Life Value Assessment Methods in Emerging Markets: Evidence from China

Abstract

1. Introduction

2. Historical Life Value Assessment

2.1. Death Penalty Ransom

2.2. Government Pricing

3. Human Capital Method

3.1. Defining the Scope of Utility Value

3.2. Building the Measurement Model

3.2.1. Macro Life Measurement Model

3.2.2. Micro Life Measurement Model

4. Willingness-to-Pay Method

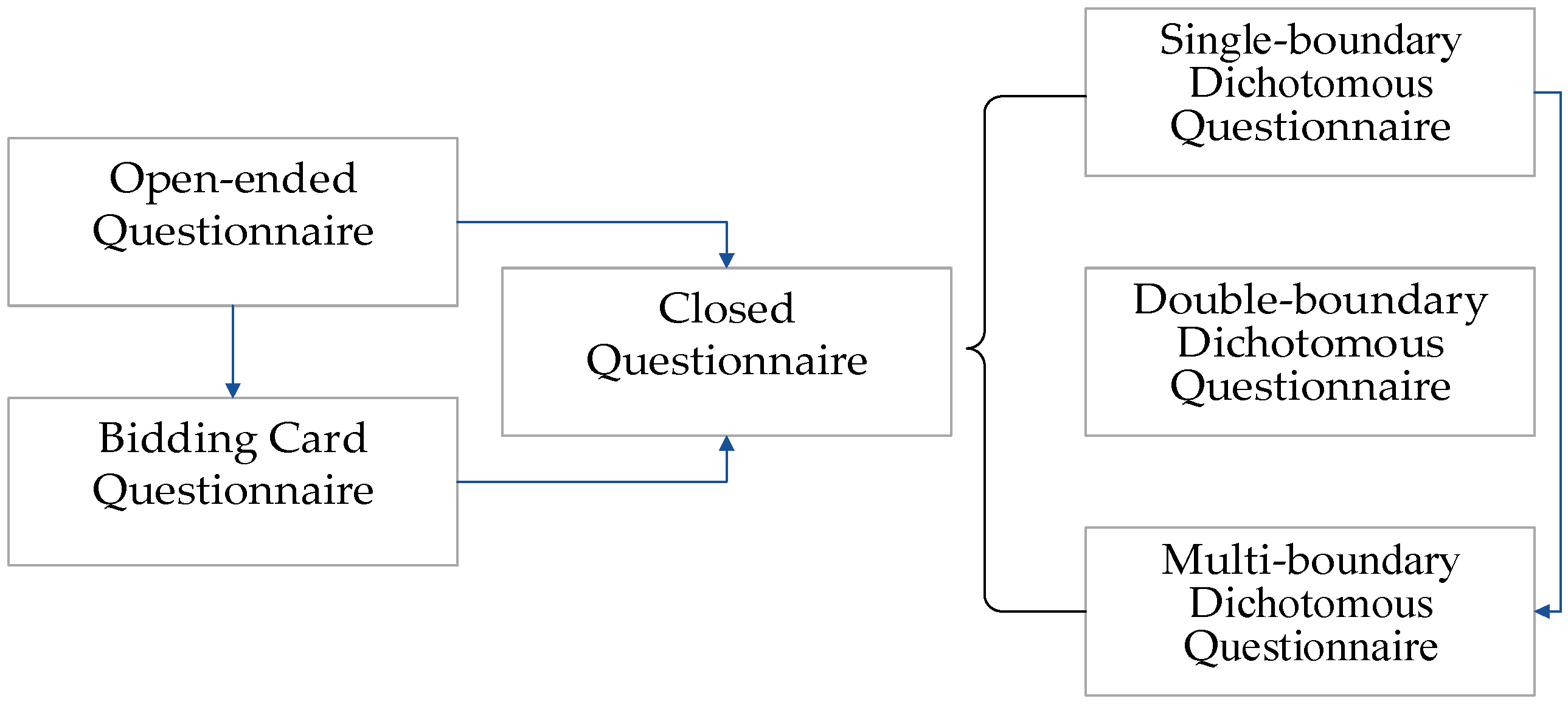

4.1. Stated Preference (SP)

4.2. Revealed Preference (RP)

5. Discussion

5.1. Improvement of Human Capital Method

5.2. Improvement of Wage Risk Approach

6. Conclusions

Funding

Conflicts of Interest

References

- Hall, R. A framework linking intangible resources and capabilities to sustainable competitive advantage. Strateg. Manag. J. 1993, 14, 607–618. [Google Scholar] [CrossRef]

- Coff, R.W. Human assets and management dilemmas: Coping with hazards on the road to resource-based theory. Acad. Manag. Rev. 1997, 22, 374–402. [Google Scholar] [CrossRef]

- Silny, J.F.; Little, R.J.; Remer, D.S. Economic Survey of the Monetary Value Placed on Human Life by Government Agencies in the United States of America. J. Cost Anal. Parametr. 2011, 3, 7–39. [Google Scholar] [CrossRef]

- Ananthapavan, J.; Moodie, M.; Milat, A.J.; Carter, R. Systematic Review to Update ‘Value of a Statistical Life’ Estimates for Australia. Int. J. Environ. Res. Public Health 2021, 18, 6168. [Google Scholar] [CrossRef]

- Hájnik, A.; Čulík, K.; Kalašová, A.; Kubíková, S.S. A statistical value of a human life in Slovakia. Transp. Res. Procedia 2021, 55, 284–290. [Google Scholar] [CrossRef]

- Becerra-Pérez, L.A.; Ramos-Álvarez, R.A.; DelaCruz, J.J.; García-Páez, B.; Páez-Osuna, F.; Cedeño-Laurent, J.G.; Boldo, E. An Economic Analysis of the Environmental Impact of PM2.5 Exposure on Health Status in Three Northwestern Mexican Cities. Sustainability 2021, 13, 10782. [Google Scholar] [CrossRef]

- Mon, E.E.; Jomnonkwao, S.; Khampirat, B.; Satiennam, T.; Ratanavarah, V. Estimating the willingness to pay and the value of fatality risk reduction for car drivers in Myanmar. Case Stud. Transp. Policy 2019, 7, 301–309. [Google Scholar] [CrossRef]

- Mekonnen, A.A.; Beza, A.D.; Sipos, T. Estimating the Value of Statistical Life in a Road Safety Context Based on the Contingent Valuation Method. J. Adv. Transp. 2022, 2022, 3047794. [Google Scholar] [CrossRef]

- Patenaude, B.N.; Semali, I.; Killewo, J.; Bearnighausen, T. The Value of a Statistical Life-Year in Sub-Saharan Africa: Evidence From a Large Population-Based Survey in Tanzania. Value Health Reg. Issues 2019, 19, 151–156. [Google Scholar] [CrossRef]

- Bharti, S.; Bandyopadhyaya, R.; Raju, N.K. Estimation of Willingness to Pay and Value of Statistical Life for Road Crash Fatality Reduction for Motorcyclists: A Case Study of Patna, India. J. Inst. Eng. Ser. A 2022, 103, 1315–1323. [Google Scholar] [CrossRef]

- Kniesner, T.J. Behavioral economics and the value of a statistical life. J. Risk Uncertain. 2019, 58, 207–217. [Google Scholar] [CrossRef]

- Vasquez-Lavin, F.; Bratti, L.; Orrego, S.; Barrientos, M. Assessing the use of pseudo-panels to estimate the value of statistical life. Appl. Econ. 2022, 34, 3972–3988. [Google Scholar] [CrossRef]

- Banzhaf, H.S. The Value of Statistical Life: A Meta-Analysis of Meta-Analyses. J. Benefit-Cost Anal. 2022, 13, 182–197. [Google Scholar] [CrossRef]

- Si, M. Historical Records; Zheng, C., Ed.; China Overseas Chinese Publishing House: Beijing, China, 2013; pp. 9–10. [Google Scholar]

- Ban, G. The Complete Mirror of Chinese Books; Dong, L., Ed.; China Textile Publishing House: Beijing, China, 2016; pp. 29–30. [Google Scholar]

- Wu, S. The Law of Blood Reward: The Game of Survival in Chinese History; China Workers Press: Beijing, China, 2003; pp. 15–39. [Google Scholar]

- Pedi, W. Political Economy; Chen, D., Ed.; Commercial Press: Beijing, China, 1978. [Google Scholar]

- Wang, L. An Empirical Study of the Value of Life. China Saf. Sci. J. 2004, 14, 7–11. [Google Scholar] [CrossRef]

- Tu, W.; Zhang, C.; Tang, P. Study on Technical and Economic Analysis of Safety Investment in Enterprises Based on Economic Value of Life. China Saf. Sci. J. 2003, 13, 26–30. [Google Scholar] [CrossRef]

- Zheng, Y. Research on Estimating the whole Value of Life: A Punitive Compensation Perspective. Theory Pract. Financ. Econ. 2014, 35, 115–120. [Google Scholar]

- Cheng, Q.; Wu, N.; Li, W. Human Capital Model Selection for Life Value Assessment—Based on Health and Safety Control Benefit Evaluation. J. Manag. 2011, 24, 1–4. [Google Scholar]

- Basakha, M.; Soleimanvandiazar, N.; Tavangar, F.; Daneshi, S. Economic Value of Life in Iran: The Human Capital Approach. Iran. J. Public Health 2021, 50, 384–390. [Google Scholar] [CrossRef]

- Farr, W. The Income and Property Tax. Q. J. Stat. Soc. 1853, 16, 1–44. [Google Scholar] [CrossRef]

- Schelling, T. The life you save may be your own. In Problem in Public Expenditure Analysis; Chase, S., Ed.; Brookings Institution: Washington, DC, USA, 1968; pp. 127–162. [Google Scholar]

- Yu, X.; Tang, Y.; Liu, C. A Review of Statistical Life Value Research. China Saf. Sci. J. 2014, 9, 146–151. [Google Scholar] [CrossRef]

- Davis, R.K. Recreation Planning as an Economic Problem. Nat. Resour. J. 1963, 3, 239–249. [Google Scholar]

- Anthony, F.; Krutilla, J. Determination of optimal capacity of resource based recreation facilities. Nat. Resour. J. 1972, 12, 417–444. [Google Scholar]

- Randall, A.; Ives, B.; Eastman, C. Bidding games for valuation of aesthetic environmental improvements. J. Environ. Econ. Manag. 1974, 1, 132–149. [Google Scholar] [CrossRef]

- Wang, H.; He, J. Estimating the Economic Value of Statistical Life in China: A Study of the Willingness to Pay for Cancer Prevention. Front. Econ. China 2014, 9, 183–215. [Google Scholar] [CrossRef]

- Cai, D.; Shi, S.; Jiang, S.; Si, L.; Wu, J.; Jiang, Y. Estimation of the cost-efective threshold of a quality-adjusted life year in China based on the value of statistical life. Eur. J. Health Econ. 2022, 23, 607–615. [Google Scholar] [CrossRef] [PubMed]

- Desaigues, B.; Ami, D.; Bartczak, A.; Braun-Kohlová, M.; Chiltond, S.; Czajkowski, M.; Farreras, V.; Huntf, A.; Hutchisona, M.; Jeanrenaudg, C.; et al. Economic valuation of air pollution mortality: A 9-country contingent valuation survey of value of a life year (VOLY). Ecol. Indic. 2011, 11, 902–910. [Google Scholar] [CrossRef]

- Luo, J.; He, Y. Conditional Value Assessment of Life Value in Road Traffic Safety Statistics. J. Highw. Transp. Res. Dev. 2008, 25, 130–134. [Google Scholar]

- Cai, C.; Chen, G.; Qiao, X.; Zheng, X. Comparison of Single-boundary and Double-boundary Dichotomous Conditional Value Assessment Methods—Taking the Questionnaire Survey on Health Hazards of Air Pollution in Beijing as an Example. China Environ. Sci. 2007, 27, 39–43. [Google Scholar]

- Li, W.; Cheng, Q. Research on Mathematical Model of Life Value Assessment Based on Willingness-to-Pay Method. J. Jianghan Univ. Nat. Sci. Ed. 2014, 42, 27–30. [Google Scholar] [CrossRef]

- Cheng, Q.; Li, W.; Wu, N. Estimation of Workers’ Life Value Based on Benefit Evaluation of Occupational Safety Control—Taking the Life Value of Workers in China’s Coal Industry as an Example. J. Yunnan Univ. Financ. Econ. 2014, 1, 145–153. [Google Scholar] [CrossRef]

- Liu, W.; Zhao, S. The Value of Statistical Life in Road Traffic Based on CVM with Dichotomous Choice Formats. J. Transp. Syst. Eng. Inf. Technol. 2014, 14, 65–70. [Google Scholar]

- Majumder, A.; Madheswaran, S. Compensation for Occupational Risk and Valuation of Statistical Life. Soc. Indic. Res. 2020, 149, 967–989. [Google Scholar] [CrossRef]

- Mei, Q.; Yang, Z.; Liu, S. Life Value Assessment Based on Wage Risk Approach. China Saf. Sci. J. 2012, 22, 15–21. [Google Scholar] [CrossRef]

- Smith, A. The Wealth of Nation; Yan, Z., Tang, R., Eds.; Huaxia Publishing House: Beijing, China, 2017; pp. 51–68. [Google Scholar]

- Qin, X.; Liu, Y.; Li, L. The Value of Life and Its Regional Differences: Evidence from National Population Sampling Survey. China Ind. Econ. 2010, 10, 33–43. [Google Scholar]

- Yang, Z. Theoretical Method and Empirical Research of Life Value Assessment. Master’s Thesis, Jiangsu University, Zhenjiang, China, 2010. [Google Scholar]

| Class | Group | Legal Amount of Life | Current Value (CNY) |

|---|---|---|---|

| 1st Class | Supreme Ruler | Gold equal to his body | 13,440,000 |

| 2nd Class | Senior officials, etc. | 300 to 400 taels of silver | 225,000–300,000 |

| 3rd Class | Intermediate officials, etc. | 200 taels of silver | 150,000 |

| 4th Class | General officials, etc. | 140 to 150 taels of silver | 105,000–112,500 |

| 5th Class | Monks in monasteries, etc. | 50 to 70 taels of silver | 37,500–52,500 |

| 6th Class | Common people, etc. | 30 to 40 taels of silver | 22,500–30,000 |

| 7th Class | Government clerks, etc. | 30 taels of silver | 22,500 |

| 8th Class | Butchers, blacksmiths, etc. | 20 taels of silver | 15,000 |

| 9th Class | Women, homeless, beggars, etc. | 10 taels of silver | 7500 |

| Utility Value—V2 | Conversion Form | Calculation Formula |

|---|---|---|

| After-Tax Labor Remuneration— | Own and Family Income | = Labor Remuneration before Tax − Personal Income Tax |

| Average Surplus Value— | Business Growth | = (Net Profit after Tax − Total Cost of Capital)/Total Headcount |

| Various Taxes— | State Fiscal Revenue | = Personal Income Tax + Other Taxes |

| Hidden Labor— | Service, Experience | = Average Salary Level of the Labor Practitioners |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tan, L.; Cao, A.; Qiu, D.; Liang, B. Life Value Assessment Methods in Emerging Markets: Evidence from China. Sustainability 2023, 15, 7786. https://doi.org/10.3390/su15107786

Tan L, Cao A, Qiu D, Liang B. Life Value Assessment Methods in Emerging Markets: Evidence from China. Sustainability. 2023; 15(10):7786. https://doi.org/10.3390/su15107786

Chicago/Turabian StyleTan, Liang, Aochen Cao, Dongyang Qiu, and Bolin Liang. 2023. "Life Value Assessment Methods in Emerging Markets: Evidence from China" Sustainability 15, no. 10: 7786. https://doi.org/10.3390/su15107786

APA StyleTan, L., Cao, A., Qiu, D., & Liang, B. (2023). Life Value Assessment Methods in Emerging Markets: Evidence from China. Sustainability, 15(10), 7786. https://doi.org/10.3390/su15107786