Abstract

Financial services providers have the funds to finance climate change, and new entrepreneurs would like to join this effort. They need ideas on what fintechs can do to make money yet be sustainable. The research purpose of this study is to explore what fintechs are doing in this field of climate change and what theoretical and policy implications can be gained. This exploratory study uses a multiple case study method, using secondary sources of information. The sample includes five big fintechs and twelve green fintechs. The study finds that large fintech firms are diverse in the extent of their reporting and the issues that they are tackling, but they all report on their Scope 1 and Scope 2 impacts, and most report on Scope 3. Smaller dedicated green fintechs in the sample are grouped into those that offer to crowdfund green projects, those that track the impact of green projects or other firms or individuals, payment firms that invest directly into green projects, and those that provide a platform for peer-to-peer trading of renewable energy. The exploration is relevant to theories and concepts, including product differentiation and enhancement, disruptive innovation, collaborative ecosystems, and environmental and social impacts. Using lateral thinking, microfinance, and work-sharing research can stimulate reflection on developing more inclusive and advanced green fintech offerings. A few directions for future research in this field have been provided for those interested in impact measurement, strategic management, business models, risk management, or innovation theories.

1. Introduction

Sustainable development is today’s burning issue [1]. The rising temperatures are reducing agricultural productivity, and perhaps the most significant impact is on Africa [2]. Governments have been unable to cope with this despite 27 COP meetings. Governments are not the only ones with vast access to funding. Banks and financial services providers have a lot of funding and could contribute to financing climate change initiatives or limit their financing to those that harm the planet. However, their involvement in cleaning the environment is limited, since they often fear that others will take their markets, for example, if they do not finance fossil fuels. Today, the buzzword in the financial services industry is fintech: a new range of high-tech firms using technology to provide finance. They are proliferating, and although many are burning cash, others are accumulating funds and are now as big as some banks and could, therefore, all finance climate change initiatives. Venture capital and private equity firms have expressed interest in fintech firms. Even socially minded traditional investors, such as Accion, have invested in fintech firms [3]. Fintechs is a broad denomination for firms providing financial services using digital technologies. It includes firms that use digital technologies in diverse fields such as crowdfunding, bill discounting, payments, investing, risk analytics, wealth management, insurance, cryptocurrencies, and many others [4,5,6]. Digital technologies can boost environmental sustainability by higher efficiency in processing, less paperwork, lower rejections and waste, and reduced wear and tear of machines [7]. Fintech firms expect to achieve these benefits for the financial industry and thus contribute to greening the planet.

Many of the large fintech firms are interested in social responsibility toward the environment. They bring out annual reports as well as sustainability reports. Whether they create a direct impact or are only greenwashing, they generate noise in the space that attracts other entrepreneurs to conceive fintechs that engage in the environmental area, promote sustainable development, and reduce the effects of climate change. These are called green fintechs. Green finance includes various products and services, including green bonds, financing renewable energy, carbon credit trading, sustainable investing, and green savings funds. Green fintech intervenes in these fields using digital tools such as internet and mobile apps, blockchain, artificial intelligence, big data analytics, chatbots, and online tools to increase the efficiency of transactions. At a macro level, there is some evidence that green finance contributes to green total factor productivity [8] and that fintech contributes to green finance, green innovation, and sustainability [9]. Although a lot is happening in the field, there are very few academic papers on the subject, and there is scope to examine the area and add to management theories.

In what follows, we use linear–analytic sequencing for the presentation. In this section, we posit the research question and review the literature on fintech in general and green fintech in particular. After that, in Section 2, we present our exploratory research design and a brief background to the sampled cases. Section 3 presents the findings from exploring the secondary data on big fintechs, which is followed by that on small green fintechs. Section 4 examines what this exploration may mean to different management concepts and theories. Section 5 presents a few concluding remarks.

1.1. Research Question

The research objective is to explore how large fintechs contribute to sustainability and see if green fintechs are doing the same more effectively. I initially suspected that large fintechs are engaging in greenwashing and that green fintechs are more devoted, but I was open-minded on this issue. What was important was to explore what was happening.

The overall question is, how are tech-enabled green finance firms creating a contribution to the environmental problem? How do fintech firms help environmental sustainability? Do fintech firms only look at sustainability from a social (inclusion) perspective, or are they contributing to the environmental goals? How are green fintech firms contributing? How can understanding these initiatives be relevant to advance theories and concepts in management?

Answering these questions could enable other fintech firms and new entrepreneurs to collect ideas on what they can do for sustainability.

1.2. Literature Review of Fintech

The studies on fintech have focused on the level of the consumer, the level of the firm, or the level of a region.

At the consumer level, the intention to use fintech seems to be based on its perceived usefulness as well as the perceived enjoyment of using it. Word-of-mouth moderates the effect of perceived usefulness. A study in Jordan [10] found that ease of use is not a significant factor in the decision to use fintech, but a study in Cameroon found that ease of use and trust in financial services are also important determinants of using fintech [11]. A study in South Korea found that trust and perceived risk are determinants of the intention to use fintech. It also showed that information quality increased trust, while the system quality reduced the perceived risk. The quality was measured by statements related to ease of use and the usefulness of the information or the system [12]. This study was interesting because fintech’s use of technology has created perceptions of risks based on privacy and bias in the data [13,14]. On the other hand, adopting financial technology also reduces manual functions and so enables the staff of a financial firm to focus on humanizing value-adding functions by providing time for improved relationships [15,16,17]. Fintech has been studied in specific sectors, such as sports, where it enhances spectator engagement by making it easier to purchase tickets and by-products through digital payments and access rewards and loyalty programs [18,19].

At the firm level, the relationship between fintech firms and other finance firms has often been studied. Fintech firms usually have lower costs and greater accessibility, and they are more efficient than traditional firms [6]. A study in Saudi Arabia showed that fintech reduced the performance of financial firms [20], indicating that other financial firms may need to brace up if they want to compete with fintech. Fintech has been a source of worry for banks, but it is often presumed that banks will collaborate or take over fintech firms, and co-opetition may be the new norm [6,21,22]. There seems to be a sentiment that fintechs may start with a B2C ideology, but in the end, they often convert to a B2B form and provide services to financial firms. This business model transformation is especially if the fintech firm has a sustainability department [23]. Fintechs may also be entering niches that banks abandon due to high costs: rural markets and people experiencing poverty [24,25]. Fintechs are usually considered specialized firms engaged in niche markets using specific technologies, while banks are more general and experiment with all kinds of technologies [26,27].

At the firm level, researchers have also studied the factors that improve the operational performance of fintech firms. These factors include the quality of data analytics and cyber risk management [28] and founder characteristics such as banking experience and technical education [29]. Other industries, such as fisheries and sports industries, could gain from better monetization of their activities thanks to fintechs if the entrepreneurs are educated on the services fintechs can offer [18,19,30].

At a regional level, a study in Cameroon [11] found that using fintech increased financial literacy and the performance of small and medium enterprises in the region. An analysis of fintech in different provinces of China indicated that the eastern regions have the most growth in fintech. The study found that fintech contributed significantly to China’s economic growth, and the relationship was bi-directional [31]. Another study of fintech development in China showed that fintech development leads to more innovation (in terms of the number of patents). The study shows that the development of fintech seems to reduce information asymmetries and increase the financial participation of stakeholders [32].

1.3. Literature Review of Green Fintech

The literature on green fintechs is nascent. Very few papers were found in the EBSCO database using the search terms fintech AND (green or climate). However, many relevant papers were found on the open access MDPI platform, especially its journal Sustainability.

The initial research on fintech and green finance provided perspective and explored possibilities, such as using blockchain [33]. Slowly, research has opened to case studies and empirical research, and now, literature reviews are also being published [34,35,36]. The primary themes in the literature include green objectives such as climate change, green financing and payments, and policy/regulation. Research shows that fintech firms and financial technology adoption by banks improve sustainability performance directly and indirectly by increasing green financing and green investments, which in turn lead to better sustainability performance [9,37].

If fintechs are growing fast and their impact on sustainability is important, how do they help achieve sustainable development goals? While most fintechs stress societal goals such as reaching out to the financially excluded, some are helping finance activities such as agriculture [34]. Since fintechs have more online data, it becomes easier to analyze it and take action. A study in Turkey showed that fintechs educate their users on sustainability issues, which helps promote responsible consumption and production [5]. A study in China shows the growth of fintechs alone can explain the reduction in sulfur dioxide and dust levels with an R-square of 93% and 88%, respectively [38]. Including other variables in the regression model does not change the R-square.

Fintechs directly reduce environmental costs by providing digital finance and reducing the need to commute [38]. Instant payment fintechs replace cheques, credit cards, and cash [39]. Electronic payments help to reduce paper and plastic. Moreover, since they allow making and receiving payments from anywhere and usually anytime, they reduce the time and energy for traveling. All of this may help in environmental cost reduction. In this view, fintechs are naturally green, since the technology enables consumers, merchants, and banks to save paper, travel costs, and energy [9,22]. Simultaneously, there may be a concern that the fintech is consuming energy. Therefore, there may need to be an internal evaluation within fintechs to reduce environmental costs from their operations.

Green finance stimulates green innovation [40] and productivity [34,41]. Therefore, fintechs may also be green if they ease the financing of green projects [22,38,42,43]. While some may be involved in attracting crowd funders or impact investors, others may be interested in providing small donations to initiatives that positively impact society or the environment [43]. Sustainability rating agencies are coming in to analyze the impact of firms on society and the environment, using big data and artificial intelligence technologies to generate climate change heat maps of different sectors [5,43]. Investors and lenders can then finance responsible production and consumption using this information. Insurance agencies could be interested in geographical heat maps to see which areas are more susceptible to climate change-induced disasters and use fintech to scale up index insurance in agriculture [34]. Investors and lenders can also examine this information to protect their collateral [5].

Green fintech also stimulates efficiency in agriculture, thus reducing the impact on climate change. Moreover, green fintech can also help farmers mitigate climate change’s effects by educating them on reducing greenhouse gas emissions, carbon sequestration, using fortified agrochemicals, and renewable energy sources [34].

A study of fintechs in Switzerland showed that they are helping with many different Sustainable Development Goals (SDGs), such as Affordable and Clean Energy (SDG 7), Sustainable Cities and Communities (SDG 11), Responsible Consumption and Production (SDG 12), Climate Action (SDG 13), Life Below Water (SDG 14), Life on Land (SDG 15) and Partnerships for the Goals (SDG 17) [36].

Green fintechs are mushrooming and promising so much. Therefore, scholars need to explore the sector further to see what lessons they can offer for management theories and what policy actions may be required to build a more sustainable planet and society. This study is a step in this exploration.

2. Materials and Methods

Since the literature in this field is nascent, we need exploratory studies to clarify the understanding of the problem, especially if the nature of the problem is unclear. The exploration can be completed by a review of the literature or through case studies using secondary or primary sources. Case studies are a form of qualitative research that focuses on contemporary events and can extend prior work and stimulate future deductive work [44]. Multiple case studies are usually used to explore similarities and differences [45] but also allow a broader discovery of research questions [46]. In exploratory research, the focus is usually wide, and it narrows as the study proceeds and new lessons are learned, raising further questions [47].

The broad research question mentioned above is to determine concrete actions fintech firms take to promote environmental sustainability. Therefore, this is exploratory, descriptive research with some analysis and critical appreciation. Secondary gray sources were used: websites, reports, and media. It is always helpful to disclose the names of the cases unless confidential information is disclosed or there is some valid reason for anonymity [45]. Since only publicly available secondary sources have been used for this study, we have proceeded to give the names of the firms. I regret if the firms do not find the research shows them in the best light, but I hope they will use this to go further in their initiatives, reporting, and transparency and recognize that it motivates others to do so, too.

A list of the five biggest fintech firms was found on the internet [48] and was first studied to investigate what they do in the green space. These five firms included Ant Group, PayPal Holdings, Stripe, Fiserv, and Adyen N.V. Since Ant Group and Stripe were still private, I checked if they had sustainability reports. Ant Group did, but Stripe did not. Therefore, I replaced Stripe with Mastercard, representing the group of large credit card companies (including American Express and Visa). I was looking for diversity in sample cases, since the initial objective was to look for different possibilities for fintechs to participate in sustainability. Their website, annual reports, and sustainable development reports were perused to examine their green activities. This provides a reference point. The sustainable development reports may go by different names. For example, PayPal calls it a global impact report. In qualitative research and in case studies, the sample size always raises problems: the smaller the number of cases, the deeper the analysis, but the more the cases, the stronger the validity (which remains limited) [45]. For this explorative study, the sample size of five cases was considered ample (Table 1).

Table 1.

Description of large fintech studies.

Since the size and businesses of these firms are different, their impact on the environment is also quite different. Greenhouse gas emissions are reported in terms of carbon dioxide equivalents. The actions that create greenhouse gas emissions are divided into three categories: Scope 1, 2, and 3. The firm directly controls Scope 1 emissions through its operations. Scope 2 emissions are indirect emissions from the firm buying the energy it uses. The firm does not control Scope 3 emissions: these are emissions produced by the suppliers or clients of the company. All the firms mentioned above report their estimated emissions (except the Ant Group for Scope 3 emissions). Table 2 shows that the environmental impact of each of these firms is quite different.

Table 2.

Carbon dioxide equivalent emissions of the fintechs studied.

In a separate study, an initial list of ten green fintechs was identified online. Later, this was expanded to thirteen such fintechs. Although Stripe Climate was not a separate company from Stripe, I included it since I had excluded Stripe from the big fintechs. A visit to the websites of the thirteen firms indicated that the proposition and business model had evolved. One firm, Miris, only posted blogs and was removed from the sample. The sample size therefore reduced to twelve (Table 3). The sample size of twelve seems large (much greater than five of the large fintechs), but since little information is available on their websites, it was feasible. Instead of depth, we are obtaining width, which was our objective.

Table 3.

Description of green fintechs studied.

These fintechs do not report their environmental emissions (Scope 1, 2 or 3). Since they are small, they are not required to report this.

3. Results

3.1. The Study of Green Activities of Large Fintechs

3.1.1. Green Goals

The study of green activities of large fintechs was based on their Sustainability Development Report or Green Impact Report for 2021, where available [49,50,51,52]. Since this was not available for Adyen, I looked at their Annual Report [53] and website. These reports cover different areas, including green activities. However, nomenclatures vary, as can be seen in Table 4. The Ant Group calls this “Green and low carbon development”, while Mastercard calls it “Planet”. The firms divide each of the topics into sub-headings. I detail the sub-heading for the Green main topic. For example, Mastercard lists its Operational footprint and environmentally conscious solutions under the Planet heading. The last column of Table 4 indicates the goals of the firm relating to the environment, which are often expressed in terms of Scopes 1, 2, and 3. Organizational carbon neutrality generally requires zero carbon equivalent emissions for Scopes 1 and 2. We can see that some of them give this as a target, but Adyen claims it has already achieved this. Adyen was not only the smallest of the five large fintechs (Table 1) but also the one with the least Scope 1 and Scope 2 emissions (see Table 2).

Table 4.

Green goals of some large fintechs.

3.1.2. Green Strategy

To achieve the above goals, each of the five firms may communicate its general strategy or be more specific on incentives it has created or green financing that it uses. However, not all the firms share all the elements in the examined secondary sources. Table 5 puts together the various elements in these three columns. Table 5 shows that their strategy and perspectives are quite different. Three of them are trying to link with green money and green incentives in their topline and communicating about it. Fiserv’s report does not indicate its strategy, if any. Surprisingly, PayPal, which had quite detailed goals (see Table 4), is silent on its strategy. While Ant Group incentivizes its customers and suppliers, Mastercard incentivizes its top management employees to achieve their goals.

Table 5.

Elements of the green strategy of fintech firms.

3.1.3. Green Operations

Three or more of the large fintech firms mentioned some of the green operations. Other green operations were specific to one firm. Table 6 shows that all the reports list waste management. However, this heading may include diverse initiatives. For example, Mastercard mentions reducing waste in its canteens; Adyen mentions refurbishing and reusing the terminals that customers return or sending them to certified waste managers, where the model has reached its end-life. Four indicate their use of renewable energy, especially for their data centers. Three of these mention in their report that 100% of their power was from green sources, including nuclear, while Adyen indicates that 88% of their energy was from renewable sources. Mastercard reports that two-thirds of the renewable energy was generated from their own solar panels. Three of the fintechs mention moving data centers to the clouds or greening their buildings or travel. The specific items considered by only one of the firms have been included in the “other measures” row of Table 6.

Table 6.

Green operations of large fintechs.

3.1.4. Greening Stakeholders

All the fintechs, except Adyen, indicated they are working on their scope 3 emissions by influencing some stakeholders (see Table 7). Four of them are influencing their employees’ behavior. Ant Financial, Mastercard and Fiserv report that they educate employees through seminars on subjects such as recycling and centralizing trash. PayPal organizes Global Earth Day and National Kids at Work Day in the U.S. to create learning for PayPal kids, their parents, and all employees. Ant Group has an app that permits employees to have car pools and share rides to come to work.

Table 7.

Greening the stakeholders of large fintechs.

Four fintechs communicate on influencing their suppliers. Ant Group and Mastercard encourage and help its supply chain to set its net-zero targets. This assistance to their network of issuers, banks, retailers, merchants, and cardholders permits them to prioritize environmental conservation by prioritizing suppliers who are eco-friendly. Mastercard has found that 250 suppliers represent more than 85 percent of their supply chain emissions, with just 50 suppliers constituting more than 60 percent. To assist in this process, they have developed a four-stage “environmental sustainability supplier engagement model” that has led to constructive engagement and collaboration. The model invites suppliers to disclose their carbon footprint; leverage educational resources for environmental programming; evaluate key performance indicators; and collaborate to find ways to reduce emissions together. Fiserv mentions the last point (collaborate) but does not provide details. PayPal indicates that 28% of its suppliers have agreed to a science-based target (their goal is to arrive at 75%). Over 40% of their vendors by spend reported specific activities to reduce their GHG emissions.

Two of the fintechs indicate that they are influencing their customers. Ant group says it encourages customers to use green lifestyles and acquire points to finance projects operated by Alipay Ant Forest’s environmental partners. Mastercard says that it helps its customers consider more climate-conscious purchasing behaviors by indicating the carbon calculation of their purchases.

Only PayPal reported that it tries to influence investors. PayPal funded the formation of the Digital Finance for Climate Resilience (DF4CR) Task Force to explore the opportunity for digital finance innovations to power greater climate resilience. The task force details immediate actions innovators, catalytic funders, investors, and policymakers can take to accelerate this growth. The fund promoted seven startup companies that enable greater resilience for climate-vulnerable communities, such as farmers, fishers, and urban poor in Latin America, Africa, and India, through catalytic capital, with direct connections with investors and corporate innovators.

3.1.5. Green Actions for Society and the Planet

Four out of the five large fintechs (except Fiserv) reported actions they are taking for society and the planet (see Table 8). Three are directly or indirectly involved with planting trees. For example, Ant Group donates to its foundation for planting trees. Alipay Ant Forest has planted 110 million trees and pays farmers to conserve these trees. It has engaged with its partners to restore 100 million trees in 5 years. PayPal has a similar partnership but with more modest goals: in collaboration with the SankalpTaru Foundation, PayPal Dharma achieved its goal of planting five thousand trees. Mastercard has a “Donate” button for consumers to participate in tree planting.

Table 8.

Society and planet-wide initiatives of large fintechs.

Table 8 also shows that three fintechs are involved with other ecological conservation and restoration initiatives. Ant Group claims it is working on protecting species and promoting the knowledge of endangered species. Adyen indicates that it compensates for its emissions by purchasing credits from third-party verified emission reduction projects, which are also known as “carbon offsets”. These projects support climate action efforts such as reforestation, wildlife protection, and education-focused subsistence farming initiatives in poorer countries. PayPal also indicates the impact of their carbon offsets: to build fuel-efficient stoves, use clean fuels, and support local economic empowerment for women.

Two large fintechs support education on environmental concerns: Ant Group promotes knowledge of endangered species, while PayPal promotes climate change action.

Three of the five fintechs support the wiser society’s carbon neutrality, i.e., going beyond their suppliers and customers. For example, Ant Group is trying to support external enterprises to conduct carbon management through its innovative green technology. They have helped these enterprises develop digital green technologies facilitating carbon emissions management and environmental information disclosure (by assisting them in measuring their carbon footprint, for example), enhanced the development of low-carbon technologies, participated in investment and incubation, and promoted carbon emission reduction and carbon neutrality in a broader industrial scope. PayPal also plans to do this beyond their existing customers and suppliers. Adyen indicates that it will also extend Scope 3 to the energy use from their products: the transactions their merchants’ shoppers conduct on POS terminals, online, and mobile payments.

3.2. The Study of Dedicated Green Fintechs

The large fintechs are reporting many green actions. As opposed to this, dedicated green fintechs have come up over the last decade, and the sample of this study includes a dozen of them (Table 9). Much less information is available on them since they are not listed, and their websites provide little information.

Table 9.

Business proposition and environmental objectives of the green fintechs.

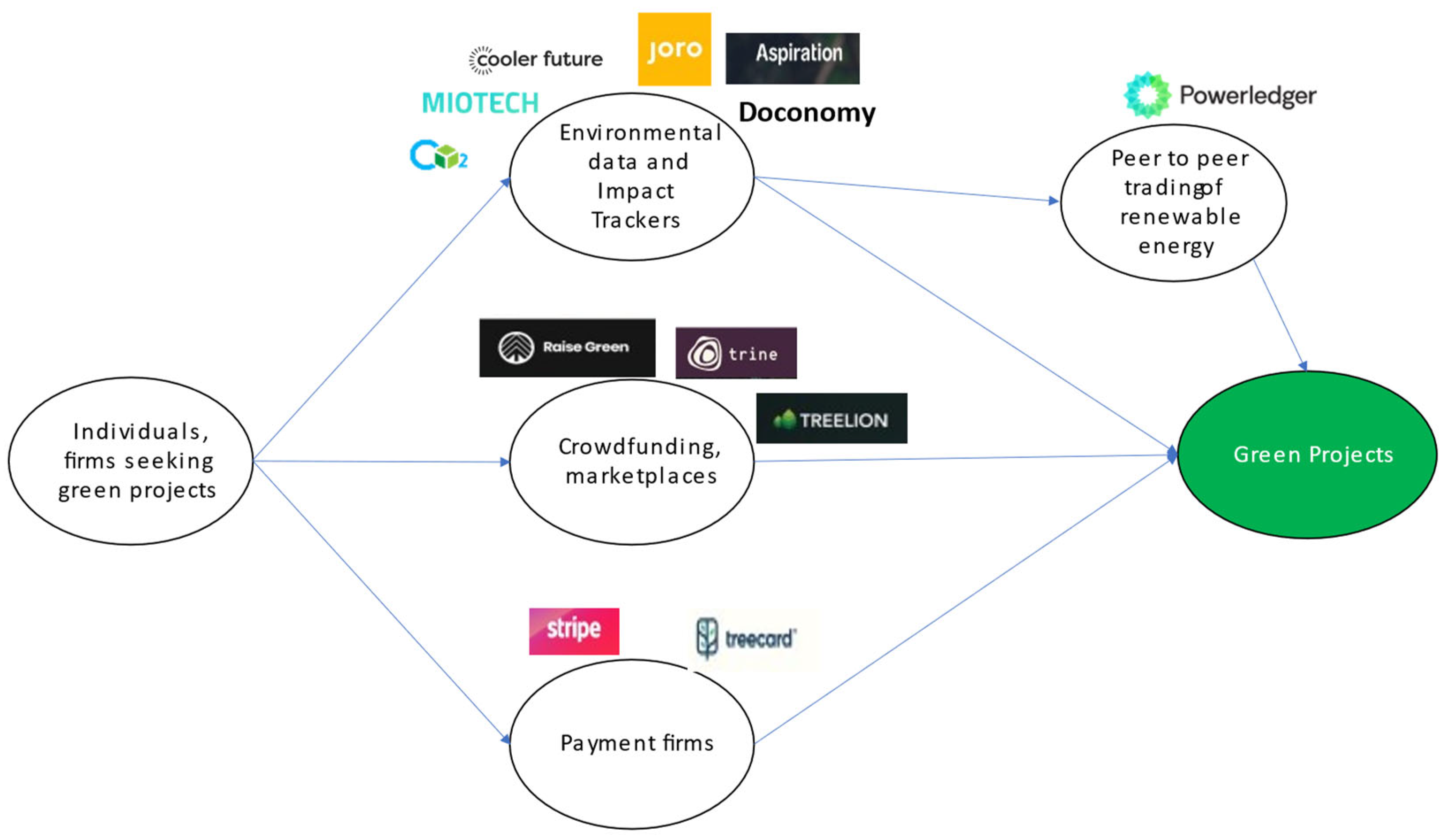

Based on the above information, a perspective framework for the actions of these twelve fintechs is presented in Figure 1. One limitation to replicability is that since these are small firms, their business proposition changes as opportunities arise and vanish. One group of green fintech firms focuses on tracking a person’s environmental impact from his payments data (Commons, Aspirations) or a firm’s environmental impact (Cooler Future, MioTech, CO2X) or both (Doconomy). A second group of green fintech firms is payment firms involved in green projects (Stripe Climate, Treecard, Treelion). A third group of Green fintech firms finds funds for green projects such as solar panels (Raise Green, Trine). One fintech has created a platform for peer-to-peer trading of renewable energy to ensure that excess solar energy is not wasted (Powerledger). Some of these fintech firm are trying to combine some of these elements and set up an ecosystem of green players (Treelion, Doconomy). Others may be offering features such as crypto token trading (POWR) that we cannot relate directly to green fintech services.

Figure 1.

Conceptualizing the green fintech market with a few examples.

4. Discussion

Large fintech firms usually talk about social inclusion. This study shows that many also communicate their environmental performance in their sustainability reports, annual reports, and websites. While some of the broader initiatives, Scope 3 and beyond, are isolated from their primary financial top line, their specific Scope 1 and Scope 2 initiatives are interlinked to their operations. The progress seems uneven, though, with some firms reporting extensively while others have not yet made environmental reporting an important communication feature. Most green fintechs have their business proposition linked to their green objective.

The research findings can add value to theories and concepts such as product differentiation and enhancement, disruptive innovation, collaborative ecosystems, and environmental impact. In addition to these immediately relevant theories, the discussion below looks at integrating more distant perspectives, such as work sharing and microfinance.

Green fintechs and large fintechs aim at product differentiation [54,55] or product enhancement [56,57]. Environmental product differentiation is typically used by industries such as toilet paper, textiles and trash bags to show that their products are more environmentally friendly or less destructive to justify a price premium or attract new products [54]. Organic coffee, which is good for the environment, may attract a price premium compared to societally responsible coffee, such as fair trade coffee, which in turn may attract higher prices than coffee with no certification [55]. Therefore, fintechs may want to go beyond financial inclusion and report on their environmental initiatives, and many of the bigger fintechs (such as Ant Group, Mastercard and PayPal in our sample) are doing this extensively. New entrants into a market need to indicate some enhancement of their product to the existing offer in order to offset the consumer’s risk of trying a new product [56]. An example could be the wooden credit card of Treecard in our sample. Fintechs are telling consumers they can deliver financial services that incumbents (banks) provide and add to sustainability. Their need to make these enhanced claims may be based on the fear of losing their markets (for large fintechs) or the hope of entering niche markets (for dedicated new fintechs).

Disruptive innovation theory suggests that innovative challengers may disrupt markets if the incumbents ignore problems that they consider niche [58,59]. Disruptive innovations create new markets or business models by entering through a niche [58]. The entry point does not have to be the low end of the market; it could be a new market [59]. The change could be gradual, but eventually, the challengers need to move upstream to attract the higher end of the market [58]. We could have expected that green fintechs would have the possibility of easing out banks or at least easing out the larger fintechs by focusing on green issues that are important for a niche but growing population segment. This study shows that this has not yet been the case. Some of the larger fintechs are displaying their initiatives in this green space, and the new green fintechs have been unable to displace them. The large fintechs that survive may be the ones that master operating in a VUCA world, and they take pains to cover their bases since they have enormous access to resources. Disrupting them would be difficult.

Instead of disruption, we see the prevalence of a more collaborative ecosystem [60]. This collaborative outcome, rather than disruption, was already witnessed between banks and the fintechs in developing countries [61]. Collaborative ecosystems are multi-party offerings that together commercialize new concepts [62]. Many actors need to come together to solve a global problem such as climate change. In this way, specialized green fintechs are providing specific services to larger fintech operators who may be their only customers or who may regroup to form a network with the objective of a greener planet. For example, Doconomy partners with Ålandsbanken, the UNFCCC, and Mastercard. These new green fintechs are thus creating a platform where larger incumbents may all participate. For example, one organization plants trees, but a more technological firm monitors the number of teas planted and may also direct, using satellite information, where to locate the trees. This technical firm may be financed by crowdfunding firms or investment platforms which channel investments from larger firms toward digital firms.

The main question of green initiatives is that of impact. Many green fintechs (such as Joro, Doconomy, Cooler Future, CO2X, Miotech, Aspiration in our sample) are developing databases and technologies that can track the carbon emissions of firms and individuals. Some large fintechs are monitoring their own Scope 1, Scope 2, and Scope 3 emissions. However, how they measure these is not transparent. To what extent are the sustainability reports about new green initiatives just rewriting business as usual in green terms? For most of the smaller fintechs, judging their impact may be a bit early. For the moment, transparency is not the strong point of most of the green fintech firms in the sample. Their annual reports and details of operations are not posted on their websites. They certainly do not indicate how exactly their proprietary software measures environmental impact. Partly, this may be because they are all new and not legally required to give more information; partly because their business model is changing as they seek survival opportunities; and partly because they may not want others to free-ride on the information they provide. However, through the lens of social impact theory [63], where social impact is viewed as a function of strength, immediacy, and the number of sources or targets, we could say that the large fintechs have higher strength but that a large number of targeted initiatives diffuses their social impact. The newer fintechs may be more targeted, but if their resources are small, they have smaller strengths and do not have the desired social impact.

Of course, the fintech entrepreneurs may still see their work as heroic despite its low impact. Their initiatives would help nurture the sociological imagination [64] if we can link this micro-debate of heroism with uncertain impact to some macro-public social structure issues. An important macro-public issue would be climate change and its effect on Africa, which is the poorest continent. This social imagination is enhanced if we include discussions from different perspectives and research from different fields. I would suggest two policy recommendations from other areas I am familiar with: work sharing and microfinance. These recommendations are more general but have been stimulated by working and reading on sustainability issues for this research project.

Researchers on work sharing have suggested moving to a four-day week [65,66]. Work sharing may soon become necessary if technological developments (such as artificial intelligence) increase unemployment [13,67,68]. Yet, policymakers and businesses with funds may hesitate to disrupt social structures. Moreover, a reduced work week may harm the environment if people use their leisure time to consume more [69,70]. I would suggest that if a business reduces work from five to four days yet pays for five days, it may stipulate that employees use the fifth day (or part of it) for environmental initiatives. Some employees may want to use this fifth day to work on developing technology for multiplying the sustainability impact. Others may want to validate the work of impact measurement agencies to confirm that impact has been measured reasonably. Yet others may want to review the work of sustainable development rating agencies to verify if the subjectivity inherent in the rating is reasonable or can be reduced. Such initiatives would then increase the confidence of those financing green fintechs.

Policymakers could make regulations permitting this possibility of work sharing for purposes not directly connected to the firm’s primary mission and form controlling authorities or institutions to report how people use this time. These institutions could harness blockchain technology (used by Treelion, CO2X and Powerledger in our sample cases) to validate the time use. Some of this government support may not require public spending but may still mitigate the externalities faced by green fintechs and other firms aiming to save the planet. The work sharing for a common cause may not affect total productivity in firms (and perhaps countries) where there is considerable disguised employment.

The booming interest in microfinance [71,72,73] in general and green microfinance in particular [74,75] would suggest that green fintech entrepreneurs link their initiatives to microfinance institutions in developing countries [76,77,78]. For example, Burundi is the poorest country in the world, where 85% of the people do not have electricity and live in rural areas. These people need solar panels sufficient to charge mobile telephones. The mobile phones would then help them receive vital information and education to start businesses in their villages. The purchase of solar panels could be financed by microfinance institutions or by solar panel suppliers on a buy-now-pay-later basis. Green crowdfunding platforms (such as Trine, Raise Green, and Treelion researched in this study) could refinance these suppliers. This refinancing could then permit the solar panel providers to grow faster.

5. Concluding Remarks

This study has shown that some fintechs are large and report on their Scope 1, 2 and 3 emissions and on many environmental initiatives. As opposed to this, small green fintechs do not report on their emissions and are operating in selective niches. The play of these enterprises may be interesting for research on innovation, especially those studying how incumbents use product differentiation and product enhancement to sustain their place. In contrast, challengers may use the same strategies to disrupt the market. Instead of disruption, there seems to be a gradual development of a collaborative ecosystem. This collaborative ecosystem can be developed by including microfinance players in developing countries since climate change is a global phenomenon. New entrants may find it interesting to approach larger fintechs to examine possible areas where they could be useful.

One critique to this sector is that the few environmental initiatives by fintech players merely constitute noise. This noise does not seem to have much impact on the environment since the planet is continuing its global warming. Global warming news creates an immediacy of action, but this does not seem to translate into adequate action. Most of the twelve green fintechs in the sample are not very transparent in what they have concretely achieved. The larger fintechs are remarkably diverse in their reporting: they are either reporting many initiatives or have not yet started reporting in this field. Therefore, much work needs to be completed on setting reporting guidelines and standards. Allowing people to work less in economic activities could also release time for engaging in report-validating activities.

The findings of this explorative study have two notable limitations. One is the standard case study limitation that it has little external validity, but it raises questions. The second limitation is that the twelve new green fintechs are evolving quickly. Therefore, it is difficult to freeze this pane as they shift their business models as new opportunities are seized. A new researcher may find it challenging to replicate this research unless it is completed immediately.

The work may open up research on several areas, such as impact measurement, strategic management, business models, risk management, and innovation theories. Let me provide a few practical or theoretical examples of each. If we want to be serious about impacting climate change, we need to find new initiatives that can be implemented at a grassroots level that fintechs can finance. Theoretical research may also be required to consider how to improve environmental impact measurement and how to attribute the impact. If this can be achieved, we could ask the polluter to pay at the micro-level (consumer, firm), meso-level (industry), or macro-level (country). Strategic management researchers may rethink theories on how enterprises enter or exit to better account for the relatively slow speed at which the work on environmental change is proceeding: for example, how much do we need to talk before we walk? Is being green just a value differentiator for some firms, or do consumers consider that it is now an eliminating criterion? Just as some small banks may have survived without ATMS, will firms that do not respect environmental norms (nor talk about it) still be able to provide some basic services to their niche of customers who free ride by not penalizing organizations if their products are cheaper? We have seen some business models of green fintech firms in our sample, but this is not exhaustive. Can we have detailed case studies on the specific challenges that founders faced? What other business models are being tried by fintech firms? Can policymakers make these models financially sustainable by removing or compensating for externalities? This externalities question can then be related to the questions mentioned above on being able to measure impact and attribute it. On risk management, researchers could look at the risks specific to green fintechs and distinguish them from those faced by other green organizations, technology organizations, and finance organizations. A lot of work on risk management is centered on auditing and reporting, and this opens questions on how researchers and environmental auditors can validate the measurements provided by those claiming to track ecological impact. On innovation theories, the discussion section mentioned disruptive and sustaining innovations as well as building ecosystems. However, there are many more innovation theories that can be applied. For example, reducing Scope 3 emissions may consider the work of open innovation theories. Finally, since we are going through a time of tremendous technological change, researchers can look at each new technology and consider how it can impact sustainability and what kind of financing this may require.

This last question is especially important for entrepreneurs. Many young entrepreneurs are concerned about the environment but do not know how to be effective. I hope the study will give them ideas on a few practices in the field. I also hope they will be able to think about how their target beneficiaries could be people living in developing countries and how they can include microfinance institutions in reaching out to the poorest of these people. This outreach would then help those people grow economically by using sustainable energy.

Finally, this study has pointed out that big corporates and governments in developed countries need to think about how they can mobilize the time of their workforce to think, discuss and act on environmental issues. Thanks to increased productivity owing to innovative technologies, there may be possibilities to use the time of billions of people to work to save the planet.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Acknowledgments

The author thanks the participants of the Green Money Conference, 16 March 2023, India International Centre, New Delhi.

Conflicts of Interest

The author declares no conflict of interest.

References

- UNFCCC. Simon Stiell at SB58 Opening: “We Are at a Tipping Point”; UNFCCC: New York, NY, USA, 2023. [Google Scholar]

- WMO. State of the Climate in Africa 2021; World Meteorological Organization: Geneva, Switzerland, 2022. [Google Scholar]

- Schlein, M. Making a Big Pivot—While Staying True to Your Original Mission. Harv. Bus. Rev. Digit. Artic. 2021, 1–9. Available online: https://hbr.org/2021/12/making-a-big-pivot-while-staying-true-to-your-original-mission (accessed on 8 June 2023).

- France Fintech; BlackFin Tech. Panorama Des Fintech Françaises 2017. Available online: https://francefintech.org/panorama-des-fintech-francaises-2017/ (accessed on 8 June 2023).

- Bayram, O.; Talay, I.; Feridun, M. Can Fintech Promote Sustainable Finance? Policy Lessons from the Case of Turkey. Sustainability 2022, 14, 12414. [Google Scholar]

- Hommel, K.; Bican, P.M. Digital Entrepreneurship in Finance: Fintechs and Funding Decision Criteria. Sustainability 2020, 12, 8035. [Google Scholar] [CrossRef]

- Parida, V.; Sjödin, D.; Reim, W. Reviewing Literature on Digitalization, Business Model Innovation, and Sustainable Industry: Past Achievements and Future Promises. Sustainability 2019, 11, 391. [Google Scholar] [CrossRef]

- Tong, L.; Chiappetta Jabbour, C.J.; belgacem, S.b.; Najam, H.; Abbas, J. Role of environmental regulations, green finance, and investment in green technologies in green total factor productivity: Empirical evidence from Asian region. J. Clean. Prod. 2022, 380, 134930. [Google Scholar] [CrossRef]

- Yan, C.; Siddik, A.B.; Yong, L.; Dong, Q.; Zheng, G.-W.; Rahman, M.N. A Two-Staged SEM-Artificial Neural Network Approach to Analyze the Impact of FinTech Adoption on the Sustainability Performance of Banking Firms: The Mediating Effect of Green Finance and Innovation. Systems 2022, 10, 148. [Google Scholar] [CrossRef]

- Al-Okaily, M.; Al Natour, A.R.; Shishan, F.; Al-Dmour, A.; Alghazzawi, R.; Alsharairi, M. Sustainable FinTech Innovation Orientation: A Moderated Model. Sustainability 2021, 13, 13591. [Google Scholar] [CrossRef]

- Lontchi, C.B.; Yang, B.; Shuaib, K.M. Effect of Financial Technology on SMEs Performance in Cameroon amid COVID-19 Recovery: The Mediating Effect of Financial Literacy. Sustainability 2023, 15, 2171. [Google Scholar] [CrossRef]

- Ryu, H.-S.; Ko, K.S. Sustainable Development of Fintech: Focused on Uncertainty and Perceived Quality Issues. Sustainability 2020, 12, 7669. [Google Scholar] [CrossRef]

- Ashta, A.; Herrmann, H. Artificial intelligence and fintech: An overview of opportunities and risks for banking, investments, and microfinance. Strateg. Chang. 2021, 30, 211–222. [Google Scholar] [CrossRef]

- Sobehart, J.R. The FinTech revolution: Quantifying earnings uncertainty and credit risk in competitive business environments with disruptive technologies. J. Risk Manag. Financ. Inst. 2016, 9, 163–174. [Google Scholar]

- Biot-Paquerot, G.; Assadi, D.; Ashta, A. La création de valeur des fintechs dans l’offre de services bancaires et financiers: Entre deshumanisation et réhumanisation. Innovations 2021, 2021, 209–235. [Google Scholar] [CrossRef]

- Flatraaker, D.-I. Mobile payments changing the landscape of retail banking: Hype or reality? J. Paym. Strategy Syst. 2013, 7, 150–158. [Google Scholar]

- White, G.R.T. Future applications of blockchain in business and management: A Delphi study. Strateg. Chang. 2017, 26, 439–451. [Google Scholar] [CrossRef]

- Glebova, E.; Mihaľová, P. New currencies and new values in professional sports: Blockchain, NFT, and fintech through the stakeholder approach. J. Phys. Educ. Sport 2023, 23, 1244–1252. [Google Scholar]

- Glebova, E.; Desbordes, M.; Geczi, G. Relocations of Sports Spectators’ Customer Experiences. Phys. Educ. Sport Sci. 2020, 5, 44–49. [Google Scholar] [CrossRef]

- Al-Matari, E.M.; Mgammal, M.H.; Alosaimi, M.H.; Alruwaili, T.F.; Al-Bogami, S. Fintech, Board of Directors and Corporate Performance in Saudi Arabia Financial Sector: Empirical Study. Sustainability 2022, 14, 10750. [Google Scholar] [CrossRef]

- Ashta, A.; Biot-Paquerot, G. Fintech Evolution: Strategic Value Management Issues In A Fast Changing Industry. Strateg. Chang. Brief Entrep. Financ. 2018, 27, 301–312. [Google Scholar] [CrossRef]

- Moro-Visconti, R.; Cruz Rambaud, S.; López Pascual, J. Sustainability in FinTechs: An Explanation through Business Model Scalability and Market Valuation. Sustainability 2020, 12, 10316. [Google Scholar] [CrossRef]

- Bittini, J.S.; Rambaud, S.C.; Pascual, J.L.; Moro-Visconti, R. Business Models and Sustainability Plans in the FinTech, InsurTech, and PropTech Industry: Evidence from Spain. Sustainability 2022, 14, 12088. [Google Scholar] [CrossRef]

- Ashta, A.; Assadi, D.; Duran, N. Capture d’innovation: Étude de cas d’une néo-banque à mission sociale et défis pour les pays en développement. Sci. Technol. Dev. 2021, 1, 1–21. Available online: http://www.openscience.fr/Capture-d-innovation-etude-de-cas-d-une-neo-banque-a-mission-sociale-et-defis# (accessed on 8 June 2023). [CrossRef]

- Kendall, J. Fintech Companies Could Give Billions of People More Banking Options; Harvard Business Publishing: Boston, MA, USA, 2017; pp. 2–4. Available online: https://hbr.org/2017/01/fintech-companies-could-give-billions-of-people-more-banking-options (accessed on 8 June 2023).

- Zhang, B.Z.; Ashta, A.; Barton, M.E. Do FinTech and financial incumbents have different experiences and perspectives on the adoption of artificial intelligence? Strateg. Chang. 2021, 30, 223–234. [Google Scholar] [CrossRef]

- Ryll, L.R.; Barton, M.E.; Zhang, B.Z.; McWaters, J. Transforming Paradigms: A Global AI in Financial Services Survey; Cambridge Centre for Alternative Finance (CCAF); University of Cambridge Judge Business School; World Ecnomic Forum (WEF), 2020; p. 126. Available online: http://www3.weforum.org/docs/WEF_AI_in_Financial_Services_Survey.pdf (accessed on 8 June 2023).

- Putra, R.; Mulyani, S.; Poulus, S.; Sukmadilaga, C. Data quality analytics, business ethics, and cyber risk management on operational performance and fintech sustainability. Int. J. Data Netw. Sci. 2022, 6, 1659–1668. [Google Scholar] [CrossRef]

- Koroleva, E.; Laidroo, L.; Avarmaa, M. Performance of FinTechs: Are founder characteristics important? J. East Eur. Manag. Stud. 2021, 26, 306–338. [Google Scholar] [CrossRef]

- Pentury, F. The Role of Knowledge and Penetration of Fintech Services in Improving MSMEs of Fishermen and Marine Farmers in Remote Small Islands Region. J. Manaj. Teor. Dan Terap. 2023, 16, 23–37. [Google Scholar] [CrossRef]

- Song, N.; Appiah-Otoo, I. The Impact of Fintech on Economic Growth: Evidence from China. Sustainability 2022, 14, 6211. [Google Scholar] [CrossRef]

- Li, H.; Lu, Z.; Yin, Q. The Development of Fintech and SME Innovation: Empirical Evidence from China. Sustainability 2023, 15, 2541. [Google Scholar] [CrossRef]

- Kouhizadeh, M.; Sarkis, J. Blockchain Practices, Potentials, and Perspectives in Greening Supply Chains. Sustainability 2018, 10, 3652. [Google Scholar] [CrossRef]

- Mapanje, O.; Karuaihe, S.; Machethe, C.; Amis, M. Financing Sustainable Agriculture in Sub-Saharan Africa: A Review of the Role of Financial Technologies. Sustainability 2023, 15, 4587. [Google Scholar] [CrossRef]

- Tamasiga, P.; Onyeaka, H.; Ouassou, E.h. Unlocking the Green Economy in African Countries: An Integrated Framework of FinTech as an Enabler of the Transition to Sustainability. Energies 2022, 15, 8658. [Google Scholar] [CrossRef]

- Puschmann, T.; Hoffmann, C.H.; Khmarskyi, V. How Green FinTech Can Alleviate the Impact of Climate Change—The Case of Switzerland. Sustainability 2020, 12, 10691. [Google Scholar] [CrossRef]

- Zhou, G.; Zhu, J.; Luo, S. The impact of fintech innovation on green growth in China: Mediating effect of green finance. Ecol. Econ. 2022, 193, 107308. [Google Scholar] [CrossRef]

- Ma, Y.; Wei, X.; Yan, G.; He, X. The Impact of Fintech Development on Air Pollution. Int. J. Environ. Res. Public Health 2023, 20, 3387. [Google Scholar] [CrossRef]

- Khiaonarong, T.; Humphrey, D. Instant Payments: Regulatory Innovation and Payment Substitution Across Countries. 2022. Available online: https://www.imf.org/en/Publications/WP/Issues/2022/11/18/Instant-Payments-Regulatory-Innovation-and-Payment-Substitution-Across-Countries-524032 (accessed on 8 June 2023).

- Huang, Y.; Chen, C.; Lei, L.; Zhang, Y. Impacts of green finance on green innovation: A spatial and nonlinear perspective. J. Clean. Prod. 2022, 365, 132548. [Google Scholar] [CrossRef]

- Jiakui, C.; Abbas, J.; Najam, H.; Liu, J.; Abbas, J. Green technological innovation, green finance, and financial development and their role in green total factor productivity: Empirical insights from China. J. Clean. Prod. 2023, 382, 135131. [Google Scholar] [CrossRef]

- Deng, X.; Huang, Z.; Cheng, X. FinTech and Sustainable Development: Evidence from China Based on P2P Data. Sustainability 2019, 11, 6434. [Google Scholar] [CrossRef]

- Chueca Vergara, C.; Ferruz Agudo, L. Fintech and Sustainability: Do They Affect Each Other? Sustainability 2021, 13, 7012. [Google Scholar] [CrossRef]

- Bansal, P.; Smith, W.K.; Vaara, E. New Ways of Seeing through Qualitative Research. Acad. Manag. J. 2018, 61, 1189–1195. [Google Scholar] [CrossRef]

- Yin, R. Case Study Research: Design and Methods; Sage Publications: London, UK, 2013. [Google Scholar]

- Gustafsson, J. Single Case Studies vs. Multiple Case Studies: A Comparative Study. 2017. Available online: https://www.semanticscholar.org/paper/Single-case-studies-vs.-multiple-case-studies%3A-A-Gustafsson/ae1f06652379a8cd56654096815dae801a59cba3 (accessed on 8 June 2023).

- Saunders, M.; Lewis, P.; Thornhill, A. Research Methods for Business Students; Pearson Education: Essex, UK, 2009. [Google Scholar]

- Farooq, O. 5 Biggest Fintech Companies in the World. 2022. Available online: https://www.insidermonkey.com/blog/5-biggest-fintech-companies-in-the-world-1089071/ (accessed on 16 February 2023).

- Ant Group. 2021 Sustainability Report. 2022. Available online: https://www.antgroup.com/en/esg/reportdetail?SustainabilityReport (accessed on 11 March 2023).

- Mastercard. Doing Well by Doing Good: Corporate Sustainability Report 2021. 2022. Available online: https://www.Mastercard.com/content/dam/public/Mastercardcom/na/global-site/documents/Mastercard-sustainability-report-2021.pdf (accessed on 11 March 2023).

- Fiserv. 2021 Corporate Social Responsibility Report. 2022. Available online: https://www.Fiserv.com/content/dam/Fiserv-com/csr-report/pdf/Fiserv-2021CSR.pdf (accessed on 11 March 2023).

- PayPal. 2021 Global Impact Report: Building a Digital Economy That Powers a More Inclusive and Resilient World. 2022. Available online: https://s202.q4cdn.com/805890769/files/doc_downloads/global-impact/PayPal-2021-Global-Impact-Report.pdf (accessed on 6 March 2023).

- Adyen. 2021 Annual Report. 2022. Available online: https://adyen.getbynder.com/m/56925f619c523f06/original/Adyen-Annual-Report-2021.pdf (accessed on 6 March 2023).

- Reinhardt, F.L. Environmental Product Differentiation: Implications for Corporate Strategy. Calif. Manag. Rev. 1998, 40, 43–73. [Google Scholar] [CrossRef]

- Valenciano-Salazar, J.A.; André, F.J.; Díaz-Porras, R. Differentiation strategies in coffee farms: Opportunities for Costa Rican growers. Environ. Dev. Econ. 2023, 28, 68–88. [Google Scholar] [CrossRef]

- Yen, H. Consumer Purchase Behaviors in Relation to Distinct Cultural Factors and Product Enhancement Type. Int. J. Organ. Innov. 2019, 12, 50–58. [Google Scholar]

- Song, J.H.; Adams, C.R. Differentiation through Customer Involvement in Production or Delivery. J. Consum. Mark. 1993, 10, 4–12. [Google Scholar] [CrossRef]

- Christensen, C.M.; Johnson, M.W.; Rigby, D.K. Foundations for Growth: How to Identify and Build Disruptive New Businesses. MIT Sloan Manag. Rev. 2002, 43, 22–31. [Google Scholar]

- Christensen, C.M.; Raynor, M.; McDonald, R. What Is Disruptive Innovation? Harv. Bus. Rev. 2015, 93, 44–53. [Google Scholar]

- Kohtamäki, M.; Parida, V.; Oghazi, P.; Gebauer, H.; Baines, T. Digital servitization business models in ecosystems: A theory of the firm. J. Bus. Res. 2019, 104, 380–392. [Google Scholar] [CrossRef]

- Zalan, T.; Toufaily, E. The Promise of Fintech in Emerging Markets: Not as Disruptive. Contemp. Econ. 2017, 11, 415–430. [Google Scholar]

- Furr, N.; O’Keeffe, K.; Dyer, J.H. Managing Multi-party Innovation. Harv. Bus. Rev. 2016, 94, 76–83. [Google Scholar]

- Latané, B. The psychology of social impact. Am. Psychol. 1981, 36, 343. [Google Scholar] [CrossRef]

- Mills, C.W. The Sociological Imagination; Oxford University Press: New York, NY, USA, 1959. [Google Scholar]

- Ashta, A. In the wake of the COVID crisis, Work-sharing from Different Angles: Employment, Equality, Ecology and Elation. Marché Et Organ. 2021, 1, 159–186. [Google Scholar] [CrossRef]

- Knight, K.W.; Rosa, E.A.; Schor, J.B. Could working less reduce pressures on the environment? A cross-national panel analysis of OECD countries, 1970–2007. Glob. Environ. Chang. 2013, 23, 691–700. [Google Scholar] [CrossRef]

- Ashta, A.; Mogha, V. Les risques liés à l’innovation: Le cas de l’intelligence artificielle. Technol. Innov. 2023, 8, 1–14. [Google Scholar] [CrossRef]

- Makridakis, S. The forthcoming Artificial Intelligence (AI) revolution: Its impact on society and firms. Futures 2017, 90, 46–60. [Google Scholar] [CrossRef]

- Shao, Q.; Shen, S. When reduced working time harms the environment: A panel threshold analysis for EU-15, 1970–2010. J. Clean. Prod. 2017, 147, 319–329. [Google Scholar] [CrossRef]

- Smetschka, B.; Wiedenhofer, D.; Egger, C.; Haselsteiner, E.; Moran, D.; Gaube, V. Time Matters: The Carbon Footprint of Everyday Activities in Austria. Ecol. Econ. 2019, 164, 106357. [Google Scholar] [CrossRef]

- Ashta, A. Microfinance: Battling a Wicked Problem; P.I.E. Peter Lang: Brussels, Belgium, 2016; p. 224. [Google Scholar]

- Dayson, K.; Sim, J. Technology to Toilets: Can Microfinance and IT Help Solve the World’s Sanitation Crisis? J. Electron. Commer. Organ. 2010, 8, 49–59. [Google Scholar] [CrossRef]

- Reed, L.R.; Marsden, J.; Rivera, C.; Ortega, A.; Rogers, S. Resilience: State of the Microcredit Summit Campaign Report 2014; Microcredit Summit Campaign: Washington, DC, USA, 2014. [Google Scholar]

- Allet, M. Why Do Microfinance Institutions Go Green? An Exploratory Study. J. Bus. Ethics 2014, 122, 405–424. [Google Scholar] [CrossRef]

- García-Pérez, I.; Muñoz-Torres, M.J.; Fernández-Izquierdo, M.Á. Microfinance institutions fostering sustainable development. Sustain. Dev. 2018, 26, 606–619. [Google Scholar] [CrossRef]

- Crosman, P. Behind Credit Suisse’s Foray into Microlending: Technology has made lending in small rural villages more efficient and profitable. Am. Bank. Mag. 2017, 127, 16–20. [Google Scholar]

- Messomo Elle, S. Understanding microfinance institutions and commercial banks’ relationships and innovations in the Cameroon financial environment. Strateg. Chang. 2017, 26, 585–597. [Google Scholar] [CrossRef]

- Blakstad, D.K.S.; Amars, S.E.L. FinTech at the frontier: Technology developments supporting financial inclusion in Niger. J. Digit. Bank. 2020, 4, 318–331. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).