Abstract

Rail operators are developing their own Mobility-as-a-Service (MaaS) applications for mobility management, integrating all the transport links for door-to-door intermodal journeys. In this context, this paper analyses the main challenges railway operators face when implementing their new MaaS applications on a national scale, analysing and evaluating the factors influencing the successful implementation of MaaS in cities with high-speed rail services. These factors are related directly to the adaptation of MaaS services to different geographies, from large metropolitan areas to small cities located in rural environments. The differences among all the HSR cities in Spain are related to both socioeconomic and transport systems’ variables. Smaller cities are generally in a more rural/suburban environment, with higher percentages of aged and illiterate inhabitants, who are much more vulnerable to the digital divide. In addition, these areas present very few and/or inefficient public transport options, and practically non-existent shared mobility services, largely limiting the possibility of competing for private car mobility. Our paper’s analysis of all these factors fills a gap in the literature and opens the debate about different approaches and transport policies that rail operators could adopt when entering the MaaS environment.

1. Introduction

The emergence of new mobility options in our cities offers a new approach for transport policies: providing better service to users for the whole door-to-door transport chain. In addition, new shared mobility services base their working models on mobile phone applications that allow users to select a certain transport service, check the route, and pay the ticket. However, travelling options are increasing rapidly and users find it difficult to navigate through all the information sources, applications, ticketing and journey planners. The concept of Mobility-as-a-Service (MaaS) is supported by this need for a single platform that integrates the supply of transport services in a user-friendly way [1]. Rail operators are starting to introduce themselves in this MaaS market, which is oriented towards easing users’ experience. Until now, rail operators in the MaaS ecosystem have played the role of transport operators, who try to expand their market share by providing access to their data and services (timetables, ticketing, etc.). However, in recent years, main international rail operators are starting to develop their own apps in their ambition to become MaaS providers.

The need to enter this MaaS market is due mainly to the changing environment generated by the new sustainable and so-called ‘smart’, transport policies being adopted globally. Focusing on the European context, the recent “Sustainable and Smart Mobility Strategy” put forward by the European Commission offers guidelines to achieve the objectives of the European Green Deal, with sustainability and emission reductions identified as the most serious challenges facing the transport sector. In this sense, regarding inter-urban mobility, there are different initiatives showing a clear interest and commitment to prioritise rail use and reduce flights and private vehicle trips, when possible (‘EU 2021 Rail Corridor Initiative’, for instance), which is in line with several official reports of the European Environment Agency (Reports: “Transport and environment report 2020—Train or plane?” and “Focusing on environmental pressures from long-distance transport”, among others)0F. On the other hand, at the urban and metropolitan level, strategies are in place to prioritise active and shared mobility and public transport in attempts to minimise the use of private vehicles (revision of the ‘Urban Mobility Package’ of 2013, among others). To address this modal change at different scales, new approaches have been proposed for the promotion of public transport, improving the quality of intermodal trips. In this context, the literature has evaluated the factors influencing the general users’ satisfaction with transfers and urban interchanges. There are different profiles of users based on their willingness to transfer when using public transport services. Workers/employees are less sensitive to transfers, as they are more focused on reliability and travel time aspects, while seniors are very sensitive to transfer and usually prefer direct services [2]. In addition, some studies highlight the information available and transfer conditions as key factors [3], being mature users the most critical with the information received [4]. Travellers’ perception and preferences about intermodal trips and transfers highlight the need for new strategies to offer a better service to users for door-to-door travel. These trends are closely linked to new strategies related to smart mobility and digitalisation. The emergence of new shared mobility services is driving the implementation and development of ‘smart’ technologies in medium-large cities, as they base their business models on mobile phone applications that provide users with a multitude of services and options to manage trips. These strategies, oriented toward a more sustainable, intermodal, and smart mobility are incorporating MaaS applications in core policies.

In addition, and especially in relation to high-speed rail (HSR) systems in Europe, some of the most important markets worldwide are liberalising the exploitation of some HSR lines to competitors (Until now, railways operation in these countries has been carried out by public transport operators)1F. In this context, national public operators are developing different strategies to gain customers’ loyalty: for instance, they are implementing low-cost services [5] in some HSR lines that are in heavy demand, and they are also offering more competitive ticket prices in traditional HSR services, with large discounts for buying tickets in advance [6]. In this new scenario, digitalising customer experience through MaaS approaches is a key strategic move being considered by Train Operating Companies (TOCs) to attract users, not only in the forthcoming rail market liberalisation, but also in modal share competition (both in local and long-distance scales). In this sense, many TOCs worldwide are following a similar strategy: to be main actors in the MaaS environment by offering an open platform for all transport operators that would like to offer their services. In fact, in this context, the SNCF president and managing director, Guillaume Pepy, stated recently:

“We are convinced that to offer more trains, we need to offer more than trains. We need to be able to offer our travellers the possibility to go from departure point to destination, by combining sustainable modes of transport with a railway backbone”.

Alexandre Viros, Managing Director of e.Voyageurs SNCF, agreed:

“We need to offer a solution that takes our customers from point A to point B as easily and seamlessly as a car. That’s our goal for Assistant SNCF”

As a global strategy, TOC’s MaaS apps would not be limited to train trips but would also include all the links of the door-to-door trip, especially the first and last mile segments of the journey. Furthermore, train operators would be able to offer regional/local trips not involving rail transport in any of the links. This predisposition for the integration of all transport options added to the national scope is a key aspect that could tip the scales in favour of TOCs as MaaS providers. However, although there are many opportunities, TOCs must also measure the threats and evaluate their competence in trying to offer a product that differentiates them from the rest. When developing their own applications, TOCs should not only adapt and orientate themselves towards the MaaS ecosystem but also take advantage of its unique offerings in journey planning and consider the singularities of different cities and the populations they are supposed to serve.

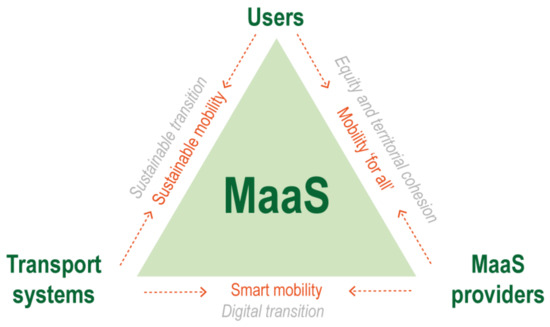

This paper aims to present and evaluate the main challenges railway operators face when implementing their new MaaS applications on a national scale and focus particularly on the factors that influence success of MaaS implementation in all those cities with long-distance rail services, especially high-speed rail. These factors will be related directly to different travellers’ needs, including urban and long-distance travellers. They will also be related to the adaptation of MaaS services to different geographies, from large metropolitan areas to small cities located in rural environments. These cities present clear differences in terms of socioeconomic levels and urban mobility options available (influencing accessibility in the first and last mile), which must be taken into account for the success of these new applications. Therefore, the scientific proposal of this paper focuses on a re-evaluation of the three key pillars of MaaS implementation—users, transport systems and providers [7]—from the national scale and the perspective of long-distance mobility. The role of MaaS providers, HSR operators in our case, is directly influenced by users’ socioeconomic profile and travel needs and the availability and efficiency of alternative transport modes trying to address the main objectives and challenges posed by ’sustainable’ and ‘smart’ mobility while maintaining transport equity/justice and territorial cohesion (Figure 1).

Figure 1.

’MaaS’ main pillars and its influence in the paper’s aim. Source: Authors.

2. MaaS in Different Travelling Scales: From Urban to Long-Distance Mobility

The concept of MaaS is relatively incipient, and its definition has not been clearly established. Examples of scientific studies on this topic started to appear only a few years ago. Some of the most commonly used definitions include keywords or core elements such as “mobility package”, “single platform”, “integration”, “cooperation”, “multimodal”, and “real-time” [8,9] Among all of them, the “scale” is not usually mentioned, and the first pilot projects of MaaS platforms have focused mainly on urban/metropolitan mobility experiences; that is, the local scale. Most famous experiences are UbiGo in Sweden and Whim in Finland. UbiGo was developed in 2013 in Gothemburg (Sweden) and represented the first pilot of what we now call MaaS. It was first oriented to carpooling, but soon it integrated public transport and taxi services [10]. On the other hand, Whim was launched in 2016 in Helsinki (Finland) as a pilot app of the MaaS global project. Nowadays, it includes many shared mobility options, public transport, and taxi services, and is expanding to other cities around the world. Although there are many other examples, these are the only two pilots in Europe that enable advanced integration and mobility packages: (1) Ticket integration, (2) Payment integration, (3) ICT integration, (4) Mobility package integration [1,11]. Independent of their level of integration, most of these MaaS projects are adapted to an urban context, and their business models focus mainly on the local scale. Although some of them, such as Whim, are already implemented in many cities, they are applied to an urban context. For instance, the UbiGo website (https://www.fluidtime.com/en/ubigo/, accessed on 15 June 2022) states: ‘We know that even if the MaaS market is global, the business will always be local.’ Even the MaaS Alliance, which is a public-private partnership establishing a common approach to MaaS in Europe and beyond, currently encompasses 116 members, among which there are only two national/international railway operators: JR East and RENFE (https://maas-alliance.eu/the-alliance/, accessed on 20 June 2022). The focus on urban mobility, especially in big metropolitan areas, is clear and, in many ways, justified: these bigger cities present much more private and public transport options to be integrated, and count on larger markets benefiting the development of shared mobility services. Also, as the development is made for a single geography—the city and its surroundings—MaaS implementation is easier.

However, the proliferation of national/international, long-distance transport operators in the MaaS market is changing the paradigm. Focusing on rail, there are currently MaaS initiatives in progress developed by rail operators of the largest HSR systems globally, although these initiatives are in their early stages. For instance, the Japanese Railway (JR) East presented their programme “Move Up” 2027, in which basic policies are oriented toward rehabilitating and revitalizing its railway services in many ways. One of these is to reinforce their network strength by focusing on technologies and information, making specific efforts in their new mobility linkage platform. They offer an easy-to-use application for seamless mobility, with all the necessary transportation information as well as purchasing and payment options for customers, enabling stress-free travel and a reduction in total travel time (https://www.jreast.co.jp/e/investor/moveup/pdf/all.pdf/, accessed on 23 June 2022). In Germany, the railway operator Deutsche Bahn (DB) has consolidated its existing mobile application, ‘DB Navigator’, into a multi-modal mobility platform by integrating other services already offered by DB apps: ‘Call a bike app’ to locate city bikes and ‘Flinkster app’ for car sharing and rental (https://fexco.com/fexco/news/how-maas-can-transform-the-rail-sector/, accessed on 20 June 2022). In addition, ‘RENFE’ (Spain) has just launched ‘Dócó’, and SNCF (France) has rebooted and reoriented its existing mobile phone application ‘L’assistant’ to include a MaaS approach.

This change on the MaaS scale and scope brings to light the need to evaluate the factors influencing the success of MaaS’ implementation. Until now, analyses on MaaS in the scientific literature have found that the focus has been mainly on conceptual approaches concerning the definition of MaaS and keys for its development [12,13,14] or ex-post empirical analysis about insights from particular experiences and case studies [15,16,17,18]. Both approaches—conceptual and empirical—highlight several factors in the success of MaaS’ implementation, but most of them focus on the urban/local scale. However, there is a paucity of literature highlighting the particularities that the integration of short and long-distance mobility could imply, especially when considering very different geographies. For instance, on the one hand, some of these studies have observed that coordinative mechanisms and cooperative agreements across modes are even more important for a successful public transport integration in this macro sector [19]. Some studies have identified different MaaS service combinations, including suburban and national and international MaaS, where collaboration among multiple operators from several business fields is key. On the other hand, focusing on users, some of these studies emphasise that ‘many people with various demands for mobility services live in smaller communities and rural areas where the availability of and accessibility to mobility services is usually entirely different and more limited than in urban areas’ [9]. These needs and demands are directly related to age and lifestyle stage. Vij et al., (2020) [20] surveyed 3985 geographically and demographically representative Australians nationwide and observed that older people, especially those with no children living at home, are much less prone to use MaaS services. Similarly, the use of MaaS services decreases notably in rural areas. The authors also revealed that local public transport, taxis and long-distance public transport are the most popular transport services for potential customers, outstripping the demand for car rentals [20]. In addition, even in urban environments, some differences are found in the potential adoption to MaaS services. López-Carreiro et al., (2021) [21] observed that, in general, most users show positive attitudes towards MaaS, although some differences are found among types of potential users: ”MaaS lovers” and “technological car-followers” are the clusters most inclined to adopt MaaS technologies’, while, “unimodal travellers”, which have a significant share of retired respondents, are the less interested. In summary, as it happens in the case of intermodal trips, the willing to adopt MaaS is mainly condition by age, distances travelled and the environment. Precisely, this long-distance travel reference could be a clear point of the paradigm shift around MaaS nowadays, because it refers to different key conceptual issues, such as the purpose of travel and distance travelled, and even user attitudes and behaviours [22]. There are some other key elements to be considered for a wider MaaS ecosystem, not only for urban but for suburban and rural territories, and long-distance mobilities, such as demographic characteristics or the public transport available, with a focus on social inclusion perspectives [23], as a reference to the three main pillars of MaaS (Figure 1). The present paper adopts this perspective, filling the gap in the literature and opening the debate about different approaches and transport policies that rail operators could adopt when entering the MaaS environment.

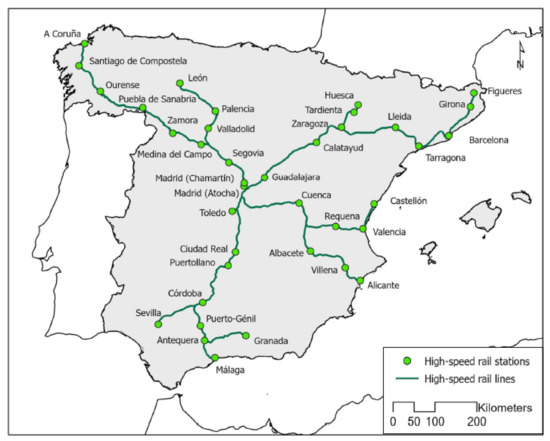

3. Case Study: The Spanish HSR System

The Spanish case study is of particular interest because it is the longest HSR network in Europe, encompassing more than 30 cities and offering diverse types of connections and services [6]. From its inception, the Spanish HSR system was oriented towards serving all the provincial capitals in the country in an attempt to achieve more cohesion and territorial development. Unlike other European countries, the cities served by HSR are not only large metropolitan areas and big cities, which imply higher traffic volumes, but also smaller intermediate cities, following a radiocentric scheme connecting them to Madrid, the capital of the country (Figure 2 and Table 1).

Figure 2.

Spanish high-speed rail network and cities involved. Source: Authors.

Table 1.

Cities groups, population and station location. Source: Authors.

In December 2020, the Spanish HSR market liberalisation was legally opened to competitors and started operating in May 2021 when the first SNCF low-cost train, OuiGO, ran on the Madrid—Barcelona line. For some years prior to liberalisation, RENFE had been changing its supply, and implemented a low-cost HSR service, AVLO (which started to run in June 2021). This was part of RENFE’s plan to reorient its customer policies to become more competitive and to promote customer loyalty. In this context and added to the new national strategies and transport policies in terms of digitalisation and smart mobility, one of RENFE’S main bets is the implementation of their own MaaS application ‘Dócó’. This MaaS project has been developed with the idea of including many other transport modes, both traditional public transport services, such as metro, commuting rail, and urban bus, and new shared-mobility options, such as scooters, bicycles, motosharing, etc. The implementation of ‘Dócó’ has been planned in different steps, starting with the main metropolitan areas, and extending the service to 26 cities of the rail network, although the level of integration will not be the same in all of them (https://www.docomobility.com/es, accessed on 12 February 2023).

Apart from RENFE’s MaaS project, in Spain most of the initiatives are local and they do not present a fully integrated platform [5]. More than MaaS applications, most of them are in the phase of journey planners, such as Moovit or Meep, although they are starting to explore the possibility of managing also the ticketing and payment. The only example promoted by a transport operator at a national scale is the one of ‘Alsa’, an interregional bus enterprise, and its application ‘Mobi4U’, but it still presents many limitations regarding the services offered. In addition, although it is a national project, it is finally implemented locally, in some cities of the country.

In general terms, as it is happening at European level, in Spain, the ‘Strategy for a Safe, Sustainable and Connected Mobility 2030’ identifies the digitalisation as a key factor, especially in the 5th Pillar about Intelligent Mobility. In this sense, the Strategy highlights the need for an active role of public bodies as open data providers and, especially, for promoting additional regulations to ease the MaaS development. However, at this stage, the strategy followed in Spain for the MaaS implementation is in the very first steps, mainly oriented to the creation of agreements between public bodies/institutions (mainly city councils at urban level), private enterprises for the technical and software support, and transport operators, both national and local.

4. Methodology: Empirical Procedures and Critical Analysis

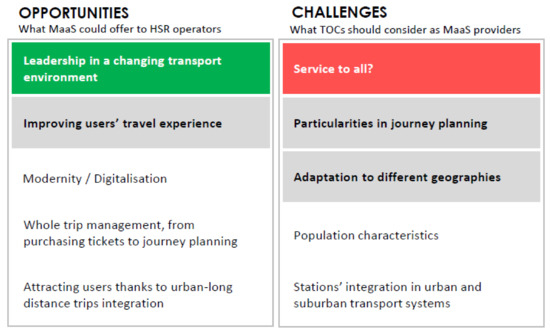

The implementation of TOCs MaaS applications has diverse implications involving diverse opportunities and challenges (Figure 3). On the one hand, what MaaS could offer to TOCs in a direct way, especially HSR operators, is related to the leadership in the above-mentioned changing environment, especially due to the increased competition resulting from liberalisation. In this sense, improving users’ travel experience is one of the main objectives of MaaS services. Modernising the rail system through digitalisation greatly facilitates the management of door-to-door trips. In addition, the strategy adopted by RENFE of including not only trips by rail but also those made by other means of transport, especially at urban/regional scales, could attract users to rail. On the other hand, apart from these direct opportunities, TOCs, as MaaS providers, evaluate aspects directly related to equity. The main challenge is the adaptation to different geographies. The final aim of TOCs MaaS applications is being implemented on a national scale, serving all the cities included in the HSR network. This implies that the new service must consider the characteristics of many different cities, in terms of population and available transport systems (see Figure 1, where users and transport systems are highlighted as MaaS’s main pillars). Also, the service should be adapted not only to these different geographies but also to the diverse requirements of journey planning, especially with regard to the differences between urban and long-distance mobility.

Figure 3.

Main opportunities and challenges for TOCs as MaaS providers. Source: Authors.

Methodologically, this paper first proposes an assessment and review of users’ satisfaction with current rail services, oriented mainly toward specific variables that could be related to MaaS in the future, evaluating potential improvements of users’ travel experience. Second, a critical evaluation of HSR medium/long-distance travellers’ behaviour and needs will be addressed, in comparison to urban mobility, which could determine the requirement for journey planning. Finally, a systematic analysis of the different geographies of cities included in the HSR network is carried out based on socioeconomic variables and the availability of local/regional public transport systems and shared-mobility options.

- Socioeconomic analysis: Methodologically, this analysis is carried out considering first, the near catchment area (up to 5 km from the station), and second, the far catchment area (from 5 to 30 km from the station). In assessing these areas, this paper tries to distinguish between urban and suburban/rural environments. Considering this approach, the variables analysed are: (1) The ‘total population’ which is the total number of inhabitants living in the area included in each of the catchment areas; (2) the population over 64 years old, which is represented as a percentage of the total population; (3) the population with no studies resulting from the sum of uneducated and illiterate people living in these areas, and also represented as a percentage of the total population; (4) the income value, referred to as the average net income per inhabitant; (5) the average density of dwellings, considering the number of dwellings per area of the cells of the populated grid included in each catchment area extension; (6) the ‘dwellings with internet’, represented as a percentage and calculated according to the weighted average of percentages of dwellings with internet of all the cells of the grid included in each catchment area extension. These socioeconomic variables are obtained from the data of INE (National Institute of Statistics of Spain), disaggregated for the 1 km × 1 km grid, and then processed using a GIS environment to obtain the values for each catchment area. The variables related to dwellings are calculated using Spanish Census data information, 2011.

- Local/regional transport systems’ analysis: Both public transport systems and shared mobility are analysed. In the case of traditional public transport, the transport modes evaluated are regional railway, commuting rail, metro, interurban bus and urban bus. For all of them, the variables analysed are: (1) the number of lines available in each city; (2) the number of direct lines connecting to each HSR station (possibilities for intermodality; a distance of less than 200 m between modes is considered a direct link). In the case of shared mobility, the transport modes analysed are: carsharing, motosharing, scooter and bicycle (both systems with and without fixed anchors), for which (3) the number of enterprises operating in each city, and (4) the total fleet are assessed.

5. Opportunities and Challenges for HSR Operators as MaaS Providers

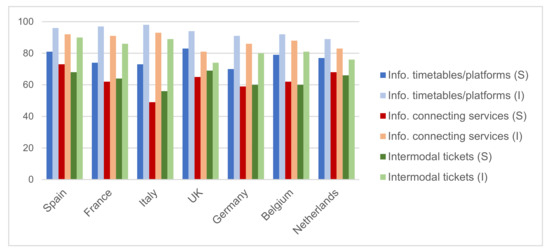

5.1. Opportunities: Improving Users’ Travel Experience

The last report of the European Commission on Europeans’ satisfaction with passenger rail services shows that in the main European HSR markets the quality of services regarding the provision of information about timetables and platforms is considered ‘Important’ in more than 90% of the answers, while the provision of information about connecting services with other transport modes is important in over 85% of the answers in those countries. A similar result was reported concerning the availability of tickets for a journey using several transport modes (i.e., tram, metro, bus, local trains, etc.). However, when the respondents were asked whether they were satisfied with railroad services, although these services obtained a pass in general terms, the percentages of ‘satisfied’ travellers was much lower, decreasing to an average of 76% (regarding timetable information) and 63% (regarding information on connecting services and the availability of intermodal tickets (Figure 4)).

Figure 4.

Europeans’ satisfaction with passenger rail services. [(I) Importance given by passengers; (S) Level of satisfaction] Source: Authors’ elaboration from the European Commission Report, 2018 [24].

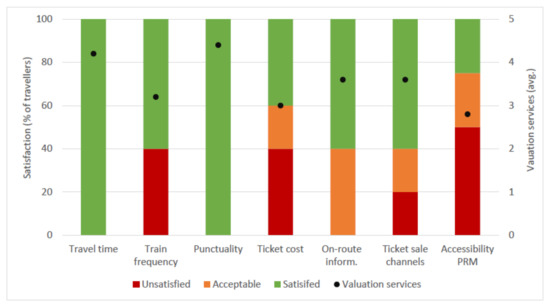

Focusing on the Spanish case, especially on HSR services, users’ perceptions about the rail services change (Figure 5). Since the beginning, the Spanish HSR system has been developed as a modern and innovative transport mode, increasing the image and future expectations of cities that benefit from an HSR station. This is also reflected in the quality of the services which was rated higher than the services of conventional Spanish railways. In this sense, travel time and punctuality are the two on-board factors that obtain the highest values in passengers’ satisfaction surveys (4.2/5 and 4.4/5, respectively). In addition, other aspects such as on-board information and ticket sale channels also pass users’ evaluation with a rating of 3.6/5 each, although 20% of passengers surveyed were unsatisfied with the latter.

Figure 5.

Spanish rail passengers’ satisfaction with HSR services. Source: Authors’ elaboration from the CNMC, 2019 [25].

As shown, most of HSR key aspects are relatively well valued, even those that are usually considered by MaaS providers, so the range of improvement in this field is reduced regarding the implementation of ‘Dócó’. However, a new paradigm is emerging where technology is now expected to be a key part of both commute and long-distance journeys. In this sense, concerning rail transport, frequent and faster trains are a step in the right direction for customer satisfaction, but this does not seem to be enough. The proliferation of the digital world and its development is increasing passengers’ expectations, and they are now demanding technology that will handle their journeys from beginning to end. This is precisely the gap rail operators are trying to cover with MaaS services, highlighting the importance of users’ perspectives [26] and their expectations. However, these advantages and opportunities that the implementation of MaaS applications can provide to the rail environment must be complemented by other strategies directly related to rail systems and users. Rail operators should not make the mistake of thinking that all the challenges they are facing will be solved by only entering the MaaS market, but that some key policies will be needed for their future success. The ‘S’ in MaaS must be highlighted, fitting the transport needs of the individuals/households (‘users’ as a main pillar of MaaS, Figure 1), because it is key in users’ final adoption or rejection of this kind of technology [18].

5.2. Challenges: Journey Planning Needs and Adaptation to Different Geographies

5.2.1. Travel Behaviour and Journey Planning

High-speed rail connections allow for a different type of mobility: medium and long-distance commuting/business trips are now possible between different city pairs thanks to competitive HSR travel times. However, the characteristics of long-distance travel, especially those of high-speed rail, imply important differences in travel behaviour and journey planning, compared to urban rail systems (Table 2). For instance, frequencies are much lower, which conditions users’ travel behaviour on these trips, mainly regarding the time in advance needed for organising a trip. In urban mobility, users could arrive directly at the station and wait for the following service because waiting times have been reduced. However, in long-distance travel, passengers must decide in advance which train they are going to take. In addition, the availability of different types of services and fares [6]. adapted to different trip purposes also conditions trip planning. In this sense, in Spain, there is a dynamic pricing system for long-distance HSR services, varying ticket prices depending on the time in advance of purchase and the level of demand [27,28] arriving at differences of more than 50% in the ticket price when it they are purchased between one and eight weeks before departure. In France, they also present a similar system, with variations of more than 40% [5]. However, in China they adopted a more static pricing system, and variations in ticket prices depend mainly on travel distance, train type and ticket classes [29]. Therefore, in general, both frequencies and ticketing/pricing clearly determine trip planning for HSR passengers, compared to urban mobility options, which could condition MaaS approaches for this long-distance travel.

Table 2.

MaaS approach comparison: urban rail and high-speed rail systems in Spain. Source: authors, adapted to HSR from Merkert et al., 2020 [19]. * Urban rail refers to metro and commuting rail systems.

Also, other aspects, such as the number of itineraries, trip duration, travel purpose or sociodemographic attributes (e.g., age, gender, the presence or absence of a companion, etc.) could influence passenger choice behaviours [30]. For instance, these differences in travel behaviour are especially remarkable for elderly people, who are less likely to use electronic services (e.g., online inquiries, online booking, and online payment services) and are more likely to interact with staff to complete these activities, because they are unfamiliar with the use of the Internet and automated machines [31]. These differences in travel behaviour must be considered when designing new MaaS applications and introducing these new elements of journey planning. In particular, planners must avoid simple extensions of urban MaaS applications to long-distance, national scales. In journey planning, the scale matters, and therefore, adapting to different geographies will be key.

5.2.2. Urban Geographies: From Big Metropolitan Areas to Small, Rural Cities

- Socioeconomic characteristics of the stations’ catchment areas

Population characteristics will be key in the adoption of MaaS services, especially for people older than 64 years and inhabitants with low educational levels. Such people are the most exposed to suffer from the digital divide. For instance, as shown in the Spanish national statistics, the percentage of the population who have used the internet in the past three months [32] decreased from 99% for those below 54 years old to 88–90% for those aged 55 to 64 and to 68–70% for people over 64. Also, average income could influence exposure to the digital divide and other types of digital exclusion.

First, evaluating the population living in the first 5 km from the HSR stations (Table 3), the nearby catchment area, the percentage of people over 64 years old reaches 17.8% in smaller cities, increasing to 20% in big metropolitan areas. Normally, bigger cities benefit from central HSR stations’ location (see Table 1), and it is precisely in the city centres where older people live, while in small cities, it is not so clear. Regarding education level, there are no significant differences, and all the cities have around 7% of people with no education (illiterate people and those with no education). However, notable differences are found when analysing the average income, which is a third higher (more than €18,000 per capita) in large metropolitan areas than in cities of less than 100,000 inhabitants, where the per capita income averages around €12,200.

Table 3.

Catchment area’s socioeconomic indicators: first 5 km from the station 11. Source: Population: Municipal register 2019; Dwellings data: census data 2011 (INE—Spanish national Institute of Statistics).

Analysing the population living between 5 km to 30 km from the station (Table 4), the suburban and rural catchment areas, the percentage of the population older than 64 years old increases notably in smaller cities, reaching 21.1%, while in bigger cities it stays between 12.7–13.5% of the total population. Also, the number of illiterate people and those with no educational qualifications is much higher in smaller cities, rising to more than 10%. These differences highlight the dichotomy between urban/rural and show that the catchment areas of many HSR cities in Spain present a more rural configuration, which should have many policy implications.

Table 4.

Catchment area’s socioeconomic indicators: between 5 km and 30 km from the station. Source: Population: Municipal register, 2019; Dwellings data: census data 2011 (INE—Spanish National Institute of Statistics).

Other examples of this dichotomy are those socioeconomic indicators related to dwellings’ characteristics. The values of average density of dwellings/ha or availability of the internet are also representative of the level of ruralisation of a certain territory. Both in the first ring from the station to the 5 first kilometres, and in the second ring from 5 km to 30 km, the density of dwellings increases exponentially, depending on the size of the cities. Even in the urban ring from the station to 5 km, the density in small cities is ten times less than in metropolitan areas. In addition, internet access is 10 points of a percentage higher in large cities than in those of less than 200,000 inhabitants for the first ring, and almost 15 points in the second ring of the catchment area. Concerning the percentage of dwellings with internet, the newest disaggregated information available is from the census data of 2011. Nowadays, the percentage of dwellings with access to the internet is around 95% in Spain and there is an average difference of around 2–3% among regions. However, it is still a good indicator for identifying rural territories.

In summary, all these socioeconomic indicators show significative differences to be considered in the MaaS implementation.

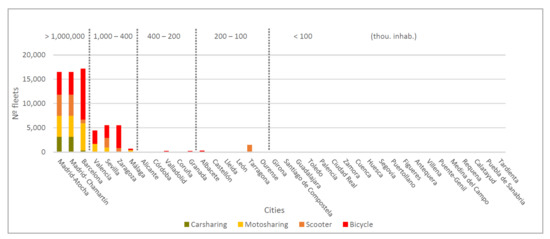

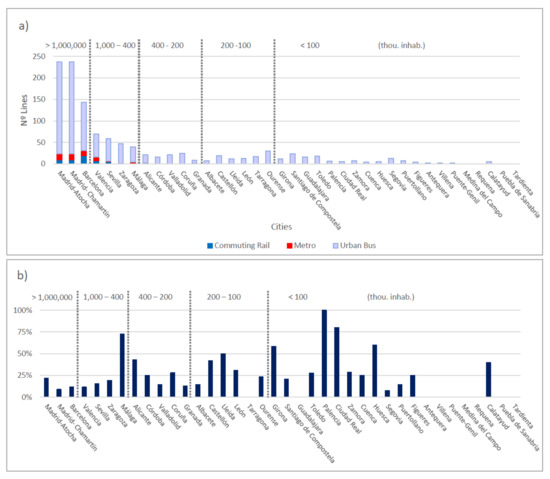

- Local/regional transport systems

Many differences can be detected in the availability of local/regional public transport and new shared-mobility options (Table 5). Most of the HSR cities have interurban bus and conventional railway services, irrespective of their size, although their utility as feeding modes for HSR largely differs. However, when analysing urban services, the differences emerge: while most of the cities have urban bus services, commuting and metro are present almost exclusively in cities of more than 400,000 people (with some exceptions). Similarly, shared-mobility options start to become available in cities of over 200,000 people, although the percentage of cities in this group (200,000–400,000) is much lower than in the groups of cities over 400,000 inhabitants. Focusing on smaller cities located in a more rural/suburban environment, only two of the 26 HSR cities of less than 200,000 inhabitants have shared-mobility transport modes. This figure is reduced to zero when considering cities of less than 100,000 inhabitants.

Table 5.

Available collective public transport modes and shared mobility options (% of cities in each group). Source: authors, based on the municipal information available.

The implementation of shared mobility options in cities depends on the number of fleets. As shown in Figure 6, even when the availability of these new mobility options is almost complete in cities of over 400,000 inhabitants, the number of fleets decreases dramatically compared to the biggest metropolitan areas (around three or four times less). For cities of less than 400,000 inhabitants, only the fleet for bike-sharing starts to become significant for these cities’ size. The case of the bicycle is special because it is usually managed by the public sector and owned by municipalities. Therefore, bicycles have more chance of being present in smaller cities, as a public service, although the fleets of bicycles in smaller cities are very small compared to those of bigger cities.

Figure 6.

Number of fleets of shared mobility transport modes (retrieved in 2022). Source: authors.

Apart from cities’ size, the success of implementation of these shared mobility modes also depends on cities’ characteristics, such as the weather, the relief (urban slopes) and even tourism attractiveness (for instance, the case of Tarragona), or its mobility strategies, such as the availability of cycling infrastructure (for instance, Barcelona compared to Madrid).

Concerning collective public transport, again, there are clear differences in the number of lines servicing the cities, depending on their size (Figure 7a). Obviously, the number of lines itself is not very significant, because the efficiency of these transport modes depends on many other factors. In this sense, the percentage of these lines servicing the station is not significant (Figure 7b). In most of the cities, stations are served by around 25% of the lines. Only in some smaller cities, such as Palencia or Ciudad Real, is this percentage over 75%, although in these cases, the efficiency of bus services has been very low. All the bus lines cover similar routes, connecting main areas of the city, such as hospitals, the city centre and the railway station, but, in the end, they are not competitive as feeding modes to HSR, in terms of frequency and travel times.

Figure 7.

Number of lines of public transport: (a) total; (b) direct lines to the HSR station (retrieved in 2022). Source: authors.

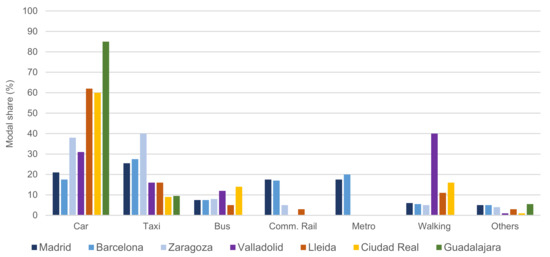

- Station integration in local/regional transport systems

Another key aspect in evaluating the differences among urban geographies is related to the stations’ integration in local/regional transport systems—the feeding services to/from stations—and access/egress quality. This integration depends mainly on the station’s location, which will determine the choice of access mode and the access and egress travel times to and from the station. Analysing all the HSR cities in the network, peripheral locations are found exclusively in smaller cities with less than 100,000 inhabitants, while all the cities of more than 200,000 inhabitants have a station located in a central setting (Table 6).

Table 6.

Station location in HSR cities (% of cities in each group). Source: authors.

Obviously, this will largely condition the possibilities of integration, especially by active modes and public transport. Focusing on the access modes shown in Figure 8, for instance, for cities with less than 200,000 inhabitants, such as Guadalajara, Ciudad Real and Lleida, the modal share varies notably for the car and walking modal share. Guadalajara has a peripheral station, with no public transport access (see Figure 7b), limiting access to private vehicle and taxi services, so the access by car reaches 85% of the modal share. In the cases of Ciudad Real and Lleida, the setting of the station on the edge allows for access by bus and walking, although the modal share for car access is still high (around 60%). In these small cities, the ease of access by car, with no congestion problems, and the availability of parking, tips the scale in favour of private vehicles, even when they present very favourable conditions for walking. In addition, the efficiency of public transport services (urban buses) is very low, with high frequencies, and routes that are not optimised and coordinated with rail services. On the contrary, in large cities, both commuting rail and metro services start to be representative, each reaching around 20% of the modal share. In addition, are the difficulties finding parking and the cost benefits of taxi services over private vehicles.

Figure 8.

Access mode to HSR stations. Source: Author’s elaboration from data in Burckhart et al., 2008 [33] and Cano, 2011 [34].

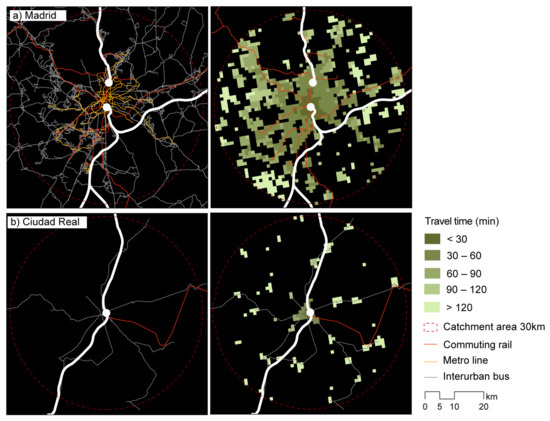

The inefficient and/or non-existent public transport services in small cities compared to bigger cities is analysed more in detail in two case studies: Madrid and Ciudad Real (Figure 9). Comparing the territorial environment first, Figure 9 shows the dispersed low-populated catchment area of the HSR station in Ciudad Real. This suburban/rural area presents a wide non-populated land and very few interurban bus lines connecting to the provincial capital. On the contrary, in big metropolitan areas, the populated areas are much larger, and the availability of public transport services is notably higher, with a vast extension of urban and interurban bus lines added to metro and commuting rail services [35]. Obviously, this opposite situation implies different access times to the station. While in Madrid, most of the areas can access the station in less than 60–90 min, in Ciudad Real, only the urban extension is included in these ranges of travel times. In Madrid only 5% of the total population living in the 30 km catchment area are more than 90 min of average travel time away from the station, while in Ciudad Real, it is more than the 47% of the total population due to very inefficient bus connections, of which there is only one service a day in some cases.

Figure 9.

Average access times to HSR stations by public transport: (a) Madrid and (b) Ciudad Real. Source: authors, based on Moyano et al., 2018 [35].

6. Discussion

This paper analyses main opportunities and challenges for national railway operators as MaaS providers. First, concerning journey-planning needs, rail operators’ MaaS services must be oriented, not only towards real-time information and combined ticketing services, but must also accommodate users’ needs for long-distance travel, especially those related to flexibility in ticket changes and ticket discounts, and the integration of return trips for commuting mobility by HSR. Second, and more important aspects for rail operators’ MaaS success, is adapting to different geographies. The differences among all the HSR cities in Spain are related to both socioeconomic and transport systems’ variables. Smaller cities are generally in a more rural/suburban environment, with higher percentages of aged and illiterate inhabitants, who are much more vulnerable to the digital divide because of their lower incomes and digitalisation levels. In addition, as it was highlighted in Section 2, these potential users are the less willing to adopt MaaS technologies and intermodal trips [2,21]. On the other hand, these areas present very few and/or inefficient public transport options, and practically non-existent shared mobility services, largely limiting the possibility of competing for private car mobility. A solution for coordinating HSR services with local public transport services in these rural environments could be the implementation of demand-responsive transport services (DRTs). In these areas, some pilot projects involving DRTs and on-demand transport are starting to come to light in Spain, in efforts to offer alternatives to these car-dependent rural areas. However, the first examples of rail operators’ MaaS services are neglecting these suburban/rural areas or, when they consider them in a general framework, they are ignoring their singularities in terms of mobility options and population characteristics, and not adopting a very inclusive approach.

Although this analysis could give interesting insights and policy recommendations, it also presents some limitations, due to mainly the lack of data available, which is a sign itself that the digitalisation strategy needs to improve open data repositories. First, the socioeconomic analysis considers information from the Census data of 2011, because, for the moment, many statistics of the census information in 2021 is not yet available. Similarly, the factors related to digital divide are related to households because the population use of internet does not present the proper level of disaggregation for this research. Finally, the information related to the access/egress modal share is very limited, reduced to some cities of the HSR network.

7. Conclusions

In the current scenario where rail services are increasing their appeal as a sustainable long-distance transport mode, and where the mobility digitalisation is one of the main pillars in the mobility strategies and policies in Europe, this paper analyses and discusses the main factors and challenges railway operators face when implementing their new MaaS applications. In the Spanish case study, the differences between urban and rural areas are increasing, and the country is facing a dramatic depopulation process of rural environments, due to the lack of services and facilities and the low accessibility levels. This process is accentuating the aging of the population living in these areas, as younger people usually move to live in bigger cities where there are more opportunities. For that reason, the factors analysed are related primarily to the national scale of implementation and the need to adapt the MaaS approach to different geographies (with different kinds of users and transport systems), from large metropolitan areas to small cities located in more rural environments, and in the process trying to develop much more inclusive services. In this context, the adequate adaptation of MaaS and digitalisation strategies to these geographies, evaluating them from users’ and transport systems’ perspectives (main pillar for MaaS, Figure 1) will be key for the success of national MaaS projects, making their applications more inclusive, and giving a boost to the market. Once the decision of entering the MaaS market is made, high-speed rail operator companies must not let the train pass.

In sum, this research presents some policy implications, mainly oriented to Train Operator Companies but also to other long-distance transport operators that could be interested in joining MaaS environments as MaaS providers. They should consider deeply the factors exposed, adapting their proposals to different contexts, not only to be more inclusive but, especially, to avoid that the implementation of MaaS do not become in an additional factor increasing spatial inequalities. For further research, this paper must be complemented with a survey to the users of the MaaS application of RENFE that has been just launched, also detecting differences in perceptions and travel needs of the users, depending on their places of living (large metropolitan areas or smaller cities in rural environments, for instance). In addition, it should include not only rail but also the analysis of other long-distance transport services, such us interurban bus systems, which could give very relevant insights. Finally, it could be interesting to propose an across Europe analysis, especially in the context of the more and more integrated Europe and cross-border connections. A European comparison could give a broader view, not only about rural/urban differences, but also about strategies of mobility adopted in each country, different travel behaviours or willingness to adopt new proposals, etc.

Author Contributions

Conceptualization, A.M. and S.S.-C.; methodology, A.M., C.T.-B. and S.S.-C.; formal analysis, A.M. and C.T.-B.; data curation, A.M. and C.T.-B.; writing—original draft preparation, A.M. and C.T.-B.; writing—revised manuscript, A.M. and C.T.-B.; supervision, A.M. and S.S.-C.; funding acquisition, A.M. and S.S.-C. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Spanish Ministry ‘Ministerio de Ciencia e Innovación’ through the projects titled “M=EI2” (PID2020-119360RB-I00/AEI/10.13039/501100011033) and “EsMaaS” (TED2021-129623A-I00), and by the funding from the Department of Civil Engineering of the University of Castilla La Mancha. The project TED2021-129623A-I00 is cofunded by MCIN/AEI/10.13039/501100011033 and by the European Union NextGenerationEU/PRTR”.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript; or in the decision to publish the results.

References

- Arias-Molinares, D.; García-Palomares, J.C. The Ws of MaaS: Understanding Mobility as a Service Fromaliterature Review. IATSS Res. 2020, 44, 253–263. [Google Scholar] [CrossRef]

- Yen, B.T.H.; Mulley, C.; Tseng, W.-C.; Chiou, Y.-C. Assessing Interchange Effects in Public Transport: A Case Study of South East Queensland, Australia. Case Stud. Transp. Policy 2018, 6, 364–375. [Google Scholar] [CrossRef]

- Hernandez, S.; Monzon, A. Key Factors for Defining an Efficient Urban Transport Interchange: Users’ Perceptions. Cities 2016, 50, 158–167. [Google Scholar] [CrossRef]

- Lois, D.; Monzón, A.; Hernández, S. Analysis of Satisfaction Factors at Urban Transport Interchanges: Measuring Travellers’ Attitudes to Information, Security and Waiting. Transp. Policy 2018, 67, 49–56. [Google Scholar] [CrossRef]

- Delaplace, M.; Dobruszkes, F. From Low-Cost Airlines to Low-Cost High-Speed Rail? The French Case. Transp. Policy 2015, 38, 73–85. [Google Scholar] [CrossRef]

- Moyano, A.; Coronado, J.M. Typology of High-Speed Rail City-to-City Links. In Proceedings of the Institution of Civil Engineers—Transport; ICE Publishing: London, UK, 2018; Volume 171, pp. 264–274. [Google Scholar] [CrossRef]

- Esztergár-Kiss, D.; Kerényi, T.; Mátrai, T.; Aba, A. Exploring the MaaS Market with Systematic Analysis. Eur. Transp. Res. Rev. 2020, 12, 67. [Google Scholar] [CrossRef]

- Wong, Y.Z.; Hensher, D.A.; Mulley, C. Mobility as a Service (MaaS): Charting a Future Context. Transp. Res. Part A Policy Pract. 2020, 131, 5–19. [Google Scholar] [CrossRef]

- Aapaoja, A.; Eckhardt, J.; Nykänen, L.; Sochor, J. MaaS Service Combinations for Different Geographical Areas. In Proceedings of the 24th World Congress on Intelligent Transportation System, Montréal, QC, Canada, 29 October–2 November 2017; pp. 1–11. [Google Scholar]

- Kriukelyte, E. New Challenges for Transport Planning: The Institutionalization of Mobility as a Service in Stockholm Region. Ph.D. Thesis, School of Architecture and the Built Environment, Stockholm, Sweden, 2018. [Google Scholar]

- Kamargianni, M.; Li, W.; Matyas, M.; Schäfer, A. A Critical Review of New Mobility Services for Urban Transport. Transp. Res. Procedia 2016, 14, 3294–3303. [Google Scholar] [CrossRef]

- Smith, G.; Hensher, D.A. Towards a Framework for Mobility-as-a-Service Policies. Transp. Policy 2020, 89, 54–65. [Google Scholar] [CrossRef]

- Li, Y.; Voege, T. Mobility as a Service (MaaS): Challenges of Implementation and Policy Required. J. Transp. Technol. 2017, 07, 95–106. [Google Scholar] [CrossRef]

- Jittrapirom, P.; Marchau, V.; van der Heijden, R.; Meurs, H. Dynamic Adaptive Policymaking for Implementing Mobility-as-a Service (MaaS). Res. Transp. Bus. Manag. 2018, 27, 46–55. [Google Scholar] [CrossRef]

- Wright, S.; Nelson, J.D.; Cottrill, C.D. MaaS for the Suburban Market: Incorporating Carpooling in the Mix. Transp. Res. Part A Policy Pract. 2020, 131, 206–218. [Google Scholar] [CrossRef]

- Chang, S.K.J.; Chen, H.Y.; Chen, H.C. Mobility as a Service Policy Planning, Deployments and Trials in Taiwan. IATSS Res. 2019, 43, 210–218. [Google Scholar] [CrossRef]

- Smith, G.; Sochor, J.; Karlsson, I.C.M.A. Mobility as a Service: Development Scenarios and Implications for Public Transport. Res. Transp. Econ. 2018, 69, 592–599. [Google Scholar] [CrossRef]

- Karlsson, I.C.M.; Mukhtar-Landgren, D.; Smith, G.; Koglin, T.; Kronsell, A.; Lund, E.; Sarasini, S.; Sochor, J. Development and Implementation of Mobility-as-a-Service—A Qualitative Study of Barriers and Enabling Factors. Transp. Res. Part A Policy Pract. 2020, 131, 283–295. [Google Scholar] [CrossRef]

- Merkert, R.; Bushell, J.; Beck, M.J. Collaboration as a Service (CaaS) to Fully Integrate Public Transportation—Lessons from Long Distance Travel to Reimagine Mobility as a Service. Transp. Res. Part A Policy Pract. 2020, 131, 267–282. [Google Scholar] [CrossRef]

- Vij, A.; Ryan, S.; Sampson, S.; Harris, S. Consumer Preferences for Mobility-as-a-Service (MaaS) in Australia. Transp. Res. Part C Emerg. Technol. 2020, 117, 102699. [Google Scholar] [CrossRef]

- Lopez-Carreiro, I.; Monzon, A.; Lois, D.; Lopez-Lambas, M.E. Are Travellers Willing to Adopt MaaS? Exploring Attitudinal and Personality Factors in the Case of Madrid, Spain. Travel. Behav. Soc. 2021, 25, 246–261. [Google Scholar] [CrossRef]

- Giesecke, R.; Surakka, T.; Hakonen, M. Conceptualising Mobility as a Service. In Proceedings of the 2016 11th International Conference on Ecological Vehicles and Renewable Energies, EVER 2016, Monte Carlo, Monaco, 6–8 April 2016. [Google Scholar]

- Barreto, L.; Amaral, A.; Baltazar, S. Mobility as a Service (MaaS) in Rural Regions: An Overview. In Proceedings of the 2018 International Conference on Intelligent Systems (IS), IEEE, Funchal-Madeira, Portugal, 25–27 September 2018; pp. 856–860. [Google Scholar]

- European Commission Report. Europeans’ Satisfaction with Passenger Rail Services. Flash Eurobarometer 463 – TNS Political & Social; European Commission Report: Brussels, Belgium, 2018. [Google Scholar] [CrossRef]

- CNMC, Comisión Nacional de los Mercados Y Valores. Acuerdo por el que se emite informe relativo a la consulta a los representantes de los usuarios sobre su punto de vista del mercado ferroviario (2019). INF/DTSP/007/19. Available online: https://www.cnmc.es/expedientes/infdtsp00719 (accessed on 20 October 2022).

- Lyons, G.; Hammond, P.; Mackay, K. The Importance of User Perspective in the Evolution of MaaS. Transp. Res. Part A Policy Pract. 2019, 121, 22–36. [Google Scholar] [CrossRef]

- Moyano, A.; Coronado, J.M.; Garmendia, M. How to Choose the Most Efficient Transport Mode for Weekend Tourism Journeys: An HSR and Private Vehicle Comparison. Open Transp. J. 2016, 10, 84–96. [Google Scholar] [CrossRef]

- Moyano, A.; Rivas, A.; Coronado, J.M. Business and Tourism High-Speed Rail Same-Day Trips: Factors Influencing the Efficiency of High-Speed Rail Links for Spanish Cities. Eur. Plan. Stud. 2019, 27, 533–554. [Google Scholar] [CrossRef]

- Sun, Y.; Jiang, Z.; Gu, J.; Zhou, M.; Li, Y.; Zhang, L. Analyzing High Speed Rail Passengers’ Train Choices Based on New Online Booking Data in China. Transp. Res. Part C Emerg. Technol. 2018, 97, 96–113. [Google Scholar] [CrossRef]

- Xie, H.; Song, X.; Zhang, H. MaaS and IoT: Concepts, Methodologies, and Applications. In Big Data and Mobility as a Service; Elsevier: Amsterdam, The Netherlands, 2022; pp. 229–243. [Google Scholar]

- Cheng, Y.H.; Huang, T.Y. High Speed Rail Passenger Segmentation and Ticketing Channel Preference. Transp. Res. Part A Policy Pract. 2014, 66, 127–143. [Google Scholar] [CrossRef]

- INE, Instituto Nacional de Estadística. Encuesta sobre Equipamiento y Uso de Tecnologías de Información y Comunicación en los Hogares, 2021; Instituto Nacional de Estadística – INE: Madrid, Spain, 2021. [Google Scholar]

- Burckhart, K.; Martí-Henneberg, J.; Tapiador, F.J. Cambio de Hábitos y Transformaciones Territoriales En Los Corredores de Alta Velocidad Ferroviaria. Resultados de Una Encuesta de Viajeros En La Línea Madrid-Barcelona. Scripta Nova 2008, 12, 1–13. [Google Scholar]

- Cano, B. Áreas de Influencia Generadas Por Estaciones de Alta Velocidad. Parámetros Que Determinan Sus Características. Master’s Thesis, Universidad de Castilla La Mancha, Ciudad Real, Spain, 2011. [Google Scholar]

- Moyano, A.; Moya-gómez, B.; Gutiérrez, J. Access and Egress Times to High-Speed Rail Stations: A Spatiotemporal Accessibility Analysis. J. Transp. Geogr. 2018, 73, 84–93. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).