How Does New Infrastructure Investment Affect Economic Growth Quality? Empirical Evidence from China

Abstract

:1. Introduction

2. Literature Review

3. Theoretical Framework and Research Hypothesis

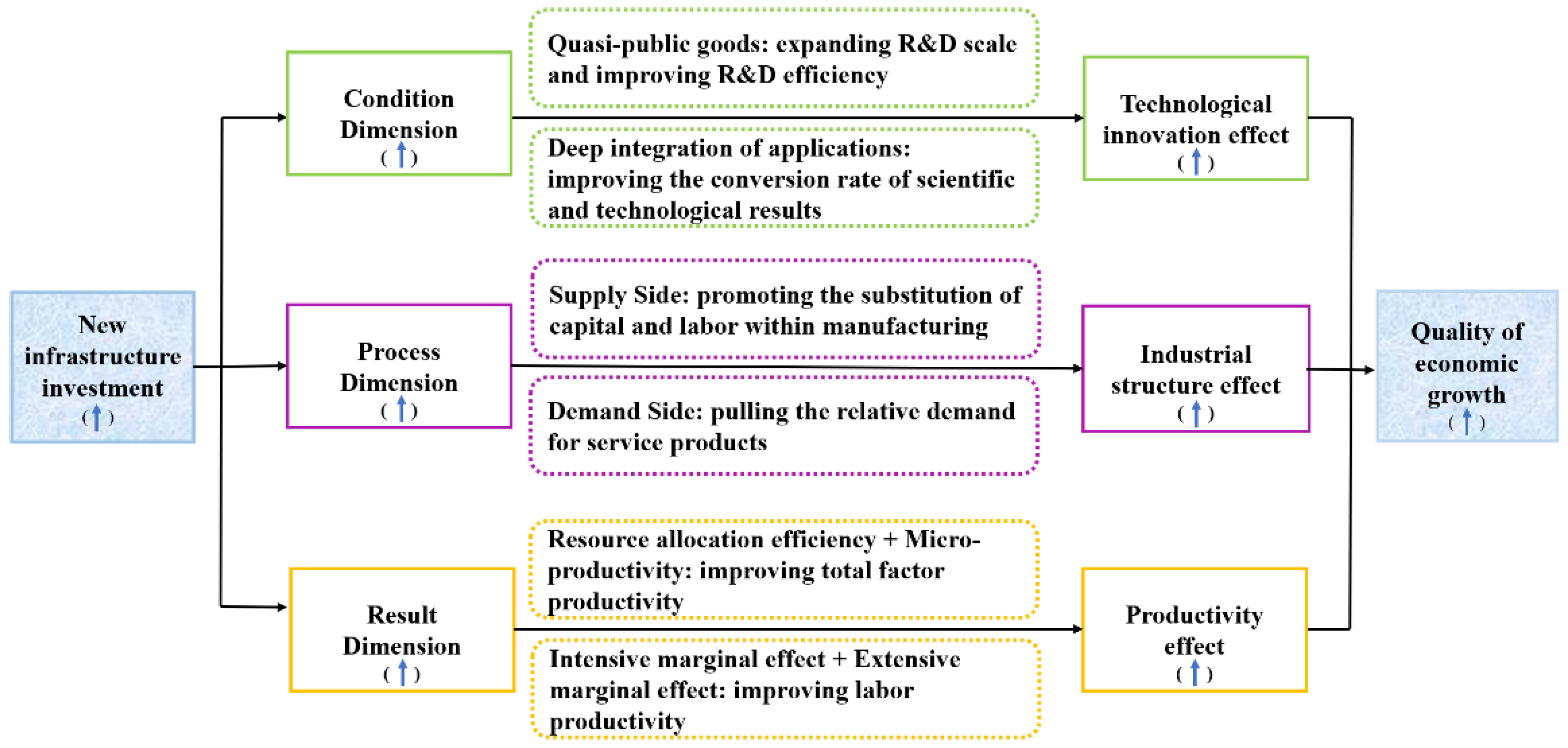

3.1. The Effect of New Infrastructure Investment on Economic Growth Quality

3.1.1. Economic Growth Condition: Technological Innovation Effect

3.1.2. Economic Growth Process: Industrial Structure Effect

3.1.3. Economic Growth Result: Productivity Effect

3.2. Theoretical Hypothesis

4. Methodology and Data

4.1. Study Area

4.2. Econometric Methodology

4.3. Variables Specification

4.3.1. Explained Variable: Economic Growth Quality (grq)

4.3.2. Core Explanatory Variable: New Infrastructure Investment (Inf)

4.3.3. Control Variables

4.3.4. Mediating Variables

4.3.5. Data Sources and Description

5. Empirical Results and Discussion

5.1. Benchmark Estimated Results

5.2. Endogeneity Problem and Treatment

5.3. Robustness Check

5.4. Extended Analysis

5.4.1. Influencing Mechanism Test

5.4.2. Regional Heterogeneity Test

5.4.3. Nonlinear Feature Test

6. Conclusions and Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

Appendix A.1. Evaluation System of Economic Growth Quality

| Dimension | Subindex | Basic Indicator | Proxy Variables | Attribute |

|---|---|---|---|---|

| Economic growth condition | Innovation capabilities | Innovation input | The ratio of expenditure on R&D to GDP. | + |

| Full-time equivalent of R&D personnel. | + | |||

| Innovation output | Number of invention patents granted. | + | ||

| The ratio of technology market turnover to GDP. | + | |||

| Element endowment | Human capital | Average years of education of schooling. | + | |

| Factor endowment structure | Capital stock per labor. | + | ||

| Degree of marketization | Marketability index (the marketization index consists of five aspects: government–market relationship, the development of a non-state economy, the development of product markets, the development of factor markets, the development of market intermediary organizations, and the rule of law environment. The related data are derived from China Marketability Index Database). | + | ||

| Economic growth process | Industry structure | Rationalization of industrial structure | Thiel index of structural deviations (the formula for measuring industrial structure rationalization is , where TL denotes the Thiel index of structural deviation, and the smaller the value, the more rational the industrial structure. i denotes the industrial sector; n denotes the total number of industries; Q represents the industrial output; L represents the number of industrial employees). | - |

| Advancement in industrial structure | Advanced index of industrial structure (the formula for measuring industrial structure advancement is , where GJ denotes the advanced index of industrial structure, and the higher the value, the more advanced the industrial structure. The meanings of i, n, and Q are the same as in Note 4; LP represents the labor productivity, and represents the labor productivity at the completion of industrialization). | + | ||

| Investment and consumption structure | Investment structure | The proportion of manufacturing fixed-asset investment in total fixed-asset investment | Moderate | |

| Consumption structure | The Engel coefficient of urban households | Moderate | ||

| Dualistic economic structure | Dual comparative coefficient | The ratio of comparative labor productivity (comparative labor productivity is equal to the ratio of the share of industry output to the share of employment) in agriculture to comparative labor productivity in non-agricultural industries. | + | |

| Dual contrast index | Absolute value of the difference between the share of non-agricultural output and the share of employment. | - | ||

| Financial development | Scale of financial development | The ratio of deposit and loan balances of financial institutions to GDP. | + | |

| Foreign trade | Foreign trade dependence | The ratio of gross imports and exports to GDP. | + | |

| Economic growth result | Growth efficiency | Labor productivity | The ratio of GDP to the number of employees. | + |

| Capital productivity | The ratio of GDP to capital stock. | + | ||

| TFP | TFP growth rate. | + | ||

| Growth benefit | Resident health | population mortality rate. | - | |

| Income distribution | The ratio of per capita disposable income of urban residents to per capita net income of rural residents. | - | ||

| Employment opportunities | Urban registered unemployment rate. | - | ||

| Growth cost | Resource consumption | Energy consumption per unit of GDP. | - | |

| Environmental pollution | Emissions of air pollutants per unit of output. | - | ||

| Solid waste emissions per unit of output. | - |

Appendix A.2. The Process of Calculating Economic Growth Quality

References

- Romer, P.M. Increasing Returns and Long-Run Growth. J. Polit. Econ. 1986, 94, 1002–1037. [Google Scholar] [CrossRef] [Green Version]

- Aschauer, D.A. Is public expenditure productive? J. Monet. Econ. 1989, 23, 177–200. [Google Scholar] [CrossRef]

- Barro, R. Government Spending in a Simple Model of Endogenous Growth. J. Polit. Econ. 1990, 98, S103–S125. [Google Scholar] [CrossRef] [Green Version]

- Faber, B. Trade Integration, Market Size, and Industrialization: Evidence from China’s National Trunk Highway System. Rev. Econ. Stud. 2014, 81, 1046–1070. [Google Scholar] [CrossRef] [Green Version]

- Farhadi, M. Transport infrastructure and long-run economic growth in OECD countries. Trans. Res. Part A Policy Pract. 2015, 74, 73–90. [Google Scholar] [CrossRef]

- Hulten, C.R.; Bennathan, E.; Srinivasan, S. Infrastructure, Externalities, and Economic Development: A Study of the Indian Manufacturing Industry. World Bank Econ. Rev. 2006, 20, 291–308. [Google Scholar] [CrossRef]

- Javid, M. Public and Private Infrastructure Investment and Economic Growth in Pakistan: An Aggregate and Disaggregate Analysis. Sustainability 2019, 11, 3359. [Google Scholar] [CrossRef] [Green Version]

- Paul, J.P.; Paul, C.J.M. Public Infrastructure Investment, Interstate Spatial Spillovers, and Manufacturing Costs. Rev. Econ. Stat. 2004, 86, 551–560. [Google Scholar]

- Shirley, C.; Winston, C. Firm inventory behavior and the returns from highway infrastructure investments. J. Urban Econ. 2004, 55, 398–415. [Google Scholar] [CrossRef]

- Wu, J.; Zhang, Y.; Shi, Z. Crafting a Sustainable Next Generation Infrastructure: Evaluation of China’s New Infrastructure Construction Policies. Sustainability 2021, 13, 6245. [Google Scholar] [CrossRef]

- Rougier, E.; Combarnous, F. Emerging capitalisms and institutional reforms in developing countries. In The Diversity of Emerging Capitalisms in Developing Countries; Rougier, E., Combarnous, F., Eds.; Palgrave Macmillan: Cham, Switzerland, 2017; pp. 413–435. [Google Scholar]

- Guo, C.; Wang, J.; Liu, H. Studies on How New Infrastructure Empowers High-quality Development of China’s Economy. Beijing Univ. Technol. 2020, 20, 13–21. [Google Scholar]

- Wensi, S. Effects of New Infrastructure Investment on Labor Productivity: Based on Producer Services Perspective. Nankai Econ. Stud. 2020, 6, 181–200. [Google Scholar]

- Roller, L.-H.; Waverman, L. Telecommunications Infrastructure and Economic Development: A Simultaneous Approach Am. Econ. Rev. 2001, 91, 909–923. [Google Scholar] [CrossRef] [Green Version]

- Mitra, A.; Sharma, C.; Veganzones-Varoudakis, M.-A. Infrastructure, information & communication technology and firms’ productive performance of the Indian manufacturing. J. Policy Model. 2016, 38, 353–371. [Google Scholar]

- Duggal, V.G.; Saltzman, C.; Klein, L.R. Infrastructure and productivity: An extension to private infrastructure and it productivity. J. Econ. 2007, 140, 485–502. [Google Scholar] [CrossRef]

- Choi, C.; Yi, M.H. The effect of the Internet on economic growth: Evidence from cross-country panel data. Econ. Lett. 2009, 105, 39–41. [Google Scholar] [CrossRef]

- Czernich, N.; Falck, O.; Kretschmer, T.; Woessmann, L. Broadband Infrastructure and Economic Growth. Econ. J. 2011, 121, 505–532. [Google Scholar] [CrossRef]

- Edquist, H.; Goodridge, P.; Haskel, J. The Internet of Things and economic growth in a panel of countries. Econ. Innov. New Technol. 2021, 30, 262–283. [Google Scholar] [CrossRef] [Green Version]

- Toader, E.; Firtescu, B.N.; Roman, A.; Anton, S.G. Impact of Information and Communication Technology Infrastructure on Economic Growth: An Empirical Assessment for the EU Countries. Sustainability 2018, 10, 3750. [Google Scholar] [CrossRef] [Green Version]

- Niebel, T. ICT and economic growth—Comparing developing, emerging and developed countries. World Dev. 2018, 104, 197–211. [Google Scholar] [CrossRef] [Green Version]

- Solow, R.M. We d better watch out. New York Times Book Review, 12 July 1987; Volume 36, p. 36. [Google Scholar]

- Brynjolfsson, E.; Hitt, L.M. Paradox Lost? Firm-Level Evidence on the Returns to Information Systems Spending. Manag. Sci. 1996, 42, 541–558. [Google Scholar] [CrossRef] [Green Version]

- Lin, W.T.; Shao, B.B.M. The business value of information technology and inputs substitution: The productivity paradox revisited. Decis. Support Syst. 2006, 42, 493–507. [Google Scholar] [CrossRef]

- Jorgenson, D.W.; Ho, M.S.; Stiroh, K.J. A retrospective look at the US productivity growth resurgence. J. Econ. Perspect. 2008, 22, 3–24. [Google Scholar] [CrossRef] [Green Version]

- Jabbouri, N.I.; Siron, R.; Zahari, I.; Khalid, M. Impact of Information Technology Infrastructure on Innovation Performance: An Empirical Study on Private Universities In Iraq. Procedia Econ. Finance 2016, 39, 861–869. [Google Scholar] [CrossRef] [Green Version]

- Pan, X.; Guo, S.; Li, M.; Song, J. The effect of technology infrastructure investment on technological innovation—A study based on spatial durbin model. Technovation 2021, 107, 102315. [Google Scholar] [CrossRef]

- Yoo, I.; Yi, C.-G. Economic Innovation Caused by Digital Transformation and Impact on Social Systems. Sustainability 2022, 14, 2600. [Google Scholar] [CrossRef]

- Fan, D.; Liu, K. The Relationship between Artificial Intelligence and China’s Sustainable Economic Growth: Focused on the Mediating Effects of Industrial Structural Change. Sustainability 2021, 13, 11542. [Google Scholar] [CrossRef]

- Crafts, N. Artificial intelligence as a general-purpose technology: An historical perspective. Oxford Rev. Econ. Policy 2021, 37, 521–536. [Google Scholar] [CrossRef]

- Graetz, G.; Michaels, G. Robots at Work. Rev. Econ. Stat. 2018, 100, 753–768. [Google Scholar] [CrossRef] [Green Version]

- Bessen, J. Automation and jobs: When technology boosts employment. Econ. Policy 2020, 34, 589–626. [Google Scholar] [CrossRef]

- Acemoglu, D.; Restrepo, P. The Race between Man and Machine: Implications of Technology for Growth, Factor Shares, and Employment. Am. Econ. Rev. 2018, 108, 1488–1542. [Google Scholar] [CrossRef] [Green Version]

- Ballestar, M.T.; Camiña, E.; Díaz-Chao, Á.; Torrent-Sellens, J. Productivity and employment effects of digital complementarities. J. Innov. Knowledge 2021, 6, 177–190. [Google Scholar] [CrossRef]

- Acemoglu, D.; Restrepo, P. Automation and New Tasks: How Technology Displaces and Reinstates Labor. J. Econ. Perspect. 2019, 33, 3–29. [Google Scholar] [CrossRef] [Green Version]

- Agrawal, A.; Gans, J.S.; Goldfarb, A. Artificial Intelligence: The Ambiguous Labor Market Impact of Automating Prediction. J. Econ. Perspect. 2019, 33, 31–49. [Google Scholar] [CrossRef] [Green Version]

- Lee, H.J.; Oh, H. A Study on the Deduction and Diffusion of Promising Artificial Intelligence Technology for Sustainable Industrial Development. Sustainability 2020, 12, 5609. [Google Scholar] [CrossRef]

- Tencent Research Institute, ‘Artificial Intelligence + Manufacturing’ Industry Development Research Report. Available online: http://gjs.cssn.cn/kydt/kydt_kycg/201806/P020180626376132711069.pdf (accessed on 8 January 2022).

- Barro, R. Quantity and Quality of Economic Growth. J. Econ. Chilena 2002, 5, 17–36. [Google Scholar]

- Li, Z.D.; Yang, W.P.; Wang, C.J.; Zhang, Y.S.; Yuan, X.L. Guided High-Quality Development, Resources, and Environmental Forcing in China’s Green Development. Sustainability 2019, 11, 1936. [Google Scholar] [CrossRef] [Green Version]

- Oh, D.H. A global Malmquist-Luenberger productivity index. J. Prod. Anal. 2010, 34, 183–197. [Google Scholar] [CrossRef]

- Mlachila, M.; Tapsoba, R.; Tapsoba, S.J.A. A Quality of Growth Index for Developing Countries: A Proposal. Soc. Indic. Res. 2017, 134, 675–710. [Google Scholar] [CrossRef]

- Kong, Q.; Peng, D.; Ni, Y.; Jiang, X.; Wang, Z. Trade openness and economic growth quality of China: Empirical analysis using ARDL model. Finance Res. Lett. 2021, 38, 101488. [Google Scholar] [CrossRef]

- Lin, B.; Zhou, Y. Does energy efficiency make sense in China? Based on the perspective of economic growth quality. Sci. Total Environ. 2022, 804, 149895. [Google Scholar] [CrossRef] [PubMed]

- Ru, S.F.; Liu, J.Q.; Wang, T.H.; Wei, G. Provincial Quality of Economic Growth: Measurements and Influencing Factors for China. Sustainability 2020, 12, 1354. [Google Scholar] [CrossRef] [Green Version]

- Prus, P.; Sikora, M. The Impact of Transport Infrastructure on the Sustainable Development of the Region—Case Study. Agriculture 2021, 11, 279. [Google Scholar] [CrossRef]

- Kaiser, N.; Barstow, C.K. Rural Transportation Infrastructure in Low- and Middle-Income Countries: A Review of Impacts, Implications, and Interventions. Sustainability 2022, 14, 2149. [Google Scholar] [CrossRef]

- Raicu, S.; Costescu, D.; Popa, M.; Dragu, V. Dynamic Intercorrelations between Transport/Traffic Infrastructures and Territorial Systems: From Economic Growth to Sustainable Development. Sustainability 2021, 13, 11951. [Google Scholar] [CrossRef]

- Elahi, S.; Kalantari, N.; Azar, A.; Hassanzadeh, M. Impact of common innovation infrastructures on the national innovative performance: Mediating role of knowledge and technology absorptive capacity. Innov. Org. Manag. 2016, 18, 536–560. [Google Scholar] [CrossRef]

- Guo, K.; Pan, S.; Yan, S. New Infrastructure Investment and Structural Transformation. China Ind. Econ. 2020, 3, 63–80. [Google Scholar]

- Yu, H.; Lee, H.; Jeon, H. What is 5G? Emerging 5G Mobile Services and Network Requirements. Sustainability 2017, 9, 1848. [Google Scholar] [CrossRef] [Green Version]

- Bresnahan, T.F.; Trajtenberg, M. General purpose technologies ‘Engines of growth’? J. Econ. 1995, 65, 83–108. [Google Scholar] [CrossRef] [Green Version]

- Bartel, A.; Ichniowski, C.; Shaw, K. How does information technology affect productivity? Plant level comparisons of product innovation, process improvement, and worker skills. Q. J. Econ. 2007, 122, 1721–1758. [Google Scholar] [CrossRef] [Green Version]

- Tengqiao, G.K.W. Effects of Infrastructure Investment on Structural Change and Productivity Growth. J. World Econ. 2019, 42, 51–73. [Google Scholar]

- CCID, White Paper on the Development Potential of “New Infrastructure” in China’s Provinces. Available online: https://www.ccidgroup.com/info/1096/21538.htm (accessed on 3 January 2022).

- Égert, B.; Koźluk, T.; Sutherland, D. Infrastructure and Growth: Empirical Evidence. Available online: https://www.oecd-ilibrary.org/content/paper/225682848268 (accessed on 7 January 2022).

- National Bureau of Statistics. China Statistics Yearbook. 2020. Available online: http://www.stats.gov.cn/tjsj/ndsj/2020/indexeh.htm (accessed on 1 March 2022).

- CCID, White Paper on “New Infrastructure” Development. Available online: https://mp.weixin.qq.com/s/F7Uu9h09oAHIkZi7-MBmOA (accessed on 9 January 2022).

- Zheng, J.; Mi, Z.; Coffman, D.M.; Milcheva, S.; Shan, Y.; Guan, D.; Wang, S. Regional development and carbon emissions in China. Energy Econ. 2019, 81, 25–36. [Google Scholar] [CrossRef]

- Deng, X.; Liang, L.; Wu, F.; Wang, Z.; He, S. A review of the balance of regional development in China from the perspective of development geography. J. Geogr. Sci. 2022, 32, 3–22. [Google Scholar] [CrossRef]

- National Bureau of Statistics. How Are the Economic Zones Divided? Available online: http://www.stats.gov.cn/ztjc/zthd/sjtjr/d12kfr/tjzsqzs/202109/t20210902_1821650.html (accessed on 2 March 2022).

- Ma, C.; Liu, J.; Ren, Y.; Jiang, Y. The Impact of economic growth, FDI and energy intensity on China’s manufacturing industry’s CO2 emissions: An empirical study based on the fixed-effect panel quantile regression model. Energies 2019, 12, 4800. [Google Scholar] [CrossRef] [Green Version]

- Balestra, P. Fixed effect models and fixed coefficient models. In The Econometrics of Panel Data; Mátyás, L., Sevestre, P., Eds.; Springer: Dordrech, The Netherlands, 1992; pp. 30–45. [Google Scholar]

- Seetaram, N.; Petit, S. Panel data analysis. In Handbook of Research Methods in Tourism; Larry, D., Alison, G., Neelu, S., Eds.; Edward Elgar Publishing: Cheltenham, UK, 2012; pp. 127–145. [Google Scholar]

- Canay, I.A. A simple approach to quantile regression for panel data. Econ. J. 2011, 14, 368–386. [Google Scholar] [CrossRef]

- Lee, M.T.; Suh, I. Understanding the effects of Environment, Social, and Governance conduct on financial performance: Arguments for a process and integrated modelling approach. Sustain. Technol. Entrep. 2022, 1, 100004. [Google Scholar] [CrossRef]

- Méndez-Picazo, M.-T.; Galindo-Martín, M.-A.; Castaño-Martínez, M.-S. Effects of sociocultural and economic factors on social entrepreneurship and sustainable development. J. Innov. Knowl. 2021, 6, 69–77. [Google Scholar] [CrossRef]

- Hansen, B.E. Threshold effects in non-dynamic panels: Estimation, testing, and inference. J. Econ. 1999, 93, 345–368. [Google Scholar] [CrossRef] [Green Version]

- National and Development and Reform Commission. What Are the Main Aspects of the New Infrastructure? Available online: https://www.ndrc.gov.cn/fggz/fgzy/shgqhy/202004/t20200427_1226808.html?code=&state=123 (accessed on 4 January 2022).

- Ge, J. Infrastructure and Non-infrastructure Capital Stocks in China and Their Productivity: A New Estimate. Econ. Res. J. 2016, 51, 41–56. [Google Scholar]

- Driscoll, J.; Kraay, A. Consistent Covariance Matrix Estimation With Spatially Dependent Panel Data. Rev. Econ. Stat. 1998, 80, 549–560. [Google Scholar] [CrossRef]

- Rehman Khan, S.A.; Zhang, Y.; Anees, M.; Golpîra, H.; Lahmar, A.; Qianli, D. Green supply chain management, economic growth and environment: A GMM based evidence. J. Clean. Prod. 2018, 185, 588–599. [Google Scholar] [CrossRef]

- Farooqi, M.R.; Rahman, A.; Ahmad, M.F. Energy Development as a Driver of Economic Growth: Evidence from Developing Nations. In Energy: Crises, Challenges and Solutions; Pardeep, S., Suruchi, S., Gaurav, K., Pooja, B., Eds.; John Wiley & Sons Ltd.: Hoboken, NJ, USA, 2021; pp. 91–107. [Google Scholar]

- Zhou, J.; Raza, A.; Sui, H. Infrastructure investment and economic growth quality: Empirical analysis of China’s regional development. Appl. Econ. 2021, 53, 2615–2630. [Google Scholar] [CrossRef]

- Evangelista, R.; Guerrieri, P.; Meliciani, V. The economic impact of digital technologies in Europe. Econ. Innov. New Technol. 2014, 23, 802–824. [Google Scholar] [CrossRef]

- Wang, J.; Wang, W.; Ran, Q.; Irfan, M.; Ren, S.; Yang, X.; Wu, H.; Ahmad, M.; Research, P. Analysis of the mechanism of the impact of internet development on green economic growth: Evidence from 269 prefecture cities in China. Environ. Sci. Pollut. Re. 2022, 29, 9990–10004. [Google Scholar] [CrossRef]

- Tranos, E. The causal effect of the internet infrastructure on the economic development of European city regions. Spatial Econ. Anal. 2012, 7, 319–337. [Google Scholar] [CrossRef]

- Lin, S.; Dhakal, P.R.; Wu, Z. The Impact of High-Speed Railway on China’s Regional Economic Growth Based on the Perspective of Regional Heterogeneity of Quality of Place. Sustainability 2021, 13, 4820. [Google Scholar] [CrossRef]

- Song, L.; van Geenhuizen, M. Port infrastructure investment and regional economic growth in China: Panel evidence in port regions and provinces. Transp. Policy 2014, 36, 173–183. [Google Scholar] [CrossRef]

- Deng, T. Impacts of transport infrastructure on productivity and economic growth: Recent advances and research challenges. Transp. Rev. 2013, 33, 686–699. [Google Scholar] [CrossRef]

| Variables | Observations | Average Value | Standard Deviation | Minimum Value | Maximum Value |

|---|---|---|---|---|---|

| grq | 464 | 0.0345 | 0.0040 | 0.0260 | 0.0469 |

| inf | 464 | 0.0071 | 0.0067 | 0.0005 | 0.0451 |

| gdp | 464 | 10.1161 | 0.6534 | 8.3158 | 11.6717 |

| urb | 464 | 0.5303 | 0.1476 | 0.1583 | 0.8960 |

| fdi | 464 | 0.0162 | 0.0215 | 0.0001 | 0.1518 |

| tra | 464 | 11.5055 | 0.9053 | 8.9625 | 13.2027 |

| lab | 464 | 0.3632 | 0.0694 | 0.1930 | 0.5760 |

| pri | 464 | 0.0274 | 0.0179 | −0.0235 | 0.1009 |

| dft | 464 | 0.3579 | 0.4381 | 0.0020 | 2.0344 |

| fin | 464 | 1.2967 | 0.8540 | 0.5372 | 13.3605 |

| huc | 464 | 8.8330 | 1.0166 | 6.3778 | 12.6811 |

| ges | 464 | 0.2188 | 0.0984 | 0.0792 | 0.6284 |

| tei | 464 | 0.0345 | 0.0173 | 0.0076 | 0.1386 |

| str | 464 | 2.0035 | 0.2502 | 1.3878 | 2.7979 |

| ifp | 464 | 0.3046 | 0.1209 | −0.8577 | 0.8477 |

| Variables | Regression of Mean | Regression of Quantile | |||

|---|---|---|---|---|---|

| FE | FGLS | 25% Quantile | 50% Quantile | 75% Quantile | |

| inf | 0.0118 ** | 0.0108 *** | 0.0193 *** | 0.0209 *** | 0.0279 *** |

| (2.55) | (4.23) | (11.97) | (5.56) | (157.81) | |

| gdp | 0.0043 *** | 0.0043 *** | 0.0046 *** | 0.0051 *** | 0.0048 *** |

| (11.26) | (25.37) | (31.04) | (172.12) | (881.87) | |

| urb | 0.0068 *** | 0.0061 *** | 0.0203 *** | 0.0155 *** | 0.0180 *** |

| (6.49) | (6.74) | (39.84) | (112.28) | (387.57) | |

| fdi | 0.0072 *** | 0.0061 *** | 0.0019 *** | 0.0121 *** | 0.0143 *** |

| (3.54) | (4.88) | (2.856) | (18.71) | (133.86) | |

| tra | 0.0006 *** | 0.0005 *** | 0.0019 *** | 0.0013 *** | 0.0005 *** |

| (5.97) | (7.35) | (93.75) | (74.17) | (560.89) | |

| lab | −0.0047 *** | −0.0027 *** | 0.0134 *** | −0.0162 *** | −0.0208 *** |

| (−2.84) | (−4.34) | (39.16) | (−35.23) | (−424.67) | |

| pri | −0.0075 | −0.0046 *** | −0.0364 *** | −0.0098 ** | 0.0077 *** |

| (−1.18) | (−2.78) | (−21.43) | (−2.48) | (23.76) | |

| cons | −0.0207 *** | −0.0196 *** | |||

| (−5.26) | (−13.11) | ||||

| Time Effects | Yes | Yes | Yes | Yes | Yes |

| Province Fixed Effect | Yes | Yes | Yes | Yes | Yes |

| F-Statistic | 132.48 *** | ||||

| Within-R2 | 0.3985 | ||||

| -Statistic | 11,459.41 *** | ||||

| Observations | 464 | 464 | 464 | 464 | 464 |

| Explained Variables | inf | grq | |

|---|---|---|---|

| 2SLS | Phase I | Phase II | |

| te_in | 0.00005 *** (3.19) | ||

| inf | 0.1454 ** (2.12) | ||

| Control Variables | Yes | Yes | |

| F-Statistic | 65.15 *** | 6.36 *** | |

| Observations | 464 | 464 | |

| Unidentifiable test | Anderson Canon LM Statistic (-Statistic) | 10.1 *** | |

| Cragg–Donald Wald Test (-Statistic) | 10.34 *** | ||

| Weak identification test | Cragg–Donald Wald Test (F-Statistic) | 10.17 *** | |

| Over-identification test | Sargan Statistic (p-value) | 0.00 *** | |

| Weak instrumental variable test | Anderson–Rubin Wald Test (F-Statistic) | 7.21 *** | |

| Anderson–Rubin Wald Test (-Statistic) | 7.32 *** | ||

| Stock–Wright LM Statistic (-Statistic) | 7.2 *** | ||

| Variables | Regression of Mean | Regression of Quantile | |||

|---|---|---|---|---|---|

| FE | FGLS | 25% Quantile | 50% Quantile | 75% Quantile | |

| inf | 0.0005 *** | 0.0003 *** | 0.0014 *** | 0.0018 *** | 0.0020 *** |

| (5.40) | (3.60) | (87.66) | (109.70) | (49.23) | |

| gdp | 0.0026 *** | 0.0043 *** | 0.0010 *** | 0.0005 *** | 0.0007 *** |

| (4.29) | (25.37) | (16.08) | (3.181) | (3.86) | |

| urb | 0.0041 *** | 0.0024 *** | 0.0131 *** | 0.0154 *** | 0.0113 *** |

| (5.47) | (7.01) | (49.83) | (15.91) | (13.73) | |

| fdi | 0.0069 *** | 0.0061 *** | 0.0094 *** | 0.0282 *** | 0.0401 *** |

| (3.55) | (4.88) | (4.10) | (27.00) | (46.53) | |

| tra | 0.0001 | 0.0023 *** | 0.0001 *** | 0.0006 *** | 0.0008 *** |

| (1.38) | (4.33) | (2.65) | (12.23) | (24.74) | |

| lab | −0.0062 *** | −0.0027 *** | 0.0139 *** | −0.0111 *** | −0.0089 *** |

| (−4.87) | (−4.34) | (27.91) | (−21.35) | (−16.58) | |

| pri | −0.0075 | −0.0043 *** | −0.0144 *** | −0.0079 | 0.0012 |

| (−1.18) | (−2.59) | (−3.35) | (−1.22) | (0.76) | |

| cons | −0.0028 | 0.0162 *** | (-) | (-) | (-) |

| (−0.464) | (4.26) | ||||

| Time Effect | Yes | Yes | Yes | Yes | Yes |

| Province Fixed Effect | Yes | Yes | Yes | Yes | Yes |

| F-Statistic | 95.36 *** | (-) | (-) | (-) | (-) |

| Within-R2 | 0.3240 | (-) | (-) | (-) | (-) |

| -Statistic | (-) | 3876.45 *** | (-) | (-) | (-) |

| Observations | 406 | 406 | 406 | 406 | 406 |

| Variables | Condition Dimension | Process Dimension | Result Dimension |

|---|---|---|---|

| inf | 0.0842 *** | 0.0272 *** | 0.0105 ** |

| (13.03) | (8.91) | (2.31) | |

| gdp | 0.0122 *** | 0.0008 *** | 0.0031 *** |

| (13.65) | (2.96) | (8.79) | |

| urb | 0.0108 *** | 0.0018 *** | 0.0027 *** |

| (7.26) | (5.16) | (10.29) | |

| fdi | 0.0009 | 0.0095 *** | 0.0077 *** |

| (0.29) | (4.96) | (5.25) | |

| tra | 0.0011 *** | 0.0003 *** | 0.0026 *** |

| (5.14) | (5.65) | (5.42) | |

| lab | −0.002 * | −0.0010 *** | −0.0019 *** |

| (−1.73) | (−4.84) | (−5.39) | |

| pri | −0.0006 | −0.0012 *** | −0.0038 *** |

| (−0.43) | (−5.43) | (−3.11) | |

| cons | −0.0473 *** | 0.0277 *** | 0.0049 ** |

| (−5.53) | (8.41) | (2.09) | |

| Time Effect | Yes | Yes | Yes |

| Province Fixed Effect | Yes | Yes | Yes |

| -Statistic | 2920.85 *** | 6462.95 *** | 7650.25 *** |

| Observations | 464 | 464 | 464 |

| Variables | Technological Innovation Effect | Industrial Structure Effect | Productivity Effect | |||

|---|---|---|---|---|---|---|

| tei | str | ifp | ||||

| inf | 0.1420 *** (2.27) | (-) | 0.8835 * (1.7) | (-) | 1.3887 *** (2.77) | (-) |

| tei | (-) | 0.2128 *** (19.23) | (-) | (-) | (-) | (-) |

| str | (-) | (-) | (-) | 0.0418 *** (9.55) | (-) | (-) |

| ifp | (-) | (-) | (-) | (-) | (-) | 0.0410 *** (10.46) |

| cons | 0.0049 *** | 0.0122 *** | 1.1167 *** | −0.284 *** | 0.4616 *** | 0.0065 * |

| (1.06) | (4.72) | (25.82) | (−5.34) | (11.82) | (1.76) | |

| Control Variables | Yes | Yes | Yes | Yes | Yes | Yes |

| -Statistic | 1111.02 *** | 1279.19 *** | 3232.37 *** | 510.89 *** | 127.23 *** | 545.13 *** |

| Observations | 464 | 464 | 464 | 464 | 464 | 464 |

| Variables | Coastal Region | Inland Region |

|---|---|---|

| inf | 0.0258 *** | 0.0062 *** |

| (6.16) | (3. 16) | |

| gdp | 0.0037 *** | 0.0014 *** |

| (10.11) | (6.45) | |

| urb | 0.0048 *** | 0.0007 ** |

| (6.93) | (2.55) | |

| fdi | 0.0066 *** | 0.0074 *** |

| (4.61) | (4.54) | |

| tra | 3.82 × 10−6 | −0.0004 *** |

| (0.026) | (−11.34) | |

| lab | −0.0041 *** | −0.0023 *** |

| (−6.20) | (−10.69) | |

| pri | −0.0054 *** | 0.0034 *** |

| (−3.40) | (9. 82) | |

| cons | 0.0025 | 0.0230 *** |

| (0.73) | (12.60) | |

| Time Effect | Yes | Yes |

| Province Fixed Effect | Yes | Yes |

| -Statistic | 2847.46 *** | 6042.60 *** |

| Observations | 176 | 288 |

| Coastal Region | Technological Innovation Effect | Industrial Structure Effect | Productivity Effect | |||

|---|---|---|---|---|---|---|

| tei | str | ifp | ||||

| inf | 0. 3378 ** (2.22) | (-) | 0.3058 (0.33) | (-) | 4.2572 *** (3.01) | (-) |

| tei | (-) | 0.1192 *** (15.12) | (-) | (-) | (-) | (-) |

| str | (-) | (-) | (-) | 0.0215 *** (10.89) | (-) | (-) |

| ifp | (-) | (-) | (-) | (-) | (-) | 0.0127 * (1.92) |

| cons | −0.0132 | 0.0292 *** | 0.7814 *** | 0.0122 *** | 0.4616 *** | 0.0065 *** |

| (−1.18) | (8.84) | (11.36) | (2.64) | (11.82) | (1.76) | |

| Control Variables | Yes | Yes | Yes | Yes | Yes | Yes |

| -Statistic | 470.28 *** | 954.75 *** | 2420.25 *** | 563.85 *** | 80.62 *** | 120.69 *** |

| Observations | 176 | 176 | 176 | 176 | 176 | 176 |

| Inland Region | Technological Innovation Effect | Industrial Structure Effect | Productivity Effect | |||

| tei | str | ifp | ||||

| inf | 0.1426 *** (4.13) | (-) | 1.5895 ** (2. 54) | (-) | 2.2743 *** (3.68) | (-) |

| tei | (-) | 0.5253 *** (12.04) | (-) | (-) | (-) | (-) |

| str | (-) | (-) | (-) | 0.0542 *** (6.74) | (-) | (-) |

| ifp | (-) | (-) | (-) | (-) | (-) | 0.0331 *** (11.67) |

| cons | 0.0342 *** | −0.0061 * | 1.2327 *** | −0.0495 *** | 0.4794 *** | 0.0009 |

| (9.06) | (−1.76) | (20.19) | (−5.27) | (7.57) | (0.22) | |

| Control Variables | Yes | Yes | Yes | Yes | Yes | Yes |

| -Statistic | 156.38 *** | 295.15 *** | 657.02 *** | 119.70 *** | 159.48 *** | 377.81 *** |

| Observations | 288 | 288 | 288 | 288 | 288 | 288 |

| Threshold Variables | Models | Threshold Estimates and Confidence Intervals | Bootstrap Test of Threshold Effect | |||

|---|---|---|---|---|---|---|

| Threshold Estimates | 95% Confidence Interval | F-Value | p-Value | Bootstrap Times | ||

| inf | Single threshold | 0.0035 | (0.003, 0.004) | 23.612 *** | 0.003 | 300 |

| Dual-threshold | 0.0029 | (0.002, 0.015) | 7.844 ** | 0.037 | 300 | |

| Three-fold threshold | 0.0127 | (0.002, 0.016) | 2.161 | 0.213 | 300 | |

| Variables | FE | FGLS |

|---|---|---|

| −0.1158 *** | −0.0927 *** | |

| (−5.75) | (−8.09) | |

| 0.1052 *** | 0.0547 *** | |

| (3.21) | (4.44) | |

| 0.1251 *** | 0.1027 *** | |

| (5.44) | (9.75) | |

| gdp | 0.0041 *** | 0.0031 *** |

| (10.12) | (11.78) | |

| urb | 0.0067 *** | 0.0027 *** |

| (5.80) | (4.19) | |

| fdi | 0.0074 *** | 0.0098 *** |

| (3.073) | (11.02) | |

| tra | 0.0004 *** | 0.0003 *** |

| (3.23) | (5.31) | |

| lab | −0.0047 *** | −0.0001 |

| (−2.97) | (−0.36) | |

| pri | −0.0069 | −0.0011 ** |

| (−1.15) | (−2.11) | |

| cons | 0.0137 *** | 0.0129 * |

| (0.0686) | (0.0073) | |

| Time Effect | Yes | Yes |

| Province Fixed Effect | Yes | Yes |

| F-Statistic | 116.68 *** | (-) |

| Within-R2 | 0.4171 | (-) |

| -Statistic | (-) | 8224.97 *** |

| Observations | 464 | 464 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Du, X.; Zhang, H.; Han, Y. How Does New Infrastructure Investment Affect Economic Growth Quality? Empirical Evidence from China. Sustainability 2022, 14, 3511. https://doi.org/10.3390/su14063511

Du X, Zhang H, Han Y. How Does New Infrastructure Investment Affect Economic Growth Quality? Empirical Evidence from China. Sustainability. 2022; 14(6):3511. https://doi.org/10.3390/su14063511

Chicago/Turabian StyleDu, Xin, Hengming Zhang, and Yawen Han. 2022. "How Does New Infrastructure Investment Affect Economic Growth Quality? Empirical Evidence from China" Sustainability 14, no. 6: 3511. https://doi.org/10.3390/su14063511

APA StyleDu, X., Zhang, H., & Han, Y. (2022). How Does New Infrastructure Investment Affect Economic Growth Quality? Empirical Evidence from China. Sustainability, 14(6), 3511. https://doi.org/10.3390/su14063511