Abstract

Digitalization has become a key driver of business innovation in recent years. It provides businesses with new opportunities to innovate and create value. Digital technologies, such as cloud computing, big data analytics, and artificial intelligence, have helped businesses boost the development of new products and services, optimize their operations, and improve customer engagement. This study aimed to analyze the impact of digitalization on business performance within business innovation. This study applied an ordinary least square regression model and an intermediary to explore relationship in the chain of digital capability–business model innovation–company performance. The object of investigation was 1663 listed A-share companies Shanghai and Shenzhen in the software and information technology service sectors. The results showed that digital capabilities could be divided into three dimensions according to the hierarchical relationship: (1) basic digital capabilities, (2) digital operation capabilities, and (3) digital integration capabilities, all of which significantly positively affected enterprise performance. Furthermore, while business model innovation significantly positively affected corporate performance, it was also driven by the preceding variables of digital capabilities. Business model innovation enhanced the positive impact of basic digital capabilities, digital operation capabilities, and digital integration capabilities on company’s performance. Considering the empirical results, this study underlines that the government should promote digital skills development, create supportive regulatory environments, promote access to funding for innovations, foster partnerships between businesses and technology providers, and promote collaboration between businesses, which are conducive to extending digitalization within the business innovation model and improving business performance.

1. Introduction

In the digital era, data are becoming the core factor in production development. The tapping and releasing the potential of data have become important paths for enterprises to take advantage of trends and improve their performance. With digital capabilities, enterprise managers can gain insight into the digital situations they face, identify digital opportunities, improve operational efficiency, and integrate digital resources, which thus affect enterprise performance [1,2]. In addition, with the rapid development of digital technology, the business model has undergone gradual as well as disruptive changes [3,4]. Business model innovation is an important innovation activity of enterprises, acting as the force driving enterprise performance improvement. It should be noted that the impact of business model innovation on business performance can vary depending on the industry [5,6], market conditions [7,8,9], and specific organizational contexts [10]. However, overall, a well-executed and innovative business model can significantly contribute to improved financial performance, market positioning, and long-term success [6,7,8,9,10]. Under digital empowerment, the business model presents new characteristics in terms of elements, processes, and target results [11]. The integration of digital capabilities can help enterprises break through industry barriers and resource constraints. Consequently, it provides new competitive advantages [12].

The literature describes some achievements in the research on digital capability and business model innovation. However, there are still some deficiencies. On the one hand, the concept and connotation of digital capability have been continuously enriched and expanded, but no consensus has been formed on its performance logic. Driven by data elements, digital capability has different value-promotion orientations according to the different stages of enterprise development and has different forms of capability according to the hierarchical relationship, but the existing research in this field is not clear. On the other hand, existing scholars agree on the influence of digital capability on enterprise performance. For example, Wang et al. [13] applied the meta-analysis method to take digital capability as one of the dimensions to discuss the relationship between digital transformation and enterprise performance and situational conditions. Guan et al. [14] started from resource arrangement theory and digital jump logic and selected 240 questionnaires for empirical analysis to test the impact of digital capability on the performance of entrepreneurial enterprises. The intermediary role of business model innovation has long been a hot topic of academic discussion [15], and digital capability has significantly influenced business model innovation [16,17]. Researchers have rarely integrated digital capability, business model innovation, and enterprise performance into a theoretical analysis framework and have not systematically analyzed the logical relationship among them.

This paper fills the scientific gaps and contributes to the theoretical landscape of digitalization, innovation, and business performance through the following: (1) considering the hierarchical order and redefining digital capability into three dimensions (digital basic, digital operation, and digital integration capabilities) to lay a foundation for subsequent research on the functional mechanism of digital capabilities; (2) further expanding the research boundary of digital capability from the academic level. The study object included listed A-share companies in Shanghai and Shenzhen. It should be noted that Shanghai and Shenzhen are major economic hubs in China with vibrant business environments and significant contributions to the country’s GDP [18]. The A-share market represents the domestic market for Chinese companies and an important indicator of economic performance [18,19,20,21,22]. Additionally, the listed A-share listed companies in Shanghai and Shenzhen are subject to regulatory requirements for financial reporting and disclosure. As a result, comprehensive and reliable data on these companies’ financial performance, operations, and digital capabilities are readily available. Access to such data enhanced the rigor and reliability of the investigation, allowing for more robust analysis.

This study analyzed the functional mechanism through which multiple dimensions of digital capability influence enterprise performance; introduced intermediary variables for business model innovation; and integrated digital capabilities, business model innovation, and enterprise performance into a theoretical framework. To a certain extent, this study expands and clarifies the influence path of digital capability–business model innovation–enterprise performance by establishing a theoretical framework and model with general significance that can comprehensively reveal the performance improvement of enterprises in the digital environment. From a practical point of view, the results of this study can be used by business managers to form a conceptual understanding of digital capabilities. On this basis, enterprises are further encouraged to efficiently innovate their traditional business models, break through the inertia of traditional organizations, integrate existing resources and capabilities, and reduce the internal logic of enterprise performance improvement.

2. Literature Review

2.1. Dimensional Division of Digital Capabilities

Research on digital capability originated from related research on information technology capability [19]. The information technology capability of an enterprise is considered to be the capability of enterprises to acquire, transmit, and process information to make effective decisions [20]. From this perspective, a study [2] outlines that the digital technology and management capabilities of enterprises in the process of developing new digital products can be defined as their digital capabilities. Information technology capabilities can effectively improve the efficiency of information processing and the efficiency of data use, but they can change the connectivity capability of enterprises to help enterprises more widely and easily reach all kinds of resources, markets, and users [21]. Therefore, an increasing number of scholars are beginning to define the connotation of digital competence from the perspective of dynamic competence. A study [22] emphasizes the special dynamic capabilities of an organization, where digital capabilities boost the digital transformation of enterprises through digital perception, digital acquisition, and digital transformation. In addition, from the perspective of resources, some scholars think that digital capability includes the capability not only to apply digital technology but also to integrate the digital resources of enterprises [16]. From a comprehensive review of the existing research, we think that digital capability refers to data as the basic factors of production; on the basis of digital hardware investment and collaborative software support, it further touches on basic business and supporting obligations, systematically redefines enterprise activities, and helps to solve the problem of upstream and downstream business synergy and internal and external stakeholders to achieve a better and more agile response and meet customer demand to achieve disruptive innovation.

We think that digital capability is driven by data as the basic factor of production and is guided by the deductive logic of value function, which can be divided into basic digital capability, digital operation capability and digital integration capability, according to a hierarchical order. Among them, the basic digital capability emphasizes the initial input of data elements that constructs a basic environment for enterprises and includes technical support, organizational strategy, talent support, and security guarantees. Enterprises form their digital capability based on the introduction of digital resources under the guidance of operational efficiency, in combination with the integration of a new generation of information technology, through the construction of digital infrastructure and the introduction of digital talent, providing enterprises with perception, connection, storage, computing, processing, and security for supporting digital infrastructure systems.

On this basis, data elements, enterprise planning, research and development, procurement, production, sales of basic business and warehousing, logistics, finance, human resources, and other supports of business integration change the organizational structure and business model, improve enterprise business efficiency, and form the enterprise’s digital operation capability through the enterprise business process and products and services. Digital integration capability includes internal and external integration capabilities. Internal integration emphasizes the use of real-time data, data lakes, data warehouses, and other technologies to link various departments within the enterprise, establish a digital resource-sharing system, and realize the exchange of internal information, knowledge, and resources in the organization. External integration mainly refers to the use of data resources, upstream and downstream supply chains, service providers, customers, peers, friends, enterprises, government, social organizations, and stakeholders to establish a collaborative network. The demands of all stakeholders help enterprises to further improve their ability to meet potential demand to reveal the new demand on the creation level, using their own digital advantages from their enterprise alliances, competition, cross-border cooperation, and the construction of comprehensive ecological networks.

2.2. Digital Capabilities Affect Enterprise Performance

There is a significant positive correlation between digital power and enterprise performance. Digitalization enables businesses to streamline their operations through the automation of processes, improved data management, and increased connectivity. By leveraging digital technologies such as cloud computing, data analytics, and automation, enterprises can optimize their resource allocation, reduce costs, and improve overall operational efficiency [23,24,25,26,27]. This, in turn, leads to improved performance indicators such as productivity, profitability, and cost-effectiveness [28,29,30,31]. According to past studies [32,33,34,35,36,37], digitalization affects enterprise performance by enhancing operational efficiency, expanding market reach, improving customer experience, driving innovation and new revenue streams, and enabling adaptation to a changing business environment. Business model innovation plays a critical role in leveraging digitalization to unlock these performance benefits. By reimagining and reconfiguring their business models to align with digital opportunities, enterprises can maximize the transformative potential of digital technologies and achieve sustainable growth [38,39,40,41,42,43,44,45].

Scholars [23] selected Chinese listed companies from 2007 to 2019 as the research sample, empirically tested digital transformation, built basic digital capabilities, compensated for the defects of insufficient enterprise resources, and then improved enterprise performance. A study [46] empirically investigated the multiple influences of digitalization on enterprise performance and its mechanisms in the form of text mining and stated that digitalization affects enterprise performance through two paths: management and sales activities.

Basic digital capability focuses on the construction of digital infrastructure and digital talent investment and emphasizes the hardware and software structure of digital technology, which constitutes the underlying logic of digital capabilities. Among them, digital infrastructure construction with big data, cloud computing, and artificial intelligence digital platforms and software system structures as the carrier emphasizes data, software, communication, software and hardware integration, form sharing, borderless enterprise digital technology systems; shortens the physical space distance; can essentially change the method of enterprise production and service; improve Chinese enterprise’s total factor productivity and technology innovation level [46]; and improve enterprise digital technology production capacity, thus driving the increase in enterprise performance. In addition, digital talent investment is an important part of enterprises’ basic digital capabilities, recruitment and training, main business, strategic direction adjustment related digital talent, building of enterprise scarcity, heterogeneity, high-quality digital human resources, sustainable competitive advantage, and enterprise performance.

The digital operation capability emphasizes the enterprise in the process of daily production and operation, and the digital solution capability of the enterprise and supporting businesses. This capability helps enterprises under the premise of digital resources support, using modern digital information technology, establishing a link plan for research and development, production management, sales management, the organizational and financial management data chain, improving the quality of products and services and output efficiency, and improving enterprise business efficiency. The digital operation capability of enterprises mainly includes the ability to apply data resources in both basic and supporting businesses. Cultivating digital operation capabilities can help enterprises make full use of artificial intelligence technology, achieve efficiency and agility, improve collaborative technical intelligent service abilities, reshape business processes, prompt enterprise internal specialization, integrate intelligent digital production operation processes, improve overall operational efficiency, and eventually promote enterprise performance.

Digital integration capability emphasizes the enterprise’s use of data integration. The basic enterprise and its supporting businesses, based on digital operation, can integrate the organization’s internal and external resources, information, and technology through continuous collaborative integration. As such, the enterprise will be able to achieve the reasonable use of data resources and management, break the enterprise’s “data islands”, and enable the formation of systematic integration capabilities [47]. When enterprises have digital integration capability, they can more quickly and accurately obtain internal information and share knowledge and resources. To achieve the coordination and matching of internal and external resources, external market opportunities must be accurately identified to choose the appropriate partners to compensate for the lack of resources and to mitigate the risk of internal operations and external cooperation to promote the improvement in enterprise performance. This paper proposes the following hypotheses:

H1:

Digital capability significantly and positively affects enterprise performance.

H1a:

Basic digital capabilities have a significant and positive impact on enterprise performance.

H1b:

Digital operation capability has a significant and positive impact on enterprise performance.

H1c:

Digital integration capability has a significant and positive impact on enterprise performance.

2.3. Digital Capabilities Influence Business Model Innovation

Business model innovation is considered another new innovation activity after a series of innovation activities, such as technological innovation, management innovation, and system innovation. It is a process of optimizing the allocation of internal and external resources and realizing the innovative optimization and reorganization of the existing resources and trading network in the enterprise business ecosystem [48]. Based on the exploration of new business models, business model innovation takes value proposition as the logical starting point and realizes organizational change through value creation, transmission, and acquisition [49]. According to the different elements of innovation, business model innovation can be divided into efficiency and novel business model innovation [50]. The former focuses on efficiency improvement, while the latter focuses on new products, new markets, and new transactions. Efficient business model innovation reduces the transaction costs and error rates, reduces information asymmetry, and accelerates resources and information integration in trading activities to improve the current business model to improve production and operation efficiency. The novel business model is more disruptive innovation, identifying and creating new transaction demand, broadening the trading subject, implementing new trading methods, and improving new trading and incentive mechanisms to help enterprises break the business boundary, break the barriers between products and the market, and realize diversified industrial development.

Digital capability is a new power and the new path of enterprise business model innovation. Digital capability—under the impetus of data elements, production operation, procurement management, supply chain management, the information system, customer relationships, and organizational boundary—put forwards new requirements; urges enterprises to realize new value propositions, transfers, and creations; and realizes the reconstruction of the business model. Specifically, first, basic digital capability is the underlying architecture of an enterprise’s digital capability and its data-collection-, storage-, and transportation-related digital infrastructure construction. Here, the more sound; the more timely the equipment update; the more complete the digital talent; the greater the enterprise combing, analysis, computing, and mining data information resources capabilities; the more enterprises are helped by digital facilities to broaden the channels of customer access. Enterprises can thus accurately analyze the positioning of customer demand, thus driving the novel innovation of the business model. At the same time, the more widely used the digital technology and platforms, the greater they can help enterprises simplify a series of transaction processes and drive efficient business model innovation.

Digital operation capability is essentially the ability of enterprise organizations to use digital technology, which is a digital capability system that promotes business model restructuring and organizational innovation [51]. Digital technology assets (under the impetus of data elements, enterprise production, research and development, sales, and other basic process systems of digital change) help enterprises to enhance their insight into each link of operation management, better develop operation management strategies, improve operational efficiency, adjust their business models to reduce path dependence, and realize efficient business model innovation. On the basis of gradually expanding and modifying the existing business model, some enterprises have achieved subversive business model innovation, that is, novel business model innovation.

Digital integration capabilities can be achieved by establishing resource-sharing systems within the enterprise. Information complementarity and resource integration are achieved through digital technology and enterprise users, upstream and downstream supply chains, service providers, enterprises and peers, friends, cross-industry enterprises, government, all sectors of society and other digital alliances, competition and cooperation, and cross-border cooperation to help enterprises accelerate the collaborative integration of internal and external data, equipment and operations to form a symbiotic data ecological network with cocreation and sharing. It helps enterprises to continuously organize innovation and gradually carry out efficient business model innovation. Additionally, it helps enterprises mine user demand information and invite users to collaborate to optimize existing products and develop new products. Moreover, a new model of cooperation can be formed and a series of new cooperation models and new strategic management initiatives can be created to achieve novel business model innovation. Therefore, the following assumptions are made:

H2a:

Basic digital capability significantly and positively affects the innovation of an efficient business model.

H2b:

Basic digital capabilities have a significantly positive impact on novel business model innovation.

H3a:

Digital operation capability significantly and positively affects the innovation of an efficient business model.

H3b:

Digital operation capability has a significantly positive impact on novel business model innovation.

H4a:

Digital integration capability significantly and positively affects the efficiency of business model innovation.

H4b:

Digital integration capability significantly and positively affects novel business model innovation.

2.4. The Intermediary Role of Business Model Innovation

The related research on digital capability shows that digital capability can directly or indirectly function through some intermediary factors [52,53], among which the intermediary role of business model innovation has been the focus of academic discussion [53,54]. The intermediary role of BMI is first reflected in its own ability to improve enterprise performance through the optimization of the value creation, transmission, and acquisition process of enterprises [55]. Business model innovation can help enterprises expand the total amount of value creation against the competition and is the key factor for enterprise performance improvement. Scholars [48] empirically tested the financial performance of business model innovation; a study [54] used the sample data of 319 Chinese enterprises to test business model innovation to help enterprises improve their integration capability and achieve higher enterprise performance. Researchers [56] verified the specific causal mechanism between business model innovation and the performance of small- and medium-sized enterprises. Digital capability affects enterprise performance, but digital capability needs to be combined with enterprise innovation activities to promote performance improvement. With the investment, application, and integration of enterprise digital resources, enterprises combine their own resources and capabilities to coordinate, reconfigure, and improve their performance.

Efficient business model innovation, which mainly focuses on improving efficiency, emphasizes the improvement in enterprise performance through the reduction in transaction costs. The reduction in transaction costs requires the investment and cultivation of enterprise digital capabilities. The continuous investment in digital infrastructure, represented by artificial intelligence, big data, and cloud computing, can consolidate a foundation of enterprise superiority, promote the improvement in the enterprise’s foundation and supporting business technologies, and improve the overall operational efficiency of the enterprise. Data integration capabilities also help the enterprise to strengthen its information exchange and contact with the participating parties, reduce information asymmetry, expand the scope of the establishing partners with other enterprises, and strengthen the negotiation and bargaining power of the enterprise to understand the products and demand information of their partners to improve the performance of the enterprise. Novel business model innovation for a new market, new products, and new transactions can improve an enterprise’s performance by constantly mining and meeting new demands and innovating transaction methods. Digital capability, with its data resource input, operation, and integration levels, helps enterprises actively introduce new products or new services; effectively optimize the configuration of existing resources; create a new market space; obtain more consumers, partners, and suppliers; obtain wealth and benefits; and achieve value appreciation. At the same time, digital capability helps enterprises to market concepts to create better identification, analysis, and understanding and answer consumer demand through new trading mechanisms, new trading incentives, retaining the existing market consumers, and increasing the consumption range. As such, enterprises can develop new areas, develop a new customer experience, improve customer purchase intention, and develop a new value creation process to improve enterprise performance. Therefore, based on the above studies, this paper proposes the following hypotheses:

H5:

Efficient business model innovation has a significant and positive impact on enterprise performance.

H5a:

Efficient business model innovation plays an intermediary role in the relationship between basic digital capability and enterprise performance.

H5b:

Efficient business model innovation plays an intermediary role in the relationship between digital operation capability and enterprise performance.

H5c:

Efficient business model innovation plays an intermediary role in the relationship between digital integration capability and enterprise performance.

H6:

Novel business model innovation has a significant and positive impact on enterprise performance.

H6a:

Novel business model innovation plays an intermediary role in the relationship between basic digital capability and enterprise performance.

H6b:

Novel business model innovation plays an intermediary role in the relationship between digital operation capability and enterprise performance.

H6c:

Novel business model innovation plays an intermediary role in the relationship between digital integration capability and enterprise performance.

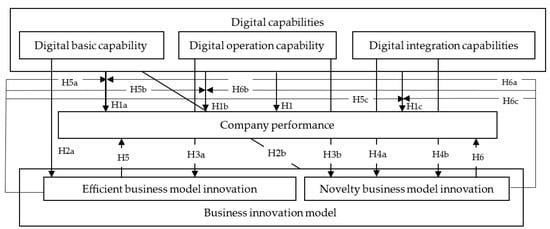

The conceptual framework of this study is shown in Figure 1.

Figure 1.

The conceptual framework of this investigation.

3. Materials and Methods

3.1. Date Resources

In this study, the panel data of listed companies in the software and information technology service industries in Shanghai and Shenzhen from 2011 to 2021 were selected as the research sample. The reasons for choosing these enterprises were as follows: first, their mature investment and application in big data, intelligence, cloud computing, blockchain, and other digital technologies; second, based on the relatively mature application of digital technology, such enterprises can carry out different degrees of business model innovation; and third, the accessibility of data. In addition, considering data integrity, accuracy, and the credibility of the model estimation, the collected data were processed as follows: (1) excluding the samples with serious data loss; (2) excluding ST, ST *, and PT companies; and (3) deleting the samples of companies listed after 2011. Finally, 1663 valid sample observations were obtained. The data used in this study were derived from the annual reports of the Guotaian CSMAR Database [57], Sina Finance [58], and the official financial and nonfinancial reports of listed companies.

Enterprise performance refers to the output efficiency and benefits of an enterprise during a period of sustainable operation, which includes financial performance and nonfinancial performance [59]. The existing empirical literature contains a wide variety of indicators used to measure enterprise performance. The representative indicators include the sales end based on the gross profit margin and net profit margin on sales, the asset end based on the return on assets and profit margin before interest and tax [60], value index based on the economic added value of enterprises [61], the net income end with the return on capital and Tobin’s Q value, and client measurement based on customer satisfaction [47,62]. Compared with other measures, Tobin’s Q value can better reflect future long-term value and digital technology application enterprise growth but income is unstable; therefore, this paper finally selected the Tobin’s Q value as a measure of enterprise performance. In the robustness test, we referenced [63].

Basic digital capability emphasizes the digital resource inputs and basics, which constitute the underlying basis of digital capability, including “hard” and “soft” digital resource inputs and their application. This paper selected the following indicators for measurement:

Digital capital investment. This index measures the investment of “hard” digital resources of the enterprise, screens the name of the project with raised funds according to the digital keywords, and summarizes the total amount of the planned investment in the project [64,65]. The larger the amount, the stronger the digital capital investment, and the stronger the basic digital capability of the enterprise.

Digital human capital investment. This index measures the investment in “soft” digital resources of an enterprise using the proportion of the number of personnel related to digitalization [66,67]. However, in the actual measurement process, due to the unavailability of the number of personnel, the proportion of the number of R&D personnel was selected as a replacement.

Digital infrastructure construction. The construction of digital infrastructure reflects the construction capacity for enterprise digital resources. First, it is closely related to the collection of buried data of the enterprise, data storage and transmission, and equipment updates, reflecting the efficiency and effectiveness through which enterprises obtain data. Second, it is the capability to process, analyze, and mine data information resources by using programming language, operation commands, and program documents based on data acquisition. Referring to the literature [68], this paper generally obtained the value of enterprise digital infrastructure construction: artificial intelligence, blockchain, cloud computing, and big data, which are four technologies related to digital infrastructure construction. Here, the higher the word occurrence frequency, the stronger the enterprise’s digital infrastructure construction. Finally, the basic digital capability was obtained by standardizing the above three indicators and taking the average value.

Digital operation capability is an important indicator used to measure the efficiency level of an enterprise’s asset operation and management through financial statement analysis of factors including the total asset turnover, current assets turnover, accounts receivable turnover, etc. It is measured as the proportion of a certain asset in the total operating income. According to this logic, the digital operation capability in this study was measured as the proportion of digital assets in total operating revenue. According to Zhang et al. [60,69], digital asset measurement considers the aspects related to the digital transformation disclosed in the notes of the financial reports of listed companies. When asset details include “software”, “network”, “client”, “management system”, “intelligent platform”, and other keywords related to digital transformation technology and related patents, the detailed project was defined as “digital assets”. In the same year for the same company’s multiple digital assets, we calculated the proportion of the current year’s operating income. The higher the proportion of the digital assets in the operating revenue, the stronger the digital operation capability.

Digital integration capability includes both internal and external integration capabilities. Among them, to measure internal integration capability, we selected the enterprise internal technology integration word frequency. Internal technology integration refers to the capability of enterprises to use emerging digital integration technology to develop and produce products, reflecting the capability to integrate the information and resources of different units within the organization. The more frequently technology integration words appear, the stronger the enterprise’s digital internal integration capability is.

External integration capability is measured as the concentration of the supply chain. This index reflects the concentration of partnerships upstream and downstream of the supply chain, including the procurement concentration upstream of the supply chain and the sales concentration downstream of the supply chain. If the enterprise actively establishes partnerships with the upstream and downstream of the supply chain and strengthens the concentration of the supply chain, it reflects the strength of the digital external integration capability of the enterprise to a certain extent. Supply chain concentration can be measured by the average of the sum of the purchases and sales ratio of the top five suppliers and customers, namely, (purchase ratio of top five suppliers + sales ratio of top five customers)/2.

The measured values of the above two indicators were standardized and averaged as the final measurement value of an enterprise’s digital integration capability.

Business model innovation. Most empirical studies on business model innovation have used design scales to measure the degree of business model innovation [55]; however, considering that the cross-sectional data obtained from a questionnaire are not conducive to examining the dynamic utility of business model innovation, this paper selected the word frequency and actual report data in the annual reports to determine efficient business model innovation and novel business models, respectively.

Efficiency-based BMI emphasizes the optimization of the transaction process, which thereby reduces transaction costs and labor costs, improves transaction efficiency, and achieves efficiency improvement. Therefore, this paper selected the word frequency of process innovation to measure the efficiency of BMI, where the higher the word frequency of process innovation, the higher the BMI efficiency.

Novel business model innovation emphasizes connecting transaction entities and adopting new transaction methods and trading mechanisms to capture new market demand and to develop new products. Therefore, this paper selected the frequency of business innovation to measure novel business model innovation. The more frequently business innovation words appear, the stronger the innovation of the enterprise’s novel business model.

Control variables. This paper selected enterprise age, enterprise size, asset–liability ratio, and management expense ratio as control variables to control the influence of other factors on the company’s digital capability and performance. The age of the establishment of the enterprise refers to the time from the registration of the enterprise to the time of observation; the difference in the size of the enterprise reflects the wealth of the assets, which affects the digital capability and innovation level of the enterprise. We selected the natural logarithm of the total assets. The asset–liability ratio measures the capital structure of the enterprise, which affects the digital capability of the enterprise; the management cost ratio reflects the profitability of the enterprise.

Explanations of the symbols, measurement indices, measurement methods, and sources for the chosen variables are presented in Table 1.

Table 1.

Variables and measures.

3.2. Model Settings

Based on the above assumptions, we sets the test models as follows: Specifically, , , , and are the intercepts of models (1)–(4), respectively; and , , , and (i = 1,2,3,4 … 7,8,9) are the coefficients of the models, respectively. Model (1) was used to verify the main-effect relationship between digital capability and enterprise performance; construct a regression model with basic digital capability, digital operation capability, and digital integration capability as independent variables; and tests hypotheses H1a, H1b, and H1c.

Model (2) was used to verify the relationship between digital capability and business model innovation; construct a regression model with basic digital capability, digital operation capability and digital integration capability as the independent variables and business model innovation as the dependent variable; and test hypotheses H2a, H2b, H3a, H3b, H4a and H4b.

Model (3) was used to verify the relationship between business model innovation (BMI) and enterprise performance, construct a regression model with efficient BMI and novel BMI as the independent variables and Tobin’s Q as the dependent variable, and test hypotheses H5 and H6.

Model (4) combined Models (1)–(3) to jointly verify the mediating role of BMI and test hypotheses H5a, H5b, H5c, H6a, H6b, and H6c.

4. Results

The results of the descriptive statistical analysis of each variable are shown in Table 2. The mean and median of the Tobin’s Q values were 2.753 and 2.243, respectively. The standard deviation (1.857) showed that the market value of the sample companies was dispersed. Market valuations of different companies greatly varied.

Table 2.

Descriptive statistical results of the variables.

The three variables of basic digital capability, digital operation capability, and digital integration capability are considered the original measurement index Z. After taking the average value, the maximum value did not differ much from the average value. In addition, the data gently fluctuated. Two variables, efficient business model innovation and novel business model innovation, were measured as the process innovation and business innovation word frequency, respectively. The maximum values were all three standard deviations above the mean. It showed that the data greatly fluctuated. In addition, the control variables age and asset size also greatly fluctuated. The results of Pearson’s correlation coefficient (Table 3) showed a significant positive correlation between the selected variables, and the correlation coefficients between the main variables were basically below the threshold of 0.8.

Table 3.

The correlation analysis of the variables.

In addition, the results in Table 2 show that the variance expansion factors were small below 10, indicating that there was no multicollinearity problem and that the selection of the variables and the construction of the models were reasonable.

OLS regression was used to analyze the relationship between digital capability, business model innovation, and enterprise performance. The results of the benchmark regression are shown in columns (1)–(4) in Table 4.

Table 4.

Analysis of the benchmark regression results.

The Breusch–Pagan test for heteroskedasticity yielded an output with a p-value (Prob > chi2) of less than 5%. This indicated that the null hypothesis, which states that there is no heteroskedasticity (i.e., the error variance is constant), was accepted.

Drawing on the method of Wen et al. [70], this paper followed the step-by-step method to test the intermediary effect of BMI, as shown in Table 4. Taking the intermediary test of the efficiency business model innovation as an example, first, the study verified whether the effect of the independent variable (digital base/digital operation/digital integration capability) was significant for the dependent variable (enterprise performance).

In column (1) in Table 4, the coefficients of the independent variable are positive and significant. In the next stage, the study verified whether the effect of the independent variable (digital base/digital operation/digital integration) had a significant impact on the intermediary variable (efficiency of BMI). The findings (column (2) in Table 4) confirmed that the coefficients of chosen variables were positive and significant. The next step verified whether the effect of the intermediary variable (efficiency business model innovation) on the dependent variable (enterprise performance) was significant. In column (4) in Table 4, the regression coefficients are positive and significant. The last stage of study verified that when the independent and mediation variables were entered into the regression model, whether the effect of the independent variables on the dependent variable was still significant (partial mediation effect) or became no longer significant (full mediating effect). In column (5) in Table 4, digital base capability did not pass the test, and other independent variables passed the test. Therefore, efficient BMI played the role of complete intermediary, partial intermediary, and partial intermediary in basic digital capability–enterprise performance, digital operation capability–enterprise performance, and digital integration capability–enterprise performance, respectively. It was found that H5a, H5b and H5c were supported. Similarly, efficient business model innovation played a complete intermediary, partial intermediation, and nonsignificant role in basic digital capability–enterprise performance, digital operation capability–enterprise performance, and digital integration capability–enterprise performance, respectively. Thus, H6a and H6b passed the test, and H6c did not.

The mediation effect sizes for various factors and their impact on the Tobin’s Q value, which is a measure of firm performance, are presented in Table 5.

Table 5.

Summary of results for mediation effect sizes.

To further test the reliability and robustness of the empirical results. In this study, the robustness test was conducted using the sample size change method [71,72]. This method involves cross-validating the findings on a new dataset to determine if they are consistent with the original findings. The similarity in the findings indicates the stability of the results and confirms that the regression model is properly specified. The sample in this study included listed companies in the software and information technology industry in the Shanghai and Shenzhen stock markets. However, the digital capabilities of industries such as computer, communications, and other electronic equipment manufacturing should not be underestimated. Therefore, this paper further extended the research object to industries such as computers. The sample size was expanded to 2827 units. Digital foundation capabilities, digital operation capabilities, and digital integration capabilities still had a significant and positive impact on enterprise performance (t = 1.709, p < 0.05; t = 0.788, p = 0.000 < 0.05; t = 1.785, p < 0.01, respectively). This further confirmed the robustness of the conclusion that digital capability affects enterprise performance (Table 6).

Table 6.

Results of the robustness test.

5. Discussion and Conclusions

By constructing a variable model of digital capability–business model innovation–enterprise performance, we studied the mechanism through which digital capability affects enterprise performance, discussed the mediating role of business model innovation in this process, and selected the annual report data of 336 listed companies in the software and information technology industry on the Shanghai and Shenzhen stock markets for empirical testing.

The output of the investigation supports the hypothesis that digital capability (basic, operation, and integration) has a significant and positive impact on enterprise performance. This means that organizations that possess digital capabilities tend to perform better in terms of various performance metrics, which has been also confirmed in other studies [23,45,46].

Digital capabilities play a driving role in digital capabilities–business model innovation–enterprise performance. Digital capabilities have changed the performance improvement path of traditional enterprises, which can be divided into basic digital capabilities, digital operation capabilities, and digital integration capabilities according to the hierarchical relationship, and the three subdivision capabilities all significantly positively affect enterprise performance. Among them, basic digital capabilities guarantee performance improvement, and the input and basic application of digital resources constitute the underlying bases of digital capabilities, providing enterprises with supporting digital infrastructure systems such as perception, connection, storage, computing, processing, and security. Digital operation capability is the key to performance improvement, and the application of digital resources provides operational efficiency guarantees for the whole input-output process of enterprises. Digital integration capability is the engine of performance improvement, and digital integration promotes the symbiosis and coexistence of enterprises and ecosystems through the integration of internal and external resources of the organization. According to the size of the role, the three capabilities are digital operation capabilities, basic digital capabilities, and digital integration capabilities. The driving role of digital capabilities is undeniable, but using its potential will require further business model innovation. Digital capabilities cover the entire process of the enterprise value chain, driving the efficiency and innovation of business models such as strategic positioning, business systems, and profit models and ultimately improving enterprise performance.

While business model innovation significantly positively affects corporate performance, it is also driven by the preceding variables of digital capabilities. The findings confirm that basic, operation, and integration capabilities significantly and positively affect the innovation of an efficient business model and novel business model innovation [49,50,51]. This suggests that organizations with strong digital capabilities (basic, operation, and integration) are more likely to develop innovative and efficient business models. Additionally, organizations that can effectively integrate digital technologies and systems are more likely to develop and implement novel business models that drive innovation. It should be noted that these conclusions are coherent with those of past studies [49,50,51]. Basic digital capabilities and digital operation capabilities have a significant positive impact on business model innovation, and digital integration capabilities have a positive effect on novel business model innovation; regardless of their high risk and high cost, they can significantly affect efficient business model innovation. Digital capability is a new driving force and new path for enterprise business model innovation and a factor enabling continuous business model improvement and innovation. Business model adjustment often shows path dependence; and the investment of digital resources, basic applications, and the improvement of the whole process operation efficiency brought by digital technology can gradually or subversively bring about business model innovation. In addition, both efficiency and novel business model innovation significantly positively affect enterprise performance, and novel business model innovation has a more direct impact on enterprise performance and a more obvious positive promotion role because of the new business, new products, and new services it brings.

Business model innovation plays an intermediary role in digital capability–business model innovation–enterprise performance. Business model innovation enhances the positive impact of basic digital capabilities, digital operation capabilities, and digital integration capabilities on enterprise performance. Among them, the intermediary effect of basic digital capabilities is 100%, and the intermediary effect played in digital operation capabilities is part of the intermediary, which is limited by the innovation risk brought by digital integration capabilities. Based on the above theoretical logic, business model innovation has become an important means and critical path for digital empowerment to create excellent enterprise performance. However, the findings did not support the hypothesis that novel business model innovation plays an intermediary role in the relationship between digital integration capability and enterprise performance, which differs from the findings of previous studies [73,74,75]. While digital integration capability enables the integration of digital technologies and systems, the successful implementation of novel business models requires more than just technological integration. Factors such as market acceptance, organizational readiness, and effective execution play crucial roles in the success of novel business model innovation. According to prior studies [76,77,78], these factors may have a more direct influence on enterprise performance than the digital integration capability itself.

It is a general trend for digital empowerment to drive business model innovation and improve enterprise performance, but in practice, less than 10% of enterprises can truly enhance enterprise value through digital capabilities [47]. Many enterprises suffer heavy losses because it is difficult to adapt to changes in the digital environment. Therefore, the management implications of this article for modern enterprises are as follows:

Enterprises should attach great importance to the construction and cultivation of digital capabilities. With basic digital capabilities as the starting point, digital operation capabilities as the core, and digital integration capabilities as the aim to build and cultivate, resources and capabilities are allocated in a targeted manner according to the internal logic of digital capability performance. Enterprises should first attach great importance to the guaranteed role of their basic digital capabilities; increase capital and talent investment related to digital technologies such as artificial intelligence, cloud computing, and 5G networks; and consolidate the underlying digital technology architecture. On this basis, guided by the improvement in operational efficiency, digital resources should be matched to various business products, coordinated with various organizational processes, empower the enterprise business ecology, and enable the digital improvement in the enterprise’s full-process operation capabilities. Finally, digital integration capabilities should be improved; internal and external processes, products, data, talent, information and other resources should be integrated; an enterprise digital ecological platform should be actively built; an enterprise digital ecosystem should be built; and enterprise value cocreation should be realized.

Enterprises should also pay full attention to business model innovation based on digital capabilities, which also allow promoting sustainable economic growth [79,80]. This study focused on how digital capabilities and business model innovation affect enterprise performance; we built a system framework for business model innovation in the context of digital empowerment and improved, formulated, and designed corresponding business models in combination with digital capabilities to enable innovation in a timely manner. Enterprises should give full play to the efficiency and novel advantages of business model innovation, break organizational inertia, improve or even design a new production and operation model, and create a new value creation system from value discovery–transmission–realization to form enterprise competitive advantages. Of course, in this process, enterprises should also pay attention to the risks of BMI, especially novel BMI.

Despite the valuable findings, the study has a few limitations. The investigation did not compare the impact of digitalization on business performance across different sectors or company sizes. This limited our ability to assess the relative effectiveness of digital capabilities and business model innovation in various contexts. Thus, in future research, it will be necessary to extend the object of investigation to enable a comparative analysis. Furthermore, it is necessary to consider more factors that impact digital development, which will increase the validity of the recommendations for business digitalization. In addition, the analysis primarily focused on the impact of digital capabilities and business model innovation on company performance. Other factors that may influence digital development, such as organizational culture, regulatory environment, or external market conditions, were not considered. Including a broader range of variables could enhance the understanding of the digitalization process. It should be noted that the potential presence of endogeneity in the business innovation process and innovation decisions necessitates the consideration of a set of unobserved factors or reverse causality between them.

Author Contributions

Conceptualization, Z.W., S.L., Y.C., O.L. and T.P.; methodology, Z.W., S.L., Y.C., O.L. and T.P.; formal analysis, Z.W., S.L., Y.C., O.L. and T.P.; investigation, Z.W., S.L., Y.C., O.L. and T.P.; writing—original draft preparation, Z.W., S.L., Y.C., O.L. and T.P.; writing—review and editing, Z.W., S.L., Y.C., O.L. and T.P.; visualization, Z.W., S.L., Y.C., O.L. and T.P.; supervision, Z.W., S.L., Y.C., O.L. and T.P. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Youth Fund of the Ministry of Education for Humanities and Social Sciences Research: “Research on the Mechanisms and Paths of Enhancing Enterprise’ Value: Perspectives on the Digital Capabilities and Dual-Model Innovation” (Project No. 22YJC630151); Fujian Provincial Education and Scientific Research Project “Research on the Green Transformation and Upgrading of Manufacturing Industry under the ‘Double Carbon’ Target” (Project No. Mincai Index [2022] No. 639); Natural Science Foundation of Fujian Province “Evaluation of the Effectiveness of Technical Innovation in Manufacturing Enterprises in Fujian Province and Policy Optimization” (Project No. 2021J01175); Scientific Research and Innovation Team Building Plan of Concord University College Fujian Normal University (Project No. 2021-TD-004).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Levallet, N.; Chan, Y.E. Role of Digital Capabilities in Unleashing the Power of Managerial Improvisation. MIS Q. Exec. 2018, 17, 3. [Google Scholar]

- Khin, S.; Ho, T.C. Digital technology, digital capability and organizational performance: A mediating role of digital innovation. Int. J. Innov. Sci. 2018, 11, 177–195. [Google Scholar] [CrossRef]

- Kasemi, S.; Gadi, I. Small and medium enterprises and economic growth in Algeria through investment and innovation. Financ. Mark. Inst. Risks 2022, 6, 55–67. [Google Scholar] [CrossRef]

- Hossain, S.; Islam, M.S.; Kundu, S.; Faruq, O.; Hossen, M.A. Women Participation in Entrepreneurial Activities in the Post COVID-19 Pandemic: Empirical Evidence from SMEs Sector. Health Econ. Manag. Rev. 2023, 4, 1–10. [Google Scholar] [CrossRef]

- Dzwigol, H.; Aleinikova, O.; Umanska, Y.; Shmygol, N.; Pushak, Y. An Entrepreneurship Model for Assessing the Investment Attractiveness of Regions. J. Entrep. Educ. 2019, 22, 1–7. [Google Scholar]

- Kwilinski, A.; Slatvitskaya, I.; Dugar, T.; Khodakivska, L.; Derevyanko, B. Main Effects of Mergers and Acquisitions in International Enterprise Activities. Int. J. Entrep. 2020, 24, 1–8. [Google Scholar]

- Vaníčková, R.; Szczepańska-Woszczyna, K. Innovation of business and marketing plan of growth strategy and competitive advantage in exhibition industry. Pol. J. Manag. Stud. 2020, 21, 425–445. [Google Scholar] [CrossRef]

- Oloveze, A.O.; Ugwu, P.A.; Okonkwo, R.V.O.; Okeke, V.C.; Chukwuoyims, K.; Ahaiwe, E.O. Factors motivating end-users’ behavioural intention to recommend m-health innovation: Multi-group analysis. Health Econ. Manag. Rev. 2022, 3, 17–31. [Google Scholar] [CrossRef]

- Tih, S.; Wong, K.-K.; Lynn, G.S.; Reilly, R.R. Prototyping, Customer Involvement, and Speed of Information Dissemination in New Product Success. J. Bus. Ind. Mark. 2016, 31, 437–448. [Google Scholar] [CrossRef]

- Kianpour, M.; Kowalski, S.J.; Øverby, H. Systematically Understanding Cybersecurity Economics: A Survey. Sustainability 2021, 13, 13677. [Google Scholar] [CrossRef]

- Xiao, H.; Yang, T. Sustainability business model innovation: Research review and outlook. Foreign Econ. Manag. 2020, 9, 3–18. [Google Scholar] [CrossRef]

- Vidal, E.; Mitchell, W. When do first entrants become first survivors? Long Range Plan. 2013, 46, 335–347. [Google Scholar] [CrossRef]

- Wang, H.; Li, Y.; Tan, Q. The impact of digital transformation based on Meta-analysis on enterprise performance. J. Syst. Manag. 2022, 1, 112–123. [Google Scholar]

- Guan, Y.; Tang, Z.; Tian, M.; Du, H. The influence of digital power on corporate entrepreneurship studies the regulatory effect of the intensity of competition. Technol. Econ. 2022, 6, 95–106. [Google Scholar]

- Zhou, Q.; Su, J.; Zhang, L. Research on the function mechanism of strategic orientation on enterprise performance: The perspective of business model innovation. Sci. Sci. Technol. Manag. 2020, 10, 74–92. [Google Scholar]

- Wang, M.; Zhang, B. The impact of enterprise digital capabilities on business model innovation–Based on the perspective of organizational resilience and environmental turbulence. Res. Financ. Issues 2022, 7, 120–129. [Google Scholar] [CrossRef]

- Qian, Y.; Sun, X.; Su, Z.; Dong, L. Case study of traditional enterprise dynamic capability and digital platform business model innovation mechanism. Res. Dev. Manag. 2021, 1, 175–188. [Google Scholar]

- Yang, C.; Zhao, S. Urban vertical profiles of three most urbanized Chinese cities and the spatial coupling with horizontal urban expansion. Land Use Policy 2022, 113, 105919. [Google Scholar] [CrossRef]

- Dong, Z. Research on the Impact of New Enterprise Digital Ability on Business Model Innovation. Ph.D. Thesis, Jilin University, Changchun, China, 2021. Available online: https://kns.cnki.net/KCMS/detail/detail.aspx?dbname=CDFDLAST2022&filename=1021100589.nh (accessed on 2 February 2023).

- Sanders, N.R.; Premus, R. Modelling the relationship between firm IT capability, collaboration; performance. J. Bus. Logist. 2005, 26, 1–23. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Warner, K.S.; Wäger, M. Building dynamic capabilities for digital transformation: An ongoing process of strategic renewal. Long Range Plan. 2019, 52, 326–349. [Google Scholar] [CrossRef]

- Li, Q.; Liu, L.; Shao, J. Digital transformation, supply chain integration and enterprise performance. The regulating effect of entrepreneurship. Econ. Manag. 2021, 10, 5–23. [Google Scholar] [CrossRef]

- Gavkalova, N.; Lola, Y.; Prokopovych, S.; Akimov, O.; Smalskys, V.; Akimova, L. Innovative Development of Renewable Energy during the Crisis Period and Its Impact on the Environment. Virtual Econ. 2022, 5, 65–77. [Google Scholar] [CrossRef]

- Miśkiewicz, R.; Matan, K.; Karnowski, J. The Role of Crypto Trading in the Economy, Renewable Energy Consumption and Ecological Degradation. Energies 2022, 15, 3805. [Google Scholar] [CrossRef]

- Hussain, H.I.; Haseeb, M.; Kamarudin, F.; Dacko-Pikiewicz, Z.; Szczepańska-Woszczyna, K. The role of globalization, economic growth and natural resources on the ecological footprint in thailand: Evidence from nonlinear causal estimations. Processes 2021, 9, 1103. [Google Scholar] [CrossRef]

- Szczepańska-Woszczyna, K.; Gatnar, S. Key Competences of Research and Development Project Managers in High Technology Sector. Forum Sci. Oeconomia 2022, 10, 107–130. [Google Scholar] [CrossRef]

- Kwilinski, A.; Tkachenko, V.; Kuzior, A. Transparent Cognitive Technologies to Ensure Sustainable Society Development. J. Secur. Sustain. Issues 2019, 9, 561–570. [Google Scholar] [CrossRef]

- Tkachenko, V.; Kwilinski, A.; Klymchuk, M.; Tkachenko, I. The Economic-Mathematical Development of Buildings Construction Model Optimization on the Basis of Digital Economy. Manag. Syst. Prod. Eng. 2019, 27, 119–123. [Google Scholar] [CrossRef]

- Miśkiewicz, R.; Rzepka, A.; Borowiecki, R.; Olesińki, Z. Energy Efficiency in the Industry 4.0 Era: Attributes of Teal Organisations. Energies 2021, 14, 6776. [Google Scholar] [CrossRef]

- Kharazishvili, Y.; Kwilinski, A.; Grishnova, O.; Dzwigol, H. Social safety of society for developing countries to meet sustainable development standards: Indicators, level, strategic benchmarks (with calculations based on the case study of Ukraine). Sustainability 2020, 12, 8953. [Google Scholar] [CrossRef]

- Pakhnenko, O.; Kuan, Z. Ethics of Digital Innovation in Public Administration. Bus. Ethics Leadersh. 2023, 7, 113–121. [Google Scholar] [CrossRef]

- Liu, K. Shanghai Stock Exchange’s Science and Technology Innovation Board: A Review. Financ. Mark. Inst. Risks 2023, 7, 1–15. [Google Scholar] [CrossRef]

- Shpak, N.; Karpyak, A.; Rybytska, O.; Gvozd, M.; Sroka, W. Assessing the business models of Ukrainian IT companies. Forum Sci. Oeconomia 2023, 11, 13–48. [Google Scholar] [CrossRef]

- Kuzior, A.; Vasylieva, T.; Kuzmenko, O.; Koibichuk, V.; Brożek, P. Global digital convergence: Impact of cybersecurity, business transparency, economic transformation, and AML efficiency. J. Open Innov. Technol. Mark. Complex. 2022, 8, 195. [Google Scholar] [CrossRef]

- Dzwigol, H. Research Methodology in Management Science: Triangulation. Virtual Econ. 2022, 5, 78–93. [Google Scholar] [CrossRef]

- Dzwigol, H. Methodological and Empirical Platform of Triangulation in Strategic Management. Acad. Strateg. Manag. J. 2020, 19, 1–8. [Google Scholar]

- Kharazishvili, Y.; Kwilinski, A.; Sukhodolia, O.; Dzwigol, H.; Bobro, D.; Kotowicz, J. The systemic approach for estimating and strategizing energy security: The case of Ukraine. Energies 2021, 14, 2126. [Google Scholar] [CrossRef]

- Oe, H.; Yamaoka, Y.; Duda, K. How to Sustain Businesses in the Post-COVID-19 Era: A Focus on Innovation, Sustainability and Leadership. Bus. Ethics Leadersh. 2022, 6, 1–9. [Google Scholar] [CrossRef]

- Chygryn, O.; Shevchenko, K. Energy industry development: Key trends and the core determinants. SocioEconomic Chall. 2023, 7, 115–128. [Google Scholar] [CrossRef]

- Veckalne, R.; Us, Y.; Gerulaitiene, N. Evaluation of Sustainability Awareness in Uzbekistan. Mark. Manag. Innov. 2022, 3, 88–102. [Google Scholar] [CrossRef]

- Saługa, P.W.; Szczepańska-Woszczyna, K.; Miśkiewicz, R.; Chład, M. Cost of equity of coal-fired power generation projects in Poland: Its importance for the management of decision-making process. Energies 2020, 13, 4833. [Google Scholar] [CrossRef]

- Miśkiewicz, R. The Impact of Innovation and Information Technology on Greenhouse Gas Emissions: A Case of the Visegrád Countries. J. Risk Financ. Manag. 2021, 14, 59. [Google Scholar] [CrossRef]

- Saługa, P.W.; Zamasz, K.; Dacko-Pikiewicz, Z.; Szczepańska-Woszczyna, K.; Malec, M. Risk-adjusted discount rate and its components for onshore wind farms at the feasibility stage. Energies 2021, 14, 6840. [Google Scholar] [CrossRef]

- Qi, Y.; Cai, C. Research on the multiple effects of digitalization on manufacturing enterprise performance and its mechanism. Learn. Explor. 2020, 7, 108–119. [Google Scholar]

- Roche, X.; Chen, L.; Zhao, Y. Digital infrastructure construction and enterprise capacity utilization–is empirical evidence from the “Broadband China” strategy. Ind. Econ. Res. 2022, 5, 1–14. [Google Scholar] [CrossRef]

- Liu, X.; Yang, Y.; Sun, Z. Construction and Evolution of enterprise digital capabilities–Based on multicase exploratory research of leading digital enterprises. Reform 2022, 10, 45–64. [Google Scholar]

- Aspara, J.; Hietanen, J.; Tikkanen, H. Business model innovation vs replication: Financial performance implications of strategic emphases. J. Strateg. Mark. 2010, 18, 39–56. [Google Scholar] [CrossRef]

- Qiao, H.; Hu, J.; Zhang, S.; Lan, S.; Zhang, S.; Lu, B. Frontier analysis and evaluation of business model innovation research: Platform ecosystem and value cocreation. Sci. Technol. Dev. 2020, 1, 40–49. [Google Scholar]

- Zott, C.; Amit, R. Business model design and the performance of entrepreneurial firms. Organ. Sci. 2007, 18, 181–199. [Google Scholar] [CrossRef]

- Ansong, E.; Boateng, R. Surviving in the digital era–business models of digital enterprises in a developing economy. Digit. Policy Regul. Gov. 2019, 21, 64–178. [Google Scholar] [CrossRef]

- Ding, X.; Li, W.; Xu, L. The relationship between IT ability and enterprise innovation performance studies the regulatory role of dual learning. Sci. Technol. Prog. Countermeas. 2020, 10, 90–98. [Google Scholar]

- Zhang, Y.; Li, X.; Xing, M. Enterprise digital transformation and audit pricing. Audit Stud. 2021, 3, 62–71. [Google Scholar]

- Pang, C.; Li, Y.; Duan, G. Integration ability and enterprise performance: The intermediary role of business model innovation. Manag. Sci. 2015, 5, 31–41. [Google Scholar]

- Chen, J.; Yang, Y.; Yu, J. Overview and prospect of business model innovation research. Soft Sci. 2022, 4, 1–7. [Google Scholar] [CrossRef]

- Latifi, M.A.; Nikou, S.; Bouwman, H. Business model innovation and firm performance: Exploring causal mechanisms in SMEs. Technovation 2021, 107, 102274. [Google Scholar] [CrossRef]

- Guotaian CSMAR Database. Available online: https://cn.gtadata.com (accessed on 2 February 2023).

- Sina Finance. Available online: https://finance.sina.com.cn (accessed on 2 February 2023).

- Meng, W.; Yang, W. Research on the performance relationship between resource integration, dual cooperation and focus enterprises in the alliance portfolio. Sci. Sci. Technol. Manag. 2018, 2, 85–94. [Google Scholar]

- Zhang, J.; Zhang, Y. Chairman-General manager heterogeneity, power gap and rapport and organizational performance. Evidence from public companies. Manag. World 2016, 50, 110–120. [Google Scholar] [CrossRef]

- Yang, H.; Zheng, Y.; Zhao, X. Exploration or exploitation? Small firms’ alliance strategies with large firms. Strateg. Manag. J. 2014, 35, 146–157. [Google Scholar] [CrossRef]

- Liu, C.; Chi, G.; Liu, C. Overseas experience of directors, dual innovation and enterprise value. Sci. Technol. Prog. Countermeas. 2021, 12, 79–88. [Google Scholar]

- Tan, Q.; Wei, D. Management power and enterprise value: Based on the perspective of product market competition. Manag. Sci. 2014, 3, 1–13. [Google Scholar]

- Leonov, S.V.; Vasylieva, T.A.; Tsyganyuk, D.L. Formalization of functional limitations in functioning of co-investment funds basing on comparative analysis of financial markets within FM CEEC. Actual Probl. Econ. 2012, 134, 75–85. [Google Scholar]

- Strielkowski, W.; Samoilikova, A.; Smutka, L.; Civín, L.; Lieonov, S. Dominant trends in intersectoral research on funding innovation in business companies: A bibliometric analysis approach. J. Innov. Knowl. 2022, 7, 100271. [Google Scholar] [CrossRef]

- Koibichuk, V.; Samoilikova, A.; Habenko, M. The effectiveness of employment in high-tech and science-intensive business areas as important indicator of socio-economic development: Cross-country cluster analysis. SocioEconomic Chall. 2022, 6, 106–115. [Google Scholar] [CrossRef]

- Veckalne, R.; Tambovceva, T. The Importance of Gender Equality in Promoting Entrepreneurship and Innovation. Mark. Manag. Innov. 2023, 1, 158–168. [Google Scholar] [CrossRef]

- Wu, F.; Hu, H.; Lin, H.; Ren, X. Enterprise digital transformation and capital market performance–empirical evidence from stock liquidity. Manag. World 2021, 37, 130–144. [Google Scholar] [CrossRef]

- Zhang, P.; Yang, Q. Digital technology capabilities, business model innovation and enterprise performance. Sci. Technol. Manag. Res. 2021, 10, 144–151. [Google Scholar]

- Wen, Z.; Ye, B. Mediation effect analysis: Method and model development. Prog. Psychol. Sci. 2014, 22, 731–745. [Google Scholar]

- Bates, S.; Hastie, T.; Tibshirani, R. Cross-validation: What does it estimate and how well does it do it? J. Am. Stat. Assoc. 2023, 1–12. [Google Scholar] [CrossRef]

- Browne, M.W. Cross-validation methods. J. Math. Psychol. 2000, 44, 108–132. [Google Scholar] [CrossRef]

- Clauss, T.; Abebe, M.; Tangpong, C.; Hock, M. Strategic agility, business model innovation, and firm performance: An empirical investigation. IEEE Trans. Eng. Manag. 2019, 68, 767–784. [Google Scholar] [CrossRef]

- Xie, X.; Han, Y.; Anderson, A.; Ribeiro-Navarrete, S. Digital platforms and SMEs’ business model innovation: Exploring the mediating mechanisms of capability reconfiguration. Int. J. Inf. Manag. 2022, 65, 102513. [Google Scholar] [CrossRef]

- Tian, Q.; Li, G.; Xu, R. Research on the Impact of Network Embeddedness on Enterprise Innovation Performance—Based on the Mediating Role of Business Model Innovation and the Moderating Role of Competition Intensity. In Proceedings of the 2021 IEEE International Conference on Industrial Engineering and Engineering Management (IEEM), Singapore, 13–16 December 2021; IEEE: Piscataway, NJ, USA; pp. 1047–1051. [Google Scholar]

- Hussain, M.; Papastathopoulos, A. Organizational readiness for digital financial innovation and financial resilience. Int. J. Prod. Econ. 2022, 243, 108326. [Google Scholar] [CrossRef]

- Piscicelli, L.; Ludden, G.D.; Cooper, T. What makes a sustainable business model successful? An empirical comparison of two peer-to-peer goods-sharing platforms. J. Clean. Prod. 2018, 172, 4580–4591. [Google Scholar] [CrossRef]

- Lokuge, S.; Sedera, D.; Grover, V.; Dongming, X. Organizational readiness for digital innovation: Development and empirical calibration of a construct. Inf. Manag. 2019, 56, 445–461. [Google Scholar] [CrossRef]

- Ziabina, Y.; Navickas, V. Innovations in Energy Efficiency Management: Role of Public Governance. Mark. Manag. Innov. 2022, 4, 218–227. [Google Scholar] [CrossRef]

- Kharazishvili, Y.; Kwilinski, A.; Bugayko, D.; Hryhorak, M.; Butorina, V.; Yashchyshyna, I. Strategic scenarios of the post-war recovery of the aviation transport sustainable development: The case of Ukraine. Virtual Econ. 2022, 5, 7–30. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).