1. Introduction

In recent years, the world’s greenhouse gas emissions have increased year by year. The climate crisis caused by global warming has become increasingly fierce, prompting countries around the world to pay more and more attention to the severe challenges brought by environmental problems.

The 2030 Agenda for Sustainable Development, launched by the UN General Assembly in 2015, aims to achieve sustainable development in three dimensions: social, economic and environmental. At present, China’s environmental problems are still serious. Developing green economy and promoting the transformation of economic growth mode to green have gradually become the basic consensus of the whole society. In this context, in order to actively adapt to the new trend of sustainable development, the Chinese government has proposed the goal of “dual carbon” and launched a series of environment-related policies. Among them, green financial instruments such as green credit, green taxation and green bonds play an increasingly prominent role in China’s environmental governance as important measures to promote green development.

In fact, as the focus of environmental governance, the financing situation of heavy polluting enterprises is bound to be more significantly affected with the implementation and maturity of green finance policies. Specifically, take green credit as an example. In 2012, the China Banking Regulatory Commission issued Green Credit Guidelines. From a strategic perspective, the document requires banking financial institutions to optimize their credit structure and improve their service level so as to promote the transformation of the development mode and the development of the green economy. It also specifically requires the banking industry to consider the environmental and social risks involved in the credit business and curb the granting of credit to non-green enterprises or projects [

1]. Therefore, the significant advantages of the steel, petrochemical, and other industries in the availability of bank credit will be weakened or even disappear for a long time [

2,

3]. Moreover, the capital market also gradually pays attention to the environmental performance of enterprises and tends to provide financial support for environmentally friendly enterprises. In other words, stakeholders such as financial institutions include the environmental risks of enterprises in the credit rating. So, the financing barriers faced by heavily polluting enterprises are self-evident. Thus, the result is that financing constraints are intensified and financing scale is reduced. Therefore, under the background of financial restraint policy and green development at the present stage, the financing problem of the high polluting enterprises is more serious. It is not only reflected in the characteristics of scale and ownership [

4]. The availability of financing for highly polluting enterprises will also be affected. However, for heavily polluting enterprises that are highly dependent on external financing, financial resources can be described as the “blood” of industrial development [

2]. The question concerning how to alleviate the sensitivity of financing availability to pollution levels (green financing constraints) has become a top priority. Existing studies have shown that enterprises can bear social responsibilities and reduce debt financing costs [

5]. Then, when enterprises have a strong “green” atmosphere, can they ease the constraints of green financing and help improve the availability of financing?

The concept of evolving from CSR (corporate social responsibility) to ESG (environment, social responsibility, corporate governance) has brought many advantages to enterprises. Enterprise ESG is a comprehensive factor reflecting enterprises’ ability in environmental protection, social responsibility and corporate governance, and plays an increasingly important role in measuring enterprises’ response to national policies and evaluating the effect of investment and financing decisions. More and more investors take it as an indicator to measure the level of sustainable development of enterprises into investment decisions, and strive to use funds in line with policy requirements and market orientation, so as to improve the security and profitability of funds. The China Securities Regulatory Commission and the Ministry of Environmental Protection signed the Cooperation Agreement on Jointly carrying out the Environmental Information Disclosure of Listed Companies in 2017, and revised the Governance Code for Listed Companies in 2018, stipulating that listed companies have the responsibility to disclose ESG information [

6]. From February 8 in 2022, the “Management Measures for Legal Disclosure of Enterprise Environmental Information” and “Corporate Environmental Information Legal Disclosure Format Guidelines” were officially implemented, indicating that enterprise ESG information disclosure has entered a new stage and is being improved [

7]. This will have an important impact on the availability of funds, investment direction and cost-benefit ratio of enterprises. In turn, it will affect the supply and flow of funds for green projects in the real economy, thus affecting the availability of funds for financing enterprises.

ESG has also attracted much attention from scholars in the academic community. Yoon et al. [

8], Qiu and Yin [

9], Wong et al. [

10], Lian et al. [

11] and Chen and Zhang [

12] all pointed out that corporate ESG performance can improve corporate value by influencing corporate stock prices, reducing corporate financing costs and enhancing capacity for technological innovation. However, Li et al. [

13], Yuan and Xiong [

14], Rupamanjari and Sandeep [

15], Peng and Mansor [

16] and Gopal and Prachi [

17] all found that ESG performance and even the performance of each sub-item can have an impact on the change of enterprise performance. Zhang et al. [

18] proposed that measures taken by enterprises to improve the performance scores of ESG can promote enterprise innovation. In addition, Zhou et al. [

19] and Gao et al. [

20] found that enterprises with better ESG performance would have higher investment efficiency and obtain higher return on investment. We can see that the existing research on the impact of corporate ESG performance in our country puts more emphasis on corporate own value and economic benefits. However, there are still few studies linking ESG performance with corporate green related financing constraints.

The main concerns of relevant research on the influencing factors of corporate financing constraints can be divided into internal factors and external factors. Most scholars believe that a variety of endogenous factors, such as the size of an enterprise, the asset-liability ratio and the degree of political correlation, can exert varying degrees of influence on the financing constraints of an enterprise [

21,

22,

23]. Enterprises can also relieve financing pressure by improving information transparency or their own business credit [

24,

25]. What’s more, some studies show that the existence of interlocking directors in corporate governance can also have an effect on the change of financing constraints [

26]. However, studies on external factors affecting corporate financing constraints mostly focus on the positive effect of relevant measures on alleviating financing constraint at the policy level. These measures specifically involve tax reduction policies, subsidies and preferential policies. All of the policies can reduce the financing pressure of enterprises by reducing their financing costs [

27,

28]. It is found that most of the research literature on factors related to corporate financing constraints tend to explore the role of corporate characteristics, external policies and other factors in reducing financing pressure. But the sensitivity of corporate financing availability to pollution level in the process of advocating green development, that is, the attention of green financing constraints is not high.

Based on the above considerations, this paper takes the manufacturing enterprises in China’s A-share market from 2011 to 2019 as research samples, combines the relevant data of manufacturing enterprises and their ESG performance, and examines the influence of ESG performance on the constraint pressure of corporate green financing from a micro perspective. The marginal contribution of this paper is mainly shown as follows. First, based on the ESG perspective, this paper not only theoretically expands the way to alleviate green financing constraints, but also serves as an important supplement to ESG related literature. Secondly, this paper discusses the mechanism by which corporate ESG performance affects green financing constraints, which helps to better understand the performance of corporate green financing when undertaking social responsibility. Finally, the conclusion will help enterprises to make investment and financing decisions from a more complete perspective, improve the efficiency of market capital and promote the development of financial markets.

The rest of this paper is arranged as follows. The second part is theoretical analysis. The third part is the research design. The fourth part is the empirical results and analysis. The fifth part is the mechanism analysis and inspection. The sixth part is the conclusion.

2. Analysis on the Influence Mechanism of ESG on Green Financing Constraints

In the context of increasing emphasis on corporate ESG performance worldwide, ESG performance, that is committed to reflecting the sustainable level and ability of enterprises, provides a data reference for capital providers to judge the current development mode of enterprises and the response degree to national green policies.

At present, Chinese green finance still has many problems, such as lack of innovation, blocked information, etc. However, if investors can effectively combine the performance of corporate ESG when analyzing the market prospect and corporate value of financing enterprises, they can directly observe the performance of corporate environmental protection, social responsibility and corporate governance, and make a more accurate judgment on the current situation and future value of financing enterprises. On this basis, investment in different enterprises is adjusted to reduce investment risks and information asymmetry in the process of enterprise financing, so as to ease the constraints of green financing of enterprises.

In general, corporate ESG performance can influence corporate green financing constraints through the following two mechanisms.

One mechanism is to guide capital flow by influencing enterprise value. Wang and Yang [

29] found that the performance of ESG responsibility can significantly reduce the financial burden of enterprises, enhance the attention of the market, release more positive signals, and thus improve the market value of enterprises. If an enterprise’s ESG performs well, it can gain broader social recognition by increasing its moral capital to some extent, so as to have a greater chance to get financial support. On the contrary, if an event occurs that reduces its ESG performance, it will increase its financing cost and pressure, which will have a negative impact on its market value [

30]. Therefore, enterprises facing financing constraints due to pollution can increase their environmental protection expenditure, actively undertake social responsibilities, improve governance level and market value, and obtain more financial capital input, so as to alleviate their green financing constraints [

31].

The second mechanism is to attract capital inflows by influencing corporate credit ratings. Analysis of corporate ESG performance can help reduce the risk of “black swan” events caused by environmental and corporate governance issues, which can reduce future uncertainty for investors pursuing long-term investment benefits [

19]. Based on the data set analysis of FTSE 350 companies, Li et al. [

32] showed that improving the transparency and accountability of corporate ESG performance disclosure can improve the trust of stakeholders, thus effectively reducing the operational risks of enterprises. Therefore, enterprises can incorporate ESG performance into their own development planning, reduce the uncertainty of enterprise development and improve their anti-risk ability by assuming more environmental protection and social responsibilities. So, they can obtain a higher credit rating, improve their reputation and brand influence, expand financing channels, reduce financing costs and attract more financial capital inflows. Thus, the constraint pressure of green financing will be reduced [

33].

Based on the above mechanism analysis, this paper proposes the following research hypotheses.

H0: Enterprise ESG performance can improve enterprise value and enhance enterprise credit rating, so as to alleviate the green financing pressure.

3. Empirical Research

3.1. Empirical Model

Based on the research of Wang and Wang [

34], this paper constructs the following panel fixed effect model as the basic regression model to investigate the pressure of green financing constraint of listed enterprises:

In Formula (1), represents the asset-liability ratio, which is used to reflect the external financing level of the enterprise. The pollutant discharge fee per each business income () is used to reflect the environmental pollution level of the enterprise. represents all control variables. Therefore, as a reflection of the sensitivity of enterprise financing level to pollution level, is used to reflect the green financing constraints of enterprises. When the level of green financing constraint of enterprises is higher, the green finance market should make enterprises that cause more pollution face greater pressure of external financing, and the satisfaction degree of financing demand of these polluting enterprises will decrease with the increase of environmental pollution level. So, the expected value of should be less than 0. The greater the absolute value, the stronger the green financing constraints on enterprises.

In order to test the impact of corporate

ESG performance on green financing constraints, we introduce

ESG and its cross term with pollutant discharge fee per unit of business income on the basis model. The expansion model is constructed as follows.

In order to further investigate the impact of each sub-index in

on corporate green financing constraints, environmental protection (), social responsibility (), corporate governance (), and their cross terms with pollutant discharge fee per unit business income are introduced in the expansion model. If the cross-term coefficient is significantly positive, it indicates that this factor has a significant effect on reducing the sensitivity of enterprise financing to pollution level. Through this process, the green financing constraints of enterprises can be alleviated.

3.2. Variable Selection

Referring to the research of Wang and Wang [

34], the dependent variable is the external financing level of enterprise which is expressed by the asset-liability ratio. The independent variable is the environmental pollution level of enterprise, which is expressed by the proportion of the enterprise pollutant discharge fee in the company’s operating income. Considering the influence of enterprise nature, size, listing period, asset structure, profitability and other factors on the availability of enterprise financing, twelve relevant indicators are selected as control variables. The variables and their measurement methods are shown in

Table 1.

Considering the pollution of Chinese manufacturing enterprises to ecological environment, the development of Chinese green finance and the development of Chinese ESG evaluation system, data of listed manufacturing enterprises in China’s A-share market from 2011 to 2019 are selected as samples, and the data are processed as follows. (1) We exclude financial industry and ST enterprise samples; (2) based on stock code and year, we match enterprises that publish pollution fee data and participate in Bloomberg ESG rating at the same time; (3) we eliminate missing data according to the integrity of pollution charges and ESG data. The final unbalanced panel data contains 187 enterprises and 1028 valid observations.

In our paper, enterprise data comes from CMSAR database and Wind database. Sewage fee data are sorted out according to the disclosure of listed companies. Overall and individual performance scores for ESG are derived from the Bloomberg database.

According to

Table 2, the average ESG performance score of listed enterprises in China is only 21.3329 (percent), and the highest score is still less than 60 points, which directly shows that the current ESG performance of Chinese enterprises is not optimistic. By observing the performance scores of three sub-items, we can find that the average and the lowest value of corporate governance (G) performance are significantly higher than the other two sub-items. The reason may be that Chinese enterprises pay more attention to leadership in the process of development.

In order to better understand the current ESG performance of Chinese manufacturing enterprises, this paper estimates the kernel density of the overall and sub-performance scores of A-share manufacturing enterprises in China based on the available Bloomberg ESG rating data. The data are then divided into three subsamples: eastern, central and western based on the rate of economic development. The kernel density is estimated respectively. We then compare the distributions of performance (the total score of each performance is 100 points).

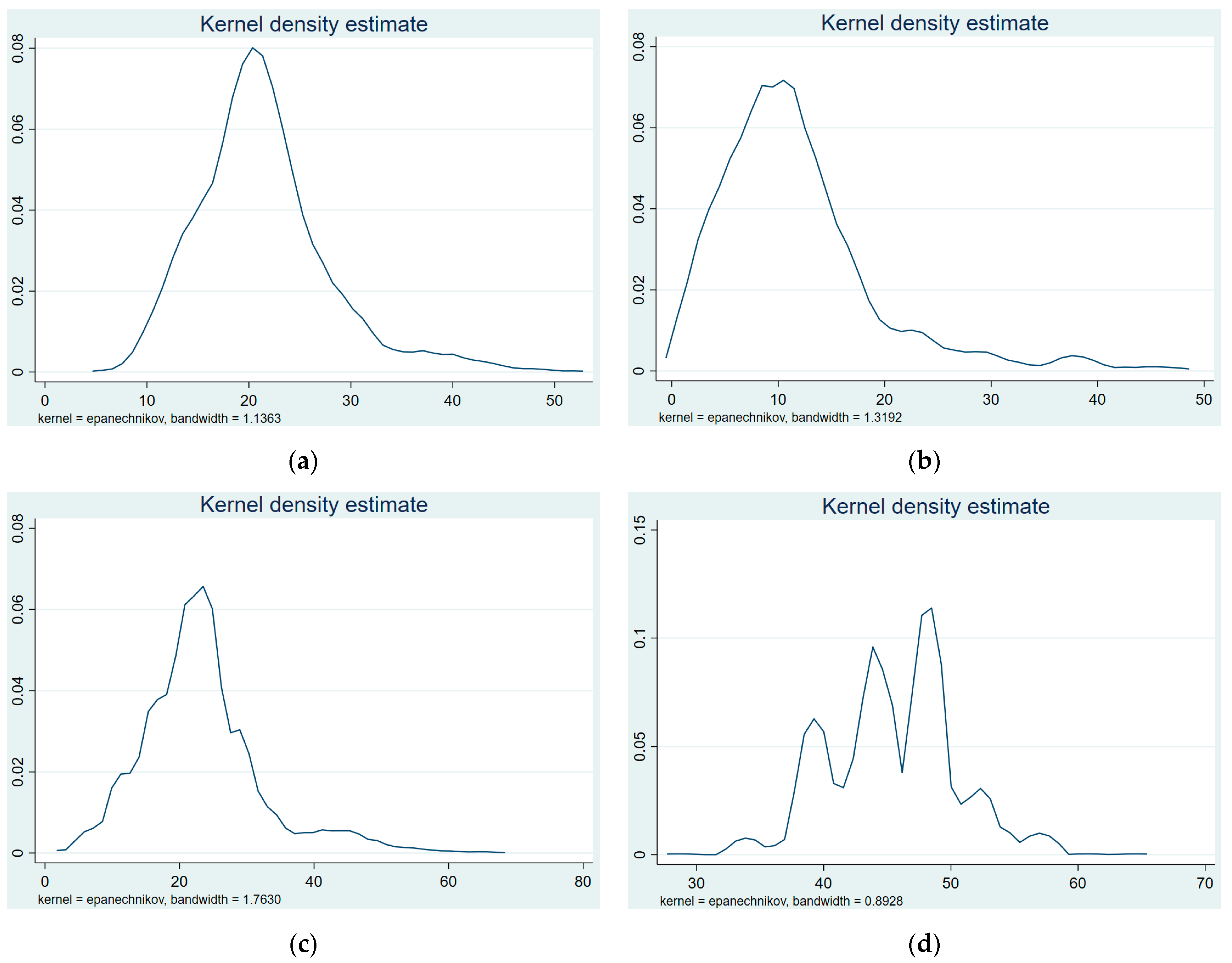

As shown in

Figure 1a below, the peak value of ESG performance scoring curve of Chinese A-share manufacturing enterprises is about 20 points, and there are few enterprises with more than 50 points and less than 10 points, indicating that the overall ESG performance of Chinese A-share manufacturing enterprises is still at a low level during the adoption of data. In

Figure 1b, the peak value of the curve is around 10 points, and only a few enterprises exceed 20 points. This means that the environmental protection performance of Chinese A-share manufacturing enterprises is generally poor, and most enterprises score between 0 and 20 points. In

Figure 1c, the peak value of the curve exceeds 20 points, but the scores of most enterprises have not exceeded 40 points, which indicates that the social responsibility performance of A-share manufacturing enterprises has not yet reached a good level in our country.

Figure 1d shows that the peak value of the curve is close to 50 points, and the scores of some enterprises are between 50 and 60 points. There are 3 small peaks between 40 and 50 points. This means that the scores of Chinese A-share manufacturing enterprises in terms of corporate governance are relatively significant compared with other aspects, and there are 3 levels between 40 and 50 points.

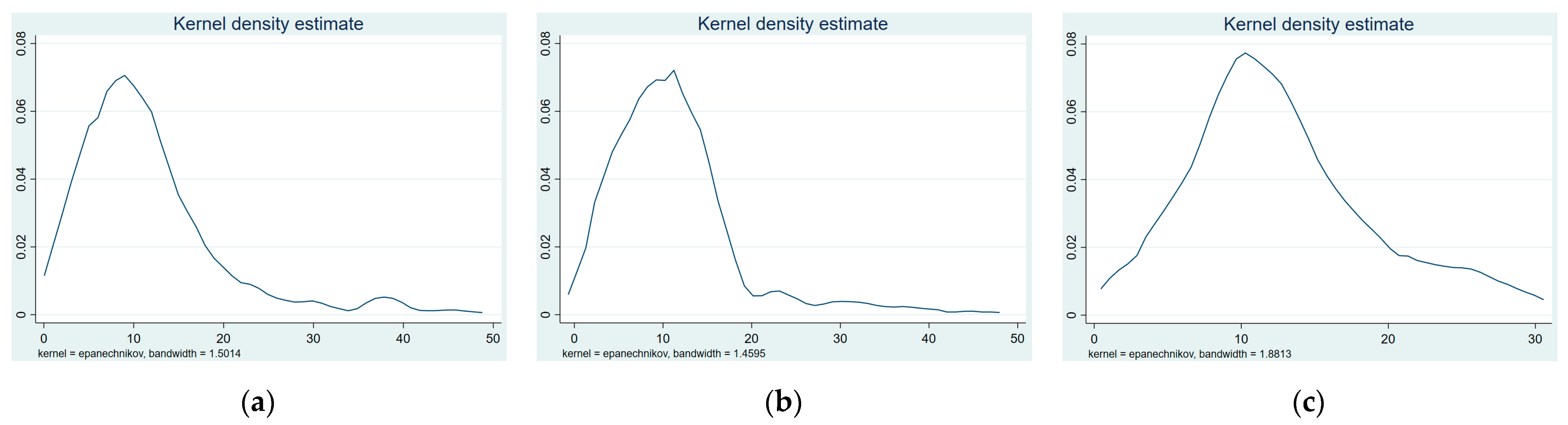

As shown in

Figure 2, in terms of the overall ESG score of manufacturing enterprises, the peak score of curve in all regions is around 20 points. But obviously the curve in the central region is steeper, which means that the overall ESG score distribution of manufacturing enterprises in the central region is more concentrated compared with the eastern and western regions.

As shown in

Figure 3, the peak score of environmental protection performance curve of manufacturing enterprises in all regions is around 10 points. However, compared with the situation where the scores of enterprises in the west are more dispersed, the scores of enterprises in the eastern and central regions are mostly below 20 points, and only a few enterprises get more than 20 points.

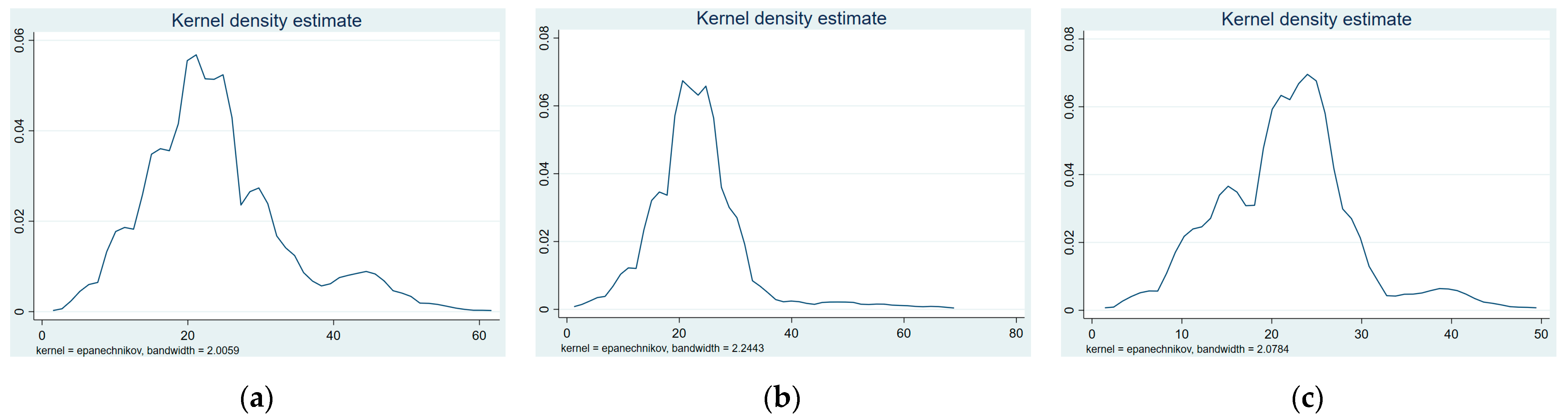

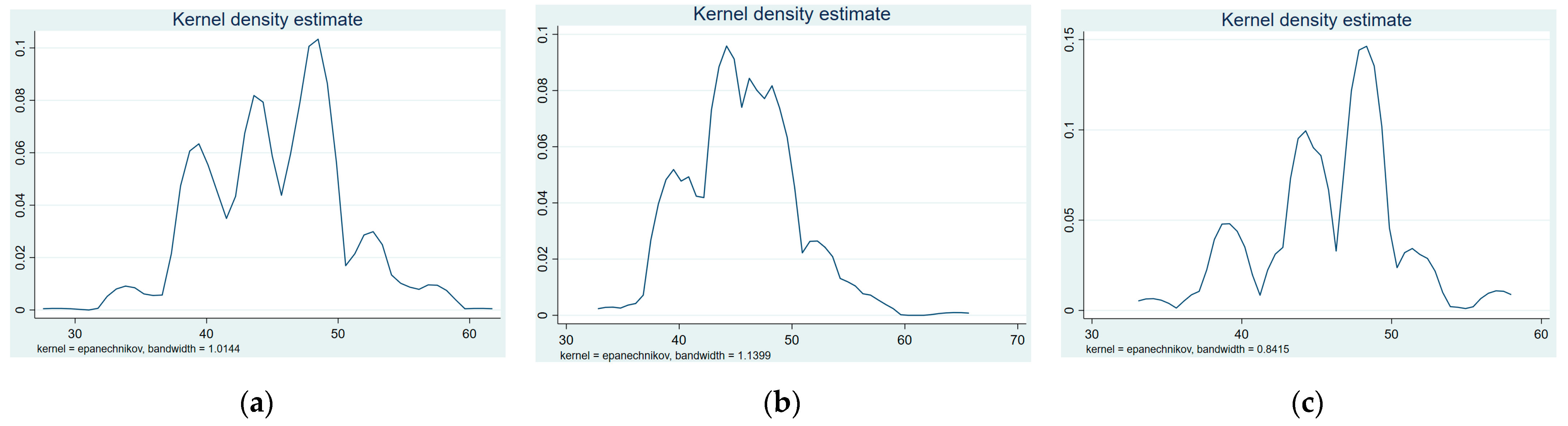

As shown in

Figure 4, the social responsibility performance score curve of all regions presents a ladder shape to some extent, with the peak value between 20 and 25 points, and most enterprises scores are between 10 and 40 points. By contrast, it can be seen that the scores of enterprises in the central region are relatively concentrated, and the curve above 40 points is the most flat.

As shown in

Figure 5, the corporate governance performance score curves in the eastern and western regions show three small peaks gradually rising, and the peak value is close to 50 points, which means that most enterprises in the two regions present three levels of scores. However, it can be found that the scores of enterprises in the eastern region are more concentrated. The first peak of the score curve of enterprises in the western region is less than 40 points. Moreover, the corporate governance scores of most companies in the central region are concentrated between 40 and 50 points, with a peak of nearly 45 points.

4. Empirical Results

In order to understand the correlation among variables, the table of correlation coefficients among variables is as follows.

By observing the result in

Table 3, it can be seen that the level of external financing of enterprises is negatively correlated with the pollutant discharge fee per unit operating income, which means that the availability of external financing of enterprises with large pollutant discharge fee per unit operating income will be limited to a certain extent. These further verify the existence of green financing constraints. In addition, the level of external financing is positively correlated with company size, asset structure, asset turnover, listing years and other factors, and is negatively correlated with net asset profit rate, revenue growth rate, cash flow and other factors. These conclusions provide a good statistical basis for subsequent research.

4.1. Full Sample Regression Results

First of all, based on all samples, we carried out regressions on the basic model and the extended model. The estimated results are shown in

Table 3. Among them, column (1) is the result of the basic regression model. Column (2) is the regression result of the extended model after the introduction of ESG and its cross term with pollutant discharge fee of unit business income. Columns (3) to (5) are the model regression results after introducing the performance of each ESG sub-item and their respective cross-terms with pollutant discharge fee of unit business income.

As can be seen from

Table 4, the coefficients of corporate debt ratio and pollutant discharge fee per unit income is negative at the significant level of 5%. It means that the current green financing constraints faced by enterprises are relatively large, and the market restricts the financing availability of enterprises with high pollution levels.

By observing column 2 of

Table 4, it can be found that the cross term of the overall performance of ESG and the pollutant discharge fee per unit operating income is positive at the significant level of 5%. This result indicates that the ESG performance of enterprises plays a certain role in reducing the sensitivity of enterprise financing satisfaction to enterprise pollution level, so as to alleviate the green financing constraints of enterprises to a certain extent. It can be concluded that enterprises with better ESG performance need to bear less financing pressure under the same pollution level, and the disclosure of ESG performance data is helpful to alleviate the financing constraints of polluting enterprises in the current development stage of our country.

Columns 3–5 of

Table 4 show the impact of corporate environmental protection, social responsibility and corporate governance on the allocative efficiency of green finance. The regression results show that the cross-term coefficient of environmental protection factor and pollutant discharge fee per unit operating income, and the cross-term coefficient of social responsibility factor and pollutant discharge fee per unit operating income are significantly positive, which indicates that these two sub-indexes in enterprise ESG rating can play a positive role in easing the green financing constraints of enterprises. One of the possible reasons is that the information disclosure system is not perfect in the research time range. Enterprises’ enthusiasm for the ESG related data, especially the management related information disclosure is not high. So that even if the relevant data has a positive role, it can only be used in a limited scope. The second reason is that there are few factors related to green financing in corporate governance. Most enterprises’ adaptation to green policies is more obviously reflected in the level of environmental protection and social responsibility. Therefore, investors pay more attention to the performance of enterprises in these two aspects in the process of alleviating the constraints of corporate green financing.

The empirical results show that listed companies are facing greater constraint pressure of green financing in the current green finance market. From an overall level, the performance of ESG has a significant positive effect on reducing the sensitivity of exogenous financing satisfaction to the pollution level of enterprises and alleviating the constraints of green financing faced by enterprises. This conclusion is similar to that of Zhang et al. [

35], but their study did not consider linking financing constraints to corporate pollution. However, it can be found from the sub-analysis that the sub-performance of environmental protection and social responsibility of ESG plays an obvious role in reducing the sensitivity of the satisfaction degree of external financing to the pollution level of enterprises while the role of corporate governance factors is limited.

4.2. Regional Heterogeneity

As a result of China’s vast territory, different areas have great differences in their level of economic and social development and relevant policies. In order to further analyze the role of Chinese enterprise ESG performance on corporate green financing constraints, this part divides the data of listed companies into three sub-samples of the eastern, central and western regions according to economic development level and economic development speed. We conduct regression analysis on the basic model and expansion model, respectively. The estimated results of the model are shown in

Table 4,

Table 5 and

Table 6. The meanings of the columns in each table are the same as in

Table 3.

By observing the data in

Table 5, it can be found that the coefficient of pollutant discharge fee per unit income presents a negative value at different significant levels. Therefore, the current Chinese market can exert a strong constraint on the financing ability of polluting enterprises in the sample of eastern region.

After introducing the overall performance of ESG, it can be found that in Column 2, the coefficient of ESG × Charge is significantly positive. It means that the overall performance of enterprise ESG can effectively reduce the sensitivity of enterprise financing satisfaction to the degree of environmental pollution in the eastern samples, so as to ease the constraints of enterprises’ green financing. In column 3 and 4, it can be found that the coefficients of E × Charge, S × Charge and G × Charge also present positive values at different significant levels, indicating that the single performance of these ESGs can also have a positive effect on alleviating the green financing constraints faced by enterprises.

According to the data in

Table 6, the coefficient of environmental pollution index (which is pollutant discharge fee per unit income) is negative, but fails to reach the significant level of 10%. This indicates that the market has limited constraints on green financing for enterprises in the central sample.

Secondly, by observing columns 2–4, it can be found that the coefficients of interaction terms between ESG and each sub-item performance and pollutant discharge fee per unit income are all positive, but only the coefficient of E × Charge is significant at the significance level of 10%. It indicates that corporate ESG can only play a limited positive role in reducing the sensitivity of corporate financing availability to the degree of environmental pollution and easing the constraints of corporate green financing in the central part of China. However, the coefficient of G × Charge is negative and does not reach the significance level of 10%, indicating that the performance of this sub-item plays a poor mitigating effect. Among them, the evaluation of environmental protection performance plays a more obvious role.

By observing the data in

Table 7, it can be found that although the coefficient of pollutant discharge fee per unit operating income is always negative, the significance level is not high. That means that enterprises also face less constraint pressure of green financing in western samples.

It can be found that the coefficients of ESG × Charge, E × Charge, S × Charge and G × Charge are all positive, but just the coefficient of S × Charge reaches the significance level of 10%. These results indicate that the performance of corporate ESGs is limited in reducing the sensitivity of corporate financing changes to pollution degree and alleviating the constraints of corporate green financing in the western region of China.

Observing the regression results in

Table 5,

Table 6 and

Table 7, we can find that the effect of ESG performance on the mitigation of corporate green financing constraints is well realized in the east, but is more limited in the central and west. This difference between regions is mainly related to the differences in characteristics of economic development of various regions in China. The eastern region is more developed, and enterprises are transforming and upgrading to the tertiary industry. Thus, the people’s requirements for the living environment are gradually increasing, so they can respond more actively to national policies. The development of the central and western regions is relatively slow. They are still in the stage when it is necessary to vigorously develop industry to upgrade the economic level. Of course, the intensity of regulation faced by different regions will also affect the effectiveness of ESG performance to some extent.

4.3. The Impact of Enterprise Ownership

Considering that the government can play an important role in the financial market, this part divides the data of listed companies into samples of state-owned enterprises and samples of private ownership enterprises in order to understand the ability of ESGs to alleviate the green financing constraints of enterprises under different ownership structures. Then we conduct regression analysis on the basic model and expansion models, respectively. The estimated results are shown in

Table 7 and

Table 8. The meanings of each column in each table are the same as in

Table 3.

By observing the data in

Table 8, it can be found that the coefficient of pollutant discharge fee per unit operating income is negative at the significance level of 1%. It indicates that the availability of enterprise financing in state-owned enterprises is highly sensitive to the level of environmental pollution, and enterprises are faced with greater constraints of green financing.

The data in column 2 of

Table 7 show that the coefficient of the cross term of the overall performance of ESG and the pollutant discharge fee per unit operating income is negative, which reflects that the performance of ESG has a poor positive effect on reducing the sensitivity of enterprise financing availability to pollution level in the sample of state-owned enterprises. That means that it cannot fully alleviate the constraints of green financing faced by enterprises.

By observing the coefficient of the cross-item of performance of each sub-item and pollutant discharge fee per unit operating income, it can be found that only the coefficient of E × Charge is positive and has no significance. The corporate governance factor is even negative at a significant level of 10%. This indicates that only the performance of environmental pollution can play a limited positive role in alleviating the constraints of enterprises’ green financing in the sample of state-owned enterprises.

By observing the data in column 1 of

Table 9, it can be found that the coefficient of pollutant discharge fee per unit operating income presents a positive value at the significance level of 5%, which reflects that the availability of enterprise financing is not highly sensitive to pollution level in the sample of private enterprises, and the constraint pressure of enterprises’ green financing is small.

By observing columns 2–5, it can be found that the coefficients of the cross term of the overall and sub-item performance of ESG and pollutant discharge fee per unit operating income are positive at different significance levels, which means that ESG performance can have a positive effect on alleviating the constraint of corporate green financing in private enterprise samples. Among them, the significance of social responsibility and corporate governance factors is higher, reflecting their positive effects are more obvious.

According to the data comparison of different ownership enterprises, we can find the following points. Compared with private enterprises, state-owned enterprises are subject to stronger constraints on green financing, while the mitigation effect of ESG performance is poor. The possible reason is that state-owned enterprises are closely related to the government. Their behaviors are paid more attention by the government. Their performance of social responsibilities and information disclosure are mandatory and inviolable. The public also has higher requirements and expectations on them. The benchmarking effect is significant, so the financing availability of state-owned enterprises is highly sensitive to the level of pollution.

4.4. The Impact of Enterprise Size

By observing the empirical results of two ownership samples, it can be found that the current green financing constraint pressure on Chinese private enterprises is low. The possible reason is that the private enterprises that dare to disclose relevant information in the observed samples are of large scale and have a stable and long-term cooperative relationship with financial institutions. Therefore, the current market and policies have relatively limited binding force on these enterprises. In order to further test the existence of this possibility, this part takes the median of the variable of company size as the boundary, divides the data of listed enterprises into large-scale enterprise samples and small-scale enterprise samples. Then we conduct regression on the basic model and extended model, respectively. The empirical results are shown in

Table 9 and

Table 10.

By comparing

Table 10 and

Table 11, it can be found that the coefficient of pollutant discharge fee per unit business income of large-scale enterprises is positive, while the coefficient of the same variable of small-scale enterprises is negative. Thus, it can be concluded that the green financing pressure faced by large-scale enterprises in the financial market is obviously smaller.

In addition to the little difference in the influence of corporate governance factors on the green financing constraints of enterprises of different sizes, the coefficients of overall performance of ESG, environmental protection factors, social responsibility factors and pollution charges per unit operating income all show higher positive significance in the sample of small-scale enterprises. It reflects that the performance of enterprise ESGs has a significantly greater easing effect on green financing constraints of small-scale enterprises than large-scale enterprises.

4.5. Robustness Test

At present, reducing the environmental damage caused by economic development is one of the short-term goals of developing green finance. Heavy polluting enterprises play an important role in the process of aggravating environmental deterioration and causing ecological damage due to the production process, resource utilization, unexpected output, and other factors, and thus inevitably become the main object of environmental governance. Therefore, in order to further investigate the mitigation effect of enterprise ESG performance on green financing constraints in heavily polluting enterprises, this paper takes eight heavily polluting industries (the mining industry, electricity and gas industry, textile and fur industry, metal and non-metal industry, bio-pharmaceutical industry, petrochemical and plastic industry, paper and printing industry, and alcohol and beverage industry) as samples. We performed regression on the baseline model and extended model. The similar approach was also adopted in related literature such as Wang and Wang [

34]. The estimated results are shown in

Table 12.

According to the results in

Table 11, the coefficient of pollutant discharge fee per unit income is always negative, but the significance level is significantly lower than that of the total sample. This indicates that the constraint pressure of green financing is relatively low among heavily polluting enterprises, and there is no effective restriction on the availability of green financing for heavily polluting enterprises in the green finance industry. The possible reason is that most of the high-polluting enterprises have relatively special product characteristics and production technology, and environmental pollution is almost inevitable in the production process.

In addition, it can be seen from the data in column 2 and column 3 of

Table 11 that the cross- term coefficient of overall performance of ESG and pollutant discharge fee per unit operating income, and the cross-term coefficient of performance of environmental protection and pollutant discharge fee per unit operating income is positive, but the significance level is lower than the coefficient of the total sample when the same variable is introduced. This indicates that ESG performance of heavily polluting enterprises has a poor ability to reduce the sensitivity of enterprise financing satisfaction to environmental pollution level, that is, the ability to relieve the green financing pressure faced by high-polluting enterprises is limited.

By observing columns 4–5 of

Table 12, when the social responsibility factor and corporate governance factor of ESG performance are tested, we can find that the significance of the cross-term coefficient between them and pollutant discharge fee per unit business income is consistent with the total sample regression. This means that the positive effect of these two sub-items on alleviating the green financing constraints of enterprises is less related to the industry in which enterprises are located.

5. Conclusions and Policy Implications

In the context of the continuous development of green finance and ESG rating systems around the world, the alleviation of corporate green financing constraints needs more information as support to achieve more targeted improvements. Based on the data of Chinese A-share manufacturing enterprises from 2011 to 2019, this paper empirically examines the impact of ESG performance on corporate green financing constraints and the differences between the overall performance and the sub-performance of ESG. The empirical results show that the green financing constraints of Chinese enterprises are relatively strong, and the market can produce obvious financing pressure to polluting enterprises. In terms of the overall performance of ESGs, corporate ESGs play a positive role in alleviating the constraints of corporate green financing, but it weakens when it comes to heavy polluting enterprises. This positive role has obvious regional and scale differences. From the perspective of ESG sub-performance, ESG sub-performance can play a role in alleviating the green financing constraints of enterprises, but the effect varies greatly with different regions, ownership, scale and pollution degree.

The conclusions of this paper have rich policy implications.

Firstly, the empirical results show that Chinese enterprises are facing great constraint pressure of green financing. In this regard, enterprises with green financing needs should start from the source, strengthen their own technological innovation, improve resource utilization efficiency, and promote enterprise growth to meet the requirements of relevant green policies, so as to reduce the pressure of green financing. In the face of green financing needs of relevant enterprises, investors should more comprehensively examine the nature of enterprises, corporate responsibility, and other aspects of performance, rather than a single vote on the basis of pollution level.

Secondly, the empirical result shows that enterprises’ ESG performance is helpful to alleviate enterprises’ green financing constraints. Therefore, relevant departments should accelerate and improve the construction of our ESG comprehensive system and establish and improve the compulsory disclosure system of ESG information by screening and supporting special agencies to carry out relevant statistics of ESG performance, so as to put pressure on companies which have their own problems and do not want to improve. Enterprises should enhance the enthusiasm of information related to ESG performance and improve their ESG performance on the premise of cost control, so as to broaden their financing channels, improve their market reputation, and ease the constraints of green financing.

Thirdly, in different regions of China, the promoting effect of enterprise ESG performance on alleviating green financing constraints is not balanced. There are obvious regional differences. This prompts policy makers and promoters to take measures based on the development status and economic characteristics of different regions, so as to ensure that relevant policies can adapt to the development requirements of different regions and reduce the financing pressure of enterprises.

Finally, the empirical test shows that the role of ESG performance on enterprises of different sizes is significantly different. Large-scale enterprises are relatively less faced with green financing pressure, and the role of ESG performance is also poor. This requires relevant financial institutions to not only consider benefits, but also supervise large-scale enterprises according to policies. Supervisory institutions should also encourage and guide large-scale enterprises to make use of their own advantages in capital, technology and other aspects to carry out green transformation.