Can Digital Finance Contribute to the Promotion of Financial Sustainability? A Financial Efficiency Perspective

Abstract

:1. Introduction

2. Literature Review and Research Hypotheses

2.1. Conceptualization

2.2. Literature Review

2.3. Research Hypotheses

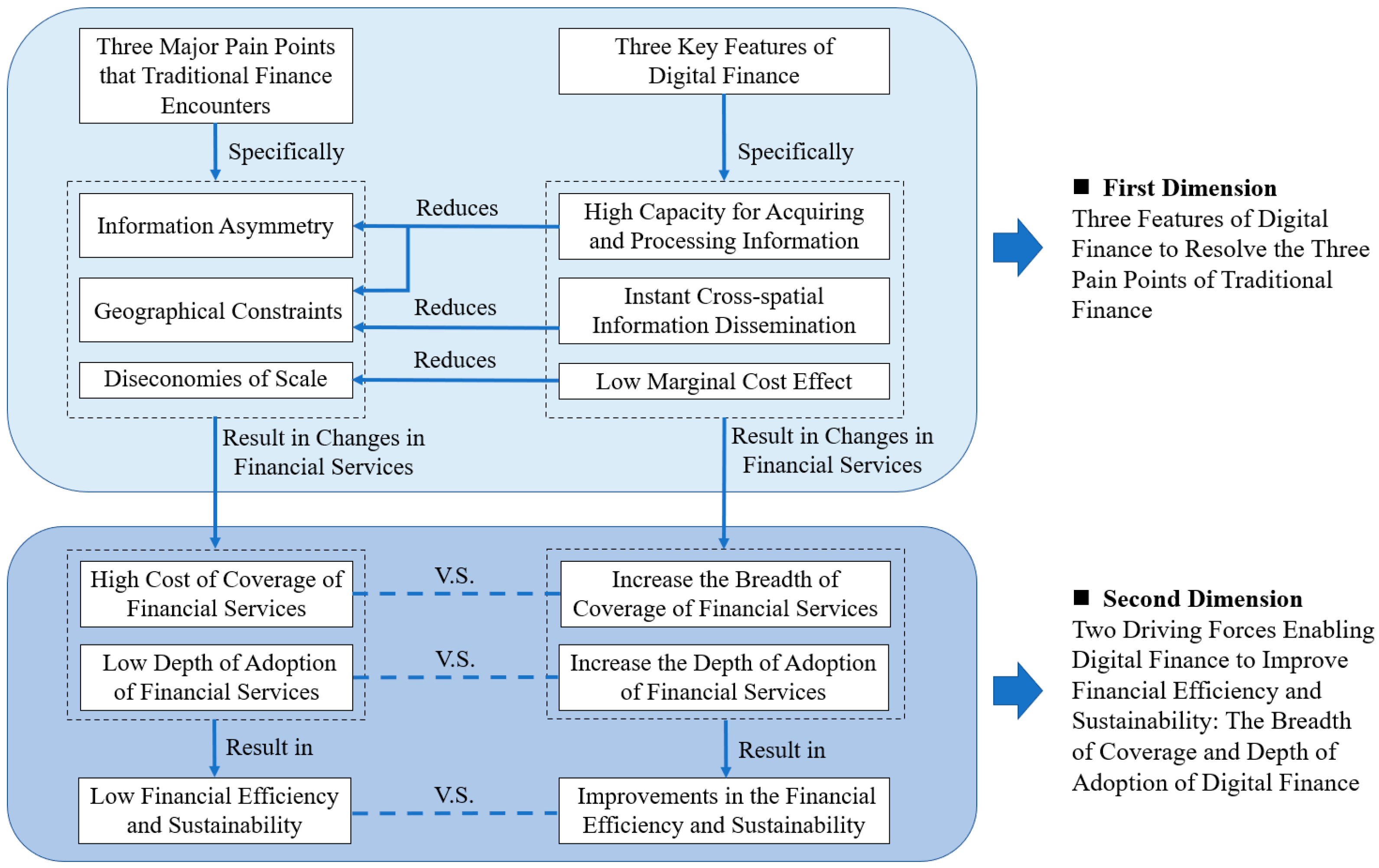

2.3.1. Three Features of Digital Finance to Resolve the Three Pain Points of Traditional Finance

2.3.2. Two Driving Forces Enabling Digital Finance to Improve Financial Efficiency and Sustainability: The Breadth of Coverage and Depth of Adoption of Digital Finance

3. Data and Methodology

3.1. Data Description

- (i)

- The Peking University Digital Financial Inclusion Index of China (PKU-DFIIC) [31] is used as a measurement of digital financial development in different regions of China in this paper. The index is released by the Institute of Digital Finance Peking University and derived from the underlying transaction account data from the Chinese digital financial giant Ant Group. It involves three sub-indexes (i.e., first-level dimensions), including breadth of coverage, depth of adoption, and level of digitization. Specifically, the breadth of coverage refers to account coverage, which is measured by three specific indicators such as the number of Alipay accounts per 10,000 people, the proportion of Alipay users who link their Alipay account to bank cards, and the average number of bank cards linked to each Alipay account; the depth of adoption considers the adoption of financial services such as payment, money market fund, loans (personal consumption loan and MSME loan), insurance, investment, and credit investigation, which is measured by 20 specific indicators such as the number of payment transactions per user and the number of purchase transaction of Yu’e Bao per user; the level of digitalization is comprised of four second-level dimensions, which are mobilization, affordability, credit-backed spending, and convenience, including 10 specific indicators such as the proportion of mobile payment transactions, and the average interest rate for MSME loans (cf. Appendix A for details). In addition, the index is calculated by the coefficient of variation method for analytic hierarchy processes. Currently, the index is the predominant choice of data source to study digital finance for Chinese scholars [12,33,34,48].

- (ii)

- Macroeconomic data at the provincial level, which includes GDP per capita, social financing scale, urbanization rate, population, and total imports and exports, is derived from sources such as China’s regional statistical yearbooks, the WIND database, the Guotaian database (CSMAR), and the Tong Hua Shun-iFind database.

3.2. Constructing Financial Efficiency Measurement Models

3.2.1. DEA-BCC Model

3.2.2. Super-Efficiency DEA Model

3.3. Econometric Model

4. Empirical Results and Discussions

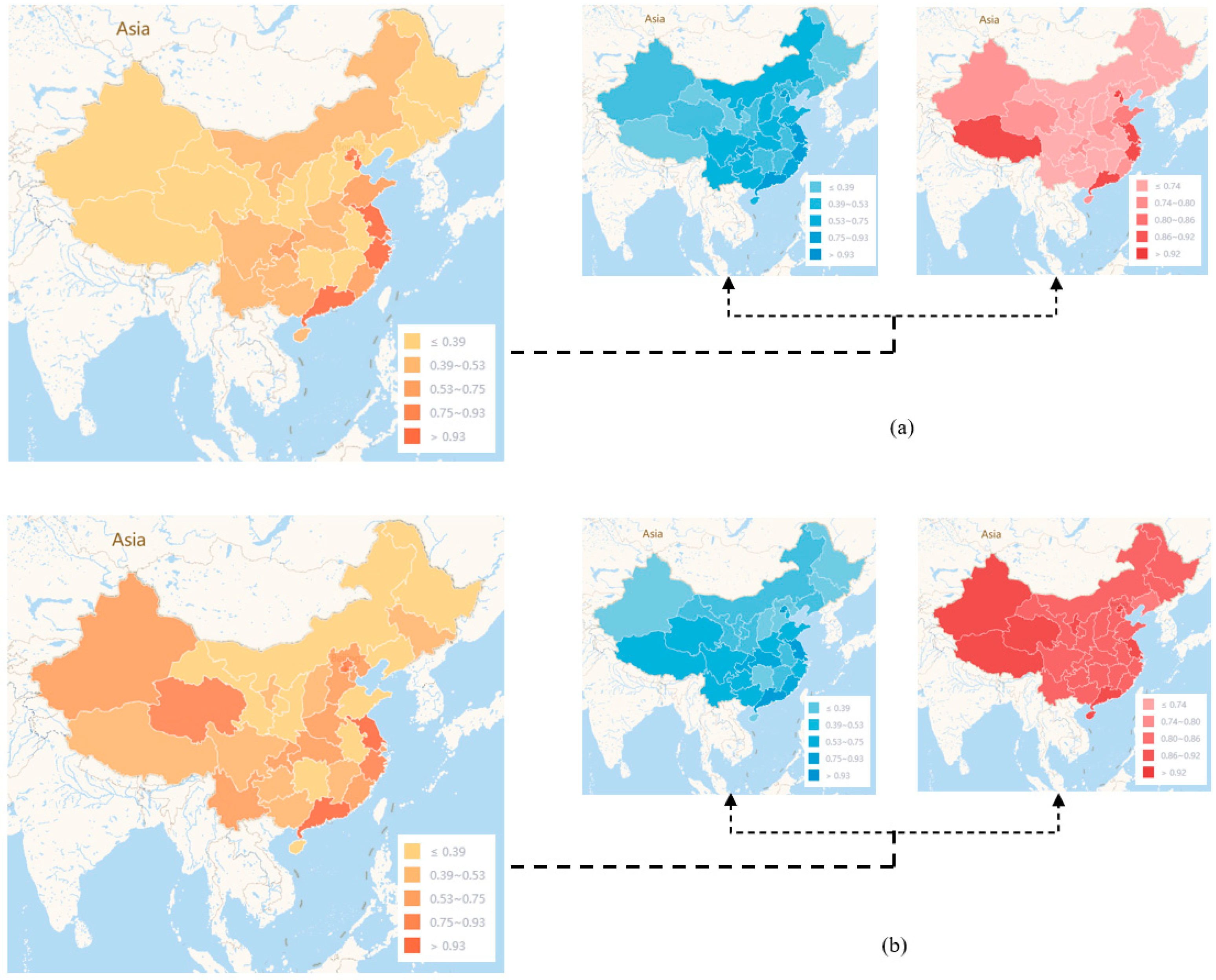

4.1. Financial Efficiency Analysis by Time and Space

4.1.1. Regional Financial Efficiency Analysis Based on the DEA-BCC Model

4.1.2. Regional Financial Efficiency Analysis Based on the Super-Efficiency DEA Model

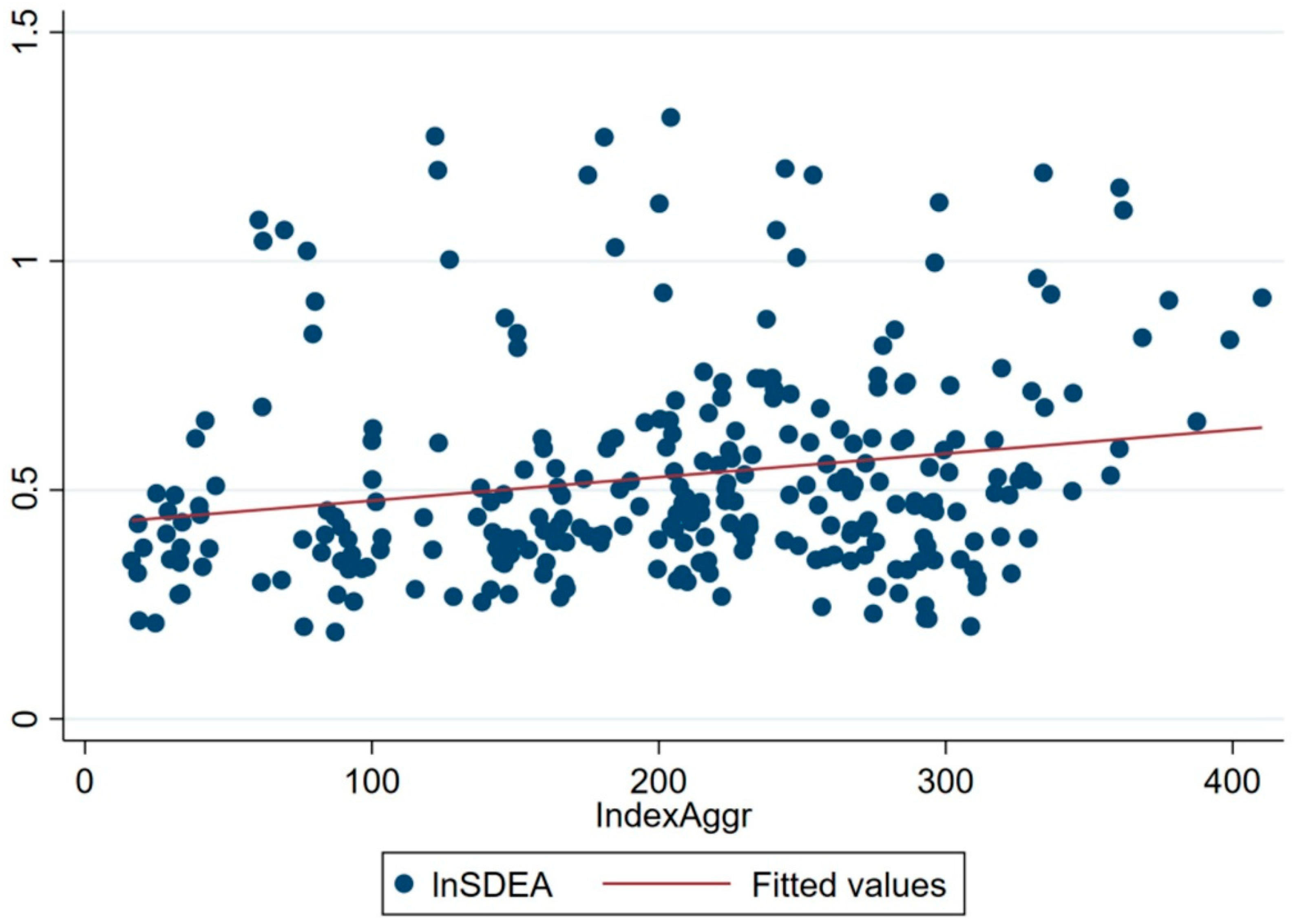

4.2. Impact of Digital Financial Development on Financial Efficiency

4.3. Impact of Breadth of Coverage and Depth of Adoption of Digital Finance on Financial Efficiency

4.4. Robustness Checks

4.4.1. Instrumental Variable Regression

4.4.2. Alternative Estimation Model

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| First-Level Dimension | Second-Level Dimension | Specific Indicator |

|---|---|---|

| Breadth of coverage | Account coverage | The number of Alipay accounts per 10,000 people |

| The proportion of Alipay users who link their Alipay account to bank cards | ||

| The average number of bank cards linked to each Alipay account | ||

| Depth of adoption | Payment | The number of payment transactions per user |

| The amount of payment transactions per user | ||

| High frequency (active 50 times a year and above) active users as a percentage of those active 1 time a year and above | ||

| Money market fund | The number of purchase transaction of Yu’e Bao per user | |

| The amount of shares purchased of Yu’e Bao per user | ||

| The number of users who have purchased Yu’e Bao per 10,000 Alipay users | ||

| Personal consumption loan | The number of users who have personal consumption loans per 10,000 Alipay adult users | |

| The number of personal consumption loans per user | ||

| The amount of personal consumption loans per user | ||

| MSME loan | The number of users who have MSME loans per 10,000 Alipay adult users | |

| The number of MSME loans per enterprise | ||

| The amount of MSME loans per enterprise | ||

| Insurance | The number of users who have purchased insurance per 10,000 Alipay users | |

| The number of purchase transaction of insurance per user | ||

| The amount of purchase transaction of insurance per user | ||

| Investment | The number of users who have involved in online investments per 10,000 Alipay users | |

| The number of online investments per user | ||

| The amount of online investments per user | ||

| Credit investigation | The number of credit report inquiries per user | |

| The number of users who have used credit-based services (including finance, accommodation, travel, social, etc.) per 10,000 Alipay users | ||

| Level of digitalization | Mobilization | The proportion of mobile payment transactions |

| The proportion of mobile payment amounts | ||

| Affordability | Average interest rate for MSME loans | |

| Average interest rate for personal consumption loans | ||

| Credit-backed spending | The proportion of Ant credit pay transactions | |

| The proportion of Ant credit pay amounts | ||

| The proportion of Sesame credit transactions without security deposits | ||

| The proportion of Sesame credit amounts without security deposits | ||

| Convenience | The proportion of QR code payment transactions | |

| The proportion of QR code payment amounts |

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | Mean | |

|---|---|---|---|---|---|---|---|---|---|---|

| Jiangsu | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| Guangdong | 1.000 | 1.000 | 1.000 | 0.931 | 1.000 | 1.000 | 0.997 | 0.963 | 1.000 | 0.988 |

| Tianjin | 0.912 | 0.811 | 0.735 | 0.745 | 0.816 | 0.850 | 0.928 | 0.914 | 0.920 | 0.848 |

| Shanghai | 1.000 | 1.000 | 1.000 | 1.000 | 0.873 | 0.710 | 0.606 | 0.609 | 0.498 | 0.811 |

| Beijing | 0.841 | 0.843 | 0.758 | 0.744 | 0.724 | 0.736 | 0.716 | 0.833 | 0.828 | 0.780 |

| Zhejiang | 0.652 | 0.607 | 0.591 | 0.613 | 0.702 | 0.744 | 0.749 | 0.728 | 0.523 | 0.657 |

| Chongqing | 1.000 | 0.876 | 0.696 | 0.587 | 0.528 | 0.511 | 0.527 | 0.532 | 0.649 | 0.656 |

| Fujian | 0.681 | 0.603 | 0.609 | 0.593 | 0.622 | 0.604 | 0.587 | 0.680 | 0.590 | 0.619 |

| Hubei | 0.465 | 0.474 | 0.506 | 0.520 | 0.629 | 0.701 | 0.729 | 0.766 | 0.712 | 0.611 |

| Yunnan | 0.493 | 0.455 | 0.505 | 0.547 | 0.652 | 0.668 | 0.679 | 0.613 | 0.610 | 0.580 |

| Shandong | 0.613 | 0.635 | 0.613 | 0.591 | 0.554 | 0.577 | 0.558 | 0.539 | 0.541 | 0.580 |

| Sichuan | 0.446 | 0.523 | 0.544 | 0.525 | 0.563 | 0.569 | 0.601 | 0.549 | 0.493 | 0.535 |

| Qinghai | 0.319 | 0.298 | 0.440 | 0.491 | 0.648 | 0.655 | 0.720 | 0.633 | 0.469 | 0.519 |

| Guangxi | 0.430 | 0.419 | 0.474 | 0.488 | 0.507 | 0.504 | 0.516 | 0.476 | 0.387 | 0.467 |

| Henan | 0.404 | 0.402 | 0.408 | 0.438 | 0.540 | 0.477 | 0.503 | 0.474 | 0.489 | 0.459 |

| Ningxia | 0.346 | 0.303 | 0.283 | 0.369 | 0.501 | 0.623 | 0.490 | 0.613 | 0.459 | 0.443 |

| Tibet | 0.489 | 0.441 | 0.441 | 0.423 | 0.450 | 0.446 | 0.467 | 0.433 | 0.396 | 0.443 |

| Guizhou | 0.426 | 0.392 | 0.370 | 0.369 | 0.464 | 0.484 | 0.511 | 0.518 | 0.377 | 0.435 |

| Inner Mongolia | 0.454 | 0.392 | 0.397 | 0.417 | 0.474 | 0.534 | 0.557 | 0.418 | 0.219 | 0.429 |

| Jiangxi | 0.349 | 0.327 | 0.339 | 0.399 | 0.472 | 0.515 | 0.497 | 0.453 | 0.398 | 0.417 |

| Anhui | 0.342 | 0.328 | 0.394 | 0.403 | 0.429 | 0.412 | 0.418 | 0.452 | 0.522 | 0.411 |

| Hainan | 0.509 | 0.369 | 0.440 | 0.385 | 0.392 | 0.419 | 0.387 | 0.327 | 0.395 | 0.403 |

| Liaoning | 0.372 | 0.396 | 0.411 | 0.422 | 0.475 | 0.429 | 0.413 | 0.344 | 0.306 | 0.396 |

| Xinjiang | 0.374 | 0.363 | 0.373 | 0.388 | 0.413 | 0.385 | 0.378 | 0.358 | 0.467 | 0.389 |

| Shanxi | 0.374 | 0.359 | 0.382 | 0.386 | 0.448 | 0.428 | 0.423 | 0.274 | 0.202 | 0.364 |

| Shaanxi | 0.332 | 0.332 | 0.360 | 0.399 | 0.397 | 0.368 | 0.345 | 0.347 | 0.318 | 0.355 |

| Hebei | 0.347 | 0.345 | 0.343 | 0.342 | 0.327 | 0.341 | 0.353 | 0.327 | 0.348 | 0.341 |

| Gansu | 0.215 | 0.201 | 0.267 | 0.316 | 0.392 | 0.421 | 0.390 | 0.403 | 0.466 | 0.341 |

| Hunan | 0.271 | 0.256 | 0.272 | 0.295 | 0.304 | 0.318 | 0.358 | 0.326 | 0.289 | 0.299 |

| Jilin | 0.209 | 0.190 | 0.255 | 0.265 | 0.316 | 0.346 | 0.347 | 0.289 | 0.247 | 0.274 |

| Heilongjiang | 0.274 | 0.271 | 0.282 | 0.285 | 0.300 | 0.267 | 0.245 | 0.230 | 0.220 | 0.264 |

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | Mean | |

|---|---|---|---|---|---|---|---|---|---|---|

| Jiangsu | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| Guangdong | 1.000 | 1.000 | 1.000 | 0.961 | 1.000 | 1.000 | 0.997 | 0.984 | 1.000 | 0.994 |

| Tianjin | 0.956 | 0.865 | 0.822 | 0.796 | 0.864 | 0.871 | 0.944 | 0.931 | 0.920 | 0.885 |

| Shanghai | 1.000 | 1.000 | 1.000 | 1.000 | 0.971 | 0.829 | 0.680 | 0.686 | 0.567 | 0.859 |

| Beijing | 0.894 | 0.882 | 0.825 | 0.789 | 0.777 | 0.780 | 0.754 | 0.846 | 0.840 | 0.821 |

| Zhejiang | 0.876 | 0.781 | 0.778 | 0.729 | 0.864 | 0.870 | 0.841 | 0.818 | 0.593 | 0.794 |

| Chongqing | 0.909 | 0.785 | 0.806 | 0.716 | 0.774 | 0.718 | 0.671 | 0.762 | 0.663 | 0.756 |

| Fujian | 1.000 | 0.929 | 0.808 | 0.682 | 0.638 | 0.604 | 0.603 | 0.608 | 0.727 | 0.733 |

| Hubei | 0.651 | 0.628 | 0.669 | 0.620 | 0.761 | 0.799 | 0.805 | 0.847 | 0.802 | 0.731 |

| Yunnan | 0.694 | 0.615 | 0.685 | 0.652 | 0.813 | 0.791 | 0.762 | 0.689 | 0.688 | 0.710 |

| Shandong | 0.744 | 0.743 | 0.728 | 0.671 | 0.648 | 0.653 | 0.620 | 0.601 | 0.607 | 0.668 |

| Sichuan | 0.614 | 0.655 | 0.682 | 0.618 | 0.677 | 0.647 | 0.659 | 0.606 | 0.560 | 0.635 |

| Qinghai | 0.612 | 0.565 | 0.642 | 0.585 | 0.634 | 0.599 | 0.585 | 0.538 | 0.444 | 0.578 |

| Guangxi | 0.413 | 0.372 | 0.557 | 0.536 | 0.752 | 0.717 | 0.720 | 0.646 | 0.478 | 0.577 |

| Henan | 0.541 | 0.517 | 0.535 | 0.521 | 0.651 | 0.552 | 0.565 | 0.537 | 0.560 | 0.553 |

| Ningxia | 0.584 | 0.515 | 0.498 | 0.442 | 0.585 | 0.578 | 0.578 | 0.578 | 0.431 | 0.532 |

| Tibet | 0.636 | 0.530 | 0.544 | 0.501 | 0.596 | 0.634 | 0.628 | 0.468 | 0.249 | 0.532 |

| Guizhou | 0.502 | 0.453 | 0.477 | 0.485 | 0.598 | 0.619 | 0.574 | 0.525 | 0.461 | 0.522 |

| Inner Mongolia | 0.654 | 0.566 | 0.577 | 0.474 | 0.531 | 0.495 | 0.487 | 0.449 | 0.413 | 0.516 |

| Jiangxi | 0.494 | 0.453 | 0.539 | 0.492 | 0.545 | 0.498 | 0.482 | 0.515 | 0.596 | 0.513 |

| Anhui | 0.528 | 0.530 | 0.554 | 0.511 | 0.586 | 0.515 | 0.476 | 0.401 | 0.359 | 0.496 |

| Hainan | 0.665 | 0.466 | 0.563 | 0.421 | 0.458 | 0.463 | 0.419 | 0.336 | 0.407 | 0.466 |

| Liaoning | 0.546 | 0.503 | 0.519 | 0.483 | 0.555 | 0.506 | 0.477 | 0.314 | 0.233 | 0.460 |

| Xinjiang | 0.481 | 0.457 | 0.498 | 0.483 | 0.503 | 0.443 | 0.395 | 0.397 | 0.364 | 0.447 |

| Shanxi | 0.346 | 0.303 | 0.283 | 0.369 | 0.501 | 0.623 | 0.490 | 0.613 | 0.459 | 0.443 |

| Shaanxi | 0.475 | 0.446 | 0.469 | 0.424 | 0.476 | 0.419 | 0.395 | 0.374 | 0.485 | 0.440 |

| Hebei | 0.309 | 0.279 | 0.374 | 0.382 | 0.502 | 0.511 | 0.446 | 0.459 | 0.542 | 0.423 |

| Gansu | 0.481 | 0.455 | 0.459 | 0.411 | 0.410 | 0.407 | 0.404 | 0.374 | 0.402 | 0.423 |

| Hunan | 0.391 | 0.354 | 0.380 | 0.359 | 0.386 | 0.384 | 0.411 | 0.374 | 0.334 | 0.375 |

| Jilin | 0.309 | 0.267 | 0.359 | 0.323 | 0.405 | 0.417 | 0.394 | 0.326 | 0.280 | 0.342 |

| Heilongjiang | 0.390 | 0.366 | 0.386 | 0.342 | 0.378 | 0.320 | 0.275 | 0.260 | 0.249 | 0.330 |

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | Mean | |

|---|---|---|---|---|---|---|---|---|---|---|

| Jiangsu | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| Guangdong | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| Tianjin | 1.000 | 1.000 | 1.000 | 0.969 | 1.000 | 1.000 | 1.000 | 0.978 | 1.000 | 0.994 |

| Shanghai | 0.954 | 0.937 | 0.895 | 0.936 | 0.944 | 0.976 | 0.983 | 0.982 | 1.000 | 0.956 |

| Beijing | 0.941 | 0.955 | 0.919 | 0.943 | 0.932 | 0.943 | 0.950 | 0.985 | 0.986 | 0.950 |

| Zhejiang | 1.000 | 1.000 | 1.000 | 1.000 | 0.899 | 0.856 | 0.891 | 0.889 | 0.877 | 0.935 |

| Chongqing | 0.772 | 0.803 | 0.791 | 0.916 | 0.861 | 0.914 | 1.000 | 0.980 | 0.982 | 0.891 |

| Fujian | 1.000 | 0.943 | 0.862 | 0.860 | 0.828 | 0.846 | 0.874 | 0.874 | 0.894 | 0.887 |

| Hubei | 0.787 | 0.815 | 0.796 | 0.915 | 0.869 | 0.919 | 0.957 | 0.957 | 0.962 | 0.886 |

| Yunnan | 0.766 | 0.793 | 0.782 | 0.915 | 0.856 | 0.906 | 0.924 | 0.972 | 0.968 | 0.876 |

| Shandong | 0.823 | 0.854 | 0.841 | 0.881 | 0.856 | 0.884 | 0.901 | 0.898 | 0.890 | 0.870 |

| Sichuan | 0.748 | 0.780 | 0.765 | 0.893 | 0.848 | 0.902 | 0.959 | 0.964 | 0.959 | 0.869 |

| Qinghai | 0.727 | 0.799 | 0.798 | 0.849 | 0.832 | 0.880 | 0.912 | 0.907 | 0.881 | 0.843 |

| Guangxi | 0.748 | 0.778 | 0.762 | 0.840 | 0.830 | 0.863 | 0.891 | 0.882 | 0.874 | 0.830 |

| Henan | 0.714 | 0.755 | 0.756 | 0.838 | 0.826 | 0.877 | 0.907 | 0.905 | 0.887 | 0.829 |

| Ningxia | 0.744 | 0.777 | 0.759 | 0.841 | 0.813 | 0.855 | 0.891 | 0.890 | 0.881 | 0.828 |

| Tibet | 0.750 | 0.768 | 0.756 | 0.829 | 0.804 | 0.841 | 0.876 | 0.893 | 0.891 | 0.823 |

| Guizhou | 0.730 | 0.761 | 0.742 | 0.835 | 0.794 | 0.837 | 0.883 | 0.896 | 0.876 | 0.817 |

| Inner Mongolia | 0.710 | 0.740 | 0.737 | 0.840 | 0.803 | 0.845 | 0.890 | 0.889 | 0.888 | 0.816 |

| Jiangxi | 0.713 | 0.740 | 0.729 | 0.832 | 0.795 | 0.842 | 0.887 | 0.894 | 0.878 | 0.812 |

| Anhui | 0.722 | 0.758 | 0.746 | 0.832 | 0.798 | 0.839 | 0.872 | 0.874 | 0.867 | 0.812 |

| Hainan | 0.703 | 0.742 | 0.731 | 0.833 | 0.794 | 0.837 | 0.889 | 0.887 | 0.883 | 0.811 |

| Liaoning | 0.702 | 0.741 | 0.738 | 0.834 | 0.800 | 0.841 | 0.883 | 0.883 | 0.872 | 0.810 |

| Xinjiang | 0.706 | 0.748 | 0.743 | 0.825 | 0.811 | 0.833 | 0.868 | 0.859 | 0.853 | 0.805 |

| Shanxi | 0.685 | 0.713 | 0.737 | 0.799 | 0.807 | 0.845 | 0.887 | 0.873 | 0.867 | 0.801 |

| Shaanxi | 0.691 | 0.727 | 0.722 | 0.827 | 0.790 | 0.831 | 0.873 | 0.873 | 0.873 | 0.801 |

| Hebei | 0.692 | 0.724 | 0.730 | 0.820 | 0.788 | 0.828 | 0.867 | 0.879 | 0.875 | 0.800 |

| Gansu | 0.678 | 0.711 | 0.711 | 0.822 | 0.781 | 0.828 | 0.882 | 0.887 | 0.883 | 0.798 |

| Hunan | 0.695 | 0.724 | 0.717 | 0.820 | 0.786 | 0.828 | 0.873 | 0.871 | 0.866 | 0.798 |

| Jilin | 0.694 | 0.722 | 0.715 | 0.827 | 0.781 | 0.825 | 0.875 | 0.878 | 0.860 | 0.797 |

| Heilongjiang | 0.695 | 0.721 | 0.712 | 0.824 | 0.789 | 0.831 | 0.865 | 0.864 | 0.862 | 0.796 |

| Variables | Test | ADF Value | Stationarity |

|---|---|---|---|

| lnSDEA | (c,0,0) | 233.27 *** | stationary |

| IndexAggr | (c,0,0) | 257.94 *** | stationary |

| IndexCover | (c,0,0) | 200.73 *** | stationary |

| IndexUser | (c,0,0) | 259.34 *** | stationary |

| AveGDP | (c,0,0) | 336.96 *** | stationary |

| FDIRt | (c,0,0) | 198.54 *** | stationary |

| GovExpenRt | (c,0,0) | 250.25 *** | stationary |

| Urbaniz | (c,0,0) | 272.09 *** | stationary |

| StudNum | (c,0,0) | 202.34 *** | stationary |

| lnAveHousingPrice | (c,0,0) | 301.02 *** | stationary |

| lnPopulation | (c,0,0) | 179.75 *** | stationary |

| Savings | (c,0,0) | 217.13 *** | stationary |

| lnRetailSale | (c,0,0) | 273.68 *** | stationary |

| lnLoan | (c,0,0) | 183.44 *** | stationary |

References

- Bruhn, M.; Hommes, M.; Khanna, M.; Singh, S.; Sorokina, A.; Wimpey, J. MSME Finance Gap: Assessment of the Shortfalls and Opportunities in Financing Micro, Small, and Medium Enterprises in Emerging Markets; World Bank: Washington, DC, USA, 2017. [Google Scholar]

- United Nations ESCAP. Transforming Our World: The 2030 Agenda for Sustainable Development; United Nations: New York, NY, USA, 2015. [Google Scholar]

- Allen, H. Village Savings, Loans Associations-Sustainable and Cost-Effective Rural Finance. Small Enterp. Dev. 2006, 17, 61. [Google Scholar] [CrossRef]

- Yip, A.W.H.; Bocken, N.M.P. Sustainable Business Model Archetypes for the Banking Industry. J. Clean Prod. 2018, 174, 150–169. [Google Scholar] [CrossRef]

- Weston, P.; Nnadi, M. Evaluation of Strategic and Financial Variables of Corporate Sustainability and ESG Policies on Corporate Finance Performance. J. Sustain. Financ. Invest. 2021, 11, 1–17. [Google Scholar] [CrossRef]

- Puschmann, T.; Leifer, L. Sustainable Digital Finance: The Role of FinTech, InsurTech & Blockchain for Shaping the World for the Better; University of Zurich: Zurich, Switzerland; Stanford University: Standford, CA, USA, 2020. [Google Scholar]

- Gomber, P.; Koch, J.A.; Siering, M. Digital Finance and FinTech: Current research and future research directions. J. Bus. Econ. 2017, 87, 537–580. [Google Scholar] [CrossRef]

- Global Partnership for Financial Inclusion. G20 High Level Principles for Digital Financial Inclusion; Group of 20: Hangzhou, China, 2016. [Google Scholar]

- Demirgüç-Kunt, A.; Leora, K.; Dorothe, S.; Saniya, A.; Jake, H. The Global Findex Database 2017: Measuring Financial Inclusion and the Fintech Revolution; World Bank: Washington, DC, USA, 2018. [Google Scholar]

- United Nations. Inter-Agency Task Force on Financing for Development, Financing for Sustainable Development Report 2020; United Nations: New York, NY, USA, 2020. [Google Scholar]

- Bauer, J.M. The Internet and Income Inequality: Socio-economic Challenges in a Hyperconnected Society. Telecommun. Policy 2018, 42, 333–343. [Google Scholar] [CrossRef]

- Yi, X.J.; Zhou, L. Does the Development of Digital Inclusive Finance Significantly Affect Resident Consumption—Micro Evidence from Chinese Households. J. Financ. Res. 2018, 11, 47–67. [Google Scholar]

- Zhang, X.; Yang, T.; Wang, C. Digital Financial Development and Consumer Growth: Theory and Practice in China. J. Manag. World 2020, 36, 48–63. [Google Scholar]

- Dillip, K.D. Migration of Financial Resources to Developing Countries; Macmillan Publ. Co.: Hampshire, UK, 1986. [Google Scholar]

- Hsieh, C.T.; Klenow, P.J. Misallocation and Manufacturing TFP in China and India. Q. J. Econ. 2009, 124, 1403–1448. [Google Scholar] [CrossRef] [Green Version]

- Brandt, L.; Tombe, T.; Zhu, X. Factor Market Distortions across Time, Space and Sectors in China. Rev. Econ. Dyn. 2013, 16, 39–58. [Google Scholar] [CrossRef] [Green Version]

- Ozili, P.K. Impact of Digital Finance on Financial Inclusion and Stability. Borsa Istanb. Rev. 2018, 18, 329–340. [Google Scholar] [CrossRef]

- Dupas, P.; Karlan, D.; Robinson, J. Banking the Unbanked? Evidence from Three Countries. Am. Econ. J.-Appl. Econ. 2018, 10, 257–297. [Google Scholar] [CrossRef] [Green Version]

- Widarwati, E.; Solihin, A.; Nurmalasari, N. Digital Finance for Improving Financial Inclusion Indonesians’ Banking. J. Ilmu. Econ. 2022, 11, 17–30. [Google Scholar] [CrossRef]

- Bettinger, A. Fintech: A series of 40 Time shared models used at Manufacturers Hanover Trust Company. Interfaces 1972, 2, 62–63. [Google Scholar]

- Arner, D.W.; Janos, B.; Ross, P.B. The evolution of Fintech: A new post-crisis paradigm. Georget. J. Int. Law. 2015, 47, 1271. [Google Scholar] [CrossRef] [Green Version]

- Huang, Y.P.; Huang, Z. China’s Digital Financial Development: Now and the Future. Q. Econ. 2018, 17, 1489–1502. [Google Scholar]

- Wurgler, J. Financial Markets and the Allocation of Capital. J. Financ. Econ. 2000, 58, 187–214. [Google Scholar] [CrossRef] [Green Version]

- Zhou, G.F.; Hu, H.M. Research on Financial Efficiency Evaluation Index System. Financ. Theory Pract. 2007, 8, 15–18. [Google Scholar]

- Brundtland, G. Report of the World Commission on Environment and Development: Our Common Future; United Nations: New York, NY, USA, 1987. [Google Scholar]

- Zhang, J.T. Research on The Sustainability of Financial Inclusion Business Based on the Internet Perspective. J. Financ. Econ. 2017, 2, 71–74. [Google Scholar]

- Gong, G.; Jiang, Z.L.; Xu, D.S. The Dynamic Evolution of Shadow Banking and Resource Allocation Efficiency of Non-Financial Firms. Q. Econ. 2021, 21, 2105–2126. [Google Scholar]

- Shahbaz, M.; Nasir, M.A.; Lahiani, A. Role of Financial Development in Economic Growth in the Light of Asymmetric Effects and Financial Efficiency. Int. J. Financ. Econ. 2022, 27, 361–383. [Google Scholar] [CrossRef]

- Lu, X.D. Is Financial Resource Mismatch Hindering China’s Economic Growth? J. Financ. Res. 2008, 4, 55–68. [Google Scholar]

- Deloitte. A Tale of 44 Cities—Connecting Global Fintech: Interim Hub Review; Deloitte: New York, NY, USA, 2017. [Google Scholar]

- Guo, F.; Wang, J.Y.; Wang, F.; Kong, T.; Zhang, X.; Cheng, Z.Y. Measuring the Development of Digital Inclusive Finance in China: Indexing and Spatial Characteristics. Q. Econ. 2020, 19, 1401–1418. [Google Scholar]

- Zhan, M.H.; Zhang, C.R.; Shen, J. Internet Finance Development and the Bank Credit Channel Transmission of Monetary Policy. Econ. Res. J. 2018, 53, 63–76. [Google Scholar]

- Wang, X.H.; Zhao, Y.X. Is There a Matthew Effect in Digital Financial Development? Empirical Comparison of Poor and Non-Poor Households. J. Financ. Res. 2020, 7, 114–133. [Google Scholar]

- Xie, X.L.; Shen, Y.; Zhang, H.X.; Guo, F. Can Digital Finance Promote Entrepreneurship? Evidence from China. Q. Econ. 2018, 17, 1557–1580. [Google Scholar]

- Li, W.Q. Research on Internet Finance to Crack the Financing Dilemma of Small and Medium-sized Enterprises. Acad. J. Zhon. 2014, 8, 51–54. [Google Scholar]

- Jiao, J.P. The Development of Inclusive Finance Should Adhere to the Principle of Sustainable Business. Tsinghua Financ. Rev. 2016, 12. [Google Scholar] [CrossRef]

- Le, T.H.; Chuc, A.T.; Taghizadeh-Hesary, F. Financial Inclusion and Its Impact on Financial Efficiency and Sustainability: Empirical Evidence from Asia. Borsa Istanb. Rev. 2019, 19, 310–322. [Google Scholar] [CrossRef]

- Bachelet, M.J.; Becchetti, L.; Manfredonia, S. The Green Bonds Premium Puzzle: The Role of Issuer Characteristics and Third-Party Verification. Sustainability 2019, 11, 1098. [Google Scholar] [CrossRef] [Green Version]

- Morduch, J.; Armendariz, B. The Economics of Microfinance; MIT Press: Cambridge, MA, USA, 2005. [Google Scholar]

- Wen, T.; Zhu, J.; Wang, X.H. Elite Capture Mechanism of Agricultural Loans In China: A Stratified Comparison of Poor and Non-Poor Counties. J. Econ. Res. 2016, 51, 111–125. [Google Scholar]

- Gomber, P.; Kauffman, R.J.; Parker, C. On the Fintech Revolution: Interpreting the Forces of Innovation, Disruption, and Transformation in Financial Services. J. Manag. Inform. Syst. 2018, 35, 220–265. [Google Scholar] [CrossRef]

- Xie, P.; Zou, C.W. Model Study on Internet Finance. J. Financ. Res. 2012, 12, 11–22. [Google Scholar]

- Duarte, J.; Siegel, S.; Young, L. Trust and Credit: The Role of Appearance in Peer-to-Peer Lending. Rev. Financ. Stud. 2012, 25, 2455–2484. [Google Scholar] [CrossRef]

- Tang, S.; Wu, X.C.; Zhu, J. Digital Finance and Corporate Technology Innovation: Structural Characteristics, Mechanism Identification and Differences in Effects under Financial Regulation. J. Manag. World 2020, 36, 52–66. [Google Scholar]

- Liu, J.Y.; Liu, C.Y. The Rural Poverty Reduction Effect of Digital Inclusive Finance: Effects and Mechanisms. Collect. Essays Financ. Econ. 2020, 1, 43–53. [Google Scholar]

- Guo, F.; Wang, Y.P. Traditional Financial Foundation, Knowledge Threshold and Digital Finance to the Countryside. J. Financ. Econ. 2020, 46, 19–33. [Google Scholar]

- Agarwal, S.; Hauswald, R.B.H. The Choice between Arm’s-Length and Relationship Debt: Evidence from E-Loans; Federal Reserve Bank of Chicago: Chicago, IL, USA, 2008. [Google Scholar]

- Li, J.; Wu, Y.; Xiao, J.J. The impact of digital finance on household consumption: Evidence from China. Econ. Model. 2020, 86, 317–326. [Google Scholar] [CrossRef] [Green Version]

- Robinson, R.I.; Wrightsman, D. Financial Markets: The Accumulation and Allocation of Wealth; McGraw-Hill Co.: New York, NY, USA, 1980. [Google Scholar]

- Campisi, D.; Mancuso, P.; Mastrodonato, S.L. Productivity Dispersion in the Italian Knowledge-Intensive Business Services (KIBS) Industry: A Multilevel Analysis. Manag. Decis. 2021, 60, 940–952. [Google Scholar] [CrossRef]

- Campisi, D.; Mancuso, P.; Mastrodonato, S.L. Efficiency Assessment of Knowledge Intensive Business Services Industry in Italy: Data Envelopment Analysis (DEA) and Financial Ratio Analysis. Meas. Bus. Excel. 2019, 23, 484–495. [Google Scholar] [CrossRef]

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the Efficiency of Decision-Making Units. Eur. J. Oper. Res. 1978, 2, 429–444. [Google Scholar] [CrossRef]

- Banker, R.D.; Charnes, A.; Cooper, W.W. A Comparison of DEA and Translog Estimates of Production Frontiers Using Simulated Observations from a Known Technology; Springer: Berlin, Germany, 1988. [Google Scholar]

- Jan, C. Financial information asymmetry: Using deep learning algorithms to predict financial distress. Symmetry 2021, 13, 443. [Google Scholar] [CrossRef]

- Shi, Z. Study on the Dynamic Spatial Effects of Financial Resource Allocation Efficiency on the Development of Real Economy. Stat. Decis. 2021, 37, 161–165. [Google Scholar]

- Roman, M.D.; Toma, G.C.; Tuchiluş, G. Efficiency of Pension Systems in the EU Countries. Rom. J. Econ. Forecast. 2018, 21, 161–173. [Google Scholar]

- Zhang, Y.J. Research on the Impact of Financial Agglomeration on Economic Growth Efficiency of Regional Central Cities; Shandong University of Finance and Economics: Jinan, China, 2021. [Google Scholar]

- Xie, P.; Zou, C.W.; Liu, H.E. The Basic Theory of Internet Finance. J. Financ. Res. 2015, 8, 1–12. [Google Scholar]

| Research Themes | Research Methodology | Research Findings | Core Literature |

|---|---|---|---|

| Digital Finance vs. Financial Efficiency |

|

| [12,13,17] |

| Digital Finance vs. Financial Sustainability |

|

| [6,26,36] |

| Financial Efficiency vs. Financial Sustainability |

|

| [37,38] |

| The interrelationship amongst Digital Finance, Financial Efficiency, and Financial Sustainability | N/A | N/A | N/A |

| Variables | Description | Measured by |

|---|---|---|

| lnSDEA | Financial efficiency level | Regional financial super-efficiency values |

| IndexAggr | Digital financial development | The Peking University Digital Financial Inclusion Index of China (PKU-DFIIC) |

| IndexCover | Breadth of digital financial coverage | Sub-index on breadth of coverage of the PKU-DFIIC |

| IndexUser | Depth of digital financial adoption | Sub-index on depth of adoption of the PKU-DFIIC |

| AveGDP | Economic development | GDP per capita |

| FDIRt | Degree of opening-up | Ratio of foreign direct investment to GDP |

| GovExpenRt | Government expenditure | Ratio of general budget expenditures to GDP |

| Urbaniz | Level of urbanization | Rate of urbanization |

| StudNum | Level of education | Number of students enrolled in general higher education institutions |

| lnAveHousingPrice | Housing conditions | Natural logarithm value of the average housing price |

| lnPopulation | Population | Natural logarithm value of the resident population |

| Savings | Household savings | Saving balance of urban and rural residents at year-end |

| lnRetailSale | Consumption | Natural logarithm value of retail sales for consumer goods |

| lnLoan | Loan size | Natural logarithm value of loan balance of financial institutions at year-end |

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | Mean | |

|---|---|---|---|---|---|---|---|---|---|---|

| Jiangsu | 1.044 | 1.273 | 1.271 | 1.314 | 1.202 | 1.188 | 1.128 | 1.193 | 1.111 | 1.192 |

| Guangdong | 1.068 | 1.003 | 1.03 | 0.931 | 1.068 | 1.008 | 0.997 | 0.962 | 1.16 | 1.025 |

| Tianjin | 1.09 | 1.199 | 1.188 | 1.126 | 0.873 | 0.71 | 0.606 | 0.609 | 0.498 | 0.878 |

| Shanghai | 0.912 | 0.811 | 0.735 | 0.745 | 0.815 | 0.85 | 0.928 | 0.914 | 0.92 | 0.848 |

| Beijing | 0.841 | 0.842 | 0.758 | 0.744 | 0.724 | 0.736 | 0.716 | 0.833 | 0.828 | 0.780 |

| Zhejiang | 1.022 | 0.876 | 0.696 | 0.587 | 0.528 | 0.511 | 0.527 | 0.532 | 0.649 | 0.659 |

| Chongqing | 0.652 | 0.607 | 0.591 | 0.613 | 0.702 | 0.744 | 0.749 | 0.728 | 0.523 | 0.657 |

| Fujian | 0.681 | 0.603 | 0.609 | 0.593 | 0.622 | 0.604 | 0.587 | 0.68 | 0.59 | 0.619 |

| Hubei | 0.465 | 0.474 | 0.506 | 0.519 | 0.629 | 0.7 | 0.729 | 0.766 | 0.712 | 0.611 |

| Yunnan | 0.493 | 0.455 | 0.505 | 0.547 | 0.652 | 0.668 | 0.678 | 0.612 | 0.61 | 0.580 |

| Shandong | 0.612 | 0.634 | 0.613 | 0.591 | 0.554 | 0.577 | 0.558 | 0.539 | 0.541 | 0.580 |

| Sichuan | 0.446 | 0.523 | 0.544 | 0.525 | 0.563 | 0.569 | 0.601 | 0.549 | 0.493 | 0.535 |

| Qinghai | 0.319 | 0.298 | 0.44 | 0.491 | 0.648 | 0.655 | 0.72 | 0.633 | 0.469 | 0.519 |

| Guangxi | 0.43 | 0.419 | 0.474 | 0.488 | 0.507 | 0.504 | 0.516 | 0.475 | 0.387 | 0.467 |

| Henan | 0.404 | 0.402 | 0.408 | 0.438 | 0.54 | 0.477 | 0.503 | 0.474 | 0.489 | 0.459 |

| Ningxia | 0.489 | 0.441 | 0.441 | 0.423 | 0.45 | 0.446 | 0.467 | 0.433 | 0.396 | 0.443 |

| Tibet | 0.345 | 0.303 | 0.283 | 0.369 | 0.501 | 0.622 | 0.49 | 0.613 | 0.459 | 0.443 |

| Guizhou | 0.426 | 0.392 | 0.369 | 0.369 | 0.464 | 0.484 | 0.511 | 0.518 | 0.377 | 0.434 |

| Inner Mongolia | 0.454 | 0.392 | 0.397 | 0.417 | 0.474 | 0.534 | 0.557 | 0.418 | 0.219 | 0.429 |

| Jiangxi | 0.349 | 0.327 | 0.339 | 0.399 | 0.472 | 0.514 | 0.496 | 0.453 | 0.398 | 0.416 |

| Anhui | 0.342 | 0.328 | 0.394 | 0.403 | 0.429 | 0.412 | 0.418 | 0.452 | 0.522 | 0.411 |

| Hainan | 0.509 | 0.369 | 0.44 | 0.384 | 0.392 | 0.419 | 0.387 | 0.327 | 0.394 | 0.402 |

| Liaoning | 0.372 | 0.396 | 0.411 | 0.422 | 0.475 | 0.429 | 0.413 | 0.344 | 0.306 | 0.396 |

| Xinjiang | 0.374 | 0.363 | 0.373 | 0.388 | 0.413 | 0.385 | 0.378 | 0.358 | 0.467 | 0.389 |

| Shanxi | 0.374 | 0.359 | 0.382 | 0.386 | 0.448 | 0.428 | 0.423 | 0.274 | 0.202 | 0.364 |

| Shaanxi | 0.332 | 0.332 | 0.36 | 0.399 | 0.397 | 0.368 | 0.345 | 0.347 | 0.318 | 0.355 |

| Hebei | 0.347 | 0.345 | 0.343 | 0.342 | 0.327 | 0.341 | 0.353 | 0.327 | 0.348 | 0.341 |

| Gansu | 0.215 | 0.201 | 0.267 | 0.316 | 0.392 | 0.421 | 0.39 | 0.403 | 0.466 | 0.341 |

| Hunan | 0.271 | 0.256 | 0.272 | 0.294 | 0.304 | 0.318 | 0.358 | 0.326 | 0.289 | 0.299 |

| Jilin | 0.209 | 0.19 | 0.255 | 0.265 | 0.316 | 0.346 | 0.347 | 0.289 | 0.247 | 0.274 |

| Heilongjiang | 0.274 | 0.271 | 0.282 | 0.285 | 0.3 | 0.267 | 0.245 | 0.23 | 0.219 | 0.264 |

| Mean | Standard Deviation | Median | Minimum | Maximum | |

|---|---|---|---|---|---|

| lnSDEA | 0.53 | 0.23 | 0.47 | 0.19 | 1.31 |

| IndexAggr | 202.35 | 91.65 | 212.36 | 16.22 | 410.28 |

| IndexCover | 182.25 | 90.47 | 189.28 | 1.96 | 384.66 |

| IndexUser | 197.02 | 91.46 | 189.78 | 6.76 | 439.91 |

| AveGDP | 54,017.93 | 26,223.36 | 46,674.00 | 16,413.00 | 164,000.00 |

| FDIRt | 0.02 | 0.02 | 0.02 | 0.01 | 0.08 |

| GovExpenRt | 0.28 | 0.21 | 0.23 | 0.11 | 1.38 |

| Urbaniz | 56.66 | 13.14 | 55.12 | 22.71 | 89.60 |

| StudNum | 84.17 | 52.78 | 73.25 | 3.24 | 231.97 |

| lnAveHousingPrice | 8.79 | 0.47 | 8.65 | 8.09 | 10.49 |

| lnPopulation | 8.13 | 0.84 | 8.25 | 5.74 | 9.43 |

| Savings | 17,190.30 | 14,184.78 | 13,399.44 | 178.40 | 77,995.87 |

| lnRetailSale | 8.73 | 1.05 | 8.88 | 5.47 | 10.67 |

| lnLoan | 9.98 | 0.94 | 10.02 | 6.01 | 12.03 |

| (1) | (2) | (3) | |

|---|---|---|---|

| RE | RE | RE | |

| IndexAggr | 0.002 | 0.003 ** | 0.003 ** |

| (1.34) | (1.89) | (1.91) | |

| AveGDP | 0.000 * | 0.000 * | 0.000 |

| (1.81) | (1.98) | (1.65) | |

| FDIRt | −0.111 | −0.596 | 0.496 |

| (−0.04) | (−0.23) | (0.20) | |

| GovExpenRt | 0.250 * | 0.430 *** | 0.246 ** |

| (1.92) | (3.20) | (2.35) | |

| Urbaniz | 0.003 | 0.008 *** | −0.001 |

| (1.12) | (2.85) | (−0.14) | |

| StudNum | 0.001 | 0.002 | 0.002 |

| (0.65) | (1.35) | (1.51) | |

| lnAveHousingPrice | −0.013 | −0.027 | −0.110 |

| (−0.11) | (−0.25) | (−0.98) | |

| lnPopulation | −0.057 | 0.004 | 0.000 *** |

| (−1.16) | (0.04) | (3.78) | |

| Savings | 0.000 *** | −0.107 | |

| (3.96) | (−1.21) | ||

| lnRetailSale | −0.054 | 0.346 *** | |

| (−0.59) | (3.72) | ||

| lnLoan | 0.250 * | ||

| (1.81) | |||

| Observations | 279 | 279 | 279 |

| Controlling for time effects | Y | Y | Y |

| Controlling for individual effects | N | N | N |

| Adj. R2 | 0.591 | 0.630 | 0.683 |

| F value | 73.60 | 144.94 | 164.89 |

| (1) | (2) | |

|---|---|---|

| LSDV | LSDV | |

| IndexCover | 0.005 *** | |

| (3.13) | ||

| IndexUser | 0.001 *** | |

| (2.55) | ||

| AveGDP | 0.000 | 0.001 *** |

| (0.24) | (3.25) | |

| FDIRt | 1.136 | 0.103 |

| (0.49) | (0.12) | |

| GovExpenRt | 0.080 | 0.178 |

| (0.16) | (1.60) | |

| Urbaniz | −0.003 | −0.001 |

| (−0.36) | (−0.27) | |

| StudNum | 0.000 | 0.002 *** |

| (0.16) | (3.37) | |

| lnAveHousingPrice | −0.096 | −0.092 * |

| (−0.56) | (−1.79) | |

| lnPopulation | 1.557 ** | 0.292 *** |

| (2.10) | (3.77) | |

| Savings | 0.000 | 0.000 *** |

| (0.99) | (5.57) | |

| lnRetailSale | 0.185 *** | −0.083 |

| (2.79) | (−1.51) | |

| lnLoan | 0.261 *** | 0.351 *** |

| (3.97) | (6.65) | |

| Observations | 279 | 279 |

| Controlling for time effects | Y | Y |

| Adj. R2 | 0.915 | 0.680 |

| F value | 174.30 | 45.80 |

| (1) | (2) | (3) | |

|---|---|---|---|

| RE | RE | RE | |

| PerMobile | 0.584 *** | 0.584 *** | 0.452 *** |

| (5.12) | (4.14) | (3.46) | |

| AveGDP | 0.000 ** | 0.000 ** | 0.000 |

| (2.63) | (2.18) | (1.26) | |

| FDIRt | −1.914 | −2.220 | −1.573 |

| (−0.82) | (−0.95) | (−0.67) | |

| GovExpenRt | 0.279 * | 0.342 ** | 0.172 |

| (1.94) | (2.10) | (0.93) | |

| Urbaniz | 0.009 *** | 0.010 *** | 0.001 |

| (2.78) | (2.84) | (0.14) | |

| StudNum | −0.000 | 0.000 | 0.002 |

| (−0.16) | (0.10) | (1.24) | |

| lnAveHousingPrice | 0.133 * | 0.145 * | 0.042 |

| (1.70) | (1.72) | (0.38) | |

| lnPopulation | 0.070 | 0.146 | 0.359 ** |

| (1.44) | (1.05) | (2.08) | |

| Savings | 0.000 *** | 0.000 | |

| (3.20) | (0.39) | ||

| lnRetailSale | 0.073 | −0.017 | |

| (0.72) | (−0.18) | ||

| lnLoan | 0.397 *** | ||

| (3.56) | |||

| Observations | 279 | 279 | 279 |

| Controlling for time effects | Y | Y | Y |

| Controlling for individual effects | N | N | N |

| Adj.R2 | 0.636 | 0.668 | 0.658 |

| F value | 158.62 | 204.4 | 131.88 |

| (1) | (2) | (3) | |

|---|---|---|---|

| EC2SLS | FE2SLS | FE | |

| IndexAggr | 0.002 *** | 0.036 ** | 0.003 ** |

| (8.85) | (2.36) | (2.54) | |

| AveGDP | 0.000 *** | 0.000 | 0.000 *** |

| (2.85) | (1.34) | (2.96) | |

| FDIRt | 0.260 | −1.976 | 0.496 |

| (0.30) | (−1.09) | (0.62) | |

| GovExpenRt | 0.159 | 1.112 ** | 0.246 ** |

| (1.31) | (2.44) | (2.13) | |

| Urbaniz | −0.004 | 0.019 * | −0.001 |

| (−1.47) | (1.71) | (−0.23) | |

| StudNum | 0.002 *** | 0.006 *** | 0.002 *** |

| (3.89) | (3.25) | (3.56) | |

| lnAveHousingPrice | 0.019 | −1.101 ** | −0.110 ** |

| (0.42) | (-2.34) | (−1.97) | |

| lnPopulation | 0.313 *** | 0.433 | 0.250 *** |

| (3.65) | (1.27) | (3.10) | |

| Savings | −0.000 | 0.000 ** | 0.000 *** |

| (−0.60) | (2.21) | (5.61) | |

| lnRetailSale | −0.018 | 0.812 ** | 0.107 * |

| (−0.31) | (2.40) | (1.84) | |

| lnLoan | 0.379 *** | 0.338 *** | 0.346 *** |

| (6.65) | (3.06) | (6.54) | |

| Observations | 279 | 279 | 279 |

| Controlling for time effects | Y | Y | Y |

| Controlling for individual effects | N | Y | Y |

| Adj.R2 | 0.617 | 0.106 | 0.680 |

| F value | - | - | 45.80 |

| Wald Chi2 | 418.01 | 1090.53 | - |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Luo, D.; Luo, M.; Lv, J. Can Digital Finance Contribute to the Promotion of Financial Sustainability? A Financial Efficiency Perspective. Sustainability 2022, 14, 3979. https://doi.org/10.3390/su14073979

Luo D, Luo M, Lv J. Can Digital Finance Contribute to the Promotion of Financial Sustainability? A Financial Efficiency Perspective. Sustainability. 2022; 14(7):3979. https://doi.org/10.3390/su14073979

Chicago/Turabian StyleLuo, Dan, Man Luo, and Jiamin Lv. 2022. "Can Digital Finance Contribute to the Promotion of Financial Sustainability? A Financial Efficiency Perspective" Sustainability 14, no. 7: 3979. https://doi.org/10.3390/su14073979

APA StyleLuo, D., Luo, M., & Lv, J. (2022). Can Digital Finance Contribute to the Promotion of Financial Sustainability? A Financial Efficiency Perspective. Sustainability, 14(7), 3979. https://doi.org/10.3390/su14073979