Abstract

There is a certain degree of difference in the knowledge and skills of alliance members, and the knowledge heterogeneity among them will have an impact on innovation. The study of the relationship between strategic alliance knowledge heterogeneity (SAKH) and enterprise innovation performance (IP) has important practical significance for enterprise-development strategies. Based on the resource-dependence theory, this study discussed the mediating effect of exploratory learning (EXR) and exploitative learning (EXI) on the impact of SAKH on IP. Using surveys collected from Chinese manufacturing enterprises with strategic alliances, we found that (1) SAKH and IP have an inverted U-shaped relationship; (2) EXR and EXI partially mediate the relationship between SAKH and IP. From the perspective of managers’ attention, this study not only extends the boundaries of knowledge heterogeneity and innovation-related research but also provides a theoretical and practical framework for the promotion and development of alliance enterprise innovation.

1. Introduction

In the current dynamic competitive environment, organizations are no longer isolated entities but tend to form alliances and networks with external parties, and firms increasingly rely on strategic alliances with partners that have knowledge heterogeneity to promote innovation and development. In the context of the new, current normal of economic transformation, the new cooperative business model—strategic alliance—is increasingly becoming an important means of enterprise innovation and technological progress. How strategic alliances can promote innovation performance and achieve the sustainable development of enterprises has received increasing attention from the management community. There is a degree of variation in the knowledge and skills among alliance members, and the knowledge heterogeneity among them has an impact on innovation. It has been suggested that the crossover and linkage between unrelated and heterogeneous knowledge can be seen as an effective driver of a firm’s innovation performance [1], and that this motivation for innovation often drives firms in different fields or across different cognitive structures to provide new horizontal/vertical convergence to partners with different resources [2]. Heterogeneous knowledge is the source for enterprises to discover new ideas and opportunities [3], can affect a firm’s knowledge structure, and provide usable knowledge elements for strategic activities [4]. Therefore, heterogeneous knowledge affects the creative behavior of more diverse knowledge elements [5]. Through strategic alliances of heterogeneous knowledge resources, enterprises can improve the knowledge stock of enterprises and, in the process of knowledge exchange, use the collision of knowledge to promote enterprise innovation [6]. Strategic alliance knowledge heterogeneity plays a central role in improving firm performance [7]. Knowledge heterogeneity among alliance partners has a direct/indirect impact on innovation; the diversity of internal R&D resources and the diversity of R&D among partners will have a positive effect on innovation [8,9]. However, there is no consensus on the results of theoretical perspectives on the impact of strategic alliances’ knowledge heterogeneity on innovation performance [10]. Early scholars have found that alliances with knowledge heterogeneity are able to rationalize the use of resources and thus develop appropriate innovation-development strategies and improve performance [11]. Recently, scholars have begun using social classification theory to analyze the negative effects of excessive knowledge heterogeneity, which can disrupt the alliance’s collaboration process, leading to weakened alliance ties and improved innovation performance [12]. Existing literature ignores the complexity of strategic alliance knowledge heterogeneity itself, thus making it difficult to accurately assess the role of knowledge heterogeneity and to realize the practical value of cognitive resources in a timely manner. Moreover, more research is needed on how strategic alliance knowledge heterogeneity according to ambidextrous organizational learning affect the innovation performance, and traditional studies of dual organizational learning and performance relationships have focused on the internal aspects of the firm and have not considered exploratory and exploitative learning between firms in strategic alliance relationship contexts. To fill this research gap, this study examines the mechanisms influencing a strategic alliance’s knowledge heterogeneity and innovation performance so as to facilitate firms to achieve sustainable innovation.

As seen in existing studies, most firms have a stronger willingness to cooperate with partners with rich knowledge resources to overcome bottlenecks in the innovation process and make up for capacity deficiencies. The main reason for this is that knowledge heterogeneity can bring a large amount of novel and heterogeneous innovation resources for enterprises [13] and avoid the dilemma of “zero” innovation in a single technology. However, Lee et al. found, through a meta-analysis of the degree of alliance portfolio heterogeneity and innovation performance, that alliance partner knowledge heterogeneity leads to different effects on innovation performance [14]. On the one hand, strategic alliance knowledge heterogeneity can provide potential opportunities for firms to explore novel ideas about product design, concept, and development and to break free from existing rules and procedures that constrain innovative ideas [15]. Cobena et al. found, through an empirical study of airlines, that alliance portfolios can significantly affect the technological innovation capability of firms in terms of knowledge differentiation [10]. Lastly, through a survey of 93 R&D team members, Juan et al. found that knowledge heterogeneity often brings extensive knowledge resources that may be relevant to team operations and propose innovative solutions [16]. On the other hand, strategic alliances knowledge heterogeneity will not allow firms to automatically generate innovation activities; thus, the process of generating innovations often requires a lot of coordination costs to manage the heterogeneous knowledge of strategic alliances [17]. Chung et al. argue that knowledge heterogeneity can hinder the smoothness of alliance collaboration, which leads to heterogeneity that will diminish breakthrough innovation [18]. To sum up, the relationship between strategic alliances knowledge heterogeneity and innovation performance needs to be dug deeper with a new aim of exploring the right inner mechanism. Chen and Liu proposed that differences in organizational types of innovation agents have a significant impact on open innovation performance and that diversity differences promote/hinder open innovation performance [19]. Similarly, Wu found that the relationship between entrepreneurial team knowledge heterogeneity and the team’s entrepreneurial performance was not a simply linear [20]. In addition, a strategic alliance’s knowledge heterogeneity can motivate firms to exchange knowledge with each other, and the learning ability of firms can often influence the motivation of firms to cross their own organizational barriers, which in turn has an effect on their innovation performance. Learning activities play a mediating role between knowledge heterogeneity and firm performance [21]. As a unique form of cooperation, whether strategic alliances can further promote the dissemination of heterogeneous knowledge resources through interactive learning and ultimately have an effect on the performance of enterprises needs to be further explored. This paper explores the role played by dual organizational learning in order to shed more light on the paths by which strategic alliances’ knowledge heterogeneity affects firms’ innovation performance.

In summary, the main purpose of this study was to analyze the relationship between strategic alliances knowledge heterogeneity (SAKH) and firms’ innovation performance (IP) and answer the following questions: (1) is there an inverted u-shape relationship between SAKH and IP? (2) Do exploration learning (EXR) and exploitation learning (EXI) play a mediating role between them? To answer the above research questions, this study introduced the resource-dependence theory to explore the relationships between SAKH, EXR, EXI, and IP.

The theoretical contribution of this paper mainly includes two points: (1) based on the resource-dependence theory (RDT), this study explains the relationships between SAKH, EXR, EXI, and IP, which breaks out of the solidified perspective of heterogeneity research and increases the main drivers and influencing paths of IP; and (2) SAKH also extends the boundaries of alliance innovation resources, providing practical references for alliance enterprises’ cooperation models and innovation paths.

In this study, a questionnaire survey was used to collect data to prove the relationships between SAKH, EXR, EXI, and IP. This paper provides insights into the paths through which SAKH affects firms’ IP, explores the role of dual organizational learning (EXR and EXI) in this influence mechanism, and provides reasonable practical insights for firms in strategic alliances to improve their innovation performance based on the findings of this paper.

2. Theory and Hypotheses

2.1. Resource-Dependence Theory

In 1978, Pfeffer and Salancik [22] proposed the concept of resource-dependence theory (RDT), which states that a firm’s choice to cooperate with external members to form some kind of dependency relationship can help develop a competitive advantage and then interact with the members/environment it depends on for information and resource exchange to better cope with the external environment. RDT focuses more on the intangible assets possessed by enterprises, which is due to the fact that when enterprises establish strategic alliance relationships with other enterprises based on their own resource qualities, SAKF exists as an intangible knowledge resource between the parties in the relationship with resource differences, and this heterogeneous knowledge determines the degree of their interdependence [23], which in turn determines the resource uniqueness of enterprises and their position in the network embedding. In addition, Rossignoli and Lionzo argue that resource dependence is the glue for the establishment of technological innovation network partnerships and that firms and partners adopt a competitive mechanism and thus enhance their competitive advantage [24]. Since no firm can generate a completely self-sufficient resource, the complementarity, scarcity, or irreplaceability of knowledge leads firms to cooperate or trade for economic purposes, thus improving their innovation performance.

Generally speaking, RDT emphasizes that a firm’s ability to obtain necessary resources from the external environment is a key asset for its survival, and all organizations try to change and manage their dependency patterns by minimizing or avoiding the manipulation of their resource requirements from other firms [25,26]. Firms only use external channels to improve technology development and knowledge absorption cannot well meet innovation needs; they should also meet higher-level development needs through dual learning, both to search and improve knowledge and to explore and develop knowledge, thus improving innovation capabilities. Some studies have shown that resource-dependent relationships between organizations can promote resource-sharing behaviors, such as knowledge sharing and cooperative innovation [27]. In addition, firms realize that exposure to heterogeneous knowledge can motivate them to learn and thus effectively identify and absorb knowledge. Bringing together companies with different skills, experience, and social resources, companies identify, utilize, transform and reconfigure, and integrate knowledge through dual organizational learning. Therefore, the development of firms should not only directly rely on the empowerment of heterogeneous knowledge, but also weaken/rid of the over-dependence on strategic alliance partners at the appropriate nodes, and achieve knowledge utilization and knowledge expansion through continuous strengthening of partners’ in-depth communication and dual organizational learning so as to obtain critical resources, high-quality innovation results, and better innovation performance necessary for survival and development.

2.2. Strategic Alliance Knowledge Heterogeneity and Innovation Performance

Strategic alliances’ knowledge heterogeneity refers to the difference in knowledge resources between two or more firms with common goals. The “heterogeneity” is the linkage of different knowledge systems across organizations and boundaries, which is a key attribute of knowledge composition and will affect the decision making or behavior of firms and the subsequent collaboration and innovation performance of the alliance [28]. This paper argues that strategic alliance knowledge heterogeneity refers to the depth, diversity, and variability of complementary capabilities possessed by the firms in the alliance in terms of knowledge constructs, types, contents, and levels, reflecting the heterogeneity of the spatial distribution state of knowledge elements in the firm’s knowledge structure. It can be seen that resource characteristics such as the richness and non-redundancy of knowledge are key elements that affect innovation performance.

Knowledge heterogeneity is likely to be a “double-edged sword” between alliance partners. Since diversified knowledge expands the scope of knowledge and horizons of alliance partners, the greater the knowledge acquired by the firm, the greater the opportunity to capture and use the knowledge to create value [29,30]. Collaboration between firms and alliance members helps to acquire the knowledge and skills needed for basic research and brings fundamental innovation to firms. Moreover, knowledge heterogeneity releases signals to potential collaborators that there will be considerable improvements in future performance, giving firms richer social capital and more open-minded models for effective decision-making and innovative behavior. In conclusion, strategic alliance knowledge heterogeneity improves firms’ accessibility, accumulation, and usage of innovation resources, which in turn enhances their innovation performance.

However, excessive heterogeneous knowledge may lead to tension and the deterioration of strategic alliance partnerships [31] and may consume significant coordination costs due to the need for highly heterogeneous knowledge, which in turn leads to reduced willingness and efficiency of cooperation. Partners with different entrepreneurial backgrounds may have different values, operating models, and problem-solving strategies due to their long-standing operating habits and different ways of thinking, and the distance and friction brought about by their differences will hinder communication between partners and bring a greater negative impact on the formation of trust and dependence of partners [20]. In addition, when firms face knowledge differences that exceed a certain threshold, they need to invest a large amount of organizational resources, such as human and material resources, to weigh the needs of different alliance members and integrate knowledge with too much heterogeneity [32,33]; their own cognitive ability and inexperience in integrating heterogeneous knowledge can directly or indirectly hinder their key knowledge search for alliance partners, and this negative effect may be amplified, inhibiting the performance-enhancing effect of diverse innovation experiences. Thereby, we proposed the following hypotheses:

Hypothesis 1 (H1).

There is an inverted U-shaped relationship between strategic alliance knowledge heterogeneity and innovation performance.

2.3. The Mediating Role of Dual Organizational Learning

March (1991) first proposed the concept of dual organizational learning, a learning approach in which companies engage in organizational learning activities through a balanced learning approach and thus improve their innovation capabilities [19,34]. The concept of dual learning in strategic alliances encompasses both types of exploratory learning and exploitative learning. Exploratory learning refers to the joint exploration of new knowledge through cooperative exchanges with alliance partners, a kind of learning behavior that goes beyond the existing technical track of the firm to create new knowledge or refine new knowledge from existing knowledge through activities such as research, discovery, and innovation. It has been pointed out that knowledge heterogeneity not only enables firms to acquire and integrate existing knowledge but also enhances the experience and ability to meet the challenges on the path of exploring new knowledge and technologies and strengthens the diversity of knowledge brought about by exploratory learning [35].

The uncertainty of the environment causes alliance members to learn continuously in order to further enhance their competitiveness in a dynamic environment. Exploratory learning requires firms to continuously try new alternatives, invest more energy in mastering new skills and knowledge, meet the needs of enterprise transformation and upgrading, aim at the market frontier, and lead market demand [36]. For example, when firms involved in unknown fields urgently need to solve knowledge and technology challenges in exchange for greater benefits, they often choose the cooperation path of exploratory learning with alliance partners who have knowledge differences [37], which will help deepen their understanding and excavation of transferred knowledge, thus realizing the growth of their own knowledge stock and technology stock and fundamentally enhancing their independent innovation capability.

However, not all heterogeneous knowledge will result in high-frequency learning behaviors or high-quality learning outcomes. When the differences in corporate knowledge are too great, the parties will weaken the willingness and motivation to learn due to the mismatch between the parties in terms of many factors leading to communication barriers and increased learning costs, or when the revenue from innovation brought by knowledge sharing is much less than the cost invested by the firms [38]. The prominence of strategic alliances’ knowledge heterogeneity will expose firms to knowledge with characteristics such as low frequency of use, narrow scope of application, and industry mismatch, and if learning behavior occurs at this time, it will require firms to mobilize more departments, executives, and employees, etc., to commit to a high-input learning mode, which makes the overall learning cost of firms increase and the absorption, application, and transformation of knowledge significantly decrease, leading to negative impacts on innovation sources and opportunities [39] and reducing innovation performance. There is a possibility that companies will not find innovative breakthroughs through exploratory learning but rather increase the cost of searching for new knowledge and technology with minimal relevance. Therefore, when the level of knowledge heterogeneity between firms exceeds a certain limit, there is no corresponding technology and experience for reference between the two parties, and the opportunities for learning will be hindered, which will ultimately have a negative effect on the improvement of innovation capabilities.

Larger knowledge differences between strategic alliances promote a strong willingness for exploratory learning. The heterogeneity of knowledge background among alliance members will bring rich knowledge resources to firms. Firms conduct cross-domain searches for external heterogeneous knowledge through exploratory learning, which is more conducive to firms to accurately grasp the boundaries of the knowledge search, shorten the knowledge iteration time, optimize the efficiency of innovative resource allocation, and provide opportunities for rapid entry into new markets [40]. Through exploratory learning, firms can quickly improve the absorption efficiency of new knowledge and accelerate the innovation process of the alliance. Thus, we proposed the following hypotheses:

Hypothesis 2 (H2).

Explorative learning mediates the relationship between strategic alliance knowledge heterogeneity and innovation performance.

Exploitative learning means that firms actively observe and learn from the knowledge of their partners and apply this mature knowledge, a learning behavior that applies and extends existing knowledge through subtle improvements, expanded reproduction, efficiency improvement, and implementation. The development of exploitative learning in the organization enables the organization to fully tap and use the existing knowledge and improve the identification of opportunities and crises existing in the current technology track [41].

Strategic alliance knowledge heterogeneity emphasizes the differences and complementarity of knowledge, focuses on improving the cognitive sensitivity and insightfulness of firms, and enhances the effectiveness of exploitative learning [42]. When firms lack information and resources to support their continuous innovation and development, alliance partners will actively explore to achieve the set goals, reduce the degree of differences between the two sides, give full play to their own learning capabilities, generate mutual learning actions from one side or both sides, reduce the degree of differences in their knowledge, capture opportunities, and enhance effectiveness with external forces.

Wang et al. pointed out that exploitative learning has a positive effect on promoting innovation performance [43]. Correspondingly, firms engage in exploitative learning that can meet short-term knowledge utilization and innovation requirements. The essence of such learning is to achieve an adaptive allocation of internal resources to the external environment by using existing knowledge. Moreover, exploitative learning helps firms to innovatively integrate the knowledge acquired from alliance partners with their own knowledge, expand their existing knowledge base, and enhance their innovation capabilities to improve the speed of market development. It is evident that exploitative learning can improve the acumen of companies to identify entrepreneurial opportunities and increase the output of innovations.

However, the integration, absorption, and utilization of the heterogeneity of external technology, management, and market knowledge also require certain costs and resources. The total cost of integrating and managing existing knowledge through exploitative learning exceeds the economies of scale and knowledge spillovers brought about by differences in business types, and the knowledge increment caused by external knowledge at this time will only bring a burden to the firm. Therefore, when the knowledge with excessive differences is transferred to its own industry, the cost to be consumed will most likely far exceed the value or profit brought by the knowledge [44]. When the knowledge originally useful in other industries is transferred to unrelated industries and cannot be used efficiently, it will lead to negative results, such as knowledge wastage, knowledge redundancy, and poor learning effectiveness, which inhibit the innovation process of enterprises and are not conducive to the excellent innovation performance of enterprises. In addition, when organizations achieve good results through exploitative learning, they tend to focus on improving their technical capabilities, as organizations attribute existing successes to breakthroughs in technology [45]. Therefore, enterprises will ignore the acquisition of other knowledge and enter the “learning trap”, which ultimately hinders the development of innovation.

Firms’ ability to digest old knowledge through exploitative learning is greatly enhanced, which can accelerate the alliance’s innovation process. The differences and diversity of knowledge can stimulate the willingness of alliance firms to engage in exploitative learning, and the expanded knowledge domain of firms through exploitative learning can drive innovative interpretations of resources and phenomena, using diverse knowledge to reduce cognitive biases and promote knowledge development. In summary, the stronger the capacity of the exploitative learning, the less likely it is that firms will have communication barriers and member conflicts, which are conducive to the impact of knowledge heterogeneity on innovation performance, both in terms of promoting the differences in firms due to knowledge asymmetries to improve performance and promoting the negative effects on innovation performance due to excessive knowledge heterogeneity in strategic alliances. Thus, we proposed the following hypotheses:

Hypothesis 3 (H3).

Exploitative learning mediates the relationship between strategic alliance knowledge heterogeneity and innovation performance.

The different development histories among firms give them diverse knowledge reserves, resulting in deviations in alliance partners’ understanding of resources and operational capabilities. Such differences trigger the interaction between exploratory and exploitative learning, prompting firms to accumulate richer knowledge and experience and enabling alliance firms to more acutely identify environmental changes and accurately grasp the direction of creative activities [46]. Therefore, dual organizational learning can increase the opportunity to understand the technological frontier in the field of cooperation, judge the value of new technologies, knowledge, and resources more accurately, and thus enhance the level of innovation and improve the transformation efficiency of innovation performance.

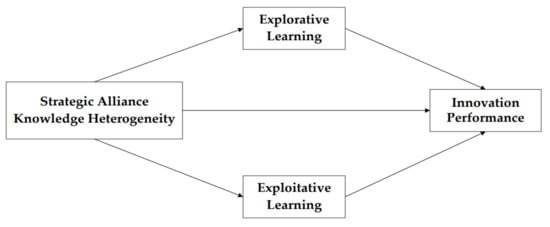

To summarize, this study discussed the relationships between SAKH, EXR, EXI, and IP. Figure 1 presents the theoretical model of this study.

Figure 1.

Theoretical model.

3. Research Design

3.1. Sample and Data Selection

In this paper, a questionnaire survey was used to collect data. The selection of the sample of firms was mainly based on the fact that firms had to have established alliances with multiple partners in recent years. Then, questionnaires were distributed to three developed areas, namely, the cities of Beijing, Shanghai, and Shenzhen. To qualify for our study, we asked these participants to be familiar with the company strategy, R&D, and overall management.

To ensure the validity and reliability of the questionnaire, the questionnaire was pre-tested among several MBA students, and some difficult items were revised. Then, a formal questionnaire, including 22 questions in total, was formed and issued in two ways: (1) we produced the questionnaires by hiring a professional data company; (2) we consulted companies with whom we work on projects to issue questionnaires directly.

In this survey, 350 questionnaires were distributed, and 226 responses were received, with a recovery rate of 64.6%. In this paper, SPSS 22.0 software (IBM Company, Armonk, NY, USA) was used to analyze the sample data, and the descriptive statistics of the sample are shown in Table 1.

Table 1.

Descriptive statistics.

3.2. Analysis Techniques

In this study, SPSS 22.0 software was used to analyze the descriptive statistics of the variables, while AMOS 23.0 (IBM company, Stanford University, USA) was used for confirmatory factor analysis. To test the mediating effect and mediating type of exploratory learning and exploitative learning, this study used the Baron–Kenny (1986) multiple-regression method. Moreover, the main effects were tested by SPSS 22.0.

3.3. Measures

The questionnaire collected ratings using seven-point Likert-type scales ranging from one (strongly disagree) to seven (strongly agree). The scales used in this paper are all from the published literature of foreign authoritative journals; they are widely used by mainstream literature at home and abroad. Appendix A shows all of the items of the scale.

Strategic alliance knowledge heterogeneity: in the Chinese context, due to the lack of awareness of patent application, the use of patent data to measure the strategic alliance’s knowledge heterogeneity will result in a low degree of knowledge heterogeneity, which cannot reflect reality [47]. We drew on the research design of Chen et al. (2020) [47] and modified the scale along with the case in this paper, and finally, SAKH determined five specific questions.

Dual organizational learning: we measured dual organizational learning with a seven-point Likert scale. We drew lessons from the research of He and Wong [48] and modified the scale along with the case in this paper, and finally, EXR determined five specific questions, and EXI determined five specific questions.

Innovation Performance: we measured innovation performance with a seven-point Likert scale. We drew lessons from the research of Akgün et al. and Laursen et al. [49,50]. Then, we modified the scale along with the case in this paper and finally determined four specific questions.

Control variables: learning from previous scholars, we selected age, size, and firm type as control variables.

4. Results

4.1. Confirmatory Factor Analysis

Confirmatory factor analysis of the following five variables was conducted using AMOS 23.0: SAKH, EXR, EXI, and IP. The results in Table 2 show that the model fit of four factors (χ2/df = 1.934, IFI = 0.968, TLI = 0.960, CFI = 0.968, RMSEA = 0.064) was significantly better than other nested models.

Table 2.

Confirmatory factor analysis.

4.2. Common Method Bias Testing

Considering that SAKH, EXR, EXI, and IP may have common method bias (CMB), this paper uses two statistical verification methods. First, a Harman single-factor test, which is generally accepted by most studies, was conducted whereby all of the items in the questionnaire were subjected to unrotated factor analysis. The variance contribution rate of the factor with the highest degree of explanation was 30.288%, which is less than the recommended 40%. This suggests that no single variable explains most of the mutations; therefore, the common method variance is not serious. Second, the results of confirmatory factor analysis show that the indicators of the single-factor model were poorly fitted and did not reach the recommended level, indicating that the deviation of the common method in this paper was not significant.

4.3. Descriptive Statistics

Table 3 presents the descriptive statistics and correlations between all variables. As shown in Table 3, strategic alliance knowledge heterogeneity is correlated with exploratory learning (r = 0.477, p < 0.010) and exploitative learning (r = 0.479, p < 0.010), and ex strategic alliance knowledge heterogeneity is correlated with innovation performance (r = 0.498, p < 0.010).

Table 3.

Descriptive statistics of the variables.

4.4. Hypotheses Testing

Using SPSS 22.0, this paper tested the main and mediating effects of the model of the Baron–Kenny (1986) multiple regression method. The hierarchical regression results are shown in Table 4: Model 3 shows that strategic alliance knowledge heterogeneity and innovation performance do not have a simple, linearly increasing relationship, but rather a typical inverted U-shaped relationship (β = −0.276, p < 0.001)—that is, a low degree of knowledge heterogeneity promotes innovation performance, but as the strategic alliance’s knowledge heterogeneity increases, its heterogeneity has a negative impact on innovation performance. Therefore, H1 is supported.

Table 4.

Result of main effects.

The results of the mediating effect are shown in Table 5. Drawing lessons from the three steps of the mediating effect test proposed by Baron (1986), this study undertook the following steps. The first step was to conduct the regression of the dependent variable to the independent variable. Models 3 show that the squared term of SAKH has a significant impact on IP (β = −0.276, p < 0.001). In the second step, the regression of mediator variables to independent variables was conducted. Models 8 and 11 show a significant negative impact on EXR (β = −0.234, p < 0.010) and EXI (β = −0.254, p < 0.001), which suggests an inverted U-shaped relationship between strategic alliance knowledge heterogeneity and both exploratory and exploitative learning. The third step was to complete the regression of the dependent variable to the independent variable and mediator variable. Models 4 and 5 shows that EXR (β = 0.099, p < 0.001) and EXI (β = 0.098, p < 0.01) have a significant impact on IP. At this time, the squared term of SAKH still has a significant impact on IP. Comprehensive Models 3, 4, and 8 show that EXR plays a partially mediating role in the relationship between the squared term of SAKH and IP. Comprehensive Models 3, 5, and 11 show that EXI plays a partially mediating role in the relationship between the squared term of SAKH and IP. H2 and H3 are supported.

Table 5.

Result of mediating effect.

5. Discussion

5.1. Research Conclusions

Based on resource-dependence theory, this paper empirically tests the relationship among strategic alliance knowledge heterogeneity, dual organizational learning, and innovation performance and reveals the impact of strategic alliance knowledge heterogeneity on firms’ innovation performance and the mediating role of dual organizational learning, drawing the following conclusions.

First, there is an inverted U-shaped curve relationship between strategic alliance knowledge heterogeneity and innovation performance. This conclusion validates Chen and Liu [19] and Lee’ [20] found that the relationship between strategic alliance knowledge heterogeneity and a firm’s innovation performance is not linear. A low degree of strategic alliance knowledge heterogeneity mainly enhances the interconnection of strategic alliance firms, improves the sharing and absorption of heterogeneous knowledge, and obtains innovation resources at a low cost, thereby improving innovation capability and innovation performance. However, not all knowledge differences will lead to improved innovation performance. If there is a high degree of knowledge heterogeneity between firms, communication barriers and costs will increase due to the mismatch in many factors between the two parties, or when the innovation income brought by knowledge sharing is far less than the cost of firm investment, strategic alliance knowledge heterogeneity will hinder the improvement of innovation performance.

Second, dual organizational learning plays a partially mediating role between knowledge heterogeneity and innovation performance in strategic alliances. When firms realize that knowledge differences among partners are constrained by each other and that firms cannot actively and fully exploit knowledge heterogeneity to improve innovation performance, they will gradually break away from their alliance partners’ control over their own resources and their own dependence on external conditions such as the environment and partners, and take the initiative to acquire the resources needed for innovation through dual organizational learning to meet competition and challenges in a more proactive posture and narrow or compensate for the existing knowledge potential differences. When dual organizational learning behavior occurs in the case of excessive knowledge differences, it will make exploratory learning less effective; at the same time, there will be obstacles and “useless” knowledge in the process of assimilating/internalizing new knowledge through exploitative learning, which will lead to the cost of knowledge search, absorption, and transformation being much higher than the related benefits, and the firm will not being able to achieve the right gains through learning in an effective time, thus reducing innovation capital and innovation performance. In summary, it is clear that dual organizational learning can facilitate the effect of strategic alliance knowledge heterogeneity on innovation performance.

5.2. Theoretical Implications

The following are this study’s theoretical implications:

- This paper deepens the study of strategic alliance knowledge heterogeneity affecting firms’ innovation performance. While previous studies have mostly focused on the relationship between knowledge heterogeneity and innovation performance from within teams, this paper focuses on knowledge heterogeneity in the strategic alliance context, verifies the role of strategic alliance knowledge heterogeneity in enhancing enterprise innovation performance, and expands the application of knowledge heterogeneity in special contexts.

- Using resource-dependence theory, this paper verifies the mediating role played by dual organizational learning in the relationship between strategic alliance knowledge heterogeneity and corporate innovation performance, dissects the intrinsic path of strategic alliance knowledge heterogeneity on corporate innovation performance, clarifies the important value of dual organizational learning in the process of innovation performance enhancement, reveals the internal and external influencing factors of corporate innovation performance, and provides a comprehensive analytical framework for subsequent research.

5.3. Practical Implications

The following are this study’s practical implications:

- Firms should identify the acquisition of heterogeneous knowledge that matches their own knowledge. The gradual increase in knowledge heterogeneity will promote firms to actively acquire heterogeneous knowledge from different strategic partners; improve knowledge sharing, absorption, and integration; and provide a positive impact on firms’ innovation capability. However, it is not necessary to pursue higher knowledge heterogeneity because too high of a knowledge heterogeneity transformation requires firms to invest larger time and effort to weigh the needs of different business models and promote the integration of highly differentiated knowledge, resulting in weakened innovation outcomes and performance; therefore, firms need to explore a moderate level of knowledge heterogeneity to improve innovation performance.

- Firms should strengthen dual organizational learning to promote innovation performance. By complementing and sharing knowledge through learning and other methods, they can compensate for the asymmetry of critical knowledge brought by different partners and improve its similarity, turn organizational learning into a “toolbox” connecting enterprise alliance strategies and innovation capabilities, mobilize dual learning and resource development, remove resource dependence, and master the function of compensating for knowledge differences, thus enhancing the function of strategic alliance knowledge heterogeneity to improve innovation performance.

5.4. Limitations and Future Directions

Although this study followed the logic of scientific research, it still has some limitations. First, this paper mainly investigates the influence of strategic alliances’ knowledge heterogeneity on firms’ innovation performance, but in addition to knowledge heterogeneity, there are also market heterogeneity and management heterogeneity, etc. Future research can consider the influence of different types of alliance heterogeneity on innovation performance in a comprehensive manner. Second, this study collects cross-sectional data, and the cross-sectional nature allows us to analyze the behavior of firms at a specific point in time, rather than over a period of time, and does not provide strong validation of the underlying dynamic relationships in the model; future research requires further longitudinal evaluation to reduce the differences that exist between constructs. Finally, this paper does not analyze the mechanistic role of strategic alliance knowledge heterogeneity on other innovation paradigms, and future attempts could be made to analyze, for example, knowledge heterogeneity on dual innovation to better reflect the multidimensional connotations of the variables and obtain more meaningful findings.

Author Contributions

J.L. and Y.S. (Yongbo Sun), contributed to the study design, data collection, manuscript drafting, revisions and financial support. Y.S. (Ying Sun) conceptualized the research design, reviewed the manuscript, and collected and sorted some of the data. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by the National Social Science Foundation (grant number 18BGL083) and the Natural Science Foundation of Beijing (grant number 9172007).

Institutional Review Board Statement

The article is about a corporate survey and does not involve psychological or medical experiments, which do not require Ethics Committee review according to regulations of authors’ institution.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Measurement scales and construct items.

Table A1.

Measurement scales and construct items.

| Strategic Alliance Knowledge Heterogeneity |

|

|

|

|

|

| Explorative learning |

|

|

|

|

|

| Exploitative learning |

|

|

|

|

|

| Innovation performance |

|

|

|

|

Table A2.

Measurement model and factor loading.

Table A2.

Measurement model and factor loading.

| Items | Factor Loading | Cronbach’s α | CR | AVE | |

|---|---|---|---|---|---|

| Strategic alliance knowledge heterogeneity | SAKH 1 | 0.903 | 0.946 | 0.9487 | 0.7875 |

| SAKH 2 | 0.856 | ||||

| SAKH 3 | 0.904 | ||||

| SAKH 4 | 0.854 | ||||

| SAKH 5 | 0.918 | ||||

| Explorative learning | ERL1 | 0.903 | 0.957 | 0.9569 | 0.8161 |

| ERL 2 | 0.909 | ||||

| ERL 3 | 0.899 | ||||

| ERL 4 | 0.907 | ||||

| ERL 5 | 0.899 | ||||

| Exploitative learning | ETL1 | 0.887 | 0.944 | 0.9443 | 0.7723 |

| ETL 2 | 0.851 | ||||

| ETL 3 | 0.869 | ||||

| ETL 4 | 0.905 | ||||

| ETL 5 | 0.881 | ||||

| Innovation performance | IP1 | 0.640 | 0.818 | 0.82 | 0.5357 |

| IP 2 | 0.696 | ||||

| IP 3 | 0.863 | ||||

| IP 4 | 0.710 |

References

- O’Dwyer, M.; Gilmore, A. Value and alliance capability and the formation of strategic alliances in SMEs: The impact of customer orientation and resource optimisation. J. Bus. Res. 2018, 87, 58–68. [Google Scholar] [CrossRef]

- Shan, W.; Zhang, C.; Wang, J. Internal Social Network, Absorptive Capacity and Innovation: Evidence from New Ventures in China. Sustainability 2018, 10, 1094. [Google Scholar] [CrossRef] [Green Version]

- Wang, M.-C.; Chen, P.-C.; Fang, S.-C. A critical view of knowledge networks and innovation performance: The mediation role of firms’ knowledge integration capability. J. Bus. Res. 2018, 88, 222–233. [Google Scholar] [CrossRef]

- Moeen, M.; Agarwal, R. Incubation of an industry: Heterogeneous knowledge bases and modes of value capture. Strat. Manag. J. 2017, 38, 566–587. [Google Scholar] [CrossRef]

- Zhao, J.; Huang, Y.; Xi, X.; Wang, S. How knowledge heterogeneity influences business model design: Mediating effects of strategic learning and bricolage. Int. Entrep. Manag. J. 2020, 17, 889–919. [Google Scholar] [CrossRef]

- Yang, J.; Wang, F.-K. Impact of social network heterogeneity and knowledge heterogeneity on the innovation performance of new ventures. Inf. Discov. Deliv. 2017, 45, 36–44. [Google Scholar] [CrossRef]

- Gao, S.; Chen, J.; Zhou, Y. Relationship between Team Knowledge Heterogeneity and Corporate Innovation Performance: An Empirical Study in Coastal Areas of East China. J. Coast. Res. 2019, 98, 320–324. [Google Scholar] [CrossRef]

- Liu, R.L.; Juasrikul, S.; Yim, S. The Effect of Seeking Resource Diversity on Post-Alliance Innovation Outcomes. Australas. Mark. J. 2021. [Google Scholar] [CrossRef]

- Santoro, G.; Bresciani, S.; Papa, A. Collaborative modes with Cultural and Creative Industries and innovation performance: The moderating role of heterogeneous sources of knowledge and absorptive capacity. Technovation 2020, 92-93, 102040. [Google Scholar] [CrossRef]

- Sabidussi, A.; Lokshin, B.; Duysters, G. Complementarity in alliance portfolios and firm innovation. Ind. Innov. 2018, 25, 633–654. [Google Scholar] [CrossRef] [Green Version]

- Das, T.K.; Teng, B.-S. A Resource-Based Theory of Strategic Alliances. J. Manag. 2000, 26, 31–61. [Google Scholar] [CrossRef]

- Tsai, F.-S.; Lin, C.-H.; Lin, J.L.; Lu, I.-P.; Nugroho, A. Generational diversity, overconfidence and decision-making in family business: A knowledge heterogeneity perspective. Asia Pac. Manag. Rev. 2018, 23, 53–59. [Google Scholar] [CrossRef]

- Huosong, X.; Qingdi, W.; Zhang, Z. Knowledge heterogeneity in university-industry knowledge transfer: A case analysis of Xu’s Ruyi textile. Knowl. Manag. Res. Pract. 2019, 17, 486–498. [Google Scholar] [CrossRef]

- Lee, J.; Rethemeyer, R.K.; Park, H.H. How Does Policy Funding Context Matter to Networks? Resource Dependence, Advocacy Mobilization, and Network Structures. J. Public Adm. Res. Theory 2018, 3, 388–405. [Google Scholar] [CrossRef]

- Zhao, J.; Wei, J.; Xi, X.; Wang, S. Firms’ heterogeneity, relationship embeddedness, and innovation development in competitive alliances. Ind. Mark. Manag. 2020, 91, 114–128. [Google Scholar] [CrossRef]

- Cegarra-Navarro, J.G.; Ruiz, F.J.A.; Martínez-Caro, E.; Garcia-Perez, A. Turning heterogeneity into improved research outputs in international R&D teams. J. Bus. Res. 2021, 128, 770–778. [Google Scholar] [CrossRef]

- Jin, J.L.; Wang, L. Resource complementarity, partner differences, and international joint venture performance. J. Bus. Res. 2021, 130, 232–246. [Google Scholar] [CrossRef]

- Chung, D.; Kim, M.J.; Kang, J. Influence of alliance portfolio diversity on innovation performance: The role of internal capabilities of value creation. Rev. Manag. Sci. 2019, 13, 1093–1121. [Google Scholar] [CrossRef]

- Chen, Q.; Liu, Z. How Does Openness to Innovation Drive Organizational Ambidexterity? The Mediating Role of Organizational Learning Goal Orientation. IEEE Trans. Eng. Manag. 2018, 66, 156–169. [Google Scholar] [CrossRef]

- Lee, D.; Kirkpatrick-Husk, K.; Madhavan, R. Diversity in Alliance Portfolios and Performance Outcomes: A Meta-Analysis. J. Manag. 2014, 43, 1472–1497. [Google Scholar] [CrossRef]

- Zhang, L.Y.; Guo, H.Y. Enabling knowledge diversity to benefit cross-functional project teams: Joint roles of knowledge leadership and transactive memory system. Inf. Manag. 2019, 56, 103156. [Google Scholar] [CrossRef]

- Zona, F.; Gomez-Mejia, L.R.; Withers, M.C. Board Interlocks and Firm Performance: Toward a Combined Agency-Resource Dependence Perspective. J. Manag. 2018, 44, 589–618. [Google Scholar] [CrossRef]

- Shi, H.X.; Graves, C.; Barbera, F. Intergenerational succession and internationalisation strategy of family SMEs: Evidence from China. Long Range Plan. 2019, 52, 101838. [Google Scholar] [CrossRef]

- Rossignoli, F.; Lionzo, A. Network impact on business models for sustainability: Case study in the energy sector. J. Clean. Prod. 2018, 182, 694–704. [Google Scholar] [CrossRef]

- Gong, R.; Xue, J.; Zhao, L.; Zolotova, O.; Ji, X.; Xu, Y. A Bibliometric Analysis of Green Supply Chain Management Based on the Web of Science (WOS) Platform. Sustainability 2019, 11, 3459. [Google Scholar] [CrossRef] [Green Version]

- Huo, B.; Tian, M.; Tian, Y.; Zhang, Q. The dilemma of inter-organizational relationships. Int. J. Oper. Prod. Manag. 2019, 39, 2–23. [Google Scholar] [CrossRef]

- Dávila, G.A.; Durst, S.; Varvakis, G. Knowledge Absorptive Capacity, Innovation, and Firm’s Performance: Insights from the South of Brazil. Int. J. Innov. Manag. 2018, 22, 1–34. [Google Scholar] [CrossRef]

- Balle, A.R.; Steffen, M.O.; Curado, C.; Oliveira, M. Interorganizational knowledge sharing in a science and technology park: The use of knowledge sharing mechanisms. J. Knowl. Manag. 2019, 23, 2016–2038. [Google Scholar] [CrossRef]

- Bodla, A.A.; Tang, N.; Jiang, W.; Tian, L. Diversity and creativity in cross-national teams: The role of team knowledge sharing and inclusive climate. J. Manag. Organ. 2018, 24, 711–729. [Google Scholar] [CrossRef] [Green Version]

- Liu, T.; Qu, S.; Scherpereel, C.M. The Influence of the Role Positioning of Investment Institutions on the Value of Start-Up Enterprises from the Perspective of Network. Sustainability 2020, 12, 491. [Google Scholar] [CrossRef] [Green Version]

- Zhang, S.; Yuan, C.; Wang, Y. The Impact of Industry–University-Research Alliance Portfolio Diversity on Firm Innovation: Evidence from Chinese Manufacturing Firms. Sustainability 2019, 11, 2321. [Google Scholar] [CrossRef] [Green Version]

- Lin, L. Vertical ally-or-acquire choice and technological performance: A resource dependence perspective. R D Manag. 2018, 48, 552–565. [Google Scholar] [CrossRef]

- Cui, Y.; Zhang, Y.; Guo, J.; Hu, H.; Meng, H. Top management team knowledge heterogeneity, ownership structure and financial performance: Evidence from Chinese IT listed companies. Technol. Forecast. Soc. Chang. 2018, 140, 14–21. [Google Scholar] [CrossRef]

- Zhou, F.; Gu, X. Fuzzy impact of quality management on organizational innovation performance. J. Intell. Fuzzy Syst. 2019, 37, 3093–3101. [Google Scholar] [CrossRef]

- Lin, W.; Ma, J.; Zhang, Q.; Li, J.C.; Jiang, F. How is Benevolent Leadership Linked to Employee Creativity? The Mediating Role of Leader-Member Exchange and the Moderating Role of Power Distance Orientation. J. Bus. Ethic 2018, 152, 1099–1115. [Google Scholar] [CrossRef]

- Ardito, L.; Petruzzelli, A.M.; Dezi, L.; Castellano, S. The influence of inbound open innovation on ambidexterity performance: Does it pay to source knowledge from supply chain stakeholders? J. Bus. Res. 2020, 119, 321–329. [Google Scholar] [CrossRef]

- McMurray, A.; Islam, M.; Siwar, C.; Fien, J. Sustainable procurement in Malaysian organizations: Practices, barriers and opportunities. J. Purch. Supply Manag. 2014, 20, 195–207. [Google Scholar] [CrossRef]

- Mennens, K.; van Gils, A.; Odekerken-Schröder, G.; Letterie, W. Exploring Antecedents of Service Innovation Excellence in Manufacturing SMEs. Int. Small Bus. J. 2016, 36, 500–520. [Google Scholar] [CrossRef]

- Ubeda, F.; Ortiz-De-Urbina-Criado, M.; Mora-Valentín, E.-M. Do firms located in science and technology parks enhance innovation performance? The effect of absorptive capacity. J. Technol. Transf. 2019, 44, 21–48. [Google Scholar] [CrossRef]

- Yang, J.; Zhang, M. Coopetition within the entrepreneurial ecosystem: Startups’ entrepreneurial learning processes and their implications for new venture performance. J. Bus. Ind. Mark. 2021. [Google Scholar] [CrossRef]

- Khursheed, A.; Mustafa, F. Role of innovation ambidexterity in technology startup performance: An empirical study. Technol. Anal. Strat. Manag. 2021, 1–16. [Google Scholar] [CrossRef]

- Lavie, D.; Rosenkopf, L. Balancing Exploration and Exploitation in Alliance Formation. Acad. Manag. J. 2006, 49, 797–818. [Google Scholar] [CrossRef] [Green Version]

- Wang, C.; Chin, T.; Lin, J.-H. Openness and firm innovation performance: The moderating effect of ambidextrous knowledge search strategy. J. Knowl. Manag. 2020, 24, 301–323. [Google Scholar] [CrossRef]

- Ye, J.; Hao, B.; Patel, P.C. Orchestrating Heterogeneous Knowledge: The Effects of Internal and External Knowledge Heterogeneity on Innovation Performance. IEEE Trans. Eng. Manag. 2016, 63, 165–176. [Google Scholar] [CrossRef]

- Fu, L.H.; Liao, S.Q.; Liu, Z.Y.; Lu, F. An Investigation of Resource Allocation Mechanism for Exploration and Exploitation Under Limited Resource. IEEE Trans. Eng. Manag. 2019, 68, 1802–1812. [Google Scholar] [CrossRef]

- Alojairi, A.; Akhtar, N.; Ali, H.M.; Basiouni, A.F. Assessing Canadian Business IT Capabilities for Online Selling Adoption: A Net-Enabled Business Innovation Cycle (NEBIC) Perspective. Sustainability 2019, 11, 3662. [Google Scholar] [CrossRef] [Green Version]

- Tao, C.; Qu, Y.; Ren, H.; Guo, Z. The Influence of Inter-Enterprise Knowledge Heterogeneity on Exploratory and Exploitative Innovation Performance: The Moderating Role of Trust and Contract. Sustainability 2020, 12, 5677. [Google Scholar] [CrossRef]

- He, Z.-L.; Wong, P.K. Exploration vs. Exploitation: An Empirical Test of the Ambidexterity Hypothesis. Organ. Sci. 2004, 15, 481–494. [Google Scholar] [CrossRef]

- Akgün, A.E.; Keskin, H.; Byrne, J.C.; Aren, S. Emotional and learning capability and their impact on product innovativeness and firm performance. Technovation 2007, 27, 501–513. [Google Scholar] [CrossRef]

- Laursen, K.; Salter, A. Open for innovation: The role of openness in explaining innovation performance among U.K. manufacturing firms. Strat. Manag. J. 2006, 27, 131–150. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).