1. Introduction

The low-carbon energy transition is a key pillar of climate change policy, aimed at achieving the Paris Agreement’s “well below 2°” target [

1]. It is also crucial for achieving the UN’s 2030 Sustainable Development Goals (SDGs) [

2]. According to the International Energy Agency’s (IEA) World Energy Outlook 2021 [

3], the total share of electricity in the global end-use energy consumption will rise from 20% in 2020 to around 50% in 2050. According to the International Renewable Energy Agency (IRENA), 14,000 GW and 8100 of solar energy and wind power (WP), respectively, will be installed in 2050, and 90% of electricity demand will be provided by renewable energy [

4]. Transportation is also a major sector for the country’s economic and social development, as well as for achieving SDGs. It is a major energy end-use sector and a contributor to greenhouse gas (GHG) emissions [

5], accounting for about 24% of global energy-related GHG emissions [

6], and electric vehicles (EVs) are considered the main solution to curb climate change in the transportation sector. Specifically, global EV ownership is expected to reach 1.78 billion in 2050 [

7].

China’s recent rapid economic growth has led to massive consumption of fossil fuels, making the country the largest primary energy consumer and CO

2 emitter. With China’s oil import dependency rising annually [

8,

9] and its long-term passive position in international climate change negotiations, low-carbon energy transition is the only option for the country’s sustainable development under the dual pressure of energy crisis and CO

2 emission reduction [

10]. Thus, renewable energy’s development will significantly reduce GHG emissions and related climate impacts, which is crucial to improve global climate change.

Accordingly, the Chinese government has proposed a series of targets for the low-carbon energy transition. The 12th and 13th Five-Year Plans predicted that the share of nonfossil energy in primary energy consumption would reach 11.4% and 15% by 2015 and 2020, respectively [

11,

12,

13]. This target is reaffirmed in the newly released 14th Five-Year Plan [

14], which expects that the share of nonfossil energy in total energy consumption will increase to about 20% by 2025. The National Development and Reform Commission has released the “China 2050 Renewable Energy High Penetration Scenario and Roadmap Study,” which provides a feasible pathway for high penetration of renewable energy (mainly wind and solar) by 2050 [

15]. Simultaneously, several agencies (e.g., the IEA [

3] and DNV [

16]) have made similarly optimistic projections for the growth of renewable energy in China. The country has recently made rapid progress in renewable energy development and is the global leader in installed renewable energy capacity. In particular, 2021 has seen approximately 1020 GW of installed capacity, with most of the growth from solar and wind [

17], and this rapid growth is expected to continue for some time.

However, clean energy technologies are more mineral-intensive than conventional energy systems. They often rely on multiple minerals, and consequently, the demand for them will increase rapidly during the transition to clean energy technologies [

18]. Some of these minerals are indispensable and extremely scarce, as well as at high risk in their supply chain [

19]. Therefore, prejudging potential resource supply bottlenecks, and dependence on foreign minerals, is critical to both China’s energy transition and climate policy. Further, China should develop a strategy accordingly.

Scientific studies have analyzed the mineral demand for energy technologies in different dimensions and perspectives (

Table 1), and the spatial boundaries of these studies cover different geographical scales, from global [

20,

21] to a particular country [

22,

23]. The energy technologies considered in these studies are diverse, conducting extensive research on WP [

24], photovoltaics (PV) [

19], and concentrated solar power (CSP) [

25]. These studies either include all metals required for energy technologies or are limited to key metals. However, the following are several of the remaining shortcomings. First, most of these studies have been conducted on a global scale, with fewer studies at the national level and much fewer in developing and emerging economies. Second, country-wide studies often consider only certain power generation technologies or material requirements for transportation electrification. However, the deployment of low-carbon energy technologies will also lead to a large expansion of electricity transmission and distribution (T&D) networks. Regarding the types of minerals analyzed, only key rare metals, such as rare earth elements (REEs), are often considered, and less often base metals and nonmetals.

The energy technologies selected for this study include WP, PV, CSP, EVs, and T&D because of the following reasons. First, they are expected to be deployed in large numbers in China and worldwide in the future. With new development targets for China’s installed WP and solar power under the carbon neutrality target, WP and solar power are ranked as top priorities for the future development of renewable energy. Second, as important clean technology with high market penetration, EVs have attracted the attention of the Chinese government. China’s “New Energy Industry Development Plan (2021–2035)” sets the goal of new energy vehicle sales. The sales will reach about 20% of total new vehicle sales by 2025, with EVs becoming the mainstream of new vehicles sold by 2035 [

33]. Additionally, future large-scale electrification may result in a significant increase in the demand for electricity T&D.

WP and EVs require large amounts of REEs (e.g.,

Nd and

Dy) to make permanent magnets for generators [

28]. Minerals such as

Cd,

Te or

In,

Ga, and

Se are required for thin-film solar technology, and

Ge is a key component of a-Si (amorphous silicon) cells [

34,

35]. Meanwhile, CSP requires

Ag for reflectors,

Ni, and

Mo for the high-strength steel alloys needed for structures [

25]. EVs drive the development of high-capacity batteries, which will increase the demand for various materials (e.g.,

Li,

Ni,

Co, and

Mg) [

27].

Cu is the “cornerstone” of all power-related technologies [

5], while

Fe and

Al are crucial components of T&D networks [

31]. In this study, 18 elements that are crucial for the future development of electricity and transportation are selected for investigation (

Table 2). We did not distinguish between metals and nonmetals as we consider them equally important.

The study aims to determine which minerals will pose constraints on energy technologies required for China’s energy transition in the medium to long term. Hence, relevant measures can be developed to avoid these constraints. This study did not aim to propose a new list of key minerals, but rather to determine which technologies may be at risk of not meeting their current deployment targets owing to shortages in mineral supply. The remainder of this paper is structured as follows.

Section 2 describes the methodology.

Section 3 provides the results of the analysis.

Section 4 discusses technology development, substitution and recycling, and the impact of energy transition in China. Finally,

Section 5 provides the main conclusions of the study.

4. Discussion

4.1. Risk of Mineral Supply

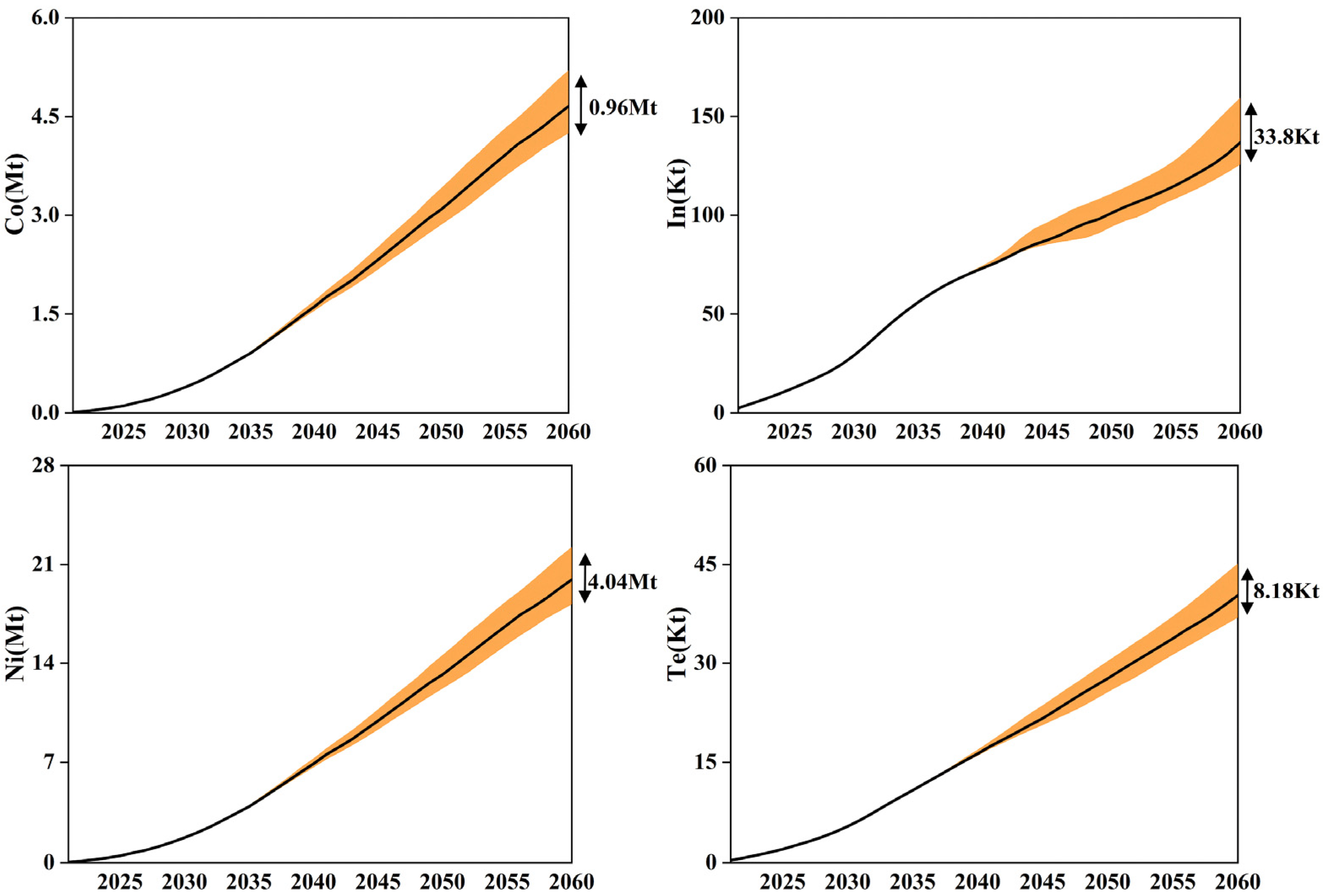

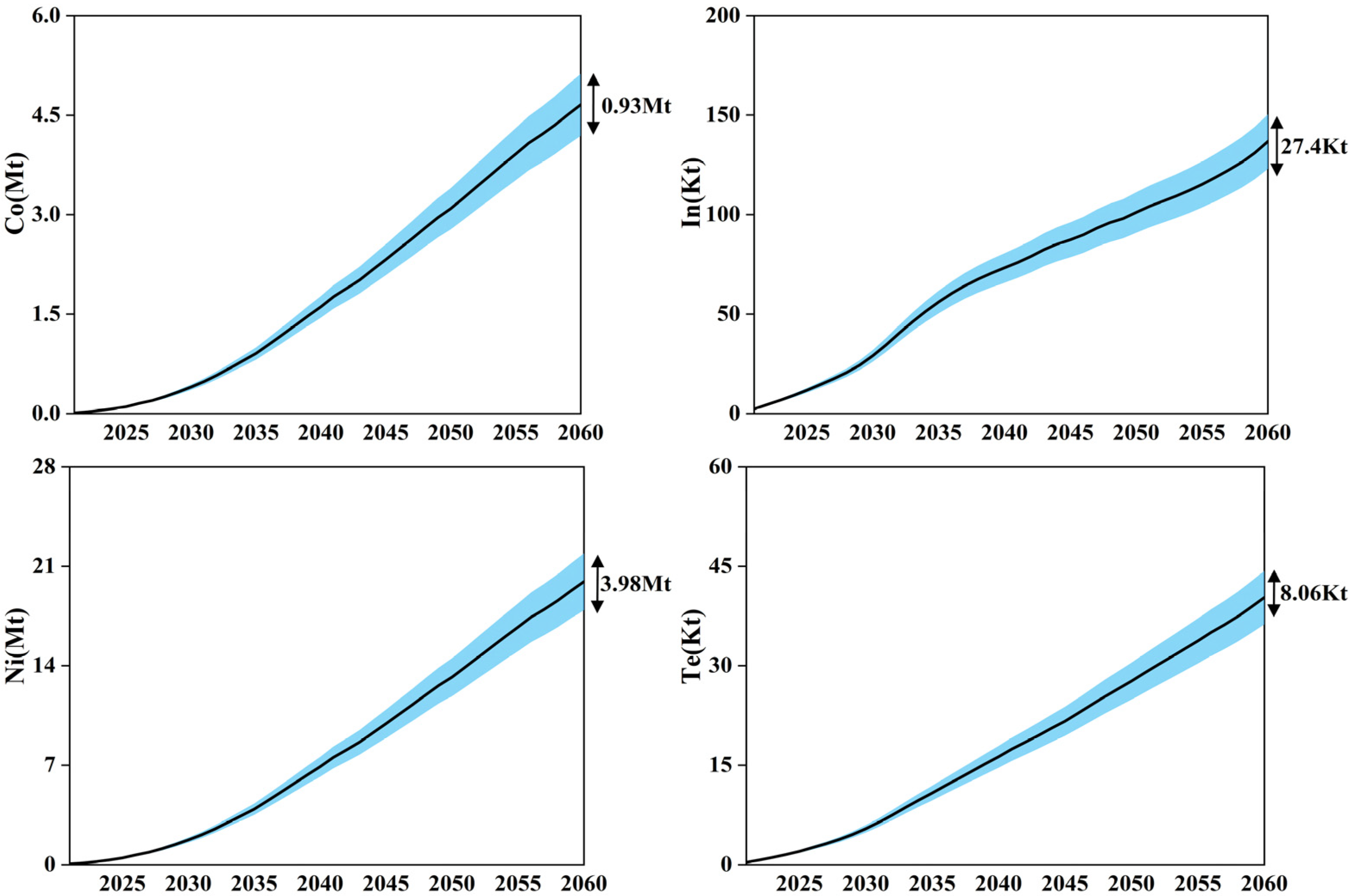

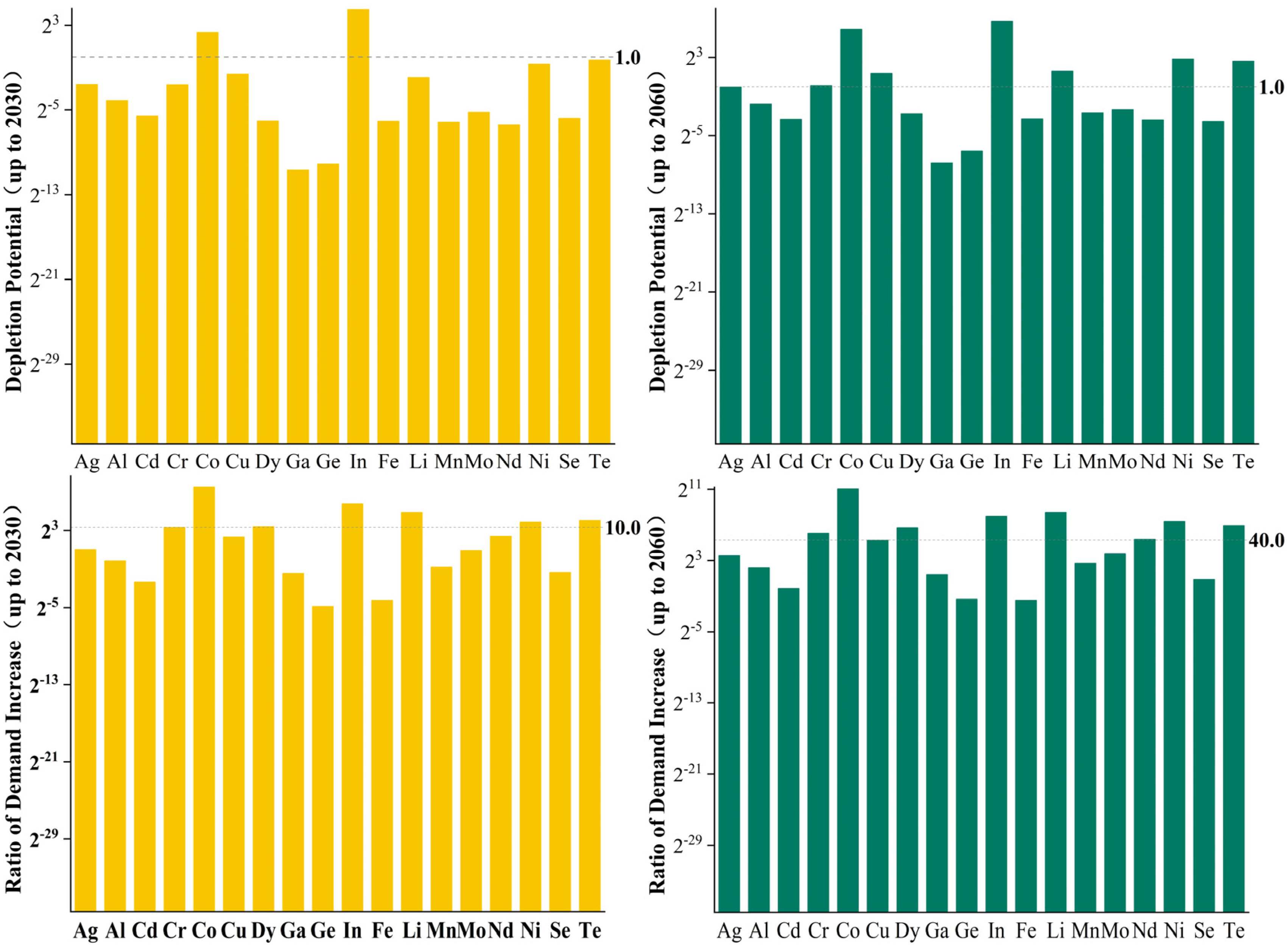

The demand for

Co and

In of China’s energy technologies by 2060 is 58 and 104 times the current reserves, wherein the demand for

Co is 0.8% of global reserves and can be met by global reserves. Conversely, the demand for In far exceeds global reserves and may face greater supply risk in the future. Cumulative demand for

Cr,

Cu,

Li, and

Ni are all higher than China’s reserves and do not exceed global reserves. China is a large consumer of

Cr, and stainless steel production accounts for more than half of the world, rapid increase in stainless steel production drives the upstream

Cr demand [

48]. Constrained by resource conditions, China’s

Cr demand is mainly met by imports.

Cumulative demand for Li and Ni exceeds 20% of global reserves, and a supply bottleneck is likely in the future. According to the current situation, demand for Te exceeds the global reserves, and the promising CdTe industry will continue driving future demand for Te. Current Chinese Te production can meet domestic demand and export slightly. However, as demand continues to increase, it will probably outstrip supply in the future. The potential for Te resources in China is large and the degree of exploitation is also large. Moreover, China is an important global supplier of Te, the resources are currently exported in large quantities in the form of raw materials or products. Hence, a national reserve policy should be established in time. Dy and Nd may be subject to production constraints. Therefore, production in China would have to be significantly higher compared to historical production to meet the demand for energy technology in China.

4.2. Supply of Coproduced Minerals

Minerals are coproduced with other host materials [

7]. For example, about 95% and 70% of

In and

Ge, respectively, are associated with

Zn; about 90% of

Te with

Cu,

Co mainly with

Ni and

Cu, and

Nd and

Dy with

Fe [

19,

34,

55]. Hence, in addition to issues related to the availability and production capacity of the metals themselves, the supply of host and associated metals should be concerned.

The amount of

Zn and

Cu that would need to be produced to meet the demand for

In and

Te in the Chinese energy system can be estimated based on current production ratios of associated (

In and

Te) and main metals (

Zn and

Cu), and the demand for the associated metals. For instance, current global production ratios are 51 g of

In per ton of

Zn and 20.4 g of

Te per ton of

Cu [

30]. In this study, demand for

In and

Te is 136 kt and 40 kt, respectively. Hence, based on the current production ratios and demand for the associated metals, to meet the demand for In and

Te, 2667 and 1960 Mt of

Zn and

Cu, respectively, should be produced to meet the demand for

Te. Considering the historical production of these two metals, these numbers are huge.

Additionally, if one associated metal drives an increase in the production of the main metal, it will also drive an increase in the production of the other associated metals produced jointly. For example, if the demand for Nd and Dy increases, the supply of the main metal Fe will increase, as will the supply of other REEs, such as La, Ce, and Y. China should increase the production of several metals including Nd and Dy to avoid a production supply shortage. Simultaneously, to minimize the impact of possible oversupply of other coproduction metals, mining these metals from Dy and Nd-rich deposits and promoting the utilization of other coproduction metals in more new applications is necessary.

4.3. Role of Recycling

Recycling is a promising alternative to primary resources, by reducing the use of primary resources, recycling can alleviate shortages of critical materials and improve resource use efficiency. Most studies have also highlighted the urgent need for more recycling of critical metals in applications [

56,

57]. However, our findings indicate that the benefits of recycling are significantly limited in terms of mitigating supply risk, especially over the next 30 years. Additionally, more emphasis should be placed on options for production and use phases (i.e., technology development and better application management, resource efficiency improvements) for the following reasons:

(a) Available recycling resources are considerably limited in the short term. First, historical inflows and lifetimes determine available recycling resources. Energy infrastructure typically has a 20-year (or more) lifespan and is installed in small volumes in the initial years. Therefore, recycling resources are very limited until 2030 and remain low until 2040. (b) Between 2021 and 2060, China will experience a rapidly growing demand for renewable energy and key materials. Owing to the limited recovery resources and large material requirements, the mineral demand for renewable energy technologies in China will continue to become dominated by primary ore resources. (c) Recycling is not always the best option. Key minerals are always used in small quantities; however, these are combined with other materials in complex ways in components [

58]. In some cases, collecting, isolating, and purifying critical materials from other components may require greater effort than extracting new materials [

59]. Therefore, recycling is not always technically, environmentally, or economically feasible.

However, critical materials for the end-of-life phase are expected to become abundant, beginning in 2040. Therefore, this study advocates that recycling should still be pursued, but more attention should be paid to extending its lifetime and efficiency during the use phase and using more advanced technologies to reduce material intensity. In conclusion, from a material perspective, attention should be paid to technological development and innovation.

4.4. Technology Development and Substitution

Technological development and substitution can mitigate risks associated with material availability. Examples include reducing the intensity of materials while maintaining performance, increasing service life, and finding substitutes. In this study, the impact of technological developments can be illustrated by changes in MI and lifetime. For example, PV technology, which adds 6 years to its current lifespan, would reduce material requirements by 27%, and an increase in the lifetime of EVs by 4 years would reduce demand for metals used by 22%. The effect of reducing the intensity of the material can be more immediate than that of extending its life. As the life-extending effect does not manifest itself until at least one service cycle is completed, a delay effect manifests. If mineral intensity maintains its continuous decline, cumulative demand will decrease.

Substitution of materials or sub-technologies can also reduce risks associated with key materials. Most technologies can be replaced by slightly lower performance (or higher cost) technologies. However, lithium batteries outperform current competitors owing to higher energy and power density, making lithium more difficult to replace while maintaining performance and cost [

26]. The choice of sub-technology is expected to make a decisive difference in material requirements and associated risks. In most cases, whether the material is important depends on the particular sub-technology used (e.g., thin-film solar PV) rather than the share or amount of renewable energy used. Demand for

Te is expected to decrease if CdTe is eliminated and the market share of CIGS increases, and other metals (e.g.,

Ag and

In) are not expected to increase much [

32]. A detailed discussion of technology development and substitution for PV and WP is included in the reference [

26]. Policymakers and researchers studying the importance of minerals should consider this finding and focus more on how risk can be reduced by developing the use of new technologies that reduce intensity or increase lifetime, and promote technological and material diversity.

4.5. International Impact

Mitigating global climate change will require an unprecedented scaling up of renewable infrastructure worldwide. Considering the greater metal intensity of renewables, global energy system demand will rapidly shift from fossil energy to metals [

18]. The enhanced metal–energy nexus will have various key impacts on mineral systems.

First, energy transition may increase resource competition among countries. While global energy governance analyzes supply risks to oil, coal, and other fossil fuels, renewable technologies enhance global energy security [

60]. With the global transition to renewable energy, demand for the requisite materials is growing [

61,

62], but availability remains limited. Key minerals are unevenly distributed across countries and concentrated in a few countries. About 82% of REE production and 37% of reserves are currently concentrated in China; more than 75% of

Li production is concentrated in Australia and Chile; 84% of reserves are concentrated in Australia, China, and Chile; and about 52% of Co production and 47% of reserves are concentrated in Congo [

49]. Consequently, global and national policymakers monitor such mineral constraints in energy planning, and have thus developed corresponding mineral policies [

63]. Future developments are expected to significantly increase the competition for these minerals among countries.

Second, driven by global energy transition, mineral demand has made international trade in key minerals increasingly important. In this study, China will require a large number of different materials to support rapid renewable energy growth. Demand for most of these minerals (i.e., Cd, Te, In, Ga, Se, and Ge) will exceed its domestic reserves, making international trade imperative. As these key minerals remain unevenly distributed and highly concentrated in a limited number of countries, the transnational exchange of technologies and minerals will be instrumental in mitigating climate change. Cooperation among countries with renewable energy and mineral resources is key to the global energy transition, enhancing international energy cooperation decisions to mitigate potential supply risks.

4.6. Environmental and Social Issues

While environmental health is a key driver in energy transition, policies and strategies that only consider decarbonization can present serious unprecedented problems. Copper mining can lead to long-term heavy mineral contamination of soil and water bodies [

64]. The production process of REEs requires large amounts of chemicals—which can endanger human health if poorly managed—and generates large amounts of solid waste, gas, and wastewater [

65]. In the early stage, while China’s rare earth industry was developing rapidly, extensive mining caused damage to mountains, soil, water bodies, and the ecological environment [

66]. In addition, the environmental impacts are unclear for some minerals (e.g., specialty minerals used in PV) because these are often mined as byproducts [

64].

Although the increase in mineral demand and a large number of mining activities can create environmental or social problems, these will reduce fossil fuel extraction impacts, especially coal mining, which can lead to lung damage and kidney disease due to coal dust exposure [

67]. For all energy-related mining activities, developing protective measures to avoid negative impacts on the environmental health of workers and local communities will contribute to the achievement of sustainable energy (or SDG 7). Considering the environmental and social impacts (including health and human rights impacts) of resource demand may help advance management policies and mitigate the potential adverse impacts of a low-carbon transition. Hence, examining the full life cycle of energy technologies and their materials ensures that these mining activities create a net positive contribution to the fight against climate change [

68].