1. Introduction

“Financial sustainability” refers to liquidity, the long-term returns, the growth potential, and the ability to withstand financial distress [

1]. Business crises, in most cases, are not natural phenomena but are the result of a number of internal and external factors, which can be proactively identified and for which it is possible to assess the potential destructive future impacts and circumvent them. The company’s failure process, in most cases, relates to a misalignment between the resources of the company, their deployment, and the environment [

2] (i.e., an inadequate balance between business goals and resources [

3]) and some form of managerial incompetence [

4].

Bankruptcy, as a final manifestation of financial problems, starts with insolvency, where the company becomes unable to realize its current liabilities on the basis of its current assets, which is followed by a scenario in which the total liabilities exceed the fair value of the firm’s assets, so that the company becomes unable to pay its debts. Bankruptcy is a disruptive, costly, and enormously impactful phenomenon for both entrepreneurs and stakeholders [

5] in the tourism and travel (hereafter, T&T) sector, such as tourists, employees, shareholders, travel agencies, restaurants, food suppliers, and local communities, as well as for users of financial statements, such as banks, investors, rating agencies, auditors, insurance companies, and legislators [

6,

7]. Bankruptcies in the T&T sector disrupt the overall business sustainability in terms of economic growth, social inclusion, and environmental protection [

8,

9]. Although they are an inseparable part of natural selection in the market, they can have destructive repercussions on economic growth, which are occasionally of significant magnitude, in terms of job losses and the destruction of assets and the productive base [

10]. Unemployment typically increases three times more if a fall in the GDP is accompanied by a similar-sized increase in bankruptcies [

11]. Furthermore, they incur enormous expenses for the company itself, for related companies, for society, and for the economy of the entire country [

12], and they constrain the social inclusion that is achieved through population movements and the exchange of experiences.

Bankruptcies in the T&T sector can have a negative impact on the environment, given that companies that are subject to bankruptcy are often taking excessive environmental and public health risks [

13] and, in many countries, accident liabilities and regulatory judgments can be discharged in such situations. The economic factors of a business are largely responsible for the degree of interest of the hospitality companies in dealing with environmental issues [

14]; this link is bilateral, given that environmental responsibility has a positive impact on the financial performance of tourism companies, including hotels that apply environmental procedures because of reduced operating costs and an improved hotel image [

15].

Bankruptcies can be avoided through “mindfulness in business”, which “facilitates the construction, discovery, and correction of unexpected events capable of escalation” [

16], or through reorganization, which is an alternative solution for resolving insolvency.

The COVID-19 health crisis has caused major changes in social and economic activities, such as problems in global trade, the reduction in the global GDP, border closures, as well as a sharp decline in tourism activities and, thus, the industry’s revenues [

17], which are changing the paradigm of world tourism. The share of tourism in the global GDP averaged 10.3% in the period, 2016–2019, while, in 2020, it was 5.5%. International tourist arrivals declined by 74% in 2020 from the previous year because of the COVID-19 crisis [

18]. The changes began with governments around the world imposing measures by travel bans, lockdowns, and shutdowns. Such changes were accompanied by changes in the tourism demand, which mainly affected the supply, in order to adjust to the new needs of tourists, and they were accompanied by problems in liquidity. Following Abraham et al. [

19], the COVID-19 disease has taken a peculiar toll on the T&T sector; the system of valorization of tourist destinations has been changed.

On the other hand, massive governmental, fiscal, monetary, and supportive measures, such as loan guarantees, the temporary suspension of requirements, and direct equity injections, as well as temporary bridging measures implemented by firms, have delayed the impact of the crisis on the risk of bankruptcy in local economies. Despite a number of negative factors in the realization of business in 2020, the number of bankruptcies worldwide decreased for the period, 2019/2020, by 12.4%, on average, according to the Global Bankruptcy Report, as bankruptcies are a lagging economic indicator [

20]. Gourinchas et al. [

21] predict that, in the absence of government support, the COVID-19 shock would have increased the yearly SME failure rate from 9 to 18% in the European Union. Thus, although it is unequivocally clear that periods of crisis in the economy inevitably increase the number of companies under reorganization and bankruptcy processes, such effects of the COVID-19 crisis, on a global scale, are yet to have fully materialized.

The T&T sector plays a significant role in the Serbian economy, which is measured by its contribution to the GDP and employment. According to the data of the World Travel and Tourism Council [

22] for 2019, the contribution of the travel and tourism industry to the Serbian GDP grew from 6.4 to 6.9% in the period, 2015–2018. According to the OECD [

23], the Serbian tourism industry operated in a positive zone and recorded noticeable growth in the period from 2015 to 2019 in various aspects, which included: overnight visitors (domestic and foreign), total international receipts, the number of persons employed, and the share of tourism in the gross income. The tourism industry directly generated 32,000 jobs in the Republic of Serbia in 2017, which represented 1.8% of the country’s total employment. The industry attracted a capital investment of RSD 33.8 billion, which was 4.1% of the total national investment. Previously, it was expected to rise by 2% over the next ten years, to RSD 43.5 billion by 2028. The total number of tourist arrivals in 2018 was 3.4 million, which marks an increase of 11.2% from 2017.

The increase in the significance of the sector is also noticeable in terms of the number of firms in the sector (with growth of 27% for the period, 2015–2019), even in 2020, when the number of entities accounted for 4185, and growth of 2.6% was achieved, compared to 2019 [

24,

25]. According to the World Economic Forum [

26], the Serbian tourism and travel competitiveness index has improved; in 2019, Serbia held 83rd place (with an index value of 3.6), and it experienced the largest score improvement in Europe, moving up 12 places. Serious improvements have been made in the business environment (from 112th place to 74th place), in human resource and labor markets (from 82nd to 58th place), in visa requirements (from 69th to 18th place), and in the increased overall T&T prioritization (from 116th to 109th place).

Therefore, Serbian tourism developed upwards until the COVID-19 crisis, and it is a promising factor in the future growth of the economy, with a growing and still insufficient share in the GDP of the country compared to the average share of world tourism. According to the data of the Statistical Office of the Republic of Serbia [

27], even in 2019, there was an increase of 9.6% in the nights spent by foreign tourists, and the number of nights spent by domestic tourists was 6.8% higher than in 2018. In 2020, however, the T&T sector in Serbia experienced dramatic changes, both in terms of the volume and in terms of the structure of the demand. In the second quarter of 2020, the number of overnight stays of foreign tourists, compared to the same period in 2019, fell by 91.1%, while, in the third quarter, this indicator was slightly higher, but still modest, when compared to the same period in 2019 (82.1%). The government’s economic support with regard to the mitigation of the economic consequences of COVID-19 was offered to hotel companies in the Republic of Serbia, and it included the postponed payment of payroll taxes and contributions free of interest; the repayment of incurred liabilities in instalments beginning, at the earliest, from 2021 [

28]; the postponement of the advance payment of taxes on profit in the second quarter of 2020; the release of donation givers from the obligation of VAT payments; the incitement of commercial bank loans for maintaining liquidity; and subventions for hospitality and tourism companies. The Ministry of Trade, Tourism and Telecommunications of the Republic of Serbia announced a public call for subsidies (EUR 350 per bed and EUR 150 per accommodation unit), and 312 hotels received the subsidies [

29]. Furthermore, there was no long-lasting mandatory closure of the hospitality companies, so that they could continue operating while implementing safety measures.

Reorganizations for the Republic of Serbia are hardly feasible; only one out of ten debtors actually pursue reorganization [

30]. They are extremely expensive, and they accounted for 20% of the value of the estates of a company in 2020, compared with the average of 13.3% for Europe and Central Asia [

31]. Reorganizations are particularly elusive for hotel companies, which have high fixed assets-to-current assets ratios, limited sales power over estates, and they are usually highly leveraged. According to Mizdraković et al. [

30], the assets of hotel companies are sold at a very low value (usually 10–30% of the market value), so that the collected money is not enough to cover the debts, and the creditors suffer along with the hotel companies.

At the same time, according to the data of the Business Registers Agency for the period, March–April 2019/2020, the number of closed companies in the Republic of Serbia decreased by 58%, while the number of newly established companies increased by 34%. In the authors’ opinion, the discerned lag in factual bankruptcies can be interpreted by the use of government measures to help the private sector, which uses the bank liquidity loans that are given to small and medium enterprises, opening “reserve companies”, feeding “zombie companies” [

32], and avoiding the liquidation procedures due to additional costs. It can be expected that the increase in the indebtedness of companies in Serbia as a result of delaying the consequences of the COVID-19 crisis will have delayed consequences in the forthcoming years.

Although Serbian tourism started to regenerate in 2021, in terms of the number of arrivals and overnight stays of foreign and domestic tourists, the question is whether the current level of recovery is sufficient to prevent the negative financial effects of the past and the current degradation brought about by the COVID-19 crisis. Under these conditions, the ability to predict bankruptcy is especially amplified for the hotel industry in the Republic of Serbia, and, if bankruptcy can be timely and accurately predicted, measures can be taken to reduce risk and job losses and, ultimately, to avoid bankruptcy itself [

33]. The financial strength will be crucial for the survival of hotel companies amid the COVID-19 crisis [

34].

The subject of this paper is the exposure of hotel companies in the Republic of Serbia to the risk of bankruptcy. The topic is relevant as: (1) The T&T sector is an important factor in the economic development in the Republic of Serbia; (2) For the hotel industry, reorganizations are hardly feasible in this country; and (3) There is a paucity of scientific papers and no government analysis or announcements on the topic. The aim of the paper is to assess the impact of the COVID-19 crisis on the exposure of hotel companies in the Republic of Serbia to the risk of bankruptcy. In order to see the prospective middle-term consequences of the crisis, the frame period of the assessment starts with the moment the COVID-19 crisis appeared, and it ends with 2026.

The analysis and forecasting of the bankruptcy risk in new and unfavorable circumstances are important, bearing in mind the previous rationale, and the fact that the T&T sector is one of the hardest hit by the COVID-19 crisis, as well as the fact that bankruptcy is a lagging phenomenon, so that the additional leveraging and reduction in the state support measures in the forthcoming period, when compared to the initial period of the crisis, have yet to materialize in the form of bankruptcies in the industry. In this paper, we strive to emphasize the importance of strong support for this vulnerable industry in the dangerous conditions that have been brought about by COVID-19.

The research questions of the paper can be summarized as follows:

RQ1: How much did the risk of bankruptcy in 2019 and 2020 deviate compared to earlier assessed trends?

RQ2: What impact has the COVID-19 crisis had on the nature and scale of the transitions between the three bankruptcy risk zones, introduced by Altman’s Z″-score model, in 2020, compared to the previous period?

RQ3: What are the expectations with regard to the exposure to the risk of bankruptcy in the hotel industry in the Republic of Serbia in the forthcoming period?

The questions were answered through the analysis of the results of the five novel multivariate structural time-series models and the zonal dynamics indicators (ZDIs) that are introduced here. For the analysis, we use data on a sample of 100 randomly selected hotel companies in the sector of accommodation and catering services for the period, 2015–2020. The research was conducted on the basis of the financial statements of the selected companies, which are available on the website of the Agency for Business Registers (hereafter, ABR). At the time of writing, no financial statements for 2021 were available, so no analysis of the factual Z″-scores for that year was performed. Given that the ABR publicly presents data for a three-year period, and as we started collecting financial reports for the purposes of this study in 2017, extending the historical period for the analysis of the factual bankruptcy risk in the industry was not feasible.

Two categories of the models are built and presented here.

The first category of the models includes two models for the assessments for 2019 and 2020, which were designed by the use of the data for the period, with regular business conditions (2015, 2018). The models were designed in order to obtain answers to RQ1, and to give ex post forecasts for an explanatory analysis, comparing the predictions of the Z″-scores to the realized Z″-scores, on the one hand, and the goodness-of-fit measures with the predictive accuracy of the model, on the other hand. The differences in the values of the predictions that were obtained by the forecasting models, and the factual values of the indicators that are forecasted, can be partially attributed to the model’s errors in the prediction phase, and to changes in the conditions that occurred in the forecasted period. Similarly, the differences among the goodness-of-fit measures of the model (model errors in the model’s building phase) and the goodness-of-prediction measures (predictive accuracy) can be attributed to changing circumstances that affect the value of the projected indicator. Hence, we built two models for forecasting the Z″-score indicators by using the training data for the pre-COVID-19 period and comparing the resulting predictions with the factual values of the Z″-scores for 2019 and 2020, and the estimated prediction errors with the goodness-of-fit measures, to evaluate the impact of the COVID-19 crisis in 2019 and 2020.

The second category of the models includes three models: the first two are derived from the identified dependencies of the relevant indicators in the conditions of the COVID-19 crisis, while the third combines regular conditions with the crisis conditions, so that it is applicable in both situations. The models were designed in order to obtain answers to RQ3 by exante forecasts (i.e., forecasts that use the forecasts of the predictors as the input variables). The exante forecast was made for the period, 2021 to 2025, and the resulting scores of the models are forecasting tools with a limited forecasting period, and so they are used for the interpretation of the bankruptcy risk in 2026.

One of the most important models for the economic time series is the basic structural model, which includes a trend, a seasonal component, and an irregular component [

35]. Structural time-series models are formulated directly, in terms of the unobserved components that have a natural interpretation and that represent the salient features of the series under investigation [

36]. Structural time-series models are regression models in which the explanatory variables are functions of time, and the parameters are time-varying [

37] and are set up in terms of components, which have a direct interpretation. A structural model cannot only provide forecasts, but can also, through the estimates of the components, present a set of stylized facts [

37].

We built different time-series models on the basis of the identified trend components, which were formulated by the use of different multiple regression models. No seasonality component is implemented by the models, as, for all the predictor time-series for all the models, no seasonal patterns were identified. Hence, the basic assumption of the modeling that is applied here is that the time series of the Z″-score has a relationship with its predictor variables, which can be formally expressed by multiple regression, and that these relationships can be explained through the intuitive model’s components. The components of the trend are expressed in the form of the effects of a stabilizing force, a force of development, a destabilizing force, etc., and they were built by using the results that were obtained by the cross-correlation and autoregression analysis and formulated by the use of different regression models.

The separation of the trend’s components allows for the identification of the processes that affect it. In the case of the bankruptcy risk prediction in the crisis conditions, it allows for the differentiation of the effects of the crisis on the bankruptcy risk, and for a better understanding of its developmental and shocking changes.

The predictor variables (which are time series by themselves) that were used by the models that are introduced by the study are indicators of the Altman’s Z″-score model for emerging markets, which are applied for the hotel companies, and its derivates for the hotel industry as a whole, including ZDI indicators. To obtain a more robust evaluation of the industry’s conditions with regard to bankruptcy risk, we introduce five novel dynamical indicators (ZDI), which were calculated for 2020 and were compared to the ZDIs of the years from 2015 to 2018 with the aim of providing a comprehensive answer to RQ2. Furthermore, the hypothesis on the changes in the types of transitions of the firms among the risk zones in 2019 and 2020 are tested in order to gain a more complete insight with regard to RQ2. ZDIs are derived from the zonal memberships of the firms, and the changes among the zones during a time that spanned the three risk zones, as estimated by Altman’s Z″-score model. The introduction of the dynamic indicators was motivated by Nyitrai [

38], so that the proposed measure may play an important role in the practice of the credit-scoring modeling as well.

In this way, we offer, in this paper, a new dynamic conceptual framework for assessing the bankruptcy-risk exposure at the level of individual firms, as well for whole markets, which prolongs the applicability of the Altman models to multiyear predictions and uses the dynamics indicators to enhance the predictive power of the models.

The models and ZDIs are validated through the comparison of the results of the models with the results that were obtained through the use of the purposely designed artificial neural networks (hereafter, ANN), and through the use of the ARIMA and exponential smoothing methods for time-series forecasting. Here, 270 MLP ANNs were built, and the neural network autoregression (NNAR) method was applied. An innovative approach to the implementation of ANN models is introduced, where the models envisage the risk zones of Altman‘s model for the firms in the future.

In order to test the robustness of the models, Zmijewski and Springate scores were applied instead of Altman’s Z″-scores as the input parameters of the models. The results that were obtained when the Springate scores were applied showed almost identical results to the Altman’s Z″-scores, while, in the case of the Zmijewski scores, there were differences (although these differences were not systematic) that led to similar conclusions, and that can be attributed to the weaker performances of the indicators of the arithmetic means of the Zmijewski scores for the sample in detecting changes in particular years.

In consideration of corporate governance, Huy [

39] stresses that, “after corporate scandals happening during and after global monetary and financial crises, it is necessary to re-evaluate code of corporate governance”. Furthermore, it is emphasized that tourism, airlines, and hotels are industries that can be significantly affected by environmental and social risks [

40]. Dat et al. [

41] stress that the construction of the operational processes of supervisory boards is a relevant matter in postcrisis periods and will also be necessary to improve auditing, risk management, accounting, and audit systems [

42].

The rest of this paper is organized as follows:

Section 2 discusses the business and bankruptcy crisis in the travel and tourism industry;

Section 3 describes the existing bankruptcy forecasting models and provides insight into the existing literature in the domain;

Section 4 describes the methodology that is used here in more detail;

Section 5 reports and discusses the empirical results;

Section 6 includes the details on the validation of the model’s results through the application of classical time-series modeling and ANNs; and

Section 7 concludes the research.

2. Business and Bankruptcy Crisis in the Travel and Tourism Industry

In assessing the possibility of bankruptcy and its impact on the T&T sector, it is important to oversee the specific characteristics of tourism, such as the seasonality, the diversity of the supply, the nonproductive nature of the business, the fluctuations in sales, a high level of elasticity of demand, the supply inelasticity, the heterogeneity of the included business entities, etc. At the same time, there are differences, depending on the tourist segment (leisure/business travels). The leisure travel market segment has a much larger income elasticity and is more sensitive to changes in the exchange rate than the business and conference travel segments [

43], while the business travel market segment is more sensitive to economic factors and business cycles [

44]. Hall [

45] points out that globalization and the reliance on mobile phones and applications, as well as the marginal liquidity and profitability in the T&T sector, have made it more fragile and have increased the chances of any global crisis to significantly threaten international tourism.

The hotel industry, specifically, has low stock levels, higher capital intensity, and the largest share of the sales of services, while the smallest share of the sales includes the sales of goods and their own products, followed by additional services [

46,

47]. Hotel firms have, in addition to the aforementioned, a high level of capital that is invested in fixed assets so that they are usually highly leveraged and dependent on creditors.

A growing awareness of the threat of tourism crises and their potential to inflict harm is reflected in the number of academic publications. The main causes of the crisis in tourism are stated as economic, political, sociocultural, environmental, and technological factors [

5], as well as its seasonal character [

44,

48]. It is confirmed that the variance in the occupancy rates in a tourist destination increases the exit risk and the likelihood of business failure for the hotels in that destination [

49]. When it comes to the hotel industry, many studies have addressed the impact of various factors, other than financial factors, on the financial sustainability of hotel companies. Gemar et al. [

50] conducted an analysis of hotels in Spain and found that the good predictors of the financial bankruptcy of hotels are their size, location, management, and the business cycle. Other studies mention the legal status for medium-sized hotels [

51], the size of the company [

51], the location [

52,

53], the number of stars [

54], the fluctuations in customer demand [

55], the gender of the CEO [

56], the Airbnb profile [

57], etc.

Since 2020, COVID-19, and its influence on the T&T sector, have joined the most represented topics in the scientific literature on the area [

58,

59]. Becker et al. [

60] point out that one of the business characteristics with the greatest impact on the momentum of the crisis in companies is the reliance on physical proximity, which is inherent for hotel services. A study conducted in Poland, for example, showed that, among the companies that declared bankruptcy and restructuring in 2020, the most represented were those in the services sector, with the accommodation and catering sectors particularly affected, and with the increase in bankruptcies being as high as 186% [

61]. The accommodation sector has been strongly affected by the crisis, whereby the “new normal” measures have resulted in hotels adapting in order to maintain their business [

41].

The results of the study presented in Crespí-Cladera et al. [

34] indicate that the financial strength will be crucial for the survival of hotel companies in the COVID-19 crisis. By the use of a stress analysis and a logit model of the bankruptcy during 2008–2013, the study predicted that 25% of these firms will face financial distress situations if revenues fall by 60%, while the percentage of these firms will be 32% if revenues fall by 80%. Certain business areas are expected to be exposed to temporary shocks; for example, the postpandemic demand for restaurants could recover completely, or could recover subject to a new distribution model, while, in other industries, the shock will have a more lasting effect. For example, business travel may not recover fully, even once organizations have improved online communication capabilities [

60]. Duro et al. [

62] identified the primary factors behind the vulnerability of tourism to COVID-19, which are as follows: the territorial dependence on tourism; the density of the tourists at the location; the type of demand characterized by little pressure, congestion, and open spaces; the relevance of the domestic demands; the proximity demand; the seasonality; and the health incidence of COVID-19 at the destination. Nguyen [

63] points out that smaller companies in the travel and tourism industry, in particular, face the risk of shutdown or even bankruptcy.

Apart from the immense disruptive impact, the present crisis will also have some positive effects on the T&T sector, such as the stimulation of innovation and creativity, a focus on resilience, efficient communication and care for the customers [

64], improvement in the knowledge about the business sensitivity to sudden crises, developments in the domain of forecasting and analytics techniques for crisis conditions, etc.

3. Literature Review on Bankruptcy Prediction Models

The estimation methods that are used in bankruptcy prediction can be generally classified into parametric methods (such as discriminant analysis, logit (see Liu et al. [

65]), probit, and quadratic regression, hazard analysis, etc.) and nonparametric methods (such as neural networks, classification and regression trees, genetic algorithms, recursive partitioning, and deep learning [

66]). Among the parametric methods, a number of statistical [

67,

68,

69,

70,

71,

72,

73,

74,

75,

76] and stochastic methodologies [

77,

78,

79] have been developed. A special class of models consists of structural models that can be parametric and nonparametric, among which the most commonly used is KMV’s (1993) Credit Monitor System, which was created on the basis of Merton’s [

80] contingent claims approach for valuing risky debt.

Early bankruptcy prediction studies dealt with the possibility of applying accounting-based financial ratios and financial analysis in order to perform an ex ante based on a retrospective ex post analysis of the real data of the companies that went bankrupt. The first of these studies were based on univariate analysis [

81], which were then followed by multivariate analysis studies (i.e., those that derive a linear combination of several parameters that, in the best way, separate bankrupt and nonbankrupt businesses [

82]). Hundreds of financial and ratio indicators have been analyzed through the scientific literature from the angle of their effectiveness in predicting financial distress and corporate default. Financial ratios are easy to calculate by using a company’s financial statements, and they can provide valuable information about the company performance and credit rating.

In the middle of the 20th century, Altman developed the first Z-Score model, which became the global gold standard in predicting bankruptcies and was later the subject of a series of adaptations and modifications. Z-Score models are credit-scoring techniques that are based on the multiple discriminant analysis (MDA) technique, and they provide a continuous metric for classifying and predicting the health of companies. As an MDA implementation, these models allow for the classification of companies into either a distressed (bankrupt) or nondistressed category on the basis of a combination of different indicators and market value measures. The original Altman’s Z-Score model [

67] was developed for manufacturing companies and it contained five financial indicators and represented an outstanding innovation among credit-scoring techniques, with a high accuracy in predicting bankruptcies (between 82 and 94% accurate in the 6-month period, 72% accurate in the 18-month period, 48% accurate in the 3-year period, and 29% accurate in the 4-year period) and no-bankruptcies (with 5% error).

The Z-Score model was later revised to be applicable to publicly traded entities by 1983 and was adapted for nonmanufacturing activities and emerging markets [

83]. In the model for nonmanufacturing and emerging markets (the EM Z″-score model (1995); hereafter, the Z″-score), the fifth variable (X

5 = Sales/Total Assets) of the original Altman model was omitted, as the turnover of assets is an industry-sensitive variable, and a constant with the value of +3.25 was added in order to ensure that the model was standardized with the bond rating equivalent method, which, in turn, allows for the estimation of the default probability on the basis of the Z″-scores. As shown by

Table 1, the Z″-score model builds the basis for the classification of companies into three groups, which are denoted as zones, in terms of their bankruptcy risk exposure.

Many studies that deal with Altman’s original Z-score model have confirmed that this test is able to significantly differentiate the financial situation between failure companies and nonfailure companies (e.g., Tung et al. [

85]; Soon et al. [

86]; Reisz and Perlich [

87]; for retail companies—Chaitanya [

88] (accuracy of 94%); for nonfinancial services and industry companies—Alkhaib and Bzour [

89] (accuracy of 93.8%)). Ashraf et al. [

90] found that both models by Altman and Zmijewski are decent for bankruptcy for emerging markets when applied in periods of financial crisis. They found that the Z-score model more accurately predicts insolvency than the probit model for two types of firms (i.e., those that are at an early stage, and those that are at an advanced stage of financial distress). Chung et al. [

91] found that, one year prior to failure, four of the five Altman ratios were superior to other financial ratios for predicting corporate bankruptcy. Altman himself claims that, although it is a 50-year-old model, the model “nevertheless demonstrates impressive endurance notwithstanding the massive growth in size and complexity of global debt markets and corporate balance sheets” [

92]. At the same time, some studies have criticized the possibilities of applying the Z-score model in certain contexts [

93].

The comparison of the results of the Altman model with other bankruptcy models, based on the scoring technique in the pre-COVID-19 period, can be found in many studies (Dolejšová [

94]—Altman, IN05, Zmijewski, Springate; Pakdaman [

95]—Altman, Springate, Zmijewski, Grover). As a whole, these studies had very different results in terms of the model rankings and accuracies. Wulandari and Maslichah [

96] tested the use of the Springate, Ohlson, Altman Z-score, and Grover score models to predict financial distress during the COVID-19 pandemic. Springate was the most rigid, and it was assessed that 61% of the sample would become bankrupt; for Ohlson, it was 33%; for the Altman Z-score, it was 16%; and the Grover score analysis estimated that 11% of the sample could be expected to go bankrupt. Furthermore, it was shown that the principal component analysis (PCA) that was applied to build a bankruptcy risk that is scored on the basis of the discriminant analysis indices and the five models for assessing bankruptcy risk—Altman, Conan and Holder, Tafler, Springate, and Zmijewski—is effective for determining the influence of the corporate performance over the risk when used for large companies in the European Union [

97].

The study on the application of artificial neural networks (hereafter, ANN) in generating financial predictions has attracted the special attention of the scientific community. A large number of studies in this domain have analyzed the efficiency of neural networks in predicting bankruptcies [

98,

99,

100], and many of them conclude that neural networks are among those methodologies with the highest accuracy when compared to other methodologies [

101,

102]. The problem with this approach stems from the difficulty of training an adequate neural network, and from the fact that users do not have the ability to understand the generated rules that the neural network builds to represent the problem [

103]. It is expected that, with the increasing complexity of the method and the greater specialization of data sources, the ability to understand and apply models in real-world applications will decrease [

92].

The usage of time-series models in bankruptcy prediction is rarely found in the literature, although it allows for the assessment of the bankruptcies of firms within a longer time horizon. For example, Hodges et al. [

104] used time-series data to analyze the effects of different bankruptcy predictors, while Nidhi and Jatinderkumar [

105] predicted bankruptcies through the use of an adaptive neuro-fuzzy inference system. Qui et al. [

106] have shown that, when the time of the crisis lasts long enough for the time-series model to capture the change, the performance of the traditional time-series model is much improved.

The structural models for predicting bankruptcy have been largely neglected by the literature when compared to the other bankruptcy prediction models. Structural models use the evolution of a firm’s structural variables, such as asset and debt values, to determine the timing of the bankruptcy [

107] and to provide a link between the credit quality of a firm and the firm’s economic and financial conditions [

108]. Thus, bankruptcies are endogenously generated. Most of the research in this domain uses structural models for bond pricing (for example, Li and Wong [

109]; Black and Cox [

110]). Charalambous et al. [

111] show that the probability of bankruptcy derived from the Leland–Toft model improves the accuracy of Altman’s and some other models.

A certain number of studies have dealt with the prediction of bankruptcies in the hotel industry in pre-COVID-19 conditions. Altman’s model was applied by Goh et al. [

53] to predict the bankruptcy of the Thomas Cook Travel Group over a ten-year period (2008–2018). Horváthová and Mokrišová [

82] demonstrated that the DEA method is an appropriate alternative to the Altman model in predicting the bankruptcy risk of hotel companies. The general conclusion of one study [

54] is that the Altman models can be applied with considerable success to the forecasting of the bankruptcy of hotel enterprises. The most accurate prediction from the EM Z″-score model application is reached below the 1.1 zone, and, specifically, in the zone <0.5 (where the constant of the model was not used), with an 80% accuracy and 20% divergence. The study by Kesuma et al. [

112] examined the accuracy of the Springate and Grover models in predicting bankruptcy, as well as the effect on the stock prices of the tourism, restaurant, and hotel sector in Indonesia. The results imply that the Grover model is more accurate than the Springate model, as the second assessed that the whole sample would go bankrupt.

Statistical techniques were also directly used in hotel bankruptcy prediction. Gu and Gao [

113] published the first study to predict bankruptcy one year prior to bankruptcy in American hotels and restaurants, using an MDA model. Pacheco [

114] used MDA and logit models in SME Portuguese hotels and restaurants and showed that financial leverage variables are the best default predictors, with accuracies of 69%. Li et al. [

115] estimated that random oversampling improved the modeling performance of the default risk prediction of 28 Chinese tourism firms where the available volume of samples was small, and when used with MDA, logit, and probit models.

Among AI techniques, the most used were ANN and SVM. Kim [

116] showed that ANNs were more accurate in bankruptcy prediction for Korean hotels when compared to SVM. Young and Gu [

117] have shown that, for a sample of 102 Korean hotels, ANNs have slightly better results than logit in terms of accuracy (77.3% with logit and 81.8% with ANNs). Fernández-Gámez et al. [

118] demonstrated the high accuracy of the MLP ANN for a set of 216 Spanish hotels and the input data set from the period, 2005–2012, in predictions with prediction horizons of 3 years. Li and Sun [

119] tested the application of MDA, logit, NN, and SVM models in insolvency predictions for a sample of 23 Chinese hotels, two and three years prior to failure, and they gave an advantage to ANNs and SVM in terms of accuracy (92 and 91%, respectively).

Among the limited number of studies for the Serbian national context, Stanišić et al. [

120] compared logistic regression, decision trees, and ANN models with the EM Altman’s model and showed that only the ANN model produces better results than Altman’s model for private companies, which, according to the author, is adequate for application for companies in the Republic of Serbia. Begovic et al. [

121] discovered, in their research on Serbian firms, a high accuracy of Altman’s model. Andrić and Vuković [

122] investigated the impact of the crisis on the performance of 50 companies in Serbia in the period from 2008 to 2010 using five models, including the Altman’s Z″-score model. Srebro et al. [

1] applied two of Altman’s models to the estimation of the probability of bankruptcy on a sample of public Serbian agricultural companies.

Milašinovic et al. [

123] applied the Z″-score model to a sample of seven hotels in the Republic of Serbia, and their results were later confirmed by practice: within the identified group of risky companies, one went bankrupt, while the other two withdrew their shares. Mizdraković et al. [

30] applied Altman’s Z’- and Z″-scores for the hotel industry of the Republic of Serbia for the period, 2008–2012. When 2008 and 2011 are compared, the average Altman scores recorded decreases of approximately 70%, and other scores confirmed the same results. Therefore, it can be concluded that the hotel industry in Serbia had the greatest risk of going bankrupt in an analyzed period in 2010, and especially in 2011. These authors also point out that further studies might focus on the formulation of a bankruptcy prediction model for Serbian hotels.

The number of studies that have dealt with the prediction of bankruptcy and financial distress, in general, in the hotel industry under the conditions of the COVID-19 crisis is modest. The problem is new and significant, and so it seems unfeasible to use earlier models and historical data under the new uncertain health conditions. In a study by Wieprow and Gawlik [

124], which assessed the risk of the bankruptcy of companies in the Polish hotel industry under the crisis conditions caused by the COVID-19 pandemic in the first half of 2020, two polish MDA models, a logit model, and Altman’s original model were used. Paper Fotiadis et al. [

125] present the results of forecasting international tourist arrivals in 2021 through the use of the long short-term memory neural network and the generalized additive model. Although the models have comparable accuracy, the forecasts varied significantly according to the training data set (they dropped from 30.8 to 76.3% in 2021) Duro et al. [

62] did not deal directly with bankruptcy forecasting, but instead built a synthetic index of the vulnerability of tourism to the COVID-19 crisis by using PCA methodology to derive the weights for the composite indicators. By using a sample of 27 Indonesian restaurants, hotels, and tourism companies, the study by Maharani and Sari [

126] compared the results of the Springate, Zmijewski, Grover, and Altman’s models when applied under COVID-19 conditions. The Springate model was the most rigorous, and it estimated that 93% of the companies were headed for bankruptcy; the Grover model accounted for 52%; the Altman model for 66.7%; and the Zmijewski model for almost 15%. Zhang et al. [

127] combined the autoregressive distributed lag error correction model, the Delphi technique, and scenario analysis in order to generate ex ante forecasts of the recovery of the tourism demand in response to the unanticipated effects of crises, such as the COVID-19 crisis. The Delphi scenario technique was used to revise the baseline forecasts in accordance with experts’ insights on tourism during and after the COVID-19 pandemic. Gössling et al. [

128] present the similarities of the COVID-19 crisis to previous crises in the tourism industry, and they show the detrimental outcomes for the sector.

Altogether, there is an evident gap in the scientific literature in the domain of the application of the time-series forecasting modeling of the risk of bankruptcy, and of prognostic modeling, in general, with the aim of identifying and predicting a crisis and assessing its impacts with regard to bankruptcy risk. This gap is even deeper for the hotel industry, especially in the Republic of Serbia, where an adapted model for this national context does not exist to date.

4. Methodology of the Research

The research was conducted on a sample of 100 randomly selected hotel companies in the Republic of Serbia that are in business. These are companies whose activity code is: 5510—hotels and similar accommodation. According to the data of the Agency for Business Registers [

129], there were 580 such companies operating in Serbia in 2015, 791 in 2016, 864 in 2017, 904 in 2018, 855 in 2019, and 704 in 2020.

Table 2 shows the share of the enterprises in the total operating assets and equity of the entire population of enterprises whose activity code is 5510 in the Republic of Serbia. It can be concluded that the sample is representative, despite the relatively small share in the total number of such enterprises. The structure of the sample, from the aspect of the legal form and size of the company, is shown in

Table 3. It can be noticed that the sample is dominated by small and limited-liability companies.

The dynamic characteristics of a complex system can often be inferred from the analyses of a stochastic time-series model that is fitted to observations of the system [

131].

Here, we use a new conceptual framework that offers a different perspective on bankruptcy risk prediction and analysis. The conceptual framework enables a more comprehensive analysis of the bankruptcy risk in relation to the classical analysis of the score values and their mean values, and it extends the usability of the Altman’s Z″-score model for a longer prediction horizon than one year. The dynamic conceptual framework involves the usage of the structural time-series models and novel ZDI indicators, where both are focused on the dynamism of the bankruptcy risk development process.

The ZDI indicators are used for monitoring the industry’s dynamism with regard to the changes in the risk zones of Altman’s Z″-score model (zonal transitions) and they are used for the analysis of the trend of the bankruptcy risk conditions, and they are also predictors for Model 4 and Model 5, which are introduced here.

The structural time-series models are, on the other hand, used for assessing the impact of the COVID-19 crisis in the past period and for assessing its future impact on hotel companies and on the hotel industry as a whole. All five models assess the value of the Z″-score, which is a forecasting tool by itself, and which gives the most accurate prediction within a one-year forecasting horizon, so that “two levels of dynamism” are included in the analysis. The first level of dynamism relates to the dynamical nature of the time series of indicators, and the other relates to the one-year time lag in interpreting the forecast, which is formulated through the Z″-scores. Thus, we conceptualize the predictors of the models (i.e., the components of the trend) as the “Risk Development Conditions” (RDCs), and the assessed state of the year with regard to the occurrence of bankruptcies, or the risk of bankruptcy for the firm in the year under review, as the “Bankruptcy Risk Exposure” (BRE). The BRE is a time-lagging indicator with regard to the RDC, which is in line with the fact that bankruptcy is a time-lagging phenomenon and with the way that the Z″-scores are interpreted.

When the effect of the COVID-19 crisis is assessed for 2020, the models are used as a basis to assess the industry’s/firm’s expected condition with regard to bankruptcy in 2019 and 2020, assuming regular market conditions, without the effects of the COVID-19 crisis. The motivation of this exercise is to differentiate the changes in the factual value of the indicators, which were expected as a result of previous market trends, and the changes induced by the COVID-19 crisis (i.e., to assess the impact of the crisis). In other words, if we assume that the estimated value of a model that is derived from data that describes a certain set of business conditions describes, to a significant extent, for a given year, the situation that would be achieved in that year under the same set of business conditions, and, to a lesser extent, includes the model’s error, then the difference between the predicted value by the model and the factual value of reality can approximate the changes that are introduced by the conditions in the year that is under analysis.

Similarly, the differences among the goodness-of-fit measures of the model (model errors in the model’s building phase) and the goodness-of-prediction measures (predictive accuracy) can be attributed to changed circumstances that affect the value of the projected indicator. Additionally, when several predictive models are combined with the same purpose, and when the results that are obtained by the models are consistent, while the factual data for the same year differ significantly, it can be assumed that the obtained error can be attributed to the unexpected changes in the conditions, which affect the predicted indicator to a greater extent. Here, the data that were used to build the time-series models originated from the pre-COVID-19 period, and so the differences among the forecasts that were obtained by the models and the factual values of the Z″-scores, and the differences between the errors in the modeling phase and the application phase, are interpreted through the impact of the unexpected changes (i.e., the COVID-19 crisis).

In the second case, when ex ante forecasting is executed, the models use the forecasts of the predictors, except for 2021, for which the actual values of the predictors are used.

One of the most important models for economic time series is the basic structural model, which includes a trend, a seasonal component, and an irregular component [

35]. No seasonal component is implemented by the models, and, as for all the predictor time series for all the models, no seasonal patterns were identified. The seasonality of the time-series data that were used by the models is checked through the Ljung–Box test on the autocorrelation of the seasonal lag, whereby two to three cycles of regular differentiation, depending on the time-series data, were applied so that the trend component was factored out from the predictor time series, and stationarity was achieved before the testing.

We built different time-series models on the basis of the identified trend components, which were formulated by the use of different multiple regression models. Bankruptcy tendency is a dynamic phenomenon, which is being gradually built, so we should extract the component of its trend component, which is a consequence of the previous period, and the component, which is a consequence of the changes in the year under review. The split of the trend component is motivated by an intention to differentiate the component, which approximates the influence of the crisis. Hence, the basic assumption of the modeling applied here was that the time series of the Z″-score has a relationship with its predictor variables, which can be expressed by multiple regression, and that these relationships can be expressed through the intuitive model components. One of the advantages of structural models, which is reflected through the possibility of formulating the model’s components through the use of classical regression models, is exploited by the models. Another assumption of the structural approach—the assumption that the independent variables must be easier to forecast than the dependent variables [

132]—was applied so that it was easier to forecast the RDCs than the Z″-scores. The components of the trend are expressed in the intuitive form of the effects of the stabilizing force, a force of development, the destabilizing force, etc.

The presented models are multivariate, as they have more than one time-dependent predictor variable, where each variable depends not only on its past values, but also has some dependency on other variables. As the predictor variables for the models, the indicators of the Altman’s Z″ score model and its derivates that are introduced here are used, whereby the selection of the predictors for the structural models, which model different trend components, was made by cross-correlation and autocorrelation analysis. The aim was to use predictors that originate from the period of two years, maximum, before the year for which the forecast is made so that the applicability of the models is magnified.

The Altman’s Z″-score model was chosen as the foundation for building the models because it is a well-known model for assessing bankruptcy risk and it has confirmed applicability in the economic environment of the Republic of Serbia [

1,

120,

121,

123]. It is also the only model that has previously been used to investigate the bankruptcy risk in the hotel industry in the Republic of Serbia [

30,

123], and so the comparability with these studies is ensured. The selection of the EM Z″-score model for emerging markets is in line with the evident progress that has been made in recent years in the hotel industry of the Republic of Serbia [

26].

The exclusive use of Altman’s Z″-score model was not applicable for assessing the bankruptcy risk within the targeted prediction horizon, as the model has the best prognostic ability when used for short-term predictions (i.e., six months to one year), while, in this paper, we attempted to assess the impact of the crisis until the moment of the crisis impact cessation. Additionally, the financial statements of the companies are not publicly available on a timely basis; in the Republic of Serbia, they are published with at least a one-year delay. With these factors in mind, the forecasts for entire sectors, industries, and markets that are built exclusively on Z″-scores under these conditions do not have prognostic value, except when used for forecasting and trend analyses.

Although earlier works have shown large variations in the results of multiple credit-scoring models [

67,

68,

69,

70,

71,

72,

73,

74,

75,

76] in different business areas (for example, Maharani and Sari [

126]; Wulandari and Maslichah [

96]; and Pakdaman [

95]), the Springate and Zmijewski scores were applied instead of the Altman’s EM score in order to test the robustness of the introduced models. In this case, the obtained scoring values for the companies were converted into Z″-score measures by converting one number range into another, so that, in this way, the applicability of the models was retained for models other than the Altman’s EM model.

We have considered the usage of ANNs as a technique for building the models, having in mind their popularity and proven accuracy, as well as the usage of other bankruptcy prediction models that are based on scoring. However, among the pioneering works that have dealt with the development of prognostic models under the conditions of the COVID-19 crisis, it was shown that it is more challenging to provide forecasting by the use of ANNs in new circumstances [

133,

134] than in regular conditions. ANNs learn by recognizing the laws of the market from an earlier period, and their effective application in the face of changing laws and relations is questionable, especially in cases where these changes occur suddenly, as was the case with the COVID-19 crisis. Extensive testing of different ANN configurations, in this case, would be accompanied by uncertainty with regard to their applicability in the emerging conditions, and, in this case, we found that a single algorithmic solution was possible to formulate. However, a limited study, which used ANNs for forecasting the bankruptcy risk zones of the firms from the sample, was performed here in order to conduct a validation test of the presented models.

As the factual validation of the models would need time to pass, whereby the warning value of the paper would be lost, the validation of the results of the models was performed by the comparative analysis of the results of the structural models, the ZDIs, well-known time-series techniques (exponential smoothing and ARIMA), and purposefully trained artificial neural networks.

5. Results and Discussion

The results of this analysis, and the assessment of the impact of the COVID-19 crisis in 2020, are presented in the

Section 5.1.

In the

Section 5.2, the zonal dynamics indicators (ZDCs) are introduced and are used with the aim of dynamically and comprehensively analyzing the bankruptcy risk and its changes for the hotel industry and the period, 2016–2020. Within the same section, ANOVA testing with regard to the changes in the transition dynamics was carried out for 2019 and 2020, relative to the previous period, 2015–2018. A discussion on the results of the evaluation of the influence of the crisis on a reallocation of the companies between three bankruptcy risk zones is also included in this subsection.

The

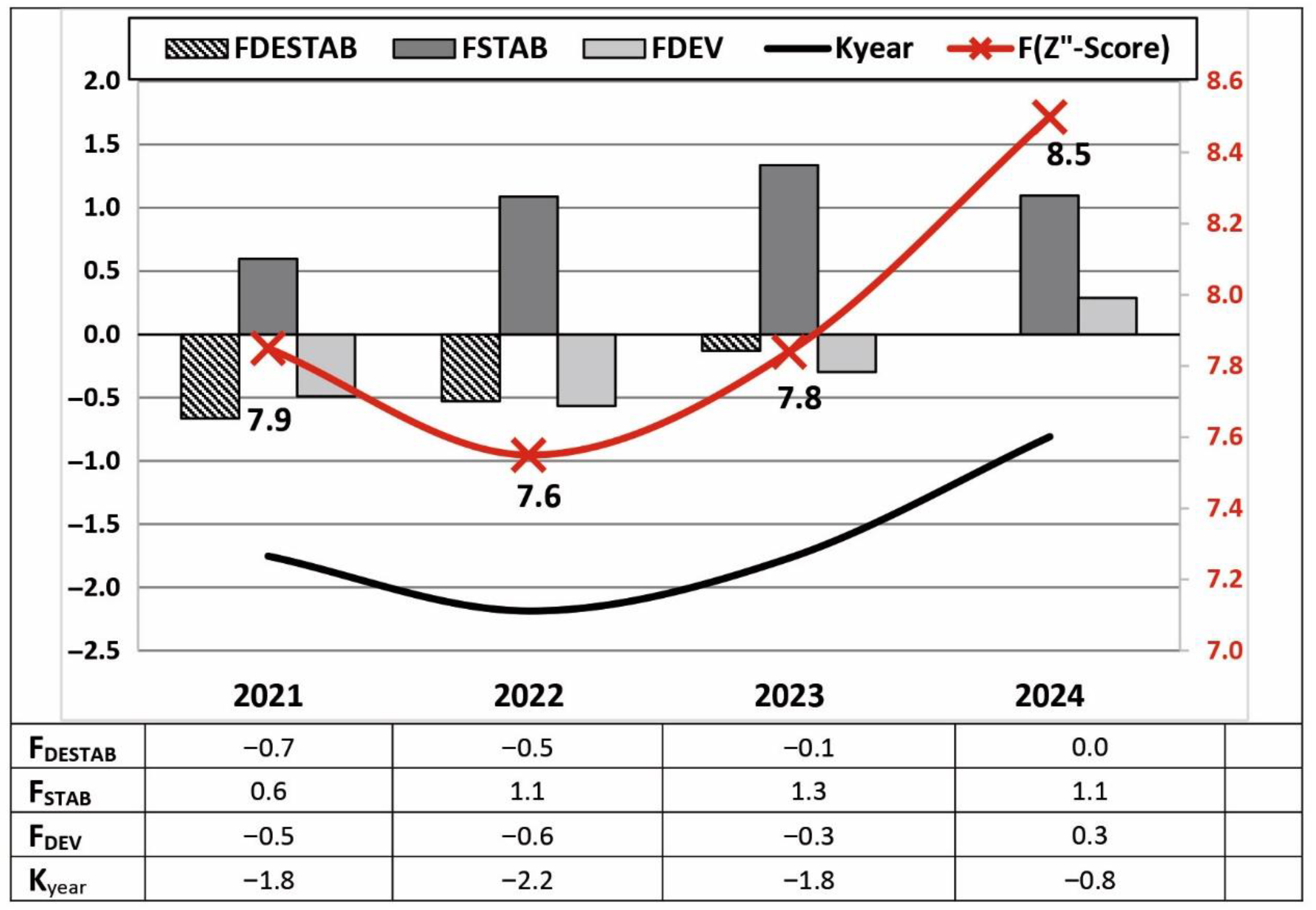

Section 5.3 introduces three time-series models that were built with the aim of assessing the risk development conditions for the forthcoming period, including 2021, and the ensuing bankruptcy risk exposure by 2026.

5.1. Assessment of the Impact of the COVID-19 Crisis on Bankruptcy Risk Exposure in 2020

For the purpose of assessing the impact of the COVID-19 crisis in 2020, the data on the hotel industry’s Z″-scores in the period, 2015–2020, were analyzed. We used data on the arithmetic means of the Z″-scores of the hotel companies in the sample in the year under review to assess the industry’s Z″-score in the same year, and then to assess the impact of the crisis on the RDCs in terms of its influence on the Z″-score that was obtained for the analyzed year. Let us call the value that is obtained by means of the arithmetic mean simply, the Z″-score (or Z″). In the analysis, the estimates that are derived from the Z″ are introduced (i.e., changes in the Z″ in the year compared to the preceding year (ΔZ″year), the estimated Z″(E(Z″year)) for the year, and the aggregated indicator (AIyear) for the year).

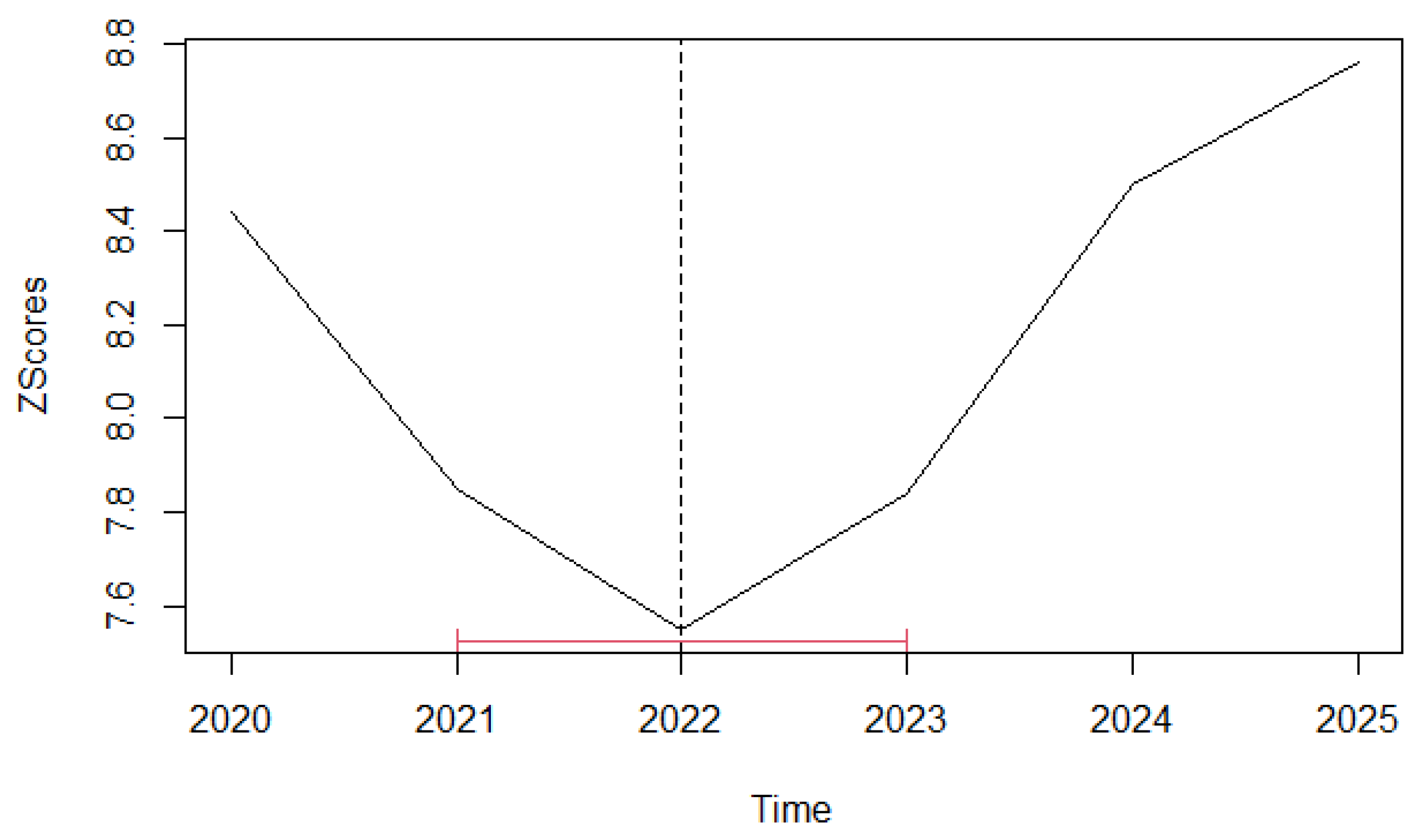

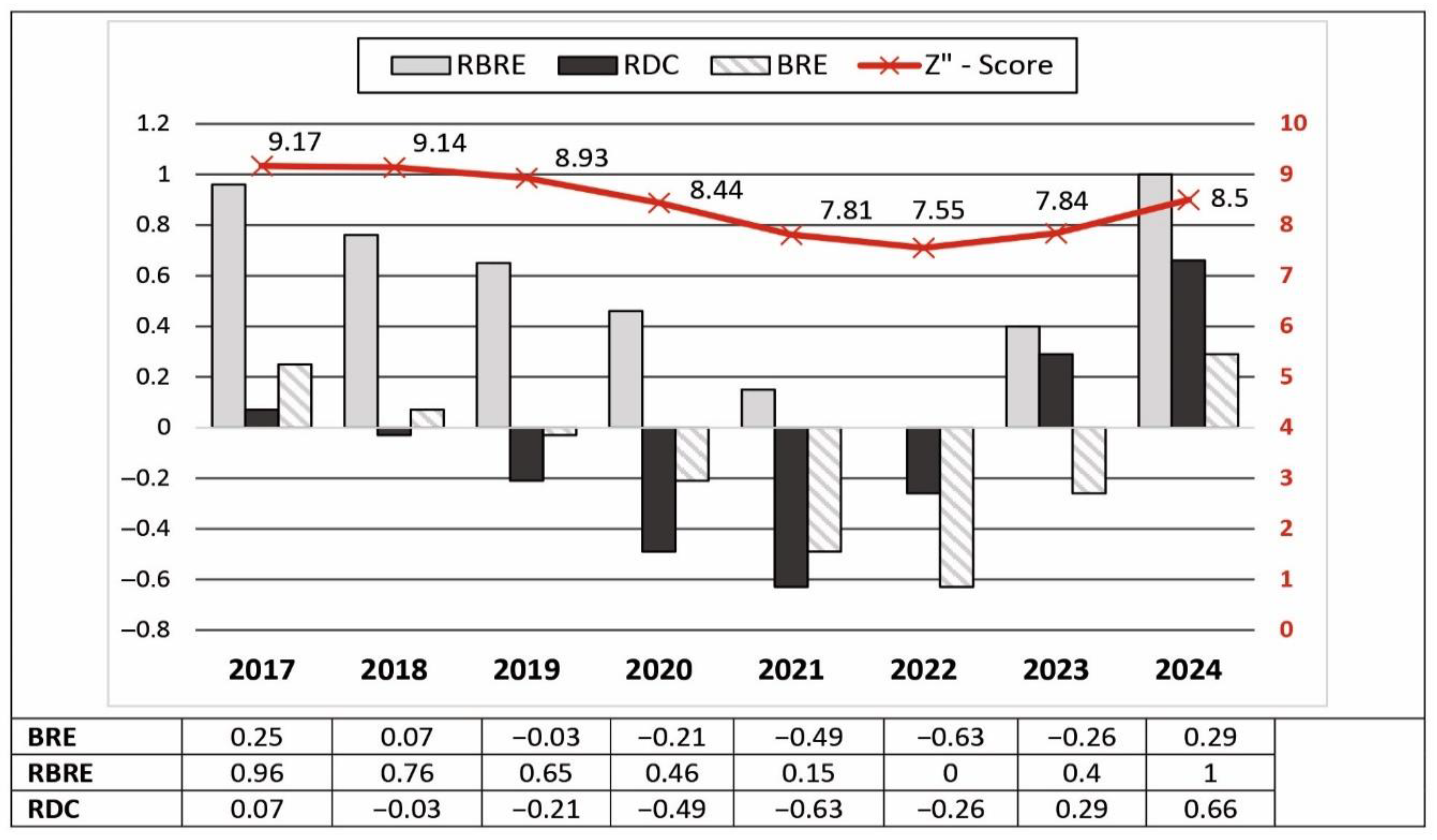

The analysis of the Z″ of the hotel industry in the analysis period indicates that, until 2017, there was a trend of the growth of this indicator, and, in 2018, there was a slight decline, as shown in

Table 4. The Z″-score that was obtained for 2018 has a value of 9.14, compared to 9.17 for 2017, and the decrement was continued in 2019, when the Z″-score took the value of 8.93, and in 2020, when it took the value of 8.44. Thus, the question that is examined in this section is whether the significant decline in 2020 is part of a negative trend of the industry, which started in 2019, or if it is a consequence of the emergence of COVID-19. In order to assess the trends under regular RDCs in terms of the Z″ values that were obtained for 2019 and 2020, and, thus, to quantify the impact of the COVID-19 crisis on the RDCs in 2020, a time-shifting cross-correlation analysis was performed with the identified differences for Z″ in the period, 2015–2018. On the basis of this analysis, prognostic modeling was carried out to estimate the expected value of this indicator in 2019 and 2020 under regular RDCs, with no COVID-19 crisis.

As shown in

Table 4, the number of companies with the code, 5510, in the Republic of Serbia in a given year is highly correlated with the Altman’s Z″-score that was obtained for the previous year. For the period, 2016–2018, this correlation amounts to 0.99; and for the period, 2018–2020, it amounts to 1. It is lower in the period, 2017–2019, and amounts to 0.71, whereby, in 2017, the number of firms in the industry was increased by 73, although the conditions for the existing firms deteriorated, especially in the lower zones. This brings us to the conclusion that Altman’s Z″-scores describe the changes in the number of companies in an effective manner, including the first year of the COVID-19 crisis.

Then, the COVID-19 crisis emerged, and the lockdown measures were introduced.

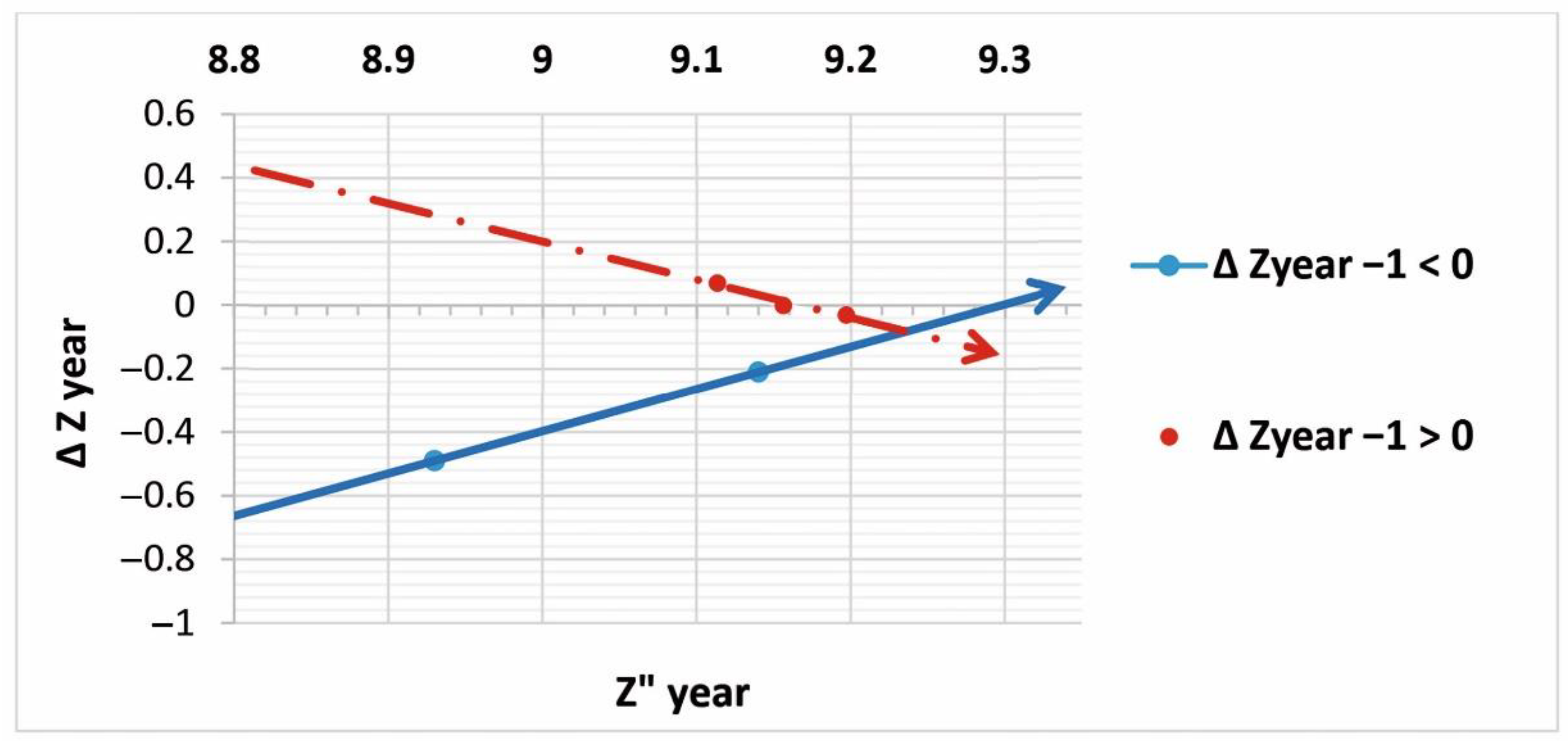

We found that, in the period from 2015 to 2017, the change in the Z″ in a given year, compared to the previous, was under the strong and statistically significant negative impact of the Z″ in the previous year (Z″year−1⟷Z″year, corr. coeff = −0.989, rsq = 0.977). The higher the Z″, the smaller the change in this score the following year, which means that the market tended towards the local maximum (where the derivate of a function is equal to 0) and, thus, the smallest change in the observed period was recorded in 2018. This happened as the Z″ that year was the closest to the local maximum of 9.156. In the period from 2018 to 2020, however, since there was a negative market trend, the change in the Z″ in the analyzed year, compared to the previous, was under the strong and statistically significant positive impact of the Z″ in the last year (Z″year−1⟷Z″year, corr. coeff = +0.987). Let us call this influence, the “stabilizing force”.

The role of the stabilizing force is to return the system to equilibrium so that its effect increases when the Z″ moves away from the local maximum and decreases as the Z″ approaches the local maximum. Practically, the effect of this force can be explained as a consequence of two scenarios that arise when the market’s Z″ is enlarged. First, for firms with a particularly high Z″, the working capital, as a component of the X1 ratio of the Altman’s Z″-score model, surpasses its optimal level, so that the companies will tend to optimize the use of their working capital (for example, by redirecting it by funding business growth) while the overall Z″ drops. Second, in these conditions, firms with a low Z″ may face increased market competition, which can cause revenues and the Z″ to decline. Thus, “unbalanced” growth can temporarily cause a decline in the market Z″-score, and vice versa; when the market’s Z″ declines, firms may seek alternative sources of financing their current assets, such as through bank loans, or they may go bankrupt, which can be the case for the firms in the first risk zone, and so the overall market Z″ will consequently grow.

Furthermore, the change in the Z″ in the previous year in the period, 2016–2019, indicates the magnitude of the change in the following year, with the relationship being positive (

Z″

year−1⟷

Z″

year, corr. coeff = +0.97, rsq = 0.95). Thus, the higher the growth of the Z″-score in the previous year, the higher the growth in the following year, while a larger decline brings about a larger decline in the following year (development force). Practically, the effect of this force can be equated to the trend effect. Thus, we notice that the Z″ movement is simultaneously affected by the stabilizing force, which is influenced by the

Z″

year, which slows down the growth when the development is positive (i.e., slows down decline when development is negative, as shown by

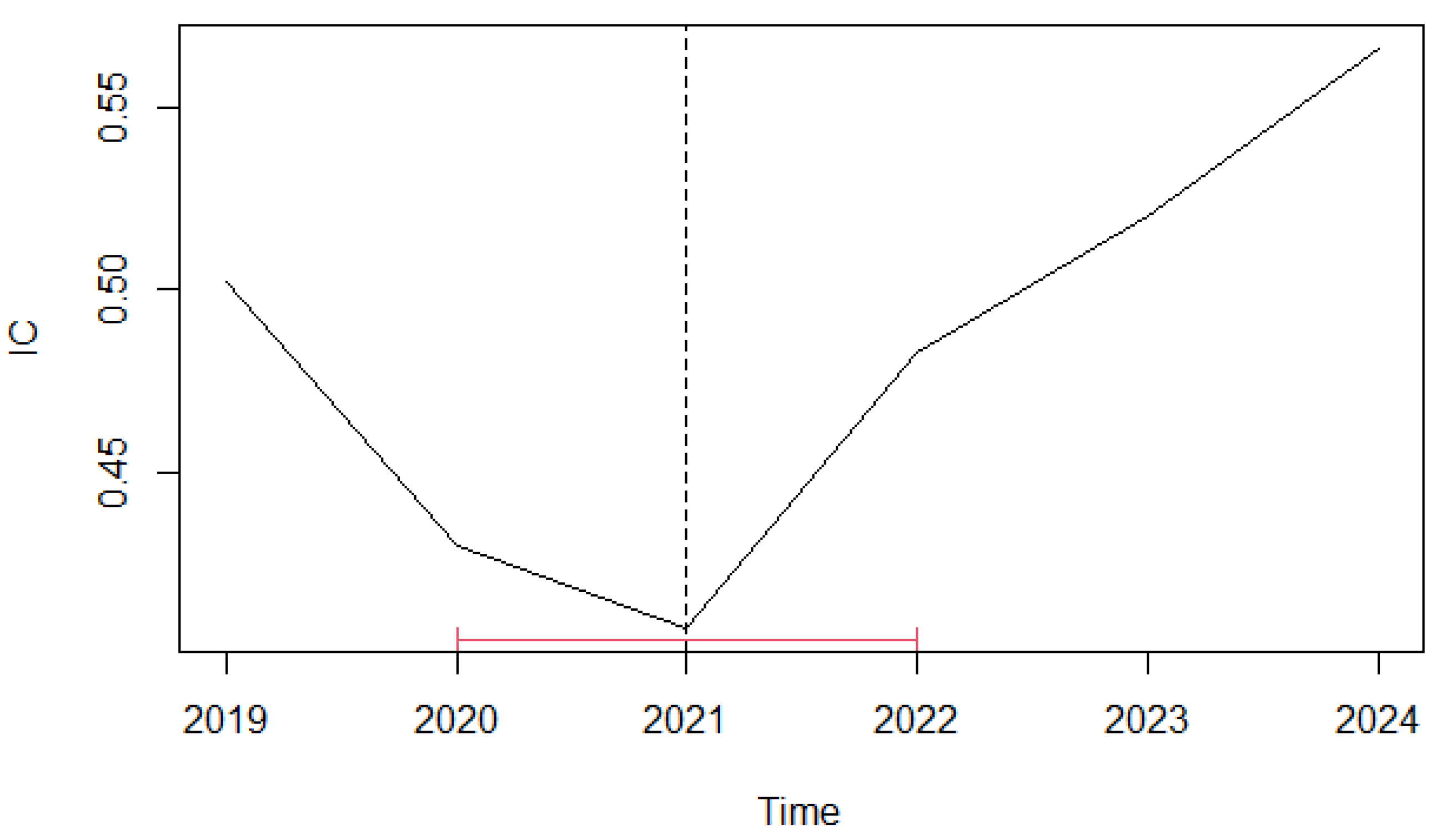

Figure 1), and the development force, which is influenced by the

Z″

year, accelerates the growth or decline, depending on the changes in the past year.

As the effect of the development force increases, so does the effect of the stabilizing force, which tries to return the system to the state of balance, although this correlation is not perfect because the latter lags behind the former, which is mainly due to the delayed financial resource optimization measures of the companies in the market, so that the system falls out of balance. Thus, the Z″ in 2017 was under the strong positive influence of the development in the past year, which significantly exceeded the effect of the stabilizing force, and, in this year, the local maximum was exceeded. Already in 2018, the development force was weakened under the influence of the weakened growth in the past year, while the stabilization force followed this trend more slowly because of the proximity of the local maximum. Thus, the Z″ in this year decreased, along with the consecutive expectations in terms of the bankruptcy risk exposure for 2019.

Model 1 was used to estimate the Z″ in 2019 and 2020 under regular RDCs (i.e., if the COVID-19 crisis did not occur, and assuming that the Z″ will not tend towards a new local maximum (pessimistic scenario)). The parameter, K, is used as an inherent determinant of the Z″, which is expressed as the difference in the effects of the development force ((

FDEV(

FDEV(Δ

Z″

year−1)))~

Z″

year−1) and the stabilizing force (

FSTAB(Δ

Z″

year)), and is calculated on the basis of multiple linear regression, as follows:

For the local maximum, .

The parameter,

K, is used as an independent variable to estimate the Z″ (

) by using the linear regression model, and so we come to the multiple regression model:

The model requires the data on the arithmetic mean of the Z″-scores of hotel companies in the previous year, and on the change in the value in the previous year (i.e., the Z″-scores for the two years before the year for which the estimation is made). As shown in

Table 5, the model estimated a Z″ of 9.02 in 2019, and it had a similar RMSE compared to the RMSE of the model for the period, 2017–2018. In 2020, the RMSE of the model was 3.8 times higher than for the period, 2017–2019, while, in the case where the predicted value for the Z″ in 2019 is used instead of the factual value of the Z″ in 2019, this error would be 3.4 times higher, and the predicted Z″ in 2020 would amount to 9.06. This means that the degradation of the Z″ in 2020 was significantly higher than in 2019, so that the RDCs in 2020 were significantly worse than in 2019.

Unlike the Z″year−1, the median Med(Z″year−1) has a strong positive effect on the value of the Z″year in the following year (corr. coeff = +0.985, rsq = 0.989), although it is a weaker prognostic indicator for forecasting the Z″, which is due to a slightly weaker correlation of these two indicators. The median generally describes the situation in the analyzed year better than the Z″year−1 because it abstracts the impact of the high scores of the firms from the third zone, so that the changes in the median compared to the previous year can be interpreted as changes in the diversification among the companies in the analyzed year. It is noticeable that, in 2017, when the value of the Z″ was at its maximum, the median decreased compared to the previous year, which means that this year’s growth was primarily driven by strong companies that were previously exposed to a relatively lower risk of bankruptcy; although, for firms that were more exposed to the risk, the Z″ declined. Unlike in 2017, in 2018, when a slightly lower Z″ was obtained, the change in the median (ΔMed(Z″2018)) was the greatest, which indicates that, in that year, the growth was a consequence of the increased Z″ for companies that were previously relatively more exposed to bankruptcy risk, and so it is more balanced.

Because of these tendencies, the aggregate indicator (

AIyear), which is calculated as the sum of the

Z″

year and the Med(

Z″

year) (values are shown in

Table 4), provides better insight into the quality of the year in terms of the RDCs. In this sense, the year with the best RDCs in the analysis period is 2018, although the overall Z″-score of the hotel industry declined that year compared to 2017. If we take into account the

AIyear of 14.93 in 2019, the question of the extent to which this value differs from those of the previous years deepens, while, in 2020, the value had already deviated significantly from the previous values.

In accordance with the above, we developed a model to estimate the Z″ for the hotel industry in 2019 and 2020 that is based on the

AIyear−1 (Model 2), which is presented in

Table 6. Previously, a significant negative correlation between the Δ

Z″

year for the period, 2016–2018, and the

AIyear−1 for 2015–2017, was estimated, with the value of −0.93.

Model 2 projected a Z″-score of 8.87 for 2019, and it had an RMSE that was 1.3 times higher compared to the average error of the model, although it assumed normal operating conditions (

Table 6). Given that the factual value of 8.93 in 2019 is within the limits set by the two forecasting models (8.87, 9.02), and considering that both models predicted a decline in the score for that year, and bearing in mind the high factual accuracy of Model 2, we can conclude that the factual score of 8.93 was in line with the previous trend in the hotel industry.

The forecasted Z″ by Model 2 for 2020 for the factual parameters in 2019 is 8.94. The factual value of the Z″ of 8.44 in 2020 is not within the limits set by these two models (8.94, 9.13). In order to make an estimation for 2020 that did not include 2019, we performed an analysis of the time series. Among the time-series prediction models, the exponential smoothing model (AAN, additive error, additive trend, no seasonality) was used for the period, 2015–2018, and it generated, with the confidence level of 95%, an expected Z″-score of 9.35 for 2020, while a low-confidence-bound (LCB) value of 9.15 was assessed, as shown in

Table 7. When the forecast for 2019 was included, the projected value was naturally lower and amounted to 9.04.

In order to test the robustness of Model 1 and Model 2, the scores from the Springate model [

72] and the Zmijewski model [

78] were calculated for each year in the analyzed period, and for each company in the sample, and these values were later averaged to represent the scores for the individual years in the analyzed period. The obtained scores were converted into Z″-scores through the translation of the interval ranges, so that the Springate and Zmijewski scores could be used by the models that are presented here. High correlation coefficients with Altman’s EM Z″-scores for the period, 2015–2020, were estimated in both cases, where the correlation with the Springate scores was 0.915, and the correlation with the Zmijewski scores was −0.914. Surprisingly, all three models produced identical Z values for 2017 and 2020, while the lowest score for 2019 was obtained by Altman’s Z″ model (8.93), and the highest value was obtained by the Zmijewski model (9.17). For 2018, the Zmijewski model produced the highest value (9.17), while the lowest value (9.11) was obtained by the Springate model.

The Springate model estimated that, in the sample of companies in 2015, there were as many as 73 failed companies, and that this number grew in the subsequent years, to 73, 73, 74, and 78, in chronological order, while, in 2020, it amounted to 93. Given that, in the period from 2015 to 2020, none of the initially poorly rated 73 companies went bankrupt, the applicability of this model for the hotel industry in the Republic of Serbia is questionable, unless the obtained scores are used as continuous values, without applying discriminatory factors, as demonstrated in this paper.

The results of the application of the Springate model with the converted values are shown in

Table A1 (

Appendix A) by Model 1 and Model 2, which confirm earlier conclusions, whereby the factual value of the converted Springate score for 2019 of 9.09 was out of the interval [8.91, 9.04] that was set by the models, but this deviation was not significant. For 2020, the discriminating interval that was set by Model 1 and Model 2 was (8.92, 9.08), and as the obtained Z was 8.44, it was significantly outside of this interval. As in the case of the application of Altman’s Z″-score, the application of the Springate scores showed that a smaller decrease was expected to happen in 2019, while, in 2020, a smaller increase in the score was expected.

As shown in

Table A3 (

Appendix A), the arithmetic mean of the Z-scores, which were obtained by the Zmijewski model, turned out to be less sensitive to the changes between the years. The converted Z-score value of 9.07 was achieved for the period, 2015–2016; 9.17 for the period, 2017–2019; and 8.44 for 2020. The Zmijewski model proved to be less rigorous than the Springate model; according to the model, the number of companies in the sample that were endangered in 2015 was 18, while, in the following years, the numbers were 16, 17, 19, and 16, in chronological order, and were 28 in 2020. According to the scores that were obtained by the Zmijewski model, which are shown in

Table A3 (

Appendix A), 2017 was just as successful as 2018; in 2019, a smaller increase in the risk of bankruptcy was registered; and the change in 2020 was drastic.

As shown in

Table A2 (

Appendix A), Model 1 did not have different expectations with regard to 2019 and 2020 (i.e., degradation in 2019, according to the arithmetic mean of the Zmijewski score, was not noticed). However, the AI indicator for the Zmijewski scores showed a positive change in 2018, and a negative one in 2019. The results of the application of the Zmijewski scores by Model 1 and Model 2 indicate a deviation in 2019, as the factual Z of 9.17 of the Zmijewski model was outside of the interval (8.79, 9.06). The registered change in 2020 was, nevertheless, 3.2 times higher than in 2019 for the discriminating interval that was set by Models 1 and 2 for 2020 (8.79, 9.06). The deviation in 2019 can be interpreted through the low sensitivity of the arithmetic means of the Zmijewski scores, which showed no changes in 2018, and which was used as an input parameter to calculate the expected Z-score in 2019.

On the basis of the results of the models, which used Altman’s, Springate, and Zmijewski scores, we can conclude that 2020 differed significantly in terms of the deviations of the Z-scores from the period, 2015–2019 (i.e., in this year, the consequences of the COVID-19 crisis were felt significantly with regard to the risk development conditions (RDCs) and the expected rate of bankruptcies (BREs). At the same time, further deterioration in the RDCs and BREs was expected for the period after 2020. As is shown by

Table 4, the number of companies in the hotel industry in 2020 fell from 885 to 704, although, at the state level, this was reduced. On the basis of the above, we can conclude that the hotel industry is more sensitive to exogenous changes with extreme measures, such as lockdowns, than other industries, so that it reacts to them quickly (i.e., the lag between the changes in the operating conditions and the real bankruptcies is shorter).

The models that used Springate and Zmijewski scores registered some change in 2019, but this change was not significant, and, in the case of the Zmijewski model, the deviation can be attributed to the weaknesses of its arithmetic mean indicator, and so we can conclude that, in 2019, when there were no registered cases of COVID-19 in the Republic of Serbia, the crisis, in the form of news and rumors about an emerging health crisis at the end of the year, had no effect on the hotel industry of the country.

Although there are no previous comparable studies on the impact of the COVID-19 crisis on the risk of bankruptcy in the hotel industry in the Republic of Serbia, the results from this section can be compared with the results of studies that have dealt with the impact of this crisis on hotel companies in other countries and/or on other relevant performance indicators of the hotel industry. The strong influence of the crisis on the different performance indicators of hotel companies worldwide in 2020 was confirmed by a multitude of studies (such as [

128,

135,

136,

137]), while, when it comes to the risk of bankruptcy, only a few studies indicated an increase in this risk in 2020 [

124].

5.2. Assessment of the Impact of the COVID-19 Crisis on Transitions between Bankruptcy Risk Zones

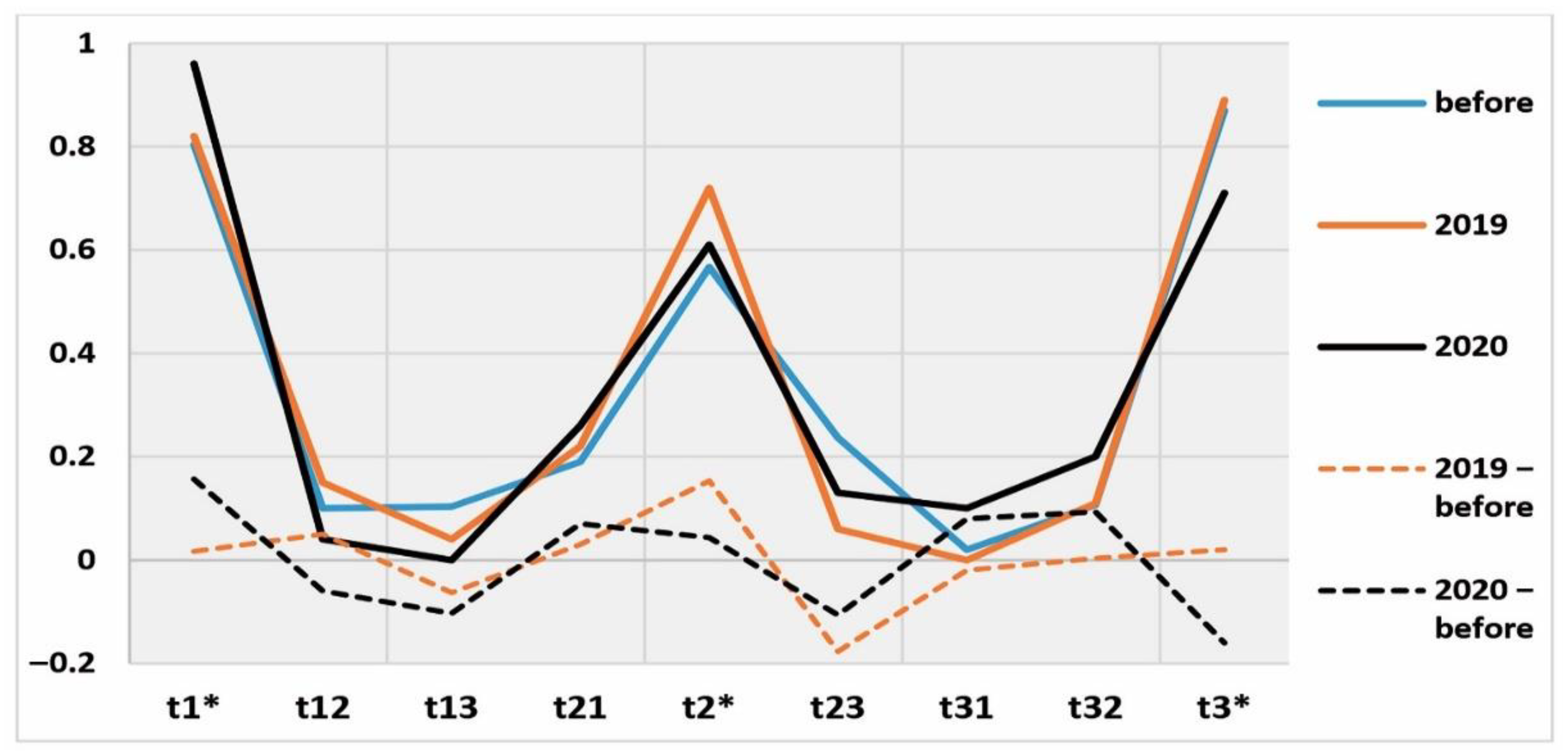

In order to evaluate the impact of the COVID-19 crisis on the relocations of companies among the three risk zones that are defined by the Altman’s Z″-score model, the data on the dynamics of the model’s interzonal transitions in the period under review were analyzed. As the data for different risk zones are interdependent variables, both in the current year and in relation to previous years, the indicators of the mean values of the Z″ for different zones do not provide adequate results for assessing the trends in the zones and the impact of the COVID-19 crisis on different zones. For example, the average Z″ in the second and third zones increased in 2020, compared to 2019, but this positive indicator was a result of a negative phenomenon (i.e., the decline in some companies from the third to the second zone). As a result, the probability of a transition between the risk zones was monitored, and the values of the zonal dynamics indicators in a one-year period were calculated.

For the sake of formalization, let tij (type of transition) be the state of the transition of a firm from Zone i (i) to Zone j (j) over two successive years, where i denotes the risk zone of a firm in the previous year compared to the analyzed year; j denotes the risk zone of the firm in the analyzed year; and . Let the indicator, ti*, be the state in which the firm has not changed zones in two successive years (i = j), . Let Tij be the sum of all the transitions from Zone i to Zone j, and ; let Ti* be the sum of the steady states that originate within Zone i (i = j), ; let Ti− be the sum of all the negative outbound transitions of Zone i under the conditions: i > j or i = j = 1, i, j; and let Ti+ be the sum of all the positive outbound transitions of Zone i under the conditions: i < j or i = j = 3, i, j. Hence, by positive transitions, we consider the states in which the firm entered a higher zone in the analyzed year compared to the previous year, or in which it stayed in the highest zone (i < j or i = j = 3), while, by the negative transitions, we consider the states in which the firm entered a lower zone or stayed in the lowest zone (i > j or i = j = 1). Similarly, Ni denotes the total number of companies within Zone i (i). Each of the previous indicators can refer to an individual year or to a desired period, with the analyzed year or period marked in the index of the variable. For example, denotes the sum of the firms in the second zone in 2019 that fell into the first zone in 2020, and denotes the sum of all the firms that had a decline in the zone, regardless of the zone that they had had in 2019, and the firms that remained in the first zone in 2020.