Identifying Market Segment for the Assessment of a Price Premium for Green Certified Housing: A Cluster Analysis Approach

Abstract

1. Introduction

1.1. Green Certification and Real Estate Market

1.2. Research Contribution

2. Methods

2.1. Data Collection and Cleaning

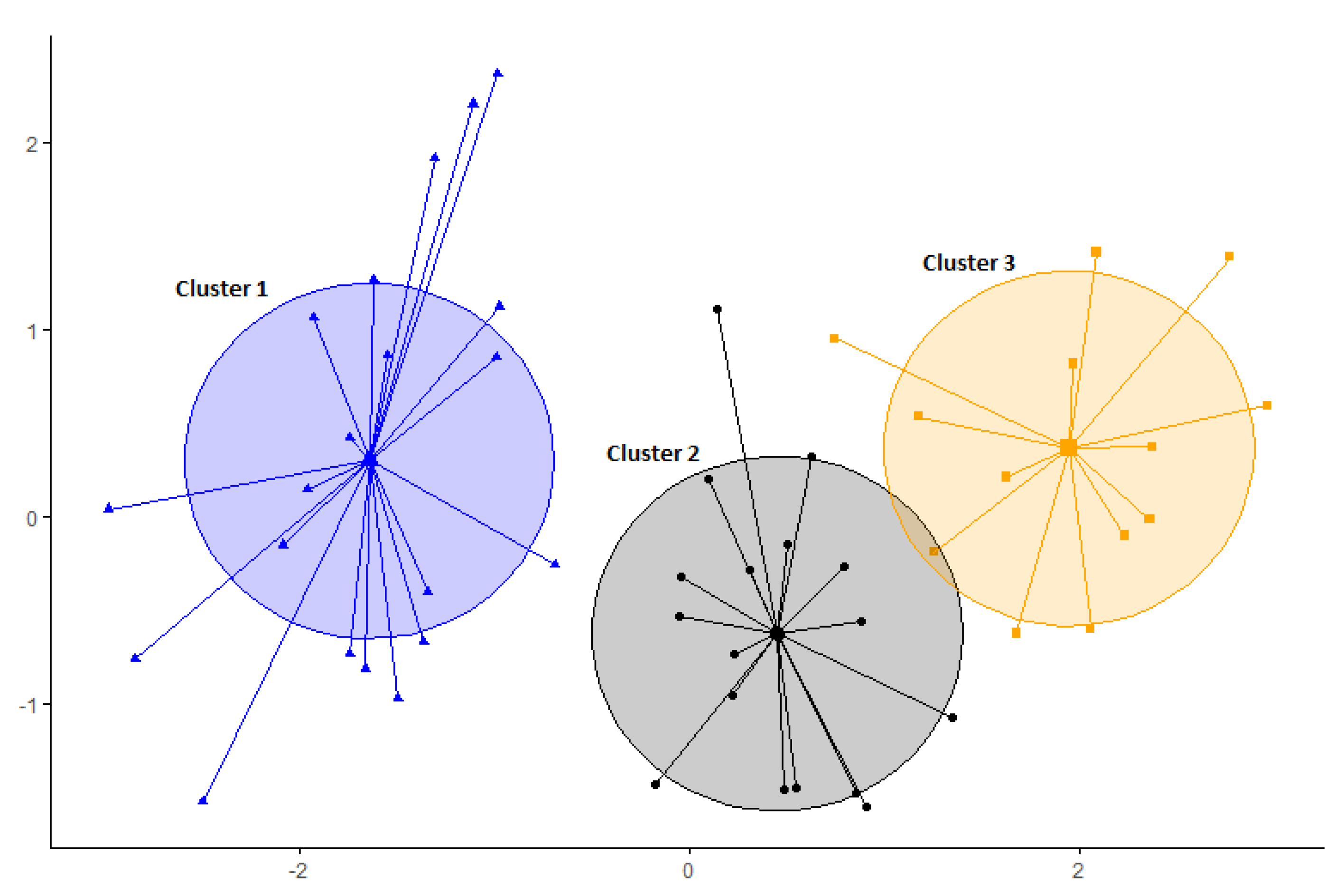

2.2. Cluster Analysis

2.3. Hedonic Model

3. Results and Discussion

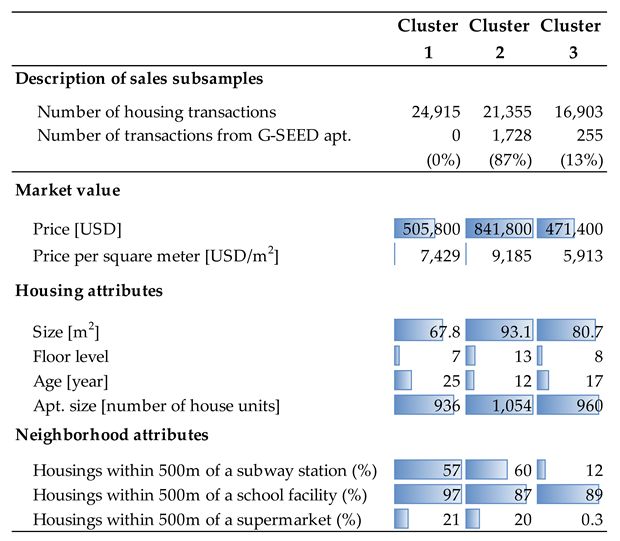

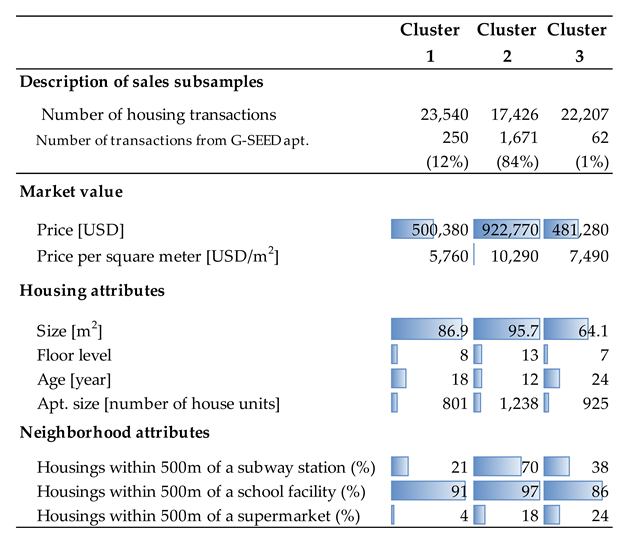

3.1. Cluster Analysis Results: Sales Subsamples

3.2. Hedonic Results: Green Premium

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Conflicts of Interest

References

- International Energy Agency. Energy Efficiency, 2017. Available online: https://www.nrcan.gc.ca/sites/www.nrcan.gc.ca/files/energy/energy-resources/Energy_Efficiency_Marketing_Report_2017.pdf (accessed on 13 May 2022).

- International Energy Agency. Energy Technology Perspectives, 2020. Available online: https://www.iea.org/topics/energy-technology-perspectives (accessed on 24 April 2022).

- Fuerst, F.; Kontokosta, C.; McAllister, P. Determinants of Green Building Adoption. Environ. Plan. B Plan. Des. 2014, 41, 551–570. [Google Scholar] [CrossRef]

- Bartlett, E.; Howard, N. Informing the decision makers on the cost and value of green building. Build. Res. Inf. 2000, 28, 315–324. [Google Scholar] [CrossRef]

- Kahn, M.E.; Kok, N. The capitalization of green labels in the California housing market. Reg. Sci. Urban Econ. 2014, 47, 25–34. [Google Scholar] [CrossRef]

- Chegut, A.; Eichholtz, P.; Kok, N. Supply, Demand and the Value of Green Buildings. Urban Stud. 2013, 51, 22–43. [Google Scholar] [CrossRef]

- Eichholtz, P.; Kok, N.; Quigley, J.M. Doing Well by Doing Good? Green Office Buildings. Am. Econ. Rev. 2010, 100, 2492–2509. [Google Scholar] [CrossRef]

- Kang, B.R.; Yuh, O.K. Analysis of the impact of G-SEED on real estate price focused on apartment house. Geogr. J. Korea 2014, 48, 79–92. [Google Scholar]

- Zhang, L.; Wu, J.; Liu, H. Turning green into gold: A review on the economics of green buildings. J. Clean. Prod. 2018, 172, 2234–2245. [Google Scholar] [CrossRef]

- European Commission. Available online: https://ec.europa.eu/energy/sites/ener/files/documents/20130619-energy_performance_certificates_in_buildings.pdf (accessed on 29 August 2022).

- McCord, M.; Haran, M.; Davis, P.; McCord, J. Energy performance certificates and house prices: A quantile regression approach. J. Eur. Real Estate Res. 2020, 13, 409–434. [Google Scholar] [CrossRef]

- Wilhelmsson, M. Energy Performance Certificates and Its Capitalization in Housing Values in Sweden. Sustainability 2019, 11, 6101. [Google Scholar] [CrossRef]

- Marmolejo-Duarte, C.; Chen, A. The Uneven Price Impact of Energy Efficiency Ratings on Housing Segments. Implications for Public Policy and Private Markets. Sustainability 2019, 11, 372. [Google Scholar] [CrossRef]

- Kim, D.H. The assessment of green premium variation across different development scales: Case of apartment complexes in Seoul, South Korea. J. Asian Arch. Build. Eng. 2022. [Google Scholar] [CrossRef]

- Wilkinson, S.; Sayce, S. Energy Efficiency and Residential Values: A Changing European Landscape; 2019; pp. 1–35. Available online: http://hdl.handle.net/10453/131081 (accessed on 18 July 2022).

- Hwang, S.J.; Suh, H. Analyzing Dynamic Connectedness in Korean Housing Markets. Emerg. Mark. Financ. Trade 2019, 57, 591–609. [Google Scholar] [CrossRef]

- Kim, K.H.; Jeon, S.-S.; Irakoze, A.; Son, K.-Y. A Study of the Green Building Benefits in Apartment Buildings According to Real Estate Prices: Case of Non-Capital Areas in South Korea. Sustainability 2020, 12, 2206. [Google Scholar] [CrossRef]

- Kang, C.-D. Spatial Access to Metro Transit Villages and Housing Prices in Seoul, Korea. J. Urban Plan. Dev. 2019, 145, 05019010. [Google Scholar] [CrossRef]

- Korea Environmental Industry Technology Institute. Available online: https://www.gbc.re.kr (accessed on 17 June 2021).

- Kassambara, A. Practical Guide to Cluster Analysis in R: Unsupervised Machine Learning; Sthda: Scotts Valley, CA, USA, 2017; Volume 1. [Google Scholar]

- MacQueen, J. Classification and analysis of multivariate observations. 5th Berkeley Symp. Math. Statist. Probab. 1967, 5, 281–297. [Google Scholar]

- Rosen, S. Hedonic Prices and Implicit Markets: Product Differentiation in Pure Competition. J. Politi-Econ. 1974, 82, 34–55. [Google Scholar] [CrossRef]

- Sirmans, G.S.; Macpherson, D.A.; Zietz, E.N. The composition of hedonic pricing models. J. Real Estate Lit. 2005, 13, 3–43. [Google Scholar] [CrossRef]

- Korea Real Estate Statistics. Available online: https://www.reb.or.kr/r-one/statistics/statisticsViewer.do?menuId=TSPIA_43100 (accessed on 16 August 2021).

- Cui, M. Introduction to the k-means clustering algorithm based on the elbow method. Account. Audit. Financ. 2020, 1, 5–8. [Google Scholar] [CrossRef]

- Hui, E.C.M.; Tse, C.-K.; Yu, K.-H. The Effect of Beam Plus Certification on Property Price in Hong Kong. Int. J. Strat. Prop. Manag. 2017, 21, 384–400. [Google Scholar] [CrossRef]

- Lee, J.; Shepley, M. Analysis of human factors in a building environmental assessment system in Korea: Resident perception and the G-SEED for MF scores. Build. Environ. 2018, 142, 388–397. [Google Scholar] [CrossRef]

- Chin, H.C.; Foong, K.W. Influence of School Accessibility on Housing Values. J. Urban Plan. Dev. 2006, 132, 120–129. [Google Scholar] [CrossRef]

- Kim, E.J.; Kim, H. Neighborhood Walkability and Housing Prices: A Correlation Study. Sustainability 2020, 12, 593. [Google Scholar] [CrossRef]

- Nijskens, R.; Lohuis, M.; Hilbers, P.; Heeringa, W. The Korean Housing Market: Its Characteristics and Policy Response. In Hot Property: The Housing Market in Major Cities; Springer Nature: London, UK, 2019; pp. 181–194. [Google Scholar]

| Variable | Unit | Descriptive (n = 63,173) | |||

|---|---|---|---|---|---|

| Min. | Max. | Mean | Std. Dev. | ||

| Housing attributes | |||||

| Price | [USD/m2] | 1854 | 15,921 | 7617 | 2712 |

| Size | [m2] | 12.5 | 245.4 | 79.8 | 27.8 |

| Floor level | [Floor number] | 1 | 69 | 9 | 6 |

| Apartment age | [year] | 0 | 52 | 19 | 9 |

| Size of the complex | [housing units] | 16 | 11,378 | 989 | 897 |

| Neighborhood attributes | |||||

| Distance to: | |||||

| Subway station | [m] | 40 | 4656 | 634 | 421 |

| School | [m] | 11 | 2120 | 275 | 144 |

| Supermarket | [m] | 5 | 4540 | 1172 | 420 |

| Attribute | Abbreviation | Definition | Expected Relationship |

|---|---|---|---|

| Dependent variable | LnPrice | Housing transaction price in natural log form | |

| Explanatory variable | |||

| Housing attributes | AREA | Floor area of the house [m2] | Positive |

| FL | Floor level | Positive | |

| AGE | Age of the apartment from its construction year to 2018 [years] | Negative | |

| HU | Total number of housing units in the apartment | Positive | |

| Neighborhood attributes | SBW | Distance to the nearest subway station [km] | Negative |

| SCH | Distance to the nearest school [km] | Negative | |

| SPK | Distance to the nearest commercial facility [km] | Negative | |

| Location and time price variation | RPI | Housing price index of the district | Positive |

| TPI | Temporal price index: 2018 quarterly housing price index | Positive | |

| Green certification | G-SEED | Dummy variable: 1 if the apartment is G-SEED certified; 0 otherwise | Positive |

|

|

| Model 1 (Full Sales Sample) | Model 2 (Subsample from k-means) | Model 3 (Subsample from PAM) | |

|---|---|---|---|

| Intercept | 17.35 *** | 15.28 *** | 12.86 *** |

| Housing attributes | |||

| AREA | 0.010 *** | 0.009 *** | 0.010 *** |

| FL | 0.002 *** | −0.009 *** | −0.002 *** |

| AGE | −0.007 *** | −0.005 *** | −0.005 *** |

| HU | 0.060 *** | 0.054 *** | 0.064 *** |

| Neighborhood attributes | |||

| SBW | 0.142 *** | 0.029 *** | 0.111 *** |

| SCH | 0.001 | 0.084 *** | 0.212 *** |

| SPK | −0.031 *** | 0.071 *** | 0.025 *** |

| Locational and temporal variation in housing market | |||

| RPI | 0.135 *** | 0.103 *** | 0.059 *** |

| TPI | 0.041 *** | 0.035 *** | 0.026 *** |

| G–SEED certification attribute | |||

| G–SEED | 0.262 *** | 0.122 *** | 0.178 *** |

| Dataset: n | 63173 | 21355 | 17426 |

| Adjusted R–square | 0.703 | 0.624 | 0.705 |

| F–statistic | 14970 | 3541 | 4161 |

| p–value | <2.2 × 10−16 | <2.2 × 10−16 | <2.2 × 10−16 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, D.H.; Irakoze, A. Identifying Market Segment for the Assessment of a Price Premium for Green Certified Housing: A Cluster Analysis Approach. Sustainability 2023, 15, 507. https://doi.org/10.3390/su15010507

Kim DH, Irakoze A. Identifying Market Segment for the Assessment of a Price Premium for Green Certified Housing: A Cluster Analysis Approach. Sustainability. 2023; 15(1):507. https://doi.org/10.3390/su15010507

Chicago/Turabian StyleKim, Dong Hyun, and Amina Irakoze. 2023. "Identifying Market Segment for the Assessment of a Price Premium for Green Certified Housing: A Cluster Analysis Approach" Sustainability 15, no. 1: 507. https://doi.org/10.3390/su15010507

APA StyleKim, D. H., & Irakoze, A. (2023). Identifying Market Segment for the Assessment of a Price Premium for Green Certified Housing: A Cluster Analysis Approach. Sustainability, 15(1), 507. https://doi.org/10.3390/su15010507