Abstract

Considering carbon emission cost and consumer loyalty, this paper establishes a three-level multi-channel supply chain composed of the leading manufacturer, the retailer, and the consumer and builds a multi-channel supply chain with centralized decision-making and decentralized decision-making modes, and the optimal decision-making under both decision-making modes is solved. The study found that the carbon emission reduction level of multi-channel centralized decision-making is better than that of decentralized decision-making under the same carbon emission cost, and centralized decision-making can improve the carbon emission reduction level. Manufacturers open a direct channel to help reduce carbon emissions and need to consider the cost of emission reduction in their channel decisions. Consumer loyalty also directly impacts channel decisions. Only when carbon emission costs and consumer loyalty are within a reasonable range can new direct sales channels be opened to bring in new profits. Simultaneously, the total profit of the supply chain is greater than that of decentralized decision-making, but the double marginal utility of both parties decreases with the increase in carbon emission costs.

1. Introduction

As the global climate continues to deteriorate in recent years, the world’s major economies and global organizations have begun to pay greater attention to low-carbon and sustainable development, with many countries proposing their own carbon peak and carbon-neutral development plans [1] and using the widely established carbon market to facilitate this goal [2].

Similarly, in the consumer market, increasing sustainability awareness is becoming a powerful driver of consumption, and more and more consumers are willing to pay for environmental protection [3,4,5]. For example, a global survey of 11,500 consumers found that 89% of consumers are making their purchases more environmentally friendly, and 66% cite sustainability as the most important factor in their consumption decisions [6]. Another report shows that 69% of consumers believe that sustainability is more important now than it was two years ago [7]. In addition, a report for the US market suggests that two thirds of Americans said they would pay a premium for environmentally friendly products, up 2% from last year [8].

The growing concern about low carbon and sustainability from governments, the media, and consumers continues to force and drive companies to make a low-carbon transition in their supply chains (SC) [9,10] and to expand the use of low-carbon and sustainability concepts in their supply chain management (SCM). Many methods are responding effectively to this external pressure, such as developing or introducing sustainable products [11,12]. It has been argued that the benefits of low-carbon SCM are multiple. In addition to reducing carbon emissions, it can help to improve the overall performance and benefits of the SC [13,14,15,16], and it also stimulates innovation, which in turn reduces costs and adds value, ultimately increasing the productivity of resources and competitive advantages [17,18]. Similar benefits will help to attract more companies to improve the management of carbon emissions in their SC.

In addition, the current trend of accelerating consumer migration to online channels and the digital transformation of companies have also led us to think about consumer channel preferences and the opening of direct sales channels by companies. In particular, the COVID-19 pandemic has greatly contributed to and further consolidated this phenomenon [19,20,21], and during this period, many upstream and midstream companies opened their own online direct channels to meet this trend and survive better [22,23,24]. For example, Chinese electric car manufacturer NIO’s online sales event on an e-commerce platform was an unprecedented success: the 40 min event generated over USD 21 million in sales, and orders continued to grow after the event [25]. The literature suggests that companies that invested and transformed digitally tended to outperform during the pandemic [19].

Furthermore, the carbon reduction effect of online shopping is in line with today’s sustainable development goals, and it is well documented that e-commerce generally generates lower carbon emissions than traditional shopping models [26,27], therefore attracting a low-carbon-conscious consumer base. Moreover, when it comes to centralized versus decentralized decision-making in the multi-channel SC following the opening of a direct sales channel, the outcome is favorable for both manufacturers and retailers [28], and those who choose the multi-channel SC will be more profitable than those who choose the original dual-channel SC [29] and will also tend to perform better in the marketplace [30]. Among these, manufacturer-led SC will perform better than retailer-led SC in overcoming fixed costs and introducing sustainable products, thereby benefiting from consumers with low-carbon preferences [31].

In conclusion, it is clear that the prospects, driven by realistic consumption trends and sustainable development goals, are good enough to motivate manufacturers to open the direct sales channel and complete the transition.

However, while consumer demand for sustainable living is growing, many consumers (26%) find it difficult to find sustainable options on the shelves, and 46% of respondents believe that brands are primarily responsible for sustainable development [7]. And in addition to the current trend of consumers and businesses moving online, it has also been researched that consumers will gradually return to traditional shopping and their online preferences will return to previous levels as the pandemic ends [32,33,34].

The gap between market demand and objective reality has sparked our research interest in consumer low-carbon preferences and carbon reduction issues, while the uncertainty between the varying findings in the existing literature has drawn our attention to the impact of the online direct channel and channel preferences on the SC. In current academic research, many scholars have conducted systematic research on dual-channel supply chains (DCSC) [35,36,37,38], low-carbon dual-channel supply chains [39,40,41], and multi-channel supply chains (MCSC) [42,43,44]. However, no research has yet been conducted to combine MCSC with carbon emission costs and consumer loyalty in low-carbon issues with the leading manufacturer, so it is necessary to fill the research gap and expand the current theoretical findings in the field of SCM research so as to provide a reference basis for enterprises’ decisions under the current global greening trend.

Overall, it is of great theoretical and practical importance to study the issue of low-carbon MCSC decision-making following the emergence of the direct sales channel. Specifically, our research aims to address the following questions:

- (1)

- What are the optimal solutions, i.e., the equilibrium outcome for low-carbon dual- and multi-channel SC decisions in centralized and decentralized decision-making scenarios?

- (2)

- Based on carbon emissions across different channels, how do carbon emission costs and consumer loyalty affect decisions in MCSC?

- (3)

- How do the costs of carbon emissions and consumer loyalty affect the total carbon emission reduction of the SC, the total profits of the SC, and the manufacturer? What are the conditions for the manufacturer to open the direct sales channel?

To answer these questions, we establish a three-level MCSC consisting of the leading manufacturer, the retailer, and the consumer market, and consumer’s demand is directly affected by their channel preferences and the carbon emission reduction level. Likewise, four decision modes were chosen to describe the different SC decision-making structures, and then the optimal results were solved based on Stackelberg game theory. This research makes the following contributions:

- (1)

- Currently, many scholars’ studies on low-carbon SC are mostly focused on the field of DCSC [39,45], but this paper extends the corresponding research to the field of MCSC, which is an effective supplement to the existing research on low-carbon SC.

- (2)

- This paper builds on previous research on MCSC and uses references from [29,46] and others. However, this study is unique in that it applies MCSC to low-carbon issues and considers more additional elements, thus expanding the existing research and contributing to the field.

- (3)

- Unlike previous publications that consider only one consumer preference, this paper incorporates both consumer loyalty and low-carbon preferences into SC decision-making. This approach leads to more realistic decisions and stronger practical guidance, providing a basis for manufacturers to transition to low-carbon operations.

The rest of the paper is organized as follows: In Section 2, the relevant literature has been reviewed to provide the theoretical foundation of this research. Section 3 introduces the low-carbon MCSC model with four decision modes and the corresponding notations and assumptions. In Section 4, we solve the four decision modes presented in the previous section. We then discuss the obtained results in Section 5, using the resulting 14 propositions and other findings to reflect the impact of each element on SC decisions. The results of the analysis are then modeled numerically in Section 6, which verifies the propositions and discusses the management implications of our findings, and the paper concludes in Section 7, noting the research limitations.

2. Literature Review

The problem studied in this paper is the decision-making problem of multi-level and multi-channel SC, focusing on the impact of factors such as the cost of carbon emissions and consumer loyalty on SC, as well as the level of carbon emission reduction and profitability. This section provides a review of competition and decision-making in DCSC, as well as the existing research on low-carbon DCSC and MCSC.

2.1. Dual-Channel Supply Chain

Many scholars have conducted systematic research on DCSC decision-making, focusing on issues such as SC pricing strategies, channel competition, etc. [47]. For example, Chen et al. [35] were inspired by the apparel industry and developed two types of single channel and a DCSC, then studied the pricing and quality decisions of the SC. Zhou et al. [36] set up a manufacturer-led DCSC to study the pricing problem under information asymmetry. Wang et al. [37] studied DCSC pricing and coordination strategies when consumers have certain channel preferences. Li et al. [38] included a consideration of the four-channel refund issue in their study of pricing strategies, and in another study, Li et al. [48] considered the market shares for different channels and studied the impact of the showrooming effect on pricing and service. Yu et al. [49] investigated the optimal decision when manufacturers have DCSC and also found an important influence of consumer channel preferences on the SC structure. Other similar studies that are instructive for this paper include Zhang et al. [50], Lin et al. [51], and Chen et al. [52], all of whom considered consumer channel preferences and conducted research on DCSC.

Moreover, some scholars choose to study the DCSC from the perspective of SC leaders. For example, Ma et al. [53] studied manufacturers’ pricing decisions and strategy choices through three analytical models based on a manufacturer-dominant perspective and found that only the dominant manufacturer could benefit from the wholesale-price-advantage strategy. In contrast, Yan et al. [54] studied optimal pricing strategies from a retailer-driven perspective and analyzed the optimal lied factors of manufacturers and the cross-price sensitivity of customers. In addition to the study of pricing strategies, other developments in the field of DCSC have explored concepts such as channel conflict and coordination in various contexts [55,56,57,58]. Notably, Cai [59] studied four different SC structures and concluded that the DCSC is not always the optimal structure of the market, which also inspires the thinking of this paper.

Most of the aforementioned literature is devoted to DCSC in terms of channel gaming, pricing, coordination, and other decisions, and while important progress has been made, none of them has considered conditions such as the cost of carbon emissions and consumer loyalty and compared centralized and decentralized decision-making in MCSC, which has emerged as a pressing issue due to current consumer trends. In order to fill the research gap, our study takes this into consideration and conducts a focused study on it in order to draw more economic conclusions.

2.2. Low-Carbon Dual-Channel Supply Chain

Similarly, there is a large body of literature within the field of SCM with research directions related to green and low-carbon DCSC, with its related research being identified as an important branch of management science and sustainable development [60]. Sarkis et al. [61] defined the related concept as increased consideration of environmental issues in inter-organizational management, and in the related research, some scholars have chosen to study this from the perspective of consumer preferences. For instance, Wu and Yang [45] analyzed the issue of low-carbon SC coordination under low-carbon consumer preferences, and Li et al. [39] explored the conditions for the existence of DCSC under the influence of factors such as consumer loyalty and carbon reduction costs, as well as the different pricing decisions and greening strategies of DCSC in the context of centralized and decentralized decision-making. Based on this research, Heydari et al. [40] considered consumer preferences for different channels and studied pricing and greening strategies under three decision structures, and Jamali and Rasti-Barzoki [62] studied a complex case of considering two competing SC with dual distribution channels. Taking another perspective, the model developed by Peng et al. [63] considered the market share of the different channels and investigated DCSC from the perspective of consumer satisfaction and green marketing. The study by Chen et al. [64] also considered the market shares of different channels and proposed contracts to coordinate the green supply chain. The research by Ji et al. [41] indicated that the introduction of online channels is beneficial to manufacturers under certain conditions, and joint emission-reduction strategies are beneficial for SC members.

As industry decarbonization is often linked to government actions, some studies further consider government actions such as subsidies [46,65], participation [66], etc. In addition, some scholars have also studied the perspective of firms in their research. For example, Wang et al. [67] studied the decision-making and coordination of retailer-led low-carbon SC based on the perspective of altruistic preferences. Carrillo et al. [68] studied the impact of environmental efficiency issues on retailers’ channel choices and investigated the influences between industries such as the book industry. There are also some studies carried out from the perspective of fairness concerns [69,70] and other related perspectives.

The contextual structure of the channels studied in the literature above is all about DCSC, which has certain limitations and does not consider the low-carbon MCSC decision problem of the leading manufacturer after adding the direct sales channel. The context of our study is based on the MCSC of the leading manufacturer, which complements the existing studies.

2.3. Multi-Channel Supply Chain

The MCSC is also a hot topic of current research, and in related studies, Sarkar and Pal [71] constructed an MCSC model with traditional and direct channels, focusing on market strategies and optimal SC decisions from the perspective of manufacturers’ service provision. The model developed by Zhen et al. [42] considered the market shares of different channels and investigated the MCSC decision problem in terms of four fairness dimensions. The model from Wang et al. [43] considered consumer channel preference and analyzed pricing decisions and channel selection in MCSC from the perspective of leading retailers. The study shows the decisive role of different channel operating costs in channel selection. Matsui [44] compared the time nodes at which pricing decisions are made in an MCSC and concluded that the decision time nodes for manufacturers and retailers are different.

Some scholars have chosen to study from the perspective of demand uncertainty, such as Hsieh et al. [72], who studied pricing and ordering decisions and ultimately concluded that decentralized systems are beneficial to overall efficiency. In addition, scholars have begun to pay attention to the low-carbon issue of MCSC. For example, Khorshidvand et al. [29] have discussed the decision-making of low-carbon issues in MCSC by constructing a three-tier SC model. Although the above literature has conducted systematic research on MCSC and made important progress, it has not considered the impact of factors such as carbon emission costs and consumer loyalty on MCSC decision-making.

Therefore, based on the existing research, this paper considers the impact of carbon emission cost and consumer loyalty on MCSC decision-making from the perspective of a leading manufacturer, constructs four centralized and decentralized decision-making modes, and solves the optimal solutions for different scenarios. It then explores the impact of carbon emission cost and consumer loyalty on MCSC decision-making, compares and analyzes the changes in carbon emission and total SC profit under different decision-making modes, and analyzes the conditions for manufacturers to open up direct sales channels so as to provide a theoretical basis for manufacturers’ decision-making.

3. Model Description

The SC considered in this paper consists of a leading manufacturer, a retailer, and a consumer market, and in order to protect the environment and enhance market competitiveness, the manufacturer offers only one standard green product. When operating in a DCSC, only the retailer’s traditional offline channel and the online channel are open. When conducting MCSC operations, the manufacturer builds its own direct sales channel on the basis of the retailer’s dual channel, and both the manufacturer’s direct sales channel and the retailer’s online channel are based on e-commerce for the sale of products.

The SC formed by both parties has two modes of decision-making, i.e., centralized and decentralized. Under centralized decision-making, both parties to the SC jointly determine the decision variables, such as the product’s carbon emission reduction level and the retail price . Under decentralized decision-making, as the Stackelberg leader of the SC, the manufacturer first decides the carbon emission reduction level and the wholesale price , then the retailer decides the retail price of the green product.

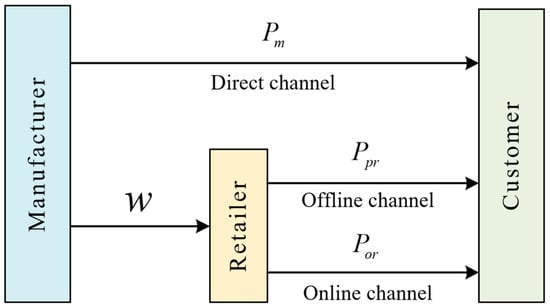

Therefore, regarding the SC channel structure ( and represent DCSC and MCSC, respectively) and the decision-making mode ( and represent centralized and decentralized decision-making, respectively), there are four combinations, i.e., and represent centralized and decentralized decision-making, respectively, in the DCSC, while and represent centralized and decentralized decision-making, respectively, in the MCSC. The end-consumer market consists of environmentally conscious consumers whose preference for green products means that overall demand increases as the carbon emission reduction in the green product increases, while consumers are also influenced by their own loyalty to different channels to determine the channel through which goods are purchased. The MCSC structure considering a leading manufacturer is shown in Figure 1, and the relevant parameters, channel variables, and their meanings used in this paper are shown in Table 1.

Figure 1.

Multi-channel supply chain structure.

Table 1.

Definition table of main parameters.

In reference to studies [39,65,67], among others, where the product demand function for the consumer market considered is the linear function of the green product price and the carbon emission reduction level, the resulting product demand functions for the retailer’s traditional offline and online channels and the manufacturer’s direct sales channel are shown as follows:

where is the total market demand, which is sufficiently large; is the loyalty of consumers to the e-commerce channel (e-channel); is the loyalty of e-channel consumers to the retailer’s online channel, where there is ; and represent the retail price and wholesale price of the product, respectively, so there is ; is the price effect of demand for the product; and is the effect of changes in a product’s carbon emission reduction level on demand.

To establish the model, some research assumptions are presented as follows:

Assumption 1:

There exists , i.e., for a linear demand function, the price effect of a product is greater than the effect of the change in the carbon emission reduction level of the product on demand [39,62,73]. Since retailers are closer to the consumer market than manufacturers, consumers can intuitively experience products and receive professional services at the retailer, so holds, i.e., when the manufacturer increases the carbon emission reduction level, the growth in demand in the retailer’s offline channel is greater than that in the retailer’s online channel, and then greater than that in the manufacturer’s direct channel.

Assumption 2:

For the purposes of this study, the units used in our calculations are dimensionless, facilitating the application of our findings across diverse environments and regions where monetary values can vary significantly. We assumed that the fixed cost per unit of production of the green product is zero, which does not affect the conclusions of this paper. Pricing is assumed to be the same between channels [39,43,46]. There is no inventory (materials, semi-finished products, etc.) in the SC, and the retailer sells offline and online through its retail shops, which generates more carbon emissions in transportation compared to the direct channel [74], so it is assumed that the channels owned by the retailer need to pay a certain carbon emission cost per unit of product sold . Since direct sales channels emit much less carbon than retail channels [26,27], we assume that the carbon emissions from the manufacturer’s direct sales channel are zero.

Assumption 3:

Manufacturers must invest a certain proportion of their production costs to purchase new, high-tech machinery and upgrade production technology to reduce emissions more efficiently, so, according to the existing literature [75,76], the investment cost is assumed to be a concave function of emission reduction per unit of green product, i.e., , where is the cost coefficient of the carbon emission reduction per unit.

The four decision modes for DCSC and MCSC under centralized and decentralized decision modes are developed here and shown below:

Mode : in this mode, the decision variables such as the price and the carbon emission reduction level are jointly determined by the manufacturer and the retailer, thus maximizing the total profit of the SC, so the total profit function is expressed as the sales profit minus the investment costs, where the sales profit is the profit per product multiplied by the total market demand, with the following equation:

Mode : In this mode, the manufacturer, as the Stackelberg leader of the DCSC, first decides the level of carbon emission reduction and the wholesale price of the product; subsequently, the retailer decides the price . Thus, the profit function for the retailer is the profit per product multiplied by the market demand for the retailer’s channel; the profit function for the manufacturer is the profit per product multiplied by the market demand for the manufacturer’s channel minus the investment cost, which is shown as follows:

Mode : In this mode, the decision variables such as the price and the carbon emission reduction level are jointly determined by the manufacturer and the retailer so as to maximize the total profit of the SC, so the profit function is expressed as the sales revenue minus the carbon emission cost minus the investment costs with the following equation:

Mode : In this mode, the leading manufacturer first decides on the carbon emission reduction level and the wholesale price of the product, and then the retailer decides on the retail price . Thus, the profit function for the retailer is the profit per product multiplied by the market demand for the retailer’s channel; the manufacturer’s profit function is the wholesale profit plus the profit from sales in its own channel minus the cost of carbon emissions, which is shown as follows:

4. Modes Solutions

The optimal solutions for the four decision modes are given in this section, and all proofs are presented in the Appendix A.

Theorem 1.

In Mode , the optimal decisions for the DCSC and the total SC profit are as follows:

Theorem 2.

In Mode , the optimal decisions for DCSC and the optimal profit for the manufacturer and the retailer are as follows:

Theorem 3.

In Mode , the optimal MCSC decisions and the total SC profit are as follows:

Theorem 4.

In Mode , the optimal decisions for the SC and the optimal profit for the manufacturer and the retailer are as follows:

5. Analysis and Discussion of the Solutions

In this section, MCSC decision-making is taken as the main line of research to analyze and discuss the impact of various parameters on the SC. The optimal decision results obtained under Mode and Mode are compared and analyzed to explore the impact of centralized and decentralized decision-making on the SC, and the corresponding propositions and conclusions are presented.

5.1. Comparison of Carbon Emission Reduction Levels between Modes and

The carbon emission reduction levels for Modes and are known as and , respectively. The aim is to compare these variables between the two modes, i.e., , with a view to obtaining a more general result.

Then, from the above, it follows that:

Thus, Proposition 1 is obtained.

Proposition 1.

When

, there are

holds, at which point the carbon emission reduction level in Mode

is greater than that in Mode

. It follows that:

5.2. The Impact of Consumer Loyalty on MCSC Decisions

Next, the impacts of consumer loyalty and on MCSC decisions are analyzed without losing the generality of the study. Mode is chosen here for the analysis, and the other modes are analyzed by such reasoning. Knowing and in Mode , the impact on is analyzed first, from which it follows that:

Since , , , ,, , and , it follows that , , and the theorem assumes that holds, so the following propositions can be obtained.

Proposition 2.

Under Mode

, there is

, i.e., the wholesale price is positively correlated with consumer loyalty to the e-channel

. Hence, when the wholesale price

rises, consumer loyalty to the e-channel

increases.

Proposition 3.

Under Mode , there is

, i.e., the wholesale price is negatively correlated to consumer loyalty to the retailer’s online channel

, hence the wholesale price

decreases as consumer loyalty

increases.

Next, let us analyze the effect of consumer loyalty on carbon emission reduction level . It can be determined that:

Proposition 4.

Under Mode

, there is

, i.e., there is a positive correlation between the carbon emission reduction level and consumer loyalty

under decentralized decision-making in the MCSC.

Proposition 5.

Under Mode

, there is

, that is, under decentralized decision-making in MCSC, the carbon emission reduction level

is negatively related to consumer loyalty γ.

Finally, in the case of consumer loyalty and green product retail prices , there are:

Therefore, it is determined that:

Proposition 6.

Under Mode

, there is

, i.e., the retail price of the green product

under decentralized decision-making in MCSC is positively correlated with consumer loyalty to the e-channel

.

Proposition 7.

Under Mode

, there is

, that is, the retail price of the green product

under decentralized decision-making in MCSC is negatively correlated with consumer loyalty γ.

5.3. Impact of Carbon Emission Costs on MCSC Decisions

In order to analyze the impact of the carbon emission cost of the products sold in the retailer channel, we first choose to study the wholesale price , the carbon emission reduction level , and the price under Mode . By combining these variables with the ones mentioned above, we obtain the following:

Proposition 8.

Under Mode

, there is

, i.e., a negative correlation between the wholesale price

and the cost of carbon emission

, which shows that the cost of carbon emission per unit of product in the retailer’s channel has a direct impact on the wholesale price, which in turn can affect the profit.

Proposition 9.

Under Mode

, there is

, i.e., a negative correlation between the carbon emission reduction level

and the carbon emission cost

under decentralized decision-making in MCSC, which shows that the carbon emission cost of the product in the retailer’s channel has a direct impact on the carbon emission reduction level.

Proposition 10.

Under Mode

, there is

, that is, the retail price

is negatively correlated to the carbon emission cost

, which shows that the carbon emission cost per unit product in the retailer’s channel has a direct impact on the retail price.

Next, the relationship between the carbon emission cost and both the carbon emission reduction level and the retail price under Mode is investigated. According to the first-order condition, the following is determined:

Proposition 11.

Under Mode

, there is

, that is, the retail price of the product

is negatively correlated with the cost of carbon emissions

under centralized decision-making in the MCSC.

Proposition 12.

Under Mode

, there is

, that is, the carbon emission reduction level

is negatively related to the carbon emission cost

.

Finally, the relationship between the retailer’s demand ( and ) and the carbon emission cost under Mode and Mode is investigated. From the previous study, it can be determined that:

Proposition 13.

Under Mode

, there is

, that is, the retailer demand

under centralized decision-making in MCSC is negatively correlated with the cost of carbon emission

.

Proposition 14.

Under Mode

, there is

, that is, the retailer demand

in a decentralized MCSC is negatively correlated with the cost of carbon emission

.

5.4. Impact of the Cost of Carbon Emissions on Total Carbon Reduction

In the assumptions above, we assume that there is no inventory in the whole SC, so the total emission reduction of the SC is the product of the product demand and the carbon emission reduction level . Assuming that the total emission reduction of the SC is , the total emission reduction in Modes and can be calculated as:

Taking the partial derivative of the above equation with respect to yields:

Here, we obtain the equation for the total carbon emission reduction versus the cost of carbon emission , which we discuss in Section 6.

6. Numerical Experiments

The relevant propositions are verified here by numerical experiments, based on the analytical basis of the existing literature [39,40,57,63], which is taken as in this paper.

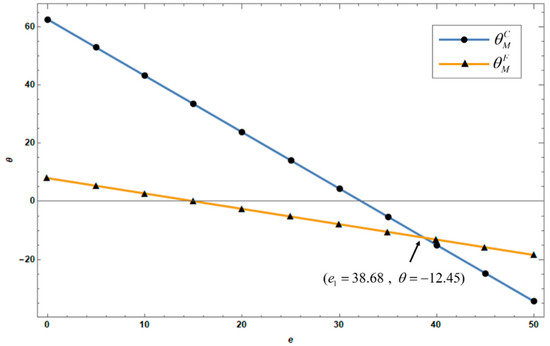

6.1. Comparison of Carbon Emission Reduction between Modes and

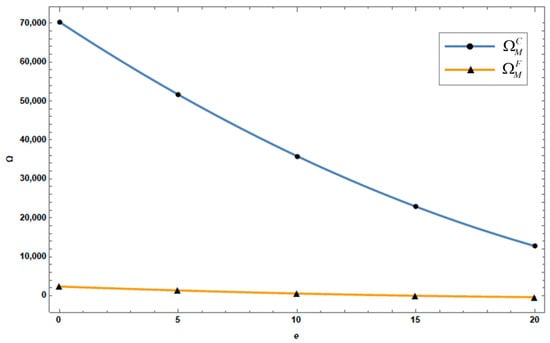

Let us first compare and analyze the carbon emission reduction level between channels under different decision modes to obtain Figure 2.

Figure 2.

The impact of carbon emission costs on inter-channel carbon reduction.

From Figure 2, it can be seen that the carbon emission cost has a greater impact on the carbon emission reduction level , and between Modes and , when , there are holds, verifying Proposition 1. This means that, in the regular operation of the SC, for the same carbon emission cost, the level of carbon emission reduction of centralized MCSC decision-making is greater than that of decentralized MCSC decision-making. Therefore, for more socially responsible and environmentally conscious companies, centralized decision-making will help to achieve a greater level of carbon reduction for the same cost of carbon emissions, which is conducive to achieving carbon emission reduction targets, so companies should first consider centralized decision-making for their SC and try to control the carbon emission cost to improve the carbon emission reduction level of the product.

6.2. The Impact of Consumer Loyalty on MCSC Decisions

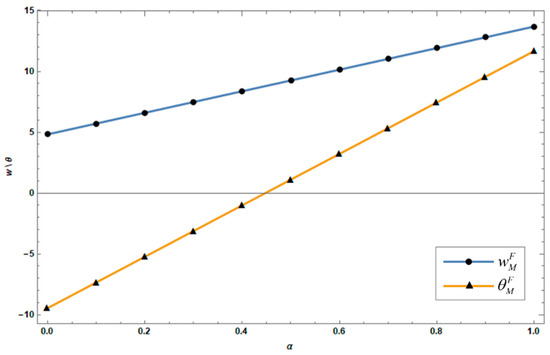

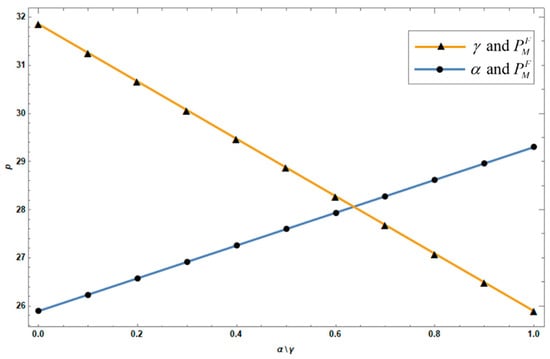

The relationship between the carbon emission reduction level , wholesale prices , and consumer loyalty to the e-channel under Mode is shown in Figure 3.

Figure 3.

The impact of on and .

As can be seen in Figure 3, and are positively correlated with and both increase as consumer loyalty to the e-channel increases, verifying the validity of Propositions 2 and 4.

The next observation is the effect of on variables and , as shown in Figure 4.

Figure 4.

The impact of on and .

specifically refers to consumer loyalty to the retailer’s online channel. As seen in Figure 4, and are negatively correlated with and both decrease as increases, so Proposition 3 and Proposition 5 are also confirmed.

It can be seen from the combination of Proposition 2 and Proposition 3 in Mode that when consumer loyalty to the e-channel increases, the e-channel market share is expanded. The manufacturer does not only raise the wholesale price to reduce the retailer’s overall competitiveness, but a comprehensive comparative evaluation of the retailer’s online channel and their own directly operated channel market share and competitiveness is also considered before making the decision. In other words, when the e-channel’s market share increases, if the main increase takes place on the retailer’s online channel side, the manufacturer will reduce the wholesale price to expand the market overall, so the e-channel market will also expand. On the other hand, when the manufacturer’s direct channel’s market growth is greater, the manufacturer will choose to increase the wholesale price to weaken the retailer’s comprehensive competitiveness. This finding offers strategic guidance for manufacturers operating within the MCSC. Given their ability to determine wholesale prices, manufacturers can dynamically adjust their pricing decisions based on changes in consumer loyalty. This informed and responsive approach empowers manufacturers to optimize profitability under varying market conditions, thereby maximizing their own gains.

Combining Proposition 4 and Proposition 5, we can know that the carbon emission reduction level is positively correlated with consumers’ loyalty to the e-channel , which also verifies the conclusion of Zhao et al. [26] that e-commerce uses less disposable energy than traditional retailing, which helps channels to reduce carbon emissions. The more consumers use e-commerce channels, the more obvious the effect of carbon emission reduction will be. At the same time, it also shows that selling products directly through e-channels can make a significant contribution to reducing carbon emissions, and the level of carbon emission reduction from the retailer’s online channel is not as good as that from the manufacturer’s direct sales channel. Therefore, in light of sustainability goals and low-carbon aspirations, this finding provides a clear direction for companies: Opening online channels emerges as a greener option that can mitigate excessive carbon emissions. Companies committed to sustainability should consider strengthening their e-commerce capabilities, particularly focusing on the manufacturer’s direct sales channel. Such a strategy serves not only to gain a competitive advantage but also to meaningfully contribute to the broader goal of corporate social responsibility.

Finally, let us observe the impact of and on the retail price of green products , as seen in Figure 5.

Figure 5.

The impact of and on .

Figure 5 depicts the impact of two types of consumer loyalty on the retail price of green products under Mode . It can be seen from Figure 5 that and are positively correlated, and the two are increasing in trend, which verifies Proposition 6. In contrast, is negatively correlated with , which verifies Proposition 7.

Figure 5 provides a decision-making reference for retailers under Mode . When retailers are preparing to price the product, they must refer to the preference ratio of market consumer loyalty to different channels to a certain extent. For example, when the e-channel’s number of consumers increases and the increase is mainly in the retailer’s online channel, the price should be reduced, which will attract more consumers to buy products to a greater extent. In contrast, when the increase is mainly in the manufacturer’s direct channel, then the retailer needs to increase the price of the product. At this time, consumers will reduce their purchases from the manufacturer’s channel due to the impact of the price effect. The practical significance of this finding is that it reveals the game mechanism between supply chain participants. As previously analyzed, manufacturers can gain benefits for themselves by controlling the wholesale price. Similarly, retailers can dynamically price according to channel preferences in the current market to gain a competitive advantage. In addition, it also shows that consumer preferences dominate the decision-making behavior of retailers to a certain extent, while the retailer will exert their effects on consumers through their decision-making.

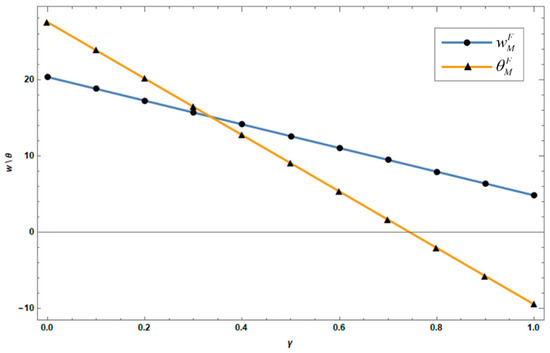

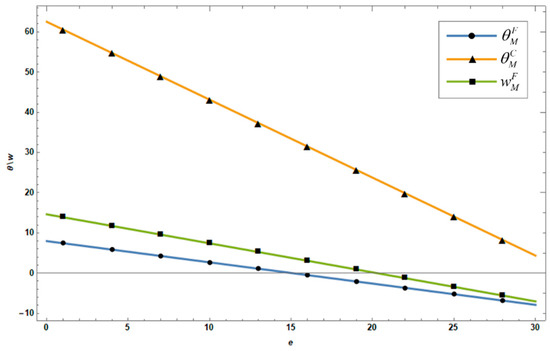

6.3. The Impact of Carbon Emission Costs on MCSC

First, let us analyze the comparison of the carbon emission reduction levels in Modes and and the product wholesale price under Mode , as seen in Figure 6.

Figure 6.

The impact of on , , and .

As shown in Figure 6, and are negatively correlated with the carbon emission cost , which verifies Propositions 9 and 12, i.e., higher costs of carbon emission will reduce the carbon reduction level. The carbon emission reduction level under Mode is greater than under Mode , which shows that centralized decision-making is conducive to increasing SC emission reduction; therefore, in practice, companies can promote carbon emission reduction by opting for centralized decision-making. At the same time, given that excessive carbon emission costs can dampen the impact of emission reduction, companies should also focus on controlling carbon emission costs, which can be achieved through measures such as the use of renewable energy sources. Also, Figure 6 reflects the change curve of with , which verifies Proposition 8. This means that the increase in carbon emission costs will put more operational pressure on the retailer, which is also unfavorable for the manufacturer, so they tend to help the retailer to tide over the difficulties by reducing wholesale prices. This finding is extremely important in operational terms, as the previous section shows how supply chain participants can benefit themselves through pricing. It also shows a way in which manufacturers can help retailers who are facing high carbon emission costs by reducing their wholesale prices.

In addition, the carbon emission cost also has a significant impact on prices and under Modes and . It can be seen from Figure 7 that and are negatively correlated with , which verifies Proposition 10 and Proposition 11.

Figure 7.

The impact of on and .

Figure 7 provides a reference for the retailer’s pricing and mode selection for the manufacturer in an MCSC. When making pricing decisions to satisfy profit maximization, the retailer needs to choose the appropriate pricing decision, and the manufacturer needs to choose the appropriate SC mode. Figure 7 shows that higher carbon costs lead to lower prices, and when in the SC, there is , i.e., the retail price of green product under Mode is greater than under Mode , so it would be more reasonable to choose Mode in that situation. Conversely, when , there is , and Mode should be chosen. The operational implication of this finding is that the size of the carbon emission cost will affect the retail price, with higher costs leading to lower prices. In the meantime, the decision modes of MCSC are not set in stone, so the appropriate operating mode should be chosen based on the actual cost of carbon emissions in the current environment.

Finally, the change trend of demand with the retailer’s carbon emission costs under Mode and Mode will be analyzed and compared in this section. As seen in Figure 8, and are negatively correlated with , verifying Propositions 13 and 14.

Figure 8.

The impact of on and .

Customer traffic drives business profitability. The increase in carbon emission costs will lead to lower demand, but within a reasonable range, the market demand for retailer under Mode is greater than the demand under Mode , which shows that Mode will attract more consumers for the retailer and, therefore, generate more revenue for the retailer in its operations. Moreover, at the same carbon emission cost, the carbon emission reduction, the retail price of green products, and market demand for the retailer under Mode are all greater than those in Mode . Although the increase in price will lead to a decline in the number of consumers, since is much greater than , the impact of the price effect on demand will be less than that of carbon emission reduction changes on demand. This insight provides another strategic perspective for companies in the MCSC. It suggests that a single variable will not necessarily cause irreversible changes in the SC; rather, it often requires a combination of multiple factors to optimize supply chain performance. Therefore, businesses should consider conducting extensive market research in various ways during their operations. This will help them to identify key factors that influence their business model transitions and enable them to enhance their overall benefits.

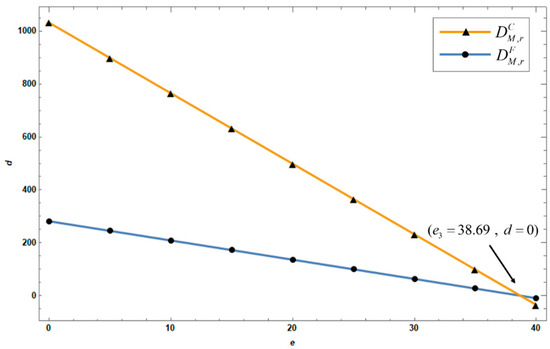

6.4. The Impact of Carbon Emission Costs on the Total Carbon Emission Reduction

It can be seen from Figure 9 that, within a reasonable range, there is . This takes place because the total demand of the SC is scaled up in a centralized decision mode, and, therefore, the total carbon emission reduction of the SC is greater for the same carbon emission cost and level of carbon emission reduction. Therefore, centralized decision-making can facilitate greater carbon reduction in the SC, which is also good for companies seeking to market themselves better in practice. Additionally, the total carbon emission reduction decreases as the cost of carbon increases, implying that companies should proactively control or reduce their carbon emission costs to improve their carbon reduction effectiveness.

Figure 9.

The impact of on and .

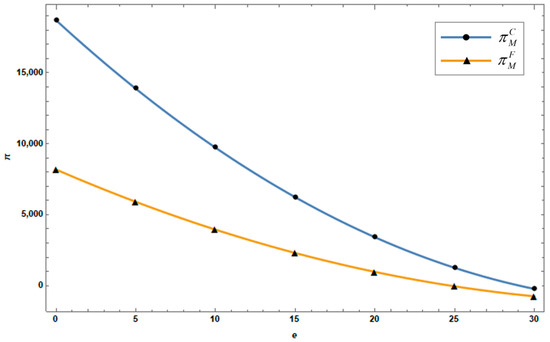

6.5. The Impact of Carbon Emission Costs on the Total Profit

Next, we will analyze the impact of the carbon emission cost on the profit of Mode and Mode (see Figure 10).

Figure 10.

The impact of on and .

Figure 10 shows that the total profit of the SC under Modes and decreases with the increase in the carbon emission cost , and holds, which shows that the profit of the MCSC under Mode is often better than under Mode . At the same time, the double marginalization effect of the SC makes the profit difference between the two decrease with the increase in the carbon emission cost . Hence, in practice, the adoption of centralized decision-making not only helps to reduce carbon emissions but also helps the supply chain to be more profitable. Nevertheless, companies operating within this mode should seek to reduce the carbon emission cost in order to increase overall profit and should remain aware of the double marginalization effects inherent in the SC to ensure an efficient operation within the prevailing mode.

6.6. The Impact of Carbon Emission Costs on Manufacturer’s Channel Choice

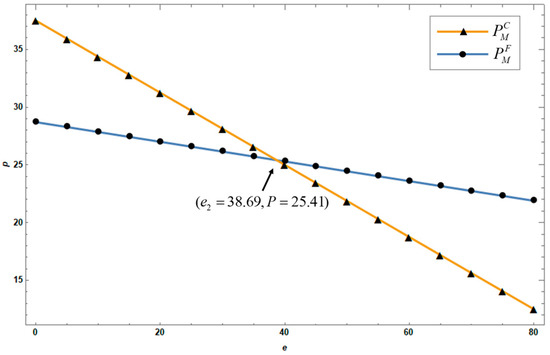

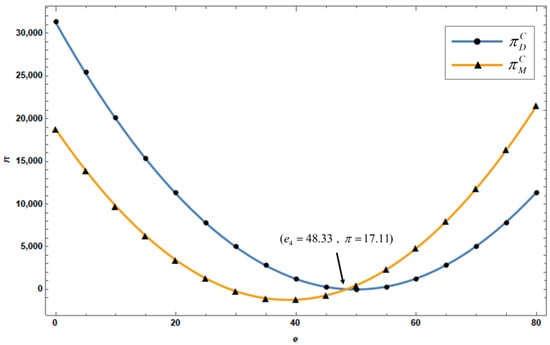

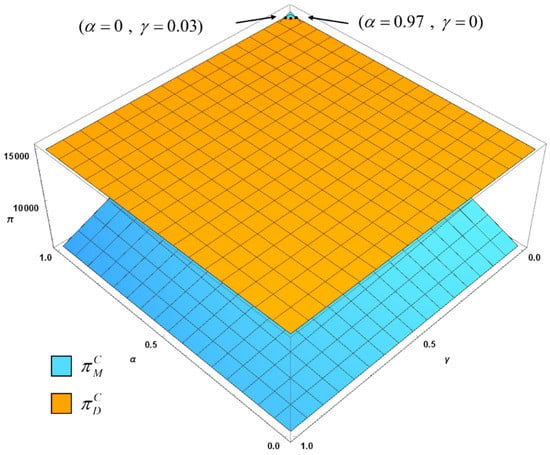

If the manufacturer wants to open up a new channel and complete the transformation from a DCSC to an MCSC, they must consider the key factor of profit. The following lines will analyze this issue. First, let us look at the situation under centralized decision-making (see Figure 11).

Figure 11.

The impact of on and .

Under centralized decision-making, if the manufacturer wants to open up a new channel, that is, to complete the transformation from Mode to Mode , they need to consider the impact of on profits. When , the profit under Mode is greater than that under Mode . A new channel will inevitably lead to diseconomy in the SC, so manufacturers have no motivation to open it up. When , the profit under Mode gradually begins to exceed that of Mode , making it suitable to open up the new channel at this time. Therefore, in the process of changing from Mode to Mode , higher carbon emission costs will prompt the manufacturer to make the decision to open up the new channel. This finding could serve as a reference for business channel decisions. Given the significant impact of carbon emission costs on SC profits, an SC under centralized decision-making can determine the point at which to open a new channel based on their own operating environments, thereby improving the overall profitability of the SC.

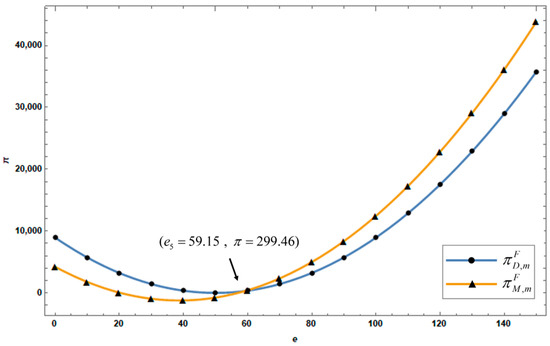

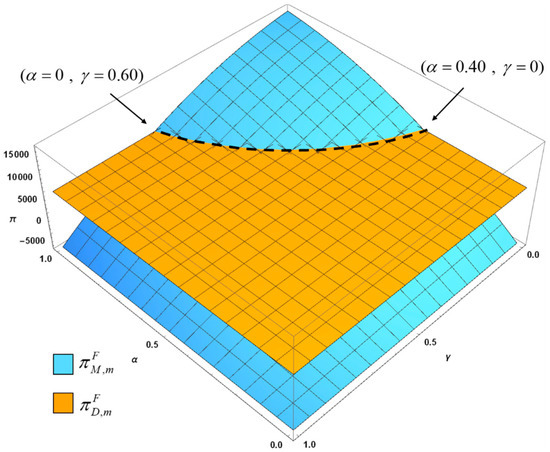

Next, we will study the conditions for a manufacturer to open up the new channel under decentralized decision-making, that is, the key point for transitioning from Mode to Mode (see Figure 12).

Figure 12.

The impact of on and .

It can be seen from Figure 12 that the unit product carbon emission cost is the key factor determining whether the manufacturer will open up the new channel under decentralized decision-making. When , there is , and at this time the manufacturer is not suitable for opening up a direct sales channel (this scenario is suitable for Mode ). When , there is , and the profit will be increased if the manufacturer opens up its own direct sales channel, so it will be a wise choice to change to Mode in time. Therefore, is the key decision point for manufacturers to open a direct sales channel in this situation. Unlike the section above, which determined when to open the new channel from the perspective of the SC, the findings in this section can help the manufacturer to decide when to open their own direct sales channel, a decision that is also relevant to the current cost of carbon emissions in the SC.

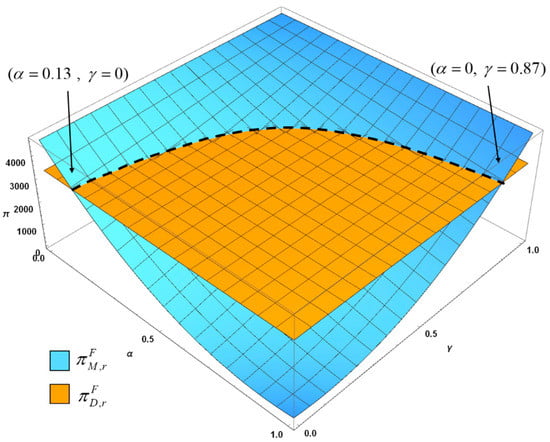

6.7. The Impact of Consumer Loyalty on Manufacturer’s Channel Choice

Next, we will analyze the impact of consumer loyalties and on the choice of the SC mode, as shown in Figure 13, Figure 14 and Figure 15.

Figure 13.

The impact of consumer loyalty on SC profits under Modes and DC.

Figure 14.

The impact of consumer loyalty on manufacturer’s profit in Modes and DF.

Figure 15.

Impact of consumer loyalty on retailer’s profit under Modes and DF.

Figure 13 shows the change trend of the SC profit with consumer loyalty under centralized decision-making under Modes and . It can be seen that the profit under Mode is considerably smaller than that of Mode in the majority of cases, and only when it is within the range of and , the profit of Mode will be greater than that of Mode . In this case, the consumers in the market will congregate in the manufacturer’s direct channel, so it is appropriate for the manufacturer to open the new channel at this time to complete the transition from Mode to Mode . This finding reminds centralized SC to actively adapt to real market conditions and make decisions from a holistic SC perspective rather than making irrational decisions based on idealized scenarios.

Figure 14 shows the trend of the manufacturer’s profit changing with consumer loyalty under decentralized decision-making Modes and . It can be seen that when consumer loyalty is in the range of and , there is , that is, at this time, the manufacturer’s profits under Mode are greater than those under Mode , so the manufacturer has the drive to open up a new channel and shift from Mode to Mode ; otherwise, there will be , and the manufacturer will continue to choose Mode . This finding suggests that a manufacturer in a decentralized SC has the flexibility to make channel decisions based on consumer loyalty, thereby increasing their own profits, but, of course, this also places demands on the manufacturer’s market perception and responsiveness.

Figure 15 shows the trend of the retailer’s profit changing with consumer loyalty under decentralized decision-making Modes and . It can be seen that when consumer loyalty is in the range of and , there is , that is, at this time, the retailer’s profits under Mode are greater than those under Mode , so the retailer will support the manufacturer to open up the new channel, changing from Mode to Mode . This finding can tell us that the conditions for the manufacturer to open up a direct sales channel are different from those for the retailer, which will lead to the risk of channel conflicts in actual operations. Therefore, reasonable coordination contracts should be used to ensure that SC participants can maximize their own interests.

7. Conclusions

Under the global development goal of carbon peaking and carbon neutrality, this paper establishes a three-level MCSC consisting of a leading manufacturer, a retailer, and a consumer market and constructs modes for centralized and decentralized decision-making. The optimal decision results of the MCSC under different scenario modes are obtained, followed by a study of the interrelationship between the factors of the SC based on the manufacturer’s perspective and answers to the questions raised above.

For question 1, this paper obtained the optimal decision-making results under different decision-making modes, which are price, carbon emission reduction level, wholesale price, market demand, and total profit of the SC under centralized decision-making and retailer’s profit and manufacturer’s profit under decentralized decision-making.

For question 2, we compared the impact of carbon emission costs on the carbon emission reduction level, the wholesale price, and the retail price under different channels and found that the carbon reduction level under centralized decision-making is much higher than that under decentralized decision-making, which means that the carbon reduction level can be greatly enhanced through centralized decision-making [67]. As for wholesale prices, we identified a mutual aid mechanism whereby manufacturers can help retailers who are facing higher carbon emission costs by reducing wholesale prices. Additionally, in the study of the retail price, we found that the optimal retail price under centralized decision-making is not always greater than that under decentralized modes.

Then, in the research on consumer loyalty, it was concluded that consumer loyalty has a direct impact on MCSC decision-making [39], and this impact will act on the SC through the game between retailer and manufacturer. For example, in the MCSC pricing problem, we found that they both should set prices based on multiple factors, but since there is a game between the manufacturer’s direct sales channel and the retailer’s dual channel in MCSC, based on the results of comparing consumer loyalty to different channels, the manufacturer can gain control over the retailer by controlling wholesale prices, and the retailer can use pricing decisions to gain an advantage for themselves. We showed that the manufacturer will reduce wholesale prices when demand for the retailer’s online channel increases, and this decision helps the manufacturer to profit, while the retailer can use pricing decisions to create countermeasures against the manufacturer, resulting in an SC game.

For question 3, we found that carbon emission costs are negatively correlated with the total carbon emission reduction and that the total carbon emission reduction of centralized decision-making under the same carbon emission cost is greater than that of decentralized decision-making [39,45,62], which is also the case for profit [29,45,56,57]. This shows that centralized decision-making can improve the level of carbon emission reduction and profit, and multi-channel centralized decision-making is suitable for manufacturing enterprises with a sense of social responsibility and environmental protection awareness.

At the same time, the opening of the new channel will bring profit to the whole SC. Carbon emission costs and consumer loyalty are important factors influencing manufacturers to open up new direct channels. Only when the two are within a reasonable range can direct channels bring increased profits to the manufacturer. Therefore, manufacturers need to make decisions with reference to their own carbon emission costs and consumer loyalty. In addition, manufacturers can achieve the goal of low carbon emissions by opening online channels without excessive carbon emissions, which is consistent with the findings of Zhao et al. [26], among others. Furthermore, we believe that it will be a trend for companies to become sustainable by opening up direct sales channels, a decision that will not only offer the opportunity to bring new profits to the SC and improve the market performance for companies but will also be a good way to help them reduce carbon emissions, and in the process, those who are more sustainable and responsible may opt for centralized supply chains that are more conducive to carbon reduction. Of course, due to the inherent influence factors in the SC, such as consumer loyalty and carbon emission costs, companies will also need to strengthen their market awareness and ability to respond quickly to changes in influence factors, which will require them to develop their capabilities in the future.

Our study is a further development of current research in the field of SCM. In previous studies, scholars have more often considered SC coordination and low-carbon management in dual-channel or multi-channel situations, but they have not added consumer loyalty, carbon emission issues, and other factors to the consideration of MCSC research under realistic conditions, which is somewhat disconnected from the real situation. Our study is the first to combine the above factors with MCSC and explore the decision-making of MCSC under the influence of multiple factors, which fills the research gap in the related research area and can provide some basis for enterprises to make decisions.

This research also has certain limitations, such as the impact of the double marginalization effect in decision-making and the cost of manufacturing investment to reduce carbon emissions, as well as supply chain inventory issues that should be further researched. The issue of coordination conflicts and differential pricing between channels is not considered, which also points the way for further research in the future.

Author Contributions

Conceptualization, methodology, and writing—original draft preparation: H.C. and H.Z.; software and validation: H.Z. and E.A.H.; investigation: Y.G., H.C. and H.Z.; writing—review and editing and resources: Y.G.; funding acquisition: H.C. and M.A.; data curation: E.A.H.; visualization and project administration: M.A. and E.A.H. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Social Science Fund of China (NO. 21BGL034) and the Prince Sattam Bin Abdulaziz University project (NO. PSAU/2023/R/1444).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Proof of Theorem 1.

In Mode , the decision is made jointly by the manufacturer and the retailer; from , , , when , that is, when , has the optimal solution. Let then the optimal price and the optimal carbon emission reduction can be solved, and can be obtained. □

Proof of Theorem 2.

In Mode , the solution is based on the inverse induction method. has a second-order partial derivative of with respect to , which shows that is a concave function with respect to . Let , then the retailer’s response function to the manufacturer’s decision can be obtained as , which can be brought into the above formula to obtain , so there is , , , and , that is, has the optimal solution when . Let and solve for the optimal wholesale price and carbon reduction in this mode, which allows to be obtained. □

Proof of Theorem 3.

In Mode , the decision is made jointly by the manufacturer and the retailer; from , , , when , that is, when , has the optimal solution. Let then the optimal price and the optimal carbon emission reduction can be solved, and can also be obtained. □

Proof of Theorem 4.

that is, has the optimal solution when . Let and solve for the optimal wholesale price and carbon reduction in this mode, which allows to be obtained. □

In Mode , the solution is based on the inverse induction method. has a second-order partial derivative of with respect to , which shows that is a concave function with respect to . Let , then the retailer’s response function to the manufacturer’s decision can be obtained as , which can be brought into the above formula to obtain , so there is , , , and

References

- Wu, X.; Tian, Z.; Guo, J. A Review of the Theoretical Research and Practical Progress of Carbon Neutrality. Sustain. Oper. Comput. 2022, 3, 54–66. [Google Scholar] [CrossRef]

- Liu, Z.; Deng, Z.; He, G.; Wang, H.; Zhang, X.; Lin, J.; Qi, Y.; Liang, X. Challenges and Opportunities for Carbon Neutrality in China. Nat. Rev. Earth Environ. 2022, 3, 141–155. [Google Scholar] [CrossRef]

- Tandon, A.; Sithipolvanichgul, J.; Asmi, F.; Anwar, M.A.; Dhir, A. Drivers of Green Apparel Consumption: Digging a Little Deeper into Green Apparel Buying Intentions. Bus. Strateg. Environ. 2023. [Google Scholar] [CrossRef]

- Su, J.; Iqbal, M.A.; Haque, F.; Akter, M.M.K. Sustainable Apparel: A Perspective from Bangladesh’s Young Consumers. Soc. Responsib. J. 2023. ahead-of-print. [Google Scholar] [CrossRef]

- Kumar, A.; Prakash, G.; Kumar, G. Does Environmentally Responsible Purchase Intention Matter for Consumers? A Predictive Sustainable Model Developed through an Empirical Study. J. Retail. Consum. Serv. 2021, 58, 102270. [Google Scholar] [CrossRef]

- Hagenbeek, O.; Ibisevic, M.; Jain, S.; Lojo, R. Environmental Sustainability in Business. Available online: https://www.simon-kucher.com/en/insights/2022-global-sustainability-study-growth-potential-environmental-change (accessed on 23 March 2023).

- Bar Am, J.; Doshi, V.; Malik, A.; Noble, S.; Frey, S. Consumers Care about Sustainability—And Back It up with Their Wallets. Available online: https://nielseniq.com/global/en/insights/report/2023/consumers-care-about-sustainability-and-back-it-up-with-their-wallets/ (accessed on 23 March 2023).

- PDI Technologies Business of Sustainability Index. Available online: https://pditechnologies.com/resources/report/business-sustainability-index/ (accessed on 23 March 2023).

- Zhang, A.; Alvi, M.F.; Gong, Y.; Wang, J.X. Overcoming Barriers to Supply Chain Decarbonization: Case Studies of First Movers. Resour. Conserv. Recycl. 2022, 186, 106536. [Google Scholar] [CrossRef]

- Zhang, A.; Tay, H.L.; Alvi, M.F.; Wang, J.X.; Gong, Y. Carbon Neutrality Drivers and Implications for Firm Performance and Supply Chain Management. Bus. Strateg. Environ. 2022, 32, 1966–1980. [Google Scholar] [CrossRef]

- Seuring, S.; Müller, M. Core Issues in Sustainable Supply Chain Management—A Delphi Study. Bus. Strateg. Environ. 2008, 17, 455–466. [Google Scholar] [CrossRef]

- Seuring, S. A Review of Modeling Approaches for Sustainable Supply Chain Management. Decis. Support Syst. 2013, 54, 1513–1520. [Google Scholar] [CrossRef]

- Green, K.W.; Zelbst, P.J.; Meacham, J.; Bhadauria, V.S. Green Supply Chain Management Practices: Impact on Performance. Supply Chain Manag. 2012, 17, 290–305. [Google Scholar] [CrossRef]

- da Silva Filho, S.C.; Miranda, A.C.; Silva, T.A.F.; Calarge, F.A.; de Souza, R.R.; Santana, J.C.C.; Tambourgi, E.B. Environmental and Techno-Economic Considerations on Biodiesel Production from Waste Frying Oil in São Paulo City. J. Clean. Prod. 2018, 183, 1034–1042. [Google Scholar] [CrossRef]

- Santana, J.C.C.; Miranda, A.C.; Souza, L.; Yamamura, C.L.K.; de Freitas Coelho, D.; Tambourgi, E.B.; Berssaneti, F.T.; Ho, L.L. Clean Production of Biofuel from Waste Cooking Oil to Reduce Emissions, Fuel Cost, and Respiratory Disease Hospitalizations. Sustainability 2021, 13, 9185. [Google Scholar] [CrossRef]

- Oliveira Neto, G.; Chaves, L.; Pinto, L.; Santana, J.; Amorim, M.; Rodrigues, M. Economic, Environmental and Social Benefits of Adoption of Pyrolysis Process of Tires: A Feasible and Ecofriendly Mode to Reduce the Impacts of Scrap Tires in Brazil. Sustainability 2019, 11, 2076. [Google Scholar] [CrossRef]

- Anning-Dorson, T. Innovation and Competitive Advantage Creation: The Role of Organisational Leadership in Service Firms from Emerging Markets. Int. Mark. Rev. 2018, 35, 580–600. [Google Scholar] [CrossRef]

- Olatunji, O.O.; Ayo, O.O.; Akinlabi, S.; Ishola, F.; Madushele, N.; Adedeji, P.A. Competitive Advantage of Carbon Efficient Supply Chain in Manufacturing Industry. J. Clean. Prod. 2019, 238, 117937. [Google Scholar] [CrossRef]

- McKinsey COVID-19 Digital Transformation & Technology|McKinsey. Available online: https://www.mckinsey.com/capabilities/strategy-and-corporate-finance/our-insights/how-covid-19-has-pushed-companies-over-the-technology-tipping-point-and-transformed-business-forever (accessed on 19 April 2023).

- Szász, L.; Bálint, C.; Csíki, O.; Nagy, B.Z.; Rácz, B.-G.; Csala, D.; Harris, L.C. The Impact of COVID-19 on the Evolution of Online Retail: The Pandemic as a Window of Opportunity. J. Retail. Consum. Serv. 2022, 69, 103089. [Google Scholar] [CrossRef]

- Kawasaki, T.; Wakashima, H.; Shibasaki, R. The Use of E-Commerce and the COVID-19 Outbreak: A Panel Data Analysis in Japan. Transp. Pol. 2022, 115, 88–100. [Google Scholar] [CrossRef]

- Wen, W.; Yang, S.; Zhou, P.; Gao, S.Z. Impacts of COVID-19 on the Electric Vehicle Industry: Evidence from China. Renew. Sust. Energ. Rev. 2021, 144, 111024. [Google Scholar] [CrossRef]

- Rapaccini, M.; Saccani, N.; Kowalkowski, C.; Paiola, M.; Adrodegari, F. Navigating Disruptive Crises through Service-Led Growth: The Impact of COVID-19 on Italian Manufacturing Firms. Ind. Mark. Manag. 2020, 88, 225–237. [Google Scholar] [CrossRef]

- Beckers, J.; Weekx, S.; Beutels, P.; Verhetsel, A. COVID-19 and Retail: The Catalyst for E-Commerce in Belgium? J. Retail. Consum. Serv. 2021, 62, 102645. [Google Scholar] [CrossRef]

- Moloughney, T. COVID-19 Sales Techniques: NIO Locks in $18 Million in Business from Livestream Event. Available online: https://insideevs.com/news/424189/nio-generates-18-million-sales-from-livestream/ (accessed on 19 April 2023).

- Zhao, Y.-B.; Wu, G.-Z.; Gong, Y.-X.; Yang, M.-Z.; Ni, H.-G. Environmental Benefits of Electronic Commerce over the Conventional Retail Trade? A Case Study in Shenzhen, China. Sci. Total Environ. 2019, 679, 378–386. [Google Scholar] [CrossRef] [PubMed]

- Smidfelt Rosqvist, L.; Winslott Hiselius, L. Online Shopping Habits and the Potential for Reductions in Carbon Dioxide Emissions from Passenger Transport. J. Clean. Prod. 2016, 131, 163–169. [Google Scholar] [CrossRef]

- Cai, G. Modeling Multichannel Supply Chain Management with Marketing Mixes: A Survey. In Handbook of Research on Distribution Channels; Edward Elgar Publishing: Northampton, MA, USA, 2019; pp. 165–199. [Google Scholar] [CrossRef]

- Khorshidvand, B.; Soleimani, H.; Sibdari, S.; Seyyed Esfahani, M.M. Revenue Management in a Multi-Level Multi-Channel Supply Chain Considering Pricing, Greening, and Advertising Decisions. J. Retail. Consum. Serv. 2021, 59, 102425. [Google Scholar] [CrossRef]

- Melis, K.; Campo, K.; Lamey, L.; Breugelmans, E. A Bigger Slice of the Multichannel Grocery Pie: When Does Consumers’ Online Channel Use Expand Retailers’ Share of Wallet? J. Retail. 2016, 92, 268–286. [Google Scholar] [CrossRef]

- Agi, M.A.N.; Yan, X. Greening Products in a Supply Chain under Market Segmentation and Different Channel Power Structures. Int. J. Prod. Econ. 2019, 223, 107523. [Google Scholar] [CrossRef]

- Alcedo, J.; Cavallo, A.; Dwyer, B.; Mishra, P.; Spilimbergo, A. E-Commerce during COVID: Stylized Facts from 47 Economies (No. W29729). Available online: https://www.nber.org/papers/w29729 (accessed on 23 March 2023).

- Sheth, J. Impact of COVID-19 on Consumer Behavior: Will the Old Habits Return or Die? J. Bus. Res. 2020, 117, 280–283. [Google Scholar] [CrossRef]

- Schleper, M.C.; Gold, S.; Trautrims, A.; Baldock, D. Pandemic-Induced Knowledge Gaps in Operations and Supply Chain Management: COVID-19’s Impacts on Retailing. Int. J. Oper. Prod. Manag. 2021, 41, 193–205. [Google Scholar] [CrossRef]

- Chen, J.; Liang, L.; Yao, D.-Q.; Sun, S. Price and Quality Decisions in Dual-Channel Supply Chains. Eur. J. Oper. Res. 2017, 259, 935–948. [Google Scholar] [CrossRef]

- Zhou, J.; Zhao, R.; Wang, W. Pricing Decision of a Manufacturer in a Dual-Channel Supply Chain with Asymmetric Information. Eur. J. Oper. Res. 2019, 278, 809–820. [Google Scholar] [CrossRef]

- Wang, R.; Wang, S.; Yan, S. Pricing and Coordination Strategies of Dual Channels Considering Consumers’ Channel Preferences. Sustainability 2021, 13, 11191. [Google Scholar] [CrossRef]

- Li, G.; Li, L.; Sethi, S.P.; Guan, X. Return Strategy and Pricing in a Dual-Channel Supply Chain. Int. J. Prod. Econ. 2019, 215, 153–164. [Google Scholar] [CrossRef]

- Li, B.; Zhu, M.; Jiang, Y.; Li, Z. Pricing Policies of a Competitive Dual-Channel Green Supply Chain. J. Clean. Prod. 2016, 112, 2029–2042. [Google Scholar] [CrossRef]

- Heydari, J.; Govindan, K.; Aslani, A. Pricing and Greening Decisions in a Three-Tier Dual Channel Supply Chain. Int. J. Prod. Econ. 2019, 217, 185–196. [Google Scholar] [CrossRef]

- Ji, J.; Zhang, Z.; Yang, L. Carbon Emission Reduction Decisions in the Retail-/Dual-Channel Supply Chain with Consumers’ Preference. J. Clean. Prod. 2017, 141, 852–867. [Google Scholar] [CrossRef]

- Zhen, X.; Shi, D.; Tsai, S.-B.; Wang, W. Pricing Decisions of a Supply Chain with Multichannel Retailer under Fairness Concerns. Math. Probl. Eng. 2019, 2019, 9547302. [Google Scholar] [CrossRef]

- Wang, W.; Li, G.; Cheng, T.C.E. Channel Selection in a Supply Chain with a Multi-Channel Retailer: The Role of Channel Operating Costs. Int. J. Prod. Econ. 2016, 173, 54–65. [Google Scholar] [CrossRef]

- Matsui, K. When and What Wholesale and Retail Prices Should Be Set in Multi-Channel Supply Chains? Eur. J. Oper. Res. 2018, 267, 540–554. [Google Scholar] [CrossRef]

- Wu, D.; Yang, Y. The Low-Carbon Supply Chain Coordination Problem with Consumers’ Low-Carbon Preference. Sustainability 2020, 12, 3591. [Google Scholar] [CrossRef]

- Barman, A.; De, P.K.; Chakraborty, A.K.; Lim, C.P.; Das, R. Optimal Pricing Policy in a Three-Layer Dual-Channel Supply Chain under Government Subsidy in Green Manufacturing. Math. Comput. Simul. 2022, 204, 401–429. [Google Scholar] [CrossRef]

- Tombido, L.; Baihaqi, I. Dual and Multi-Channel Closed-Loop Supply Chains: A State of the Art Review. J. Remanuf. 2021, 12, 89–123. [Google Scholar] [CrossRef]

- Li, G.; Li, L.; Sun, J. Pricing and Service Effort Strategy in a Dual-Channel Supply Chain with Showrooming Effect. Transport. Res. Part E Logist. Transport. Rev. 2019, 126, 32–48. [Google Scholar] [CrossRef]

- Yu, Y.; Sun, L.; Guo, X. Dual-Channel Decision in a Shopping Complex When Considering Consumer Channel Preference. J. Oper. Res. Soc. 2019, 71, 1638–1656. [Google Scholar] [CrossRef]

- Zhang, P.; He, Y.; Shi, C. Retailer’s Channel Structure Choice: Online Channel, Offline Channel, or Dual Channels? Int. J. Prod. Econ. 2017, 191, 37–50. [Google Scholar] [CrossRef]

- Lin, X.; Zhou, Y.-W.; Hou, R. Impact of a “Buy-Online-and-Pickup-in-Store” Channel on Price and Quality Decisions in a Supply Chain. Eur. J. Oper. Res. 2020, 294, 922–935. [Google Scholar] [CrossRef]

- Chen, Y.C.; Fang, S.-C.; Wen, U.-P. Pricing Policies for Substitutable Products in a Supply Chain with Internet and Traditional Channels. Eur. J. Oper. Res. 2013, 224, 542–551. [Google Scholar] [CrossRef]

- Ma, L.; Zhang, R.; Guo, S.; Liu, B. Pricing Decisions and Strategies Selection of Dominant Manufacturer in Dual-Channel Supply Chain. Econ. Model. 2012, 29, 2558–2565. [Google Scholar] [CrossRef]

- Yan, B.; Wang, T.; Liu, Y.; Liu, Y. Decision Analysis of Retailer-Dominated Dual-Channel Supply Chain Considering Cost Misreporting. Int. J. Prod. Econ. 2016, 178, 34–41. [Google Scholar] [CrossRef]

- Cao, E. Coordination of Dual-Channel Supply Chains under Demand Disruptions Management Decisions. Int. J. Prod. Res. 2014, 52, 7114–7131. [Google Scholar] [CrossRef]

- Chen, J.; Zhang, H.; Sun, Y. Implementing Coordination Contracts in a Manufacturer Stackelberg Dual-Channel Supply Chain. Omega 2012, 40, 571–583. [Google Scholar] [CrossRef]

- Ranjan, A.; Jha, J.K. Pricing and Coordination Strategies of a Dual-Channel Supply Chain Considering Green Quality and Sales Effort. J. Clean. Prod. 2019, 218, 409–424. [Google Scholar] [CrossRef]

- Zhang, Z.; Liu, S.; Niu, B. Coordination Mechanism of Dual-Channel Closed-Loop Supply Chains Considering Product Quality and Return. J. Clean. Prod. 2020, 248, 119273. [Google Scholar] [CrossRef]

- Cai, G. Channel Selection and Coordination in Dual-Channel Supply Chains. J. Retail. 2010, 86, 22–36. [Google Scholar] [CrossRef]

- Tseng, M.-L.; Islam, M.S.; Karia, N.; Fauzi, F.A.; Afrin, S. A Literature Review on Green Supply Chain Management: Trends and Future Challenges. Resour. Conserv. Recycl. 2019, 141, 145–162. [Google Scholar] [CrossRef]

- Sarkis, J.; Zhu, Q.; Lai, K. An Organizational Theoretic Review of Green Supply Chain Management Literature. Int. J. Prod. Econ. 2011, 130, 1–15. [Google Scholar] [CrossRef]

- Jamali, M.-B.; Rasti-Barzoki, M. A Game Theoretic Approach for Green and Non-Green Product Pricing in Chain-to-Chain Competitive Sustainable and Regular Dual-Channel Supply Chains. J. Clean. Prod. 2018, 170, 1029–1043. [Google Scholar] [CrossRef]

- Peng, Y.; Wang, W.; Li, S.; Veglianti, E. Competition and Cooperation in the Dual-Channel Green Supply Chain with Customer Satisfaction. Econ. Anal. Policy 2022, 76, 95–113. [Google Scholar] [CrossRef]

- Chen, T.; Zhou, R.; Liu, C.; Xu, X. Research on Coordination in a Dual-Channel Green Supply Chain under Live Streaming Mode. Sustainability 2023, 15, 878. [Google Scholar] [CrossRef]

- Meng, Q.; Li, M.; Liu, W.; Li, Z.; Zhang, J. Pricing Policies of Dual-Channel Green Supply Chain: Considering Government Subsidies and Consumers’ Dual Preferences. Sustain. Prod. Consum. 2021, 26, 1021–1030. [Google Scholar] [CrossRef]

- Li, N.; Deng, M.; Mou, H.; Tang, D.; Fang, Z.; Zhou, Q.; Cheng, C.; Wang, Y. Government Participation in Supply Chain Low-Carbon Technology R&D and Green Marketing Strategy Optimization. Sustainability 2022, 14, 8342. [Google Scholar] [CrossRef]

- Wang, Y.; Yu, Z.; Jin, M.; Mao, J. Decisions and Coordination of Retailer-Led Low-Carbon Supply Chain under Altruistic Preference. Eur. J. Oper. Res. 2021, 293, 910–925. [Google Scholar] [CrossRef]

- Carrillo, J.E.; Vakharia, A.J.; Wang, R. Environmental Implications for Online Retailing. Eur. J. Oper. Res. 2014, 239, 744–755. [Google Scholar] [CrossRef]

- Zhou, Y.; Bao, M.; Chen, X.; Xu, X. Co-Op Advertising and Emission Reduction Cost Sharing Contracts and Coordination in Low-Carbon Supply Chain Based on Fairness Concerns. J. Clean. Prod. 2016, 133, 402–413. [Google Scholar] [CrossRef]

- Zhong, Y.; Sun, H. Game Theoretic Analysis of Prices and Low-Carbon Strategy Considering Dual-Fairness Concerns and Different Competitive Behaviours. Comput. Ind. Eng. 2022, 169, 108195. [Google Scholar] [CrossRef]

- Sarkar, A.; Pal, B. Competitive Pricing Strategies of Multi Channel Supply Chain under Direct Servicing by the Manufacturer. RAIRO-Oper. Res. 2021, 55, S1849–S1873. [Google Scholar] [CrossRef]

- Hsieh, C.-C.; Chang, Y.-L.; Wu, C.-H. Competitive Pricing and Ordering Decisions in a Multiple-Channel Supply Chain. Int. J. Prod. Econ. 2014, 154, 156–165. [Google Scholar] [CrossRef]

- Kandil, N.; Hammami, R.; Battaïa, O. Insourcing versus Outsourcing Decision under Environmental Considerations and Different Contract Arrangements. Int. J. Prod. Econ. 2022, 253, 108589. [Google Scholar] [CrossRef]

- Edwards, J.B.; McKinnon, A.C.; Cullinane, S.L. Comparative Analysis of the Carbon Footprints of Conventional and Online Retailing. Int. J. Phys. Distrib. Logist. Manag. 2010, 40, 103–123. [Google Scholar] [CrossRef]

- Liu, K.; Li, W.; Jia, F.; Lan, Y. Optimal Strategies of Green Product Supply Chains Based on Behaviour-Based Pricing. J. Clean. Prod. 2022, 335, 130288. [Google Scholar] [CrossRef]

- Jena, S.K.; Meena, P. Competitive Sustainable Processes and Pricing Decisions in Omnichannel Closed-up Supply Chains under Different Channel Power Structures. J. Retail. Consum. Serv. 2022, 69, 103114. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).