Business Sustainability of Small and Medium Enterprises during the COVID-19 Pandemic: The Role of AIS Implementation

Abstract

1. Introduction

2. Literature Review

2.1. Theoretical Understanding and Foundation

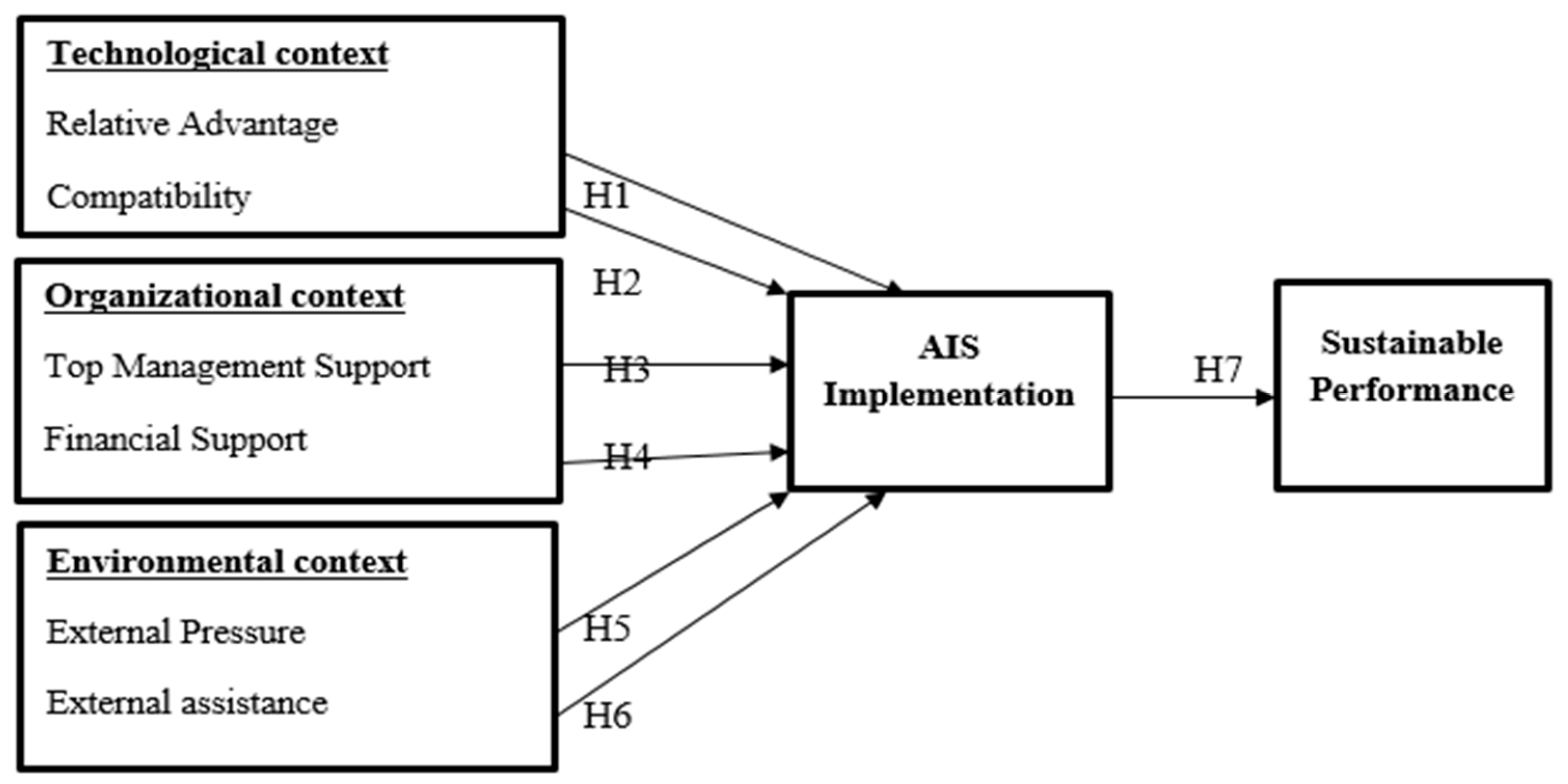

2.2. The Research Model and Hypotheses

2.2.1. Technological Factors and AIS Implementation

2.2.2. Organizational Factors and AIS Implementation

2.2.3. Environmental Factors and AIS Implementation

2.2.4. AIS Implementation and Business Sustainability

3. Material and Methods

3.1. Measurements

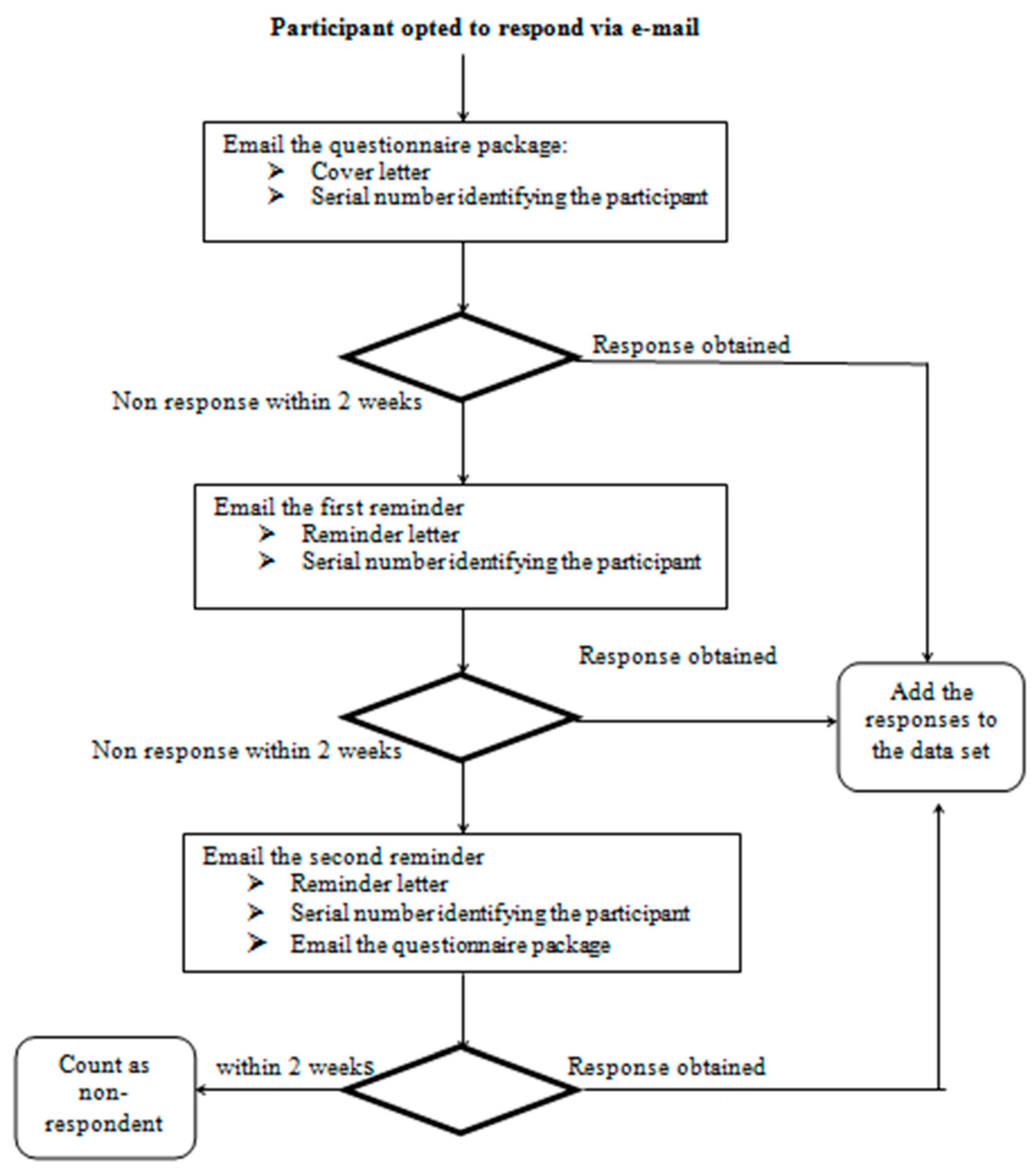

3.2. Data Collection

4. Data Analysis

5. Results

5.1. Demographic Characteristics

5.2. Assessment of Measurement Model

5.3. Assessment of Structural Model

6. Discussion

7. Implications

8. Conclusions, Limitations, and Future Studies

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Alshirah, M.; Lutfi, A.; Alshirah, A.; Saad, M.; Ibrahim, N.; Mohammed, F. Influences of the environmental factors on the intention to adopt cloud based accounting information system among SMEs in Jordan. Accounting 2021, 7, 645–654. [Google Scholar] [CrossRef]

- Bani-Khalid, T.; Alshira’h, A.F.; Alshirah, M.H. Determinants of Tax Compliance Intention among Jordanian SMEs: A Focus on the Theory of Planned Behavior. Economies 2022, 10, 30. [Google Scholar] [CrossRef]

- Lutfi, A.; Alsyouf, A.; Almaiah, M.A.; Alrawad, M.; Abdo, A.A.K.; Al-Khasawneh, A.L.; Saad, M. Factors Influencing the Adoption of Big Data Analytics in the Digital Transformation Era: Case Study of Jordanian SMEs. Sustainability 2022, 14, 1802. [Google Scholar] [CrossRef]

- OECD Council. ‘SMEs and SDGs: Challenges and Opportunities’, OECD Development Matters. 10 November 2019. Available online: https://oecd-development-matters.org/2019/04/23/smes-and-sdgs-challenges-and-opportunities/ (accessed on 4 March 2022).

- Lutfi, A.A.; Idris, K.M.; Mohamad, R. AIS usage factors and impact among Jordanian SMEs: The moderating effect of environmental uncertainty. J. Adv. Res. Bus. Manag. Stud. 2017, 6, 24–38. [Google Scholar] [CrossRef]

- Al-Jinini, D.K.; Dahiyat, S.E.; Bontis, N. Intellectual capital, entrepreneurial orientation, and technical innovation in small and medium-sized enterprises. Knowl. Process Manag. 2019, 26, 69–85. [Google Scholar] [CrossRef]

- McConaghy, P. Supporting Job Creation and Innovation through MSME Development in MENA. 2013. Available online: https://openknowledge.worldbank.org/handle/10986/16130 (accessed on 5 March 2022).

- Lutfi, A.A.; Idris, K.M.; Mohamad, R. The influence of technological, organizational and environmental factors on accounting information system usage among Jordanian small and medium-sized enterprises. Int. J. Econ. Financ. Issues 2016, 6, 240–248. [Google Scholar] [CrossRef]

- Ali, A.; Rahman, M.; Ismail, W. Predicting Continuance Intention to Use Accounting Information Systems among SMEs in Terengganu, Malaysia. Int. J. Econ. Manag. 2012, 6, 295–320. Available online: https://www.researchgate.net/profile/Azwadi_Ali/ (accessed on 5 March 2022).

- Dyt, R.; Halabi, A.K. Empirical evidence examining the accounting information systems and accounting reports of small and micro business in Australia. Small Enterp. Res. 2007, 15, 1–9. [Google Scholar] [CrossRef]

- Son, D.D.; Marriot, N.; Marriot, P. Users’ perceptions and uses of financial reports of small and medium companies in transitional economies: Qualitative evidence from Vietnam. Qual. Res. Account. Manag. 2006, 3, 218–235. [Google Scholar] [CrossRef]

- Hameed, M.A.; Counsell, S. Establishing relationships between innovation characteristics and IT innovation adoption in organizations: A meta-Analysis Approach. Int. J. Innov. Manag. 2014, 18, 1–41. [Google Scholar] [CrossRef]

- Owoseni, A.; Twinomurinzi, H. Mobile apps usage and dynamic capabilities: A structural equation model of SMEs in Lagos, Nigeria. Telemat. Inform. 2018, 35, 2067–2081. [Google Scholar] [CrossRef]

- Wang, Y.; Shi, X. Thrive, not just survive: Enhance dynamic capabilities of SMEs through IS competence. J. Syst. Inf. Technol. 2011, 13, 200–222. [Google Scholar] [CrossRef]

- Kumar, A.; Ayedee, D. Technology adoption: A solution for SMEs to overcome problems during COVID-19. Forthcom. Acad. Mark. Stud. J. 2021, 25, 1–16. [Google Scholar]

- Watson, H.E., III. Small Business Strategies in Pandemics and Economic Crises: A Qualitative Descriptive Multiple Case Study. Doctoral Dissertation, University of Phoenix, Phoenix, AZ, USA, 2020. [Google Scholar]

- Lutfi, A. Understanding Cloud Based Enterprise Resource Planning Adoption among SMEs in Jordan. J. Theor. Appl. Inf. Technol. 2021, 99, 5944–5953. [Google Scholar]

- Utami, E.S.; Aprilia, M.R.; Putra, I.C.A. Financial literacy of micro, small, and medium enterprises of consumption sector in probolinggo city. J. Manaj. Dan Kewirausahaan 2021, 23, 10–17. [Google Scholar] [CrossRef]

- Saeidi, H. Impact of Accounting Information Systems (AIS) on organizational performance: A case study of TATA Consultancy Services (TCS)-India. UTC J. Manag. Account. Stud. 2014, 1, 412–417. Available online: http://uctjournals.com/archive/ujmas/2014/Sep/2.pdf (accessed on 8 March 2022). [CrossRef]

- Mcmahon, R.G.P. Growth and performance of manufacturing SMEs: The influence of financial management characteristics. Int. Small Bus. J. 2001, 19, 10–28. [Google Scholar] [CrossRef]

- Khairi, M.S.; Baridwan, Z. An empirical study on organizational acceptance accounting information systems in Sharia banking. Int. J. Account. Bus. Soc. 2015, 23, 97–122. [Google Scholar]

- Alyatama, S.; Al-rawad, M.; Al Khattab, A.; AlSoboa, S. Customer’s Perception of Online Shopping Risks: A Multi-Group Analysis Approach. Int. J. Bus. Inf. Syst. 2021, in press. [Google Scholar] [CrossRef]

- Hossain, M.M. Financial resources, financial literacy and small firm growth: Does private organizations support matter? J. Small Bus. Strategy 2020, 30, 35–58. [Google Scholar]

- Almaiah, M.A.; Hajjej, F.; Lutfi, A.; Al-Khasawneh, A.; Alkhdour, T.; Almomani, O.; Shehab, R.A. Conceptual Framework for Determining Quality Requirements for Mobile Learning Applications Using Delphi Method. Electronics 2022, 11, 788. [Google Scholar] [CrossRef]

- Alsyouf, A. Mobile Health for COVID-19 pandemic surveillance in developing countries: The case of Saudi Arabia. Solid State Technol. 2020, 63, 2474–2485. [Google Scholar]

- Alsyouf, A.; Masa’deh, R.; Albugami, M.; Al-Bsheish, M.; Lutfi, A.; Alsubahi, N. Risk of Fear and Anxiety in Utilising Health App Surveillance Due to COVID-19: Gender Differences Analysis. Risks 2021, 9, 179. [Google Scholar] [CrossRef]

- Almaiah, M.A.; Al-Khasawneh, A.; Althunibat, A.; Almomani, O. Exploring the main determinants of mobile learning application usage during COVID-19 pandemic in Jordanian universities. In Emerging Technologies during the Era of COVID-19 Pandemic; Springer: Cham, Switzerland, 2021; Volume 16, pp. 275–290. Available online: https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7980165 (accessed on 8 March 2022).

- Fernandes, N. Economic Effects of Coronavirus Outbreak (COVID-19) on the World Economy. 22 March 2020. Available online: https://ssrn.com/abstract=3557504 (accessed on 8 March 2022).

- Gupta, S.; Montenovo, L.; Nguyen, T.D.; Rojas, F.L.; Schmutte, I.M.; Simon, K.I.; Weinberg, B.A.; Wing, C. Effects of social distancing policy on labor market outcomes (No. w27280). Natl. Bur. Econ. Res. 2020, 3, 1–40. [Google Scholar]

- Olarewaju, O.; Msomi, T. Accounting skills and the sustainability of Small and Medium Enterprises in South Africa. J. Account. Manag. 2021, 11, 111–121. [Google Scholar]

- Nurunnabi, M.; Alhawal, H.M.; Hoque, Z. Impact of COVID-19: How CEOs respond to SMEs recovery planning in Saudi Arabia. White Pap. 2020, 3, 1–41. [Google Scholar]

- Lutfi, A. Investigating the moderating effect of Environment Uncertainty on the relationship between institutional factors and ERP adoption among Jordanian SMEs. J. Open Innov. Technol. Mark. Complex. 2020, 6, 91. [Google Scholar] [CrossRef]

- Smirat, B.Y.A. The use of accounting information by small and medium enterprises in south district of Jordan. Res. J. Financ. Account. 2013, 4, 169–175. [Google Scholar]

- Ahmad, M.; Ayasra, A.; Zawaideh, F. Issues and problems related to data quality in AIS implementation. Int. J. Latest Res. Sci. Technol. 2013, 2, 17–20. [Google Scholar]

- Global Information Technology Report [GITR]. 2012. Available online: http://www3.weforum.org/docs/Global_IT_Report_2012.pdf (accessed on 8 March 2022).

- Khassawneh, A.A.L. The influence of organizational factors on accounting information systems (AIS) effectiveness: A study of Jordanian SMEs. Int. J. Mark. Technol. 2014, 4, 36–46. [Google Scholar]

- Ismail, N.A.; Mat Zin, R. Usage of accounting information among Malaysian Bumiputra small and medium non-manufacturing firms. J. Enterp. Resour. Plan. Stud. 2009, 2009, 101113. [Google Scholar]

- Alshirah, M.; Alshirah, A.; Lutfi, A. Audit committee’s attributes, overlapping memberships on the audit committee and corporate risk disclosure: Evidence from Jordan. Accounting 2021, 7, 423–440. [Google Scholar] [CrossRef]

- Fanelli, R.M. Barriers to Adopting New Technologies within Rural Small and Medium Enterprises (SMEs). Soc. Sci. 2021, 10, 430. [Google Scholar] [CrossRef]

- Lussier, R.N.; Halabi, C.E. A three-country comparison of the business success versus failure prediction model. J. Small Bus. Manag. 2010, 48, 360–377. [Google Scholar] [CrossRef]

- Ismail, W.; Ali, A. Conceptual model for examining the factors that influence the likelihood of Computerized Accounting Information System (CAIS) adoption among Malaysian SMEs. Int. J. Inf. Technol. Bus. Manag. 2013, 15, 122–151. [Google Scholar]

- Astutie, Y.P.; Fanani, B. The factors affecting intention to adopt FAS for SMEs and to use IT in financial report: Empirical study in Central Java Indonesia. In International Conference on Accounting Studies; ICAS: Johor Bahru, Malaysia, 2015; pp. 17–20. [Google Scholar]

- Fanelli, R.M. Rural small and medium enterprises development in Molise (Italy). Eur. Countrys. 2018, 10, 566–589. [Google Scholar] [CrossRef]

- Mbelwa, L. Factors influencing the use of accounting information in Tanzanian local government authorities (LGAs): An institutional theory approach. In The Public Sector Accounting, Accountability and Auditing in Emerging Economies; Emerald Group Publishing Limited: Bingley, UK, 2015; pp. 143–177. [Google Scholar] [CrossRef]

- Almaiah, M.A.; Ayouni, S.; Hajjej, F.; Lutfi, A.; Almomani, O.; Awad, A.B. Smart Mobile Learning Success Model for Higher Educational Institutions in the Context of the COVID-19 Pandemic. Electronics 2022, 11, 1278. [Google Scholar] [CrossRef]

- Bruwer, J.P.; Smit, Y. Accounting Information Systems- A value-adding phenomenon or a mere trend? The situation in Small and Medium financial service organizations in the Cape Metropolis. Expert J. Bus. Manag. 2015, 3, 38–52. [Google Scholar]

- Almaiah, M.A.; Al-Otaibi, S.; Lutfi, A.; Almomani, O.; Awajan, A.; Alsaaidah, A.; Awad, A.B. Employing the TAM Model to Investigate the Readiness of M-Learning System Usage Using SEM Technique. Electronics 2022, 11, 1259. [Google Scholar] [CrossRef]

- Alshirah, M.H.; Alshira’h, A.F.; Lutfi, A. Political connection, family ownership and corporate risk disclosure: Empirical evidence from Jordan. Meditari Account. Res. 2021. ahead-of-print. [Google Scholar] [CrossRef]

- Salwani, M.I.; Marthandan, G.; Norzaidi, M.D.; Chong, S.C. E-commerce usage and business performance in the Malaysian tourism sector: Empirical analysis. Inf. Manag. Comput. Secur. 2009, 17, 166–185. [Google Scholar] [CrossRef]

- Fitriati, A.; Mulyani, S. Factors that affect accounting information system success and its implication on accounting information quality. Asian J. Inf. Technol. 2015, 14, 154–161. [Google Scholar]

- Esmeray, A. The Impact of Accounting Information Systems (AIS) on Firm Performance: Empirical Evidence in Turkish Small and Medium Sized Enterprises. Int. Rev. Manag. Mark. 2016, 6, 233–236. [Google Scholar]

- Ramli, A. Usage of, and Satisfaction with, Accounting Information Systems in the Hotel Industry: The case of Malaysia. Doctoral Dissertation, University of Hull, Kingston upon Hull, UK, 2013. Available online: https://hydra.hull.ac.uk/resources/hull:7180 (accessed on 9 March 2022).

- Tornatzky, L.G.; Fleischer, M. The Processes of Technological Innovation; Lexiton Books: Lexiton, MA, USA, 1990. [Google Scholar]

- Rogers, E.M. Diffusion of Innovations, 5th ed.; Free Press: New York, NY, USA, 2003. [Google Scholar]

- Pfeffer, J.; Salancik, G.R. The External Control of Organizations: A Resource Dependence Perspective; Stanford University: Stanford, CA, USA, 2003. [Google Scholar]

- Hillman, A.J.; Withers, M.C.; Collins, B.J. Resource dependence theory: A review. J. Manag. 2009, 35, 1404–1427. [Google Scholar] [CrossRef]

- Haldma, T.; Lääts, K. Contingencies influencing the management accounting practices of Estonian manufacturing companies. Manag. Account. Res. 2002, 13, 379–400. [Google Scholar] [CrossRef]

- Bouchard, M.J.; Rousselière, D. Do hybrid organizational forms of the social economy have a greater chance of surviving? An examination of the case of Montreal. Int. J. Volunt. Nonprofit Organ. 2016, 27, 1894–1922. [Google Scholar] [CrossRef]

- Wei, T.; Clegg, J. Exploring sources of value destruction in international acquisitions: A synthesized theoretical lens. Int. Bus. Rev. 2017, 26, 927–941. [Google Scholar] [CrossRef]

- Zhu, K. The complementarity of information technology infrastructure and e-commerce capability: A resource-based assessment of their business value. J. Manag. Inf. Syst. 2004, 21, 167–202. [Google Scholar] [CrossRef]

- Picoto, W.N.; Bélanger, F.; Palma-dos-Reis, A. An organizational perspective on m-business: Usage factors and value determination. Eur. J. Inf. Syst. 2014, 23, 571–592. [Google Scholar] [CrossRef]

- Henderson, D.; Sheetz, S.D.; Trinkle, B.S. The determinants of inter-organizational and internal in-house adoption of XBRL: A structural equation model. Int. J. Account. Inf. Syst. 2012, 13, 109–140. [Google Scholar] [CrossRef]

- Garg, A.K.; Choeu, T. The adoption of electronic commerce by small and medium enterprises in Pretoria East. Electron. J. Inf. Syst. Dev. Ctries. 2015, 68, 1–23. [Google Scholar] [CrossRef]

- Rahayu, R.; Day, J. Determinant factors of E-commerce adoption by SMEs in developing country: Evidence from Indonesia. Procedia-Soc. Behav. Sci. 2015, 195, 142–150. [Google Scholar] [CrossRef]

- Ahmad, S.Z.; Abu Bakar, A.R.; Faziharudean, T.M.; Mohamad Zaki, K.A. An empirical study of factors affecting e-commerce adoption among small-and medium-sized enterprises in a developing country: Evidence from Malaysia. Inf. Technol. Dev. 2015, 21, 555–572. [Google Scholar] [CrossRef]

- Al-Alawi, A.I.; Al-Ali, F.M. Factors affecting E-commerce adoption in SMEs in GCC: An empirical study of Kuwait. Res. J. Inf. Technol. 2015, 7, 1–21. [Google Scholar] [CrossRef]

- Alsyouf, A. Self-Efficacy and Personal Innovativeness Influence on Nurses Beliefs about EHRs Usage in Saudi Arabia: Conceptual Model. Int. J. Manag. (IJM) 2021, 12, 1049–1058. [Google Scholar] [CrossRef]

- Chung, S.H.; Snyder, C.A. ERP adoption: A technological evolution approach. Int. J. Agil. Manag. Syst. 2000, 2, 24–32. [Google Scholar] [CrossRef]

- Grandon, E.E.; Pearson, J.M. Electronic commerce adoption: An empirical study of small and medium US businesses. Inf. Manag. 2004, 42, 197–216. [Google Scholar] [CrossRef]

- Zhu, K.; Kraemer, K.L.; Xu, S. The process of innovation assimilation by firms in different countries: A technology diffusion perspective on e-business. Manag. Sci. 2006, 52, 1557–1576. [Google Scholar] [CrossRef]

- Maryeni, Y.Y.; Govindaraju, R.; Prihartono, B.; Sudirman, I. E-commerce adoption by Indonesian SMEs. Aust. J. Basic Appl. Sci. 2014, 8, 45–49. [Google Scholar]

- Thong, J.Y.; Yap, C.S.; Raman, K.S. Top management support, external expertise and information systems implementation in small businesses. Inf. Syst. Res. 1996, 7, 248–267. [Google Scholar] [CrossRef]

- Mehrtens, J.; Cragg, P.B.; Mills, A.M. A model of Internet adoption by SMEs. Inf. Manag. 2001, 39, 165–176. [Google Scholar] [CrossRef]

- Zhu, K.; Kraemer, K.L. Post-adoption variations in usage value of e-business by organizations: Cross-country evidence from retail industry. Inf. Syst. Res. 2005, 16, 61–84. [Google Scholar] [CrossRef]

- Al-Khasawneh, A.L.; Barakat, H.J. The role of the Hashemite leadership in the development of human resources in Jordan: An analytical study. Int. Rev. Manag. Mark. 2016, 6, 654–667. [Google Scholar]

- Alsyouf, A.; Ishak, A.K. Understanding EHRs continuance intention to use from the perspectives of UTAUT: Practice environment moderating effect and top management support as predictor variables. Int. J. Electron. Healthc. 2018, 10, 24–59. [Google Scholar] [CrossRef]

- Porter, M.E.; Millar, V.E. How Information Gives you Competitive Advantage. Harvard Business Review. Available online: https://hbr.org/1985/07/how-information-gives-you-competitive-advantage (accessed on 9 March 2022).

- Ghobakhloo, M.; Arias-Aranda, D.; Benitez-Amado, J. Adoption of e-commerce applications in SMEs. Ind. Manag. Data Syst. 2011, 111, 1238–1269. [Google Scholar] [CrossRef]

- Soh, C.P.; Yap, C.S.; Raman, K.S. Impact of consultants on computerization success in small businesses. Inf. Manag. 1992, 22, 309–319. [Google Scholar] [CrossRef]

- Riyadh, M.; Akter, S.; Islam, N. The adoption of e-banking in developing countries: A theoretical model for SMEs. Int. Rev. Bus. Res. Pap. 2009, 5, 212–230. [Google Scholar]

- Najib, M.; Abdul Rahman, A.A.; Abror, A.; Rachmawati, R.; Simanjuntak, M.; Prasetya, P.; Suhartanto, D.; Fahma, F. Leaders’ Support of Sustainable Innovation and Business Sustainability in Developing Countries: Evidence from Small and Medium Food Processing Enterprises. Sustainability 2021, 13, 13091. [Google Scholar] [CrossRef]

- Gross-Gołacka, E.; Kusterka-Jefma´nska, M.; Jefmański, B. Can Elements of Intellectual Capital Improve Business Sustainability?—The Perspective of Managers of SMEs in Poland. Sustainability 2020, 12, 1545. [Google Scholar] [CrossRef]

- Jang, H.-W.; Lee, S.-B. Serving Robots: Management and Applications for Restaurant Business Sustainability. Sustainability 2020, 12, 3998. [Google Scholar] [CrossRef]

- Najib, M.; Fahma, F. Investigating the Adoption of Digital Payment System through an Extended Technology Acceptance Model: An Insight from the Indonesian Small and Medium Enterprises. Int. J. Adv. Sci. Eng. Inf. Technol. 2020, 10, 1702–1708. [Google Scholar] [CrossRef]

- Al-Khasawneh, A.L.; Malkawi, N.M.; AlGarni, A.A. Sources of recruitment at foreign commercial banks in Jordan and their impact on the job performance proficiency. Banks Bank Syst. 2018, 13, 12–26. [Google Scholar] [CrossRef][Green Version]

- Amman Chamber of INDUSTRY [ACI]. Annual Report. 2014. Available online: http://www.aci.org.jo/development/en/ (accessed on 6 March 2022).

- Alshira’h, A.F. The Effect of Peer Influence on Sales Tax Compliance among Jordanian SMEs. Int. J. Acad. Res. Bus. Soc. Sci. 2019, 9, 710–721. [Google Scholar] [CrossRef]

- Alshira’h, A.F.; Abdul-Jabbar, H. Moderating role of patriotism on sales tax compliance among Jordanian SMEs. Int. J. Islamic Middle East. Financ. Manag. 2020, 13, 389–415. [Google Scholar] [CrossRef]

- Hair, J.F.; Risher, J.J.; Sarstedt, M.; Ringle, C.M. When to use and how to report the results of PLS-SEM. Eur. Bus. Rev. 2019, 31, 2–24. [Google Scholar] [CrossRef]

- Chang, L.; Krosnick, J.A. National Surveys via RDD Telephone Interviewing versus the Internet Comparing Sample Representativeness and Response Quality. Public Opin. Q. 2009, 73, 641–678. [Google Scholar] [CrossRef]

- Alshira’h, A.; Alsqour, M.; Lutfi, A.; Alsyouf, A.; Alshirah, M. A Socio-Economic Model of Sales Tax Compliance. Economies 2020, 8, 88. [Google Scholar] [CrossRef]

- Alshirah, A.; Magablih, A.; Alsqour, M. The effect of tax rate on sales tax compliance among Jordanian public shareholding corporations. Accounting 2021, 7, 883–892. [Google Scholar] [CrossRef]

- Alkhater, N.; Walters, R.; Wills, G. An empirical study of factors influencing cloud adoption among private sector organisations. Telemat. Inform. 2018, 35, 38–54. [Google Scholar] [CrossRef]

- Wang, Y.-M.; Wang, Y.-S.; Yang, Y.-F. Understanding the determinants of RFID adoption in the manufacturing industry. Technol. Forecast. Soc. Chang. 2010, 77, 803–815. [Google Scholar] [CrossRef]

- Lutfi, A. Understanding the Intention to Adopt Cloud-based Accounting Information System in Jordanian SMEs. Int. J. Digit. Account. Res 2022, 22, 47–70. [Google Scholar] [CrossRef]

- Almaiah, M.A.; Hajjej, F.; Lutfi, A.; Al-Khasawneh, A.; Shehab, R.; Al-Otaibi, S.; Alrawad, M. Explaining the Factors Affecting Students’ Attitudes to Using Online Learning (Madrasati Platform) during COVID-19. Electronics 2022, 11, 973. [Google Scholar] [CrossRef]

- Lutfi, A.A. Antecedents and Impact of AIS Usage amongst Jordanian SMEs: Moderating Effects of Environmental Uncertainty and Firm Size. Available online: https://www.researchgate.net/publication/336366141_ANTECEDENTS_AND_IMPACT_OF_AIS_USAGE_AMONGST_JORDANIAN_SMEs_MODERATING_EFFECTS_OF_ENVIRONMENTAL_UNCERTAINTY_AND_FIRM_SIZE (accessed on 6 March 2022).

- Alrawad, M.; Lutfi, A.; Alyatama, S.; Elshaer, I.A.; Almaiah, M.A. Perception of Occupational and Environmental Risks and Hazards among Mineworkers: A Psychometric Paradigm Approach. Int. J. Environ. Res. Public Health 2022, 19, 3371. [Google Scholar] [CrossRef] [PubMed]

- Lutfi, A. Factors Influencing the Continuance Intention to Use Accounting Information System in Jordanian SMEs from the Perspectives of UTAUT: Top Management Support and Self-Efficacy as Predictor Factors. Economies 2022, 10, 75. [Google Scholar] [CrossRef]

| Latent Construct | Measurement Items No. | Source |

|---|---|---|

| AIS Implementation | 3 items | [5] |

| Relative Advantage | 6 items | [8] |

| Compatibility | 3 items | [8] |

| Top Management Support | 5 items | [81] |

| Financial Support | 5 items | [8] |

| External Pressure | 5 items | [5] |

| External assistance | 6 items | [8] |

| Business sustainability | 6 items | [81] |

| Characteristic | Frequency | Percent | |

|---|---|---|---|

| Position | CEO | 92 | 47.4% |

| Senior manager | 53 | 27.3% | |

| Manager | 49 | 25.3% | |

| Experience (number of years in position) | 3 years or less | 51 | 26.3% |

| 4–7 years | 45 | 23.2% | |

| 8–11 years | 52 | 26.9% | |

| More than 11 | 46 | 23.6% | |

| Gender | Male | 112 | 57.7% |

| Female | 82 | 42.3% | |

| Age | 20–29 years | 42 | 21.6% |

| 30–39 years | 49 | 25.3% | |

| 40–49 years | 69 | 35.6% | |

| 50 years and above | 34 | 17.5% | |

| Education level | Diploma or below | 32 | 16.5% |

| Bachelor’s degree | 84 | 43.3% | |

| Master’s degree | 62 | 31.9% | |

| PhD | 16 | 8.3% |

| Latent Construct | Item | Item Loading | Cronbach’s Alpha | Composite Reliability | AVE |

|---|---|---|---|---|---|

| >0.4 | >0.7 | >0.7 | >0.5 | ||

| Business Sustainability (BS) | BS1 | 0.873 | 0.841 | 0.884 | 0.558 |

| BS2 | 0.799 | ||||

| BS3 | 0.734 | ||||

| BS4 | 0.751 | ||||

| BS5 | 0.692 | ||||

| BS6 | 0.567 | ||||

| AIS Implementation (AISIM) | AIS IM1 | 0.772 | 0.738 | 0.832 | 0.557 |

| AIS IM2 | 0.698 | ||||

| AIS IM3 | 0.822 | ||||

| Relative Advantage (RA) | RA1 | 0.503 | 0.843 | 0.887 | 0.565 |

| RA2 | 0.707 | ||||

| RA3 | 0.803 | ||||

| RA4 | 0.796 | ||||

| RA5 | 0.816 | ||||

| RA6 | 0.741 | ||||

| Compatibility (CO) | CO1 | 0.756 | 0.725 | 0.842 | 0.638 |

| CO2 | 0.901 | ||||

| CO3 | 0.713 | ||||

| Top Management Support (TMS) | TMS1 | 0.830 | 0.862 | 0.899 | 0.632 |

| TMS2 | 0.844 | ||||

| TMS3 | 0.842 | ||||

| TMS4 | 0.725 | ||||

| TMS5 | 0.709 | ||||

| Financial Support (FS) | OR1 | 0.653 | 0.855 | 0.898 | 0.630 |

| OR2 | 0.836 | ||||

| OR3 | 0.877 | ||||

| OR4 | 0.853 | ||||

| OR5 | 0.720 | ||||

| External Pressure (EP) | CP1 | 0.455 | 0.776 | 0.854 | 0.542 |

| CP3 | 0.511 | ||||

| CP4 | 0.801 | ||||

| CP5 | 0.888 | ||||

| CP6 | 0.889 | ||||

| External Assistance (EA) | GR1 | 0.719 | 0.821 | 0.872 | 0.528 |

| GR2 | 0.838 | ||||

| GR3 | 0.825 | ||||

| GR4 | 0.734 |

| BS | AIS IM | Co | EP | EA | FS | TMS | RA | |

|---|---|---|---|---|---|---|---|---|

| BS | 0.752 | |||||||

| AIS IM | 0.379 | 0.742 | ||||||

| Co | 0.449 | 0.352 | 0.797 | |||||

| EP | 0.291 | 0.390 | 0.321 | 0.742 | ||||

| EA | 0.151 | 0.159 | 0.201 | 0.031 | 0.732 | |||

| FS | 0.090 | 0.282 | 0.173 | 0.430 | 0.063 | 0.789 | ||

| TMS | 0.421 | 0.282 | 0.357 | 0.342 | 0.159 | 0.119 | 0.788 | |

| RA | 0.692 | 0.2616 | 0.530 | 0.328 | 0.174 | 0.108 | 0.379 | 0.741 |

| Hypothesis No. | Relationships | Path Coefficient | T-Value | p-Value | Effect |

|---|---|---|---|---|---|

| H1 | RA → AIS IM | 0.052 | 0.231 | --------- | Insignificant |

| H2 | CO → AIS IM | 0.210 | 2.865 | 0.011 ** | Significant |

| H3 | TMS → AIS IM | 0.136 | 1.898 | 0.044 ** | Significant |

| H4 | FS → AIS IM | 0.132 | 1.875 | 0.046 ** | Significant |

| H5 | EP → AIS IM | 0.213 | 2.137 | 0.027 ** | Significant |

| H6 | EA → AIS IM | 0.142 | 1.906 | 0.042 ** | Significant |

| H7 | AIS IM → BS | 0.362 | 5.867 | 0.000 *** | Significant |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lutfi, A.; Al-Khasawneh, A.L.; Almaiah, M.A.; Alsyouf, A.; Alrawad, M. Business Sustainability of Small and Medium Enterprises during the COVID-19 Pandemic: The Role of AIS Implementation. Sustainability 2022, 14, 5362. https://doi.org/10.3390/su14095362

Lutfi A, Al-Khasawneh AL, Almaiah MA, Alsyouf A, Alrawad M. Business Sustainability of Small and Medium Enterprises during the COVID-19 Pandemic: The Role of AIS Implementation. Sustainability. 2022; 14(9):5362. https://doi.org/10.3390/su14095362

Chicago/Turabian StyleLutfi, Abdalwali, Akif Lutfi Al-Khasawneh, Mohammed Amin Almaiah, Adi Alsyouf, and Mahmaod Alrawad. 2022. "Business Sustainability of Small and Medium Enterprises during the COVID-19 Pandemic: The Role of AIS Implementation" Sustainability 14, no. 9: 5362. https://doi.org/10.3390/su14095362

APA StyleLutfi, A., Al-Khasawneh, A. L., Almaiah, M. A., Alsyouf, A., & Alrawad, M. (2022). Business Sustainability of Small and Medium Enterprises during the COVID-19 Pandemic: The Role of AIS Implementation. Sustainability, 14(9), 5362. https://doi.org/10.3390/su14095362