Abstract

In practice, we see examples of firms offering product refresh services across different industries. Refresh services promote sustainable reuse and are distinct from typical refurbished-product sales which imply a change in ownership. This study is the first to use an analytic model to derive optimal prices and quantities for a firm offering product-refresh services in tandem with new products. Using a two-period framework, we establish that a firm can use a refresh service to align its second-period decisions with its overall profitability objective. We show that by committing to offering a refresh service at a pre-established price, the firm can enjoy higher selling prices in the first period. Thus, we find that even if the direct profit contribution of refresh-service sales is negative, it is possible for their overall impact on profits to be positive. Therefore, managers must view the contribution of product refresh services holistically, considering indirect price effects, to account for their full potential value.

1. Introduction

Durable goods are products that provide consumers with utility over an extended period of time. At the time of purchase, the present market value of a durable product therefore not only depends on the immediate value it affords the buyer, but also upon its future value. Few products are perfectly durable (i.e., never wearing out), instead, most are “semi-durable,” having a value that declines over time. Product wear and related deterioration is typical of most consumer products, including common examples such as shoes, watches, handbags, and bicycles. As a result of deterioration, products are frequently discarded despite being serviceable, potentially resulting in significant waste. Seeking more sustainable alternatives to such waste, the recent “right to repair” European Union directive aims to encourage firms to offer customers a more sustainable alternative to product disposal [1]. This trend is consistent with the notion of maintenance for sustainability, which relates to a growing body of literature recently reviewed in [2].

In practice, we already see example of firms that offer services that will refresh customers’ used products back to a like-new state. For example, Johnston & Murphy’s $115 refresh service will restore their shoes to (quoting from Johnston & Murphy’s website) “close to their original appearance.” Breitling will refresh its Swiss wristwatches for USD 500. Similarly, in the sporting-goods industry, Titleist offers a refresh service for its golf putters, and Moots and Seven Cycles offer refinishing services for both their mountain and road bike products. Similarly, but in an industrial-products setting, Mesa Labs offer refresh services for their testing equipment. Motivated by these examples, we analyze the implications of a firm offering a refresh service in parallel with new-product sales. While in this paper we use the label product refresh services, in practice, alternative terms are used, such as product restoration, refinishing, refurbishment, and overhaul services. A related topic and term that we do not address in this paper is that of product design refreshes, which relate to launching new product designs over time.

We consider a refresh service to be a fee-based service that a firm offers to restore an existing customer’s product closer to a like-new state. Unlike product repairs, which occur when a product fails, refresh services can apply pre-failure. Related to this point, refreshing a used product also differs from maintenance on a used product, as the latter entails simply maintaining the product’s state. A refresh service is also distinct from a remanufacturing service because whereas any consumer can purchase a remanufactured product, a refresh is available only to customers who already own the product. Refresh services are intriguing from several perspectives. First, the existence of such a service can potentially raise products’ expected value. Second, the pricing of the service will not only affect demand for the service itself, but may also impact new-product sales over time since refreshed products are partial substitutes for new products. Third, product refreshes may be attractive from a sustainability perspective, as they support product longevity. The research questions we aim to address are whether, and under what conditions, a firm can benefit from refresh services.

Refresh services relate to three streams of literature: servitization, remanufacturing, and product maintenance. The terms servitization, remanufacturing (often referred to as refurbishing), and maintenance all relate to the central idea of extending a product’s useful life. Servitization refers to a seller complementing their sales of a physical product with supporting services [3], and therefore a refresh service is a particular form of servitization. The servitization literature (reviewed in [4,5,6,7]) has primarily focused on conceptual and empirical models for understanding the motivations behind servitization (e.g., increasing customer loyalty), and on identifying effective supporting technologies [3]. Our work differs from this stream because we analyze pricing and time-related commitment issues using a microeconomic modeling framework. The authors of [8,9] also study servitization via analytic economic models. The work in [8] considers two competing firms: one that offers a servitized product (a bundle containing the product and after-sales service) and another that sells the product and service separately. The study shows that servitization is more profitable when products require a high level of service and have a high degree of substitutability with the competing firm’s product. The authors of [9] consider offering a service guarantee to risk averse customers and find that the wholesale price is higher when offering the guarantee. Both of these analytic studies consider a single time period, whereas our model spans two time periods.

Extensive reviews of the second research stream, remanufacturing, was conducted by [10,11]. As noted above, a key distinction between remanufacturing and the product refresh services we consider is that the latter are available only to existing customers who own the product. The remanufacturing literature focuses on distinct settings, considering: (a) a single firm (e.g., [12,13,14]), (b) an original equipment manufacturer competing with an independent contractor (e.g., [15,16,17]), (c) two competing original equipment manufacturers (e.g., [18,19]), and (d) a manufacturer coordinating product returns for remanufacturing with a retailer (e.g., [20,21]). In all of these papers, a key assumption is that a given product purchase provides only one period of use, except for [13], who assess the profitability of charging relicensing fees to an independent refurbisher, and [14], who consider new and refurbished product sales via a diffusion model. In our analyses, we focus instead on a discrete two-period setting with forward-looking consumers, who anticipate the future value of a first-period purchase, including the option to refresh the product and thus derive additional value in the subsequent (second) period.

The third research stream, regarding product maintenance, spans the literature in both operations management and economics. Papers in this stream assume that maintenance reduces a product’s failure likelihood, which may improve a product’s environmental impact [22]; as mentioned earlier, maintaining a product in a functioning state is distinct from improving a used product via a refresh. In their extensive reviews of the operations literature on maintenance, the authors of [23,24] highlight that the operations literature focuses primarily on the scheduling of resources and on identifying the optimal timing of maintenance to minimize costs (including direct maintenance costs as well as potential costs of downtime and repair). The impact of after-sales maintenance on customers’ purchasing decisions has also been considered in the operations literature. For example, the work in [25] examines the profitability of flexible extended warranty options in which multiple options with different lengths and prices are offered to customers. The authors of [26] investigate a scenario when a manufacturer sets the price of its own maintenance service to compete with that of a third-party repair provider, and the study in [27] examines after-sales warranties as a signaling mechanism to improve contract design. In contrast with the operations literature on product maintenance, the economics literature focuses on comparing leasing and selling scenarios. Mann [28] showed that by offering maintenance for its product, a monopolist can optimally adjust its product durability to earn higher profits via selling than from leasing. The authors of [29] show that, assuming that used products have low scrap value, by monopolizing the maintenance market for its product, a firm can increase profits. The work in [30] considers a two-period setting in which maintenance is provided by third-party firms, and shows that leasing yields higher total surplus than selling. In our study, rather than contrasting leasing versus selling, we consider selling only—with and without refreshes.

Our model leverages the two-period durable goods framework by [31]. Bulow’s work highlights the commitment problem facing a producer that is unable to commit to its future output decisions. Specifically, the firm has an incentive to increase its output in the second period. Anticipating that increase, forward-looking consumers adjust what they are willing to pay in the first period, thereby lowering the firm’s profits. Bulow showed that leasing eliminates a seller’s incentive to “flood the market” in the second period, thereby aligning the firm’s incentives over time to yield the profit-maximizing outcome. Several papers have subsequently explored the potential benefits of leasing, including [32,33,34,35,36,37,38]. We show that refresh services provide an alternative to leasing, by which a firm can address the aforementioned commitment problem. We establish that by employing a refresh service with a pre-announced price, rather than quantity, a firm can eliminate the market-flooding incentive in the second period, thus increasing profit. By analyzing the potential profit gains from a refresh service, we show that those gains can be significant if consumers’ valuation of refreshed products relative to used products is high, and/or if product-refresh costs are low.

Our study is the first to model product-refresh services and analyze their potential benefits. Our results highlight that properly accounting for those benefits requires a holistic perspective that incorporates indirect new-product pricing effects. Without a holistic perspective, viewing only the immediate direct costs and revenues from a refresh service, a manager may incorrectly view the service as unprofitable. However, our analyses show that refresh services also (indirectly) support higher new-product prices, and those gains are significant. Establishing that refreshes can be profitable overall, even when their direct costs and revenues might imply otherwise, is important as it supports broader application of such services in practice. More widespread support for product longevity and reuse is consistent with Extended Producer Responsibility (EPR) initiatives, which are in line with sustainability objectives. We thus conclude our study by including the possibility of government-mandated EPR legislation that requires a firm to support some level of product refreshes.

The paper is organized as follows. In the next section, we introduce the firm’s decision problem when it offers a refresh service and commits to a refresh price. We also introduce two benchmark problems, one with no refresh service and another where the firm is able to commit to all future decisions (for both new and refreshed products) at the outset. In Section 3, we explore the optimal results given linear utility functions and compare the optimal decisions and profits with the no-refresh benchmark. In Section 4, we prove the general result that refresh price commitment alone resolves the firm’s incentive to flood the market in the second period and thus achieves the full-commitment solution. We also show that committing to a refresh quantity (instead of price) does not yield the optimal outcome. Section 5 considers the potential impact of a mandated volume of refreshes on the firm’s decisions and profit, and Section 6 concludes the study.

2. Modeling the Seller’s Problem with Product Refreshes

We employ an analytic model and nonlinear optimization methodology to examine how a monopolist should price new and refreshed products in order to maximize profits when products have limited durability. We leverage Bulow’s (1986) well-known framework for a monopolist seller of a semi-durable good. In this setting, the firm produces and units of its product in periods 1 and 2, respectively. If the firm’s product were perfectly durable, the second-period aggregate quantity of the product in the market would simply be ; at the other extreme, given a non-durable product, the period 2 available quantity would simply be due to the initial units being defunct. In contrast, a semi-durable product has some limited durability , with . In this framework for semi-durable products, the durability parameter reflects the percentage of first-period units that survive in the second period. (An alternative interpretation that Bulow [31] discusses for is that a full unit of the product from the first period is treated as a fractional (<1) unit in the second period. Thus, of the initial units sold in period 1, only remain in period 2). Therefore, is the aggregate product quantity available in the second-period market—ignoring potential refreshes. We add to this framework in one respect: we allow the firm to offer customers a refresh service at the end of period 1. At that time, any existing customer can purchase a refresh, which raises the product durability level from to (>) for the second period. We consider , i.e., a refreshed unit is not fully equivalent to a new one. Thus, both durability parameters and specify percentages of first-period units that are available in the second period, making these units part of the total market quantity of that period. We denote the quantity of refreshed products as , where must hold and assume that refreshes occur at the end of period 1. We express the firm’s production costs for new output in periods 1 and 2 via the functions and , and the cost associated with refreshes as .

2.1. Firm’s Decision Problem

We first focus on the scenario where the firm will commit, when initiating sales in period 1, to offering a refresh service at the end of that period at an announced (i.e., committed-to) price, which we denote as . In periods 1 and 2, the firm also chooses its new-product volumes and , respectively. These decisions imply the resulting first- and second-period prices and , as well as the market-clearing volume of refreshes that customers will demand, which we denote as . (Alternatively and equivalently, we could treat the new product prices as decision variables and the corresponding quantities as derived functions.) In the following formulation, the objective function expresses the firm’s net discounted profit. We use to denote the specific value of that optimizes the firm’s period-2 profit, which is then embedded within the firm’s two-period profit optimization problem. The inner optimization defining thus reflects that this selling quantity is set at the beginning of the second period, and that the solution procedure follows a backward induction approach (i.e., optimal second-period decision(s) are considered at the time the firm makes its first-period decisions). The decision problem, denoted as , is as follows.

For succinctness, we express the first- and second-period market-clearing prices simply as the functions and . These prices are functions of the firm’s decisions and will be defined in the next subsection. The refresh quantity, denoted as , is likewise a function of the firm’s decisions (, , and ), as we also address in detail within the next section after defining consumer utility. Finally, notice in the formulation objective that second-period revenues and costs are discounted by a time-discount factor we denote as (where ). We summarize all of our key notation within Table 1.

Table 1.

Summary of key notation.

If the firm were to not offer a refresh option, then does not apply (and ), and the decision problem reduces to the following formulation, which we denote as . This reduced problem is equivalent to that studied in [31].

As the choice (not offering a refresh service) is feasible for problem , its resulting optimal profit cannot be lower than that of . Our interest is in understanding whether, and to what extent, the firm benefits from committing to a refresh service with some price , and to what extent the service may increase profits (with or without commitment).

From a conceptual perspective, it is also of interest to understand how committing to a refresh service with price compares to a scenario in which the firm can also commit to the second-period decision. Having the added power of commitment to would enable the firm to maximize its profit via joint optimization over all first- and second-period decisions. (Whereas, in problem , the joint optimization was over only the two initial decisions (, with the subsequent decision being decoupled.) The seller’s problem with this full commitment power, which we denote as , expressed in terms of its quantity decisions , is as follows (equivalently, the problem could be expressed via price decisions ):

We denote the profit objective as , and the optimized profit from this best-case (i.e., full commitment) scenario as , and its corresponding optimal solution as . This best-case scenario will often be infeasible in practice, due to the challenge of committing in advance to the quantities and . Quantities, whether for new output or refreshes, are challenging to commit to credibly, because there is no simple way for consumers to monitor quantities—in contrast with prices which are public. Quantity commitment is sometimes possible, however, via “numbered edition” or “limited production run” product offerings. Thus, we will later also consider the alternative of committing specifically to a refresh volume —rather than as in . We next derive the price functions and within the formulations above, assuming the firm’s customers are rational and forward looking, and thus assess the product’s value over time.

2.2. Relating Prices to the Firm’s Quantity Decisions

To derive demand and prices we must first clarify our notation for market quantities in both periods, comprising new, refreshed, and nonrefreshed units. The market quantity in the first period is simply the firm’s new output . However, in period 2, there are new units plus a mix of both refreshed and non-nonrefreshed units carried forward from period 1. The refreshed units (with durability ) contribute a quantity in period 2; the nonrefreshed () units (with durability ) carry forward a quantity of . Thus, the aggregate quantity in period 2, which we denote as , is given by:

Note that the aggregate quantity in expression (4) is a function of , , and , but to reduce notation, we use a bold , in lieu of explicitly showing the arguments .

We derive prices by considering consumers’ forward-looking utility associated with their purchase alternatives. We assume each consumer’s per-period utility associated with owning one unit of the product in period i is , where q reflects the extant market quantity in period i. We treat () as general functional forms here, assuming only continuous differentiability with , and in the next section we derive closed-form results for linear . There are two distinct rationales for allowing the per-period utility to depend on the market quantity. First, as assumed by [31], there exists a rental market with rental prices that decline in quantity, specified by , which defines a consumer’s single-period value (i.e., in period i) associated with owning a unit of the product—Bulow refer to this as implicit rental value. Alternatively, it may be that for “conspicuous goods” [39,40], for which higher utility is associated with less availability, as may apply to some of the products—such as formal shoes, luxury watches, and fashion handbags—that we introduced earlier.

Irrespective of the rationale applied, the extant quantity in period 1 is simply . A single (new) unit purchased in the first period will yield utility in that period. If that unit is refreshed, then it diminishes to a quantity and thus yields utility in period 2; without a refresh, it will yield a period 2 utility of )—where in either case reflects the corresponding aggregate market quantity as defined above.

The quantities and will generally differ, and thus the degree to which a consumer values a unit in the first versus second periods—i.e., versus —will also generally differ (even if given identical functions ). Furthermore, because any unit purchased in the first period will subsequently deteriorate to a level , with corresponding value to the consumer , a rational (forward-looking) consumer will assess that incremental value as well, when making the first first-period purchase. For example, if the value of a new product in period 2 were $100 (=) and , then a consumer would anticipate a (future, second-period) value of $75 (=) from any first-period purchase. Thus, the full utility associated with the purchase of a unit in the first period is: . Recalling that and denote the firm’s period 1 and 2 new-product prices, we can thus express the consumer participation constraints for first- and second-period purchases, respectively, as:

Both of these must bind at optimality because, given any set of quantity decisions by the firm, if either price constraint is slack, then the firm can increase profit by raising that price. Similarly, a consumer who opts to purchase a second period refresh at some price thus gains utility equal to . The corresponding selection constraint for inducing consumers to purchase a refresh is:

which also binds at optimality. In other words, the price reflects the value increase resulting from the product’s increase in durability, . Observe that the expressions for the effective market quantity and prices in (4)–(7) establish a direct link between prices and quantities. Thus, once quantities are set, prices are unique.

We can now revisit the structure of the firm’s profit objective, using these price relationships. We will generally denote the firm’s profit NPV across both periods as , and its embedded second-period profit . Thus, we have:

where the prices , , and are implied by the (binding) constraints (5)–(7). Using (5)–(7), we can express and explicitly in terms of and as follows:

Notice that the function depends on via the effective market quantity , which couples the first and second period decisions. Regarding the form of , because multiplies , , and , and given that (4) can be rewritten as , we can write most succinctly as:

Due to this rearrangement of terms, the first and second terms in (10) do not directly correspond to first- and second-period revenues, respectively. That is because within this succinct form (which we use later with first order conditions), the first term omits a component of first-period revenue, namely, , which has been included within the second term —to arrive to a more compact but algebraically equivalent form. Therefore, when optimizing the full commitment problem in (3), we conveniently use the profit function in (10), with as the decision variables.

We can now re-express problem from (1) by explicitly showing function arguments while also using (7) to define the refresh-quantity as a function. For any committed-to price , we determine the resulting refresh quantity by solving expression (7) with respect to (recall all three price constraints are binding), yielding . Note that we henceforth use a bold (rather than ) to highlight that the refresh quantity is not a direct decision variable, but rather depends upon the firm’s decisions . Therefore, using the (binding) constraints (5) and (6) to substitute for prices and , and keeping as a decision variable along with and , yields this fully specified form of problem :

Note that in formulation (11), the inner optimization problem (with respect to ) depends on because depends on , as we discussed above. Further, notice that we have also implicitly used and within the aggregate quantity function so that .

3. Impact of Refreshes on Seller’s Decisions

We next address the problem of optimizing the firm’s optimal decisions for the products’ prices and their respective sales quantities. Although we later derive structural results for more general functional forms, here we assume the firm’s costs are given by , where c reflects the variable production cost. Since the refresh service may be less standardized than the firm’s standard production process (i.e., for new output), we define the firm’s (convex) refresh cost as: , with . Assuming a convex cost for refreshes reflects the inefficiency resulting from having to process variable inputs with distinct service needs. We refer to as the normalized refresh cost coefficient. We restrict our analysis to cases when ; otherwise refreshes become more expensive than new products, and the firm will not offer a refresh service. Beyond costs, we must also characterize the consumer utility functions, which we treat in this section as linear, with . We refer to these costs and utility assumptions as the linear utility setting. We next formally establish profit function concavity; all proofs of results are in Appendix A.

Proposition 1.

For the linear utility setting, the profit function in (and ) is concave, implying a unique solution to the first-order optimality conditions.

Having established unique interior solutions to (and ), in the next subsection, we derive closed-form solutions for the optimal quantity and prices. We subsequently apply those results over ranges of parameters to illustrate the profit implications of refreshes and price commitment. We will also consider the baseline case where the firm offers no refreshes, i.e., constraining .

3.1. Refresh Price Commitment Benefit

In this section, we show that by optimally establishing and committing to a refresh-service price, the service’s price will indirectly support the second-period optimal price and sales-quantity for new products as well. Thus, the firm obtains the best-profit level associated with , as if such full commitment—to all second period decisions—were possible. We begin by deriving the optimal solution for , which is the firm’s ideal scenario with full commitment power.

Proposition 2.

For the linear utility setting, the optimal quantities for are as follows:

We can easily see the impact of changes to product refreshes’ costs and value on the second-period optimal quantities in (12). Notice that increasing either of the refresh cost parameters ( and ) shifts output from refreshes to new output (i.e., decreases, increases). Conversely, increasing the value of refreshes () causes a shift from new production to refreshes.

Given the optimal quantities in Proposition 2, we can obtain the optimal prices and aggregate period 2 quantity for problem via the expressions in (4)–(7) yielding:

We next establish that committing to a refresh service price alone is sufficient to support the best-case (optimal) full commitment outcome.

Proposition 3.

For the linear utility setting, the optimal solutions to and coincide.

This result shows that by committing to the refresh price , the firm indirectly achieves the outcome of supporting the optimal second-period price () that it would commit to, if possible. This result is important from a practical standpoint because a firm may have direct control over its own refresh service pricing, but not have control over if new units are sold via an independent retailer, for example. In the next section, we prove that this is a robust result which holds for more general utility and cost functions. Further, we will also show that, in contrast to committing to a refresh price, committing a priori to a refresh quantity does not yield the same best-case outcome (i.e., if the firm commits to —rather than —then it will not achieve the best-case profits).

3.2. Impact of Refreshes on Firm’s Optimal Decisions

To better understand the implications of offering a refresh service, here we contrast the previous results with a variation on problem (which we showed to be equivalent to ) with the additional constraint that , i.e., we contrast with , introduced in (2). As problem ’s objective function is concave, as per Proposition 1, and since setting will not affect the concavity of the objective function, we can also conclude that problem ’s objective function is concave. We can thus apply first-order conditions to formulation (2) to obtain the following optimal-quantity results for .

Observe from expressions (12) and (14) that , implying . Thus, we see that refresh price commitment induces larger quantities in the first period. We can also contrast period-2 quantities and prices. Given the optimal quantities in (14), we can now use expressions (4)–(6) to determine the resulting (period-2) aggregate quantity and prices with no refreshes (case ); note that, for brevity and ease of comparison, we show these expressions as functions of , , and .

The behavior of these optimal decisions, both for the firm’s setting with refreshes () and without (—which, recall, simply adds constraint to ) are consistent with intuition. Prices and quantities increase in consumer utility (higher ). Increasing costs (higher c) cause quantities to decrease while optimal prices increase. Additionally, from the results for , we see that to the extent to which refreshes support product durability (i.e., increasing ), both and increase. We also see by contrasting the results in (13) and (15) that , which shows that by not committing to a refresh service, the firm ultimately sets a higher quantity in period 2 (hence, “flooding” the market), thus reducing the second-period price, i.e., . Similarly, by contrasting the first-period prices and , we can show that , provided that , which must hold because a necessary condition for profitability is that the maximum utility level must exceed the variable cost c. Moreover, this price benefit holds even while . Thus, the first-period benefits from refreshes are twofold: a higher selling price as well as a higher quantity. This occurs because the forward-looking consumers associate greater value with knowing that the firm will not flood the market in the second period.

Overall, these comparisons have revealed that, relative to offering no refreshes, committing to a refresh price supports: (i) higher new product prices in both periods, (ii) a higher first-period quantity, and (iii) a lower aggregate quantity in the second period—avoiding market flooding.

3.3. Profit Benefit from Refreshes and Commitment

Thus far in this section, we have shown that by committing to a refresh-service price (scenario ), the seller achieves the best-case outcome consistent with the full-commitment scenario . In this subsection, we will investigate the extent to which the resulting profits exceed those with no refresh service (the benchmark case ). We also contrast these profits with a scenario in which the firm offers a refresh service but does not make any commitments regarding second-period prices or quantities. In this case, which we denote as , the seller makes the decisions such that only is set at the beginning of the first period and thus delays setting until the beginning of period two. In other words, considering the stage-wise decision problem’s backward induction solution process, problem ’s inner optimization is: (,,) (where (,,) is defined in (9) above), and the outer optimization of is over only . Thus, problem is an adjustment to (in (11) above), where the outer optimization on is only over because the firm does not commit to period-two decisions. We can derive analytic solutions for with an approach similar to that within the proof of Proposition 3, but our primary interest here is to assess both problems’ and profitabilities numerically, relative to (the no-refreshes benchmark). Comparing and allows us to separate commitment-related benefits from those resulting from only offering a refresh service.

To assess the profit impact of refreshes and commitment, we consider a range of scenarios employing the following baseline settings: utility parameters and , time discount factor , and the pre- and post-refresh product durabilities as and . The linear and convex cost terms’ coefficients are and , with a normalized refresh cost coefficient .

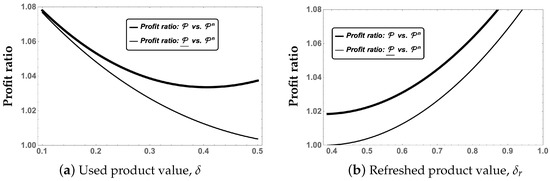

We first consider how profits relate to the durability parameter for non-refreshed (used) products. In Figure 1a, we see that for low values of , the firm enjoys nontrivial gains from refreshes, but these benefits do not stem from commitment, since we see that the profits from converge to those of . At the other extreme, as the used-product durability increases and approaches , refreshes continue to drive profits (albeit with a lower approximate 4% gain rather than 8%), while nearly all the gains stem from commitment—since profits under converge to those for . To understand these trends, first recognize that if products have no residual value at the end of the first period (i.e., if ) then there are no products of value that consumers carry forward into the second period. In this case, the two periods effectively decouple and thus commitment concerns are moot. In contrast, when used products have notable value (large ), commitment matters because it leads the firm to set a lower , which in turn helps maintain the value of those products. In the limit, as , refreshes do not improve the product, and therefore the profit gains stem solely from the price support of commitment.

Figure 1.

Optimal profit ratios from refreshes with and without commitment ( and ), relative to , versus: (a) used-product durability (for ), and (b) refreshed-product durability (for ).

Figure 1b shows the same set of profit comparisons as Figure 1a, but with changes to (the post-refresh durability), rather than . At the left edge of this figure, as , we see that the sole benefit from offering a refresh service is the potential for the (price) commitment benefit—yielding approximately a 2% profit gain. Moving to the right, as increases, we see that the seller realizes additional profit gains from refreshes, to above 8% in magnitude akin to the highest profit gains occurring at the leftmost region of Figure 1a—where the difference is high. Summarizing these observations from Figure 1, we see that: (i) profit gains from refreshes can be significant, (ii) profit gains can stem not only from commitment power but also from the refresh service itself, and (iii) even if , the seller’s (price) commitment benefit from its refresh service is nontrivial—approximately 2–4% across these instances.

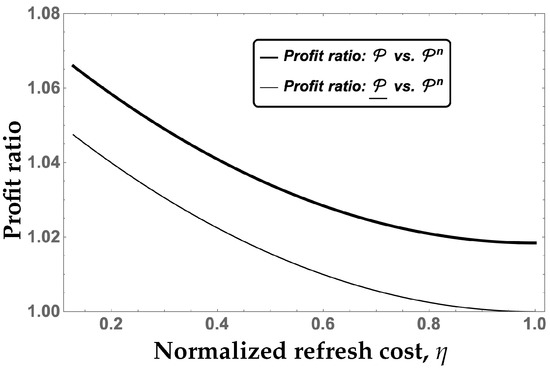

In Figure 2, we adjust the normalized refresh cost coefficient , which reflects the cost efficiency of refreshes relative to new output. From the results for , we see that, apart from commitment, offering refreshes yields an optimal profit gain as high as nearly 5%, but that advantage naturally is diminishing as the relative cost of refreshes () increases, eventually vanishing altogether as at which point refreshes are at least as expensive as new units. Contrasting the curves for and in Figure 2 we see that, similar to the results of Figure 1b, commitment yields an incremental (approximately) 2% gain that is relatively consistent over .

Figure 2.

Optimal profit () from refreshes with and without commitment (i.e., and ) vs. , for varying refresh cost .

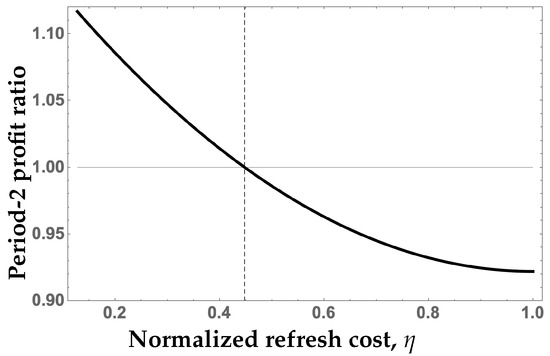

Whereas with Figure 1a,b and Figure 2, we focused on the full discounted profit (), let us now consider second-period profits () specifically. Given that we have seen generally higher profits associated with , relative to , we know that commitment benefits the firm. Intuitively, this implies that if the firm were not committed to its refresh price , then the firm would myopically wish to change that price upon reaching period 2. Potentially, as we illustrate next, upon reaching period 2, the firm may even have a myopic incentive (i.e., considering only) to set —i.e., to eschew refreshes entirely. Under its committed-to optimal decisions , the resulting second-period profits are given by . In Figure 3, we contrast those profits with , reflecting the best period-2 profit the firm could achieve if it could (hypothetically) abandon refreshes and set . The vertical dashed line in Figure 3 corresponds to setting , which reduces to , which holds at approximately . We see from the figure that the ratio is below one for moderate-to-high values of , where refreshes are relatively costly. In other words, for such a range of values, a myopic manager would opt (if not committed) to deviate from the original plan to offer refreshes in the second period. Yet, from Figure 2 we see, considering both periods, that a refresh service (with commitment) contributes to profits () even at higher levels of . This highlights that commitment can increase overall profits () even if potentially forfeiting second-period profits to some degree.

Figure 3.

Myopic (period-2) impact of refresh commitment relative to no refreshes, i.e., , versus .

In sum, the three figures above show that: (i) offering a refresh service has the potential to increase profits even apart from any ancillary commitment benefits, (ii) commitment-related benefits from a refresh service are relatively robust across durability and cost parameters, and (iii) a manager must take a holistic view of refreshes (i.e., spanning both first- and second-period pricing ramifications) to assess their full value.

4. Generalizing Results

In this section, we generalize the conclusion of Proposition 3 and also contrast the possibilities of the firm committing to a refresh quantity versus price. In Section 3.1, for the linear utility setting, we showed that refresh price commitment yields the full commitment solution. The following result proves that this correspondence holds even for general demand and cost functions.

Proposition 4.

Given continuously differentiable utility and cost functions, and yield the same interior optimal solution.

Given this more general finding that committing to a refresh price yields the optimal full commitment results, we next consider whether the same benefit holds if the firm commits to a refresh quantity (instead of price). As we will see, committing to a refresh quantity does not yield the same outcome. When committing to refresh quantity, the problem formulation is as follows.

Observe that Problem in (16) is distinct from Problem in (11) in two ways. First, the refresh decision variable is rather than . Accordingly, the refresh quantity is not denoted by a bold symbol for problem because it is no longer a function of other decision variables (as was the case in problem ). In addition, the second-period quantity function defined via the inner maximization of is now a function of and , rather than and . Given these differences, it is reasonable to expect the two formulations to yield distinct optimal solutions. Indeed, we can easily verify this via the linear utility setting of Section 3.1.

Applying first-order conditions to problem (parallel to the approach for obtaining the optimal solutions for within the proof of Proposition 3), yields the following optimal quantities for , which we denote as (:

Comparing the expressions in (12) and (17), we see that indeed the optimal solutions for Problem and differ. Both scenarios yield the same optimal number of refreshes but they differ with regards to both the first- and second-period new-product sales. More specifically, given that these quantities differ only in the denominator of their respective third (negative) terms, and we know that (since ). Furthermore, clearly given that . Thus, we see that committing to a refresh quantity implies lower first-period and higher second-period production, relative to committing to refresh price. We have thus established that an equivalence between the solutions for the refresh price versus quantity commitment alternatives does not hold even for the linear utility setting, and we generalize this finding with the following lemma.

Lemma 1.

For continuously differentiable utility and cost functions, and do not coincide.

Intuitively, why does committing to the refresh price, but not quantity, resolve the commitment problem? Recall that without commitment the firm has an incentive to increase new-product output () in the second period. Limiting the extent of refreshes () continues to allow the firm to flood the market with new units () in the second period. On the other hand, if the firm instead commits to a refresh price, then the firm also indirectly supports the value of new and used products (with prices tied to the aggregate market quantity via ). Given this implicit “value guarantee,” even though the firm has the flexibility to increase (or even ) when the second period arrives, doing so is no longer attractive given that this value guarantee implies a constraint on the quantity , via . For any level of , the firm strikes the optimal balance of and that minimizes production and refresh costs. This optimal balance between and is the same as the firm sets for any in problem , and so the optimal second-period quantities result, thus yielding the best-case profit NPV .

Contrasting the optimality conditions for for and provides an alternative basis for explaining this result. We show within the proofs of Lemma 1 and Proposition 4 that the first-order condition with respect to for problem is (from expression (A8)), whereas for problem , it is (from expression (A3)). The missing multiplying in the first of these expressions reflects the used units that a consumer holds at the end of the first period. We see clearly here that without the aforementioned “value guarantee”, the optimality condition for ignores the value of those (past customers’) used units. The firm is thus more inclined to flood the market in the second period, given that it does not consider the resulting loss in value for those units. This fact ultimately hurts the firm’s profit due to causing lower (forward-looking) utility for consumers and thus lowering prices even in the first period.

5. Impact of Legislated Refreshes

We conclude our analyses by considering exogenously imposed refreshes. Environmental legislation, initially led by European countries, promotes the idea of Extended Producer Responsibility (EPR). Product take backs are a particular form of EPR legislation that relates to refresh services. Ref. [41] note that “Take-back laws can influence the design for reuse, recyclability and durability…To-date, most take-back laws do not promote product reuse since the focus is on product recycling for e-waste recovery.” Take back programs have been proactively initiated by many prominent firms including Electrolux, Dell, Samsung, Sony Ericsson, Fujitsu-Siemens, and Philips [34]. Likewise, refreshes can be voluntarily initiated, or potentially legislated. In this section, we consider the possibility of including a legislated (i.e., enforced) constraint on the extent of the firm’s refreshes. In the related context of product recycling, “A recycling target is a standard recycling objective set by the policy maker and can be defined as the proportion of products that need to be recycled” [41]. Analogously, we consider a constraint of the form , with , so the constant k reflects the mandated (minimum) proportion of the products that must be refreshed. Including this constraint yields the following constrained problem, which we denote as .

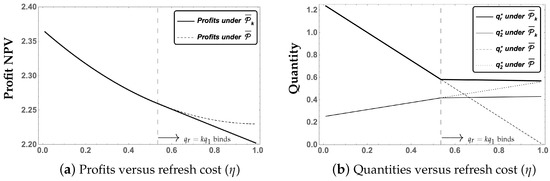

Problem differs from only by the new constraint . For small k, the constraint will be slack and the two problems are equivalent. At larger values of k, where the constraint binds, it is straightforward to solve problem by using the binding constraint to first eliminate the variable and then solve the problem in terms of only . To determine when the constraint binds, we use the solution to and solve for the value of k that equates .

We leverage the linear utility setting from the prior section to explore the impact of such legislation. Recall from (12) that the firm’s optimal and values with full commitment are and . Therefore, increasing the refresh cost reduces the firm’s refreshes, and, if becomes large enough, the constraint will bind. Specifically, setting , we find that this constraint holds at . At higher levels of the refresh cost (i.e., ), the firm would wish to set (which would violate the constraint, implying that the constraint binds), and at lower levels of (i.e., when ), the constraint will be slack. When the constraint binds (), the problem reduces, as noted above, to a two-variable problem in that is straightforward to solve via first-order conditions.

We now employ the baseline parameter set introduced in Section 3.3, with a legislated refreshes proportion equal to . For this parameter set, the threshold value beyond which the legislated constraint () binds is equal to . Figure 4 contrasts results for versus , thus allowing us to see the impact of a legislated refreshes proportion. Specifically, Figure 4a highlights the impact on profits, whereas Figure 4b shows the impact on optimal second-period quantities. In both panels (a) and (b), the vertical dashed line represents the threshold beyond which the legislated constraint binds. We see from Figure 4a that past this threshold, the optimal profits the firm can achieve under begin to drop due to the binding constraint. Beyond that threshold, the profit gap increases as increases, due to it being more costly to support the mandated level (i.e., the proportion k) of refreshes. From Figure 4b, we again see the impact of the constraint binding, specifically on the optimal second-period quantities. For (i.e., when is slack), as refreshes become more costly (i.e., increasing), the firm gradually reduces refreshes () while increasing new output (); first-period quantity () remains constant in this region (as we know from (12), is independent from ). At , the ratio falls to k, at which point the mandated proportion constraint binds and thus shifting from refreshes to new output is no longer possible. In sum, these results demonstrate that mandating a minimum level of refreshes may result in lower output of new products (and lower profit), which, although undesirable for the firm, may be beneficial for the environment.

Figure 4.

Impact on profits (panel (a)) and quantities (panel (b)) from legislating a refresh proportion ().

6. Conclusions

In this paper, we have analyzed a firm offering a service by which it will charge prior customers a fee to refresh their used products. Such a service is consistent with the “right to repair” concept and lies at the intersection of maintenance and sustainability [1,2]. We have employed a two-period analytic model to analyze how product refreshes influence product values and market prices in the second period. Given that forward-looking consumers assess the future value of products when making their purchases, there are price repercussions in the initial selling period as well. Specifically, consumers may be willing to pay more for a new product, knowing that they will have the option to extend its durability via a refresh service in the second period.

Potentially, managers may view refresh services as a double-edged sword. On the one hand, the service may support higher first-period prices, but on the other hand, it may inhibit the opportunity to make subsequent new and replacement sales. A related challenge facing sellers of durable goods, first analyzed by Bulow (1986), is that the firm may have an incentive to increase output in the second period, and this incentive can be predicted by consumers, who then correspondingly lower their first-period willingness to pay. We prove that the commitment problem indeed remains pertinent for a firm that offers a refresh service. We also show that even if the firm can commit to a certain number of refreshes, doing so does not resolve the commitment problem. However, we prove that by committing to its refresh price, the firm can realize its best-case profit level. In a linear utility setting, we have also investigated a wide range of problem instances, and explored the relative benefits of refreshes both with and without commitment power.

As evidenced by our results, refresh services offer two distinct sources of value. The first source of value is straightforward: if the value of new products is sufficiently high, then the refresh price may exceed the firm’s refresh cost—thus supporting a positive direct contribution margin from a refresh service. The second source is subtler. That is, the ability to use the refresh service as a means to assure consumers that the firm will not act to undermine the future value of its products (used and new). We see that in many cases this commitment-related benefit is significant. Our findings thereby highlight the need for managers to take a holistic view of the impact of refresh services, considering not only their direct impact, but also their indirect pricing impact on new products. Therefore, we have shown that a firm can potentially increase its overall profit even if the direct impact of refreshes on (second period) profits appears negative. Finally, we explored the possibility of a mandated extent of refreshes (e.g., from EPR legislation), and the resulting impact on the firm’s optimal trade-off between refreshes and new production in the second period, with associated profits.

As natural resources become increasingly scarce, the use of refresh services to extend products’ useful lifespans may become increasingly important. Our work serves as a building block in developing an understanding of how a firm can offer refresh services profitably, in a baseline setting with two periods and linear consumer utilities. There are multiple promising avenues for future study. One path would be to consider nonlinear consumer utility functions. For example, convex utility can imply prices that fall rapidly in quantity, thus (ceteris paribus) intuitively implying lower production quantities and profits. While the absolute profit gains from refreshes will be lower in such instances, on a relative basis (i.e., percentage gains) refreshes may still yield worthwhile profit benefits—provided refresh costs are low. Additional interesting avenues for future research would be to consider competition between firms (e.g., duopoly) or the product durability decision—in this study, we focused on analyzing prices and profits with exogenous durability. Another avenue for exploration is to empirically study industry and firm-specific factors that induce companies to adopt a refresh service, and assess whether such adoptions tend to lead to higher profits.

Author Contributions

The authors contributed equally to all aspects of this paper. All authors have read and agreed to the submitted version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Proof.

Proposition 1

Applying Equations (9) and (10) for the full commitment problem , we can simplify the total and second-period profit functions for the linear utility setting as follows:

To guarantee a unique optimal solution for the full-commitment case, we first show that the Hessian of given in expression (A1) is negative definite. Let denote the corresponding Hessian matrix for , where

Letting denote the kth leading principal minor of a Hessian matrix, we know that is negative definite if , for all . We can see that this is indeed the case by verifying ,

and . Thus, the full commitment problem is well behaved.

We next consider the refresh price commitment scenario, . To guarantee a unique optimal we first derive the second order condition for the second-period profit function , where , as discussed prior to formulation (1). More specifically, for the linear demand case, we have . Therefore, , implying that . Thus is concave in and there is a unique that maximizes . Employing the profit function in (11) for the linear utility setting, let H denote the Hessian matrix of the resulting , maximized with respect to and . We can show

and since and , we know that H is negative definite, ensuring that there is a unique global maximum ( that maximizes . Therefore, problem is well behaved. □

Proof.

Proposition 2

Given that the problem is well behaved, per Proposition 1, we apply first order conditions (FOC) to the profit function in (A1) yielding:

Setting the above expressions to zero and solving the simultaneous system of equations yields the optimal expressions for . □

Proof.

Proposition 3

To derive the optimal solution for the refresh price commitment problem , we first optimize with respect to , where

as discussed prior to problem formulation in (11). More specifically, for the linear demand case, we have . Thus, , implying that . Setting this second-period profit derivative to zero yields

Notice that is indeed a function of and . We can now evaluate the profit function of (11) for the linear demand case. Applying first-order conditions for the resulting two-period profit function yields , and = . We can now see that setting these first-order condition to zero and solving for and yields exactly the full-commitment optimal solutions for problem , and given in expressions (12) and (13), respectively. The last observation also implies that the remaining decision variables and prices for the refresh price commitment and the full commitment are identical. For example, we can see that . □

Proof.

Proposition 4

We will show that the refresh-price commitment solution, based on the backward induction FOC , yields the same form as the full-commitment problem’s FOC , implying the same optimal solution . In other words, we will show that the firm’s optimal second-period decision for problem (solved with backward induction) matches that of , which is derived by simultaneously solving the three FOCs for . As we will see, this result further implies that the remaining decision variables also match, thus making the solutions to and identical. We begin by deriving the First-Order Conditions (FOCs) for Problem . Given the profit function expression in (10), the FOCs for problem are as follows.

We list the FOCs in the order , , , and we also follow this ordering subsequently. Leveraging the derivative notation from Table 1 and the third FOC result’s implication that , we obtain the following simplified forms for these conditions.

We next derive the FOCs for by (equivalently) re-expressing formulation (11) to more clearly show its dependence on the committed-to price . Recall that the refresh quantity function . Since the firm’s revenue in (11) is , we can use (7) to write , or equivalently . We can therefore express the firms’ revenue as and the firm’s profit NPV for problem as follows:

When the firm pre-commits to the refresh price , we find the refresh price commitment solution via backward induction by evaluating the FOC , where, from (9), the second-period decision problem is:

Noting that is equal to , we can rewrite the maximization conveniently as:

We can now again use the relationships and , to substitute for the terms, yielding:

Setting , we see that the optimal second-period quantity is such that . To evaluate , we leverage the expression for in (4) to write the refresh price expression as , which implies . From this, we see that . Therefore, implies that , which is the identical FOC (with respect to ) for the full-commitment problem ; see the FOCs in expression (A3). This proves that the optimal second-period quantity decisions of and match. Substituting for in (A4) yields the remaining two FOCs for the refresh price commitment problem :

What remains is to show that the FOCs for the optimal and of the refresh price commitment problem and the full-commitment problem also match. We can see this by employing an alternative but equivalent method for deriving the FOCs of . Rather than deriving three corresponding simultaneous FOCs for , as in expression (A3), we employ the profit NPV expression (A4) in the decision space , derive the FOC for , and then explicitly substitute into the profit NPV. Considering interior point solutions, we can show that implies , or equivalently . Let the solution to this FOC be denoted as , which is an implicit function of and . Substituting in the profit NPV (A4) and treating it as an implicit function, we find that and yield the exact same FOCs in (A5) corresponding to problem , which thus completes the proof. □

Proof.

Lemma 1

Applying backward induction to problem , the firm maximizes defined in (9) by identifying a second-period quantity satisfying , i.e.,

Thus, the optimal and maximize , where is an implicit function of . The FOCs corresponding to the decisions follow.

Within these two relations, substituting with (derived from ) provides the final result. Simplifying the form of the above results, we obtain that for problem , the FOCs for are:

where is an implicit function of satisfying

Thus, we establish that the resulting FOCs are not equivalent to (A3) for problem . □

References

- Hernandez, R.J.; Miranda, C.; Goñi, J. Empowering sustainable consumption by giving back to consumers the ‘right to repair’. Sustainability 2020, 12, 850. [Google Scholar] [CrossRef] [Green Version]

- Franciosi, C.; Iung, B.; Miranda, S.; Riemma, S. Maintenance for sustainability in the industry 4.0 context: A scoping literature review. IFAC-PapersOnLine 2018, 51, 903–908. [Google Scholar] [CrossRef]

- Baines, T.; Baines, T.; Ziaee Bigdeli, A.; Ziaee Bigdeli, A.; Bustinza, O.F.; Bustinza, O.F.; Shi, V.G.; Shi, V.G.; Baldwin, J.; Baldwin, J.; et al. Servitization: Revisiting the state-of-the-art and research priorities. Int. J. Oper. Prod. Manag. 2017, 37, 256–278. [Google Scholar] [CrossRef]

- Kanatlı, M.A.; Karaer, Ö. Servitization as an alternative business model and its implications on product durability, profitability & environmental impact. Eur. J. Oper. Res. 2021, in press.

- Kohtamäki, M.; Henneberg, S.C.; Martinez, V.; Kimita, K.; Gebauer, H. A configurational approach to servitization: Review and research directions. Serv. Sci. 2019, 11, 213–240. [Google Scholar] [CrossRef]

- Raddats, C.; Baines, T.; Burton, J.; Story, V.M.; Zolkiewski, J. Motivations for servitization: The impact of product complexity. Int. J. Oper. Prod. Manag. 2016, 36, 572–591. [Google Scholar] [CrossRef] [Green Version]

- Lightfoot, H.; Baines, T.; Smart, P. The servitization of manufacturing: A systematic literature review of interdependent trends. Int. J. Oper. Prod. Manag. 2013, 33, 1408–1434. [Google Scholar] [CrossRef] [Green Version]

- Lee, S.; Yoo, S.; Kim, D. When is servitization a profitable competitive strategy? Int. J. Prod. Econ. 2016, 173, 43–53. [Google Scholar] [CrossRef]

- Xiao, T.; Choi, T.M.; Yang, D.; Cheng, T. Service commitment strategy and pricing decisions in retail supply chains with risk-averse players. Serv. Sci. 2012, 4, 236–252. [Google Scholar] [CrossRef]

- Souza, G.C. Closed-loop supply chains: A critical review, and future research. Decis. Sci. 2013, 44, 7–38. [Google Scholar] [CrossRef]

- Chakraborty, K.; Mukherjee, K.; Mondal, S.; Mitra, S. A systematic literature review and bibliometric analysis based on pricing related decisions in remanufacturing. J. Clean. Prod. 2021, 310, 127265. [Google Scholar] [CrossRef]

- Atasu, A.; Souza, G.C. How does product recovery affect quality choice? Prod. Oper. Manag. 2013, 22, 991–1010. [Google Scholar] [CrossRef]

- Oraiopoulos, N.; Ferguson, M.E.; Toktay, L.B. Relicensing as a secondary market strategy. Manag. Sci. 2012, 58, 1022–1037. [Google Scholar] [CrossRef] [Green Version]

- Debo, L.G.; Toktay, L.B.; Wassenhove, L.N.V. Joint life-cycle dynamics of new and remanufactured products. Prod. Oper. Manag. 2006, 15, 498–513. [Google Scholar] [CrossRef]

- Ferrer, G.; Swaminathan, J.M. Managing new and remanufactured products. Manag. Sci. 2006, 52, 15–26. [Google Scholar] [CrossRef] [Green Version]

- Bulmus, S.C.; Zhu, S.X.; Teunter, R. Competition for cores in remanufacturing. Eur. J. Oper. Res. 2014, 233, 105–113. [Google Scholar] [CrossRef]

- Wu, C.H. Product-design and pricing strategies with remanufacturing. Eur. J. Oper. Res. 2012, 222, 204–215. [Google Scholar] [CrossRef]

- Atasu, A.; Sarvary, M.; Van Wassenhove, L.N. Remanufacturing as a marketing strategy. Manag. Sci. 2008, 54, 1731–1746. [Google Scholar] [CrossRef] [Green Version]

- Heese, H.S.; Cattani, K.; Ferrer, G.; Gilland, W.; Roth, A.V. Competitive advantage through take-back of used products. Eur. J. Oper. Res. 2005, 164, 143–157. [Google Scholar] [CrossRef]

- Bazan, E.; Jaber, M.Y.; Zanoni, S. Carbon emissions and energy effects on a two-level manufacturer-retailer closed-loop supply chain model with remanufacturing subject to different coordination mechanisms. Int. J. Prod. Econ. 2017, 183, 394–408. [Google Scholar] [CrossRef]

- Zeng, A.Z. Coordination mechanisms for a three-stage reverse supply chain to increase profitable returns. Nav. Res. Logist. 2013, 60, 31–45. [Google Scholar] [CrossRef]

- Saihi, A.; Ben-Daya, M.; As’ ad, R.A. Maintenance and sustainability: A systematic review of modeling-based literature. J. Qual. Maint. Eng. 2022, in press. [CrossRef]

- Shafiee, M.; Chukova, S. Maintenance models in warranty: A literature review. Eur. J. Oper. Res. 2013, 229, 561–572. [Google Scholar] [CrossRef]

- Wang, H. A survey of maintenance policies of deteriorating systems. Eur. J. Oper. Res. 2002, 139, 469–489. [Google Scholar] [CrossRef]

- Wang, X.; Zhao, X.; Liu, B. Design and pricing of extended warranty menus based on the multinomial logit choice model. Eur. J. Oper. Res. 2020, 287, 237–250. [Google Scholar] [CrossRef]

- Kurata, H.; Nam, S.H. After-sales service competition in a supply chain: Optimization of customer satisfaction level or profit or both? Int. J. Prod. Econ. 2010, 127, 136–146. [Google Scholar] [CrossRef]

- Bakshi, N.; Kim, S.H.; Savva, N. Siggnaling new product reliability with after-sales service contracts. Manag. Sci. 2015, 61, 1812–1829. [Google Scholar] [CrossRef] [Green Version]

- Mann, D.P. Durable goods monopoly and maintenance. Int. J. Ind. Organ. 1992, 10, 65–79. [Google Scholar] [CrossRef]

- Morita, H.; Waldman, M. Durable goods, monopoly maintenance, and time inconsistency. J. Econ. Manag. Strategy 2004, 13, 273–302. [Google Scholar] [CrossRef]

- Goering, G.E. Durable-Goods Monopoly with Maintenance. Bull. Econ. Res. 2007, 59, 231–246. [Google Scholar] [CrossRef]

- Bulow, J. An economic theory of planned obsolescence. Q. J. Econ. 1986, 101, 729–750. [Google Scholar] [CrossRef]

- Li, K.; Zhou, T.; Liu, B. The comparison between selling and leasing for new and remanufactured products with quality level in the electric vehicle industry. J. Ind. Manag. Optim. 2021, 17, 1505. [Google Scholar] [CrossRef] [Green Version]

- Gilbert, S.M.; Randhawa, R.S.; Sun, H. Optimal Per-Use Rentals and Sales of Durable Products and Their Distinct Roles in Price Discrimination. Prod. Oper. Manag. 2014, 23, 393–404. [Google Scholar] [CrossRef]

- Pangburn, M.S.; Stavrulaki, E. Take back costs and product durability. Eur. J. Oper. Res. 2014, 238, 175–184. [Google Scholar] [CrossRef]

- Xiong, Y.; Yan, W.; Fernandes, K.; Xiong, Z.K.; Guo, N. “Bricks vs. Clicks”: The impact of manufacturer encroachment with a dealer leasing and selling of durable goods. Eur. J. Oper. Res. 2012, 217, 75–83. [Google Scholar] [CrossRef]

- Bhaskaran, S.R.; Gilbert, S.M. Implications of Channel Structure for Leasing or Selling Durable Goods. Mark. Sci. 2009, 28, 918–934. [Google Scholar] [CrossRef]

- Agrawal, V.V.; Ferguson, M.; Toktay, L.B.; Thomas, V.M. Is Leasing Greener Than Selling? Manag. Sci. 2012, 58, 523–533. [Google Scholar] [CrossRef] [Green Version]

- Desai, P.; Purohit, D. Leasing and Selling: Optimal Marketing Strategies for a Durable Goods Firm. Manag. Sci. 1998, 44, S19–S34. [Google Scholar] [CrossRef]

- Tereyagoglu, N.; Veeraraghavan, S. Selling to Conspicuous Consumers: Pricing, Production, and Sourcing Decisions. Manag. Sci. 2012, 58, 2168–2189. [Google Scholar] [CrossRef] [Green Version]

- Agrawal, V.V.; Kavadias, S.; Toktay, L.B. The Limits of Planned Obsolescence for Conspicuous Durable Goods. Manuf. Serv. Oper. Manag. 2016, 18, 216–226. [Google Scholar] [CrossRef] [Green Version]

- Atasu, A.; Van Wassenhove, L.N. An Operations Perspective on Product Take-Back Legislation for E-Waste: Theory, Practice, and Research Needs. Prod. Oper. Manag. 2012, 21, 407–422. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).