Do Science Parks Promote Companies’ Innovative Performance? Micro Evidence from Shanghai Zhangjiang National Innovation Independent Demonstration Zone

Abstract

1. Introduction

2. Literature Review

2.1. The Controversy about the Positive Effect of Science Parks on Companies

2.2. The Potential Impact Factors of Science Parks on Companies

2.3. Research on China’s Science Parks

3. Data and Methods

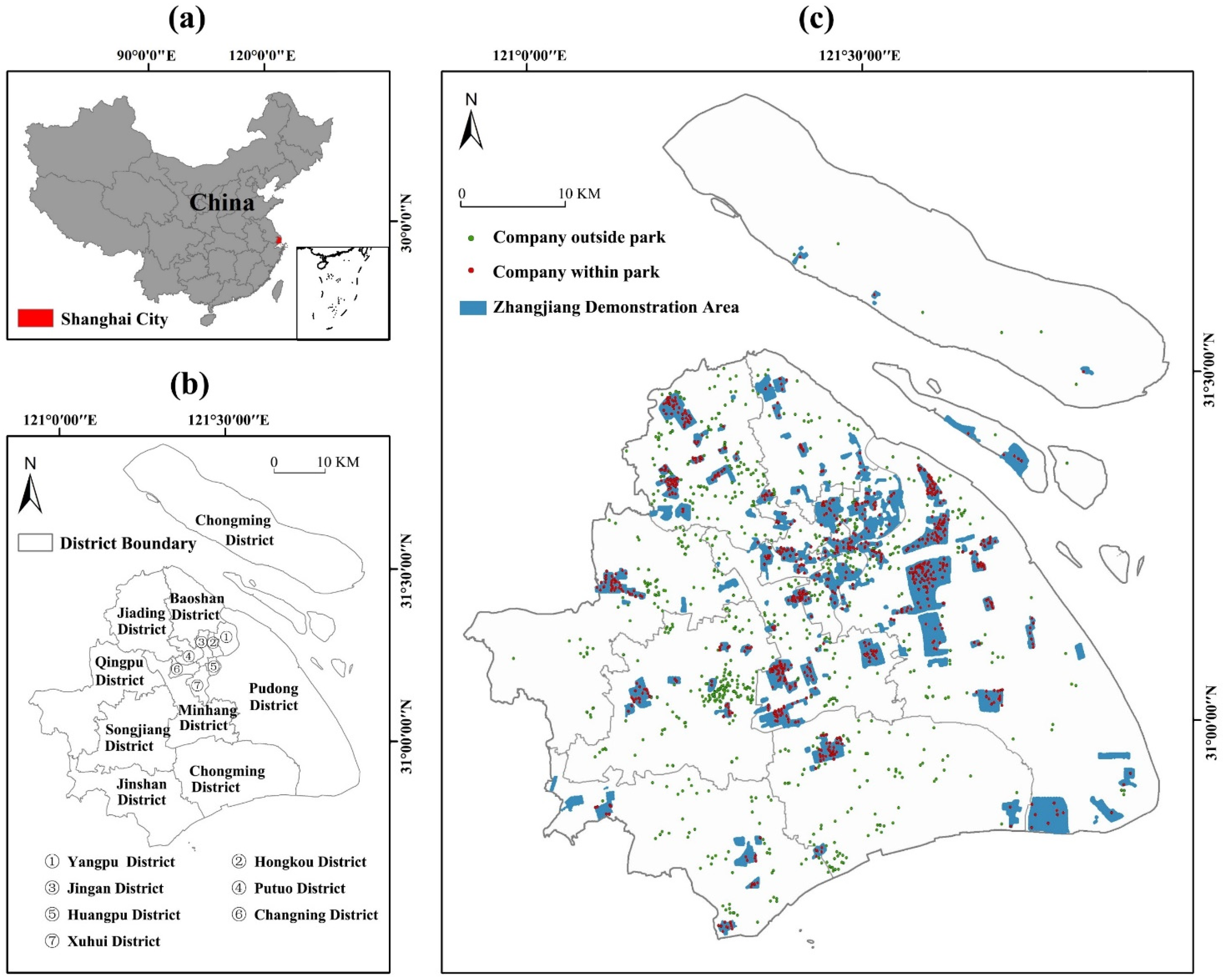

3.1. Data Collection

3.2. Variable Definition

3.3. Data Matching and Robustness Testing

3.4. Model Building

4. Results

4.1. Evidences for Whether Science Parks Promote Companies’ Innovative Performance

4.2. Impact Factors of Science Parks That Affect the Companies’ Innovative Performance

5. Discussion

5.1. The Positive Effect of Science Parks on the Companies

5.2. The Impact Factors of Science Park on the Companies

5.3. Potential Impact Mechanisms of Science Parks on Firm Innovation

5.4. Policy Suggestions

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Corrocher, N.; Lamperti, F.; Mavilia, R. Do science parks sustain or trigger innovation? Empirical evidence from Italy. Technol. Forecast. Soc. Chang. 2019, 147, 140–151. [Google Scholar] [CrossRef]

- Yan, M.R.; Chien, K.M.; Hong, L.Y.; Yang, T.N. Evaluating the Collaborative Ecosystem for an Innovation-Driven Economy, A Systems Analysis and Case Study of Science Parks. Sustainability 2018, 10, 887. [Google Scholar] [CrossRef]

- Albahari, A.; Perez-Canto, S.; Barge-Gil, A. Technology Parks versus Science Parks, Does the university make the difference? Technol. Forecast. Soc. Chang. 2017, 116, 13–18. [Google Scholar] [CrossRef]

- Torres De Oliveira, R.; Gentile-Ludecke, S.; Figueira, S. Barriers to innovation and innovation performance, The mediating role of external knowledge search in emerging economies. Small Bus. Econ. 2022, 58, 1953–1974. [Google Scholar] [CrossRef]

- Huang, K.F.; Yu, C.M.J.; Seetoo, D.H. Firm innovation in policy-driven parks and spontaneous clusters, the smaller firm the better? J. Technol. Transf. 2012, 37, 715–731. [Google Scholar] [CrossRef]

- Siegel, D.S.; Westhead, P.; Wright, M. Assessing the impact of university science parks on research productivity, exploratory firm-level evidence from the United Kingdom. Int. J. Ind. Organ. 2003, 21, 1357–1369. [Google Scholar] [CrossRef]

- Squicciarini, M. Science parks, seedbeds of innovation? A duration analysis of firms’ patenting activity. Small Bus. Econ. 2009, 32, 169–190. [Google Scholar] [CrossRef]

- Castells, M.; Hall, P. Techno Poles of the World, The Making of the 21st Century Industrial Complexes; Routledge: London, UK, 1994. [Google Scholar]

- Zhang, Y.; Dong, J.; Cao, Y.; Cantwell, J. The Double-Edged Sword of Government Role in Innovation Systems, A Case Study in the Development of Policy-led University Science Parks in China. In Proceedings of the IEEE-Technology-and-Engineering-Management-Society Conference (TEMSCON), Santa Clara, CA, USA, 8–10 June 2017; pp. 7–12. [Google Scholar]

- Felsenstein, D. University-related science parks—Seedbeds or enclaves of innovation. Technovation 1994, 14, 93–110. [Google Scholar] [CrossRef]

- Lindelöf, P.; Löfsten, H. Science park location and new technology-based firms in Sweden-implications for strategy and performance. Small Bus. Econ. 2003, 20, 245–258. [Google Scholar] [CrossRef]

- Westhead, P. R&D “inputs” and “outputs” of technology-based firms located on and off science parks. R D Manag. 1997, 27, 45–62. [Google Scholar]

- Lamperti, F.; Mavilia, R.; Castellini, S. The role of science parks, A puzzle of growth, innovation and R&D investments. J. Technol. Transf. 2017, 42, 158–183. [Google Scholar]

- Squicciarini, M. Science parks’ tenants versus out-of-Park firms, Who innovates more? A duration model. J. Technol. Transf. 2008, 33, 45–71. [Google Scholar] [CrossRef]

- Ubeda, F.; Ortiz-De-Urbina-Criado, M.; Mora-Valentín, E. Do firms located in science and science parks enhance innovation performance? The effect of absorptive capacity. J. Technol. Transf. 2019, 44, 21–48. [Google Scholar] [CrossRef]

- Ramirez-Aleson, M.; Fernandez-Olmos, M. Unravelling the effects of Science Parks on the innovation performance of NTBFs. J. Technol. Transf. 2018, 43, 482–505. [Google Scholar] [CrossRef]

- Vásquez-Urriago Ar Barge-Gil, A.; Rico, A.m. Which firms benefit more from being located in a Science and Science park? Empirical evidence for Spain. Res. Eval. 2016, 25, 107–117. [Google Scholar] [CrossRef]

- Claver-Cortés, E.; Marco-Lajara, B.; Manresa-Marhuenda, E.; García-Lillo, F. Location in scientific-technological parks, dynamic capabilities, and innovation. Technol. Anal. Strateg. Manag. 2018, 30, 377–390. [Google Scholar] [CrossRef]

- Chan Ka Oerlemans, L.A. Innovation outcomes of South African new technology-based firms, a contribution to the debate on the performance of science park firms. S. Afr. J. Econ. Manag. Sci. 2011, 4, 361–378. [Google Scholar] [CrossRef]

- Liberati, D.; Marinucci, M.; Tanzi, G.M. Science and science parks in Italy, main features and analysis of their effects on the firms hosted. J. Technol. Transf. 2016, 41, 694–729. [Google Scholar] [CrossRef]

- Yang, Y.; She, Y.; Hong, J.; Gan, Q. The centrality and innovation performance of the quantum high-level innovation team, the moderating effect of structural holes. Technol. Anal. Strateg. Manag. 2021, 33, 1332–1346. [Google Scholar] [CrossRef]

- Teng, T.; Zhang, Y.; Si, Y.; Chen, J.; Cao, X. Government support and firms’ innovation performance in Chinese science and science parks, The perspective of firm and sub-park heterogeneity. Growth Chang. 2020, 51, 749–770. [Google Scholar] [CrossRef]

- Jiang, Q.B.; Tan, Q.M. The Non-dynamic Threshold Effect of the Influence of Government—A Research from the Perspective of Financing Constraints. Econ. Surv. 2020, 37, 97–105. [Google Scholar]

- Díez-Vial, I.; Fernández-Olmos, M. The effect of science and science parks on firms’ performance, how can firms benefit most under economic downturns? Technol. Anal. Strateg. Manag. 2017, 29, 1153–1166. [Google Scholar] [CrossRef]

- Kocak, O.; Can, O. Determinants of inter-firm networks among tenants of science science parks. Ind. Corp. Chang. 2014, 23, 467–492. [Google Scholar] [CrossRef]

- Ng, W.K.; Appel-Meulenbroek, R.; Cloodt, M.; Arentze, T. Perceptual measures of science parks, Tenant firms’ associations between science park attributes and benefits. Technol. Forecast. Soc. Chang. 2020, 163, 120408. [Google Scholar] [CrossRef]

- Ng, W.K.; Junker, R.; Appel-Meulenbroek, R.; Cloodt, M.; Arentze, T. Perceived benefits of science park attributes among park tenants in the Netherlands. J. Technol. Transf. 2020, 45, 1196–1227. [Google Scholar] [CrossRef]

- Salvador, E. Are science parks and incubators good “brand names” for spin-offs? The case study of Turin. J. Technol. Transf. 2011, 36, 203–232. [Google Scholar] [CrossRef]

- Wang, X.B.; Feng, Y.C. The effects of National High-tech Industrial Development Zones on economic development and environmental pollution in China during 2003–2018. Environ. Sci. Pollut. Res. 2021, 28, 1097–1107. [Google Scholar] [CrossRef]

- Yu, Q.; Wu, Y.; Chen, X.; Zhang, L.; Liang, Y. Do China’s National Agricultural Science and Technology Parks Promote County Economic Development? An Empirical Examination Based on Multi-Period DID Methods. Agriculture 2023, 13, 213. [Google Scholar] [CrossRef]

- Xie, K.; Song, Y.; Zhang, W.; Hao, J.; Liu, Z.; Chen, Y. Technological entrepreneurship in science parks, A case study of Wuhan Donghu High-Tech Zone. Technol. Forecast. Soc. Chang. 2018, 135, 156–168. [Google Scholar] [CrossRef]

- Wu, J.R.; Zhao, C.Y. Enterprises’ R&D Efficiency Inside and Outside Science parks—A Comparative Empirical Study Based on Heckman Two-step Model. J. Dalian Univ. Technol. (Soc. Sci.) 2020, 41, 16–23. [Google Scholar]

- Yang, J.L.; Zhu, Y.J.; Sheng, D.L. University, Corporate Innovation and Geographical Distance, Evidence from China. Rev. Investig. Stud. 2020, 39, 19–38. [Google Scholar]

- OECD. OECD Science, Technology and Industry Scoreboard 2007; OECD Publishing: Paris, France, 2007. [Google Scholar]

- Shanghai Science and Technology Innovation Center Construction Office. Annual Report of Zhangjiang Independent Innovation Demonstration Zone 2016–2020 [R/OL]. (2021-07) [2022-03]. Available online: https://kcb.sh.gov.cn/html/1/167/index.html#page6 (accessed on 2 May 2022).

- Albahari, A.; Barge-Gil, A.; Perez-Canto, S. The influence of Science and Science park characteristics on firms’ innovation results. Pap. Reg. Sci. 2018, 97, 253–279. [Google Scholar] [CrossRef]

- Montoro-Sanchez, A.; Ortiz-De-Urbina-Criado, M.; Mora-Valentin, E.M. Effects of knowledge spillovers on innovation and collaboration in science and science parks. J. Knowl. Manag. 2011, 15, 948–970. [Google Scholar] [CrossRef]

- Lavoratori, K.; Castellani, D. Too close for comfort? Microgeography of agglomeration economies in the United Kingdom. J. Reg. Sci. 2021, 61, 1002–1028. [Google Scholar] [CrossRef]

- Holl, A.; Peters, B.; Rammer, C. Local knowledge spillovers and innovation persistence of firms. Econ. Innov. New Technol. 2022. [Google Scholar] [CrossRef]

- Rammer, C.; Kinne, J.; Blind, K. Knowledge proximity and firms’ innovation, A microgeographic analysis for Berlin. Urban Stud. 2020, 57, 996–1014. [Google Scholar] [CrossRef]

| Variable | Variable Label | Variable Definition | Unit of Measure |

|---|---|---|---|

| Explained variables | |||

| Patent Applications | Inpatapl | The number of patents applied for by the enterprise in the current year * | pcs |

| Patent Granted | Inpatnext-imp | The number of patents granted to the enterprise in the following year * | pcs |

| Explanatory variables (firm-related) | |||

| Location | park | Within park or not | 1: In the park |

| Explanatory variables (park-related) | |||

| Industrial output | pa_Inoutput | Total industrial output value of the sub-park for the year * | billion yuan |

| Number of employees | pa_Instaff | Number of employees at the end of the year * | million people |

| Area | pa_Inarea | Campus area for the year * | km2 |

| Age | pa_Inage | The number of years since the establishment of the sub-park to this year * | year |

| Innovation atmosphere | pa_Inhtcomp | Number of high-tech enterprises in the park for the year * | pcs |

| Innovation support institutions | pa_Ininsti | The sum of the number of national incubators and national key laboratories in the park for the year * | pcs |

| Financial subsidies | pa_Infond | Number of municipal special funds received by the park this year * | million |

| Control variables (company-related) | |||

| Number of employees | Instaff | Number of employees for the year * | people |

| Turnover | Inincome | Turnover for the year * | million yuan |

| Capital status | Infixa | Number of fixed assets for the year * | ten thousand yuan |

| Age | age | Number of years since establishment to the current year | year |

| Knowledge accumulation | Inpatbeapl | Cumulative number of patent applications before the current year * | individual |

| Inpatbe-imp | Cumulative number of patents granted before the current year * | individual | |

| R&D investment | Inresa | Capital investment in R&D for the current year * | million yuan |

| Ownership | stateowned | State-owned or not | 1: State-owned |

| Holding | group | Whether it is a subsidiary held by a large company | 1: Held by |

| Industry Technology Level | techlevelmanu1 | Whether it belongs to high-technology level manufacturing industry | 1: Belong to |

| techlevelmanu2 | Whether it is a medium-high technology manufacturing industry | ||

| techlevelmanu3 | Whether it belongs to medium-technology manufacturing industry | ||

| techlevelmanu4 | Whether it belongs to low-technology manufacturing industry | ||

| techlevelnonmanu1 | Whether it is a high-technology level non-manufacturing industry | ||

| techlevelnonmanu2 | Whether it belongs to medium-high technology non-manufacturing industry | ||

| techlevelnonmanu3 | Whether it belongs to the low-technology non-manufacturing industry | ||

| techlevelnonmanu4 | Whether it is a low-tech level non-manufacturing industry | ||

| Stateowned | Instaff | Inincome | Age | |||||

|---|---|---|---|---|---|---|---|---|

| Within Park | Outside Park | Within Park | Outside Park | Within Park | Outside Park | Within Park | Outside Park | |

| N | 4555 | 4305 | 4555 | 4305 | 4555 | 4305 | 4555 | 4305 |

| Mean | 0.008 | 0.010 | 5.468 | 5.245 | 10.260 | 9.924 | 14.430 | 14.420 |

| Median | 0 | 0 | 5.407 | 5.303 | 10.330 | 9.993 | 14 | 14 |

| Std. Dev. | 0.090 | 0.098 | 1.424 | 1.491 | 1.917 | 1.902 | 6.707 | 6.706 |

| Min. | 0 | 0 | 0.511 | 0.405 | 0 | 0 | 0 | 0 |

| Max. | 1 | 1 | 9.918 | 9.711 | 16.230 | 16.270 | 39 | 39 |

| Tests | ||||||||

| Kolmogorov–Smirnov test | p = 1.000 | p = 0.598 | p = 0.497 | p = 0.856 | ||||

| Kruskal–Wallis test | p = 0.760 | p = 0.354 | p = 0.181 | p = 0.449 | ||||

| t-test | p = 0.791 | p = 0.460 | p = 0.266 | p = 0.549 | ||||

| Variable Label | Mean | Standard Deviation | Min | Max | VIF Value |

|---|---|---|---|---|---|

| Inpatapl | 1.085 | 1.416 | 0 | 7.610 | - |

| park | 0.549 | 0.549 | 0 | 1 | 1.100 |

| Instaff | 5.368 | 1.459 | 0.405 | 9.918 | 7.620 |

| Inincome | 10.110 | 1.917 | 0 | 16.27 | 6.760 |

| Infixa | 8.215 | 2.728 | 0 | 15.580 | 5.490 |

| age | 14.430 | 6.707 | 5 | 39 | 1.370 |

| Inpatbeapl | 2.151 | 2.050 | 0 | 9.946 | 1.580 |

| Inresa | 6.138 | 2.973 | 0 | 12.67 | 1.510 |

| stateowned | 0.009 | 0.094 | 0 | 1 | 1.090 |

| group | 0.748 | 0.434 | 0 | 1 | 1.250 |

| techlevelmanu1 | 0.152 | 0.359 | 0 | 1 | 7.970 |

| techlevelmanu2 | 0.433 | 0.496 | 0 | 1 | 7.860 |

| techlevelmanu3 | 0.078 | 0.269 | 0 | 1 | 4.550 |

| techlevelmanu4 | 0.027 | 0.164 | 0 | 1 | 6.390 |

| techlevelnonmanu1 | 0.007 | 0.083 | 0 | 1 | 1.410 |

| techlevelnonmanu2 | 0.181 | 0.385 | 0 | 1 | 5.530 |

| techlevelnonmanu3 | 0.052 | 0.218 | 0 | 1 | 3.810 |

| techlevelnonmanu4 | 0.069 | 0.254 | 0 | 1 | 4 |

| Model | (1) | (2) | (3) | (4) | (5) | |||

|---|---|---|---|---|---|---|---|---|

| Mixed Regression Model | Random Effects Model | Negative Binomial Model | Random Effects Negative Binomial Model | Zero-Inflated Negative Binomial Model | ||||

| Zero-Count | Non-Zero-Count | |||||||

| Coefficient | Percentage | Coefficient | Percentage | |||||

| park | 0.523 ** | 0.68 ** | 1.221 ** | 1.313 ** | −2.173 ** | −88.6% | 0.385 *** | 47.0% |

| (0.021) | (0.019) | (0.02) | (0.033) | (0.051) | (0.017) | |||

| stateowned | 0.630 ** | 0.723 * | 0.121 | 0.287 ** | −0.248 * | −22.0% | 0.166 *** | 18.1% |

| (0.184) | (0.196) | (0.133) | (0.057) | (1.156) | (0.044) | |||

| group | −0.140 *** | −0.187 ** | −0.173 *** | −0.246 *** | 0.407 *** | 60.3% | −0.088 *** | −8.4% |

| (0.036) | (0.035) | (0.39) | (0.044) | (0.128) | (0.023) | |||

| Instaff | 0.060 ** | 0.084 *** | 0.052 ** | 0.093 *** | −0.116 ** | −11.0% | 0.033 * | 3.4% |

| (0.017) | (0.016) | (0.021) | (0.025) | (0.056) | (0.013) | |||

| Inincome | 0.020 | 0.024 ** | −0.023 | −0.031 | 0.084 * | 8.8% | 0.023 | 2.3% |

| (0.013) | (0.128) | (0.016) | (0.017) | (0.051) | (0.015) | |||

| Infixa | 0.019 ** | 0.037 * | 0.014 | 0.030 | −0.018 | −1.8% | 0.024 * | 2.4% |

| (0.009) | (0.008) | (0.012) | (0.019) | (0.034) | (0.009) | |||

| age | −0.020 *** | 0.015 *** | −0.015 *** | −0.021 *** | 0.069 *** | 7.1% | −0.008 *** | −0.8% |

| (0.002) | (0.002) | (0.002) | (0.002) | (0.008) | (0.001) | |||

| Inpatbeapl | 0.494 *** | 0.403 *** | 0.431 *** | 0.460 *** | −1.156 *** | −68.5% | 0.212 *** | 23.6% |

| (0.01) | (0.012) | (0.013) | (0.024) | (0.041) | (0.009) | |||

| Inresa | 0.023 ** | 0.028 *** | 0.068 *** | 0.076 ** | −0.157 ** | −14.5% | 0.017 | 1.7% |

| (0.013) | (0.01) | (0.021) | (0.019) | (0.067) | (0.014) | |||

| techlevelmanu1 | 0.006 | 0.009 | 0.038 | 0.236 *** | −0.571 * | −43.5% | 0.200 *** | 22.1% |

| (0.107) | (0.069) | (0.094) | (0.067) | (0.312) | (0.05) | |||

| techlevelmanu2 | 0.072 | 0.038 | 0.129 | 0.301 ** | −0.395 | −32.6% | 0.107 *** | 11.3% |

| (0.1) | (0.055) | (0.086) | (0.104) | (0.298) | (0.048) | |||

| techlevelmanu3 | 0.003 | 0.139 | 0.023 | 0.171 ** | −0.321 | −27.5% | 0.165 ** | 17.9% |

| (0.108) | (0.07) | (0.098) | (0.08) | (0.321) | (0.053) | |||

| techlevelmanu4 | 0.002 | 0.084 | 0.016 | 0.226 ** | −0.380 | −31.6% | 0.181 ** | 19.8% |

| (0.126) | (0.096) | (0.121) | (0.112) | (0.47) | (0.077) | |||

| techlevelnonmanu1 | 0.444 ** | 0.392 * | 0.561 ** | 0.807 *** | −1.208 ** | −70.1% | 0.140 | 15.0% |

| (0.185) | (0.2) | (0.136) | (0.099) | (0.5) | (0.086) | |||

| techlevelnonmanu2 | 0.158 | 0.041 | 0.045 | 0.218 * | −0.333 | −28.3% | 0.072 | 7.5% |

| (0.103) | (0.055) | (0.097) | (0.13) | (0.283) | (0.056) | |||

| techlevelnonmanu3 | 0.126 | 0.042 | 0.041 | 0.192 | −0.366 | −30.6% | 0.124 ** | 13.2% |

| (0.12) | (0.087) | (0.115) | (0.144) | (0.363) | (0.061) | |||

| techlevelnonmanu4 | 0.132 | 0.038 | 0.042 | 0.201 | −0.321 | −27.5% | 0.081 | 8.4% |

| (0.105) | (0.093) | (0.103) | (0.121) | (0.198) | (0.094) | |||

| Number of samples | 8860 | 8860 | 8860 | 8860 | 8860 | |||

| R2 | 0.568 | 0.583 | 0.425 | - | - | |||

| F | 205.89 *** | - | - | - | - | |||

| Wald chi2 | - | 1637.20 *** | 2089.03 *** | 1762.31 *** | 2191.43 *** | |||

| Variable Label | Mean | Standard Deviation | Min | Max | VIF Value |

|---|---|---|---|---|---|

| pa_Inoutput | 6.625 | 1.921 | 0 | 8.358 | 7.95 |

| pa_Instaff | 2.7 | 0.741 | 0.451 | 3.735 | 6.68 |

| pa_Inarea | 3.461 | 0.816 | 1.141 | 4.391 | 6.86 |

| pa_Inage | 2.384 | 0.693 | 0 | 3.401 | 4.66 |

| pa_Inhtcomp | 5.688 | 0.941 | 2.565 | 7.451 | 5.44 |

| pa_Ininsti | 2.968 | 1.391 | 0 | 5.347 | 3.72 |

| pa_Infond | 8.107 | 0.775 | 5.369 | 9.609 | 1.85 |

| Regression Equation: | Probability Equation: | ||

|---|---|---|---|

| Explanatory Variables (Park-Related) | Explanatory Variables (Firm-Related) | ||

| pa_Inoutput | 0.176 *** | park | 2.454 *** |

| (0.058) | (0.373) | ||

| pa_Instaff | 0.018 | ||

| (0.097) | |||

| pa_Inhtcomp | 0.082 ** | ||

| (0.042) | |||

| pa_Inarea | −0.239 ** | ||

| (0.148) | |||

| pa_Inage | 0.055 | ||

| (0.090) | |||

| pa_Ininsti | 0.024 * | ||

| (0.043) | |||

| pa_Infond | 0.065 | ||

| (0.050) | |||

| Control variables (park-related) | Control variables (firm-related) | ||

| stateowned | 0.839 *** | stateowned | 0.953 ** |

| (0.169) | (0.333) | ||

| group | −0.171 ** | group | −0.023 |

| (0.183) | (0.099) | ||

| Instaff | 0.123 *** | Instaff | 0.156 ** |

| (0.031) | (0.643) | ||

| Inincome | 0.029 | Inincome | 0.035 |

| (0.469) | (0.417) | ||

| Infixa | 0.057 ** | Infixa | 0.069 ** |

| (0.021) | (0.319) | ||

| age | −0.041 *** | age | −0.017 ** |

| (0.005) | (0.009) | ||

| Inpatbeapl | 0.569 *** | Inpatbeapl | 0.523 *** |

| (0.024) | (0.037) | ||

| Inresa | 0.052 ** | Inresa | 0.058 ** |

| (0.212) | (0.020) | ||

| techlevelmanu1 | 0.184 | techlevelmanu1 | 0.172 ** |

| (0.172) | (0.163) | ||

| techlevelmanu2 | 0.051 | techlevelmanu2 | 0.080 * |

| (0.167) | (0.157) | ||

| techlevelmanu3 | 0.022 | techlevelmanu3 | 0.076 * |

| (0.181) | (0.183) | ||

| techlevelmanu4 | 0.221 | techlevelmanu4 | 0.261 |

| (0.473) | (0.489) | ||

| techlevelnonmanu1 | 0.260 | techlevelnonmanu1 | 0.600 ** |

| (0.217) | (0.316) | ||

| techlevelnonmanu2 | 0.154 | techlevelnonmanu2 | 0.211 |

| (0.156) | (0.168) | ||

| techlevelnonmanu3 | 0.083 | techlevelnonmanu3 | 0.125 * |

| (0.196) | (0.189) | ||

| techlevelnonmanu4 | 0.108 | techlevelnonmanu4 | 0.107 |

| (0.134) | (0.159) | ||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wei, M.; Dong, B.; Jin, P. Do Science Parks Promote Companies’ Innovative Performance? Micro Evidence from Shanghai Zhangjiang National Innovation Independent Demonstration Zone. Sustainability 2023, 15, 7936. https://doi.org/10.3390/su15107936

Wei M, Dong B, Jin P. Do Science Parks Promote Companies’ Innovative Performance? Micro Evidence from Shanghai Zhangjiang National Innovation Independent Demonstration Zone. Sustainability. 2023; 15(10):7936. https://doi.org/10.3390/su15107936

Chicago/Turabian StyleWei, Minming, Baiyu Dong, and Pingbin Jin. 2023. "Do Science Parks Promote Companies’ Innovative Performance? Micro Evidence from Shanghai Zhangjiang National Innovation Independent Demonstration Zone" Sustainability 15, no. 10: 7936. https://doi.org/10.3390/su15107936

APA StyleWei, M., Dong, B., & Jin, P. (2023). Do Science Parks Promote Companies’ Innovative Performance? Micro Evidence from Shanghai Zhangjiang National Innovation Independent Demonstration Zone. Sustainability, 15(10), 7936. https://doi.org/10.3390/su15107936