Evaluation of Optimal Policy on Environmental Change through Green Consumption

Abstract

:1. Introduction

2. Model: Decentralized Equilibrium

3. Quantitative Analysis

3.1. Calibration

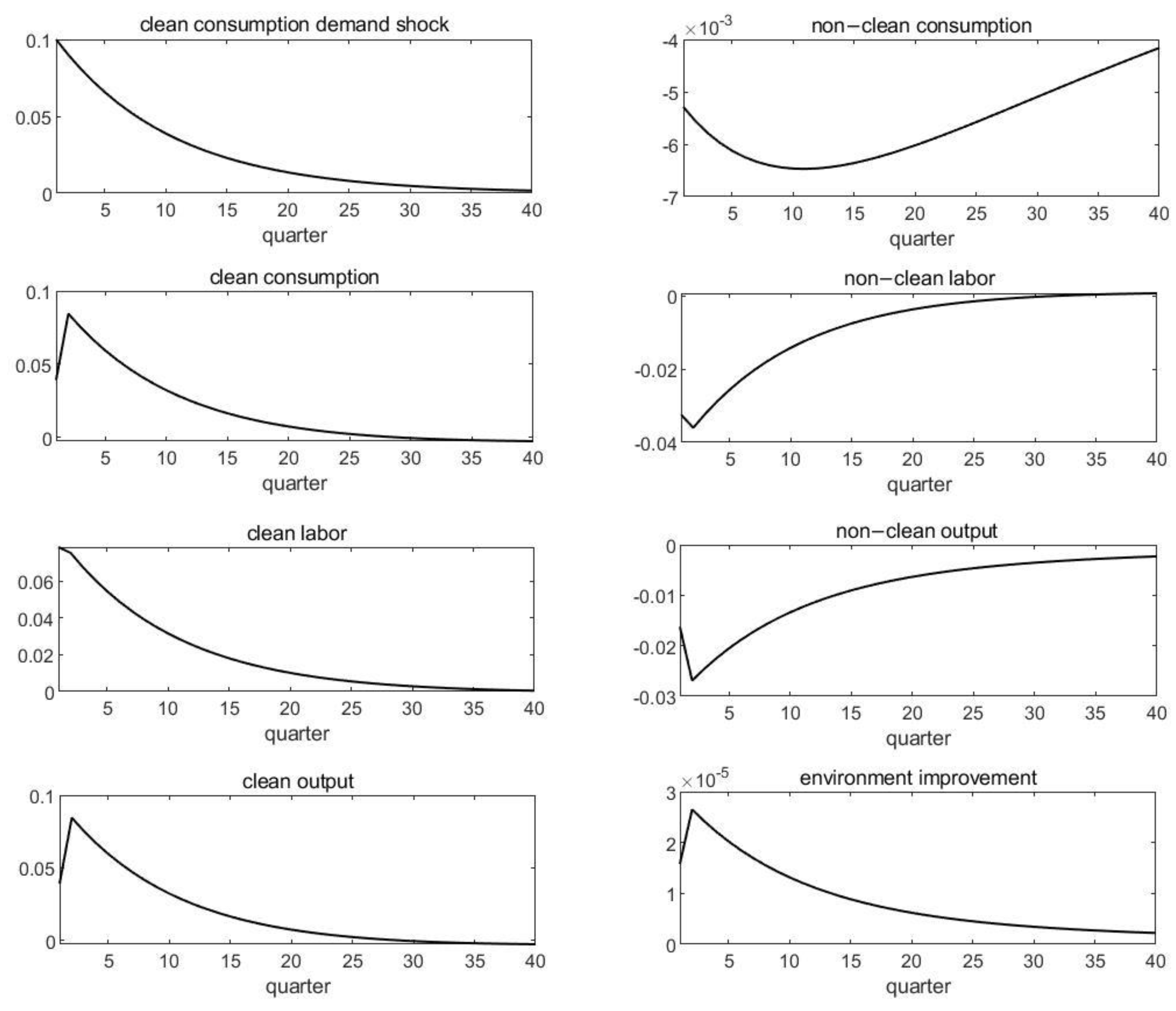

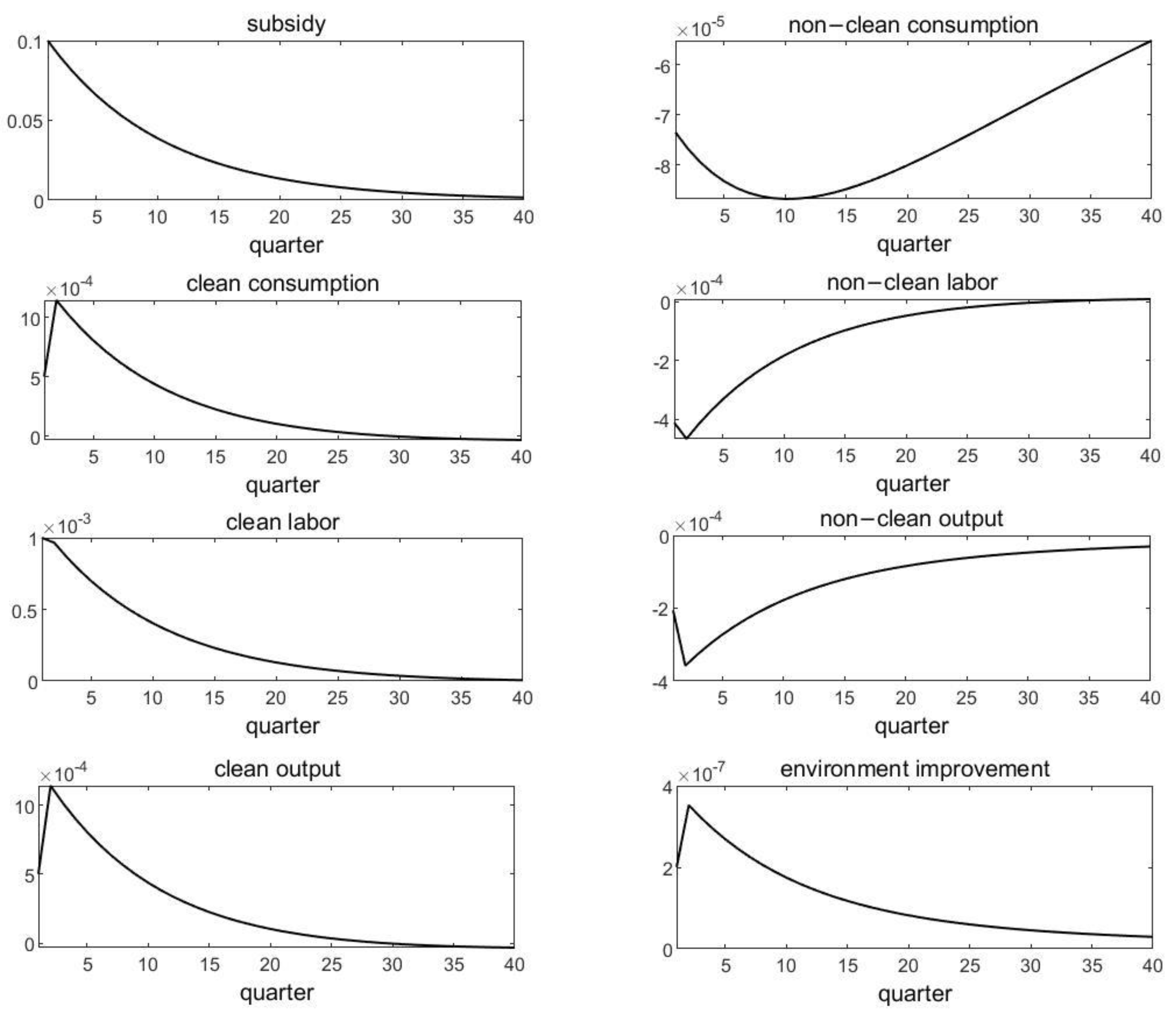

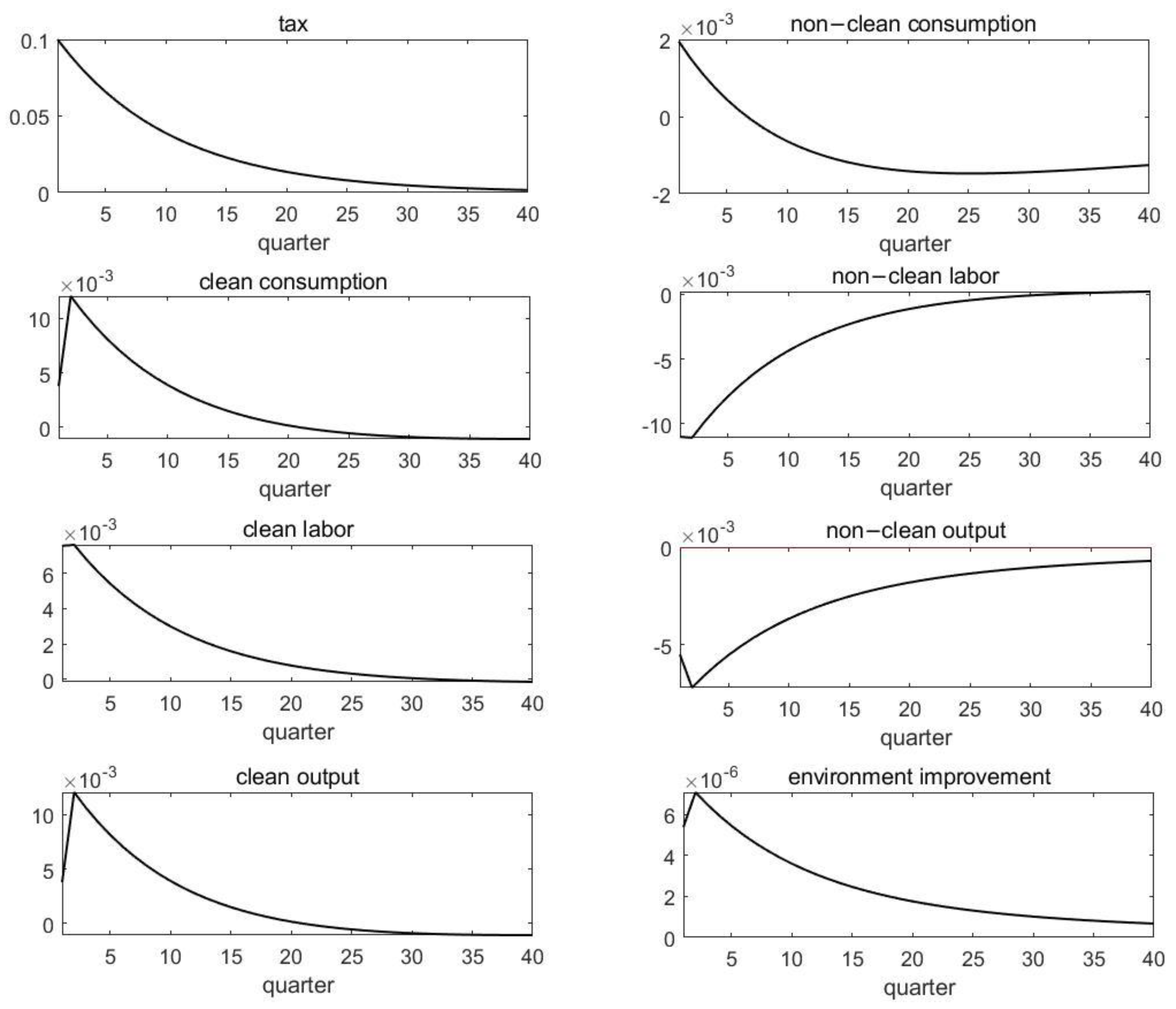

3.2. Impulse Responses and Welfare Analysis

4. Extension

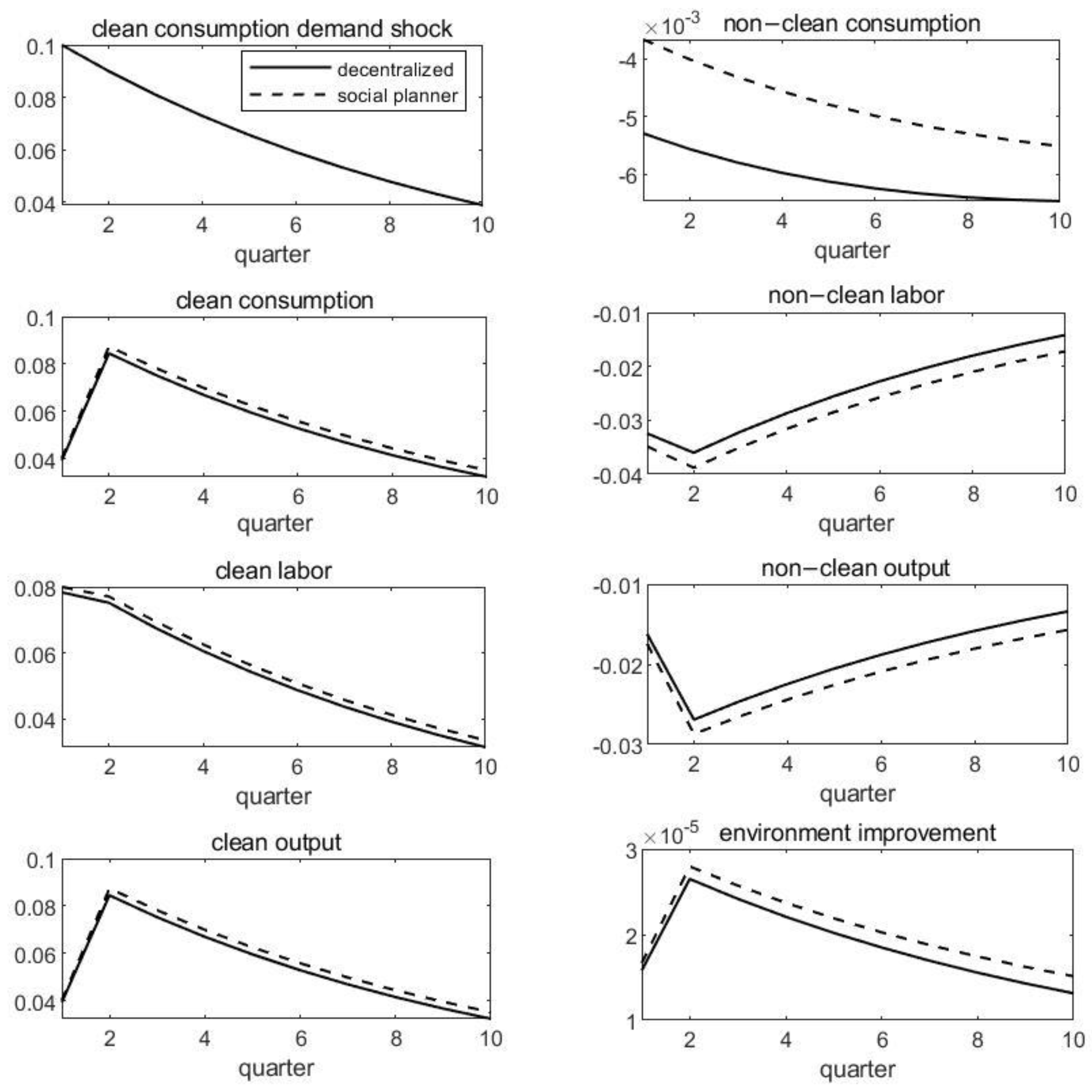

4.1. Comparison of Two Equilibria

4.2. Discussion on the Optimal Policy

4.3. Discussion of the Results

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Decentralized Equilibrium

A.1. The Representative Household

A.2. The Representative Firms

A.3. Market Clearing Conditions and Equilibrium

Appendix B. Social Planner Equilibrium

References

- Grossman, G.M.; Krueger, A.B. Economic growth and the environment. Q. J. Econ. 1995, 110, 353–377. [Google Scholar] [CrossRef] [Green Version]

- Wu, H.; Hao, Y.; Ren, S. How do environmental regulation and environmental decentralization affect green total factor energy efficiency: Evidence from China. Energy Econ. 2020, 91, 104880. [Google Scholar] [CrossRef]

- Cardenas, L.M.; Franco, C.J.; Dyner, I. Assessing emissions–mitigation energy policy under integrated supply and demand analysis: The Colombian case. J. Clean. Prod. 2016, 112, 3759–3773. [Google Scholar] [CrossRef]

- Acemoglu, D.; Aghion, P.; Bursztyn, L.; Hemous, D. The environment and directed technical change. Am. Econ. Rev. 2012, 102, 131–166. [Google Scholar] [CrossRef] [Green Version]

- Grimaud, A.; Rouge, L. Environment, directed technical change and economic policy. Environ. Resour. Econ. 2008, 41, 439–463. [Google Scholar] [CrossRef]

- Acemoglu, D.; Akcigit, U.; Hanley, D.; Kerr, W. Transition to clean technology. J. Political Econ. 2016, 124, 52–104. [Google Scholar] [CrossRef] [Green Version]

- Acemoglu, D.; Rafey, W. Mirage on the Horizon: Geo-Engineering and Carbon Taxation without Commitment; Working Paper No.24411; National Bureau of Economic Research: Cambridge, MA, USA, 2018. [Google Scholar]

- Tripathi, A.; Singh, M.P. Determinants of sustainable/green consumption: A review. Int. J. Environ. Technol. Manag. 2016, 19, 316–358. [Google Scholar] [CrossRef]

- Testa, F.; Pretner, G.; Iovino, R.; Bianchi, G.; Tessitore, S.; Iraldo, F. Drivers to green consumption: A systematic review. Environ. Dev. Sustain. 2021, 23, 4826–4880. [Google Scholar] [CrossRef]

- Wang, L.; Lu, J. Analysis of the social welfare effect of environmental regulation policy based on a market structure perspective and consumer. Sustainability 2019, 12, 104. [Google Scholar] [CrossRef] [Green Version]

- Kotani, K.; Kakinaka, M. Some implications of environmental regulation on social welfare under learning-by-doing of eco-products. Environ. Econ. Policy Stud. 2017, 19, 121–149. [Google Scholar] [CrossRef]

- Kahia, M.; Aïssa, M.S.B.; Lanouar, C. Renewable and nonrenewable energy use-economic growth nexus: The case of MENA net oil importing countries. Renew. Sustain. Energy Rev. 2017, 71, 127–140. [Google Scholar] [CrossRef]

- Bhattacharya, M.; Churchill, S.A.; Paramati, S.R. The dynamic impact of renewable energy and institutions on economic output and CO2 emissions across regions. Renew. Energy 2017, 111, 157–167. [Google Scholar] [CrossRef]

- Jaforullah, M.; King, A. Does the use of renewable energy sources mitigate CO2 emissions? A reassessment of the US evidence. Energy Econ. 2015, 49, 711–717. [Google Scholar] [CrossRef]

- Salahuddin, M.; Gow, J.; Ozturk, I. Is the long-run relationship between economic growth, electricity consumption, carbon dioxide emissions and financial development in Gulf Cooperation Council Countries robust? Renew. Sustain. Energy Rev. 2015, 51, 317–326. [Google Scholar] [CrossRef] [Green Version]

- Saidi, K.; Omri, A. Reducing CO2 emissions in OECD countries: Do renewable and nuclear energy matter? Prog. Nucl. Energy 2020, 126, 103425. [Google Scholar] [CrossRef]

- Jebli, M.B.; Farhani, S.; Guesmi, K. Renewable energy, CO2 emissions and value added: Empirical evidence from countries with different income levels. Structural Change Econ. Dyn. 2020, 53, 402–410. [Google Scholar] [CrossRef]

- Kirikkaleli, D.; Adebayo, T.S. Do renewable energy consumption and financial development matter for environmental sustainability? New global evidence. Sustain. Dev. 2021, 29, 583–594. [Google Scholar] [CrossRef]

- Feng, T.; Sun, L.; Zhang, Y. The relationship between energy consumption structure, economic structure and energy intensity in China. Energy Policy 2009, 37, 5475–5483. [Google Scholar] [CrossRef]

- Yuan, B.; Ren, S.; Chen, X. The effects of urbanization, consumption ratio and consumption structure on residential indirect CO2 emissions in China: A regional comparative analysis. Appl. Energy 2015, 140, 94–106. [Google Scholar] [CrossRef]

- Chang, C.; Liu, Z.; Spiegel, M.M. Capital controls and optimal Chinese monetary policy. J. Monet. Econ. 2015, 74, 1–15. [Google Scholar] [CrossRef]

- Wei, Y.; Liu, L.; Fan, Y.; Wu, G. The impact of lifestyle on energy use and CO2 emission: An empirical analysis of China’s residents. Energy Policy 2007, 35, 247–257. [Google Scholar] [CrossRef]

- John, A.; Pecchenino, R. An overlapping generations model of growth and the environment. Econ. J. 1994, 104, 1393–1410. [Google Scholar] [CrossRef]

- Dasgupta, S.; Laplante, B.; Wang, H.; Wheeler, D. Confronting the Environmental Kuznets Curve. J. Econ. Perspect. 2002, 16, 147–168. [Google Scholar] [CrossRef] [Green Version]

- Song, T.; Zheng, T.; Tong, L. An empirical test of the Environmental Kuznets Curve in China: A panel cointegration approach. China Econ. Rev. 2008, 19, 381–392. [Google Scholar] [CrossRef]

- Gui, S.; Zhao, L.; Zhang, Z. Does municipal solid waste generation in China support the Environmental Kuznets Curve? New evidence from spatial linkage analysis. Waste Manag. 2019, 84, 310–319. [Google Scholar] [CrossRef]

- Shen, J. A simultaneous estimation of Environmental Kuznets Curve: Evidence from China. China Econ. Rev. 2006, 17, 383–394. [Google Scholar] [CrossRef]

- Song, M.; Zhang, W.; Wang, S. Inflection point of Environmental Kuznets Curve in mainland China. Energy Policy 2013, 57, 14–20. [Google Scholar] [CrossRef]

- Liu, Z.; Wang, P.; Zha, T. Land-price dynamics and macroeconomic fluctuation. Econometrica 2013, 8, 1147–1184. [Google Scholar]

| Parameters | Value | Description |

|---|---|---|

| 0.5 | Capital share | |

| 0.995 | Subjective discount factor | |

| 2 | Inverse Frisch elasticity | |

| 0.025 | Depreciation rate | |

| 2.46 | Environment disruption parameter | |

| 0.001 | Environment self-healing parameters | |

| 0.9 | Persistence of TFP shock | |

| 0.1 | S.D. of TFP shock | |

| 0.9 | Persistence of clean consumption demand shock | |

| 0.1 | S.D. of clean consumption demand shock | |

| 0.3645 | Steady-state of non-clean consumption to non-clean output |

| Demand-Driven | Supply-Driven (Subsidy) | Supply-Driven (Tax) | |

|---|---|---|---|

| S.D. of non-clean consumption | 0.0380 | 0.0429 | 0.0470 |

| S.D. of clean consumption | 0.1866 | 0.1807 | 0.1873 |

| S.D. of labor supply | 0.0212 | 0.0213 | 0.0210 |

| S.D. of non-clean capital | 0.0653 | 0.0703 | 0.0782 |

| S.D. of clean capital | 0.1978 | 0.1917 | 0.2009 |

| Welfare gains (%) | - | −0.31 × 10−³ | −0.14 × 10−³ |

| Decentralized Equilibrium | Social Planner Equilibrium | |

|---|---|---|

| S.D. of non-clean consumption | 0.0380 | 0.0413 |

| S.D. of clean consumption | 0.1866 | 0.1983 |

| S.D. of labor supply | 0.0212 | 0.0173 |

| S.D. of non-clean capital | 0.0653 | 0.0834 |

| S.D. of clean capital | 0.1978 | 0.2145 |

| Welfare gains (%) | - | 6.21 × 10−4 |

| Policy | Value | Mechanism | |

|---|---|---|---|

| I: with green consumption | I-1: only subsidize clean consumption by | The demand curve of clean goods moves outward to increase its consumption. | |

| I-2: subsidize clean consumption by + subsidize clean output by | The demand curve and supply curve of clean goods move outward at the same time. | ||

| I-3: subsidize clean consumption by + environmental tax on non-clean output by | The demand curve of clean goods moves outward and the supply curve of non-clean output moves inward. | ||

| II: no green consumption | II-1: only environmental tax on non-clean output by | The supply curve of non-clean output moves inward to suppress its output incentive. | |

| II-2: environmental tax on non-clean output by + subsidize clean output by | The non-clean output supply curve moves inward to reduce the output, and at the same time moves the clean output supply curve outward to stimulate production. |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jiang, H.; He, Y. Evaluation of Optimal Policy on Environmental Change through Green Consumption. Sustainability 2022, 14, 4869. https://doi.org/10.3390/su14094869

Jiang H, He Y. Evaluation of Optimal Policy on Environmental Change through Green Consumption. Sustainability. 2022; 14(9):4869. https://doi.org/10.3390/su14094869

Chicago/Turabian StyleJiang, Haiwei, and Yiyao He. 2022. "Evaluation of Optimal Policy on Environmental Change through Green Consumption" Sustainability 14, no. 9: 4869. https://doi.org/10.3390/su14094869

APA StyleJiang, H., & He, Y. (2022). Evaluation of Optimal Policy on Environmental Change through Green Consumption. Sustainability, 14(9), 4869. https://doi.org/10.3390/su14094869