Container Shipping Optimization under Different Carbon Emission Policies: A Case Study

Abstract

1. Introduction

- Profit maximum, type selection, ship number, and speed as decision variables, build the two common carbon emissions under the policy of the liner optimization model and design the algorithm to solve.

- Through empirical analysis, sensitivity analysis, and marginal cost analysis of common carbon emission adjustment policies, the internal mechanism of emission policies is revealed, and the regulation effect, adaptability, and advantages and disadvantages of the two kinds of carbon emission policies are analyzed.

- According to the analysis results, it provides reference suggestions for transportation optimization of enterprises and policy formulation of relevant departments.

2. Literature Review

2.1. Liner Transportation Optimization

2.2. Liner Transportation Optimization Considering Carbon Emission Regulation Policies

3. Models

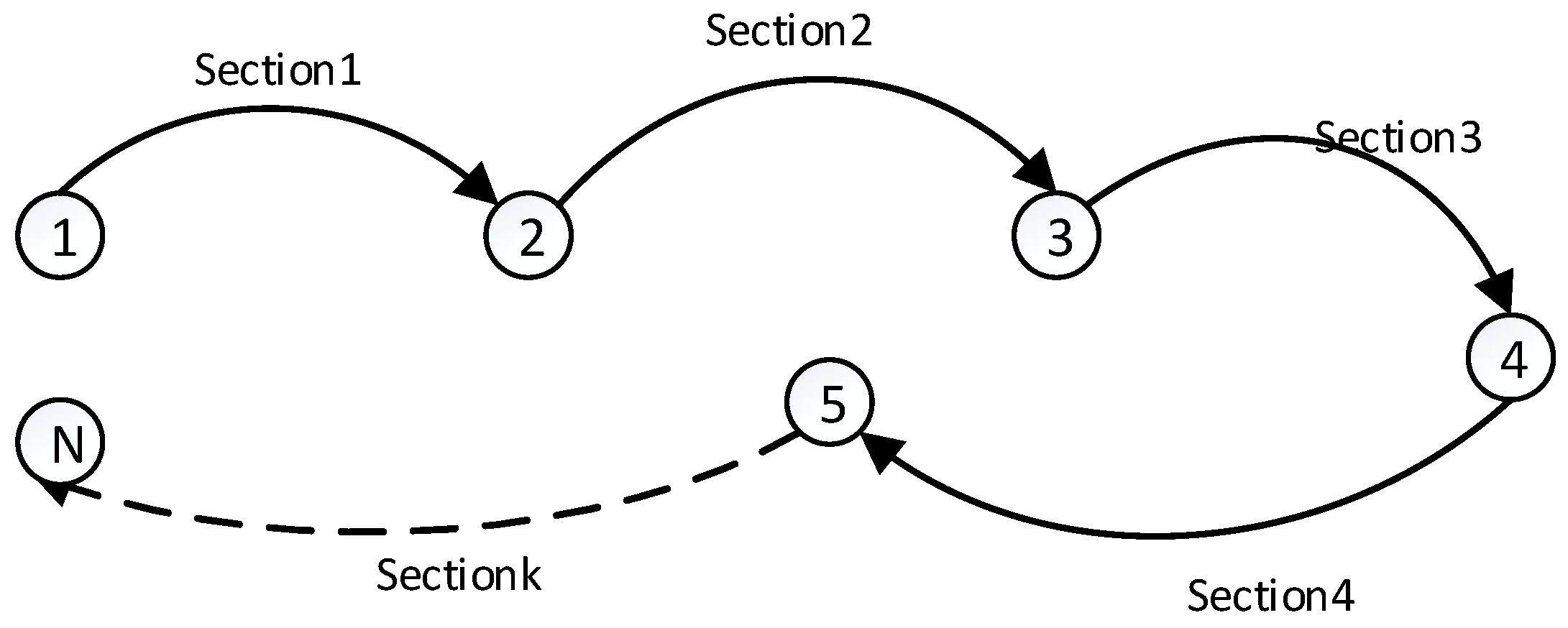

3.1. Optimization Model of Liner Shipping under a Carbon Tax Policy

3.2. Optimization Model of Liner Transportation under the Carbon Cap-and-Trade Policy

4. Arithmetic Design

Description of Improved Whale Swarm Algorithm

5. Case Study

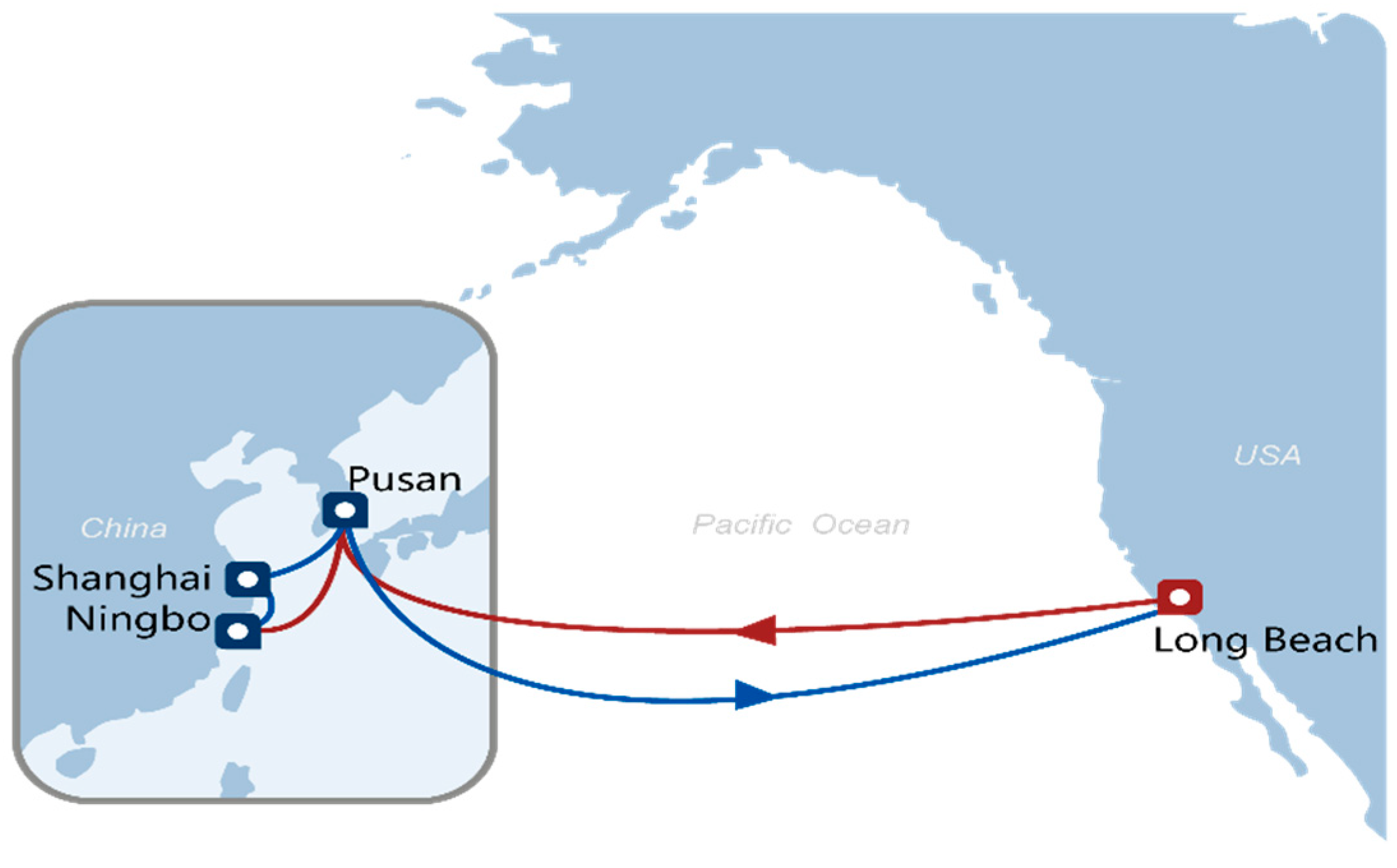

5.1. Data Collection

5.2. Analysis of Results

5.3. Sensitivity Analysis

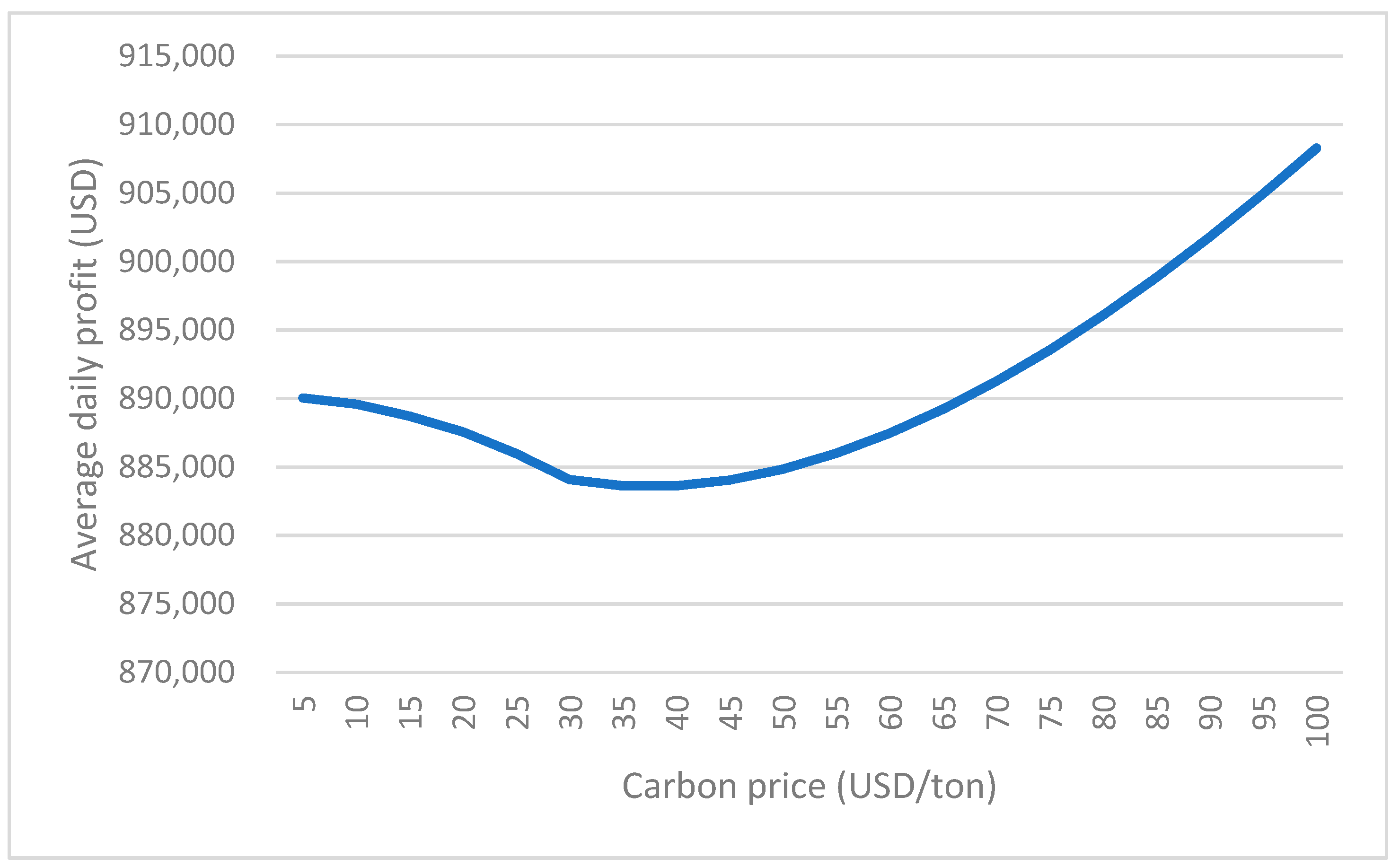

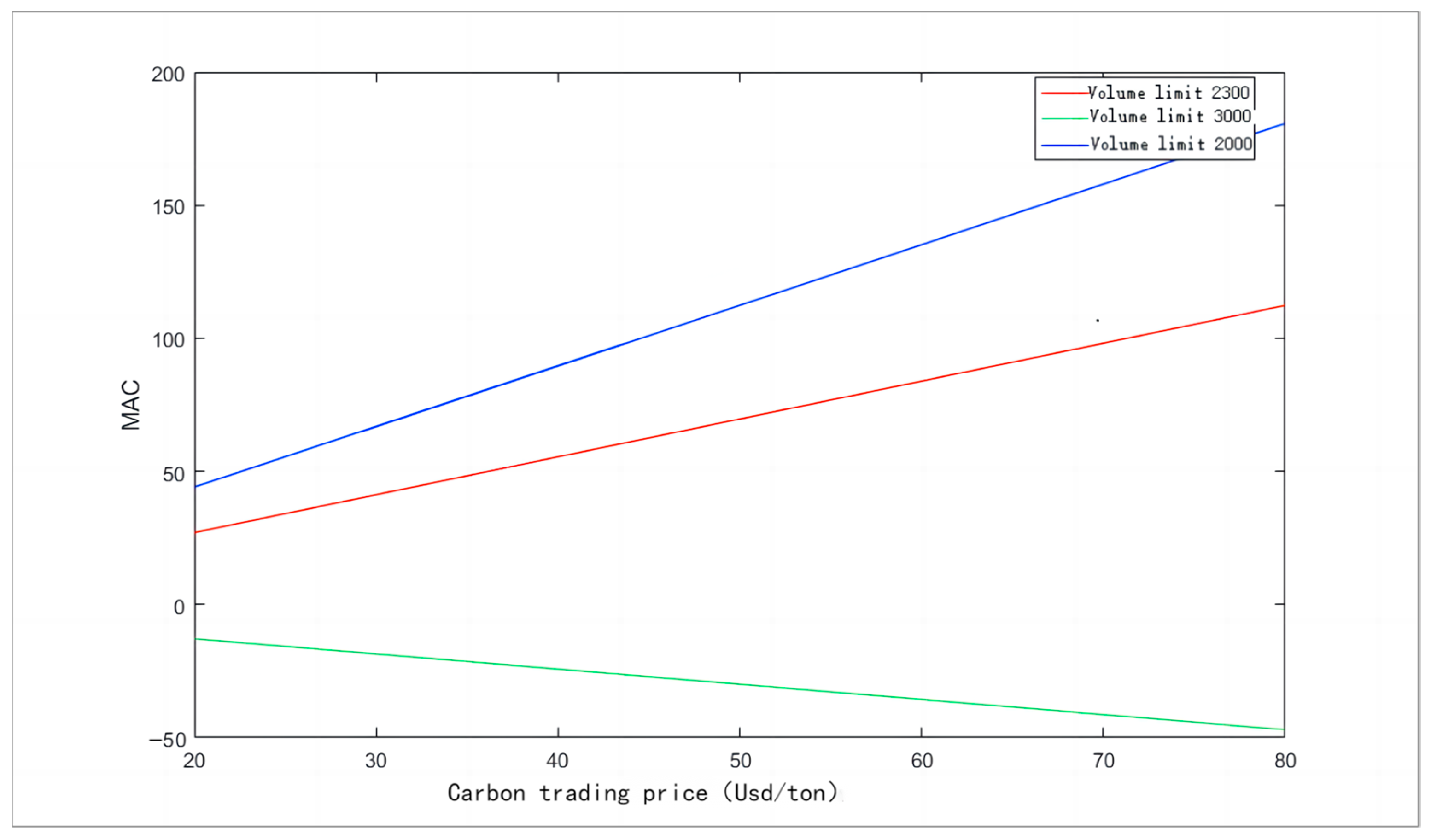

5.3.1. Sensitivity Analysis of Carbon Tax and Carbon Price

5.3.2. Changes in Fuel Prices

5.3.3. Changes in Vessel Size and Carbon Emissions

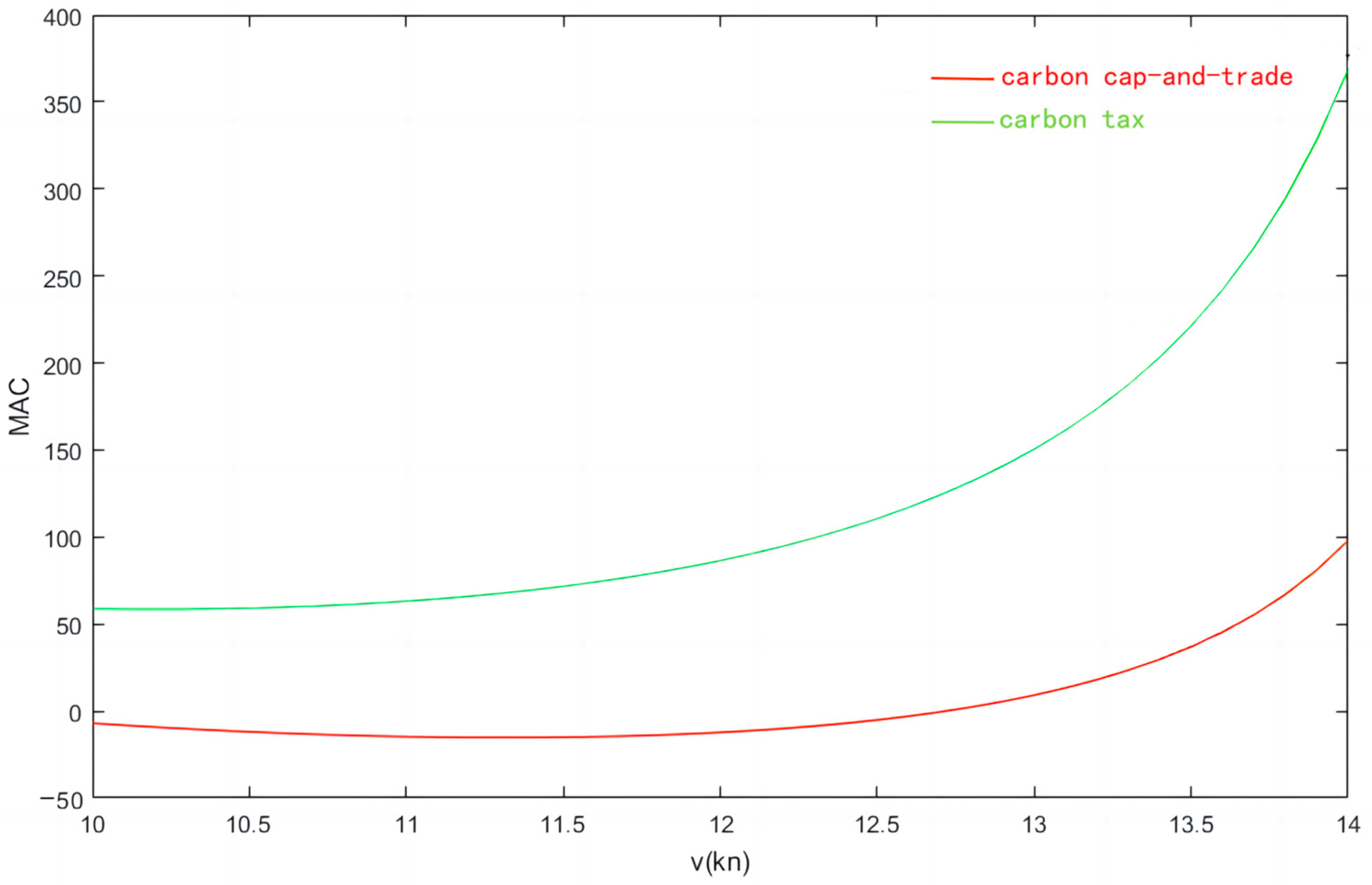

6. Marginal Abatement Cost Analysis

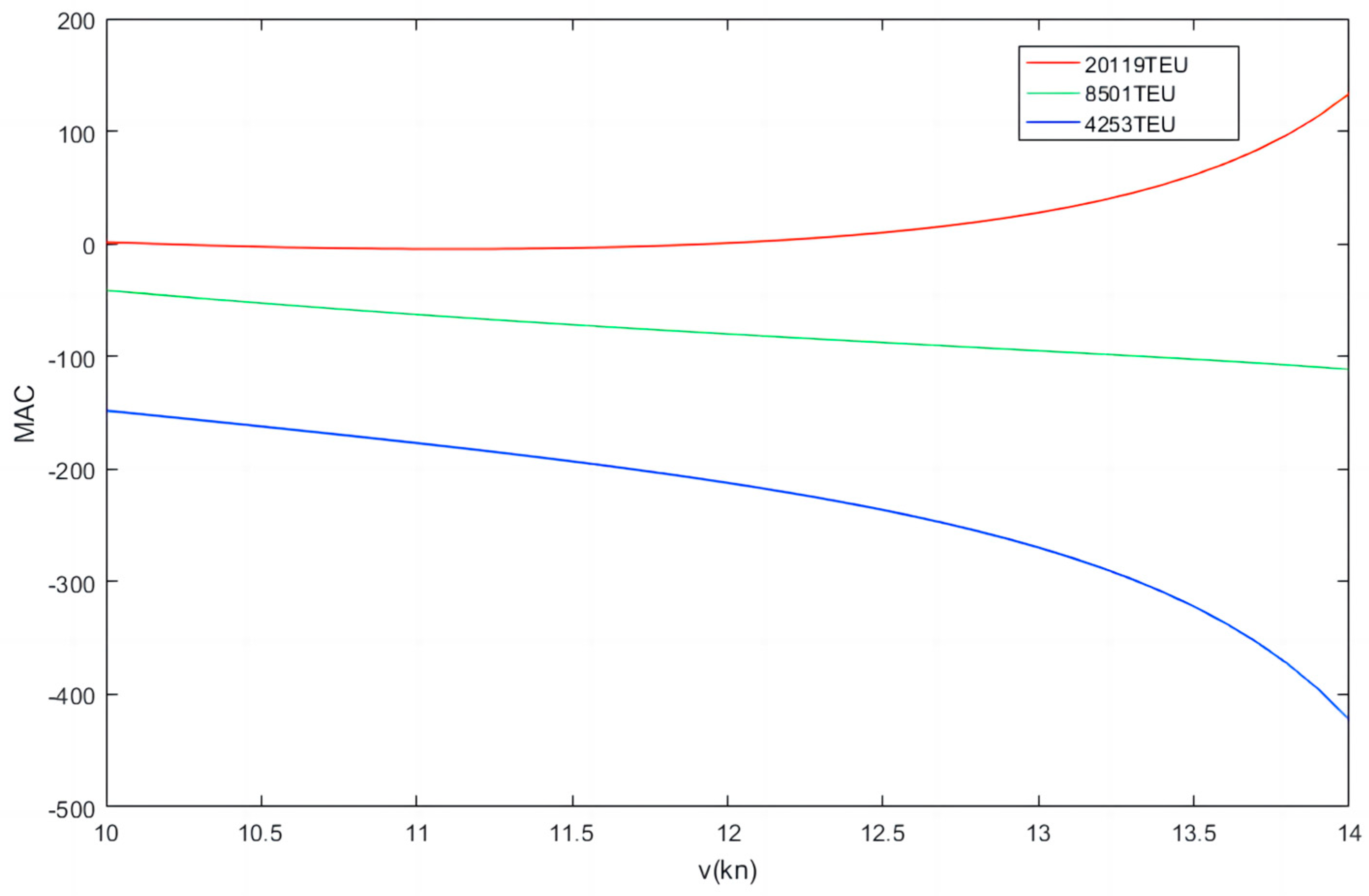

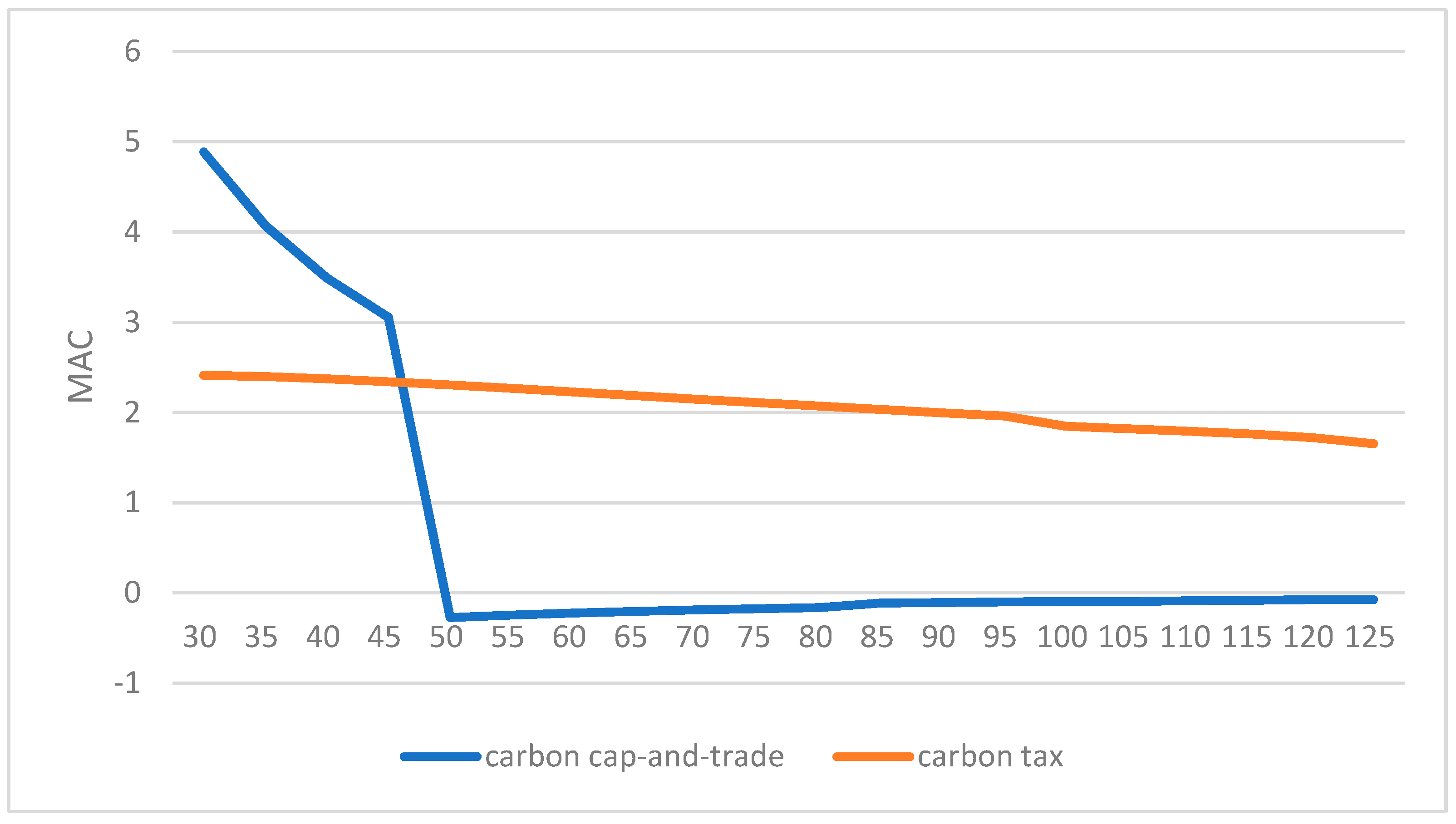

- Marginal Abatement Costs of the Carbon Cap-and-Trade Model

- 2.

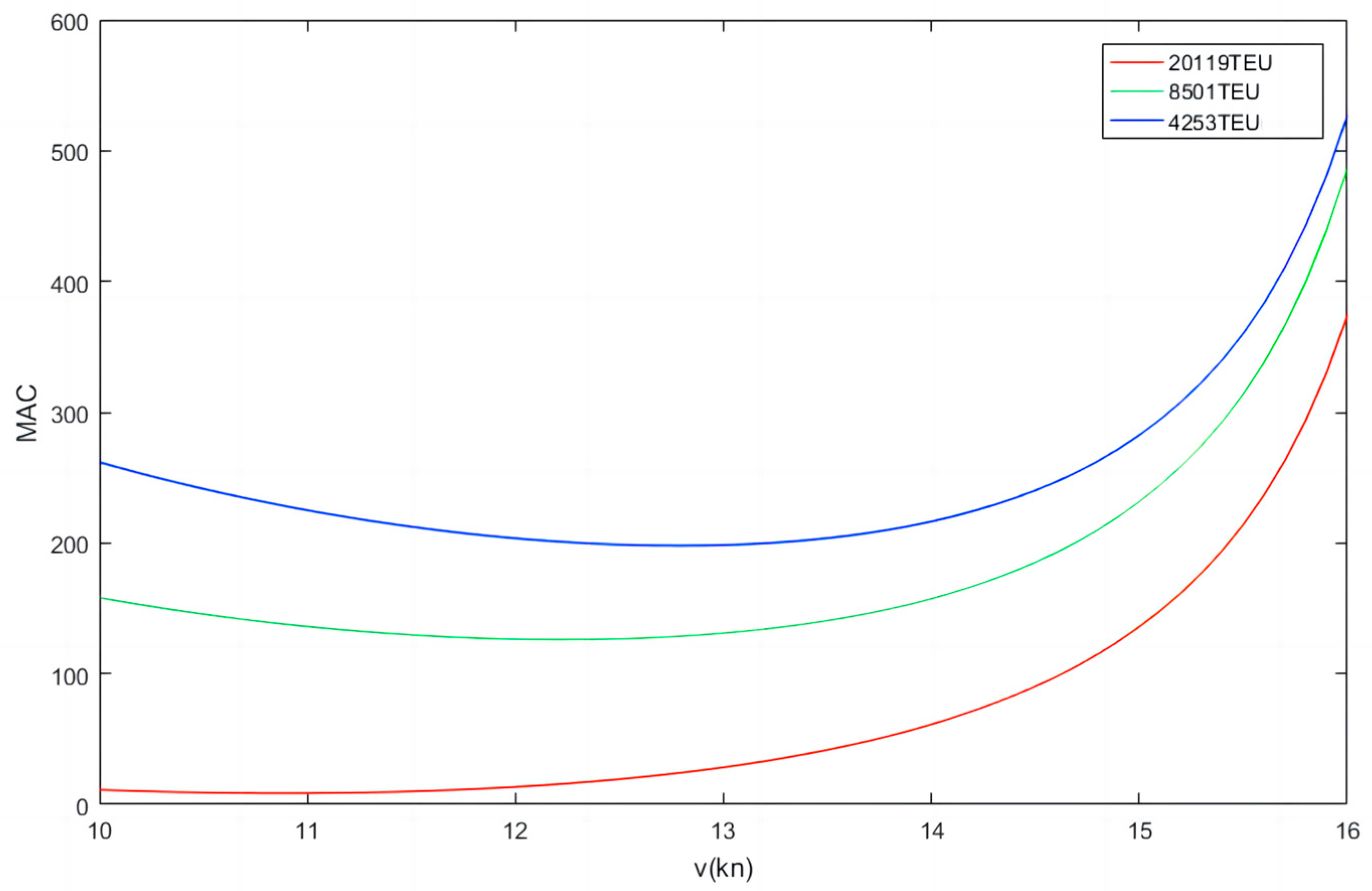

- Marginal Abatement Cost of the Carbon Tax Model

Analysis of the Case Calculation Results

7. Conclusions

- The nonlinear optimization model constructed in this paper and the improved Whale Swarm Algorithm designed in this paper can well solve the container transportation optimization problem under different carbon emission policies and can provide enterprises with better ship speed, ship investment, and ship type selection reference.

- Both kinds of carbon emission regulation policies will lead to a reduction in the profits of liner transport companies, a reduction in average speed, and a reduction in carbon emissions. The carbon tax model has the greatest impact on the profits of shipping companies, and carbon cap-and-trade is easier to obtain support from enterprises. However, the current carbon trading price is too low, and its market regulation effect is weak.

- Under the carbon tax policy, the marginal cost of reducing carbon emissions by means of optimizing shipping speed is less than that of a carbon tax, and the emission reduction method of optimizing shipping speed is profitable. The shipping company is willing to reduce emissions by this method to reduce tax. Under the condition that the current carbon trading market is not mature enough and the trading price is low, compared with the carbon tax model, the carbon cap-and-trade model has less incentive for shipping enterprises to reduce emissions. As the carbon trading market continues to mature and the carbon trading price continues to rise, shipping companies will greatly improve their enthusiasm for reducing emissions. From the perspective of the emission reduction effect and enterprise enthusiasm, the carbon cap-and-trade model is better than the carbon tax model, which is more in line with the sustainable development of shipping.

- The implementation of a carbon cap-and-trade policy or carbon tax policy is closely and complexly related to carbon trading price, carbon tax rate, fuel price, and ship size, and there are uncertainties. The uncertainty caused by these factors makes the uncertainty of the implementation effect of each policy should arouse the attention of relevant decision-makers. The optimal measures should be formulated under the premise of fully understanding the uncertainty factors.

- Policy suggestions: (1) It is the general trend to formulate carbon emission policies reasonably and achieve carbon emission reduction through dual means of regulation and market; (2) In the case of immature carbon trading markets, carbon taxes are more flexible, allowing enterprises to respond to market signals in the most economical way, choose between paying taxes and reducing carbon emissions, and significantly eliminate the environmental externalities of carbon emissions. However, the imposition of a carbon tax will increase the financial burden of shipping companies and inhibit the development of the shipping market to some extent. Therefore, the setting of a carbon emission tax rate is particularly important. We can refer to the current marginal emission reduction cost MAC of the shipping industry to set the tax rate in line with the actual development. (3) The emission reduction effect of carbon cap-and-trade in total cap control is clear. No matter what behavior choice shipping companies adopt, the total emission reduction control target in the equilibrium shipping market is constant and can promote the development of low-carbon production technology. Therefore, the establishment of a carbon emission trading market in the shipping market should be accelerated.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Description of the Variables

| Decision variables | |

| nm | is the number of m vessels assigned; |

| xm | is variable 0, 1, and its value is 1 when m vessel is configured on the route and 0 otherwise; |

| Vm | is ship speed (kn); |

| Port-related parameters | |

| Total route distance (kn); | |

| qij | is the weekly freight volume between ports j and i (TEU); |

| N | Number of ports on the route; |

| rij | is the freight rate between ports j and i (USD$/TEU). |

| tpil | is the sum of berthing and unberthing time of the ship in and out of the port (hour); |

| l | The overall average handling efficiency of the port (TEU/hour); |

| Cm | Fixed daily rate of m-vessel (USD$/day); |

| Cl | Port charges for loading containerized cargo (USD$/TEU); |

| Cu | Port charges for unloading containerized cargo (USD$/TEU); |

| is the entry fee of the m vessel (USD/time), including berthing fee, mooring and unmooring fee, port clearance fee and other charges incurred in port; | |

| Ship-related parameters | |

| M | is the set of ship types. |

| Weekly average CO2 emissions of the fleet (tons). | |

| Costs of carbon emissions. | |

| (tp) | is the average daily profit of the fleet (USD$). |

| Fm | Main engine daily fuel consumption of m-vessel at designed speed (t/day). |

| Am | Auxiliaries daily fuel consumption of m-vessel at designed speed (t/day). |

| PIFO | Heavy crude oil prices (USD$/ton). |

| PVLSFO | Very low sulfur fuel oil prices (USD$/ton). |

| λ | Carbon conversion factor of ships. |

| T | The expression of the total voyage time (day). |

| Yk | The total amount of cargo (tons) on segment k. |

| Qi | is the loading and unloading of port i. |

| Cop | The weekly operating costs of the fleet (USD$). |

| CP | The average port charges per week (USD$). |

References

- Cheng, T.; Farahani, R.; Lai, K.; Sarkis, J. Sustainability in maritime supply chains: Changes and opportunities for theory and practice. Transp. Res. E Logist. Transp. Rev. 2015, 78, 1–2. [Google Scholar] [CrossRef]

- Fourth Greenhouse Gas Study 2020. (11/10/2022). Available online: https://www.imo.org/en/OurWork/Environment/Pages/Fourth-IMO-Greenhouse-Gas-Study-2020.aspx (accessed on 1 March 2023).

- John, B. Intergovernmental Panel on Climate Change Special Report on Global Warming of 1.5 °C Switzerland: IPCC. Popul. Dev. Rev. 2018, 45, 251–252. [Google Scholar]

- IMO Agrees to Cut Emissions by at Least 50% by 2050. Lloyd’s List. Available online: https://lloydslist.maritimeintelligence.informa.com/LL1122195/IMO-agrees-to-cut-emissions-by-at-least-50-by-2050 (accessed on 2 March 2023).

- Xing, Y.; Yang, H.; Ma, X.; Zhang, Y. Optimization of ship speed and fleet deployment under carbon emissions policies for container shipping. Transport 2019, 34, 260–274. [Google Scholar] [CrossRef]

- Aldy, J.E.; Pizer, W.A. The competitiveness impacts of climate change mitigation policies. J. Assoc. Environ. Resour. Econ. 2015, 2, 565–595. [Google Scholar] [CrossRef]

- Yang, H.; Ma, X.; Xing, Y. Trends in CO2 emissions from China-oriented international marine transportation activities and policy implications. Energies 2017, 10, 980. [Google Scholar] [CrossRef]

- Kontovas, C. Reduction of emissions along the maritime intermodal container chain: Operational models and policies. Marit. Policy Manag. 2011, 38, 451–469. [Google Scholar] [CrossRef]

- Fagerholt, K.; Laporte, G. Norstad. Reducing fuel emissions by optimizing speed on shipping routes. J. Oper. Res. Soc. 2010, 61, 523–529. [Google Scholar] [CrossRef]

- Wang, S.; Qiang, M. Sailing speed optimization for container ships in a liner shipping network. Transp. Res. Part E Logist. Transp. Rev. 2012, 48, 701–714. [Google Scholar] [CrossRef]

- Norlund, E.K.; Gribkovskaia, I. Corrigendum to “Reducing emissions through speed optimization in supply vessel operations” [Transp. Res.—Part D 23 (2013) 105–113]. Transp. Res. Part D Transp. Environ. 2013, 24, 135. [Google Scholar] [CrossRef]

- Wang, S.; Wang, X. A polynomial-time algorithm for sailing speed optimization with containership resource sharing. Transp. Res. Part B Methodol. 2016, 93, 394–405. [Google Scholar] [CrossRef]

- Wang, Y.; Meng, Q.; Du, Y. Liner container seasonal shipping revenue management. Transp. Res. Part B Methodol. 2015, 82, 141–161. [Google Scholar] [CrossRef]

- Guericke, S.; Tierney, K. Liner shipping cargo allocation with service levels and speed optimization. Transp. Res. Part E Logist. Transp. Rev. 2015, 84, 40–60. [Google Scholar] [CrossRef]

- Norlund, E.K.; Gribkovskaia, I. Environmental performance of speed optimization strategies in offshore supply vessel planning under weather uncertainty. Transp. Res. Part D Transp. Environ. 2017, 57, 10–22. [Google Scholar] [CrossRef]

- Wen, M.; Pacino, D.; Kontovas, C.; Psaraftis, H. A multiple ship routing and speed optimization problem under time, cost and environmental objectives. Transp. Res. Part D Transp. Environ. 2017, 52, 303–321. [Google Scholar] [CrossRef]

- Cepeda, M.A.F.; Assis, L.F.; Marujo, L.G.; Caprace, J.-D. Effects of slow steaming strategies on a ship fleet. Mar. Syst. Ocean. Technol. 2017, 12, 178–186. [Google Scholar] [CrossRef]

- Adland, R.; Jia, H. Dynamic speed choice in bulk shipping. Marit. Econ. Logist. 2018, 20, 253–266. [Google Scholar] [CrossRef]

- Karsten, C.; Ropke, S.; Pisinger, D. Simultaneous optimization of container ship sailing speed and container routing with transit time restrictions. Transp. Sci. 2018, 52, 769–787. [Google Scholar] [CrossRef]

- Corbett, J.J.; Wang, H.; Winebrake, J.J. The effectiveness and costs of speed reductions on emissions from international shipping. Transp. Res. Part D Transp. Environ. 2009, 14, 593–598. [Google Scholar] [CrossRef]

- Zheng, J.; Ma, Y.; Ji, X.; Cheng, J. Is the weekly service frequency constraint tight when optimizing ship speeds and fleet size for a liner shipping service? Ocean. Coast. Manag. 2021, 212, 105–815. [Google Scholar] [CrossRef]

- Zhao, Z.; Wang, X.; Wang, H.; Cheng, S.; Liu, W. Fleet Deployment Optimization for LNG Shipping Vessels Considering the Influence of Mixed Factors. J. Mar. Sci. Eng. 2022, 10, 2034. [Google Scholar] [CrossRef]

- Kim, J.; Kim, H.; Lee, P.T. Optimising containership speed and fleet size under a carbon tax and an emission trading scheme. Int. J. Shipp. Transp. Logist. 2013, 5, 571–590. [Google Scholar] [CrossRef]

- Lee, T.; Chang, Y.; Lee, P. Economy—Wide impact analysis of a carbon tax on international container shipping. Transp. Res. Part A Policy Pract. 2013, 58, 87–102. [Google Scholar] [CrossRef]

- Huang, Z.; Shi, X.; Wu, J. How Will the Marine Emissions Trading Scheme Influence the Profit and CO2 Emissions of a Containership. In Proceedings of the 4th International Conference (ICCL 2013), Copenhagen, Denmark, 25–27 September 2013; Springer: Berlin/Heidelberg, Germany, 2013; Volume 8197, pp. 45–57. [Google Scholar]

- Cullinane, K.; Cullinane, S. Atmospheric emissions from shipping: The need for regulation and approaches to compliance. Transp. Rev. 2014, 33, 377–401. [Google Scholar] [CrossRef]

- Kim, J.-G.; Kim, H.-J.; Lee, P.T.-W. Optimizing ship speed to minimize fuel consumption. Transp. Lett. 2014, 6, 109–117. [Google Scholar] [CrossRef]

- Wang, C.; Xu, C. Sailing speed optimization in voyage chartering ship considering different carbon emissions taxation. Comput. Ind. Eng. 2015, 89, 108–115. [Google Scholar] [CrossRef]

- Wang, C.; Chen, J. Strategies of refueling, sailing speed and ship deployment of containerships in the low-carbon background. Comput. Ind. Eng. 2017, 114, 142–150. [Google Scholar] [CrossRef]

- Zhu, M. Modeling the impacts of uncertain carbon tax policy on maritime fleet mix strategy and carbon mitigation. Transport 2018, 33, 707–717. [Google Scholar] [CrossRef]

- Cheaitou, A.; Cariou, P. Greening of maritime transportation: A multi-objective optimization approach. Ann. Oper. Res. 2018, 273, 501–525. [Google Scholar] [CrossRef]

- Xin, X.; Wang, X.; Tian, X.; Chen, Z.; Chen, K. Green scheduling model of shuttle tanker fleet considering carbon tax and variable speed factor. J. Clean. Prod. 2019, 234, 1134–1143. [Google Scholar] [CrossRef]

- Xing, H.; Spence, S.; Chen, H. A comprehensive review on countermeasures for CO2 emissions from ships. Renew. Sustain. Energ. Rev. 2020, 134, 110222. [Google Scholar] [CrossRef]

- Ma, W.; Lu, T.; Ma, D. Ship route and speed multi-objective optimization considering weather conditions and emission control area regulations. Marit. Policy. Manag. 2020, 48, 1053–1068. [Google Scholar] [CrossRef]

- Lan, X.; Tao, Q.; Wu, X. Liner Shipping Network Design with ECAs: A Real Case Study. Sustainability 2023, 15, 3734. [Google Scholar] [CrossRef]

- ESMA Final Report (2022, ESMA70-445-38). Available online: https://www.esma.europa.eu/databases-library/esma-library?f%5B0%5D=basic_%3A44&page=2 (accessed on 3 March 2023).

- Eide, M.S.; Endresen, O.; Skjong, R. Cost-effectiveness assessment of CO2 reducing measures in shipping. Marit. Policy Manag. 2009, 36, 367–384. [Google Scholar] [CrossRef]

| Name of Vessel | m | Bm (TEU) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| XIN ZHANG ZHOU | 1 | 4253 | 139.5 | 6.33 | 18.2 | 11.34 | 25.15 | 9000 | 3001 |

| XIN WENZHOU | 2 | 4738 | 82 | 4.3 | 18 | 11.04 | 24.7 | 10,026 | 3344 |

| XIN YAN TIAN | 3 | 5668 | 202 | 7.81 | 17.7 | 12.05 | 26.7 | 11,994 | 4000 |

| COSCO THAILAND | 4 | 8501 | 250 | 10.47 | 18.6 | 12 | 26.6 | 17,989 | 6000 |

| XIN SHANGHAI | 5 | 9572 | 248.2 | 10.43 | 17.2 | 11.22 | 26.73 | 20,255 | 6204 |

| COSCO ASIA | 6 | 10,036 | 250 | 12.75 | 16.8 | 11.04 | 25.8 | 21,238 | 6505 |

| COSCO FAITH | 7 | 13,114 | 274.9 | 13.2 | 16.7 | 11 | 26.2 | 27,751 | 8500 |

| CSCLJUPITER | 8 | 14,074 | 262 | 14.51 | 16.1 | 11.18 | 26.62 | 29,783 | 9122 |

| CSCLPACIFIC OCEAN | 9 | 18,982 | 195.5 | 13.768 | 18 | 10 | 24.6 | 40,169 | 13,000 |

| COSCO SHIPPING VIRGO | 10 | 20,119 | 168 | 10.263 | 19 | 8.4615 | 22.5 | 42,575 | 13,040 |

| Outward Voyage | Singapore | Felixstowe | Rotterdam |

|---|---|---|---|

| Shanghai | (570,150) | (1040,800) | (1040,850) |

| Ningbo | (570,150) | (1050,750) | (1050,750) |

| Xiamen | (380,140) | (1040,745) | (1040,745) |

| Yantian | (570,100) | (1050,600) | (1050,650) |

| Singapore | (0,0) | (1060,550) | (1050,550) |

| Return voyage | Singapore | Xiamen | Shanghai |

| Rotterdam | (570,550) | (640,900) | (640,900) |

| Gdansk | (570,550) | (650,900) | (650,900) |

| Wilhelmshaven | (380,550) | (640,900) | (640,900) |

| Felixstowe | (570,550) | (650,900) | (650,900) |

| Singapore | (0,0) | (660,150) | (650,150) |

| Carbon Cap-and-Trade | Carbon Tax | |

|---|---|---|

| daily profit of the fleet | 884,841.6 | 809,853.48 |

| carbon emission | 1851.27 | 1840.09 |

| Carbon emission cost | 5977.27 | 92,004.56 |

| Main engine fuel cost | 168,868.10 | 165,568.10 |

| Fuel cost of auxiliaries | 104,541.10 | 104,541.10 |

| Daily operating cost | 360,766.0 | 360,766.0 |

| port dues | 15,785.71 | 15,785.71 |

| speed | 12.31 | 12.26 |

| speed | 13 | 13 |

| ship type | 7 | 7 |

| Carbon Tax | Carbon Cap-and-Trade | |||

|---|---|---|---|---|

| m | 9 | 10 | 9 | 10 |

| Speed | 11.36 | 12.31 | 11.36 | 12.31 |

| Carbon Emissions | 2640.28 | 2162.93 | 2640.28 | 2162.93 |

| Average daily profit of the fleet | 453,292.70 | 559,063.81 | 559,325.02 | 653,162.53 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lan, X.; Zuo, X.; Tao, Q. Container Shipping Optimization under Different Carbon Emission Policies: A Case Study. Sustainability 2023, 15, 8388. https://doi.org/10.3390/su15108388

Lan X, Zuo X, Tao Q. Container Shipping Optimization under Different Carbon Emission Policies: A Case Study. Sustainability. 2023; 15(10):8388. https://doi.org/10.3390/su15108388

Chicago/Turabian StyleLan, Xiangang, Xiaode Zuo, and Qin Tao. 2023. "Container Shipping Optimization under Different Carbon Emission Policies: A Case Study" Sustainability 15, no. 10: 8388. https://doi.org/10.3390/su15108388

APA StyleLan, X., Zuo, X., & Tao, Q. (2023). Container Shipping Optimization under Different Carbon Emission Policies: A Case Study. Sustainability, 15(10), 8388. https://doi.org/10.3390/su15108388