Research on Enterprise R&D Strategy of Product-Service Innovation Guided by Quality Preference

Abstract

1. Introduction

2. Literature Review

3. Methods

3.1. Hypotheses and Notations

- Both enterprises have their own sales channels in the market, and have a risk-neutral attitude, aiming to maximize their profits.

- In the R&D stage, both enterprises invest in research and development to lower SOLUTION costs and improve R&D efficiency.

- In the production stage, both enterprises face the same fixed production costs for their SOLUTIONs. They utilize quality inputs to showcase the durability, functionality, aesthetics, and uniqueness of their products, with the objective of enhancing consumer preferences and expanding their market share during the sales stage [27].

- If collusion occurs between the enterprises during the sales stage, it will result in reduced market competition intensity. For the purpose of this analysis, it is assumed that there is no collusion between the two enterprises during the sales stage.

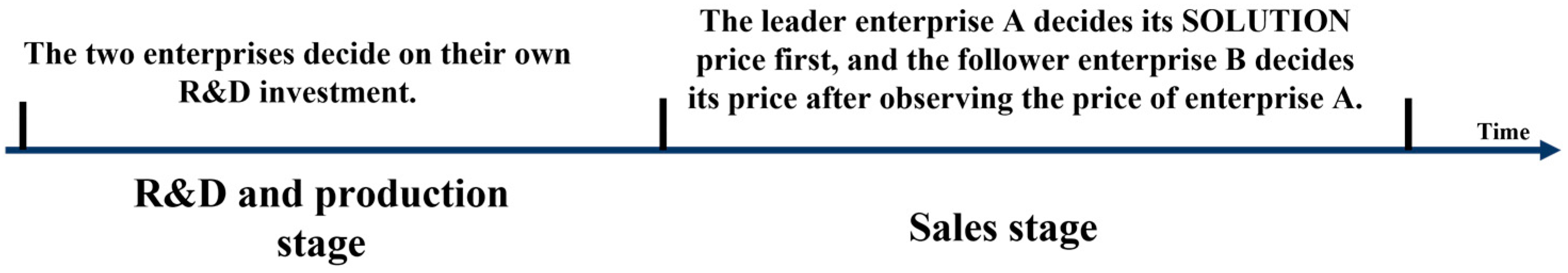

- Under the framework of Stackelberg game, both enterprises simultaneously make decisions regarding their R&D investments based on their own profits (or total profits).

- The Notations part lists the notations and corresponding description.

3.2. Model Building

4. Model Solving

4.1. The Optimal Solution under the Non-Cooperative Strategy

4.2. The Optimal Solution under the Cooperative Strategy

4.3. Parameter Discussion

- Enterprises adopt a non-cooperative strategy during the R&D stage.

- 2.

- Enterprises adopt cooperative strategy during the R&D stage.

5. Results and Discussion

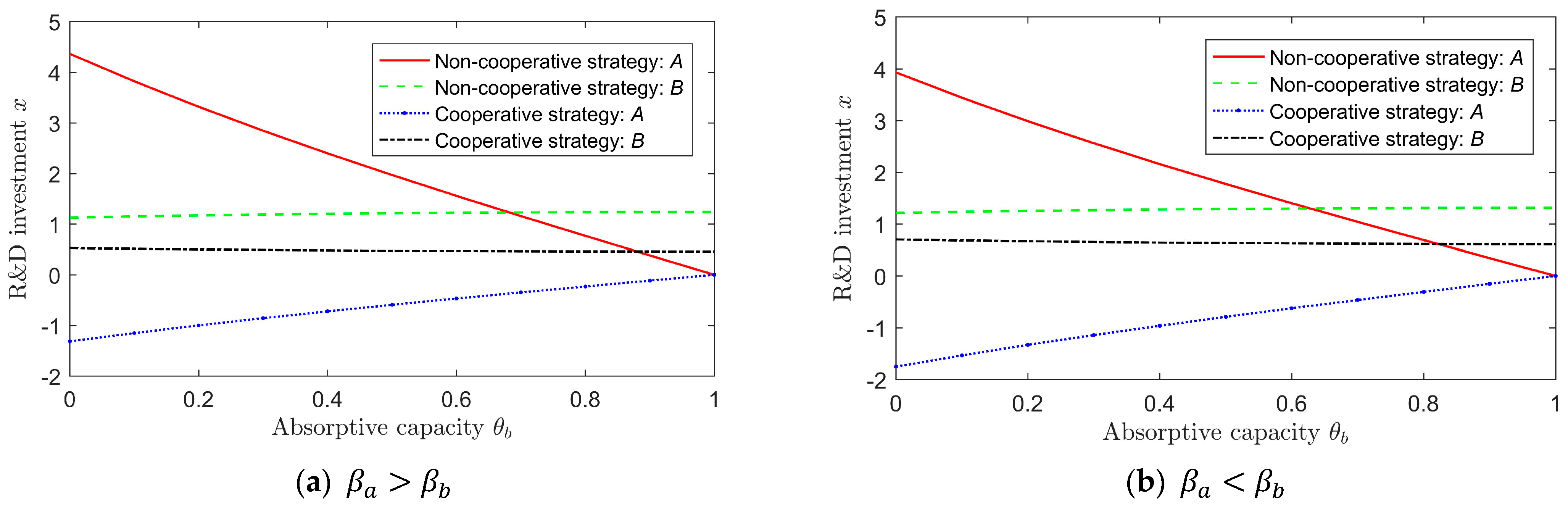

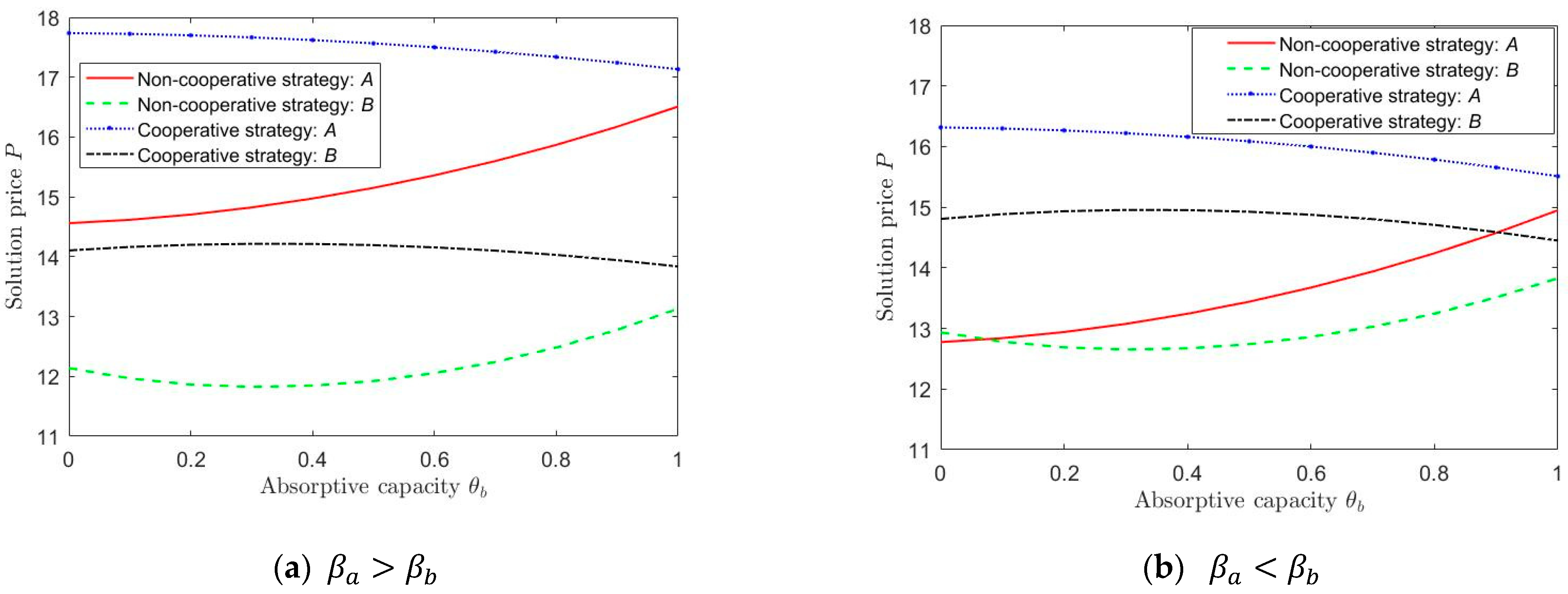

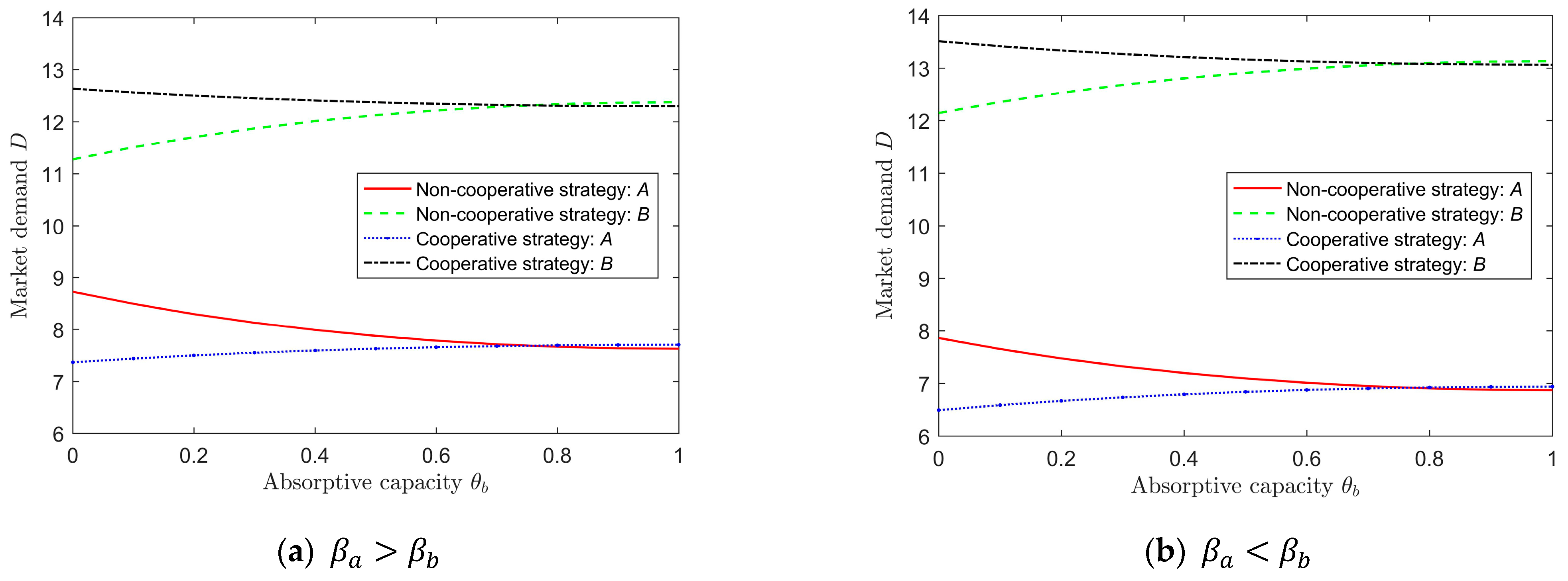

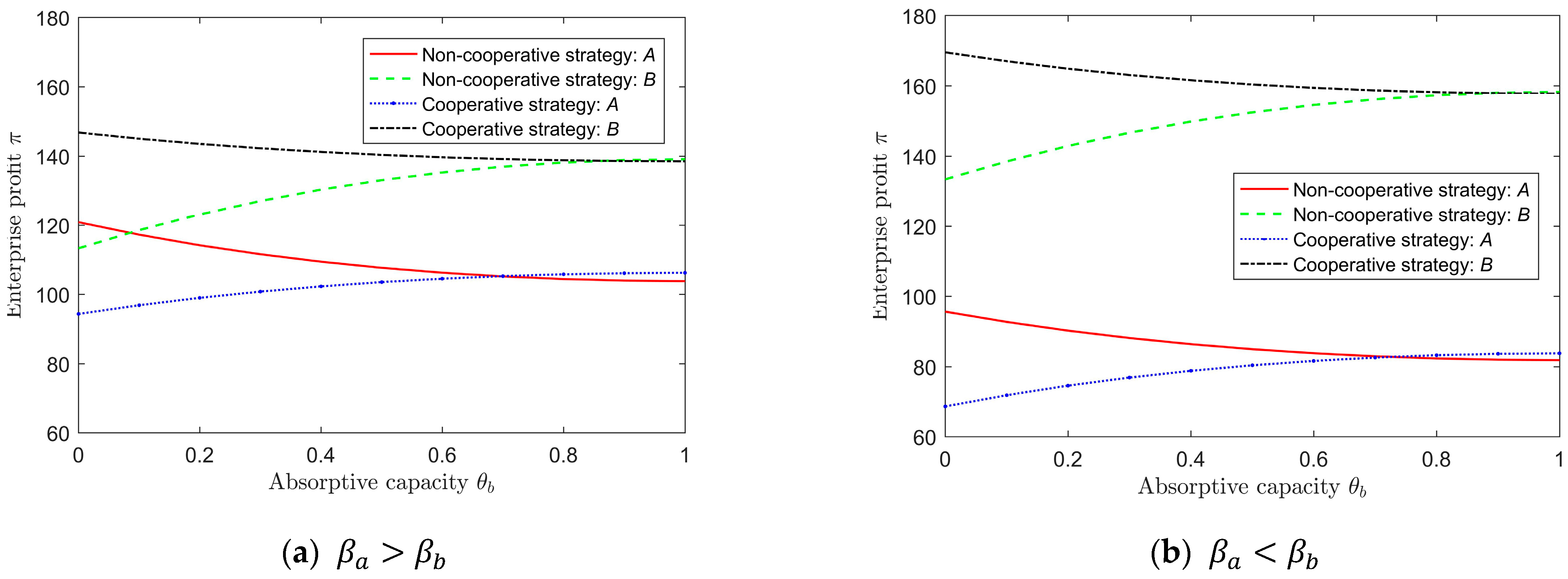

- When , we assume that the difference in customers’ quality preference for the two enterprises’ SOLUTIONs is relatively small, and we set

- When , there is a relatively large difference in customers’ quality preference for the two enterprises’ SOLUTIONs. Then, we set

6. Conclusions and Future Work

- Manufacturing enterprises should fully recognize the importance of learning and absorptive capabilities, which can supplement their current R&D capabilities.

- For the vulnerable follower enterprises which are typically limited by factors such as personnel, capital and R&D capabilities, diversifying their R&D strategies can be crucial. This can include outsourcing R&D, integrating with the industrial chain, or collaborating with industry, university, and research partners. These approaches can serve as effective ways for these enterprises to seek external R&D cooperation.

- Increasing R&D investment can undoubtedly bring lucrative benefits to strong follower enterprises. However, it is unwise for enterprises to blindly pursue product-service upgrading and ignore customers’ feelings about product service. Enterprises should make efforts to improve the quality and publicity of their product service in order to obtain superior customers’ recognition and loyalty.

- While the cooperative R&D strategy can enhance the follower enterprise’s relative profit advantage, its actual effect is minimal. Similarly, the non-cooperative R&D strategy does not effectively promote the profits and market demand of the follower enterprise, but it does have a significant incentive effect on enterprise R&D investment. This approach enables effective accumulation during the R&D stage, and enables control over costs incurred during the production process and service design. In contrast, the benefits of adopting a non-collaborative R&D strategy outweigh the disadvantages. Therefore, enterprises should carefully consider their R&D strategies and choose the most suitable approach based on their own circumstances, customers’ quality preferences, and market demand.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Notations

| Notation | Description |

| Fixed costs of an enterprise | |

| Demand for an enterprise’s SOLUTIONs | |

| Total profit of the two enterprises | |

| Price of the SOLUTIONs provided by an enterprise | |

| Total demand size for the SOLUTIONs provided by the two enterprises | |

| R&D investment scale of an enterprise | |

| Degree of customer’s quality preference for an enterprise’s SOLUTION | |

| R&D efficiency coefficient of an enterprise | |

| Absorptive capacity coefficient of an enterprise | |

| Cost coefficient of quality of and enterprise | |

| Profit of an enterprise’s SOLUTION | |

| Quality level of an enterprise |

References

- Liu, Q.; Geertshuis, S.; Grainger, R. Understanding academics’ adoption of learning technologies: A systematic review. Comput. Educ. 2020, 151, 103857. [Google Scholar] [CrossRef]

- Vendrell-Herrero, F.; Bustinza, O.F.; Opazo-Basaez, M. Information technologies and product-service innovation: The moderating role of service R&D team structure. J. Bus. Res. 2021, 128, 673–687. [Google Scholar]

- Paschou, T.; Rapaccini, M.; Adrodegari, F.; Saccani, N. Digital servitization in manufacturing: A systematic literature review and research agenda. Ind. Mark. Manag. 2020, 89, 278–292. [Google Scholar] [CrossRef]

- Grimpe, C.; Sofka, W.; Bhargava, M.; Chatterjee, R. R&D, marketing innovation, and new product performance: A mixed methods study. J. Prod. Innov. Manag. 2017, 34, 360–383. [Google Scholar]

- Hwang, B.-N.; Hsu, M.-Y. The impact of technological innovation upon servitization: Evidence from Taiwan community innovation survey. J. Manuf. Technol. Manag. 2019, 30, 1097–1114. [Google Scholar] [CrossRef]

- Guajardo, J.A.; Cohen, M.A.; Netessine, S. Service Competition and Product Quality in the U.S. Automobile Industry. Manag. Sci. 2016, 62, 1860–1877. [Google Scholar] [CrossRef]

- Saccani, N.; Visintin, F.; Rapaccini, M. Investigating the linkages between service types and supplier relationships in servitized environments. Int. J. Prod. Econ. 2014, 149, 226–238. [Google Scholar] [CrossRef]

- Ganek, A.; Kloeckner, K. An overview of IBM service management. IBM Syst. J. 2007, 46, 375–385. [Google Scholar] [CrossRef]

- Zhang, Z.; Liu, S.; Niu, B. Coordination mechanism of dual-channel closed-loop supply chains considering product quality and return. J. Clean. Prod. 2020, 248, 119273. [Google Scholar] [CrossRef]

- Basir, M.; Modding, B.; Kamase, J.; Hasan, S. Effect of service quality, orientation services and pricing on loyalty and customer satisfaction in marine transportation services. Int. J. Humanit. Soc. Sci. Invent. 2015, 4, 1–6. [Google Scholar]

- Taleizadeh, A.A.; Moshtagh, M.S.; Moon, I. Optimal decisions of price, quality, effort level and return policy in a three-level closed-loop supply chain based on different game theory approaches. Eur. J. Ind. Eng. 2017, 11, 486–525. [Google Scholar] [CrossRef]

- Nasib, N. The Role of Costumer Satisfaction in Mediating the Relationship Between Service Quality and Price on Costumer Loyalty. Enrich. J. Manag. 2021, 12, 400–411. [Google Scholar]

- Sharma, N.; Sahay, B.S.; Shankar, R.; Sarma, P.R.S. Supply chain agility: Review, classification and synthesis. Int. J. Logist. Res. Appl. 2017, 20, 532–559. [Google Scholar] [CrossRef]

- Vaittinen, E.; Martinsuo, M.; Ortt, R. Business customers’ readiness to adopt manufacturer’s new services. J. Serv. Theory Pract. 2017, 28, 52–78. [Google Scholar]

- Yu, M.; Debo, L.; Kapuscinski, R. Strategic waiting for consumer-generated quality information: Dynamic pricing of new experience goods. Manag. Sci. 2016, 62, 410–435. [Google Scholar]

- Wei, M.M.; Zhang, F. Recent research developments of strategic consumer behavior in operations management. Comput. Oper. Res. 2018, 93, 166–176. [Google Scholar]

- Permadi, A.; Silalahi, S. The Effect of Customer Experience and Customer Engagement Through Customer Loyalty on Sales Revenue Achievement at PT United Tractors. Emerg. Mark. Bus. Manag. Stud. J. 2021, 9, 1–17. [Google Scholar]

- Baskara, A.; Pranaditya, A. Customer Experience and Customer Engagement in Relationship with Customer Loyalty During Black Swan Events COVID-19. Indones. Interdiscip. J. Sharia Econ. 2022, 5, 481–495. [Google Scholar]

- Chuang, F.-M.; Morgan, R.E.; Robson, M.J. Customer and Competitor Insights, New Product Development Competence, and New Product Creativity: Differential, Integrative, and Substitution Effects. J. Prod. Innov. Manag. 2015, 32, 175–182. [Google Scholar] [CrossRef]

- Grünfeld, L.A. Multinational Production, Absorptive Capacity, and Endogenous R&D Spillovers. Rev. Int. Econ. 2006, 14, 922–940. [Google Scholar]

- Yu, X.; Lan, Y.; Zhao, R. Strategic green technology innovation in a two-stage alliance: Vertical collaboration or co-development? Omega 2021, 98, 102116. [Google Scholar] [CrossRef]

- D’Aspremont, C.; Jacquemin, A. Cooperative and noncooperative R & D in duopoly with spillovers. Am. Econ. Rev. 1988, 78, 1133–1137. [Google Scholar]

- Wang, A.; Zhang, Q.; Zhao, S.; Lu, X.; Peng, Z. A review-driven customer preference measurement model for product improvement: Sentiment-based importance—Performance analysis. Inf. Syst. E-Bus. Manag. 2020, 18, 61–88. [Google Scholar] [CrossRef]

- Tripsas, M. Customer preference discontinuities: A trigger for radical technological change. Manag. Decis. Econ. 2008, 29, 79–97. [Google Scholar] [CrossRef]

- Chen, J.; Sun, C.; Wang, Y.; Liu, J.; Zhou, P. Carbon emission reduction policy with privatization in an oligopoly model. Environ. Sci. Pollut. Res. 2023, 30, 45209–45230. [Google Scholar] [CrossRef]

- Li, T.; Sethi, S.P. A review of dynamic Stackelberg game models. Discret. Contin. Dyn. Syst. B 2017, 22, 125. [Google Scholar] [CrossRef]

- Stone-Romero, E.F.; Stone, D.L.; Grewal, D. Development of a multidimensional measure of perceived product quality. J. Qual. Manag. 1997, 2, 87–111. [Google Scholar] [CrossRef]

- Ghotbabadi, A.R.; Feiz, S.; Baharun, R. Service Quality Measurements: A Review. Int. J. Acad. Res. Bus. Soc. Sci. 2015, 5, 267–286. [Google Scholar] [CrossRef]

- El Ouardighi, F.; Kogan, K. Dynamic conformance and design quality in a supply chain: An assessment of contracts’ coordinating power. Ann. Oper. Res. 2013, 211, 137–166. [Google Scholar] [CrossRef]

- Han, X.; Liu, X. Equilibrium decisions for multi-firms considering consumer quality preference. Int. J. Prod. Econ. 2020, 227, 107688. [Google Scholar] [CrossRef]

- Chandrasekhar, N.; Gupta, S.; Nanda, N. Food delivery services and customer preference: A comparative analysis. J. Foodserv. Bus. Res. 2019, 22, 375–386. [Google Scholar] [CrossRef]

- Kowalkowski, C.; Gebauer, H.; Kamp, B.; Parry, G. Servitization and deservitization: Overview, concepts, and definitions. Ind. Mark. Manag. 2017, 60, 4–10. [Google Scholar] [CrossRef]

- Lambertini, L.; Orsini, R. Quality improvement and process innovation in monopoly: A dynamic analysis. Oper. Res. Lett. 2015, 43, 370–373. [Google Scholar] [CrossRef]

- Luo, J.; Guo, Y. Research on value creation mechanism of manufacturing enterprises service innovation under given product technology. Oper. Res. Manag. Sci. 2022, 31, 225–231. [Google Scholar]

- Safitri, V.A.D.; Anggara, B. Factors that affect the company innovation. In II. In Traders Uluslararası Ticaret Kongresi Kongre Kitabı the Second in Traders International Conference on International Trade Conference Book; Hiper Yayın: Istanbul, Turkey, 2019. [Google Scholar]

- Aschhoff, B.; Schmidt, T. Empirical evidence on the success of R&D cooperation—Happy together? Rev. Ind. Organ. 2008, 33, 41–62. [Google Scholar]

- Belderbos, R.; Carree, M.; Lokshin, B.; Fernández Sastre, J. Inter-temporal patterns of R&D collaboration and innovative performance. J. Technol. Transf. 2014, 40, 123–137. [Google Scholar]

- Li, C.; Liu, Q.; Zhou, P.; Huang, H. Optimal innovation investment: The role of subsidy schemes and supply chain channel power structure. Comput. Ind. Eng. 2021, 157, 107291. [Google Scholar] [CrossRef]

- Gao, L.; Guo, L.; Orsdemir, A. Dual-Channel Distribution: The Case for Cost Information Asymmetry. Prod. Oper. Manag. 2020, 30, 494–521. [Google Scholar] [CrossRef]

- Iqbal, N.; Naeem, M.A.; Suleman, M.T. Quantifying the asymmetric spillovers in sustainable investments. J. Int. Financ. Mark. Inst. Money 2022, 77, 101480. [Google Scholar] [CrossRef]

- Lu, J.-C.; Tsao, Y.-C.; Charoensiriwath, C. Competition under manufacturer service and retail price. Econ. Model. 2011, 28, 1256–1264. [Google Scholar] [CrossRef]

- Wang, Y.; Niu, B.; Guo, P. On the Advantage of Quantity Leadership When Outsourcing Production to a Competitive Contract Manufacturer. Prod. Oper. Manag. 2013, 22, 104–119. [Google Scholar] [CrossRef]

- Smith, K.G.; Collins, C.J.; Clark, K.D. Existing knowledge, knowledge creation capability, and the rate of new product introduction in high-technology firms. Acad. Manag. J. 2005, 48, 346–357. [Google Scholar] [CrossRef]

- Poyago-Theotoky, J. Research joint ventures and product innovation: Some welfare aspects. Econ. Innov. New Technol. 1997, 5, 51–73. [Google Scholar] [CrossRef]

- Engelman, R.M.; Fracasso, E.M.; Schmidt, S.; Zen, A.C. Intellectual capital, absorptive capacity and product innovation. Manag. Decis. 2017, 55, 474–479. [Google Scholar] [CrossRef]

- Lin, C.; Tan, B.; Chang, S. The critical factors for technology absorptive capacity. Ind. Manag. Data Syst. 2002, 102, 300–308. [Google Scholar] [CrossRef]

- Sadeghi Asl, R.; Bagherzadeh Khajeh, M.; Pasban, M.; Rostamzadeh, R. A systematic literature review on supply chain approaches. J. Model. Manag. 2022, 18, 372–415. [Google Scholar] [CrossRef]

| Entry | Equilibrium Solution |

|---|---|

| Entry | Equilibrium Solution |

|---|---|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, S.; Zhou, S.; Guan, H.; Zhang, Q.-M.; Qin, T.; Lin, J. Research on Enterprise R&D Strategy of Product-Service Innovation Guided by Quality Preference. Sustainability 2023, 15, 9004. https://doi.org/10.3390/su15119004

Liu S, Zhou S, Guan H, Zhang Q-M, Qin T, Lin J. Research on Enterprise R&D Strategy of Product-Service Innovation Guided by Quality Preference. Sustainability. 2023; 15(11):9004. https://doi.org/10.3390/su15119004

Chicago/Turabian StyleLiu, Shangwen, Shijie Zhou, Hao Guan, Qian-Ming Zhang, Tong Qin, and Jiarong Lin. 2023. "Research on Enterprise R&D Strategy of Product-Service Innovation Guided by Quality Preference" Sustainability 15, no. 11: 9004. https://doi.org/10.3390/su15119004

APA StyleLiu, S., Zhou, S., Guan, H., Zhang, Q.-M., Qin, T., & Lin, J. (2023). Research on Enterprise R&D Strategy of Product-Service Innovation Guided by Quality Preference. Sustainability, 15(11), 9004. https://doi.org/10.3390/su15119004