Hard Cash in Hard Times—The Effect of Institutional Support for Businesses Shaken by COVID-19

Abstract

1. Introduction

- Identify the importance of institutional support in a pandemic crisis;

- Analyze the structure of businesses at risk of negative impacts from the COVID-19 pandemic that have received public support;

- Verify the type of investments that received the most support and the diversification in this respect;

- Diagnose institutional support during the COVID-19 pandemic by industry to provide evidence of how the regional economy supports business development in a public health crisis.

2. New Institutional Economics in the COVID-19 Economy

- Traditional theories (classical and neoclassical) characterizing the company in a free competition market and under monopoly;

- Managerial theories known for their different approaches to corporate goals and the separation of ownership from management;

- The behavioral approach pointing to multiple goals;

- Other theories distinguishing different aspects of the company, e.g., innovation and entrepreneurship, transaction costs, contracts, agency costs, firm life cycle and institutions.

- Theories that assume a single main objective other than profit maximization (managerial business theories);

- Theories that deny the existence of a single goal and assume the existence of a “bundle of goals” (behavioral business theories).

- Business operations involve risk and uncertainty;

- Company analysis is performed through a “bundle of contacts”;

- Management controls the coordination of resources through hierarchy;

- The functioning of markets relies on a structure of regulation that must be exploited;

- The use of agency theory and management methods.

3. Materials and Methods

4. Results and Discussion

4.1. Types of Business Studied According to the International Standard Industrial Classification

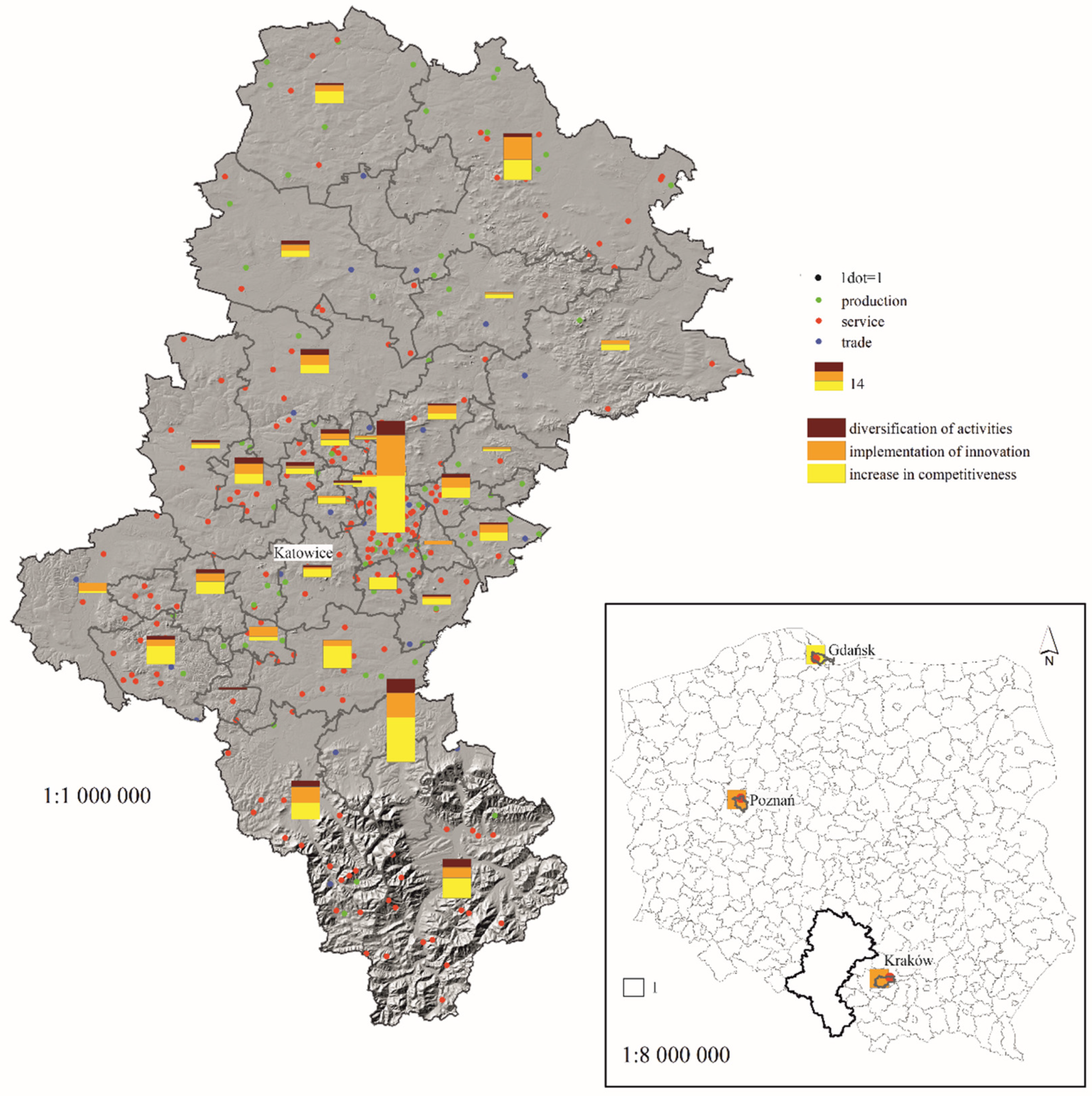

4.2. Industry Analysis and Type of Investments Realized

4.3. Analysis of Project Values, Eligible Costs and Amounts of Support Requested

4.4. Detailed Analysis of the Amount of Financial Aid Requested

4.4.1. Type of Investment Realized

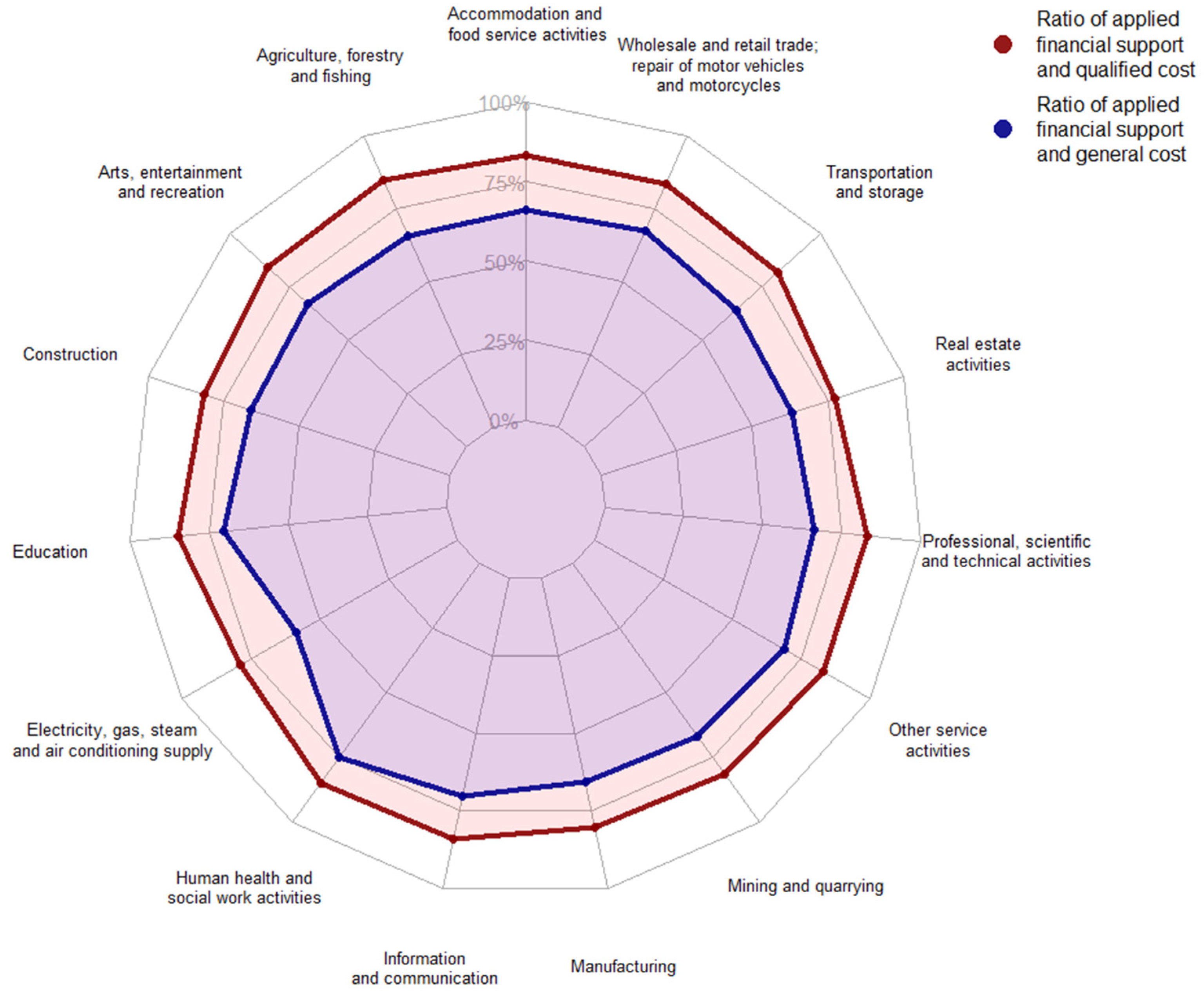

4.4.2. Analysis of Funding Value per Industry

4.4.3. Type of Business Activity

5. Conclusions

- Regional public support for industries particularly vulnerable to the health crisis, e.g., the catering and hotel industry; the tourism and leisure industry; wholesale and retail trade; and cosmetic, hairdressing and rehabilitation services, has proven relevant.

- SMEs that were in demand and applied for nonrefundable public support have proven to be particularly sensitive to the economic crisis triggered by COVID-19. This confirms that these businesses require public intervention to survive on the market.

- What motivated the owners to apply for the aid was not only covering liabilities, but also diversifying the business according to market needs.

- Has public support during the pandemic (both regional and national) led to the improved financial health and sustainability of SMEs and contributed to their supply chain sustainability?

- Can regulatory policies to support businesses during a pandemic, both SMEs and large companies, more effectively include activities, especially informal ones, through the development of interorganizational networks?

- Has there been any networking among stakeholder groups during the COVID-19 crisis, will it be sustained and what lessons can be drawn from this?

- What types of activity proved most effective in generating revenue, and what strategies kept businesses operating during the COVID-19 pandemic?

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Klemeš, J.J.; Van Fan, Y.; Tan, R.R.; Jiang, P. Minimising the present and future plastic waste, energy and environmental footprints related to COVID-19. Renew. Sustain. Energy Rev. 2020, 127, 109883. [Google Scholar] [CrossRef] [PubMed]

- Tahir, M.B.; Batool, A. COVID-19: Healthy environmental impact for public safety and menaces oil market. Sci. Total Environ. 2020, 740, 140054. [Google Scholar] [CrossRef] [PubMed]

- He, P.; Sun, Y.; Zhang, Y.; Li, T. COVID–19’s impact on stock prices across different sectors—an event study based on the chinese stock market. Emerg. Mark. Financ. Trade 2020, 56, 2198–2212. [Google Scholar] [CrossRef]

- Goodell, J.W. COVID-19 and finance: Agendas for future research. Financ. Res. Lett. 2020, 35, 101512. [Google Scholar] [CrossRef] [PubMed]

- Brunnermeier, M.; Krishnamurthy, A. The Macroeconomics of Corporate Debt. Rev. Corp. Financ. Stud. 2020, 9, 656–665. [Google Scholar] [CrossRef]

- Ellul, A.; Erel, I.; Rajan, U. The COVID-19 Pandemic Crisis and Corporate Finance. Rev. Corp. Financ. Stud. 2020, 9, 421–429. [Google Scholar] [CrossRef]

- Baker, R.; Bloom, N.; Davis, S.J.; Kost, K.; Sammon, M.; Viratyosin, T. The Unprecedented Stock Market Reaction to COVID-19; NBER Working Papers 26945; National Bureau of Economic Research, Inc.: Cambridge, MA, USA, 2020. [Google Scholar]

- Ramelli, S.; Wagner, A.F. Feverish Stock Price Reactions to COVID-19; CEPR Discussion Papers 14511; CEPR: London, UK, 2020. [Google Scholar]

- Hosseini, S.E. An outlook on the global development of renewable and sustainable energy at the time of COVID-19. Energy Res. Soc. Sci. 2020, 68, 10163. [Google Scholar] [CrossRef]

- Albuquerque, R.; Koskinen, Y.; Yang, S.; Zhang, C. Resiliency of Environmental and Social Stocks: An Analysis of the Exogenous COVID-19 Market Crash. Rev. Corp. Financ. Stud. 2020, 9, 593–621. [Google Scholar] [CrossRef]

- Broadstock, D.; Chan, K.; Cheng, L.; Wang, X. The role of ESG performance during times of financial crisis: Evidence from COVID-19 in China. Financ. Res. Lett. 2021, 38, 101716. [Google Scholar] [CrossRef]

- Alekseev, G.; Amer, S.; Gopal, M.; Kuchler, T.; Schneider, J.W.; Stroebel, J.; Wernerfelt, N. The Effects of COVID-19 on US Small Businesses: Evidence from Owners, Managers, and Employees; Working Paper 27833; NBER: Cambridge, MA, USA, 2020; Available online: https://www.nber.org/papers/w27833 (accessed on 15 March 2022).

- Brinks, V.; Ibert, O. From Corona Virus to Corona Crisis: The value of an analytical and geographical understanding of crisis. Tijdschr. Econ. Soc. Geogr. 2020, 111, 275–287. [Google Scholar] [CrossRef]

- Hiles, A. The Definitive Handbook of Business Continuity Management; John Wiley & Sons: Hoboken, NJ, USA, 2010. [Google Scholar]

- ISO 22301; Business Continuity Management Systems—Requirements. International Organization for Standardization Security and Resilience: Geneva, Switzerland, 2019. Available online: https://www.iso.org/obp/ui#iso:pub:PUB100442 (accessed on 15 March 2022).

- International Labour Organization. The SIX-STEP COVID-19 BUSINESS CONTINUITY PLAN for SMEs. 2020. Available online: https://www.ilo.org/wcmsp5/groups/public/---ed_dialogue/---act_emp/documents/publication/wcms_740375.pdf (accessed on 15 March 2022).

- Herbane, B. The evolution of business continuity management: A historical review of practices and drivers. Bus. Hist. 2010, 52, 978. [Google Scholar] [CrossRef]

- Slim, H. Business actors in armed conflict: Towards a new humanitarian agenda. Int. Rev. Red Cross 2012, 94, 903. [Google Scholar] [CrossRef]

- Donthu, N.; Gustafsson, A. Effects of COVID-19 on business and research. J. Bus. Res. 2020, 117, 284–289. [Google Scholar] [CrossRef] [PubMed]

- Ozili, P.K.; Arun, T. Spillover of COVID-19: Impact on the global economy. SSRN Electron. J. 2020, 10. [Google Scholar] [CrossRef]

- Shafi, M.; Liu, J.; Ren, W. Impact of COVID-19 pandemic on micro, small, and medium-sized Enterprises operating in Pakistan. Res. Glob. 2020, 2, 100018. [Google Scholar] [CrossRef]

- Jurd De Girancourt, F.; Kuyoro, M.; Amaah Ofosu-Amaah, N.; Seshie, E.; Twum, F. How The COVID-19 Crisis May Affect Electronic Payments in Africa. 2020. Available online: https://www.telegraph.co.uk/news/2020/03/02/exclusive-dirty-banknotes-may-spreading-coronavirus-world-health/ (accessed on 22 March 2022).

- Groenewegen, J.; Hardemana, S.; Stam, E. Does COVID-19 state aid reach the right firms? COVID-19 state aid, turnover expectations, uncertainty and management practices. J. Bus. Ventur. Insights 2021, 16, e00262. [Google Scholar] [CrossRef]

- Qiao, L.; Fei, J. Government subsidies, enterprise operating efficiency, and “stiff but deathless” zombie firms. Econ. Model. 2022, 107, 105728. [Google Scholar] [CrossRef]

- Blankson, C.; Nukpezah, J.A. Market orientation and poverty reduction: A study of rural microentrepreneurs in Ghana. Afr. J. Manag. 2019, 5, 332–357. [Google Scholar] [CrossRef]

- Nandi, S.; Sarkis, J.; Hervani, A.; Helms, M. Do blockchain and circular economy practices improve post COVID-19 supply chains? A resource-based and resource dependence perspective. Ind. Manag. Data Syst. 2021, 121, 333–363. [Google Scholar] [CrossRef]

- Quayson, M.; Bai, C.; Osei, V. Digital inclusion for resilient post-COVID-19 supply chains: Smallholder farmer perspectives. IEEE Eng. Manag. Rev. 2020, 48, 104–110. [Google Scholar] [CrossRef]

- Bai, C.; Quayson, M.; Sarkis, J. COVID-19 pandemic digitization lessons for sustainable development of micro-and small- enterprises. Sustain. Prod. Consum. 2021, 27, 1989–2001. [Google Scholar] [CrossRef] [PubMed]

- Räisänen, J.; Tuovinen, T. Digital innovations in rural micro-enterprisesJ. Rural Stud. 2020, 73, 56–67. [Google Scholar] [CrossRef]

- Tucker, H. Coronavirus Bankruptcy Tracker: These Major Companies Are Failing amid the Shutdown, Forbes. 2020. Available online: https://www.forbes.com/sites/hanktucker/2020/05/03/coronavirus-bankruptcy-tracker-these-major-companies-are-failing-amid-the-shutdown/#5649f95d3425 (accessed on 24 March 2022).

- Bradley, S.; Aldrich, H.; Shepherd, D.A.; Wiklund, J. Resources, environmental change, and survival: Asymmetric paths of young independent and subsidiary organizations. Strateg. Manag. J. 2011, 32, 486–509. [Google Scholar] [CrossRef]

- Cook, L.; Barrett, C. How Covid-19 Is Escalating Problem Debt. Available online: https://www.ft.com/content/4062105a-afaf-4b28-bde6-ba71d5767ec0 (accessed on 14 March 2022).

- OECD. An In-Depth Analysis of One Year of SME and Entrepreneurship Policy Responses to COVID-19: Lessons Learned for Moving Forward; OECD SME and Entrepreneurship Papers No. 25; OECD Publishing: Paris, France, 2021. [Google Scholar] [CrossRef]

- Martin, R.L. Shocking aspects of regional development: Towards an economic geography of resilience. In The New Oxford Handbook of Economic Geography; Clark, G., Gertler, M., Feldman, M.P., Wójcik, D., Eds.; Oxford University Press: Oxford, UK, 2018; p. 839. [Google Scholar]

- Barasa, E.; Mbau, R.; Gilson, L. What is resilience and how can it be nurtured? A systematic review of empirical literature on organizational resilience. Int. J. Health Policy Manag. 2018, 7, 491–503. [Google Scholar] [CrossRef]

- Lengnick-Hall, C.A.; Beck, T.E.; Lengnick-Hall, M.L. Developing a capacity for organizational resilience through strategic human resource management. Hum. Resour. Manag. Rev. 2011, 21, 243–255. [Google Scholar] [CrossRef]

- Gruszecki, T. Współczesne Teorie Przedsiębiorstwa; Wydawnictwo Naukowe PWN: Warsaw, Poland, 2002; Volume 37. [Google Scholar]

- Bentkowska, K. Ekonomia Instytucjonalna; SGH: Warsaw, Poland, 2020; Volume 7. [Google Scholar]

- Freeman, R.E.; William, M.E. Corporate Governance: A Stakeholder Interpretation. J. Behav. Econ. 1990, 19, 337–359. [Google Scholar] [CrossRef]

- Carías Vega, D.E.; Keenan, R.J. Situating community forestry enterprises within New Institutional Economic theory: What are the implications for their organization? J. For. Econ. 2016, 25, 1–13. [Google Scholar] [CrossRef]

- Guinnane, T.W.; Schneebacher, J. Enterprise form: Theory and history 1. Explor. Econ. Hist. 2020, 76, 101331. [Google Scholar] [CrossRef]

- Fiedor, B. State as Economic Subject: Neo-institutionalists Versus New Institutional Economics. Prace Naukowe Uniwersytetu Ekonomicznego we Wrocławiu. Ekonomia 2009, 3, 91–107. [Google Scholar]

- Czarny, E.; Miroński, J. Grupy interesu w przedsiębiorstwie—Analiza neoklasycznej i współczesnych teorii. In Zrównoważony Rozwój Przedsiębiorstwa a Relacje z Interesariuszami; Brdulak, H., Gołębiowski, T., Eds.; SGH: Warsaw, Poland, 2005; p. 75. [Google Scholar]

- Williamson, O.E. The Modern Corporation: Origins, Evolution, Attributes. J. Econ. Lit. 1981, 19, 1537–1568. [Google Scholar]

- Leibenstein, H. Allocative Efficiency vs. “X-Efficiency”. Am. Econ. Rev. 1966, 56, 392–415. [Google Scholar]

- Adamczyk, J. Tworzenie wartości dla interesariuszy w łańcuchu wartości przedsiębiorstwa. In Logistyka w Naukach o Zarzadzaniu; Prace Naukowe AE: Katowice, Poland, 2010; pp. 173–184. [Google Scholar]

- Czarny, E.; Miroński, J. Alternatywne wizje przedsiębiorstwa w teorii mikroekonomii i nauce o zarządzaniu. Zeszyty Naukowe Kolegium Gospodarki Światowej 2005, 17, 145–166. [Google Scholar]

- Krugman, P.R. Scale economics, product differentiation and the pattern of trade. Am. Econ. Rev. 1980, 70, 950–959. [Google Scholar]

- Aldrich, H.E.; Martinez, M.A. Many are called, but few are chosen: An evolutionary perspective for the study of entrepreneurship. Entrep. Theory Pract. 2001, 25, 41–56. [Google Scholar] [CrossRef]

- Amankwah-Amoah, J. An integrative process model of organisational failure. J. Bus. Res. 2016, 69, 3388–3397. [Google Scholar] [CrossRef]

- Amankwah-Amoah, J.; Wang, X. Opening editorial: Contemporary business risks: An overview and new research agenda. J. Bus. Res. 2019, 97, 208–211. [Google Scholar] [CrossRef]

- Gródek-Szostak, Z.; Suder, M.; Szeląg-Sikora, A.; Ochoa Siguencia, L. The “Dobry Czas Na Biznes” (“Good Time for Business”) Program as a Form of Support for Self-Employment in Poland. A Case Study of the Sub-Regions of the Małopolskie Province. Sustainability 2020, 12, 9688. [Google Scholar] [CrossRef]

- Jõeveer, K. Firm, Country and Macroeconomic Determinants of Capital Structure: Evidence from Transition Economies. J. Comp. Econ. 2013, 41, 294–308. [Google Scholar] [CrossRef]

- Sibirskaya, E.; Stroeva, O.; Simonova, E. The Characteristic of the Institutional and Organizational Environment of Small Innovative and Big Business Cooperation. Procedia Econ. Financ. 2015, 27, 507–515. [Google Scholar] [CrossRef][Green Version]

- Dołęgowski, T. Od etyki gospodarczej i etyki biznesu do Corporate Social Responsibility i koncepcji rozwoju zrównoważonego. In Zrównoważony Rozwój Przedsiębiorstwa a Relacje z Interesariuszami; Brdulak, H., Gołębiowski, T., Eds.; Oficyna Wydawnicza AGH: Warsaw, Poland, 2005. [Google Scholar]

- Atkinson, A. Economics as a Moral Science. Economica 2009, 76, 791–804. [Google Scholar] [CrossRef]

- Blaug, M. The Fundamental Theorems of Modern Welfare Economics, Historically Contemplated. Hist. Political Econ. 2007, 39, 185–207. [Google Scholar] [CrossRef]

- Harberger, A.C. Three basic postulates for applied welfare economics: An interpretive essay. J. Econ. Lit. 1971, 9, 785–797. [Google Scholar]

- Raport o Sytuacji Społeczno-Gospodarczej Województwa Śląskiego. 2021. Available online: https://katowice.stat.gov.pl/publikacje-i-foldery/inne-opracowania/raport-o-sytuacji-spoleczno-gospodarczej-wojewodztwa-slaskiego-2021,8,10.html (accessed on 17 February 2022).

- Going Global—Dolnaśląska Dyplomacja Gospodarcza. Available online: https://umwd.dolnyslask.pl/urzad/wspolpraca-z-zagranica/going-global-dolnoslaska-dyplomacja-gospodarcza/ (accessed on 27 February 2022).

- Silesia. Województwo Śląskie Informacje Gospodarcze; Urząd Marszałkowski Województwa Śląskiego: Katowice, Poland, 2018; p. 6. [Google Scholar]

- Eksport Szansą Dla Sektora MŚP. Available online: https://www.slaskie.pl/content/eksport-szansa-dla-sektora-msp (accessed on 27 February 2022).

- Kruskal, W.H.; Wallis, W.A. Use of Ranks in One-Criterion Variance Analysis. J. Am. Stat. Assoc. 1952, 47, 583–621. [Google Scholar] [CrossRef]

- Kim, T.K. Understanding one-way ANOVA using conceptual figures. Korean J. Anesthesiol. 2017, 70, 22–26. [Google Scholar] [CrossRef]

- Nahm, F.S. Nonparametric statistical tests for the continuous data: The basic concept and the practical use. Korean J. Anesthesiol. 2016, 69, 8–14. [Google Scholar] [CrossRef]

- Dunn, O.J. Multiple comparisons among means. J. Am. Stat. Assoc. 1961, 56, 52–64. [Google Scholar] [CrossRef]

- Dunn, O.J. Multiple Comparisons Using Rank Sums. Technometrics 1964, 6, 241–252. [Google Scholar] [CrossRef]

- Barrero, J.M.; Bloom, N.; Davis, S.J. Covid-19 Is Also a Reallocation Shock; No. w27137; National Bureau of Economic Research: Cambridge, MA, USA, 2020; Available online: https://www.nber.org/papers/w27137 (accessed on 20 March 2022).

- Santarelli, E.; Vivarelli, M. Is subsidizing entry an optimal policy? Ind. Corp. Chang. 2002, 11, 39–52. [Google Scholar] [CrossRef]

- The European Parliament and the Council of the European Union. Regulation (EU) No 1303/2013 of the European Parliament and of the Council of 17 December 2013 laying down common provisions on the European Regional Development Fund, the European Social Fund, the Cohesion Fund, the European Agricultural Fund for Rural Development and the European Maritime and Fisheries Fund and laying down general provisions on the European Regional Development Fund, the European Social Fund, the Cohesion Fund and the European Maritime and Fisheries Fund and repealing Council Regulation (EC) No 1083/2006. Off. J. Eur. Union 2013, L 347, 320. [Google Scholar]

- International Standard Industrial Classification of All Economic Activities Revision 4. Available online: https://unstats.un.org/unsd/publication/seriesm/seriesm_4rev4e.pdf (accessed on 17 February 2022).

- Morikawa, M. Productivity of firms using relief policies during the COVID-19 crisis. Econ. Lett. 2021, 203, 109869. [Google Scholar] [CrossRef]

- Foster, L.; Grim, C.; Haltiwanger, J. Reallocation in the great recession: Cleansing or not? J. Labor Econ. 2016, 34, S293–S331. [Google Scholar] [CrossRef]

- Landini, F. Distortions in firm selection during recessions: A comparison across European countries. Ind. Corp. Change 2016, 29, 683–712. [Google Scholar] [CrossRef]

- Torabi, S.A.; Giahi, R.; Sahebjamnia, N. An enhanced risk assessment framework for business continuity management systems. Saf. Sci. 2016, 89, 201–218. [Google Scholar] [CrossRef]

- Nicola, M.; Alsafi, Z.; Sohrabi, C.; Kerwan, A.; Al-Jabir, A.; Iosifidis, C.; Agha, M.; Agha, R. The socio-economic implications of the coronavirus pandemic (COVID-19): A review. Int. J. Surg. 2020, 78, 185–193. [Google Scholar] [CrossRef]

- Iacus, S.M.; Natale, F.; Santamaria, C.; Spyratos, S.; Vespe, M. Estimating and projecting Air passenger traffic during the COVID-19 coronavirus outbreak and its socio-economic impact. Saf. Sci. 2020, 129, 104791. [Google Scholar] [CrossRef]

- Cros, M.; Epaulard, A.; Martin, P. Will schumpeter catch COVID-19? Covid Econ. 2021, 70, 49–69. [Google Scholar]

- Gourinchas, P.O.; Kalemli-Özcan, Ṣ.; Penciakova, V.; Sander, N. COVID-19 and SME Failures; NBER Working Paper w27877; NBER: Cambridge, MA, USA, 2020. [Google Scholar]

- Lorié, J.; Ciobica, I. Coronasteun houdt vaak ook nietlevensvatbare bedrijven overeind. Econ. Stat. Ber. 2020, 105, 488–489. [Google Scholar]

- Claessens, S.; Ueda, K.; Yafeh, Y. Financial Frictions, Investment, and Institutions; Working Paper No. 10/231; IMF: Washington, DC, USA, 2010; Available online: https://ssrn.com/abstract=1750720 (accessed on 15 March 2022). [CrossRef]

- Claessens, S.; Ueda, K. Basic employment protection, bargaining power, and economic outcomes. J. Law Financ. Acc. 2020, 5, 179–229. [Google Scholar] [CrossRef]

- Tsao, Y.-C.; Thanh, V.-V.; Chang, Y.-Y.; Wei, H.-H. COVID-19: Government subsidy models for sustainable energy supply with disruption risks. Renew. Sustain. Energy Rev. 2021, 150, 111425. [Google Scholar] [CrossRef]

- Ji, Q.; Zhang, D.; Zhao, Y. Searching for safe-haven assets during the COVID-19 pandemic. Int. Rev. Financ. Anal. 2020, 71, 101526. [Google Scholar] [CrossRef]

| Type of Investment | Amount of Funding Requested | Percentage of the Project Value Covered by the Subsidy | Percentage of the Value of Eligible Costs Covered by the Subsidy |

|---|---|---|---|

| Diversification of business activities | PLN 581,208.4 | 67.3% | 83.1% |

| Implementation of innovations | PLN 603,101.8 | 67.6% | 82.1% |

| Increase in competitiveness | PLN 556,170.4 | 67.4% | 82.5% |

| Industry | Amount of Funding Requested | Percentage of the Project Value Covered by the Subsidy | Percentage of the Value of Eligible Costs Covered by the Subsidy |

|---|---|---|---|

| Wholesale and retail trade | PLN 650,842.2 | 66.7% | 81.6% |

| Production | PLN 616,473.0 | 65.2% | 80.0% |

| Services | PLN 552,907.7 | 68.4% | 83.5% |

| Comparison | Z | p Unadjusted | p Adjusted | |

|---|---|---|---|---|

| Amount of funding requested | Wholesale and retail trade—manufacturing | 0.547 | 0.585 | 1.000 |

| Wholesale and retail trade—services | 1.987 | 0.047 | 0.141 | |

| Production—services | 2.558 | 0.011 | 0.032 | |

| Share of subsidy in the project value | Wholesale and retail trade—manufacturing | 0.528 | 0.597 | 1.000 |

| Wholesale and retail trade—services | −1.213 | 0.225 | 0.675 | |

| Production—services | −3.229 | 0.001 | 0.004 | |

| Share of subsidy in the value of eligible costs | Wholesale and retail trade—manufacturing | 1.496 | 0.135 | 0.404 |

| Wholesale and retail trade—services | −0.385 | 0.700 | 1.000 | |

| Production—services | −3.594 | 0.000 | 0.001 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gródek-Szostak, Z.; Adamczyk, J.; Luc, M.; Suder, M.; Tora, J.; Kotulewicz-Wisińska, K.; Zysk, W.; Szeląg-Sikora, A. Hard Cash in Hard Times—The Effect of Institutional Support for Businesses Shaken by COVID-19. Sustainability 2022, 14, 4399. https://doi.org/10.3390/su14084399

Gródek-Szostak Z, Adamczyk J, Luc M, Suder M, Tora J, Kotulewicz-Wisińska K, Zysk W, Szeląg-Sikora A. Hard Cash in Hard Times—The Effect of Institutional Support for Businesses Shaken by COVID-19. Sustainability. 2022; 14(8):4399. https://doi.org/10.3390/su14084399

Chicago/Turabian StyleGródek-Szostak, Zofia, Jadwiga Adamczyk, Małgorzata Luc, Marcin Suder, Justyna Tora, Karolina Kotulewicz-Wisińska, Wojciech Zysk, and Anna Szeląg-Sikora. 2022. "Hard Cash in Hard Times—The Effect of Institutional Support for Businesses Shaken by COVID-19" Sustainability 14, no. 8: 4399. https://doi.org/10.3390/su14084399

APA StyleGródek-Szostak, Z., Adamczyk, J., Luc, M., Suder, M., Tora, J., Kotulewicz-Wisińska, K., Zysk, W., & Szeląg-Sikora, A. (2022). Hard Cash in Hard Times—The Effect of Institutional Support for Businesses Shaken by COVID-19. Sustainability, 14(8), 4399. https://doi.org/10.3390/su14084399