Does Green Credit Policy Promote or Inhibit Firms’ Green Innovation in China? Moderating Effect of Environmental Information Disclosure

Abstract

1. Introduction

2. Theoretical Background

2.1. Environmental Regulation and Firms’ Green Innovation

2.2. Green Credit Policy and Firms’ Activities

2.3. The Moderating Role of Environmental Information Disclosure

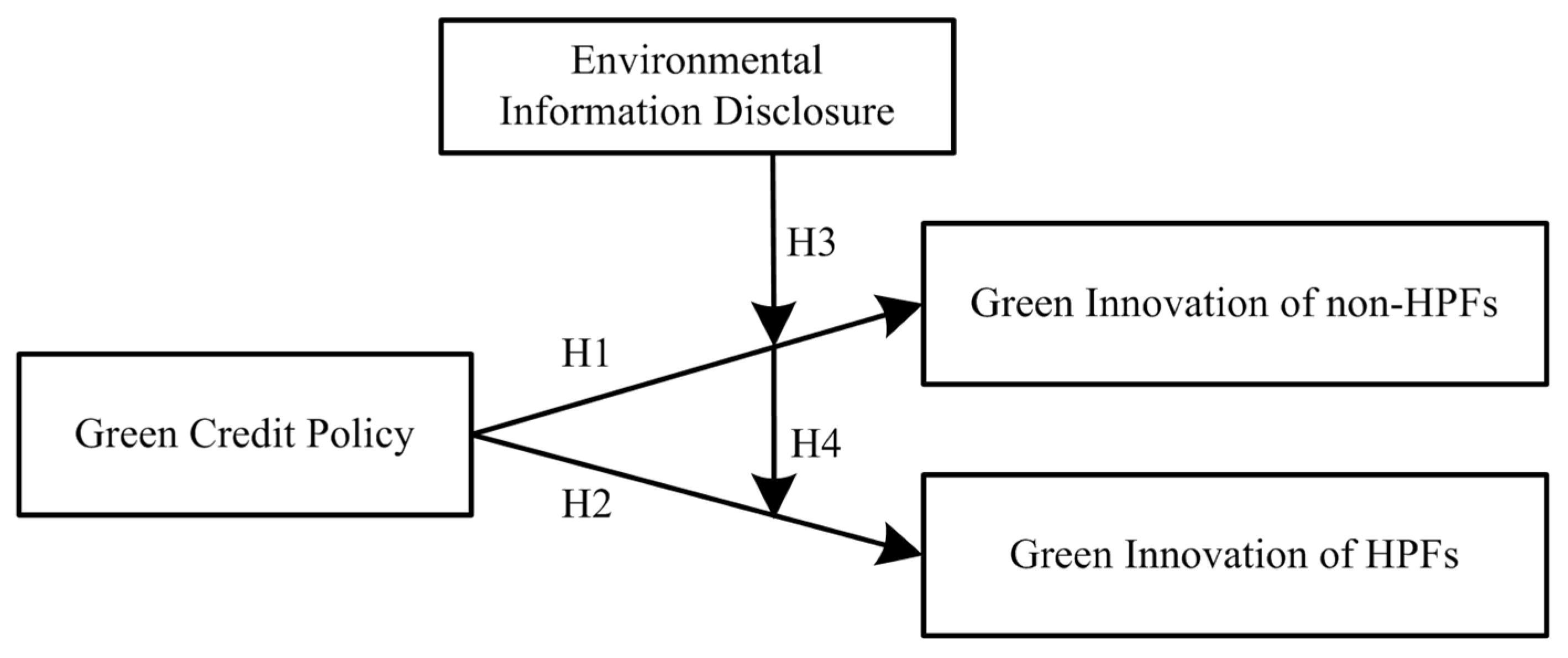

3. Hypotheses Development

3.1. Green Credit Policy and Green Innovation

3.2. The Moderating Effect of Environmental Information Disclosure

4. Data and Methodology

4.1. Data

4.2. Variables

4.2.1. Dependent Variable

4.2.2. Independent Variable

4.2.3. Control Variables

4.2.4. Moderation Variable

4.3. Methodology

5. Empirical Results

5.1. Descriptive Statistics

5.2. Baseline Regression Results

5.3. Moderating Effects of Environmental Information Disclosure

5.4. Heterogeneity Analysis

5.5. Robustness Testing

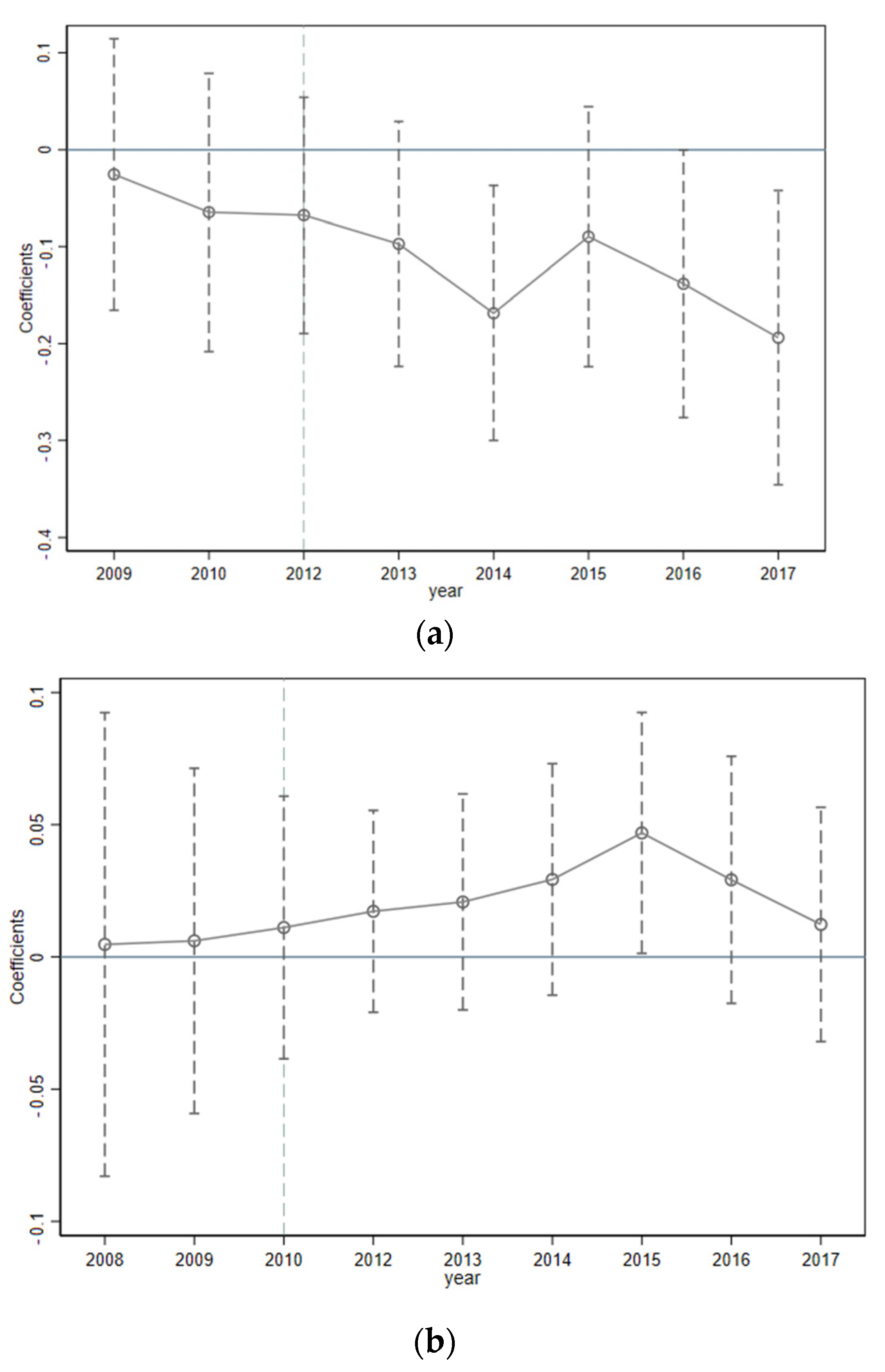

5.5.1. Parallel Trend Test

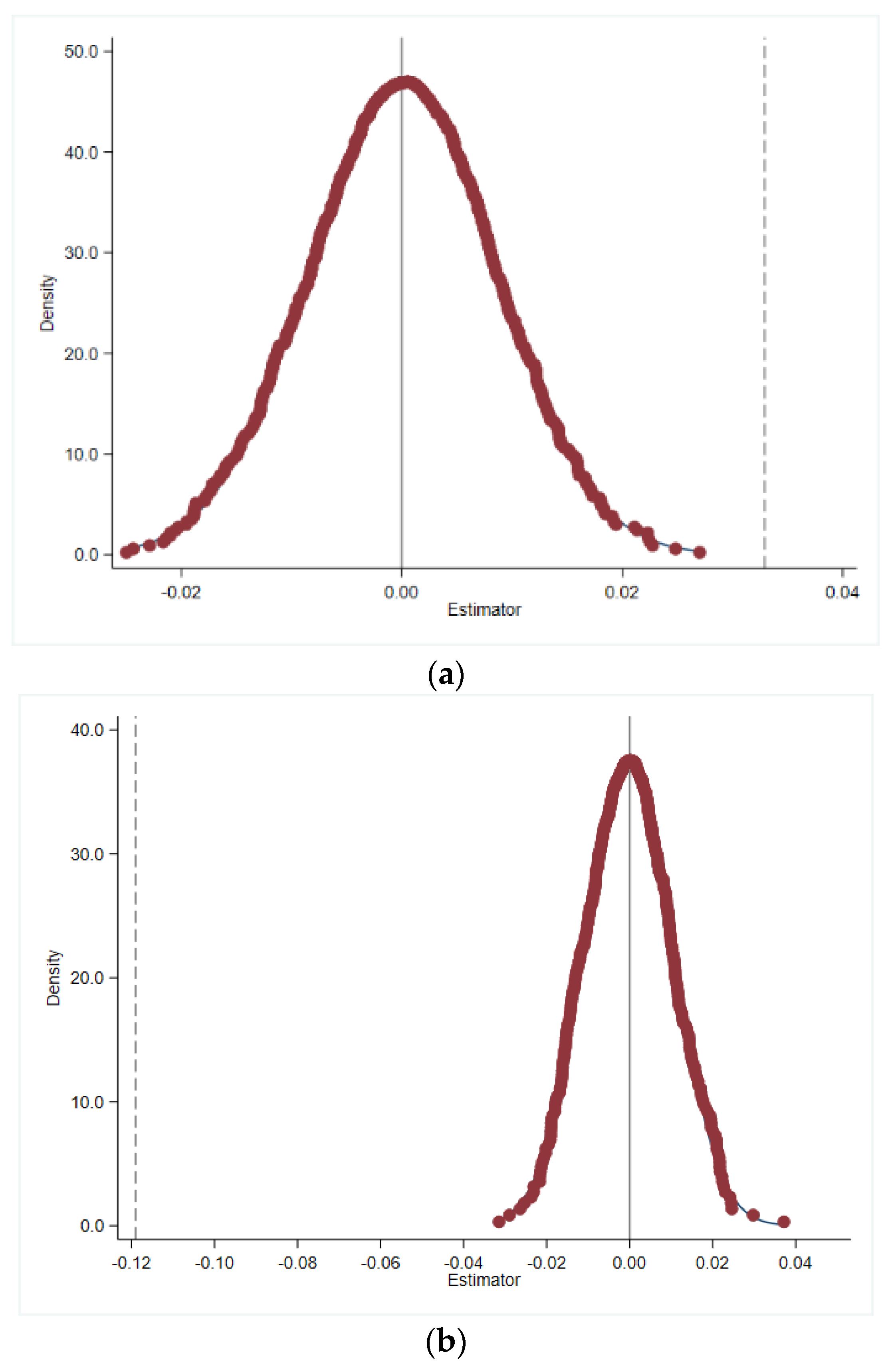

5.5.2. Placebo Test

6. Conclusions, Implications, and Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Cui, J.B.; Dai, J.; Wang, Z.X.; Zhao, X.D. Does environmental regulation induce green innovation? A panel study of Chinese listed firms. Technol. Forecast. Soc. Change 2022, 176, 121492. [Google Scholar] [CrossRef]

- The China Banking Regulatory Commission (CBRC). Suggestions on Implementation of Environmental Policies and Regulations and Guard Against Credit Risks. 2007. Available online: http://www.gov.cn/zwhd/2007-12/29/content_846830.htm (accessed on 12 December 2022).

- The China Banking Regulatory Commission (CBRC). Notice on Printing and Issuing Green Credit Guidelines. 2012. Available online: http://www.gov.cn/gzdt/2012-02/24/content_2076079.htm (accessed on 12 December 2022).

- Xing, C.; Zhang, Y.M.; Tripe, D. Green credit policy and corporate access to bank loans in China: The role of environmental disclosure and green innovation. Int. Rev. Financ. Anal. 2021, 77, 101838. [Google Scholar] [CrossRef]

- Zhang, A.X.; Deng, R.R.; Wu, Y.F. Does the green credit policy reduce the carbon emission intensity of heavily polluting industries? Evidence from China’s industrial sectors. J. Environ. Manag. 2022, 311, 114815. [Google Scholar] [CrossRef]

- Hu, G.Q.; Wang, X.Q.; Wang, Y. Can the green credit policy stimulate green innovation in heavily polluting enterprises? Evidence from a quasi-natural experiment in China? Energy Econ. 2021, 98, 105134. [Google Scholar] [CrossRef]

- Liu, S.; Xu, R.X.; Chen, X.Y. Does green credit affect the green innovation performance of high-polluting and energy-intensive enterprises? Evidence from a quasi-natural experiment. Environ. Sci. Pollut. Res. 2021, 28, 65265–65277. [Google Scholar] [CrossRef]

- Sun, J.X.; Wang, F.; Yin, H.T.; Zhang, B. Money talks: The environmental impact of China’s green credit policy. J. Policy Anal. Manag. 2019, 38, 653–680. [Google Scholar] [CrossRef]

- Yao, S.Y.; Pan, Y.Y.; Sensoy, A.; Uddin, G.S.; Cheng, F.Y. Green credit policy and firm performance: What we learn from China? Energy Econ. 2021, 101, 105415. [Google Scholar] [CrossRef]

- Xie, Q.X.; Zhang, Y.; Chen, L. Does green credit policy promote innovation: A case of China. Manage. Decis. Econ. 2022, 43, 2704–2714. [Google Scholar] [CrossRef]

- Chen, Y.S.; Lai, S.B.; Wen, C.T. The influence of green innovation on corporate advantage in Taiwan. J. Bus. Ethics. 2006, 67, 331–339. [Google Scholar] [CrossRef]

- Chen, Z.F.; Zhang, X.; Chen, F.L. Do carbon emission trading schemes stimulate green innovation in enterprises? Evidence from China? Technol. Forecast. Soc. Change 2021, 168, 120744. [Google Scholar] [CrossRef]

- Chen, Z.G.; Zhang, Y.Q.; Wang, H.S.; Xiao, O.Y.; Xie, Y.X. Can green credit policy promote low-carbon technology innovation? J. Clean. Prod. 2022, 359, 132061. [Google Scholar] [CrossRef]

- Cui, X.; Wang, P.P.; Sensoy, A.; Nguyen, D.K.; Pan, Y.Y. Green credit policy and corporate productivity: Evidence from a quasi-natural experiment in China. Technol. Forecast. Soc. Change 2022, 177, 121516. [Google Scholar] [CrossRef]

- Porter, M.E.; Van Der Linde, C. Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Ding, J.X.; Lu, Z.; Yu, C. Environmental information disclosure and firms’ green innovation: Evidence from China. Int. Rev. Econ. Financ. 2022, 81, 147–159. [Google Scholar] [CrossRef]

- Wang, F.; Yang, S.Y.; Reisner, A.; Liu, N. Does green credit policy work in China? The correlation between green credit and corporate environmental information disclosure quality. Sustainability 2019, 11, 733. [Google Scholar] [CrossRef]

- Kreuze, J.G.; Newell, G.E. A strategy for improving the quality of entry-level management accountants. J. Edu. Bus. 1996, 71, 334–338. [Google Scholar] [CrossRef]

- Geng, J.X.; Jiao, R.J. On environmental accounting information disclosure of listed companies. Account. Res. 2002, 1, 43–47. [Google Scholar]

- Luo, Y.D.; Xiong, G.B.; Mardani, A. Environmental information disclosure and corporate innovation: The “Inverted U-shaped” regulating effect of media attention. J. Bus. Res. 2022, 146, 453–463. [Google Scholar] [CrossRef]

- Peng, H.; Shen, N.; Ying, H.Q.; Wang, Q.W. Can environmental regulation directly promote green innovation behavior? Based on situation of industrial agglomeration. J. Clean. Prod. 2021, 314, 128044. [Google Scholar] [CrossRef]

- Chen, Z.; Jin, J.; Li, M. Does media coverage influence firm green innovation? The moderating role of regional environment. Technol. Soc. 2022, 70, 102006. [Google Scholar] [CrossRef]

- Shang, H.; Jiang, L.; Pan, X.Y.; Pan, X.F. Green technology innovation spillover effect and urban eco-efficiency convergence: Evidence from Chinese cities. Energy Econ. 2022, 114, 106307. [Google Scholar] [CrossRef]

- Scott, W.R. Institutions and Organizations, 2nd ed.; Sage: Thousand Oaks, CA, USA, 2001. [Google Scholar]

- Zhang, H. The green paradox puzzle: Interpretation from the perspective of local government competition. J. Financ. Econ. 2014, 40, 114–127. [Google Scholar]

- Yang, Q.Y.; Gao, D.; Song, D.Y.; Li, Y. Environmental regulation, pollution reduction and green innovation: The case of the Chinese Water Ecological Civilization City Pilot Policy. Econ. Sys. 2021, 45, 100911. [Google Scholar] [CrossRef]

- Tao, F.; Zhao, J.; Zhou, H. Does environmental regulation improve the quantity and quality of green innovation: Evidencefrom the target responsibility system of environmental protection. China Ind. Econ. 2021, 2, 136–154. [Google Scholar]

- Lu, N.; Wu, J.; Liu, Z. How does green finance reform affect enterprise green technology innovation? Evidence from China. Sustainability 2022, 14, 9865. [Google Scholar] [CrossRef]

- Zhang, D.Y.; Kong, Q.X. Credit policy, uncertainty, and firm R&D investment: A quasi-natural experiment based on the Green Credit Guidelines. Pac.-Basin Financ. J. 2022, 73, 101751. [Google Scholar]

- Liu, X.H.; Wang, E.X.; Cai, D.T. Green credit policy, property rights and debt financing: Quasi-natural experimental evidence from China. Financ. Res. Lett. 2019, 29, 129–135. [Google Scholar] [CrossRef]

- Zhang, S.L.; Wu, Z.H.; Wang, Y.; Hao, Y. Fostering green development with green finance: An empirical study on the environmental effect of green credit policy in China. J. Environ. Manag. 2021, 296, 113–159. [Google Scholar] [CrossRef]

- Liu, Q.; Dong, B. How does China’s green credit policy affect the green innovation of heavily polluting enterprises? The perspective of substantive and strategic innovations. Environ. Sci. Pollut. Res. 2022, 29, 77113–77130. [Google Scholar] [CrossRef]

- Li, S.; Zhang, W.; Zhao, J. Does green credit policy promote the green innovation efficiency of heavy polluting industries? Empirical evidence from China’s industries. Environ. Sci. Pollut. Res. 2022, 29, 46721–46736. [Google Scholar] [CrossRef]

- Zhang, Y.; Li, X.L.; Xing, C. How does China’s green credit policy affect the green innovation of high polluting enterprises? The perspective of radical and incremental innovations. J. Clean. Prod. 2022, 336, 130387. [Google Scholar] [CrossRef]

- Feng, Y.C.; Liang, Z. How does green credit policy affect total factor productivity of the manufacturing firms in China? The mediating role of debt financing and the moderating role of environmental regulation. Environ. Sci. Pollut. Res. 2022, 29, 31235–31251. [Google Scholar] [CrossRef]

- Wang, H.T.; Qi, S.Z.; Zhou, C.B.; Zhou, J.J.; Huang, X.Y. Green credit policy, government behavior and green innovation quality of enterprises. J. Clean. Prod. 2022, 331, 129834. [Google Scholar] [CrossRef]

- Li, Q.; Ruan, W.; Shi, H.; Xiang, E.; Zhang, F. Corporate environmental information disclosure and bank financing: Moderating effect of formal and informal institutions. Bus. Strat. Environ. 2022. Early view. [Google Scholar] [CrossRef]

- Zhang, S.H.; Zhang, M.; Qiao, Y.B.; Li, X.; Li, S. Does improvement of environmental information transparency boost firms’ green innovation? Evidence from the air quality monitoring and disclosure program in China. J. Clean. Prod. 2022, 357, 131921. [Google Scholar] [CrossRef]

- Zhou, Q.; Song, Y.; Wan, N.; Zhang, X. Non-linear effects of environmental regulation and innovation-spatial interaction evidence from the Yangtze River Delta in China. Environ. Sci. Pol. 2020, 114, 263–274. [Google Scholar] [CrossRef]

- Acharya, V.; Xu, Z. Financial dependence and innovation: The case of public versus private firms. J. Financ. Econ. 2017, 124, 223–243. [Google Scholar] [CrossRef]

- Feng, Y.C.; Wang, X.H.; Liang, Z. How does environmental information disclosure affect economic development and haze pollution in Chinese cities? The mediating role of green technology innovation. Sci. Total Environ. 2021, 775, 145811. [Google Scholar] [CrossRef]

- Suchman, M.C. Managing legitimacy: Strategic and institutional approaches. Acad. Manag. Rev. 1995, 20, 571–610. [Google Scholar] [CrossRef]

- Meng, X.H.; Zeng, S.X.; Xie, X.M.; Zou, H.L. Beyond symbolic and substantive: Strategic disclosure of corporate environmental information in China. Bus. Strat. Env. 2019, 28, 403–417. [Google Scholar] [CrossRef]

- Li, W.A.; Cui, G.Y.; Zheng, M.N. Does green credit policy affect corporate debt financing? Evidence from China. Environ. Sci. Pollut. Res. 2022, 29, 5162–5171. [Google Scholar] [CrossRef] [PubMed]

- Chai, S.L.; Zhang, K.; Wei, W.; Ma, W.Y.; Abedin, M.Z. The impact of green credit policy on enterprises’ financing behavior: Evidence from Chinese heavily-polluting listed companies. J. Clean. Prod. 2022, 363, 132458. [Google Scholar] [CrossRef]

- Jiang, P.C.; Jiang, H.L.; Wu, J.H. Is inhibition of financialization the sub-effect of the green credit policy? Evidence from China. Financ. Res. Lett. 2022, 47, 102737. [Google Scholar] [CrossRef]

- Zhang, S.L.; Hao, Y.; Zhang, Y.P. Does public opinion affect air quality? Evidence based on the monthly data of 109 prefecture-level cities in China. Energy Policy 2018, 116, 299–311. [Google Scholar] [CrossRef]

- Sun, J.M.; Xue, J.A.; Qiu, X.D. Has the sustainable energy transition in China’s resource-based cities promoted green technology innovation in firms? Soc. -Econ. Plan. Sci. 2022. Early view. [Google Scholar] [CrossRef]

- Zhang, Y.; Xie, H.B.; Li, J. Does green credit policy mitigate financialization? Evidence from Chinese heavily polluting enterprises. Environ. Sci. Pollut. Res. 2022. [Google Scholar] [CrossRef] [PubMed]

| Variable Name | Variable Symbol | Definition |

|---|---|---|

| Green innovation of non-HPFs | NHPFGI | Green invention patent grants of non-heavily polluting firms |

| Green innovation of HPFs | HPFGI | Green invention patent grants of heavily polluting firms |

| Treatment group 1 | Treat | The value of non-HPFs affected by GCP is 1, and the value of non-HPFs not affected by GCP is 0 |

| Treatment group 2 | Treat | The value of HPFs is 1, and the value of non-HPFs not affected by GCP is 0 |

| Treatment period | Post | For HPFs, the value of the sample is 1 in and after 2012, otherwise it is 0; for non-HPFs, the value of the sample is 1 in and after the policy impact point, otherwise it is 0. |

| Environmental information disclosure | EID | With content analysis method, environmental information is first classified, then each category is assigned a value according to its content, and finally, the score for each firm is calculated |

| Firm growth | Growth | The growth rate of business revenue |

| Returns on asset | ROA | Return on assets equal to earnings before interest, tax and abnormal items at fiscal year-end divided by average total assets |

| Firm age | Age | The number of years from the issue period to the current period, taking the logarithm, ln(current year − year of incorporation + 1) |

| Asset–liability ratio | Lev | Total debt divided by total assets at fiscal year-end |

| Fixed assets | FixAss | Fixed assets divided by total assets at fiscal year-end |

| Cashflow | CaF | Net cash flow from operating activities divided by total assets |

| Institutional investors | Inst | The percentage of shares owned by institutional investors in the enterprise |

| Individual fixed effect | δi | Control of individual firm |

| Time fixed effect | μt | Control of year |

| Control Group | Treatment Group 1 | Treatment Group 2 | ||||

|---|---|---|---|---|---|---|

| Variable | Mean | SD | Mean | SD | Mean | SD |

| GI | 0.600 | 1.020 | 0.570 | 0.950 | 0.420 | 0.780 |

| EID | 1.680 | 0.750 | 1.550 | 0.680 | 2.090 | 0.810 |

| ROA | 0.0600 | 0.0600 | 0.0400 | 0.0600 | 0.0500 | 0.0600 |

| CaF | 0.0500 | 0.0700 | 0.0400 | 0.0700 | 0.0600 | 0.0700 |

| FixAss | 0.180 | 0.150 | 0.170 | 0.140 | 0.300 | 0.170 |

| Lev | 0.380 | 0.210 | 0.440 | 0.210 | 0.420 | 0.210 |

| INST | 0.370 | 0.260 | 0.370 | 0.230 | 0.390 | 0.240 |

| Age | 2.820 | 0.350 | 2.820 | 0.370 | 2.830 | 0.340 |

| Growth | 0.470 | 1.360 | 0.550 | 1.400 | 0.210 | 0.830 |

| (1) | (2) | |

|---|---|---|

| NHPFGI | HPFGI | |

| Treati*Postt | −0.119 ** (−2.33) | |

| Postt | 0.0331 ** (2.17) | |

| Age | 0.405 *** (3.00) | 0.289 (1.70) |

| ROA | 0.261 ** (2.10) | 0.405 * (2.39) |

| Cashflow | −0.207 ** (−2.55) | −0.0195 (−0.20) |

| Lev | 0.253 *** (3.48) | 0.289 *** (3.43) |

| Inst | −0.0219 (−0.53) | 0.0341 (0.65) |

| Growth | −0.00272 (−0.69) | −0.00454 (−0.56) |

| FixAss | 0.0157 (0.17) | 0.0633 (0.69) |

| Constant | −0.685 * (−1.80) | −0.433 (−0.91) |

| Year-fixed | YES | YES |

| Firm-fixed | YES | YES |

| N | 18,168 | 11,576 |

| Adjusted R2 | 0.668 | 0.645 |

| (1) | (2) | |

|---|---|---|

| NHPFGI | HPFGI | |

| Treati*Postt*EID | 0.019 (0.47) | |

| Treati* EID | −0.108 *** (−4.07) | |

| Postt*EID | 0.055 *** (2.80) | 0.100 *** (3.38) |

| Treati*Postt | −0.122 * (−1.66) | |

| Age | 0.397 *** (2.95) | 0.318 * (1.89) |

| ROA | 0.252 ** (2.04) | 0.421 ** (2.50) |

| Cashflow | −0.214 *** (−2.65) | −0.012 (−0.12) |

| Lev | 0.254 *** (3.51) | 0.286 *** (3.41) |

| Inst | −0.022 (−0.54) | 0.034 (0.65) |

| Growth | −0.003 (−0.69) | −0.005 (−0.65) |

| FixAss | 0.009 (0.09) | 0.050 (0.54) |

| Constant | −0.687 * (−1.82) | −0.558 (−1.20) |

| Year-fixed | YES | YES |

| Firm-fixed | YES | YES |

| N | 18,168 | 11,576 |

| Adjusted R2 | 0.670 | 0.650 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| NHPFGI | NHPFGI | NHPFGI | HPFGI | HPFGI | HPFGI | |

| Postt*Size | 0.137 *** (5.05) | |||||

| Postt*Findev | 0.040 ** (1.15) | |||||

| Postt*Pollute | 0.076 *** (2.96) | |||||

| Treati*Postt*Size | 0.106 (1.57) | |||||

| Treati*Postt*Findev | 0.134 * (1.75) | |||||

| Treati*Postt*Pollute | 0.072 (1.14) | |||||

| Constant | −0.651 * (−1.72) | −0.678 * (−1.79) | −0.679 * (−1.79) | −0.525 (−1.12) | −0.450 (−0.95) | −0.411 (−0.87) |

| Control Variables | YES | YES | YES | YES | YES | YES |

| Year-fixed | YES | YES | YES | YES | YES | YES |

| Firm-fixed | YES | YES | YES | YES | YES | YES |

| N | 18,168 | 18,168 | 18,168 | 11,576 | 11,576 | 11,576 |

| Adjusted R2 | 0.670 | 0.668 | 0.668 | 0.647 | 0.645 | 0.645 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, Y.; Ding, H.; Sun, B. Does Green Credit Policy Promote or Inhibit Firms’ Green Innovation in China? Moderating Effect of Environmental Information Disclosure. Sustainability 2023, 15, 462. https://doi.org/10.3390/su15010462

Liu Y, Ding H, Sun B. Does Green Credit Policy Promote or Inhibit Firms’ Green Innovation in China? Moderating Effect of Environmental Information Disclosure. Sustainability. 2023; 15(1):462. https://doi.org/10.3390/su15010462

Chicago/Turabian StyleLiu, Yu, Huiping Ding, and Biao Sun. 2023. "Does Green Credit Policy Promote or Inhibit Firms’ Green Innovation in China? Moderating Effect of Environmental Information Disclosure" Sustainability 15, no. 1: 462. https://doi.org/10.3390/su15010462

APA StyleLiu, Y., Ding, H., & Sun, B. (2023). Does Green Credit Policy Promote or Inhibit Firms’ Green Innovation in China? Moderating Effect of Environmental Information Disclosure. Sustainability, 15(1), 462. https://doi.org/10.3390/su15010462