The Effect of COVID-19 on the Performance of SMEs in Emerging Markets in Iran, Iraq and Jordan

Abstract

1. Introduction

2. Theoretical Foundation and Hypothesis Development

2.1. The Pandemic and Communication Performance

2.2. The Pandemic and Internal Processes

2.3. The Pandemic and the Innovation of Companies

3. Research Methods

4. Results

5. Discussion

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Chen, H.C.; Yeh, C.W. Global financial crisis and COVID-19: Industrial reactions. Financ. Res. Lett. 2021, 42, 101940. [Google Scholar] [CrossRef] [PubMed]

- Zou, P.; Huo, D.; Li, M. The impact of the COVID-19 pandemic on firms: A survey in Guangdong Province, China. Glob. Health Res. Policy 2020, 5, 41. [Google Scholar] [CrossRef] [PubMed]

- Liu, L.; Wang, E.Z.; Lee, C.C. Impact of the COVID-19 pandemic on the crude oil and stock markets in the US: A time-varying analysis. Energy Res. Lett. 2020, 1, 13154. [Google Scholar] [CrossRef]

- Iyke, B.N. COVID-19: The reaction of US oil and gas producers to the pandemic. Energy Res. Lett. 2020, 1, 13912. [Google Scholar] [CrossRef]

- Phan, D.H.B.; Narayan, P.K. Country responses and the reaction of the stock market to COVID-19—A preliminary exposition. Emerg. Mark. Financ. Trade 2020, 56, 2138–2150. [Google Scholar] [CrossRef]

- Piccarozzi, M.; Silvestri, C.; Morganti, P. COVID-19 in management studies: A systematic literature review. Sustainability 2021, 13, 3791. [Google Scholar] [CrossRef]

- Islam, D.M.Z.; Khalid, N.; Rayeva, E.; Ahmed, U. COVID-19 and financial performance of SMEs: Examining the nexus of entrepreneurial self-efficacy, entrepreneurial resilience and innovative work behavior. Rev. Argent. Clínica Psicológica 2020, 29, 587. [Google Scholar]

- Xu, L.; Yang, S.; Chen, J.; Shi, J. The effect of COVID-19 pandemic on port performance: Evidence from China. Ocean Coast. Manag. 2021, 209, 105660. [Google Scholar] [CrossRef]

- Fu, M.; Shen, H. COVID-19 and corporate performance in the energy industry. Energy Res. Lett. 2020, 1, 1–4. [Google Scholar] [CrossRef]

- Khatib, S.F.; Nour, A.N.I. The impact of corporate governance on firm performance during the COVID-19 pandemic: Evidence from Malaysia. J. Asian Financ. Econ. Bus. 2021, 8, 0943–0952. [Google Scholar]

- Shen, H.; Fu, M.; Pan, H.; Yu, Z.; Chen, Y. The impact of the COVID-19 pandemic on firm performance. Emerg. Mark. Financ. Trade 2020, 56, 2213–2230. [Google Scholar] [CrossRef]

- Markovic, S.; Koporcic, N.; Arslanagic-Kalajdzic, M.; Kadic-Maglajlic, S.; Bagherzadeh, M.; Islam, N. Business-to-business open innovation: COVID-19 lessons for small and medium-sized enterprises from emerging markets. Technol. Forecast. Soc. Chang. 2021, 170, 120883. [Google Scholar] [CrossRef]

- Baker, S.; Bloom, N.; Davis, S.; Terry, S. COVID-induced economic uncertainty and its consequences. Behav. Exp. Financ. 2020, 27, 100326. [Google Scholar] [CrossRef]

- Veselinova, E.; Samonikov, M.G. The Impact of COVID-19 Pandemic on Firms Performance: Analysis of the Companies from the MBI10 Index. J. Econ. 2021, 6, 174–184. [Google Scholar] [CrossRef]

- Baek, S.; Mohanty, S.K.; Glambosky, M. COVID-19 and stock market volatility: An industry level analysis. Financ. Res. Lett. 2020, 37, 101748. [Google Scholar] [CrossRef]

- Kraus, S.; Clauss, T.; Breier, M.; Gast, J.; Zardini, A.; Tiberius, V. The economics of COVID-19: Initial empirical evidence on how family firms in five European countries cope with the corona crisis. Int. J. Entrep. Behav. Res. 2020, 26, 1067–1092. [Google Scholar] [CrossRef]

- Bagherpour, M.A.; Monroe, G.S.; Shailer, G. Government and managerial influence on auditor switching under partial privatization. J. Account. Public Policy 2014, 33, 372–390. [Google Scholar] [CrossRef]

- Briguglio, L.P. Exposure to external shocks and economic resilience of countries: Evidence from global indicators. J. Econ. Stud. 2016, 43, 1057–1078. [Google Scholar] [CrossRef]

- Cannavale, C.; Zohoorian Nadali, I.; Esempio, A. Entrepreneurial orientation and firm performance in a sanctioned economy–does the CEO play a role? J. Small Bus. Enterp. Dev. 2020, 27, 1005–1027. [Google Scholar] [CrossRef]

- Didier, T.; Huneeus, F.; Larrain, M.; Schmukler, S.L. Financing firms in hibernation during the COVID-19 pandemic. J. Financ. Stab. 2021, 53, 100837. [Google Scholar] [CrossRef]

- Ahmed, S.Y. Impact of COVID-19 on Performance of Pakistan Stock Exchange No. 101540; MPRA Paper: Lahore, Pakistan, 2020. [Google Scholar]

- Abuhussein, T.; Barham, H.; Al-Jaghoub, S. The effects of COVID-19 on small and medium-sized enterprises: Empirical evidence from Jordan. J. Enterprising Communities People Places Glob. Econ. 2023, 17, 334–357. [Google Scholar] [CrossRef]

- World Bank. Jordan Economic Update, October 2020. Available online: https://thedocs.worldbank.org/en/doc/1466316030473586160280022020/original/7mpoam20jordanjorkcm.pdf (accessed on 20 January 2021).

- Kano, L.; Hoon Oh, C. Global Value Chains in the Post-COVID World: Governance for Reliability. J. Manag. Stud. 2020, 57, 1773–1777. [Google Scholar] [CrossRef]

- Gil-Alana, L.A.; Monge, M. Crude Oil Prices and COVID-19-Persistence of the Shock. Energy Res. Lett. 2021, 1, 1–4. [Google Scholar] [CrossRef]

- Alsamhi, M.H.; Al-Ofairi, F.A.; Farhan, N.H.; Al-Ahdal, W.M.; Siddiqui, A. Impact of Covid-19 on firms’ performance: Empirical evidence from India. Cogent Bus. Manag. 2022, 9, 2044593. [Google Scholar] [CrossRef]

- Hu, S.; Zhang, Y. COVID-19 pandemic and firm performance: Cross-country evidence. Int. Rev. Econ. Financ. 2021, 74, 365–372. [Google Scholar] [CrossRef]

- Ming, Z.; Ping, Z.; Shunkun, Y.; Ge, Z. Decision-making model of generation technology under uncertainty based on real option theory. Energy Convers. Manag. 2016, 110, 59–66. [Google Scholar] [CrossRef]

- Song, P. R&D Investment Strategies of Firms: Renewal or Abandonment. A Real Options Perspective. Ph.D. Thesis, Georgia State University, Atlanta, GA, USA, 2009. [Google Scholar]

- Yang, S.; Kang, H.H. Is synergy always good? Clarifying the effect of innovation capital and customer capital on firm performance in two contexts. Technovation 2008, 28, 667–678. [Google Scholar] [CrossRef]

- Shafeeq Nimr Al-Maliki, H.; Salehi, M.; Kardan, B. The effect of COVID 19 on risk-taking of small and medium-sized, family and non-family firms. J. Facil. Manag. 2023, 21, 298–309. [Google Scholar] [CrossRef]

- Jorgensen, S.C.; Kebriaei, R.; Dresser, L.D. Remdesivir: Review of pharmacology, pre-clinical data, and emerging clinical experience for COVID-19. Pharmacother. J. Hum. Pharmacol. Drug Ther. 2020, 40, 659–671. [Google Scholar] [CrossRef]

- Zheng, C.; Zhang, J. The impact of COVID-19 on the efficiency of microfinance institutions. Int. Rev. Econ. Financ. 2021, 71, 407–423. [Google Scholar] [CrossRef]

- Harel, R. The Impact of COVID-19 on Small Businesses’ Performance and Innovation. Glob. Bus. Rev. 2021, 1–22. [Google Scholar] [CrossRef]

- Golubeva, O. Firms’ performance during the COVID-19 outbreak: International evidence from 13 countries. Corp. Gov. 2021, 21, 1011–1027. [Google Scholar] [CrossRef]

- Elmarzouky, M.; Albitar, K.; Hussainey, K. Covid-19 and performance disclosure: Does governance matter? Int. J. Account. Inf. Manag. 2021, 29, 776–792. [Google Scholar] [CrossRef]

- Wu, S.; Zhou, W.; Xiong, X.; Burr, G.S.; Cheng, P.; Wang, P.; Niu, Z.; Hou, Y. The impact of COVID-19 lockdown on atmospheric CO2 in Xi’an, China. Environ. Res. 2021, 197, 111208. [Google Scholar] [CrossRef]

- Fodor, O.C.; Flestea, A.M. When fluid structures fail: A social network approach to multi-team systems’ effectiveness. Team Perform. Manag. 2016, 22, 156–180. [Google Scholar] [CrossRef]

- Xie, C.; Wu, D.; Luo, J.; Hu, X. A case study of multi-team communications in construction design under supply chain partnering. Supply Chain Manag. 2010, 15, 363–370. [Google Scholar] [CrossRef]

- Izam Ibrahim, K.; Costello, S.B.; Wilkinson, S. Key practice indicators of team integration in construction projects: A review. Team Perform. Manag. 2013, 19, 132–152. [Google Scholar] [CrossRef]

- Sha’ar, K.Z.; Assaf, S.A.; Bambang, T.; Babsail, M.; Fattah, A.A.E. Design–construction interface problems in large building construction projects. Int. J. Constr. Manag. 2017, 17, 238–250. [Google Scholar] [CrossRef]

- Goswami, B.; Mandal, R.; Nath, H.K. COVID-19 pandemic and economic performances of the states in India. Econ. Anal. Policy 2021, 69, 461–479. [Google Scholar] [CrossRef]

- Vaccaro, I.G.; Jansen, J.J.; Van Den Bosch, F.A.; Volberda, H.W. Management innovation and leadership: The moderating role of organizational size. J. Manag. Stud. 2012, 49, 28–51. [Google Scholar] [CrossRef]

- Mothe, C.; Uyen Nguyen Thi, T. The link between non-technological innovations and technological innovation. Eur. J. Innov. Manag. 2010, 13, 313–332. [Google Scholar] [CrossRef]

- Gorzelany-Dziadkowiec, M. COVID-19: Business innovation challenges. Sustainability 2021, 13, 11439. [Google Scholar] [CrossRef]

- Birkinshaw, J.; Hamel, G.; Mol, M.J. Management innovation. Acad. Manag. Rev. 2008, 33, 825–845. [Google Scholar] [CrossRef]

- Schumpeter, J.A.; Grzywicka, J.; Górski, J. Teoria Rozwoju Gospodarczego; Państwowe Wydawnictwo Naukowe: Kasinka Mała, Poland, 1960. [Google Scholar]

- Devinney, T.M.; Yip, G.S.; Johnson, G. Using frontier analysis to evaluate company performance. Br. J. Manag. 2010, 21, 921–938. [Google Scholar] [CrossRef]

- Fernández-Temprano, M.A.; Tejerina-Gaite, F. Types of director, board diversity and firm performance. Corp. Gov. 2020, 20, 324–342. [Google Scholar] [CrossRef]

- Ferreira, A.; Otley, D. The design and use of performance management systems: An extended framework for analysis. Manag. Account. Res. 2009, 20, 263–282. [Google Scholar] [CrossRef]

- Giovannoni, E.; Pia Maraghini, M. The challenges of integrated performance measurement systems: Integrating mechanisms for integrated measures. Account. Audit. Account. J. 2013, 26, 978–1008. [Google Scholar] [CrossRef]

- Melnyk, S.A.; Bititci, U.; Platts, K.; Tobias, J.; Andersen, B. Is performance measurement and management fit for the future? Manag. Account. Res. 2014, 25, 173–186. [Google Scholar] [CrossRef]

- Chavda, M.V. Effectiveness of E-banking during COVID 19 Pandemic. Int. J. Adv. Res. Comput. Commun. Eng. 2021, 10, 1–5. [Google Scholar] [CrossRef]

- El-Mousawi, H.; Kanso, H. Impact of COVID-19 outbreak on financial reporting in the light of the international financial reporting standards (IFRS) (an empirical study). Res. Econ. Manag. 2020, 5, 21–38. [Google Scholar] [CrossRef]

- Dai, R.; Feng, H.; Hu, J.; Jin, Q.; Li, H.; Wang, R.; Xu, L.; Zhang, X. The impact of COVID-19 on small and medium-sized enterprises (SMEs): Evidence from two-wave phone surveys in China. China Econ. Rev. 2021, 67, 101607. [Google Scholar] [CrossRef]

- Martin, D.; Neale, E.A.; Bertini, R.; Smith-Omomo, J.; Aymerich, O. Impact of Covid-19 on Small-and Medium-sized Enterprises in Iraq; Working Paper; Economic Research Forum (ERF): Baghdad, Iraq, 2022. [Google Scholar]

- Atayah, O.F.; Dhiaf, M.M.; Najaf, K.; Frederico, G.F. Impact of COVID-19 on financial performance of logistics firms: Evidence from G-20 countries. J. Glob. Oper. Strateg. Sourc. 2022, 15, 172–196. [Google Scholar] [CrossRef]

- Cui, L.; Kent, P.; Kim, S.; Li, S. Accounting conservatism and firm performance during the COVID-19 pandemic. Account. Financ. 2021, 61, 5543–5579. [Google Scholar] [CrossRef]

- Ren, Z.; Zhang, X.; Zhang, Z. New evidence on COVID-19 and firm performance. Econ. Anal. Policy 2021, 72, 213–225. [Google Scholar] [CrossRef]

- Rahman, M.D.; Mutsuddi, P.; Roy, S.K.; Amin, M.; Jannat, F. Performance efficiency evaluation of information and communication technology (ICT) application in human resource management during COVID-19 pandemic: A study on banking industry of Bangladesh. South Asian J. Soc. Stud. Econ. 2020, 8, 46–56. [Google Scholar] [CrossRef]

- Siagian, H.; Tarigan, Z. The central role of it capability to improve firm performance through lean production and supply chain practices in the COVID-19 era. Uncertain Supply Chain Manag. 2021, 9, 1005–1016. [Google Scholar] [CrossRef]

- Behbahaninia, P.S.; Golbidi, M. The effect of R&D activities on the market response and company’s performance during the shock caused by the COVID-19 pandemic in Iran. J. Appl. Account. Res. 2022, 23, 884–896. [Google Scholar] [CrossRef]

- Lestari, D.; Siti, M.; Wardhani, W.; Yudaruddin, R. The impact of COVID-19 pandemic on performance of small enterprises that are e-commerce adopters and non-adopters. Probl. Perspect. Manag. 2021, 19, 467. [Google Scholar] [CrossRef]

- Christa, U.; Kristinae, V. The effect of product innovation on business performance during COVID 19 pandemic. Uncertain Supply Chain Manag. 2021, 9, 151–158. [Google Scholar] [CrossRef]

- Sharma, G.D.; Kraus, S.; Srivastava, M.; Chopra, R.; Kallmuenzer, A. The changing role of innovation for crisis management in times of COVID-19: An integrative literature review. J. Innov. Knowl. 2022, 7, 100281. [Google Scholar] [CrossRef]

| Iran | Iraq | Jordan | ||||

|---|---|---|---|---|---|---|

| Number | Percentage | Number | Percentage | Number | Percentage | |

| Gender | ||||||

| Male | 127 | 54 | 127 | 64 | 48 | 70 |

| Female | 109 | 46 | 70 | 36 | 21 | 30 |

| Age | ||||||

| 25 to 30 years | 126 | 53 | 44 | 22 | 6 | 9 |

| 31 to 35 years | 22 | 9 | 2 | 1 | 13 | 19 |

| 36 to 40 years | 65 | 28 | 103 | 52 | 26 | 38 |

| over 40 years | 21 | 9 | 48 | 24 | 24 | 35 |

| Education | ||||||

| Bachelor’s degree | 207 | 88 | 136 | 69 | 51 | 74 |

| Master’s degree | 24 | 10 | 47 | 24 | 11 | 16 |

| P.H.D | 5 | 2 | 14 | 7 | 7 | 10 |

| Job | ||||||

| Accountants | 114 | 48 | 126 | 64 | 28 | 41 |

| Financial manager | 37 | 16 | 18 | 9 | 7 | 10 |

| CEO | 20 | 8 | 13 | 7 | 5 | 7 |

| Internal auditors | 63 | 27 | 35 | 18 | 24 | 35 |

| Independent auditors | 0 | 0 | 5 | 3 | 5 | 7 |

| Iran | Iraq | Jordan | ||||

|---|---|---|---|---|---|---|

| Number | Percentage | Number | Percentage | Number | Percentage | |

| Work experience (duration) | ||||||

| Less than 5 years | 100 | 42 | 1 | 1 | 5 | 7 |

| 5 to 10 years | 36 | 15 | 55 | 28 | 24 | 35 |

| 11 to 15 years | 46 | 19 | 53 | 27 | 23 | 33 |

| 16 to 20 years | 14 | 6 | 26 | 13 | 5 | 7 |

| 21 years and over | 37 | 16 | 62 | 31 | 12 | 17 |

| Work experience | ||||||

| Accounting history | 155 | 66 | 148 | 75 | 37 | 54 |

| Financial manager experience | 9 | 4 | 1 | 1 | 1 | 1 |

| Management experience | 13 | 6 | 6 | 3 | 1 | 1 |

| Internal auditor experience | 59 | 25 | 37 | 19 | 23 | 33 |

| Experience as an independent auditor | 0 | 0 | 5 | 3 | 6 | 9 |

| Industry | ||||||

| Chemical (1) | 120 | 51 | 0 | 0 | 18 | 26 |

| Medicinal (2) | 32 | 14 | 46 | 23 | 19 | 28 |

| Rubber and plastic (3) | 31 | 13 | 15 | 8 | 0 | 0 |

| Machinery and equipment (4) | 24 | 10 | 0 | 12 | 17 | |

| Paper products (5) | 7 | 3 | 22 | 11 | 0 | 0 |

| Sugar and sugar (6) | 7 | 3 | 0 | 0 | 0 | 0 |

| Food other than sugar (7) | 10 | 4 | 38 | 19 | 18 | 26 |

| Healthcare (8) | 4 | 2 | 0 | 0 | 0 | 0 |

| Services (9) | 1 | 0 | 3 | 2 | 1 | 1 |

| Manufacturing (10) | 0 | 0 | 65 | 33 | 0 | 0 |

| Questionnaire | Cronbach’s Alpha | Composite Reliability Coefficient | AVE |

|---|---|---|---|

| Iran | 0.881 | 0.758 | 0.640 |

| Iraq | 0.814 | 0.742 | 0.679 |

| Jordan | 0.852 | 0.791 | 0.639 |

| Criteria | Value | Acceptable Value | ||

|---|---|---|---|---|

| Iran | Iraq | Iran | ||

| Chi-square index | 0.040 | 0.043 | Chi-square index | 0.040 |

| NFI index | 0.901 | 0.886 | NFI index | 0.901 |

| Index Q2 | More than 0.50 for all variables | More than 0.30 | ||

| Question | The Spread of the Coronavirus Causes | |||

|---|---|---|---|---|

| Q1 | 1.930 | 3.230 | 1.660 | The company’s future incoming cash flows will be further reduced in Jordan, Iran and Iraq. |

| Q2 | 2.290 | 2.520 | 2.550 | Operating costs and other company costs have increased in all three countries at the same rate. |

| Q3 | 2.690 | 2.300 | 2.360 | The decrease in the share price of companies in all three countries is the same. |

| Q4 | 2.410 | 2.080 | 2.340 | The same influence on determining the risk factors related to the discount rate and cash flows in all three countries. |

| Q5 | 2.770 | 3.030 | 3.400 | The decrease in the prices of goods in Iran is more proportional than in Iraq and Jordan. |

| Q6 | 2.790 | 2.500 | 2.300 | It causes the same effect on the credit losses of all three countries. |

| Q7 | 3.270 | 2.020 | 1.690 | The fluctuation of prices has increased in different markets of Jordan to a greater extent than in Iraq and Iran. |

| Q8 | 2.480 | 2.320 | 2.150 | The same influence on the fair values of investments in three countries’ subsidiaries, affiliates and special partnerships. |

| Q9 | 2.240 | 1.890 | 2.470 | The decrease in the income of Iraqi companies has increased in proportion. |

| Q10 | 2.310 | 2.300 | 2.040 | The contractual terms of borrowings and loans have been affected equally in all three countries. |

| Q11 | 2.270 | 2.430 | 2.750 | The same impact has been made on debt related to suppliers and employees in the three countries. |

| Q12 | 3.180 | 2.280 | 2.340 | It has been determined that the influence on the determination of Iran’s deferred tax liabilities is less than the other two countries. |

| Q13 | 2.180 | 2.050 | 2.240 | It has happened that the organizations of all three countries face problems in the same proportion for paying the salaries and wages of employees and repaying loans and debts. |

| Q14 | 2.010 | 2.670 | 2.430 | It has caused an increase in the prices of the products of the three countries in the same proportion. |

| Q15 | 2.150 | 2.350 | 2.240 | The price increase due to the change in the price of raw materials in the three countries has been relatively the same. |

| Q16 | 2.890 | 2.010 | 2.090 | Iran’s financial statements for the next period have been less affected than the other two countries. |

| Q17 | 2.340 | 2.460 | 2.250 | The same influence has been applied to measuring a financial instrument based on the fair value of three countries. |

| Q18 | 2.560 | 3.190 | 2.700 | Iraq’s degree of estimation uncertainty has increased more than in the other two countries. |

| Q19 | 3.040 | 3.360 | 3.430 | It causes damage to the goodwill of the three countries in the same proportion. |

| Q20 | 2.670 | 2.380 | 2.190 | The same impact on recognizing the liability related to the end-of-service benefits of the employees of the three countries. |

| Question | The Spread of the Coronavirus Causes | |||

|---|---|---|---|---|

| Q21 | 2.700 | 2.300 | 2.180 | The same disruption occurs in corporate or joint cooperation in three countries |

| Q22 | 1.780 | 2.480 | 1.960 | It has less influence on the lease terms between the lessor and the lessee in Iraq compared to the other two countries. |

| Q23 | 2.010 | 2.220 | 2.200 | The actions of the governments in all three countries have been affected equally. |

| Q24 | 2.320 | 2.610 | 2.330 | There has been an equal decrease in the supply of raw materials in three countries. |

| Q25 | 2.670 | 2.380 | 2.030 | The quality organisation’s communication with specific customers has improved in three countries. |

| Q26 | 2.630 | 2.390 | 2.330 | It has been established that the program organization of all three countries should try equally to create and maintain loyalty among certain customers. |

| Q27 | 2.260 | 2.340 | 2.140 | It has been decided that the organization will meet the long-term needs of the target customers in order to ensure repeat purchases in all three countries in equal proportion. |

| Question | The Spread of the Coronavirus Causes | |||

|---|---|---|---|---|

| Q28 | 2.370 | 2.100 | 2.130 | The decrease in inventory turnover in all three countries is equal to one. |

| Q29 | 2.600 | 2.540 | 2.530 | The suspension of capital projects, the cost of depreciation of property and machinery and the same influence on the equipment of all three countries. |

| Q30 | 2.520 | 2.510 | 2.700 | The same impact has been made on disclosing essential accounting practices in all three countries. |

| Q31 | 2.780 | 2.420 | 2.290 | The content of interim financial statements has been affected equally in all three countries. |

| Q32 | 2.460 | 2.770 | 3.540 | Less than Iran and Iraq, organizations in Jordan have developed and implemented a support program to protect employees against the corona disease at their own expense. |

| Question | The Spread of the Coronavirus Causes | |||

|---|---|---|---|---|

| Q33 | 2.040 | 2.000 | 1.930 | All three countries have increased their income through internet sales to the same extent. |

| Q34 | 2.770 | 2.710 | 3.120 | The compensation for the decrease in sales volume through online sales in Jordan is less than in Iran and Iraq. |

| Q35 | 2.530 | 2.310 | 2.420 | The severity of the decrease in the demand for the company’s products is the same in all three countries. |

| Q36 | 2.580 | 2.170 | 2.080 | An increase in instalment sales, internet sales and discount sales are the same in all three countries. |

| Q37 | 2.320 | 2.170 | 2.270 | A decrease in changes in business income in the last three months is the same in all three countries. |

| Q38 | 2.520 | 2.250 | 2.380 | The evaluation of the company’s ability to continue operating in all three countries is affected to the same extent. |

| Iran | Iraq | Jordan | |||||

|---|---|---|---|---|---|---|---|

| Function | Q | Cronbach’s alpha | factor analysis | Cronbach’s alpha | factor analysis | Cronbach’s alpha | factor analysis |

| Financial | 20 | 0.839 | −0.792 0.887 | 0.884 | −0.799 0.893 | 0.889 | −0.812 0.951 |

| Communication | 7 | 0.745 | −0.915 0.982 | 0.838 | 0.831–0.899 | 0.845 | −0.795 0.954 |

| Business processes | 5 | 0.993 | −0.869 0.997 | 0.992 | 0.904–0.998 | 0.969 | −0.847 0.995 |

| Innovation | 6 | 0.779 | −0.645 0.987 | 0.685 | 0.791–0.889 | 0.653 | −0.705 0.805 |

| Iran | Iraq | Jordan | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Components | Latin Sign | Observations | Mean | Std. dev | Min. | Max. | Observations | Mean | Std. dev | Min. | Max. | Observations | Mean | Std. dev | Min. | Max. |

| Financial | FNI | 237 | 2.448 | 0.340 | 1.500 | 3.200 | 197 | 2.519 | 0.399 | 1.400 | 3.800 | 69 | 2.440 | 0.447 | 1.700 | 4.100 |

| Communication | REl | 237 | 2.296 | 0.439 | 1.000 | 3.000 | 197 | 2.362 | 0.539 | 1.000 | 4.000 | 69 | 2.373 | 0.481 | 1.286 | 4.143 |

| Business processes | INP | 237 | 2.463 | 0.519 | 1.000 | 3.400 | 197 | 2.415 | 0.571 | 1.200 | 4.400 | 69 | 2.609 | 0.567 | 1.600 | 4.400 |

| Innovation | COM | 237 | 2.335 | 0.462 | 1.000 | 3.167 | 197 | 2.261 | 0.506 | 1.000 | 4.167 | 69 | 2.428 | 0.578 | 1.500 | 4.667 |

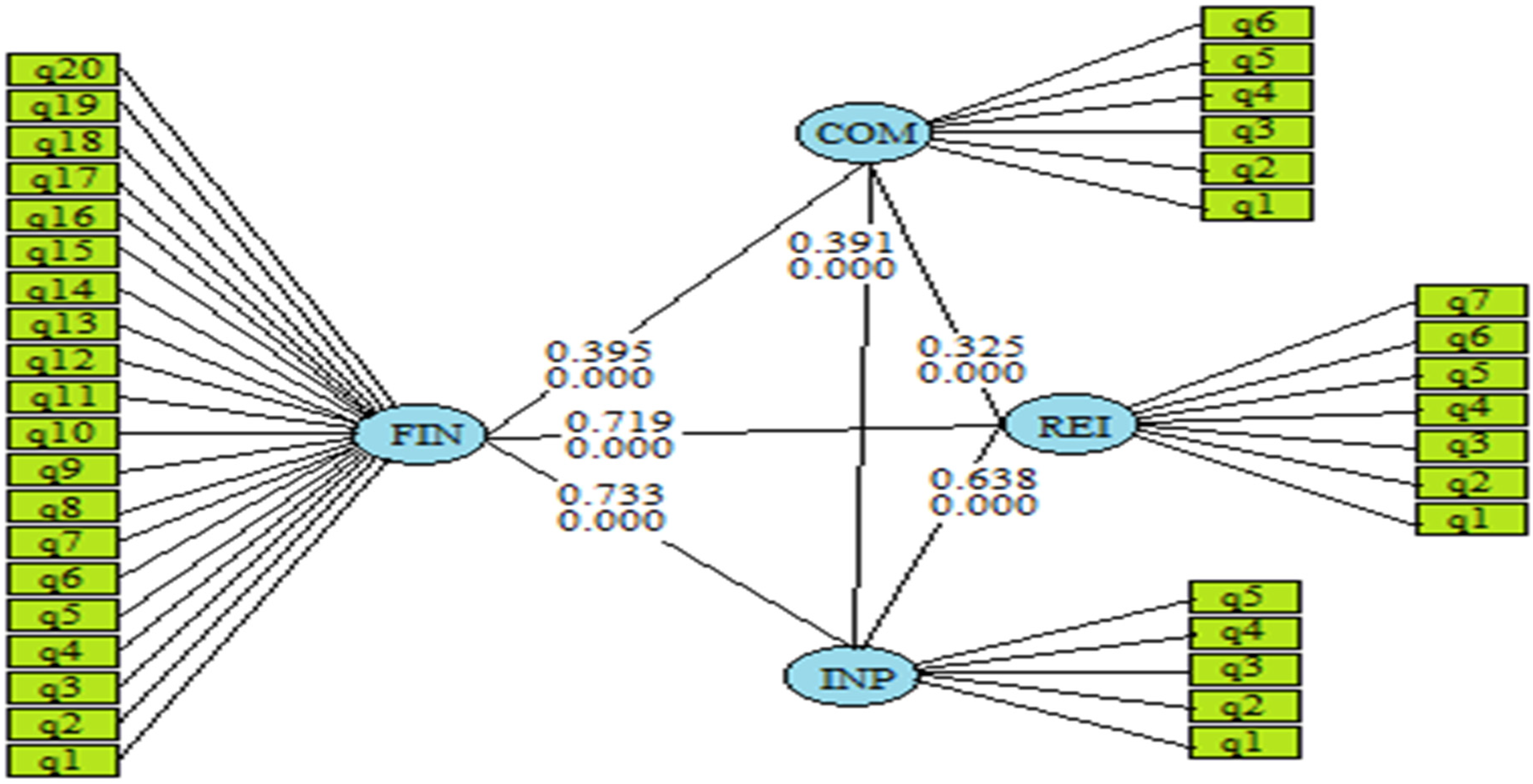

| FIN | REI | INP | COM | |

|---|---|---|---|---|

| FIN | 1.000 | |||

| REI | 0.719 *** | 1.000 | ||

| INP | 0.733 *** | 0.638 *** | 1.000 | |

| COM | 0.395 *** | 0.325 *** | 0.391 *** | 1.000 |

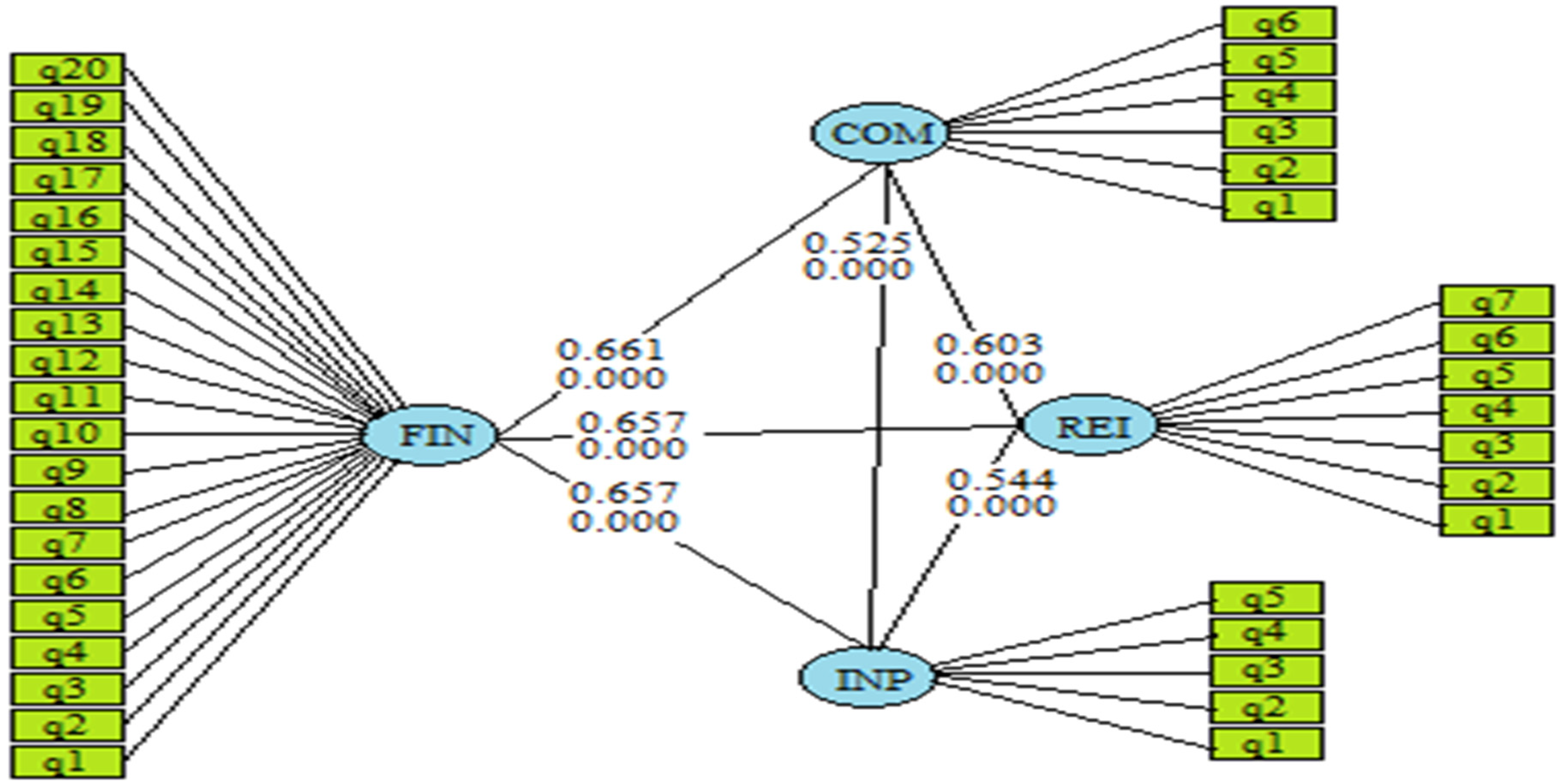

| FIN | REI | INP | COM | |

|---|---|---|---|---|

| FIN | 1.000 | |||

| REI | 0.657 *** | 1.000 | ||

| INP | 0.657 *** | 0.544 *** | 1.000 | |

| COM | 0.661 *** | 0.603 *** | 0.525 *** | 1.000 |

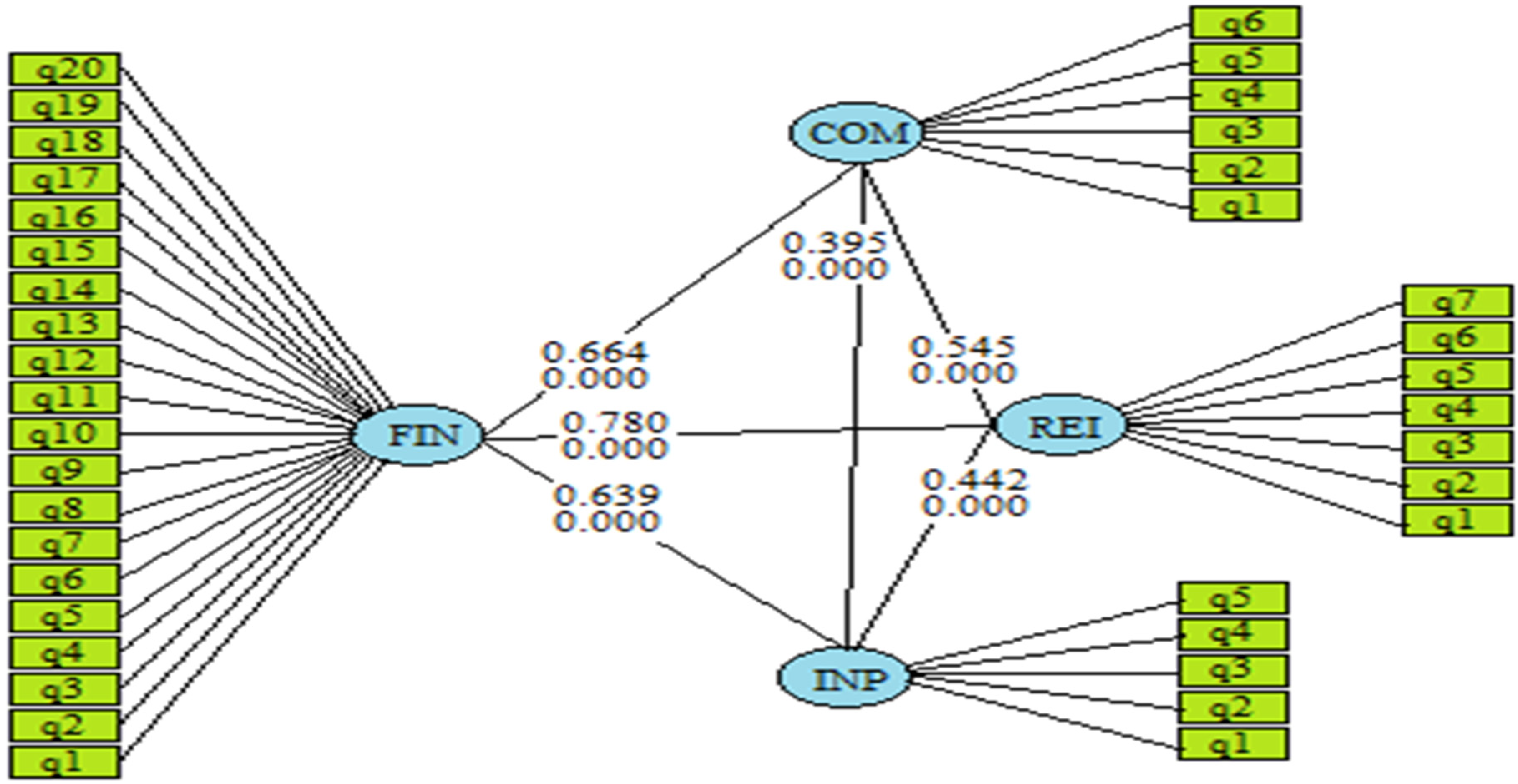

| FIN | REI | INP | COM | |

|---|---|---|---|---|

| FIN | 1.000 | |||

| REI | 0.783 *** | 1.000 | ||

| INP | 0.639 *** | 0.442 *** | 1.000 | |

| COM | 0.664 *** | 0.545 *** | 0.395 *** | 1.000 |

| Hypotheses | Iran | Iraq | Jordan | Comparison of Averages |

|---|---|---|---|---|

| There is a negative and significant relationship between the pandemic and the financial performance of SMEs. | accepted (99 percent) | accepted (99 percent) | accepted (99 percent) | No significant difference |

| There is a negative and significant relationship between the pandemic and the communication performance of SMEs. | accepted (99 percent) | accepted (99 percent) | accepted (99 percent) | No significant difference |

| A positive and significant relationship exists between the pandemic and changes in SMEs’ internal processes. | accepted (99 percent) | accepted (99 percent) | accepted (99 percent) | No significant difference |

| A positive and significant relationship exists between the pandemic and SMEs’ innovation. | accepted (99 percent) | accepted (99 percent) | accepted (99 percent) | No significant difference |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Homayoun, S.; Velashani, M.A.B.; Abbas Alkhafaji, B.K.; Jabbar Mezher, S. The Effect of COVID-19 on the Performance of SMEs in Emerging Markets in Iran, Iraq and Jordan. Sustainability 2023, 15, 7847. https://doi.org/10.3390/su15107847

Homayoun S, Velashani MAB, Abbas Alkhafaji BK, Jabbar Mezher S. The Effect of COVID-19 on the Performance of SMEs in Emerging Markets in Iran, Iraq and Jordan. Sustainability. 2023; 15(10):7847. https://doi.org/10.3390/su15107847

Chicago/Turabian StyleHomayoun, Saeid, Mohammad Ali Bagherpour Velashani, Bashaer Khdhair Abbas Alkhafaji, and Siham Jabbar Mezher. 2023. "The Effect of COVID-19 on the Performance of SMEs in Emerging Markets in Iran, Iraq and Jordan" Sustainability 15, no. 10: 7847. https://doi.org/10.3390/su15107847

APA StyleHomayoun, S., Velashani, M. A. B., Abbas Alkhafaji, B. K., & Jabbar Mezher, S. (2023). The Effect of COVID-19 on the Performance of SMEs in Emerging Markets in Iran, Iraq and Jordan. Sustainability, 15(10), 7847. https://doi.org/10.3390/su15107847