1. Introduction

To agree on steps to combat climate change and keep temperatures below a 1.5 °C increase, government leaders and environmental experts convened at the 26th United Nations Climate Change Conference (COP26) in the first half of November 2021. The goals of COP26 underscore the interconnectedness of finance, sustainability, and technology. Green FinTech describes this merging of financial and environmental technologies, which will be essential in achieving sustainable development. We divide a country’s ecological footprint by its population to obtain its per-capita footprint. To live within Earth’s resources, the world’s ecological footprint must match the biocapacity per person, which is 1.6 global hectares. A country with an ecological footprint per person of 6.4 global hectares uses four times as much material as the Earth can renew and recycle. The US has seven times India’s and twice China’s ecological footprint per person. The footprint helps nations to improve sustainability and quality of life, local authorities to maximize public project returns, and individuals to realize their global footprint. The US has the second-largest ecological footprint after China, which has four times the US population. The existing population of the United States is using twice as much of the renewable natural resources and services that are available in the country as can be replenished. Alaska, Montana, South Dakota, Wyoming, and Arkansas have the smallest ecological footprints per citizen. According to the data presented in

Figure 1, the states of Arizona, California, Colorado, Florida, and Virginia have the largest ecological footprints for their respective populations. Texas and Michigan have the most abundant natural resources, according to biodiversity, which is a measure of how bio-productive land is. Rhode Island (RI), Delaware, and Arizona are the three states in the United States that have the lowest biocapacity. California, Florida, and Texas are the three states that have the biggest ecological gaps in the United States. South Dakota and Montana are home to some of the most important ecological preserves in the United States.

Following China in terms of total carbon emissions, the United States ranks in second place [

1]. Recently, the economy of the United States, which was the second-largest emitter of greenhouse gases (GHG) in 2017, set a goal for a significant reduction in the amount of GHG emissions by approximately 27% in 2025 when compared to the level of emissions in 2005 [

2]. In order to tackle challenges related to global warming and other dangers to the environment, a synergistic plan to manage excessive levels of CO

2 emissions is required. Spending money on research and development could end up being the most productive tactic. This is because lowering carbon emissions and encouraging the growth of eco-friendly economies necessitate the creation of new environmentally friendly products and technologies [

3,

4].

The 27th Conference of the Parties, often known as COP27, brought together nations from all around the world in an effort to raise the bar for achieving already established goals as well as to enhance commitments. Programs and initiatives hosted by the United States concentrate on the ways in which the leadership of the United States is delivering solutions to the climate crisis and the approaches by which the United States is engaging with allies from across the world. In order to bolster climate ambition and ensure substantial results at the 27th Conference of the Parties (COP27), the United States exhibits a steadfast dedication to collaborating with international allies. With the overarching objective of advancing the global trajectory towards attaining a state of net-zero emissions by the year 2050, the United States assumes a pivotal role in combating the looming climate catastrophe, consistently upholding this responsibility both presently and in the future.

The use of FinTech has the potential to make significant contributions toward achieving environmental sustainability in the United States. By financing the installation of solar panels, advancing renewable energy sources, and monitoring environmental impact, it can aid in the reduction of ecological footprints. Loans for firms and individuals trying to mitigate their environmental effect are possible due to FinTech, which also facilitates the flow of capital into environmentally conscious businesses. The switch to renewable energy, however, calls for heavy spending on infrastructure, R&D, and mass acceptance of clean energy technology. This is where the importance of the connection between financial inclusion and FinTech really emerges. By making it simpler to secure funding for renewable energy projects, FinTech platforms can encourage more people and businesses to adopt this clean energy technology. Renewable energy initiatives can now gain access to capital from a wider spectrum of investors by utilizing digital platforms, crowdfunding, and peer-to-peer financing.

Reducing a state’s or nation’s ecological footprint can be accomplished in a number of effective ways, but one of the most powerful is to make the switch to renewable energy. Earlier this year, California made history by becoming the first state to produce more than 5% of its electricity from utility-scale solar. However, there are currently six states that are further ahead of California in terms of overall dependency on renewable energy. Hydropower, on the other hand, accounts for the vast bulk of these states’ renewable energy resources; nevertheless, this resource is already being heavily utilized and is very location-dependent. Despite this, it is evident that the United States is planning for a future in which FinTech and renewable energy play a considerably larger role, and the majority of states still have a significant chance to tap into renewable energy in order to lower the carbon intensity of their economies. Although the United States cannot function without energy, the majority of its principal sources cannot be maintained indefinitely. The existing fuel mix is linked to a wide variety of negative effects on the surrounding environment, and countries such as the United States that produce a sizable portion of the world’s output and are mostly responsible for global warming. However, the United States also has one of the highest concentrations of financial technology worldwide.

The United Nations’ declaration of climate change as a “code red” emergency has highlighted the urgency of climate-related concerns. Financial services organizations have been found to annually dispatch 5.2 billion paper documents to customers, resulting in a loss of 2.4 million trees. FinTech is making the sector greener by eliminating paper, cutting energy waste, and tracking environmental impact in real time. FinTech can expedite the transition to a greener economy by equipping financial institutions and consumers with sustainable practices. Carbon emissions will not disappear overnight, but adopting new technology could help meet current and future environmental concerns. The first crucial point to make is that renewable energy consumption has a negative impact on the ecological footprint, in contrast to the positive impact that using non-renewable energy sources has. However, the United States has not joined the Kyoto Protocol or made any other global commitment to reduce its ecological footprint, despite its outsized influence on the worldwide energy market, international concerns, and its share of global production and emissions. This is a fascinating subject because

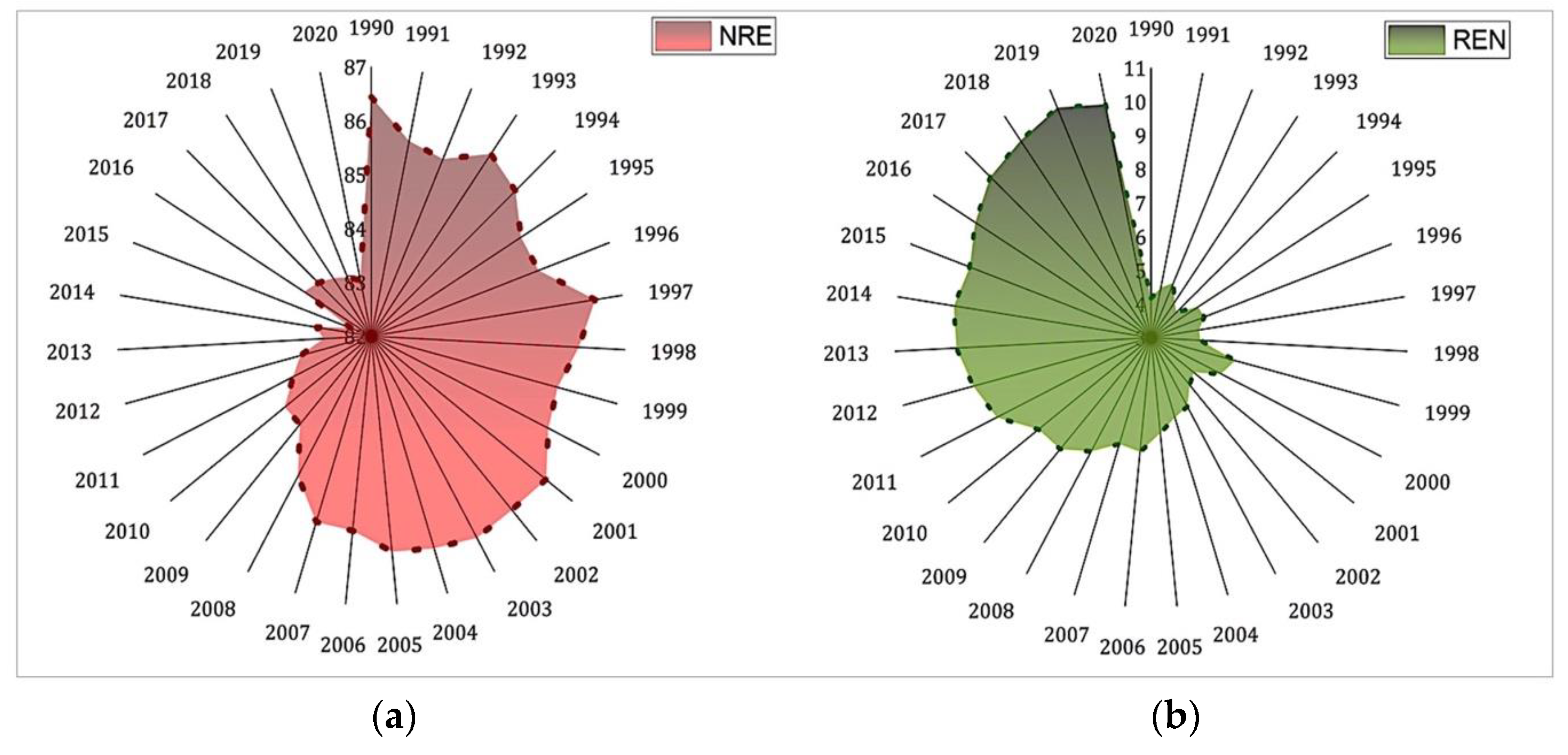

Figure 2a shows that in both 1990 and 2020, around 87% and 83% of world energy consumption originated from fossil fuels in the USA, respectively. It can be seen in

Figure 2b that renewable energy contributed only 4% of final energy consumption in 1990, but that amount is projected to surge to 10% by 2020. However, we believe the United States government should be open to trying to employ renewable energy and do what it can for the environment.

This research examines the interplay between FinTech, economic growth, renewable energy, non-renewable energy, and ecological footprint, making a contribution to global discourse on environmental sustainability. Additionally, in order to confirm the environmental Kuznets curve (EKC) hypothesis, a more recent estimation technique, the QARDL approach, is utilized in order to gain new insights into the analysis of the United States. The QARDL model uncovers non-linear patterns and explores implications within the context of the EKC hypothesis. These unique aspects contribute to the novelty of our research and differentiate it from existing studies in the field. In conclusion, the Quantile Granger Causality Strategy, which is currently the method that has proven to be the most reliable, is used to investigate the causality test. Due to the fact that the development of financial technology in a nation has a negative effect on its ecological footprint, our research has shown that this type of growth is beneficial to the process of shifting towards a low-carbon economy. Our findings, which are both enlightening and applicable, contribute significantly to the resolution of a contentious issue about the ambiguous role that FinTech development and renewable energy play in the improvement or destruction of the environment. These findings also provide regulators and policymakers with knowledge, which enables them to promote the agenda of FinTech development with more assurance and determination.

The remaining portions of the paper are organized as follows: In the following section, a literature assessment is presented that focuses on the connection between FinTech and renewable energy, with the goal of finding a solution to the problem of climate change. After that, the third section illuminates the intricacies of the models and methodological framework used to conduct empirical research. Moving on, the outcomes of our study are detailed in

Section 4, along with a discussion of how these results compare to prior research in the same field. Finally,

Section 5 of this study presents our conclusion, with key findings for scholars as well as policymakers.

2. Review Literature

The ecological footprint, which is associated with FinTech, renewable energy, economic growth, and non-renewable energy sources, can be a representation of environmental deterioration. The associated environmental Kuznets curve (EKC) suggests that there is an inverted U-shaped relationship between economic growth and environmental degradation. The EKC theory states that high income levels bring about a reversal of environmental deterioration and pollution that occurred during the early stages of economic development. As a result, when more people are able to participate in the economy, the environment benefits. That is to say, environmental pollution indicators have an inverse U-shaped relationship with economic growth [

5,

6,

7]. Since the introduction of the EKC idea, numerous further investigations have been conducted within the EKC framework [

8,

9,

10,

11,

12] and are included in this group of studies. Even for the same countries and regions, during the early phases of economic development, the EKC hypothesis anticipates that environmental quality might deteriorate; however, this deterioration will be followed by an improvement as income levels raised. For instance, whereas Ref. [

13] found evidence to support the EKC hypothesis for the United States, Ref. [

14] found no evidence to support the notion that the EKC hypothesis is accurate for the same nation.

The literature on environmental topics during the past two decades has given extensive attention to the effects of technological progress, alternative energy sources, economic development, and ecological footprint. Researchers are split into two camps, with the first believing that technological advances have helped the environment as a whole by reducing ecological footprints and increasing energy efficiency [

15,

16,

17,

18,

19], and according to the second set of studies, technology has a negative impact on the environment because of the massive ecological footprint it leaves behind when used and consumed [

20,

21]. The interesting view is that technology is a double-edged sword, positively affecting the environment through the creation of more effective infrastructure systems, smarter cities, and energy-saving industries, and negatively through the manufacture, use, and eventual disposal of technological devices. However, new technologies are promoted as the best way to curb rising pollution. Based on the current discussion, it is obvious that the environmental impact of global economic development and technological advancement is multifaceted and understudied, and that conventional linear approaches and one-dimensional proxies are unable to capture this complexity [

22].

As a direct consequence of the so-called “fourth industrial revolution”, a significant amount of progress has been made in the field of technology. In this light, it is anticipated that the financial sector will be one of the key beneficiaries of the growth of established businesses as well as the introduction of novel technology [

23]. Additionally, the financial technology sector has witnessed great expansion, which has been accompanied by enormous increases in both the quantity invested and the rates of return [

24]. The widespread adoption of these financial technologies can be attributed to a number of variables, including but not limited to demography; social system; financial climate; knowledge; income level; accessibility; velocity; cost of maintenance; and so forth [

25,

26,

27,

28].

Previous study has proven a link between financial innovations and their influence on banking systems and economic growth within countries [

29,

30,

31]. According to [

32], which proposes the technology compared to an innovative-growth approach, developments in financial technology and innovations can have positive and detrimental impacts on the growth of the economy [

29,

33,

34], contend that financial innovations facilitate risk sharing, cultivate industry integration, and enhance resource allocation efficiency. However, it is essential to observe that the excessive credit provision that may result from financial innovations may contribute to financial crises [

35]. Currently, FinTech has altered the financial environment and had far-reaching impacts on economies around the world [

36]. On top of that, it has made banks and the overall financial system more effective [

37]. That is to say, the rise of e-banking and other examples of FinTech has increased efficiency and competitiveness among banks [

38]. FinTech is the primary factor propelling the growth of stock markets [

39]. Even though the relationship between FinTech and economic, financial, and banking development has been well studied, there is an absence of research that examines how FinTech is linked with the environment [

40]. This is despite the fact that rapid financial innovations and development have positive externalities, such as increasing financial inclusion and decentralizing financial services.

However, digitalization’s results are energy-saving because of increased energy efficiency and industry shifts. A country can increase its economy’s energy efficiency through the use of ICT (information and communication technology). It is still unknown how exactly digitalization affects the tertiarization of the economy; however, there is evidence to suggest it has an energy-reducing effect. If we are going to talk about how cutting-edge technology is changing the banking industry, we have to talk about how it is changing the economy as a whole, too. As a result, there has been a rise in the worldwide production and consumption of ICT goods and services, which has led to higher demands for power and other environmental costs [

41]. The importance of ICT in raising both productivity and efficiency has been well recognized. However, there is still no agreement on how it will affect the ecosystem in the long run. There is strong empirical evidence linking the use of ICT to the reduction of GHG emissions, as shown by a number of different studies. On the other hand, some people argue that the widespread use of ICT products and services increases worldwide CO2 emissions because of the increased need for power [

42]. Additionally, Ref. [

43] examines the influence of ICT on power consumption in developing countries using panel data analysis techniques such as the dynamic generalized method of moments (GMM), pooled ordinary least squares (OLS), fixed effects, and random effects. Different methods provide different findings; for example, dynamic-GMM and pooled OLS analyses show a negative and statistically insignificant association between ICT and power use.

However, the fact is that all these studies look at how cryptocurrency might damage the ecosystem. Nevertheless, there is noticeably less research on the subject of how the growth and development of FinTech have altered an economy’s ecosystem. As such, a recent literature review has been provided by [

44], focusing on the intersection of technology and ecology. The authors have stated that innovation and sustainability are the two key drivers of financial business today. This subject has been studied, but only in a limited capacity. FinTech, however, is now being viewed as potentially instrumental in addressing climate change and its effects. Therefore, it is crucial to comprehend the complexities that go beyond blockchain and cryptocurrencies, as well as how the growth of the FinTech ecosystem is connected to the economic ecosystem as a whole. To address this gap, this study provides an empirical evaluation of the connection between FinTech advancement and environmental quality, arguing that the more advanced a country’s financial ecosystem, the higher the quality of its environment would be. The impact of FinTech on ecological footprint in the presence of renewable and non-renewable energy, GDP, and its square relied on the work of [

45,

46,

47].

This study primarily contributes to FinTech, an innovative financial strategy that uses information technology and includes all necessary financial services activities. While there is a growing body of research looking at how blockchain and cryptocurrencies might affect environmental impacts, we are not aware of any that evaluates the relationship between FinTech development and ecological well-being. Moreover, we hypothesize that less environmental harm will occur in countries with more advanced FinTech ecosystems. The connection is explained through a number of pathways, including new developments in systems and processes, increased efficiency, green finance, etc. We have also argued that technological progress is enabled by strategic corporate investment and well-timed government regulation. Therefore, governments play a crucial role in fostering an atmosphere conducive to eco-friendly inventions.