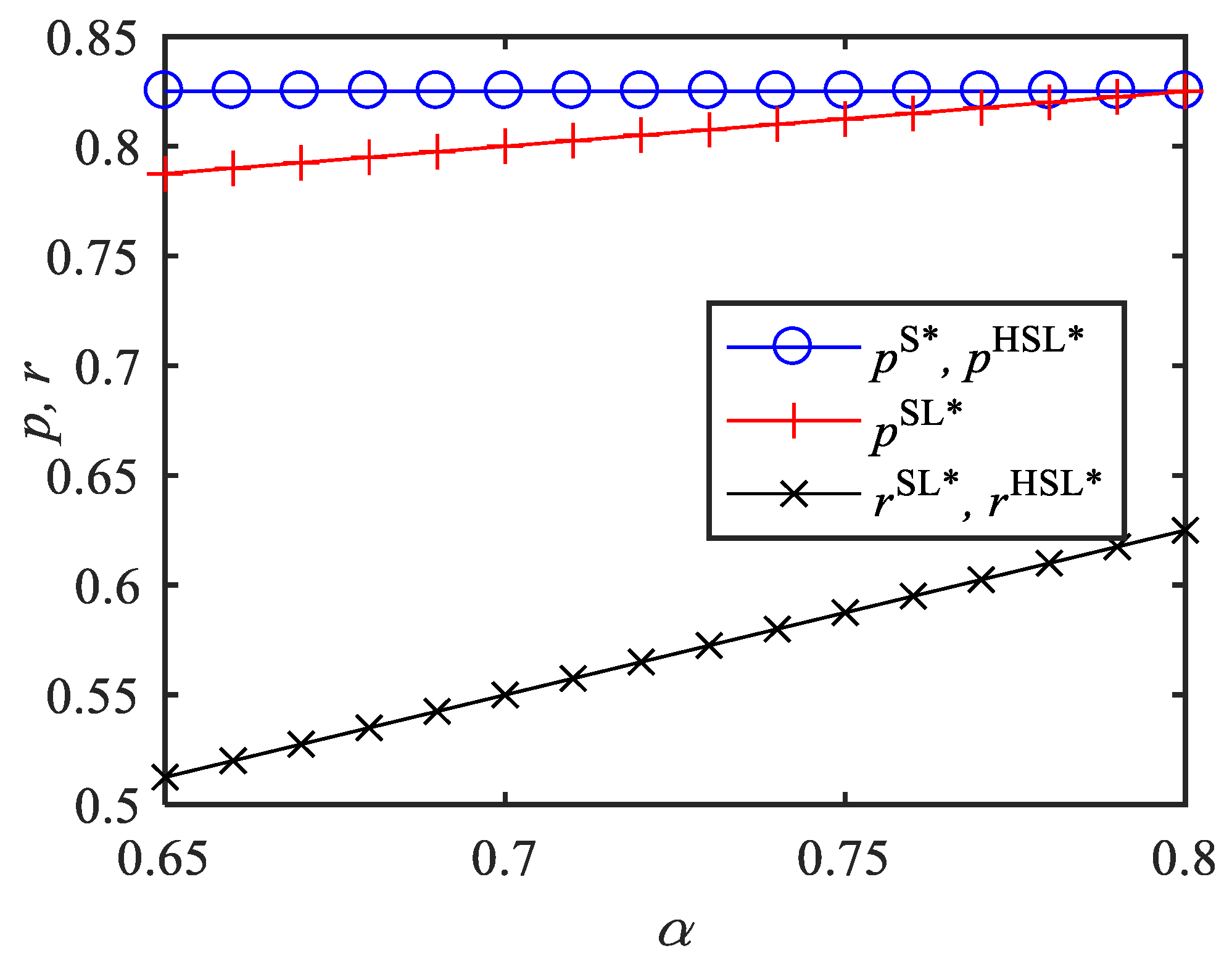

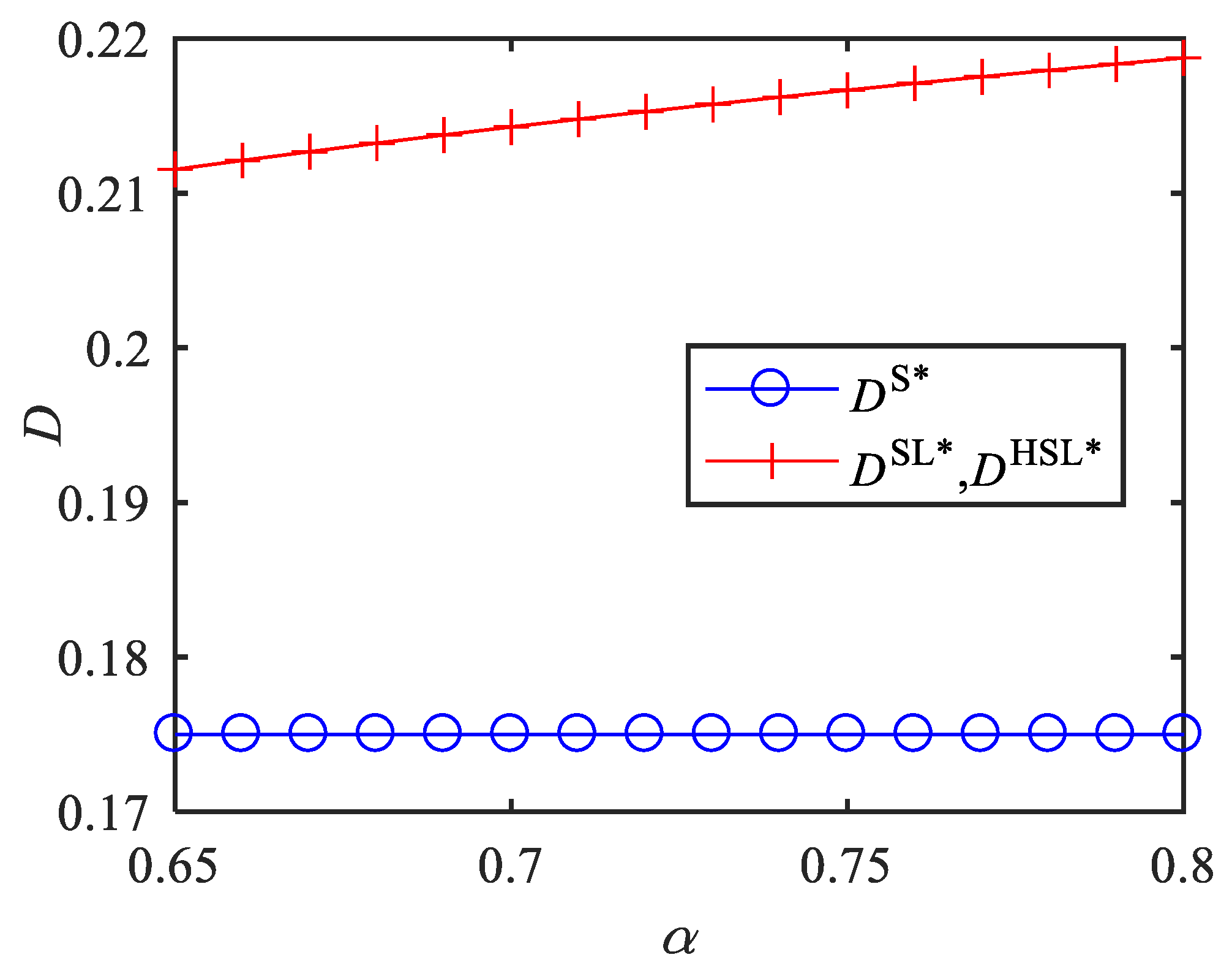

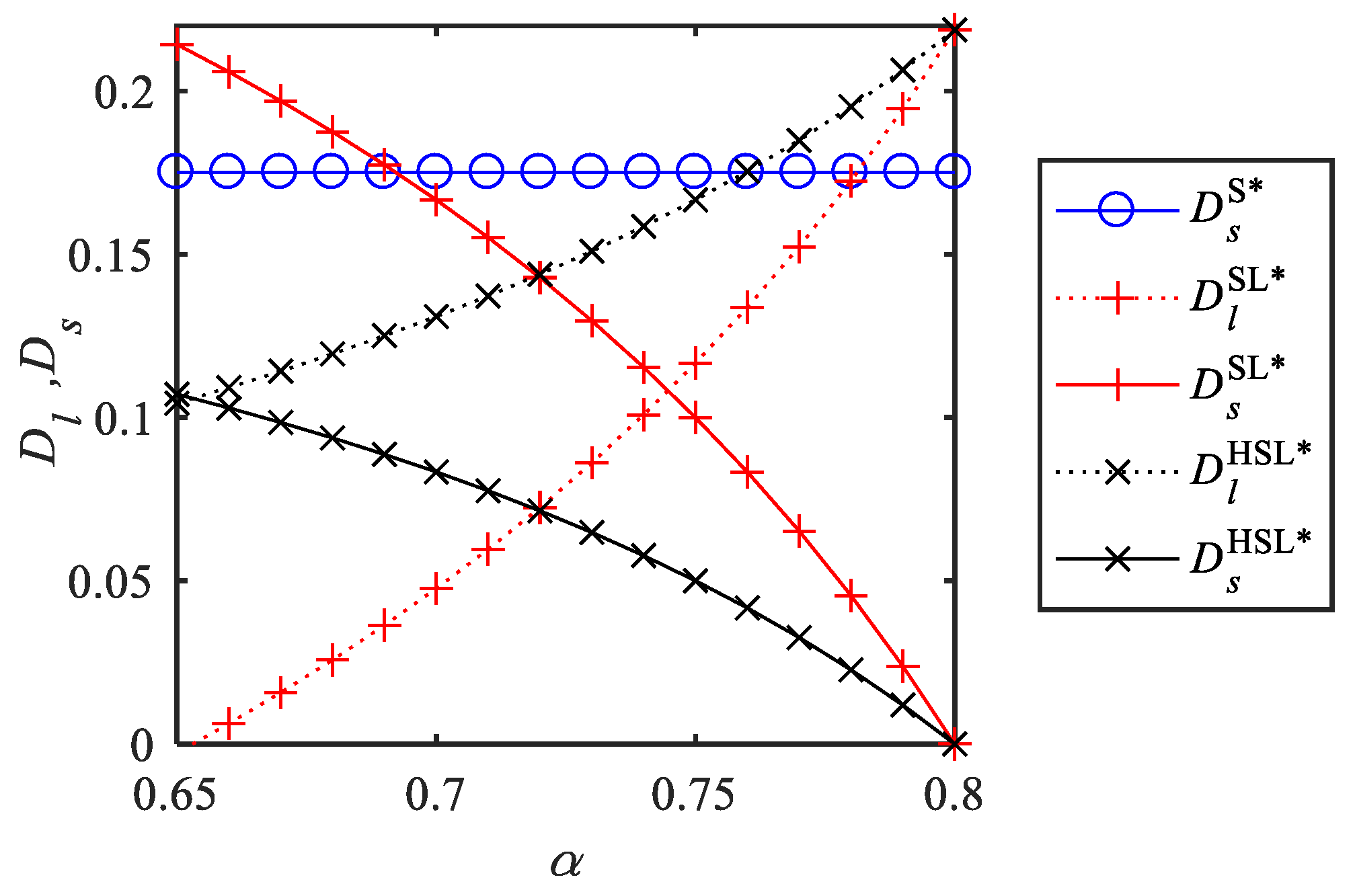

5.2. Influence Analysis of Parameters

- (1)

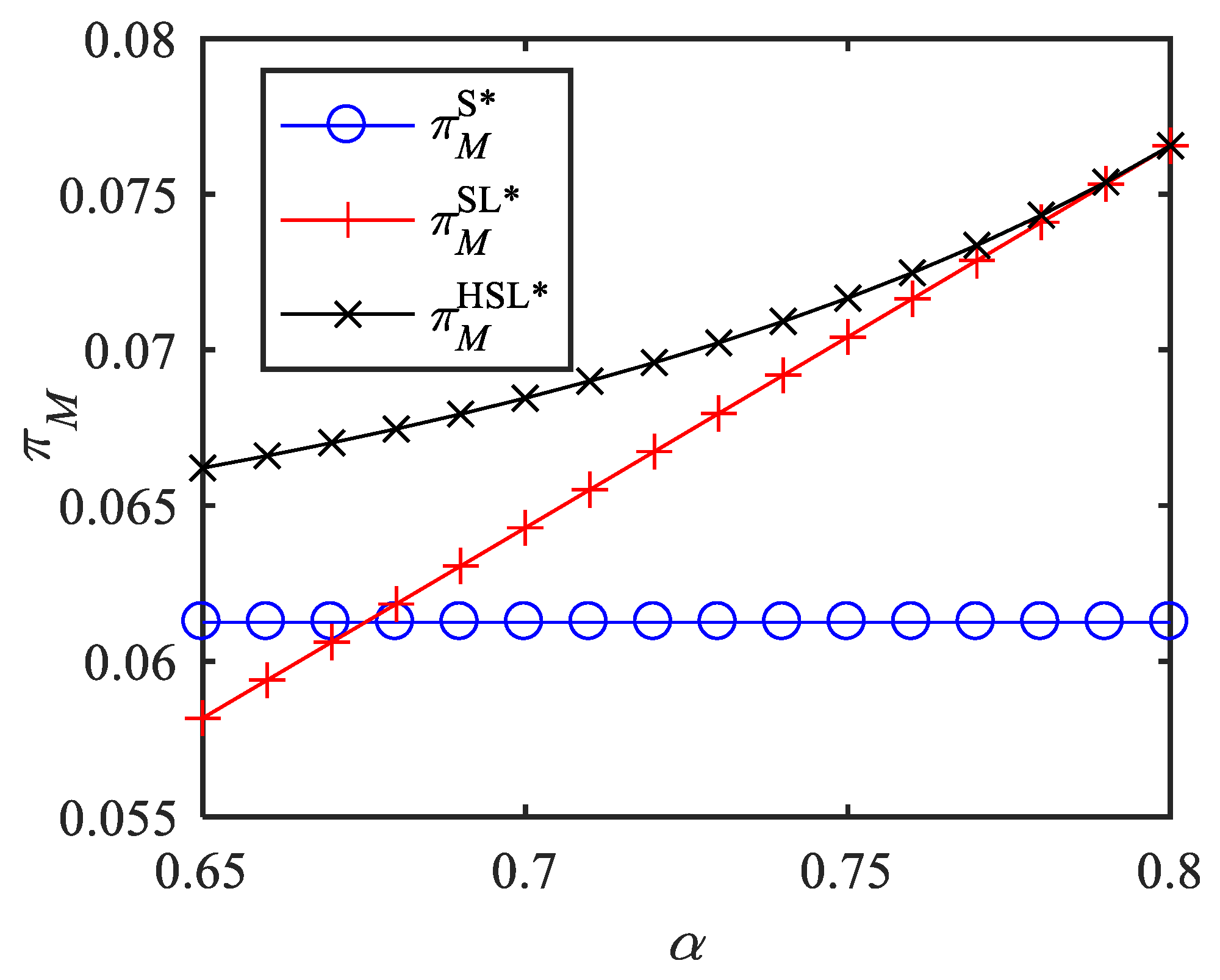

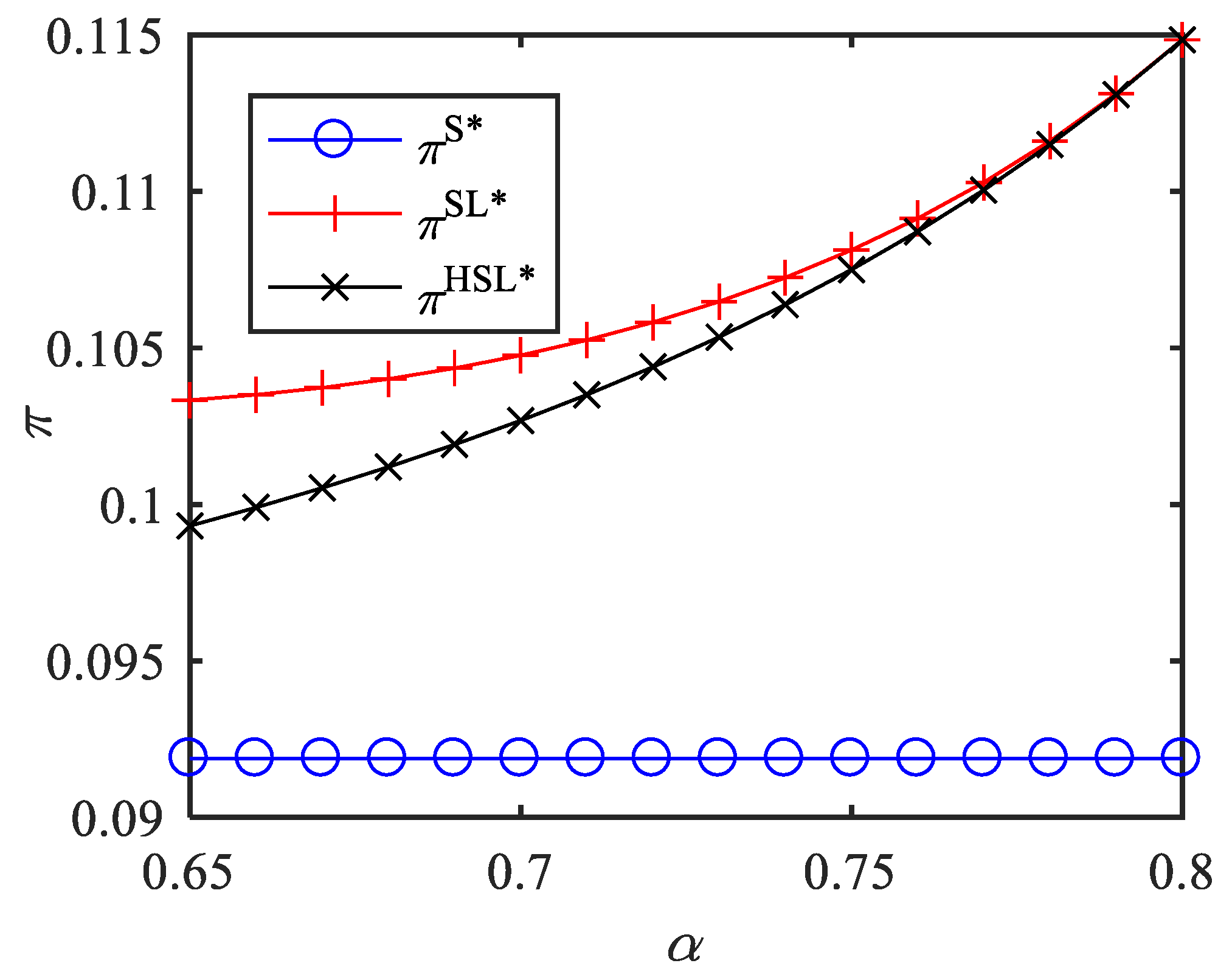

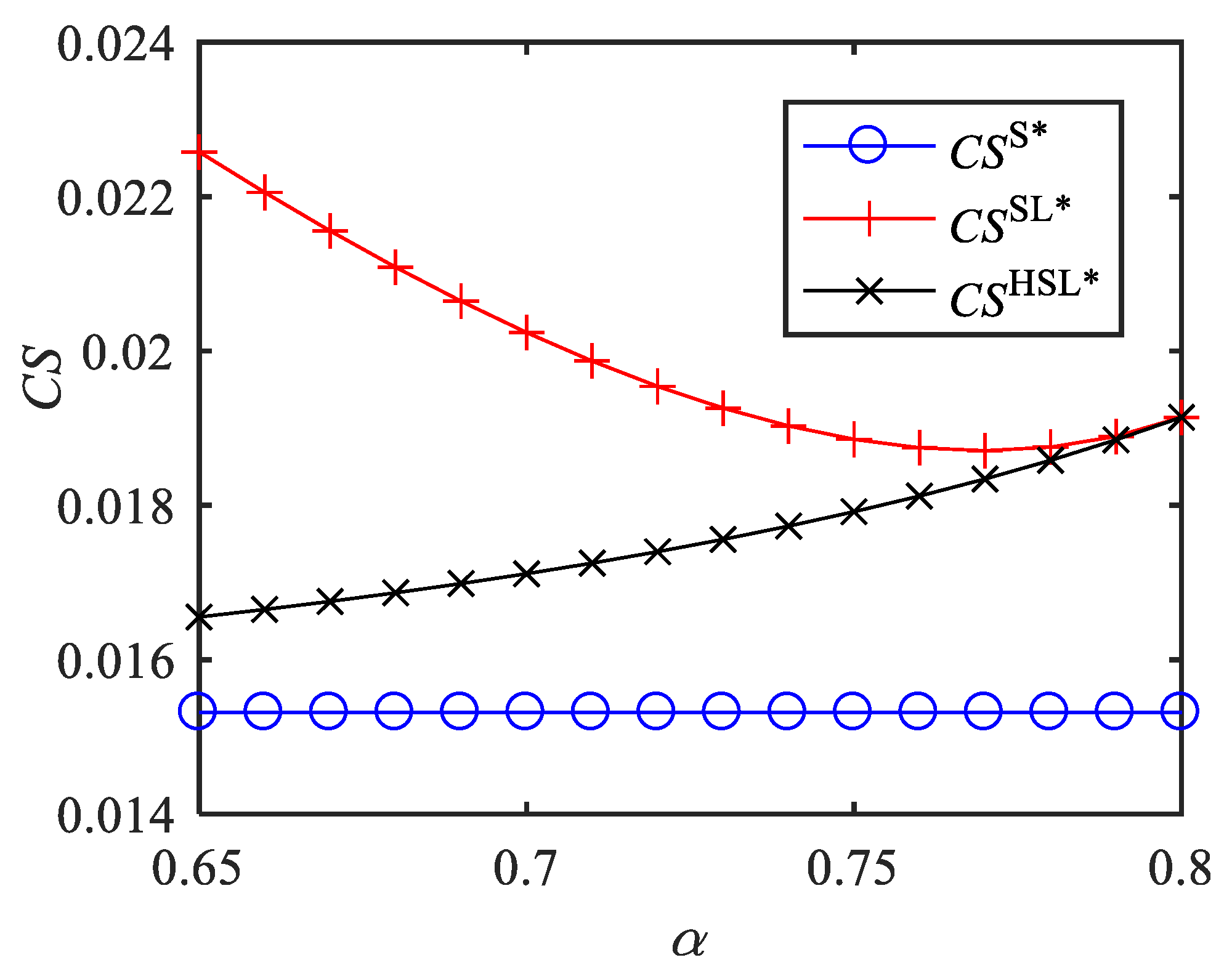

- As α increases, , , , , , and increase, while , , , and decrease.

- (2)

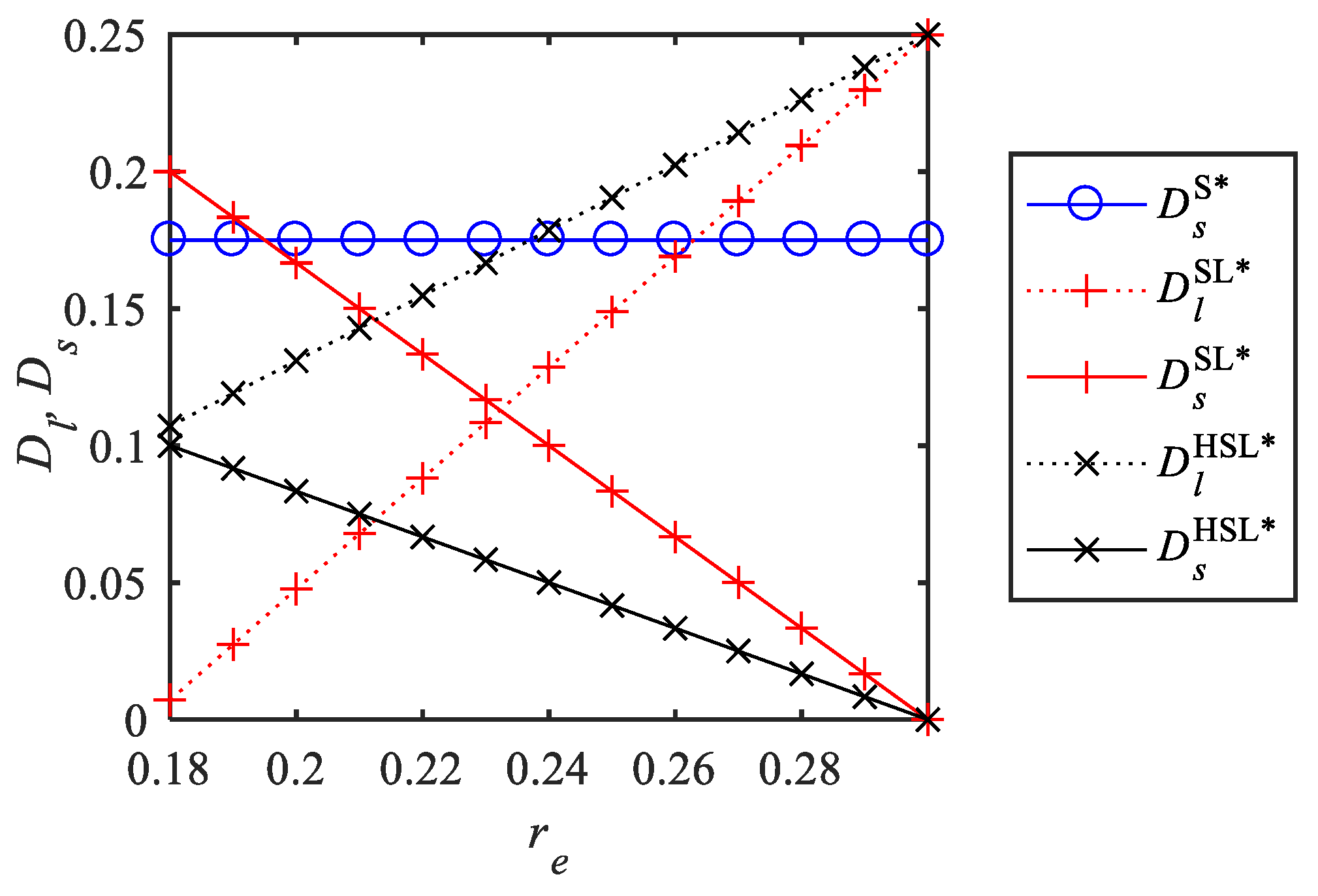

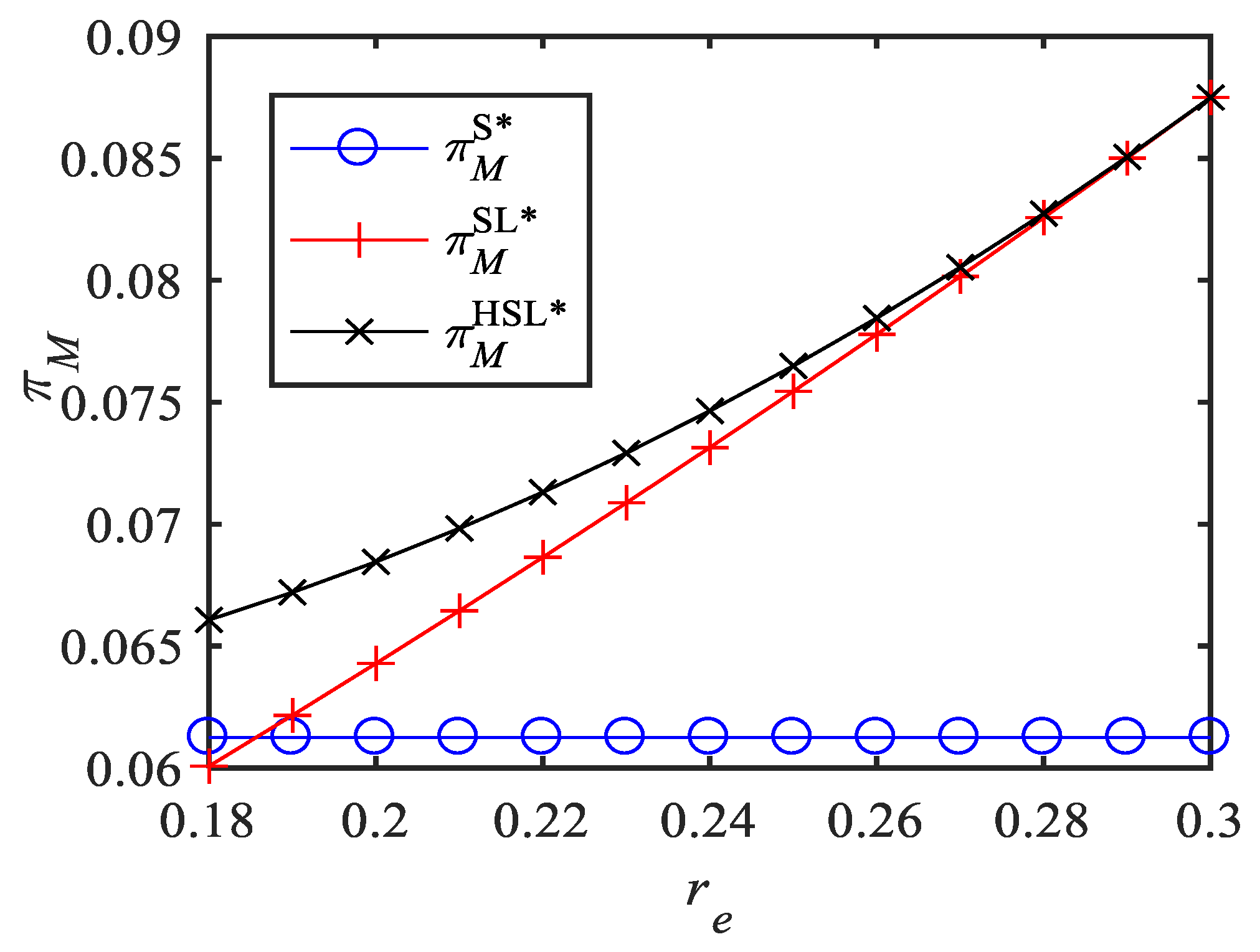

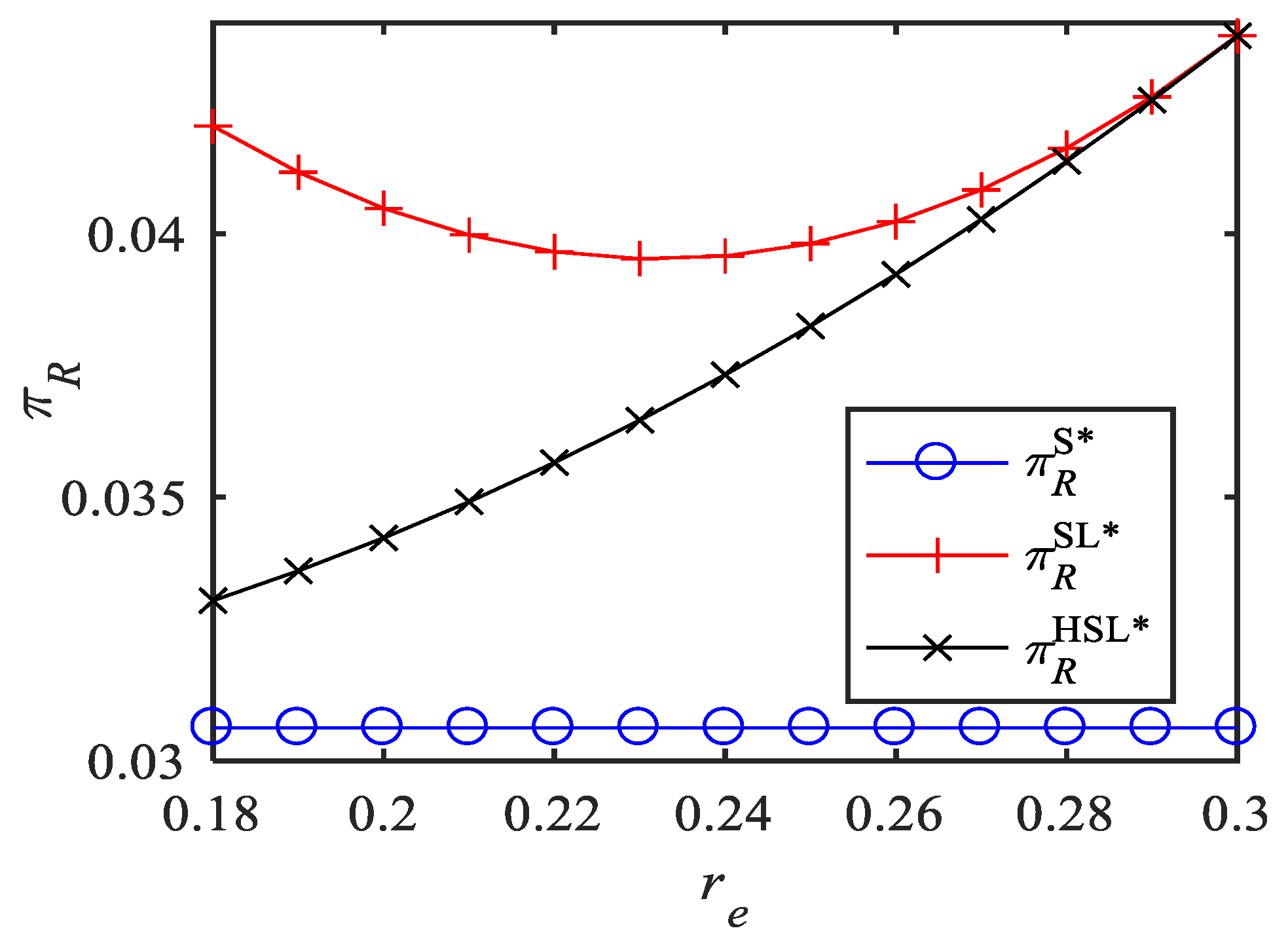

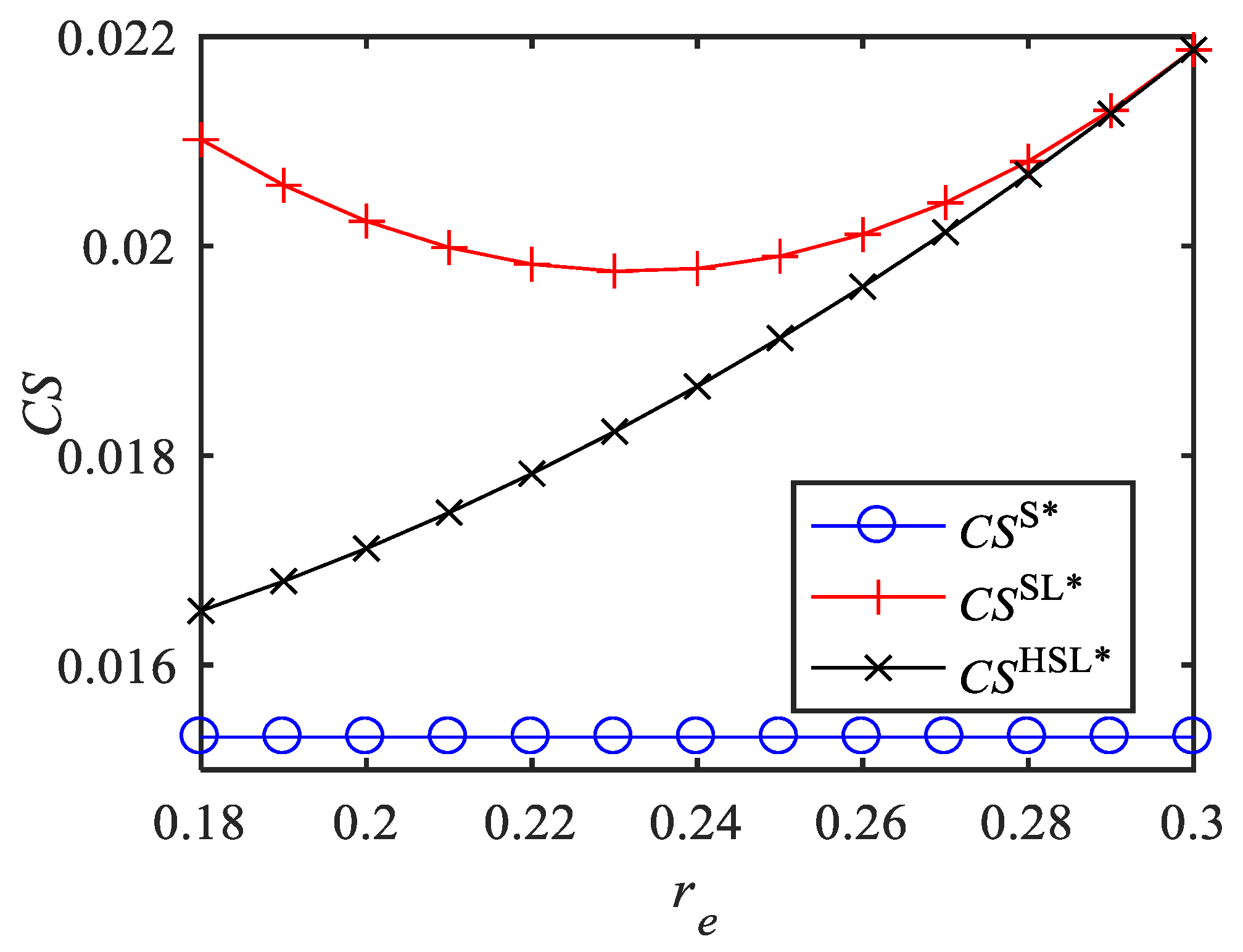

- As re increases, , , , , and increase, while , , and decrease, and and first decrease, and then increase.

- (1)

- As α increases, , , , , , and increase, , , decrease;

- (2)

- As re increases, , , , , , increase, , , decrease.

6. Numerical Simulations

6.1. Impact of Consumers’ Acceptance of Leasing

6.2. Impact of Residual Value

7. Extensions

| Wholesale price () | |

| Buyback price () | |

| Leasing price () | |

| Selling price () | |

| Wholesale quantity () | |

| Leasing quantity () | |

| Selling quantity () | |

| Profit of manufacturer () | |

| Profit of retailer () | |

| Profit of supply chain () | |

| Consumer surplus () | |

| Social welfare () |

8. Conclusions

- (1)

- When consumers’ acceptance of leasing is moderate, purchasing and leasing demand coexist, and the retailer should conduct a hybrid selling–leasing transformation to attain more profit. If the manufacturer chooses to buy back used leasing smartphones from the retailer, he should set a high buyback price that is not lower than the residual value of the used leasing smartphone unit.

- (2)

- The buyback program cannot change a retailer’s leasing price, but it can increase a retailer’s selling price, thereby widening the gap between the selling and leasing prices, boosting leasing demand, increasing the manufacturer’s profits, and mitigating the supply chain system’s environmental impact. Additionally, when consumers have a relatively low acceptance of leasing, without a buyback program, there is no leasing demand, but with a buyback program, there is leasing demand, which allows both the manufacturer and retailer to benefit from hybrid selling–leasing transformation. Consistent with the conclusions of Xue et al. [37], this result shows that a buyback program can benefit all supply chain members under certain conditions.

- (3)

- After a hybrid selling–leasing transformation, there will be internal competition between the retailer’s selling and leasing businesses, and because of this competition, without a buyback program, the retailer’s profits will decline as consumers’ acceptance of leasing rises. However, with a buyback program, the retailer’s profits will surge as consumers’ acceptance of leasing rises, enhancing the retailer’s motivation to promote smartphone leasing by improving consumers’ acceptance of leasing.

- (1)

- Promote hybrid selling–leasing transformation. To smooth the channels for retailers’ hybrid selling–leasing transformation, the government must provide robust backing for intermediary leasing platforms, which can be achieved via tax incentives and financial subsidies. At the same time, retailers should actively expand their leasing business and then identify and analyze consumers’ acceptance of leasing based on historical data to scientifically set smartphone leasing prices.

- (2)

- Pay attention to the buyback program. In response to retailers’ hybrid selling–leasing transformation, manufacturers should not adjust the wholesale price but offer a buyback program for used leasing smartphones and appropriately set a higher buyback price that is not lower than the residual value of used leasing smartphones. When the leasing market is sluggish, retailers who provide a mixed selling and leasing service should actively participate in smartphone buyback programs.

- (3)

- Improving consumers’ acceptance of leasing. The government should promote the leasing and replacement of smartphones among consumers in a reasonable manner while also implementing strict regulations in the leasing market to reduce the risks associated with smartphone leasing. Additionally, the establishment and improvement of a social credit system can help to lower the security deposit required for smartphone leasing. Manufacturers should continue to innovate and iterate their smartphone designs, creating secure and convenient replacement systems to encourage consumers to lease and replace their devices. Retailers who have participated in manufacturer buyback programs can improve the quality of their leasing services by utilizing network credit systems and blockchain technology while also promoting the benefits of smartphone leasing and replacement to consumers.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

- (1)

- , , , , , and , so .

- (2)

- , , , , , , so .

- (3)

- .

- (4)

- , , so , . ☐

- (1)

- , , , so .

- (2)

- , , , . ☐

- (1)

- , .

- (2)

- , let , we can find , ; if , , , if , , . , , , , so if , , if , .

- (3)

- , , , so . ☐

- (1)

- If , ; If , .

- (2)

- If , ; , , let , we have , and , so if , , if , ; and if , , if , , if , , if , , , so . ☐

- (1)

- If , ; ; , , so .

- (2)

- If , , , ; , , so ; , and , so . ☐

- (1)

- , so if and , .

- (2)

- . We obtain the following conclusion from Proposition 2, if , . Because , , so . ☐

- (1)

- , , ; , , ; , , increase with , so increases with ; because , where , so , decreases as increases. is maximum when , and , , , so and decrease as increases; , and because , , so .

- (2)

- , , ; , , ; , , when , , when , ; , and because , , so . ☐

- (1)

- , , , if , , if , because , , , so ; , ; , , , and if , , if , because , , so , , ; , and because , , so .

- (2)

- , , ; , ; , , , ; , and because , , so . ☐

References

- Cheshmeh, Z.A.; Bigverdi, Z.; Eqbalpour, M.; Kowsari, E.; Ramakrishna, S.; Gheibi, M. A comprehensive review of used electrical and electronic equipment management with a focus on the circular economy-based policy-making. J. Clean. Prod. 2023, 398, 136132. [Google Scholar] [CrossRef]

- Chinese People Have 1.856 Billion Phones, More Than Half of the Old Phones “Lying” at Home? Available online: https://new.qq.com/rain/a/20221029A072EC00 (accessed on 7 July 2023).

- Ghiasi, M.; Wang, Z.; Mehrandezh, M.; Jalilian, S.; Ghadimi, N. Evolution of smart grids towards the Internet of energy: Concept and essential components for deep decarbonisation. IET Smart Grid. 2023, 6, 86–102. [Google Scholar] [CrossRef]

- Hobson, K.; Lynch, N.; Lilley, D.; Smalley, G. Systems of practice and the Circular Economy: Transforming mobile phone product service systems. Environ. Innov. Soc. Transit. 2018, 26, 147–157. [Google Scholar] [CrossRef]

- Poppelaars, F.; Bakker, C.; Van Engelen, J. Does Access Trump Ownership? Exploring Consumer Acceptance of Access-Based Consumption in the Case of Smartphones. Sustainability 2018, 10, 2133. [Google Scholar] [CrossRef]

- Peng, Y.; Li, H. A Leasing Platform Service Supply Chain Network Equilibrium Model Considering Digital Detection Technology Investment and Big Data Marketing. Sustainability 2023, 15, 9955. [Google Scholar] [CrossRef]

- Mashhadi, A.R.; Vedantam, A.; Behdad, S. Investigation of consumer’s acceptance of product-service-systems: A case study of cell phone leasing. Resour. Conserv. Recycl. 2019, 143, 36–44. [Google Scholar] [CrossRef]

- Wang, S.; Lin, Q.; Zhou, Z.; Nie, C. Exploring the Role of Attitudinal Factors in Electric Vehicle Timeshare Rentals Adoption. Appl. Sci. 2023, 13, 12. [Google Scholar] [CrossRef]

- Xiong, Y.; Yan, W.; Fernandes, K.; Xiong, Z.K.; Guo, N. “Bricks vs. Clicks”: The impact of manufacturer encroachment with a dealer leasing and selling of durable goods. Eur. J. Oper. Res. 2012, 217, 75–83. [Google Scholar] [CrossRef]

- Smartphone Rental Business Emerges, but Market Response Lukewarm. Available online: https://www.chinadaily.com.cn/business/tech/2017-08/22/content_30949022.htm (accessed on 30 January 2023).

- “Gome Rent” Tests the Waters of Mobile Phone Rental. Available online: https://finance.china.com.cn/roll/20170815/4350406.shtml (accessed on 30 January 2023).

- Zhao, M.; Wang, X. Perception value of product-service systems: Neural effects of service experience and customer knowledge. J. Retail. Consum. Serv. 2021, 62, 102617. [Google Scholar] [CrossRef]

- Ghiasi, M.; Niknam, T.; Wang, Z.; Mehrandezh, M.; Dehghani, M.; Ghadimi, N. A comprehensive review of cyber-attacks and defense mechanisms for improving security in smart grid energy systems: Past, present and future. Electr. Power Syst. Res. 2023, 215, 108975. [Google Scholar] [CrossRef]

- Dehghani, M.; Ghiasi, M.; Niknam, T.; Kavousi-Fard, A.; Shasadeghi, M.; Ghadimi, N.; Taghizadeh-Hesary, F. Blockchain-Based Securing of Data Exchange in a Power Transmission System Considering Congestion Management and Social Welfare. Sustainability 2021, 13, 90. [Google Scholar] [CrossRef]

- Tian, G.; Li, C.; Li, D. How does the electronic smartphones retailer transform operational modes considering consumers’ acceptance of leasing? Math. Probl. Eng. 2022, 2022, 1–17. [Google Scholar] [CrossRef]

- Purohit, D.; Staelin, R. Rentals, sales, and buybacks: Managing secondary distribution channels. J. Mark. Res. 1994, 31, 325–338. [Google Scholar] [CrossRef]

- Purohit, D. Dual distribution channels: The competition between rental agencies and dealers. Market. Sci. 1997, 16, 228–245. [Google Scholar] [CrossRef]

- Esenduran, G.; Lu, L.X.; Swaminathan, J.M. Buyback pricing of durable goods in dual distribution channels. Environ. Innov. Soc. Transit. 2020, 22, 412–428. [Google Scholar] [CrossRef]

- Agrawal, V.; Atasu, A.; Ülkü, S. Leasing, modularity, and the circular economy. Manag. Sci. 2021, 67, 6782–6802. [Google Scholar] [CrossRef]

- Agrawal, V.V.; Bellos, I. The potential of servicizing as a green business model. Manag. Sci. 2017, 63, 1545–1562. [Google Scholar] [CrossRef]

- Amasawa, E.; Shibata, T.; Sugiyama, H.; Hirao, M. Environmental potential of reusing, renting, and sharing consumer smartphones: Systematic analysis approach. J. Clean. Prod. 2020, 242, 118487. [Google Scholar] [CrossRef]

- Desai, P.S.; Purohit, D. Competition in durable goods markets: The strategic consequences of leasing and selling. Market. Sci. 1999, 18, 42–58. [Google Scholar] [CrossRef]

- Bhaskaran, S.R.; Gilbert, S.M. Selling and leasing strategies for durable goods with complementary smartphones. Manag. Sci. 2005, 51, 1278–1290. [Google Scholar] [CrossRef]

- Tilson, V.; Wang, Y.; Yang, W. Channel strategies for durable goods: Coexistence of selling and leasing to individual and corporate consumers. Prod. Oper. Manag. 2009, 18, 402–410. [Google Scholar] [CrossRef]

- Gilbert, S.M.; Randhawa, R.S.; Sun, H. Optimal Per-Use Rentals and Sales of Durable Smartphones and Their Distinct Roles in Price Discrimination. Prod. Oper. Manag. 2014, 23, 393–404. [Google Scholar] [CrossRef]

- Yu, Y.; Dong, Y.; Guo, X. Pricing for sales and per-use rental services with vertical differentiation. Eur. J. Oper. Res. 2018, 270, 586–598. [Google Scholar] [CrossRef]

- Jalili, M.; Pangburn, M.S. Pricing joint sales and rentals: When are purchase-conversion discounts optimal? Prod. Oper. Manag. 2020, 29, 2679–2695. [Google Scholar] [CrossRef]

- Liu, J.; Mantin, B.; Song, X. Rent, sell, and remanufacture: The manufacturer’s choice when remanufacturing can be outsourced. Eur. J. Oper. Res. 2022, 303, 184–200. [Google Scholar] [CrossRef]

- Choi, T.M.; Li, D.; Yan, H. Mean–variance analysis of a single supplier and retailer supply chain under a returns policy. Eur. J. Oper. Res. 2008, 184, 356–376. [Google Scholar] [CrossRef]

- Pasternack, B.A. Optimal pricing and return policies for perishable commodities. Market. Sci. 1985, 4, 166–176. [Google Scholar] [CrossRef]

- Padmanabhan, V.I.P.L.; Png, I.P. Returns policies: Make money by making good. Mit. Sloan. Manag. Rev. 1995, 37, 65–72. [Google Scholar]

- Lau, H.S.; Lau, A.H.L. Manufacturer’s pricing strategy and return policy for a single-period commodity. Eur. J. Oper. Res. 1999, 116, 291–304. [Google Scholar] [CrossRef]

- Lau, A.H.L.; Lau, H.S.; Willett, K.D. Willett, Demand uncertainty and returns policies for a seasonal product: An alternative model. Int. J. Prod. Econ. 2000, 66, 1–12. [Google Scholar] [CrossRef]

- Granot, D.; Yin, S. On the effectiveness of returns policies in the price-dependent newsvendor model. Nav. Res. Log. 2015, 52, 765–779. [Google Scholar] [CrossRef]

- Zhao, Y.; Choi, T.M.; Cheng, T.C.E.; Sethi, S.P.; Wang, S. Buyback contracts with price-dependent demands: Effects of demand uncertainty. Eur. J. Oper. Res. 2014, 239, 663–673. [Google Scholar] [CrossRef]

- Ji, X.; Sun, J.; Wang, Z. Turn bad into good: Using transshipment-before-buyback for disruptions of stochastic demand. Int. J. Prod. Econ. 2017, 185, 150–161. [Google Scholar] [CrossRef]

- Xue, W.; Hu, Y.; Chen, Z. The value of buyback contract under price competition. Int. J. Prod. Res. 2019, 57, 2679–2694. [Google Scholar] [CrossRef]

- Doganoglu, T.; Inceoglu, F. Buyback contracts to solve upstream opportunism. Eur. J. Oper. Res. 2020, 287, 875–884. [Google Scholar] [CrossRef]

- Chen, J. The impact of sharing customer returns information in a supply chain with and without a buyback policy. Eur. J. Oper. Res. 2011, 213, 478–488. [Google Scholar] [CrossRef]

- Wu, J.; Zou, L.; Gong, Y.; Chen, M. The anti-collusion dilemma: Information sharing of the supply chain under buyback contracts. Transport. Res. E-Log. 2021, 152, 102413. [Google Scholar] [CrossRef]

- Zhang, Q.; Chen, J.; Chen, B. Information strategy in a supply chain under asymmetric customer returns information. Transport. Res. E-Log. 2021, 155, 102511. [Google Scholar] [CrossRef]

- Gong, M.; Lian, Z.; Xiao, H. Inventory control policy for perishable smartphones under a buyback contract and Brownian demands. Int. J. Prod. Econ. 2022, 251, 108522. [Google Scholar] [CrossRef]

- Li, D.; Chen, J.; Chen, B.; Liao, Y. Manufacturer’s contract choice and retailer’s returns management strategy. Transport. Res. E-Log. 2022, 165, 102862. [Google Scholar] [CrossRef]

- Handset Leasing and Telecommunication Operators (From Implementing to Saving an Entire Industry). Available online: https://www.researchgate.net/publication/341655539_Handset_Leasing_and_Telecommunication_Operators_From_Implementing_to_saving_an_Entire_Industry (accessed on 30 January 2023).

- Rousseau, S. Millennials’ acceptance of product-service systems: Leasing smartphones in Flanders (Belgium). J. Clean. Prod. 2020, 246, 118992. [Google Scholar] [CrossRef]

- Li, Y.; Bai, X.; Xue, K. Business modes in the sharing economy: How does the OEM cooperate with third-party sharing platforms? Int. J. Prod. Econ. 2020, 221, 107467. [Google Scholar] [CrossRef]

- Coto-Millán, P. Theory of utility and consumer behaviour: A comprehensive review of concepts, properties and the most significant theorems. In Utility and Production: Theory and Applications; Springer: Berlin/Heidelberg, Germany, 1999; pp. 7–23. [Google Scholar] [CrossRef]

- Akbary, P.; Ghiasi, M.; Pourkheranjani, M.R.R.; Alipour, H.; Ghadimi, N. Extracting Appropriate Nodal Marginal Prices for All Types of Committed Reserve. Comput. Econ. 2019, 53, 1–26. [Google Scholar] [CrossRef]

- Liu, Z.; Xiao, Y.; Feng, J. Manufacturer’s Sharing Servitization Transformation and Product Pricing Strategy. Sustainability 2021, 13, 1503. [Google Scholar] [CrossRef]

- Lin, J.; Li, Z.; Mohamed, N.; Virginia, S.; Aris, S. Push or Pull? The impact of ordering policy choice on the dynamics of a hybrid closed-loop supply chain. Eur. J. Oper. Res. 2022, 300, 282–295. [Google Scholar] [CrossRef]

- Huang, J.; Leng, M.; Parlar, M. Demand functions in decision modeling: A comprehensive survey and research directions. Decis. Sci. 2013, 44, 557–609. [Google Scholar] [CrossRef]

- Agrawal, V.V.; Ferguson, M.; Toktay, L.B.; Thomas, V.M. Is leasing greener than selling? Market. Sci. 2012, 58, 523–533. [Google Scholar] [CrossRef]

- Ghiasi, M.; Ghadimi, N.; Ahmadinia, E. An analytical methodology for reliability assessment and failure analysis in distributed power system. SN Appl. Sci. 2019, 44, 1–9. [Google Scholar] [CrossRef]

- Ferrer, G.; Swaminathan, J.M. Managing new and remanufactured smartphones. Market. Sci. 2006, 52, 15–26. [Google Scholar]

| Data Items | Gross Profit Margin | Selling Price of New iPhone (Unit: CNY) | Leasing Price of New iPhone (Unit: CNY) | Selling Price of Used iPhone (Unit: CNY) | Cost of New iPhone (Unit: CNY) | |

|---|---|---|---|---|---|---|

| IPhone Models | ||||||

| Apple iPhone 11 | 37.8% | 4699 | 3289 | 2299 | 3410 | |

| Apple iPhone 12 | 38.2% | 4650 | 3387 | 2289 | 3364 | |

| Apple iPhone 13 | 41.8% | 5070 | 3599 | 2839 | 3575 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tian, G.; Li, C. How Can We Promote Smartphone Leasing via a Buyback Program? Sustainability 2023, 15, 11386. https://doi.org/10.3390/su151411386

Tian G, Li C. How Can We Promote Smartphone Leasing via a Buyback Program? Sustainability. 2023; 15(14):11386. https://doi.org/10.3390/su151411386

Chicago/Turabian StyleTian, Gaidi, and Chunfa Li. 2023. "How Can We Promote Smartphone Leasing via a Buyback Program?" Sustainability 15, no. 14: 11386. https://doi.org/10.3390/su151411386

APA StyleTian, G., & Li, C. (2023). How Can We Promote Smartphone Leasing via a Buyback Program? Sustainability, 15(14), 11386. https://doi.org/10.3390/su151411386