1. Introduction

Global warming significantly contributes to global climate change, and reducing greenhouse gas (GHG) emissions is necessary to avoid the most catastrophic effects of global warming. By adopting the COP-21 of the United Nations Framework Convention on Climate Change (UNFCCC) via the Paris Agreement, officials worldwide agreed that the average global temperature should not exceed 1.5 degrees Celsius above pre-industrial levels. The financial issue has gained a major position as a result of the recent COP-27. It was stated during the COP-27 conference that a substantial increase in financial resources is required to facilitate the implementation of actions outlined in the nationally determined contributions (NDCs) and long-term strategies. Recent progress in this regard has been observed in the financial sector, where portfolios have been adjusted to support the transition to a net zero economy, but more must be done to leverage the trillions necessary to implement low-emission, climate-resilient development pathways. All parties are now genuinely concerned with greenhouse gas (GHG) reduction via a financial stimulus, which makes the situation captivating.

In the last decade, researchers and policymakers have also become greatly interested in analyzing the role of ecology and finance. There is a need to synergize multidisciplinary knowledge and expertise to combat climate change. The higher the population, the higher the chances of environmental problems. However, there is always a limit to population growth on Earth. Limiting elements such as light, water, temperature, space, nutrition, or exposure to predators or infectious illnesses eventually determines the population size limit of a rapidly expanding population [

1]. Zhang et al. (2019) mentioned that the objectives of developing sustainable (green) finance are to provide proper financial tools to achieve sustainable economic development [

2]. Several studies also have stated that financial market participants are currently very concerned about the issue of financial system resilience against environmental pollution and its sustainability [

3,

4,

5].

To accomplish climate objectives, the world must transition to a greener, more climate-resilient economy, where green finance will stimulate the development of greener infrastructure and innovation [

6]. Several jurisdictions have varying definitions of “green finance,” an important investment and financing tool. The European Commission viewed it as a financial tool to help the adaptation, mitigation, and other green aspects of the environment. In order to combat climate change, this can be formed out of green bonds, green credit, green funds, and carbon finance. Eventually, resources will be allocated to green development projects for sustainable environments [

7,

8]. Additionally, it has been observed that over the past several years, green financial considerations have changed from being risk mitigation strategies to constituting a catalyst for innovation and brand-new prospects that will ultimately benefit businesses and society.

The results of the financial system and financial competence on carbon emissions are complex and varied [

9]. The development of sustainable financial strategies could overcome and reduce emissions yielded from environmental indicators, such as manufacturing actual waste [

10]. On the assumption that the financial perspective ignores ecology or the environment, it can lead to a growing record of environmental difficulties, such as the destruction of biodiversity, climate change, contamination, and exhaustion of natural resources. Financial policies play an essential and fundamental role in environmental protection, but only a little has been accomplished in blending ecological concerns with finance and economics.

The implications of green finance can be seen in the reduced amount of carbon dioxide emissions. The authors Le et al. considered the issue from the point of view of financial inclusion and came to the conclusion that the growth of inclusive finance would lead to a lowering in carbon emissions [

11]. In addition, the financial sector’s banking, insurance, and investment activities now take climate change into consideration. This business must deal with a number of climate-change-related obstacles, including regulations that aim to limit GHG emissions, physical changes caused by climate change, and the need for adequate legal governance. Companies in various sectors of the economy will be subjected to this pressure, with some affected more than others. Companies in the financial services industry have a responsibility to prepare to assist clients and businesses in coping with the effects of climate change, as well as to develop products and services that reduce the risk of a carbon-constrained society causing economic instability [

12].

Furthermore, due to the high complexity and multiple dimensions of ecological and environmental problems, it is difficult to finance ecological and environmental restoration only using existing government assistance and policies [

2]. Therefore, a market mechanism (supply and demand) is required to secure sufficient funding for ecological and environmental projects. In this instance, sustainable finance encompasses the role of the financial services sector and other private financing. One of the problems caused by the energy transition and climate change is paying for mitigation and adaptation activities and closing the funding gap to pay for the necessary investments in low-carbon industries, as well as what risks, opportunities, and incentives the government can offer. Creating conducive policies, particularly for the economic and financial sectors, presents a challenge for several nations, especially developing countries.

For developing countries, especially those without long-standing domestic financial exchanges and established institutional commodity markets, green finance can be a critical element to support and enhance the effectiveness and efficiency of the carbon market in carbon trading. There are several terms used to depict the actual meaning of green finance, such as “sustainable finance”, “environmental finance”, “climate finance” and “green investment” [

13]. For alignment purposes, we utilize the terms “sustainable finance”, “green finance” and “carbon finance” to refer to financing support for the purpose of decarbonization. IFC (2009) described green finance as investment solutions that protect the environment, promote social justice, and stimulate economic growth [

14]. There has been a significant increase in financial institutions worldwide beginning to implement and adopt lending systems, policies and practices to reduce businesses’ environmental, social and economic impact. Financial institutions (banks) play an important role as intermediaries to absorb, allocate and distribute idle funds in society for economic growth [

15,

16].

Article 6 of the Paris Agreement is the key tool to boost climate ambition by governing the carbon market. It mobilizes resources to allow countries and companies to actualize the low-carbon transition, and hence, be able to achieve the goal of net zero emissions in the most effective way. Several academics have conducted studies indicating that the purpose of green finance is to finance green companies, assist in the improvement of environmental quality, and encourage technical innovation in green sectors. It has also been demonstrated that green money may significantly contribute to emission reductions [

17,

18,

19]. GHG reduction may be pursued through a variety of methods. A carbon price mechanism is one of the most economical means of reducing greenhouse gas emissions. Under a carbon pricing system, governments impose a cost on businesses and other entities that emit significant amounts of CO

2 in order to provide an economic incentive to reduce such pollution. Carbon pricing can be implemented in multiple ways. A survey of policy practice categorized carbon pricing mechanisms as falling into three main types: cap and trade emission trading systems, carbon taxation and hybrid systems that blend taxation and emission trading schemes [

20]. Under an emission trading scheme (ETS), the government sets a cap on emissions or emission intensity, and then issues allowances to firms that can choose to sell their allowances to firms with higher abatement costs or use the allowances for a set period of time before surrendering them back to the government. Typically, the government gives primary allowances to regulated industries for free or sells them at auction to establish a base price.

This paper aims to review the literature that discusses the extent to which green finance or sustainable finance has been a potential factor to speed up the implementation of cap-and-trade (carbon trading). The literature review is ultimately aimed at identifying the lack of information on how green finance can take place to support the carbon market. This article will address the following research questions:

- a.

What is the trend in the number of publications within the research field?

- b.

Which nations, organizations, publications, subject areas, and writers are most prominent in the current research field?

- c.

What are the main research directions in the current field?

- d.

How effective is the development of studies on the application of green finance in carbon trading transactions in reducing emissions?

The structure of this paper is as follows. Following the introduction, the second sec-tion reviews the literature on the transformation of carbon trading, as well as the integra-tion of green finance (or sustainable finance and climate finance). The third section dis-cusses the analytical method used and the bibliometrics as part of a systematic literature review, along with the structure of the keyword search filtering used. The fourth section discusses the search results and the network analysis using VOSViewer, as well as key-words, countries, and methods used in the selected articles.

2. Materials and Methods

To perform this research, we focused on any financing that covers environmental, social and governance aspects to reduce carbon emission and to support the Sustainable Development Goals (SDGs). The financial sector plays a crucial role in accelerating the post-COVID-19 economic recovery process, primarily by transforming conventional business patterns to become sustainable through the implementation of environmental, social, and governance aspects. The role and support of sustainable finance to support SDG and nationally determined contributions are essential as part of a strategy to meet funding needs, such as generating innovative financing instruments, increasing access to global funding, strengthening fiscal policy, or increasing the attractiveness of private investment [

21,

22].

SDGs issued by the United Nations emphasize the importance of environmental sustainability that correlates well with human health and standards of living. Not only does environmental pollution adversely affect human health and future generations but it also causes climate change. Investments in sustainable energy and clean energy for low-carbon economic development are widely considered prerequisites for creating environmental sustainability.

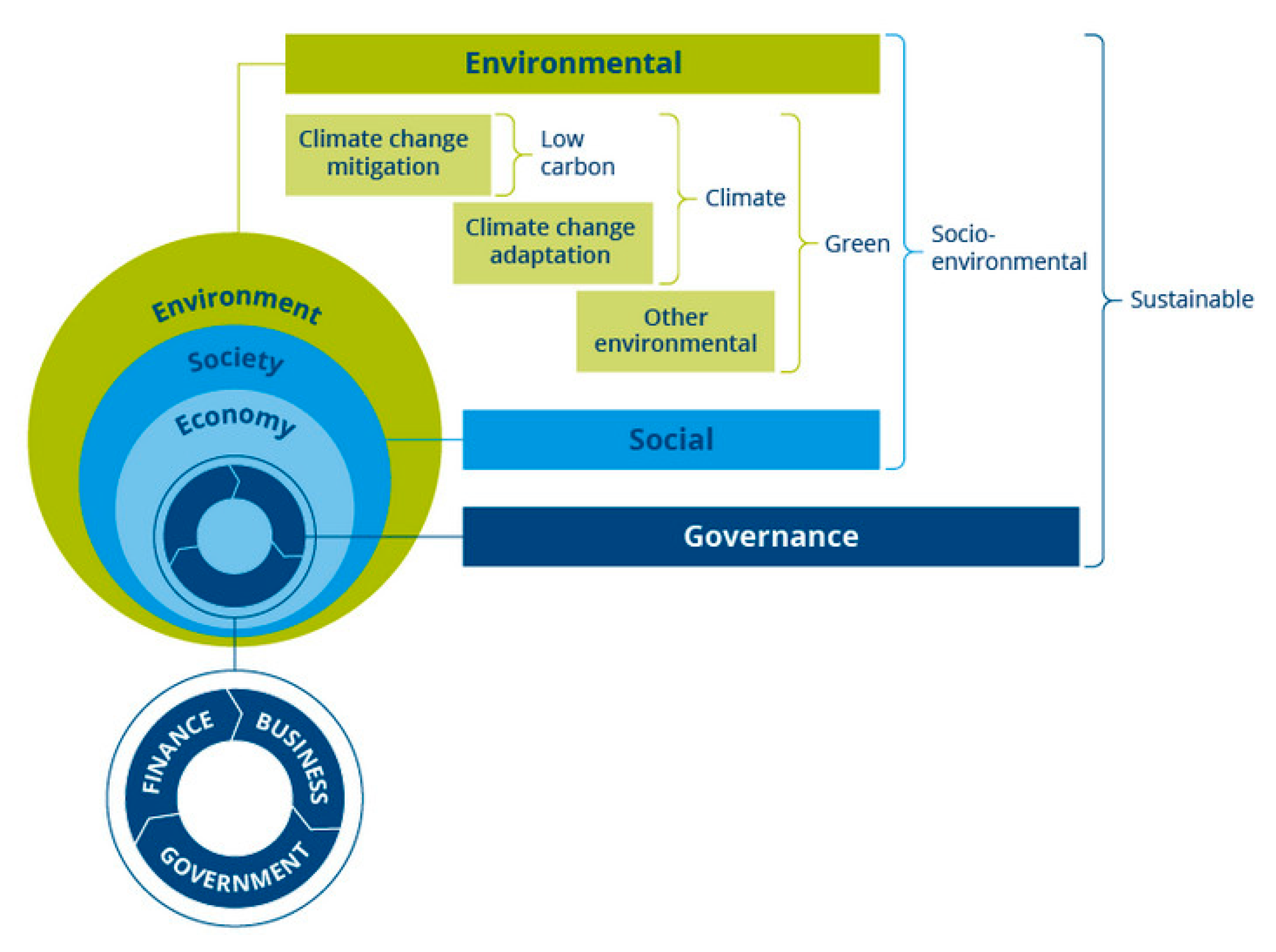

Figure 1 illustrates the larger position of sustainable finance and includes the overall objectives of the SDGs. Sustainable financial instruments, such as green bonds, can act as a bridge for a country to achieve SDGs.

Figure 2 depicts how the various components of sustainable finance relate to one another in an illustrative manner.

Figure 2, which is presented in a slightly different manner than

Figure 1, places an emphasis on the participation of governance as an essential component in order to create a sustainable ecosystem.

The framework set out in the Paris Agreement and the SDGs can be utilized as an appropriate parameter to mitigate and adapt to climate change in relation to sustainable financing [

23,

24]. Through the SDGs and the Paris Agreement, the global framework now leads to sustainable development that focuses on environmental protection and its relation to financial mobilization. A moderately novel concept in financial and environmental issues, sustainable finance, plays a crucial role in supporting the transition to a greener transformation in both industrialized and developing nations [

25].

This section aims to disclose how the review procedures and processes specific to our research topic were performed. The objective of this research is to develop linguistic bridges between the literature on sustainable finance and carbon trading. To address the limitations of narrative reviews, this paper uses a systematic literature review to obtain all relevant and available research on green finance and carbon trading [

26]. A literature review is a research synthesis conducted by review groups with specialized skills to identify, retrieve, appraise, and synthesize a body of literature [

27]. It follows a predefined and rigorous process to ensure the reliability and reproducibility of the results. This literature review integrates quantitative and qualitative evaluation through bibliometrics and content analysis.

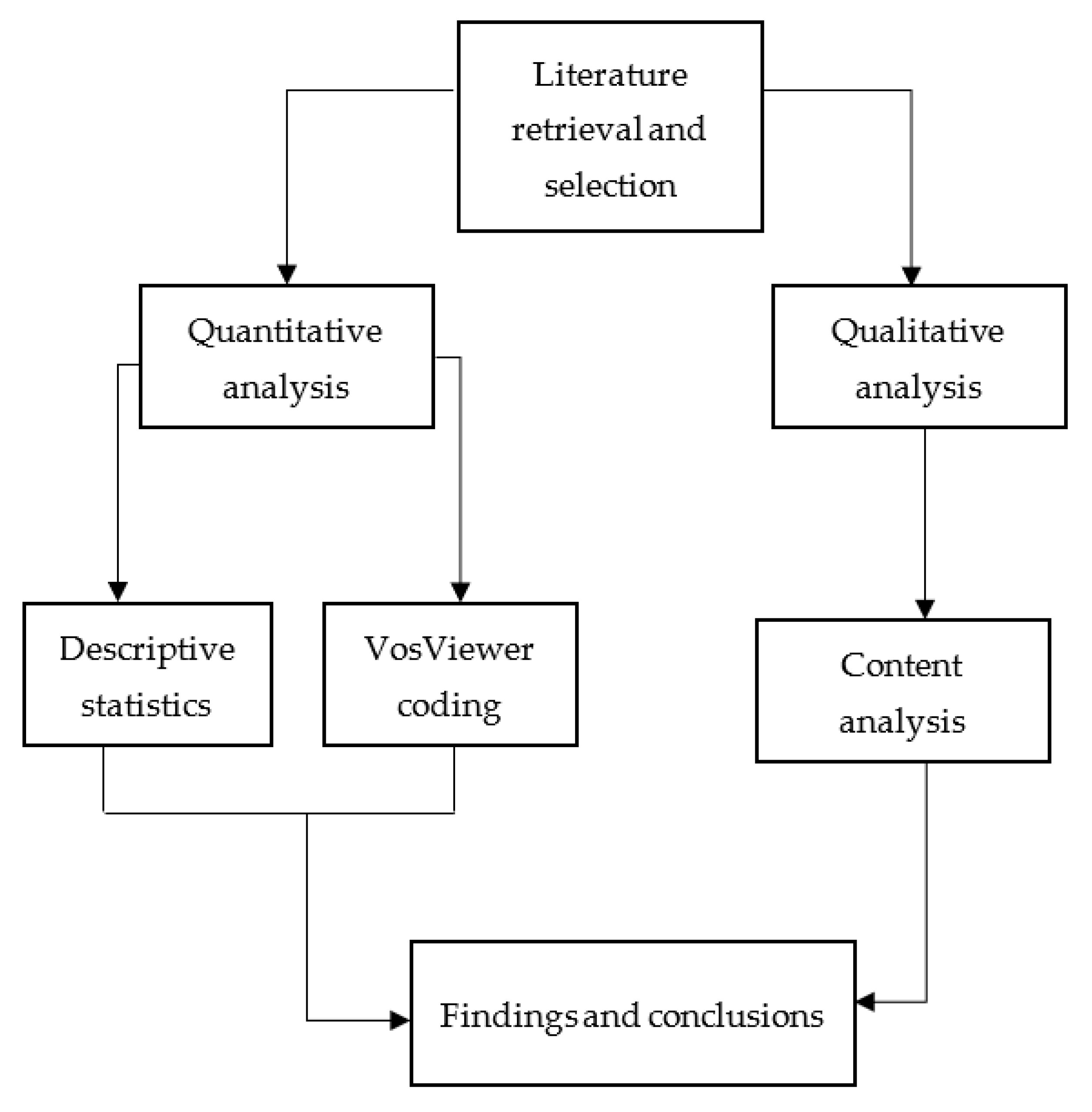

The framework that was utilized for the approach is depicted in

Figure 3. This framework begins with the selection of the literature that is tailored to the search criteria, followed by the quantitative and qualitative analysis of this literature, in order to arrive at findings and conclusions.

2.1. Literature Retrieval and Selection

This paper adopted the preferred reporting items for systematic reviews and meta-analyses (PRISMA) statement, published in 2009 and later updated in 2020 (referred to as PRISMA 2020), for the selection of the retrieved literature. Although the PRISMA 2020 statement was designed for a systematic literature review of studies related to health interventions, this method applies to other disciplines [

28]. The following steps were performed as suggested by PRISMA 2020 statements:

This step specified the studies’ inclusion and exclusion criteria and how we classified them for the syntheses. There were three eligibility criteria for this study. First, the article had to be written in English. This criterion ensures the maximum reach and impact of research findings on the global community. Second, the article had to have been published between 2014 and 2022. We opted for this timeline to discern the Paris Agreement’s impact on the advancement of research related to green (sustainable) finance and carbon trading. Third, the article had to be relevant to sustainable finance or carbon trading. This criterion is critical as we attempted to identify linkages between the two concepts in research papers;

- (2)

Information sources

This step specified all sources (i.e., databases, registers, websites, organizations, reference lists and others) used to obtain the articles. It also specified the date when each source was last searched or consulted. We utilized Scopus as the only source to ensure the homogeneity of the articles’ quality. Scopus indexed 25,000 active journals or titles from 7000 publishers, meticulously reviewed and curated by an independent board. It utilizes a rich underlying metadata architecture to connect authors, published ideas and institutions.

Furthermore, the Scopus database offers the feasibility and workability to explore several fundamental keywords concurrently in an article title and abstract, thus enabling one to locate the necessary word within the identified elements of a published paper/journal. Therefore, we assessed it as an adequate representation of academic research publications. The article queries were last conducted in July 2022;

- (3)

Search strategy

To obtain the documents/journals/papers that were required, we entered and registered keywords that appear in or resemble those in the article title, abstract, or keyword lists. To avoid duplicating the document, the remaining or unused keywords in the title, abstract, and keyword list were eliminated; for example, when the word “sustainable” was searched for in titles, abstracts, and keywords, it excluded other keywords that may also appear in the article title, abstract, or keyword lists.

We employed keywords related to carbon trading, banking, and green finance, e.g., carbon pricing, carbon trading, cap-and-trade, emission trading scheme, green finance, and green banking. We limited the document search by date, document type, and subject. Wildcards and Boolean operators were used, such as AND/OR, for example: carbon pric*” OR “carbon tax*” OR “cap-and-trad*” AND “green financ*”. Furthermore, the literature review method provided elements to distinguish the main characteristics of the research, which would explore the following relevant topics: sustainable finance, green finance, carbon trading, and emission trading;

- (4)

Selection process

The selection process specified the techniques used to determine whether an article met the inclusion criteria, including how many reviewers sifted each search result, how the reviewers worked in teams, and, if necessary, what automation tools were used.

Figure 4 illustrates the selection process under eligibility criteria, information sources, and selection criteria adopted by the graph from PRISMA [

28]. We performed three rounds of queries for each. The SCOPUS database identified a combined 506 articles. We removed duplicate records by manual skimming. We did not use automation since the database is small and manageable. We screened 494 articles based on titles and decided to retrieve all of them. Based on our criteria, we removed 6 articles due to them having publication dates prior to 2014, 15 articles that were not written in English and 184 articles that were not relevant to the research question. The total number of articles included for the bibliometrics analysis was 289 articles.

- (5)

Data collection process

Three independent reviewers assembled the needed information from the selected articles using an extraction template. Any disagreement was resolved during our weekly meetings with the researchers. The following data were intended to be extracted: first author, country of study, publication year, source, methods, results and citation.

2.2. Quantitative Analysis

The data extracted from the previous step present a bibliometric analysis to broadly explain what research has been performed on green (sustainable) finance and carbon trading. The data are presented in bar graphs and pie charts. Bibliometric indicators have become some of the most common routine practice tools in evaluation research management. We used article-level, author-level, and journal-level indicators for bibliometric analysis. Article-level indicators measure the scope and impact of academic research at the article level through alternative indicators or “surrogate indicators.” Due to the broad use of the internet and information technology, article-level indicators are more relevant in the digital environment. Author-level indicators help to track the impact of individual researchers in the discipline. These indicators are traditionally calculated by using the number of times other researchers cite their scholarly publications. Journal-level metrics quantified the impact of a journal in a particular field. They calculate how many articles are published per year and how many citations use articles published in that journal. The data will be summarized in line and pie charts for visual aid.

The text mining software VOSviewer was adopted for science mapping. VOSviewer is a comprehensive bibliometric analysis tool based on the visualization of similarities (VOS) technology, which has unique advantages in clustering fragmented knowledge from different domains according to their similarity and relatedness. In the visualized networks, a node signifies a particular bibliographic item, such as an organization, country, keyword, or reference. The node size represents the counting of the evaluated item, i.e., a citation or occurrence. Links denote the co-citation, co-occurrence, or collaboration relationship. The software automatically calculates the total link strength (TLS) metric to reflect the degree of correlation between any two produced nodes. The greater the TLS value, the greater the significance and centrality of the item. Nodes with a high degree of similarity were clustered and were distinguishable from other clusters by color, whilst nodes with a low degree of similarity were separated as much as feasible.

2.3. Qualitative Analysis

A qualitative analysis of the literature was also carried out. The study settings and main findings were displayed using a table and a narrative summary. The main findings were used in a thematic analysis to connect keywords identified from the SGDs indicator framework. Thematic analysis is a type of qualitative data analysis technique. It can be used to describe a group of writings (e.g., interview transcripts, documents, and studies). The researcher carefully examines the data to identify common themes—ideas, topics, and patterns that emerge frequently. Thematic analysis is a flexible qualitative analysis method that enables us to garner new insights and concepts from non-numerical data. Because thematic analysis is such a flexible method, there are many ways to interpret meaning from the dataset, which can be biased without adherence to specific steps. There are six common steps in conducting a thematic analysis:

This stage entails going through the text to become immersed in and intimately familiar with its substance. This stage was accomplished by reading through the articles and taking preliminary notes to become acquainted with the qualitative data. It is the first and most important step in carrying out a successful thematic analysis;

- (2)

Coding

This phase entails identifying significant broader patterns of meaning (potential themes) by collecting and examining codes. We obtained the code from the process of highlighting important phrases or sentences of the text and creating shorthand labels to represent their content. We also gathered relevant data to assess the viability of each candidate theme;

- (3)

Generating themes

This phase entails identifying themes, which are typically broader than codes. Several codes can usually be combined into a single theme. We examined the codes we created and looked for general themes. In this study, we also tried to match the themes with the relevant goals of sustainable development;

- (4)

Reviewing themes

This phase involves comparing the candidate themes to the dataset to ensure that they tell a convincing story about the data and answer the research question. Themes are typically refined during this phase, which may include splitting, combining, or discarding them. Our approach defined themes as a pattern of shared meaning underpinned by a central concept or idea;

- (5)

Defining themes

This phase entails conducting a detailed analysis of each theme, determining the scope and focus of each theme, and determining their ‘story’. It also entails selecting an informative name for each theme;

- (6)

Narrating

This final phase involves weaving together the analytic narrative and data extracts and contextualizing the analysis of the existing literature.

3. Results and Discussion

3.1. Chronological Publication Trend

Figure 5 shows the number of research papers published annually from 2014–2022 related to green finance and carbon trading. There is an exponential growth trend in the number of publications each year; from only 1 article in 2014 to 131 articles in 2022. This trend is expected to continue in 2023, as the number of published articles will rise by the end of the year. It is evident that the financial market acceptance, public awareness, and discussions of these issues are increasing. The topic is expected to become more popular as the deadline for Sustainable Development Goals is approaching.

As previously stated, the year 2014 was chosen due to the ratification of the Paris Agreement. The Paris Agreement was the first-ever universal, legally binding global climate change agreement, adopted at the Paris climate conference (COP21). Since then, research on the topics of green finance and carbon trading has been significantly increasing year by year. Green finance and carbon trading roles are essential for climate action. Therefore, policy makers need to have a better understanding of how to effectively implement them.

3.2. Journal Allocation and Co-Citation Analysis

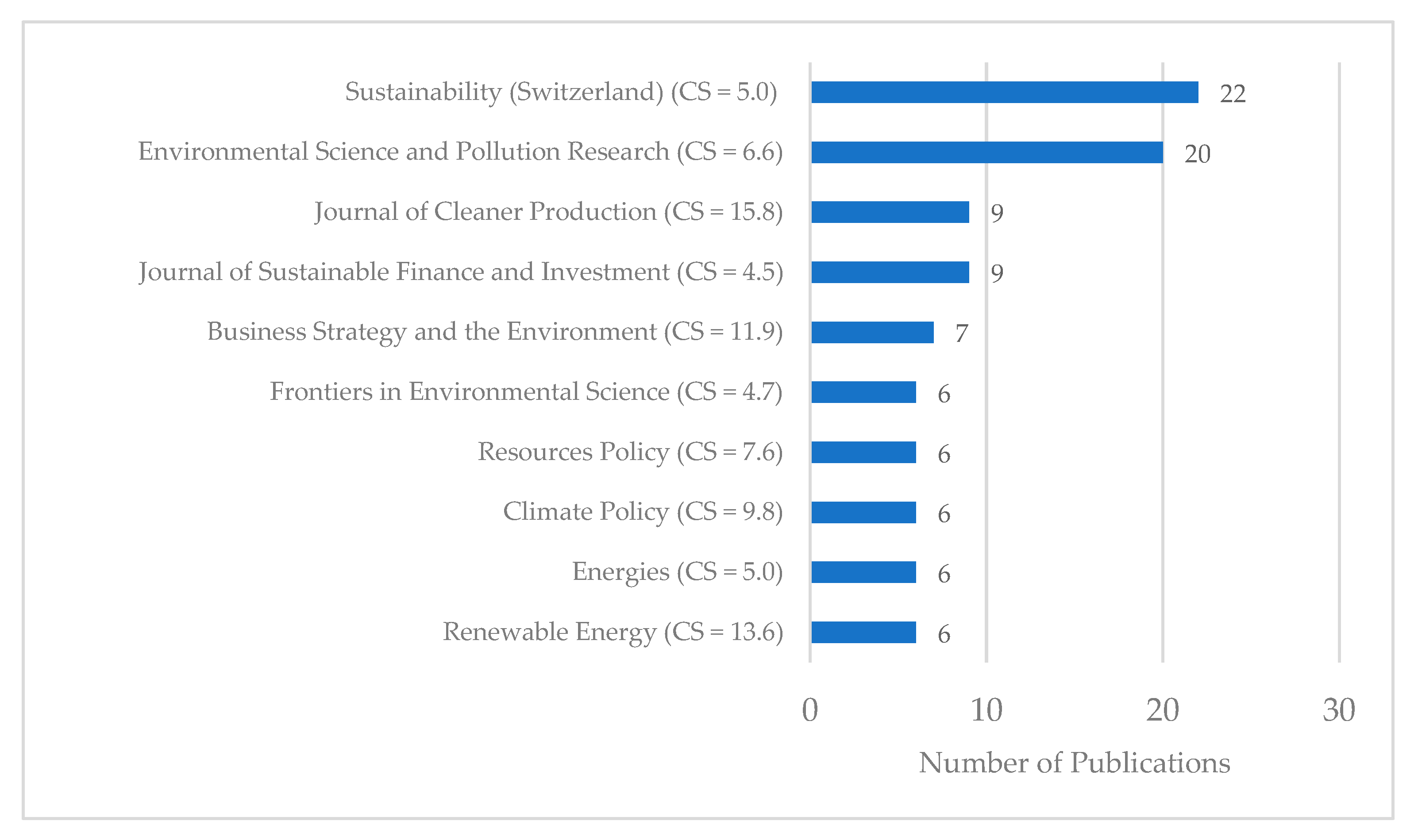

The 289 documents were published in 111 journals and 16 conference proceedings.

Figure 4 shows that the top 10 journals contributed 97 documents or 33.56% of the total documents.

Figure 6 also shows the impact factor of the journals based on the Journal Citation Reports. We used CiteScore, calculated by Scopus in 2021, which is the number of citations received by a journal in one year to documents published in the three previous years, divided by the number of documents indexed in Scopus published in those same three years. It can be deduced from a journal’s CiteScore that the articles it publishes have a greater impact when the score is higher.

Sustainability published most of the articles related to green finance and carbon trading, contributing 7.61% of the total articles. It is followed by Environment Science and Pollution Research (6.92%), Journal of Cleaner Production (3.11%), Journal of Sustainable Finance and Investment (3.11%), and Business Strategy and Environment (2.42%). Renewable Energy has the highest CiteScore of 13.6, followed by Business Strategy and the Environment (CS = 11.98) and Climate Policy (CS = 9.8).

It can be inferred that the research papers related to green finance and carbon trading are not concentrated in a certain journal or field of study. Both are complex subjects that require multidisciplinary and interdisciplinary approaches.

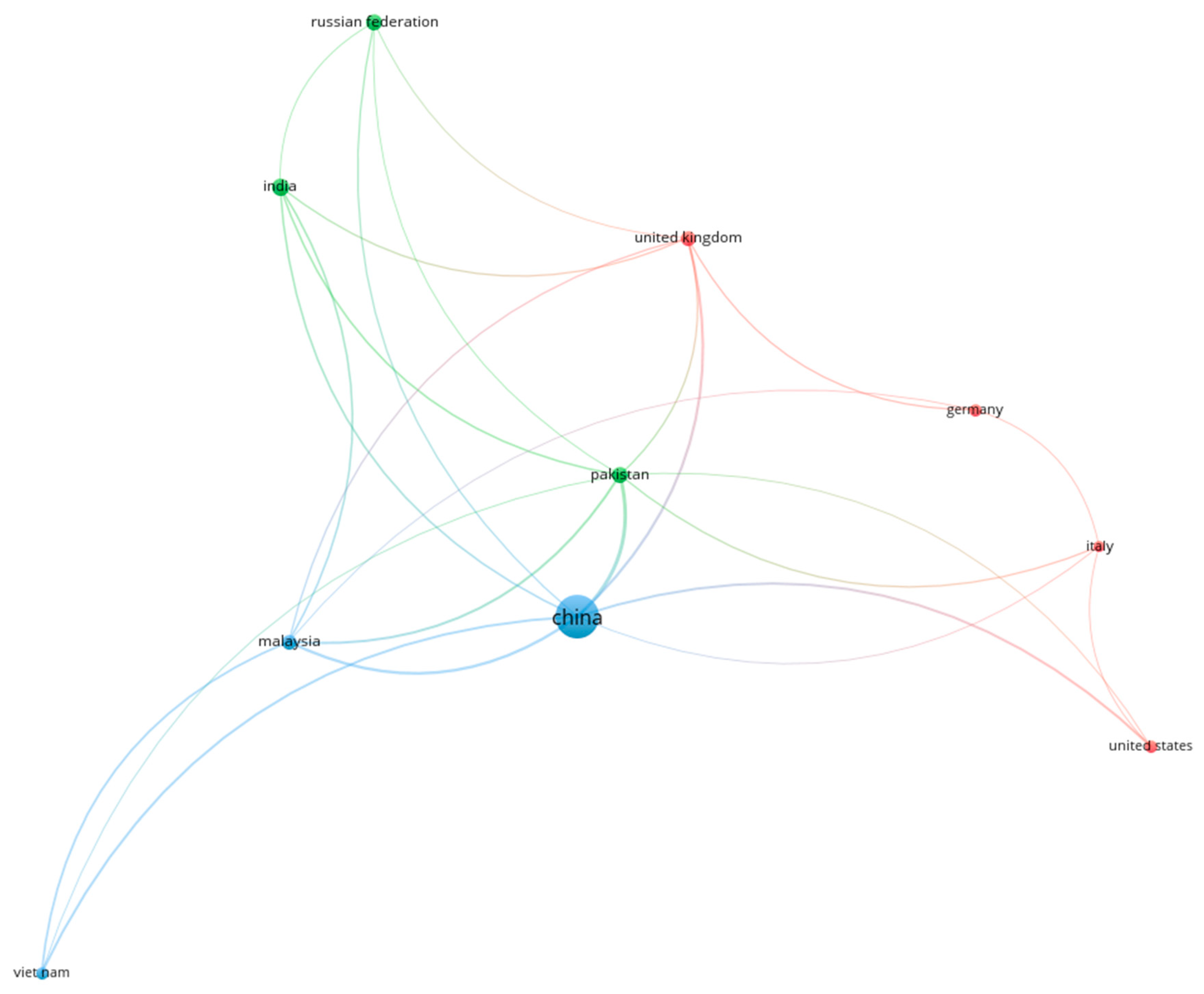

3.3. Countries/Organization Collaboration

Table 1 lists the countries that are actively participating in research on sustainable (green) finance and carbon trading, the number of documents published, citations, and total link strength (TLS). The minimum number of documents and citations per country was set at 10. Of the 66 countries that have published papers on green finance and carbon trading, only 10 of them meet the minimum threshold for documents and citations. China published the highest number of publications and generated the most citations. These data suggest the discussion on green finance and carbon trading is a worldwide concern, in both emerging and developed countries.

Based on

Figure 7, the global research of green finance and carbon trading is divided into three clusters. The first cluster is dominated by European countries (United Kingdom, Germany, and Italy) and the United States. The second cluster consists of India, Pakistan, and Russia. China leads the third cluster with Malaysia and Vietnam. The map suggests that the research collaboration between countries regarding green finance and carbon trading is influenced by the region. China and Pakistan have collaborated with most countries except for Germany.

Regarding the organization or the authors’ affiliations, more than 90% of them only published one research paper. There are five notable organizations that contributed to the research of green finance and carbon trading based on their number of publications, citations, and link strengths:

School of Management and Economics, Beijing Institute of Technology, Beijing, 100081, China. It has published 4 documents with 183 citations;

School of Statistics and Applied Mathematics, Anhui University of Finance and Economics, Bengbu, 233030, China. It has published 2 documents with 124 citations;

Department of Economics and Finance, Sunway University Business School, Sunway University, Subang Jaya, Malaysia. It has published 2 documents with 38 citations;

School of Economics and Management, Huanghuai University, Zhumadian, 463000, China. It has published 2 paper with 2 citations;

School of Management and Economics, Beijing Institute of Technology, Beijing, 100081, China. It has published 3 documents with 179 citations.

3.4. Influential Research

Table 2 shows the top 10 most cited research papers about green finance and carbon trading. Almost all the articles were published in the last 5 years, except for 1 article, which was published in 2016. The trend shows that the topic of green finance and carbon trading has been gaining more traction in recent years.

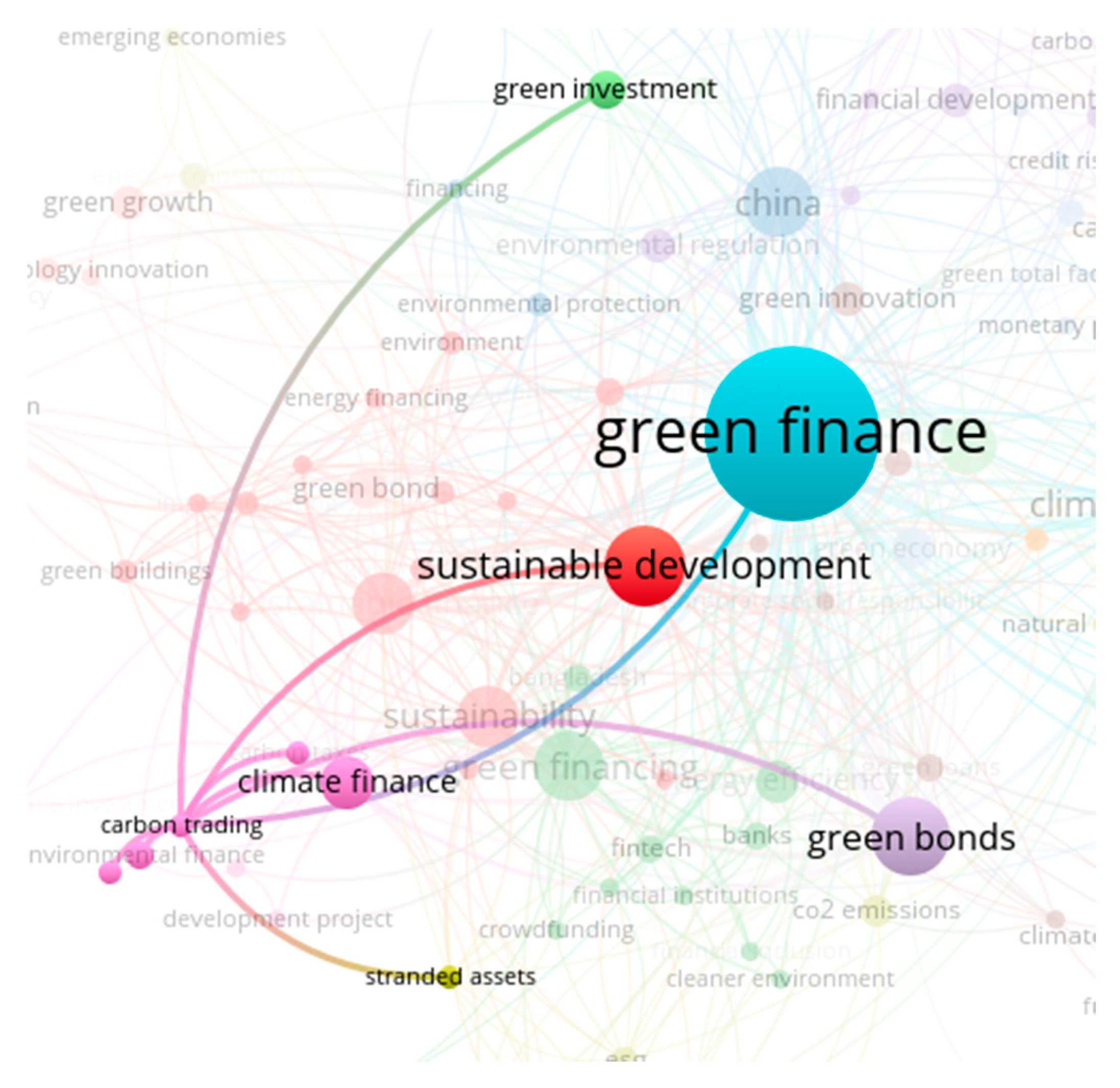

3.5. Keywords Co-Occurance Analysis

Figure 8 shows all the author keywords from the published documents. A total of 118 author keywords are clustered into 15 groups. ‘Green finance’ is the common denominator in all the clusters, with 142 occurrences, 94 links, and a total link strength of 274. Author keywords that are often associated with ‘green finance’ (indicated by their link strength) are ‘sustainable development’, ‘China’, ‘climate change’, and ‘green bonds’. ‘Green finance’ and ‘sustainable development’ most often co-occur, with a link strength of 20. This result is to be expected, as the purpose of green finance stated in the UN Environment Program aims to increase the financial flows to the sustainable development priorities. Meanwhile, the least explored linkages with green finance are technology and innovation.

‘Green finance’ is classified in Cluster 6, along with ‘banking system’, ‘central banking’, ‘climate change’, ‘COVID-19′, ‘financial stability’, ‘green energy’, ‘green recovery’, and ‘Paris agreement’. It is suggested that the role of green finance in the economic recovery post-pandemic is an emerging research topic in recent years.

Figure 9 shows all of the author keywords that are linked with ‘carbon trading’. It shows that there are documents linking ‘green finance’ with ‘carbon trading’, but they are far less explored compared to other themes.

Figure 9 suggests the term ‘green finance’ is uncommonly used to define the financial aspects of carbon trading. The more common terminology is ‘climate finance’, which is defined by UNFCCC as local, national or transnational financing—drawn from public, private and alternative sources of financing—which seeks to support mitigation and adaptation actions that will address climate change.

4. Discussion

Our study covers the theoretical underpinnings of the topic determined from the results and literature evaluation of sample studies. Additionally, it provides a list of the current research trends, as well as possible topics of research that could be investigated in the future. Our current research examines the publications that highlight the involvement of green finance towards carbon trading and carbon emission reduction by employing an integrative review, which comprises a bibliometric analysis and manual literature review of a sample of 184 relevant articles. This review is carried out in order to implement an integrative review. The results of the bibliometric show the interesting fact that only a few documents or journals discussed and explored the implementation of green finance in carbon trading. The literature review performed unveils a substantial finding on the importance of sustainable finance or climate finance with respect to its involvement to support carbon emission reduction. Based on the analysis conducted by Claudius and Betz (2018), the EU Transaction Log data reveal that it is more suitable to associate extended organizations with long trading knowledge and practices with the financial services sector, including banking [

5]. In executing carbon trading, financial institutions can play the following roles: (a) Acting as intermediary institutions in carbon trading transactions with broker specialization; (b) Offering additional services by managing accounts directly; (c) Providing relevant market information to customers through the publication of newspapers or market analysis reports; (d) Acting as a market maker by continuously carrying out supply and demand on the exchange in a particular price corridor; (e) Making transactions through a company’s account to acquire profit; (f) Borrowing a company’s quota and returning it at interest (using it as speculative capital); (g) Assisting in exchanging carbon quotas with certified emission reductions (CERs) or emission reduction units (ERUs) by selling carbon quotas and buying CERs/ERUs annually; (h) Acting as an aggregator by collecting the excess quota of customers and selling it on the market; (i) Becoming the leading hedging partner in which the bank has a role in developing and offering derivative products to manage price risk for regulated companies.

In general, the theory of emission trading focuses on the trading activities of regulated organizations. In reality, however, non-regulated entities also actively participate in the emission allowances market. They frequently serve as intermediaries and can enhance market efficiency by reducing transaction costs [

29]. In our bibliometric analysis and systematic literature review, we observed that the role of the financial sector in commodity markets in general and in emissions trading in particular is underexplored, and there appears to be a lack of research into the roles that banks play in these markets. In order to better comprehend the significance of financial institutions (such as banks) involved in EU emission trading, particularly as trading partners of companies governed by current emission trading schemes, we consider it necessary to conduct a survey analysis.

The carbon market is a compliance market in which the original seller or issuer of the product is the government (i.e., carbon allowances). Therefore, the market lacks typical sellers who would act as counterparties for buyers seeking to hedge against the rising prices of allowances [

30].

According to the several studies that have been reviewed, there are findings that imply that financial development plays a fundamental role in the mitigation of emissions. In theory, financial function and its development include capitalization, the involvement of technology, and implementation of regulations with respect to environmental protection and earning/generation of value and income. That said, with some assistance from more developed countries that have attained high financial development to improve environmental performance, it is expected that other developing countries would be benefited by policymakers as a reminder of how important it is to take into consideration financial aspects and their development to protect the environment for both developed and developing nations [

31,

32]. In addition, Geddes et al. (2020) also implied that the role of government in executing the financial policy is crucial [

33]. Furthermore, Wang, Y and Zhi, Q (2016) emphasized that the concept of green finance is still at the theoretical level, and therefore, it is essential for researchers to explore more and analyze how to reduce environmental risks through more sustainable financing by refining existing traditional financing mechanisms and supporting the development of the renewable energy industry [

34].

We further noticed that there are several challenges and opportunities to improve financial sustainability and highlight the already attained actions. Marx (2020) affirms that managing the obstacles demands an influential political will, with an engagement plan that will be performed [

35]. In this case, proper coordination is required at both the global and regional levels, such as a centralized distribution system on an environmentally sustainable economic movement, the so-called taxonomy. Based on some studies we have examined [

36,

37,

38], we have summarized the following conditions that are also imperative to bring about: (i) Regulations that acknowledge the association of sustainable investments and sustainability risks, including the disclosure of how institutions and the government combine environmental, social, and governance factors in their risk management process; (ii) Public and private businesses and funding are highly required; (iii) Multidisciplinary experts to solve the complicated dilemmas of climate change, but also poverty and other SDGs; and (iv) A competitive market to guarantee efficient resource allocation would also be imperative for thriving carbon trading actions [

36,

37,

38].

We specifically note that in formulating policies related to carbon trading mechanisms, governments must determine appropriate and targeted criteria to provide necessary carbon “credits” to companies that acquire these emissions. This mechanism requires accountability and transparency, including disclosing information from governments on which companies or industry players are releasing carbon emissions and detailed transaction figures. Accountability and transparency will prevent the possibility of under-the-table transactions between government actors and companies that release carbon emissions. With a better future projection of carbon trading or a carbon market, clear and straight regulations that can underlie and support its implementation are required. It is also possible for the government to become involved by enacting policies that evaluate the corporation’s financial and operational requirements and encourage green and sustainable investments in emission reduction measures. For instance, governments might take into consideration putting in place systems for carbon trading (and/or carbon taxes). This may increase awareness among investors, lenders, and financial service providers for market segmentation, and it may also assist in flexible implementation by financial institutions and investors, thereby keeping policy risks (such as stricter environmental policy) relatively low, and making green investments attractive to a wider range of stakeholders [

39].

5. Conclusions and Policy Implications

Using a bibliometric methodology, this study attempts to describe and assess the current status and trajectory of the development of academic research on the topic of green finance in its association with carbon trading (or the carbon market). The sustainable ecological and environmental development has become a vital objective of green finance. Green finance is a powerful component for carbon emission reduction and other environmentally friendly projects. Based on the paper generated in the system, most studies examine the relationship between green finance and carbon dioxide (CO2) emissions that support green finance or the impact of green finance can be reflected in CO2 emission reduction.; however, there is no specific analysis of the impact and/or correlation of green finance or sustainable finance on carbon trading transactions.

However, there are some open analyses or opinion in the media showing that there might be several correlations between carbon trading (cap-and-trade) transactions and green finance. First, green finance intends to raise awareness, share knowledge and other ideas that can facilitate and increase participation in various carbon market developments. Second, green finance involves government-enforced programs around carbon compliance and how private industry responds to these mandates. Third, green finance requires a functioning voluntary carbon market, which allows financial institutions to provide green bonds or loans for green projects and governments to provide tax incentives. Hence, further research is required to justify the validity of the opinion. Through this study, it is anticipated that both private institutions that provide the market for the green finance industry and institutions that regulate the governance of the market in a broader context of the creation of economic sustainability and environmental protection will gain a better understanding of the condition of a number of countries engaging in carbon trading and its green finance policy. With clear information advantages, more opportunities will be provided to researchers and it is anticipated that the international collaboration between developing and developed nations will increase. This study will also be of great use to a number of stakeholders directly involved in the implementation of green finance and carbon trading policies, as it will present potential findings regarding the development of research on green finance and carbon trading. Despite the fact that the quality of the articles has been ensured, the quantity of papers is relatively moderate. This is a limitation of the study that exists due to the fact that the majority of the articles selected for analysis are derived from the Scopus database. By conducting a manual search on the website, we were able to locate a number of useful articles originating from different databases other than Scopus. As a result, making use of multiple databases is something that could be carried out to make the results more representative for future research.