1. Introduction

In order to achieve sustainable development for humanity, achieving low-carbon production is an important challenge facing the manufacturing industry at present. To promote the reduction of emissions in the shipbuilding industry, the International Maritime Organization has implemented a series of measures to limit carbon emissions from ships, requiring all ships at sea worldwide to have a fuel oil sulfur content of no more than 0.5 percent. At present, there is no specific carbon emissions policy in the shipbuilding industry. However, it can be anticipated that similar policies such as carbon quotas will be introduced in the future.

Many companies have successfully implemented carbon quota policies and achieved both profitability and emission reduction goals. For example, Siemens in Germany has utilized efficient power generation technology and energy management systems to improve energy efficiency. Scania, in Sweden, is dedicated to promoting eco-friendly transportation solutions and has implemented a carbon quota policy to launch a range of low-carbon and zero-emission public transportation solutions in order to achieve emission reduction and profitability goals. These cases demonstrate that the implementation of carbon quota policies can effectively achieve both profitability and emission reduction goals for companies. Therefore, the shipbuilding industry should also take corresponding measures.

The recycling challenge in remanufacturing has always been a difficult and complex issue, involving planning and selection of recycling channels, cost allocation, consumer willingness to recycle, etc. While many researchers have made a more comprehensive discussion on the recycling process [

1,

2,

3], few have examined how shipbuilders can develop effective rebuilding strategies for decommissioned ships under the carbon quota policy set by the International Maritime Organization. The research question addressed in this paper is whether the shipbuilder can achieve profitability through the use of decommissioned ships for rebuilding when facing carbon emission quotas, and how shipbuilders can optimize their reuse strategies to comply with industry or government carbon emission quotas.

To respond to the aforementioned issue, this study investigates the potential for shipbuilders to utilize decommissioned ships for rebuilding purposes, with the aim of reducing carbon emissions and increasing profitability. The paper formulates a dynamic rebuilding model and derives optimal strategies, considering the impact of carbon quotas and emission savings. The results indicate that shipbuilders can improve their profitability while contributing to energy conservation and emission reduction through technological innovation. The study also emphasizes the important role of government regulation in managing shipbuilders, especially in instances where the unit price of carbon quotas is excessively high.

Furthermore, the paper highlights the need for shipbuilders to balance compliance costs with remaining competitive in the global market. To achieve this, pricing strategies that maintain profitability while incentivizing customers to choose sustainable shipping options can be explored.

In conclusion, this paper provides shipbuilders with a comprehensive understanding of the challenges they face under the carbon quota policy set by the International Maritime Organization, and offers practical solutions that can assist them in navigating this complex regulatory landscape. By offering optimal rebuilding and pricing control strategies, this research contributes to the existing literature and provides a roadmap for achieving sustainable and profitable growth in the marine industry. The findings have important implications for both shipbuilders and policymakers seeking to address the pressing challenge of reducing carbon emissions in the marine industry.

2. Literature Review

Ship rebuilding is an effective way for carbon emission reduction as well as resource saving. A shipbuilder in Norway, Vard, started ship rebuilding in 2013 (

https://www.oecd.org/industry/ind/PeerReviewNorway_FINAL.pdf, accessed on 10 May 2023). As a major carbon-emitting country, China has also proposed strengthening the research and development of energy-saving and emission reduction technologies to promote the development of green ships, energy-saving ships and intelligent ships. These policy measures provide opportunities and challenges for shipbuilding enterprises and require active response and implementation by these enterprises. Many scholars have provided reference suggestions for the sustainable development of shipbuilding enterprises. Fang et al. [

4] discussed the incentive effect of green management on green innovation, and proposed some feasible green management measures and strategies. They emphasized that the government should try carbon quota restrictions at the policy level, which is more beneficial to the development of enterprises. Feng et al. [

5] explored the application of carbon emission reduction technology in the ship manufacturing industry. They analyzed practical effects and application prospects, and also proposed some feasible abatement technologies and application suggestions. Chen et al. [

6] analyzed the current situation and potential emission reduction capacity of China’s ship manufacturing industry, and proposed a series of emission reduction measures and policy recommendations which provide a reference for the ship manufacturing industry to achieve carbon emission limits.

By imposing carbon quota restrictions on manufacturers, the government can encourage them to continuously reduce carbon emissions to gain more profits from carbon quota trading, which can kill two birds with one stone. For example, in the field of carbon trading regulation, Zhao et al. [

7] conducted a study on wholesale price and cost-sharing coordination under cap-and-trade regulation and consumers’ low-carbon preferences. He et al. [

8] focused on how strict carbon regulations and operational decision patterns jointly affect system profitability and emission control. This paper showed that appropriate adjustment of cap tightness and combining decision patterns with cap-sharing schemes can achieve incremental individual profit improvements, especially to achieve a win-win situation for system profitability and emission reduction. Therefore, in the context of carbon allowances, how shipbuilding companies should develop their own production strategies to seek the most substantial profits becomes an issue worthy of further discussion.

In addition, a large number of studies have been conducted by scholars to address corporate decision-making under carbon quota policies. Gong and Zhou [

9] obtained optimal production strategies for manufacturers in the context of carbon cap-and-trade policies. Ghosh et al. [

10] investigated the problem of optimal order and production strategies in a consumer low-carbon preference and cap-and-trade regulation context, studying stochastic dual-channel supply chain analysis. The study shows that the introduction of a dual-channel strategy is profitable when consumers’ low-carbon preferences are high and initial ship emissions are low. Kushwaha et al. [

11] investigated the optimal combination of channels for manufacturers to determine channels for collecting used products from these regions in a limited multi-cycle scenario, based on channel selection for collection activities in a reverse supply chain under carbon cap-and-trade regulation. Liu and Chen [

12] investigated the problem of optimal order and production strategies for stochastic demand supply chains under a trading mechanism in the context of carbon caps. Zhang et al. [

13] explored the impact of disruptions in the low-carbon supply system on channel members, considering the existence of government green subsidies and carbon cap-and-trade policies. All the above literature conducts research in the context of government implementation of carbon cap-and-trade, which provides a rich theoretical basis for relevant shipbuilding companies.

Meanwhile, in recent years, the carbon quota policy is not only widely used in conventional enterprises, but also gradually developed for the remanufacturing industry. Compared with traditional manufacturing enterprises, remanufacturing enterprises can reduce more carbon emissions per unit of ship through recycling and remanufacturing waste ships, so they can obtain more residual carbon quotas, make more profit through carbon trading, and produce more products. There is a trade-off for remanufacturers. There is also a growing interest in remanufacturers’ decision-making in the context of government carbon quota policies. García-Alvarado et al. [

14] studied co-product recycling and inventory management under cap-and-trade constraints, exploring the impact of environmental legislation on inventory control policies. Wang et al. [

15] investigated the issue of manufacturers’ manufacturing/remanufacturing programs applying downward substitution strategies between new and remanufactured products, providing applicable recommendations for manufacturers and policy makers. Chai et al. [

16] studied the competitive strategies of original equipment manufacturers considering carbon cap-and-trade contexts. Yang et al. [

17] studied the closed-loop supply chain for remanufacturing under cap-and-trade regulation. Cheng et al. [

18] investigated the optimal strategy for economically constrained closed-loop supply chain networks, and the model proved that under certain conditions, economic and ecological objectives can be consistently achieved. All of the above literature has explored the production and pricing decisions of remanufacturers under carbon quota policies.

By reading the above articles, we compared the focal points of different studies, as shown in

Table 1.

However, the above studies only solve the optimal production and pricing strategies of remanufacturing enterprises by constructing static models, and ignore the dynamic recycling process, which is the most critical in remanufacturing; they also do not make relevant decision analysis for the recycling of used products.

This paper contributes to the literature by providing decision analysis for shipbuilders seeking to reduce carbon emissions and increase profitability through the reuse of decommissioned ships, which has been ignored by existing studies. Specifically, we investigate the optimal rebuilding and pricing strategies for shipbuilders to comply with carbon emission quotas imposed by industry or government regulations. This study fills a gap in the literature by an examination of the reuse of decommissioned ships in the context of carbon emission quotas.

3. Model Formulation

Consider a shipbuilder who makes new ships and sells them to customers. The shipbuilder can use raw materials for building ships, and can also make use of decommissioned ships for building new ships. The ships manufactured by the two methods are the same, which means rebuilding decommissioned ships is a way for the shipbuilder to gather materials.

The unit costs of producing with raw materials and with decommissioned ships are and , respectively. The unit cost saved from ship rebuilding is . means that ship rebuilding can effectively reduce the shipbuilder’s cost, while means that ship rebuilding will not save costs, or even causes more costs to the shipbuilder. Usually, remanufacturing in many industries can generate cost savings for manufacturers.

The unit carbon emission with raw materials is denoted by . Since rebuilding can save the consumption of raw materials, it will contribute to saving carbon emissions. We assume the unit carbon emission saved from ship rebuilding is , indicating that ship rebuilding has a positive effect on reducing the ship builder’s carbon emission.

The ship rebuilding process renovates and rebuilds ships by dismantling and reusing decommissioned ships. This dismantling and rebuilding process is a continuous learning process, and the higher the learning effort invested by the shipbuilder, the higher its reutilization rate of decommissioned ships. We use

to denote the rebuilding learning effort devoted by the ship builder to improve its ship reutilization rate. Let

represent the proportion of reutilization rate, which indicates the proportion of materials derived from decommissioned ships in a new ship. The higher the proportion, the higher the ship’s level of recovery and reutilization. Since this dismantling and rebuilding effort can be regarded as R&D and innovation activities, we utilize the dynamic model proposed by Huang et al. [

19] to reflect the relationship between the reutilization rate and the level of rebuilding effort. The reutilization rate, reflecting the ability of the ship builder to dismantle and rebuild a decommissioned ship, is formulated as the state variable. The rebuilding learning effort is formulated as the control variable, which is decided by the ship builder. The reutilization rate dynamics is then formulated as,

where

is the coefficient of impact of the rebuilding effort on the reutilization rate,

is the decay factor of the reutilization rate, and

denotes the initial reutilization rate. Assume that the decision period is

and the discount rate of the system is

.

Assume that the rebuilding costs of the ship builder is , where is the rebuilding cost coefficient. The larger the rebuilding coefficient , the higher the rebuilding costs.

According to the common assumption in economics and management, the demand rate of the rebuilding ship at time

is given by:

Meanwhile, this paper considers a carbon quota policy based on the model of Wang et al. [

15], in which the government sets a cap on carbon quotas for shipbuilders to regulate carbon emissions while encouraging them to reduce the environmental pollution through technological innovations in remanufacturing. The total carbon quota given by the government to shipbuilders to produce ships is

. If the shipbuilder’s total carbon emission exceeds the government’s carbon quota, the shipbuilder needs to purchase new carbon quotas from the carbon trading market to maintain its production, and if the carbon emissions are lower than the carbon quota given, it can resell the remaining part at a unit price

in the carbon trading market. Therefore, the shipbuilder’s objective function is formulated as:

is the revenue from the ship-selling.

is the revenue of carbon resale or the expense of carbon purchase. When

, the shipbuilder does not use up its carbon quota and gains some revenue by reselling carbon quota; when

, the enterprise uses up all of its carbon quota and should buy a portion of carbon quota in the carbon trading market to maintain production.

The notations used in this paper are summarized in

Table 2.

4. Model Analysis

This section uses optimal control theory to solve the optimal control strategies of the shipbuilder under the carbon quota policy; the trajectory evolution equation of the ship recovery rate is also solved. We refer the readers to Sethi [

20] for the details of the method. Proposition 1 gives the optimal control strategy for the shipbuilder under the government carbon quota.

Proposition 1. Under the government carbon quota, when

, the optimal ship pricing control strategy and the optimal rebuilding effort control strategy of the shipbuilder are given by:

The shipbuilder’s optimal value function is:where Proof. We use the HJB (Hamilton-Jacobi-Bellman) control strategy (Sethi [

20]) to solve the problem. Formulate the HJB function of the shipbuilder as:

where

. To make the subsequent equations as concise as possible, we combine and simplify Equation (7) as:

Let

, and based on the first order derivatives of the above equations, the optimal ship pricing strategy and the optimal rebuilding effort of shipbuilder are solved as:

Substituting Equation (9) into (8), and combining homogeneous terms of

as:

By observing Equation (10),

will be a quadratic function. We assume

, where

are the coefficients to be solved and

. Substitute

into Equation (10), and according to the principle of equivalence of coefficients, we can obtain the following equation:

Further,

are solved as:

It can be seen that the coefficient has two roots, while the coefficients can be expressed by the equations containing , respectively. In order to ensure the feasibility of the strategy in practice, it is necessary to ensure that the level of the shipbuilder’s rebuilding effort is still positive. In the case of a small reutilization rate, the coefficient needs to be greater than 0. In order to ensure that is positive at any value, the final coefficient is taken as shown in Proposition 1. □

Proposition 2 gives the equation for the evolution of the trajectory of the reutilization rate .

Proposition 2. The equation for the evolution of the trajectory of the shipbuilder’s reutilization rate

under the government’s carbon quota policy is:

Proof. A first-order differential equation can be obtained by substituting the optimal rebuilding effort into the state equation, and the expression for the reutilization rate can be obtained by solving the differential equation and obtaining the evolution equation for the trajectory of the reutilization rate in Proposition 2 according to . □

5. Numerical Analysis

In the following section, we will analyze the effects of the unit price of carbon allowances

and unit carbon emission saved by remanufacturing

on ship reutilization rate, optimal ship pricing strategy, optimal rebuilding effort strategy, shipbuilder′s profit, total carbon emission and remaining carbon allowance to provide a reasonable reference basis for shipbuilder′s decision. Firstly, the system parameters are assigned, and combined with existing studies, such as Chiu et al. [

21]. Set

. Setting these parameters ensures the validity of the model results, such as: the range of values for the ship’s reutilization rate is between 0 and 1, the remaining carbon quota is greater than zero, etc.

5.1. Impact of Unit Price of Carbon Allowances in Carbon Trading Market

Figure 1 shows the effect of the unit price of carbon allowances

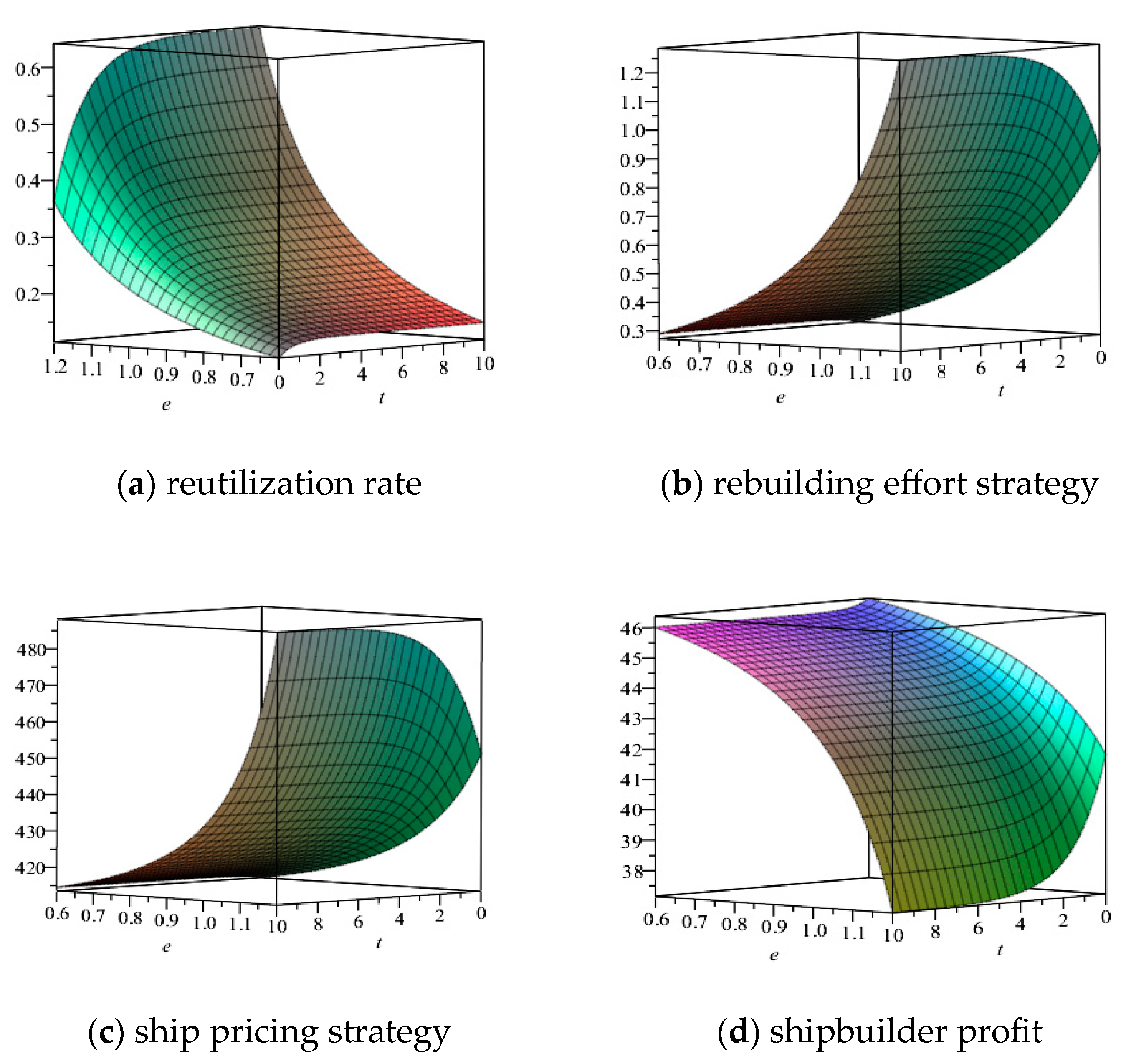

on ship reutilization rate, optimal ship pricing strategy, optimal rebuilding effort strategy, shipbuilder profit, total shipbuilder carbon emissions and remaining carbon allowances in the carbon trading market.

Figure 1a,b show that the ship reutilization rate and the shipbuilder’s optimal rebuilding effort tend to increase and then decrease as

increases.

increases to indicate that the unit price of carbon allowances in the carbon trading market is increasing. At this point, if the shipbuilder can save more carbon emissions through remanufacturing, it can gain more profit in the subsequent carbon trading market. When the unit price of carbon allowances is large enough, selling carbon allowances directly may be more profitable than remanufacturing, so shipbuilders will not insist on rebuilding decommissioned ships and prefer to make profits through direct trading, so the rebuilding effort will gradually decrease and the reutilization rate will slowly fall.

Figure 1c shows the effect of

on the shipbuilder′s optimal ship pricing strategy, where the larger the

, the higher the price of the ship. When the unit price of carbon quota increases, shipbuilders choose to reduce the rebuilding effort, which leads to a decreasing number of recycled ships in the market, and the market price of the ship will gradually converge to the price when all raw materials are used to make a new ship, so the ship pricing is monotonically increasing.

Figure 1d shows the effect of

on shipbuilders′ profit, which tends to decrease and then increase as

increases. In the initial stage of increasing reutilization, the cost of rebuilding is higher than the profit from selling carbon allowances, and the profit gradually decreases.

Figure 1e shows the variation of shipbuilders’ total carbon emissions with the unit price of carbon allowances. The increase of

makes the total carbon emissions from production activities gradually decrease. The increase in

leads to a decrease in the market demand for the ship, so that the decrease in quantity leads to a gradual decrease in the total carbon emissions of the shipbuilder with the same carbon emissions per unit of ship. This observation suggests that a high unit price of carbon allowances has a significant effect on reducing carbon emissions of production firms.

Figure 1f reflects the effect of

on the remaining carbon allowances of shipbuilders. A negative value of remaining carbon allowances means that shipbuilders go to the market to buy additional carbon allowances to increase their production, while a positive value of carbon allowances means that shipbuilders reduce their production scale and go to the market to sell their excess carbon allowances. When

is small, the remaining carbon quota is negative and the shipbuilder needs to buy additional carbon quota in the carbon trading market, and when

is large, the remaining carbon quota gradually increases and the overall trend is from negative to positive. From

Figure 1e, we can see that the increase of

makes the total carbon emissions from production activities decrease gradually, so when the price of carbon allowances is low, shipbuilders choose to buy carbon allowances to increase production, while when the price of carbon allowances is high, shipbuilders choose to sell some carbon allowances to reduce the scale of production.

The unit price of carbon quota is the equilibrium price formed by the supply–demand relationship in the market. From the above analysis, it is clear that when is large enough, there is a high probability that the shipbuilders will seek more profits by selling carbon quotas directly. Such a situation obviously has a negative impact on the healthy development of the carbon trading market, and the government should introduce relevant regulations to restrain the shipbuilders’ trading behavior at this time.

5.2. Impact of Unit Carbon Emission Saved by Remanufacturing

Figure 2 shows the impact of remanufacturing savings per unit carbon emission

on ship reutilization rate, optimal ship pricing strategy, optimal rebuilding effort strategy, shipbuilder profit, total shipbuilder carbon emissions and remaining carbon allowances.

Figure 2a–c show that the ship reutilization rate, the optimal rebuilding effort strategy and the profit of the shipbuilder all increase with the increase of the carbon emission saving per unit

. A larger

means that the shipbuilder can save more carbon emissions by remanufacturing decommissioned ships than by manufacturing new ships with raw materials. In this case, shipbuilders will increase rebuilding investment, improve the reutilization rate of ships to expand the proportion of remanufacturing, and reduce carbon emissions while leaving more carbon allowances for them to sell for profit, thus increasing profits.

Figure 2d shows the effect of

on the shipbuilder′s optimal ship pricing strategy: the larger

is, the lower the market price of the ship. If the shipbuilder increases the rebuilding of decommissioned ships when

increases, the proportion of remanufactured ships will gradually increase, and since the price of remanufactured ships is lower than that of new ships, the overall price of ships sold in the market will gradually decrease as the proportion of remanufactured ships increases.

Figure 2e shows the variation in the total carbon emissions of shipbuilders with

.

The increase of

makes the total carbon emissions from production activities increase gradually. As the carbon emission per unit saved from rebuilding ships increases, shipbuilders will increase the rebuilding of their ships and increase the proportion of rebuilding ships in their sales, thus reducing the carbon emission per unit of ship. However, on the other hand, as shipbuilders increase the reutilization rate, the market price of the ship decreases and, thus, the demand increases, which may also increase the total carbon emissions of the system due to the demand expansion effect. The results in

Figure 2e show that the effect of ship demand expansion is more pronounced, and the total carbon emissions increase gradually with the increase of the amount

. This conclusion shows that, although the increase of

can reduce the unit carbon emission of the ship, the increase of demand for the ship will still cause an increase of the total carbon emissions.

Figure 2f reflects the effect of

on shipbuilders′ remaining carbon allowances, which decreases gradually with the increase of

. The value of

represents the reduction effect of remanufacturing on shipbuilders’ production activities. Even though purchasing additional carbon allowances to increase production will increase shipbuilders’ expenditure costs,

Figure 2c shows that the profit generated by expanding production scale is significantly higher than the purchase cost of carbon allowances, so in this case, shipbuilders will choose to further expand production scale by purchasing additional carbon allowances. This finding suggests that

has an important influence on the production pattern of shipbuilders, and that with the increase of carbon emission per unit saved by remanufacturing, shipbuilders will gradually expand their production scale, thus leading to the consumption of carbon allowances.

Based on the analysis above, it can be concluded that, on one hand, reducing carbon emissions per unit of remanufacturing provides a greater incentive for shipbuilders to recycle and remanufacture waste ships, leading to the reuse of more waste materials and solving the problem of waste ship disposal while reducing the consumption of raw materials; on the other hand, shipbuilders’ rebuilding investment results in an increased number of recycled ships, leading to lower overall market prices, expanding market demand, and allowing shipbuilders to expand their production scale and increase profits while offering consumers the same quality ships at a lower price. This creates a win-win situation for both shipbuilders and consumers.

However, the analysis reveals a potential challenge in the context of reducing carbon emissions through ship remanufacturing. While reducing the carbon emission of individual ships, an increase in market demand and production scale could still lead to an overall increase in total carbon emissions, which goes against the goal of energy conservation and emission reduction. Therefore, it is necessary for the government to establish a reasonable policy to regulate the total carbon emissions generated by shipbuilders’ production activities and impose a cap on carbon emissions to avoid an uncontrolled increase in carbon emissions, which could cause more significant environmental impacts. Shipbuilders should also strive to improve their remanufacturing technology under government regulation, aiming to reduce the carbon emission per unit of ship production and increase their profits while contributing to the objective of energy conservation and emission reduction.

6. Conclusions

In this paper, we examine the problem of rebuilding decommissioned ships within the framework of government carbon quotas. Using optimal control theory, we propose optimal ship rebuilding effort strategies for shipbuilders who must operate under a certain carbon quota imposed by the government. Through a numerical example analysis, we illustrate the impact of two key parameters on the shipbuilder’s reutilization rate, optimal control strategy, profit, total carbon emissions and remaining carbon allowance. This enables shipbuilders to make informed decisions by understanding the impact of each parameter.

Our conclusions are as follows: Given a reasonable carbon allowance policy from the government, shipbuilders should strive to reduce the unit carbon emissions of their ships as much as possible by adopting innovative production technologies. This will not only promote their profit growth and rebuilding enthusiasm, but also contribute to the goal of energy saving and emission reduction. The government’s carbon quota policy serves not only as a means of regulating shipbuilders’ remanufacturing, but also as a successful incentive and supervision mechanism for the shipbuilding industry.

From the perspective of the government, formulating a feasible carbon quota policy is crucial. The government needs to prevent shipbuilders from engaging in direct trading of carbon allowances when there is undue competition in the market, which could disrupt the orderly development of the carbon trading market and the remanufacturing industry. Additionally, regulating the total amount of carbon emissions generated by shipbuilders’ production activities is necessary to reduce pollution in the ecological environment.

On one hand, the government plays an essential role in managing the shipbuilding remanufacturing industry by setting authoritative carbon emission standards in the form of a carbon quota policy. This encourages more enterprises to choose the remanufacturing mode of production and make efforts to reduce carbon emissions and cost. On the other hand, the participation of shipbuilding remanufacturing enterprises in the carbon trading market can activate it and change its previously depressed and ineffective state. Both contribute to the government’s environmental protection goals and the country’s economic growth while setting the two industries, which are still in their infancy in China, on the right track to develop and play a more significant role in the future.

The limitations of this paper are that it only considers individual shipbuilders for individual rebuilding, ignoring the many shipbuilders and multiple recycling channels that may exist in reality, and the complexity of the model calculation, which only uses the government as an external regulatory instrument without exploring the utility of the government and related decision-making issues.

Further research on the government’s carbon quota policy to regulate ship rebuilding in closed-loop supply chains can be conducted in the following areas: Firstly, since the government’s decision problem is not considered in this paper, the optimal control strategy of the government can be further solved. Secondly, the rebuilding and decision-making problem of supply chain members in multi-channel rebuilding can be considered.