Abstract

Driven by the “double carbon” goal, the sale of financial assets at reduced prices by firms due to carbon emission constraints is bound to aggravate the uncertainty and volatility of carbon trading among firms, and potentially create counterparty risk contagion. In view of this, this paper considers the sensitivity of the transaction of corporate financial assets, the transaction price of carbon quotas, and corporate carbon performance; constructs a network model for the risk contagion of carbon quota counterparties; theoretically discusses the risk formation and infection mechanism of carbon quota counterparties; and calculates and simulates the evolutionary characteristics of the risk contagion of carbon quota counterparties. The main research conclusions are as follows. (1) In the interfirm debt network, the sensitivity to the price of selling the financial asset, the probability of credit risk contagion of carbon quotas among firms, the cumulative proportion of assets sold, and the proportion of rational investors in the financial market exert a decreasing phenomenon on the risk of carbon quota counterparties. In addition, the corporate carbon performance shows a marginal increasing phenomenon. (2) When multiple factors intersect, the proportion of rational investors in the financial market has the greatest influence on the formation of the carbon quota counterparty risk, whereas the effect of corporate carbon performance has the least. Corporate carbon risk awareness has the greatest effect on the risk contagion of carbon quota counterparties, whereas the trading price of the carbon quota has the least influence. In addition, the total score of the interfirm assessment has a great impact on the trend and range of the risk contagion of carbon quota counterparties. (3) Corporate carbon risk awareness and the carbon quota trading price have a marginally decreasing effect on the risk contagion of carbon quota counterparties, and corporate carbon performance and the total score of interfirm assessment have a marginally increasing effect. This study has important theoretical and practical significance for preventing interfirm counterparty risk contagion under the double carbon target.

1. Introduction

In recent years, with the development of the low-carbon economy, the carbon emission trading scheme, as the main measure to achieve emission reduction targets, has achieved positive results in many countries [1]. Counterparty risk has become the main risk faced by market participants and, with the proposal of the “dual carbon” goal, a new counterparty risk contagion has been triggered, and the increasing complexity of carbon trading risk contagion has attracted extensive attention from academic and practical circles [2,3,4]. Therefore, this paper studies the influence mechanism and evolution characteristics of carbon trading risk contagion between firms.

At present, scholars have mainly studied the contagion of counterparty risk from the perspective of traditional finance [5,6,7,8,9,10,11,12]. With the proposed goal of carbon peak and carbon neutrality, green finance has been considered the most important solution [13], and new counterparty risks will be induced in the development of green finance. Therefore, scholars began to study the problem of counterparty risk contagion from the perspective of green finance. At present, studies on green finance have mainly focused on green credit. Ling [14] studied the effect of green credit policies on the investment decisions of firms. They found that green credit policies tend to reduce the investment level of polluting firms but improve their investment efficiency. Zhou [15] empirically analyzed the relationship between bank green loans and credit risk and how China’s green finance regulations contribute to the solvency of individual banks and the resilience of the financial system. They found that the correlation between the proportion of banks’ green loans in their overall loan portfolio and their credit risk depends critically on the size and structure of state-owned holdings. However, there is less research on carbon trading, and the only research focuses on the emission reduction benefits of carbon trading policies. Song [16] used the difference-in-difference model to test whether the carbon trading systems can improve energy efficiency through a quasi-natural experiment. However, ignoring the impact of carbon counterparty risk contagion on firms, this paper studies the contagion of carbon counterparty risk at the firm level from the perspective of green finance, which is the first innovation point in this paper.

As the most important emission reduction strategy, carbon trading has always been the focus of scholars’ research, and in recent years, research on carbon trading has mainly focused on the emission reduction benefits of carbon trading and the factors of carbon trading risks. Wang [17] conducted an empirical test based on the data of 30 provincial samples in China from 2011 to 2020, using the dynamic spatial econometric model and system GMM estimation method, and analyzed digital trade and carbon emissions; the moderating effects of industrial agglomeration and carbon emissions trading mechanisms on the effects of digital trade on carbon emission reduction are also covered. Zhou [18] took Beijing as an example, while this paper selects six indexes, including macroeconomic factors, energy market factors, climate environmental factors, and international market factors—which affect carbon emission trading prices—and establishes an appropriate VAR model for the analysis of carbon emission trading prices in Beijing. Few scholars have studied carbon trading risk contagion. Dong [19] adopted a data-driven factor analysis strategy by introducing the Fuzzy Cognitive Maps (FCM) model to establish a carbon market network and identify risk-related factors, and evaluated the carbon market’s risk level and spillover effects. They found that five factors which influenced carbon market risk emerged from the FCM, including OIL, COAL, SP500ENERGY, SPCLEANENERGY, and GPR, and they also found a notable rise in risk spillover from GPR to EUA during the Russia–Ukraine conflict and an escalation of total cross-market spillover during extreme events. However, the impact of other financial market fluctuations on the carbon trading market is often ignored, so this paper studies the risk contagion of carbon counterparties between firms from the perspective of asset price reduction, which is the second innovation point of this paper.

Complex networks can better describe the interrelation among various agents and truly describe and simulate the complex risk contagion mechanism [20,21]. At present, many counterparty risks have been analyzed with the help of complex networks, representative of which are the following examples. Chen and He [22] proposed the network model of credit risk contagion and studied the influence mechanism of investor behavior and network structure on credit risk contagion. Chen [23] constructed the SIRS model of counterparty credit risk contagion and analyzed the influence, mechanism, and evolution characteristics of the counterparty credit network structure and its heterogeneity, counterparty behavior preference, counterparty fitness, and regulatory rescue strategy on counterparty credit risk contagion in the CRT market. On the basis of an epidemic model, Wang [4] established its network model by considering investor behavior and information disclosure strategy, and they analyzed the mechanism of counterparty credit risk contagion. However, when the network model is constructed in this paper, the relationship among the nodes is related through the scoring system, which is different from previous studies. The association of firms through the scoring system can more truly reflect the relationship between various entities in the real trading market, as well as the phenomenon that firms are more inclined to trade with large firms.

To sum up, from the perspective of green finance and on the basis of the asset sale, this article analyzes the transmission mechanism of the carbon quota counterparty risk, a network model of the risk contagion of carbon quota counterparties is constructed based on complex network theory, and the evolutionary characteristics of the risk formation effect and contagion effect of carbon quota counterparty are analyzed by means of MATLAB R2019a software numerical simulation. The contributions of this paper are as follows. (1) This paper studies carbon quota counterparty risk from the perspective of green finance, which is different from that of traditional finance. (2) From the perspective of green finance and on the basis of asset price reduction, this paper studies the evolution characteristics of the risk contagion of carbon quota counterparties, which is different from the existing studies that only focus on the influence of carbon trading on firms, financial markets, and industry structure on the emission reduction efficiency. (3) Different from the previous studies that used power law distribution to associate network nodes, this paper uses an interfirm scoring system to associate interfirm network nodes, which makes the counterparty credit network more consistent with reality and reduces the conclusion deviation caused by the deviation of the counterparty credit network from reality. (4) This paper obtains novel conclusions with theoretical values. In the interfirm debt network, the price sensitivity of firms to the sale of financial assets, the proportion of rational investors in the financial market, the probability of credit risk contagion of the carbon quota among firms, and the cumulative proportion of assets sold have a marginally decreasing phenomenon on the formation of the carbon quota counterparty risk, whereas the corporate carbon performance has a marginally increasing phenomenon. Corporate carbon risk awareness and the carbon quota trading price have a marginally decreasing effect on the risk contagion of carbon quota counterparties, whereas corporate carbon performance and the total score of interfirm assessment have a marginally increasing effect. Under the cross-effects of various factors, the proportion of rational investors in the financial market has the greatest influence on the risk of carbon quota counterparties, whereas corporate carbon performance has the least. Corporate carbon risk awareness has the greatest effect on the risk contagion effect of carbon quota counterparties, whereas the trading price of the carbon quota has the least influence on the risk contagion effect. The total score of interfirm assessment has a great effect on the trend and range of the risk contagion of carbon quota counterparties. (5) This study not only enriches the theoretical research results of carbon quota counterparty risk, but also provides practical suggestions for governments and firms to prevent and control carbon quota counterparty risk contagion.

The rest of this paper is organized as follows. Section 2 constructs an interfirm debt network model. Section 3 presents an interfirm model of the risk contagion of carbon quota counterparties. Section 4 analyzes, theoretically, the formation and contagion mechanism of carbon quota counterparty risks. Section 5 analyzes the evolutionary characteristics of the formation and contagion of carbon quota counterparty risks. Section 6 summarizes the conclusions of this paper.

2. Interfirm Debt Network Model

2.1. Corporate Balance Sheets

Suppose there exist firms in the interfirm market, and each firm’s assets consist of carbon quota accounts receivables , trading financial assets , and cash ; and the firm’s liabilities comprise carbon quota accounts payable and trading financial liabilities . The owner’s equity of a firm is equal to assets minus liabilities (). The owner’s equity is also the capital buffer of the firm. When the loss of the firm is greater than the owner’s equity of the firm, the firm is insolvent () and will default. The structure of the corporate capital sheet in this paper is shown in Table 1.

Table 1.

Corporate balance sheet.

In the interfirm market, the changes in the balance sheet and the characteristics of the interfirm network structure are affected by the carbon quota trading decisions among firms. That is, firms make decisions on whether carbon quota trading occurs among firms based on the carbon quota ratio in the balance sheet to the target ratio of corporate carbon quotas . If , then the firm will choose to sell the carbon quota and increase carbon quota accounts receivables; otherwise, if , then the firm will choose to purchase the carbon quota and increase the carbon quota accounts payable. Carbon quota ratio is expressed as the ratio of carbon quota accounts receivables to carbon quota accounts payable, shown as follows:

2.2. Interfirm Debt Network

Firm networks with customer–supplier, licensee–licensor, and strategic alliances have the characteristics of a scale-free network structure, and the degree distribution of firm credit network follows the power law distribution [24,25,26]. On the basis of the above research, this paper constructs an interfirm debt network model. The network model takes the firm as the network node, the number of nodes in the interfirm market represents the number of firms, and the interfirm debt network has nodes.

By using the agent-based modeling (ABM) method of American finance to describe the interfirm debt network, the firms are divided into large firms and small firms. Particularly, large firms are the first choice for seeking counterparties due to their large scale and abundant assets, which are in a dominant position in the economy and have more carbon emission indexes allocated by the state. The capital and technology of small firms are weak, and the carbon emission index allocated by the country is less than that for large firms. The edge of the interfirm debt network is abstracted from the carbon quota debt relationship among firms, the degree of nodes is the number of other nodes connected to the node in the network, and the degree distribution of the network is .

The debt relation of the carbon quota among firms forms the debt network, which is represented by the following adjacency matrix:

At that time, when , firm is the creditor of firm , and firm is in the debt of firm . When , no debt relationship exists between firm and . Moreover, firms will not have a debt relationship with themselves, that is, . and represent the number of debt firms and creditor firms of firm , respectively. The default of interfirm debt affects the creditor through the adjacency matrix. When the creditor suffers losses or goes bankrupt, the risk will be transmitted to the interfirm debt network.

3. Construction of a Counterparty Risk Contagion Model for Carbon Quota Trading among Firms

For a firm, when the owner’s equity , the firm will default. Given that the owner’s equity of the firm is equal to its assets minus its liabilities, then:

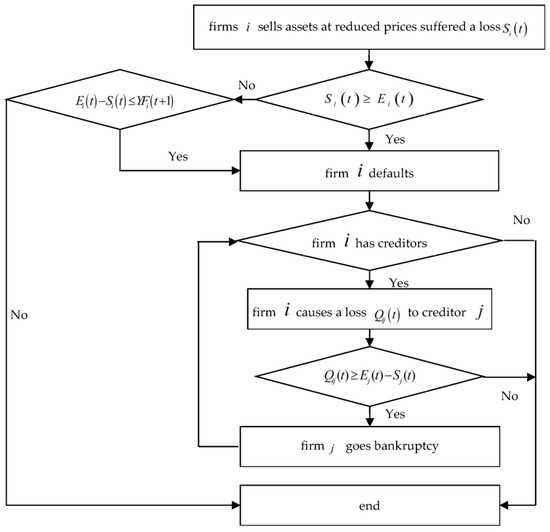

Given that the loss of assets is an important cause of firm bankruptcy, this paper focuses on the influence of capital loss of firms due to asset reduction on the entire firm system. The loss can be considered to be caused by the need to repay interfirm debts and stabilize the liquidity of corporate assets. The loss is also influenced by other factors such as investor sentiment, carbon trading, and carbon performance, which prompts the company to sell its financial assets at less than their value. Carbon performance refers to the performance of corporate carbon management, that is, the comprehensive assessment of the development and implementation of corporate carbon policies, carbon emission reduction targets, carbon management-related education, carbon management R&D capability, carbon emission intensity, and carbon disclosure degree [27]. The sale of financial assets by firms affects the payment of carbon quota trading accounts among firms, thereby forming interfirm carbon quota counterparty risk and triggering risk contagion through the interfirm debt network. The contagion process is shown in Figure 1.

Figure 1.

Flowchart of credit risk formation process among carbon quota counterparties.

3.1. Fire Sale of Firm Assets

In order to maintain the normal operation of the firm, the firm will choose to sell its financial assets, and the market reprices the financial assets that are sold. The sensitivity of firms to asset prices reflects the perception and reaction degrees of transaction subjects to asset price changes [28]. Therefore, this paper constructs an asset pricing model based on the differences in sensitivity of firms to asset prices. Moreover, in view of the fact that the asset price sensitivity will affect the scale of the fire sale of firms, it will also affect the repricing of assets in the financial market. The factors which affect the asset price sensitivity are as follows. First, the proportion of rational investors: under the condition of asymmetric information, investors in the financial market are divided into rational investors and uninformed emotional investors. The larger the proportion of rational investors is, the more efficient the financial market will be [29,30,31]. At this point, the more sensitive firms are more likely to be susceptible to the changes in the market price of their assets. Second, the greater the credit risk contagion probability of carbon quota trading among firms is, the greater the effect on the ability and risk preference of firms to withstand market price volatility risks will be and the more sensitive firms will be to market prices [32,33]. Finally, high carbon performance can promote the improvement of firms’ financial performances. The greater the corporate carbon performance is, the lower the sensitivity of the asset prices of firms will be [34,35]. Therefore, the firm sensitivity function to asset prices can be set as follows:

The demand function for asset price changes caused by supply and demand is an exponential function [28]. The asset inverse demand function is used to determine the price at which firm sells a certain transactional financial asset at moment . Then, after asset reduction, the price of asset sold at moment can be expressed as follows:

where is the initial price of asset , denotes the cumulative proportion of asset sold, and is the market capacity of an asset as a percentage of the market’s absorbable assets.

Moreover, the loss of firm caused by the price reduction of assets at moment through the price of assets can be expressed as .

Particularly, other current assets contain types of assets.

3.2. Construction of the Relationship of Carbon Quota Debt among Firms

According to Section 3.1, the asset loss caused by firm at moment can be known. When , firm goes bankrupt. When , firm will not go bankrupt but will default due to its inability to pay off its carbon quota liabilities. Then, in both cases, firm will cause certain losses to the creditor with which it has a carbon quota business contact. The process of establishing a carbon quota debt relationship between firm and its creditor is described as follows.

According to the score system, the firm evaluates the scale of its counterparty and its relationship with the counterparty. In addition, the firm decides on the carbon quota trading among firms through the scale score and relationship score . It also selects a more suitable counterparty to establish a new debt relationship and realizes the asset flow and balance sheet update of the firm.

(1) The scale score is calibrated by comparing the size of the firm with the average size of existing counterparties. Firms are more inclined to establish interfirm market relations with large firms. Firm ’s scale evaluation of firm at moment can be expressed as follows:

(2) The relationship score describes a preference of whether to continue business with the existing counterparties. The relationship evaluation of firms and in period can be expressed as follows:

where the memory decay function is .

(3) The total amount of carbon quota sold by firm to firm is determined according to the total score system of the interfirm evaluation. The total evaluation score determines the amount of carbon quota that the creditor will sell to the debt firm. The total score between the firms and is expressed as follows:

where is the weight of the relationship score.

Equations (7)–(12) describe how to establish a new debt relationship among firms, and reflects the debt relationship, the flow of capital, and the daily financial and operational activities among firms.

3.3. Risk Contagion Process of Carbon Quota Counterparties

This paper mainly considers the influence of the government and firms on the establishment of carbon quota trading among firms to form a new debt relationship. The main influencing factors include the following. First, the trading price of carbon quota : under the carbon tax–carbon trading hybrid policy, the higher the trading price of the carbon quota is, the greater the substitution effect of a carbon tax on carbon emission trading and the smaller the probability of establishing a carbon quota debt relationship among firms will be [36,37]. Second, the carbon risk awareness : carbon risk awareness refers to a firm’s ability to proactively identify carbon-related risks and seriously consider their potential consequences. The greater the carbon risk awareness is, the stronger the firm’s ability to identify carbon-related risks and the smaller the probability of establishing a carbon quota debt relationship among firms will be [38]. Third, carbon performance : the larger the carbon performance is, the more carbon quota will be left and the higher the probability of trading carbon quota will be [32,33,39]. Fourth, the interfirm assessment scores : the greater the interfirm assessment score is, the greater the probability of carbon quota trading will be [40].

Therefore, the probability of establishing a new debt relationship of carbon quota among firms , that is, the probability that defaulting firms transmit carbon quota counterparty risk to creditor firms , can be expressed as follows:

(1) Scenario 1

If , then firm defaults. That is, at moment , the firm is unable to pay off the debt, and forms a carbon quota counterparty risk.

This paper assumes that the defaulting firm causes the same loss to its creditor. The loss caused by the defaulting firm to its creditor can be expressed as follows:

If and , then firm defaults due to the risk contagion of carbon quota counterparties. In this case, firm will continue to transmit the carbon quota counterparty risk to its associated creditors until no new defaulting firm exists.

(2) Scenario 2

If , then firm defaults due to its failure to repay carbon quota liabilities in full. The loss caused by the defaulting firm to its creditor can be expressed as follows:

(3) Scenario 3

If and , then firm maintains its liquidity by selling its financial assets at a discount due to its insufficient liquidity. represents the current assets of the firm at moment . represents the threshold value of the current assets of the firm at moment , which can be expressed by , where is the threshold value of the liquidity of the firm and represents the influence of asset price reduction on the current assets of the firm. If and , then the firm sells its financial assets at a reduced price for debt repayment and keeps its current assets at no lower than the threshold. Then, the current assets required by firm to repay its debt can be expressed as .

(4) Scenario 4

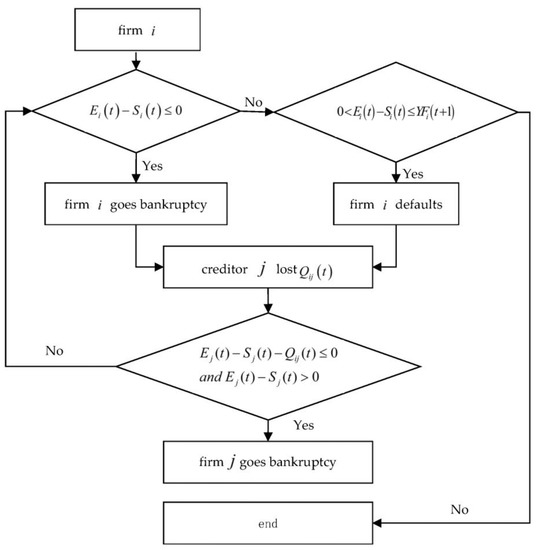

To solve the short-term liquidity problem of firms, firm chooses to sell its financial assets at a reduced price at moment , resulting in losses . If , then firm will be bankrupted and liquidated. When the bankrupt firm cannot repay the accounts payable of the creditor, the creditor of the bankrupt firm will suffer losses . If and , then the firm will also go bankrupt, thus forming default contagion among firms. Firm is bankrupted and liquidated, causing losses to its creditors . Similarly, when and , the firm will go bankrupt. If new bankruptcies occur among creditors of the firm , credit risk will continue to be passed on until the risk is completely absorbed and no new bankruptcies will be formed. The credit risk contagion process among carbon quota counterparties is shown in Figure 2.

Figure 2.

Flowchart of credit risk contagion process among carbon quota counterparties.

4. Analysis of the Mechanism of Carbon Quota Counterparty Risks

In the interfirm network, the loss caused by the fire sale of financial assets will not only affect the formation of carbon quota counterparty risk among firms but also the size of the credit risk. Suppose that the loss of assets of firms is used to measure the credit risk of carbon quota counterparties among firms [41].

4.1. Analysis of the Mechanism of Risk Formation of Carbon Quota Counterparty Risks

Asset price reduction affects the solvency of firms, thereby causing a counterparty risk of carbon quotas among firms, and the greater the difference between the current price of assets sold in finance and the initial price, the greater the impact of selling at a reduced price will be on firms. At the same time, the sensitivity and rationality of firms to asset prices affect the decision of firms to sell assets at a reduced price and the scale of assets sold, thereby affecting the losses caused by the sale of assets at a reduced price. In addition, the counterparty risk of the carbon quota affects the related firms, which further affects the solvency of firms and causes the risk of carbon quota counterparties among firms. Thus, Theorem 1:

Theorem 1.

The marginal utility of the loss caused by the price of financial assets sold , the sensitivity of asset prices , the proportion of rational investors , and the possibility of credit risk contagion in carbon quota trading among firms all show a decreasing trend. The marginal utility of corporate carbon performance on the loss caused by the price reduction of financial assets shows an increasing trend.

Proof.

On the basis of Equations (16)–(20), the sale financial asset prices , the firm asset price sensitivity , the proportion of rational investors, and the possibility of credit risk contagion in carbon quota trading among firms is the monotonically decreasing function of loss on sale firm financial assets. According to Equation (20), to determine whether is equal to 0, assume that . The three cases where the deterministic formula exists are . When , that is, , If has no real root and . then . At this time, the loss caused by the fire sale of financial assets is a monotonically increasing function regarding the corporate carbon performance . When , that is, , has a real root and solves for . Moreover, if and , then ; at this time, the loss caused by the fire sale of financial assets is a monotonically increasing function regarding the corporate carbon performance . When , that is, , has two real roots and solves for , . If . and , then ; at this time, the loss caused by the fire sale of financial assets is a monotonically increasing function regarding the corporate carbon performance . Therefore, Theorem 1 is proved. □

According to Theorem 1, effectively controlling the price of the financial assets sold, the carbon performance, and the probability of risk contagion in carbon quota trading among firms, and improving the price sensitivity of firm assets and the proportion of rational investors, can effectively reduce the losses caused by asset price reductions, and reduce the counterparty risks of firms.

4.2. Analysis of the Mechanism of Risk Contagion of Carbon Quota Counterparties

The higher the awareness of the carbon risk is, the stronger the company’s ability to deal with carbon-related risks will be in the future, reducing the contagion of carbon counterparty risks. A firm’s evaluation of counterparties affects the firm’s decision-making regarding carbon trading, and the firm’s evaluation of the counterparty reflects the willingness of the firm to bear the risk of carbon allowance trading, thereby affecting the price of carbon trading. At the same time, since carbon performance reflects a series of measures taken by firms for emission reduction, a high carbon performance reflects the degree of correlation of the carbon trading of firms to a certain extent, which may affect the risk contagion channel of carbon quota counterparties, and then affect the risk contagion of carbon quota counterparties. Thus, Theorem 2 and Theorem 3:

Theorem 2.

The marginal utility of carbon risk awareness on the credit risk contagion probability of the carbon quota among firms is decreasing and convex. When , the marginal utility of carbon quota trading price on the probability of credit risk contagion of carbon quota shows a decreasing trend. When , the marginal utility of carbon quota trading price on the probability of credit risk contagion of carbon quota shows an increasing trend.

Proof.

According to Equations (21) and (22), the probability of credit risk contagion of the carbon quota among firms is a monotonically decreasing concave function regarding carbon risk awareness . Equation (23) shows that . When , the probability of credit risk contagion of the carbon quota among firms , is a monotonically decreasing function regarding the trading price

of the carbon quota. When , the probability of credit risk contagion of the carbon quota among firms

is a monotonically increasing function regarding the trading price of the carbon quota. Therefore, Theorem 2 is proved. □

Theorem 3.

When , the marginal utility of carbon performance on the probability of credit risk contagion of the carbon quota among firms is increasing and concave; when , the marginal utility of carbon performance on the probability of credit risk contagion of the carbon quota among firms is decreasing and concave. When , in the interval , the marginal utility of carbon performance on the probability of credit risk contagion of the carbon quota among firms is increasing and convex. In the interval , the marginal utility of carbon performance on the probability of credit risk contagion of the carbon quota among firms is increasing and concave. The marginal utility of interfirm assessment score on the probability of credit risk contagion of the carbon quota among firms is increasing and concave.

Proof.

Let and . When , , then takes the maximum value of at on the interval of , . When , , . According to Equations (24) and (25), ; therefore, when , the probability of credit risk contagion of the carbon quota among firms is a monotonically increasing convex function regarding carbon performance . When and , then takes the maximum value of at on the interval of , and there exists two situations: . When and , then . At this time, the credit risk contagion probability of the carbon quota among firms is a monotonically decreasing convex function regarding carbon performance . When , has a unique zero point ; thus, on the interval of . Then, the probability of credit risk contagion of the carbon quota among firms is a monotonically decreasing concave function regarding carbon performance . When on the interval of , the credit risk contagion probability of the carbon quota among firms is a monotonically decreasing convex function regarding carbon performance . In conclusion, the monotonicity and convexity of the probability of credit risk contagion of the carbon quota among firms on carbon performance can be proven to be related to the interfirm assessment scores.

Similarly, let , , and . Then, takes the maximum value of at on the interval of , and . At this time, and . Therefore, the credit risk contagion probability of the carbon quota among firms is a monotonically increasing convex function of the evaluation score among firms. Therefore, Theorem 3 is proved. □

According to Theorems 2 and 3, to effectively control the risk contagion of carbon quota trading among firms, firms should improve their awareness of carbon risks and carbon performance, focus on screening and evaluating the assets and credits of carbon quota counterparties while improving their carbon performance, cooperate with the government’s macro adjustment of trading price carbon allowances, and choose an appropriate carbon trading strategy.

5. Simulation Analysis

On the basis of the risk contagion research model of carbon quota counterparties, a numerical simulation analysis of the evolution characteristics of the risk contagion of carbon quota counterparties is conducted based on the asset discount using MATLAB R2019a software. The baseline value of the parameters is determined according to the literature [21,28,29,30,31,36,37,40,42,43]. Suppose that the scale of firm asset losses is used to measure the credit risk of carbon quota counterparties among firms [41]. The specific benchmark values of each parameter are shown in Table 2.

Table 2.

Benchmark values of parameters.

5.1. Formation Effect of Carbon Quota Counterparty Risk

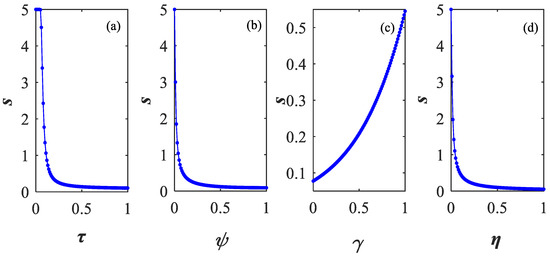

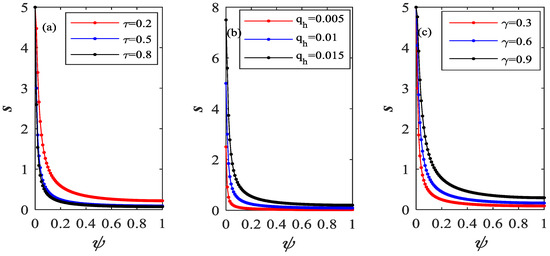

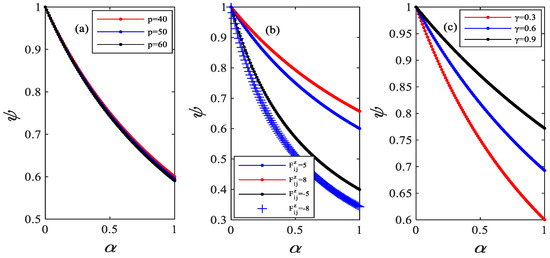

The effects of the following evolutionary characteristics with different parameter values on the counterparty risk evolution are determined via simulation: the formation effect of the carbon quota counterparty risk, the proportion of rational investors through financial markets , the probability of credit risk contagion of the carbon quotas among firms , the corporate carbon performance , the price sensitivity of the firm to the sale of financial assets , the cumulative proportion of class assets sold , and the initial market price of class assets .

Figure 3 depicts the correlation between the size of the carbon quota counterparty risk and the proportion of rational investors in the financial market, the probability of credit risk contagion of carbon quota among firms, the corporate carbon performance, and the price sensitivity of firms to the sale of financial assets. Figure 3 also verifies the conclusion of Theorem 1. According to Figure 3a–d, the carbon quota counterparty risk in the interfirm debt network presents a decreasing marginal feature with the increase in the proportion of rational investors in the financial market , the probability of credit risk contagion of the carbon quota among firms and the sensitivity of firms to the price of financial assets sold , and an increasing marginal feature with the increase in the corporate carbon performance . Moreover, when the proportion of rational investors is less than 0.2 and the credit risk contagion probability of the carbon quotas among firms is less than 0.1, or when the sensitivity of firms to the price of financial assets sold is less than 0.2, the carbon quota counterparty risk accelerates in the interfirm debt network. Otherwise, when the value exceeds the threshold, the variation range of the carbon quota counterparty risk becomes smaller in the interfirm debt network. Thus, the strategy of information disclosure, the credit risk contagion probability of carbon quotas among firms, and the price sensitivity of firms to the sale of financial assets considerably affect the formation of carbon quotas between counterparty risks in the market. If the effective prevention and management of carbon quota trading risks are to be achieved, then the government should be encouraged to market information, and firms should be reasonable, avoid blindly following, and adhere to the sensitivity of asset prices to reduce unnecessary losses. As shown in Figure 3c, the carbon quota counterparty risk shows a marginally increasing feature with the increase in the carbon performance in the interfirm debt network. Moreover, the variation range of the carbon quota counterparty risk is accelerated in the interfirm debt network; however, the overall variation range of the carbon quota counterparty risk is not obvious. Thus, the carbon performance in the interfirm network significantly improves financial performance, helps firms reduce costs, and increases the cost of firm technology; however, evidently, firm investment in new technology costs less than the benefits that the new technology will bring. As a result, the influence of the corporate carbon performance on the risks caused by firms is not obvious, and the overall change in the carbon quota counterparty risk is also not evident.

Figure 3.

Single effect of different influencing factors on carbon quota counterparty risk. (a) the effect of the proportion of rational investors on carbon quota counterparty risk; (b) the effect of the probability of credit risk contagion of the carbon quota among firms on carbon quota counterparty risk; (c) the effect of the corporate carbon performance on carbon quota counterparty risk; (d) the effect of the sensitivity of firms to the price of financial assets sold on carbon quota counterparty risk.

Moreover, as shown in Figure 3, the influence of the proportion of rational investors in the financial market, the probability of credit risk contagion of the carbon quota among firms , the corporate carbon performance and the sensitivity of firms to the price of financial assets sold on the formation of the carbon quota counterparty risk are mainly reflected in the change in the size of the losses suffered by firms due to asset price reductions in the interfirm debt networks. Conversely, the risk of carbon quota counterparties shows a gradual trend of extinction in interfirm debt networks. Thus, the single influencing factor of credit risk in carbon quota trading cannot play a leading role in the formation of carbon quota counterparty risk in the firm debt network. If the strategy of preventing and controlling the carbon quota counterparty risk is based on a single influencing factor, then it can easily cause deviation and has a limited effect.

Figure 4 depicts the correlation between the size of the carbon quota counterparty risk and the price sensitivity of financial assets. When the initial market price of the class assets and the cumulative proportion of class assets sold interact with the price sensitivity to the selling of financial assets , the carbon quota counterparty risk in the interfirm debt network increases with the increase of the initial market price of the asset and the cumulative proportion of class assets sold. However, generally, the carbon quota counterparty risk decreases with the increase in the firm’s sensitivity to the price of the financial assets sold. From Figure 4a,b, it can be seen that the initial market price of the financial assets and the cumulative proportion of the assets sold interact with sensitivity to selling the financial asset price in the interfirm debt network, and that the changes in the initial market price of the financial assets sold and the cumulative proportion of assets sold do not have significant effects on the carbon quota counterparty risk. This finding indicates that, when the government and firms develop strategies to prevent and control the risks of carbon quota trading, the government’s macro-control of the carbon quota price in the market can prevent and defuse the carbon quota counterparty risks to a certain extent, although it will not be evident. The change in the cumulative proportion of assets sold by firms is more evident than the effect of regulating the price of the carbon quota. Moreover, firms reduce the sale of financial assets, decrease the saturation of assets in the market, and adjust the relationship between supply and demand in the market to a certain extent. Therefore, firms reduce the cumulative proportion of assets sold, which has a certain effect on preventing and mitigating carbon quota counterparty risks.

Figure 4.

The interaction between different influencing factors and the price sensitivity to selling financial assets on carbon quota counterparty risk. (a) the interaction between the initial market price of the class assets and the price sensitivity to selling financial assets on carbon quota counterparty risk; (b) the interaction between the cumulative proportion of class assets sold and the price sensitivity to selling financial assets on carbon quota counterparty risk.

Figure 5 depicts the correlation between the size of the carbon quota counterparty risk and the probability of credit risk contagion of the carbon quota among firms when the proportion of rational investors in the financial market, the cumulative proportion of class assets sold, and the corporate carbon performance interact with the probability of the risk contagion of the carbon quota counterparties among firms. According to Figure 5a–c, it can be seen that the carbon quota counterparty risk decreases with the increase in the proportion of rational investors in financial markets, and increases with the increase in the cumulative proportion of assets sold and the corporate carbon performance in the firm debt network. However, with the increase in the probability of contagion of the carbon quota counterparty risk between firms, the risk of carbon quota counterparty risk increases and shows the characteristics of marginal decline. In the firm debt network, when the financial market proportion of rational investors , the cumulative proportion of class assets sold , and the corporate carbon performance interact with the contagion probability of the carbon credit counterparty risk, the interactions of corporate carbon performance and the contagion probability of the carbon quota counterparty risk on the risk of carbon quota counterparties are more obvious. However, in general, the changes in the proportion of assets sold, the proportion of rational investors in the financial market, and the corporate carbon performance do not have obvious effects on the risk of carbon quota counterparties. Hence, corporate carbon performance has a significantly positive incentive for firms to improve their financial performance, and a high-carbon performance can help firms to reduce financing costs, reduce losses, and hedge risks to a certain extent. These findings are consistent with the analysis in Figure 3c.

Figure 5.

The interaction between different influencing factors and the probability of credit risk contagion of the carbon quota among firms on carbon quota counterparty risk. (a) the interaction between the proportion of rational investors and the probability of credit risk contagion of the carbon quota among firms on carbon quota counterparty risk. (b) the interaction between the cumulative proportion of class assets sold and the probability of credit risk contagion of the carbon quota among firms on carbon quota counterparty risk; (c) the interaction between the corporate carbon performance and the probability of credit risk contagion of the carbon quota among firms on carbon quota counterparty risk.

Figure 6 depicts the correlation between the size of the carbon quota counterparty risk and corporate carbon performance when the proportion of rational investors in the financial market, the cumulative proportion of class assets sold, and the probability of credit risk contagion of the carbon quota among firms interact with the corporate carbon performance. When the financial market proportion of rational investors , the cumulative proportion of class assets sold , and the contagion probability of the carbon quota counterparty risk interact with corporate carbon performance , in the interfirm debt network, the risk of carbon quota counterparties decreases with the increase in the proportion of rational investors and the probability of contagion of carbon quota counterparties, and increases with the cumulative proportion of assets sold. According to Figure 6a–c, it can be seen that the risk of carbon quota counterparties shows marginally increasing characteristics with the increase in corporate carbon performance. In addition, the smaller the proportion of the rational investors in the financial market and the contagion probability of carbon quota counterparty risk among firms is, the larger the variation range of the carbon quota counterparty risk in the interfirm debt network will be. The smaller the cumulative proportion of assets sold is, the smaller the variation range of the carbon quota counterparty risk in the interfirm debt network will be. Thus, the larger the risk contagion probability of the carbon quota counterparty among firms and the proportion of rational investors in the financial market are, the more sensitive firms will be to asset prices and in the selection of and decision-making regarding counterparties. And the greater the degree of information disclosure is, the more transparent the information of the counterparties will be. The effects of counterparties on the formation of carbon quota counterparty risk in the interfirm debt network are gradually reduced. Therefore, when the proportion of rational investors in the financial market and the risk contagion probability of the carbon quota counterparty among firms is large, the formation of carbon quota counterparty risk in the interfirm debt network is less affected by the corporate carbon performance.

Figure 6.

The interaction between different influencing factors and corporate carbon performance on carbon quota counterparty risk. (a) the interaction between the proportion of rational investors and the corporate carbon performance on carbon quota counterparty risk. (b) the interaction between the cumulative proportion of class assets sold and the corporate carbon performance on carbon quota counterparty risk; (c) the interaction between the probability of credit risk contagion of the carbon quota among firms and the corporate carbon performance on carbon quota counterparty risk.

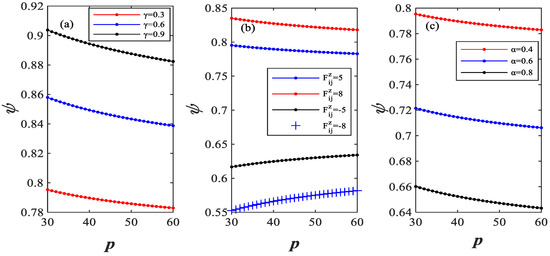

Figure 7 depicts the correlation between the size of the carbon quota counterparty risk and the proportion of rational investors in the financial market when the corporate carbon performance, the cumulative proportion of class assets sold, and the contagion probability of the carbon quota counterparty risk among firms interact with the proportion of rational investors in the financial market. When the corporate carbon performance , the cumulative proportion of class assets sold , and the contagion probability of carbon quota counterparty risk between firms interact with the proportion of rational investors in the financial market, the risk of carbon quota counterparties increases with the increase in corporate carbon performance, the cumulative proportion of assets sold, and the probability of contagion of the carbon quota counterparties among firms. According to Figure 7a–c, it can be seen that the risk of carbon quota counterparties shows a marginal decline with the increase in the proportion of rational investors in the financial market. Furthermore, when the corporate carbon performance, cumulative proportion of assets sold, and contagion probability of carbon quota counterparty risk among firms are kept at a small state, they interact with the proportion of rational investors in the financial market. If the proportion of rational investors in the financial market is less than 0.1, then the risk of carbon quota counterparties among firms will not change with the proportion of rational investors in the financial market. Generally, the counterparty risk of carbon quota trading among firms is greatly affected by the proportion of rational investors in the financial market. This finding indicates that, in the initial stage of credit events, the disclosure degree of information about credit events tends to be consistent for the counterparties in financial markets, and the degree of market information circulation and disclosure, as well as investor sentiment, have greater effects on the risk of carbon quota counterparties. At the same time, the proportion of rational investors in the financial market has a greater influence on the risk of carbon quota counterparties among firms, and the government can implement strategies based on the information disclosure degree and investor sentiment to prevent and resolve the carbon quota counterparty risks among firms, and these strategies will work more effectively.

Figure 7.

The effects of interaction between different influencing factors and the proportion of rational investors on carbon quota counterparty risk. (a) the interaction between the corporate carbon performance and the proportion of rational investors on carbon quota counterparty risk. (b) the interaction between the cumulative proportion of class assets sold and the proportion of rational investors on carbon quota counterparty risk; (c) the interaction between the probability of credit risk contagion of the carbon quota among firms and the proportion of rational investors on carbon quota counterparty risk.

In sum, Figure 4, Figure 5, Figure 6 and Figure 7 verify Theorem 1. The figures indicate that, in the interfirm debt network, the proportion of rational investors in the financial market has the greatest influence on the formation of the carbon quota counterparty risk, followed by the influence of the sensitivity of firms to the sale of financial assets on the formation of the carbon quota counterparty risk; corporate carbon performance has the least influence on the formation of the carbon quota counterparty risk. Thus, information disclosure and investor sentiment are crucial to firms in trading, and the more complete the information held by the firm is, the more rationally the state will be maintained, and, thus, the decisions made by the firm can avoid losses caused by the risks. However, the positive incentive effect of carbon performance on corporate financial performance will make firms fall into the illusion of good financial condition, but it will only temporarily cause insensitivity of firms to the price of selling financial assets. Nevertheless, corporate carbon performance generally has a positive effect on corporate financial performance, and the losses caused to firms are negligible.

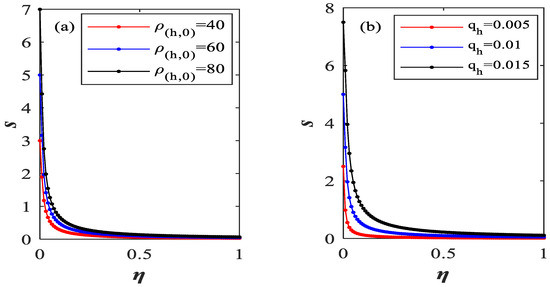

5.2. Risk Contagion Effect of Carbon Quota Counterparties

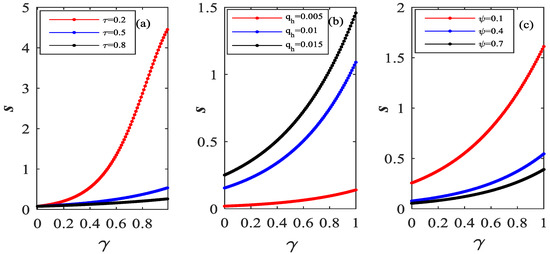

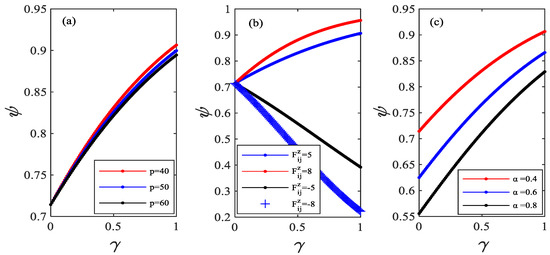

In order to describe the evolution characteristics of the risk contagion effect of carbon quota counterparties, the evolution characteristics of the risk contagion effect of carbon quota counterparties are simulated by different parameter values of the carbon risk awareness , carbon quota trading price , corporate carbon performance , and total score of interfirm assessment .

Figure 8 depicts the correlation between the risk contagion probability of carbon quota counterparties and the corporate carbon risk awareness, the trading price of carbon quota, the corporate carbon performance, and the total score of interfirm assessment. It also verifies some of the conclusions of Theorems 2 and 3. As shown in Figure 8a,b, the risk contagion probability of the carbon quota counterparty in the interfirm debt network shows a decreasing marginal feature with the increase in the carbon risk awareness and carbon quota trading price . As shown in Figure 8c,d, the risk contagion probability of the carbon quota counterparty in the interfirm debt network shows a marginally increasing feature with the increase in the carbon performance and the total score of interfirm assessment . The analysis of Figure 8 shows that the probability of the risk contagion of carbon quota counterparties does not start from 0, and the variation range of the carbon quota counterparty risk in the interfirm debt network does not change significantly. Hence, the influencing factors of the credit risk contagion of single carbon quota transactions cannot play a leading role in the influence of the risk contagion of carbon quota counterparties in the interfirm debt network. Moreover, if the strategy of preventing and controlling the risk contagion of carbon quota counterparties is based on a single influencing factor, then it can easily cause deviation and has a limited effect.

Figure 8.

Single effect of different influencing factors on the risk contagion effect of carbon quota counterparties. (a) the effect of the corporate carbon risk awareness on the risk contagion effect of carbon quota counterparties; (b) the effect of the carbon quota trading price on the risk contagion effect of carbon quota counterparties; (c) the effect of the corporate carbon performance on the risk contagion effect of carbon quota counterparties; (d) the effect of the total score of interfirm assessment on the risk contagion effect of carbon quota counterparties.

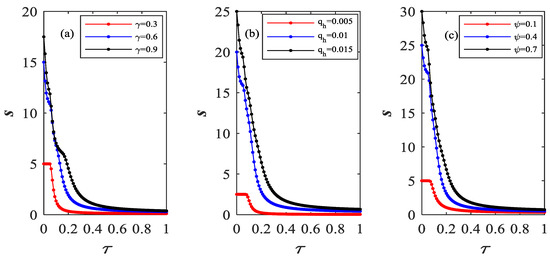

Figure 9 depicts the correlation between the risk contagion probability of carbon quota counterparties and the corporate carbon risk awareness when the trading price of the carbon quota, the total score of the interfirm assessment, and the corporate carbon performance interact with the corporate carbon risk awareness. Figure 9 also verifies part of the conclusion of Theorem 2. According to Figure 9, when the trading price of the carbon quota , the total score of the interfirm assessment , and the corporate carbon performance interact with the corporate carbon risk awareness , the risk contagion probability of the carbon quota counterparties in the interfirm debt network presents a decreasing marginal feature with the increase in the corporate carbon risk awareness. Figure 9a shows that the higher the trading price of the carbon quota is, the higher the risk contagion probability of the carbon quota counterparties will be when the trading price of the carbon quota intersects with corporate carbon risk awareness . However, in the interfirm debt network, the risk contagion probability of the carbon quota counterparties is not significantly affected by the trading price of carbon quota. Figure 9b,c shows that, when the total score of the interfirm assessment and the corporate carbon performance interact with the corporate carbon risk awareness , the higher the total score of interfirm assessment and the higher the corporate carbon performance are, the higher the contagion probability of carbon quota counterparties risk will be. The contagion of the carbon quota counterparties risk changes with the increase in the total score of the interfirm assessment in the debt interfirm network. Thus, a single influencing factor in the debt interfirm network has little impact on the risk contagion effect of carbon quota counterparties. However, with the intersection of the corporate carbon performance and the total score of interfirm assessment, the correlation of debt, such as carbon quotas between firms, has increased, which has a greater effect on the risk contagion of carbon quota counterparties. Conversely, the trading price of the carbon quota is affected by the market supply and demand, and the influence of its change on the risk contagion of carbon quota counterparties tends to be consistent.

Figure 9.

The interaction between different influencing factors and corporate carbon risk awareness on the risk contagion effect of carbon quota counterparties. (a) the interaction between the carbon quota trading price and the corporate carbon risk awareness on the risk contagion effect of carbon quota counterparties; (b) the interaction between the total score of the interfirm assessment and the corporate carbon risk awareness on the risk contagion effect of carbon quota counterparties; (c) the interaction between the corporate carbon performance and the corporate carbon risk awareness on the risk contagion effect of carbon quota counterparties.

Figure 10 depicts the correlation between the risk contagion probability of carbon quota counterparties and the corporate carbon performance when the trading price of the carbon quota, the total score of the interfirm assessment, and the corporate carbon risk awareness interact with corporate carbon performance. Figure 10a,b verifies the conclusion of Theorem 2. As shown in Figure 10a,c, when the trading price of the carbon quota and the corporate risk consciousness interact with the corporate carbon performance in the debt interfirm network, the risk contagion probability of carbon quota counterparties shows a marginal incremental characteristic in the increase in the corporate carbon performance. The higher the trading price of the carbon quota and the carbon risk awareness are, the lower the risk contagion probability of the carbon quota counterparties will be. Moreover, in the debt interfirm network, the risk contagion probability of the carbon quota counterparties does not change significantly because of the influence of the carbon quota trading price and carbon risk awareness. Figure 10b shows that, when the total score of interfirm assessment interacts with the corporate carbon performance and the total score of the interfirm assessment is less than 0, the risk contagion probability of the carbon quota counterparties in the debt interfirm network presents a decreasing marginal feature with the increase in the corporate carbon performance. When the total score of the interfirm assessment is greater than 0, in the debt interfirm network, the risk contagion probability of the carbon quota counterparties shows an increasing marginal feature with the increase in the corporate carbon performance. Moreover, a positive or negative total score of the interfirm assessment will change the trend in the risk contagion of carbon quota counterparties in the debt interfirm network. In addition, when the total score of the interfirm assessment is lower, the change range of the probability of the risk contagion of carbon quota counterparties in the debt interfirm network will accelerate with the change in corporate carbon performance. Thus, when firms trade with firms with small assets and low correlation degrees, firms are more likely to have credit events due to the lack of understanding of counterparties information and the small size of counterparties assets. Given that small-scale firms do not have a strong capital base, firms that trade with them are less resistant to risks. As a result, the risk contagion of the carbon quota counterparties in the debt interfirm network is intensified.

Figure 10.

The interaction between different influencing factors and corporate carbon performance on the risk contagion effect of carbon quota counterparties. (a) the interaction between the carbon quota trading price and the corporate carbon performance on the risk contagion effect of carbon quota counterparties; (b) the interaction between the total score of the interfirm assessment and the corporate carbon performance on the risk contagion effect of carbon quota counterparties; (c) the interaction between the corporate carbon risk awareness and the corporate carbon performance on the risk contagion effect of carbon quota counterparties.

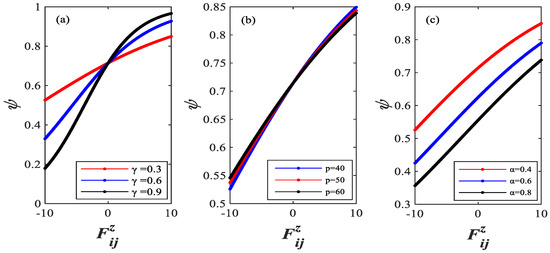

Figure 11 depicts the correlation between the risk contagion probability of carbon quota counterparties and the trading price of the carbon quota when the corporate carbon performance, the total score of the interfirm assessment, and the corporate carbon risk awareness interact with the trading price of the carbon quota. Figure 11a,b verifies Theorem 2. As shown in Figure 11a,c, when the corporate carbon performance and corporate carbon risk awareness interact with the trading price of the carbon quota , the risk contagion probability of the carbon quota counterparties in the debt interfirm network presents a decreasing marginal feature with the increase in the trading price of the carbon quota. The higher the corporate carbon performance is, the higher the risk contagion probability of carbon quota counterparties will be. Further, the higher the carbon risk awareness is, the lower the risk contagion probability of carbon quota counterparties in the debt interfirm network will be. Figure 11b shows that, when the total score of the interfirm assessment interacts with the trading price of the carbon quota , and the total score of interfirm assessment is less than 0, the risk contagion probability of the carbon quota counterparties in the debt interfirm network presents an increasing marginal feature with the increase in the trading price of the carbon quota. When the total score of the interfirm assessment is greater than 0, in the debt interfirm network, the risk contagion probability of the carbon quota counterparties shows a decreasing marginal feature with the increase in the carbon quota trading price. Moreover, when the corporate carbon performance, the total score of the interfirm assessment, and the corporate carbon risk awareness interact with the carbon quota trading price, the change trend in the probability of the risk contagion of carbon quota counterparties in the debt interfirm network does not change significantly with the change in the carbon quota trading price. Thus, the trading price of the carbon quota is influenced by the market supply and demand, and its price is always fluctuating around a fixed value. Therefore, the intersection of the corporate carbon performance, the total score of the interfirm assessment, the corporate carbon risk awareness, and the trading price of the carbon quota tend to be consistent with the influence of the risk contagion of carbon quota counterparties.

Figure 11.

The interaction between different influencing factors and the trading price of carbon quota on the risk contagion effect of carbon quota counterparties. (a) the interaction between the corporate carbon performance and the carbon quota trading price on the risk contagion effect of carbon quota counterparties; (b) the interaction between the total score of the interfirm assessment and the carbon quota trading price on the risk contagion effect of carbon quota counterparties; (c) the interaction between the corporate carbon risk awareness and the carbon quota trading price on the risk contagion effect of carbon quota counterparties.

Figure 12 depicts the correlation between the risk contagion probability of carbon quota counterparties and the total score of the interfirm assessment when the corporate carbon performance, the trading price of the carbon quota, and the corporate carbon risk awareness interact with the total score of the interfirm assessment. It also validates Theorem 3. As shown in Figure 12a, when the corporate carbon performance interacts with the total score of the interfirm assessment , the risk contagion probability of the carbon quota counterparties in the debt interfirm network shows an increasing marginal feature with the increase in the total score of the interfirm assessment. Moreover, when the corporate carbon performance is 0.3, the probability of contagion of the carbon quota counterparties risk does not change with the change curve of the total score of the interfirm assessment. When the corporate carbon performance is greater than 0.3, the risk contagion probability of the carbon quota counterparties changes significantly with the change curve of the total score of interfirm assessment. When the total score of the interfirm assessment is 0, it indicates the inflection point of the change curve, and the curve of the probability of risk contagion of carbon quota counterparties becomes increasingly significant with the increase in the corporate carbon performance. Thus, the corporate carbon performance has a significantly positive incentive effect on the occurrence of carbon quota trading, innovation and invention, and other emission reduction measures of firms. When the corporate carbon performance is small, the possibility of carbon quota transactions between firms is also small, so the influence of the debt correlation between firms is insignificant. Thus, when the corporate carbon performance and the total score of the interfirm assessment is small and intersecting, the curve of change in the probability of risk contagion of carbon quota counterparties is not significantly bumpy.

Figure 12.

The interaction between different influencing factors and the total score of interfirm assessment on the risk contagion effect of carbon quota counterparties. (a) the interaction between the corporate carbon performance and the total score of interfirm assessment on the risk contagion effect of carbon quota counterparties; (b) the interaction between the carbon quota trading price and the total score of interfirm assessment on the risk contagion effect of carbon quota counterparties; (c) the interaction between the corporate carbon risk awareness and the total score of interfirm assessment on the risk contagion effect of carbon quota counterparties.

Figure 12b,c shows that, when the trading price of the carbon quota and the total score of the interfirm assessment interact with each other, the probability of the risk contagion of carbon quota counterparties in the debt interfirm network shows an increasing marginal feature with the increase in the total score of the interfirm assessment. When the corporate carbon risk awareness and the total score of the interfirm assessment interact with each other, the risk contagion probability of carbon quota counterparties in the debt interfirm network shows a marginally increasing feature with the increase in the total score of interfirm assessment, and the greater the carbon risk awareness is, the smaller the risk contagion probability of the carbon quota counterparties will be. Moreover, with the increase in the carbon quota price, the starting point of the change curve of the risk contagion probability of carbon quota counterparties and the total score of the interfirm assessment increases slightly, and the change curve of the change range decreases slightly. However, generally, the probability of the risk contagion of the carbon quota counterparties in the debt interfirm network does not change significantly with the change curve of the total score of the interfirm assessment. With the increase in the corporate carbon risk awareness, the starting point floating degree of the change curve of the contagion probability of the carbon quota counterparties risk with the change in the corporate carbon risk awareness is larger. However, in general, in the debt interfirm network, the change curve of the contagion probability of the carbon quota counterparties risk and the corporate carbon risk awareness has a significant upward shift, but no significant changes are observed in the trends. Thus, regulating the market price of the carbon quota alone by the government is insufficient, and firms must improve their awareness of carbon risk and their capacity to resist risks. Therefore, the strategy of preventing and controlling the risk contagion of carbon quota counterparties based on multiple factors is more effective.

Figure 8, Figure 9, Figure 10, Figure 11 and Figure 12 verify Theorems 2 and 3. The findings show that a single factor cannot explain the risk formation and contagion effects of the carbon quota counterparties. Instead, studying the risk formation and contagion effects of the carbon quota counterparties risk by examining the cross-interaction of multiple factors is more significant and in line with the actual financial market and trading environment.

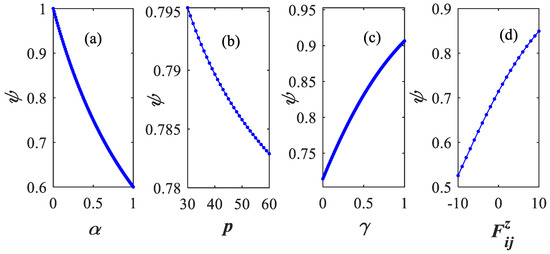

5.3. Carbon Quota Counterparty Risk Contagion Effect Based on Carbon Trading Data and Corporate Carbon Emission Intensity

In order to better verify the network model of the counterparty risk contagion of the carbon quota, this part of this paper uses the average daily transaction price of carbon emission allowances from 2019 to 2022 of the Beijing Green Exchange and the data of more than 230 chemical firms, and simulates the evolution characteristics of counterparty risk contagion effects through different parameter values of the carbon quota trading price and corporate carbon performance .

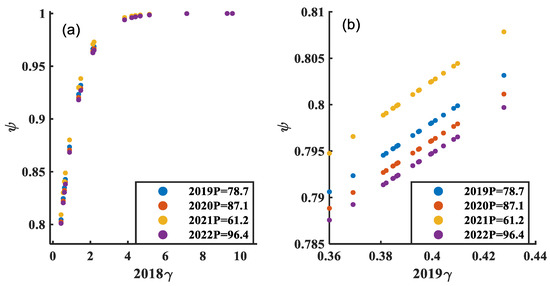

Figure 13 depicts the correlation between the risk contagion probability of carbon quota counterparties and the corporate carbon performance under the interaction between the corporate carbon performance and carbon quota trading price in 2018–2019. Figure 13 better verifies Theorem 3. From Figure 13, under the interaction between the corporate carbon performance and carbon quota trading price, the risk contagion probability of carbon quota counterparties in the debt interfirm network shows a marginally increasing characteristic with the increase in the corporate carbon performance. This is consistent with the results in Figure 8 and Figure 10. Furthermore, Figure 13a,b shows that the higher the trading price of the carbon quota is, the lower the probability of contagion of counterparty risks of the carbon quota will be. In 2018, the corporate carbon performance was generally high, which had a greater impact on the risk contagion of carbon quota counterparties. This is because, in 2018, in the early stage of the development of low-carbon green emission reduction, firms could obtain greater emission reduction benefits through the implementation of emission reduction strategies, and, in 2019, with the introduction and popularization of green emission reduction policies, the marginal benefits of green emission reduction strategies in firms decreased, so the carbon performance of firms gradually decreases with the popularity of green emission reduction strategies, and the impact on the risk contagion of carbon quota counterparties also decreases.

Figure 13.

The interaction between the corporate carbon performance and the price of carbon quota trading from 2018 to 2022 on the risk contagion effect of carbon quota counterparties. (a) the interaction between the corporate carbon performance in 2018 and the price of carbon quota trading from 2018 to 2022 on the risk contagion effect of carbon quota counterparties. (b) the interaction between the corporate carbon performance in 2019 and the price of carbon quota trading from 2018 to 2022 on the risk contagion effect of carbon quota counterparties.

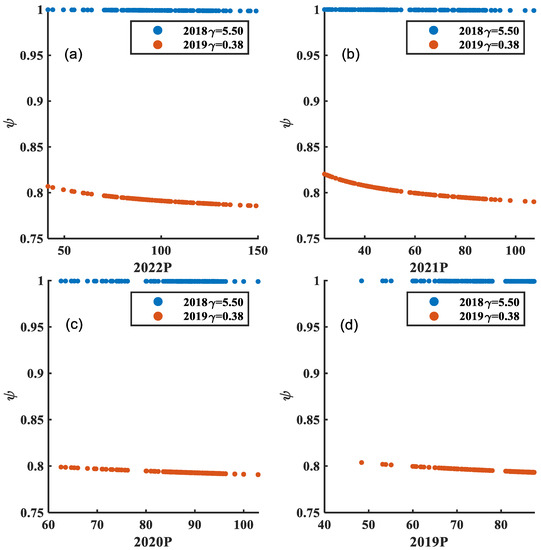

Figure 14 depicts the correlation between the risk contagion probability of the carbon quota counterparties and the price of carbon quota trading from 2019 to 2022 under the interaction between the trading price of the carbon quota and the corporate carbon performance. Figure 14 better verifies Theorem 2. Figure 14 shows that, under the interaction between the corporate carbon performance and carbon quota trading price, the risk contagion probability of the carbon quota counterparties in the debt interfirm network shows a marginally decreasing characteristic with the increase in the carbon quota trading price. This is consistent with the results shown in Figure 8 and Figure 11. Furthermore, Figure 14 shows that the interaction between the carbon quota trading price and the corporate carbon performance in 2018 had a great impact on the risk contagion effect of carbon quota counterparties, but there is no obvious change trend. Conversely, the interaction between carbon quotas and the corporate carbon performance in 2019 had a more obvious marginal diminishing impact on the change trend of counterparties risks of the carbon quota between firms. This shows that, under the “dual carbon” goal, in the early stage of green and low-carbon development, the low-carbon emission reduction behavior of firms can bring greater benefits, stimulate carbon trading behavior between firms, increase the risk contagion channel of carbon counterparties between firms, and aggravate the contagion of risks, but with the development of green and low-carbon, low-carbon emission reduction of firms has become a common behavior, so the benefits brought by this behavior to firms show marginal decreasing characteristics, thereby reducing the risk contagion of carbon quota counterparties. This is consistent with the results of Figure 13. Therefore, for the current general understanding of green and low-carbon firms, the impact of the carbon performance carbon quota trading price on the risk contagion of carbon quota counterparties in 2019 is of more significance as a reference.

Figure 14.

The interaction between the price of carbon quota trading and the corporate carbon performance from 2018 to 2019 on the risk contagion effect of carbon quota counterparties. (a) the interaction between the price of carbon quota trading in 2022 and the corporate carbon performance from 2018 to 2019 on the risk contagion effect of carbon quota counterparties. (b) the interaction between the price of carbon quota trading in 2021 and the corporate carbon performance from 2018 to 2019 on the risk contagion effect of carbon quota counterparties. (c) the interaction between the price of carbon quota trading in 2020 and the corporate carbon performance from 2018 to 2019 on the risk contagion effect of carbon quota counterparties. (d) the interaction between the price of carbon quota trading in 2019 and the corporate carbon performance from 2018 to 2019 on the risk contagion effect of carbon quota counterparties.

Figure 13 and Figure 14 verify Theorems 2 and 3. The findings show the impact of the interaction between the corporate carbon performance and carbon trading price on the risk contagion of carbon quota counterparties. With the development of green and low-carbon, the carbon performance of firms and the impact on the risk contagion of carbon counterparties is gradually decreasing.

5.4. Robustness Analysis

To test the robustness of factors which affect counterparties risk formation and contagion in carbon quota trading, this article performs a sensitivity analysis of the parameters (Table 3, Table 4, Table 5, Table 6 and Table 7). The variation trend of the same parameter is basically the same under different values, indicating strong robustness.

Table 3.

Sensitivity analysis of the initial market price of class asset, the price sensitivity of the firm to the sale of financial assets, and the cumulative proportion of class assets sold on the evolution characteristics of firm carbon quota counterparties formation.

Table 4.

Sensitivity analysis of the carbon performance, the proportion of rational investors in the market, and the cumulative proportion of class assets sold on the evolution characteristics of firm carbon quota counterparties formation.

Table 5.

Sensitivity analysis of the corporate carbon performance, the proportion of rational investors in the market, and the probability of credit risk contagion of carbon quota among firms on the evolution characteristics of corporate carbon quota counterparties risk formation.

Table 6.

Sensitivity analysis of the corporate carbon performance, corporate carbon risk awareness, and carbon quota trading price in the carbon trading market on the evolution characteristics of the risk contagion of corporate carbon quota counterparties.

Table 7.

Sensitivity analysis of corporate carbon performance, corporate carbon risk awareness, and total score of interfirm assessment on the evolution characteristics of the risk contagion of corporate carbon quota counterparties.

The sensitivity analysis in Table 3 further validates Theorem 1. It shows that the higher the initial market price of the class asset is, the higher the carbon quota counterparties risk and the greater the volatility of the carbon quota counterparties risk will be, and the latter is more sensitive to the initial market price of the asset. The higher the sensitivity of a firm to the price of financial assets sold is, the lower the risk of carbon quota counterparties and the smaller the volatility of the risk of carbon quota counterparties will be, is the latter being less sensitive to the price sensitivity of a firm to the price of financial assets sold. Thus, when the sensitivity of the firm to the price of selling financial assets increases to a certain extent, the marginal benefit of the firm’s sensitivity to the price of selling financial assets to the risk of the carbon quota counterparties does not change significantly, which is consistent with the analysis in Figure 5.

Theorem 1 is further verified by the sensitivity analyses in Table 4 and Table 5. The findings indicate that the higher the corporate carbon performance is, the greater the carbon quota counterparties risk and the larger the degree of fluctuation of the carbon quota counterparties risk will be, with the latter being more sensitive to the corporate carbon performance. The larger the proportion of rational investors in the market is, the smaller the risk of carbon quota counterparties will be, the smaller the degree of fluctuation of carbon quota counterparties risk will be, and the less the sensitivity to the proportion of rational investors in the market will be. The higher the contagion probability of credit risk contagion of the carbon quota among firms is, the smaller the carbon quota counterparties risk will be. When the proportion of rational investors in the market is small, the carbon quota counterparties risk is more sensitive to the proportion of rational investors in the market, and the degree of fluctuation is larger, which is consistent with the analysis in Figure 7.

Theorems 2 and 3 are further verified by the sensitivity analyses in Table 6 and Table 7. The findings show that the higher the corporate carbon risk awareness is, the lower the risk contagion probability of carbon quota counterparties will be. However, the volatility of the carbon quota counterparties risk is not obvious, indicating that the risk contagion probability of carbon quota counterparties is not significantly sensitive to the corporate carbon risk awareness; this is because the factors which influence the risk of carbon quota counterparties are complex and changeable, and the most important influencing factors are policy uncertainty and the volatility of carbon asset trading prices, etc., while corporate carbon risk awareness mainly plays a role in avoiding corporate carbon counterparties risk, in addition to carbon risk awareness, carbon performance, financial performance, and other factors which also affect corporate the carbon quota counterparties risk; the single factor of firms has no significant impact on carbon quota counterparties risk, Which is consistent with the analysis in Figure 9. When the corporate carbon performance is more than 0, the greater the corporate carbon performance is, the greater the risk contagion probability of the carbon quota counterparties will be, and the smaller the volatility of the risk contagion of carbon quota counterparties and its sensitivity to the corporate carbon performance will be, which is consistent with the analyses in Figure 10 and Figure 12a. At the same time, Table 5 and Table 6 reflect that the change in the carbon quota trading price does not make the probability of the risk contagion of carbon quota counterparties fluctuate greatly, but the probability of the risk contagion of carbon quota counterparties is more sensitive to the positive or negative total score of the interfirm assessment. These findings are consistent with the analyses in Figure 9, Figure 10, Figure 11 and Figure 12.

6. Conclusions