The Structural Causes and Trend Evolution of Imbalance and Insufficiency of Development of Digital Inclusive Finance in China

Abstract

1. Introduction

2. Literature Review

3. Study Methods and Data

3.1. Research Methods

3.1.1. Analytic Hierarchy Process

3.1.2. Weighted Dagum Gini Coefficient

3.1.3. Quantile Standardization

3.1.4. Kernel Density Estimation

3.1.5. Markov Chain Analysis Method

3.2. Data Sources

4. Construction and Level Measurement of Digital Inclusive Financial Index

4.1. Index System of Digital Inclusive Finance

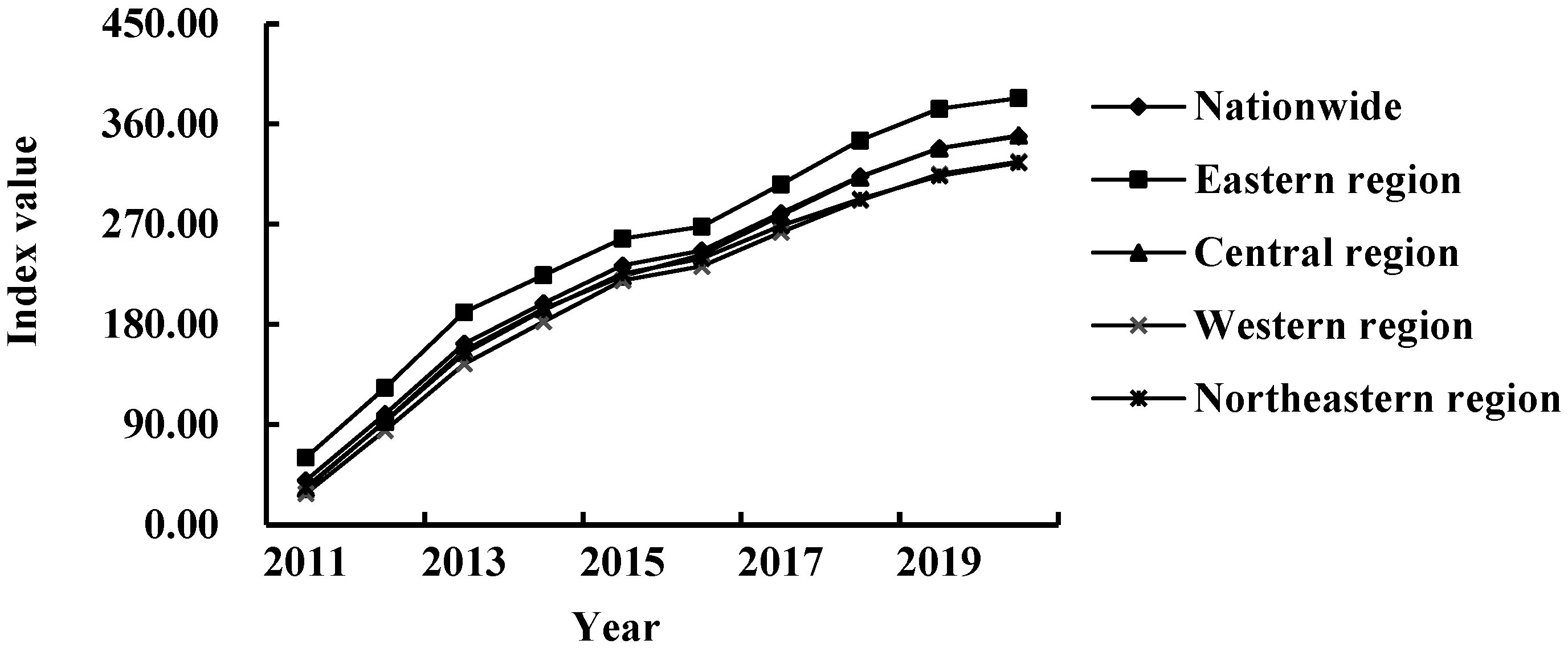

4.2. Measurement of Digital Inclusive Finance Level

5. Analysis of the Imbalance of Development of Digital Inclusive Finance

5.1. Imbalance Level and Source

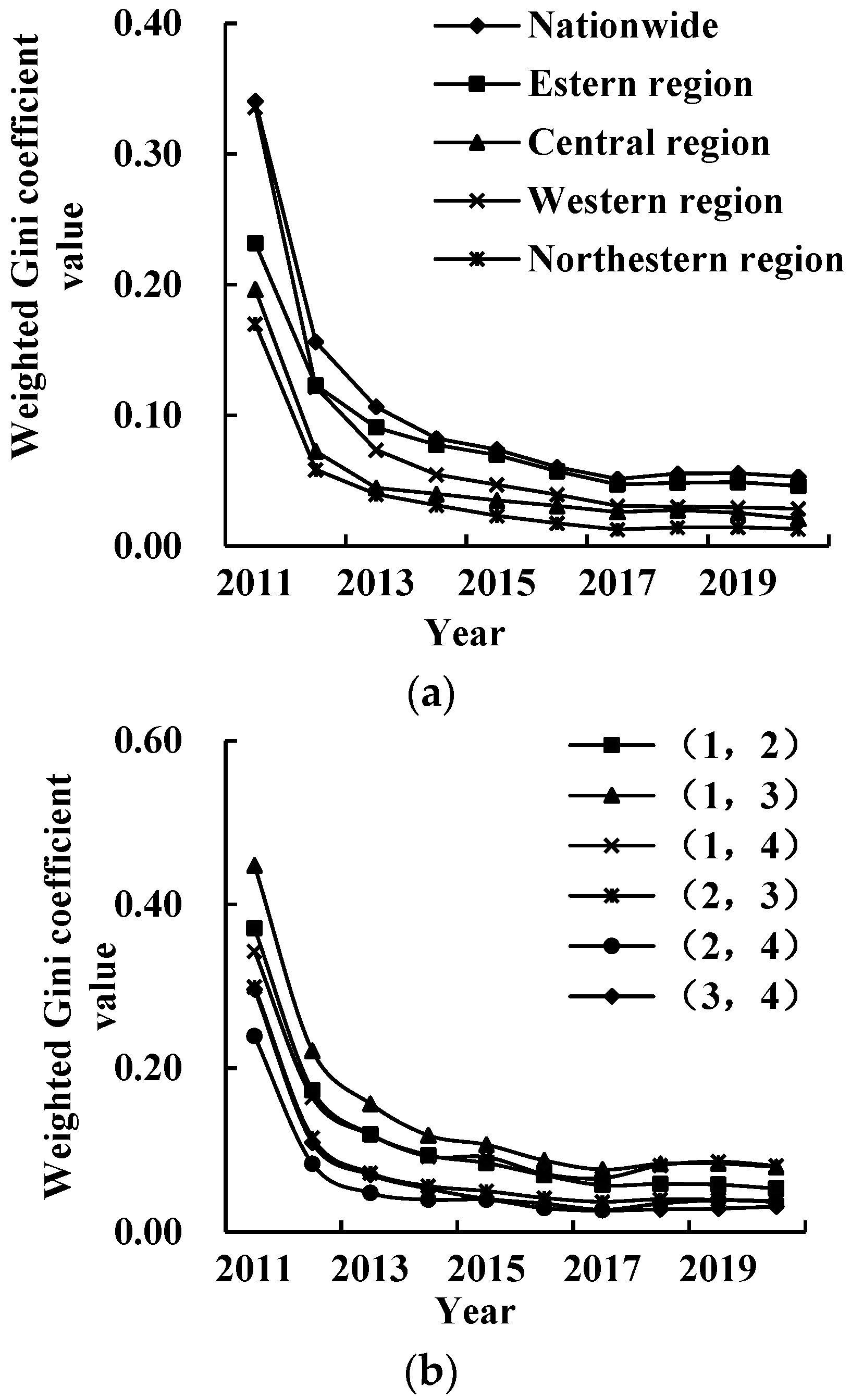

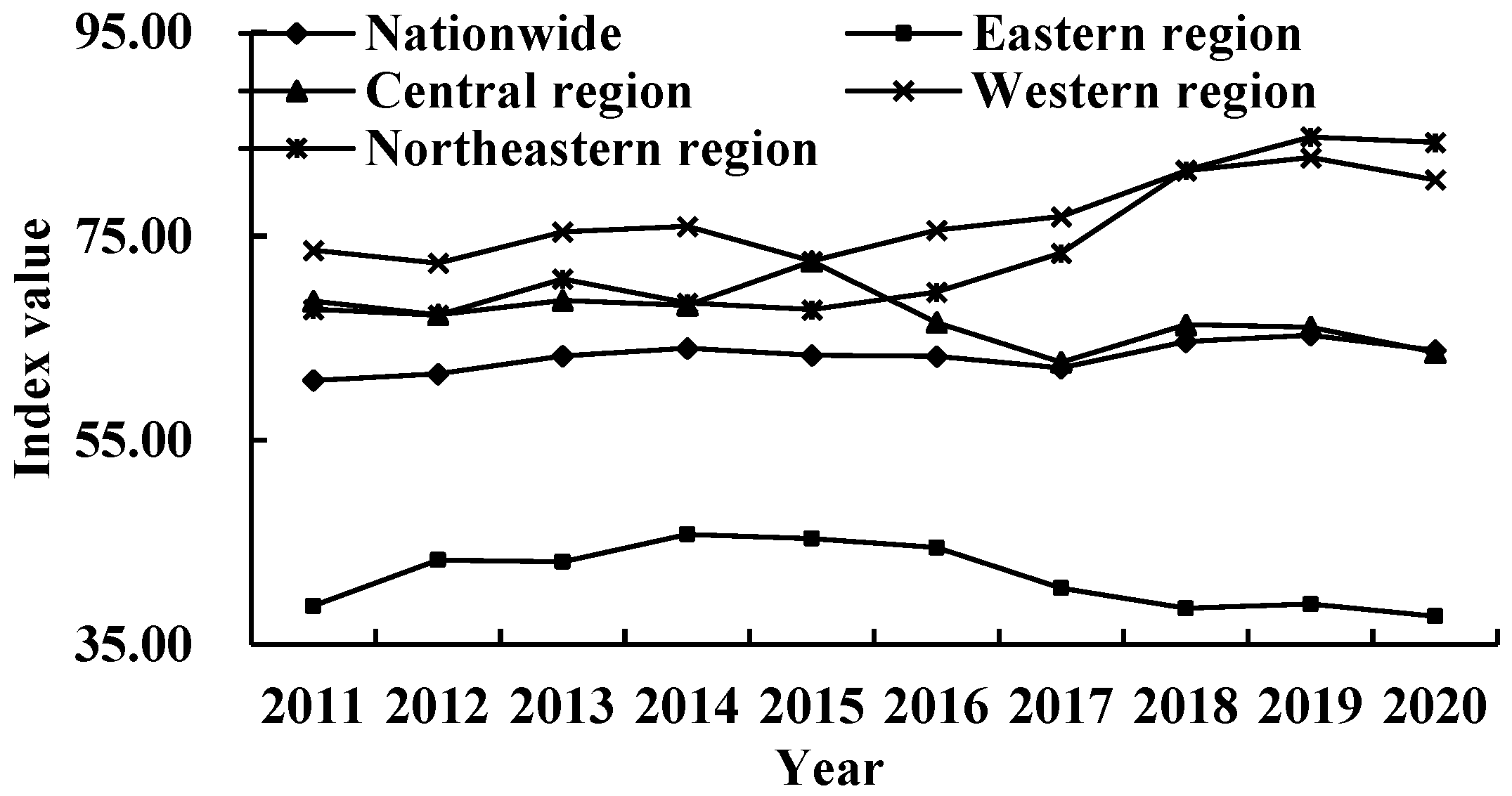

5.1.1. Imbalance Level

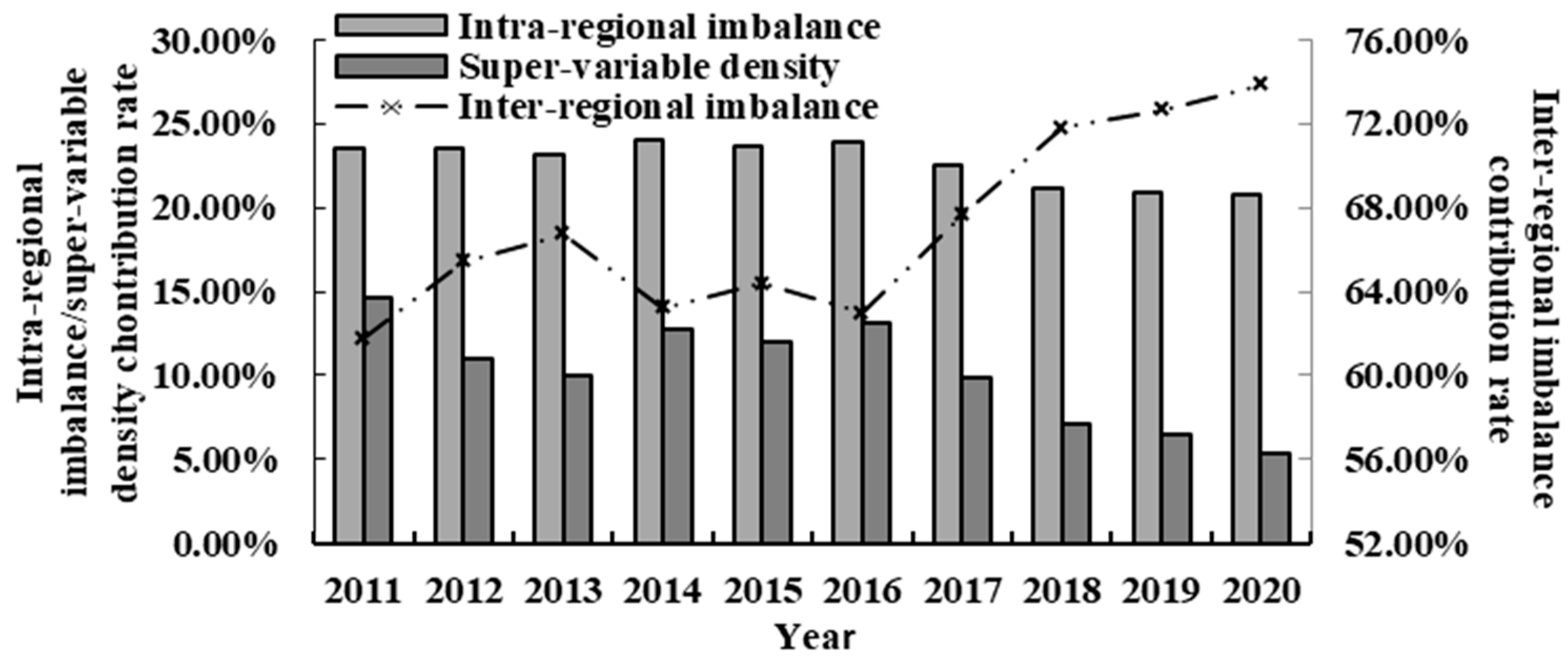

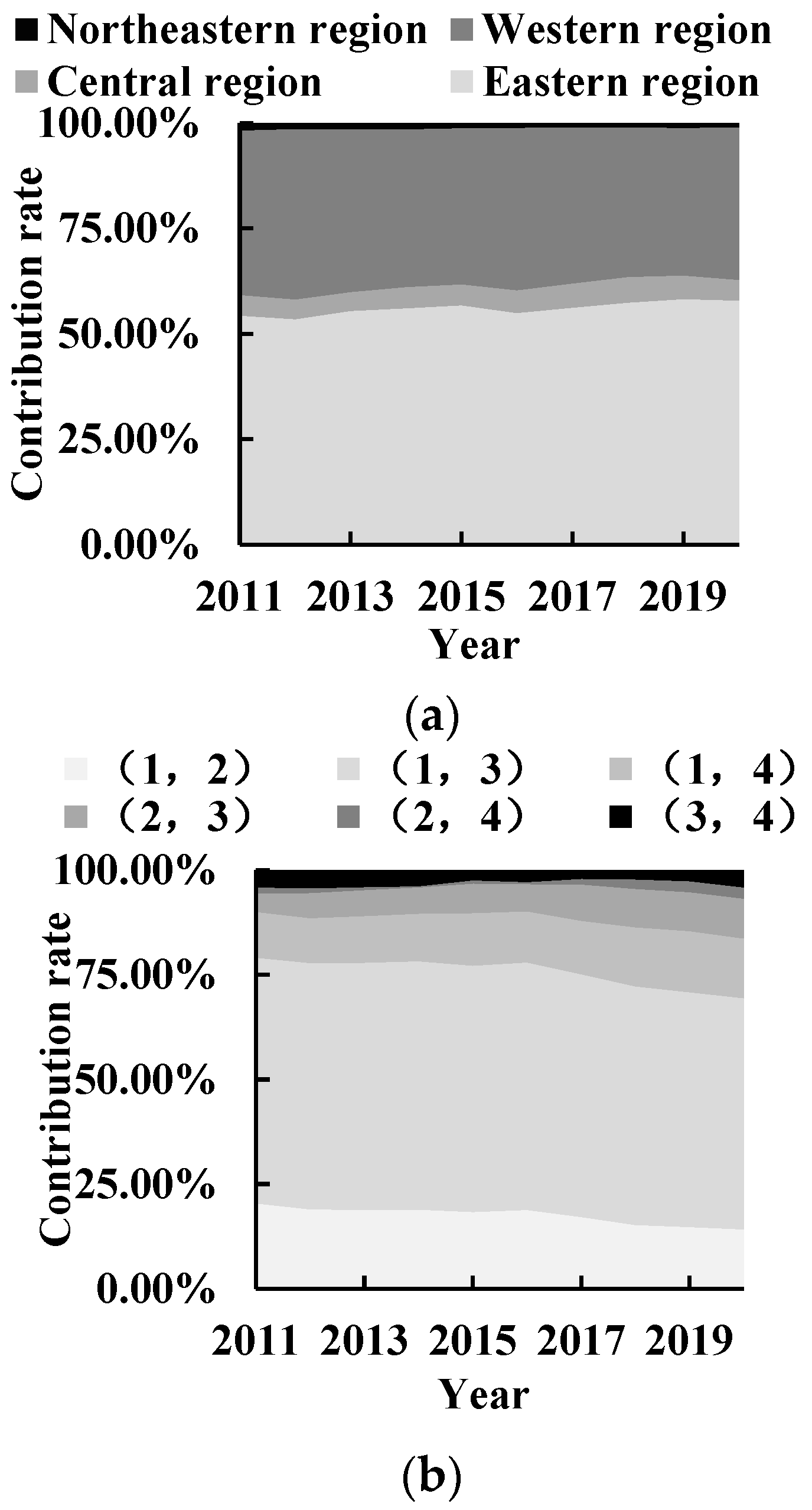

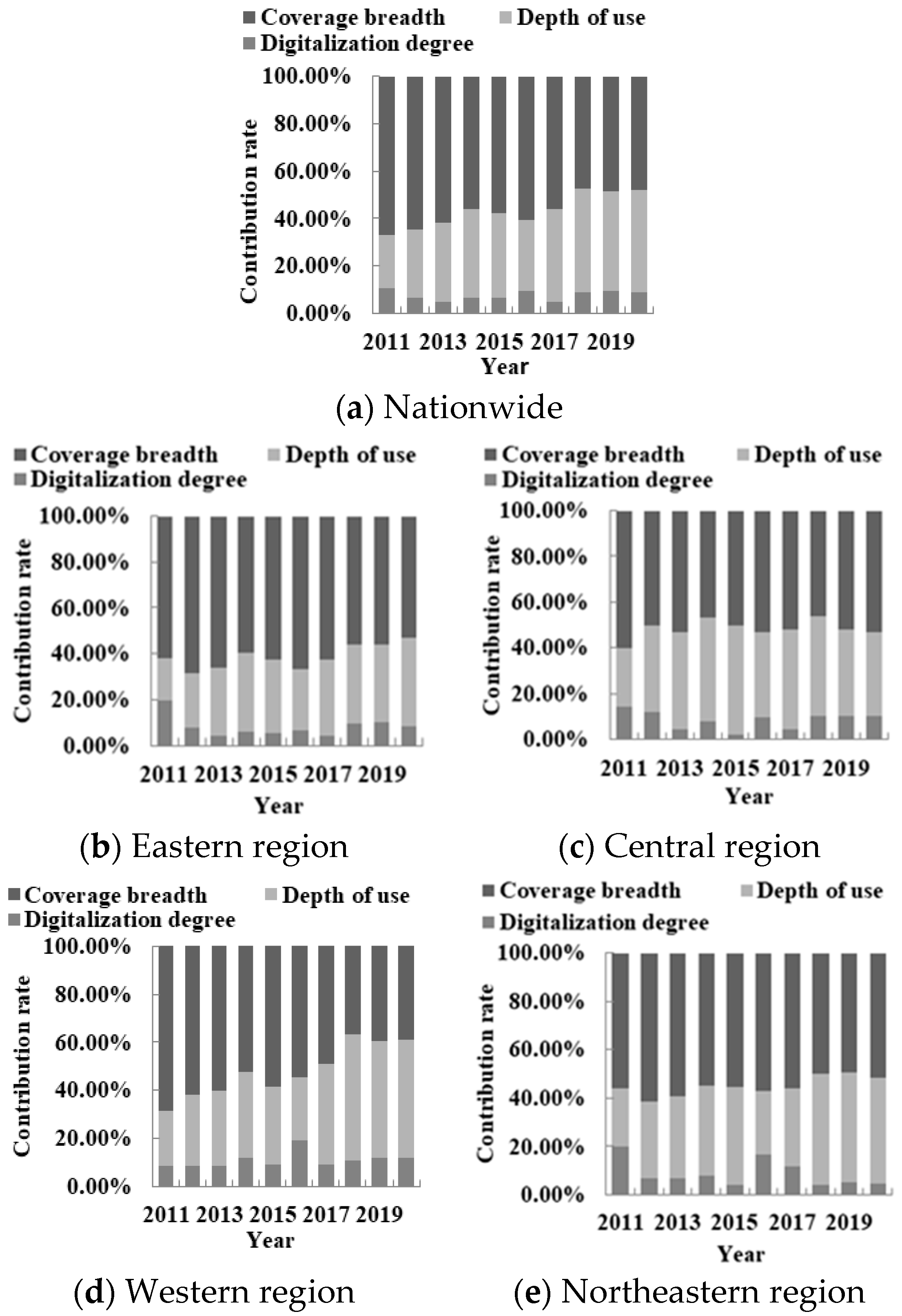

5.1.2. Sources of Imbalance and Their Contribution

5.2. Structural Causes of Imbalance Development

5.3. Trend Evolution of Imbalance Development

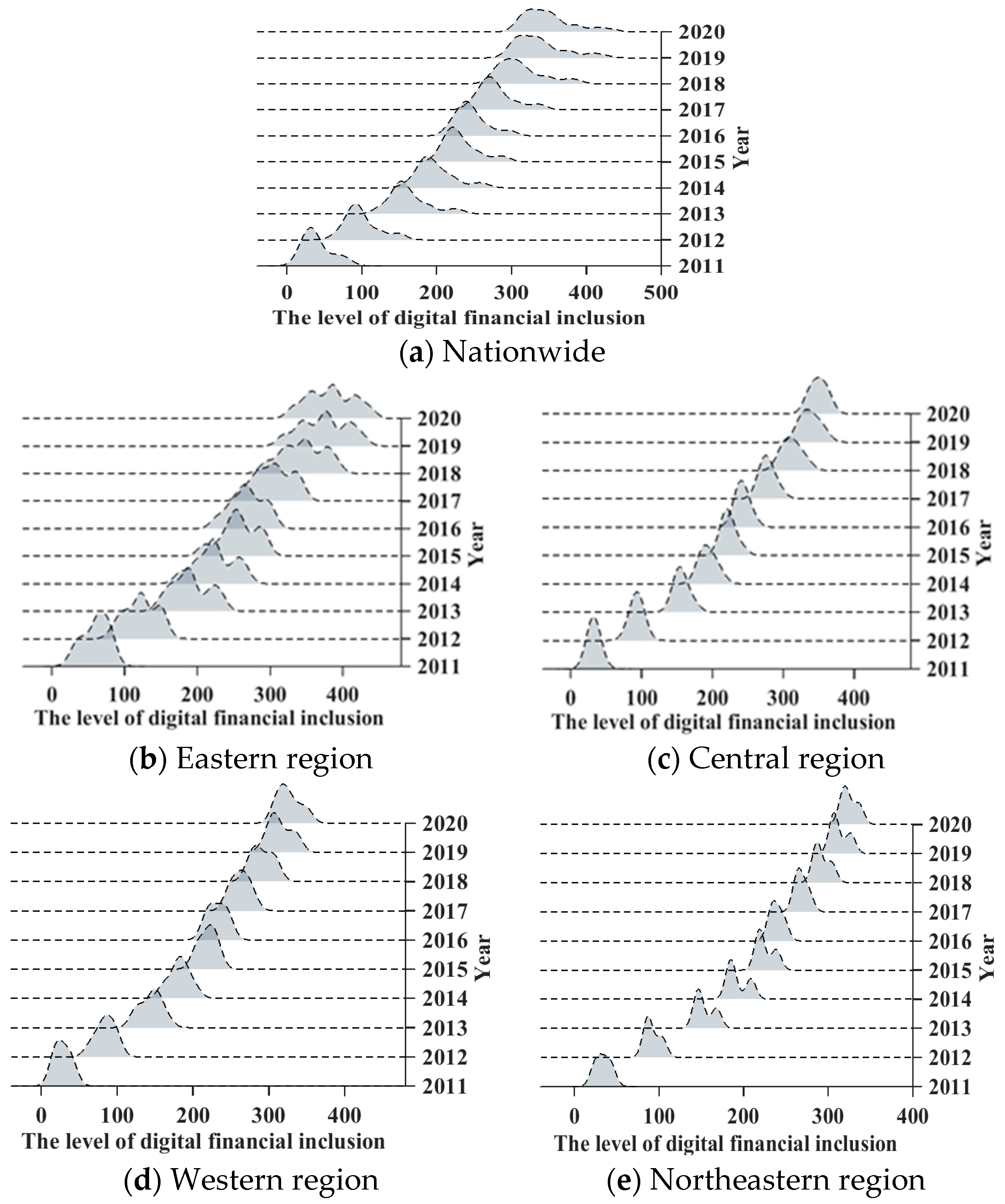

- (1)

- The rightward shift in the distribution of digital inclusive finance across China and in the four major regions indicates an increasing level of development of digital inclusive finance across the country and in the four major regions, which is consistent with the objective facts presented in the previous section. Bounded by 2015, the rightward shift is greater until 2015, after which the shift decreases significantly. In addition, the right shift is relatively large across the country and in the eastern region, while the right shift decreases in the central, western and northeastern regions. This suggests that digital inclusive finance is growing faster nationwide and in the eastern region, and relatively slowly in the other three regions. Hence, the development gap of digital inclusive finance between the eastern region and the other three major regions has gradually widened.

- (2)

- The main peaks show a downward trend nationally and in the eastern, central and western regions, with the width of the main peaks widening. In the northeastern region, the peak value of the main peak increases slightly, and the width of the main peak is obviously reduced. This indicates that the development of digital inclusive finance is gradually dispersed nationwide and in the eastern, central and western regions, and the absolute difference in the internal development of digital inclusive finance tends to expand. However, the development of the northeastern region is gradually concentrated, which represents the improvement in the absolute difference.

- (3)

- From a national perspective, the distribution curve of digital inclusion shows a more pronounced trailing to the right, with a widening trend of distribution extension. This indicates that the provinces with a higher development degree of digital inclusive finance (such as Beijing and Shanghai) have been further improved, and the gap between the development level of the provinces and that of other provinces nationwide is gradually increasing, with the situation of “the best getting better”. From the regional perspective, there is no obvious tailing in the distribution curves of the four regions. This indicates that the provinces in the region have similar levels, with the highest level of development having a very small gap with other provinces in the region.

- (4)

- The development of digital inclusive finance is multi-polar nationwide and in the eastern region. The western and northeastern region shows polarization and the central region shows no polarization. Specifically, the national Kernel density curve develops from one side peak to two side peaks, but the peaks of the side peaks are both lower. It is indicated that the digital inclusive finance in China is gradually shifting from polarization to multi-polarization, but the degree of polarization is always weak. The density curve in the eastern region is mainly composed of a main peak and two lateral peaks distributed on both sides of the main peak. The left-hand peak tends to diverge into two lateral peaks, with a gradual deepening of multipolar differentiation. In most years, the western and northeastern regions consist of one main peak and one lateral peak, showing obvious polarization. The distribution curve in the central region has only one peak, and there is no polarization phenomenon. The development of digital inclusive finance in the central region is balanced.

6. Analysis of the Insufficiency of Development of Digital Inclusive Finance

6.1. Level Measures of Insufficiency

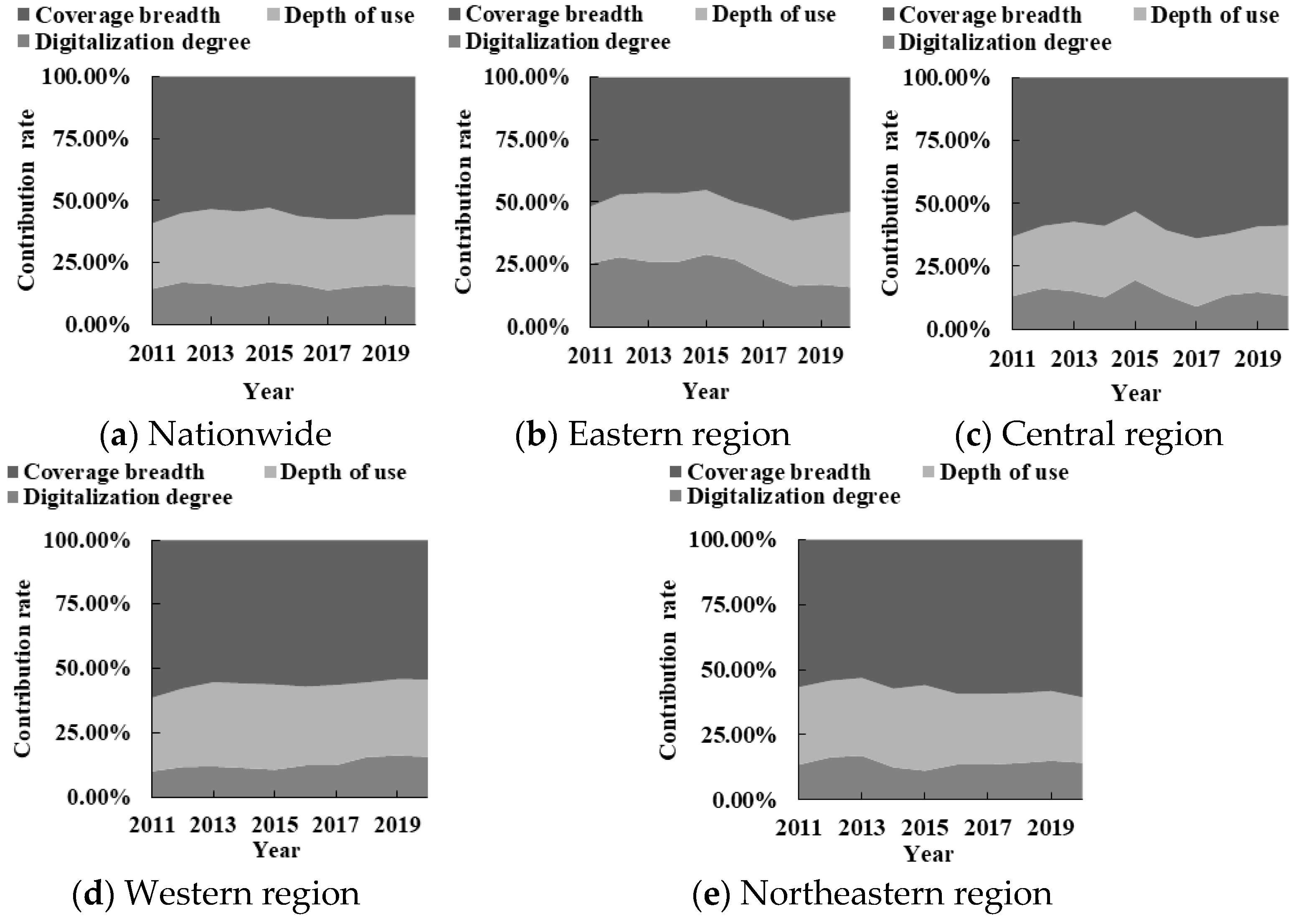

6.2. Structural Causes of Insufficiency Development

6.3. Trend Evolution of Insufficiency Development

- (1)

- There is a significant “Club Convergence” in the sufficiency development of digital inclusive finance in the whole country and in the eastern, central and western regions. The transfer probability on the main diagonal is higher than that on the non-main diagonal in the transfer matrix. From the national transfer matrix, the mean of the main diagonal shift probability is 0.7779, suggesting that the overall insufficiency level is likely to remain stable. According to the regional transfer matrix, it is easy to self-solidify if the main diagonal of the eastern, central and western regions is not sufficient. In the transfer matrix of the northeastern region, the medium- and low-level transfer probability is less than the corresponding downward transfer probability. It indicates that the development of digital inclusive finance in the northeastern region is not fully self-reinforcing, and the structural weakness will be more obvious.

- (2)

- There is a “Matthew Effect” of insufficient development of digital inclusive finance nationwide and in the four major regions. Provinces at low and high levels are less likely to transfer, especially the low ones. The low-level stable probability of the whole country and the four major regions is more than 65%. It indicates that the insufficiency development of the low-level provinces will not be expanded basically, and it is difficult for the high-level provinces to make up for the development gaps, and the sufficiency development of digital inclusive finance is easy to fall into spatial disequilibrium.

- (3)

- The probabilities on both sides of the diagonal of the shift matrix are mostly non-zero nationwide and in the four major regions, suggesting that the insufficiency level of digital inclusive finance development is shifted upward or downward within one year. In addition, there is no leapfrog transfer in the whole country and in the eastern, central and northeastern regions, and the level of insufficiency tends to remain stable. With the exception of the low- and medium-level provinces, provinces with other insufficiency level in the western region are likely to experience leapfrogging, but the probability is small, not exceeding 0.0811. For provinces in the western region, no matter whether there is a high or low level of insufficiency development of digital inclusive finance, there will be little leapfrogging or further improvement in a year.

7. Discussion

- (1)

- The imbalance of development of digital financial inclusion in China. It was found that there are regional differences in the development of digital financial inclusion in China, and the development of the eastern region is generally better than that of other regions, which is consistent with the study of Wang et al. [5]. The digital financial inclusion in the western region has the fastest growth, but the development gap between western and eastern regions is still large. This indicates that with the effective implementation of China’s financial poverty alleviation policy, the development of digital financial inclusion in the western region has achieved initial results, but the favorable conditions for the development of digital inclusive finance in the western region are insufficient, so that its service acceptance and usage are still far lower than that in the eastern region. Further examination found that the development within the eastern region is the most imbalanced, which may be due to the large differences between the provinces with higher levels of digital financial inclusion development (Beijing, Shanghai, Zhejiang, Guangdong, etc.) and the provinces with lower levels of development (Hebei, Hainan, Shandong, etc.) in the eastern region. In addition, in terms of structural causes, affected by the size of China’s population, the imbalance of coverage breadth has the greatest impact on the imbalance of development of digital inclusive finance in China’s four major regions. The above confirms hypothesis 1. In terms of the evolution trend, the rightward shift of the distribution of digital financial inclusion in 2020 is significantly smaller than that of the previous year, which may be because the COVID-19 pandemic has hindered the development of digital financial inclusion to a certain extent.

- (2)

- The insufficiency of development of digital inclusive finance in China. In order to better promote the further development of digital inclusive finance, this paper takes this as a starting point to conduct empirical research and reveal the shortcomings of China’s digital inclusive finance. The study found that the current development of digital inclusive finance in China is not sufficient, which is mainly affected by insufficiency of coverage breadth. For a country with a large population, it is difficult to achieve full coverage of digital accounts. The above also confirms hypothesis 2. In addition, from the specific point of view of each region, there are deficiencies in the use of financial services in the eastern region; the overall insufficiency level in the central region has not decreased significantly; the financial environment in the western region is relatively poor, and the use scenario of credit score is limited to some extent, which leads to the increase in the contribution rate of insufficiency of the digitalization degree; the population loss in the northeastern region leads to the decrease in effective financial accounts and the increase in the contribution rate of insufficiency of coverage breadth. Further examining the impact of COVID-19 on the shortcomings of digital inclusive finance in the four major regions, it was found that the contribution rate of insufficiency of digitalization degree in the four major regions has declined in 2020. This may be due to the implementation of contactless prevention and control measures during the epidemic period, which has made mobile payment widely used; mobile payment means such as two-dimensional code payments are widely used in major places, and the mobile and convenience advantages of digital inclusive finance have been fully brought into play in the era of the epidemic.

8. Conclusions and Insights

- Over all, the Digital Inclusive Financial Index in China and the four major regions show an upward trend, maintaining positive growth under the impact of the COVID-19 epidemic in 2020, but the growth rate has declined. Specifically, the eastern region has the highest development level. The western region has the highest annual growth rate.

- In terms of the imbalance of development, the imbalance level of digital inclusive finance development shows an downward trend. The eastern region has the highest imbalance level, and the development between the eastern and western regions is the most unbalanced. Inter-regional imbalance is the main source of overall development imbalance. The imbalance in coverage breadth is the main structural cause of imbalance development in China and the four major regions. The development gap of digital inclusive finance between the eastern region and the other three major regions has gradually widened, and the absolute difference tends to expand nationwide and in the eastern, central and western regions. The gap between the provinces with higher development degree and other provinces nationwide is gradually increasing, and there is a trend of bipolarization or multipolarization in China and the other three major regions, with the exception of the central region.

- In terms of the insufficiency of development, the insufficiency level of digital inclusive finance rose slightly in China. The eastern region is relatively fully sufficient, and the western region is the most insufficient. The development shortcoming of digital inclusive finance in China and the four major regions is the coverage breadth. There is a significant “Club Convergence” nationwide and in the eastern, central and western regions. There is a “Matthew effect” of insufficient development of digital inclusive finance nationwide and in the four major regions. With the exception of the low- and medium-level provinces, provinces with other insufficiency levels in the western region are likely to experience leapfrogging.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Joia, L.A.; Cordeiro, J.P.V. Unlocking the Potential of Fintechs for Financial Inclusion: A Delphi-Based Approach. Sustainability 2021, 13, 11675. [Google Scholar] [CrossRef]

- Morgan, P.J. Fintech and Financial Inclusion in Southeast Asia and India. Asian Econ. Policy Rev. 2022, 17, 183–208. [Google Scholar] [CrossRef]

- Hu, M.; Zhang, J.; Chao, C. Regional financial efficiency and its non-linear effects on economic growth in China. Int. Rev. Econ. Financ. 2019, 59, 193–206. [Google Scholar] [CrossRef]

- Jiang, L.L.; Tong, A.; Hu, Z.; Wang, Y. The impact of the inclusive financial development index on farmer entrepreneurship. PLoS ONE 2019, 14, e0216466. [Google Scholar] [CrossRef] [PubMed]

- Wang, Q.; Yang, J.B.; Chiu, Y.H.; Lin, T.Y. Cross-regional comparative study on digital finance and finance efficiency in China: The eastern and non-eastern areas. Manag. Decis. Econ. 2022, 44, 68–83. [Google Scholar] [CrossRef]

- Lloyd, A.D.; Antonioletti, M.; Sloan, T.M. Able but not willing? Exploring divides in digital versus physical payment use in China. Inf. Technol. People 2016, 29, 250–279. [Google Scholar] [CrossRef]

- Aziz, A.; Naima, U. Rethinking digital financial inclusion: Evidence from Bangladesh. Technol. Soc. 2021, 64, 101509. [Google Scholar] [CrossRef]

- Li, J.; Wu, Y.; Xiao, J.J. The Impact of Digital Finance on Household Consumption: Evidence from China. Econ. Model. 2020, 86, 317–326. [Google Scholar] [CrossRef]

- Guo, C.; Wang, X.J.; Yuan, G.C. Digital Finance and the Efficiency of Household Investment Portfolios. Emerg. Mark. Financ. Trade 2022, 58, 2895–2909. [Google Scholar] [CrossRef]

- Ye, Y.; Pu, Y.J.; Xiong, A.L. The impact of digital finance on household participation in risky financial markets: Evidence-based study from China. PLoS ONE 2022, 17, e0265606. [Google Scholar] [CrossRef]

- Kouladoum, J.C.; Wirajing, M.A.K.; Nchofoung, T.N. Digital technologies and financial inclusion in Sub-Saharan Africa. Telecommun. Policy 2022, 46, 102387. [Google Scholar] [CrossRef]

- Li, F.H.; Zang, D.G.; Chandio, A.A.; Yang, D.M.; Jiang, Y.S. Farmers’ adoption of digital technology and agricultural entrepreneurial willingness: Evidence from China. Technol. Soc. 2023, 73, 102253. [Google Scholar] [CrossRef]

- Luo, S.M.; Sun, Y.K.; Zhou, R. Can fintech innovation promote household consumption? Evidence from China family panel studies. Int. Rev. Financ. Anal. 2022, 82, 102137. [Google Scholar] [CrossRef]

- Carter, M.R. Can digitally-enabled financial instruments secure an inclusive agricultural transformation? Agric. Econ. 2022, 53, 953–967. [Google Scholar] [CrossRef]

- Kim, D.W.; Yu, J.S.; Hassan, M.K. Inclusive finance and economic growth in OIC countries. Res. Int. Bus. Financ. 2017, 43, 1–14. [Google Scholar] [CrossRef]

- Ozili, P.K. Impact of digital finance on inclusive finance and stability. Borsa Istanb. Rev. 2018, 18, 329–340. [Google Scholar] [CrossRef]

- Duvendack, M.; Mader, P. Impact of inclusive finance in low- and middle-income countries: A systematic review of reviews. Campbell Syst. Rev. 2019, 15, e1012. [Google Scholar] [CrossRef]

- Liang, C.A.; Du, G.M.; Cui, Z.D.; Faye, B. Does Digital Inclusive Finance Enhance the Creation of County Enterprises? Taking Henan Province as a Case Study. Sustainability 2022, 14, 14542. [Google Scholar] [CrossRef]

- Liu, S.; Koster, S.; Chen, X.Y. Digital divide or dividend? The impact of digital finance on the migrants entrepreneurship in less developed regions of China. Cities 2022, 131, 103896. [Google Scholar] [CrossRef]

- Li, L.; Li, Z.L.; Li, L.H.; Wang, Z.H. Digital financial inclusion and environmental entrepreneurship: Evolution of state legal environmental responsibility in China. Environ. Sci. Pollut. Res. 2023, 30, 50309–50318. [Google Scholar] [CrossRef]

- Chen, B.; Zhao, C.K. Poverty reduction in rural China: Does the digital finance matter? PLoS ONE 2021, 16, e0261214. [Google Scholar] [CrossRef] [PubMed]

- Xiong, M.Z.; Li, W.Q.; Teo, B.S.X.; Othman, J. Can China’s Digital Inclusive Finance Alleviate Rural Poverty? An Empirical Analysis from the Perspective of Regional Economic Development and an Income Gap. Sustainability 2023, 14, 16984. [Google Scholar] [CrossRef]

- Xiong, M.Z.; Fan, J.J.; Li, W.Q.; Xian, B.T.S. Can China’s digital inclusive finance help rural revitalization? A perspective based on rural economic development and income disparity. Front. Environ. Sci. 2022, 10, 985620. [Google Scholar] [CrossRef]

- Li, Q.Q.; Liu, Q.L. Impact of Digital Financial Inclusion on Residents’ Income and Income Structure. Sustainability 2023, 15, 2196. [Google Scholar] [CrossRef]

- Ding, X.M.; Gao, L.F.; Wang, G.J.; Nie, Y. Can the development of digital financial inclusion curb carbon emissions? Empirical test from spatial perspective. Front. Environ. Sci. 2022, 10, 1045878. [Google Scholar] [CrossRef]

- Zhao, H.; Yang, Y.R.; Li, N.; Liu, D.S.; Li, H. How Does Digital Finance Affect Carbon Emissions? Evidence from an Emerging Market. Sustainability 2021, 13, 12303. [Google Scholar] [CrossRef]

- Wang, H.L.; Guo, J.G. Impacts of digital inclusive finance on CO2 emissions from a spatial perspective: Evidence from 272 cities in China. J. Clean. Prod. 2022, 355, 131618. [Google Scholar] [CrossRef]

- Guo, F.; Wang, J.; Wang, F.; Kong, T.; Zhang, X.; Cheng, Z. Measuring the Development of Digital Inclusive Finance in China: Index Compilation and Spatial Characteristics. China Econ. Q. 2020, 19, 1401–1418. [Google Scholar]

- Razzaq, A.; Yang, X.D. Digital finance and green growth in China: Appraising inclusive digital finance using web crawler technology and big data. Technol. Forecast. Soc. Chang. 2023, 188, 122262. [Google Scholar] [CrossRef]

- Shen, Y.; Hueng, C.J.; Hu, W.X. Measurement and spillovereffect of digital financial inclusion: A cross-country analysis. Appl. Econ. Lett. 2021, 28, 1738–1743. [Google Scholar] [CrossRef]

- Khera, P.; Ng, S.; Ogawa, S.; Sahay, R. Measuring Digital Financial Inclusion in Emerging Market and Developing Economies: A New Index. Asian Econ. Policy Rev. 2022, 17, 213–230. [Google Scholar] [CrossRef]

- Vasile, V.; Panait, M.; Apostu, S.A. Financial Inclusion Paradigm Shift in the Postpandemic Period. Digital-Divide and Gender Gap. Int. J. Environ. Res. Public Health 2022, 18, 10938. [Google Scholar] [CrossRef]

- Takmaz, S.; Sari, E.; Alatas, S. Financial inclusion in Turkey: Unpacking the provincial inequality and its determinants. Appl. Econ. Lett. 2022. [Google Scholar] [CrossRef]

- Lyons, A.C.; Kass-Hanna, J.; Fava, A. Fintech development and savings, borrowing, and remittances: A comparative study of emerging economies. Emerg. Mark. Rev. 2022, 51, 100842. [Google Scholar] [CrossRef]

- Li, H.J.; Shi, Y.; Zhang, J.X.; Zhang, Z.K.; Zhang, Z.S.; Gong, M.G. Digital inclusive finance & the high-quality agricultural development: Prevalence of regional heterogeneity in rural China. PLoS ONE 2023, 18, e0281023. [Google Scholar] [CrossRef]

- Bacha, O.I.; Mirakhor, A. Funding development infrastructure without leverage: A risk-sharing alternative using innovative sukuk structures. World Econ. 2018, 41, 752–762. [Google Scholar] [CrossRef]

- Loganathan, T.; Chan, Z.X.; Pocock, N.S. Healthcare financing and social protection policies for migrant workers in Malaysia. PLoS ONE 2020, 15, e0243629. [Google Scholar] [CrossRef] [PubMed]

- Saviano, M.; Nenci, L.; Caputo, F. The financial gap for women in the MENA region: A systemic perspective. Gend. Manag. Int. J. 2017, 32, 203–217. [Google Scholar] [CrossRef]

- Spires, E.E. Using the Analytic Hierarchy Process to Analyze Multiattribute Decisions. Multivar. Behav. Res. 1991, 26, 345–361. [Google Scholar] [CrossRef]

- Dagum, C. A New Approach to the Decomposition of the GiNi Income Inequality Ratio. Empir. Econ. 1997, 22, 515–531. [Google Scholar] [CrossRef]

- Quah, D. Galton’s Fallacy and Tests of the Convergence Hypothesis. Scand. J. Econ. 1993, 95, 427–443. [Google Scholar] [CrossRef]

- Peng, P.; Mao, H. The Effect of Digital Financial Inclusion on Relative Poverty Among Urban Households: A Case Study on China. Soc. Indic. Res. 2023, 165, 377–407. [Google Scholar] [CrossRef]

- Xu, S.; Wang, J.W. The Impact of Digital Financial Inclusion on the Level of Agricultural Output. Sustaninability 2023, 15, 4138. [Google Scholar] [CrossRef]

- Xie, B.; Charness, N.; Fingerman, K.; Kaye, J.; Kim, M.T.; Khurshid, A. When Going Digital Becomes a Necessity: Ensuring Older Adults’ Needs for Information, Services, and Social Inclusion During COVID-19. J. Aging Soc. Policy 2020, 32, 460–470. [Google Scholar] [CrossRef]

| Payment | Insurance | Credit | |

|---|---|---|---|

| Payment | 1 | 1/2 | 1/3 |

| Insurance | 2 | 1 | 1/2 |

| Credit | 3 | 2 | 1 |

| Level 1 Dimension | Level 2 Dimension | Indicator | |

|---|---|---|---|

| Coverage breadth 0.540 | Account coverage rate 1.000 | Number of Alipay accounts owned by per 10,000 people | |

| Proportion of Alipay users who have bank cards bound to their Alipay accounts | |||

| Average number of bank cards bound to each Alipay account | |||

| Depth of use 0.297 | Payment 0.163 | Number of payments per capita | |

| Amount of payments per capita | |||

| Proportion of number of high frequency active users (50 times or more each year) to number of users with frequency of once or more each year | |||

| Credit 0.540 | Individual user | Number of users with an Internet loan for consumption per 10,000 adult Alipay users | |

| Number of loans per capita | |||

| Total Amount of loan per capita | |||

| Small and Micro Business | Number of users with an Internet loan for small and micro businesses per 10,000 adult Alipay users | ||

| Number of loans per small and micro business | |||

| Average amount of loan among small and micro businesses | |||

| Insurance 0.297 | Number of insured users per 10,000 Alipay users | ||

| Number of insurance policies per capita | |||

| Average insurance amount per capita | |||

| Digitalization degree 0.163 | Mobility 0.497 | Proportion of the number of mobile payments | |

| Proportion of total amount of mobile payments | |||

| Affordability 0.248 | Average loan interest rate for small and micro businesses | ||

| Average loan interest rate for Individuals | |||

| Credit 0.095 | Proportion of number of Ant Check Later payments | ||

| Proportion of total amount Ant Check Later payment | |||

| Proportion of number of ‘Zhima Credit as deposit’ case (to number of full-deposit cases) | |||

| Proportion of total amount of ‘Zhima Credit as deposit’ (to amount of full-deposit) | |||

| Convenience 0.160 | Proportion of number of QR-code payments by users | ||

| Proportion of as above, please clarify with ‘average amount’ or ‘total amount’ of QR-code payments by users | |||

| Mean | Std. Dev. | Medians | Min | Max | |

|---|---|---|---|---|---|

| Coverage breadth | 196.6696 | 96.5560 | 197.2300 | 1.9600 | 397.0000 |

| Depth of use | 244.2729 | 108.3670 | 255.2713 | 7.1574 | 500.7732 |

| Digitalization degree | 290.1423 | 117.2522 | 323.2500 | 7.5800 | 462.2300 |

| Nationwide | 226.0438 | 100.5417 | 238.9117 | 16.0615 | 435.5007 |

| Eastern region | 253.1093 | 104.4651 | 263.6745 | 31.3925 | 435.5007 |

| Central region | 221.9263 | 100.7315 | 236.2479 | 27.5815 | 361.7904 |

| Western region | 208.6356 | 95.1380 | 227.0750 | 16.0615 | 351.8110 |

| Northeastern region | 213.6933 | 93.2581 | 233.3055 | 24.4965 | 336.1731 |

| Region | t/t + 1 | L | ML | MH | H |

|---|---|---|---|---|---|

| Nationwide | L | 0.8400 | 0.0238 | 0 | 0 |

| ML | 0.0400 | 0.8333 | 0.0140 | 0 | |

| MH | 0 | 0.0714 | 0.7483 | 0.1600 | |

| H | 0 | 0 | 0.1678 | 0.6900 | |

| Eastern region | L | 0.6818 | 0.1379 | 0 | 0 |

| ML | 0.1818 | 0.5862 | 0.1250 | 0 | |

| MH | 0 | 0.1724 | 0.7188 | 0.1765 | |

| H | 0 | 0 | 0.0625 | 0.7647 | |

| Central region | L | 0.8000 | 0.1000 | 0 | 0 |

| ML | 0 | 0.7000 | 0.0909 | 0 | |

| MH | 0 | 0 | 0.5455 | 0.2609 | |

| H | 0 | 0 | 0.3182 | 0.6522 | |

| Western region | L | 0.7027 | 0.1786 | 0.0556 | 0 |

| ML | 0.1351 | 0.5000 | 0.1667 | 0 | |

| MH | 0.0811 | 0.2500 | 0.4167 | 0.3158 | |

| H | 0.0270 | 0 | 0.2222 | 0.5263 | |

| Northeastern region | L | 0.8333 | 0 | 0 | 0 |

| ML | 0.1667 | 0.2000 | 0.1538 | 0 | |

| MH | 0 | 0.8000 | 0.6154 | 0 | |

| H | 0 | 0 | 0.1538 | 0.6667 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, M.; Chu, Q.; Zhang, T.; Li, Q.; Liu, J.; Yamaka, W. The Structural Causes and Trend Evolution of Imbalance and Insufficiency of Development of Digital Inclusive Finance in China. Sustainability 2023, 15, 10286. https://doi.org/10.3390/su151310286

Chen M, Chu Q, Zhang T, Li Q, Liu J, Yamaka W. The Structural Causes and Trend Evolution of Imbalance and Insufficiency of Development of Digital Inclusive Finance in China. Sustainability. 2023; 15(13):10286. https://doi.org/10.3390/su151310286

Chicago/Turabian StyleChen, Minghua, Qinru Chu, Tengwen Zhang, Qian Li, Jianxu Liu, and Woraphon Yamaka. 2023. "The Structural Causes and Trend Evolution of Imbalance and Insufficiency of Development of Digital Inclusive Finance in China" Sustainability 15, no. 13: 10286. https://doi.org/10.3390/su151310286

APA StyleChen, M., Chu, Q., Zhang, T., Li, Q., Liu, J., & Yamaka, W. (2023). The Structural Causes and Trend Evolution of Imbalance and Insufficiency of Development of Digital Inclusive Finance in China. Sustainability, 15(13), 10286. https://doi.org/10.3390/su151310286