1. Introduction

With the continuous acceleration of China’s urbanization construction, its construction industry has maintained rapid development momentum. In 2018, when the GDP growth rate was 8.85%, the added value of its construction industry was 2114.197 billion yuan, or an increase of 9.88% compared to the previous year, and it accounted for 26.11% of GDP, or the same as the previous year. As an important sector in China, the construction industry is a basic industry that others rely on for development. The construction industry not only strongly supports the development of the national economy in a healthy and stable direction, but also has a significant role in absorbing wealthy labor on the road to urbanization, promoting investment to stimulate domestic demand, enhancing economic development and stabilizing society.

The construction industry, with its large scope and scale, will be faced with more difficulties than any other industries. On the one hand, construction products affect national economic activities, consumer health, national identity, and social identity [

1]. On the other hand, the huge scale and high energy consumption of the construction industry present many shortcomings, such as environmental pollution caused by engineering projects, depletion of natural resources, greenhouse gas emissions, and man-made global warming [

2]. As far as the industry is concerned, carbon emissions closely relate to energy consumption [

3]. The building and construction sectors together account for more than one-third of the world’s final energy consumption. Due to the huge consumption of energy and raw materials in the construction industry, direct and indirect carbon dioxide emissions account for nearly 40% of the total. Climate change caused by carbon emissions from the construction industry has become a serious problem for the global environmental economy, and the construction industry is facing tremendous pressure to reduce emissions. At present, China’s construction industry is a pillar for national economic growth and a major contributor to carbon emissions [

4].

The early green economy only focused on protecting the environment, which opened the prelude to the study of the green economy [

5]. With the deepening of economists’ awareness of green development, the development of the green economy has shifted from the core focus on protecting the ecological environment in the early days to the mutual reinforcement and promotion of economic growth and environmental protection. Research on the green economy is no longer limited to environmental governance [

6]. Although different scholars have different focuses and research perspectives on the connotation of green development, they basically agree with the view that economic green development can help achieve the coordinated development of industry, economy, and ecology under resource and environmental constraints, maximizing the overall benefits of the three.

Developing countries and developed countries have different energy-saving potentials in the construction industry. The greatest potential of developing countries comes from electricity saving in electrical appliances and lighting, while the greatest potential of economies in transition and developed countries comes from energy fuel saving [

7]. As far as China is concerned, the carbon emission efficiency of its construction industry is low and is showing a downward trend year by year. In terms of internal driving factors, technological progress and energy structure adjustment can improve the carbon emission efficiency of the construction industry, but the economic scale of the extensive development model will have a certain negative impact [

8].

Going green has nowadays become the theme of global economic development, and the advancement of the green industry has become an inevitable trend in the economic development of various countries in the world. In order to reduce greenhouse gas emissions, China passed the Environmental Protection Tax Law in 2016 and promulgated and implemented it in 2018. By 2030, non-fossil energy is expected to account for 20% of total energy consumption. As a feasible solution to solve the carbon emission problem caused by energy in various industries, an environmental tax is gradually attracting the attention of various countries [

9,

10,

11]. Based on this, we would like to know whether these relevant green taxes can reduce the construction industry’s carbon emissions to a minimum while ensuring normal economic growth, so as to improve the industry’s carbon emission efficiency. Other interesting issues are also worth exploring. Except for low-income countries, carbon emission taxes have created welfare gains in almost all regions and have an impact on production and the environment. However, the transmission mechanism of green taxes on the carbon emission efficiency of the construction industry under China’s green tax policies is unclear [

12]. While environmental taxes reduce carbon emissions, they also generate considerable tax revenue and affect energy use [

13]. When the concentration of carbon emissions in the air exceeds the critical value of environmental harm, environmental taxes are imposed on polluting industries. With the increase of environmental taxes, the concentration of carbon dioxide may decrease [

14].

It is therefore imperative to coordinate the relationship between green taxes and carbon emission efficiency in the construction industry, so as to promote its transformation from extensive development to high-quality, low-carbon development. Under the framework of the green development strategy, this research evaluates the efficiency of carbon emissions from the construction industry in various provinces from the perspective of the intermediary effect of green taxation and explores the path between the two and the regional heterogeneity of the green development of the construction industry. The research significance is mainly reflected in the following three points. First, this study selects relevant indicators of green taxation based on the existing literature and constructs the green taxation evaluation index through the time-series global principal component analysis method in order to eliminate possible collinearity problems between data and to reduce model complexity. Second, the academic community’s measurement of carbon emission efficiency in the construction industry is mainly based on a single efficiency index and has failed to truly unify green taxation and efficiency for in-depth research. Therefore, this study constructs green taxation and construction industry carbon emission efficiency and explores the relationship between efficiency and green taxation, so that the two are no longer a single one. Third, from a macro-level policy perspective, taxation is one of the important tools for regulating economic green development, and fixed capital investment and technological effects are the key factors impacting carbon emissions. This research thus uses fixed asset investment in the construction industry and inter-provincial technology as intermediary variables, with a view to an in-depth exploration of the path and mechanism of how macro-level taxation affects carbon emission efficiency.

2. Literature Review

Based on the existing definitions and research on carbon emission efficiency in academia, this paper defines total factor carbon emission efficiency as the total factor carbon emission efficiency in the process of economic and social development, that is, while reducing factor input and increasing expected output, the scale of carbon emission is reduced as much as possible [

15]. As the international community pays attention to the coordinated development of the environment and economy, the literature on carbon emissions in the construction industry has experienced long-term expansion, and scholars have begun to conduct extensive research on carbon emissions in this industry. Scholars believe that the development of green industries is to promote sustainable and rapid economic growth of the industry, while improving energy and resource efficiency and reducing carbon emissions and pollutants [

16]. Many scholars focus on the development differences and distribution characteristics of carbon emissions in the construction industry between countries. Chen [

17] and others compare carbon emissions in the world’s two largest carbon emitters, China and the U.S. construction industry, using structural decomposition analysis, shows that China’s building carbon emissions are much larger than those of the United States, and the most obvious is the demand effect and production structure effect. Ayodeji [

18] and others examine the carbon pollution reduction control and emissions trading system and its adoption in the construction industry in South Africa, propose a mitigation of greenhouse gas emissions, and suggest that the construction industry implement it in advance based on their benefits to achieve sustainable development goals. There is certainly a complicated relationship between the construction industry and economic growth, labor, and productivity [

19,

20]. At present, the research direction of carbon emissions in the construction industry focuses on their calculation in the industry, their influencing factors in the industry, and their efficiency in the industry.

There are two main types of research on the influencing factors of carbon emissions: the study of only a single influencing factor and the study of multiple influencing factors. The former is often used to compare the effects of the same influencing factor on different regions or in different years, while the latter often focuses on the comparison of differences between various influencing factors. Scholars such as Trinks [

21] have conducted research on energy rebound factors in the construction industry, showing that China’s construction industry has an energy rebound effect, and technological changes can save about half of the potential energy, thereby reducing industry emissions. Other scholars such as Shi [

22] have used structural analysis methods to divide the development period of the construction industry into five driving factors, including the carbon factor effect and energy intensity effect, and found that the final total demand contributed the most to the growth of building carbon emissions. Sattar et al. [

23] conduct a study on the energy use of the construction industry in Australia. Their evaluation of the potential carbon emissions of the construction industry shows that Australia should focus on energy use in the life cycle stage of the building system and use energy-saving materials instead of traditional materials. Omar [

24] confirmed that different materials have a great impact on carbon emissions by comparing the differences in the calculation process and results of carbon emissions in the life cycle of building materials by different methods, and any material-related decision should be carefully considered.

As the world’s environmental problems continue to deteriorate, economists begin to realize that the role of the environment is an important issue in decision-making, and carbon emissions begin to be considered as an undesired output in empirical issues [

25]. Regarding the impact of taxation on carbon emissions, the existing research mainly includes two viewpoints: inhibitory and conditional, and no consistent research conclusion has been reached yet. The first view holds that taxation has an inhibitory effect on carbon emissions, and a moderate carbon tax will significantly reduce carbon emissions and fossil fuel energy consumption [

26,

27]. The second view holds that the impact of taxation on carbon emissions is conditional, and a single green tax policy can only partially reduce carbon emissions and requires the cooperation of other ways [

28]. A modest carbon tax would significantly reduce carbon emissions and fossil fuel energy consumption, and slightly reduce the rate of economic growth. Imposing a large carbon tax has a significant negative impact on China’s economic and social welfare, and in addition, imposing a high carbon tax will cause significant price changes in China [

29]. While reducing carbon emissions can be achieved in different ways, in general, green taxes can facilitate the entry of clean energy into industrial markets and reduce energy demand through energy efficiency and other indirect measures [

30].

Looking at the existing research results in academia, the research results on green taxation and carbon emissions show two characteristics: First, DEA has been widely used as a model for measuring efficiency in different industries in various countries [

2,

31,

32,

33]. However, due to the vast area of China, the large gap in energy and economic structure between provinces, and the obvious differences in the development of regional carbon emissions [

34], there are relatively few studies on the carbon emission efficiency of the construction industry at the national and provincial levels. Second, relevant studies mainly focus on economic growth as a single indicator, measuring the relationship between carbon emissions from the construction industry and the economy and considering the impact of the construction industry on the environment from the perspective of carbon emissions. There is a lack of analysis of the impact of environmental regulations and policies on the results. Increased economic activity does not always ensure environmental protection. In addition to growth itself, the path of growth is also important [

33]. Based on this, this study uses the SBM-DEA model and the intermediary effect model to verify the impact of green taxes on the carbon emission efficiency of the construction industry and analyzes the path of green taxes on the carbon emission efficiency of the construction industry.

3. Theoretical Analysis and Research Hypothesis

Environmental regulation policies represented by green taxation have always been controversial in terms of their effects. Taking Sinn [

35] as the representative put forward the “green paradox”, they believe that the imperfect environmental regulatory policy measures to limit climate change are ineffective in reducing the demand for fossil energy, due to the incorrect setting of carbon tax and other reasons, they only depressed energy prices. In buildings, there are long-term and short-term elasticities between households’ energy prices. The reduction of energy prices promotes housing investment [

36], which accelerates carbon emissions in the atmosphere. This leads to environmental degradation [

35,

37,

38]. The government has promoted the “reverse emission reduction” effect through two environmental regulatory measures. First, through green taxation, pollution control subsidies and other incentive-based environmental regulatory policies, and through an increase in the cost of energy use in the construction industry, it promotes scientific research and development and the adoption of new environmental protection technologies, but this only reduces carbon emissions. Second, through compulsory environmental regulations such as the rectification of high energy-consuming projects, the construction industry is forced to reduce its current scale or enterprises must use new energy sources to reduce energy consumption intensity to a certain extent to help reduce the China’s carbon emissions [

39,

40]. Based on this, this research proposes the Hypothesis 1.

Hypothesis 1. Since the negative effect of the “green paradox” is weaker than the “reverse emission reduction” effect caused by the government’s environmental regulation policy of green taxation; green taxation has a direct positive effect on carbon emission efficiency.

In the existing research, environmental regulatory policies can be divided into command control environmental regulation policy and market incentive environmental regulation policy. Between them, green taxation is a market incentive environmental regulation policy. Generally speaking, the purpose of green taxation is to protect the environment and reduce carbon emissions in the air. Green taxation on carbon emission efficiency is expected to have a positive emission reduction effect. Specifically, the government levies green taxes and other environmental taxes on the producers and users of fossil energy, increasing their production costs and reducing energy demand, thereby helping to reduce carbon emissions. Environmental regulation not only has a direct effect on the action of carbon, may also have effect on carbon as a fixed assets path [

41]. In terms of the path of green taxation—fixed assets—carbon emissions, stringent environmental regulations have made high-energy-consumption and high-polluting construction industries bear high tax compliance costs. In order to avoid this cost, companies are known for their pollution-intensive construction. The industry will shift investment to areas with relatively loose environmental regulations, and strict green tax policies will effectively curb the unreasonable expansion of the scale of the pollution-intensive construction industry. The tertiary industry, which emits fewer pollutants, is less impacted and promotes the development of fixed asset investment in the direction of a clean industry. Carbon emissions will also be significantly reduced, thereby improving carbon emission efficiency. Based on this, this study proposes the Hypothesis 2.

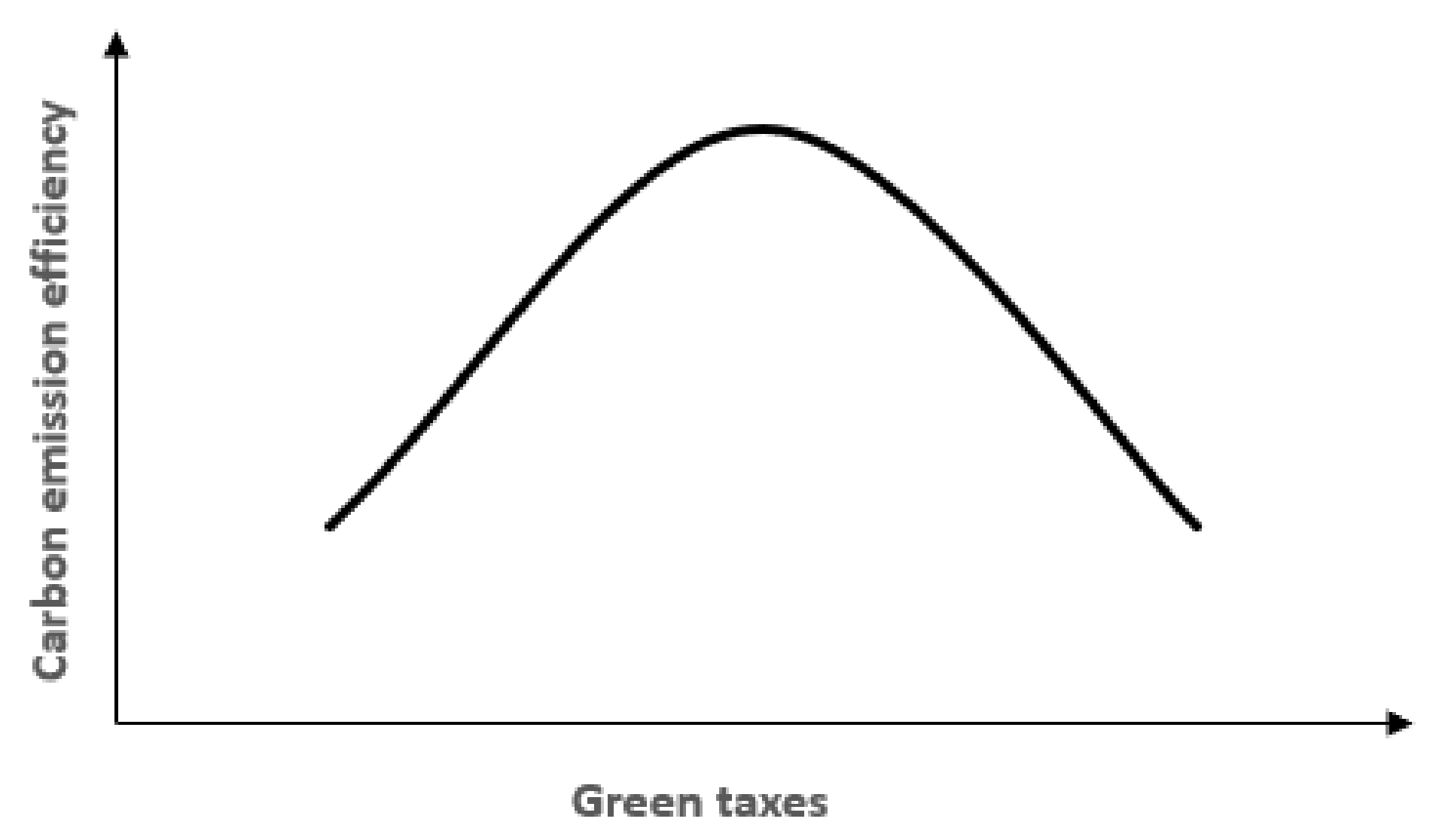

Hypothesis 2. The relationship between green taxes and carbon emission efficiency is an inverted U-shape curve (Figure 1). The neoclassical investment theory believes that tax and investment analysis can be simply summarized as follows: a tax policy affects the cost of capital, and the cost of capital determines the optimal capital stock for balanced investment, which finally determines the actual investment of the enterprise. A series of transmission mechanisms have established a link between tax policy and investment. Green taxation with the pros and cons of fixed asset adjustment can effectively reduce carbon emissions.

Due to China’s unique government governance model, the effects of environmental regulatory policies on carbon emissions may also be affected by the “races” of local governments. For a low-level economic area, local governments pay more attention to GDP growth, which may partially implement the central government’s environmental tax policies, by easing the tax to attract more policy fixed assets and other inputs, in order to purse short-term higher economic. As a result, the green tax policy formulated by the central government cannot really effectively restrain the growth of carbon emissions in various places, and carbon emission efficiency is ultimately in a low state. With the improvement of regional economic development and people’s living standards, residents demand a better quality of life, forcing local governments to pay more attention to regional air quality improvement. While the China government and relevant departments clean industries, provide greater tax incentives, and raise higher public awareness of environmental protection, the government is developing and implementing environmental laws and regulations to take active measures to change into environmental management [

42]. The government began to change the goal of competition from simply pursuing economic growth to stable economic growth, while pursuing the improvement of public satisfaction. To enhance the level of environmental regulation, those highly polluting fixed assets will incur high taxes in order to force them to shut down, which will help achieve carbon reduction targets. Based on this, our study proposes the Hypothesis 3.

Hypothesis 3. The path 1 through which green tax affects carbon emissions is: Green tax → Fixed asset investment → Carbon emission.

According to the theory of public goods, the public has a non-exclusive product in consumer resistance—that is, every member of society can benefit from public goods in the interests of the individual having a market incentive to maximize the existence of the “free rider” phenomenon. To a certain extent, technological progress has the characteristic of strong public products. Since technological research and development is an economic activity with high investment costs, once a new product is put on the market, other companies will quickly copy it. This will undoubtedly have a negative impact on companies with active technology R&D activities.

Environmental taxation may exhibit the Porter hypothesis for technological innovation—that is, appropriate environmental taxation will stimulate technological innovation, or there may be a following cost effect. Therefore, government intervention is needed to implement tax policies to encourage enterprises to carry out innovative activities. The well-known economist Keynes put forward the policy theory that economic operation requires government intervention in his book “General Theory of Employment, Currency and Interest”, emphasizing the stimulating effect of fiscal policy on the economy, and pointed out that taxation and fiscal expenditure are the main means of government fiscal policy. As one of the main sources of fiscal revenue, taxation can provide the necessary source of funds for the government’s various fiscal expenditures and at the same time can provide indirect financial support for enterprise technological progress activities. Its adjustment function is mainly to influence and guide the technological progress activities of enterprises by formulating relevant preferential tax policies. Based on this, our study proposes the Hypothesis 4.

Hypothesis 4. The path 2 for green taxation to affect carbon emissions is: Green taxation →Technical progress → Carbon emission.

4. Model with Variable Data

4.1. DEA-SBM Model

The SBM model (Slack Based Measure, SBM) is used to estimate the carbon emission efficiency of the construction industry. Assuming that the country under study has much land, the land is divided into different decision-making units (DMU

i,

i = 1, 2…

k). These DMUs represent each province in China. Each DMU has the same input and output indicators—that is, there are

m input elements and

n outputs (

n1 is the expected output,

n2 is the undesired output). The input index value of the

i-th DMU

i is

xi, while the expected output index value

yg and the undesired output index value

yb are respectively:

According to the construction idea of the SBM model containing undesired output, the production technology set

T of the DMU is:

Here, is the weight of the non-negative multiplier for the production technology concentration construction of linear programming.

The traditional DEA model (Data Envelopment Analysis, DEA) uses radial measurement and ignores slack variables. When there are slack variables, the phase efficiency may be overestimated. Based on this, Tone [

43] proposes a non-radial and non-angle SBM model, which directly considers the slack variables of input and output in the DMU. It can avoid the shortcomings of the traditional DEA model in terms of input and output and the same ratio improvement. When the SBM model deals with undesired output problems such as environmental pollution, it can calculate the efficiency of the DMU and also point out the direction of improvement of non-effective input. Based on Tone’s method, when considering bad output variables, the non-directional SBM model can be specified as follows:

We note that s−, sg, and sb denote input factors, expected output, and undesirable output slack variable, and [rho] is the objective function—namely, efficiency values that we ask about s−, sg, and sb are strictly decreasing. Here, 0 ≤ ρ ≤ 1, as when ρ = 1, the DMU is efficient, meaning the slack variable is 0 (s− = 0, sg = 0, sb = 0) at the forefront of the production line, when ρ ≤ 1, there is room for efficiency improvement in the DMU. The efficiency measurement of model (2) includes economic and carbon emission factors, and so we can define it as including the construction industry’s carbon emission efficiency value.

4.2. Time Series Global Principal Component Analysis Method

Based on the existing literature on the evaluation and research on the level of green development and combined with the characteristics of green taxation and the availability of data, this paper selects resource tax (X1), urban maintenance and construction tax (X2), real estate tax (X3), urban land use tax (X4) and land value-added tax (X5). These 5 indicators represent the green taxation of the construction industry, and through the time-series global principal component analysis, the impact weight of the green taxation of each province is measured from a dynamic perspective. The specific calculation steps are as follows.

Before performing principal component analysis, we perform dimensionless processing on the data to obtain a standardized vector to avoid heteroscedasticity in the data. The standardization process is as follows:

Xij is the original index normalized value; Xij is original index; μ is for the first j mean of indicators; and δ is for the first j indices the standard deviation.

We are now establishing a time series global data table. Suppose there are K selected indicators, denoted as X

1, X

2, X

3…, X

k. If there are n provinces, then the data table for year t can be expressed as X

t = (X

ij)

n×k, where 0 < t ≤ T, and T represents the number of years of study. Arrange the T data sheets by year to form a three-dimensional time series table of n, t, and k, which can be marked as

For data validity check, after data standardization, a validity test is required to confirm whether the data can be analyzed by principal components. KMO value comprehensively measures the information overlap between analysis items, that is, the correlation between analysis items. Too low of a correlation coefficient between analysis items will lead to low KMO value. When KMO ≥ 0.6, the data are suitable for principal component analysis. We then perform Bartlett’s sphere test to show that there is a correlation between the indicators, and principal component analysis can be performed on the data.

We now confirm the initial eigenvalue variance percentage. By establishing the factor load matrix, we input the standardized decision matrix to calculate the load matrix a

ij and obtain the factor load

Pij of each index. We finally do the percentage processing to get

wj:

Through the calculated weights, the various indicators are weighted and processed to finally obtain the green tax index:

4.3. Mediating Effect Model

To verify the existence of the mediating effect, the following three conditions must be met: Condition A: Before the mediating variable is not included, the core explanatory variable has a significant impact on the explained variable. Condition B: In order to include the explained variable, the core variable has a significant effect on the mediator variable. Condition C: Among the three mediator variables, the mediator variable has a significant impact on the explained variable, but the influence of the core explanatory variable on the explained variable is reduced. This study uses China’s provincial panel data from 2008 to 2017. For the analysis method and process of the intermediary effect, carbon emission efficiency is selected as the explanatory variable, and the green tax index is the core explanatory variable to verify the direct impact of green tax on the carbon emissions of the construction industry. The regression model runs as follows:

In Formula (7), LCE is the carbon emission efficiency of the construction industry calculated in (2), and LGT stands for green taxation. This study uses principal component analysis to calculate the green taxation index. LUR, LTIH, and FD are control variables, representing urbanization rate, total residential investment, and financial development level, respectively. is a random disturbance item. It represents the total effect of a green tax on the carbon emission efficiency of the construction industry. When β1 is significant and positive, Hypothesis 1 is validated, and when β2 is significant and negative, Hypothesis 3 is validated.

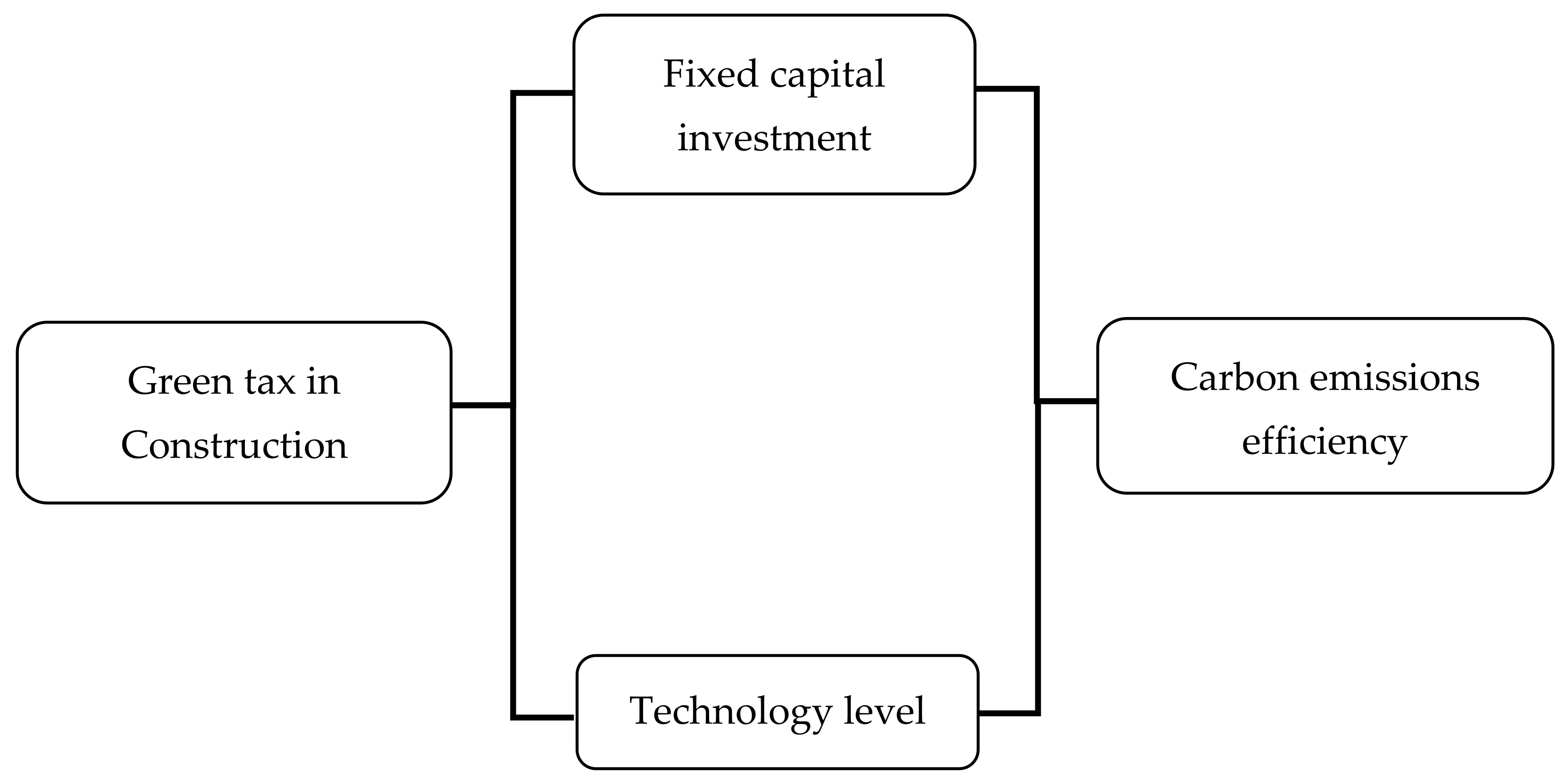

The theoretical analysis of this research believes that green taxation can directly affect carbon emission efficiency and also indirectly conduct carbon emission efficiency through fixed asset investment and technological level. Therefore, this study sets fixed asset investment and technological level as intermediary variables and includes them in Formula (8) to verify whether the mediating effect exists. Therefore, this study builds model (8) to verify the existence of the B condition of the mediation effect. The specific model is constructed as follows:

In Formula (8),

M is the intermediary variable, which means fixed asset investment and technical level. If the

coefficient is significant, then the core explanatory variable has a significant impact on the intermediary variable, and Hypothesis 2 holds. On the basis of the verification of condition 1 and condition 2 that the mediation effect holds, model (8) is further constructed to verify the existence of the mediation effect C condition:

If the coefficient λ1 drops significantly, but the coefficient λ3 passes the significance test, then the mediation effect is satisfied.

In summary, the impact of green taxation on the carbon emission efficiency of the construction industry is mainly through the following paths, as shown in

Figure 2.

4.4. Explained Variables

In the theoretical analysis of this article, it is believed that green taxation can directly affect carbon emission efficiency and also indirectly conduct carbon emission efficiency through fixed asset investment and technological level. Therefore, this study sets fixed asset investment and technological level as intermediary variables.

For carbon emission efficiency of the construction industry, when most scholars analyze the industry’s carbon emission efficiency [

44], the input indicators are generally energy consumption, labor input, and fixed asset investment as input indicators, while output indicators are profit or total output as the main variables. Based on the comprehensive consideration of the characteristics of green development of the construction industry, this study draws lessons from the evaluation of the green development efficiency of the existing construction industry, selects the following indicators, and uses the statistical software DEAsolver 13.0 to measure carbon emission efficiency of the construction industry.

From the existing literature, the input indicators are mainly selected from three aspects: labor, technology, and capital. To comprehensively reflect the actual production input of the construction industry, this study takes the number of construction industry employees, steel, cement, wood, aluminum, and energy terminal consumption, and technical equipment rate as input indicators. The use of building materials such as cement, steel, and glass are the main source of carbon dioxide emissions in the construction industry. The final energy consumption data come from the China Energy Statistical Yearbook, and the other construction industry data come from the China Construction Statistical Yearbook.

The traditional DEA model cannot distinguish the limitations of efficient DMUs, while the non-radial (slack based measure, SBM) efficiency model can deal with undesired output. The SBM model has significant advantages. Therefore, this study selects the annual output value of the construction industry as the expected output and the carbon dioxide emissions as the undesired output. The specific index selection is shown in

Table 1, and

Table 2 is the specific efficiency calculation results:

4.5. Explanatory Variables

Most research on green taxation in China focuses on theoretical analysis, as well as the theoretical design and current analysis of the construction of the green taxation system. Real taxation data are rarely used to study the system construction model, but this study conducts theoretical analysis. On the basis of this, a macro-level tax that includes both micro-level taxation and the influencing factors of taxation on output is constructed. As the basis for the construction of a green tax system, this study selects resource tax (X

1), urban maintenance and construction tax (X

2), real estate tax (X

3), urban land use tax (X

4), and land value-added tax (X

5) as green tax indicators, and a factor analysis model is used for the green tax system under the model. A weight assignment is performed, and missing values are compensated by linear interpolation. This study uses SPSS analysis to find that the original data pass the KMO and Bartlett tests, indicating that the data are suitable for principal component analysis, and the data are all from the regional economic sector of the CSMAR database. The specific indicators of explanatory variables are shown in

Table 3:

4.6. Mediation Variables

The construction industry is an industry that is seeing increased carbon emissions, and fixed asset investment plays an important role in its development. Therefore, it is essential to study the impact of fixed asset investment on carbon emission efficiency. At the same time, neoclassical theory and Tobin’s q theory believe that the adjustment of tax policy will have a direct impact on the investment decision of enterprises. In particular, highly targeted tax policies such as green taxation will guide local enterprises to invest more fixed capital into green transformation and upgrading projects. Therefore, this study takes fixed assets as an intermediary variable.

The government uses taxation to promote the development of the green economy and circular economy by actively accelerating technological progress by market entities such as enterprises. Technological factors are considered to have active energy to reduce carbon emissions. For example, Sun et al. [

45] construct a total factor productivity index subject to carbon intensity constraints and after decomposing it believe that “technical progress is the promotion of all factors under carbon intensity constraints and the main factor of productivity increase.” Accordingly, this study takes the technological development level of each province as an intermediate variable in the model, in order to further deepen the path analysis of green taxation on carbon emission efficiency of the construction industry.

4.7. Control Variables

In order to achieve unbiased estimation results, other variables that affect the carbon emission efficiency of the construction industry need to be controlled in the model. This study draws on the research of Shi [

46] on the impact of optimal policies on environmental quality and combined with data availability selects the following indicators as control variables.

China’s economy is developing rapidly, and the urbanization rate is rising year by year. The influx of a large number of people into cities has caused huge housing demand. The increase in per capita living area and the development of new rural construction and industrial construction are all driving forces for the development of the construction industry.

With China’s rapid urbanization, total residential investment can measure the development of the urban construction industry.

Compared with ordinary commodities, construction products have a longer service life, a large amount of value storage, and stable value preservation, which will attract more capital injections. Therefore, this study takes the loan ratio of each province as a substitute variable for the level of financial development.

Table 4 shows the variables involved in the model and their definitions,

Table 5 shows the descriptive statistics of each control variable:

5. Empirical Results and Analysis

5.1. Research on the Intermediary Path of Green Taxation to Carbon Emission Efficiency

In order to deal with potential model endogenous problems, this study lags all the determinants of carbon emissions by one period and uses a fixed effects model to regress Formula (6). First, it examines the direct impact of green taxes on carbon emissions from the construction industry. The regression results are shown in

Table 6, where the regression model (1) represents the direct impact of green taxes on the carbon emission efficiency of the construction industry; regression model (2) represents the impact of green taxes on the fixed capital investment of each province, regression model (3) is the effect of taxation on technology level, regression model (4) represents the mechanism of green taxation—fixed capital investment—carbon emission efficiency, and regression model (5) represents the mechanism of green taxation—technical level—carbon emission efficiency.

It can be seen from the regression model (1) that the regression coefficients of the primary and secondary terms of green taxation are 0.3494 and −0.1012, respectively, and have passed the significance test, indicating the green tax has a direct effect path on the carbon emission efficiency of the construction industry. It also has an inverted U-shape impact on the carbon emission efficiency of the construction industry. Hypotheses 1 and 2 are thus supported. At present, green taxes can effectively improve the carbon emission efficiency of the construction industry, and the advancement of urbanization can also promote the increase of inter-provincial fixed asset investment. In recent years, the central government’s emphasis on improving the ability of financial services to the real economy, especially the establishment of a financial service system supported by the concept of green development, has promoted the improvement of carbon emission efficiency to a certain extent. Thus, the relationship between residential investment and carbon emission efficiency is also positive. Conversely, consumers in the construction industry are not sensitive to fossil energy prices, and the green paradox effect of increasing carbon emissions is weak in China, which is in line with expectations.

Models (2) and (3) respectively verify the impact of green taxes on intermediary variables. The regression coefficients of the primary and secondary terms of a green tax in model (2) are −0.0744 and 0.0276, respectively, and both pass the 5% significance test. Compared with model (1), the opposite effect is produced—that is, a green tax and fixed asset investment have a U-shape relationship. The reason is that green taxes have increased the cost of enterprises using fossil energy to a certain extent, forcing them to transform into clean energy. China is still in a situation of a shortage of energy resources. “Rich coal, poor oil, and low gas” will keep China energy consumption for a long time. The state of energy consumption makes companies reduce their investment in fixed assets due to costs on the one hand. On the other hand, companies lack funds in the short term and cannot carry out green transformation in the short term. Therefore, green taxes have a negative effect on fixed asset investment.

From the regression result of model (3), we find that green taxation positively promotes technological progress, while the level of financial development has a restraining effect on technological progress. With China’s strict environmental regulations, the government is considering performance appraisal, and companies are considering environmental governance costs. Companies will look to accelerate their technological advancement to make exhaust gas, wastewater, and waste residues meet the standards. There is the Porter hypothesis effect for promoting the innovation of corporate carbon emission efficiency technologies. However, due to the current strict real estate regulation and control policies in China, technological innovation undoubtedly squeezes out loans to a certain extent under the limited financial development level, thus making the current financial development level insufficient to support enterprises’ technological innovation.

The regression coefficient of fixed capital investment in model (4) is 0.2635, and it passes the 10% significance test, indicating that the green tax has a mediating effect on the carbon emission efficiency of the construction industry, thus supporting Hypothesis 3. The regression results of model (5) show that technology factors have a promoting effect on carbon emission efficiency. The regression coefficient of technological progress is 0.3675, which passes the 1% significance test. Based on this, Hypothesis 4 is supported.

Compared with model (1), after adding fixed capital investment and technological progress level variables, the absolute value of the estimated coefficient of green tax, which is the core explanatory variable, has decreased. This shows that the above two variables have an intermediary role. In addition, to ensure the validity of the mediation effect estimation results, this paper conducts the Sobel test. The Z statistics of the two mediation channels are 1.98 and 2.09, respectively, and both are significant at the 5% level. The Sobel test results show that the mediating effects of the two account for 0.273 and 0.268, respectively, further indicating that fixed capital investment and technological progress do play a mediating role in the process of a green tax influencing the carbon emission efficiency of the construction industry.

5.2. Robustness Test

The above empirical analysis uses green tax as the core explanatory variable to reflect the impact on the carbon emission efficiency of the inter-provincial construction industry. It is based on the government’s macro-level policy to examine the impact mechanism of carbon emission efficiency. It does not examine the carbon emission efficiency of the construction industry in each province from the enterprise level. As an important factor affecting fixed capital investment and technology research and development, equity concentration is a good substitute variable for robustness testing. In this regard, this study selects 26 companies with a market value of more than 4 billion yuan in the A-share market and excludes *ST and ST companies. By collecting and arranging the equity concentration data of these 26 enterprises in various provinces, a regression model of equity concentration (SHARE) on fixed capital investment and technical level is constructed, so as to indirectly reflect the carbon emission efficiency of the construction industry in each province. The regression results are as follows:

Table 7 reports the test results of robustness. According to the test results, we see that the equity structure in the early stage has a dynamic influence mechanism on the later stage. According to the estimation results in models 6–10, the concentration of equity has a significant positive effect on carbon emission efficiency, and both fixed capital investment and technology research and development play an intermediary role. This proves that the previous empirical conclusions are robust.

6. Discussion

Based on the previous analysis, the research hypotheses proposed in this paper are all supported by the results of empirical analysis. We find that the relevant departments will increase the production cost during the process of implementing a green tax for the construction industry. The green tax also forces the construction industry to carry out technological improvements and renewal of fixed capital, thereby improving the carbon emission efficiency indirectly. However, the carbon emission efficiency of the construction industry has declined via an increasing green tax index, which reflects that positive and negative effects exist at the same time.

In terms of the effects of environmental regulations on carbon emissions, there are two views with regards to the green paradox and the forced emission reduction. Scholars who hold the green paradox view suggest that increasing the intensity of environmental regulations does not promote carbon emission reduction. However, others who hold the view of reducing emissions believe that China’s current environmental regulations can effectively curb carbon emissions [

47]. According to the research results herein, when the technology remains unchanged and fixed capital has not been updated, the industry will initially reduce the input of polluting energy due to the production cost caused by tax avoidance and promote the construction industry to carry out environmental protection innovations, thereby making the industry carbon emission efficiency improve gradually. Once the industry tax burden reaches a certain level, there will be an inflection point in the carbon emission efficiency, thus supporting Hypotheses 1 and 2. This shows that as industry tax incentives should be dedicated to improving technological progress, the government can optimize them to increase economic growth by stimulating innovation and production, validating the research conclusions of Ahn et al. [

48] on green buildings. Since China has entered the stage of high-quality economic and social development, the construction industry can only adapt to the current economic development by continuously accumulating and developing more environmentally friendly technologies.

In addition to the direct impact of green taxes on the carbon emission efficiency of the construction industry, this study also introduces the technology level and fixed capital investment into the carbon emission efficiency impact mechanism. According to the empirical analysis results, green taxation and construction industry fixed asset investment show a U-shape relationship, meaning that the initial increase of green taxation will reduce the industry’s fixed capital investment, but as the tax burden increases, fixed capital investment will increase, which is consistent with the research of Wu [

49] and also validates Hypothesis 3.

From the perspective of technological progress, the results in

Table 6 show that green taxation and technological progress also have a U-shape relationship, denoting that green taxation has a non-linear impact on the technology level of the construction industry. This coincides with the conclusion reached by Wang and Yu [

50] that environmental taxes have production externalities, which in the short term will cause companies to lose part of their profits, thereby reducing R&D investment. With the gradual elimination of medium and small enterprises with heavy environmental tax burden and low technical level in this industry, the remaining large enterprises have improved their competitiveness by developing new technologies. Therefore, in the short term, the local employed population and economic level may be affected by the environmental tax, resulting in a certain retrogression; However, in the long run, it is conducive for the employed population to flow into other enterprises with high technical level and production efficiency. Green tax helps to promote the development of the technical level of the construction industry and adjust the industrial structure of the construction industry, supporting Hypothesis 4.

In summary, the implementation of green tax policies can effectively improve the overall carbon emission efficiency of the construction industry, and both technical factors and fixed capital factors play a role in transmission. This requires relevant departments to fully examine the impact of the construction industry’s technology level and fixed capital investment on carbon emission efficiency when formulating and implementing green tax policies.

7. Conclusions and Recommendations

Driven by its infrastructure policy, China’s large-scale construction industry has amazed the world. Relatedly, a green tax is an important adjustment tool for the government to implement green economic development and has an important impact on improving carbon emission efficiency. In order to reveal the impact and effect channels of a green tax on carbon emissions in the construction industry, it is thus helpful to comprehensively evaluate the impact on the construction industry. Based on these considerations, this study takes 26 provinces in China as the research object and constructs a mediation effect model to empirically test the impact of green taxation on the high-quality economic development of China’s construction industry. The conclusions show that green taxation not only has a direct effect on the carbon emission efficiency of the construction industry, but also indirectly affects carbon emission efficiency through the dual paths of fixed asset investment and technological progress, pushing China to realize that improving carbon emission efficiency requires two-way optimization of fixed assets and technology investment. Although a green tax will increase the cost burden of high-pollution and energy-intensive enterprises, it can reduce their dependence on energy by internalizing their negative externalities. This forces the enterprises to gradually phase out high-energy-consuming fixed assets through technological upgrading, optimizing the industrial structure, and turning to clean energy, thereby further promoting the industry’s development in the direction of low-carbon and high-efficiency.

Taking into account the economic development status of each region and combining with the characteristics of the regional industrial structure, green taxes and fees shall be levied according to local conditions. We see from the conclusion that green taxation is improving carbon emission efficiency, but at the same time, green taxation increases the cost of enterprises to a certain extent and squeezes their financial development. Therefore, the introduction of green taxation nationwide must take into account the strict credit relationship faced by China’s construction industry and the fact that China will still be “rich in coal, poor in oil, and less in gas”. China should gradually improve the green tax system, coordinate the development relationship between environmental protection and economic growth, strengthen energy-saving standards for new buildings, focus on energy-saving projects for building renovations, and target the goal of adjusting the country’s economic structure.

Since carbon emissions of the construction industry account for more than 20% of the national energy carbon emission, it is necessary to increase guidance for the high-polluting construction industry. With increasing saturation of the construction industry, plans can be made to shut down some low-value-added and high-energy-consuming enterprises, actively guide the development of high-tech manufacturing and service industries, and fundamentally curb highly resource-consuming production models.

China should also choose sensible green tax tools. On the one hand, the empirical analysis shows that China’s current green tax policy exerts a stronger reverse emission reduction effect than the green paradox effect. At the same time, in terms of technological innovation, the Porter hypothesis effect brought by green taxation is also more significant. Therefore, a further moderate expansion of the green tax policy will not only help improve carbon emission efficiency, but also help technological innovation. At the same time, the government should also prevent unrealistic policies that increase the intensity of green taxation due to blindly trying to improve performance, which can increase the risk of triggering the green paradox to a certain extent. At the same time, the government should strengthen incentive taxation tools such as tax subsidies to prevent enterprises from being unable to continue technological innovation due to insufficient funds.

Author Contributions

Conceptualization, Y.Z. and Z.F.; Data curation, S.L., J.W. and J.T.; Formal analysis, Y.Z. and S.L.; Investigation, Z.F.; Methodology, Z.F. and J.W.; Visualization, Y.Z.; Supervision, Z.F. and Y.Z.; Project administration, Z.F.; Writing—original draft preparation, Z.F.; Writing—review and editing, Y.Z. and Z.F. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Social Science Foundation of China (grant number No.18BJL127), “National Finance” and “Mezzo Economics” teaching, and the research Fund of Guangfa Securities Social Charity Foundation for financial support.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest. The funding sponsors had no role in the design of the study, the collection, analyses, or interpretation of data, the writing of the manuscript, or in the decision to publish the results.

References

- Pearce, D.W. The Social and Economic Value of Construction: The Construction Industry's Contribution to Sustainable Development; nCrisp: London, UK, 2003; pp. 9–24. [Google Scholar]

- Wang, N. The Role of the Construction Industry in China’s Sustainable Urban Development. Habitat Int. 2014, 44, 442–450. [Google Scholar] [CrossRef]

- Ang, B.W. Is the Energy Intensity a Less Useful Indicator than the Carbon Factor in the Study of Climate Change? Energy Policy 1999, 27, 943–946. [Google Scholar] [CrossRef]

- Wu, Y.; Chau, K.W.; Lu, W.; Shen, L.; Shuai, C.; Chen, J. Decoupling Relationship between Economic Output and Carbon Emission in the Chinese Construction Industry. Environ. Impact Assess. Rev. 2018, 71, 60–69. [Google Scholar] [CrossRef]

- Jacobs, M. The Green Economy: Environment Sustainable Development and the Politics of the Future; Pluto Press: Concord, MA, USA, 1993; pp. 29–46. [Google Scholar]

- Fiorino, D.J. Explaining National Environmental Performance: Approaches, Evidence, and Implications. Policy Sci. 2011, 44, 367–389. [Google Scholar] [CrossRef]

- Ürge-Vorsatz, D.; Novikova, A. Potentials and Costs of Carbon Dioxide Mitigation in the World’s Buildings. Energy Policy 2008, 36, 642–661. [Google Scholar] [CrossRef]

- Zhou, Y.; Liu, W.; Lv, X.; Chen, X.; Shen, M. Investigating Interior Driving Factors and Cross-Industrial Linkages of Carbon Emission Efficiency in China’s Construction Industry: Based on Super-SBM DEA and GVAR Model. J. Clean. Prod. 2019, 241, 118322. [Google Scholar] [CrossRef]

- Niu, T.; Yao, X.; Shao, S.; Li, D.; Wang, W. Environmental Tax Shocks and Carbon Emissions: An Estimated DSGE Model. Struct. Change Econ. Dyn. 2018, 47, 9–17. [Google Scholar] [CrossRef]

- Babatunde, K.A.; Begum, R.A.; Said, F.F. Application of Computable General Equilibrium (CGE) to Climate Change Mitigation Policy: A Systematic Review. Renew. Sustain. Energy Rev. 2017, 78, 61–71. [Google Scholar] [CrossRef]

- Ghaith, A.F.; Epplin, F.M. Consequences of a Carbon Tax on Household Electricity Use and Cost, Carbon Emissions, and Economics of Household Solar and Wind. Energy Econ. 2017, 67, 159–168. [Google Scholar] [CrossRef]

- Wesseh, P.K.; Lin, B.; Atsagli, P. Carbon Taxes, Industrial Production, Welfare And The Environment. Energy 2017, 123, 305–313. [Google Scholar] [CrossRef]

- Hammar, H.; Sjöström, M. Accounting for Behavioral Effects of Increases in the Carbon Dioxide (CO2) Tax in Revenue Estimation in Sweden. Energy Policy 2011, 39, 6672–6676. [Google Scholar] [CrossRef]

- Sundar, S.; Mishra, A.K.; Naresh, R. Effect of environmental tax on carbon dioxide emission: A mathematical model. Int. J. Appl. Math. Stat. 2016, 4, 16–23. [Google Scholar]

- Sun, W.; Huang, C. How Does Urbanization Affect Carbon Emission Efficiency? Evidence From China. J. Clean. Prod. 2020, 272, 122828. [Google Scholar] [CrossRef]

- Wang, K.; Wang, J.; Hubacek, K.; Mi, Z.; Wei, Y. A Cost–Benefit Analysis of the Environmental Taxation Policy in China: A Frontier Analysis-based Environmentally Extended Input—Output Optimization Method. J. Ind. Ecol. 2020, 24, 564–576. [Google Scholar] [CrossRef]

- Chen, J.; Shi, Q.; Shen, L.; Huang, Y.; Wu, Y. What Makes the Difference in Construction Carbon Emissions between China and USA? Sustain. Cities Soc. 2019, 44, 604–613. [Google Scholar] [CrossRef]

- Oke, A.E.; Aigbavboa, C.O.; Dlamini, S.A. Carbon Emission Trading In South African Construction Industry. Energy Procedia 2017, 142, 2371–2376. [Google Scholar] [CrossRef]

- Strassmann, W.P. The Construction Sector In Economic Development*. Scott. J. Polit. Econ. 1970, 17, 391–409. [Google Scholar] [CrossRef]

- Ruddock, L.; Lopes, J. The Construction Sector and Economic Development: The ‘Bon Curve’. Constr. Manag. Econ. 2006, 24, 717–723. [Google Scholar] [CrossRef]

- Trinks, A.; Mulder, M.; Scholtens, B. An Efficiency Perspective On Carbon Emissions And Financial Performance. Ecol. Econ. 2020, 175, 106632. [Google Scholar] [CrossRef]

- Shi, Q.; Chen, J.; Shen, L. Driving Factors of the Changes in the Carbon Emissions in the Chinese Construction Industry. J. Clean. Prod. 2017, 166, 615–627. [Google Scholar] [CrossRef]

- Sattary, S.; Thorpe, D. Potential Carbon Emission Reductions in Australian Construction Systems through Bioclimatic Principles. Sustain. Cities Soc. 2016, 23, 105–113. [Google Scholar] [CrossRef]

- Wan Omar, W.-M.-S.; Doh, J.-H.; Panuwatwanich, K. Variations in Embodied Energy and Carbon Emission Intensities of Construction Materials. Environ. Impact Assess. Rev. 2014, 49, 31–48. [Google Scholar] [CrossRef]

- Zaim, O.; Taskin, F. Environmental Efficiency in Carbon Dioxide Emissions in the OECD: A Non-Parametric Approach. J. Environ. Manag. 2000, 58, 95–107. [Google Scholar] [CrossRef]

- Meng, S.; Siriwardana, M.; Mcneill, J. The Environmental And Economic Impact Of The Carbon Tax In Australia. Environ. Resour. Econ. 2013, 54, 313–332. [Google Scholar] [CrossRef]

- Chen, W.; Zhou, J.-F.; Li, S.-Y.; Li, Y.-C. Effects of an Energy Tax (Carbon Tax) on Energy Saving and Emission Reduction in Guangdong Province-Based on a Cge Model. Sustainability 2017, 9, 681. [Google Scholar] [CrossRef]

- Li, Z.; Dai, H.; Song, J.; Sun, L.; Geng, Y.; Lu, K.; Hanaoka, T. Assessment of the Carbon Emissions Reduction Potential of China’s Iron and Steel Industry Based on a Simulation Analysis. Energy 2019, 183, 279–290. [Google Scholar] [CrossRef]

- Guo, Z.; Zhang, X.; Zheng, Y.; Rao, R. Exploring The Impacts Of A Carbon Tax On The Chinese Economy Using A Cge Model With A Detailed Disaggregation Of Energy Sectors. Energy Econ. 2014, 45, 455–462. [Google Scholar] [CrossRef]

- Calderón, S.; Alvarez, A.C.; Loboguerrero, A.M.; Arango, S.; Calvin, K.; Kober, T.; Daenzer, K.; Fisher-Vanden, K. Achieving Co2 Reductions in Colombia: Effects of Carbon Taxes and Abatement Targets. Energy Econ. 2016, 56, 575–586. [Google Scholar] [CrossRef]

- Pérez, K.; González-Araya, M.C.; Iriarte, A. Energy and GHG Emission Efficiency in the Chilean Manufacturing Industry: Sectoral and Regional Analysis by DEA and Malmquist Indexes. Energy Econ. 2017, 66, 290–302. [Google Scholar] [CrossRef]

- Boyd, G.A. Estimating the Changes in the Distribution of Energy Efficiency in the U.S. Automobile Assembly Industry. Energy Econ. 2014, 42, 81–87. [Google Scholar] [CrossRef]

- Halkos, G.E.; Tzeremes, N.G. Exploring the Existence of Kuznets Curve in Countries’ Environmental Efficiency Using DEA Window Analysis. Ecol. Econ. 2009, 68, 2168–2176. [Google Scholar] [CrossRef]

- Xu, J. Is There Causality From Investment For Real Estate To Carbon Emission In China: A Cointegration Empirical Study. Procedia Environ. Sci. 2011, 5, 96–104. [Google Scholar] [CrossRef][Green Version]

- Sinn, H.-W. Public Policies against Global Warming: A Supply Side Approach. Int. Tax Public Financ. 2008, 15, 360–394. [Google Scholar] [CrossRef]

- Alberini, A.; Gans, W.; Velez-Lopez, D. Residential Consumption of Gas and Electricity in the U.S.: The Role of Prices and Income. Energy Econ. 2011, 33, 870–881. [Google Scholar] [CrossRef]

- Smulders, S.; Tsur, Y.; Zemel, A. Announcing Climate Policy: Can a Green Paradox Arise without Scarcity? J. Environ. Econ. Manag. 2012, 64, 364–376. [Google Scholar] [CrossRef]

- Van Der Ploeg, F.; Withagen, C. Is There Really a Green Paradox? J. Environ. Econ. Manag. 2012, 64, 342–363. [Google Scholar] [CrossRef]

- Price, L.; Levine, M.D.; Zhou, N.; Fridley, D.; Aden, N.; Lu, H.; Mcneil, M.; Zheng, N.; Qin, Y.; Yowargana, P. Assessment of China’s Energy-Saving and Emission-Reduction Accomplishments and Opportunities During the 11th Five Year Plan. Energy Policy 2011, 39, 2165–2178. [Google Scholar] [CrossRef]

- Hanemann, M. Cap-and-Trade: A Sufficient or Necessary Condition for Emission Reduction? Oxf. Rev. Econ. Policy 2010, 26, 225–252. [Google Scholar] [CrossRef]

- Chen, W.; Yang, R. Evolving Temporal–Spatial Trends, Spatial Association, and Influencing Factors of Carbon Emissions in Mainland China: Empirical Analysis Based on Provincial Panel Data from 2006 to 2015. Sustainability 2018, 10, 2809. [Google Scholar] [CrossRef]

- Deng, F.; Jin, Y.; Ye, M.; Zheng, S. New Fixed Assets Investment Project Environmental Performance and Influencing Factors—An Empirical Analysis in China’s Optics Valley. J. Environ. Res. Public. Health 2019, 16, 4891. [Google Scholar] [CrossRef]

- Tone, K. Dealing with Undesirable Outputs in Dea: A Slacks-Based Measure (Sbm) Approach. Grips Res. Rep. Ser. 2003, 44–45. [Google Scholar]

- Akram, R.; Chen, F.; Khalid, F.; Ye, Z.; Majeed, M.T. Heterogeneous Effects of Energy Efficiency and Renewable Energy on Carbon Emissions: Evidence from Developing Countries. J. Clean. Prod. 2020, 247, 119122. [Google Scholar] [CrossRef]

- Sun, C.; Liu, X.; Lin, J. Estimation and Convergence of China's Totalfactor Productivity under Carbon Intensity Constraints. Financ. Res. 2010, 6, 17–33. [Google Scholar]

- Shi, Q.; Ren, H.; Cai, W.; Gao, J. How to Set the Proper Level Of Carbon Tax in the Context Of Chinese Construction Sector? A Cge Analysis. J. Clean. Prod. 2019, 240, 117955. [Google Scholar] [CrossRef]

- De Santis, R.; Esposito, P.; Lasinio, C.J. Environmental Regulation and Productivity Growth: Main Policy Challenges. Int. Econ. 2021, 165, 264–277. [Google Scholar] [CrossRef]

- Ahn, Y.H.; Jung, C.W.; Suh, M.; Jeon, M.H. Integrated Construction Process for Green Building. Procedia Eng. 2016, 145, 670–676. [Google Scholar] [CrossRef]

- Wu, X.; Peng, B.; Lin, B. A Dynamic Life Cycle Carbon Emission Assessment on Green and Non-Green Buildings in China. Energy Build. 2017, 149, 272–281. [Google Scholar] [CrossRef]

- Wang, Y.; Yu, L. Can the Current Environmental Tax Rate Promote Green Technology Innovation?—Evidence from China’s Resource-Based Industries. J. Clean. Prod. 2021, 278, 123443. [Google Scholar] [CrossRef]

| Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).