1. Introduction

In the field of business, knowledge has become very important in the success of organizations and their contribution to transformation into a knowledge economy, where most of knowledge is implicit and is available in the minds of individuals, and depends on their intuition, intellectual experience and skills. It is also available in the form of meaningful information about the market, the beneficiary, communications and technology. In fact, knowledge can be measured and plays a crucial role in achieving competitive advantage [

1]. Competitive advantage is defined as a distinct skill, technology or resource that enables the organization to provide a service, commodity or benefits distinct from what competitors provide within the same sector, which confirms the distinction and difference of the organization from its competitors from the point of view of customers [

2]. However, Dynamic Capabilities, sustainable competitive advantage, innovations and market responsiveness are all sources of competitive advantage. Dynamic Capabilities are the organizational and strategic routines by which firms achieve new resource configurations as markets emerge, collide, split, evolve and die [

3]. An innovation is defined as an idea, a product or process, or a system that is perceived to be new to an individual [

4]. Sustainable competitive advantage is defined as a strategy that cannot be easily imitated by the competitors of the resources owned and used by a company and thus creates value [

5]. Market responsiveness describes how timely the organization is in responding to market changes [

6]. In light of this, the methods of developing performance in organizations have changed, after they were focused on the organizational or material side of the administrative process, which was losing its spirit or human nature, and leading to a feeling of frustration for workers and beneficiaries. These methods became focused on the human aspect of the administrative process in its practical sense, including the elements of effective leadership, empowering workers and attention to intellectual capital [

7].

Intellectual capital emerged as a term in the past decades [

8]. It is the talent, skills, technical knowledge, relationships, and machines, which can be converted into value. It is the sum of all that known by all individuals in the organization and achieves a competitive advantage in the market [

9]. According to Al-Maani et al. [

10], intellectual capital is divided into structural capital, which is represented in systems, patents and databases; human capital, which is represented in education, training, experience; relational capital, which is represented in contracts, loyalty, and the brand; and psychological capital, which is represented in optimism, confidence, hope and the ability to resist that exist among the members of the organization. However, many scholars have considered the relationship between intellectual capital and competitive advantage to be impacted by the mediation of some factors such as business intelligence system, innovation speed and innovation quality. Business Intelligence is the process of providing insights that will enable business managers to make tactical decisions. It is defined as the method of converting data into information and subsequently to knowledge [

11]. Innovation speed is defined as the pace of progress that a firm displays in innovating and commercializing new products. It describes a firm’s capability to accelerate the activities and tasks that occur through the new product development process [

12]. Innovation quality is defined as the summation of evaluation on customers’ satisfaction and firm’s innovativeness [

13].

In light of a competitive economy and the information age, intellectual capital has become the real capital of organizations, which is considered the main role of innovation. It is the leader in the process of change, and therefore is able to transform knowledge into value and then into a competitive advantage, which means that the center of gravity in value generation has moved from the exploitation of natural (physical) resources to the exploitation of tangible and intellectual assets, and from the law of diminishing returns (applicable to material goods) to the law of increasing returns (regarding knowledge and ideas) [

14]. Therefore, intellectual capital is becoming one of the prominent features in the current era, the era of the knowledge revolution and the revolution of smart technology. In fact, data, technology, intellectual capital and business intelligence tools are the components that without which the use of information in the decision-making process would be impossible. On the other hand, the use of such data requires certain knowledge and skills that are embedded in intellectual capital [

15].

Therefore, there is a steady increase in the studies and research related to intellectual capital management in the past two decades, as it has been increasingly recognized by both the academic community and practitioners as the key to achieving a competitive advantage for most companies. Intellectual assets such as patents, trade secrets, human capital, and organizational structures are widely considered important components of business performance and economic growth. Intellectual capital is one of the organizational capabilities that have a positive impact on competitive advantage [

16]. As indicated by Choudhury [

17], organizations need to create innovative capabilities to gain competitive advantage due to the impact of innovation and learning on the structure of advantage. Organizational competitiveness, increased customer expectations, rapid technological changes, and unexpected customer behavior. Newbert [

18] also linked resources and capabilities to competitive advantage. This means that an organization that owns and exploits scarce and valuable resources (tangible or intangible) and capabilities (ability to deploy resources) will be in a better competitive position and performance [

19,

20]. By combining these intangible resources and capabilities in a way that provides access to multiple, unique, and sustainable market opportunities, a company can create and maintain a core competency in the form of competitive advantage.

Nevertheless, the pharmaceutical and medical supplies sector constitutes a successful story in terms of gaining competitive advantage, as it currently occupies a prominent and pioneering position in the region, which mainly comes as a result of the expansion of export markets, which reached 58 export markets in 2019, which according to experts is due to the fact that the Jordanian pharmaceutical companies are subject to strict laws and high supervision, and they compete at the global level due to the many competitive advantages it contains. Therefore, this study seeks to investigate some factors that help to develop such competitive advantage, where the researchers see it is a priority to investigate the effect of the mediation of some factors such as business intelligence, innovation speed and innovation quality on the relationship between intellectual capital and competitive advantage in the context of Jordanian companies, because of their significant impact as indicated by the results of the recent studies in the contexts of other countries. Indeed, this is important for the Jordanian national economy, where unemployment is on the rise, reaching 25% in Q1-2021, while the central government debt rose to almost 106.3% of GDP during 11M-2020, almost 10 percentage points of GDP higher than at end-2019 [

21].

2. Literature Review

In examining the impact of intellectual capital on company performance under the mediating role of innovation speed and quality, Wang et al. [

22] show that the components of intellectual capital, which are human, relational and structural, have a positive relationship with both the speed of innovation and quality, which facilitates the financial and operational performance of the company. In addition, Nzewi et al. [

23] aimed to determine the relationship between intellectual capital and the competitive advantage of selected commercial banks in Anambra State, where they found that there is a positive relationship between both human capital and employee innovation, with the change in employee innovation reaching 95%. However, Chukwuemeka and Onuoha [

24] focused on the relationship between each of the dynamic capabilities and the competitive advantage of fast-food restaurants in Rivers State in Nigeria and found that the dimensions of dynamic capabilities are significantly related to the competitive advantage of companies. Moreover, Mukuche [

25] aimed to establish a relationship between the application of business intelligence and competitive advantage in insurance companies in Kenya, where it was concluded that various aspects of business intelligence have already been used by insurance companies in Kenya to achieve a competitive advantage. Al-Douri and Bousalem [

26] sought to determine the role of intellectual capital in achieving sustainable competitive advantage through a field study on Algeria Telecom. They found that there is a role for structural capital in achieving the sustainable competitive advantage of Algeria Telecom, and there is no role for human and customer capital in achieving the sustainable competitive advantage of Algeria Telecom. Chen [

6] investigated business intelligence from an organizational agility perspective that Holsapple and Li [

27] identified in the dimensions of agility: alertness and responsiveness. The results showed that business intelligence and IT infrastructure flexibility are significant sources of organizational agility, and organizational agility partially mediates the effects of business intelligence and IT infrastructure flexibility on an organization’s competitive advantage.

However, Le and Lei [

28] aimed to verify the effect of organizational learning (OL) and two specific aspects of innovation—innovation speed and innovation quality—on competitive advantage. The findings show that innovation speed and quality play mediating roles in the relationship between OL and competitive advantage. In general, while innovation speed has greater effects on low-cost competitive advantage, OL and innovation quality have greater effects on differentiation competitive advantage. Kessler and Chakrabarti [

29] organize and integrate the innovation speed literature, develop a conceptual framework of innovation speed, and offer researchable propositions relating to the need for antecedents and outcomes of innovation speed. They argue that innovation speed (a) is most appropriate in environments characterized by competitive intensity, technological and market dynamism, and low regulatory restrictiveness; (b) can be positively or negatively affected by strategic-orientation factors and organizational-capability factors; and (c) has an influence on development costs, product quality, and ultimately project success. Moreover, Stefanus et al. [

30] discussed the factors in regard to innovation types that contribute to improve SMEs’ competitiveness. The study revealed that, to some extent, an innovation becomes a creative destruction, especially for SMEs that have limited access to innovation capabilities. In addition, it confirmed that there has been little discussion regarding when an innovation speed is appropriate, what factors speed up or hamper innovation, and how differences in speed affect a firm’s performance.

Besides, Ba and Lei [

28] aimed to verify the effect of organizational learning (OL) and two specific aspects of innovation, innovation speed and innovation quality, on competitive advantage. The findings show that innovation speed and quality play mediating roles in the relationship between OL and competitive advantage. In general, while innovation speed has greater effects on low-cost competitive advantage, OL and innovation quality have greater effects on differentiation competitive advantage. Furthermore, Marc [

31] in one study found that that intellectual capital affects innovation success through knowledge augmentation, and that the degree to which different forms of intellectual capital facilitate knowledge augmentation, and innovation success in turn, varies with industry dynamics. In a second study that was deliberately conducted in an industry facing higher environmental dynamism than those in the first study—pharmaceuticals—the researcher found that only human capital was positively linked to innovation quality and efficiency through knowledge augmentation where organizational capital was found to have no effect, while social capital was found to have a negative effect on innovation success in the pharmaceutical industry.

More importantly, Al-Rabihat [

32] investigated the impact of intellectual capital on competitive advantage in a field study in companies operating at King Hussein Business Park. The study aimed to identify the impact of intellectual capital on the competitive advantage of companies operating in King Hussein Business Park, and to identify the extent to which the dimensions of intellectual capital are applied in those companies. The study showed that the relative importance of intellectual capital was generally high, with human capital in first place, followed by structural capital and then relational capital. In addition, it showed that the competitive advantage came in a high degree, where the cost came in the first place, followed by the flexibility followed by the quality. In addition, Al-Saqqa [

33] examined the role of marketing intelligence in achieving competitive advantage in Internet service providers in the Gaza Strip. The results of the study show a statistically significant relationship between marketing intelligence with its four components (competitor intelligence, product intelligence, market intelligence, and customer intelligence) and achieving competitive advantage. The results of the study also showed that there were no statistically significant differences between the respondents’ answers with regard to marketing intelligence and with regard to the competitive advantage in the companies providing Internet service in the Gaza Strip due to sex qualification—year of experience—job title—income level.

As seen, the influence of intellectual capital on competitive advantages has been a topic of interest to many researchers. However, there are only a few reports on the industrial sector exploring the relationship between intellectual capital and competitive advantages through mediators. Therefore, many researchers consider that the study of the effect of the intellectual capital on competitive advantages should be the subject of future efforts. However, despite the fact that some studies have found that intellectual capital has a major influence on competitive advantages, there are fewer studies that considered the mediation of business intelligence, innovation speed and innovation quality. Moreover, fewer studies have investigated the impact of the different components of intellectual capital as human capital, relational capital and structural capital with mediation of business intelligence, innovation speed and innovation quality, which will be the focus of this study.

3. Hypotheses Development

According to previous studies, competitive advantage has been linked to a direct or indirect way with intellectual capital. For example, Zerenler et al. [

34] indicated that there might be other variables such as communication methods and characteristics of organizational culture and other important factors that affect intellectual capital management, planning and control. In addition, Juma and Mc Gee [

35] indicated that there is limited support for a direct relationship between intellectual capital and organizational performance. In addition, Kong and Prior [

36] and Wu et al. [

4] highlighted the need to focus on different comparisons based on different industries, countries and factors such as learning, value, and culture to understand intellectual capital. Further, Ding and Li [

37], Wu et al. [

4], Renko et al. [

38], Ngo and Loi [

39] and Reed et al. [

40] studied the relationship between the dynamic aspects of intellectual capital and innovative capital and emphasized the need for innovation in human resource practices. Moreover, many researchers such as Wang et al. [

22] and Hardeep and Purnima [

41] studied the effect of intellectual capital on competitive advantage and business performance while considering the role of innovation and learning culture where they emphasize the need for a longitudinal study to further develop the conceptual framework of intellectual capital. In addition, Wang et al. [

22] investigated Intellectual capital and firm performance with the mediating role of innovation speed and quality.

3.1. Mediating Effect of Business Intelligence

In fact, none of the researcher have examined such relationship, especially at the individual level, of the different components of intellectual capital. However, Mukuche [

25] aimed to establish a relationship between the application of business intelligence and competitive advantage in insurance companies in Kenya. Karim [

42] aimed to measure the value of competitive business intelligence system (CBIS) to stimulate competitiveness in global market. MacGillivray [

43] aimed to measure sustaining intellectual capital through business intelligence. Balouei [

44] aimed to measure the relationship between intellectual capital and organizational intelligence in knowledge-based organizations. English [

45] aimed to measure the business Intelligence as a source of competitive advantage in SMEs. Karami et al. [

46] aimed to enhancing hospital performance from intellectual capital to business intelligence. Thakur [

47] aimed to identify the role of artificial intelligence and expert systems in business competitiveness. However, the scarcity of works examining this relationship between the three different components of intellectual capital on competitive advantage through the mediation of business intelligence may be responsible for the different impacts achieved by researchers, which requires examining such mediating factors, which accordingly sets a base for this study to hypothesize a positive relationship between Human capital, relational capital and structural capital and competitive advantages through the mediation of business intelligence, as follows.

Hypothesis 1 (H1). Business intelligence positively mediates the impact of the relationship between the three different components of intellectual capital and the competitive advantage in the pharmaceutical and medical supplies companies in Jordan.

Hypothesis 1a (H1a). Business intelligence positively mediates the impact of the relationship between human capital and competitive advantage.

Hypothesis 1b (H1b). Business intelligence positively mediates the impact of the relationship between relational capital and competitive advantage.

Hypothesis 1c (H1c). Business intelligence positively mediates the impact of the relationship between structural capital and the competitive advantage.

3.2. Mediating Effect of Innovation Speed

Wang et al. [

22] examined the impact of intellectual capital on company performance under the mediating role of innovation speed and quality. The study revealed, after analyzing the data, that the components of intellectual capital, which are human, relational and structural capital, have a positive relationship with both the speed of innovation and quality, which facilitates the financial and operational performance of the company. Le and Lei [

28] aimed to verify the effect of organizational learning and two specific aspects of innovation, innovation speed and innovation quality, on competitive advantage. Kessler and Chakrabarti [

29] argue that innovation speed (a) is most appropriate in environments characterized by competitive intensity, technological and market dynamism, and low regulatory restrictiveness; (b) can be positively or negatively affected by strategic-orientation factors and organizational-capability factors; and (c) has an influence on development costs, product quality, and ultimately project success. Stefanus et al. [

30] discussed the factors in regard to innovation types that contribute to improve SMEs’ competitiveness. It revealed that to some extent, an innovation becomes a creative destruction, especially for SMEs that have limited access to innovation capabilities. In addition, it is confirmed that there has been little research regarding when an innovation speed is appropriate, what factors speed up or hamper innovation, and how differences in speed affect a firm’s performance. However, according to Kessler and Chakrabarti [

29], there is a growing recognition that innovation speed is important to a firm’s creating and sustaining competitive advantage amidst rapidly changing business environments. Therefore, the following relationship between human capital, relational capital and structural capital through the mediation of innovation speed can be proposed.

Hypothesis 2 (H2). Innovation speed positively mediates the impact of the relationship between the three different components of intellectual capital and the competitive advantage at in the pharmaceutical and medical supplies companies in Jordan.

Hypothesis 2a (H2a). Innovation speed positively mediates the impact of the relationship between human capital and competitive advantage.

Hypothesis 2b (H2b). Innovation speed positively mediates the impact of the relationship between relational capital and competitive advantage.

Hypothesis 2c (H2c). Innovation speed positively mediates the impact of the relationship between structural capital and competitive advantage.

3.3. Mediating Effect of Innovation Quality

Wang et al. [

22] examined the impact of intellectual capital on company performance under the mediating role of innovation speed and quality. The study revealed, after analyzing the data, that the components of intellectual capital, which are human, relational and structural capital, have a positive relationship with both the speed of innovation and quality, which facilitates the financial and operational performance of the company. Le and Lei [

28] aimed to verify the effect of organizational learning and two specific aspects of innovation, innovation speed and innovation quality, on competitive advantage. Stopa and Lewandowska [

48] aimed to explore views on the very complex phenomenon of innovation, mainly innovation quality. They concluded that, taking into account the specificity of the broader context, i.e., the socio-economic conditions of the Podkarpackie region, it is possible to better understand the factors affecting the quality of innovation and potential barriers to further use strategies aimed at the implementation of innovation in enterprises. Marc [

31] hypothesized that intellectual capital affects innovation success through knowledge augmentation, and that the degree to which different forms of intellectual capital facilitate knowledge augmentation, and innovation success in turn, varies with industry dynamics. Moreover, in a multi-industry study, Marc [

31] found support for his hypothesis: core forms of intellectual capital—human, organizational, and social—were positively associated with knowledge augmentation, which in turn was associated with innovation success, as indicated by innovation quality and efficiency. In a second study, deliberately conducted in an industry facing higher environmental dynamism than those in the first study—pharmaceuticals— Marc [

31] found that only human capital was positively linked to innovation quality and efficiency through knowledge augmentation. Organizational capital had no effect, and social capital had a negative effect on innovation success in the pharmaceutical industry.

Thus, as prior works suggest, as mentioned by Marc [

31], the intellectual capital plays a critical role in organizations’ ability to succeed at innovation, that is, to create new and better products or services efficiently. However, since little research has examined how intellectual capital translates into innovation success, and whether all forms of intellectual capital are needed for innovation success across industries, this study hypothesizes a positive relationship between human capital, relational capital and structural capital through the mediation of innovation quality.

Hypothesis 3 (H3). Innovation quality positively mediates the impact of the relationship between the three different components of intellectual capital and competitive advantage in the pharmaceutical and medical supplies companies in Jordan.

Hypothesis 3a (H3a). Innovation quality positively mediates the impact of the relationship between human capital and competitive advantage.

Hypothesis 3b (H3b). Innovation quality positively mediates the impact of the relationship between relational capital and competitive advantage.

Hypothesis 3c (H3c). Innovation quality positively mediates the impact of the relationship between structural capital and competitive advantage.

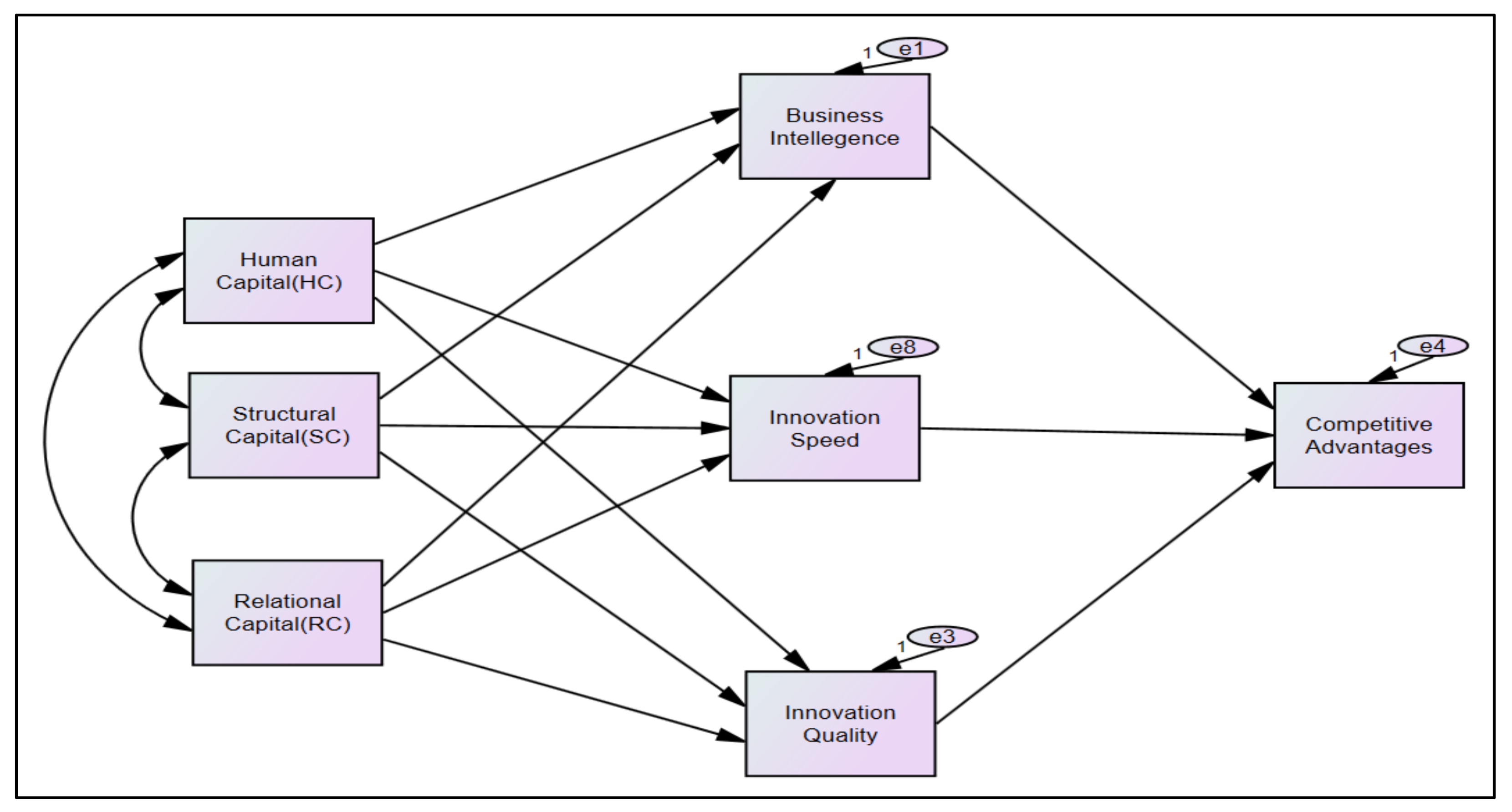

Figure 1 represents the conceptual model of this study, which illustrates the different indirect relationship between human capital, structural capital and relational capital, and the competitive advantage through the mediation of business intelligence, innovative speed and innovation quality.

4. Methodology

The population of this study includes, according to Statistics [

49], about 130 factories in Jordan, scattered geographically between the pharmaceutical and medical supplies industries. Perhaps the most prominent characteristic of this sector is its reliance on Jordanian hands, as it provides job opportunities for 27 thousand workers, where administrative and technical-level workers constitute more than 99% (10,000 male and female) of the total number of workers. However, to achieve the objectives of this study, this study employed an empirical method that used a questionnaire as a tool. Since the population size at administrative level, which is the main focus of this study, is around 2500 [

49], then 334 or more measurements/surveys are needed to have a confidence level of 95% that the real value is within ±5% of the measured/surveyed value. The questionnaire was distributed online and 600 questionnaires were collected, and with only 569 cases that are valid for analysis due to data screening that included missing data, and univariate and multivariate outliers, which represent 95% of the collected questionnaires. The data were then input into IBM SPSS AMOS (23) and Process software Developed by Hayes [

50] for analysis. Structural equation modeling, SEM (CB-SEM), was used for confirmatory factor analysis (CFA) for model fit and to assess validity and reliability, which was tested again using the Chronbach’s Alpha coefficient. Process software was used for path analysis to estimate the different indirect effects. However, the model fitness was evaluated using several criteria, including the Chi-square, (GFI), Adjusted Goodness-of-Fit Index (AGFI), Comparative Fit Index (CFI), and Root Mean Square Error of Approximation (RMSEA) [

51]. The first regression path in each measurement component was fixed at (1) for model identification purposes. All items of the constructs were initially incorporated into the model testing for first confirmatory factor analysis. Items were evaluated using item loading, error variance estimates and evidence of items needing to cross-load on more than one component factor.

In fact, CFA is the best-known statistical analysis for testing a hypothesized factor structure [

51,

52]. This method was recommended and used by [

53,

54,

55,

56]. However, in the hypotheses verification step, we tested all hypotheses using Process software developed by Hayes, so that the mediation effects were tested using bootstrapping analysis, which is a powerful method to determine the statistical significance of mediation, to confirm a significant indirect effect [

50].

5. Measurements of Constructs

The study was based on quantitative data. The data were collected randomly through online means from a population of 2500 employees in the administrative level in Jordanian pharmaceutical and medical supplies companies. A questionnaire, based on a 5-Likert scale, was used to collect data, where 5 = strongly agree, 4 = agree, 3 = neutral, 2 = disagree, and 1 = strongly disagree. In addition to the section for the demographic variables that included gender, age, level of education, experience and management level, the questionnaire had three other sections with five instruments to measure the five different variables involved in this study, as shown in

Table 1. For the understandability issue, the questionnaire was translated to Arabic, in accordance with the criteria of translation from one language to another, particularly the recommendations from Brislin [

57]. In addition, the participants of this study were provided with enough time, as the questionnaire was available online, where it took 18 days to collect data. A letter of consent was enclosed with the survey that included asking for participation, an overview of the purpose of the study and its significance with confidentiality being also ensured to decrease the risk of “common method bias” (CMB) [

58].

The questionnaire was divided into four parts. Part 1 included the demographic variables: Gender, age, level of education, experience and management level. Part 2 was for the independent variable “Intellectual Capital”. The instruments used to measure human capital, relational capital and structural capital were adopted from [

22]. Part 3 was for the dependent variable “Competitive Advantage”. The instrument used for dynamic capabilities was adopted from [

24]. The instrument used for innovation was adopted from [

4]. The instrument used for sustainable competitive advantages was adopted from [

59], and the instrument used for market responsiveness was adopted from [

6]. Part 4 was for the mediators where the instrument used to measure “Business Intelligence” was adopted from [

6]; the instrument used to measure “Innovation Quality” was adopted from [

22], and the instrument used to measure “Innovation Speed” was adopted from [

22]. The instruments used in the study that make up the questionnaire (which have been referred to above) were ALL OPEN ACCESS, and therefore there is no need to receive permission from the authors.

6. Results

Gender, age, level of education, experience and management level were considered in this research as the demographic variables. The sample consisted of 600 participants. After data screening of missing values, univariate and multivariate outliers, the cases valid for analysis totaled 569 cases. Among the participants, 55.2% were male and 44.8% were female. Bachelor’s degree holders dominated the sample, with 91.9% against 8.1% master’s and doctorate degree holders. In addition, employees of 5 to 10 years were the largest group, at 39.5%, followed by employees of less than 5 year’ experience, 37.3%, while employees of 11 years’ experience and higher formed the smallest portion of the sample at 23.2%. Among participants, 62.4% were in supervisory/operative/first-line managers positions (lower level), while 23.4% were in the executory positions (middle level) and only 14.2% in the administrative positions (top level), as shown in

Table 2.

6.1. Summary of the Respondents’ Answers

Table 3 shows the means and Standard Deviation of the answers of the 569 participants. In addition, it shows skewness and kurtosis.

Respondents’ answers show that sustainable competitive advantages scored the highest level with a mean of 4.0621 and a standard deviation of 0.56783, followed by innovation quality with a mean of 3.4359 and a standard deviation of 0.80236, then innovation, business intelligence, human capital, innovation speed, relational capital, structural capital, where marketing responsiveness and dynamic capabilities scored the lowest level with a mean and standard deviation of 2.6059, 0.53886, 2.5153, 0.84319, respectively.

With regard to normality, which refers to the distribution of the data for a particular variable, the distribution of the variables seems to be fine. However, there are two rules on skewness: (1) if skewness value is greater than 1 then it is positive (right) skewed; if it is less than −1 it is negative (left) skewed; if it is in between, then it is fine though some published thresholds are a bit more liberal and allow for up to ±2.2, instead of ±1, which means that our data are fine. The rule for evaluating whether kurtosis absolute value of the kurtosis is if the value is less than three times the standard error, then the kurtosis is not significantly different from that of the normal distribution; otherwise, there are kurtosis issues. However, a looser rule is an overall kurtosis score of 2.200 or less, which means that our data are fine.

6.2. Structural Equation Modeling (SEM)

The analyses of structural equation modeling (SEM) is composed of two main parts: the measurement model or the confirmatory factor analysis (CFA), and the structural equation model. In statistics, confirmatory factor analysis (CFA) is a form of factor analysis that is commonly used in social research [

60]. It is used to examine whether measures of a certain construct are consistent with the understanding of a researcher for the nature of that construct or what is called sometimes a factor. In fact, the objective of (CFA) confirmatory factor analysis is to examine the fitness of a hypothesized measurement model.

6.3. Measurement Model (CFA)

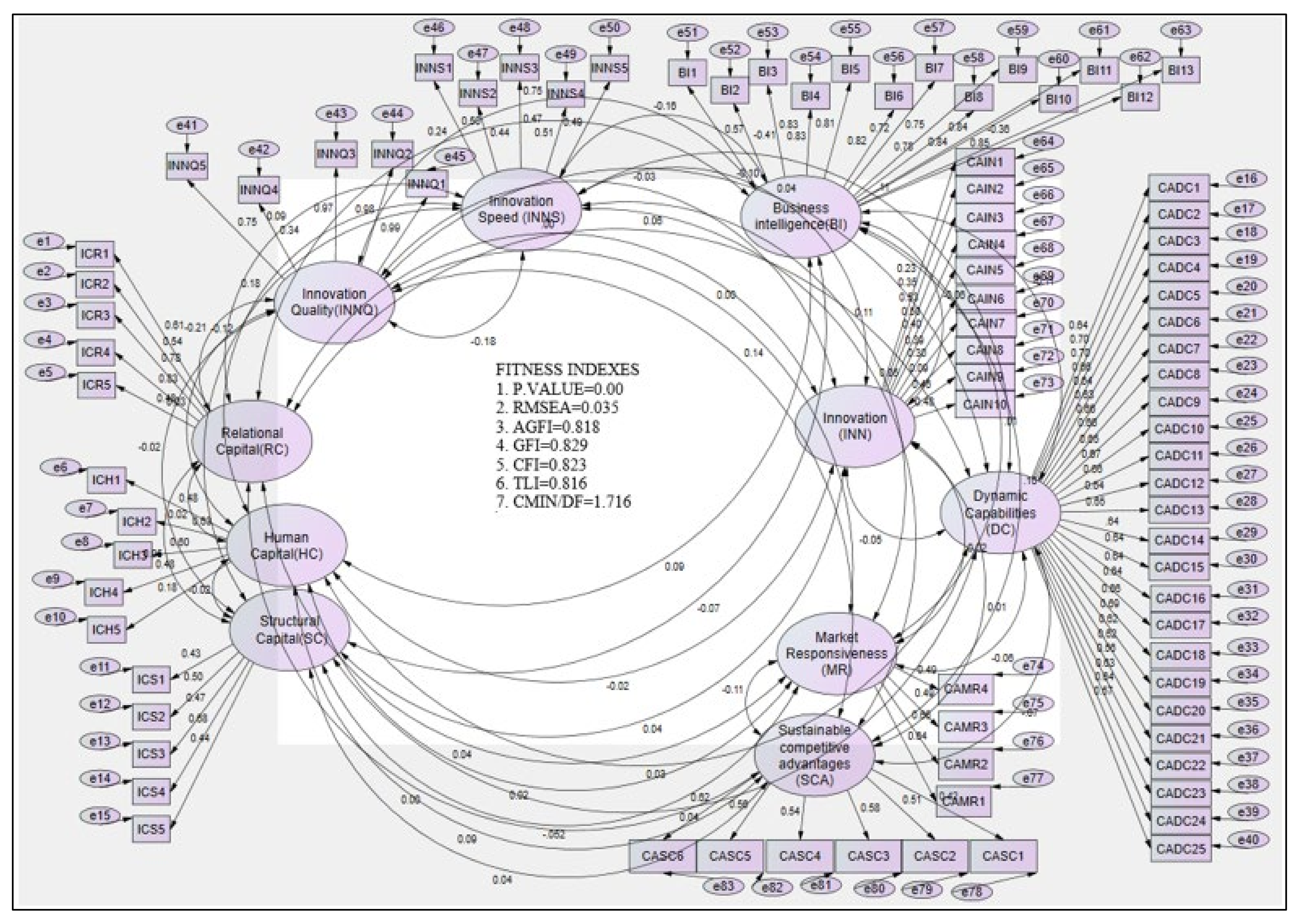

In the current study, 83 items were used to measure 10 first-order constructs, namely: structural capital, human capital, relational capital, innovation quality, innovation speed, business intelligence, dynamic capabilities, innovation, sustainable competitive advantages and marketing responsiveness. To clarify this, the relational capital construct consists of five items, namely ICR1, ICR2, ICR3, ICR4 and ICR5, which are the five questions of the scale that measure the relational capital. However, the initial CFA model with all 83 items, their initial standardized loadings and fitness indexes are portrayed in

Figure 2.

The lowest loading was for CAIN8 on innovation (086), ICH5 on HC (0.176), CAIN1 on innovation (0.226), CAIN7 on innovation (0.305), INNQ4 on IQ (0.341), CAIN2 on innovation (0.355) and CAIN6 on innovation (0.393). However the highest loading was for INNQ1 on intellectual innovation (0.983), INNQ2 on intellectual innovation (0.979), INNQ3 on intellectual innovation (0.974), BI10 on business intelligence (0.842), BI11 on business intelligence (0.835), BI4 on business intelligence (0.828), ICR4 on relational capital (0.827), BI3 on business intelligence (0.827), BI12 on business intelligence (0.826), BI6 on business intelligence (0.820) and BI5 on business intelligence (0.814) where the rest of the loadings were 0.4 and 0.8.

The results of the Goodness-of-fit test for the 83 items model were evaluated using several criteria, including the Chi-square, (GFI), Adjusted Goodness-of-Fit Index (AGFI), Comparative Fit Index (CFI), and Root Mean Square Error of Approximation (RMSEA). This will be based on the cut-off values in

Table 4. Nevertheless, the initial measurements without any modification were: Chi-square = 5620.137., Chi-square/df = 1.716, df = 3276,

p = 0.00, GFI = 0.829, AGFI =.818, CFI = 0.823, TLI = 0.816, CFI = 0.823, RMSEA = 0.035. Indeed, these values are not as recommended according to the cut-off values shown in

Table 4.

6.4. Goodness of Fit Improvement

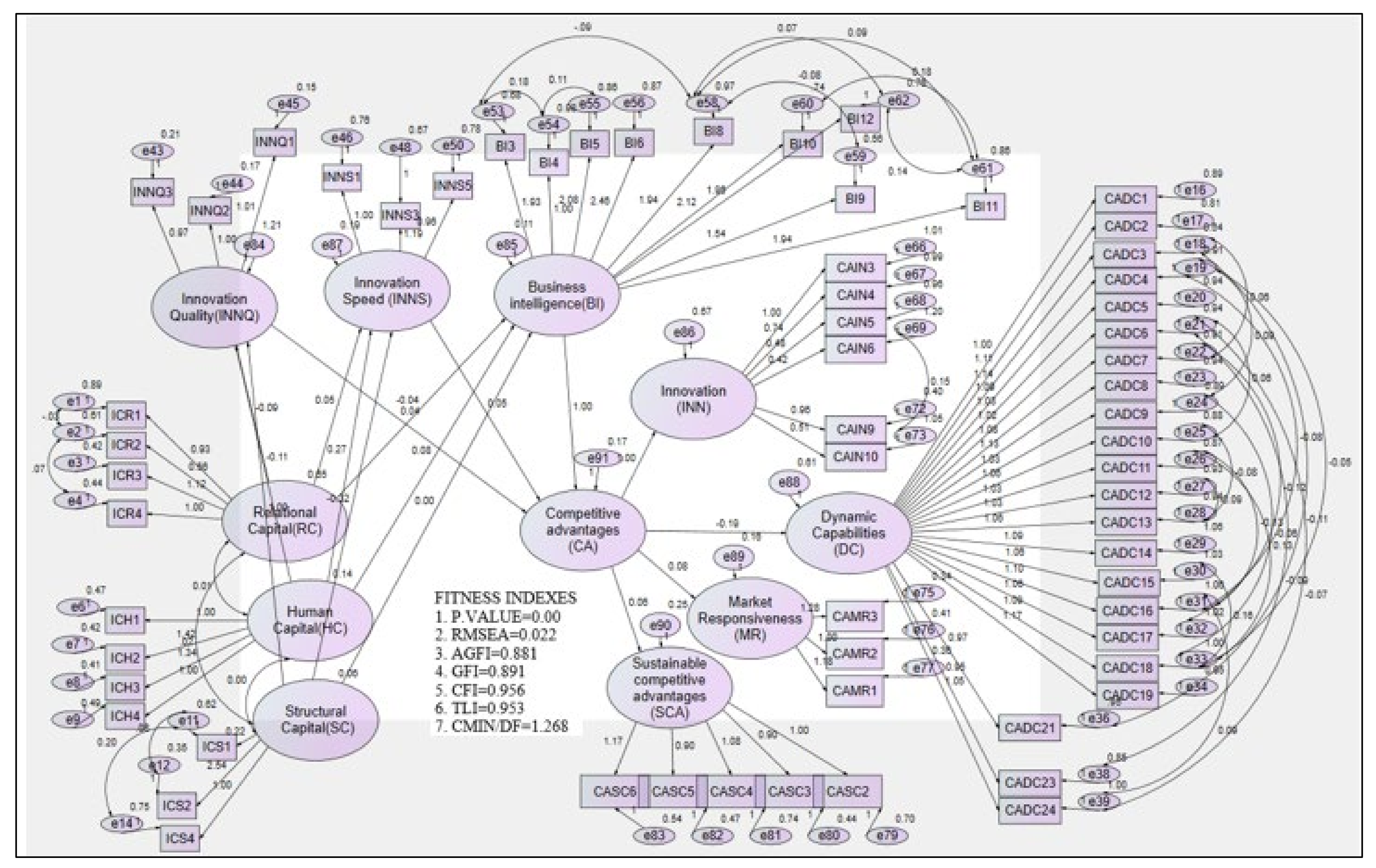

To improve the fitness of this model, 23 items were eliminated using item loadings with a cut-off value of 0.4 regression weight, the error variance estimate and items cross-load on more than one component factor. However,

Figure 3 shows the new model with 69 items remaining. The results of the goodness of fit test for the remaining 69 items model were evaluated using the same criteria, including the Chi-square, (GFI), Adjusted Goodness-of-Fit Index (AGFI), Comparative Fit Index (CFI), and Root Mean Square Error of Approximation (RMSEA). The modified measurements were Chi-square = 2043.508, Chi-square/df = 1.268, df = 1783,

p = 0.000, GFI = 0.891, AGFI = 0.881, CFI = 0.956, TLI = 0.953, RMSEA = 0.022. In fact, this model satisfies the requirements for the analysis as it is much better than the initial model with the 83 items. However, the internal reliability increased for most of the constructs, especially those with deleted items. Reliability for the factors of the three constructs was carried out using Cronbach’s Alpha coefficient which ranged, for the 10 constructs and their remaining items, from 0.71 to 0.89, which is very acceptable.

Figure 3 shows the new acceptable structural model with the new standardized weights and goodness of fit indices.

6.5. The Indirect Effect and Path Analysis

By definition, the indirect effects theory is the assessment of the “impact of one variable on another, as that variable’s influence works through one or more intervening variables” [

64].

After using the measurement model or the confirmatory factor analysis (CFA) and having confirmed the good fit of the data for the model, the structural equation model of path analysis was used to estimate the indirect effect of the independent variables of intellectual capital (human capital, relational capital and structural capital) on the dependent variables competitive advantage (dynamic capabilities, innovation, sustainable competitive advantages and marketing responsiveness) through the mediation of business intelligence, innovation quality and innovation speed. However, to achieve the goal of this study, direct and indirect effects were tested in the different path shown in

Figure 1 and

Figure 3. These effects were estimated using P software developed by Hayes [

50]. First, human, structural, relational capital, business intelligence, innovation speed and quality were regressed on competitive advantage as shown in

Table 5.

Second, human, structural and relational capital were regressed on business intelligence, innovation speed and quality as shown in

Table 6.

Finally, the mediation effects were tested using bootstrapping analysis—a powerful method to determine the statistical significance of mediation—to confirm a significant indirect effect, following the work of Hayes [

50]. Therefore, we tested the indirect effects of human, structural, and relation capital on competitive advantage through business intelligence, innovation speed and quality and the results are shown in

Table 7.

6.6. Testing Hypotheses

Testing for the significance of the results of the intended path analysis presented in

Figure 1 is based on the null hypothesis, which states that if zero falls between the lower bound of the 95% confidence interval and the upper bound of that 95% confidence interval, then the null hypothesis will be retained, which infers that the effect is insignificant. However, if zero falls outside the lower and the upper bound then the null hypothesis would be rejected, which infers that the effect is significant.

Based on the analysis of the data obtained, the study found that only business intelligence, innovation speed and quality constructs were significantly directly related to competitive advantage. In addition, the total effect of relational capital on competitive advantage was significant, as shown in

Table 5. Further, according to the test results shown in

Table 6, only structural capital’s effect on business intelligence, human capital on innovation quality and relational capital on innovation quality was insignificant. More importantly, the test outcome in

Table 7 revealed that H1c, H3a and H3b were not supported—in other words, structural capital does not have an indirect effect on competitive advantage through business intelligence and human capital, and relational capital does not have an indirect effect on competitive advantage through innovation quality. These path analyses confirmed H1a, H1b, H3c, H2a, H2c and H2b. Among these, H1a had the most significant mediating effect. In addition, based on the test outcomes, this study confirmed full mediation effects, as full mediation effects would occur if constructs had no direct influence on competitive advantage [

50], which is the case here.

Moreover, the total impact of HC on CA via all the mediators was 0.1132 and significant as the lower bound of the 95% confidence interval was 0.0351 and the upper bound of the 95% confidence interval was 0.1926. The total impact of SC on CA via all the mediators was −0.0033 and insignificant, as the lower bound of the 95% confidence interval was −0.1261 and the upper bound of the 95% confidence interval was 0.1180. The total impact of RC on CA via all the mediators was −0.0396 and significant, as the lower bound of the 95% confidence interval was −0.0702 and the upper bound of the 95% confidence interval was −0.0082.

Nevertheless,

Table 8 summarizes the indirect impact of mediators, where (+) means positive impact, (−) means negative impact, and no-highlight cells means significant and highlighted cells means insignificant.

7. Discussion, Conclusions and Recommendations

Based on the results obtained, the study found that the impact of structural capital on competitive advantage via the mediation of business intelligence is insignificant, and the impact of relational capital on competitive advantage via the mediation of business intelligence is negatively significant, while the impact of human capital on competitive advantage via the mediation of business intelligence is positively significant. These findings together prove the existence of the mediation effect of business intelligence. This role of business intelligence is supported by [

25], who showed that the various types of business intelligence are used for competitive advantage. In addition, business intelligence is involved in various other relations linked to competitive advantage as shown by [

6]. However, in the current study, this is only clearly shown between human capital and competitive advantage. This result clarifies the mediating mechanism of business intelligence through which human capital improves competitive advantage in the pharmaceutical and medical supply companies in the Jordanian context. This means that pharmaceutical and medical supply companies in Jordan are effectively taking advantage of business intelligence by which human capital improves competitive advantage.

Having said this, the insignificant impact of structural capital and the negative impact of relational capital on competitive advantage through business intelligence could be attributed to either a low level of both structural and relational capital or the absence of such effect at all. These findings indicate that merely emphasizing structural capital and relational capital may not guarantee the expected competitive advantage. However, as none of the researchers have examined such mediation of the business intelligence relationship, especially at the individual level of the different components of intellectual capital, our findings can be partially supported by [

6,

25,

33,

42,

43,

44] only in the impact of Business intelligence on competitive advantage.

In addition, the results showed that the impact of human capital and relational capital on competitive advantage via the mediation of innovation speed is positively significant, while the impact of structural capital on competitive advantage via the mediation of innovation speed is negatively significant. These findings together prove again the existence of the mediating effect of innovation speed as it is clearly shown in the positive impact of human capital and relational capital. However, such results emphasize that human capital and relational capital appear to play a good role in facilitating competitive advantage. According to [

22], this is probably due to the relationship-oriented culture in the Jordanian business environment, which highly emphasizes interpersonal harmony and social relations. This means that pharmaceutical and medical supply companies in Jordan are effectively taking advantage of innovation speed by which human capital and relational capital improve competitive advantage. These results are supported by the findings of [

22,

29].

Moreover, the impact of human capital and relational capital on competitive advantage via the mediation of innovation quality was found to be negatively insignificant, while the impact of structural capital on competitive advantage via the mediation of innovation quality was positively significant. These findings together confirm the existence of a positive mediation effect of innovation quality, which is supported by [

22,

28,

31]. However, the current study shows only the positive impact of structural capital on competitive advantage via the mediation of innovation quality. This means that pharmaceutical and medical supply companies in Jordan are effectively taking advantage of innovation quality by which structural capital improves competitive advantage.

In addition to this, it was found that the aggregate impact of human capital on competitive advantage via the mediation of business intelligence, innovation speed and quality combined is significant. However, only the total aggregate impact of intellectual capital on competitive advantage, through the mediation of innovation quality, was found to be positively significant and this is supported by [

22]. Therefore, this study confirms the significant impact of business intelligence, innovation speed and innovation quality, as mediators, between human capital, relational capital and structural capital and competitive advantage in the pharmaceutical and medical supply companies in Jordan.

Nevertheless, a closer look at

Table 7, which summarizes the indirect impact of mediator, brings the fact that the business intelligence, innovation speed and innovation quality respond differently to human capital, structural capital and relational capital, and consequently give different results. However, the only explanation of the absence of the mentioned mediation effect (if there should be) is the low level of the related components of the intellectual capital.

7.1. Conclusions

In this study, we developed a theoretical framework that depicts the mediation of innovation speed, quality and business intelligence between intellectual capital components and the competitive advantage where we tested the hypotheses by analyzing the data collected from pharmaceutical and medical supply companies in Jordan. In sum, these findings reveal the underlying mechanisms through which intellectual components lead to improved competitive advantage through the mediating mechanism of business intelligence, innovation speed and innovation quality in the pharmaceutical and medical supply companies in the Jordanian context, as the findings provide evidence that all mediators serve differently as important mediating mechanisms between the different components of intellectual capital and competitive advantage.

More importantly, the scarcity of works that studied the relationship between the components of intellectual capital through the mediation of business intelligence, innovation speed and innovation quality may be responsible for the different effects and sizes of the effects between the different components of intellectual capital and competitive advantage obtained by different researchers, as the effect does not come from the direct relationship between the different components of intellectual capital and competitive advantages, which makes results inaccurate. This means that high levels of human capital, relational capital and structural capital help and accelerate the effect of business intelligence, innovation speed and innovation quality in their mediation process in the pharmaceutical and medical supply companies in Jordan.

7.2. Implications

Practitioners should strive to continuously develop and maintain their intellectual capital, through investments in staff recruitment and selection, staff training and development, process design and improvement, and more. They must allocate more resources to certain components, in proportion to the competitive advantage they aspire to. It should also be noted that different components of intellectual capital may achieve different goals, which must be taken into consideration and which require an understanding of the components of intellectual capital and how they work. For example, a company may need to enhance structural and relational capital instead of human capital. Eventually, this research contributes to the literature by increasing academic knowledge concerning the crucial role of the mediators, which are business intelligence, innovative speed and quality, in the relationship between the intellectual capital and competitive advantage. In addition, it contributes to this field as no research has so far been conducted on this mediation topic in Jordan, giving this research its value and originality. This means that researchers, in their future studies in this field, will be aware of the probable missing link between intellectual capital and competitive advantage.

7.3. Recommendations

The pharmaceutical and medical supply companies in Jordan should be focusing and recognizing business intelligence, innovation speed and innovation quality through which human capital, relational capital and structural capital improve competitive advantage in the pharmaceutical and medical supply companies in the Jordanian context. More importantly, companies in Jordan should be aware that it is necessary to take into account the general context of the study in order to know the nature and size of the impact, because it certainly differs according to the dynamics of the industry.

7.4. Limitations and Future Studies

This study presents some limitations, such as the possibility that these results or factors may not be the only criteria for raising the competitive advantage. Consequently, this study recommends conducting some future research, such as the application of the same study in a search for other factors that may increase the competitive advantage, whether mediators or moderators. It also recommends applying the same study in other contexts or sectors and in a broader form to increase the possibility of generalization.