Leveraging Complementary Resources through Relational Capital to Improve Alliance Performance under an Uncertain Environment: A Moderated Mediation Analysis

Abstract

1. Introduction

2. Literature Review and Hypotheses

2.1. Resource Complementarity, Relational Capital, and Alliance Performance

2.2. The Moderating Effects of Environmental Dynamism and Environmental Hostility

2.3. The Moderated Mediation Model

3. Methodology

3.1. Research Design, Samples and Data Collection

3.2. Measures

3.2.1. Dependent Variable

3.2.2. Independent Variable

3.2.3. Control Variable

4. Results

4.1. Reliability and Validity

4.2. Assessment of Common Method Bias (CMV)

4.3. Hypotheses Tests

5. Discussion

5.1. Theoretical Contributions

5.2. Managerial Implications

5.3. Limitations and Directions for Future Research

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Gulati, R. Alliances and networks. Strateg. Manag. J 1998, 19, 293–317. [Google Scholar] [CrossRef]

- Larsson, R.; Bengtsson, L.; Henriksson, K.; Sparks, J. The interorganizational learning dilemma: Collective knowledge development in strategic alliances. Organ. Sci. 1998, 9, 285–305. [Google Scholar] [CrossRef]

- Gulati, R.; Wohlgezogen, F.; Zhelyazkov, P. The Two Facets of Collaboration: Cooperation and Coordination in Strategic Alliances. Acad. Manag. Ann. 2012, 6, 531–583. [Google Scholar] [CrossRef]

- Das, T.K.; Teng, B.S. A resource-based theory of strategic alliances. J. Manag. 2000, 26, 31–61. [Google Scholar] [CrossRef]

- Robson, M.J.; Katsikeas, C.S.; Schlegelmilch, B.B.; Pramböck, B. Alliance capabilities, interpartner attributes, and performance outcomes in international strategic alliances. J. World Bus. 2019, 54, 137–153. [Google Scholar] [CrossRef]

- Park, N.K.; Mezias, J.M.; Song, J. A resource-based view of strategic alliances and firm value in the electronic marketplace. J. Manag. 2004, 30, 7–27. [Google Scholar] [CrossRef]

- Clarke, A.; MacDonald, A. Outcomes to Partners in Multi-Stakeholder Cross-Sector Partnerships: A Resource-Based View. Bus. Soc. 2019, 58, 298–332. [Google Scholar] [CrossRef]

- Li, L.W.; Jiang, F.F.; Pei, Y.L.; Jiang, N.Q. Entrepreneurial orientation and strategic alliance success: The contingency role of relational factors. J. Bus. Res. 2017, 72, 46–56. [Google Scholar] [CrossRef]

- Jiang, X.; Bao, Y.C.; Xie, Y.; Gao, S.X. Partner trustworthiness, knowledge flow in strategic alliances, and firm competitiveness: A contingency perspective. J. Bus. Res 2016, 69, 804–814. [Google Scholar] [CrossRef]

- Blonska, A.; Storey, C.; Rozemeijer, F.; Wetzels, M.; de Ruyter, K. Decomposing the effect of supplier development on relationship benefits: The role of relational capital. Ind. Mark. Manag. 2013, 42, 1295–1306. [Google Scholar] [CrossRef]

- Sambasivan, M.; Siew-Phaik, L.; Mohamed, Z.A.; Leong, Y.C. Factors influencing strategic alliance outcomes in a manufacturing supply chain: Role of alliance motives, interdependence, asset specificity and relational capital. Int. J. Prod. Econ. 2013, 141, 339–351. [Google Scholar] [CrossRef]

- Sarkar, M.B.; Echambadi, R.; Cavusgil, S.T.; Aulakh, P.S. The influence of complementarity, compatibility, and relationship capital on alliance performance. J. Acad. Mark. Sci. 2001, 29, 358–373. [Google Scholar] [CrossRef]

- Chen, T.-Y.; Liu, H.-H.; Hsieh, W.-L. The influence of partner characteristics and relationship capital on the performance of international strategic alliances. J. Relatsh. Mark. 2009, 8, 231–252. [Google Scholar] [CrossRef]

- Cullen, J.B.; Johnson, J.L.; Sakano, T. Success through commitment and trust: The soft side of strategic alliance management. J. World Bus. 2000, 35, 223–240. [Google Scholar] [CrossRef]

- Shymko, Y.; Diaz, A. A resource dependence, social network and contingency model of sustainability in supply chain alliances. Int. J. Bus. Excell. 2012, 5, 502–520. [Google Scholar] [CrossRef]

- Negandhi, A.R.; Reimann, B.C. A contingency theory of organization re-examined in the context of a developing country. Acad. Manag. J. 1972, 15, 137–146. [Google Scholar] [CrossRef]

- Donaldson, L. The contingency theory of organizational design: Challenges and opportunities. In Organization Design; Springer: Boston, MA, USA, 2006; pp. 19–40. [Google Scholar] [CrossRef]

- Fredericks, E. Infusing flexibility into business-to-business firms: A contingency theory and resource-based view perspective and practical implications. Ind. Mark. Manag. 2005, 34, 555–565. [Google Scholar] [CrossRef]

- Van de Ven, A.H.; Ganco, M.; Hinings, C.R. Returning to the frontier of contingency theory of organizational and institutional designs. Acad. Manag. Ann. 2013, 7, 393–440. [Google Scholar] [CrossRef]

- Lin, Z.; Yang, H.B.; Arya, B. Alliance Partners and Firm Performance: Resource Complementarity and Status Association. Strateg. Manag. J. 2009, 30, 921–940. [Google Scholar] [CrossRef]

- Johnson, J.L.; Cullen, J.B.; Sakano, T.; Takenouchi, H. Setting the stage for trust and strategic integration in Japanese-US cooperative alliances. J. Int. Bus. Stud. 1996, 27, 981–1004. [Google Scholar] [CrossRef]

- Dyer, J.H.; Singh, H. The relational view: Cooperative strategy and sources of interorganizational competitive advantage. Acad. Manag. Rev. 1998, 23, 660–679. [Google Scholar] [CrossRef]

- Kale, P.; Singh, H.; Perlmutter, H. Learning and protection of proprietary assets in strategic alliances: Building relational capital. Strateg. Manag. J 2000, 21, 217–237. [Google Scholar] [CrossRef]

- Khalid, S.; Ali, T. An integrated perspective of social exchange theory and transaction cost approach on the antecedents of trust in international joint ventures. Int. Bus. Rev. 2017, 26, 491–501. [Google Scholar] [CrossRef]

- Dyer, J.H.; Singh, H.; Hesterly, W.S.J.S. The relational view revisited: A dynamic perspective on value creation and value capture. Strateg. Manag. J. 2018, 39, 3140–3162. [Google Scholar] [CrossRef]

- Das, T.K.; Teng, B.-S. Partner analysis and alliance performance. Scand. J. Manag. 2003, 19, 279–308. [Google Scholar] [CrossRef]

- Mohr, J.; Spekman, R. Characteristics of partnership success: Partnership attributes, communication behavior, and conflict resolution techniques. Strateg. Manag. J. 1994, 15, 135–152. [Google Scholar] [CrossRef]

- Mohr, J.; Fisher, R.; Nevin, J. Collaborative Communication in Interfirm Relationships: Moderating Effects of Integration and Control. J. Mark. 1996, 60, 103–115. [Google Scholar] [CrossRef]

- Handoko, I.; Bresnen, M.; Nugroho, Y. Knowledge exchange and social capital in supply chains. Int. J. Oper. Prod. Manag. 2018, 38, 90–108. [Google Scholar] [CrossRef]

- Luo, Y.D. An integrated anti-opportunism system in international exchange. J. Int. Bus. Stud. 2007, 38, 855–877. [Google Scholar] [CrossRef]

- Liu, C.-L.E.; Ghauri, P.N.; Sinkovics, R.R. Understanding the impact of relational capital and organizational learning on alliance outcomes. J. World Bus. 2010, 45, 237–249. [Google Scholar] [CrossRef]

- Morgan, R.M.; Hunt, S.D. The commitment-trust theory of relationship marketing. J. Mark. 1994, 58, 20–38. [Google Scholar] [CrossRef]

- Sahadev, S. Economic satisfaction and relationship commitment in channels—The moderating role of environmental uncertainty, collaborative communication and coordination strategy. Eur. J. Mark. 2008, 42, 178–195. [Google Scholar] [CrossRef]

- Lavie, D.; Haunschild, P.R.; Khanna, P. Organizational differences, relational mechanisms, and alliance performance. Strateg. Manag. J. 2012, 33, 1453–1479. [Google Scholar] [CrossRef]

- Zhao, X.; Huo, B.; Flynn, B.B.; Yeung, J.H.Y. The impact of power and relationship commitment on the integration between manufacturers and customers in a supply chain. J. Oper. Manag. 2008, 26, 368–388. [Google Scholar] [CrossRef]

- Huo, B.; Zhang, C.; Zhao, X. The effect of IT and relationship commitment on supply chain coordination: A contingency and configuration approach. Inf. Manag. Decis. 2015, 52, 728–740. [Google Scholar] [CrossRef]

- Anh, N.T.M.; Hui, L.; Khoa, V.D.; Mehmood, S. Relational capital and supply chain collaboration for radical and incremental innovation An empirical study in China. Asia Pac. J. Mark. Logist. 2019, 31, 1076–1094. [Google Scholar] [CrossRef]

- Jansen, J.J.P.; Van den Bosch, F.A.J.; Volberda, H.W. Exploratory innovation, exploitative innovation, and performance: Effects of organizational antecedents and environmental moderators. Manag. Sci. 2006, 52, 1661–1674. [Google Scholar] [CrossRef]

- Frank, H.; Guttel, W.; Kessler, A. Environmental dynamism, hostility, and dynamic capabilities in medium-sized enterprises. Int. J. Entrep. Innov. 2017, 18, 185–194. [Google Scholar] [CrossRef]

- Heavey, C.; Simsek, Z.; Roche, F.; Kelly, A. Decision comprehensiveness and corporate entrepreneurship: The moderating role of managerial uncertainty preferences and environmental dynamism. J. Manag. Stud. 2009, 46, 1289–1314. [Google Scholar] [CrossRef]

- Hambrick, D.C. Environmental scanning and organizational strategy. Strateg. Manag. J. 1982, 3, 159–174. [Google Scholar] [CrossRef]

- Powell, W.W.; Koput, K.W.; Smith-Doerr, L. Interorganizational collaboration and the locus of innovation: Networks of learning in biotechnology. Adm. Sci. Q. 1996, 41, 116–145. [Google Scholar] [CrossRef]

- Xu, S.C.; Cavusgil, E. Knowledge breadth and depth development through successful R&D alliance portfolio configuration: An empirical investigation in the pharmaceutical industry. J. Bus. Res. 2019, 101, 402–410. [Google Scholar] [CrossRef]

- Bakker, R.M.; Knoben, J. Built to Last or Meant to End: Intertemporal Choice in Strategic Alliance Portfolios. Organ. Sci. 2015, 26, 256–276. [Google Scholar] [CrossRef]

- Robertson, T.S.; Gatignon, H. Technology development mode: A transaction cost conceptualization. Strateg. Manag. J. 1998, 19, 515–531. [Google Scholar] [CrossRef]

- Perry, M.L.; Sengupta, S.; Krapfel, R. Effectiveness of horizontal strategic alliances in technologically uncertain environments: Are trust and commitment enough? J. Bus. Res. 2004, 57, 951–956. [Google Scholar] [CrossRef]

- Krishnan, R.; Martin, X.; Noorderhaven, N.G. When does trust matter to alliance performance? Acad. Manag. J. 2006, 49, 894–917. [Google Scholar] [CrossRef]

- Krishnan, R.; Geyskens, I.; Steenkamp, J.B.E.M. The Effectiveness of Contractual and Trust-Based Governance in Strategic Alliances under Behavioral and Environmental Uncertainty. Strateg. Manag. J. 2016, 37, 2521–2542. [Google Scholar] [CrossRef]

- Mura, M.; Radaelli, G.; Spiller, N.; Lettieri, E.; Longo, M. The effect of social capital on exploration and exploitation: Modelling the moderating effect of environmental dynamism. J. Intellect. Cap. 2014, 15, 430–450. [Google Scholar] [CrossRef]

- Strobl, A.; Bauer, F.; Matzler, K. The impact of industry-wide and target market environmental hostility on entrepreneurial leadership in mergers and acquisitions. J. World Bus. 2020, 55, 100931. [Google Scholar] [CrossRef]

- Covin, J.G.; Slevin, D.P. Strategic management of small firms in hostile and benign environments. Strateg. Manag. J. 1989, 10, 75–87. [Google Scholar] [CrossRef]

- Miller, D.; Friesen, P.H. Strategy-making and environment: The third link. Strateg. Manag. J. 1983, 4, 221–235. [Google Scholar] [CrossRef]

- Zahra, S.A.; Bogner, W.C. Technology strategy and software new ventures’ performance: Exploring the moderating effect of the competitive environment. J. Bus. Ventur. 2000, 15, 135–173. [Google Scholar] [CrossRef]

- Dutta, D.K. Hypercompetitive environments, coopetition strategy, and the role of complementary assets in building competitive advantage: Insights from the resource-based view. Strateg. Manag. Rev. 2015, 9, 1–11. [Google Scholar] [CrossRef]

- Baum, J.A.; Korn, H. Competitive dynamics of interfirm rivalry. Acad. Manag. J. 1996, 39, 255–291. [Google Scholar] [CrossRef]

- Lahiri, S.; Kedia, B. Determining quality of business-to-business relationships: A study of Indian IT-enabled service providers. Eur. Manag. J. 2011, 29, 11–24. [Google Scholar] [CrossRef]

- Zhang, C.; Cavusgil, S.T.; Roath, A.S. Manufacturer governance of foreign distributor relationships: Do relational norms enhance competitiveness in the export market? J. Int. Bus. Stud. 2003, 34, 550–566. [Google Scholar] [CrossRef]

- Fang, E. The Effect of Strategic Alliance Knowledge Complementarity on New Product Innovativeness in China. Organ. Sci. 2011, 22, 158–172. [Google Scholar] [CrossRef]

- Wang, L.W.; Yeung, J.H.Y.; Zhang, M. The impact of trust and contract on innovation performance: The moderating role of environmental uncertainty. Int. J. Prod. Econ. 2011, 134, 114–122. [Google Scholar] [CrossRef]

- Bello, D.; Leung, K.; Radebaugh, L.; Tung, R.L.; van Witteloostuijn, A. From the Editors: Student samples in international business research. J. Int. Bus. Stud. 2009, 40, 361–364. [Google Scholar] [CrossRef]

- Brislin, R.W. Translation and content analysis of oral and written material. In Handbook of Cross-Cultural Psychology; Allyn and Bacon: Boston, MA, USA, 1980; Volume 2, pp. 349–444. [Google Scholar]

- Saxton, T. The effects of partner and relationship characteristics on alliance outcomes. Acad. Manag. J. 1997, 40, 443–461. [Google Scholar] [CrossRef]

- Sambasivan, M.; Siew-Phaik, L.; Mohamed, Z.A.; Leong, Y.C. Impact of interdependence between supply chain partners on strategic alliance outcomes Role of relational capital as a mediating construct. Manag. Decis 2011, 49, 548–569. [Google Scholar] [CrossRef]

- Lambe, C.J.; Spekman, R.E.; Hunt, S.D. Alliance competence, resources, and alliance success: Conceptualization, measurement, and initial test. J. Acad. Mark. Sci. 2002, 30, 141–158. [Google Scholar] [CrossRef]

- Deitz, G.D.; Tokman, M.; Richey, R.G.; Morgan, R.M. Joint venture stability and cooperation: Direct, indirect and contingent effects of resource complementarity and trust. Ind. Mark. Manag. 2010, 39, 862–873. [Google Scholar] [CrossRef]

- Charterina, J.; Landeta, J. The pool effect of dyad-based capabilities on seller firms’ innovativeness. Eur. J. Innov. Manag. 2010, 13, 172–196. [Google Scholar] [CrossRef]

- Miller, D. The structural and environmental correlates of business strategy. Strateg. Manag. J. 1987, 8, 55–76. [Google Scholar] [CrossRef]

- Li, S.H.; Lin, B.S. Accessing information sharing and information quality in supply chain management. Decis. Support Syst. 2006, 42, 1641–1656. [Google Scholar] [CrossRef]

- Dyer, J.H.; Chu, W.J. The determinants of trust in supplier-automaker relationships in the US, Japan, and Korea. J. Int. Bus. Stud. 2000, 31, 259–285. [Google Scholar] [CrossRef]

- Jap, S.D.; Anderson, E. Safeguarding interorganizational performance and continuity under ex post opportunism. Manag. Sci. 2003, 49, 1684–1701. [Google Scholar] [CrossRef]

- Nunnally, J.C. Psychometric Theory, 3rd ed.; Tata McGraw-Hill Education: New York, NY, USA, 1994. [Google Scholar]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; Organ, D.W. Self-reports in organizational research: Problems and prospects. J. Manag. 1986, 12, 531–544. [Google Scholar] [CrossRef]

- Harman, H.H. Modem Factor Analysis; University of Chicago: Chicago, IL, USA, 1967. [Google Scholar]

- Podsakoff, P.M.; MacKenzie, S.B.; Podsakoff, N.P. Sources of method bias in social science research and recommendations on how to control it. Annu. Rev. Psychol. 2012, 63, 539–569. [Google Scholar] [CrossRef] [PubMed]

- Podsakoff, P.M.; MacKenzie, S.B.; Lee, J.Y.; Podsakoff, N.P. Common method biases in behavioral research: A critical review of the literature and recommended remedies. J. Appl. Psychol. 2003, 88, 879–903. [Google Scholar] [CrossRef] [PubMed]

- Richardson, H.A.; Simmering, M.J.; Sturman, M.C. A Tale of Three Perspectives Examining Post Hoc Statistical Techniques for Detection and Correction of Common Method Variance. Organ. Res. Methods 2009, 12, 762–800. [Google Scholar] [CrossRef]

- Aiken, L.S.; West, S.G.; Reno, R.R. Multiple Regression: Testing and Interpreting Interactions; Sage: Newbury Park, CA, USA, 1991. [Google Scholar]

- Baron, R.M.; Kenny, D.A. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Pers. Soc. Psychol. 1986, 51, 1173. [Google Scholar] [CrossRef] [PubMed]

- Preacher, K.J.; Hayes, A.F. Asymptotic and resampling strategies for assessing and comparing indirect effects in multiple mediator models. Behav. Res. Methods 2008, 40, 879–891. [Google Scholar] [CrossRef]

- Lioukas, C.S.; Reuer, J.J.; Zollo, M. Effects of Information Technology Capabilities on Strategic Alliances: Implications for the Resource-Based View. J. Manag. Stud. 2016, 53, 161–183. [Google Scholar] [CrossRef]

- Bicen, P.; Hunt, S.D.; Madhavaram, S. Coopetitive innovation alliance performance: Alliance competence, alliance’s market orientation, and relational governance. J. Bus. Res. 2021, 123, 23–31. [Google Scholar] [CrossRef]

- Lee, W.-L. Environmental uncertainty affects inter-organisational partner selection: The mediating role of cost and strategy in alliance motivations among SMEs. J. Manag. 2014, 20, 38–55. [Google Scholar] [CrossRef]

- Murray, J.Y.; Kotabe, M. Performance implications of strategic fit between alliance attributes, and alliance forms. J. Bus. Res. 2005, 58, 1525–1533. [Google Scholar] [CrossRef]

- Fourné, S.P.; Rosenbusch, N.; Heyden, M.L.; Jansen, J.J. Structural and contextual approaches to ambidexterity: A meta-analysis of organizational and environmental contingencies. Eur. Manag. J. 2019, 37, 564–576. [Google Scholar] [CrossRef]

- Lee, P.K.; Yeung, A.C.; Cheng, T.E. Supplier alliances and environmental uncertainty: An empirical study. Int. J. Prod. Econ. 2009, 120, 190–204. [Google Scholar] [CrossRef]

- Long, Y.; Li, P.; You, B. Knowledge transfer, governance mechanisms in alliance and environmental uncertainty: An empirical study. Chin. Manag. Stud. 2014, 8, 438–472. [Google Scholar] [CrossRef]

- David, R.J.; Han, S.K. A systematic assessment of the empirical support for transaction cost economics. Strateg. Manag. J. 2004, 25, 39–58. [Google Scholar] [CrossRef]

- Sivadas, E.; Dwyer, F.R. An examination of organizational factors influencing new product success in internal and alliance-based processes. J. Mark. 2000, 64, 31–49. [Google Scholar] [CrossRef]

| Variables | Items | Cronbach’s α | C.R. | Factor Loading | AVE |

|---|---|---|---|---|---|

| Resource Complementarity | 4 | 0.709 | 0.729 | 0.607–0.768 | 0.411 |

| Environmental Dynamism | 3 | 0.761 | 0.760 | 0.759–0.804 | 0.515 |

| Environmental Hostility | 4 | 0.783 | 0.857 | 0.655–0.811 | 0.475 |

| Communication | 3 | 0.688 | 0.754 | 0.570–0.816 | 0.535 |

| Trust | 6 | 0.907 | 0.884 | 0.675–0.831 | 0.607 |

| Commitment | 4 | 0.824 | 0.820 | 0.626–0.828 | 0.545 |

| Alliance Performance | 5 | 0.884 | 0.914 | 0.703–0.863 | 0.607 |

| RSC | EVD | EVH | CMU | TRS | CMI | APF | |

|---|---|---|---|---|---|---|---|

| RSC | 0.641 | ||||||

| EVD | 0.073 | 0.718 | |||||

| EVH | 0.264 ** | 0.388 ** | 0.689 | ||||

| CMU | 0.406 ** | –0.041 | 0.132 | 0.731 | |||

| TRS | 0.147 * | –0.185 ** | 0.149 * | 0.258 ** | 0.779 | ||

| CMI | 0.254 ** | 0.231 ** | 0.231 ** | 0.323 ** | 0.289 ** | 0.738 | |

| APF | 0.279 ** | –0.134 | 0.129 | 0.307 | 0.517 ** | 0.334 ** | 0.779 |

| Mean | 3.920 | 3.213 | 3.900 | 3.706 | 3.454 | 3.791 | 3.655 |

| S.D. | 0.649 | 0.828 | 0.664 | 0.696 | 0.816 | 0.648 | 0.799 |

| Variables | Relational Capital | Alliance Performance | |||||

|---|---|---|---|---|---|---|---|

| Model 1a | Model 1b | Model 1c | Model 2a | Model 2b | Model 2c | Model 2d | |

| Control variables | |||||||

| Firm age | −0.101 | −0.060 | −0.056 | −0.044 | 0.009 | −0.013 | 0.019 |

| Firm size | 0.162 | 0.109 | 0.095 | 0.080 | −0.014 | 0.040 | −0.018 |

| Firm ownership | 0.068 | 0.095 | 0.080 | −0.060 | 0.071 | −0.040 | −0.091 |

| Alliance types | 0.162 | 0.109 | 0.095 | 0.080 | 0.026 | 0.040 | −0.018 |

| Main effects | |||||||

| Resource complementarity | 0.366 ** | 0.298 ** | 0.274 ** | 0.080 | |||

| Environmental dynamism | −0.183 ** | ||||||

| Environmental hostility | 0.231 ** | ||||||

| Mediating effect | |||||||

| Relational capital | 0.564 ** | 0.532 ** | |||||

| Moderating effects | |||||||

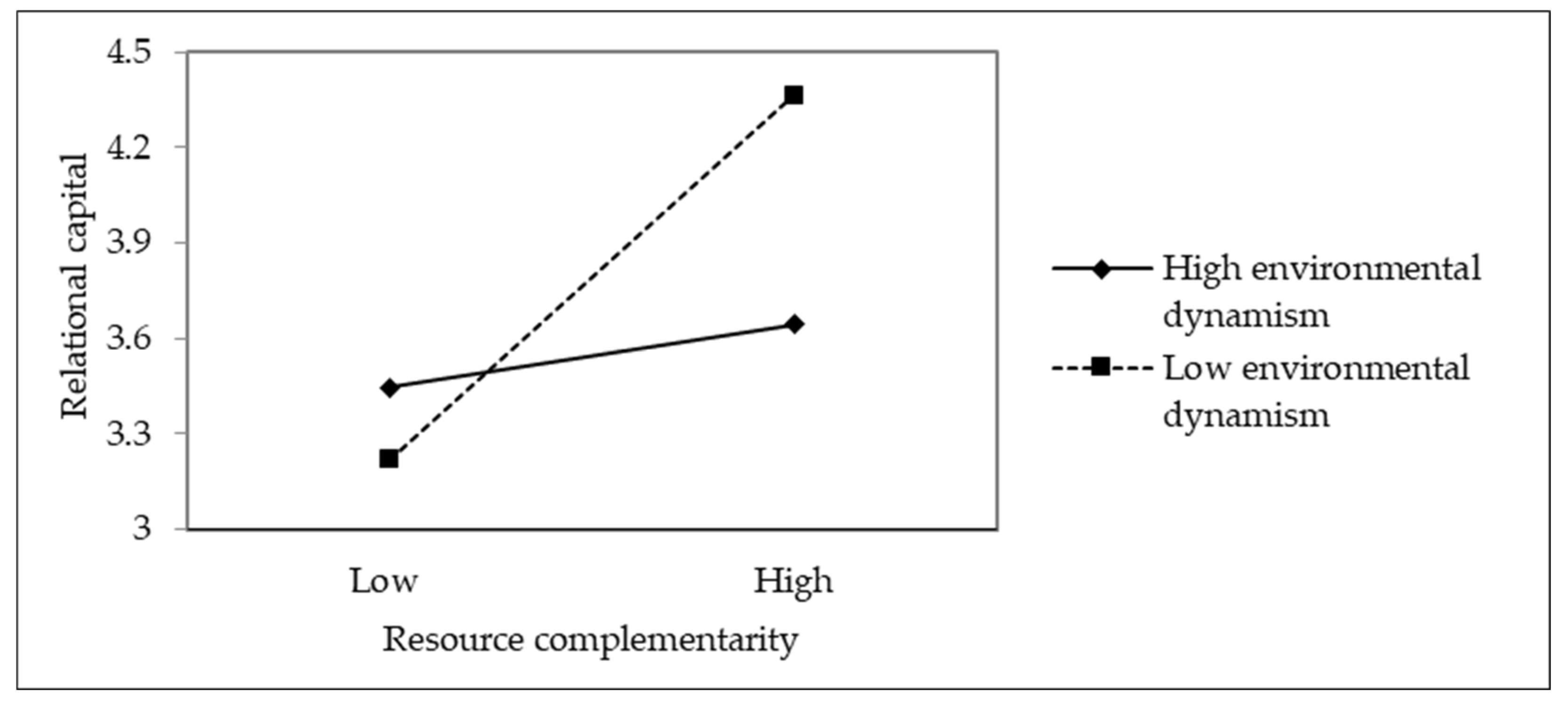

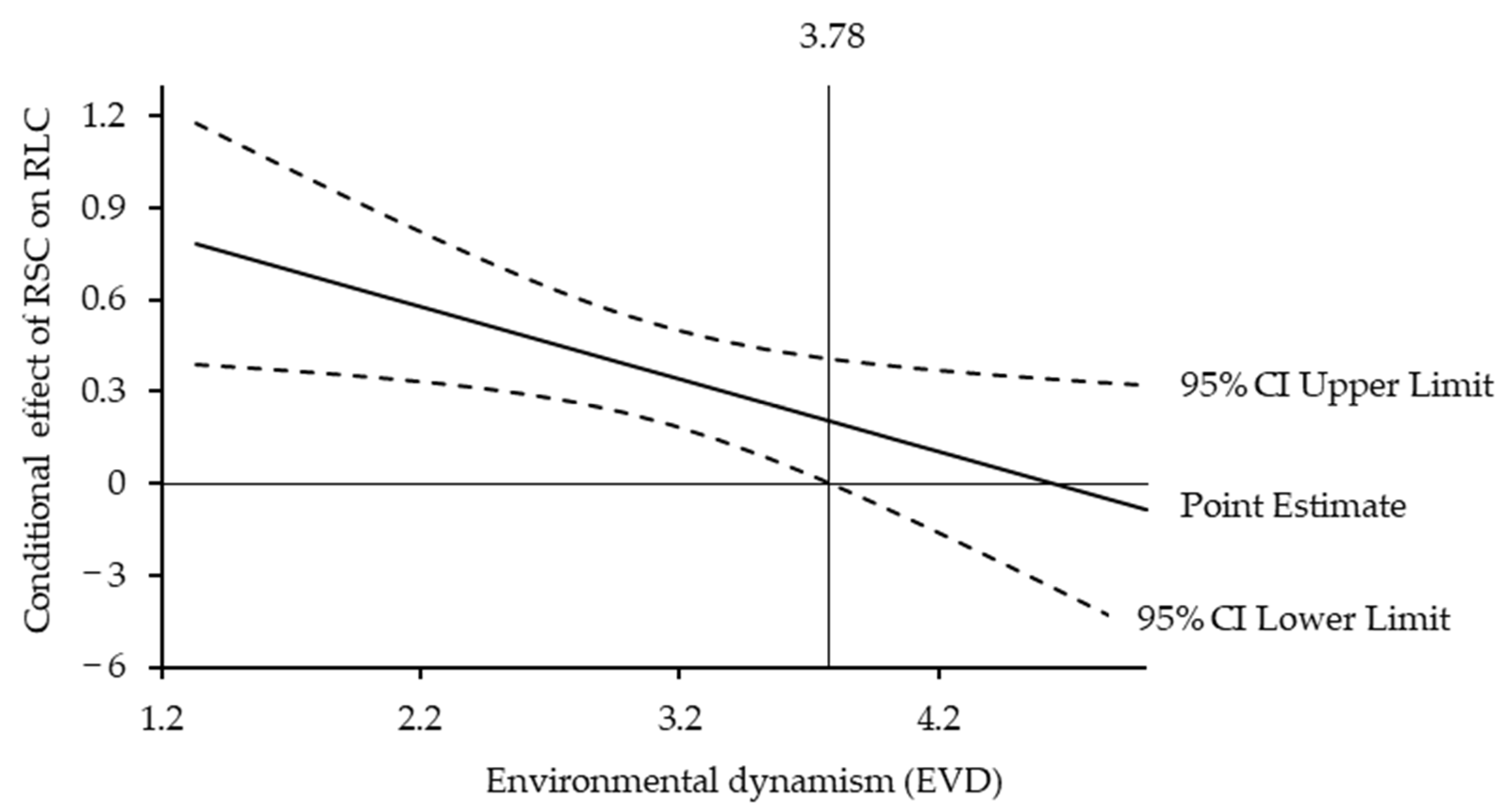

| Resource complementarity × Environmental dynamism | −0.207 ** | ||||||

| Resource complementarity × Environmental hostility | 0.063 | ||||||

| R2 | 0.205 | 0.415 | 0.506 | 0.008 | 0.313 | 0.284 | 0.315 |

| Adjusted R2 | 0.023 | 0.152 | 0.222 | −0.012 | 0.296 | 0.058 | 0.294 |

| F | 2.248 | 8.478 ** | 7.631 ** | 0.398 | 18.588 ** | 3.582 ** | 15.539 ** |

| Path | Effect | BootSE | LLCI | ULCI | |

|---|---|---|---|---|---|

| Mediation Model: Direct effect RSC→APF | 0.098 | 0.078 | −0.056 | 0.252 | |

| indirect effect | |||||

| RSC→RLC→APF | 0.439 | 0.363 | 0.160 | 1.335 | |

| Moderated Mediation Model | |||||

| EVD | EVH | Effect | BootSE | LLCI | ULCI |

| −0.828(-1SD) | −0.665(-1SD) | 0.299 | 0.071 | 0.168 | 0.447 |

| −0.828(-1SD) | 0.000(Mean) | 0.337 | 0.076 | 0.203 | 0.499 |

| −0.828(-1SD) | 0.665(+1SD) | 0.375 | 0.098 | 0.206 | 0.585 |

| 0.000(Mean) | −0.665(-1SD) | 0.159 | 0.069 | 0.029 | 0.295 |

| 0.000(Mean) | 0.000(Mean) | 0.197 | 0.059 | 0.098 | 0.326 |

| 0.000(Mean) | 0.665(+1SD) | 0.235 | 0.073 | 0.112 | 0.398 |

| 0.828(+1SD) | −0.665(-1SD) | 0.019 | 0.110 | −0.205 | 0.231 |

| 0.828(+1SD) | 0.000(Mean) | 0.057 | 0.095 | −0.124 | 0.249 |

| 0.828(+1SD) | 0.665(+1SD) | 0.095 | 0.094 | -0.077 | 0.294 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, X.; Wang, W.; Su, Y. Leveraging Complementary Resources through Relational Capital to Improve Alliance Performance under an Uncertain Environment: A Moderated Mediation Analysis. Sustainability 2023, 15, 310. https://doi.org/10.3390/su15010310

Liu X, Wang W, Su Y. Leveraging Complementary Resources through Relational Capital to Improve Alliance Performance under an Uncertain Environment: A Moderated Mediation Analysis. Sustainability. 2023; 15(1):310. https://doi.org/10.3390/su15010310

Chicago/Turabian StyleLiu, Xian, Wenyu Wang, and Yiyi Su. 2023. "Leveraging Complementary Resources through Relational Capital to Improve Alliance Performance under an Uncertain Environment: A Moderated Mediation Analysis" Sustainability 15, no. 1: 310. https://doi.org/10.3390/su15010310

APA StyleLiu, X., Wang, W., & Su, Y. (2023). Leveraging Complementary Resources through Relational Capital to Improve Alliance Performance under an Uncertain Environment: A Moderated Mediation Analysis. Sustainability, 15(1), 310. https://doi.org/10.3390/su15010310