Abstract

Traditionally, infrastructure has been considered an essential component of a country’s development. Therefore, European Union (EU) Member States (MS) invest heavily in this area. A lot of support for infrastructure development is also directed from the EU Structural Funds (SF). However, the results of previous studies do not fully reveal whether the development of infrastructure contributes to EU MS’ economic growth and what factors mediate this effect. Considering the limitations of previous studies, this article aims to examine whether the development of different types of infrastructure (transport, information and communication technologies (ICT), energy, and water and sanitation) contribute to economic growth and to assess whether government quality affects the growth outcomes of infrastructure. Empirical estimations are based on neoclassical specifications and cover 28 EU countries from 2000 to 2019. Estimates revealed that all types of infrastructure positively correlate with growth but not all correlations are significant. Only mobile cellular, which proxies ICT infrastructure, electricity production, which proxies energy infrastructure, and pipeline transport infrastructure significantly affect economic growth. Water and sanitation infrastructure development do not significantly contribute to EU MS’ economic growth. The institutional environment, i.e., less corruption, has a considerable positive effect on the growth outcomes of electricity production and pipeline transport infrastructure.

1. Introduction

Each country strives for socio-economic prosperity. Core infrastructure that consists of ICT, transport, energy, and water and sanitation, creates necessary conditions for achieving economic development goals. Therefore, EU countries, like others, invest a lot to develop core infrastructure. The EU Structural Funds also provide significant funding for infrastructure projects. For example, the European Commission (EC) has allocated 71 billion euros from the EU Structural Funds budget to develop core infrastructure in EU countries during 2014–2020. EU countries invested an additional 18 billion euros for this purpose. The main purpose of these investments is to encourage the development of lagging countries and regions and reduce the economic disparities between them. Although infrastructure development is obvious, it is unclear whether its main goal is being achieved.

An analysis of previous research on evaluating the growth outcomes of infrastructure development reveals that using different methods (Generalised Method of Moments, Auto Regressive Distributed Lag Model, Fixed effect, Random effect, Ordinary Least square regression) had a positive effect on Gross Domestic Product (GDP) growth. Unfortunately, many studies cover non-EU countries or regions: African countries [1,2,3,4,5], China [6,7,8,9,10,11], India [12,13,14], Pakistan [15,16], Turkey [17], Uganda [18], Indonesia [19], Tunisia [20], a group of Asian countries [21], BRICS countries (Brazil, Russia, India, China and South Africa) [22], or different groups of countries [23,24] (see Table A1 in the Appendix A).

Several studies, which cover some or all EU countries and evaluate the impact of infrastructure development on economic growth, assessed the impact of one type of infrastructure. These studies provide valuable results but the growth outcomes of all types of infrastructure need to be assessed comprehensively in order to be able to formulate policies for allocating limited financial resources and for planning for different types of infrastructure development. It is noteworthy that the European Commission [25], using 1950–2012 data, assessed the impact of two different types of infrastructure development (transport and energy) on per capita GDP in EU-28 countries and found a positive relationship between those variables, but the impact of ICT and water and sanitation infrastructure development has not been assessed. Interesting research by Palei [26] examined how infrastructure development influences 124 countries’ (including EU) competitiveness and found a significant positive relationship. Still, since the paper uses an infrastructure index that includes transport, ICT, and energy infrastructure to proxy the infrastructure, the impact of a particular type on infrastructure is unclear. In summary, there is a lack of research covering different types of infrastructure. This paper fills this research gap.

An analysis of previous studies also reveals heterogeneity of estimated effects. Many studies [27,28,29] that evaluated the impact of transport development on economic growth in EU countries or regions have revealed that transport infrastructure development has a positive effect on economic growth. However, the results are not homogeneous. For example, Luz et al. [30] did not find a relationship between the transport infrastructure index and GDP. Lenz et al. [31] found that railway infrastructure development harms the GDP of Central and Eastern European (CEE) countries that belong to the EU. According to Crescenzi & Rodriguez-Pose’s [32] findings, the impact of road transport infrastructure development on per capita GDP in the regions of EU-15 countries is positive but slightly significant. They conclude that the effects of transport infrastructure depend on the socio-economic conditions, innovation capacity, and the ability to attract migrants. Farhadi’s [33] research results support the findings of Crescenzi & Rodriguez-Pose [32]. The author [33] concludes that transport development positively influences labour and total factor productivity, but not substantially. Kyriacou et al. [34] found a positive relationship between transport infrastructure investment and physical infrastructure development, but the intensity of the effects varies across countries and depends on government quality.

Almost all research [35,36,37,38,39] investigating the economic outcomes of ICT infrastructure development in EU countries found a positive relationship between ICT infrastructure variables and per capita GDP. However, Pahjola [36], in evaluating the impact of information technology spending on GDP per working-age population in 39 countries (including EU-15), found a positive but not significant relationship in most sampled countries.

There are no studies that examine the economic outcomes of the development of energy, water, and sanitation infrastructure in EU countries. Therefore, this research gap should also be filled.

Previous studies have not assessed the possible lagged effects of infrastructure development in EU countries, but studies that cover other countries suggest that the outcomes may be heterogeneous in the short and long run. For example, Muvawala et al. [18] found that expenditure on transport infrastructure has a significant positive impact on Uganda’s GDP growth but negatively affects it in the short run. In addition, investment in the same infrastructure network is usually made over several years, therefore, the effects may occur with a lag.

Considering the results and identified limitations and gaps of previous studies, this paper aims to assess the growth outcomes of different types of core infrastructure development and its relationship with government quality. The decision to investigate the effects of government quality on the growth outcomes of infrastructure development was based on Kyriacou et al.’s [34] findings. If the outcomes of transport infrastructure development depend on government quality, it is likely that this relationship could also exist in the case of other types of infrastructure.

The rest of this paper is organized as follows. Section 2 is dedicated to the theoretical background of the impact of infrastructure on growth. Section 3 presents the methodology for the examination of the growth outcomes of infrastructure. Section 4 presents the results of the evaluation. Section 5 discusses the results. Section 6 provides conclusions.

2. Theoretical Background

On a theoretical level, core infrastructure covering transport, ICT, energy, and water and sanitation, is considered the basis for economic and social prosperity. According to Stupak [40], infrastructure is a critical factor in a country’s wealth. Favourable infrastructure ensures the efficient production of goods and services, reduces production costs, and leads to lower product prices. Nevertheless, the effects of infrastructure development on the economy also manifest through other channels. Ongoing infrastructure projects increase labour demand in the construction and related sectors and reduce the country’s or region’s unemployment level [28]. Infrastructure development may cause economic growth through improved health and education [26] since proper infrastructure provides access to better health and education services. Infrastructure creates conditions for accession to undeveloped regions and increases communication, which ensures knowledge flows from developed areas.

Although all types of infrastructure affect the economy through the abovementioned channels, the impact of each type of infrastructure on economic growth also manifests through specific channels (see Table 1).

Table 1.

The role of core infrastructure in economic growth.

It should be noted that different types of infrastructure are connected. Energy infrastructure covers natural gas, fuels, and electric power networks [44]. The functioning of transportation systems is based on fuel networks; ICT and water supply systems rely on electric power systems. Disruption of the energy system can disrupt other infrastructure systems. On the other hand, the operation of energy, transport, water, and sanitation systems and their management relies on ICT systems. ICT includes software, hardware, networks, data, information collection, transmission, storage, information (data, voice, text, images) provision, and manipulation [20,38]. Developed ICT networks save transaction costs and reduce price dispersion [5]. ICT development effectiveness is related to transport infrastructure. For example, the transportation costs for ICT equipment depend on transport infrastructure and its quality. Developing a separate type of infrastructure can strengthen the total effects of infrastructure on economic growth.

Although infrastructure development is expected to impact economic growth positively, the effect may be reduced by the private investment crowding-out effect. Infrastructure investment is generally a public investment. According to public investment theory, in the long run, a crowding-out effect of private investments [40] could occur.

The real positive effect of infrastructure development on economic growth may be smaller than the potential one due to low government quality [34]. Due to the high level of corruption, the government may direct infrastructure investment to less-productive projects.

3. Methodology

The examination of the impact of infrastructure on growth is based on a neoclassical specification, which is conventional in the related literature [4,11,17,22,28,31,38,39]:

where i stands for the country and t for the period. The dependent variable is the average per capita GDP (Y) growth rate. Variables used to control growth sources, included in the right-hand side of the equation, are presented in Table 2. θt, and μi are time- and country-specific effects, respectively, modelled including time dummies and estimated by Equation (1) using a within estimator. εi,t is the idiosyncratic error term. β and c(.) are parameters to be estimated.

Table 2.

Research variables and summary statistics.

A variable INFR that represents infrastructure as a usual growth factor is added to the right-hand side of Equation (1):

It is assumed that the effect of infrastructure on growth is mediated by the quality of institutions:

where the multiplicative term INFR × inst allows us to examine whether better institutions lead to better growth outcomes of the infrastructure and vice versa. Equation (3) could be slightly rearranged to show that introducing a multiplicative term, i.e., INFR × inst, allows modelling the conditional relationship between INFR and growth, which depends on the quality of institutions:

where γ + φinst is the is the composite slope of growth on infrastructure. For the general estimations, as a proxy for institutional quality, the control of corruption and regulatory quality for the robustness check will be used.

With the introduction of the multiplicative term, not only the slope coefficient becomes conditional, but also the standard error associated with the coefficient. It implies that a certain level of institutional quality could be needed for the positive and significant effects of the infrastructure on growth to appear. In the present research the formulas developed by Brambor et al. [45] will be applied in order to calculate standard errors.

In estimating the equations, it is necessary to select the span of the growth episode (T). Research that uses T = 1 (i.e., annual per capita GDP growth) maximises the sample size [3,18,35,37]. Still, this strategy might lead to estimates that are highly affected by the cyclical patterns of economic fluctuations and endogeneity (since INFR is lagged only by one period with respect to growth). These issues will be addressed by setting T equal to 5 (and to 3 for robustness check), aiming to estimate the effect of the current level of infrastructure (and the other left-hand-side variables) on the 5-year forward-looking average per capita GDP growth rate. Having a relatively short period under investigation instead of non-overlapping growth episodes, as an alternative we decided to use 5-year overlapping growth periods even though the usage of overlapping growth rates as the dependent variable creates a moving average structure in the error term. Following Panizza and Presbitero [46], the Huber–White Sandwich correction is used, which yields almost identical results as Newey and West’s [47] estimator and which allows modelling of the autocorrelation in the error term.

This unbalanced panel data covers 28 EU countries for the period 2000–2019. Data are collected from Eurostat, Our World in data and World Bank databases. Table 2 presents summary statistics of the research variables.

For the infrastructure, many types of variables that could be grouped into a couple of categories are used: ICT, water and sanitation, transport, and energy infrastructure.

4. Results

Panel diagnostics revealed that country-fixed effects are present (see Table 3). Thus, all estimates include country dummies along with the time effects. The estimated coefficients on control variables have a theoretically justified impact on growth and are consistent with previous research. For example, other growth conditions being equal, better institutions (in this case—less corruption) are related to faster growth rates. The negative coefficient on initial per capita GDP indicates that less-developed EU countries experience faster growth rates and thus catch up to more developed ones, i.e., countries are converging in terms of their development level at a rate close to “the legendary 2%” [48]. Growth of the labour force and openness to trade positively correlate with growth, whereas higher rates of inflation, government size, and population growth have a negative effect on economic growth. Evidence of an inverted U-shaped form of the relationship between capital and growth is also found, which is in line with the neoclassical assumption of the diminishing marginal effect of capital on economic growth. The estimated threshold level lies around 23–25%.

Table 3.

Fixed effects estimates of Equations (1) and (2). Dependent variable—5-year forward-looking average per capita GDP growth rate.

A significant effect of human capital, R&D, FDI, population density, and urbanisation level on growth is not found. In the case of human capital, the 5-year period could be too short for capturing its effect. The same could be considered with R&D since this variable is proxied, using an input approach, i.e., investment in R&D activities. The population density and urbanisation level in EU countries did not change much during the analysed period and small variations in the variables were not captured as significant. Considering FDI, it can be argued that the insignificance of the estimated coefficient could be caused by the difference in the effect (some countries might experience positive and some negative growth outcomes of FDI) and by analysing all these effects together they cancel each other out.

Considering the infrastructure, all types of infrastructure positively correlate with growth but not all correlations are significant. Only mobile cellular, electricity production, and pipeline transportation infrastructure have a significant effect on growth, the first two being significant at a marginal 10% level. The estimates show that a 1% increase in mobile cellular subscriptions is associated with an additional 0.024% in economic growth. The development of pipeline infrastructure (1 percent bigger network) is related to a 0.045 percent faster economic growth. One percent larger electricity production capacities boost growth by 0.026%. Table A2 (see Appendix B) presents estimations of Equations (1) and (2) but with a 3-year forward-looking average per capita GDP growth rate as the dependent variable. The results are consistent across two alternative growth episodes, indicating, in most cases, the positive but insignificant effects of different types of infrastructure on growth. Two main explanations of the findings and why they at some point contradict previous ones can be put forward here. First, previous research analysing the effects of infrastructure on current growth rates ignores the potentially arising feedback effects. It means that not only does infrastructure affect growth, but also growth (or lack of growth along with expansionary government policy) creates conditions for the development of infrastructure projects. Second, research that does not control growth factors such as government consumption or capital investment might create an omitted variable bias. It means that the size of infrastructure reflects the effects of government expenditure and capital investment.

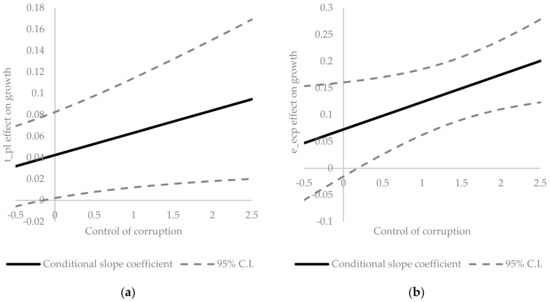

Estimations of Equation (3) show (see Table 4) that the institutional environment (control of corruption) has a significant effect on the growth outcomes of the electricity production and pipeline transportation infrastructure, i.e., the estimated coefficient on the interaction term is positive and significant. Despite the fact that sanitation facilities are not significantly related to economic growth, the institutional environment marginally statistically significantly but positively is associated with this relationship. It could be related to the fact that this type of infrastructure is almost entirely controlled, owned, and developed by governments.

Table 4.

Fixed effect estimates of Equation (3). Dependent variable—5-year forward-looking average per capita GDP growth rate.

Figure 1 shows that a higher control of corruption, i.e., less corruption, increases the effects of infrastructure on growth. Moreover, a low level of control of corruption is related to still positive but insignificant growth outcomes of infrastructure. The results show that large investment in developing electricity production and pipeline transportation infrastructure is justified if corruption is defeated. These results are consistent with estimates using the 3-year instead of 5-year average per capita GDP growth rate (see Table A3 in the Appendix B) and regulatory quality instead of control of corruption to proxy government quality (see Table A4 in the Appendix B).

Figure 1.

The relationship between infrastructure and growth moderated by the quality of institutions; (a) Effect of pipeline transportation infrastructure on growth; (b) Effect of electricity production infrastructure on growth.

5. Discussion

Three variables to proxy ICT infrastructure development have been used: fixed telephone subscription, fixed broadband subscription, and mobile cellular subscription (per 100 people). It was found that only mobile cellular infrastructure significantly impacts growth. Teoder et al. [38] also estimate how different ICT technologies affect economic growth using data from the EU-28 over 2000–2017 and found a strong positive effect. Nevertheless, research [14] concludes that “the magnitude of the effect differs depending on the type of technology examined”. The results of the estimations are close to those of Teoder et al. [38] as they found that the greatest positive impact on economic growth comes from mobile cellular technologies. The fact that mobile cellular infrastructure has a great impact on EU MS’ economic growth is not surprising. Nowadays, mobile connectivity plays an essential role in the digital connection of people and businesses to the internet, the cloud, and each other [49]. Mobile technologies and systems support the effective delivery of public services and learning opportunities for societies.

To confirm the obtained results were consistent with the actual situation and to be more objective and form additional insights, the development of the fixed telephone, fixed broadband, and mobile networks during 2000–2019 was analysed using World Bank data.

During the period 2000–2019, telecommunication services providers and governments of EU MS focused on developing broadband and mobile networks. In EU MS, fixed networks were already well-developed by 2020 so the focus is not on creating new networks but on maintaining them. Girard & Gruber [50] noted that the peak of investment in fixed networks in EU countries was reached during 1990–1994. In 1995, investment in the development of these networks by telecommunication services operators was also intense. They predicted that investment during 1996–2000 would be directed to the modernization of fixed phone networks (not for the construction of new ones) and that investment in mobile networks would be equal to investment in fixed networks and in some countries, higher. This forecast reflects the declining importance of the fixed network and the growing importance of mobile networks.

In addition, during the analysis period, fixed-telephone subscriptions (per 100 people) decreased in almost all EU MS (except France, Malta, Portugal, and Spain). On average, the number of subscriptions decreased by 33.22 percent. These facts justify the observed statistically insignificant effects of fixed phone infrastructure on economic growth.

Broadband networks were the most intensively developed during 2000–2008. During this period, the number of fixed-broadband subscriptions (per 100 people) grew on average by about 150 percent per year. The average growth rate over 2009–2019 slowed down to 4.5 percent per year. Due to the slowdown in broadband development, its impact on economic growth is becoming less significant. The results of an empirical examination reveal this.

During the analysed period, the rate of increase in mobile-cellular subscriptions (per 100 people) in EU MS was on average 286.67 percent. This rapid, steady growth and focus on developing mobile infrastructure networks have significantly positively impacted economic growth. In 2000, the least-developed mobile network infrastructure was in Bulgaria (9.23 subscriptions per 100 people), Romania (11.23 subscriptions per 100 people), and Lithuania (14.95 subscriptions per 100 people). Therefore, during the period analysed, the rate of mobile network infrastructure development in these countries was the highest (respectively, 1159.37%, 937.11%, and 1028.21%). Bulgaria and Romania were close to the EU average in 2019 in terms of this indicator, whereas Lithuania exceeded the average. Meanwhile, mobile infrastructure continues to develop and there are plans to develop it further focusing on 5G networks. In Europe’s Digital Compass proposed by the EC, one of the areas of focus is “performant and sustainable digital infrastructure” [51]. It states that “By 2030, all EU households should have gigabit connectivity and all populated areas should be covered by 5G” [51]. It is appropriate to focus on the development of 5G networks because the World Economic Forum [52] has discussed in detail the potential of 5G for economic and social value. One key point is that 5G will primarily contribute to an industry’s progress, although previous solutions include earlier generations of mobile technologies (WiFi, 4G) [52].

Despite the positive impact of mobile infrastructure on the economy, major investment in its development is by private entities as service providers are mostly private companies. Thus, the role of the government is to provide favourable conditions for this development. In addition, governments should continue to deploy ICT technologies in the public sector (including education) and strengthen ICT skills. This should be enshrined in the EC’s Digital Strategy. Europe’s Digital Compass [51] claims that by 2030, 80 percent of the adult population will have basic digital skills and all essential public services will be available online.

To proxy water and sanitation infrastructure, two variables have been used: the share of the population with access to safely managed sanitation facilities and the share of the population with access to safely managed drinking water facilities. The estimations revealed a positive but not significant effect of water and sanitation infrastructure on economic growth. These results are not comparable to any other study due to a lack of research that coves EU countries. However, the results of the estimations are logical for several reasons. First of all, most EU countries developed water and sanitation infrastructure a long time ago and governments are prone to investing more in transport and energy (especially renewable) infrastructure. For example, according to Our World in Data statistics, in 23 out of 28 EU countries, the share of the population with access to drinking water facilities (safely managed) exceeded 90 percent in 2000. The growth of this indicator during the whole analysed period was about 2.14 percentage points. The average increase in the remaining five countries was about 13.50 percentage points. Only in a few countries has the development been very intensive. In Lithuania, the share of the population with access to drinking water facilities has grown by 27.70 percentage points and in Slovenia by 18.11 percentage points. In these countries, the share of the population with access to drinking water facilities has reached 94.90 and 98.27 percent, respectively. Croatia, Hungary, and Romania should pay attention to water infrastructure development as they are lagging far behind other EU MS.

The development of sanitation infrastructure is a different situation. According to Our World in Data statistics, only in 10 EU MS does the share of the population with access to safely managed sanitation facilities exceed 90 percent. The growth of this indicator during the whole analysed period was about 1.18 percentage points. In the remaining 18 EU MS, the share of the population with access to safely managed sanitation facilities ranges from 24.69 to 86.80%, with an average rate of increase of 15.52 percentage points over the analysed period. Thus, the overall impact on economic growth may have been statistically insignificant due to different development intensities. However, this does not mean that infrastructure should not be further developed. Particular attention should be paid to sanitation infrastructure development in EU MS where the share of the population with access to safely managed sanitation facilities in 2019 was below the EU average: Bulgaria, Croatia, Cyprus, Check Republic, Finland, France, Ireland, Latvia, Portugal, Romania, Slovakia, and Slovenia. The development of sanitation infrastructure in these countries may be underfunded due to the poor quality of local and central governments. As mentioned in the WaterAid report [53], governments play an essential role in improving the governance of water, sanitation, and hygiene (WASH) through better financing, planning, monitoring, and coordinating of services.

Another reason the examination revealed an insignificant impact of water and sanitation infrastructure on growth is that the study covers all EU countries and countries’ investments in water and sanitation infrastructure differ in the total amount and the categories [54,55]. For example, in Hungary, 68 percent of water infrastructure investment is allocated to wastewater treatment, 14 percent to water infrastructure for human consumption, and 5 percent to water management and drinking water conservation. In Latvia, 99 percent of investment is allocated to water management and drinking water conservation and 1 percent to wastewater treatment. Moreover, the results can be influenced by different water services management systems. According to the EurEau organization [56], EU countries use different water services management systems that can be categorized into Direct public, Delegated public, Direct private, and Delegated private management.

One more possible reason for the estimated insignificant effect is that the study was conducted at the country rather than the regional level. The overall water and sanitation infrastructure development level in EU countries is high but there are significant regional differences. Consequently, when examining the impact of water and sanitation infrastructure development at the regional level, the results may differ. Therefore, it may be worth investigating the impact of infrastructure at the regional level in future studies.

It should be noted that the development of water and sanitation infrastructure is important not only for economic reasons but also for social reasons, as it is directly related to life quality and health. According to the European Commission (54), “High quality drinking water and access to sanitation are essential for our daily life and economic activities”. Moreover, the development of water and sanitation infrastructure must focus on achieving Sustainable Development Goals by 2030: equitable and universal access to affordable and safe drinking water for all; access to equitable and adequate sanitation and hygiene; reduction of pollution to improve water quality; increased water usage efficiency; integration of water resources management; and restoration and protection of water-related ecosystems [57]. According to Water Europe [58], Europe should invest in transformation water systems based on new concepts: Digital water, Multiple water, and the Hybrid Grey and Green Infrastructure. The Roundtable on Financing Water meeting [59], organized in partnership between the European Investment Bank and the Organisation for Economic Co-operation and Development (OECD), emphasized the importance of water and sanitation system renovation and development. One of the key messages from this meeting was that “Investment needs for water supply and sanitation in Europe are substantial: All member states need to scale up their expenditure by at least 20% to reach EU water standards and there is an aggregated financing gap of EUR 289 billion up to 2030” [59].

Five indicators for proxy physical transport infrastructure have been used: railway tracks, roads, navigable inland waterways, and pipeline-operated (kilometres per 1000 sq. km of land areas) and air passenger transport (passengers on board per 1000 inhabitants). According to the estimations, only pipeline transportation has a significant impact on growth. These results partly contradict the results obtained by Lenz et al. [31]. The authors [31] found positive and significant GDP outcomes for the road network and negative for railway infrastructure. Their research covers only 10 EU Member States (Central and Eastern Europe) so it is possible that the results of the present research may differ. The European Commission [25] research also identified a significant positive relationship between road and railway infrastructure using EU-28 1950–2012 data. A significant positive effect of road and transport infrastructure on economic growth was identified by Meersman & Nazemsadeh [28] in the case of Belgium. The results of the present research are not comparable with the results of other previous studies due to the usage of different indicators to proxy transport infrastructure. For example, Carruthers [27], Kyriacou et al. [34] used transport infrastructure investment, and Palei [26], Luz et al. [30], and Cigu et al. [29] used the transport infrastructure index to reflect transport infrastructure development.

The assessment of the impact of road infrastructure yielded some unexpected results. The economic benefits of road infrastructure are very widely emphasized in previous studies. The EU MS invest in road infrastructure heavily so the insignificant impact is unexpected. Nevertheless, it may have been left unscathed because we used the length of the roads for the proxy development of road infrastructure. Meanwhile, part of the investment is directed to road reconstruction. Therefore, the effects of investment in road infrastructure on growth should be examined in the future.

Meanwhile, the assessment results of the economic output of railway, waterway, and pipeline infrastructure are not surprising.

According to Eurostat statistics, during the period analysed the length of railway tracks increased in only a few countries (in Estonia by 43%, in Ireland by 29%). This shows that governments invest more in reconstructing old rather than constructing new railway infrastructure. This may have had a positive but insignificant effect on economic growth compared to other factors. Additionally, data from some countries are not available, which may also affect the results. Nevertheless, large-scale rail infrastructure projects may have a significant economic growth effect in the future. For example, it is expected that the Rail Baltic project, which covers 5 EU countries (Poland, Lithuania, Latvia, Estonia, and, indirectly, Finland), will have a big effect on economic growth both during the construction (due to job creation and employment) and the operation phase (due to increasing the accessibility of the Baltic market and the competitiveness of trade, increasing the attractiveness of foreign investment, maintaining higher productivity, and increased competitiveness of the Baltic transport and logistics industry) [60]. Moreover, railway transport is more environmentally friendly; therefore, railway infrastructure development would contribute to achieving economic growth sustainability [31].

During the period analysed, the length of navigable inland waterways has not changed at all in some EU MS (for example, Austria, Bulgaria, Romania, Slovakia). Small changes appeared in Finland, Italy, Netherlands, and Poland. Research does not cover the data from 11 EU MS due to missing observations. It is, therefore, possible that the effects found are insignificant. Nevertheless, investment in inland waterways development and restoration is very important since the fishing industry relies on its services; it creates tourism opportunities; and supports small- and medium-sized enterprises by creating jobs [61]. Moreover, it establishes social, health, environmental, and heritage benefits [61].

After discussing the results of the study on the impact of individual modes of transport infrastructure on growth, it is worth mentioning as other studies show that the inequality of transport infrastructure may be one of the reasons for unbalanced economic growth at the regional and national level due to growing agglomeration [62]. It is, therefore, essential to reduce regional disparities in transport infrastructure. Moreover, the economic output of transport infrastructure development can depend on a country’s or region’s absorption capacity. Therefore, as mentioned by Chen et al. [62], transport infrastructure development policy must be an integrated part of regional economic growth strategy and must be focused on ensuring regional balance.

Electricity production capacities were used to proxy energy infrastructure. The estimations revealed that electricity production has a significant positive effect on growth. These results are in line with the findings of Canning & Perdoni’s [63] research conducted using data on 67 countries during 1950–1992. It should be noted that the development of energy infrastructure in EU countries nowadays is essential not only for economic but also political reasons as it guarantees independence from the energy resources of other countries. Countries that have energy resources can create conditions and blackmail other countries that depend on their energy resources, primarily when authoritarian governments pursue political goals. Therefore, EU countries must strive for energy independence from authoritarian countries even if this would harm the economy in the short term. According to the European Commission [64], the EU must become more energy-efficient, integrate new technologies and innovations, consistently increase renewable energy, improve cross-border energy, and reduce dependence on energy imports. This has become even more relevant in light of the current political situation in Europe (Russia’s invasion of Ukraine). The European Commission [65] proposed a project “to make Europe independent from Russian fossil fuels well before 2030”.

Energy infrastructure plays a pivotal role among other types of critical infrastructure since it is a prerequisite for the operation of other infrastructure [66]. Consequently, special attention must be paid to its development and condition. Moreover, climate change and the prospects for achieving environmental goals depend on the energy infrastructure used. Great attention should be paid to solar power and wind power infrastructure development. Governments must implement renewable energy support schemes that encourage the private sector to invest in clean energy infrastructure. The mechanisms of renewable energy support policy covers feed-in tariffs and premiums, soft lean and guarantees, investment grants, tendering schemes, tax incentives, and quota obligations [67].

The estimations also allow us to conclude that government quality influences the growth outcomes of infrastructure development. Less corruption increases the positive impact of infrastructure on growth. These results are in line with Kyriacou et al.’s [34] findings. The aggregate indicator Control of Corruption shows the extent to which public authorities seek private gain in their decision making. The value of the indicator ranges from −2.5 to 2.5. A higher index indicates a lower level of corruption. The indicators’ average value in the EU-28 was 0.98 in 2019. In 16 countries, the corruption level is below average, i.e., the value of the indicator does not reach 0.98 (Bulgaria, Croatia, Cyprus, Czech Republic, Greece, Hungary, Italy, Latvia, Lithuania, Malta, Poland, Portugal, Romania, Slovakia, Slovenia, and Spain). To use financial and other resources more efficiently and to direct investment to the most productive projects, the level of corruption must be reduced and government efficiency increased. According to Cigu et al. [29], sometimes government policy decisions are inappropriate and impact negatively on both society and sustainable development. “It is required that public institutions be associated towards efficiency and effectiveness” Cigu et al. [29].

In summarizing it may be noted that the research findings contradict, at some point, previous research for the reasons discussed above. Still, differences in the results may also arise since previous research ignores the potentially arising feedback effect. For example, Maparu & Mazumder [14] investigated the Granger causality between India’s transport infrastructure development and per capita GDP growth and, in most cases, found a unidirectional positive causality running from economic growth to transport infrastructure (but not in the opposite direction). Moreover, if the research does not control growth factors such as government consumption or capital investment, the results might be affected by an omitted variable bias.

The study contributes to previous research with new results and insights, providing direction for policy implications. Nevertheless, before formulating more concrete policy implications for infrastructure development, further research must solve the main limitations of the study—an examination could be conducted at the regional level. The study assesses the impact of core infrastructure only on economic growth but it is also valuable to evaluate its convergence outcomes.

6. Conclusions

Previous studies analysing the impact of infrastructure on economic growth in EU countries have raised questions about the kind of effects of a particular type of core infrastructure and the factors that cause heterogeneous estimation results across countries. This research using data on EU-28 countries during 2000–2019, examines the growth outcomes of ICT, transport, energy, and water and sanitation infrastructure using different variables to proxy infrastructure and found that all types of infrastructure positively influence economic growth but in most cases insignificantly.

Only mobile cellular, electricity production, and pipeline transport infrastructure significantly affect economic growth. Other variables (fixed-telephone subscription, fixed-broadband subscription; and railway tracks, roads, navigable inland waterways, and pipeline-operated and air passenger transport) that proxy ICT and transport infrastructure development do not contribute to the EU MS’ economic growth. Water and sanitation infrastructure development also do not significantly contribute to the EU MS’ economic growth. Nevertheless, this does not mean that these types of infrastructure should not be developed in the future. Croatia, Hungary, and Romania should invest in developing sanitation infrastructure to reach the EU MS average. Large-scale rail infrastructure projects (for example, Real Baltic) may have a significant economic growth effect in the future so they should be further developed to ensure the effectiveness of their implementation. The development and restoration of inland waterways are also important for economic, social, and environmental reasons. However, governments making decisions to ensure economic growth need to assess which investments will have the biggest positive effects on growth and which investments will not significantly contribute to growth but will bring social and environmental benefits. Governments need to find a balance between economic, social, and environmental goals.

The institutional environment, i.e., less corruption, has a considerable positive effect on the growth outcomes of electricity production and pipeline transport infrastructure. A comparative analysis of the EU MS situation according to the level of corruption revealed that special attention should be paid to the control of corruption in Bulgaria, Croatia, Cyprus, Czech Republic, Greece, Hungary, Italy, Latvia, Lithuania, Malta, Poland, Portugal, Romania, Slovakia, Slovenia, and Spain. It would ensure a more efficient allocation and implementation of investment for infrastructure development.

Author Contributions

Conceptualisation, A.M.-S. and M.B.; methodology, M.B.; software, M.B.; validation, A.M.-S. and M.B.; formal analysis and investigation, A.M.-S. and M.B.; resources, A.M.-S.; data curation, A.M.-S.; writing—original draft preparation, A.M.-S.; writing—review and editing, M.B., visualization A.M.-S. and M.B. All authors have read and agreed to the published version of the manuscript.

Funding

This research is a part of the project on Evaluation of the Interaction Between Economic Growth and Infrastructure Development in the European Union Member States (IP&EASVES). This project has received funding from European Social Fund (project No. 09.3.3-LMT-K-712-19-0036) under a grant agreement with the Research Council of Lithuania (LMTLT).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data supporting reported results can be found in publicly available databases using links: https://ec.europa.eu/eurostat/data/database; https://data.worldbank.org/indicator; https://ourworldindata.org/. Accessed on 16 July 2021.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Results of analysis of previous studies on infrastructure development effects.

Table A1.

Results of analysis of previous studies on infrastructure development effects.

| Research by | Covered Period | Units and Level | Methods Applied | Infrastructure Variable | Outcome Variable | Main Results |

|---|---|---|---|---|---|---|

| Transport infrastructure impact | ||||||

| Boopen [1] | 1980–2000 | 38 Sub-Saharan African countries | Pooled OLS **, FE **, RE ** | Length of paved road in kilometres | GDP per capita based on PPP | Positive, significant. |

| Zhang [6] | 1993–2004 | China 29 provinces | FE **, RE ** with spatial matrix | Local TI capital stock | GDP | Positive, significant. |

| Hong et al. [7] | 1998–2007 | 31 Chinese provinces | FE **, RE **, OLS ** | Land transport index, Air transport index, Water transport index | GDP per capita | Strong positive, significant impact of land transport. Positive significant of water transport after the investments exceeds a threshold level. Weak impact of airway transport. |

| Crescenzi & Rodríguez-Pose [32] | 1990–2004 | EU-15, NUTS1 and NUTS2 | Two-way FE ** and GMM **-diff regressions | Kilometres of motorways (per land area, per thousand inhabitants, per million Euro of GDP) | GDP per capita | Positive, small, and middle significant. Depends on socio-economic conditions, innovation capacity and capacity to attract migrants. |

| Yu et al. [8] | 1978–2008 | China provinces (3 clusters according to GDP) | Linear regression, Granger causality test | Transport investment | GDP | At national level: unidirectional Granger causality from economic growth to transport infrastructure; At the regional level: bidirectional causality in the eastern region, and unidirectional causality from economic growth to transport infrastructure in central and western regions. |

| Pradhan & Badgchi [12] | 1970–2010 | India | Granger causality test, VECM ** | Length of road and rail in kilometres | GDP | Bidirectional causality between road transportation and economic growth. Unidirectional causality from rail transportation to economic growth. |

| Carruthers [27] | 20 years (not specified) | EU27 (4 scenario) | Cost-benefit, elasticity analysis | TI investments | GDP per capita, trade balance as % of GDP | Positive impact both on economic growth and trade balance. |

| Farhadi [33] | 1870–2009 | 18 OECD countries | FE **, FGLS **, GMM ** | Capital stock of transportation provided by the government as a share of GDP | Labour productivity (LP), TFP | Positive, significant, but not substantial impact on LP and TFP. |

| Luz et al. [30] | 2010–2014 | 10 countries | Linear regression | LPI* as transport infrastructure index | GDP, GDP per capita | Insignificant on GPD; positive, significant on GDP per capita. |

| Meersman & Nazemzadeh [28] | 1979–2013 | Belgium | LA-VAR ** | The total length of the road and rail network | GDP per capita | Positive, significant. |

| Maparu & Mazumder [14] | 1990–2011 | India | VAR **, VECM ** | 9 indicators: Total Transport Expenditure, Railway Density, Total Road Density, etc. | GDP per capita, urbanisation | Positive, significant in long run. Unidirectional causality from economic development to transport infrastructure in most of the cases. |

| Cigu et al. [29] | 2000–2014 | EU-28 countries | Pooled OLS **, RE **, FE ** | The index of transport infrastructure status | GDP per capita based on PPP | Positive, significant even after institutional and other factors are controlled for. |

| Lenz et al. [31] | 1995–2016 | CEE* Member States | Pooled OLS **, FE **, RE ** | Length of total railways (km), length of total road network (km) | GDP | Positive, significant, except negative impact of railway infrastructure. |

| Saidi et al. [4] | 2000–2016 | MENA* countries (3 subgroups) | GMM ** | Kilometres of roads per capita | GDP per capita | Positive, significant in all regions. |

| Kyriacou et al. [34] | 1996–2010 | 34 countries | DEA **, Regression analysis | TI investment | TI index | Positive, significant. Depends on government quality. |

| Batool & Goldmann [16] | 1973–2014 | Pakistan | VAC **, VAR ** models | The length of the paved road and rails network, public and private capital stock in transport | GDP, GDP per capita | Positive, significant in long-run. |

| Elburz & Cubukcu [17] | 2004–2014 | Turkey 26 NUTS 2 regions | OLS **, SDM ** | Roads and motorway infrastructure length (km) per capita | Regional GDP per capita | Positive, significant. |

| Muvawala et al. [18] | 1983–2018 | Uganda | ARDL ** model | Expenditure on Transport Infrastructure | GDP Growth Rate | Positive significant in long run, but negative significant in short run |

| Wang et al. [11] | 2000–2017 | China’s 30 provincial-level regions | Threshold panel model | Industrial agglomeration index, highway density (length of highway route relative to physical space) | Energy consumption/GDP; TFEE* | Positive, significant only when a certain threshold is exceeded. |

| Wang et al. [22] | 2007–2016 | 42 BRI countries divide in to 5 regions | SA ** tests, SLM **, SEM **, SDM ** | The railway network density, the road network density | GDP per capita | Positive, significant at the national level. Negative, significant at regional level in East Asia-Central Asia. Positive, significant at regional level in Central and Eastern Europe. |

| ICT infrastructre impact | ||||||

| Madden & Savage [35] | 1990–1995 | 27 CEE * | OLS ** | Share of telecommunications investment in GDP | Real GDP per capita growth rate | Positive, significant. |

| Pohjola [36] | 1980–1995 | 39 countries | Regression | Ratio of spending on IT to nominal GDP | GDP per working age population in PPP | Positive, strong, and significant in the smaller sample of the developed (OECD) countries. |

| Datta & Agarwal [37] | 1980–1992 | 22 OECD | Dynamic FE ** | Access lines per 100 inhabitants | Real GDP per capita growth rate | Positive, significant after controlling for a number of other factors. |

| Sridhar, K. S. & Sridhar, V. [23] | 1990–2001 | 63 countries | 3SLS ** | Telephones per 100 inhabitants, total Telecom penetration, telephone revenue per user, investments, etc. | Real GDP, Real GDP per capita | Positive, significant. |

| Donou-Adonsou et al. [3] | 1993–2012 | All Sub-Saharan Africa countries | FE **, 2SLS **, IV-GMM ** | Internet usage andMobile phone subscriptions | GDP per capita growth rate | Positive, significant. |

| Pradhan et al. [68] | 2001–2012 | G-20 countries | VECM **, Granger causality test | Broadband users and Internet users in percentage of total population | GDP per capita | Positive, significant. Granger causality relationship among per capita economic growth, ICT infrastructure and other factors. |

| Toader et al. [38] | 2000–2017 | EU-28 | GMM **, OLS ** | Fixed-broadband subscriptions per 100 inhabitants, the percentage of households with a broadband Internet connection, percentage of individuals using the Internet; mobile cellular subscriptions (per 100 people) | GDP per capita in market prices | Positive, significant. |

| Haftu [5] | 2006–2015 | 40 Sub-Saharan Africa (SSA) countries | Two-step system GMM ** | The percentage of individuals using the Internet, cellular telephone subscription per 100 inhabitants | GDP per capita | Mobile phone penetration has positive significant impact on growth; Internet has not contributed to the per capita GDP. |

| Untari, Priyarsono & Noviani [19] | 2011–2016 | Indonesia provinces | TSLS ** | Cellular telephones, Internet accessibility, number of BTS, and government ICT expenditure | Regional GDP, Gini coefficient | Physical infrastructure indicators have a positive, significant impact on economic growth. Government spending on ICTs do not significantly impact economic growth and income inequality. |

| Maneejuk & Yamaka [24] | 1995–2017 | 5 developed and 5 developing countries | TKR ** model, PKR ** model | Fixed-Telephone Subscriptions (FTS), Mobile Cellular Subscriptions (MCS), Fixed-Broadband Subscriptions (FBS), Percentage of Individuals using the Internet (PUI) | Real GDP per capita in PPP* | (i) FTS, MCS have significant non-linear impact on economic growth in developing and developed countries (TKR model); (ii) FTS, MCS and FBS have positive direct impact on growth in developed countries (PKR model); (iii) FTS, MCS have a non-linear impact on growth in developing countries. |

| Nair, Pradhan & Arvin [39] | 1961–2018 | 36 OECD countries | VECM ** | Composite index of ICT | Real GDP per capita | Positive, significant in the long-run and in the short run. |

| Kallal, Haddaji & Ftiti [20] | 1997–2015 | Tunisia, sectoral level | ARDL ** | ICT diffusion index (ICTD) | Real value-added | Significant, positive long-term effect and negative short-term effect. |

| Energy infrastructure impact | ||||||

| Lin & Chiu [9] | 2016–2020 | 30 regional/ provincial level in China | Leontief I-O model | Amount of investment in the energy industry | regional GDP | The energy infrastructure investment increased the final demand of other related manufacturing sectors, whose services were required for the completion of infrastructure construction. |

| Yang et al. [10] | 2000–2014 | China 29 provinces | GMM ** | Effective Cost Index (ECI), power grid infrastructure (PGI) investments | Real GDP per capita | (i) ECI impact the regional economic growth negatively; (ii) PGI investment generate higher marginal benefits for the less developed inland areas than the developed coastal areas. |

| Mixed (severel types) infrastructure impact | ||||||

| Calderón & Servén [69] | 1960–2000 | Macro, 121 countries | GMM ** | The Aggregate Index of Infrastructure Stocks, The Aggregate Index of Infrastructure Quality. Covers transport, ICT, and energy infrastructure. | GDP per capita, Gini Coefficient | Positive, significant impact of infrastructure on economic growth in long-run. Robust negative, significant impact of infrastructure quantity and quality on income inequality. |

| Canning & Pedroni [52] | 1950–1992 | 67 countries | ADF ** test, Granger causality test | Paved roads per capita, Electricity generating capacity per capita, Telephones per capita. | GDP per capita | Positive, significant in the vast majority of cases in long run. Results vary across individual countries. In some countries infrastructure is under-supplied and over-supplied in others. |

| Kumo [2] | 1960–2009 | South Africa, country level | VAR ** model, Granger causality tests | Government infrastructure investment and GDP ratio | GDP | Strong bidirectional Granger causality between economic infrastructure investment and GDP growth. |

| Awan & Anum [15] | 1971–2013 | Pakistan, country level | ARDL ** | Infrastructure Development Index. Covers transport, ICT, and energy infrastructure. | GDP | Positive, significant. |

| European Commission [25] | 1950–2012 | Macro, EU-28 | Full Modified OLS ** and Dynamic OLS ** estimations, FE ** | Infrastructure provision per capita (kilometres of roads and railway lines; megawatt of electrical capacity (electricity) per million people | GDP per capita | Positive, significant. |

| Palei [26] | 2012 | 124 countries | Regression analysis | Infrastructure index | Global competitiveness index | Positive, significant. |

| Mitra et al. [13] | 1994–2010 | Indian manufacturing sector (8 industries) | Fully modified OLS **, panelcointegration and System GMM ** | An aggregate infrastructure index (covers transport, ICT, and energy infrastructure). ICT infrastructure index | TFP* and technical efficiency (TE) | Positive, significant. Stronger impact in industries which are more exposed to foreign competition (Textile, Transport Equipment, Chemicals, Metal & Metal Products). |

| Apurv & Uzma [70] | 1980–2017 | BRICS Countries | OLS **, FE **, RE** | Electric power Consumption (kWh per capita), Fixed telephone subscriptions, Raillines (total route, km), Agricultural irrigated land | GDP | Panel data results: (i) positive, significant impact of energy infrastructure on economic growth; (ii) negative, significant impact telecommunication infrastructure on economic growth. |

| Arif et al. [21] | 2006–2016 | 19 Asian countries, 16 manufacturing industries | Fully modified OLS ** | Telecom, road, and power infrastructure | TFP* | Positive, significant. Road infrastructure is more important for low technology-intensive industries, whereas power infrastructure is crucial for high technology-intensive industries. |

* explanation abbreviations: CEE—Central and Eastern European, LPI—logistic performance index, MENA—the Middle East and North Africa, PPP—purchasing power parity, TFEE—total factor energy efficiency, TFP—total factor productivity. ** explanation methods used abbreviations: ARDL model—Auto Regressive Distributed Lag model, DEA—Data Envelopment Analysis, FGLS—feasible generalised (weighted) least squares, FE—Fixed Effect, GMM—Generalised Method of Moments, IV-GMM—instrumental variable-generalised method of moments, LA-VAR—the lag-augmented vector-auto- regression, OLS—Ordinary Least Square, PKP—Panel kink regression model, RE—Random Effects, SA—Spatial autocorrelation, SDM—spatial Durbin model, SEM—spatial error model, SLM—spatial lag model, TKR—Time-series kink regression model, TSLS—Two Stages Least Square, VECM—Vector Error Correction Model.

Appendix B

Table A2.

Fixed effect estimates of Equations (1) and (2). Dependent variable—the 3-year forward-looking average per capita GDP growth rate.

Table A2.

Fixed effect estimates of Equations (1) and (2). Dependent variable—the 3-year forward-looking average per capita GDP growth rate.

| (24) | (25) | (26) | (27) | (28) | (29) | (30) | (31) | (32) | (33) | (34) | (35) | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Core Infrastructure (INFR) | ICT infrastructure | Fixed telephone | ln(ict_ft) | γ | 0.0009 | |||||||||||

| (0.0046) | ||||||||||||||||

| Fixed broadband | ln(ict_fb) | 0.0034 | ||||||||||||||

| (0.0029) | ||||||||||||||||

| Mobile cellular | ln(ict_mc) | 0.0260 * | ||||||||||||||

| (0.0151) | ||||||||||||||||

| Water and sanitation | Sanitation facilities | ln(ws_sf) | 0.0425 | |||||||||||||

| (0.0561) | ||||||||||||||||

| Drinking water facilities | ln(ws_dwf) | 0.0083 | ||||||||||||||

| (0.0335) | ||||||||||||||||

| Transport infrastructure | Railways | ln(t_rw) | 0.0027 | |||||||||||||

| (0.0149) | ||||||||||||||||

| Roads | ln(t_r) | 0.0019 | ||||||||||||||

| (0.0073) | ||||||||||||||||

| Inland waterways | ln(t_ww) | 0.0052 | ||||||||||||||

| (0.0171) | ||||||||||||||||

| Pipelines | ln(t_pl) | 0.0237 *** | ||||||||||||||

| (0.0050) | ||||||||||||||||

| Air transport | ln(t_ap) | 0.0116 | ||||||||||||||

| (0.0074) | ||||||||||||||||

| Energy | Electricity | ln(e_epc) | 0.0145 ** | |||||||||||||

| (0.0072) | ||||||||||||||||

| Institutions (Control of corruption) | inst_cc | c1 | 0.0122 * | 0.0120 ** | 0.0104 * | 0.0130 ** | 0.0122 ** | 0.0109 ** | 0.0104 | 0.0126 ** | 0.0120 | 0.0205 *** | 0.0184 *** | 0.0151 *** | ||

| (0.0060) | (0.0060) | (0.0055) | (0.0055) | (0.0060) | (0.0055) | (0.0094) | (0.0061) | (0.0092) | (0.0055) | (0.0051) | (0.0058) | |||||

| Population growth | Δln(pop) | c2 | −0.9613 | −0.9570 | −1.0570 * | −0.9655 | −0.9665 | −0.8976 | −1.0780 | −1.0570 | −0.1386 | −0.0847 | −1.0420 * | −1.0910 * | ||

| (0.5851) | (0.5857) | (0.6124) | (0.5879) | (0.5921) | (0.5902) | (0.7675) | (0.7102) | (0.2284) | (0.2528) | (0.6275) | (0.6325) | |||||

| Population density | ln(dens) | c3 | 0.0598 | 0.0601 | 0.0599 | 0.0648 | 0.0604 | 0.0651 | 0.0436 | 0.0261 | −0.1598 *** | −0.0608 | −0.0008 | 0.0308 | ||

| (0.0832) | (0.0837) | (0.0835) | (0.0845) | (0.0836) | (0.0856) | (0.0924) | (0.0812) | (0.0398) | (0.0436) | (0.0749) | (0.0848) | |||||

| Urbanisation level | ln(urb) | c4 | 0.0250 | 0.0237 | 0.0019 | 0.0317 | 0.0118 | 0.0503 | 0.1071 | −0.0067 | −0.1299 | −0.0266 | −0.0007 | 0.0248 | ||

| (0.0746) | (0.0730) | (0.0756) | (0.0738) | (0.0688) | (0.0720 | (0.1016) | (0.0812) | (0.0758) | (0.0916) | (0.0659) | (0.0732) | |||||

| Growth of the labour force | Δln(lf) | c5 | 0.1963 *** | 0.1959 *** | 0.1952 *** | 0.1926 *** | 0.2003 *** | 0.1930 *** | 0.1772 ** | 0.1938 *** | 0.09386 ** | 0.1265 *** | 0.1816 ** | 0.1686 *** | ||

| (0.0531) | (0.0523) | (0.0538) | (0.0546) | (0.0560) | (0.0543) | (0.0715) | (0.0608) | (0.0382) | (0.0463) | (0.0735) | (0.0557) | |||||

| Gross capital formation | gcf | c6 | 0.0042 ** | 0.0042 ** | 0.0034 * | 0.0043 ** | 0.0042 ** | 0.0042 ** | 0.0049 | 0.0030 * | 0.0018 | 0.0000 | 0.0038 ** | 0.0035 | ||

| (0.0019) | (0.0019) | (0.0018) | (0.0020) | (0.0019) | (0.0019) | (0.0031) | (0.0018) | (0.0026) | (0.0024) | (0.0019) | (0.0023) | |||||

| Squared Gross capital formation | gcf2 | c7 | −0.0001 *** | −0.0001 *** | −0.0000 ** | −0.0001 *** | −0.0001 *** | −0.0001 *** | −0.0001 ** | −0.0000 ** | −0.0000 | −0.0000 | −0.0001 *** | −0.0000 ** | ||

| (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | |||||

| Openness to trade | ln(opn) | c8 | 0.0597 *** | 0.0597 *** | 0.0525 *** | 0.0599 *** | 0.0589 *** | 0.0584 *** | 0.0630 *** | 0.0594 *** | 0.0616 *** | 0.0693 *** | 0.0517 *** | 0.0517 *** | ||

| (0.0164) | (0.0164) | (0.0153) | (0.0165) | (0.0157) | (0.0176) | (0.0183) | (0.0156) | (0.0178) | (0.0204) | (0.0167) | (0.0187) | |||||

| Foreign direct investment | fdi | c9 | −0.0000 | −0.0000 | −0.0000 | −0.0000 | −0.0000 | −0.0000 | 0.0000 | −0.0000 ** | −0.0000 | −0.0003 *** | −0.0000 | −0.0000 *** | ||

| (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | |||||

| Government size | ln(gov) | c10 | −0.0235 * | −0.0234 ** | −0.0270 ** | −0.0247 ** | −0.0248 * | −0.0251 ** | −0.0288 | −0.0134 | −0.0083 | 0.0016 | −0.0225 | −0.0173 | ||

| (0.0120) | (0.0118) | (0.0109) | (0.0122) | (0.0139) | (0.0117) | (0.0203) | (0.0160) | (0.0178) | (0.0159) | (0.0136) | (0.0124) | |||||

| Research and development | ln(r&d) | c11 | −0.0029 | −0.0031 | −0.0052 | −0.0015 | −0.0037 | −0.0013 | −0.0160 * | −0.0033 | −0.0051 | −0.0144 | −0.0019 | −0.0098 | ||

| (0.0119) | (0.0120) | (0.0118) | (0.0123) | (0.0130) | (0.0130) | (0.0081) | (0.0111) | (0.0094) | (0.0107) | (0.0132) | (0.0079) | |||||

| Inflation | Δln(cpi) | c12 | 0.0076 | 0.0087 | −0.0137 | 0.0130 | 0.0138 | −0.0149 | 0.0143 | −0.0186 | −0.0644 | −0.0230 | 0.0464 | −0.0055 | ||

| (0.0436) | (0.0445) | (0.0462) | (0.0413) | (0.0534) | (0.0488) | (0.0457) | (0.0391) | (0.0454) | (0.0392) | (0.0761) | (0.0489) | |||||

| Human capital | ln(hc) | c13 | 0.0076 | 0.0075 | 0.0126 | 0.0077 | 0.0068 | 0.0043 | 0.0042 | 0.0071 | 0.0060 | 0.0090 | 0.0080 | 0.0027 | ||

| (0.0096) | (0.0097) | (0.0101) | (0.0095) | (0.0109) | (0.0087) | (0.0133) | (0.0113) | (0.0113) | (0.0079) | (0.0102) | (0.0097) | |||||

| GDP per capita | ln(Y) | β | −0.1267 *** | −0.1267 *** | −0.1187 *** | −0.1325 *** | −0.1279 *** | −0.1313 *** | −0.1166 *** | −0.1469 *** | −0.1889 *** | −0.1570 *** | −0.1222 *** | −0.1363 *** | ||

| (0.0292) | (0.0293) | (0.0323) | (0.0329) | (0.0272) | (0.0302) | (0.0348) | (0.0247) | (0.0214) | (0.0167) | (0.0326) | (0.0349) | |||||

| Intercept | α | 0.6846 | 0.6846 | 0.6867 | 0.7745 | 0.6528 | 0.7309 | 0.4192 | 0.4118 | 1.1510 | 2.9360 | 1.6920 *** | 1.1710 | |||

| (0.9196) | (0.9196) | (0.9181) | (0.9107) | (0.9284) | (0.8402) | (1.018) | (1.095) | (0.8505) | (0.5449) | (0.5360) | (0.7877) | |||||

| Number of observations | 342 | 342 | 339 | 342 | 342 | 332 | 237 | 294 | 201 | 166 | 320 | 312 | ||||

| Within R2 | 0.7854 | 0.7854 | 0.7869 | 0.7861 | 0.7857 | 0.7904 | 0.8004 | 0.8204 | 0.8708 | 0.8683 | 0.7734 | 0.7884 | ||||

| Pesaran CD test for cross-sectional dependence (1) [p-value] | [0.213] | [0.1969] | [0.2122] | [0.211] | [0.2154] | [0.1967] | [0.1998] | [0.2004] | [0.1884] | [0.222] | [0.2212] | [0.1734] | ||||

| Test for differing group intercepts (2) [p-value] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | ||||

| Wald joint test on time dummies (3) [p-value] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | ||||

| Hausman test (4) [p-value] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | ||||

| Wooldridge test (5) [p-value] | [0.1717] | [0.1532] | [0.1593] | [0.1667] | [0.1573] | [0.1673] | [0.1625] | [0.1756] | [0.1414] | [0.198] | [0.1779] | [0.1538] | ||||

Note: (1) A low p-value counts against the null hypothesis: cross-sectional independence. (2) A low p-value counts against the null hypothesis: the groups have a common intercept. (3) A low p-value counts against the null hypothesis: no time effects. (4) A low p-value counts against the GLS estimates with random effects in favour of LSDV. (5) A low p-value counts against the null hypothesis: no first-order serial correlation in error terms. Heteroscedasticity robust standard errors are presented in parentheses. All estimations include time- and country-fixed effects, and Huber–White Sandwich corrections. *, **, *** indicate significant at the 10, 5, and 1 percent level, respectively.

Table A3.

Fixed effect estimates of Equation (3). Dependent variable—the 3-year forward-looking average per capita GDP growth rate.

Table A3.

Fixed effect estimates of Equation (3). Dependent variable—the 3-year forward-looking average per capita GDP growth rate.

| (36) | (37) | (38) | (39) | (40) | (41) | (42) | (43) | (44) | (45) | (46) | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Core Infrastructure (INFR) | ICT infrastructure | Fixed telephone | ln(ict_ft) | γ | 0.0109 | ||||||||||

| (0.0138) | |||||||||||||||

| ln(ict_ft)× inst_cc | φ | 0.0065 | |||||||||||||

| (0.0070) | |||||||||||||||

| Fixed broadband | ln(ict_fb) | γ | 0.0034 | ||||||||||||

| (0.0029) | |||||||||||||||

| ln(ict_fb)× inst_cc | φ | 0.0004 | |||||||||||||

| (0.0015) | |||||||||||||||

| Mobile cellular | ln(ict_mc) | γ | 0.02256 *** | ||||||||||||

| (0.0040) | |||||||||||||||

| ln(ict_mc)× inst_cc | φ | 0.0087 | |||||||||||||

| (0.0059) | |||||||||||||||

| Water and sanitation | Sanitation facilities | ln(ws_sf) | γ | 0.0028 | |||||||||||

| (0.0360) | |||||||||||||||

| ln(ws_sf)× inst_cc | φ | 0.0243 | |||||||||||||

| (0.0617) | |||||||||||||||

| Drinking water facilities | ln(ws_dwf) | γ | 0.0495 | ||||||||||||

| (0.0667) | |||||||||||||||

| ln(ws_dwf)× inst_cc | φ | 0.0135 | |||||||||||||

| (0.0984) | |||||||||||||||

| Transport infrastructure | Railways | ln(t_rw) | γ | 0.0164 | |||||||||||

| (0.0304) | |||||||||||||||

| ln(t_rw)× inst_cc | φ | 0.0096 | |||||||||||||

| (0.0182) | |||||||||||||||

| Roads | ln(t_r) | γ | 0.0018 | ||||||||||||

| (0.0088) | |||||||||||||||

| ln(t_r)× inst_cc | φ | 0.0002 | |||||||||||||

| (0.0094) | |||||||||||||||

| Inland waterways | ln(t_ww) | γ | 0.0117 | ||||||||||||

| (0.0154) | |||||||||||||||

| ln(t_ww)× inst_cc | φ | 0.0012 | |||||||||||||

| (0.0073) | |||||||||||||||

| Pipelines | ln(t_pl) | γ | 0.0154 ** | ||||||||||||

| (0.0064) | |||||||||||||||

| ln(t_pl)× inst_cc | φ | 0.0192 ** | |||||||||||||

| (0.0074) | |||||||||||||||

| Air transport | ln(t_ap) | γ | 0.0059 | ||||||||||||

| (0.0095) | |||||||||||||||

| ln(t_ap)× inst_cc | φ | 0.0090 | |||||||||||||

| (0.0093) | |||||||||||||||

| Energy | Electricity | ln(e_epc) | γ | 0.0423 *** | |||||||||||

| (0.0114) | |||||||||||||||

| ln(e_epc)× inst_cc | φ | 0.0335 *** | |||||||||||||

| (0.0114) | |||||||||||||||

| Institutions (Control of corruption) | inst_cc | c1 | 0.0354 | 0.0091 | 0.0074 | −0.0997 | 0.0722 | 0.0510 | 0.0114 | 0.0516 *** | 0.0404 *** | 0.0877 | 0.1067 *** | ||

| (0.0270) | (0.0071) | (0.0337) | (0.2802) | (0.4475) | (0.0812) | (0.0649) | (0.0166) | (0.0146) | (0.0705) | (0.0334) | |||||

| Population growth | Δln(pop) | c2 | −0.9488 | −1.0530 * | −0.9655 | −0.9132 | −0.8908 | −1.076 | −1.0570 | −0.0743 | −0.1499 | −0.9161 * | −0.8158 | ||

| (0.5802) | (0.6105) | (0.5911) | (0.5874) | (0.6150) | (0.7778) | (0.7048) | (0.2087) | (0.2597) | (0.5365) | (0.5364) | |||||

| Population density | ln(dens) | c3 | 0.0616 | 0.0571 | 0.0644 | 0.0575 | 0.0664 | 0.0553 | 0.0261 | −0.1542 *** | −0.0550 | −0.0065 | 0.0451 | ||

| (0.0838) | (0.0804) | (0.0861) | (0.0866) | (0.0823) | (0.0888) | (0.0818) | (0.0346) | (0.0417) | (0.0721) | (0.0830) | |||||

| Urbanisation level | ln(urb) | c4 | 0.0144 | 0.0008 | 0.0331 | 0.0413 | 0.0515 | 0.1317 | −0.0068 | −0.1850 ** | −0.0658 | 0.0169 | 0.0450 | ||

| (0.0744) | (0.0741) | (0.0718) | (0.0689) | (0.0688) | (0.1163) | (0.0838) | (0.0779) | (0.0921) | (0.0723) | (0.0801) | |||||

| Growth of the labour force | Δln(lf) | c5 | 0.1910 *** | 0.1963 *** | 0.1929 *** | 0.1942 *** | 0.1924 *** | 0.1790 ** | 0.1940 *** | 0.1055 ** | 0.1285 *** | 0.1831 ** | 0.1713 *** | ||

| (0.0499) | (0.0549) | (0.0543) | (0.0564) | (0.0545) | (0.0738) | (0.0583) | (0.0375) | (0.0477) | (0.0740) | (0.0523) | |||||

| Gross capital formation | gcf | c6 | 0.0042 ** | 0.0033 * | 0.0043 ** | 0.0039 * | 0.0042 ** | 0.0045 | 0.0030 * | 0.0017 | −0.0005 | 0.0044 ** | 0.0027 | ||

| (0.0019) | (0.0018) | (0.0020) | (0.0019) | (0.0017) | (0.0029) | (0.0018) | (0.0024) | (0.0024) | (0.0020) | (0.0018) | |||||

| Squared Gross capital formation | gcf2 | c7 | −0.0001 *** | −0.0000 *** | −0.0001 *** | −0.0001 ** | −0.0001 *** | −0.0001 * | −0.0000 ** | −0.0000 | −0.0000 | −0.0001 *** | −0.0000 ** | ||

| (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | |||||

| Openness to trade | ln(opn) | c8 | 0.0620 *** | 0.0523 *** | 0.0601 *** | 0.0588 *** | 0.0583 *** | 0.0667 *** | 0.0594 *** | 0.0651 *** | 0.0719 *** | 0.0502 *** | 0.0457 ** | ||

| (0.0165) | (0.0151) | (0.0159) | (0.0164) | (0.0179) | (0.0168) | (0.0152) | (0.0187) | (0.0205) | (0.0161) | (0.0171) | |||||

| Foreign direct investment | fdi | c9 | −0.0000 | −0.0000 | −0.0000 | −0.0000 | −0.0000 | 0.0000 | −0.0000 *** | −0.0000 | −0.0003 *** | −0.0000 | −0.0000 *** | ||

| (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | |||||

| Government size | ln(gov) | c10 | −0.0244 * | −0.0268 ** | −0.0244 * | −0.0246 * | −0.0248 * | −0.0278 | −0.0134 | −0.0072 | 0.0011 | −0.0188 | −0.0247 * | ||

| (0.0119) | (0.0110) | (0.0126) | (0.0140) | (0.0131) | (0.0223) | (0.0163) | (0.0182) | (0.0162) | (0.0133) | (0.0127) | |||||

| Research and development | ln(r&d) | c11 | −0.0018 | −0.0053 | −0.0015 | −0.0011 | −0.0013 | −0.0181 * | −0.0033 | −0.0055 | −0.0156 | −0.0015 | −0.0181 ** | ||

| (0.0121) | (0.0119) | (0.0122) | (0.0133) | (0.0130) | (0.0091) | (0.0118) | (0.0092) | (0.0106) | (0.0131) | (0.0078) | |||||

| Inflation | Δln(cpi) | c12 | 0.0139 | −0.0163 | 0.0097 | −0.0119 | −0.0130 | 0.0102 | −0.0188 | −0.0671 | −0.0389 | 0.0609 | 0.0061 | ||

| (0.0463) | (0.0438) | (0.0473) | (0.0601) | (0.0499) | (0.0409) | (0.0424) | (0.0459) | (0.0443) | (0.0806) | (0.0479) | |||||

| Human capital | ln(hc) | c13 | 0.0098 | 0.0128 | 0.0081 | 0.0035 | 0.0042 | 0.0038 | 0.0071 | 0.0063 | 0.0062 | 0.0059 | 0.0091 | ||

| (0.0104) | (0.0101) | (0.0103) | (0.0110) | (0.0088) | (0.0133) | (0.0120) | (0.0112) | (0.0081) | (0.0109) | (0.0100) | |||||

| GDP per capita | ln(Y) | β | −0.1246 *** | −0.1180 *** | −0.1317 *** | −0.1274 *** | −0.1319 *** | −0.1139 *** | −0.1469 *** | −0.1889 *** | −0.1573 *** | −0.1227 *** | −0.1617 *** | ||

| (0.0304) | (0.0326) | (0.0315) | (0.0285) | (0.0327) | (0.0349) | (0.0247) | (0.0194) | (0.0185) | (0.0322) | (0.0308) | |||||

| Intercept | α | 0.6379 | 0.6379 | 0.7850 | 0.6380 | 0.6340 | 0.3817 | 0.1719 | 1.1520 | 3.1240 *** | 1.8500 *** | 1.1290 | |||

| (0.9413) | (0.9413) | (0.8958) | (0.8968) | (0.8677) | (0.9015) | (1.1740) | (0.8632) | (0.4747) | (0.5711) | (0.8060) | |||||

| Number of observations | 342 | 339 | 342 | 332 | 332 | 237 | 294 | 201 | 166 | 320 | 312 | ||||

| Within R2 | 0.7866 | 0.7869 | 0.7861 | 0.7896 | 0.7905 | 0.8017 | 0.8204 | 0.8772 | 0.8707 | 0.7770 | 0.8043 | ||||

| Pesaran CD test for cross-sectional dependence (1) [p-value] | [0.1916] | [0.1748] | [0.2423] | [0.1981] | [0.2106] | [0.1955] | [0.2109] | [0.2252] | [0.1825] | [0.192] | [0.1976] | ||||

| Test for differing group intercepts (2) [p-value] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | ||||

| Wald joint test on time dummies (3) [p-value] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | ||||

| Hausman test (4) [p-value] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | [<0.001] | ||||

| Wooldridge test (5) [p-value] | [0.1705] | [0.1523] | [0.1963] | [0.1578] | [0.1783] | [0.1552] | [0.1536] | [0.1986] | [0.1532] | [0.1357] | [0.1491] | ||||

Note: (1) A low p-value counts against the null hypothesis: cross-sectional independence. (2) A low p-value counts against the null hypothesis: the groups have a common intercept. (3) A low p-value counts against the null hypothesis: no time effects. (4) A low p-value counts against the GLS estimates with random effects in favour of LSDV. (5) A low p-value counts against the null hypothesis: no first-order serial correlation in error terms. Heteroscedasticity robust standard errors are presented in parentheses. All estimations include time- and country-fixed effects, and Huber–White Sandwich corrections. *, **, *** indicate significant at the 10, 5, and 1 percent level, respectively.

Table A4.

Fixed-effect estimates of Equation (3). Dependent variable—the 5-year forward-looking average per capita GDP growth rate. Regulatory quality is used as a proxy for institutional quality.

Table A4.

Fixed-effect estimates of Equation (3). Dependent variable—the 5-year forward-looking average per capita GDP growth rate. Regulatory quality is used as a proxy for institutional quality.

| (47) | (48) | (49) | (50) | (51) | (52) | (53) | (54) | (55) | (56) | (57) | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Core Infrastructure (INFR) | ICT infrastructure | Fixed telephone | ln(ict_ft) | γ | 0.0325 | ||||||||||

| (0.0333) | |||||||||||||||

| ln(ict_ft)× inst_rq | φ | 0.0188 | |||||||||||||

| (0.0198) | |||||||||||||||

| Fixed broadband | ln(ict_fb) | γ | 0.0025 | ||||||||||||

| (0.0034) | |||||||||||||||

| ln(ict_fb)× inst_rq | φ | 0.0021 | |||||||||||||

| (0.0027) | |||||||||||||||

| Mobile cellular | ln(ict_mc) | γ | 0.3764 ** | ||||||||||||

| (0.1577) | |||||||||||||||

| ln(ict_mc)× inst_rq | φ | 0.3308 * | |||||||||||||

| (0.1755) | |||||||||||||||

| Water and sanitation | Sanitation facilities | ln(ws_sf) | γ | 0.0608 | |||||||||||

| (0.0481) | |||||||||||||||

| ln(ws_sf)× inst_rq | φ | 0.0289 | |||||||||||||

| (0.0223) | |||||||||||||||

| Drinking water facilities | ln(ws_dwf) | γ | 0.0106 | ||||||||||||

| (0.0136) | |||||||||||||||

| ln(ws_dwf)× inst_rq | φ | 0.0129 | |||||||||||||

| (0.0111) | |||||||||||||||

| Transport | Railways | ln(t_rw) | γ | 0.0378 | |||||||||||

| (0.0304) | |||||||||||||||

| ln(t_rw)× inst_rq | φ | 0.0186 | |||||||||||||

| (0.0183) | |||||||||||||||

| Roads | ln(t_r) | γ | 0.0259 | ||||||||||||

| (0.0240) | |||||||||||||||

| ln(t_r)× inst_rq | φ | 0.0133 | |||||||||||||

| (0.0102) | |||||||||||||||

| Inland waterways | ln(t_ww) | γ | 0.0361 | ||||||||||||

| (0.0445) | |||||||||||||||

| ln(t_ww)× inst_rq | φ | 0.0089 | |||||||||||||

| (0.0242) | |||||||||||||||

| Pipelines | ln(t_pl) | γ | 0.0541 *** | ||||||||||||

| (0.0131) | |||||||||||||||

| ln(t_pl)× inst_rq | φ | 0.0283 ** | |||||||||||||

| (0.0111) | |||||||||||||||

| Air transport | ln(t_ap) | γ | 0.0034 | ||||||||||||

| (0.0133) | |||||||||||||||

| ln(t_ap)× inst_rq | φ | 0.0024 | |||||||||||||

| (0.0119) | |||||||||||||||

| Energy | Electricity | ln(e_epc) | γ | 0.1426 *** | |||||||||||

| (0.0349) | |||||||||||||||

| ln(e_epc)× inst_rq | φ | 0.1057 *** | |||||||||||||

| (0.0314) | |||||||||||||||

| Institutions (Regulatory Quality) | inst_rq | c1 | 0.0465 | 0.0242 *** | 0.0432 | 0.4437 *** | 1.696 ** | 0.0950 | 0.1096 | 0.0216 | 0.0579 ** | 0.0410 | 0.0937 | ||

| (0.0714) | (0.0078) | (0.0549) | (0.1355) | (0.7200) | (0.0757) | (0.0720) | (0.0577) | (0.0233) | (0.0919) | (0.0662) | |||||

| Population growth | Δln(pop) | c2 | −1.4100 * | −1.4700 * | −1.3860 * | −1.2210 * | −1.2810 * | −1.8640 ** | −1.6230 ** | −1.2210 ** | −0.4674 | −1.2530 | −1.600 ** | ||

| (0.6998) | (0.7174) | (0.6923) | (0.6253) | (0.6691) | (0.7228) | (0.8077) | (0.4958) | (0.3981) | (0.7398) | (0.6899) | |||||

| Population density | ln(dens) | c3 | 0.1142 | 0.1275 | 0.1355 | 0.0768 | 0.1164 * | 0.0946 | 0.0824 | −0.1094 | −0.0822 | 0.1431 | 0.0723 | ||

| (0.0798) | (0.0823) | (0.0862) | (0.0730) | (0.0702) | (0.0843) | (0.0746) | (0.1002) | (0.1001) | (0.0858) | (0.0802) | |||||