Digital Inclusive Finance, Environmental Regulation, and Regional Economic Growth: An Empirical Study Based on Spatial Spillover Effect and Panel Threshold Effect

Abstract

:1. Introduction

2. Literature Review

3. Theoretical Mechanisms and Theoretical Hypotheses

4. Data Sources and Research Methods

4.1. Index Selection

4.1.1. Explained Variable

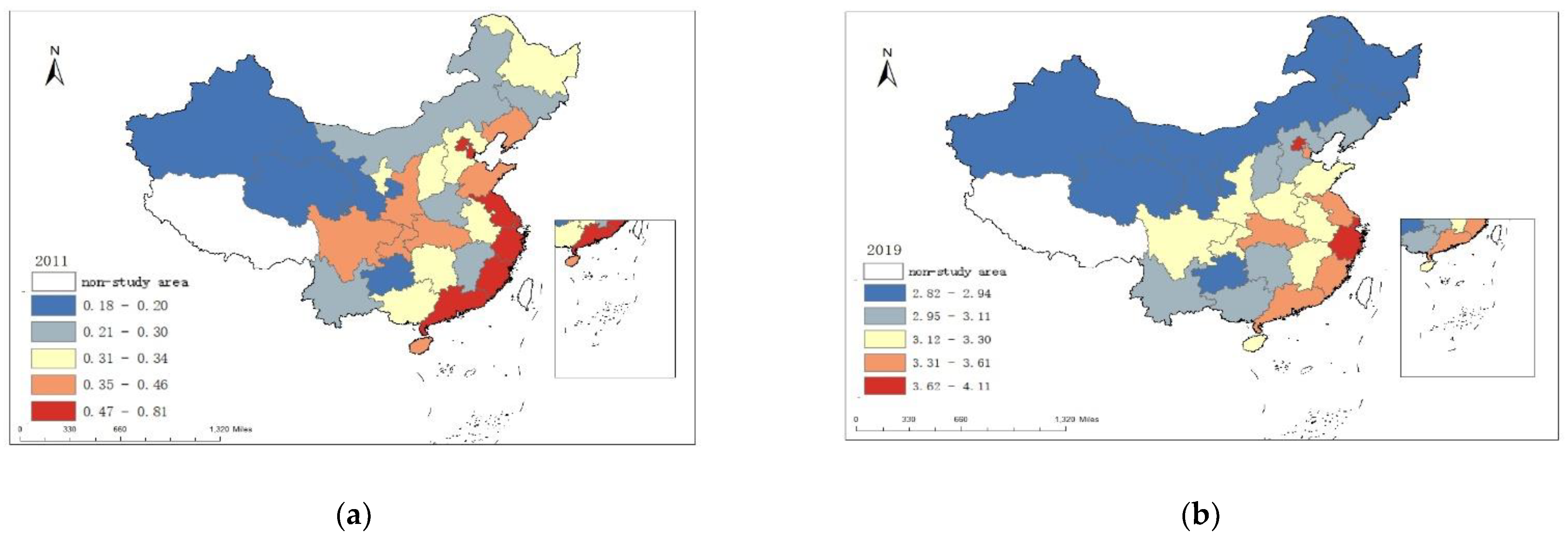

4.1.2. Core Explanatory Variable

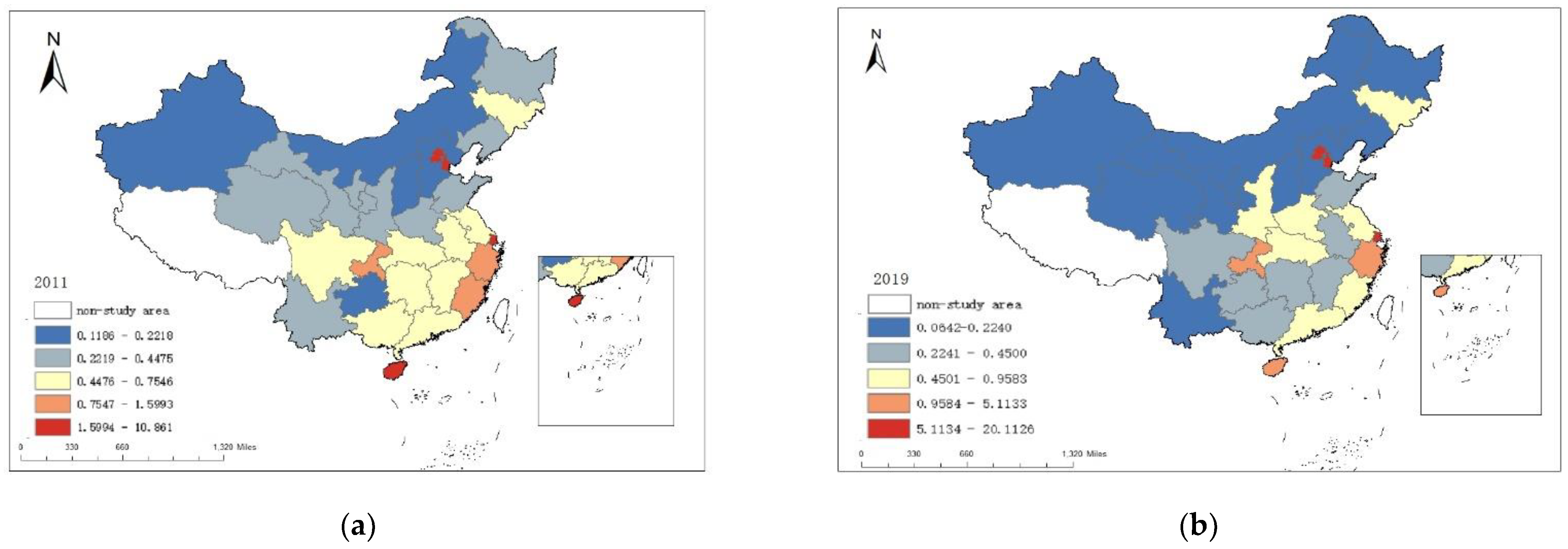

4.1.3. Control Variables

4.2. Data Description

4.3. Research Methods

4.3.1. Spatial Correlation Test

4.3.2. Model Selection and Construction

4.3.3. Panel Threshold Model

5. Empirical Results

5.1. Spatial Econometric Model

5.1.1. Spatial Correlation Test

5.1.2. Analysis of Spatial Econometric Models

5.1.3. Spatial Effect Decomposition

5.1.4. Research on Regional Space

5.2. Empirical Analysis of the Panel Threshold Mode

5.2.1. Analysis of Threshold Regression Results

5.2.2. Analysis of Thresholds by Region

6. Conclusions and Suggestions

6.1. Main Conclusions

6.2. Policy Recommendations

6.3. Research Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Ma, H.; Qu, X. Impact of Digital Financial Inclusion on the High-quality Economic Development—Based on Rural Human Capital and Digital Divide Perspective. Inq. Into Econ. Issues 2021, 10, 173–190. [Google Scholar]

- Hui, X. Digital Financial Inclusion Development and Urban Total Factor Productivity: Empirical Evidence from 278 Cities. Inv. Res. 2021, 40, 4–15. [Google Scholar]

- Imam, P.; Kpodar, K. Islamic banking: Good for growth? Econ. Model. 2016, 59, 387–401. [Google Scholar] [CrossRef]

- Brander, J.A. The Effect of Ethical Fund Portfolio Inclusion on Executive Compensation. J. Bus. Ethics 2006, 69, 317–329. [Google Scholar] [CrossRef]

- Hu, Y.; Liu, C.; Peng, J. Financial inclusion and agricultural total factor productivity growth in China. Econ. Model. 2020, 96, 68–82. [Google Scholar] [CrossRef]

- Swamy, V. Financial Inclusion, Gender Dimension, and Economic Impact on Poor Households. World Dev. 2014, 56, 1–15. [Google Scholar] [CrossRef]

- Yan, S.; Hua, W.; Hueng, J.C. Digital Financial Inclusion and Economic Growth: A Cross-country Study. Proc. Comp. Sci. 2021, 187, 218–223. [Google Scholar]

- Myovella, G.; Karacukaa, M.; Haucap, J. Digitalization and economic growth: A comparative analysis of Sub-Saharan Africa and OECD economies. Telecom. Policy 2020, 44, 101586. [Google Scholar] [CrossRef]

- Hao, Y.; Lei, H. Does Digital Inclusive Finance Drive Economic Growth?—Empirical Analysis Based on Spatial Panels. J. Cont. Financ. Res. 2018, 3, 90–101. [Google Scholar]

- Lv, J.; Ye, J.; Zhang, L. Research on Regional Differences and Effects of Coordinated Development of Digital Inclusive Finance and Real Economy. Cont. Financ. Econ. 2021, 9, 53–65. [Google Scholar]

- Yang, G.; Zhang, H. Digital Inclusive Finance, Regional Innovation and Economic Growth. Stat. Dec. 2022, 38, 155–158. [Google Scholar]

- Jiang, X.; Wang, X.; Ren, J.; Xie, Z. The Nexus between Digital Finance and Economic Development: Evidence from China. Sustainability 2021, 13, 7289. [Google Scholar] [CrossRef]

- Wang, Y.; Ye, X.; Xu, L. Can digital finance boost the real economy? Financ. Econ. 2020, 3, 1–13. [Google Scholar]

- Yang, Y.; Zhang, C. Research on Digital Inclusive Finance and China’s Regional Economic Growth Based on Spatial Dubin Model. China Bus. Trade 2021, 24, 24,109–113. [Google Scholar]

- Chu, C.; Tong, M.; Li, Y.; Fei, W. China’s Digital Inclusive Finance and Provincial Economic Growth—Empirical Research Based on Spatial Econometric Model. Inq. Into Econ. Issues 2021, 6, 179–190. [Google Scholar]

- He, Y.; Wang, M. Nonlinear and heterogeneous economic growth effects of digital financial inclusion: An empirical study based on smooth transition model and quantile model. J. Sichuan. Norm. Univ. 2021, 48, 54–64. [Google Scholar]

- Yang, L.; Lin, L.; Wu, W.; Zhang, Z.; Hsu, Y. Can digital financial inclusion promote China’s economic growth? Int. Rev. Financ. Anal. 2021, 78, 101889. [Google Scholar]

- Zhan, Y. Research on the Effect of Digital Inclusive Finance on the Quantity and Quality of Economic Growth: System GMM Estimation Based on Provincial Panel Data. Cr. Info. 2018, 36, 51–58. [Google Scholar]

- Porter, M.E. Towards a dynamic theory of strategy. SMJ 1991, 12, 95–117. [Google Scholar] [CrossRef]

- Porter, M.E.; Van Der Linde, C. Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 1995, 4, 97–118. [Google Scholar] [CrossRef] [Green Version]

- Peng, X. Strategic interaction of environmental regulation and green productivity growth in China: Green innovation or pollution refuge? Sci. Total Environ. 2020, 732, 139200. [Google Scholar] [CrossRef] [PubMed]

- Wang, K.; Li, G. On Environment—Economy Effects of Environmental Regulation. Bus. Res. 2020, 2, 34–43. [Google Scholar]

- He, X.B. Environmental regulation and China’s economic growth quality—An empirical analysis based on provincial panel data. Mod. Econ. Sci. 2018, 40, 1–10. [Google Scholar]

- Hu, Z.; Zhang, Y.; Deng, J.; Yang, Z. Research on Mechanism of and Effects of Stringent Environment Regulation on Economic Growth. J. Hunan Univ. 2021, 35, 50–59. [Google Scholar]

- Jorgenson, D.W.; Wilcoxen, P.J. Environmental regulation and U.S economic growth. RAND. J. Econ. 1990, 21, 314–340. [Google Scholar] [CrossRef]

- Gray, W.B.; Shadbegian, R.J. Plant vintage, technology, and environmental regulation. J. Environ. Econ. Manag. 2003, 46, 384–402. [Google Scholar] [CrossRef] [Green Version]

- Chong, Z.; Qin, C.; Ye, X. Environmental Regulation, Economic Network and Sustainable Growth of Urban Agglomerations in China. Sustainability 2016, 8, 467. [Google Scholar] [CrossRef] [Green Version]

- Mi, Z.; Zeng, G.; Xin, X.; Shang, Y.; Hai, J. The extension of the Porter hypothesis: Can the role of environmental regulation on economic development be affected by other dimensional regulations? J. Clean Prod. 2018, 203, 933–942. [Google Scholar]

- Li, L.; Tao, F. Selection of Optimal Environmental Regulation Intensity for Chinese Manufacturing Industry—Based on the Green TFP Perspective. China Ind. Econ. 2012, 5, 70–82. [Google Scholar]

- Yin, Q. Environmental Regulation and China’s Green Total Factor Productivities: Based on the Perspective of Vertical Specialization. China Pop. Res. Environ. 2012, 22, 60–66. [Google Scholar]

- Ji, J.; Zhang, Y.; Ren, W. Research on the relationship between Environmental Regulation Intensity and Economic Growth Rate—Based on Physical Capital and Human Capital Perspective. China Manag. Sci. 2019, 27, 57–65. [Google Scholar]

- Tang, X.; Sun, Y. The Impact of Environmental Regulation on Regional Economic Growth—From the View of Industrial Structure Rationalization and Upgrading. J. Cap. Univ. Econ. Bus. 2019, 21, 72–83. [Google Scholar]

- Xiong, Y. Research on the Relationship Between Environmental Regulation and Economic Growth Based on the Provincial Data in China. China Pop. Res. Environ. 2011, 21, 126–131. [Google Scholar]

- Cao, Y.; Wan, N.; Zhang, H.; Zhang, X.; Zhou, Q. Linking environmental regulation and economic growth through technological innovation and resource consumption: Analysis of spatial interaction patterns of urban agglomerations. Ecol. Indic. 2020, 112, 106062. [Google Scholar] [CrossRef]

- Wang, H. The Threshold Effect of Environmental Regulation on Economic Growth from the Perspective of Human Capital. China. Soft Sci. 2016, 16, 52–61. [Google Scholar]

- Ma, W.; Wu, C.; Tang, D. Environmental regulation, entrepreneurship and economic growth: An empirical study based on threshold effect test in China. Prague Econ. Pap. 2021, 30, 358–377. [Google Scholar]

- Ni, Y.; Chen, B.; Wang, Y. Financial Development, Environmental Regulation and Green Total Factor Productivity: An Empirical Analysis Based on Spatial Durbin Model. J. Guizhou Univ. Financ. Econ. 2020, 3, 12–21. [Google Scholar]

- Li, R.; Yang, Y. Environmental Regulation, Financial Resource Allocation and Green Development Efficiency. Ecol. Econ. 2020, 36, 147–152. [Google Scholar]

- Li, L.; Tian, W. Environmental Regulation, Financial Development and Industrial Structure Upgrading. Financ. Theory Explor. 2018, 6, 15–24. [Google Scholar]

- Wang, F.; Shi, X.; Liu, J.; He, X.; Chen, H. Environmental Regulation, Financial Development and Industrial Structure Upgrading. Financ. Econ. 2018, 8, 55–61. [Google Scholar]

- ShangGuan, X.; Ge, B. Digital Finance, Environmental Regulation and High-quality Economic Development. Mod. Financ. Econ. J. Tianjin Univ. Financ. Econ. 2021, 41, 84–98. [Google Scholar]

- Li, Y.; Li, F.; Li, X. Environmental Regulation, Digital Inclusive Finance and Urban Industrial Upgrading—Analysis Based on Spatial Spillover Effect and Regulation Effect. Inq. Into Econ. Issues 2022, 1, 50–66. [Google Scholar]

- Cao, S.; Nie, L.; Sun, H.; Sun, W.; Taghizadeh-Hesary, F. Digital finance, green technological innovation and energy-environmental performance: Evidence from China’s regional economies. J. Clean. Prod. 2021, 327, 129458. [Google Scholar] [CrossRef]

- Xiao, X.; Li, S. Research on the Dynamic Influence of Environmental Regulation on the Path of Industrial Upgrading. Econ. Theory Econ. Manag. 2013, 6, 102–112. [Google Scholar]

- Chen, H.; Luo, L. The Impact and Spatial Effects of Environmental Regulation on High-quality Economic Development: Based on the Intermediary Perspective of Industrial Structure Transformation. J. Beijing Inst. Technol. 2021, 23, 27–40. [Google Scholar]

- Shen, K.; Jin, G.; Fang, X. Does Environmental Regulation Cause Pollution to Transfer Nearby? Econ. Res. 2017, 52, 44–59. [Google Scholar]

- Guo, F.; Wang, J.; Wang, F.; Kong, T.; Zhang, X.; Cheng, Z. Measuring China’s Digital Financial Inclusion: Index Compilation and Spatial Characteristics. China Econ. Q. 2020, 19, 1401–1418. [Google Scholar]

- Chen, S.; Zhang, J.; Liu, C. Environmental Regulation, Financing Constraints and Enterprise Pollution Reduction: Evidence from the Adjustment of Pollution Fee Standards. J. Financ. Res. 2021, 9, 51–71. [Google Scholar]

- Hui, X. Digital Inclusive Finance and Urban Green Total Factor Productivity: Internal Mechanism and Empirical Evidence. South. China Financ. 2021, 5, 20–31. [Google Scholar]

- Zheng, W.; Zhao, H.; Zhao, M. Is the development of digital finance conducive to environmental pollution control? Concurrently discussing the regulatory impact of local resource competition. Ind. Econ. Res. 2022, 1, 1–13. [Google Scholar]

- Feng, X.; Zhang, R. Industrial Structure Change, Green Ecological Efficiency and Regional Economic Growth. Stat. Dec. 2021, 37, 104–108. [Google Scholar]

- Li, X.; Ran, G. How does the development of digital finance affect the quality of technological innovation? Mod. Econ. Res. 2021, 9, 69–77. [Google Scholar]

- Yuan, Y.; Xie, R. Research on the Effect of Environmental Regulation to Industrial Restructuring—Empirical Test Based on Provincial Panel Data of China. China Ind. Econ. 2014, 8, 57–69. [Google Scholar]

- Pei, X.; Hu, X. An Empirical Study on the Impact of Urbanization and Environmental Regulation on Industrial Structure Upgrade. Stat. Dec. 2021, 37, 102–105. [Google Scholar]

- Song, H.; Zhang, G.; Liu, C.; Yang, L. Research on the Influence of Environmental Regulation on China’s Provincial Industrial Structure Optimization. Sci. Dec.-Mak. 2020, 9, 68–85. [Google Scholar]

- Li, C.; Zhou, Y. Influence of Digital Inclusive Finance on Rural Consumption: Based on Spatial Econometric Model. Econ. Geogr. 2021, 41, 177–186. [Google Scholar]

- Li, Q.; Ding, C. Environmental regulation, spatial spillover and industrial upgrading: Evidence from the Yangtze River Economic Zone. J. Chongqing Univ. 2018, 25, 17–28. [Google Scholar]

- He, X. The Impact of Urbanization on the Quality of China’s Economic Growth: An Analysis Based on Provincial Panel Data. Urban Issues 2019, 1, 4–13. [Google Scholar]

- Tang, W.; Li, S.; Tao, Y. The Development of Digital Inclusive Finance and Industrial Structure Upgrading: Empirical Evidence from 283 Cities. J. Guangdong Univ. Financ. Econ. 2019, 34, 35–49. [Google Scholar]

- Sun, Z.; Nie, W. The impact of fiscal information transparency on regional green innovation capacity under the carbon neutrality goal: Based on the dual perspectives of spatial spillover effect and threshold effect. Sci. Technol. Progr. Policy 2021, 38, 58–66. [Google Scholar]

- Lin, G.; Long, Z.; Wu, M. A Spatial Econometric Empirical Analysis of Regional Economic Convergence in my country: 1978–2002. China Econ. Q. 2005, 4, 67–82. [Google Scholar]

- Xu, Z. Does the Development of Digital Inclusive Finance Promote Urban Innovation?—An Empirical Analysis Based on Spatial Spillover and Threshold Characteristics. South. China Financ. 2021, 2, 53–66. [Google Scholar] [CrossRef]

- Cheng, X.; Gong, Q. How the Digital Inclusive Finance Affects the Development of the Real Economy—Analysis Based on System GMM Model and Mediation Test. J. Hunan Univ. 2020, 34, 59–67. [Google Scholar]

- Li, L.; Tian, W. Digital Finance Development, Industrial Structure Transformation and Regional Economic Growth: An Empirical Analysis Based on Spatial Durbin Model. Financ. Theory. Pract. 2021, 2, 8–16. [Google Scholar]

- Chen, J. Research on the Impact of Digital Inclusive Finance on the Development of the Real Economy—Empirical Based on Provincial Panel Data. Manag. Admin. 2021, 6, 153–158. [Google Scholar]

| Variable | Definition | Obs | Mean | Std. Dev. | Min | Max | Unit |

|---|---|---|---|---|---|---|---|

| lnpgdp | Regional economic growth | 270 | 10.8081 | 0.4348 | 9.7058 | 12.0090 | CNY |

| df | Digital financial inclusion | 270 | 2.0336 | 0.9157 | 0.1833 | 4.1028 | -- |

| er | Environmental regulation | 270 | 1.8269 | 4.0204 | 0.0617 | 24.5849 | -- |

| te | Technological innovation | 270 | 3.1122 | 4.1180 | 0.0204 | 21.6469 | 10,000 pieces |

| is | Industrial structure | 270 | 0.9028 | 0.0512 | 0.7387 | 0.9973 | % |

| hc | Human capital | 270 | 0.0195 | 0.0049 | 0.0080 | 0.0345 | % |

| urb | Urbanization | 270 | 57.5142 | 12.4075 | 17.8100 | 89.6000 | % |

| gov | The degree of government intervention | 270 | 0.2490 | 0.1027 | 0.1103 | 0.6284 | % |

| fdi | Foreign direct investment | 270 | 0.0215 | 0.0166 | 0.0000 | 0.0796 | % |

| Year | Regional Economic Growth | Digital Financial Inclusion | Environmental Regulation | ||||||

|---|---|---|---|---|---|---|---|---|---|

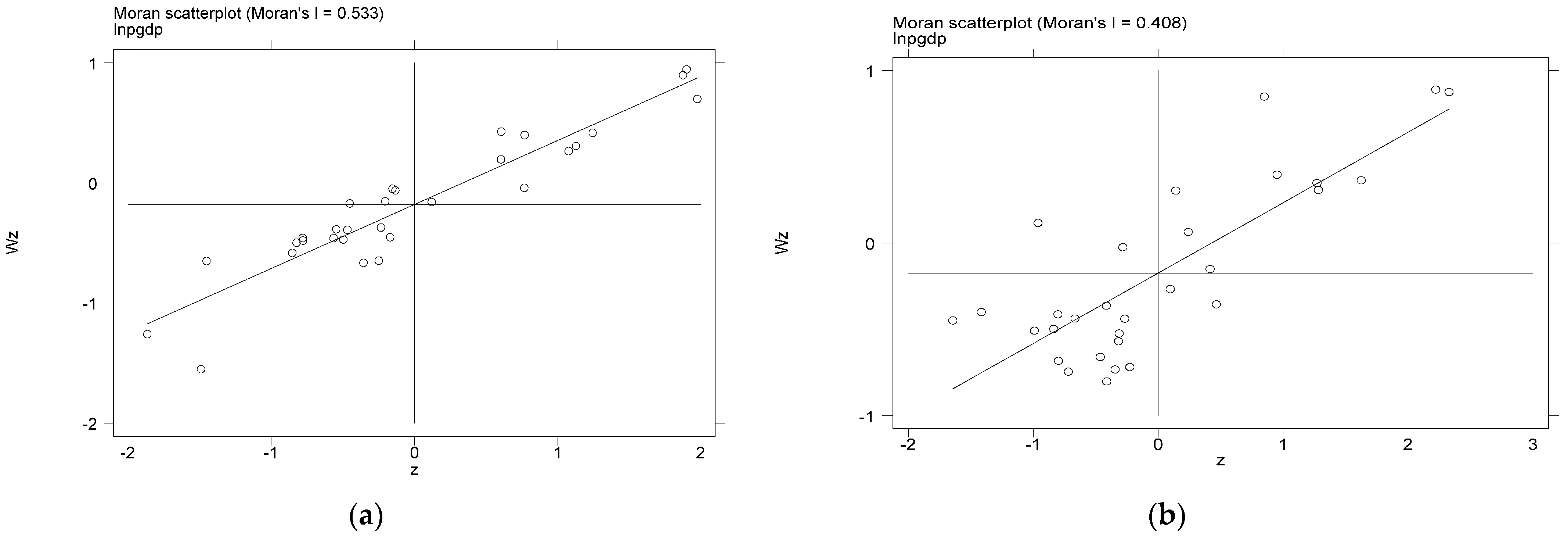

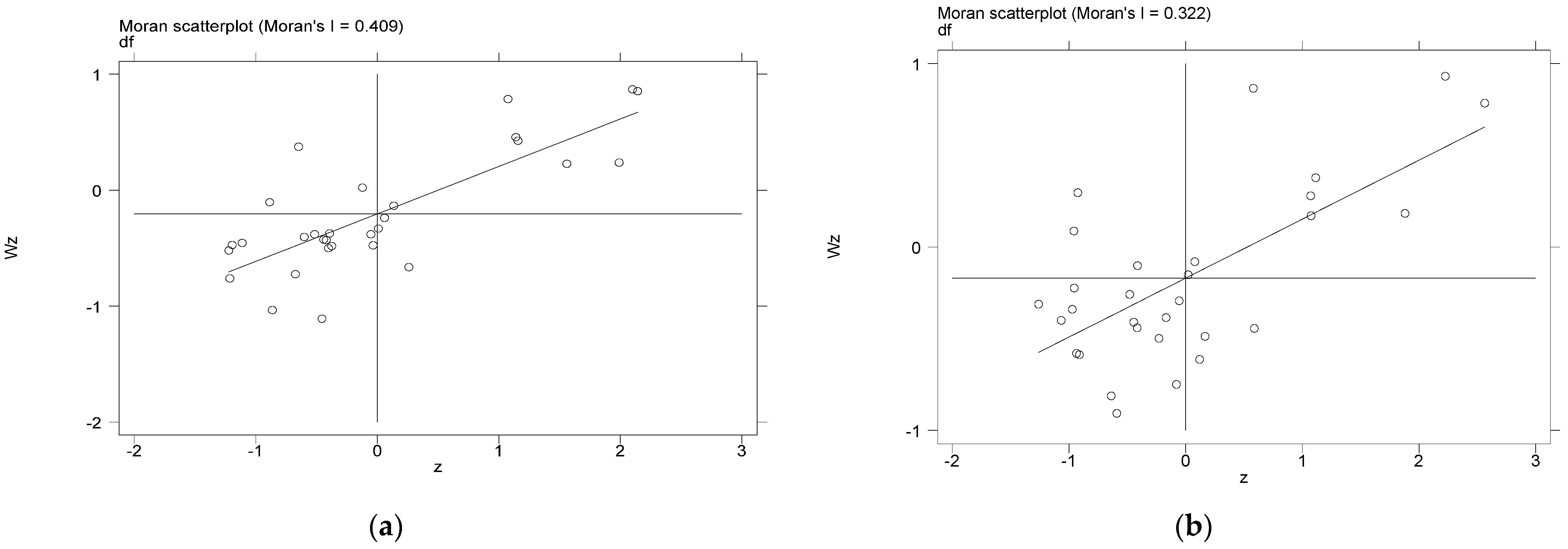

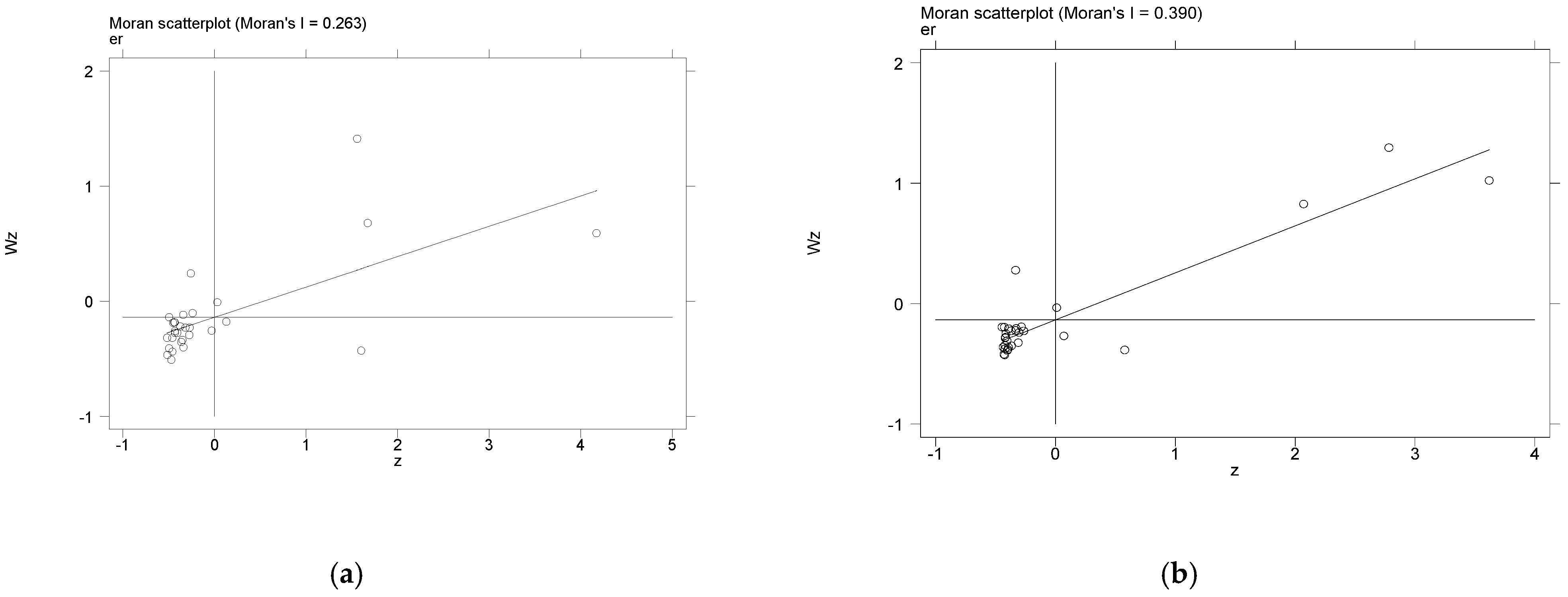

| Moran’s I | Z Value | p Value | Moran’s I | Z Value | p Value | Moran’s I | Z Value | p Value | |

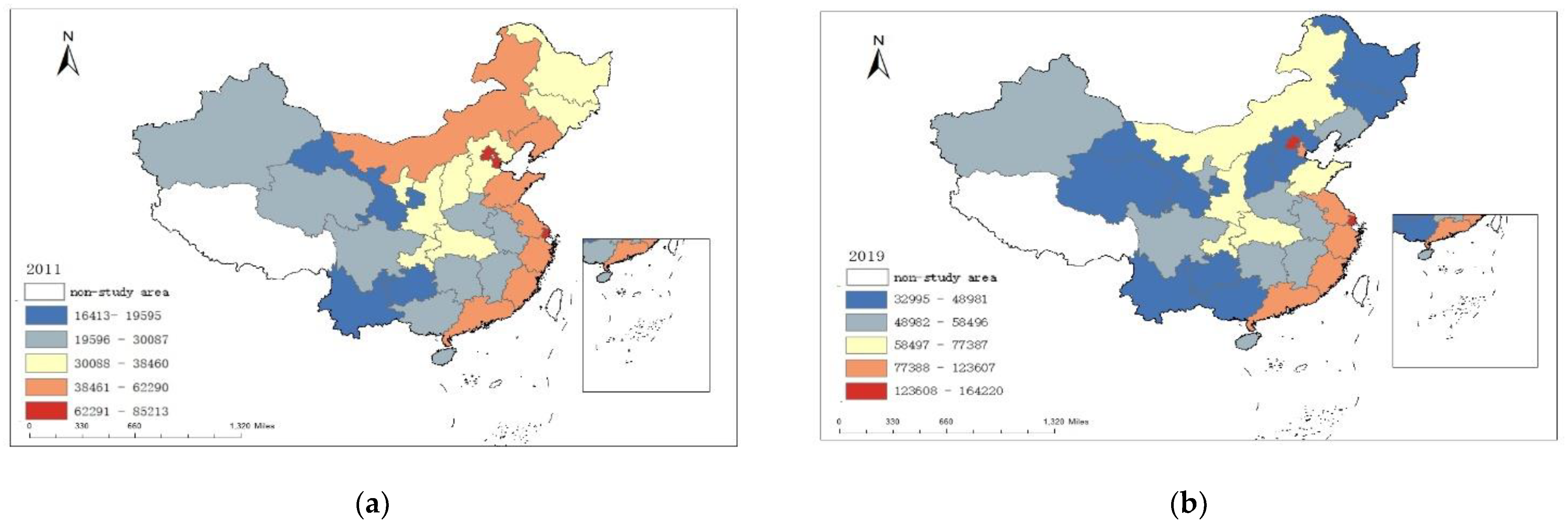

| 2011 | 0.533 | 5.380 | 0.000 | 0.409 | 4.225 | 0.000 | 0.263 | 3.490 | 0.000 |

| 2012 | 0.533 | 5.375 | 0.000 | 0.414 | 4.321 | 0.000 | 0.260 | 3.528 | 0.000 |

| 2013 | 0.537 | 5.401 | 0.000 | 0.401 | 4.215 | 0.000 | 0.241 | 3.545 | 0.000 |

| 2014 | 0.529 | 5.334 | 0.000 | 0.431 | 4.512 | 0.000 | 0.220 | 3.851 | 0.000 |

| 2015 | 0.546 | 5.477 | 0.000 | 0.440 | 4.605 | 0.000 | 0.214 | 3.809 | 0.000 |

| 2016 | 0.540 | 5.440 | 0.000 | 0.426 | 4.475 | 0.000 | 0.238 | 3.373 | 0.000 |

| 2017 | 0.513 | 5.178 | 0.000 | 0.364 | 3.877 | 0.000 | 0.351 | 4.198 | 0.000 |

| 2018 | 0.512 | 5.192 | 0.000 | 0.318 | 3.396 | 0.000 | 0.360 | 4.264 | 0.000 |

| 2019 | 0.408 | 4.226 | 0.000 | 0.322 | 0.322 | 0.000 | 0.390 | 4.637 | 0.000 |

| Variable | SDM | SEM | SAR | |||

|---|---|---|---|---|---|---|

| Model I | Model II | Model III | Model IV | Model V | Model VI | |

| df | 0.2528 *** (4.08) | 0.1892 *** (16.3) | 0.1416 *** (9.35) | |||

| er | 0.0059 ** (2.43) | 0.0081 *** (3.61) | 0.0078 *** (3.32) | |||

| dfxer | 0.0025 *** (3.91) | 0.0028 *** (4.8) | 0.0034 *** (5.36) | |||

| te | 0.0083 *** (3.23) | 0.0125 *** (4.82) | 0.0075 *** (3.04) | 0.0106 *** (4.17) | 0.0091 *** (3.62) | 0.0169 *** (6.37) |

| is | 1.9405 *** (4.91) | 2.1621 *** (5.15) | 1.9373 *** (5.2) | 2.2957 *** (6.01) | 1.8374 *** (4.88) | 2.1603 *** (5.25) |

| hc | 11.1150 *** (2.82) | 16.0666 *** (3.93) | 10.4545 *** (2.81) | 12.8462 *** (3.27) | 11.6521 *** (3) | 23.8500 *** (5.72) |

| urb | 0.0036 ** (2.32) | 0.0047 *** (2.84) | 0.0028 * (1.83) | 0.0040 ** (2.34) | 0.0037 ** (2.34) | 0.0088 *** (5.1) |

| gov | −2.2475 *** (−9.54) | −2.3418 *** (−9.67) | −2.2535 *** (−10.17) | −2.1068 *** (−8.17) | −2.1364 *** (−10.29) | −1.2151 *** (−6.11) |

| fdi | 2.2492 *** (4.71) | 2.2901 *** (4.62) | 2.2848 *** (4.87) | 1.7578 *** (3.57) | 2.3153 *** (4.81) | 1.4190 *** (2.69) |

| Cons | 5.9973 *** (5.53) | 4.2601 *** (4.29) | 8.7807 *** (25.09) | 8.6751 *** (22) | 6.5410 *** (9.45) | 1.9448 *** (4.29) |

| W * df | −0.1663 ** (−2.55) | |||||

| W * er | −0.0144 ** (−2.07) | |||||

| W * dfxer | −00130 (−0.68) | |||||

| ρ | 0.2622 *** (3.01) | 0.3807 *** (4.91) | 0.2144 *** (3.41) | 0.5683 *** (12.79) | ||

| λ | 0.3804 *** (4.55) | 0.8908 *** (38.98) | ||||

| R2 | 0.9285 | 0.9196 | 0.9189 | 0.5054 | 0.9176 | 0.8469 |

| Variable | Model I | Model II | ||||

|---|---|---|---|---|---|---|

| Direct Effect | Indirect Effect | Total Effect | Direct Effect | Indirect Effect | Total Effect | |

| df | 0.2497 *** (4.09) | −0.1312 ** (−1.96) | 0.1185 *** (4.72) | |||

| er | 0.0051 ** (2) | −0.0172 * (−1.85) | −0.0122 (−1.14) | |||

| dfxer | 0.0025 *** (3.33) | −0.0004 (−0.14) | 0.0021 (0.58) | |||

| te | 0.0096 *** (3.74) | 0.0261 *** (2.69) | 0.0358 *** (3.31) | 0.0144 *** (5.32) | 0.0355 *** (2.83) | 0.0499 *** (3.56) |

| is | 1.9264 *** (4.9) | −0.1838 (−0.22) | 1.7426 * (1.72) | 2.1761 *** (5.1) | −0.5458 (−0.51) | 1.6304 (1.23) |

| hc | 11.6836 *** (2.87) | 11.1298 (0.96) | 22.8133 * (1.69) | 17.9420 *** (4.42) | 32.6641 ** (2.29) | 50.6060 *** (3.19) |

| urb | 0.0040 ** (2.55) | 0.0086 (1.18) | 0.0126 (1.62) | 0.0059 *** (3.49) | 0.0218 *** (2.59) | 0.0277 *** (3.03) |

| gov | −2.2372 *** (−9.26) | 0.0671 (0.14) | −2.1701 *** (−4.4) | −2.2679 *** (−9.44) | 0.9769 * (1.8) | −1.2910 ** (−2.18) |

| fdi | 2.2274 *** (4.62) | 0.1919 (0.1) | 2.4193 (1.16) | 2.4499 *** (4.45) | 2.9521 (1.3) | 5.4021 ** (2.1) |

| Variable | East | Central | West | |||

|---|---|---|---|---|---|---|

| Model VII | Model VIII | Model IX | Model X | Model XI | Model XII | |

| df | 0.3770 *** (4.87) | 0.1295 (0.71) | 0.2645 *** (2.72) | |||

| er | 0.0050 ** (1.97) | 0.1834 *** (2.98) | 0.0371 ** (1.86) | |||

| dfXer | 0.0013** (2.01) | 0.0480** (2.11) | 0.0200 *** (2.88) | |||

| te | 0.0126 *** (5.02) | 0.0179 *** (7.36) | 0.0006 (0.05) | −0.0157 (−1.53) | 0.0141 (1.63) | 0.0194 ** (2.18) |

| is | 0.0304 (0.06) | 3.0089 *** (4.31) | 0.3153 (0.88) | 1.9714 * (1.85) | 1.6571 *** (2.95) | 1.6718 *** (2.76) |

| hc | 15.6458 *** (3.69) | 16.4493 ** (2.52) | −4.9819 (−0.53) | −24.0641 * (−1.95) | 32.6429 *** (5.02) | 37.8767 *** (5.44) |

| urb | 0.0105 *** (3.36) | −0.0037 (−1.05) | 0.0272 *** (4.23) | 0.0338 *** (3.43) | 0.0028 ** (2.11) | 0.0026 * (1.87) |

| gov | −2.1355 *** (−6.31) | −2.6226 *** (−7.87) | −3.2222 *** (−7.52) | −2.0096 *** (−3.09) | −1.9209 *** (−6.66) | −2.1169 *** (−7.26) |

| fdi | 1.6784 ** (2.32) | 0.9285 * (1.70) | 2.5224 (1.33) | −0.8252 (−0.37) | 2.8550 ** (2.09) | 3.2122 ** (2.04) |

| Cons | 7.5378 *** (5) | 3.2897 *** (5.27) | 8.8373 *** (5.58) | 6.6526 *** (3.86) | 11.1541 *** (5.91) | 6.6670 *** (4.37) |

| ρ | 0.2943 *** (2.69) | 0.4008 *** (4.31) | 0.0508 (0.35) | 0.0351 (0.27) | −0.0954 (−0.58) | 0.2213 * (1.68) |

| R2 | 0.9244 | 0.9549 | 0.8926 | 0.9339 | 0.9655 | 0.9574 |

| Variable | Digital Financial Inclusion as the Threshold Variable | Environmental Regulation as the Threshold Variable | ||||

|---|---|---|---|---|---|---|

| Single Threshold | Double Threshold | Triple Threshold | Single Threshold | Double Threshold | Triple Threshold | |

| 95% confidence interval of single threshold estimation | 2.7638 (2.3892, 2.7691) | 2.3536 (2.1771, 2.3753) | 0.8422 (0.7436, 0.8629) | 0.8422 (0.7149, 0.8629) | ||

| 95% confidence interval of double threshold estimation | 0.3358 (0.3341, 0.3389) | 0.1518 (0.1498, 0.1552) | ||||

| F-statistic | 22.22 | 16.82 | 11.85 | 12.89 | 7.25 | 8.24 |

| p-value | 0.0467 | 0.0133 | 0.5767 | 0.3067 | 0.58 | 0.73 |

| 10% critical value | 19.3783 | 10.3908 | 23.4653 | 17.8197 | 18.1907 | 20.9257 |

| 5% critical value | 21.4364 | 12.1664 | 27.1831 | 21.2592 | 22.3662 | 26.1239 |

| 1% critical value | 28.0512 | 17.8374 | 33.8956 | 28.7577 | 30.4831 | 36.1273 |

| Variable | Value | t-Value |

|---|---|---|

| te | 0.0300 *** | 9.2 |

| is | 3.5189 *** | 6.44 |

| hc | 55.2600 *** | 11.39 |

| urb | 0.0117 *** | 5.22 |

| gov | −1.0984 *** | −4.1 |

| fdi | 0.0652 | 0.09 |

| Cons | 6.0560 *** | 13.01 |

| er(df ≤ 0.3358) | −0.2472 *** | −3.24 |

| er(0.3358 < df ≤ 2.3536) | −0.0085 | −1.14 |

| er(2.3536 < df) | 0.0122 *** | 3.15 |

| R2 | 0.8449 | |

| Variable | East | Central | West | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Digital Financial Inclusion as the Threshold Variable | Environmental Regulation as the Threshold Variable | Digital Financial Inclusion as the Threshold Variable | Environmental Regulation as the Threshold Variable | Digital Financial Inclusion as the Threshold Variable | Environmental Regulation as the Threshold Variable | |||||||

| Value | t-Value | Value | t-Value | Value | t-Value | Value | t-Value | Value | t-Value | Value | t-Value | |

| te | 0.0292 *** | 8.38 | 0.0144 *** | 4.14 | −0.0139 | −1.47 | −0.0084 | −0.96 | 0.03452 *** | 3.69 | 0.0036 | 0.52 |

| is | 6.8975 *** | 5.47 | 4.9418 *** | 4.65 | −0.0371 | −0.03 | 3.9847*** | 3.19 | 2.8851 *** | 3.84 | 1.0409 * | 1.84 |

| hc | 26.2093 ** | 2.31 | 3.5962 | 0.4 | −12.0743 | −0.89 | −18.2380 | −1.53 | 67.1613 *** | 14.04 | 23.4818 *** | 5.02 |

| urb | 0.0144 ** | 2.57 | −0.0016 *** | −0.32 | 0.0472 *** | 4.58 | 0.0143 | 1.11 | 0.0061 *** | 3.45 | 0.0042 ** | 2.58 |

| gov | −1.4248 *** | −2.83 | −2.2528 | −5.19 | −2.2450 *** | −2.96 | −1.2179 ** | −1.94 | −0.7668 ** | −2.66 | −1.8278 *** | −7.76 |

| fdi | 1.1452 | 1.58 | 2.1431 *** | 3.61 | −3.2210 | −1.39 | −3.6244 | −1.66 | 3.6675 * | 1.8 | 0.8623 | 0.72 |

| Cons | 3.2185 *** | 3.31 | 6.4992 | 6.88 | 9.0350 *** | 8.73 | 6.7310 | 7.17 | 6.7299 *** | 10.5 | 9.3141 *** | 18.6 |

| er(df ≤ 2.7638) | 0.0112 *** | 2.90 | ||||||||||

| er(2.7638 < df) | 0.0220 *** | 6.56 | ||||||||||

| er(df ≤ 0.2889) | −0.5541 *** | −4.55 | ||||||||||

| er(0.2889 < df) | 0.0898 *** | 3.06 | ||||||||||

| Single threshold (F/P) | 20.73 ** | 0.0533 | 15.80 | 0.1233 | 13.51 | 0.2067 | 8.24 | 0.33 | 35.36 *** | 0 | 15.61 | 0.19 |

| Double threshold (F/P) | 7.87 | 0.2167 | 10.91 | 0.1500 | 7.8 | 0.3933 | 4.28 | 0.62 | 11.45 | 0.2 | 7.43 | 0.4633 |

| Triple threshold | 4.50 | 0.5600 | 4.62 | 0.9067 | 12.83 | 0.5367 | 3.65 | 0.8033 | 4.32 | 0.7867 | 4.95 | 0.66 |

| Number of thresholds (F/P) | single threshold | no threshold | no threshold | no threshold | single threshold | no threshold | ||||||

| Value of the threshold | 2.7638 | 0.2889 | ||||||||||

| confidence interval | (2.5659,2.7811) | (0.2263,0.3131) | ||||||||||

| R2 | 0.8764 | 0.9261 | 0.9270 | 0.9409 | 0.9246 | 0.9645 | ||||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ding, R.; Shi, F.; Hao, S. Digital Inclusive Finance, Environmental Regulation, and Regional Economic Growth: An Empirical Study Based on Spatial Spillover Effect and Panel Threshold Effect. Sustainability 2022, 14, 4340. https://doi.org/10.3390/su14074340

Ding R, Shi F, Hao S. Digital Inclusive Finance, Environmental Regulation, and Regional Economic Growth: An Empirical Study Based on Spatial Spillover Effect and Panel Threshold Effect. Sustainability. 2022; 14(7):4340. https://doi.org/10.3390/su14074340

Chicago/Turabian StyleDing, Rijia, Fenfen Shi, and Suli Hao. 2022. "Digital Inclusive Finance, Environmental Regulation, and Regional Economic Growth: An Empirical Study Based on Spatial Spillover Effect and Panel Threshold Effect" Sustainability 14, no. 7: 4340. https://doi.org/10.3390/su14074340

APA StyleDing, R., Shi, F., & Hao, S. (2022). Digital Inclusive Finance, Environmental Regulation, and Regional Economic Growth: An Empirical Study Based on Spatial Spillover Effect and Panel Threshold Effect. Sustainability, 14(7), 4340. https://doi.org/10.3390/su14074340