Influences of Environmental Regulations on Industrial Green Technology Innovation Efficiency in China

Abstract

:1. Introduction

2. Materials and Methods

2.1. Variables and Data Sources

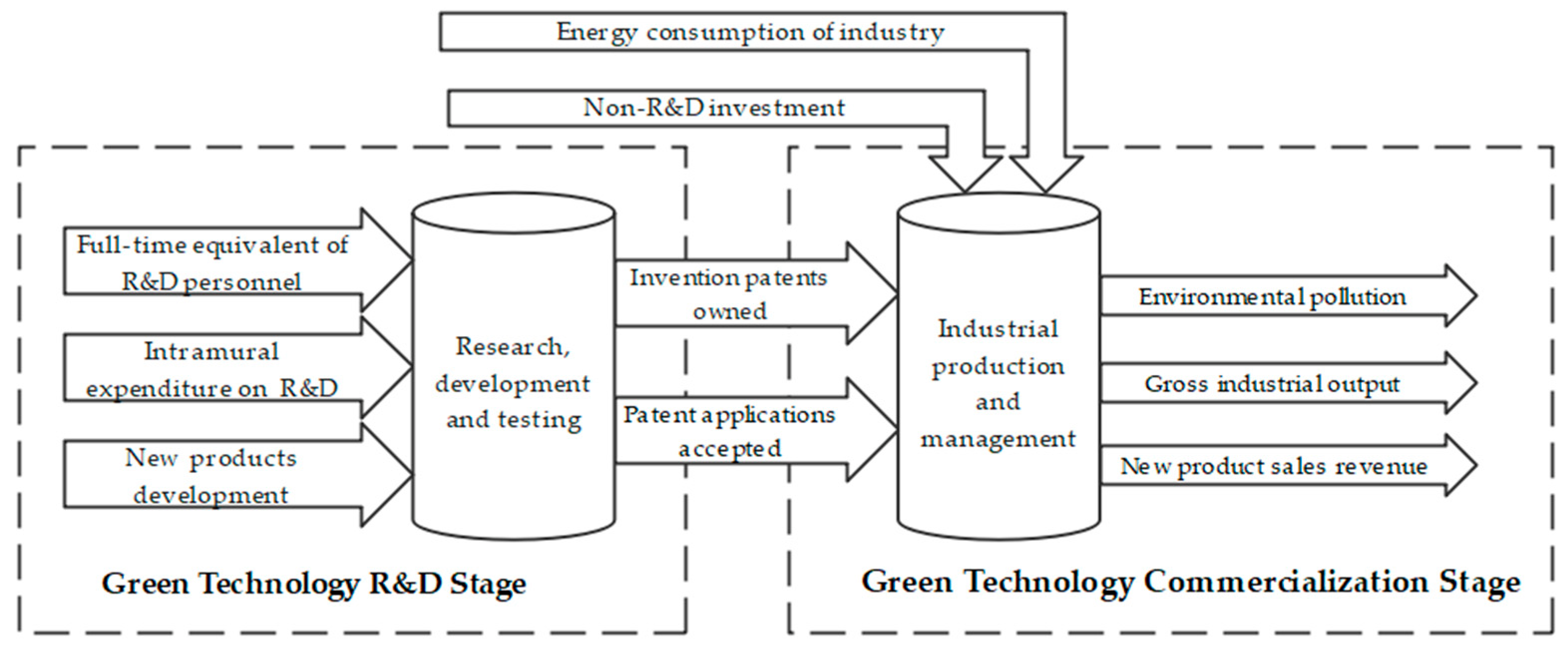

2.1.1. Process of GTI

- (1)

- Green technology R&D stage (Stage 1)

- (2)

- Green technology commercialization stage (Stage 2)

2.1.2. Explained Variables: Industrial Green Technology Innovation Efficiency

2.1.3. Industrial CO2 Emission

2.1.4. Core Explanatory Variable: Environmental Regulation

2.1.5. Control Variables

- (1)

- Foreign direct investment (FDI): the proportion of FDI in GDP [48].

- (2)

- (3)

- Industrial structure (Structure): the ratio of the value-added by tertiary industry to GDP [51].

- (4)

- (5)

- Degree of intellectual property rights protection (Property): the proportion of technology market turnover in GDP [52].

- (6)

- Traffic convenience (Traffic): the proportion of length of highways in total area of territory [50].

2.2. Model Construction

2.2.1. Two Stage Network SBM-DEA Model

2.2.2. Kernel Density Estimation

2.2.3. The Benchmark Regression Model

2.2.4. The Panel Threshold Model

3. Results

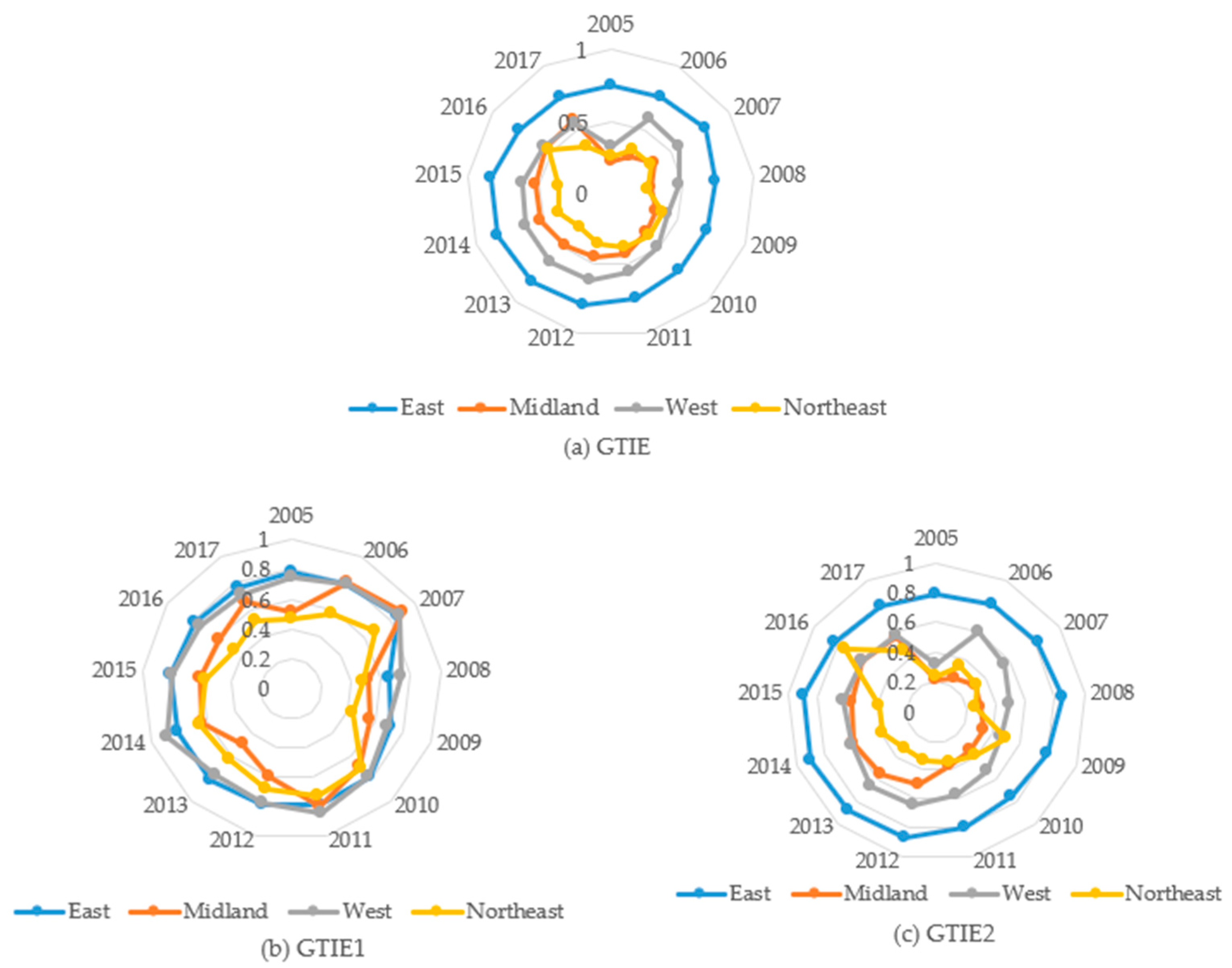

3.1. Results and Analysis of Industrial Green Technology Innovation Efficiency

3.2. Results of Regression

3.2.1. The Test and Empirical Results of the Benchmark Model

3.2.2. The Test and Empirical Results of the Dynamic Effect Model

3.2.3. The Test and Empirical Results of the Threshold Effect Model

3.3. Heterogeneity Analysis

- (1)

- Eastern region

- (2)

- Midland region

- (3)

- Western region

- (4)

- Northeast region

4. Discussions and Conclusions

4.1. Discussions

4.2. Conclusions

4.3. Policy Implementations, Limitations and Future Insights

4.3.1. Policy Implications

4.3.2. Limitations and Future Insights

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Ma, Y.; Zhang, Q.; Yin, Q. Top management team faultlines, green technology innovation and firm financial performance. J. Environ. Manag. 2021, 285, 112095. [Google Scholar] [CrossRef] [PubMed]

- National Bureau of Statistics. China Statistical Yearbook on Environment 2006–2020. Available online: https://data.cnki.net/yearbook/Single/N2021070128 (accessed on 24 March 2022).

- Zhao, W.D. Reflections and suggestions on industrial green development during the 14th Five-Year Plan. In Proceedings of the China Center for Information Industry Development Industry Economic Forum, Beijing, China, 29 March 2021. [Google Scholar]

- China Environmental News. Available online: http://epaper.cenews.com.cn/html/2020-09/30/content_98273.htm (accessed on 24 March 2022).

- Zeng, S.; Li, G.; Wu, S.; Dong, Z. The Impact of Green Technology Innovation on Carbon Emissions in the Context of Carbon Neutrality in China: Evidence from Spatial Spillover and Nonlinear Effect Analysis. Int. J. Environ. Res. Public Health 2022, 19, 730. [Google Scholar] [CrossRef] [PubMed]

- Wang, H.; Cui, H.; Zhao, Q. Effect of green technology innovation on green total factor productivity in China: Evidence from spatial durbin model analysis. J. Clean. Prod. 2021, 288, 125624. [Google Scholar] [CrossRef]

- Liu, D.; Chen, J.; Zhang, N. Political connections and green technology innovations under an environmental regulation. J. Clean. Prod. 2021, 298, 126778. [Google Scholar]

- Porter, M.E.; Linde, C.V.D. Toward a New Conception of the Environment-Competitiveness Relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef] [Green Version]

- Zhang, J.; Ouyang, Y.; Ballesteros-Pérez, P.; Li, H.; Philbin, S.P.; Li, Z.; Skitmore, M. Understanding the impact of environmental regulations on green technology innovation efficiency in the construction industry. Sustain. Cities Soc. 2021, 65, 102647. [Google Scholar] [CrossRef]

- Liu, Y.; Wang, A.; Wu, Y. Environmental regulation and green innovation: Evidence from China’s new environmental protection law. J. Clean. Prod. 2021, 297, 126698. [Google Scholar] [CrossRef]

- Zhang, P.; Zhang, P.; Cai, G. Comparative Study on Impacts of Different Types of Environmental Regulation on Enterprise Technological Innovation. China Population. Resour. Environ. 2016, 26, 8–13. [Google Scholar]

- Zhang, C.; Lu, Y.; Guo, L.; Yu, T. The Intensity of Environmental Regulation and Technological Progress of Production. Econ. Res. J. 2011, 46, 113–124. [Google Scholar]

- Li, H.; Zhang, J.; Wang, C.; Wang, Y.; Coffey, V. An evaluation of the impact of environmental regulation on the efficiency of technology innovation using the combined DEA model: A case study of Xi’an, China. Sustain. Cities Soc. 2018, 42, 355–369. [Google Scholar] [CrossRef]

- Ye, T.; Zheng, H.; Ge, X.; Yang, K. Pathway of Green Development of Yangtze River Economics Belt from the Perspective of Green Technological Innovation and Environmental Regulation. Int. J. Environ. Res. Public Health 2021, 18, 10471. [Google Scholar] [CrossRef] [PubMed]

- Zhao, T.; Zhou, H.; Jiang, J.; Yan, W. Impact of Green Finance and Environmental Regulations on the Green Innovation Efficiency in China. Sustainability 2022, 14, 3206. [Google Scholar] [CrossRef]

- Wu, F.; Fu, X.; Zhang, T.; Wu, D.; Sindakis, S. Examining Whether Government Environmental Regulation Promotes Green Innovation Efficiency—Evidence from China’s Yangtze River Economic Belt. Sustainability 2022, 14, 1827. [Google Scholar] [CrossRef]

- Wang, F.; Jiang, T.; Guo, X. Government quality, environmental regulation and green technological innovation of enterprises. Sci. Res. Manag. 2018, 39, 26–33. [Google Scholar]

- Bai, J.; Jiang, K.; Li, J. Using Stochastic Frontier Model to Estimate the Efficiency of Regional R&D and Innovation in China. Manag. World 2009, 10, 51–61. [Google Scholar]

- Yang, G. Reviews of Returns to Scale in DEA models. Chin. J. Manag. Sci. 2015, 23, 64–71. [Google Scholar]

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the efficiency of decision making units. Eur. J. Oper. Res. 1978, 2, 429–444. [Google Scholar] [CrossRef]

- Kao, C. Efficiency decomposition in network data envelopment analysis: A relational model. Eur. J. Oper. Res. 2009, 192, 949–962. [Google Scholar] [CrossRef]

- Fan, J.; Xiao, Z.H. Analysis of spatial correlation network of China’s green innovation. J. Clean. Prod. 2021, 299, 126815. [Google Scholar] [CrossRef]

- Hansen, M.T.; Birkinshaw, J. The Innovation Value Chain. Harv. Bus. Rev. 2007, 85, 121–130, 142. [Google Scholar]

- Tone, K.; Tsutsui, M. Network DEA: A slacks-based measure approach. Eur. J. Oper. Res. 2009, 197, 243–252. [Google Scholar] [CrossRef] [Green Version]

- National Bureau of Statistics. China Statistical Yearbook 2004–2018. Available online: http://www.stats.gov.cn/tjsj/ndsj/ (accessed on 24 March 2022).

- National Bureau of Statistics. China Industrial Economy Statistical Yearbook 2006–2018. Available online: https://data.cnki.net/Yearbook/Single/N2021020054 (accessed on 24 March 2022).

- Editorial Board of China Environment Yearbook. China Environment Yearbook 2006–2018. Available online: https://data.cnki.net/yearbook/Single/N2021070108 (accessed on 24 March 2022).

- National Bureau of Statistics; Ministry of Science and Technology of the People’s Republic of China. China Statistical Yearbook of Science and Technology 2004–2018. Available online: https://data.cnki.net/yearbook/Single/N2022010277 (accessed on 24 March 2022).

- National Bureau of Statistics. China Energy Statistical Yearbook 2006–2018. Available online: https://data.cnki.net/yearbook/Single/N2021050066 (accessed on 24 March 2022).

- EPS Database. Available online: https://www.epsnet.com.cn/index.html#/Index (accessed on 24 March 2022).

- Macrochina Statistical Database. Available online: http://edu.macrochina.com.cn/skins/11/stat/index.shtml?ny=1 (accessed on 24 March 2022).

- The Official Website of National Bureau of Statistics of China. Available online: https://data.stats.gov.cn/easyquery.htm?cn=E0103 (accessed on 24 March 2022).

- BeiJing Statistical Yearbook 2018. Available online: http://nj.tjj.beijing.gov.cn/nj/main/2018-tjnj/zk/indexch.htm (accessed on 24 March 2022).

- Liang, S.; Luo, L. The Dynamic Effect of International R&D Capital Technology Spillovers on the Efficiency of Green Technology innovation. Sci. Res. Manag. 2019, 40, 21–29. [Google Scholar]

- Chen, S. Green Industrial Revolution in China: A Perspective from the Change of Environmental Total Factor Productivity. Econ. Res. J. 2010, 45, 21–34. [Google Scholar]

- Peng, X.; Li, B. On Green Industrial Transformation in China under Different Types of Environmental Regulation. J. Financ. Econ. 2016, 42, 134–144. [Google Scholar]

- Griliches, Z. R&D and Productivity Slowdown. Am. Econ. Rev. 1980, 70, 343–348. [Google Scholar]

- Goldsmith, R.W. A Perpetual Inventory of National Wealth. Stud. Income Wealth 1951, 14, 5–74. [Google Scholar]

- Goto, A.; Suzuki, K. R&D capital, rate of return on R&D investment and spillover of R & D in Japanese manufacturing industries. Rev. Econ. Stat. 1989, 71, 555–564. [Google Scholar]

- Li, Q.; Wang, W.; Xiao, R. Research on the regional disparities of China’s industrial enterprises green innovation efficiency from the perspective of shared inputs. China Popul. Resour. Environ. 2018, 28, 27–39. [Google Scholar]

- Chen, S. Energy Consumption, CO2 Emission and Sustainable Development in Chinese Industry. Econ. Res. J. 2009, 44, 41–55. [Google Scholar]

- National Greenhouse Gas Inventories Programme; Eggleston, H.S.; Buendia, L.; Miwa, K.; Ngara, T.; Tanabe, K. 2006 IPCC Guidelines for National Greenhouse Gas Inventories; IGES: Hayama, Japan, 2006. [Google Scholar]

- National Development and Reform Commission of China. The Notice of Reporting and Verifying Annual Carbon Emissions and Making Plans of Emission Monitoring from the General Office of National Development and Reform Commission of China. Available online: https://www.ndrc.gov.cn/xxgk/zcfb/tz/201712/t20171215_962618.html?code=&state=123 (accessed on 24 March 2022).

- Yang, S. Evaluation and Prediction on Carbon Emissions Transferring across the Industrial Sectors in China. China Ind. Econ. 2015, 327, 55–67. [Google Scholar]

- He, X.; Zhang, Y. Influence Factors and Environmental Kuznets Curve Relink Effect of Chinese Industry’s Carbon Dioxide Emission—Empirical Research Based on STIRPAT Model with Industrial Dynamic Panel Data. China Ind. Econ. 2012, 1, 26–35. [Google Scholar]

- Liu, Z.; Geng, Y.; Xue, B.; Xi, F.; Jiao, J. A Calculation Method of CO2 Emission from Urban Energy Consumption. Resour. Sci. 2011, 33, 1325–1330. [Google Scholar]

- Zhao, L.; Gao, H.; Xiao, Q. An Empirical Study of Environment Regulation Influence on Efficiency of Green Technology Innovation. Stat. Decis. 2021, 37, 125–129. [Google Scholar]

- Jing, W.; Zhang, L. Environment Regulation, Economic Opening and China’s Industrial Green Technology Progress. Econ. Res. J. 2014, 49, 34–47. [Google Scholar]

- Nie, M.; Qi, H. Can OFDI Improve China’s Industrial Green Innovation Efficiency?: Based on the Perspective of Innovation Value Chain and Spatial Correlation Effect. Word Econ. Stud. 2019, 2, 111–122. [Google Scholar]

- Xiao, Q.; Lu, Z. Heterogeneous Environment Regulation, FDI and the Efficiency of China’s Green Technology Innovation. Mod. Econ. Res. 2020, 4, 29–40. [Google Scholar]

- Jiang, Z.; Lyu, P. Stimulate or inhibit? Multiple environmental regulations and pollution-intensive Industries’ Transfer in China. J. Clean. Prod. 2021, 328, 129528. [Google Scholar] [CrossRef]

- Hu, K.; Wu, Q.; Hu, Y. The Effects of Intellectual Property Rights Protection on Technology Innovation: Empirical Analysis Based on Technology Trading Market and Provincial Panel Data in China. J. Financ. Econ. 2012, 38, 15–25. [Google Scholar]

- National Bureau of Statistics of China. From January to October 2021, the national investment in real estate development increased by 7.2%. Available online: http://www.stats.gov.cn/xxgk/sjfb/zxfb2020/202111/t20211115_1824507.html (accessed on 24 March 2022).

- Rubashkina, Y.; Galeotti, M.; Verdolini, E. Environmental regulation and competitiveness: Empirical evidence on the Porter Hypothesis from European manufacturing sectors. Energy Policy 2015, 83, 288–300. [Google Scholar] [CrossRef] [Green Version]

- Javeed, S.A.; Latief, R.; Jiang, T.; Ong, T.S.; Tang, Y.J. How environmental regulations and corporate social responsibility affect the firm innovation with the moderating role of Chief executive officer (CEO) power and ownership concentration? J. Clean. Prod. 2021, 308, 127212. [Google Scholar] [CrossRef]

- Ford, J.A.; Steen, J.; Verreynne, M.L. How environmental regulations affect innovation in the Australian oil and gas industry: Going beyond the Porter Hypothesis. J. Clean. Prod. 2014, 84, 204–213. [Google Scholar] [CrossRef] [Green Version]

- Qiu, D.; Zhou, M.; Xu, W. Regulation, innovation, and firm selection: The porter hypothesis under monopolistic competition. J. Environ. Econ. Manag. 2018, 92, 638–658. [Google Scholar] [CrossRef]

- Martínez-Zarzoso, I.; Bengochea-Morancho, A.; Morales-Lage, R. Does environmental policy stringency foster innovation and productivity in OECD countries? Energy Policy 2019, 134, 110982. [Google Scholar] [CrossRef] [Green Version]

- Gao, H.G.; Xiao, T. Whether the heterogeneous environmental regulation can force the optimization of industrial structure—Based on the mediating effect and threshold effect of industrial green technology innovation efficiency. Jianghan Trib. 2022, 3, 13–21. [Google Scholar]

- Habibi, Z.; Habibi, H.; Mohammadi, M.A. The Potential Impact of COVID-19 on the Chinese GDP, Trade, and Economy. Economies 2022, 10, 73. [Google Scholar] [CrossRef]

| Variable | Explanations | Indicators | ||

|---|---|---|---|---|

| Industrial GTIE | Green technology R&D stage (Stage 1) | Input variables (2003–2015) | R&D investment | Full-time equivalent of R&D personnel |

| Internal R&D expenditure | ||||

| Expenditure on new product development | ||||

| Output variables (2004–2016) | Intermediate outputs | Domestic invention patents owned | ||

| Domestic patent applications accepted | ||||

| Green technology commercialization stage (Stage 2) | Input variables (2005–2017) | R&D investment | Intermediate outputs | |

| Non-R&D investment | Sum of expenditure | |||

| Output variables (2005–2017) | Desirable output | Sales Revenue of New Products | ||

| Gross industrial output | ||||

| Undesirable output | Energy consumption of industry for unit industrial value-added | |||

| The environmental pollution index | ||||

| Variable | Explanations | Indicators |

|---|---|---|

| ER | Command-based ER | Total number of local environmental laws, regulations, and standards issued |

| The number of environmental administrative punishment cases | ||

| Market-based ER | Investment in treatment of industrial pollution sources | |

| Receipt from of fee on wastes discharge | ||

| Environmental protection investment in environmental protection acceptance projects | ||

| Voluntary ER | Number of environmental proposals by the NPC * and CPPCC * | |

| Number of environmental petitions completed |

| Region | GTIE | Ranking | GTIE1 | Ranking1 | GTIE2 | Ranking2 |

|---|---|---|---|---|---|---|

| Nation | 0.577 | 0.810 | 0.575 | |||

| East | 0.754 | 1 | 0.796 | 3 | 0.796 | 1 |

| Midland | 0.428 | 3 | 0.798 | 2 | 0.375 | 3 |

| West | 0.567 | 2 | 0.850 | 1 | 0.567 | 2 |

| Northeast | 0.384 | 4 | 0.729 | 4 | 0.342 | 4 |

| Beijing | 0.848 | 5 | 0.696 | 24 | 1 | 1 |

| Tianjin | 0.597 | 13 | 0.708 | 22 | 0.594 | 13 |

| Hebei | 0.368 | 23 | 0.776 | 19 | 0.271 | 25 |

| Shanxi | 0.218 | 27 | 0.809 | 17 | 0.166 | 29 |

| Neimenggu | 0.209 | 28 | 0.521 | 28 | 0.224 | 27 |

| Liaoning | 0.296 | 26 | 0.480 | 29 | 0.256 | 26 |

| Jilin | 0.665 | 11 | 0.928 | 7 | 0.598 | 12 |

| HeilongJiang | 0.191 | 29 | 0.780 | 18 | 0.172 | 28 |

| Shanghai | 0.778 | 8 | 0.556 | 27 | 1 | 1 |

| Jiangsu | 1 | 1 | 1 | 1 | 1 | 1 |

| Zhejiang | 0.680 | 10 | 0.894 | 9 | 0.640 | 11 |

| Anhui | 0.437 | 20 | 0.765 | 20 | 0.302 | 24 |

| Fujian | 0.831 | 7 | 0.662 | 26 | 1 | 1 |

| Jiangxi | 0.474 | 17 | 0.810 | 16 | 0.516 | 15 |

| Shandong | 0.686 | 9 | 0.867 | 12 | 0.661 | 10 |

| Henan | 0.420 | 21 | 0.698 | 23 | 0.432 | 17 |

| Hubei | 0.467 | 18 | 0.820 | 15 | 0.421 | 18 |

| Hunan | 0.551 | 15 | 0.886 | 11 | 0.415 | 19 |

| Guangdong | 1 | 1 | 1 | 1 | 1 | 1 |

| Guangxi | 0.530 | 16 | 0.976 | 5 | 0.444 | 16 |

| Chongqing | 0.599 | 12 | 0.909 | 8 | 0.574 | 14 |

| Sichuan | 0.394 | 22 | 0.865 | 13 | 0.320 | 21 |

| Guizhou | 0.319 | 25 | 0.954 | 6 | 0.310 | 22 |

| Yunnan | 0.832 | 6 | 0.664 | 25 | 1 | 1 |

| Shanxi | 0.333 | 24 | 0.836 | 14 | 0.307 | 23 |

| Gansu | 0.575 | 14 | 0.736 | 21 | 0.663 | 9 |

| Qinghai | 1 | 1 | 1 | 1 | 1 | 1 |

| Ningxia | 0.442 | 19 | 0.891 | 10 | 0.3933 | 20 |

| Xinjiang | 1 | 1 | 1 | 1 | 1 | 1 |

| Variables | GTIE | GTIE1 | GTIE2 | |||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| ER | 0.0361 * | −0.0340 | 0.0545 ** | |||

| (1.76) | (−1.37) | (2.12) | ||||

| CER | −0.0126 | 0.0034 | −0.0211 | |||

| (−0.41) | (0.10) | (−0.53) | ||||

| VER | −0.0265 | −0.1417 ** | 0.0076 | |||

| (−0.37) | (−2.22) | (0.09) | ||||

| MER | 0.1067 * | −0.0022 | 0.1334 ** | |||

| (1.91) | (−0.05) | (2.09) | ||||

| Open | −0.1758 | −0.2394 | −0.0202 | −0.1381 | −0.2921 | −0.3364 |

| (−0.95) | (−1.29) | (−0.10) | (−0.71) | (−1.22) | (−1.44) | |

| FDI | 0.2817 *** | 0.2326 *** | −0.0018 | −0.0043 | −0.3322 *** | −0.2678 ** |

| (−3.12) | (−2.77) | (−0.01) | (−0.03) | (−3.00) | (−2.50) | |

| Structure | 0.0606 | 0.0565 | −0.2171 | −0.2009 | 0.1868 | 0.1765 |

| (0.46) | (0.42) | (−1.57) | (−1.45) | (1.22) | (1.12) | |

| Scale | 0.2412 ** | 0.2213 ** | −0.0188 | −0.0522 | 0.2955 * | 0.2812 |

| (2.29) | (2.06) | (−0.16) | (−0.45) | (1.75) | (1.68) | |

| Property | −0.0377 | 0.0270 | 0.2687 | 0.2427 | −0.1753 | −0.0832 |

| (−0.16) | (0.12) | (0.90) | (0.83) | (−0.44) | (−0.22) | |

| Traffic | 0.4461 *** | 0.3947 *** | 0.2754 ** | 0.2989 ** | 0.5059 *** | 0.4336 *** |

| (4.70) | (3.68) | (2.32) | (2.38) | (4.58) | (3.44) | |

| Constant | 0.3367 *** | 0.3543 *** | 0.7246 *** | 0.7549 *** | 0.3039 *** | 0.3180 *** |

| (5.94) | (6.19) | (12.40) | (13.54) | (4.38) | (5.20) | |

| Observations | 377 | 377 | 377 | 377 | 377 | 377 |

| LM | [0.0000] | [0.0000] | [0.0000] | [0.0000] | [0.0000] | [0.0000] |

| Hausman | [0.0100] | [0.0071] | [0.0923] | [0.0696] | [0.0024] | [0.0018] |

| Overid | [0.0000] | [0.0000] | [0.0079] | [0.0001] | [0.0000] | [0.0000] |

| Variables | GTIE | GTIE1 | GTIE2 | |||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| L. Y | 0.3902 *** | 0.3957 *** | 0.3299 *** | 0.3289 *** | 0.3089 ** | 0.2833 * |

| (2.97) | (2.72) | (3.36) | (2.70) | (2.40) | (1.77) | |

| ER | −0.0435 | 0.0102 | −0.0348 | |||

| (−0.81) | (0.21) | (−0.89) | ||||

| CER | −0.0559 | 0.0733 | −0.0382 | |||

| (−0.58) | (0.72) | (−0.34) | ||||

| VER | −0.2634 | 0.0094 | −0.1421 | |||

| (−1.11) | (0.04) | (−0.95) | ||||

| MER | 0.0603 | −0.0367 | 0.0516 | |||

| (0.44) | (−0.20) | (0.50) | ||||

| Open | 0.4536 ** | 0.4038 ** | 0.2193 * | 0.2210 * | 0.5877 *** | 0.5878 *** |

| (2.55) | (2.31) | (1.79) | (1.70) | (4.62) | (3.70) | |

| FDI | −0.1254 | −0.1083 | −0.2694 ** | −0.2959 ** | −0.0040 | −0.0325 |

| (−1.04) | (−0.87) | (−2.31) | (−2.00) | (−0.03) | (−0.22) | |

| Structure | −0.0162 | 0.0568 | 0.1346 | 0.1342 | −0.0966 | −0.0534 |

| (−0.13) | (0.42) | (0.84) | (0.83) | (−0.69) | (−0.38) | |

| Scale | 0.1221 | 0.0196 | −0.0028 | 0.0029 | 0.0695 | 0.0126 |

| (0.92) | (0.15) | (−0.02) | (0.01) | (0.47) | (0.08) | |

| Property | 0.1494 | 0.1285 | 0.1163 | 0.0747 | 0.3033 ** | 0.3158 * |

| (0.95) | (0.72) | (0.77) | (0.39) | (2.19) | (1.86) | |

| Traffic | −0.0351 | 0.0499 | −0.1830 | −0.1531 | −0.1609 | −0.1396 |

| (−0.23) | (0.25) | (−1.40) | (−1.06) | (−0.89) | (−0.64) | |

| Constant | 0.3073 *** | 0.3072 *** | 0.5021 *** | 0.5059 *** | 0.4134 *** | 0.4093 *** |

| (3.46) | (3.15) | (4.90) | (4.13) | (3.89) | (3.43) | |

| Observations | 348 | 348 | 348 | 348 | 348 | 348 |

| AR (1) | [0.016] | [0.020] | [0.001] | [0.002] | [0.020] | [0.021] |

| AR (2) | [0.145] | [0.247] | [0.449] | [0.487] | [0.429] | [0.365] |

| Hansen | [0.289] | [0.272] | [0.128] | [0.043] | [0.572] | [0.556] |

| Explained Variables | Explanatory Variables | Threshold Quantity | Threshold Value | F-Statistic | p-Value | BS Times |

|---|---|---|---|---|---|---|

| Threshold variable: Traffic | ||||||

| GTIE | ER | Single | 0.012 | 31.11 | 0.03 | 300 |

| CER | Single | 0.012 | 28.05 | 0.03 | 300 | |

| MER | Single | 0.012 | 32.37 | 0.05 | 300 | |

| VER | Single | 0.012 | 27.82 | 0.05 | 300 | |

| GTIE2 | CER | Single | 0.012 | 21.69 | 0.08 | 300 |

| MER | Single | 0.012 | 25.08 | 0.09 | 300 | |

| VER | Single | 0.012 | 21.4 | 0.09 | 300 | |

| Threshold variable: CER | ||||||

| GTIE1 | MER | Single | 0.1596 | 12.03 | 0.07 | 300 |

| GTIE2 | ER | Single | 0.7593 | 15.38 | 0.05 | 300 |

| MER | Single | 0.7593 | 13.78 | 0.08 | 300 | |

| Threshold variable: MER | ||||||

| GTIE | MER | Single | 0.1794 | 17.77 | 0.07 | 300 |

| GTIE2 | ER | Single | 0.4334 | 19.29 | 0.06 | 300 |

| MER | Single | 0.1794 | 15.63 | 0.09 | 300 | |

| VER | Single | 0.4308 | 21.73 | 0.06 | 300 | |

| Panel A: Results of the Threshold Effect Model with Traffic as the Threshold Variable | |||||||

|---|---|---|---|---|---|---|---|

| Variables | GTIE | GTIE2 | |||||

| Core ExplanatoryVariables (X) | ER | CER | MER | VER | CER | MER | VER |

| (1) | (2) | (3) | (4) | (6) | (7) | (8) | |

| VER(CER)(CER) | −0.0226 | −0.0120 | −0.0117 | 0.0117 | −0.0204 | −0.0202 | |

| (−0.32) | (−0.40) | (−0.38) | (0.14) | (−0.52) | (−0.51) | ||

| MER(VER)(MER) | 0.0931 * | −0.0222 | 0.0930 * | 0.1194 * | 0.0121 | 0.1192 * | |

| (1.81) | (−0.31) | (1.81) | (1.99) | (0.15) | (1.99) | ||

| X × I (Traffic ≤ γ) | −1.1018 *** | −3.4437 *** | −3.9486 *** | −2.6035 *** | −3.5725 *** | −4.0726 *** | −2.6525 *** |

| (−9.98) | (−5.87) | (−28.44) | (−5.89) | (−5.74) | (−24.83) | (−5.54) | |

| X × I (γ < Traffic) | 0.0312 | −0.0112 | 0.0917 * | −0.0223 | −0.0197 | 0.1178 * | 0.0119 |

| (1.56) | (−0.37) | (1.79) | (−0.31) | (−0.50) | (1.97) | (0.15) | |

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 377 | 377 | 377 | 377 | 377 | 377 | 377 |

| Panel B: Results of the Threshold Effect Model with CER or MER as the Threshold Variable | |||||||

| Variables | Threshold: CER | Threshold: MER | |||||

| Explained Variables | GTIE1 | GTIE2 | GTIE | GTIE2 | |||

| Core Explanatory Variables (X) | MER | ER | MER | MER | ER | MER | VER |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

| VER(CER)(CER) | 0.0672 * | 0.0784 | −0.0102 | −0.0184 | −0.0150 | ||

| (1.93) | (1.48) | (−0.33) | (−0.46) | (−0.38) | |||

| MER(VER)(MER) | −0.1199 * | 0.0192 | −0.0258 | 0.0084 | 0.0954 | ||

| (−1.99) | (0.26) | (−0.36) | (0.10) | (1.67) | |||

| X × I (Threshold ≤ γ) | 0.0831 | 0.1117 *** | 0.1710 ** | −1.1817 * | −0.0517 | −1.2813 ** | −0.2276 |

| (1.68) | (2.97) | (2.42) | (−2.00) | (−1.32) | (−2.11) | (−1.63) | |

| X × I (γ < Threshold) | −0.0424 | 0.0590 ** | 0.0533 | 0.0950 * | 0.0556 ** | 0.1205 * | 0.0831 |

| (−0.98) | (2.29) | (0.85) | (1.83) | (2.21) | (2.01) | (0.97) | |

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 377 | 377 | 377 | 377 | 377 | 377 | 377 |

| Variables | GTIE | GTIE1 | GTIE2 | |||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| No Lag | ||||||

| ER | 0.0460 * | 0.0334 | 0.0421 | |||

| (1.94) | (1.56) | (1.28) | ||||

| CER | −0.0826 | 0.0756 | −0.1620 * | |||

| (−1.30) | (1.21) | (−1.81) | ||||

| MER | 0.1395 ** | 0.1347 ** | 0.1017 | |||

| (2.11) | (2.00) | (1.44) | ||||

| One-year lag | ||||||

| LCER | −0.1225 * | 0.0329 | 0.0159 | −0.1754 ** | ||

| (−1.71) | (1.34) | (0.15) | (−2.36) | |||

| LVER | 0.1287 ** | 0.1216 * | 0.1066 | |||

| (2.03) | (1.75) | (1.05) | ||||

| LMER | 0.1449 *** | 0.1236 ** | 0.1086 ** | |||

| (3.49) | (2.10) | (2.02) | ||||

| Two-year lag | ||||||

| L2MER | 0.1044 ** | 0.1744 *** | 0.0199 | |||

| (2.05) | (2.68) | (0.36) | ||||

| Variables | GTIE | GTIE1 | GTIE2 | |||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| No Lag | ||||||

| ER | −0.0939 * | −0.0924 ** | −0.0976 | |||

| (−1.85) | (−2.16) | (−1.13) | ||||

| VER | 0.1442 | −0.4000 *** | 0.2664 | |||

| (0.88) | (−4.10) | (1.19) | ||||

| MER | −0.1462 *** | −0.1072 *** | −0.1645 * | |||

| (−2.76) | (−3.16) | (−1.67) | ||||

| One-year lag | ||||||

| LER | −0.0929 ** | 0.0512 | −0.1180 | |||

| (−2.10) | (1.4140) | (−1.49) | ||||

| LVER | 0.2681 | 0.1907 * | 0.3624 | |||

| (1.10) | (1.83) | (1.19) | ||||

| LMER | −0.1245 ** | 0.0266 | −0.1635 * | |||

| (−2.46) | (0.34) | (−1.84) | ||||

| Two-year lag | ||||||

| L2ER | −0.1064 ** | 0.0208 | −0.1428 ** | |||

| (−2.44) | (0.5579) | (−2.16) | ||||

| L2CER | −0.0234 | −0.0942 *** | 0.0253 | |||

| (−0.27) | (−2.63) | (0.25) | ||||

| L2VER | 0.3618 * | 0.3753 | 0.4091 | |||

| (1.73) | (1.25) | (1.47) | ||||

| L2MER | −0.1127 | 0.1293 *** | −0.1949 | |||

| (−1.34) | (3.21) | (−1.43) | ||||

| Variables | GTIE | GTIE1 | GTIE2 | |||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| No Lag | ||||||

| ER | 0.0868 * | 0.0058 | 0.0904 | |||

| (1.82) | (0.10) | (1.58) | ||||

| One-year lag | ||||||

| LVER | 0.0942 | 0.2949 ** | 0.0344 | |||

| (0.88) | (2.49) | (0.32) | ||||

| Two-year lag | ||||||

| L2VER | 0.3111 ** | 0.3576 *** | 0.2559 ** | |||

| (2.74) | (4.20) | (2.31) | ||||

| Variables | GTIE | GTIE1 | GTIE2 | GTIE2 | ||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| No Lag | ||||||

| ER | −0.0506 *** | −0.1147 | −0.1147 | |||

| (−3.07) | (−1.56) | (−1.56) | ||||

| VER | −0.5349 ** | −0.7028 ** | −0.7028 ** | |||

| (−1.98) | (−2.14) | (−2.14) | ||||

| MER | −0.0192 | −0.2633 *** | −0.2633 *** | |||

| (−0.50) | (−11.13) | (−11.13) | ||||

| One-year lag | ||||||

| LER | −0.0598 * | −0.1053 ** | −0.0684 | |||

| (−1.6788) | (−2.07) | (−1.06) | ||||

| LVER | −0.1090 ** | −0.6144 *** | 0.0873 | |||

| (−2.44) | (−16.10) | (1.48) | ||||

| LMER | −0.1564 *** | −0.2039 ** | −0.1569 *** | |||

| (−11.36) | (−1.96) | (−2.72) | ||||

| Two-year lag | ||||||

| L2MER | −0.2223 *** | −0.1483 *** | −0.2637 *** | |||

| (−23.03) | (−3.12) | (−5.40) | ||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Shen, W.; Shi, J.; Meng, Q.; Chen, X.; Liu, Y.; Cheng, K.; Liu, W. Influences of Environmental Regulations on Industrial Green Technology Innovation Efficiency in China. Sustainability 2022, 14, 4717. https://doi.org/10.3390/su14084717

Shen W, Shi J, Meng Q, Chen X, Liu Y, Cheng K, Liu W. Influences of Environmental Regulations on Industrial Green Technology Innovation Efficiency in China. Sustainability. 2022; 14(8):4717. https://doi.org/10.3390/su14084717

Chicago/Turabian StyleShen, Wanfang, Jianing Shi, Qinggang Meng, Xiaolan Chen, Yufei Liu, Ken Cheng, and Wenbin Liu. 2022. "Influences of Environmental Regulations on Industrial Green Technology Innovation Efficiency in China" Sustainability 14, no. 8: 4717. https://doi.org/10.3390/su14084717

APA StyleShen, W., Shi, J., Meng, Q., Chen, X., Liu, Y., Cheng, K., & Liu, W. (2022). Influences of Environmental Regulations on Industrial Green Technology Innovation Efficiency in China. Sustainability, 14(8), 4717. https://doi.org/10.3390/su14084717