Dynamic Corporate Governance, Innovation, and Sustainability: Post-COVID Period

Abstract

:1. Introduction

2. Literature Review

2.1. Corporate Governance and Sustainability Research in the Energy Sector and Beyond

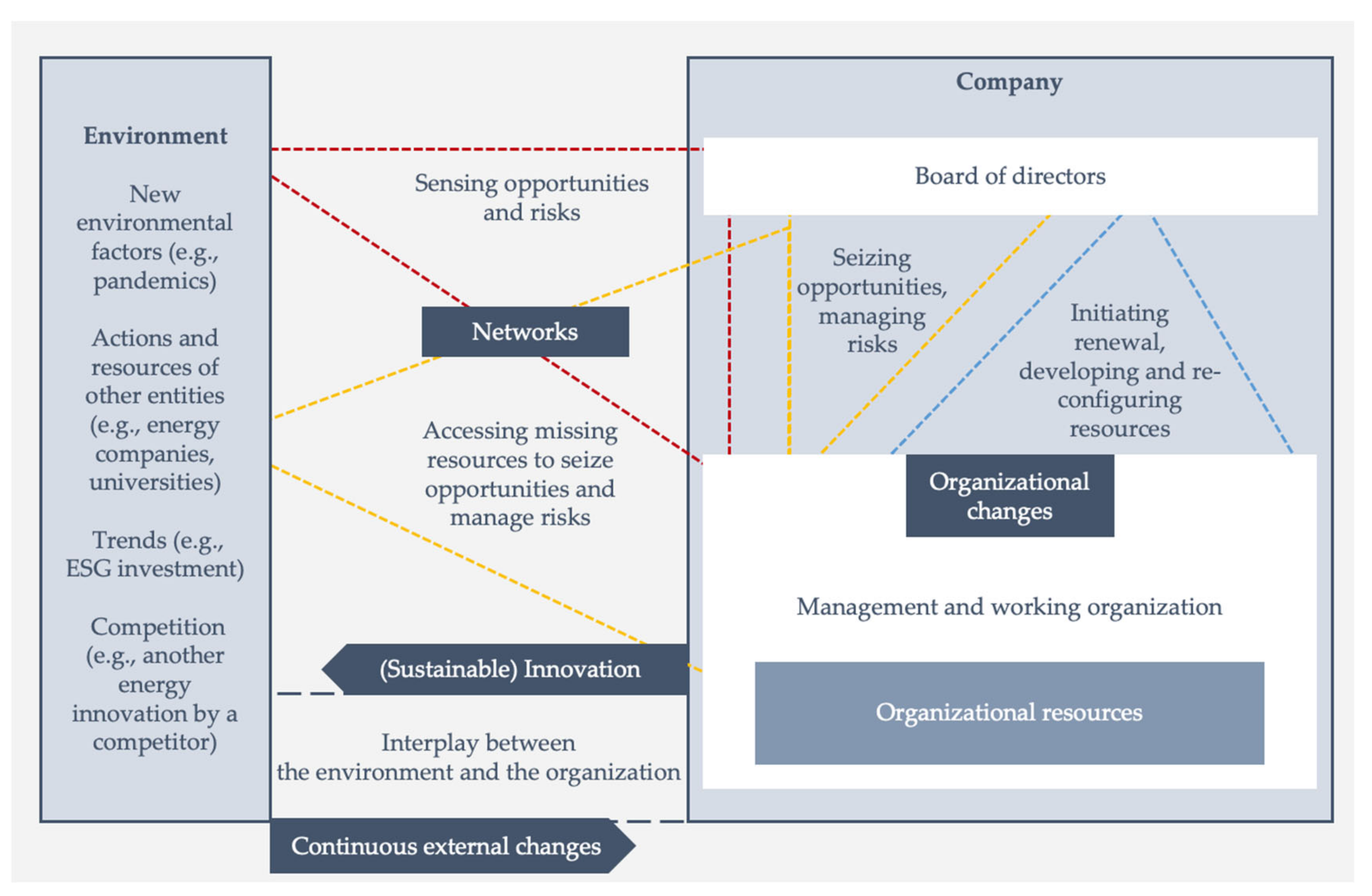

2.2. The Background of Dynamic Corporate Governance

2.3. Theoretical Framework

3. Materials and Methods

3.1. Research Setting and Data Collection

3.2. Data Analysis

- The authors conducted a qualitative content analysis [101], to understand the situation inductively, which oriented the further data collection (e.g., interview questions).

- The coding technique of the grounded theory was used, based on Strauss and Corbin [102], which is a more functionalist and well-structured approach and allows the use of categories from existing theories.

4. Results

4.1. Collaboration A

4.1.1. Inter-Organizational Board Conflict and Unbalanced Power Relations (SQ1–2)

- (1)

- optimizing processes in the administrative areas, focusing on how “home office” could be efficient (e.g., reconfiguring individual task groups, modifying reporting routines) to meet the standards of public health, but also efficient operations;

- (2)

- acceleration of new ESG (primarily environmental) project planning (e.g., extending e-mobility infrastructure) to show the adaptive capacity to the owners, and

“…become the winner of the uncertain times.”—Chairman of Incumbent A

4.1.2. The Role of Strategic Foresight and Networks (SQ3)

“In the case of such high-volume and complex development projects, I usually prefer to build core modules with basic functions that can be combined later. Until this time, this left space to reconfigure and reuse modules for different purposes. It requires more time in the beginning but saves time and costs later. Surprisingly, this modular structure also provided the opportunity later to handle the changing needs by quasi-outsourcing” (CEO of Startup A)

4.2. Collaboration B

4.2.1. Value Creation Opportunities and the Perceived Risks of Innovation (SQ1–2)

4.2.2. The Importance of Stability, Dividing but Convergent Roads (SQ3)

“…this company is one of the key players of the energy sector in the CEE region. We have vast responsibilities, we cannot bear any financial risks that can be avoided. This applies to innovation, as well.”—Member of the Executive Board of Incumbent B

“The development of the Carbon Capture prototype is an important step towards the commercial-scale implementation of the P2G technology as well. P2G and Carbon Capture together will provide a cost-effective Carbon Capture and Utilization solution for industrial companies with flue gas emissions.”—Director of Startup B

5. Discussion

5.1. Comparison of the Results of ESG and COVID-19 Research

5.2. Interpretation of Dynamic CG Based on the Theoretical Iteration

- In case of organizational changes, intervention in case of low performance [117], conflicts about mergers and acquisitions [20], changing the strategy and the board composition and behavior [18], CEO risks taking and its effects [118], institutional conflicts influencing CSR [22], and responsible actions after misconduct [23] have appeared recently as important research areas.

- Considering inter-organizational networks, acquisitions [122], directing knowledge flows and knowledge defense [123], network actions, building or cutting connections [124] in balanced and unbalanced network structures [125], using board interlock networks [126] and strategic partnerships [125], and imitating exploitation or exploration [127] are the main goals of CG.

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Topic | Organizational Changes and Required AI-Based KMS Functions | |||

|---|---|---|---|---|

| Category | Initial Organizational Changes | Further (Ongoing) Organizational Changes | ||

| Incumbent A directors’ communication patterns | Omitting to mention | Mentioning occasionally | ||

| Startup A directors’ communication patterns | Accentuation | Mentioning frequently | ||

| Code/Sub-category | Implemented function | Un-implemented function | Imperfect function | Unplanned, unimplemented function |

| Comment | All the developed functions, not only the planned ones in system requirements | It was a system requirement but is not developed | Developed functions which are unsatisfactory based on incumbent perception | Not planned in the system requirements, and is not developed |

| Incumbent A directors’ main messages | It was a fundamental requirement, not relevant anymore | Obligatory to implement | Wrong functions | Urgent request |

| Startup A directors’ main messages | Needed additional resources to implement | Already compensated | To be fine-tuned | Opportunity for further development |

| Incumbent A directors’ phrases | - | “handling the problem of the missing function” | “actual errors” “annoying errors” “how could it be corrected?” “wrong messages and notifications” | “actual topic” “function that increases user experience” “truly missing function” “it would be nice, if...” “another way is...” “it could be seen...” |

| Startup A directors’ phrases | “mobilizing overplus resources” “fits the new business needs” “generated additional resource need” “fully new” “not specificated” “redesigning” “redevelopment” | “it was not an initial need” “it should not have been working this way” | “adaptation” “fine-tuning” “almost ready” | “future development goals” “modification request” “request for extension” |

| Topic | Investing in the Up-Scaling of the P2G Technology | |||

|---|---|---|---|---|

| Category | Opportunities | Risks | ||

| Incumbent B directors’ communication patterns | Recognizing strategic fit to the portfolio | Focusing on high CAPEX of commercial-scale implementation | ||

| Startup B directors’ communication patterns | Demonstrating R&D&I results and discussing future benefits | Underlining the risk of missing the opportunity to be first-mover in the region | ||

| Code/Sub-category | Environmental adaptation by innovation | Socio-economic and environmental value creation | Legal environment affecting business model | Technological risks and site selection affecting business model |

| Comment | P2G drives renewable energy integration and provides long-term energy storage [132,133] | There is no specific regulation for P2G in Hungary, but it is planned. Potential biomethane feed-in-tariffs and/or reduced electricity system usage fees, etc. can significantly affect the business model [134]. | Sector coupling by P2G is possible if there is a connection to the natural gas grid. Attractive financial results can be generated by direct connection to a solar park. A biogas plant might be an ideal site by converting the CO2 of the biogas into methane [135]. | |

| Incumbent B directors’ main messages | No question that P2G is the future | The volume of the decarbonization potential | Wait and see approach | Complexity of the infrastructure |

| Startup B directors’ main messages | Scaling up gradually is possible | There is an opportunity for decarbonization | Be proactive, shape the environment | Know-how is available, trends are favorable |

| Incumbent B directors’ phrases | “P2G is promising” “We see the importance of the technology” “Fit the trends” | “How many tons of CO2...?” | “First wait and see the future conditions” “We have to be careful and patient” | “Infrastructural limitations of the sites” “Additional investments” “Optimization of an extended technological infrastructure” “Questions for reducing the time of return” |

| Startup B directors’ phrases | “Disruptive technology” “Modular configuration” | “Helping decarbonization” “Reusing carbon dioxide” “Producing green gases” | “International project developments had several phases before commercial-scale implementation” “Must take steps ahead to keep pace with international trends” “Demonstration in the relevant environment is impactful for policymakers” | “Decreasing capital expenditures” “International projects have been finished, lessons have been learned” “Hungarian R&D background is existing with universities and research centres” |

References

- Aras, G.; Tezcan, N.; Furtuna, O.K. Multidimensional comprehensive corporate sustainability performance evaluation model: Evidence from an emerging market banking sector. J. Clean. Prod. 2018, 185, 600–609. [Google Scholar] [CrossRef]

- Karaman, A.S.; Kilic, M.; Uyar, A. Green logistics performance and sustainability reporting practices of the logistics sector: The moderating effect of corporate governance. J. Clean. Prod. 2020, 258, 120718. [Google Scholar] [CrossRef]

- Bose, S.; Khan, H.Z.; Rashid, A.; Islam, S. What drives green banking disclosure? An institutional and corporate governance perspective. Asia Pac. J. Manag. 2018, 35, 501–527. [Google Scholar] [CrossRef]

- Ong, T.; Djajadikerta, H.G. Corporate governance and sustainability reporting in the Australian resources industry: An empirical analysis. Soc. Responsib. J. 2018, 16, 1–14. [Google Scholar] [CrossRef]

- Doumpos, M.; Andriosopoulos, K.; Galariotis, E.; Makridou, G.; Zopounidis, C. Corporate failure prediction in the European energy sector: A multicriteria approach and the effect of country characteristics. Eur. J. Oper. Res. 2017, 262, 347–360. [Google Scholar] [CrossRef]

- Stjepcevic, J.; Siksnelyte, I. Corporate social responsibility in energy sector. Transform. Bus. Econ. 2017, 16, 40. [Google Scholar]

- Shahbaz, M.; Karaman, A.S.; Kilic, M.; Uyar, A. Board attributes, CSR engagement, and corporate performance: What is the nexus in the energy sector? Energy Policy 2020, 143, 111582. [Google Scholar] [CrossRef]

- del Mar Miras-Rodriguez, M.; Di Pietra, R. Corporate Governance mechanisms as drivers that enhance the credibility and usefulness of CSR disclosure. J. Manag. Gov. 2018, 22, 565–588. [Google Scholar] [CrossRef]

- Naciti, V.; Cesaroni, F.; Pulejo, L. Corporate governance and sustainability: A review of the existing literature. J. Manag. Gov. 2021, 1–20. [Google Scholar] [CrossRef]

- Behl, A.; Kumari, P.S.; Makhija, H.; Sharma, D. Exploring the relationship of ESG score and firm value using cross-lagged panel analyses: Case of the Indian energy sector. Ann. Oper. Res. 2021, 1–26. [Google Scholar] [CrossRef]

- Liu, G.; Hamori, S. Can One Reinforce Investments in Renewable Energy Stock Indices with the ESG Index? Energies 2020, 13, 1179. [Google Scholar] [CrossRef] [Green Version]

- Eroğlu, H. Effects of Covid-19 outbreak on environment and renewable energy sector. Environ. Dev. Sustain. 2021, 23, 4782–4790. [Google Scholar] [CrossRef] [PubMed]

- Lagasio, V.; Cucari, N. Corporate governance and environmental social governance disclosure: A meta-analytical review. Corp. Soc. Responsib. Environ. Manag. 2019, 26, 701–711. [Google Scholar] [CrossRef]

- Shive, S.A.; Forster, M.M. Corporate Governance and Pollution Externalities of Public and Private Firms. Rev. Financ. Stud. 2020, 33, 1296–1330. [Google Scholar] [CrossRef]

- Filatotchev, I.; Aguilera, R.V.; Wright, M. From Governance of Innovation to Innovations in Governance. Acad. Manag. Perspect. 2020, 34, 173–181. [Google Scholar] [CrossRef]

- Eccles, R.G.; Johnstone-Louis, M.; Mayer, C.; Stroehle, J.C. The Board’s Role in Sustainability. Harv. Bus. Rev. 2020, 98, 48–51. [Google Scholar]

- Gao, H.; Huang, J.; Zhang, T. Can online annual general meetings increase shareholders’ participation in corporate governance? Financ. Manag. 2020, 49, 1029–1050. [Google Scholar] [CrossRef]

- Hoppmann, J.; Naegele, F.; Girod, B. Boards as a source of inertia: Examining the internal challenges and dynamics of boards of directors in times of environmental discontinuities. Acad. Manag. J. 2019, 62, 437–468. [Google Scholar] [CrossRef] [Green Version]

- McNulty, T.; Pettigrew, A.; Jobome, G.; Morris, C. The role, power and influence of company chairs. J. Manag. Gov. 2011, 15, 91–121. [Google Scholar] [CrossRef]

- Greve, H.R.; Zhang, C.M. Institutional Logics and Power Sources: Merger and Acquisition Decisions. Acad. Manag. J. 2017, 60, 671–694. [Google Scholar] [CrossRef]

- Clarke, T. International Corporate Governance—A Comparative Approach; Routledge: London, UK, 2017. [Google Scholar]

- Luo, X.R.; Wang, D.; Zhang, J. Whose Call to Answer: Institutional Complexity and Firms’ CSR Reporting. Acad. Manag. J. 2017, 60, 321–344. [Google Scholar] [CrossRef] [Green Version]

- Hersel, M.C.; Helmuth, C.; Zorn, M.L.; Shropshire, C.; Ridge, J. The Corrective Actions Organizations Pursue Following Misconduct: A Review and Research Agenda. Acad. Manag. Ann. 2019, 13, 547–585. [Google Scholar] [CrossRef]

- Allais, R.; Roucoules, L.; Reyes, T. Governance maturity grid: A transition method for integrating sustainability into companies? J. Clean. Prod. 2017, 140, 213–226. [Google Scholar] [CrossRef] [Green Version]

- Qi, W.; Huang, Z.; Dinçer, H.; Korsakienė, R.; Yüksel, S. Corporate Governance-Based Strategic Approach to Sustainability in Energy Industry of Emerging Economies with a Novel Interval-Valued Intuitionistic Fuzzy Hybrid Decision Making Model. Sustainability 2020, 12, 3307. [Google Scholar] [CrossRef] [Green Version]

- Ministry for Innovation and Technology. National Energy Strategy 2030, with an Outlook Up to 2040; Ministry for Innovation and Technology: Budapest, Hungary, 2020. [Google Scholar]

- Ministry for Innovation and Technology. Hungary’s National Hydrogen Strategy; Ministry for Innovation and Technology: Budapest, Hungary, 2021. [Google Scholar]

- Tihanyi, L.; Graffin, S.; George, G. Rethinking Governance in Management Research. Acad. Manag. J. 2014, 57, 1535–1543. [Google Scholar] [CrossRef]

- Sen, S.; Kotlarsky, J.; Budhwar, P. Extending Organizational Boundaries Through Outsourcing: Toward a Dynamic Risk-Management Capability Framework. Acad. Manag. Perspect. 2020, 34, 97–113. [Google Scholar] [CrossRef]

- Peng, M.W. Outside directors and firm performance during institutional transitions. Strateg. Manag. J. 2004, 25, 453–471. [Google Scholar] [CrossRef]

- Freeman, R.E. Divergent Stakeholder Theory. Acad. Manag. Rev. 1999, 24, 233–236. [Google Scholar] [CrossRef]

- Pfeffer, J.; Salancik, G.R. The External Control of Organizations; Harper and Row: New York, NY, USA, 1978. [Google Scholar]

- Teece. Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strateg. Manag. J. 2007, 28, 319–1350. [Google Scholar] [CrossRef] [Green Version]

- Aguilera, R.V.; Aragón-Correa, J.A.; Marano, V.; Tashman, P.A. The Corporate Governance of Environmental Sustainability: A Review and Proposal for More Integrated Research. J. Manag. 2021, 47, 1468–1497. [Google Scholar] [CrossRef]

- Lu, J.; Ren, L.; Yao, S.; Qiao, J.; Strielkowski, W.; Streimikis, J. Comparative Review of Corporate Social Responsibility of Energy Utilities and Sustainable Energy Development Trends in the Baltic States. Energies 2019, 12, 3417. [Google Scholar] [CrossRef] [Green Version]

- Grabinska, B.; Kedzior, M.; Kedzior, D.; Grabinski, K. The Impact of Corporate Governance on the Capital Structure of Companies from the Energy Industry. The Case of Poland. Energies 2021, 14, 7412. [Google Scholar] [CrossRef]

- Srivastava, G.; Kathuria, V. Impact of corporate governance norms on the performance of Indian utilities. Energy Policy 2020, 140, 111414. [Google Scholar] [CrossRef]

- Aras, G.; Crowther, D. Corporate Sustainability Reporting: A Study in Disingenuity? J. Bus. Ethics 2009, 87, 279. [Google Scholar] [CrossRef]

- Loh, L.; Thomas, T.; Wang, Y. Sustainability Reporting and Firm Value: Evidence from Singapore-Listed Companies. Sustainability 2017, 9, 2112. [Google Scholar] [CrossRef] [Green Version]

- Loh, L.; Tan, S. Impact of Sustainability Reporting on Brand Value: An Examination of 100 Leading Brands in Singapore. Sustainability 2020, 12, 7392. [Google Scholar] [CrossRef]

- Hu, M.; Loh, L. Board Governance and Sustainability Disclosure: A Cross-Sectional Study of Singapore-Listed Companies. Sustainability 2018, 10, 2578. [Google Scholar] [CrossRef] [Green Version]

- Aras, G.; Crowther, D. What Level of Trust is Needed for Sustainability? Soc. Responsib. J. 2007, 3, 60–68. [Google Scholar] [CrossRef]

- Aras, G.; Aybars, A.; Kutlu, O. Managing corporate performance: Investigating the relationship between corporate social responsibility and financial performance in emerging markets. Int. J. Product. Perform. Manag. 2010, 59, 229–254. [Google Scholar] [CrossRef]

- Zhang, Q.; Loh, L.; Wu, W. How do Environmental, Social and Governance Initiatives Affect Innovative Performance for Corporate Sustainability? Sustainability 2020, 12, 3380. [Google Scholar] [CrossRef] [Green Version]

- Subramanian, G. Corporate Governance 2.0. Harv. Bus. Rev. 2015, 93, 96–105. [Google Scholar]

- Tosi, H.L.; Gomez-Mejia, L.R. CEO compensation monitoring and firm performance. Acad. Manag. J. 1994, 37, 1002–1016. [Google Scholar] [CrossRef]

- Jones, T.M.; Wicks, A.C. Convergent Stakeholder Theory. Acad. Manag. Rev. 1999, 24, 206–221. [Google Scholar] [CrossRef]

- Donaldson, L.; Davis, J.H. Stewardship Theory or Agency Theory: CEO Governance and Shareholder Returns. Aust. J. Manag. 1991, 16, 19–64. [Google Scholar] [CrossRef] [Green Version]

- Rubin, P.H. Introduction. Manag. Decis. Econ. 1993, 14, 95. [Google Scholar] [CrossRef]

- Alaghehband, F.K.; Rivard, S.; Wu, S.; Goyette, S. An assessment of the use of Transaction Cost Theory in information technology outsourcing. J. Strateg. Inf. Syst. 2011, 20, 125–138. [Google Scholar] [CrossRef]

- Kosnik, R.D. Greenmail: A Study of Board Performance in Corporate Governance. Adm. Sci. Q. 1987, 32, 163–185. [Google Scholar] [CrossRef]

- Barney, J.B. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Hillman, A.J.; Dalziel, T. Boards of Directors and Firm Performance: Integrating Agency and Resource Dependence Perspectives. Acad. Manag. Rev. 2003, 28, 383–396. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Schuen, A. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Lungeanu, R.; Zajac, E.J. Venture Capital Ownership As A Contingent Resource: How Owner–Firm Fit Influences Ipo Outcomes. Acad. Manag. J. 2016, 59, 930–955. [Google Scholar] [CrossRef]

- Garg, S.; Eisenhardt, K. Unpacking the CEO-Board relationship: How strategy making happens in entrepreneurial firms. Acad. Manag. J. 2017, 60, 1828–1858. [Google Scholar] [CrossRef]

- Garg, S. Venture Governance: A New Horizon for Corporate Governance. Acad. Manag. Perspect. 2020, 34, 252–265. [Google Scholar] [CrossRef]

- Voinea, C.; Logger, M.; Rauf, F.; Roijakkers, N. Drivers for Sustainable Business Models in Start-Ups: Multiple Case Studies. Sustainability 2019, 11, 6884. [Google Scholar] [CrossRef] [Green Version]

- Kim, B.; Kim, B.-G. An Explorative Study of Korean Venture Companies: Do CSR and Company Competitiveness Improve Non-Financial and Financial Performance? Sustainability 2021, 13, 13106. [Google Scholar] [CrossRef]

- Duncan, R. The ambidextrous organization: Designing dual structures for innovation. Manag. Organ. Des. 1976, 1, 167–188. [Google Scholar]

- March, J.G. Exploration and exploitation in organizational learning. Organ. Sci. 1991, 2, 71–87. [Google Scholar] [CrossRef]

- Burgelman, R.A. Intraorganizational Ecology of Strategy Making and Organizational Adaption: Theory and Field Research. Organ. Sci. 1991, 2, 239–262. [Google Scholar] [CrossRef]

- Nisar, A.; Palacios, M.; Grijalvo, M. Open organizational structures: A new framework for the energy industry. J. Bus. Res. 2016, 69, 5175–5179. [Google Scholar] [CrossRef]

- Luthra, S.; Kumar, S.; Kharb, R.; Ansari, M.F.; Shimmi, S.L. Adoption of smart grid technologies: An analysis of interactions among barriers. Renew. Sustain. Energy Rev. 2014, 33, 554–565. [Google Scholar] [CrossRef]

- Grant, R.M. Prospering in Dynamically-Competitive Environments: Organizational Capabilities as Knowledge Integration. Organ. Sci. 1996, 7, 375–387. [Google Scholar] [CrossRef] [Green Version]

- Pisano, G.P. Toward a prescriptive theory of dynamic capabilities: Connecting strategic choice, learning, and competition. Ind. Corp. Change 2017, 26, 747–762. [Google Scholar] [CrossRef] [Green Version]

- Hofer, C.W.; Schendel, D. Strategic Formulation: Analytical Concepts; West Publishing Company: St. Paul, MN, USA, 1978. [Google Scholar]

- Hillman, A.M.; Withers, M.C.; Collins, B.J. Resource Dependence Theory: A Review. J. Manag. 2009, 35, 1404–1427. [Google Scholar] [CrossRef] [Green Version]

- European Central Bank. Annual Report: 2004; European Central Bank: Frankfurt am Main, Germany, 2004. [Google Scholar]

- Owen, N. The Failure of HIH Insurance. In Volume 1: A Corporate Collapse and Its Lessons; HIH Royal Commission, Commonwealth of Australia: Canberra, Australia, 2003. [Google Scholar]

- Organisation for Economic Co-operation and Development. OECD/G20 Priciples of Corporate Governance; Organisation for Economic Co-operation and Development: Paris, France, 2004. [Google Scholar]

- Tricker, B. Corporate Governance: Principles, Policies and Practices; Oxford University Press: Oxford, UK, 2012. [Google Scholar]

- Pound, J. The Promise of the Governed Corporation. Harv. Bus. Rev. 1995, 73, 89–98. [Google Scholar]

- Cadbury, A. Report of the Committee on the Financial Aspects of Corporate Governance; Gee & Co.: London, UK, 1992. [Google Scholar]

- World Bank. Corporate Governance: A Framework for Implementation; World Bank: Washington, DC, UK, 2000. [Google Scholar]

- Van De Ven, A.; Poole, M. Explaining Development and Change in Organizations. Acad. Manag. Rev. 1995, 20, 510–540. [Google Scholar] [CrossRef] [Green Version]

- Andrews, K.R. Corporate strategy as a vital function of the board. Harv. Bus. Rev. 1981, 59, 174–184. [Google Scholar]

- Baysinger, B.; Hoskisson, R.E. The Composition of Boards of Directors and Strategic Control: Effects on Corporate Strategy. Acad. Manag. Rev. 1990, 15, 72–87. [Google Scholar] [CrossRef]

- Bonn, I.; Pettigrew, A. Towards a dynamic theory of boards: An organisational life cycle approach. J. Manag. Organ. 2015, 15, 2–16. [Google Scholar] [CrossRef]

- Westphal, J.D.; Fredrickson, J.W. Who directs strategic change? Director experience, the selection of new CEOs, and change in corporate strategy. Strateg. Manag. J. 2001, 22, 1113–1137. [Google Scholar] [CrossRef]

- Przybyłowski, M.; Aluchna, M.; Zamojska, A. Role of independent supervisory board members in Central and Eastern European countries. Nternational J. Discl. Gov. 2011, 8, 77–98. [Google Scholar] [CrossRef]

- Haig, B.D. An Abductive Theory of Scientific Method. In Method Matters in Psychology. Studies in Applied Philosophy, Epistemology and Rational Ethics, 45; Springer: Cham, Switzerland, 2018; pp. 35–64. [Google Scholar] [CrossRef] [Green Version]

- Burawoy, M. The extended case method. Sociol. Theory 1998, 16, 4–33. [Google Scholar] [CrossRef]

- Sanders, C.; Gibson, K.; Lamm, A. Rural Broadband and Precision Agriculture: A Frame Analysis of United States Federal Policy Outreach under the Biden Administration. Sustainability 2022, 14, 460. [Google Scholar] [CrossRef]

- Navarrete-Oyarce, J.; Moraga-Flores, H.; Gallegos Mardones, J.A.; Gallizo, J.L. Why Integrated Reporting? Insights from Early Adoption in an Emerging Economy. Sustainability 2022, 14, 1695. [Google Scholar] [CrossRef]

- Štuopytė, E. Towards Sustainability: The Involvement of the Elderly in the Educational Activities of NGOs in Lithuania. Sustainability 2022, 14, 2095. [Google Scholar] [CrossRef]

- Adamik, A.; Nowicki, M. Pathologies and Paradoxes of Co-Creation: A Contribution to the Discussion about Corporate Social Responsibility in Building a Competitive Advantage in the Age of Industry 4.0. Sustainability 2019, 11, 4954. [Google Scholar] [CrossRef] [Green Version]

- Fubah, C.N.; Moos, M. Exploring COVID-19 Challenges and Coping Mechanisms for SMEs in the South African Entrepreneurial Ecosystem. Sustainability 2022, 14, 1944. [Google Scholar] [CrossRef]

- Jonsdottir, G.E.; Sigurjonsson, T.O.; Alavi, A.R.; Mitchell, J. Applying Responsible Ownership to Advance SDGs and the ESG Framework, Resulting in the Issuance of Green Bonds. Sustainability 2021, 13, 7331. [Google Scholar] [CrossRef]

- Salvioni, D.M.; Gennari, F.; Bosetti, L. Sustainability and Convergence: The Future of Corporate Governance Systems? Sustainability 2016, 8, 1203. [Google Scholar] [CrossRef] [Green Version]

- Ziesemer, F.; Hüttel, A.; Balderjahn, I. Pioneers’ Insights into Governing Social Innovation for Sustainable Anti-Consumption. Sustainability 2019, 11, 6663. [Google Scholar] [CrossRef] [Green Version]

- Kim, J.; Paek, B.; Lee, H. Exploring Innovation Ecosystem of Incumbents in the Face of Technological Discontinuities: Automobile Firms. Sustainability 2022, 14, 1606. [Google Scholar] [CrossRef]

- Coghlan, D.; Brydon-Miller, M. The SAGE Encyclopedia of Action Research (Volumes 1–2); SAGE Publications: London, UK, 2014. [Google Scholar]

- Nestor, S.; Thompson, J.K. Corporate Gobernance Patterns in OECD Economies: Is Onvergence Under Way; Discussion Paper; Organisation for Economic Co-Operation and Development: Paris, France, 2000. [Google Scholar]

- Bezemer, P.; Peij, S.; Kruijs, L.; Maassen, G. How two-tier boards can be more effective. Corp. Gov. 2014, 14, 15–31. [Google Scholar] [CrossRef] [Green Version]

- Danneels, E. The dynamics of product innovation and firm competences. Strateg. Manag. J. 2002, 23, 1095–1121. [Google Scholar] [CrossRef]

- Tripsas, M.; Gavetti, G. Capabilities, cognition and inertia: Evidence from digital imaging. Strateg. Manag. J. 2000, 21, 1147–1161. [Google Scholar] [CrossRef]

- Bingham, C.B.; Heimeriks, K.H.; Schijven, M.; Gates, S. Concurrent learning: How firms develop multiple dynamic capabilities in parallel. Strateg. Manag. J. 2015, 36, 1802–1825. [Google Scholar] [CrossRef] [Green Version]

- Danneels, E. Trying to become a different type of company: Dynamic capability at Smith Corona. Strateg. Manag. J. 2010, 32, 1–31. [Google Scholar] [CrossRef]

- Burrell, G.; Morgan, G. Sociological Paradigms and Organisational Analysis: Elements of the Sociology of Corporate Life; Heinemann: London, UK, 1979. [Google Scholar]

- Zhang, Y.; Wildemuth, B. Qualitative analysis of content. In Applications of Social Research Methods to Questions in Information and Library Science; Libraries Unlimited: Westport, CT, USA, 2009; pp. 308–319. [Google Scholar]

- Strauss, A.; Corbin, J. Basics of Qualitative Research: Techniques and Procedures for Developing Grounded Theory; Sage Publications: Thousand Oaks, CA, USA, 1998. [Google Scholar]

- Gibbert, M.; Ruigrok, W.; Wicki, B. What passes as a rigorous case study? Strateg. Manag. J. 2008, 29, 1465–1474. [Google Scholar] [CrossRef]

- Glaser, B.; Strauss, A. The Discovery of Grounded theory: Strategies for Qualitative Research; Aldine: Chicago, IL, USA, 1967. [Google Scholar]

- Orb, A.; Eisenhauer, L.; Wynaden, D. Ethics in qualitative research. J. Nurs. Scholarsh. 2000, 33, 93–96. [Google Scholar] [CrossRef]

- May, K.A. Interview techniques in qualitative research: Concerns and challenges. In Qualitative Nursing Research: A Contemporary Dialogue; Morse, J.M., Ed.; Sage Publications: Newbury Park, CA, USA, 1989; pp. 188–201. [Google Scholar]

- Barriball, K.L.; While, A. Collecting data using a semi-structured interview: A discussion paper. J. Adv. Nurs. 1994, 19, 328–335. [Google Scholar] [CrossRef]

- Agudelo, M.A.L.; Johannsdottir, L.D.B. Drivers that motivate energy companies to be responsible. A systematic literature review of Corporate Social Responsibility in the energy sector. J. Clean. Prod. 2020, 247, 119094. [Google Scholar] [CrossRef]

- Tseng, M.-L.; Tan, P.A.; Jeng, S.-Y.; Lin, C.-W.R.; Negash, Y.T.; Darsono, S.N.A.C. Sustainable Investment: Interrelated among Corporate Governance, Economic Performance and Market Risks Using Investor Preference Approach. Sustainability 2019, 11, 2108. [Google Scholar] [CrossRef] [Green Version]

- Lu, J.; Ren, L.; Qiao, J.; Yao, S.; Strielkowski, W.; Streimikis, J. Corporate Social Responsibility and Corruption: Implications for the Sustainable Energy Sector. Sustainability 2019, 11, 4128. [Google Scholar] [CrossRef] [Green Version]

- Bae, S.M.; Masud, M.A.K.; Kim, J.D. A Cross-Country Investigation of Corporate Governance and Corporate Sustainability Disclosure: A Signaling Theory Perspective. Sustainability 2018, 10, 2611. [Google Scholar] [CrossRef] [Green Version]

- Bel-Oms, I.; Segarra-Moliner, J.R. How Do Remuneration Committees Affect Corporate Social Responsibility Disclosure? Empirical Evidence from an International Perspective. Sustainability 2022, 14, 860. [Google Scholar] [CrossRef]

- Zattoni, A.; Pugliese, A. Corporate Governance Research in the Wake of a Systemic Crisis: Lessons and Opportunities from the COVID-19 Pandemic. J. Manag. Stud. 2021, 58, 1405–1410. [Google Scholar] [CrossRef]

- Hsu, Y.L.; Liao, L.K.C. Corporate governance and stock performance: The case of COVID-19 crisis. J. Account. Public Policy, 2021; 106920, in press. [Google Scholar] [CrossRef]

- Tampakoudis, I.; Noulas, A.; Kiosses, N. The market reaction to syndicated loan announcements before and during the COVID-19 pandemic and the role of corporate governance. Res. Int. Bus. Financ. 2022, 60, 101602. [Google Scholar] [CrossRef]

- Liu, H.; Jiang, J.; Xue, R.; Meng, X. Corporate Environmental Governance Scheme and Investment Efficiency over the Course of COVID-19. Financ. Res. Lett. 2022; 102726, in press. [Google Scholar] [CrossRef] [PubMed]

- Desai, V.M. The Behavioral Theory of The (Governed) Firm: Corporate Board Influences on Organizations’ Responses to Performance Shortfalls. Acad. Manag. J. 2016, 59, 860–879. [Google Scholar] [CrossRef]

- Quigley, T.J.; Hambrick, D.C.; Misangyi, V.F.; Rizzi, G.A. CEO Selection as Risk-taking: A New Vantage on the Debate about the Consequences of Insiders Versus Outsiders. Strateg. Manag. J. 2019, 40, 1453–1470. [Google Scholar] [CrossRef]

- Jia, N.; Huang, K.G.; Zhang, C.M. Public Governance, Corporate Governance, and Firm Innovation: An Examination of State-Owned Enterprises. Acad. Manag. J. 2019, 62, 220–247. [Google Scholar] [CrossRef]

- Scherer, A.G.; Voegtlin, C. Corporate Governance for Responsible Innovation: Approaches to Corporate Governance and Their Implications for Sustainable Development. Acad. Manag. Perspect. 2020, 34, 182–208. [Google Scholar] [CrossRef]

- Nadkarni, S.; Chen, J. Bridging Yesterday, Today and Tomorrow: CEO Temporal Focus, Environmental Dynamism and Rate of New Product Introduction. Acad. Manag. J. 2014, 57, 1810–1833. [Google Scholar] [CrossRef]

- Hernandez, E.; Shaver, J.M. Network Synergy. Adm. Sci. Q. 2019, 64, 171–202. [Google Scholar] [CrossRef]

- Hernandez, E.; Sanders, W.G.; Tuschke, A. Network defense: Pruning, grafting and closing to prevent leakage of strategic knowledge to rivals. Acad. Manag. J. 2015, 58, 1233–1260. [Google Scholar] [CrossRef] [Green Version]

- Hernandez, E.; Menon, A. Corporate Strategy and Network Change. Acad. Manag. Rev. 2021, 46, 80–107. [Google Scholar] [CrossRef]

- Sytch, M.; Tatarynowicz, A. Friends and Foes: The Dynamics of Dual Social Structures. Acad. Manag. J. 2014, 57, 585–613. [Google Scholar] [CrossRef]

- Srinivasan, R.; Wuyts, S.; Mallapragada, G. Corporate Board Interlocks and New Product Introductions. J. Mark. 2018, 82, 132–150. [Google Scholar] [CrossRef] [Green Version]

- Duysters, G.; Lavie, D.; Sabidussi, A.; Stettner, U. What Drives Exploration? Convergence and Divergence of Exploration Tendencies among Alliance Partners and Competitors. Acad. Manag. J. 2020, 63, 1425–1454. [Google Scholar] [CrossRef]

- Signori, S.; San-Jose, L.; Retolaza, J.L.; Rusconi, G. Stakeholder Value Creation: Comparing ESG and Value Added in European Companies. Sustainability 2021, 13, 1392. [Google Scholar] [CrossRef]

- Hu, Y.; Shan, J.; Zhan, P. Institutional Investors’ Corporate Site Visits and Firms’ Sustainable Development. Sustainability 2020, 12, 7036. [Google Scholar] [CrossRef]

- Boyer, J. Toward an Evolutionary and Sustainability Perspective of the Innovation Ecosystem: Revisiting the Panarchy Model. Sustainability 2020, 12, 3232. [Google Scholar] [CrossRef] [Green Version]

- Csedő, Z.; Zavarkó, M. The role of inter-organizational innovation networks as change drivers in commercialization of disruptive technologies: The case of power-to-gas. Int. J. Sustain. Energy Plan. Manag. 2020, 28, 53–70. [Google Scholar] [CrossRef]

- Zavarkó, M.; Imre, A.R.; Pörzse, G.; Csedő, Z. Past, Present and Near Future: An Overview of Closed, Running and Planned Biomethanation Facilities in Europe. Energies 2021, 14, 5591. [Google Scholar] [CrossRef]

- Pintér, G. The Potential Role of Power-to-Gas Technology Connected to Photovoltaic Power Plants in the Visegrad Countries—A Case Study. Energies 2020, 13, 6408. [Google Scholar] [CrossRef]

- Csedő, Z.; Sinóros-Szabó, B.; Zavarkó, M. Seasonal Energy Storage Potential Assessment of WWTPs with Power-to-Methane Technology. Energies 2020, 13, 4973. [Google Scholar] [CrossRef]

- Pörzse, G.; Csedő, Z.; Zavarkó, M. Disruption Potential Assessment of the Power-to-Methane Technology. Energies 2021, 14, 2297. [Google Scholar] [CrossRef]

| Propositions for… | Temporal Focus | Contextual Focus | |

|---|---|---|---|

| Present (Short-Term) | Future (Long-Term) | ||

| Required dynamic capabilities (1) | Sensing legal, business, financial, and social risks | Sensing strategic opportunities and risks | (1) External environment |

| Examples for general tasks (1) | Ensuring accountability: evaluating audit reports, communication with shareholders | Participation in strategy formulation: initiating strategy analyses, interpretation of analyses, consulting with management | |

| Required dynamic capabilities (2) | Sensing organizational, operational risks Seizing strategic opportunities and managing risks | Allowing and facilitating transformation | (2) Internal environment |

| Examples for general tasks (2) | Monitoring and intervention (if needed): evaluating business results, management performance, resource utilization, and potential reconfiguration opportunities | Modifying, shaping policies: accepting financial plans, shaping the management incentives, reviewing risk management system, investment decisions about building new capabilities | |

| Collaboration A | Collaboration B | |||

|---|---|---|---|---|

| Startup A | Incumbent A | Startup B | Incumbent B | |

| Status | Operations only in Hungary | European multinational company | Operations only in Hungary | European multinational company |

| Main activities | ICT development (knowledge management system/KMS), project management system, artificial intelligence/AI development) | Electricity producer, energy trader, and energy provider | Power-to-X (P2X), carbon capture and utilization (CCU) technology developer | Electricity producer and trader, natural gas trader, system operator |

| Examples for ongoing sustainability-related initiatives | Specializing in AI-based knowledge management for the energy sector | Renewable electricity production, E-mobility, waste management | Developing technologies for energy storage, green gas production and decarbonization | Renewable electricity production, environmental protection programs (e.g., waste management, water quality management) |

| Number of employees | 10–20 | >500 | 5–10 | >900 |

| Corporate governance structure | One-tier 3 directors | Two-tier 3–7 directors in the executive board 3–7 members in the supervisory board | One-tier 3 directors | Two-tier 3–7 directors in the executive board 3–7 members in the supervisory board |

| Supporting ESG | Indirectly by AI-based digital technology | Directly by breakthrough energy technology | ||

| Short project description | Developing unique KMS with sector-specific AI, in order to explore and utilize organizational knowledge for innovative, renewable energy projects | Planning the up-scaling of power-to-gas (P2G) technology at different commercial sites. The project involved a potential financial investor that was not specialized in the energy sector. | ||

| Time horizon of the case studies (focus of the analyses) | 2019 Q2–2020 Q3 | 2019 Q2–2021 Q4 | ||

| Data collection methods |

|

| ||

| Method | Description | Research Sub-Questions | Followed Methodological Suggestions | |

|---|---|---|---|---|

| Framework | Extended case study | In-depth analysis of a company with a longer time-horizon and iteration between theory and data |

| [83,99] |

| Phase 1/Data analysis technique 1 | Qualitative content analysis |

|

| [101] |

| Phase 2/Data analysis technique 2 | Grounded theory coding technique |

|

| [102] |

| Phase 3 |

| Fine-tuning conclusions | [103,104] | |

| Improving generalizability, reliability, and validity |

| |||

| Incumbent | Project | Startup | ||

|---|---|---|---|---|

| Examples for Organizational Changes | Characteristics | Affected System Function | Critical Success Factor on Board Level | Implementation on the Professional Level |

| Operative policies | Incremental, once | Structures and contents of forms Database-structure | - | - |

| Task groups Internal power relations (authorization) | Radical, once | New module for collaboration Structure and content of AI-support and standard reports | Strategic foresight, sensing the risk of the complex development | Building a modular system, reconfiguring the modules |

| Changes in human resources, new project sponsor unit | Ad hoc reporting platform for knowledge property, network, and utilization | |||

| Operational processes | Incremental, multiple times | Modified functions of AI-support Permissions for actions Data communication among organizational units, sites, and with “legacy” systems | Using the inter-organizational network | Involving other companies (developers) quickly |

| Focus | Present (Short-Term) | Future (Long-Term) | Validation |

|---|---|---|---|

| Required dynamic capabilities and tasks regarding the external environment | Sensing legal, business, financial, and social risks (e.g., ensuring accountability: evaluating audit reports, communication with shareholders) | Sensing strategic opportunities and risks (e.g., participation in strategy formulation: initiating strategy analyses, interpretation of analyses, consulting with management) | Propositions |

| Incumbent B: Wait and see approach in case of breakthrough innovation with high CAPEX and uncertain business model (P2M) Startup A: Identifying danger of not meeting the needs of Incumbent A because of the organizational changes | Incumbent A: Accelerating renewable-energy project planning with AI-based KMS aimed at innovation Startup B: Identifying the opportunity in the network for another innovation (CC) | Empirical examples | |

| Required dynamic capabilities and tasks regarding the internal environment | Incumbent A: Realizing organizational changes (directorial and structural) and using bargaining power against Startup A Startup A: Using the inter-organizational network to handle operational risks of work overload Startup B: Developing a new technology to support the commercialization of the core technology | Incumbent A: Initiating organizational changes as an answer for the new environmental conditions Incumbent B: Implementing a more mature technology first (P2H), which can be combined later with a more innovative one (P2M) | |

| Sensing organizational, operational risks Seizing strategic opportunities and managing risks (e.g., monitoring and intervention (if needed): evaluating business results, management performance, resource utilization, and potential reconfiguration opportunities) | Allowing and facilitating transformation (e.g., modifying, shaping policies: accepting financial plans, shaping the management incentives, reviewing risk management system, investment decisions about building new capabilities) | Propositions |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Csedő, Z.; Magyari, J.; Zavarkó, M. Dynamic Corporate Governance, Innovation, and Sustainability: Post-COVID Period. Sustainability 2022, 14, 3189. https://doi.org/10.3390/su14063189

Csedő Z, Magyari J, Zavarkó M. Dynamic Corporate Governance, Innovation, and Sustainability: Post-COVID Period. Sustainability. 2022; 14(6):3189. https://doi.org/10.3390/su14063189

Chicago/Turabian StyleCsedő, Zoltán, József Magyari, and Máté Zavarkó. 2022. "Dynamic Corporate Governance, Innovation, and Sustainability: Post-COVID Period" Sustainability 14, no. 6: 3189. https://doi.org/10.3390/su14063189

APA StyleCsedő, Z., Magyari, J., & Zavarkó, M. (2022). Dynamic Corporate Governance, Innovation, and Sustainability: Post-COVID Period. Sustainability, 14(6), 3189. https://doi.org/10.3390/su14063189