3.2. Index Calculation

For static financing efficiency, Data Envelopment Analysis (DEA) is a multi-objective decision analysis method for calculating the relative effectiveness of decision-making units. It is proposed by Charnes et al. [

33] based on the concept of “relative efficiency”. DEA is a non-parametric systematic analysis method for relative efficiency. At present, DEA is widely used in the field of financing efficiency, and it has achieved many important research milestones. Pang and Gai [

34] study the financing efficiency of small and medium-sized enterprises based on the DEA method. Jin et al. [

35] use the DEA method to measure the financing efficiency of listed companies in the energy conservation and environmental protection industry. Yin et al. [

36] study the impact of social networks on corporate financing efficiency. DEA has the advantages of being easy to understand and easy to apply. Data Envelopment Analysis (DEA) is a method to deal with multi-objective decision-making problems with multiple inputs and outputs. Therefore, this article chooses the DEA method for calculating financing efficiency.

In this study, the DEA method is used to measure financing efficiency in high-tech manufacturing. Assuming there are

n decision-making units (DMU), each evaluated object has

m types of inputs and s types of outputs. The input and output vectors of each decision-making unit (

) are represented by

X and

Y, respectively:

The input vector is

, where

represents the amount of the

th decision-making unit’s investment in the

th input type. Similarly,

, and

represents the amount of output of the

th DMU for the

th output type. In the selection of radial distance and non-radial distance, this paper refers to relevant literature on financing efficiency measurement. At the same time, the BCC and CCR models for radial distance are classic models for measuring efficiency. Therefore, we use radial distance to measure efficiency. Meanwhile, the sample size of this paper is relatively large, with a total of 496 enterprises and 3170 valid samples obtained, so it can effectively avoid the problem of small sample bias. The CCR model for measuring the static financing efficiency of listed high-tech manufacturing companies is as follows:

On the basis of the CCR model, the BCC model, with variable returns to scale in financing for companies, can be obtained by incorporating the condition of variable returns to scale.

In Equations (3) and (4), represents the non-Archimedean infinitesimal, represents the weights, represents input redundancy, and represents output insufficiency. The optimal solution in the model represents the efficiency value of the decision-making unit, with a larger indicating a more reasonable input–output ratio and higher financing efficiency for the company. In the estimation of the model, output orientation is adopted. The DEA–CCR model in Equation (3) can be used to obtain the comprehensive financing efficiency of the company, and the DEA–BCC model in Equation (4) can calculate the pure technical efficiency of the company’s financing. The scale efficiency value can be further calculated based on the comprehensive efficiency value and the pure technical efficiency value.

For Dynamic Financing Efficiency, the dynamic trend of financing efficiency in high-tech manufacturing is solved using the DEA–Malmquist model. The DEA–CCR and DEA–BCC models reflect the efficiency values of decision-making units in the current period, but the production technology level of enterprises will change over time, and the frontier will also change in different periods. The Malmquist index is widely used for evaluating the dynamic efficiency. Campisi et al. [

37,

38] calculate the MPI to measure the evolutions of the knowledge-intensive business services’ productivities. Giacalone et al. [

39] evaluate the dynamic efficiency of the Italian judicial system using DEA-based Malmquist productivity indexes. Yan [

40] uses the Malmquist productivity index model to measure the dynamic efficiency of China’s rural water conservancy investment. Song et al. [

41] employ the Malmquist productivity index model to measure the dynamic efficiency of China’s tradable green certificate market. Jin et al. [

35] use the DEA–Malmquist method to measure the dynamic financing efficiency of listed companies in the energy conservation and environmental protection industry.

The dynamic financing efficiency lies in comparing the changes in efficiency values between adjacent periods. Considering that the external environment faced by enterprises in adjacent phases is relatively similar, the comparability of financing efficiency is higher. Meanwhile, referring to current literature on dynamic financing efficiency, we ultimately chose to use traditional methods to calculate the dynamic financing efficiency. The basic idea of the Malmquist index is to use one set of isoquant curves as a reference set, when comparing efficiency values at different times, and to measure the changes in input–output productivity by comparing distance function ratios at different times. Its specific expression is as follows.

Among them, is the Malmquist index, which represents the change in total factor productivity of input and output from period to . The D represents the matrix of inputs and outputs, and represent the output vectors of period and , and and represent the input vectors of period and .

represents the efficiency change index (), which is the change in static comprehensive efficiency. represents the scale efficiency change index, represents the pure technical efficiency change index, and represents the technical progress efficiency index. The Malmquist index can be decomposed into the comprehensive efficiency change index and the technical progress efficiency index, where the former reflects the speed of catching up to the production frontier curve from period to , that is, the change of financing efficiency, and it can be further decomposed into the scale efficiency change index and the pure technical efficiency change index.

If , it indicates that the financing efficiency of high-tech manufacturing is improved and enhanced; if , it indicates that the financing efficiency of high-tech manufacturing is deteriorating and worsening. The index, index, index, and index, if any of them are greater than 1, indicate that the change of the index is conducive to the improvement of dynamic financing efficiency. If they are less than 1, they indicate that the index decreases dynamic financing efficiency.

Financing efficiency refers to the ability of an enterprise to use funds at as low of a cost as possible and fully utilize the funds to create value, which is a manifestation of the ability of an enterprise to create value with funds. The level of financing efficiency is influenced by two factors: the efficiency of fund inflow and the efficiency of fund allocation. Therefore, the selection of financing efficiency indicators needs to consider the accessibility of corporate financing, financing costs, financing risks (operating debt capacity, creditor interest protection level, etc.), profitability, development capability, operational ability, etc.

From the perspective of financing availability, to some extent, the size of a company can reflect the level of collateral for corporate loans and the size of available financing. The financing cost reflects the cost that a company needs to spend on production and operation, and it reflects the company’s ability to raise funds and use them. Financing risk characterizes the ability of a company to operate in debt and the degree of protection for creditors’ interests. The asset–liability ratio can reflect the capital structure of the company and better reflect the financing risk of the company. The development ability reflects the ability of an enterprise to gain competitiveness and achieve sustainable development in production and operation. Profitability reflects the ability of a company to utilize existing resources to obtain profits and its operational efficiency. The operation capability of an enterprise reflects the efficiency of enterprise asset management and the utilization rate of funds, and asset turnover can better measure the operation capability of an enterprise. Based on the above analysis, and referring to relevant research on financing efficiency [

3,

35,

42,

43], on the input indicators, financing availability, financing cost, and financing risk are represented by total assets, operating cost, and the asset–liability ratio, respectively. On the output indicators, the development capacity, profitability, and operating capacity are expressed in operating income, return on assets, and asset turnover, respectively. The financing efficiency input–output indicators constructed in this paper are shown in

Table 1.

On the treatment of the outlier, before the calculation of financing efficiency, truncation was performed on all input–output variables at the 1% and 99% levels to eliminate the impact of outliers on the model. Inflation may affect the financial indicators of enterprises. During the sample observation period, 2013–2020, the average growth rate of the CPI index was 1.88%. It can be seen that, during the sample observation period, the inflation rate is relatively low and has little impact on financial data. Secondly, from the perspective of impact of inflation on the production and operation of enterprises, all enterprises face the same inflation. It can be seen that the impact of inflation is systemic. Therefore, inflation has a relatively small impact on the calculation of financing efficiency in this paper. To ensure that all input and output indicators in the data envelopment (DEA) model are positive, and to eliminate the difference in scale between the various indicators, we use a data standardization formula to normalize all input and output indicators, which transforms the original data of each input and output indicator into the [1, 100] interval.

3.3. Typical Case Analysis

3.3.1. Analysis of Financing Efficiency Based on DEA Model

In general, if the comprehensive efficiency value of a decision-making unit (DMU) is 1, it is considered an effective DMU, indicating that the DMU is operating optimally. When the comprehensive efficiency value is less than 1, there are two situations: if the value is between 0.9 and 1, it is considered a mild DEA inefficiency, while if it is significantly less than 0.9, it is considered a severe DEA inefficiency. The comprehensive efficiency evaluation results are shown in

Table 2. From 2013 to 2020, the maximum number of effective financing companies is 37 in 2014, and the minimum is 17 in 2020, accounting for 7.43% and 3.41%, respectively. The average proportion of companies with comprehensive efficiency values greater than or equal to 0.8 is 19.7%. The average maximum and minimum comprehensive efficiency values are 0.716 and 0.652 in 2019 and 2013, respectively, with an overall mean of 0.682 over the observation period. These results indicate that the financing efficiency of China’s listed high-tech manufacturing companies is generally low from 2013 to 2020, showing a slow upward trend.

The pure technical efficiency reflects the level of management and internal governance ability of an enterprise in terms of resource allocation and investment efficiency. From 2013 to 2020, the maximum number of listed high-tech manufacturing companies with a pure technical efficiency value of 1 is 61 in 2013, while the minimum is 26 in 2020, accounting for 12.25% and 5.22% respectively. The proportion of companies with a pure technical efficiency value greater than or equal to 0.8 is 35.79%. The maximum value of pure technical efficiency is 0.794 in 2017, while the minimum value is 0.735 in 2014. The overall evaluation results are presented in

Table 3. The findings suggest that the majority of listed high-tech manufacturing companies in China showed relatively low pure technical efficiency from 2013 to 2020, and they exhibited a slow and minor fluctuating development trend, highlighting the need for improvement in their management level and internal governance ability.

The scale efficiency reflects the impact of the financing and investment scale of the enterprise on its overall performance. During the period from 2013 to 2020, the maximum number of companies with a scale efficiency value of 1 is 147 in 2013, while the minimum is 45 in 2018, accounting for 29.52% and 9.04%, respectively. The proportion of companies with a scale efficiency value greater than or equal to 0.8 is 84.71%. The maximum value of scale efficiency is 0.936 in 2020, and the minimum is 0.871 in 2016. The overall evaluation results are presented in

Table 4. The findings suggest that the listed high-tech manufacturing companies in China demonstrated a relatively high scale efficiency from 2013 to 2020, with a substantial financing and investment scale, and they displayed a positive trend of continuous improvement.

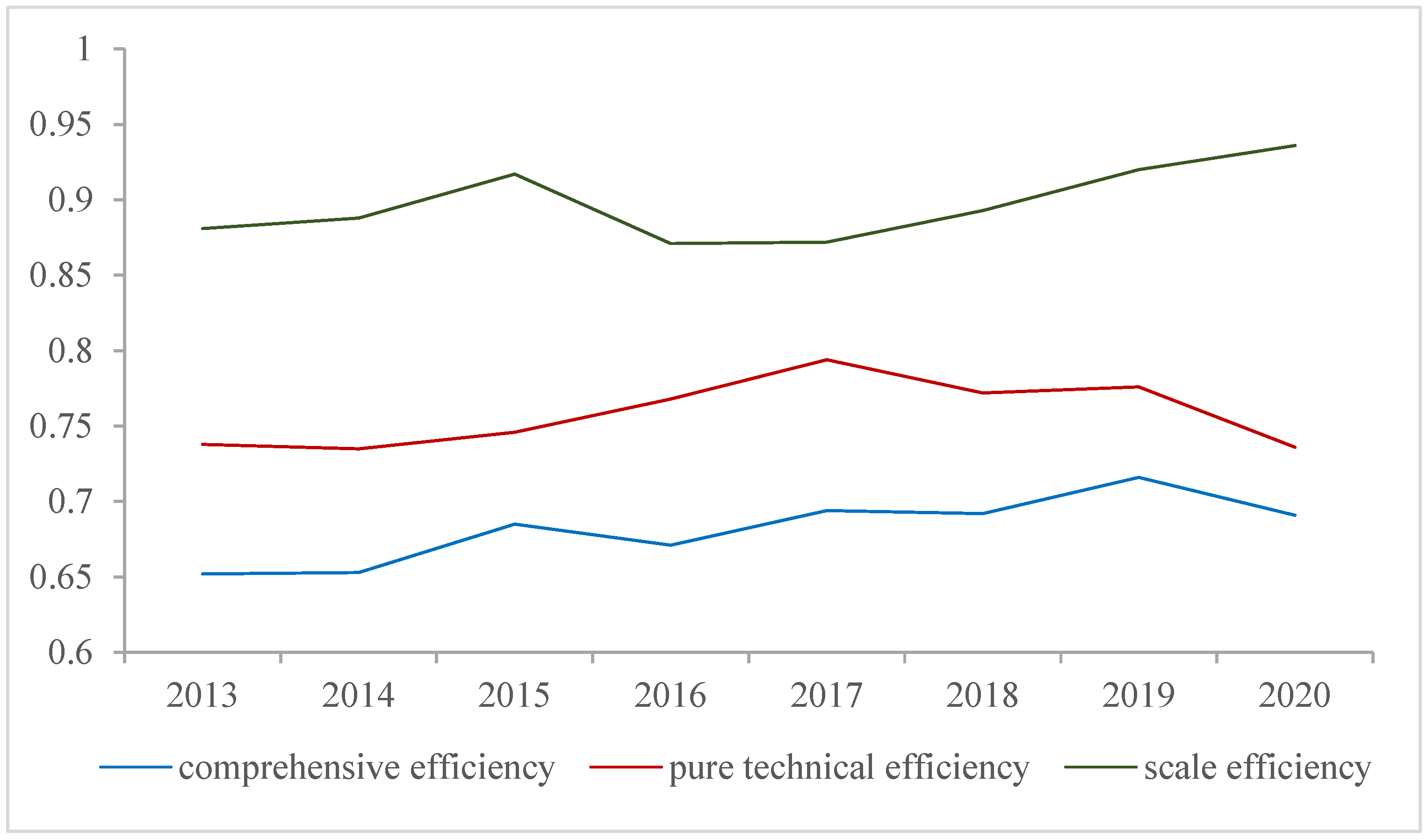

The trend in the comprehensive efficiency of high-tech manufacturing, as well as its further decomposition into pure technical efficiency and scale efficiency, is depicted in

Figure 1. In general, the financing efficiency of listed high-tech manufacturing companies in China is relatively low, with a mean comprehensive efficiency of only 0.682 from 2013 to 2020, a mean pure technical efficiency of 0.758, and a mean scale efficiency of 0.897. Furthermore, the scale efficiency is consistently higher than the pure technical efficiency throughout the observation period. This indicates that China’s high-tech manufacturing sector has a relatively low capacity to adjust the input–output structure, to achieve the maximum financing efficiency, without taking into account the scale factor. However, the increasing trend in scale efficiency suggests a strong financing support for high-tech manufacturing in China to some extent.

3.3.2. A Dynamic Analysis of Financing Efficiency Based on the DEA-Malmquist Model

This study employs the DEA–Malmquist model to measure the dynamic changes in the financing efficiency of listed high-tech manufacturing companies in China from 2013 to 2020. Compared with static analysis, this approach provides a better understanding of changes over time. During the observation period, the comprehensive efficiency change index, pure technical efficiency change index, and scale efficiency change index are 1.028, 1.012, and 1.015, respectively, and they are all greater than 1. The comprehensive efficiency change is influenced by both pure technical efficiency and scale efficiency, with the latter having a higher impact (1.015 > 1.012), which is consistent with previous research findings.

The Malmquist index, a measure of dynamic financing efficiency, was 0.996 from 2013 to 2020, indicating slow improvement in financing efficiency in China’s high-tech manufacturing industry. However, the averages of comprehensive efficiency change index, pure technical efficiency change index, and scale efficiency change index were all greater than 1, suggesting a positive impact on financing efficiency in the industry. The average technical progress index was slightly lower than 1, with values of 1.013 and 1.015 in the periods of 2015–2016 and 2019–2020, respectively.

The annual changes analysis reveals that the improvement of corporate financing efficiency is fluctuating during the observation period. The Malmquist index was greater than or equal to 1 in the 2013–2014, 2015–2016, and 2018–2019 periods, but it was less than 1 in other years. The decrease in production technology explains the lower Malmquist index in the periods of 2014–2015 and 2016–2017. The decrease in production technology and pure technical efficiency explains the lower Malmquist index in the 2017–2018 period. The decrease in comprehensive financing efficiency was the main factor in the 2019–2020 period. These findings suggest that, while the financing efficiency of China’s high-tech manufacturing industry is continuously improving, the overall dynamic financing efficiency remains relatively low (

Table 5).

Based on the analyses presented above, the following findings can be highlighted. Firstly, the financing efficiency of China’s high-tech manufacturing industry is relatively low, with the scale efficiency being higher than the pure technical efficiency. The mean values of comprehensive efficiency, pure technical efficiency, and scale efficiency from 2013 to 2020 are 0.682, 0.758, and 0.897, respectively. The proportion of enterprises with efficiency values greater than or equal to 0.8 is 19.7%, 35.79%, and 84.71%, respectively. The mean value of the scale efficiency is the highest, followed by the pure technical efficiency, and the mean value of comprehensive efficiency is the lowest. This indicates that the high-tech manufacturing industry needs to improve its management level and internal governance capacity to optimize resource allocation and investment efficiency, and to a certain extent, it presents an extensive development mode. However, relevant policies that favor high-tech manufacturing, such as credit financing, have promoted the improvement of scale efficiency.

Secondly, the financing efficiency of China’s high-tech manufacturing industry is in a fluctuating and continuously improving state. From 2013 to 2020, the mean value of the Malmquist index was 0.996, the mean value of the comprehensive efficiency change index was 1.028, and the mean value of the technical progress index was 0.973. The Malmquist index was greater than or equal to 1 in the 2013–2014, 2015–2016, and 2018–2019 periods, but it was less than 1 in other years. These indicate that the financing efficiency is fluctuating during the observation period. China’s high-tech manufacturing industry needs to work towards improving its overall dynamic financing efficiency by further enhancing technical progress and optimizing resource allocation.