Raising the Resilience of Industrial Manufacturers through Implementing Natural Gas-Fired Distributed Energy Resource Systems with Demand Response

Abstract

1. Introduction

2. Literature Review of the Topic of Natural Gas-Fired Distributed Energy Resource (DER) Systems with Demand Response

- (1)

- There is no methodological approach to the complex management of costs for electricity and natural gas in DER systems implemented by industrial and commercial facilities in Russia;

- (2)

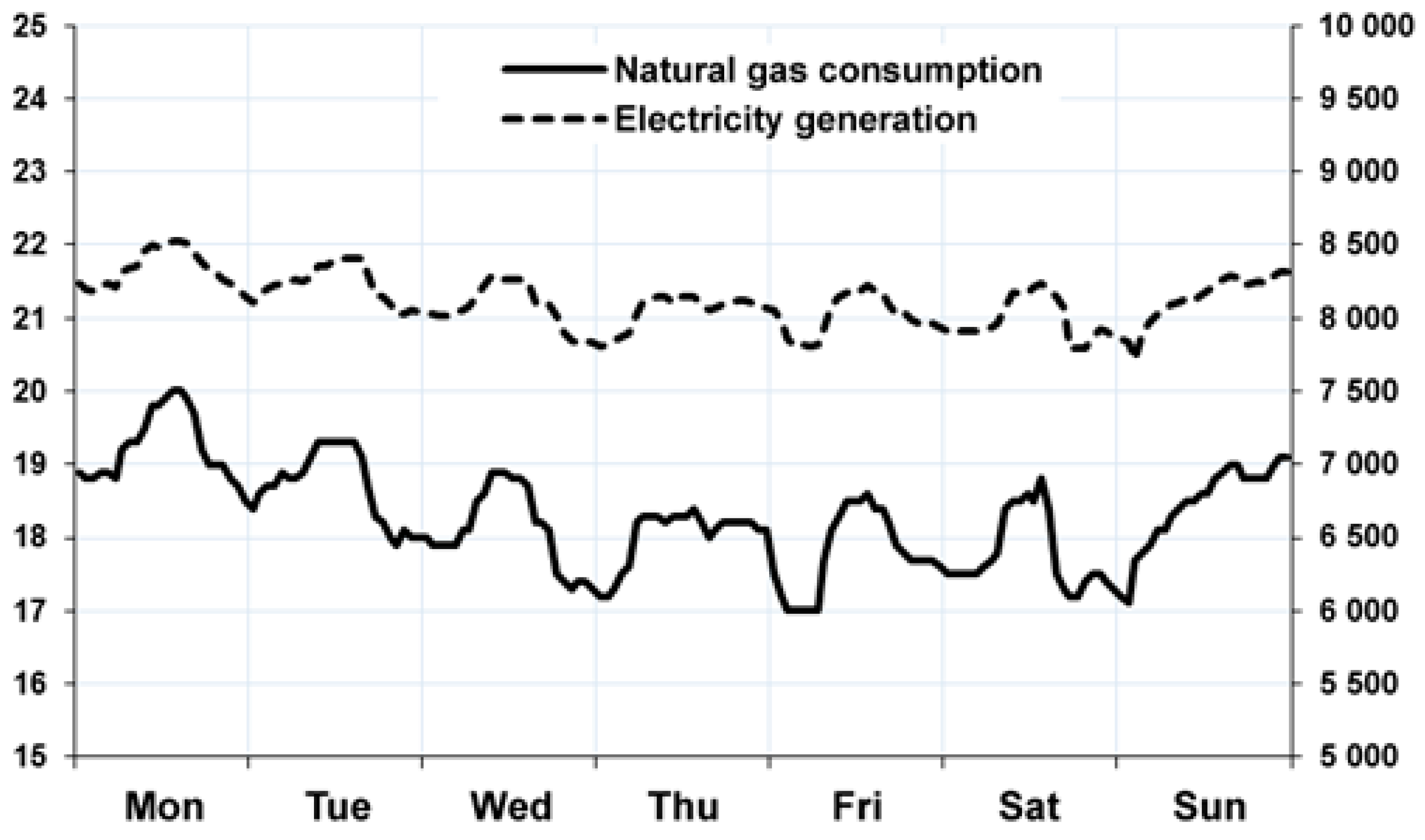

- The uneven nature of the natural gas demand curves is not properly accounted for in the operation of DER systems;

- (3)

- Changes in the complex demand for natural gas and electricity are not properly accounted for in scheduling DER systems;

- (4)

- The pricing in the wholesale and retail electricity markets is not properly accounted for in the operation of DER systems;

- (5)

- No methods developed for analyzing the price parameters of the electricity purchased by industrial and commercial entities that have direct connection to the networks of electricity producers; and

- (6)

- No algorithm for the integrated management of behind-the-meter DER systems in the context of the existing power (capacity) and natural gas markets.

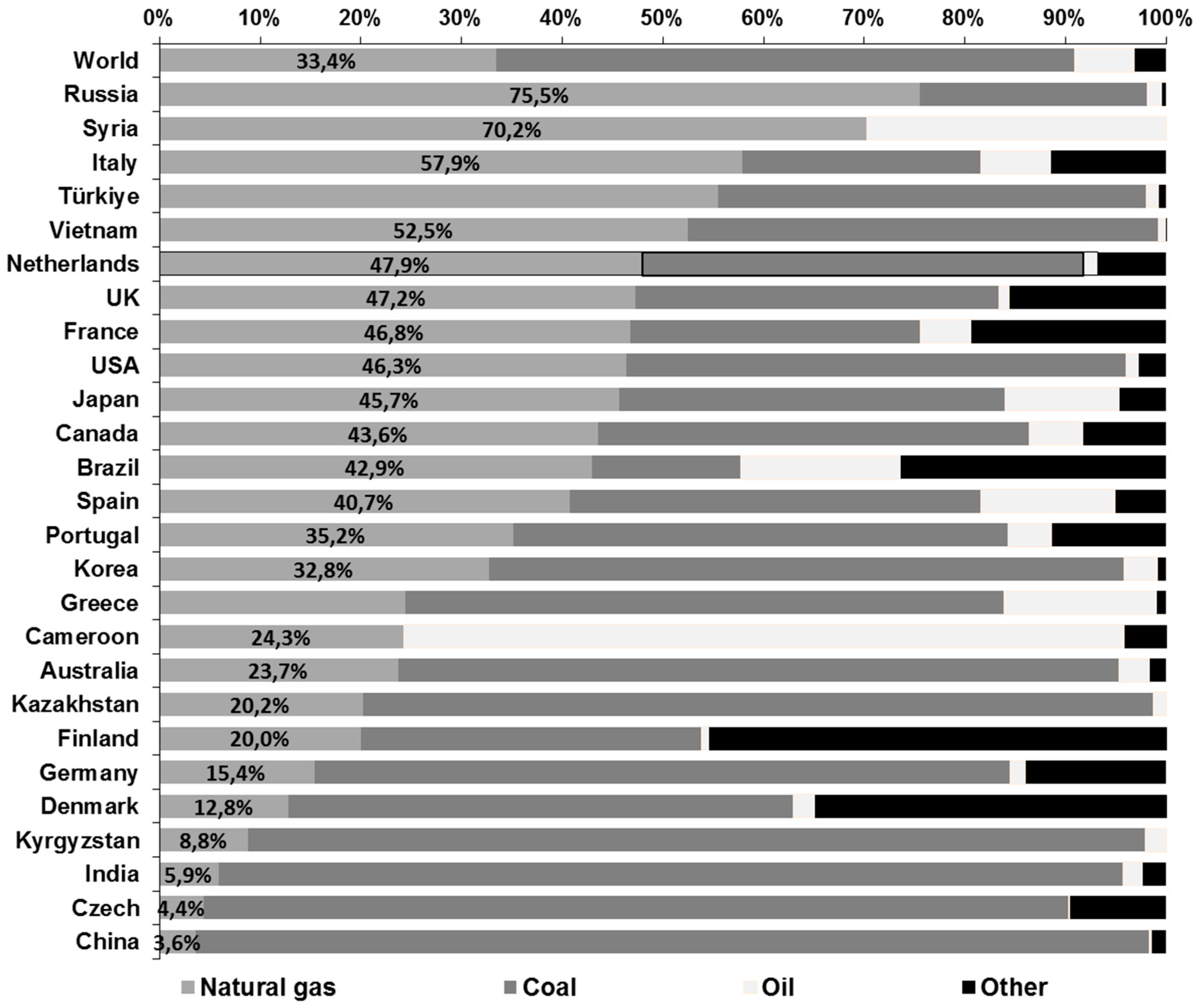

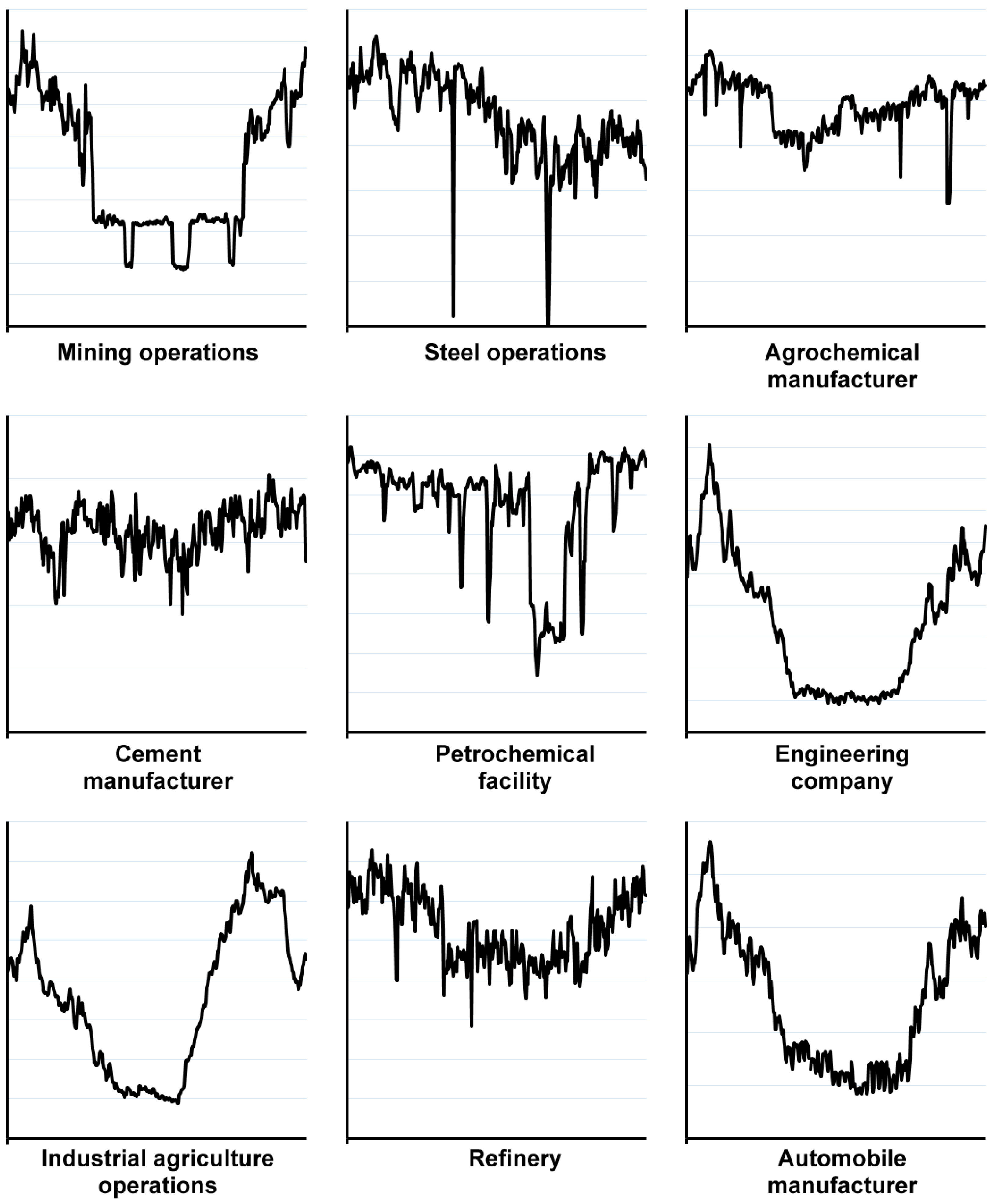

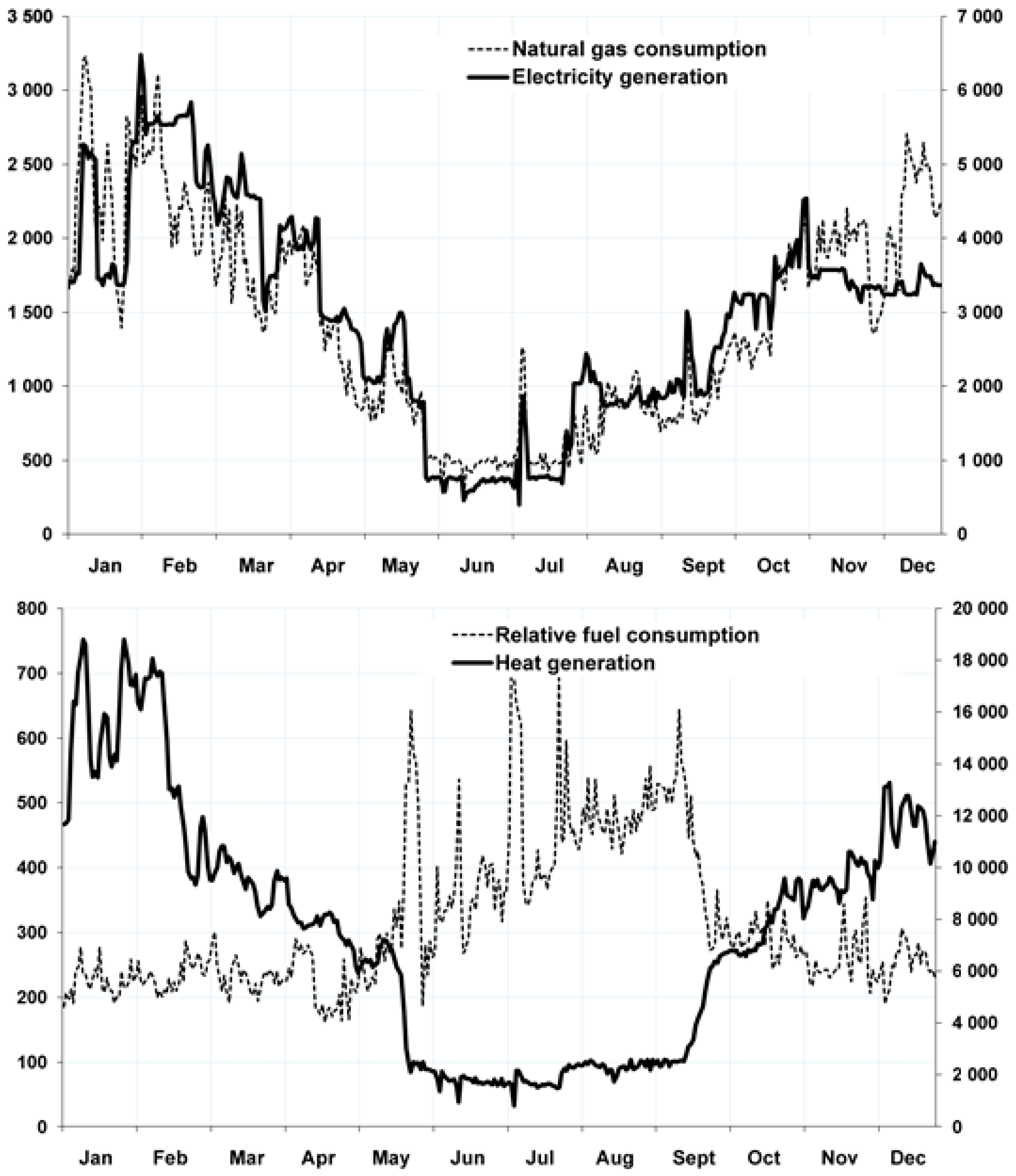

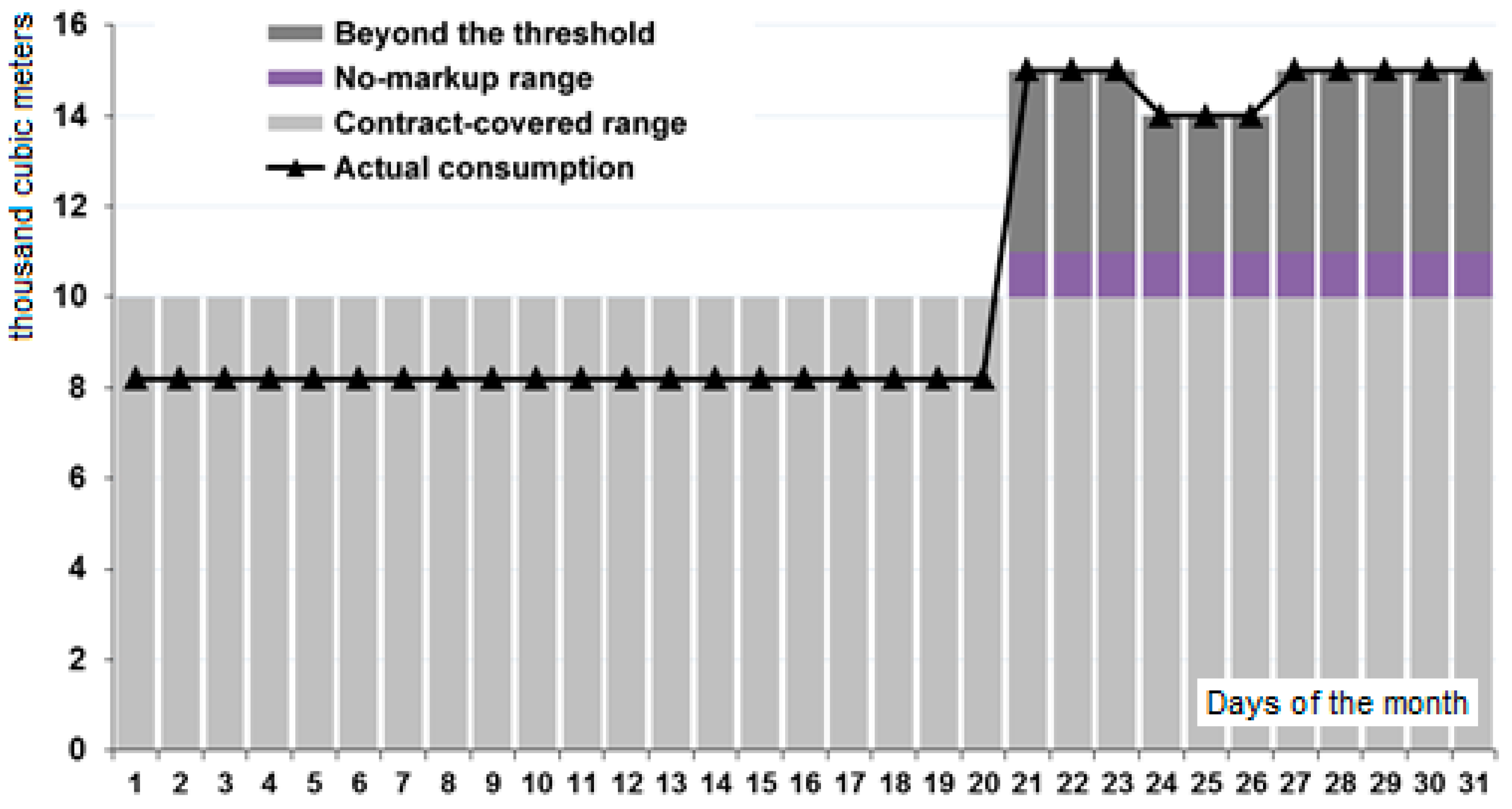

3. The Specifics of Industries’ Demand Curves for Natural Gas

- Natural gas as well as electricity are supplied from the centralized grids whenever the demand appears;

- Natural gas, like electricity, cannot be stored on a large scale at an industrial enterprise in order to balance its demand from the grid in the context of continuous gas consumption by the operating equipment; and

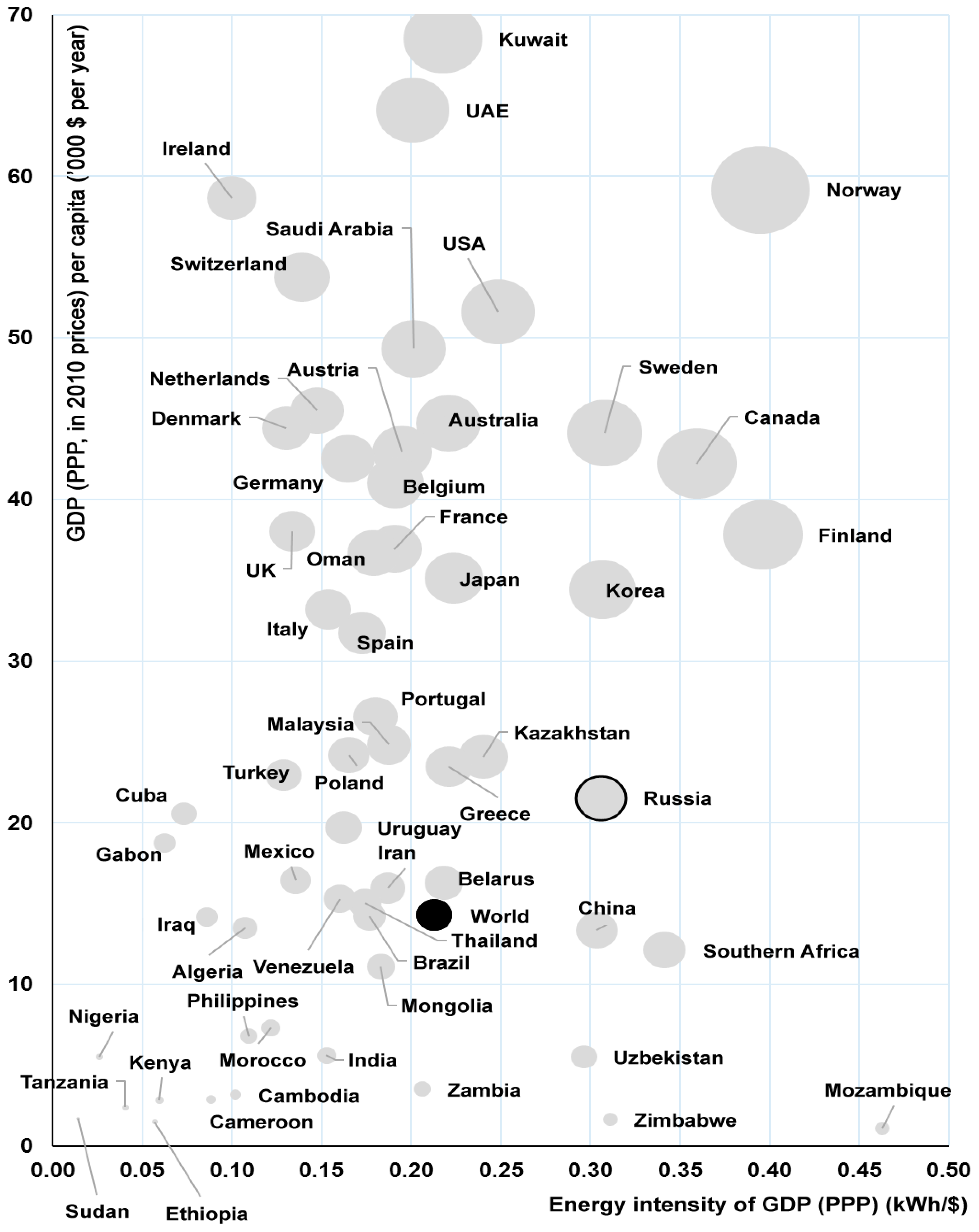

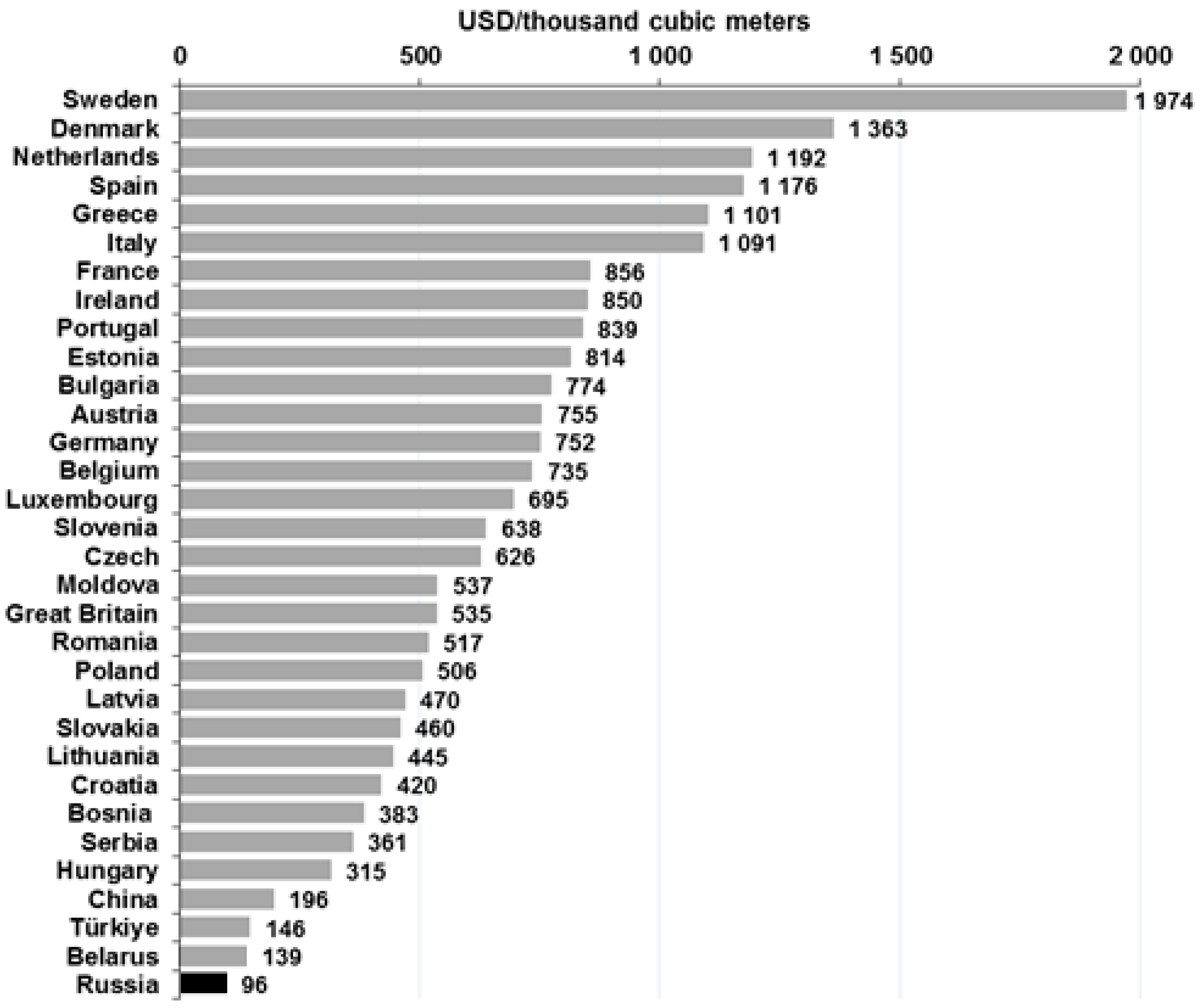

4. The Impact of Natural Gas Demand Volatility on Industrial Electricity Pricing

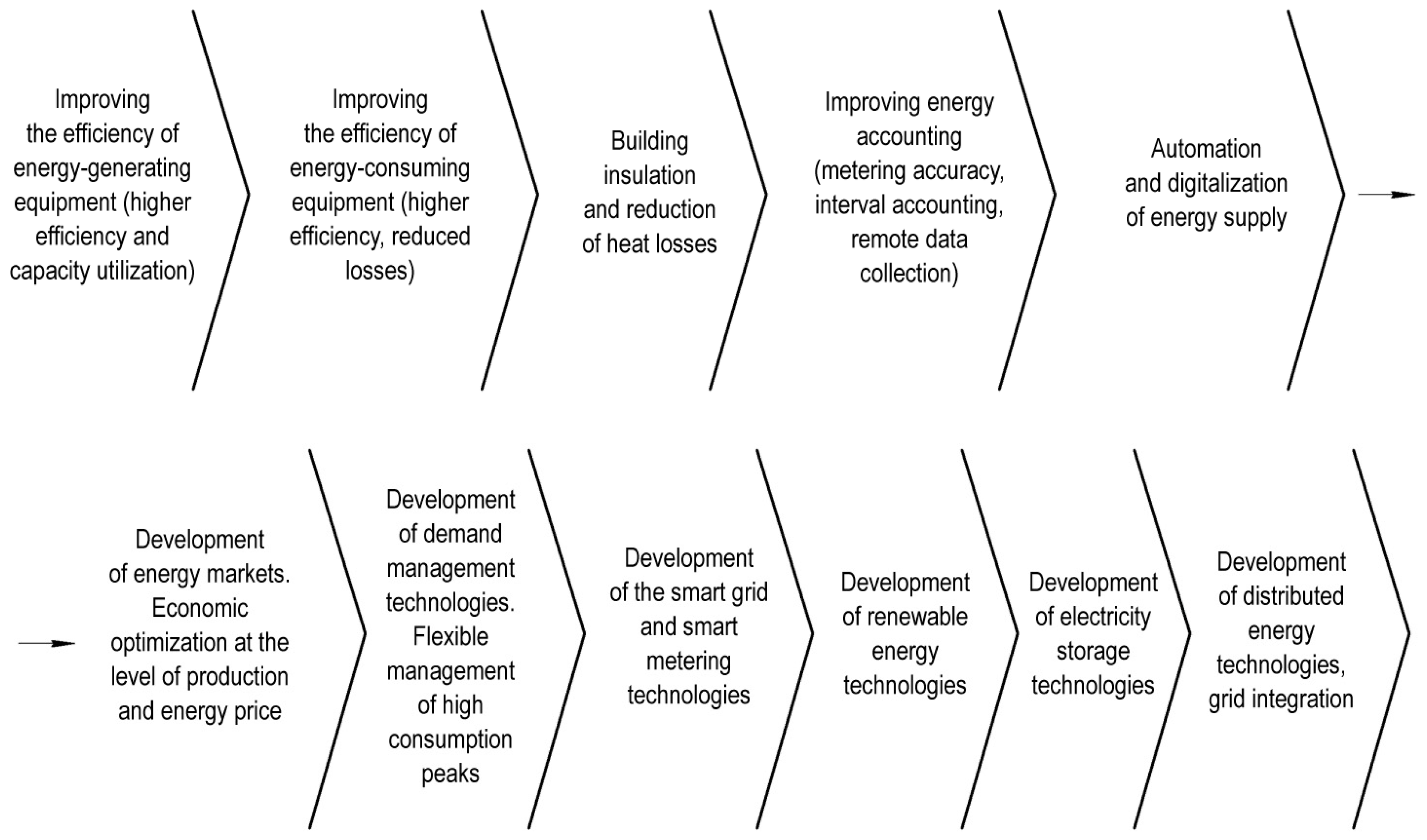

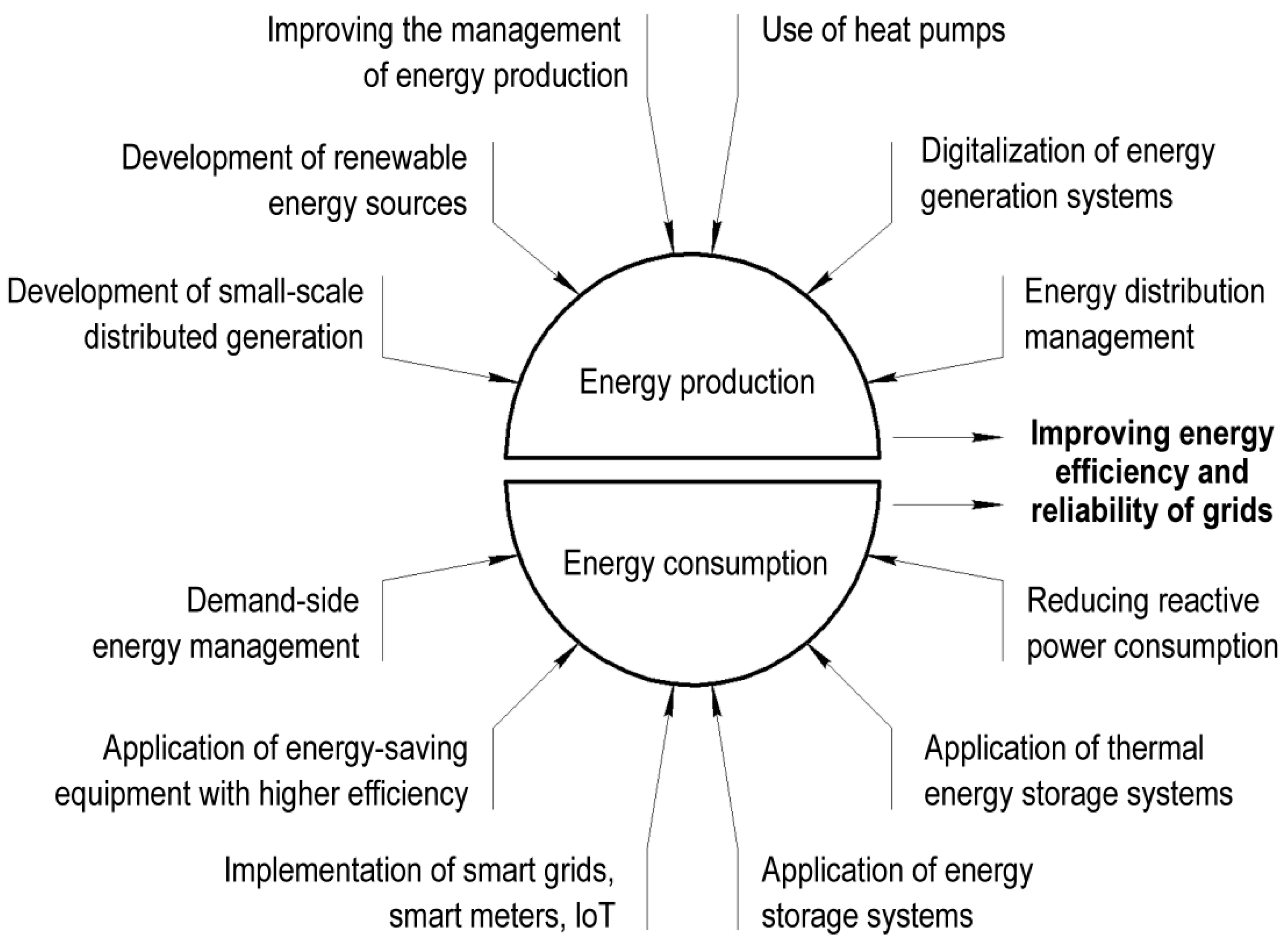

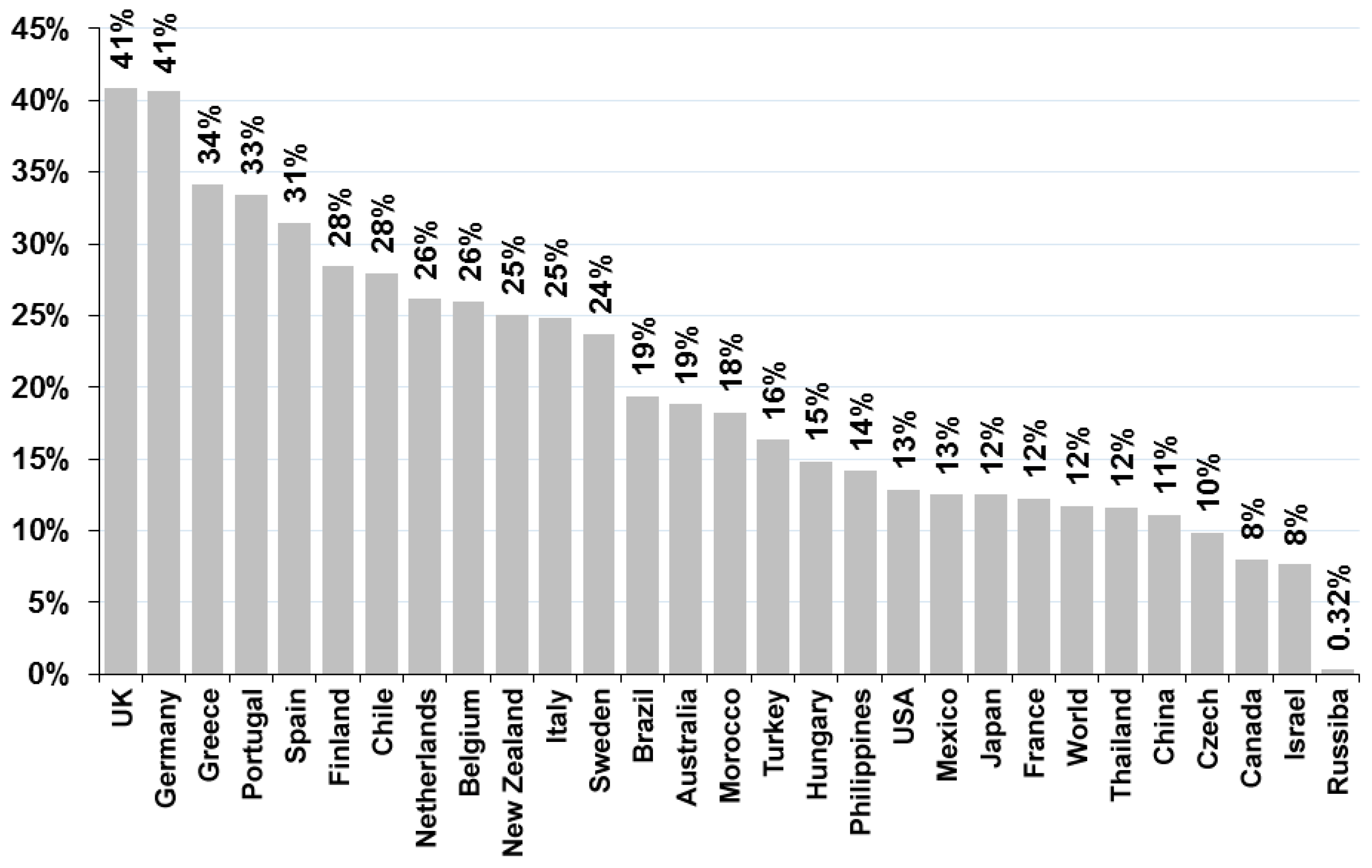

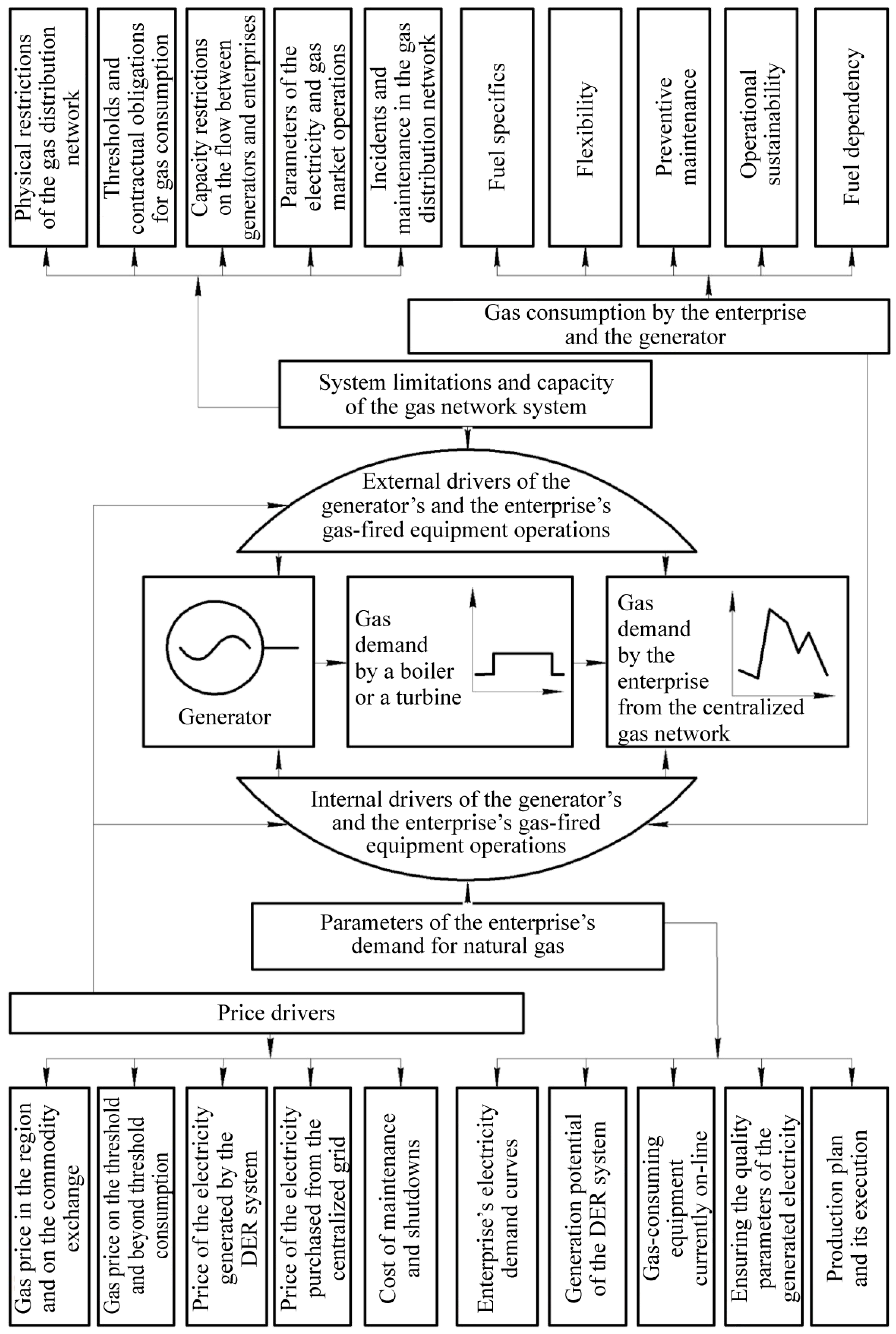

5. Review of the Drivers Affecting the Natural Gas Demand Fluctuations in Industry

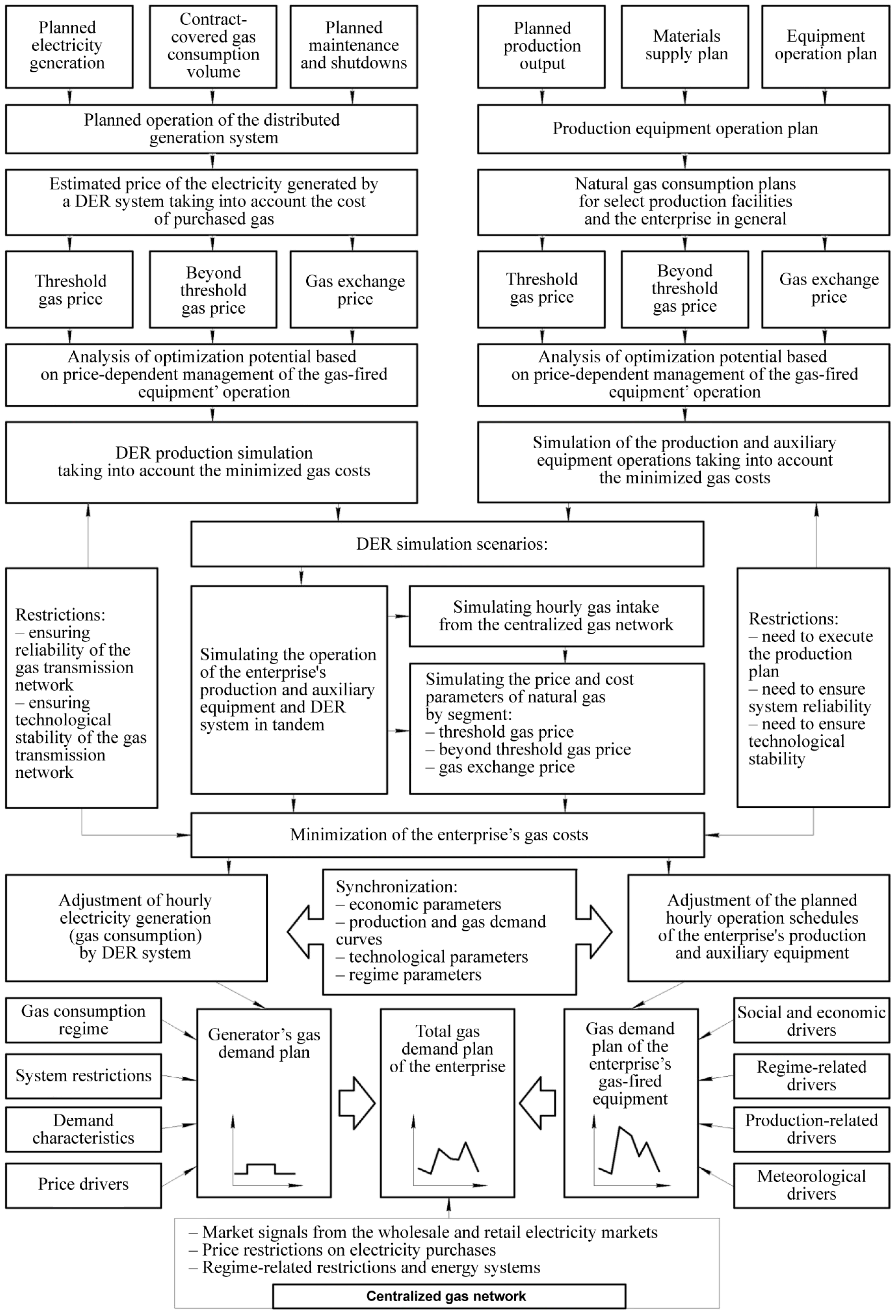

6. Proprietary Model for the Management of DER Systems in Integration with the Gas Demand Response

- (1)

- accounting for the operation of energy-consuming equipment of an industrial enterprise and generating equipment of a system of small, distributed generation of electricity within a single control system;

- (2)

- accounting for the simultaneous consumption of electrical energy and natural gas by the system of the active energy complex of an industrial enterprise, during the operation of which, within the framework of a single technological system, there is mutual influence and a change in demand schedules for the consumption of electrical energy and natural gas;

- (3)

- comprehensive accounting of both the consumption of electrical energy and natural gas by the system of an industrial enterprise, and the simultaneous generation of electrical energy by a system of small distributed generation and the consumption of natural gas for the needs of electricity generation within the framework of a unified technological and economic management system;

- (4)

- comprehensive accounting of dynamic hourly price indicators of both the external environment of the wholesale and retail electricity (capacity) markets, regional conditions for natural gas supplies and price indicators of natural gas supply on the commodity exchange, and price indicators of the internal environment of the active energy complex in terms of dynamic hourly price indicators of electricity generation by the active energy complex system into the internal network of an industrial enterprise;

- (5)

- taking into account the limitations of managing an active energy complex, such as: ensuring the conditions for the economic efficiency of the operation of an industrial enterprise, taking into account the conditions for ensuring the technological stability of the operation of the technological equipment of an industrial enterprise and a small distributed generation system, taking into account the system reliability of power supply and the operation of an enterprise operating within a single technological process with external energy supply infrastructure within the framework of the Unified Energy System and the Unified Gas Supply System.

- (1)

- the direction of the external environment—the environment of the wholesale and retail electricity markets and the conditions for the supply of natural gas from a regional supplier and the supply of natural gas from the commodity exchange. The price indicators of these pricing mechanisms are characterized by dynamic changes depending on the hours of the day, days of the week, types of days, seasons, periods of planned peak hours of the energy system, periods of the actual hourly maximum of the regional electric power system, introduction of systemic restrictions by the electric grid and gas infrastructure, etc. An active energy complex cannot influence the change in the dynamic change in price indicators acting from the external environment.

- (2)

- the direction of the internal environment—the environment of schedules of own hourly, daily demand for the consumption of electricity and natural gas of an industrial enterprise, on the basis of which pricing is carried out for the indicators of purchased electricity and natural gas. Taking into account the fact that schedules of demand for energy resources are characterized by volatility, their characteristics influence the dynamic change in price indicators for the purchase of energy resources by an enterprise. Unlike the direction of the external environment, an active energy complex has the ability to manage changes in price indicators acting from the factors of the internal environment.

7. Proprietary Mechanism for Managing industrial DER systems in Integration with Demand Response

8. Overview of the Testing Case Study

9. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Conflicts of Interest

References

- Ivannikov, P.O. Energy efficiency, resource saving and environmental management in urban economy and construction: Economics and management. In Proceedings of the III International Scientific and Technical Conference, Volgograd, Russia, 20–25 May 2016. 792p. [Google Scholar]

- Dziuba, A.P.; Semikolenov, A.V. The Relevance of Using Industrial DER Systems with Demand Response in Russia. OG Econ. Manag. 2021, 201, 31–40. [Google Scholar] [CrossRef]

- Statistical Review of World Energy 2021. Statistics Report British Petroleum. 2021. 72 P. Available online: https://www.bp.com/ (accessed on 1 April 2023).

- Dziuba, A.P. Theory and Methodology of Demand Management for Energy Resources in Industry: Monograph; Publishing Center of SUSU: Chelyabinsk, Russia, 2020; 323p. [Google Scholar]

- Dziuba, A.P.; Solovyov, I.A. Energy Demand Management in Industrial Complexes and Regions; Publishing Center of SUSU: Chelyabinsk, Russia, 2019; 239p. [Google Scholar]

- Pilipenko, N.V.; Sivakov, I.A. Energy Saving and Energy Efficiency Improvement of Engineering Systems and Networks; Tutorial; NRU ITMO: St. Petersburg, FL, USA, 2013; 274p. [Google Scholar]

- Energy Saving in the Mirror of Industrial Policy. Information Review of the Analytical Center for the Government of the Russian Federation. 2012; 37p. Available online: https://ac.gov.ru/files/publication/a/3017.pdf (accessed on 1 April 2023).

- Energy Regulators Regional Association. Available online: https://erranet.org/?lang=ru (accessed on 1 April 2023).

- Key World Energy Statistics 2020. Statistics Report International Energy Agency. 2020/81 P. Available online: https://iea.blob.core.windows.net/assets/1b7781df-5c93-492a-acd6-01fc90388b0f/Key_World_Energy_Statistics_2020.pdf (accessed on 1 April 2023).

- Electricity Information 2020. Statistics Report International Energy Agency. 2020/683 P. Available online: https://www.iea.org/reports/global-energy-review-2020/electricity (accessed on 1 April 2020).

- Sibikin, Y.D.; Sibikin, M.Y. Non-Traditional and Renewable Energy Sources: A Tutorial; KNORUS: Moscow, Russia, 2010; 227p. [Google Scholar]

- Organization of the Petroleum Exporting Countries. Available online: https://www.opec.org/ (accessed on 1 April 2023).

- Mapping of Existing Technologies to Enhance Energy Efficiency in Buildings in the UNECE Region/United Nations Economic Commission for Europe. 2019. 66P. Available online: https://unece.org/ (accessed on 1 April 2023).

- Global Energy Trends-2021 Edition/Enerdata. 2021–56 P. Available online: https://www.enerdata.net/publications/reports-presentations/world-energy-trends.html (accessed on 1 April 2023).

- Matos, S.P.S.; Vargas, M.C.; Fracalossi, L.G.V.; Encarnação, L.F.; Batista, O.E. Protection philosophy for distribution grids with high penetration of distributed generation. Electr. Power Syst. Res. 2021, 196, 107203. [Google Scholar] [CrossRef]

- Beltrán, J.C.; Aristizábal, A.J.; López, A.; Castaneda, M.; Zapata, S.; Ivanova, Y. Comparative analysis of deterministic and probabilistic methods for the integration of distributed generation in power systems. Energy Rep. 2020, 6 (Suppl. 3), 88–104. [Google Scholar] [CrossRef]

- Sandhya, K.; Chatterjee, K. A review on the state of the art of proliferating abilities of distributed generation deployment for achieving resilient distribution system. J. Clean. Prod. 2021, 287, 125023. [Google Scholar] [CrossRef]

- Martínez, S.D.; Campos, F.A.; Villar, J.; Rivier, M. Joint energy and capacity equilibrium model for centralized and behind-the-meter distributed generation. Int. J. Electr. Power Energy Syst. 2021, 131, 107055. [Google Scholar] [CrossRef]

- Anuradha, K.B.J.; Jayatunga, U.; Ranjit, H.Y. PereraLoss-Voltage Sensitivity Analysis Based Battery Energy Storage Systems Allocation and Distributed Generation Capacity Upgrade. J. Energy Storage 2021, 36, 102357. [Google Scholar] [CrossRef]

- Baghbanzadeh, D.; Salehi, J.; Samadi Gazijahani, F.; Shafie-khah, M.; Catalão, J.P.S. Resilience improvement of multi-microgrid distribution networks using distributed generation. Sustain. Energy Grids Netw. 2021, 27, 100503. [Google Scholar] [CrossRef]

- Li, Z.; Chen, G. Fixed-time consensus based distributed economic generation control in a smart grid. Int. J. Electr. Power Energy Syst. 2022, 134, 107437. [Google Scholar] [CrossRef]

- Kakran, S.; Chanana, S. Smart operations of smart grids integrated with distributed generation: A review. Renew. Sustain. Energy Rev. 2018, 81, 524–535. [Google Scholar] [CrossRef]

- Howlader, H.O.R.; Matayoshi, H.; Senjyu, T. Distributed generation incorporated with the thermal generation for optimum operation of a smart grid considering forecast error. Energy Convers. Manag. 2015, 96, 303–314. [Google Scholar] [CrossRef]

- Belmahdi, B.; ElBouardi, A. Simulation and Optimization of Microgrid Distributed Generation: A Case Study of University Abdelmalek Essaâdi in Morocco. Procedia Manuf. 2020, 46, 746–753. [Google Scholar] [CrossRef]

- Valencia, A.; Hincapie, R.A.; Gallego, R.A. Optimal location, selection, and operation of battery energy storage systems and renewable distributed generation in medium–low voltage distribution networks. J. Energy Storage 2021, 34, 102158. [Google Scholar] [CrossRef]

- Menke, J.-H.; Bornhorst, N.; Braun, M. Distribution system monitoring for smart power grids with distributed generation using artificial neural networks. Int. J. Electr. Power Energy Syst. 2019, 113, 472–480. [Google Scholar] [CrossRef]

- Rahiminejad, A.; Vahidi, B.; Hejazi, M.A.; Shahrooyan, S. Optimal scheduling of dispatchable distributed generation in smart environment with the aim of energy loss minimization. Energy 2016, 116, 190–201. [Google Scholar] [CrossRef]

- Abdulkareem, S.A.; Haghifam, M.R.; GhanizadehBolandi, T. A novel approach for distributed generation expansion planning considering its added value compared with centralized generation expansion. Sustain. Energy Grids Netw. 2021, 25, 100417. [Google Scholar] [CrossRef]

- Craig, M.T.; Jaramillo, P.; Hodge, B.-M.; Williams, N.J.; Severnini, E. A retrospective analysis of the market price response to distributed photovoltaic generation in California. Energy Policy 2018, 121, 394–403. [Google Scholar] [CrossRef]

- Yu, H.; Hong, B.; Luan, W.; Huang, B.; Semero, Y.K.; Eseye, A.T. Study on business models of distributed generation in China. Glob. Energy Interconnect. 2018, 1, 162–171. [Google Scholar] [CrossRef]

- Liu, S.; Bie, Z.; Liu, F.; Li, Z.; Li, G.; Wang, X. Policy Implication on Distributed Generation PV Trading in China. Energy Procedia 2019, 159, 436–441. [Google Scholar] [CrossRef]

- Lin, Q.; Liu, L.-J.; Yuan, M.; Ge, L.-J.; Wang, Y.-H.; Zhang, M. Choice of the distributed photovoltaic power generation operating mode for a manufacturing enterprise: Surrounding users vs a power grid. J. Clean. Prod. 2021, 293, 126199. [Google Scholar] [CrossRef]

- Kumar, M.; Kumar, A.; Sandhu, K.S. Impact of distributed generation on nodal prices in hybrid electricity market. In Proceedings of the International Conference on Processing of Materials, Minerals and Energy, Ongole, Andhra Pradesh, India, 29–30 July 2016; Volume 5, pp. 830–840. [Google Scholar] [CrossRef]

- Zhang, L.; Chen, C.; Wang, Q.; Zhou, D. The impact of feed-in tariff reduction and renewable portfolio standard on the development of distributed photovoltaic generation in China. Energy 2021, 232, 120933. [Google Scholar] [CrossRef]

- Samper, M.; Coria, G.; Facchini, M. Grid parity analysis of distributed PV generation considering tariff policies in Argentina. Energy Policy 2021, 157, 112519. [Google Scholar] [CrossRef]

- Garlet, B.T.; Ribeiro, J.L.D.; Savian, F.S.; Siluk, J.C. Paths and barriers to the diffusion of distributed generation of photovoltaic energy in southern Brazil. Renew. Sustain. Energy Rev. 2019, 111, 157–169. [Google Scholar] [CrossRef]

- Ahmadi, M.; BodeAdewuyi, O.; ShahDanish, M.S.; Mandal, P.; Yona, A.; Senjyu, T. Optimum coordination of centralized and distributed renewable power generation incorporating battery storage system into the electric distribution network. Int. J. Electr. Power Energy Syst. 2021, 125, 106458. [Google Scholar] [CrossRef]

- Yanine, F.; Sanchez-Squella, A.; Parejos, A.; Barrueto, A.; Rother, H.; Sahoo, S.K. Grid-tied distributed generation with energy storage to advance renewables in the residential sector: Tariff analysis with energy sharing innovations; Part I. Procedia Comput. Sci. 2019, 162, 111–118. [Google Scholar] [CrossRef]

- Das, S.; Ray, A.; De, S. Optimum combination of renewable resources to meet local power demand in distributed generation: A case study for a remote place of India. Energy 2020, 209, 118473. [Google Scholar] [CrossRef]

- Thopil, M.S.; Bansal, R.C.; Zhang, L.; Sharma, G. A review of grid connected distributed generation using renewable energy sources in South Africa. Energy Strategy Rev. 2018, 21, 88–97. [Google Scholar] [CrossRef]

- Abdmouleh, Z.; Gastli, A.; Ben-Brahim, L.; Haouari, M.; AhmedAl-Emadi, N. Review of optimization techniques applied for the integration of distributed generation from renewable energy sources. Renew. Energy 2017, 113, 266–280. [Google Scholar] [CrossRef]

- Monteiro, R.V.A.; Bonaldo, J.P.; Silva, R.F.; Bretas, A.S. Electric distribution network reconfiguration optimized for PV distributed generation and energy storage. Electr. Power Syst. Res. 2020, 184, 106319. [Google Scholar] [CrossRef]

- Wang, Y.; Huang, Y.; Wang, Y.; Zeng, M.; Li, F.; Wang, Y.; Zhang, Y. Energy management of smart micro-grid with response loads and distributed generation considering demand response. J. Clean. Prod. 2018, 197, 1069–1083. [Google Scholar] [CrossRef]

- Nakada, T.; Shin, K.; Managi, S. The effect of demand response on purchase intention of distributed generation: Evidence from Japan. Energy Policy 2016, 94, 307–316. [Google Scholar] [CrossRef]

- Nejad, H.C.; Tavakoli, S.; Ghadimi, N.; Korjani, S.; Nojavan, S.; Pashaei-Didani, H. Reliability based optimal allocation of distributed generations in transmission systems under demand response program. Electr. Power Syst. Res. 2019, 176, 105952. [Google Scholar] [CrossRef]

- Poudineh, R.; Jamasb, T. Distributed generation, storage, demand response and energy efficiency as alternatives to grid capacity enhancement. Energy Policy 2014, 67, 222–231. [Google Scholar] [CrossRef]

- Viana, M.S.; Junior, G.M.; Udaeta, M.E.M. Analysis of demand response and photovoltaic distributed generation as resources for power utility planning. Appl. Energy 2018, 217, 456–466. [Google Scholar] [CrossRef]

- Jiang, B.; Fei, Y. Dynamic Residential Demand Response and Distributed Generation Management in Smart Microgrid with Hierarchical Agents. Energy Procedia 2011, 12, 76–90. [Google Scholar] [CrossRef]

- Guo, Y.; Yu, C.; Zhang, H.; Cheng, H. Asymmetric between oil prices and renewable energy consumption in the G7 countries. Energy 2021, 226, 120319. [Google Scholar] [CrossRef]

- Katircioglu, S.; Köksal, C.; Katircioglu, S. The role of financial systems in energy demand: A comparison of developed and developing countries. Heliyon 2021, 7, e07323. [Google Scholar] [CrossRef]

- Sohag, K.; Chukavina, K.; Samargandi, N. Renewable energy and total factor productivity in OECD member countries. J. Clean. Prod. 2021, 296, 126499. [Google Scholar] [CrossRef]

- Shao, X.; Zhong, Y.; Liu, W.; Li, R.Y.M. Modeling the effect of green technology innovation and renewable energy on carbon neutrality in N-11 countries? Evidence from advance panel estimations. J. Environ. Manag. 2021, 296, 113189. [Google Scholar] [CrossRef]

- Silva, N.; Fuinhas, J.A.; Koengkan, M. Assessing the advancement of new renewable energy sources in Latin American and Caribbean countries. Energy 2021, 237, 121611. [Google Scholar] [CrossRef]

- Zhang, Y.; Fan, Y.; Xia, Y. Structural evolution of energy embodied in final demand as economic growth: Empirical evidence from 25 countries. Energy Policy 2021, 156, 112473. [Google Scholar] [CrossRef]

- Dormidonov, P.V. Distributed energy with the use of cogeneration technology. In Collection of Articles Based on Materials of the XXXIV Student International Scientific and Practical Conference; Youth Scientific Forum: Moscow, Russia, 2019; pp. 24–26. [Google Scholar]

- Safonov, A.I.; Lipikhin, E.G.; Shevelev, D.V. Overview of the state of the market for cogeneration units of low power. Actual Probl. Humanit. Nat. Sci. 2016, 94–99. [Google Scholar]

- Pivnyuk, V.A. Innovative energy technologies for energy conversion and distributed cogeneration-the basis of the energy of the future. Integral 2008, 42–43. [Google Scholar]

- Makarova, A.S.; Pankrushina, T.G.; Khorshev, A.A. Approaches to assessing the competitiveness of sources of distributed cogeneration in comparison with large thermal power plants. In Management of the Development of Large-Scale Systems (MLSD’2018), Proceedings of the Eleventh International Conference, Moscow, Russia, 1–3 October 2018; Vasilyeva, S.N., Tsvirkun, A.D., Eds.; IEE: New York, NY, USA, 2018; Volume 2, pp. 468–469. [Google Scholar]

- Lachkov, G.G.; Fedyaev, A.V. Improving the Energy Supply of the Region through the Use of Distributed Cogeneration; Bulletin of the Irkutsk State Technical University: Irkutsk, Russia, 2015; pp. 165–171. [Google Scholar]

- Nalbandyan, G.G.; Zholnerchik, S.S. Key factors of effective application of distributed generation technologies in industry. Strateg. Decis. Risk Manag. 2018, 80–87. [Google Scholar] [CrossRef]

- Smirnova, S.V.; Bolotov, P.V.; Petrushin, D.E.; Glukhov, D.A.; Popov, M.G. Time trend-distributed generation: How it is implemented in Russia and how it affects the industry. Quest. Electr. Technol. 2020, 20–28. [Google Scholar]

- Polomoshina, M.A. Analysis of the impact of distributed generation on the development of the global electric power industry. Educ. Sci. Russ. Abroad 2020, 189–197. [Google Scholar]

- Volkov, E.P. GOELRO Electrification Plan and the Development of the Modern Energy Industry in Russia. Proc. Russ. Acad. Sci. 2020, 1, 7–16. [Google Scholar]

- Decree of the Government of the Russian Federation dated March 21, 2020 No. 320 “On Amendments to Certain Acts of the Government of the Russian Federation on the Operation of Active Energy Complexes”. Available online: http://publication.pravo.gov.ru (accessed on 1 April 2023).

- Voropay, N.I.; Podkovalnikov, S.V.; Stennikov, V.A.; Trufanov, V.V. Innovative Trends in the Development of the Energy Industry in Russia. Electro. Electr. Eng. Energy Ind. Electr. Ind. 2011, 13–18. [Google Scholar]

- Voropay, N.I.; Chulyukova, M.V. Emergency Control for Better Flexibility of Electric Power Systems; Bulletin of the Irkutsk State Technical University: Irkutsk, Russia, 2020; Volume 24, pp. 781–794. [Google Scholar]

- Datsko, K.A. Distributed Energy Systems with Demand Response. Energy Policy 2020, 148, 64–75. [Google Scholar]

- Protsenko, P.P.; Lisovsky, V.V. Integration of Distributed Generation in the UES of Russia as Part of Active Energy Complexes. In Series: Natural and Economic Sciences; Bulletin of the Amur State University: Blagoveshchensk, Russia, 2021; Volume 93, pp. 79–82. [Google Scholar]

- Byk, F.L.; Epifantsev, A.V. Industrial Distributed Energy Systems: A Legal Experiment or a “Probing Action”? Bus. Educ. Law 2021, 55, 234–238. [Google Scholar]

- Anikeeva, A.S. Introduction of Distributed Energy Systems with Demand Response as Alternative for Microgrids, Moscow. Radio Electronics, Electrical Engineering and Energy. In Proceedings of the 27th International Scientific and Technical Student and Graduate Conference, Knoxville, TN, USA, 27–28 March 2021; p. 545. [Google Scholar]

- Semerenko, A.A.; Murugov, I.K.; Volodarsky, M.V.; Kosharnaya, Y.V. Assessment of the conditions for the functioning of active energy complexes. In Collection: Fedorov Readings—2020: L, Proceedings of the International Scientific and Practical Conference with Elements of a Scientific Moscow, Veliky Novgorod, Russia, 9–10 December 2020; Springer Nature: Berlin/Heidelberg, Germany, 2020; pp. S428–S430. [Google Scholar]

- Karanina, E.V.; Kochetkov, M.N.; Bortnikov, M.A. Creation of active energy complexes in TASED: Formation of a new subject of the energy market and assessment of economic (commercial) effects from its implementation. Bull. Acad. 2020, 74–85. [Google Scholar]

- Mokhov, V.G.; Chebotareva, G.S. Mathematical Modelling and Analysis of Activities of PJSC “FORTUM”. In Series: Mathematical Modelling, Programming & Computer Software; Bulletin of the South Ural State University: Chelyabinsk, Russia, 2022; Volume 15, pp. 111–117. [Google Scholar]

- Mokhov, V.G.; Demyanenko, T.S. A Long-Term Forecasting Model of Electricity Consumption Volume on the Example of UPS of the Ural with the Help of Harmonic Analysis of a Time Series. In Series: Mathematical Modelling, Programming & Computer Software; Bulletin of the South Ural State University: Chelyabinsk, Russia, 2020; Volume 13, pp. 80–85. [Google Scholar]

| No. | Parameter | Unit of Measurement | Before DER System | After DER System | Difference |

|---|---|---|---|---|---|

| 1 | Total electricity consumption by the enterprise | MWh | 7000 | 7000 | 0 |

| 2 | Total electricity consumption from the centralized grid | MWh | 7000 | 4500 | −2500 |

| 3 | Total electricity consumption from the DER system | MWh | 0 | 2500 | 2500 |

| 4 | Total electricity generation by the DER system | MWh | 0 | 2500 | 2500 |

| 5 | Total capacity utilization from the centralized grid | MW | 9 | 6 | −3 |

| 6 | Total electricity transmission costs | MW | 10 | 7 | −3 |

| 7 | Price of the electricity component purchased from the centralized grid | USD/ MWh | 1900 | 1900 | 0 |

| 8 | Price of the capacity component purchased from the centralized grid | USD/ MW | 850,000 | 850,000 | 0 |

| 9 | Transmission services | USD/ MW | 1,050,000 | 1,050,000 | 0 |

| 10 | Price of the electricity component generated by the DER system | USD/ MWh | 1350 | 1350 | 0 |

| 11 | Price of the capacity component generated by the DER system | USD/ MWh | 530,000 | 530,000 | 0 |

| 12 | Cost of electricity distribution from the DER system | USD/ MWh | 0 | 0 | 0 |

| 13 | Total cost of the electricity component purchased by the enterprise | USD | 13,300,000 | 11,925,000 | −1,375,000 |

| 14 | Total cost of the capacity component purchased by the enterprise | USD | 7,650,000 | 6,690,000 | −960,000 |

| 15 | Total outgoing distribution costs | USD | 10,500,000 | 7,350,000 | −3,150,000 |

| 16 | Total cost of electricity purchased by the enterprise | USD | 31,450,000 | 25,965,000 | −5,485,000 |

| 17 | Total price of electricity purchased by the enterprise | USD/ kWh | 4.492 | 3.709 | −0.783 |

| 18 | Total price of electricity purchased by the enterprise | % | 100% | 83% | −17% |

| No. | Parameter | Unit of Measurement | Before DER System | After DER System | Difference |

|---|---|---|---|---|---|

| 1 | Total natural gas consumption by the enterprise | ’000 m3 | 3000 | 2700 | −300 |

| 2 | Total natural gas consumption by the DER system | ’000 m3 | 5500 | 4900 | −600 |

| 3 | Total natural gas consumption by the enterprise and its DER system | ’000 m3 | 8500 | 7600 | −900 |

| 4 | Daily gas limit established by the centralized gas network operator | ’000 m3 per day | 230 | 230 | 0 |

| 5 | Natural gas consumption less the allowed threshold range | ’000 m3 | 0 | 0 | 0 |

| 6 | Natural gas consumption beyond the allowed threshold range | ’000 m3 | 53 | 0 | −53 |

| 7 | Gas purchased from the commodity exchange | ’000 m3 | 0 | 1000 | 1000 |

| 8 | Price of gas from the centralized gas network | USD/ ’000 m3 | 5000 | 5000 | 0 |

| 9 | Penalty for underconsumption in the centralized gas network | USD/ ’000 m3 | 2500 | 2500 | 0 |

| 10 | Penalty for overconsumption in the centralized gas network | USD/ ’000 m3 | 2500 | 2500 | 0 |

| 11 | Price of the gas purchased from the commodity exchange | USD/ ’000 m3 | 4500 | 4500 | 0 |

| 12 | Total gas purchased from the centralized gas network within contract-covered thresholds | USD | 42,500 | 30,400 | −12,100 |

| 13 | Total penalties for underconsumption of the contract-covered thresholds | USD | 0 | 0 | 0 |

| 14 | Total gas purchased from the centralized gas network in addition to the contract-covered thresholds | USD | 400 | 0 | −400 |

| 15 | Total gas purchased from the commodity exchange | USD | 0 | 4500 | 4500 |

| 16 | Total gas costs | USD | 42,900 | 34,900 | −8000 |

| 17 | Average gas price | USD/’000 m3 | 5047 | 4592 | −455 |

| 18 | Average gas price | % | 100% | 91% | −9% |

| No. | Parameter | Unit of Measurement | Before DER System | After DER System | Difference |

|---|---|---|---|---|---|

| 1 | Total costs for the purchase of energy resources | thousand USD | 74,350 | 60,865 | −13,485 |

| 2 | including electricity | thousand USD | 31,450 | 25,965 | −5485 |

| 3 | including natural gas | thousand USD | 42,900 | 34,900 | −8000 |

| 4 | Reduction of energy resources costs | % | 100% | 82% | −18% |

| 5 | including electricity | % | 100% | 83% | −17% |

| 6 | including natural gas | % | 100% | 81% | −19% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dzyuba, A.; Solovyeva, I.; Semikolenov, A. Raising the Resilience of Industrial Manufacturers through Implementing Natural Gas-Fired Distributed Energy Resource Systems with Demand Response. Sustainability 2023, 15, 8241. https://doi.org/10.3390/su15108241

Dzyuba A, Solovyeva I, Semikolenov A. Raising the Resilience of Industrial Manufacturers through Implementing Natural Gas-Fired Distributed Energy Resource Systems with Demand Response. Sustainability. 2023; 15(10):8241. https://doi.org/10.3390/su15108241

Chicago/Turabian StyleDzyuba, Anatolyy, Irina Solovyeva, and Aleksandr Semikolenov. 2023. "Raising the Resilience of Industrial Manufacturers through Implementing Natural Gas-Fired Distributed Energy Resource Systems with Demand Response" Sustainability 15, no. 10: 8241. https://doi.org/10.3390/su15108241

APA StyleDzyuba, A., Solovyeva, I., & Semikolenov, A. (2023). Raising the Resilience of Industrial Manufacturers through Implementing Natural Gas-Fired Distributed Energy Resource Systems with Demand Response. Sustainability, 15(10), 8241. https://doi.org/10.3390/su15108241