Abstract

With the aggravation of the global climate problem, various countries are gradually formulating relevant policies and targets for carbon emission reduction in the infrastructure industry. Some countries or cities may have the problem of insufficient investment in infrastructure construction or blind investment, so it is urgent to carry out related research on the efficiency of infrastructure investment. From the perspective of carbon emission constraints, this study takes Chinese cities as the research case, and uses the unexpected output ultra-efficiency SBM model to measure the infrastructure investment efficiency and total-factor productivity from 2010 to 2020, and analyzes the influencing factors of infrastructure investment efficiency. The study found that (1) the regions with high infrastructure investment efficiency have the following two characteristics: the first relates to the cities with high investment, high output and fewer carbon emissions, and these cities rank at the forefront of economic development and scientific and technological level in the country. The second relates to the cities with high investment, high output and large carbon emissions. These cities have a large urban scale, their industrial structure is dominated by the secondary and tertiary industries, and their high output level plays a benign leading role. (2) Cities with low infrastructure investment efficiency are mainly manifest a large input of some infrastructure resources, low output level, high carbon emissions, and insufficient scale efficiency. (3) Economic level, industrial structure and fiscal expenditure play a positive role in improving the efficiency of infrastructure investment, and the development strategy of policies also affects the infrastructure investment mode. Finally, there are recommendations for the sustainable and high-quality development of infrastructure investment in developing countries.

1. Introduction

The International Energy Agency (IEA) released the “Global Energy Review: CO2 Emissions in 2021—Global Emissions” [1], saying that global energy-related carbon dioxide emissions had hit a record high, with global energy combustion and industrial process emissions reaching 36.3 billion tons, increasing carbon emissions in almost all regions. Lingegard [2] studied the implementation of policies for carbon emission reduction in five countries in the infrastructure field, and the results showed that national or regional policy ambitions, market maturity and strategies of project leaders play a key role in the process of carbon emission reduction; Xie studied panel data from 283 cities in China between 2003 and 2013, to explore the impact of transportation infrastructure on urban carbon emissions, and found that transport infrastructure in large and medium-sized cities increased urban carbon emissions and carbon intensity [3]. In the post-pandemic era, the world will see a recovery in the economy and infrastructure, as well as huge carbon emissions. Realizing the importance of managing carbon emissions through infrastructure, The UK Green Building Council has proposed a life-cycle carbon target for the infrastructure industry. Sweden has taken action to set carbon reduction requirements for all infrastructure projects worth more than EUR 5 million. The Paris Agreement integrates and enriches the goals of tackling global climate change, with Article 6 of the Paris Agreement being the latest multilateral consensus on establishing an international carbon trading market. China has proposed accelerating green and low-carbon development, improving the efficiency of resource utilization, and setting the goal of achieving a carbon peak by 2030 and carbon neutrality by 2060. It can be seen that how to improve infrastructure investment under the background of energy conservation and emission reduction has become a hot topic. The sustainable development of urban infrastructure needs to take into account economic, environmental and social factors. On the economic side, urban infrastructure needs to allocate resources rationally to ensure the sustained growth of the urban economy. In terms of the environment, urban infrastructure needs to strengthen environmental awareness and protect the ecological environment. On the social side, urban infrastructure needs to meet people’s living needs and ensure social stability. Scientific evaluation of the efficiency of infrastructure investment is conducive to the government and the market grasping the current situation of infrastructure investment and better guiding its sustainable and high-quality development.

Under the background of carbon emissions, infrastructure investment research has gradually attracted more attention from scholars. Infrastructure construction inevitably brings about carbon emissions. The level of technology, scale of the city, information infrastructure construction level [4], degree of economic development [5], national space function division [6], and the degree of traffic development [3] directly or indirectly affect the carbon emission intensity, specifically at the level of the projects related to carbon emission impact factors and the factors of hydropower infrastructure projects, including construction engineering, electrical equipment, land acquisition, resettlement, etc.

Infrastructure investment is also affected by many factors. The infrastructure investment subject influences the funding source of infrastructure investment. Investment in public funds plays a major role in economic growth, and affects some stages of the project. [7] Private capital investment has less effect on economic growth, but helps to address the problem of financial constraints. The government should do more to attract private investment [8]; the PPP investment model has played a positive role in infrastructure investment, and transportation infrastructure investment using PPP can bring greater benefits, in addition, at the level of transportation infrastructure, investment in roads and railways has a positive effect on the cost and output of the private sector industry [9], and for multiple infrastructures, investors can also achieve higher performance by trying to build different infrastructure portfolios [10]. The key factors of inefficient infrastructure funds, the government agencies’ lack of effective land acquisition rules and the industry’s construction companies’ ability is insufficient [11]; low government integrity will significantly reduce the efficiency of infrastructure investment [12], and when the government prioritizes fairness, the efficiency of urban infrastructure investment is higher [13].

By combing the research methods on the efficiency of infrastructure investment, some scholars use the stochastic frontier model [14], the DEA model [13], the three-stage DEA model [12], the DEA cross efficiency model [15] and infrastructure investment efficiency. For example, Liu [12], using three-stage DEA model excluding environmental factors and random factors, and the research into the transportation infrastructure investment efficiency of 31 provinces, found that low government integrity will significantly reduce the efficiency of infrastructure investment. Lan et al. [13] used DEA analysis and the Tobit model to explore the relationship between regional economic development and investment efficiency, and found that investment efficiency is high when the government prioritizes fairness; they provided policy advice for economically underdeveloped areas from the perspective of efficiency and investment allocation fairness. DEA (data envelope analysis) is a classic method for measuring input–output efficiency. However, the traditional DEA model is insufficient, as it is assumed that the expected output increases in the same or fixed proportion as that in which the desired output decreases, which is not consistent with the real production activities, and efficiency is overestimated without considering the relaxation variables; in addition, the efficiency value is 1, so the decision unit with an efficiency value greater than 1 cannot be compared. Therefore, Tone constructs a super-efficiency SBM (Slacks-based measure model, an efficiency measurement method based on relaxation variables, which can better solve these two problems [16,17].

To sum up, scholars are becoming more and more mature in infrastructure investment, but it is rare to research infrastructure investment efficiency while considering carbon emissions. Infrastructure construction is the main source of carbon emissions, and energy conservation and emission reduction is a common problem facing the world. Therefore, studying the efficiency of infrastructure investment under the constraint of carbon emissions is urgent. Based on the existing research, this paper considers the inclusion of carbon emissions as the undesirable output index, constructs a super-efficiency SBM model to measure the investment efficiency of infrastructure, and explores the factors affecting the efficiency of infrastructure through the Tobit model, to provide a reference for the realization of economic, social and environmentally sustainable and high-quality development.

2. Research Methods

2.1. Model Construction

The technology roadmap is shown in Figure 1, first using the undesirable output efficiency SBM model to calculate the urban infrastructure efficiency value, and through the spatial and temporal changes of total-factor productivity and the decomposition efficiency of the Malmquist index value of decomposition, using the Tobit model to analyze the other important input and output indices of the environmental factors on the efficiency of infrastructure investment.

Figure 1.

Technical Roadmap.

(1) Undesirable output super-efficiency SBM model

DEA is a method of comparing the relative efficiency of decision units based on the operations research planning model. It is used to study the efficiency evaluation of multi-input and multi-output decision units (DMU).

Assuming that there are n evaluated decision units, denoted as DMUj (j = 1, 2, …, n), each decision unit has m input and q1 expected output, and q2 undesirable output. The input, expected output and undesirable output of the kth decision unit are denoted as (), () and (), respectively; ρ represents the efficiency value of the decision unit. When ρ = 1, it means that the evaluated decision unit is effective; , , are the relaxation variables of input elements, expected output and undesirable output, respectively, and is the weight variable. , and are the input, expected output and undesirable output variables of each decision unit, respectively. Therefore, the undesirable output super-efficiency SBM model is expressed as:

The evaluated DMUk projection value () in the undesirable output super-efficiency SBM model, which is the optimal solution of the model, is the nearest point to the front of the possible production set built by the other DMU. The calculated efficiency value of the undesirable output super-efficiency SBM model is a static description of urban infrastructure investment efficiency, and the Malmquist index can not only measure total-factor productivity (TFP), but can also be decomposed into comprehensive efficiency (EFF) and technical changes (TC); comprehensive efficiency (EFF) can be decomposed into pure technical efficiency changes (PEC) and scale efficiency changes (SEC), where: (1) PEC refers to the effectivity degree of the utilization of the existing technology of the decision unit to maximize the output; (2) TC reflects the long-term innovation ability of the decision unit, and is the real source of the continuous improvement in infrastructure investment efficiency; and (3) the SEC reflects the case where the infrastructure output increment and input increment have the same direction, that is, the matching degree of the infrastructure input and the output. Tthe above index is greater than 1, which is conducive to the improvement in the total productivity factor. The decomposition formula of the Malmquist exponential method is:

where: refers to the distance function of decision units in period t and period t + 1, when the data in period t are taken as the reference set. The obtained from fixed returns to scale (CRS) reflects the comprehensive technical efficiency (the subscript “c” represents fixed returns to scale), which is not only affected by the organization’s management system and technical policy, but also affected by returns to scale. The obtained under variable returns to scale (VRS) takes into account the effect of returns to scale (the subscript “v” represents variable returns to scale), so it mainly reflects the influence of the management system and the technical policy.

(2) Tobit regression analysis

In addition to the input–output index, the efficiency of infrastructure is also affected by environmental factors, such as government support, industrial structure, scientific and technological input and population flow. In this paper, the regression of the efficiency value (the explained variable) to various environmental factors is made, and the influence of the direction and intensity of environmental factors on the efficiency value is judged by the coefficient of the explained variable. Since the efficiency value obtained by using the undesirable output super-efficiency SBM model belongs to the non-negative truncated discrete data, the Tobit model is selected for regression, which can effectively avoid the bias of the ordinary least-squares parameter estimation, due to the truncation of the efficiency value. Set the explained variable as and the explanatory variable vector as , and the year dummy variable and the region dummy variable to construct the following regression model:

where, αit is the fixed effect in the t year of the city, i is the unknown fixed constant, and βT is the unknown parameter, εit ~ N(0, σ2).

2.2. Index Establishment

Infrastructure investment refers to economic activities in which economic entities provide basic and mass services for social production and life, such as engineering and facilities, to meet public needs. Through the classification of infrastructure in the “Providing Infrastructure for Development” 1994 World Bank Development Report and the organization of some collation of the literature [15,16,17,18,19,20,21,22,23,24,25,26,27,28,29,30], infrastructure can be classified from two aspects: economic and social. Economic infrastructure can cover multiple fields, such as energy, communication, transportation, and water conservation, while social infrastructure mainly focuses on areas such as education, social services, culture and healthcare. In addition, the applicability of the research method is considered, to ensure that the number of input and output indicators is less than one third of the DMU. The selected indicators and their literature sources are shown in Table 1.

Table 1.

Input–output index of efficiency evaluation of urban infrastructure investment.

Infrastructure can be classified in both economic and social ways. Economic infrastructure can cover energy, communications, transportation, water conservation, and other fields, while social infrastructure mainly focuses on education, social services, culture, health care, and other fields.

The input index reflects the developmental level of urban infrastructure. The role of transportation infrastructure is to ease traffic jams, provide employment opportunities, reduce logistics and manufacturing costs, and promote commercial agglomeration and growth [33]. The per capita urban road area can reflect the degree of construction of urban transportation facilities. Benefiting the people, clean and safe energy is crucial to improving economic productivity, improving the quality of life, and protecting our environment [34]. The power supply system and the gas supply system can reflect the level of energy security in the region, and are important supports for energy infrastructure. Water infrastructure should incorporate sustainability principles in making infrastructure investment decisions to ensure the long-term recovery capacity of mission-critical equipment and components [35]. Urban green space can improve urban air quality and reduce living pollution. Urbanization without urban greening will cause many social and material impacts on residents [36], and the green space area can reflect the ecological environment level of the city. The construction of medical and health infrastructure is used to meet normal medical needs and respond to various sudden disasters [13], and the waste disposal rate and the number of medical institutions are used to reflect the medical and health level. Education is the fundamental factor for enhancing the comprehensive strength of a country [32]. The investment in education includes the construction of schools, public libraries and cultural and sport facilities, which reflect the cultural soft power of a city and provide an intellectual guarantee for the efficiency of infrastructure investment.

Output indicators reflect people’s income level and social development. Infrastructure construction and economic development level are discussed by Xu [37], Mohanty and Bhanumurthy [38], and Toader [39]; through the infrastructure investment of multiple countries after development, the transportation, power and information and communication facilities can greatly improve the economic growth of the region, and GDP is one of the important macroeconomic indicators for measuring the economic situation of the country or region. The built-up area index can reflect the size of the urban urbanization area, which is an objective reflection of the regional distribution of urban construction and development. The built-up area refers to the areas that have actually been developed and constructed, and the municipal public facilities and other public facilities are easily accessible. The built-up area marks the scale and size of the construction land in different developmental periods of the city. Infrastructure investment needs to take climate factors into account, and single or more multifaceted damage to energy, transportation, and critical industrial and social infrastructures will increase, due to global warming [40]. Climate change will reduce the life expectancy of the existing infrastructure and the quality of its services, and place stress on areas such as population growth and an aging infrastructure [41]. Brockway et al. [42] assessed the applicability of power planning using existing climate models and data, and introduced progress in climate forecasting, grid modeling architecture, and disaster preparedness, providing guidance for promoting and improving climate awareness among coordinating entities (e.g., regulators or policy makers) in the California grid planning process. Mitoulis [43] introduced a new integrated framework for application in bridge recovery, quantifying the trade-off between sustainability and resilience; the research found that low-carbon remediation strategies are the best solution for achieving sustainability, and can advises operators and stakeholders on making decisions. Infrastructure construction from planning and design, raw material manufacturing, processing, transportation, installation, construction, garbage disposal and operation and maintenance will bring huge carbon emissions. The response to climate change not only needs scientific and technological innovation, enhancing the elasticity of infrastructure for climate change and reducing vulnerability, but also for controlling the whole process of the buildup of carbon emissions, building an environmentally friendly society, in response to climate change. Therefore, this paper selects the greenhouse gas carbon dioxide emissions as the undesirable output index.

3. Empirical Analysis

3.1. Measurement Results of Infrastructure Investment Efficiency

In this paper, the infrastructure input–output data of 30 provincial capitals in China were selected (Lhasa, Hong Kong, Macao and Taipei are missing, but were not included in the research objective). The index data were all obtained from the China Urban Construction Statistical Yearbook from 2010 to 2020, the China City Statistical Yearbook, and the Statistical Yearbook of each city. The reasons for using provincial capital cities as the objects of the research are as follows: first, as the political and economic centers of various provinces, provincial capitals have a relatively complete infrastructure construction compared with non-provincial capital cities, and the efficiency of urban infrastructure investment can function as a reference for, and have a guiding role in, the urban development and construction of other non-provincial capital cities. Second, provincial capitals have the characteristics of population agglomeration and strong economic strength, and play a key role in the formation and development of metropolitan areas and economic belts and in regional coordinated development. Third, the central or local governments will give priority to provincial cities when formulating policies or development strategies. Taking provincial cities as the object of the research can not only test the effectiveness of policies, but also help local governments to formulate the relevant policies to guide urban construction and infrastructure investment.

After obtaining the original data and carrying out the processing, to eliminate the impact of population on the city the data are processed by analyzing the per capita index; in addition, considering the time value of monetary funds, that is, the per capita GDP value, 2010 is set as the base year to remove the inflation impact of per capita GDP, and the obtained “true value” is used as the output.

This paper uses the super-efficiency SBM model of undesirable output (carbon emission) to calculate the investment efficiency of urban infrastructure investment, and the infrastructure investment efficiency of 30 provincial capitals in China from 2010 to 2020 is shown in Table 2. In order to further analyze the spatial and temporal differences in urban infrastructure investment efficiency, this paper divides the provincial capitals according to seven geographical zones, namely, South China, Central China, North China, East China, Southwest China, Northwest China, and Northeast China.

Table 2.

Infrastructure investment efficiency of 30 provincial capitals in China from 2010 to 2020.

As can be seen from Table 2, the mean efficiency of Chinese provincial capital cities fluctuates up and down within [0.76, 0.85], with a mean of 0.81. Among them, there are 10 cities with an infrastructure investment efficiency greater than 1, and the top 10 cities are Beijing, Shanghai, Guangzhou, Chongqing, Fuzhou, Yinchuan, Changsha, Zhengzhou, Tianjin, and Jinan, whose infrastructure construction promotes the local economic level and urbanization level, while Xining, Lanzhou, Shijiazhuang, Guiyang and Shenyang rank low, and the infrastructure investment efficiency value is less than 0.5, with a low efficiency value.

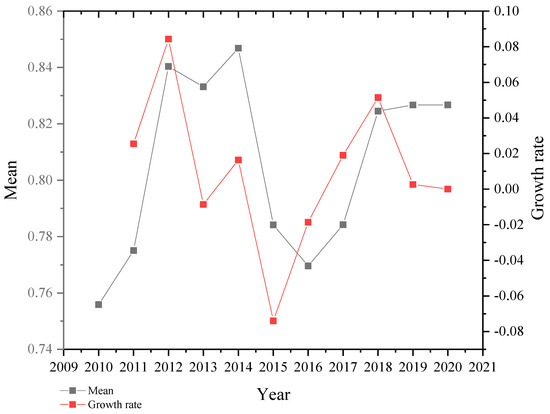

As shown in Figure 2, the average value of Chinese provincial capitals showed a trend of rising first, then decreasing, then rising again. From 2010 to 2014, reaching a peak of 0.85 in 2014, and decreasing from 2014 to 2016, the average efficiency decreased to 0.77 in 2016, and then increased to about 0.83 from 2018 to 2020. The reason is that, in 2013, China issued the Opinions on Strengthening Urban Infrastructure Construction for the first time. During the period of 2013–2017, local governments greatly improved the construction of urban municipal infrastructure such as the water supply, power supply and gas supply, but at the same time, due to the excessive investment in infrastructure, it caused the waste of resources and the increase in carbon emissions. By searching the original data, it is found that the water supply, power supply, and gas supply in Shijiazhuang, Hohhot, Changchun, Hefei, Nanchang, Jinan and Nanning increased significantly. For example, the per capita gas supply in Shijiazhuang increased by 2 times, the electricity consumption increased by 10%,and the carbon emission by 63%; the per capita living water consumption in Hohhot increased by 28%, the electricity consumption of urban and rural residents by 26%, and the carbon emission by 49%. Therefore, an excessive resource input cannot bring about the corresponding improvement in economic level and urban construction level, and will even cause a surge in carbon emissions, leading to a decline in the efficiency of infrastructure investment.

Figure 2.

Average value and growth rate of infrastructure investment efficiency in the provincial capitals of China.

In 2017, China put forward a strategy of high-quality economic development. Instead of taking economic growth rate as the top priority, it paid more attention to sustainable and high-quality urban development, and shifted from a stage of high-speed growth to a stage of high-quality development. The Chinese government has put forward the basic principles of urban infrastructure construction and the ecological civilization concept of low-carbon and green construction; this has made local governments pay more attention to the resource endowment from science and technology, energy, talent, industry and other resources of each city in the construction process, and promoted the improvement of the efficiency of infrastructure investment. In 2020, due to the impact of COVID-19, many enterprises in the infrastructure industry were affected by material supply shortages, manpower shortages, construction delays, financial risks and other factors, and the efficiency of infrastructure investment was suppressed.

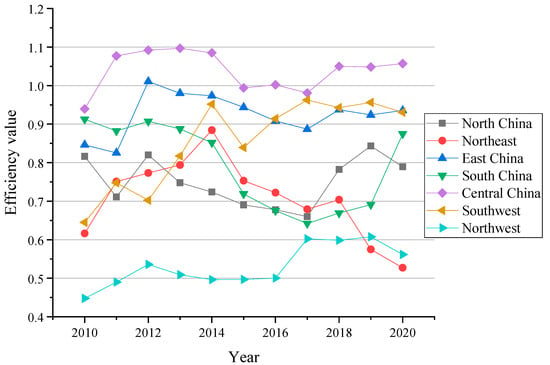

The efficiency values of the seven geographic divisions in 2010–2020 are shown in Figure 3. From the perspective of the seven geographical zones, the regional efficiency value is obviously unbalanced. Specifically, the efficiency of infrastructure investment from high to low is, respectively, Central China, East China, South China, Southwest China, North China, Northeast China and Northwest China. At the same time, it can be seen that from 2010 to 2015, all regions showed a trend of rising first and then declining. From 2016 to 2020, except for the provincial capitals in Northeast China, the values showed a downward trend, while the rest of the regions showed a fluctuating trend. This is related to the high-quality economic development strategy proposed by the Chinese Government in 2017.

Figure 3.

Distribution diagram of infrastructure investment efficiency in provincial capitals in different periods.

From the perspective of the range of change, the investment efficiency of provincial capitals in North China showed a trend in first declining and then rising, with a lowest value of 0.66 in 2017. The CO2 emissions of Hohhot surged by about 20 million tons in 2017, and the infrastructure investment efficiency was 0.44. For the Northeast capital cities, the infrastructure investment efficiency, after the downward trend following the initial rising, reached a lowest value of 0.53 in 2020; from the study of carbon emissions, carbon emissions in 2020 increased by 52.25% and 81.27% over 2010 and 2015, respectively, and the rapid industrial development but high resource consumption and rapid social development led to the Northeast capital cities’ infrastructure investment efficiency being reduced. The trend in infrastructure investment efficiency in provincial capitals in Eastern China and Central China was roughly the same, maintaining a high and stable level. The efficiency of infrastructure investment in Southern China showed a trend of declining first and then rising. After China proposed a high-quality development strategy in 2017, the efficiency of infrastructure investment increased year after year; infrastructure investment efficiency in the Southwest increased by the largest amount of the seven subdivisions, by 44% in 2020, compared with 2010. It can be seen that the construction of the “Chengdu–Chongqing Economic Circle” in capital cities in Southwest China had a positive impact on the efficiency of infrastructure investment. The infrastructure investment efficiency of the provincial capital cities in Northwest China was at the lowest level among the seven subdivisions of China: the mean value was 0.53, and the main reason is that the average per capita GDP of the Western provincial capitals is relatively low. The Western provincial capitals are rich in material resources, and they have a relatively robust development model, causing high levels of carbon emissions.

By combining the raw data, the high energy consumption, low per capita GDP level, and low number of urban built-up areas are seen to be the main factors that lead to the decline in infrastructure investment efficiency; infrastructure investment efficiency is also related to regional resource characteristics, and most provincial capitals in Northwest and Northeast China prefer coal and oil. Excessive carbon emissions curb the rising efficiency of infrastructure investment, and, moreover, the low degree of industrial agglomeration leads to the low per capita GDP. The Government’s economic development strategy influences the city’s investment model, and China has gradually changed the extensive growth model of factor input and scale expansion, changing from a stage of rapid economic growth to a stage of high-quality development. The Chinese Government’s establishment of the Urban Economic Circle has strengthened the connectivity between the inside and outside the city, promoting the flow of urban factors and the sharing of scientific and technological achievements, thus improving the efficiency of infrastructure investment.

3.2. Malmquist Index Efficiency Decomposition and Analysis

This paper divides the total-factor productivity of capital cities of China into pure technical efficiency, scale efficiency and technical changes. From Table 3, it is seen that twenty-eight cities had total-factor productivity growth from 2010 to 2020, and the top five cities in terms of growth rate were Chengdu, Hangzhou, Kunming, Hohhot, and Yinchuan; two cities experienced a decline, namely Shijiazhuang and Guangzhou.

Table 3.

Breakdown of total-factor productivity in provincial capitals.

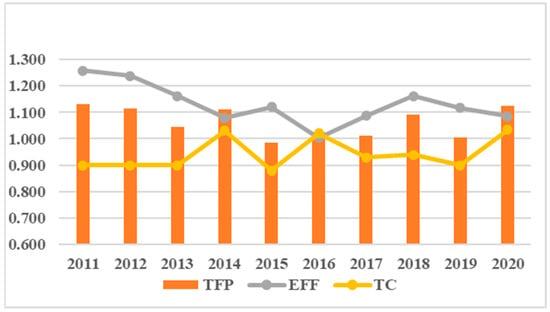

It can be concluded from Figure 4, that from 2011 to 2020, the comprehensive efficiency and technological changes show opposite change patterns, meaning that the total-factor productivity also fluctuates and changes; the comprehensive efficiency and total factor productivity of the two stages from 2011 to 2013 and from 2017 to 2019 showed the same trend of change, show that the total-factor productivity is greatly affected by the overall efficiency and the degree of infrastructure input and output matching has a positive impact on the efficiency of infrastructure investment. The degree of use of existing technologies in various cities also promotes the efficiency of infrastructure investment; the technological changes and total-factor productivity trends are consistent in 2013–2017, which shows that the influence of technological innovation ability has a greater influence at this stage. Therefore, this shows that when the technological level is improved, the insufficient running-in between the technological level and the input–output system will lead to the decline in the comprehensive efficiency. Following technological progress, the technology and the input-output system adapt to each other to improve the total-factor productivity. At the same time, some technologies are not adapted to the current system, limiting technological progress to some extent.

Figure 4.

Annual total-factor productivity and its decomposition.

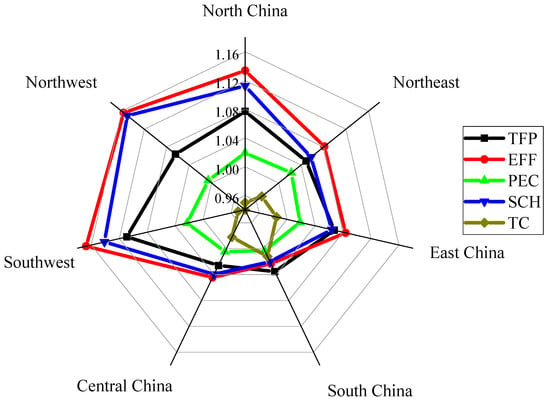

In order to further analyze the reasons for the change in total-factor productivity in urban infrastructure, this paper decomposes the total-factor productivity in provincial capitals, as shown in Figure 5. It can be seen that from 2010 to 2020, the total-factor productivity of Chinese infrastructure in provincial capitals shows an increasing trend, and the total-factor productivity ranking is Southwest China > North China > East China > Northwest China > Northeast China > South China > Central China. The spatial variation of comprehensive efficiency and scale efficiency are consistent, indicating that scale efficiency has a great impact on comprehensive efficiency.

Figure 5.

Decomposition of total-factor productivity from 2010 to 2020.

Provincial capitals in Southwest China (Chongqing, Chengdu, Guiyang and Kunming) have the largest total-factor productivity, and their scale efficiency contributes the most to the total-factor productivity. The total-factor productivity in Southwest and Northwest China is 10.9% and 6.4%, respectively, indicating that since the implementation of the National Western Development Strategy, the infrastructure construction in Southwest and Northwest China has been greatly improved, and the productivity in capital cities in North China has increased by 7.7%, mainly with respect to their scale efficiency; the capital cities in South China have knowledge-intensive high-tech enterprises, and their technical level ranks first in China.

In summary, provincial capitals in Southwest and North China have relatively high total-factor productivity, while provincial capitals in Southwest China (Chongqing, Chengdu, Guiyang and Kunming) have developed rapidly in recent years; for example, in 2018, Chongqing invested CNY 400 billion. In addition, Southwest China is rich in tourism resources, and tourism drives economic development, promoting infrastructure construction. With the proposal of the development strategy of “Beijing–Tianjin–Hebei integration” in 2014, capital cities in North China are strengthening connectivity among cities, promoting economic development and increasing total-factor productivity. As can be seen from total-factor productivity, scale efficiency has a great influence on the total-factor productivity and the matching degree of infrastructure input and output plays a key role in improving the efficiency of infrastructure investment.

3.3. Factors and Analysis on the Efficiency of Infrastructure Investment

3.3.1. Variable Selection

After measuring the efficiency of infrastructure investment, this paper plans to analyze the factors affecting the efficiency of infrastructure investment. Based on the research achievements of previous scholars and the above analysis, the influencing factors are selected as follows:

(1) Economic level (ECO), using per capita GDP (RMB) measurement. Infrastructure investment and construction needs to take into account production factors, including raw materials, capital and labor force. Moreover, infrastructure projects invested in in provincial capitals are often characterized by a large scale and long cycle. Economic growth can provide financial support for infrastructure construction, thus driving infrastructure investment.

(2) Industrial structure (INDU), using the proportion of secondary industry in GDP (%) measurement: secondary industry refers to the mining, manufacturing, electricity, gas, and water industries and construction, and it is an important support for the national economy. It can reflect the input of infrastructure, and infrastructure can also improve the productivity and innovation capacity of industrial development [44].

(3) Government factor (GOV) measures the proportion of government financial expenditure in GDP (%); local government financial competition is an important factor affecting the efficiency of infrastructure investment. On the one hand, financial competition may encourage local governments to increase their investment in infrastructure to improve the local infrastructure level, and the multiplier effect may increase the utilization efficiency of the capital; on the other hand, financial competition may also cause local governments to invest the limited funds into the infrastructure construction; with a series of problems such as repeated construction, the waste of financial funds and distortion of fiscal expenditure structure, the efficiency of infrastructure investment is low.

(4) Technical factor (TCH), measuring the proportion (%) of GDP; scientific research innovation can change the combination of production factors, reduce the cost of infrastructure construction, and directly reduce investment; on the other hand, technological innovation can meet the maximum demands of a constant infrastructure supply.

(5) Level of opening to the outside world (OPEN), using the per capita utilization amount of foreign capital (RMB) measurement. Foreign investment can promote international cooperation, show an improvement in the business environment, and promote the dual cycle development of China’s economy.

(6) Population factor (PEO), using the population density (person/per square kilometer) measure. Population density can reflect the scale of population mobility [45], and the coupling relationship between infrastructure investment and the population was studied. On the one hand, population agglomeration requires the transformation and upgrading of infrastructure and more reasonable urban planning. On the other hand, infrastructure investment is conducive to improving the business environment, creating employment opportunities, improving the public service capacity, and promoting the spatial agglomeration of the population and economy.

(7) Communication level (COMM), using the number of international Internet users per 100 people (number) measurement. The number of Internet users reflects the improvement degree of information infrastructure construction. The improvement in the level of communication can improve the flow of capital and information, and significantly reduce carbon emissions [4].

3.3.2. Tobit Regression Analysis

The infrastructure investment efficiency is selected as the explanatory variable, including the economic level (ECO), industrial structure (INDU, governmental factors (GOV), technical factors (TCH), opening to the outside world (OPEN), demographic factors (PEO) and communication level (COMM) as separate explanatory variables. The definitions and symbols of the explanatory variables are shown in Table 4 and Table 5.

Table 4.

Definitions and symbols of the explanatory variables.

Table 5.

Descriptive statistics of variables.

In this paper, the observation data of 30 cities are selected, which may not be able to obtain a rigorous causal relationship. However, the residual difference of the observed data does not follow a normal distribution of mean 0, but shows that a city is a distribution, and there may be heteroscedasticity, so the clustering standard error needs to be used. The Tobit regression model with infrastructure investment efficiency as the explained variable is shown in Formula (4), and the results obtained from the Stata running data are shown in Table 6.

Table 6.

Regression results of Tobit model.

According to Table 6, the effect of economic level (GDP per capita) on the value of infrastructure investment efficiency is significantly positively correlated at the 1% level; that is, the effect of economic level on the efficiency of infrastructure investment is significant, which is similar to the results of the Mohanty [38] study on the interrelationship between infrastructure and economic growth in India.

Industrial structure (the second industry accounting for GDP figures) for the Chinese capital city infrastructure investment efficiency at a 10% level, namely the second highest industry structure can bring higher infrastructure investment efficiency. The scope of the second industry covers industrial production and all areas of infrastructure construction, including all kinds of raw materials and resources processing, as well as the production of various basic industrial products, providing material basis for infrastructure investment.

The Government’s financial input (the proportion of government fiscal expenditure in GDP) has a significant positive correlation with China’s infrastructure investment efficiency at 1%. The infrastructure investment in each region accounts for a large proportion of GDP. For example, the proportion of fiscal expenditure of provincial capitals in Northeast China is 14.03% of GDP, and the fiscal expenditure in East China accounts for 13.24% of GDP. Government financial investment has a positive impact on the PPP investment and financing mode of infrastructure, and a good government investment structure is conducive to the stable operation of the capital chain of infrastructure investment [46].

The impact of population density on the efficiency of China’s infrastructure investment has a negative effect at the 10% level. The expansion of urban scale and increased population density will bring great pressure on the ecological environment and infrastructure, such as traffic pressure, resulting in resource tension, environmental pollution, housing difficulties and social security problems.

In order to more clearly analyze the relationship between the various variables and the investment efficiency of the infrastructure, this paper further tests the heterogeneity of the regional differences, and the results are shown in Table 7.

Table 7.

Results of the heterogeneity test.

Through the results of the heterogeneity test in Table 7, it can be seen that the regression coefficient and significant conditions of various influencing factors in the seven regional provincial capitals of China are inconsistent, For example, for the economic level variables (ECO), industrial structure variables (INDU), governmental factors (GOV), and opening to the outside world (OPEN), these items have different effects on different regions, which shows that the effect of variables of different regions on the influence of infrastructure investment efficiency has a certain heterogeneity. As found by regional dummy variable regression, the interaction terms of the economic level variables (ECO), industrial structure variables (INDU), governmental factors (GOV), and opening to the outside world (OPEN) are significantly correlated. The presence of heterogeneity in the model was verified.

The regression of all variables in phase I was used to obtain the robustness test results, as shown in Table 8. It can be seen that the economic level variables (ECO), governmental factors (GOV), and population factors (PEO) are still related to the explained variables, so the conclusions are robust.

Table 8.

Results of the robustness test.

4. Conclusions and Suggestions

4.1. Conclusions

From the perspective of carbon emission constraints, this paper adopts the super-efficiency SBM model and the Malmquist index method to measure infrastructure investment efficiency and total-factor productivity, and analyzes the influencing factors of infrastructure investment efficiency. This study found that there were large differences in infrastructure investment efficiency among different regions, with provincial capitals in Central China being the highest, while provincial capitals in Northwest, Northeast and North China were lower. Through the decomposition of total-factor productivity, it is found that the performance of technological changes, scale efficiency and pure technical changes in different regions are also quite different, and targeted measures should be taken to promote the coordinated development. After the analysis of the regional infrastructure efficiency of space and time, this paper explores the economic level, industrial structure, government financial investment, opening to the outside world, population flow, level of science and technology and communication level in terms of the influence of infrastructure investment efficiency, economic level, industrial structure, government fiscal expenditure and population density factors which influence the efficiency significantly, and which should be focused on.

According to the comparative study:

(1) Regions with high infrastructure investment efficiency have the following two characteristics: The first is cities with high investment, high output and fewer carbon emissions. These cities’ population agglomeration, economic development and scientific and technological level rank among the top in the country. The second is the city with high investment, high output and high carbon emissions. These cities have a large urban scale and are core cities in the national city circle. They have developed rapidly and their industrial structure is dominated by the secondary and tertiary industries. Although they have high carbon emissions, the high output level still plays a benign leading role. In the process of high-quality development, these cities pay attention to the coordinated development of economic benefits and industrial structure, from which it can be seen that the level of economic development and industrial structure have a positive impact on the efficiency of infrastructure investment.

(2) Cities with low infrastructure investment efficiency are mainly reflected in the large input of some infrastructure resources, low output level, high carbon emissions, and insufficient scale efficiency, which is reflected in high energy consumption, such as high electricity and gas consumption, and low output GDP. The economic development of these cities is poor compared with that of efficient cities. There may be excessive energy extraction and excessive carbon emissions in the process of infrastructure construction.

(3) The economic development strategy of the Government affects the investment mode of cities. China is gradually changing the extensive growth mode of factor input and scale expansion, and the economy is shifting from the high-speed growth stage to the high-quality development stage; the Chinese Government is strengthening the connectivity inside and outside the city, and promoting the flow of urban elements and the sharing of scientific and technological achievements, thus promoting the efficiency of infrastructure investment.

4.2. Suggestions

These include optimizing the industrial structure in areas with insufficient scale efficiency and improving the degree of industrial agglomeration, to realize the centralized allocation of resources; in addition, according to the geographical advantages of regional resources, we will vigorously develop clean energy sources, such as wind energy and water energy, improving the energy consumption structure, and reducing carbon emissions. The present study also found that both customers, policy guidance and financial support have a significant impact on infrastructure investment projects [7,47], and therefore, in the process of improving governance, Government departments should introduce relevant policies to ensure and improve the business environment, attaching importance to talent training, promoting technological innovation, and reducing population movement. Thus, in promoting economic development, the efficiency of infrastructure investment will be improved.

Specifically, the following measures can be adopted in the process of urban infrastructure investment: improving the traffic efficiency of roads and reducing traffic congestion; improving the operational efficiency of the water supply and power supply systems, to ensure the basic living needs of the city; introducing environmental protection technology, reducing the pollutants emitted by the city, and improving the urban air quality; promoting public transportation, reducing the use of urban motor vehicles and reducing the carbon dioxide emission; in urban planning and construction, attention should be paid to protecting the ecological environment of the city, such as the construction of green building and the introduction of a green lighting system. The above also provides advice for infrastructure investment in developing countries.

As the leader of the infrastructure investment policy, the Government should change the concept of development at the different stages of the infrastructure investment and construction; this will provide a reference for the sustainable and high-quality development of the infrastructure in developing countries.

5. Discussion

This paper conducts a theoretical and empirical study on the efficiency of infrastructure investment to explore the spatial and temporal changes and influencing factors of infrastructure investment efficiency. The data envelope model provides a scientific calculation method for the infrastructure input–output analysis. Previous studies mostly used the classical DEA model to measure efficiency, and did not consider the impact of carbon emissions on the efficiency of infrastructure investment. In this paper, we use the undesirable output ultra-efficiency SBM model to include carbon emission indicators as the undesirable output in the model, which enriches the research into infrastructure investment efficiency. This paper finds that the economic level, government investment structure, industrial structure and population density can affect the investment efficiency of urban infrastructures, in common with the Mohanty findings on the interrelationship between infrastructure and economic growth in India [38]. The Government’s financial investment has a positive impact on the infrastructure investment and financing mode, and a good governmental investment structure is conducive to the stable operation of the infrastructure investment capital chain [46]. However, as the representative Chinese provincial capitals were selected for this paper, the sample size is small, and subsequent research can further expand the scope of the research subject and make the statistical results more scientific.

Author Contributions

C.S. conceived and designed the experiments; C.S. and S.L. performed the experiments; C.S. and Q.L. analyzed the data; J.Z. and Z.Q. contributed reagents/materials/analysis tools; C.S. and S.L. wrote the paper. All authors have read and agreed to the published version of the manuscript.

Funding

This study is supported by the Beijing Social Science Key Project (SZ2020100160080) Foundation.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data was collected through the author’s statistical yearbook in China and can be obtained by contacting a second author.

Conflicts of Interest

The authors declare no conflict of interest.

References

- IEA. Global Energy Review: CO2 Emissions in 2021-Global Emissions Rebound Sharply to Highest Ever Level; IEA: Paris, France, 2022. [Google Scholar]

- Lingegård, S.; Olsson, J.A.; Kadefors, A.; Uppenberg, S. Sustainable public procurement in large infrastructure projects—Policy implementation for carbon emission reductions. Sustainability 2021, 13, 11182. [Google Scholar] [CrossRef]

- Xie, R.; Fang, J.; Liu, C. The effects of transportation infrastructure on urban carbon emissions. Appl. Energy 2017, 196, 199–207. [Google Scholar] [CrossRef]

- Lyu, Y.; Ji, Z.; Liang, H.; Wang, T.; Zheng, Y. Has Information Infrastructure Reduced Carbon Emissions?—Evidence from Panel Data Analysis of Chinese Cities. Buildings 2022, 12, 619. [Google Scholar] [CrossRef]

- Fisch-Romito, V. Embodied carbon dioxide emissions to provide high access levels to basic infrastructure around the world. Glob. Environ. Chang. 2021, 70, 102362. [Google Scholar] [CrossRef]

- Chen, X.; Xu, H.; Zhang, L.; Cao, H. Spatial functional division, infrastructure and carbon emissions: Evidence from China. Energy 2022, 256, 124551. [Google Scholar] [CrossRef]

- Novikova, T.S. Investments in research infrastructure on the project level: Problems, methods and mechanisms. Eval. Program Plan. 2022, 91, 102018. [Google Scholar] [CrossRef]

- Javid, M. Public and private infrastructure investment and economic growth in pakistan: An aggregate and disaggregate analysis. Sustainability 2019, 11, 3359. [Google Scholar] [CrossRef]

- Min, S. Cost structure and efficiency of Korea’s road and rail in the manufacturing industries. J. Infrastruct. Syst. 2011, 17, 118–128. [Google Scholar] [CrossRef]

- Panayiotou, A.; Medda, F. Portfolio of infrastructure investments: Analysis of European infrastructure. J. Infrastruct. Syst. 2016, 22, 04016011. [Google Scholar] [CrossRef]

- Giang, D.T.H.; Pheng, L.S. Critical factors affecting the efficient use of public investments in infrastructure in Vietnam. J. Infrastruct. Syst. 2014, 21, 05014007. [Google Scholar] [CrossRef]

- Liu, Q.; Luo, C. The Impact of government integrity on investment efficiency in regional transportation infrastructure in China. Sustainability 2019, 11, 6747. [Google Scholar] [CrossRef]

- Lan, T.; Chen, T.; Hu, Y.; Yang, Y.; Pan, J. Governmental investments in hospital infrastructure among regions and its efficiency in China: An assessment of building construction. Front. Public Health 2021, 9, 1553. [Google Scholar] [CrossRef]

- Chen, B. Public–private partnership infrastructure investment and sustainable economic development: An empirical study based on efficiency evaluation and spatial spillover in China. Sustainability 2021, 13, 8146. [Google Scholar] [CrossRef]

- Sun, Y.; Huang, H.; Zhou, C. DEA game cross-efficiency model to urban public infrastructure investment comprehensive efficiency of China. Math. Probl. Eng. 2016, 2016, 9814313. [Google Scholar] [CrossRef]

- Tone, K. A slacks-based measure of efficiency in data envelopment analysis. Eur. J. Oper. Res. 2001, 130, 498–509. [Google Scholar] [CrossRef]

- Du, J.; Liang, L.; Zhu, J. A slacks-based measure of super-efficiency in data envelopment analysis: A comment. Eur. J. Oper. Res. 2010, 204, 694–697. [Google Scholar] [CrossRef]

- World Bank. World Development Report 1994: Infrastructure for Development; The World Bank: Washington, DC, USA, 1994. [Google Scholar]

- Mastromarco, C.; Woitek, U. Public infrastructure investment and efficiency in Italian regions. J. Prod. Anal. 2006, 25, 57–65. [Google Scholar] [CrossRef]

- Kyriacou, A.P.; Muinelo-Gallo, L.; Roca-Sagalés, O. The efficiency of transport infrastructure investment and the role of government quality: An empirical analysis. Transp. Policy 2019, 74, 93–102. [Google Scholar] [CrossRef]

- Gan, L.; Huang, M. Establishing of an Evaluation System on Government Investment Efficiency in Infrastructure Projects Based on the Input/Output Theory. In ICCREM 2013: Construction and Operation in the Context of Sustainability; American Society of Civil Engineers: Reston, VA, USA, 2013; pp. 1258–1268. [Google Scholar]

- Yang, J.P.; Gao, L. DEA’s CCR model for evaluation of urban infrastructure investment efficiency of Shaanxi Province. In Applied Mechanics and Materials; Trans Tech Publications Ltd.: Stafa-Zurich, Switzerland, 2014; Volume 685, pp. 424–428. [Google Scholar]

- Saxena, M.; Chotia, V.; Rao, N.M. Estimating the efficiency of public infrastructure investment: A state-wise analysis. Glob. Bus. Rev. 2018, 19, 1037–1049. [Google Scholar] [CrossRef]

- Herranz-Loncán, A. Infrastructure investment and Spanish economic growth, 1850–1935. Explor. Econ. Hist. 2007, 44, 452–468. [Google Scholar] [CrossRef]

- Dong, X.; Du, X.; Li, K.; Zeng, S.; Bledsoe, B.P. Benchmarking sustainability of urban water infrastructure systems in China. J. Clean. Prod. 2018, 170, 330–338. [Google Scholar] [CrossRef]

- Chen, Y.; Shen, L.; Zhang, Y.; Li, H.; Ren, Y. Sustainability based perspective on the utilization efficiency of urban infrastructure—A China study. Habitat Int. 2019, 93, 102050. [Google Scholar] [CrossRef]

- Granoff, I.; Hogarth, J.R.; Miller, A. Nested barriers to low-carbon infrastructure investment. Nat. Clim. Chang. 2016, 6, 1065–1071. [Google Scholar] [CrossRef]

- Chen, C. A bigger bang for the public buck: A non-parametric efficiency analysis of state highway infrastructure investment. J. Public Budg. Account. Financ. Manag. 2018, 30, 270–285. [Google Scholar] [CrossRef]

- Goyal, G.; Dutta, P. Performance analysis of Indian states based on social–economic infrastructural investments using data envelopment analysis. Int. J. Prod. Perform. Manag. 2021, 70, 2258–2280. [Google Scholar] [CrossRef]

- Liu, Q.; Wang, S.; Zhang, W.; Li, J.; Zhao, Y.; Li, W. China’s municipal public infrastructure: Estimating construction levels and investment efficiency using the entropy method and a DEA model. Habitat Int. 2017, 64, 59–70. [Google Scholar] [CrossRef]

- Ngobeni, V.; Breitenbach, M.C.; Aye, G.C. Technical efficiency of provincial public healthcare in South Africa. Cost Eff. Resour. Alloc. 2020, 18, 3. [Google Scholar] [CrossRef]

- Chen, L.; Yu, Y.; Addis, A.K.; Guo, X. Empirical assessment and comparison of educational efficiency between major countries across the world. Sustainability 2022, 14, 4009. [Google Scholar] [CrossRef]

- Magazzino, C.; Mele, M. On the relationship between transportation infrastructure and economic development in China. Res. Transp. Econ. 2021, 88, 100947. [Google Scholar] [CrossRef]

- Siddiqui, S.; Vaillancourt, K.; Bahn, O.; Victor, N.; Nichols, C.; Avraam, C.; Brown, M. Integrated North American energy markets under different futures of cross-border energy infrastructure. Energy Policy 2020, 144, 111658. [Google Scholar] [CrossRef]

- Woodward, J.; Stoughton, K.M.; Begley, L.; Boyd, B. Evaluating water assets using water efficiency framework for infrastructure intensive agency. J. Water Resour. Plan. Manag. 2019, 145, 04018090. [Google Scholar] [CrossRef]

- Anguluri, R.; Narayanan, P. Role of green space in urban planning: Outlook towards smart cities. Urban For. Urban Green. 2017, 25, 58–65. [Google Scholar] [CrossRef]

- Xu, Z.; Das, D.K.; Guo, W.; Wei, W. Does power grid infrastructure stimulate regional economic growth? Energy Policy 2021, 155, 112296. [Google Scholar] [CrossRef]

- Mohanty, R.K.; Bhanumurthy, N.R. Analyzing the dynamic relationships between physical infrastructure, financial development and economic growth in India. Asian Econ. J. 2019, 33, 381–403. [Google Scholar] [CrossRef]

- Toader, E.; Firtescu, B.N.; Roman, A.; Anton, S.G. Impact of information and communication technology infrastructure on economic growth: An empirical assessment for the EU countries. Sustainability 2018, 10, 3750. [Google Scholar] [CrossRef]

- Forzieri, G.; Bianchi, A.; E Silva, F.B.; Herrera, M.A.M.; Leblois, A.; LaValle, C.; Aerts, J.C.J.H.; Feyen, L. Escalating impacts of climate extremes on critical infrastructures in Europe. Glob. Environ. Chang. 2018, 48, 97–107. [Google Scholar] [CrossRef]

- Dawson, R.J.; Thompson, D.; Johns, D.; Wood, R.; Darch, G.; Chapman, L.; Hughes, P.N.; Watson, G.V.R.; Paulson, K.; Bell, S.; et al. A systems framework for national assessment of climate risks to infrastructure. Philos. Trans. R. Soc. A Math. Phys. Eng. Sci. 2018, 376, 20170298. [Google Scholar] [CrossRef]

- Brockway, A.M.; Dunn, L.N. Weathering adaptation: Grid infrastructure planning in a changing climate. Clim. Risk Manag. 2020, 30, 100256. [Google Scholar] [CrossRef]

- Mitoulis, S.A.; Bompa, D.V.; Argyroudis, S. Sustainability and Climate Resilience Trade-Offs in Transport Infrastructure Recovery. Soc. Sci. Res. Netw. 2022. [Google Scholar] [CrossRef]

- Agénor, P.R.; Alpaslan, B. Infrastructure and industrial development with edogenous skill acquisition. Bull. Econ. Res. 2018, 70, 313–334. [Google Scholar] [CrossRef]

- Lu, C.; Hong, W.; Wang, Y.; Zhao, D. Study on the Coupling Coordination of Urban Infrastructure and Population in the Perspective of Urban Integration. IEEE Access 2021, 9, 124070–124086. [Google Scholar] [CrossRef]

- Liu, C. Infrastructure Public–Private Partnership (PPP) Investment and Government Fiscal Expenditure on Science and Technology from the Perspective of Sustainability. Sustainability 2021, 13, 6193. [Google Scholar] [CrossRef]

- Wang, Y.; Lee, H.W.; Tang, W.; Whittington, J.; Qiang, M. Structural equation modeling for the determinants of international infrastructure investment: Evidence from Chinese contractors. J. Manag. Eng. 2021, 37, 04021033. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).