Unregistered Employment, Lower Volatility of Unemployment Rate and Sustainable Development of the Chinese Labor Market

Abstract

1. Introduction

2. The DSGE Model

2.1. Household

2.2. Firms

2.2.1. Final Goods Firms

2.2.2. Domestic Final Goods Firm

2.2.3. Domestic Intermediate Goods Firms

2.2.4. Importing Firms

2.2.5. Exporting Firms

2.3. Nash Bargaining and Real Wage Rigidity

2.4. Monetary Authority

2.5. Government

2.6. Model Estimation

3. Results

3.1. Model Fit

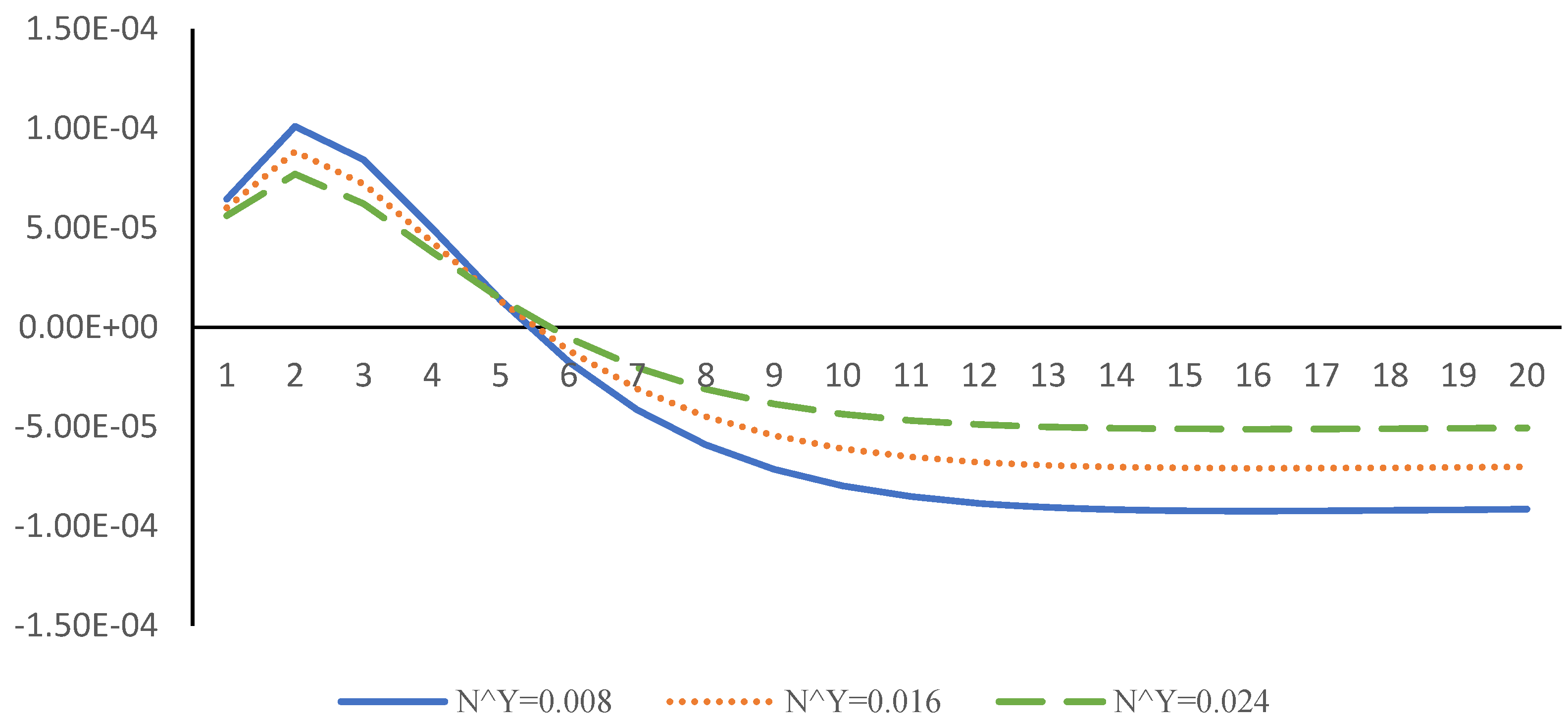

3.2. Impulse Response Function (IRF)

4. Discussion

5. Conclusions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

- 1.

- 2.

- 3.

- 4.

- 5.

- 6.

- 7.

- 8.

- 9.

- 10.

- 11.

- 12.

- 13.

- 14.

- 15.

- 16.

- 17.

- 18.

- 19.

- 20.

- 21.

- 22.

- 23.

- 24.

- 25.

- 26.

- 27.

- 28.

- 29.

- 30.

- 31.

- 32.

- 33.

- 34.

- 35.

- 36.

- 37.

- 38.

- 39.

- 40.

- ,

- 41.

- 42.

- 43.

- 44.

- 45.

- 46.

- 47.

- 48.

- 49.

- 50.

- 51.

- 52.

- 53.

References

- Horvath, J.; Yang, G.Y. Unemployment Dynamics and Informality in Small Open Economies. Eur. Econ. Rev. 2021, 141, 103949. [Google Scholar] [CrossRef]

- Schneider, F.; Buehn, A.; Montenegro, C.E. Shadow Economies All Over the World: New Estimates for 162 Countries from 1999 to 2007. In Handbook on the Shadow Economy; Edward Elgar Publishing: Cheltenham, UK, 2011; pp. 9–77. [Google Scholar]

- Yuan, Z.G.; Lu, M. Theoretical Analysis on Implicit Employment. Zhejiang Soc. Sci. 1999, 1, 12–16. [Google Scholar]

- Wei, H.Q.; Cai, S.X. Theoretical Analysis of Implicit Employment. J. Cent. Univ. Financ. Econ. 1999, 5, 10–14. [Google Scholar]

- Xiang, P.; Zhao, D.; Xie, S.Y. The Effect of Minimum Wage on Formal and Informal Sectors’ Wage and Employment. J. Quant. Tech. Econ. 2016, 10, 94–109. [Google Scholar]

- Lu, M.; Tian, S.C. Explicit Unemployment or Implicit Employment?—Evidence from Shanghai Household Survey Data. Manag. World 2008, 1, 48–56. [Google Scholar]

- Fernández, A.; Meza, F. Informal Employment and Business Cycles in Emerging Economies: The case of Mexico. Rev. Econ. Dyn. 2015, 18, 381–405. [Google Scholar] [CrossRef]

- Leyva, G.; Urrutia, C. Informality, Labor Regulation, and the Business Cycle. J. Int. Econ. 2020, 126, 103340. [Google Scholar] [CrossRef]

- Diamond, P.A. Aggregate Demand Management in Search Equilibrium. J. Political Econ. 1982, 90, 881–894. [Google Scholar] [CrossRef]

- Mortensen, D.T. Property Rights and Efficiency in Mating, Racing, and Related Games. Am. Econ. Rev. 1982, 72, 968–979. [Google Scholar]

- Pissarides, C.A. Short-run Equilibrium Dynamics of Unemployment, Vacancies, and Real Wages. Am. Econ. Rev. 1985, 74, 676–690. [Google Scholar]

- Shimer, R. The Cyclical Behavior of Equilibrium Unemployment and Vacancies. Am. Econ. Rev. 2005, 95, 25–49. [Google Scholar] [CrossRef]

- Hagedorn, M.; Manovskii, I. The Cyclical Behavior of Equilibrium Unemployment and Vacancies Revisited. Am. Econ. Rev. 2008, 98, 1692–1706. [Google Scholar] [CrossRef]

- Gertler, M.; Trigari, A. Unemployment Dynamics with Staggered Nash Wage Bargaining. J. Political Econ. 2009, 117, 38–86. [Google Scholar] [CrossRef]

- Christiano, L.J.; Eichenbaumz, M.S.; Trabandt, M. Unemployment and Business Cycles. Econometrica 2016, 84, 1523–1569. [Google Scholar] [CrossRef]

- Christiano, L.J.; Trabandt, M.; Walentin, K. Involuntary Unemployment and the Business Cycle. Rev. Econ. Dyn. 2021, 39, 26–54. [Google Scholar] [CrossRef]

- Yang, S.L.; Yao, J. Research on the Unemployment Risk Change of China’s Floating Population and Its Proximate Determinants. Chin. J. Popul. Sci. 2020, 3, 33–46. [Google Scholar]

- Cai, F. China’s Labor Market Development and Employment Changes. Econ. Res. J. 2007, 7, 4–14. [Google Scholar]

- Cai, F.; Du, Y.; Gao, W.S. Employment Elasticity, NAIRU, and Macroeconomic Policies. Econ. Res. J. 2004, 9, 18–25. [Google Scholar]

- Guo, C.L. Fiscal Expansion, Heterogeneous Firms, and Employment in Urban China. Econ. Res. J. 2018, 5, 88–102. [Google Scholar]

- Horvath, J. Business Cycles, Informal Economy, and Interest Rates in Emerging Countries. J. Macroecon. 2018, 55, 96–116. [Google Scholar] [CrossRef]

- Chang, C.; Liu, Z.; Spiegel, M.M. Capital Controls and Optimal Chinese Monetary Policy. J. Monet. Econ. 2015, 74, 1–15. [Google Scholar] [CrossRef]

- Christiano, L.J.; Trabandt, M.; Walentin, K. Introducing Financial Frictions and Unemployment into a Small Open Economy Model. J. Econ. Dyn. Control. 2011, 35, 1999–2041. [Google Scholar] [CrossRef]

- Calvo, G.A. Staggered Prices in a Utility-maximizing Framework. J. Monet. Econ. 1983, 12, 383–398. [Google Scholar] [CrossRef]

- Blanchard, O.; Galí, J. Labor Markets and Monetary Policy: A New-Keynesian Model with Unemployment. Am. Econ. J. Macroecon. 2010, 2, 1–30. [Google Scholar] [CrossRef]

- Galí, J. Monetary Policy and Unemployment. In Handbook of Monetary Economics; Elsevier: Amsterdam, The Netherlands, 2010; pp. 487–546. [Google Scholar]

- Hall, R.E. Employment Dynamics with Equilibrium Wage Stickiness. Am. Econ. Rev. 2005, 95, 50–65. [Google Scholar] [CrossRef]

- Christiano, L.J.; Motto, R.; Rostagno, M. Risk Shocks. Am. Econ. Rev. 2014, 104, 27–65. [Google Scholar] [CrossRef]

- Wang, B.; Li, L.; Hao, D.P. Monetary Policy Uncertainty, Default Risks, and Macroeconomic Dynamics. Econ. Res. J. 2019, 3, 119–134. [Google Scholar]

- Wang, L.Y.; Ji, Y. Fiscal Volatility and Fiscal Roles: Based on Open Economy DSGE Model. Econ. Res. J. 2019, 6, 121–135. [Google Scholar]

- Mei, D.Z.; Zhao, X.J. Country Portfolio and Business Cycle Transmission. Econ. Res. J. 2015, 4, 62–76. [Google Scholar]

- Li, X.Y. Dynamic Stochastic General Equilibrium Model: Theory, Methodology, and Dynare Practice, 1st ed.; Tsinghua University Press: Beijing, China, 2018. [Google Scholar]

- Kang, L.; Gong, L.T. Financial Frictions, Net Worth of Bank, and Transmission of International Crisis: Based on Multi-sector DSGE Model Analysis. Econ. Res. J. 2014, 5, 147–159. [Google Scholar]

- Burriel, P.; Fernández-Villaverde, J.; Rubio-Ramírez, J.F. MEDEA: A DSGE Model for the Spanish Economy. SERIEs 2010, 1, 175–243. [Google Scholar] [CrossRef]

- Sheen, J.; Wang, B.Z. An Estimated Small Open Economy Model with Labour Market Frictions. In Dynare Working Papers Series; CEPREMAP: Paris, France, 2014. [Google Scholar]

- Wang, X.; Wang, L.; Peng, Y.L.; Song, X.F. Comparative Study of China’s Monetary Policy Roles: On the Perspective of Three Roles Based on the DSGE Model. Econ. Res. J. 2017, 9, 24–38. [Google Scholar]

- Deng, H.L.; Chen, L.Y. Labor Productivity Shock, Wage Stickiness, and Real Business Cycle in China. China Ind. Econ. 2019, 1, 23–42. [Google Scholar]

| Country | (%) | (%) | Informality (%) | ||

|---|---|---|---|---|---|

| Emerging | |||||

| Argentina | 3.47 | 6.30 | 1.82 | −0.62 | 25.3 (45) |

| Brazil | 1.90 | 10.00 | 5.27 | −0.38 | 39.0 (105) |

| Chile | 1.80 | 10.56 | 5.88 | −0.71 | 19.3 (35) |

| Czech Republic | 1.88 | 12.49 | 6.64 | −0.58 | 18.4 (27) |

| Hungary | 1.40 | 6.44 | 4.59 | −0.37 | 24.4 (43) |

| Israel | 1.69 | 8.67 | 5.13 | −0.33 | 22.0 (38) |

| Malaysia | 2.14 | 7.36 | 3.44 | −0.43 | 30.9 (65) |

| Mexico | 3.24 | 12.62 | 3.89 | −0.35 | 30.0 (62) |

| Peru | 1.46 | 5.28 | 3.61 | −0.34 | 58.0 (147) |

| Philippines | 1.04 | 7.60 | 7.29 | −0.05 | 41.6 (115) |

| Slovakia | 2.29 | 9.34 | 4.07 | −0.66 | 18.1 (25) |

| Slovenia | 1.99 | 9.21 | 4.63 | −0.69 | 26.2 (48) |

| Thailand | 2.33 | 13.31 | 5.72 | −0.29 | 50.6 (143) |

| Turkey | 3.71 | 10.48 | 2.83 | −0.78 | 31.3 (68) |

| Mean | 2.17 | 9.26 | 4.63 | −0.47 | - |

| Median | 1.94 | 9.28 | 4.61 | −0.41 | - |

| Advanced | |||||

| Australia | 1.20 | 9.04 | 7.51 | −0.71 | 14.0 (12) |

| Austria | 1.06 | 9.36 | 8.81 | −0.33 | 9.7 (4) |

| Belgium | 0.96 | 7.37 | 7.65 | −0.59 | 8.5 (1) |

| Canada | 1.44 | 8.26 | 5.74 | −0.86 | 21.9 (38) |

| Denmark | 1.30 | 11.21 | 8.61 | −0.68 | 17.7 (22) |

| Finland | 2.32 | 14.82 | 6.38 | −0.72 | 17.7 (21) |

| Ireland | 3.04 | 10.73 | 3.53 | −0.52 | 15.7 (17) |

| Netherlands | 1.21 | 10.92 | 9.01 | −0.70 | 13.2 (11) |

| New Zealand | 1.35 | 10.71 | 7.94 | −0.42 | 12.4 (6) |

| Norway | 1.80 | 14.29 | 7.93 | −0.40 | 18.7 (30) |

| Portugal | 1.46 | 8.35 | 5.72 | −0.80 | 23.0 (42) |

| Spain | 1.32 | 9.09 | 6.89 | −0.72 | 22.5 (40) |

| Sweden | 1.64 | 14.58 | 8.87 | −0.48 | 18.8 (31) |

| Switzerland | 1.14 | 15.74 | 13.80 | −0.70 | 8.5 (1) |

| Mean | 1.52 | 11.03 | 7.74 | −0.62 | - |

| Median | 1.33 | 10.72 | 7.79 | −0.69 | - |

| Country | (%) | (%) | Informality (%) | ||

|---|---|---|---|---|---|

| Emerging | |||||

| China | 1.2 | 2.3 | 1.92 | −0.51 | 12.7 (9) |

| Advanced | |||||

| Australia | 0.47 | 5.4 | 11.5 | −0.46 | 14.0 (12) |

| USA | 1.1 | 10.7 | 9.7 | −0.86 | 8.6 (2) |

| Num. | Parameters | Values | References | |

|---|---|---|---|---|

| 1 | habit formation parameter | h | 0.7 | Wang et al. [29] |

| 2 | discount factor | 0.99 | Wang and Ji [30] | |

| 3 | quadratic portfolio adjustment cost coefficient | 0.6 | Chang et al. [22] | |

| 4 | labor utility constant | 0.1 | Mei and Zhao [31] | |

| 5 | real investment adjustment cost constant | 0.25 | Li [32] | |

| 6 | Frisch elasticity | 2 | Wang et al. [29] | |

| 7 | capital depreciation rate | 0.025 | Kang and Gong [33] | |

| 8 | capital share of production function | 0.4 | Kang and Gong [33] | |

| 9 | fiscal role coefficient | Tp | 0.05 | Burriel et al. [34] |

| 10 | job separation rate | 0.1 | Sheen and Wang [35] | |

| 11 | wage rate of unregistered employment worker | 0.6 | Real data | |

| 12 | hiring cost curvature parameter | 1 | Sheen and Wang [35] | |

| 13 | Taylor monetary role inflation response parameter | 1.5 | Wang et al. [36] | |

| 14 | Taylor monetary role output response parameter | 0.25 | Wang et al. [36] | |

| 15 | home bias in domestic consumption | 0.75 | Deng and Chen [37] | |

| 16 | home bias in domestic investment | 0.84 | Deng and Chen [37] | |

| 17 | steady-state ratio of domestic bonds holding | 0.9 | Chang et al. [22] | |

| 18 | steady-state markup of domestic goods market | 10/9 | Li [32] | |

| Num. | Parameters | Posterior Mean | Prior Distribution | |||

|---|---|---|---|---|---|---|

| Type | Mean | S.d. | ||||

| 1 | autoregressive coefficient of foreign interest rate shock | 0.6147 | Beta | 0.5 | 0.2 | |

| 2 | autoregressive coefficient of world output shock | 0.4983 | Beta | 0.5 | 0.2 | |

| 3 | autoregressive coefficient of world inflation shock | 0.8958 | Beta | 0.5 | 0.2 | |

| 4 | autoregressive coefficient of technology shock | 0.4938 | Beta | 0.5 | 0.2 | |

| 5 | autoregressive coefficient of capital utilization rate shock | 0.5032 | Beta | 0.5 | 0.2 | |

| 6 | autoregressive coefficient of investment-specific technology shock | 0.2309 | Beta | 0.5 | 0.2 | |

| 7 | autoregressive coefficient of Taylor monetary role | 0.4875 | Beta | 0.5 | 0.2 | |

| 8 | autoregressive coefficient of government expenditure shock | 0.4443 | Beta | 0.5 | 0.2 | |

| 9 | autoregressive coefficient of markup shock of domestic goods market | 0.8025 | Beta | 0.5 | 0.2 | |

| 10 | autoregressive coefficient of markup shock of export goods market | 0.6153 | Beta | 0.5 | 0.2 | |

| 11 | autoregressive coefficient of markup shock of import goods market | 0.5752 | Beta | 0.5 | 0.2 | |

| 12 | domestic goods price indexation | 0.4092 | Beta | 0.5 | 0.2 | |

| 13 | import goods price indexation | 0.3589 | Beta | 0.5 | 0.2 | |

| 14 | export goods price indexation | 0.4588 | Beta | 0.5 | 0.2 | |

| 15 | Calvo domestic goods price parameter | 0.0431 | Beta | 0.5 | 0.2 | |

| 16 | Calvo import goods price parameter | 0.3263 | Beta | 0.5 | 0.2 | |

| 17 | Calvo export goods price parameter | 0.5945 | Beta | 0.5 | 0.2 | |

| 18 | steady-state markup of import goods market | 2.2938 | Inv_gamma | 1.2 | 2 | |

| 19 | steady-state markup of export goods market | 1.2012 | Inv_gamma | 1.2 | 0.1 | |

| 20 | degree of the real wage rigidity | 0.0482 | Beta | 0.5 | 0.2 | |

| 21 | elasticity of substitution on domestic final consumption goods | 1.9034 | Inv_gamma | 1.42 | 2 | |

| 22 | elasticity of substitution on domestic final investment goods | 9.2064 | Inv_gamma | 1.42 | 2 | |

| 23 | elasticity of substitution on export goods | 1.4277 | Inv_gamma | 1.5 | 0.1 | |

| 24 | standard deviation of markup shock of domestic goods market | 0.0108 | Inv_gamma | 0.002 | 2 | |

| 25 | standard deviation of markup shock of import goods market | 0.0576 | Inv_gamma | 0.002 | 2 | |

| 26 | standard deviation of markup shock of export goods market | 0.0689 | Inv_gamma | 0.002 | 2 | |

| 27 | standard deviation of foreign interest rate shock | 0.0015 | Inv_gamma | 0.002 | 2 | |

| 28 | standard deviation of technology shock | 0.0015 | Inv_gamma | 0.002 | 2 | |

| 29 | standard deviation of world output shock | 0.0014 | Inv_gamma | 0.002 | 2 | |

| 30 | standard deviation of world inflation shock | 0.0040 | Inv_gamma | 0.002 | 2 | |

| 31 | standard deviation of capital utilization rate shock | 0.0014 | Inv_gamma | 0.002 | 2 | |

| 32 | standard deviation of investment-specific technology shock | 0.0197 | Inv_gamma | 0.002 | 2 | |

| 33 | standard deviation of government expenditure shock | 0.0088 | Inv_gamma | 0.002 | 2 | |

| 34 | standard deviation of monetary policy shock | 0.0084 | Inv_gamma | 0.002 | 2 | |

| Targeted Moments | Real Data | Baseline Model |

|---|---|---|

| 0.012 | 0.019 | |

| 0.019 | 0.031 | |

| 1.58 | 1.63 | |

| −0.51 | −0.47 |

| Targeted Moments | Real Data | Modified Model |

|---|---|---|

| 0.019 | 0.082 | |

| 1.58 | 3.73 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sun, Z. Unregistered Employment, Lower Volatility of Unemployment Rate and Sustainable Development of the Chinese Labor Market. Sustainability 2023, 15, 377. https://doi.org/10.3390/su15010377

Sun Z. Unregistered Employment, Lower Volatility of Unemployment Rate and Sustainable Development of the Chinese Labor Market. Sustainability. 2023; 15(1):377. https://doi.org/10.3390/su15010377

Chicago/Turabian StyleSun, Zhaojun. 2023. "Unregistered Employment, Lower Volatility of Unemployment Rate and Sustainable Development of the Chinese Labor Market" Sustainability 15, no. 1: 377. https://doi.org/10.3390/su15010377

APA StyleSun, Z. (2023). Unregistered Employment, Lower Volatility of Unemployment Rate and Sustainable Development of the Chinese Labor Market. Sustainability, 15(1), 377. https://doi.org/10.3390/su15010377