Abstract

We hypothesize that Fashion brands’ demand for organic agroforestry cotton (OAC) may foster more sustainable supply chains in the cotton industry. However, to realize the potential of the OAC market, a better understanding of the market demand for OAC, as well as the quality and production standards under which the brands operate, the institutional frameworks, and the market mechanisms that underpin its commercialization, is needed. We evaluated the existing organic markets in Brazil using an interview-based methodology with key stakeholders throughout the organic cotton supply chain in 2022. Our study revealed that some brands are willing to pay prices ranging from USD$ 2.57 to USD$ 4.61 per kg of cotton lint depending on the brand. These brands require suppliers to meet quality specifications for the cotton fiber; for example, they require average to long fibers and specify harvesting practices that influence fiber quality. There are also social and environmental criteria that prioritize vulnerable communities of family farmers and women groups planting cotton based on established sustainable practices. The institutional framework includes different stakeholders throughout the organic cotton supply chain, which is fundamentally driven by private demand for cotton, counts on the support of agents connecting brands to farmers, and is indirectly supported by public policies. Existing markets for organic cotton are established via contracts that provide farmers with guarantees to invest in planting cotton and have different certification systems used by the brands that monitor and verify adherence to the standards. Market demand for OAC may, therefore, potentially lead to new markets that promote sustainable supply chains and farming practices. However, existing markets for organic cotton reveal complex requirements that must be addressed, such as the need for supporting agents connecting brands to farmers, and market mechanisms, such as complex contracts and certification.

1. Introduction

Markets can play a significant role in fostering more sustainable supply chains [1,2]. Growing market demand for sustainable goods can add to existing initiatives led by civil society and governments to promote sustainable agricultural supply chains in a context where environmental, social, and corporate governance (ESG) has become fundamental for the success of companies in the long term [3].

Markets arise when prices are attractive enough to enable supply to meet demand. While in spot markets (also referred to as cash markets), the price is agreed upon at the moment of trade. In a contract-based market, the price is agreed upon beforehand, but delivery and transfer of funds take place at a later date [4]. Market agreements also depend on requirements made by buyers being met by suppliers in terms of quality, volume, and delivery schedules [5].

Besides demand for a specific good, functioning markets require a supportive institutional framework and reassuring market mechanisms [6]. Different stakeholders (both private and public) play different roles in connecting supply with demand [7,8] and market mechanisms, such as contracts and traceability systems, providing traders with the necessary assurance needed to invest [6,9].

Different studies have characterized the functioning of existing sustainable markets, such as organic and fair trade [9,10,11,12,13,14]. While most of these sustainable markets have the potential for expansion, embryonic new eco-business markets based on bioeconomy and circular economy have, in most cases, yet to realize their full potential [15].

This is the case for organic agroforestry cotton (OAC), which is demanded by some fashion brands, but not yet produced and commercialized by farmers, except in pilot initiatives [16]. Brazil has a well-established, nationwide spot market for conventional cotton and cases of contract markets for organic cotton established in the Northeast region, particularly in the state of Paraíba. However, there is not yet a well-established market for OAC.

OAC has an environmental and social appeal since it is produced in agroforestry systems by family farmers, including women and marginalized traditional communities. OAC is cultivated alongside other forestry and food crops, applying regenerative agriculture practices that seek to maintain and replenish soil fertility and protect the environment. Diversified agricultural production systems, such as agroforestry, have the potential to contribute to more sustainable and fair agricultural practices based on the smart use of water and soil nutrition [17,18].

The socio-environmental challenges that the fashion industry faces are viewed as an opportunity to create value and market [9,13]. Some fashion brands are seeking to reinvent themselves based on the values of sustainability [2]. Responding to market demands for sustainable clothing, fashion brands are adopting sustainable and ethical practices, investing in clothes production using recycled and organic fabrics, promoting cleaner production practices whilst enhancing their product’s life cycle, and adopting fair trade practices [14]. The textile industry is in the process of adapting to these new values [19], anticipating growing demand for sustainably sourced organic cotton in the coming years [20]. However, one of the most significant challenges for these brands is finding local suppliers of organic cotton that are transparent and committed to socio-environmental goals in their production processes [9].

OAC is deemed a good option for more sustainable cotton production. Nonetheless, the deployment of OAC is still in its infancy, with no dedicated public support for its development within Brazil. Currently, OAC production in Brazil relies on demand and private initiatives. In this study, we explore this demand and the initiatives that could be used to evaluate the scalability of OAC markets, identifying opportunities and challenges for the road ahead. Since the existing demand for organic cotton produced in agroforestry systems is largely unmet, this study provides insights into how fashion market niches for OAC can be used to foster sustainable supply chains for the cotton industry.

When produced without intercropping with other plants, organic cotton is considered a monoculture by brands that require the use of cotton produced in regenerative systems. Cotton production in agroforestry systems, which is based on simple techniques such as soil cover and plant intercropping, generates complex systems and services such as carbon sequestration and regulation of the local microclimate [18,21]. The production of organic cotton in agroforestry systems meets the demands of brands that have an awareness of the environmental services that are provided by agroforestry systems [22]. Besides sustainable cotton production in the field, market demands for OAC also require sustainable practices throughout the supply chain [16]. Consumers are willing to pay a premium price for sustainability efforts by the whole supply chain, including brands, middlemen, and farmers [23]. This may lead to new methods of supply chain management that differ from the conventional cotton supply chain in terms of efforts to establish fair trade with farmers and mechanisms for certification and traceability [24,25].

This study aims to assess the potential of niche markets in the fashion sector for OAC produced by family farmers. Specifically, this paper describes the potential demand for OAC in Brazil, including volumes and prices, the requirements of fashion brands in terms of cotton quality and the social and environmental aspects of production practices; the institutional framework; and the market mechanisms connecting supply with demand.

The results of this study are based on interviews conducted with fashion brands and other stakeholders of the organic cotton supply chain in Brazil and on the fieldwork conducted in the Brazilian states of Mato Grosso and Paraíba. The research work in Mato Grosso focused on the experience of a pilot initiative for OAC production, which forms part of the AGROcotton project. This project sought to build capacity for OAC production and develop scalable business models for sustainable OAC supply chains in Brazil. It is for this reason that Mato Grosso was chosen as a pilot case study due to its well-established and developed cotton industry, producing around 90% of Brazilian cotton.

Our interest in Paraíba was motivated by the ambition of learning from existing markets of organic cotton in the state. Due to the lack of a structured market for OAC in Brazil, information relating to organic cotton was used to ascertain the potential for a novel OAC market and explore how this could potentially develop in the future.

2. Literature on Organic Cotton for the Fashion Industry in Brazil

There is a rapidly growing body of literature addressing the issue of sustainability in managing textile and clothes production supply chains [26]. Market demand for sustainability-related products and services may promote new niche markets and new supply chain arrangements based on sustainable practices [24]. This market demand for OAC needs to be analyzed in terms of its own initiative, alongside the requirements this new demand imposes on the way current supply chains are structured [27]. In order to address the sustainability aspects related to market demand, suppliers and middlemen must restructure their practices and marketing arrangements [28].

The textile industry is committed to reducing the high environmental impact associated with cotton fiber production by switching to organic cotton cultivation. This is attributed to the fact that the consumption of water and energy is potentially lower than that of traditional cotton cultivation, despite the lower yields of cotton produced in organic cultivation systems [29]. The environmental degradation caused by the cotton industry drives the search for sustainable alternative cotton production systems [12]. Organic cotton farming does not use synthetic chemical inputs or transgenic seeds [18,30] and has reduced or no greenhouse gas emissions associated with it [31].

Organic cotton markets are well-established and rapidly growing throughout the world [9,19]. In Brazil’s Northeast Region, where most of the national organic cotton production takes place, family farmers plant cotton intercropped with other crops [7] based on manual planting and harvesting practices without using machinery or herbicides [32,33]. The most commonly cultivated variety of organic cotton is white, but there are also plantations of brown and green cotton, yielding short fibers that are widely accepted by fashion brands [7].

Organic cotton markets are based on direct links between farmers and brands, which do not exist in the conventional cotton spot market [34]. These links demand strong organizational and negotiation power on the part of farming cooperatives or agents, such as NGOs, who provide support to farmers. The relationships between the fashion industry and family farmers supplying organic cotton often start through NGOs, working in partnership with producer associations [7]. Fashion brands often work directly with farmers that plant organic cotton based on contracts signed prior to planting [7]. These contracts allow for pre-financing of the planting costs, provision of market guarantee, and the possibility of negotiating for a premium price on the quality of the cotton produced [34].

For cotton labelled as organic [12], brands pay a higher price than that paid for conventional (non-organic) cotton [32] (This premium price reflects a recognition by consumers of the importance of the lower environmental impact of the farming practices adopted by organic cotton farmers [34]. The premium offsets the reduced yields of organic as opposed to conventional cotton, as well as the higher costs for organic fertilizers, the use of alternative pest control, and the additional labour required by organic farming systems [34].

In Brazil, for a product to be sold as organic, it is mandatory that the farm undergoes one of the two organic quality assurance mechanisms: audit certification, participatory certification, or certification by a social control organization [13]. Additionally, there are two major organic certifiers: 1. IBD Certificados, the largest certifier of organic and sustainable products in Latin America, and 2. ECOCERT, the largest certifier of organic products in the world [13]. Besides organic cotton, some brands buy agro-ecological cotton. (In Brazil, the only requirement to have organic products is to grow them without agrochemicals. Agro-ecological systems, besides not using agrochemicals, also use local inputs, taking into consideration the working conditions of farmers, how compatible the crop is with the local ecosystem, and the level of industrialization throughout the production process. Another main principle of agro-ecological systems is the diversity of crops or species through associative or rotational agriculture) This is based on trust emanating from the relationship developed by farmers with the brands since there is no formal agro-ecological cotton certification acknowledged by Brazilian authorities [13].

Certification schemes alone do not guarantee agricultural sustainability [35] (. Nevertheless, they have become a key mechanism for improving practices and accountability in transnational supply chains [2]. Thus, certification schemes rewarding good agricultural practices are deemed as a potential motivator for farmers to switch to new and robust sustainability approaches in the production of textile fibers [17].

3. Materials and Methods

This study builds on a review of the scientific literature. We searched the Web of Science and Scopus databases for relevant material published in the period 2017–2022, using the following keyword phrases: “organic cotton” (39 articles available), “organic cotton and textiles” (9 articles available) and “organic cotton and sustainability” (11 articles available), “organic cotton and family farming” (12 articles available). The search resulted in a total of 71 papers, 24 of which were used to map out the key actors in the different stages of the cotton supply chain and to inform the preparation of structured questionnaires used for the interviews.

Interviews conducted with fashion brands were used to explore and characterize the demand for OAC. To identify interviewees, we searched for companies using organic cotton from Brazil and having a presence online. The search returned 69 companies, of which 13 agreed to be interviewed (Table 1). Brands were classified into small or medium-to-large, according to the volume of organic cotton purchased. Small companies were defined as those purchasing below 50 tons per year, while medium-to-large companies bought more than 50 tons of organic cotton per year. The interviews were structured around a research questionnaire, including questions on the quantity of organic cotton currently used, the price paid for organic cotton, environmental and social aspects that influence the choice of suppliers, cotton quality aspects, and overall interest in purchasing OAC.

Table 1.

Brands and stakeholders interviewed.

We also interviewed key stakeholders from organic cotton supply chains (such as NGOs, farmers’ cooperatives, and government agencies) that were identified based on their expert knowledge in the field. Stakeholders for the interview were selected from two states: the state of Paraiba (in Northeast Brazil), home to the most successful initiatives in organic cotton marketing, and the state of Mato Grosso, where the AGROcotton pilot project is based. A total of seven interviews were conducted with public and private stakeholders (Table 1).

The interviews focused on the characterization of the institutional framework and market mechanisms for organic cotton commercialization. It followed an interview protocol having questions aimed at understanding the role of key stakeholders in the cotton supply chain, the function of public policies, the contractual relations between brands and farmers, the role of product certification, and the range of organizations that monitor and provide data on the organic cotton supply chain.

All the interviews were conducted between October 2021 and July 2022. They were carried out using conferencing software (Google Meet and Teams) and lasted approximately one hour each. Interviews were not recorded or transcribed.

In addition to the interviews, fieldwork was conducted in the Brazilian states of Mato Grosso and Paraíba. Technical visits were carried out in Mato Grosso from 26 to 29 April 2022, mainly visiting the farming areas of organic cotton produced within agroforestry systems. These field visits to farmers were made in the municipalities of General Carneiro (Indigenous Aldeia Bororó), Torixoréu, Ribeirãozinho and Nova Nazaré (Indigenous Aldeia Nova Aliança and Rural Settlement Rio do Coco). During these visits, a meeting was also held with the state branch of Empaer, to understand the agency’s role in the OAC pilot project. The farmers’ impressions of the project, as well as the outcome of the partnership with Empaer that supported the implementation of the project, were noted in a field notebook.

Similarly, technical visits were carried out in the state of Paraíba from 18 to 21 July 2022, covering the municipalities of Ingá, Campina Grande, João Pessoa and Remígio, to understand details of the organic cotton supply chain. Organic cotton production areas were visited, together with technicians of the state branch of Empaer and representatives of the Ingá city hall, in order to collect information about municipal public policies targeting the organic cotton supply chain. Meetings were also held with Embrapa, with the Participatory Certification Association of Agro-ecological Producers of Cariri Paraíbano (ACEPAC), alongside the Borborema Agro-ecology Network.

During the field visits to Joao Pessoa, interviews were carried out with stakeholders of the cotton supply chain in order to resolve some questions that had not been covered in the online interview process. The visit focused on understanding how the participatory certification of farmers began, the structure of prices, and the support offered by purchasing brands and the municipal government for the organic cotton supply chain. All the information collected during the visits was recorded in a field notebook.

4. Results

4.1. Demand for OAC

Overall, the interviews revealed a trend for fashion brands to switch to organic cotton planted in agroforestry systems (Table 2). Out of the 13 interviewed brands, 11 showed specific interest in going beyond organic cotton (intercropped with few crop species) and investing in organic cotton produced in highly diverse agroforestry systems. These brands held the view that sustainable agroforestry, embodied by OAC systems, is able to provide both quality cotton goods and ecosystem services and that sustainability added value to their cotton supply chain. They see the use of cotton grown through OAC systems as being critical for accessing premium prices in niche markets in both Brazil and abroad.

Table 2.

Potential demand for Organic Agroforestry Cotton in Brazil based on brands’ statements.

Interviewees highlighted that the current production of organic cotton in Brazil meets the market demand by fashion companies. Nevertheless, there is a growing demand for cotton from even more sustainable sources, either from new areas of organic or agro-ecological cotton, in intercropped planting systems, or in agroforestry systems owned and implemented by family farmers.

The interviewed brands have a combined demand for OAC estimated at 631 tons of cotton per year and a willingness to pay prices ranging from USD$ 2.57 to USD$ 4.61 per kg of cotton lint. Different units are used since some brands buy cotton fabric directly, for example, in the form of knitwear (malharias), while others buy cotton as lint (pluma), yarn (fio), or ginned cotton (rama) (Table 2). Since brands use different types of cotton (such as white, brown, and green cotton, with short to long fibers) for manufacturing different products (such as clothes and shoes) based on different processes (such as manual and industrial), we decided not to convert to the same unit (e.g., kg of lint), given that it could result in incorrect figures. Even the interviewed experts found such conversions to be a complicated and risky task, preferring not to rely on it during the interviews.

The experts interviewed expressed the opinion that organic cotton produced in agroforestry systems will be traded and paid for as organic cotton during the initial contracts made for the first harvests of OAC. These experts also speculated that since there is not yet enough OAC to interfere in the market supply and until there is demand for OAC as differentiated from organic, there is no mechanism to determine prices for its specific attributes. Therefore, the prices for OAC will continue to be aligned with prices paid for organic cotton produced in intercropped planting.

In the organic cotton market, brands negotiate prices directly with farmers and their organizations, such as cooperatives. Two brands indicated their willingness to negotiate better prices for OAC than the ones paid for organic cotton in recognition of the higher costs associated with OAC production. For example, the Flávia Aranha brand is open to passing on the extra costs to the final customer, who is willing to pay more. The Fouta Harissa brand reported that they could pay up to three times more for OAC than for conventional cotton, provided that orders can be placed for small quantities, as small brands have difficulties with stocking these products. In contrast, the representative of the Coopernatural brand reported that organic cotton is also produced in other countries, such as Peru, China, and Turkey, and the price they pay for organic cotton tends not to be higher than that on the international market.

One company (Singapura Store) already buys OAC from a pilot initiative in Ceará. However, this provides only 30% of the company’s demand for cotton. At this early stage of growing demand, OAC is seen as an additional source of organic cotton and not as a product with distinct characteristics, being viewed as supplying an even smaller niche of the fashion market. However, the Flávia Aranha and Fouta Harissa brands expected that, in the future, the premium price of OAC will be higher than that of organic cotton.

4.2. Requirements

Brands reported requirements in terms of the quality of the cotton fiber but also in terms of social and environmental criteria to be met by suppliers (Table 3). Key quality parameters to be addressed by organic farmers producing either organic cotton or OAC are: 1. the size of the fibers since the industry prefers average to long fibers (organic cotton usually has shorter fibers); 2. the integrity of the fiber, since brittle fiber (fibra quebradiça) can be prevented by adequate harvesting and processing practices; 3. the weight of the cotton since organic cotton tends to be naturally lighter than conventional cotton and there is no market drive to sell organic cotton in different weights, as is the case for conventional cotton. Since the brand Veja produces shoes instead of clothes, the 28–32 medium-size fiber of herbaceous cotton provides exactly the fiber they need. Singapura Store reported that they require cotton that can be processed industrially with less shrinkage, whilst the LaLuz brand mentioned that organic cotton has better quality and characteristics when compared with conventional cotton. Given that these are initial pilot projects for planting and implementing OAC in Brazil, it is still not known whether OAC complies/can comply with these requirements.

Table 3.

Brand requirements.

When asked about the aspects that influence the purchase of organic cotton, almost all the interviewees declared that they would be interested in buying from women, traditional communities, and family farmers. These are not features of organic cotton (based on most certifications), but they are key features of the OAC pilot initiative developed in Mato Grosso. The only exception was the Passalinho brand, which reported being mainly influenced by the quality of the cotton. Having women in cotton production and manufacturing is particularly important for the Flávia Aranha brand, which has a partnership with the Rede Borborema de Agroecologia to establish a batch of cotton produced by women. The LaLuz brand has a network of partner seamstresses, the majority of whom are women in vulnerable situations.

All brands also mentioned the importance of environmental aspects in cotton production. When asked about the price to pay for cotton, brands report that they would pay more for organic cotton as long as it had a quality equivalent to that of conventional cotton. The Cooperativa Justa Trama and the Flávia Aranha brand demands are for agro-ecological cotton intercropped with other plants. They had criticisms about the production of organic cotton in monoculture and said that agro-ecological cotton should be more valuable because the organic stamp is not enough to indicate that this cotton is more sustainable. They also prefer participatory certification, as they believe that it enables greater farmer empowerment than third-party audit certification. The Veja brand pays a higher price for agro-ecological cotton (higher value) and cotton from farms transitioning towards agro-ecology. In this process, 80% of the seeds stay with the farmers, and 20% go to the seed bank at the Borborema Agro-ecology Network.

4.3. Institutional Framework and Policies

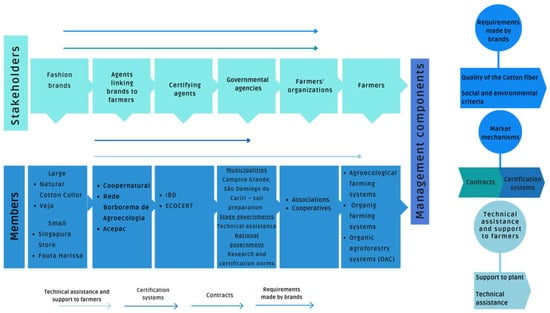

Existing organic cotton supply chains are formed by private sector brands’ demand for sustainable cotton, NGOs or private agents connecting brands to farmers, governmental agencies providing specific support to farmers, third-party certifying bodies, and farmers and their cooperatives and associations. The organic cotton supply chain is fundamentally driven by private demand for cotton and only indirectly supported by public policies. Figure 1 presents a prospective OAC supply chain for Brazil.

Figure 1.

A potential supply chain network structure for organic agroforestry cotton in Brazil.

Since fashion companies do not have experience with negotiating contracts with family farmers, they often need agents who can connect with farmers. Only the larger companies obtain direct contracts with farmers, while the smaller and medium-sized companies tend to source the industrialized cotton from companies that produce fabric or knitwear.

Agents connecting brands to farmers are contacted and supported by brands and by international donors, helping brands to mobilize farmers and negotiate contracts. These agents also play a fundamental role in engaging with government agencies that provide support to farmers (Table 4). Municipal governments support farmers with machinery for soil preparation, and the state government provides technical assistance to farmers. The national government contributes with research and credit lines. However, since family farmers face challenges in accessing the credit system (The credit system in Brazil has a productivist and sectoral approach, which means that to access resources, the family farmer is required by government agencies to have an infrastructure in the productive activity and documented proof of income, these procedures make family farmers linked to the agro-ecological or organic cotton chain less able to access the credit policy), they need support from other stakeholders in the cotton supply chain to finance the inputs needed for planting. In Paraíba, fashion brands supply seeds and pre-finance plantations based on contracts with farmers.

Table 4.

Key government agencies providing support to farmers planting organic cotton.

4.4. Market Mechanisms

4.4.1. Contracts

Marketing of organic cotton in Brazil is based on contracts signed between buyers, such as brands or textile companies, and farmers or farmers’ organizations, such as cooperatives. Contracts are usually flexible due to the limited amount of raw material that is produced. These contracts are signed before planting and often provide advance financing for farmers to pay for key inputs, such as seeds and manure. Contracts also guarantee a market for organic cotton and provide the possibility of negotiating a premium.

In the state of Paraíba, contracts are negotiated directly between farmers and the owners of purchasing companies, particularly in the case of small brands. For example, Veja purchases directly from Rede Borborema de Agroecologia and ACEPAC, which have participatory certification and provide a fair price for cotton. The OAC pilot case in Mato Grosso follows the contract model used in the case of organic cotton planted in intercropped planting systems in Paraíba.

To market the cotton, farmers need to issue an invoice (nota fiscal), which is often issued by the farmers’ cooperative. The Veja brand makes direct purchases from the Borborema Agroecology Network and from ACEPAC since both use participatory certification. The brand also makes contracts with families, stipulating that the cotton crops cover no more than 40% of the family’s total farming area so that they intercrop cotton with other species to guarantee their food sovereignty, as well as to ensure soil health.

According to Coopnatural, the contracts made by the companies were refined over the years, considering the needs of the farmers. Interviewed brands are particularly careful to ensure that their contracts adequately cover their sustainability requirements; they establish a relationship of trust with farmers by, for example, financing the seeds, certification, bags for transporting cotton, etc., and farmers are paid within 24 h of taking the cotton from the farms.

4.4.2. Certification

Brazil is one of the five largest cotton producers in the world, and most of its production applies monoculture farming and intensive mechanization on large properties with high yields [19]. Around 84% of cotton producers are certified through the Better Cotton Initiative (BCI) [2,36] but still use large amounts of agrochemicals [36].

In the case of organic cotton, despite its production representing only 1% of total Brazilian production, certification is often required by brands (Table 3) to guarantee that the cotton has been produced in accordance with established organic practices. Brazilian law defines two certification mechanisms: 1. Audit Certification or third-party certification, and 2. the Participatory Guarantee System (PGS). Each certification requires traceability, with the necessary monitoring being carried out by various accredited public or private institutions.

In Audit Certification, certificates are issued by a third-party auditing firm, such as IBD Certificados or Ecocert, following international standards, and the various stages of the cotton supply chain are monitored by professionals hired and paid for by the brand companies. The cost per certified farm per year is around USD$ 4000, which is paid by the brands, and consequently reduces the price they pay to farmers.

In PGS, certificates are issued by a number of bodies, composed of commissions, technicians, and producers’ associations, which are accredited as Participatory Organisms for Organic Conformity Assessment (OPACs) by the Ministry of Agriculture, Livestock and Supply [36]. These bodies involve professionals hired by companies and people from public institutions who share product traceability and monitoring information. These certification systems are built on a foundation of trust, social networks, and knowledge exchange [2]. Rede Borborema de Agroecologia (“Borborema Network of Agroecology”), ACEPAC, ACEPI, APASPI, ACOPASA, and ECOARARIPE are the main PGS bodies in Brazil. Within a PGS certification, the contracts signed with the organizations representing the farmers, such as Associations and Cooperatives, stipulate that 3% of the revenue will be used by these organizations to cover the costs of certification, involving paperwork and field visits.

As a result of the high price of third-party certifications, PGS bodies have increased in recent years. According to Rede Borborema de Agroecologia and ACEPAC, the demand for participatory certification arose from the high cost of certification by audit and the growing participation of farmers in this process. During the field visit, the women farmers participating in Rede Borborema said that they prefer participatory certification, as it gives them the freedom to choose whom they sell their product to, as well as allowing greater participation in the process, which did not happen when certification was carried out by audit. The Coopnatural cooperative, in partnership with interested brands, covers 100% of the audit certification process, as it needs this certification to export clothes produced with organic cotton. In this process, brands hire technical inspectors to assist in the certification process, and Empaer/PB contributes by providing technical assistance to farmers.

Despite the importance of certification in expanding the production and marketing of organic products in Brazil, guaranteeing credibility and differentiating from conventional production, there are barriers to certification for family farmers. Firstly, certification by external auditing has high costs, and although they are paid for by brands, it usually reduces the money that is finally paid to farmers, and this is often not feasible for the family farmer economy. Secondly, while PGS certification is more accessible to family farmers, the process requires knowledge of managing production, marketing, and registration of all information, which is complex for family farmers and requires support. A potential solution for facilitating this process could be the use of new technologies enabling digital data collection and the creation of organic production platforms, such as those developed by the Brazilian company Elysios, allowing producers and brands to control the supply chain and manage agricultural activities and processes in one place, ensuring quality, sustainability, and traceability (https://elysios.com.br/, accessed on 15 July 2022).

In addition to these limitations, for OAC production, there is still no certification that encompasses the agro-ecological production of organic cotton and other products in agroforestry lands. Although other agroforestry certifications could be used for OAC, such as the Fair for Life certification that has been successfully applied to certified Açaí agroforestry production in Brazil [37], this represents a unique opportunity to develop a new certification for cotton systems that are deemed not just sustainable, but also regenerative, not only maximizing productivity but also providing ecosystem and socio-economic benefits [38]. Embracing a tactical approach for expanding cotton agro-ecological certification should involve collaboration across several sectors. Governments, civil society, cotton producers, family farmers, and brands will have to work together to identify how certification might offer the greatest benefits to environmental protection and sustainable livelihoods.

4.4.3. Risk Management

Farmers seek to manage the risks of their production system by manually controlling boll weevil (bicudo do algodoeiro) infestations and marketing by-products, such as cotton seeds, used in animal feed in the Northeast of Brazil. Companion plant species that are known to provide barriers to the propagation of the weevil insect are intercropped with the cotton and planted in small strips. The use of short-cycle plants in intercropping means that the farmers are always active in cultivation areas, enabling monitoring and manual control of any infestation of the boll weevil, particularly during the most critical stages of the boll weevil’s lifecycle. This is when the bolls begin to appear or shortly after the flower is fertilized and during hot and humid conditions. If the insect has pierced the cotton bolls, it is necessary to clean the area by pulling out and burning the infested plants, thereby preventing the proliferation of the insect.

5. Discussion

This study evaluated the potential for OAC markets based on the assessment of existing organic cotton supply chains and existing demand by fashion brands, highlighting challenges to be addressed to establish an OAC supply chain. This approach is aligned with similar studies on established green markets, such as organic and fair trade [9,10,11,12,13,14].

The market for organic cotton in Brazil differs from conventional cotton spot markets, as it is based on flexible contracts between brands and farmers aiming to meet niche market demands. The organic cotton market in Brazil relies on different stakeholders (both private, public, and NGOs), connecting supply with demand [7] and market mechanisms, such as contracts and certification systems [9]. However, there are as yet no commercial cases of OAC in Brazil, only small-scale pilot projects.

Since OAC production in Brazil is incipient, the first harvests tend to yield very small amounts of OAC, which tend to be marketed in the organic cotton market and receive the same price as organic cotton, provided that technical requirements for the fiber are met by farmers. OAC is seen as a complement to organic production, supplying a small market niche. Brands investing in this market expect that OAC will receive a premium price in the future, exceeding that of organic cotton.

If this is the case and farmers’ costs for managing agroforestry can be adequately covered, a dedicated OAC supply chain can be established, with contracts more closely resembling those made in the organic cotton supply chain than in spot markets for conventional cotton, providing farmers with a supportive institutional framework and reassuring market mechanisms to invest in planting OAC [7,8].

Efforts to replicate, for OAC, the experience of organic cotton planted in Paraíba should consider the existence of market demand, requirements made by brands, the need for supporting agents connecting brands to farmers, and market mechanisms such as contracts and certifications. It is also important to consider regional characteristics that may not exist elsewhere, such as the heavy manual labour involved in the activity, the relatively low opportunity cost of local labour, and the existence of a market for by-products, such as cotton seeds used in animal feed in Northeast Brazil.

In this study, the evaluation of OAC scalability was hindered by a few factors. Firstly, the sample of interviews was small, as only 18% of the contacted stakeholders participated in the process, requiring further study to encourage greater participation. Secondly, a related issue was the small number of public organizations that were interviewed. This limits the evaluation of potential public support for OAC markets and the consideration of additional steps in the market development not required for existing organic markets. Thirdly, there is a need for more quantification of the environmental and socio-economic benefits of OAC in comparison with organic cotton production, as well as more understanding of the agricultural requirements expected of farmers. Further work could include defining specific certifications for OAC, which could remove some of the barriers and expand, on the one hand, the support and willingness of brands and, on the other hand, the participation of more family farmers, increasing the association between family farmers and the brands. Finally, future work should focus on collating more data and insights from key expert stakeholders by conducting more interviews and/or surveys. It is widely accepted that high-quality data are essential for all empirical research. Given that reliability is generally thought to be necessary for validity, it does not guarantee validity. This makes it more likely that valid and robust conclusions can be drawn if a sample of expert stakeholders is complete and data collated through a thoughtful process. Nevertheless, the results of this pilot study should be considered preliminary and a starting point for a future market analysis of OAC supply chains.

6. Conclusions

Under-developed markets are the main challenge for agroforestry value chains. Establishing market connections requires linking OAC farmers, with specific attention to vulnerable and marginalized groups, to local, regional, and export markets while attracting economic actors to engage with the sector.

This study provides an understanding of the main actors and drivers of the sector, as well as a clear understanding of the size and characteristics of existing and potential OAC markets in Brazil. It characterizes the markets by quality requirements of cotton fiber, prices, demand for traceability and certification, willingness to pay, and trading practices (e.g., contractual vis-à-vis spot markets).

This study revealed a potential demand for OAC with the following characteristics:

- Some brands have an interest in OAC, estimated at 631 tons of cotton per year, and a willingness to pay prices ranging from USD$ 2.57 to USD$ 4.61 per kg of cotton lint;

- These brands have requirements in terms of the quality of the cotton fiber (they require average to long fibers and specific harvesting practices that influence fiber quality) and also in terms of social and environmental criteria (priority is given to vulnerable communities of family farmers and women groups planting cotton based on sustainable practices).

In order to address the demands of established organic cotton supply chains, farmers count on a supportive institutional framework and functional market mechanisms:

- The institutional framework includes different stakeholders that are fundamental for setting up the organic cotton supply chain, which is influenced by private demand for cotton, counts on the support of agents connecting brands to farmers, and is only indirectly supported by public policies;

- Existing markets for organic cotton are established via contracts that provide farmers with guarantees to invest in planting cotton and have different certification systems used by brands to make sure that their requirements are met by farmers.

Further research is needed on the barriers preventing the scale-up of agroforestry systems at the farm level, at the value chain level, at the level of capacity, and/or at the institutional and policy level. It is important to analyze existing policies in terms of their capacity to promote OAC systems, identifying policy inconsistencies, barriers and inadequacies while revealing potential synergies with other sectoral policies. We conclude that market demand for OAC may potentially lead to new markets promoting sustainable supply chains as long as the features that make existing markets for organic cotton work well are established, such as support for agents connecting brands to farmers and market mechanisms that provide guarantees to brands and farmers, in the form of contracts and certifications, and also that the idiosyncrasies of the OAC supply chain are addressed in these mechanisms, such as the requirements made by brands for OAC.

Author Contributions

Conceptualization, G.d.S.M.; methodology, M.G., R.C.e.S. and R.d.S.C.; validation and formal analysis, G.d.S.M.; R.C.e.S. and R.d.S.C.; investigation, R.C.e.S. and R.d.S.C.; data curation, R.C.e.S. and R.d.S.C.; writing—original draft preparation, G.d.S.M.; R.C.e.S., R.d.S.C., M.G., E.S.-I., and O.N.M.; writing—review and editing, E.S.-I., M.G., L.D.L. and O.N.M.; project principal investigator, O.N.M.; funding acquisition, E.S.-I. and O.N.M. All authors have read and agreed to the published version of the manuscript.

Funding

Agroforestry potential for sustainable cotton growing in Brazil for the fashion industry (AGROcotton Project) seeks to build capacity for Agroforestry systems for Organic Cotton production (OAC) production and develop scalable business models for sustainable OAC supply chains in Brazil, contributing to; (i) sustained reduction of GHG emissions, (ii) green and resilient recovery reducing deforestation, biodiversity loss and water stress, and (iii) inclusive recovery generating income opportunities for marginalized communities. This research was jointly funded by United Kingdom, Foreign Commonwealth and Development Office (FCDO) and the Department for Business, Energy and Industrial Strategy (BEIS) under the UK PACT (Partnering for Accelerated Climate Transitions) flagship program as part of the UK’s International Climate Finance (ICF) portfolio. The AGROcotton research grant number: FPNBS\100006.

Institutional Review Board Statement

Exempted from Institutional Review Board Statement based on the RESOLUTION No. 510 of the Brazilian government that states that: “Article 1. Single paragraph. Will not be registered or evaluated by the CEP/CONEP system: I—public opinion poll with unidentified participants;” (text translated with google in order to avoid personal bias).

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

Not applicable.

Acknowledgments

The authors would like to thank all the interviewed stakeholder experts who collaborated in this study. In addition, the authors acknowledge the kind contributions provided by Jeremy Wood, Jaqueline Sophie Edge and Victoria Hoare, in proofreading the manuscript.

Conflicts of Interest

The authors declare no conflict of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript; or in the decision to publish the results.

References

- Hinrichs, C.C. Embeddedness and local food systems: Notes on two types of direct agricultural market. J. Rural. Stud. 2000, 16, 295–303. [Google Scholar] [CrossRef]

- Textile-Exchange. Organic Cotton-Market Report 2021 (Covering Production Trends and Industry Insights from the 2019/20 Harvest and Beyond). 2021. Available online: https://textileexchange.org/wp-content/uploads/2021/07/Textile-Exchange_Organic-Cotton-Market-Report_2021.pdf (accessed on 11 July 2022).

- Khurana, K.; Ricchetti, M. Two decades of sustainable supply chain management in the fashion business, an appraisal. J. Fash. Mark. Manag. 2016, 20, 89–104. [Google Scholar] [CrossRef]

- Thomé, K.M.; Cappellesso, G.; Ramos, E.L.A.; de Lima Duarte, S.C. Food Supply Chains and Short Food Supply Chains: Coexistence conceptual framework. J. Clean. Prod. 2021, 278, 123207. [Google Scholar] [CrossRef]

- Lambert, D.M.; Cooper, M.C. Issues in supply chain management. Ind. Mark. Manag. 2000, 29, 65–83. [Google Scholar] [CrossRef]

- North, D. Institutions. J. Econ. Perspect. 1991, 5, 97–112. [Google Scholar] [CrossRef]

- de Camargo Ferraz, F.P. Sustentabilidade na Cadeia de Suprimento do Algodão: Um Estudo de Caso da Relação Entre Uma Empresa de Calçados Esportivos e Produtores de Algodão Orgânico; Fundação Getulio Vargas: São Paulo, Brazil, 2018; Available online: https://hdl.handle.net/10438/24173 (accessed on 12 May 2022).

- Williamson, O. The economics of organization: The transaction cost approach. Am. J. Sociol. 1981, 87, 548–577. [Google Scholar] [CrossRef]

- Mattos, L.C.; de Mattos, J.L.S.; Blackburn, R.; dos Santos Santiago, F.; de Menezes Neto, J.B. A saga do algodão no semiárido nordestino: Histórico, declínio e as perspectivas de base agroecológica. Desenvolv. E Meio Ambiente 2020, 55, 556–580. [Google Scholar] [CrossRef]

- De Oliveira, C.S.C.; Oliveira-Filho, E.C. Agricultura ecológica e indústria têxtil: O papel da comunicação para o algodão orgânico no Brasil. Univ. Arquitetura E Comun. Soc. 2014, 11, 27–37. [Google Scholar] [CrossRef][Green Version]

- FAO. FAO’s Director-General on how to Feed the World in 2050. In Insights from an Expert Meeting at FAO; John Wiley & Sons Ltd.: New York, NY, USA, 2009. [Google Scholar] [CrossRef]

- Glin, L.C.; Mol, A.P.; Oosterveer, P.; Vodouhe, S.D. Governing the transnational organic cotton network from Benin. Glob. Netw. 2012, 12, 333–354. [Google Scholar] [CrossRef]

- Lavrati, G. Tendência Global de Desenvolvimento Sustentável e a Cadeia Produtiva do Algodão Orgânico; Universidade Federal de Santa Catarina: Blumenau, SC, Brasil, 2022; Available online: https://repositorio.ufsc.br/handle/123456789/234036 (accessed on 20 June 2022).

- Mishra, S.; Jain, S.; Malhotra, G. The anatomy of circular economy transition in the fashion industry. Soc. Responsib. J. 2020, 2020, 216. [Google Scholar] [CrossRef]

- Medina, G.; Pereira, C.; Ferreira, J.; Berenguer, E.; Barlow, J. Searching for Novel Sustainability Initiatives in Amazonia. Sustainability 2022, 14, 10299. [Google Scholar] [CrossRef]

- Hasan, M.M.; Cai, L.; Ji, X.; Ocran, F.M. Eco-Friendly Clothing Market: A Study of Willingness to Purchase Organic Cotton Clothing in Bangladesh. Sustainability 2022, 14, 4827. [Google Scholar] [CrossRef]

- Duarte, L.O. Organic Cotton Network in Brazil Addressing Textile and Clothing Sector. Ph.D. Thesis, University of São Paulo School, São Paulo, Brazil, 2020. [Google Scholar]

- Oliveira-Duarte, L.; Kohan, L.; Pinheiro, L.; Filho, H.F.; Baruque-Ramos, J. Textile natural fibers production regarding the agroforestry approach. SN Appl. Sci. 2019, 1, 914. [Google Scholar] [CrossRef]

- Da Cunha, S.G.C.; De Oliveira, A.J. A adesão da fibra de algodão orgânico branco e o naturalmente colorido ao mercado da moda sustentável. 7° Sustain. Des. Symp. 2019, 6, 413–423. [Google Scholar] [CrossRef]

- Ferrigno, S.; Lizzaraga, A.; Tovignan, S.; Nagarajan, P. Beyond Organic, Ensuring Responsible Fiber Production and Trade in Organic Cotton: A Background Report into Existing Practices as a Preliminary Step Towards a Guidance Code on Rights, Responsibilities and Obligations for Farmers, Traders, Promoters, Service Providers and Buyers. Textile Exchange. 2010. Available online: http://textileexchange.org/content/textile-exchange-publications (accessed on 15 July 2022).

- Wolf, R.; Barbosa, F.R.G.M.; da Silva, L.F.; Padovan, M.P. Agroforestry Systems: Potential for Carbon Sequestration and Production of Other Environmental Ser 4th Mato Grosso do Sul Agroecology Semina 2014. Available online: https://www.infoteca.cnptia.embrapa.br/bitstream/doc/937494/1/093Sistemasagroflorestaispotencialparasequestrodecarbono.pdf (accessed on 25 July 2022).

- Fahad, S.; Chavan, S.B.; Chichaghare, A.R.; Uthappa, A.R.; Kumar, M.; Kakade, V.; Pradhan, A.; Jinger, D.; Rawale, G.; Yadav, D.K.; et al. Agroforestry Systems for Soil Health Improvement and Maintenance. Sustainability 2022, 14, 14877. [Google Scholar] [CrossRef]

- Mellick, Z.; Payne, A.; Buys, L. From Fibre to Fashion: Understanding the Value of Sustainability in Global Cotton Textile and Apparel Value Chains. Sustainability 2021, 13, 12681. [Google Scholar] [CrossRef]

- Qureshi, M.R.N.M. Evaluating Enterprise Resource Planning (ERP) Implementation for Sustainable Supply Chain Management. Sustainability 2022, 14, 14779. [Google Scholar] [CrossRef]

- Zhao, M.; Guo, W. Does Land Certification Stimulate Farmers’ Entrepreneurial Enthusiasm? Evidence from Rural China. Sustainability 2022, 14, 11453. [Google Scholar] [CrossRef]

- Kozlowski, A.; Searcy, C.; Bardecki, M. Corporate sustainability reporting in the apparel industry: An analysis of indicators disclosed. Int. J. Product. Perform. Manag. 2015, 64, 377–397. [Google Scholar] [CrossRef]

- Nazam, M.; Hashim, M.; Nută, F.M.; Yao, L.; Zia, M.A.; Malik, M.Y.; Usman, M.; Dimen, L. Devising a Mechanism for Analyzing the Barriers of Blockchain Adoption in the Textile Supply Chain: A Sustainable Business Perspective. Sustainability 2022, 14, 16159. [Google Scholar] [CrossRef]

- Alzubi, E.; Noche, B. A Multi-Objective Model to Find the Sustainable Location for Citrus Hub. Sustainability 2022, 14, 14463. [Google Scholar] [CrossRef]

- La Rosa, A.D.; Grammatikos, S.A. Comparative Life Cycle Assessment of Cotton and Other Natural Fibers for Textile Applications. Fibers 2019, 7, 101. [Google Scholar] [CrossRef]

- Murugesh Babu, K.; Selvadass, M.; Somashekar, R. Characterization of the conventional and organic cotton fibers. J. Text. Inst. 2013, 104, 1101–1112. [Google Scholar] [CrossRef]

- Esteve-Turrillas, F.A.; De La Guardia, M. Environmental impact of Recover cotton in textile industry. Resour. Conserv. Recycl. 2017, 116, 107–115. [Google Scholar] [CrossRef]

- Lima, P.J.B.F.; Souza, M.C.M. Produção Brasileira de Algodão Orgânico e Agroecológico. 2006. Available online: https://algodaoagroecologico.com/wp-content/uploads/2022/10/Producao-brasileira-de-algodao-organico-e-agroecologico-em-2006.pdf (accessed on 12 June 2022).

- Rashid, B.H.T.; Yousaf, I.; Rasheed, Z.; Ali, Q.; Javed, F.; Husnain, T. Roadmap to sustainable cotton production. Life Sci. J. 2016, 13, 41–48. [Google Scholar] [CrossRef]

- Souza, M.C.M. A Produção de Têxteis de Algodão Orgânico: Uma Análise Comparativa Entre o Subsistema Orgânico e o Sistema Agroindustrial Convencional; Instituto de Economia Agrícola: São Paulo, Brazil, 2000; Volume 47, pp. 83–104. [Google Scholar]

- Tayleur, C.; Balmford, A.; Buchanan, G.M.; Butchart, S.H.M.; Ducharme, H.; Green, R.E.; Milder, J.C.; Sanderson, F.J.; Thomas, D.H.L. Global Coverage of Agricultural Sustainability Standards, and Their Role in Conserving Biodiversity. J. Soc. Conserv. Lett. 2017, 10, 610–618. [Google Scholar] [CrossRef]

- Duarte, L.O.; Vasques, R.A.; Filho, H.F.; Baruque-Ramos, J.; Nakano, D. From fashion to farm: Green marketing innovation strategies in the Brazilian organic cotton ecosystem. J. Clean. Prod. 2022, 360, 13219. [Google Scholar] [CrossRef]

- Damasco, G.; Anhalt, M.; Perdiz, R.O.; Witimann, F.; De Assis, R.L.; Schongart, J.; Piedade, M.T.F.; Bacon, C.D.; Antonelli, A.; Fine, P.A.V.A. Certification of açaí agroforestry increases the conservation potential of the Amazonian tree flora. Agrofor. Syst. 2022, 96, 407–416. [Google Scholar] [CrossRef]

- Elevitch, C.R.; Mazaroli, D.N.; Ragone, D. Agroforestry Standards for Regenerative Agriculture. Sustentabilidade 2018, 10, 3337. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).